UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

FOR THE QUARTERLY PERIOD ENDED

or

Commission File Number:

(Exact Name of Registrant as Specified in its Charter)

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification Number) |

| (Address of principal executive offices) | (Zip Code) |

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Name of each exchange on which registered | |

| Trading symbol: |

Indicate by check mark whether the registrant (1) has

filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months

(or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements

for the past 90 days.

Indicate by check mark whether the registrant has

submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted

pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that

the registrant was required to submit and post such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |

| ☒ | Smaller reporting company | |||

| Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is

a shell company (as defined in Rule 12b-2 of the Exchange Act.): Yes ☐ No

As of March 13, 2024, the registrant had the following shares outstanding:

| Class A common stock, $.01 par value: | ||

| Class B common stock, $.01 par value: |

ZEDGE, INC.

TABLE OF CONTENTS

i

PART I. FINANCIAL INFORMATION

Item 1. Condensed Consolidated Financial Statements

ZEDGE, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(in thousands, except par value data)

| January 31, | July 31, | |||||||

| 2024 | 2023 | |||||||

| (Unaudited) | ||||||||

| Assets | ||||||||

| Current assets: | ||||||||

| Cash and cash equivalents | $ | $ | ||||||

| Trade accounts receivable | ||||||||

| Prepaid expenses and other receivables | ||||||||

| Total current assets | ||||||||

| Property and equipment, net | ||||||||

| Intangible assets, net | ||||||||

| Goodwill | ||||||||

| Deferred tax assets, net | ||||||||

| Other assets | ||||||||

| Total assets | $ | $ | ||||||

| Liabilities and stockholders’ equity | ||||||||

| Current liabilities: | ||||||||

| Trade accounts payable | $ | $ | ||||||

| Accrued expenses and other current liabilities | ||||||||

| Deferred revenues | ||||||||

| Total current liabilities | ||||||||

| Term loan, net of deferred financing costs | - | |||||||

| Deferred revenues--non-current | - | |||||||

| Other liabilities | ||||||||

| Total liabilities | ||||||||

| Commitments and contingencies (Note 9) | ||||||||

| Stockholders’ equity: | ||||||||

| Preferred stock, $ | ||||||||

| Class A common stock, $ | ||||||||

| Class B common stock, $ | ||||||||

| Additional paid-in capital | ||||||||

| Accumulated other comprehensive loss | ( | ) | ( | ) | ||||

| Accumulated deficit | ( | ) | ( | ) | ||||

| Treasury stock, | ( | ) | ( | ) | ||||

| Total stockholders’ equity | ||||||||

| Total liabilities and stockholders’ equity | $ | $ | ||||||

See accompanying notes to unaudited condensed consolidated financial statements.

1

ZEDGE, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE (LOSS) INCOME

(in thousands, except for per share data)

(Unaudited)

| Three Months Ended | Six Months Ended | |||||||||||||||

| January 31, | January 31, | |||||||||||||||

| 2024 | 2023 | 2024 | 2023 | |||||||||||||

| Revenues | $ | $ | $ | $ | ||||||||||||

| Costs and expenses: | ||||||||||||||||

| Direct cost of revenues (excluding amortization of capitalized software and technology development costs which is included below) | ||||||||||||||||

| Selling, general and administrative | ||||||||||||||||

| Depreciation and amortization | ||||||||||||||||

| Impairment of intangible assets | ||||||||||||||||

| Change in fair value of contingent consideration | ( | ) | ( | ) | ||||||||||||

| (Loss) income from operations | ( | ) | ( | ) | ||||||||||||

| Interest and other income, net | ||||||||||||||||

| Net gain (loss) resulting from foreign exchange transactions | ( | ) | ||||||||||||||

| (Loss) income before income taxes | ( | ) | ( | ) | ||||||||||||

| Income tax (benefit) provision | ( | ) | ( | ) | ||||||||||||

| Net (loss) income | $ | ( | ) | $ | $ | ( | ) | $ | ||||||||

| Other comprehensive gain (loss): | ||||||||||||||||

| Changes in foreign currency translation adjustment | ( | ) | ( | ) | ||||||||||||

| Total other comprehensive gain (loss) | ( | ) | ( | ) | ||||||||||||

| Total comprehensive (loss) income | $ | ( | ) | $ | $ | ( | ) | $ | ||||||||

| (Loss) income per share attributable to Zedge, Inc. common stockholders: | ||||||||||||||||

| Basic | $ | ( | ) | $ | $ | ( | ) | $ | ||||||||

| Diluted | $ | ( | ) | $ | $ | ( | ) | $ | ||||||||

| Weighted-average number of shares used in calculation of income (loss) per share: | ||||||||||||||||

| Basic | ||||||||||||||||

| Diluted | ||||||||||||||||

See accompanying notes to unaudited condensed consolidated financial statements.

2

ZEDGE, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS’ EQUITY

(in thousands)

(Unaudited)

| Class A Common Stock | Class B Common Stock | Additional Paid-in | Accumulated Other Comprehensive | Accumulated | Treasury Stock | Total Stockholders’ | ||||||||||||||||||||||||||||||||||

| Shares | Amount | Shares | Amount | Capital | Loss | Deficit | Shares | Amount | Equity | |||||||||||||||||||||||||||||||

| Balance – July 31, 2023 | $ | | $ | | $ | $ | ( | ) | $ | ( | ) | $ | ( | ) | $ | |||||||||||||||||||||||||

| Exercise of stock options | - | - | ||||||||||||||||||||||||||||||||||||||

| Stock-based compensation | - | - | ||||||||||||||||||||||||||||||||||||||

| Purchase of treasury stock | - | - | ( | ) | ( | ) | ||||||||||||||||||||||||||||||||||

| Foreign currency translation adjustment | - | - | ( | ) | - | ( | ) | |||||||||||||||||||||||||||||||||

| Net loss | - | - | ( | ) | - | ( | ) | |||||||||||||||||||||||||||||||||

| Balance – October 31, 2023 | $ | ( | ) | ( | ) | ( | ) | |||||||||||||||||||||||||||||||||

| Stock-based compensation | - | |||||||||||||||||||||||||||||||||||||||

| Foreign currency translation adjustment | - | - | ||||||||||||||||||||||||||||||||||||||

| Net loss | - | - | ( | ) | ( | ) | ||||||||||||||||||||||||||||||||||

| Balance – January 31, 2024 | $ | $ | $ | $ | ( | ) | $ | ( | ) | $ | ( | ) | $ | |||||||||||||||||||||||||||

| Class A Common Stock | Class B Common Stock | Additional Paid-in | Accumulated Other Comprehensive | Retained | Treasury Stock | Total Stockholders’ | ||||||||||||||||||||||||||||||||||

| Shares | Amount | Shares | Amount | Capital | Loss | Earnings | Shares | Amount | Equity | |||||||||||||||||||||||||||||||

| Balance – July 31, 2022 | $ | | $ | $ | $ | ( | ) | $ | $ | ( | ) | $ | | |||||||||||||||||||||||||||

| Stock-based compensation | - | |||||||||||||||||||||||||||||||||||||||

| Purchase of treasury stock | - | - | ( | ) | ( | ) | ||||||||||||||||||||||||||||||||||

| Foreign currency translation adjustment | - | - | ( | ) | ( | ) | ||||||||||||||||||||||||||||||||||

| Net loss | - | - | ( | ) | ( | ) | ||||||||||||||||||||||||||||||||||

| Balance – October 31, 2022 | ( | ) | ( | ) | ||||||||||||||||||||||||||||||||||||

| Restricted stock issuance in connection with GuruShots acquisition | - | ( | ) | |||||||||||||||||||||||||||||||||||||

| Stock-based compensation | - | |||||||||||||||||||||||||||||||||||||||

| Purchase of treasury stock | - | - | ( | ) | ( | ) | ||||||||||||||||||||||||||||||||||

| Foreign currency translation adjustment | - | - | ||||||||||||||||||||||||||||||||||||||

| Net income | - | - | ||||||||||||||||||||||||||||||||||||||

| Balance – January 31, 2023 | $ | $ | $ | $ | ( | ) | $ | $ | ( | ) | $ | |||||||||||||||||||||||||||||

See accompanying notes to unaudited condensed consolidated financial statements.

3

ZEDGE, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands)

(Unaudited)

| Six Months Ended | ||||||||

| January 31, | ||||||||

| 2024 | 2023 | |||||||

| Operating activities | ||||||||

| Net (loss) income | $ | ( | ) | $ | ||||

| Adjustments to reconcile net (loss) income to net cash provided by operating activities: | ||||||||

| Depreciation | ||||||||

| Amortization of intangible assets | ||||||||

| Amortization of capitalized software and technology development costs | ||||||||

| Amortization of deferred financing costs | ||||||||

| Stock-based compensation | ||||||||

| Impairment charge of intangible assets | ||||||||

| Impairment of investment in privately-held company | ||||||||

| Change in fair value of contingent consideration | - | ( | ) | |||||

| Deferred income taxes | ( | ) | ||||||

| Change in assets and liabilities: | ||||||||

| Trade accounts receivable | ( | ) | ( | ) | ||||

| Prepaid expenses and other current assets | ( | ) | ( | ) | ||||

| Other assets | ||||||||

| Trade accounts payable and accrued expenses | ||||||||

| Deferred revenue | ( | ) | ||||||

| Net cash provided by operating activities | ||||||||

| Investing activities | ||||||||

| Final payments for asset acquisitions | ( | ) | ||||||

| Capitalized software and technology development costs | ( | ) | ( | ) | ||||

| Purchase of property and equipment | ( | ) | ( | ) | ||||

| Net cash used in investing activities | ( | ) | ( | ) | ||||

| Financing activities | ||||||||

| Prepayment of term loan | ( | ) | ||||||

| Proceeds from term loan payable | ||||||||

| Payment of deferred financing costs | ( | ) | ||||||

| Proceeds from exercise of stock options | ||||||||

| Purchase of treasury stock in connection with share buyback program and stock awards vesting | ( | ) | ( | ) | ||||

| Net cash (used in) provided by financing activities | ( | ) | ||||||

| Effect of exchange rate changes on cash and cash equivalents | ( | ) | ( | ) | ||||

| Net (decrease) increase in cash and cash equivalents | ( | ) | ||||||

| Cash and cash equivalents at beginning of period | ||||||||

| Cash and cash equivalents at end of period | $ | $ | ||||||

| SUPPLEMENTAL DISCLOSURE OF CASH FLOW INFORMATION | ||||||||

| Cash payments made for income taxes | $ | $ | ||||||

| Cash payments made for interest expenses | $ | $ | ||||||

See accompanying notes to unaudited condensed consolidated financial statements.

4

ZEDGE, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

Note 1—Basis of Presentation and Summary of Significant Accounting Policies

Description of Business

Zedge, Inc. (“Zedge”) builds digital marketplaces and friendly competitive games around content that people use to express themselves. Our leading products include Zedge Ringtones and Wallpapers, which we refer to as our Zedge App, a freemium digital content marketplace offering mobile phone wallpapers, video wallpapers, ringtones, and notification sounds as well as pAInt, a generative AI wallpaper maker, GuruShots, a skill-based photo challenge game, and Emojipedia, the #1 trusted source for ‘all things emoji’. Our vision is to enable and connect creators who enjoy friendly competitions with a community of prospective consumers in order to drive commerce. Except where the context clearly indicates otherwise, the terms the “Company,” “Zedge” “we,” “us” or “our” refer to Zedge, Inc. and its consolidated subsidiaries.

Basis of Presentation

The accompanying unaudited condensed consolidated financial statements of Zedge, Inc. and its subsidiaries: GuruShots Ltd. (“GuruShots”); Zedge Europe AS; and Zedge Lithuania UAB (the “Company”), have been prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”) for interim financial information and with the instructions to Form 10-Q and Article 8 of Regulation S-X. Accordingly, they do not include all of the information and footnotes required by U.S. GAAP for complete financial statements. In the opinion of management, all adjustments (consisting of normal recurring accruals) considered necessary for a fair presentation have been included. Operating results for the three and six months ended January 31, 2024 and 2023 are not necessarily indicative of the results that may be expected for the fiscal year ending July 31, 2024 or any other period. The balance sheet at July 31, 2023 has been derived from the Company’s audited financial statements at that date but does not include all of the information and footnotes required by U.S. GAAP for complete financial statements. For further information, please refer to the consolidated financial statements and footnotes thereto included in the Company’s Annual Report on Form 10-K for the fiscal year ended July 31, 2023 (the “2023 Form 10-K”), as filed with the U.S. Securities and Exchange Commission (the “SEC”).

The Company’s fiscal year ends on July 31 of each calendar year. Each reference below to a fiscal year refers to the fiscal year ending in the calendar year indicated (e.g., fiscal 2023 refers to the fiscal year ended July 31, 2023).

Reportable Segments

Effective August 1, 2022, we revised the presentation

of segment information to reflect our acquisition of GuruShots. As such, we now report operating results through

Use of Estimates

The preparation of the Company’s unaudited condensed consolidated financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets, liabilities, revenue and expenses, as well as related disclosure of contingent assets and liabilities. Actual results could differ materially from the Company’s estimates due to risks and uncertainties, including uncertainty in the economic environment due to various global events. To the extent that there are material differences between these estimates and actual results, the Company’s financial condition or operating results will be affected. The Company bases its estimates on past experience and other assumptions that the Company believes are reasonable under the circumstances, and the Company evaluates these estimates on an ongoing basis.

5

Recently Issued Accounting Pronouncements

In November 2023, the Financial Accounting Standards Board ("FASB") issued Accounting Standards Update ("ASU") 2023-07 Segment Reporting (Topic 280): Improvements to Reportable Segment Disclosures. The guidance in ASU 2023-07 seeks to improve reportable segment disclosure requirements, primarily through enhanced disclosures about significant segment expenses. The amendments in this ASU require a public entity to disclose the following: significant segment expenses that are regularly provided to the chief operating decision maker ("CODM") and included within each reported measure of segment profit or loss; an amount for other segment items by reportable segment and a description of its composition; and the title and position of the CODM and how the CODM uses the reported measure(s) of segment profit or loss in assessing segment performance and deciding how to allocate resources. This ASU requires public entities to provide all annual disclosures about a reportable segment's profit or loss and assets currently required by Topic 280 in interim periods. ASU 2023-07 clarifies that if the CODM uses more than one measure of a segment's profit or loss in assessing segment performance and deciding how to allocate resources, a public entity may report one or more of those additional measures of segment profit. ASU 2023-07 is effective for fiscal years beginning after December 15, 2023, and interim periods within fiscal years beginning after December 15, 2024. Early adoption is permitted. ASU 2023-07 is a requirement for additional disclosure and is not expected to materially impact the consolidated financial statements.

In December 2023, the FASB issued ASU 2023-09

Income Taxes (Topic 740): Improvements to Income Tax Disclosures. The guidance in this ASU enhances the transparency and decision functionality

of income tax disclosures to provide investors information to better assess how an entity's operations and related tax risks, tax planning

and operational opportunities affect its tax rate and prospects for future cash flow. The amendments in this ASU require public entities

to disclose the following specific categories in the rate reconciliation by both percentages and reporting currency amounts: the effect

of state and local income tax, net of federal (national) income tax, foreign tax effects, effects of changes in tax laws or rates enacted

in the current period, effects of cross-border tax laws, tax credits, changes in valuation allowances, nontaxable or nondeductible items

and changes in unrecognized tax benefits. The amendments in ASU 2023-09 also require public entities to provide additional information

for reconciling items that meet the qualitative threshold (if the effect of those reconciling items is equal to or greater than

Related Party Transactions

The Company was formerly a majority-owned subsidiary of IDT Corporation (“IDT”). On June 1, 2016, IDT’s interest in the Company was spun-off by IDT to IDT’s stockholders and the Company became an independent public-held company. IDT charges the Company for services it provides, and the Company charges IDT for services it provides, pursuant to a Transition Services Agreement (“TSA”).

The Company is party to a consulting agreement with Activist Artist Management, LLC (“Activist”), which assists the Company in strategic business development. A member of the Company’s Board of Directors owns a significant minority stake in Activist.

Transactions with these related parties did not have a material impact to the consolidated balance sheets as of January 31, 2024 or July 31, 2023, or the consolidated statements of operations and comprehensive loss for the three and six months ended January 31, 2024 and 2023.

6

Note 2—Revenue

Disaggregation of Revenue

| Three Months Ended | Six Months Ended | |||||||||||||||

| January 31, | January 31, | |||||||||||||||

| 2024 | 2023 | 2024 | 2023 | |||||||||||||

| (in thousands) | ||||||||||||||||

| Zedge Marketplace | ||||||||||||||||

| Advertising revenue | $ | $ | $ | $ | ||||||||||||

| Paid subscription revenue | ||||||||||||||||

| Other revenues | ||||||||||||||||

| Total Zedge App revenue | ||||||||||||||||

| GuruShots | ||||||||||||||||

| Digital goods and services | ||||||||||||||||

| Total revenue | $ | $ | $ | $ | ||||||||||||

Contract Balances

The Company enters into contracts with its customers,

which may give rise to contract liabilities (deferred revenue) and contract assets (unbilled revenue). The payment terms and conditions

within the Company’s contracts vary by products or services purchased, substantially all of which are due in less than

Deferred revenues

On April 1, 2022, the AppLovin Corporation paid

the Company a one-time integration bonus of $

The Company also records deferred revenues when

users purchase or earn Zedge Credits. Unused Zedge Credits represent the value of the Company’s unsatisfied performance obligation

to its users. Revenue is recognized when Zedge App users use Zedge Credits to acquire Zedge Premium content or upon expiration of the

Zedge Credits upon 180 days of account inactivity (“Breakage”). As of January 31, 2024, and July 31, 2023, the Company’s

deferred revenue balance related to Zedge Premium was approximately $

The amount of deferred revenue recognized in the

six months ended January 31, 2024 that was included in the deferred revenue balance at July 31, 2023 was $

Significant Judgments

The advertising networks and advertising exchanges to which the Company sells its inventory track and report the impressions and revenues to Zedge and Zedge recognizes revenues based on these reports. The networks and exchanges base their payments off of those reports and Zedge independently compares the data to each of the client sites to validate the imported data and identify any differences. The number of impressions and revenues delivered by the advertising networks and advertising exchanges is determined at the end of each month, which resolves any uncertainty in the transaction price during the reporting period.

7

Practical Expedients

The Company expenses the fees retained by Google Play and App Store related to subscription revenue when incurred as marketing expense because the duration of the contracts for which the Company pays commissions are less than one year, except for the new lifetime subscriptions we rolled out in August 2023. These costs are included in the selling, general and administrative expenses of the condensed consolidated statements of operations and comprehensive (loss) income.

Note 3—Fair Value Measurements

| Level 1 | Level 2 | Level 3 | Total | |||||||||||||

| January 31, 2024 | ||||||||||||||||

| Liabilities: | ||||||||||||||||

| Foreign exchange forward contracts | $ | $ | | $ | $ | |||||||||||

| July 31, 2023 | ||||||||||||||||

| Assets: | ||||||||||||||||

| Foreign exchange forward contracts | $ | $ | $ | $ | ||||||||||||

(1) – quoted prices in active markets for identical assets or liabilities

(2) – observable inputs other than quoted prices in active markets for identical assets and liabilities

(3) – no observable pricing inputs in the market

Contingent Consideration

Contingent consideration related to business combinations are classified within Level 3 of the fair value hierarchy as the determination of fair value uses considerable judgement and represents the Company’s best estimate of an amount that could be realized in a market exchange for the asset or liability.

| Balance at July 31, 2022 | $ | |||

| Change in fair value | ( | ) | ||

| Balance at January 31, 2023 | $ |

The overall fair value of the contingent consideration

decreased by $

Fair Value of Other Financial Instruments

Fair value of the outstanding foreign exchange forward contracts are marked to market price at the end of each measurement period.

The Company’s other financial instruments at January 31, 2024 and July 31, 2023 included trade accounts receivable and trade accounts payable. The carrying amounts of other assets and liabilities such as prepaid expenses, trade accounts receivable and trade accounts payable approximated fair value due to their short-term nature.

Note 4—Derivative Instruments

The primary risk managed by the Company using derivative instruments is foreign exchange risk. Foreign exchange forward contracts are entered into as hedges against unfavorable fluctuations in the U.S. Dollar (USD) to Norwegian Kroner (NOK) and USD to Euro (EUR) exchange rates. The Company is party to a Foreign Exchange Agreement with Western Alliance Bank (“WAB”) allowing the Company to enter into foreign exchange contracts under its revolving credit facility with the bank (see Note 10 Term Loan and Revolving Credit Facility). The Company does not apply hedge accounting to these contracts, and therefore the changes in fair value are recorded in unaudited condensed consolidated statements of operations and comprehensive (loss) income. By using derivative instruments to mitigate exposures to changes in foreign exchange rates, the Company is exposed to credit risk from the failure of the counterparty to perform under the terms of the contract. The credit or repayment risk is minimized by entering into transactions with high-quality counterparties.

8

| Settlement Date | U.S. Dollar Amount | NOK Amount | ||||||

| Feb-24 | ||||||||

| Mar-24 | ||||||||

| Apr-24 | ||||||||

| May-24 | ||||||||

| Total | ||||||||

| Settlement Date | U.S. Dollar Amount | EUR Amount | ||||||

| Feb-24 | ||||||||

| Mar-24 | ||||||||

| Apr-24 | ||||||||

| May-24 | ||||||||

| Total | ||||||||

| January 31, | July 31, | |||||||||

| (in thousands) | 2024 | 2023 | ||||||||

| Assets and Liabilities Derivatives: | Balance Sheet Location | |||||||||

| Derivatives not designated or not qualifying as hedging instruments | ||||||||||

| Foreign exchange forward contracts | Other current assets | $ | $ | |||||||

| Foreign exchange forward contracts | Accrued expenses and other current liabilities | $ | $ | |||||||

| Three Months Ended January 31, | Six Months Ended January 31, | |||||||||||||||||

| Amount of Loss Recognized on Derivatives | 2024 | 2023 | 2024 | 2023 | ||||||||||||||

| Derivatives not designated or not qualifying as hedging instruments | Location of income (loss) recognized on derivatives | (in thousands) | (in thousands) | |||||||||||||||

| Foreign exchange forward contracts | Net loss resulting from foreign exchange transactions | $ | $ | ( | ) | $ | ||||||||||||

Note 5—Intangible Assets and Goodwill

Intangible assets are initially recorded at fair

value and stated net of accumulated amortization and impairments. The Company amortizes its intangible assets that have finite lives using

either the straight-line method, or if reliably determinable, based on the pattern in which the economic benefit of the asset is expected

to be utilized. Amortization is recorded over the estimated useful lives ranging from

9

| January 31, 2024 | July 31, 2023 | |||||||||||||||||||||||||||

| Gross Carrying Value | Accumulated Amortization | Allocation of Impairment Loss | Net Carrying Value | Gross Carrying Value | Accumulated Amortization | Net Carrying Value | ||||||||||||||||||||||

| Emojipedia.org and other internet domains acquired | ||||||||||||||||||||||||||||

| Acquired developed technology | ||||||||||||||||||||||||||||

| Customer relationships | ||||||||||||||||||||||||||||

| Trade names | ||||||||||||||||||||||||||||

| Total intangible assets | $ | $ | $ | $ | $ | $ | ||||||||||||||||||||||

During the second quarter of fiscal 2024, in connection with its company-wide strategic planning process as well as evaluating the current operating performance of its GuruShots reporting unit, including product enhancement and marketing, the Company reassessed its short-term and long-term commercial plans for this business. The Company made certain operational and strategic decisions to invest in, and increase its focus on, the long-term success of this business, which resulted in the Company significantly reducing its forecasted revenues and operating results.

As a result, the Company identified indicators

of impairment and performed an undiscounted cash flow analysis pursuant to ASC 360, Property, Plant, and Equipment - Overall, to

determine if the cash flows expected to be generated by the GuruShots business over the estimated remaining useful life of its primary

assets were sufficient to recover the carrying value of the asset group. Based on this analysis, the undiscounted cash flows were not

sufficient to recover the carrying value of the long-lived assets. As a result, the Company was required to perform Step 3 of the impairment

test and determine the fair value of the asset group. To estimate the fair value of the asset group, the Company utilized the income approach,

which is based on a discounted cash flow (DCF) analysis and calculates the fair value by estimating the after-tax cash flows attributable

to the asset group and then discounting the after-tax cash flows to present value using a risk-adjusted discount rate. Assumptions used

in the DCF require significant judgment, including judgment about appropriate discount rates, growth rates, and the amount and timing

of expected future cash flows. The forecasted cash flows were based on the Company's most recent strategic plan and for periods beyond

the strategic plan, the Company's estimates were based on assumed growth rates expected as of the measurement date. The Company believes

its assumptions were consistent with the plans and estimates that a market participant would use to manage the business. The discount

rate used was intended to reflect the risks inherent in future cash flow projections and was based on an estimate of the weighted average

cost of capital (WACC) of market participants relative to the asset group. The Company used a discount rate of

To record the adjustment of the carrying value

of the asset group to fair value, the Company recorded an impairment charge of $

10

| Fiscal 2024 | $ | |||

| Fiscal 2025 | ||||

| Fiscal 2026 | ||||

| Fiscal 2027 | ||||

| Fiscal 2028 | ||||

| Thereafter | ||||

| Total | $ |

The Company’s amortization expense for intangible

assets were $

Goodwill

| (in thousands) | Carrying Amounts | |||

| Balance as of July 31, 2023 | ||||

| Impact of currency translation | ( | ) | ||

| Balance as of January 31, 2024 | $ | |||

The total accumulated impairment loss of the Company’s

goodwill as of January 31, 2024 was $

Note 6—Accrued Expenses and Other Current Liabilities

| January 31, | July 31, | |||||||

| 2024 | 2023 | |||||||

| Accrued payroll and bonuses | $ | $ | ||||||

| Accrued vacation | ||||||||

| Accrued payroll taxes | ||||||||

| Due to artists | ||||||||

| Accrued expenses | ||||||||

| Operating lease liability-current portion | ||||||||

| Derivative liability for foreign exchange contracts | - | |||||||

| Accrued income taxes payable | ||||||||

| Due to related party - IDT | ||||||||

| Total accrued expenses and other current liabilities | $ | $ | ||||||

Note 7—Stock-Based Compensation

2016 Incentive Plan

On March 23, 2022, the Company’s Board of

Directors amended the Company’s 2016 Stock Option and Incentive Plan (as amended to date, the “2016 Incentive Plan”)

to increase the number of shares of the Company’s Class B common stock available for the grant of awards thereunder by an additional

11

At January 31, 2024, there were

Stock-based compensation

The Company recognizes stock-based compensation for stock-based awards, including stock options, restricted stock and DSUs based on the estimated fair value of the awards and recognized over the relevant service period and/or market conditions. The Company estimates the fair value of stock options on the measurement date using the Black-Scholes option valuation model. The Company estimates the fair value of the restricted stock and DSU’s with service conditions only using the current market price of the stock. The Company estimates the fair value of the DSU’s with both service and market conditions using the Monte Carlo Simulation valuation model.

The Black-Scholes and Monte Carlo Simulation valuation

models incorporate assumptions as to stock price volatility, the expected life of options or awards, a risk-free interest rate and dividend

yield. The Company recognizes stock-based compensation expense related to options and restricted stock units on a straight-line basis

over the service period of the award, which is generally

| Three Months Ended January 31, |

Six Months Ended January 31, |

|||||||||||||||

| 2024 | 2023 | 2024 | 2023 | |||||||||||||

| (in thousands) | ||||||||||||||||

| Stock-based compensation expense | $ | $ | $ | $ | ||||||||||||

As of January 31, 2024, the Company’s unrecognized

stock-based compensation expense was $

In the six months ended January 31, 2024 and 2023,

awards of restricted stock and DSUs with respect to

Repricing of Outstanding and Unexercised Options

On October 20, 2022, the Board unanimously approved

the repricing of all then outstanding and unexercised stock options granted under the 2016 Incentive Plan with exercise prices above the

then current market value held by then current employees, executive officers, and consultants of the Company (the “Eligible Stock

Options”). Effective October 20, 2022, the exercise price of the eligible stock options was reduced to $

Pursuant to the 2016 Incentive Plan, the Compensation

Committee of the Board of Directors, as the administrator, has discretionary authority, exercisable on such terms and conditions that

it deems appropriate under the circumstances, to reduce the exercise price in effect for outstanding options under the 2016 Incentive

Plan. In approving the repricing, the Compensation Committee considered the impact of the current exercise prices of outstanding stock

options on the incentives provided to employees and consultants, the lack of retention value provided by the outstanding stock options

to employees and consultants, and the impact of such options on the capital structure of the Company. As of October 20, 2022, there were

12

Jonathan Reich, the Company’s Chief Executive

Officer, and Yi Tsai, the Company’s Chief Financial Officer, held Eligible Stock Options exercisable for an aggregate of

The option repricing resulted in incremental stock-based

compensation of $

Note 8—Earnings Per Share

Basic earnings per share is computed by dividing net income attributable to all classes of common stockholders of the Company by the weighted average number of shares of all classes of common stock outstanding during the applicable period. Diluted earnings per share is computed in the same manner as basic earnings per share, except that the number of shares is increased to include restricted stock still subject to risk of forfeiture, issuances to be made on the vesting of unvested DSUs and the exercise of potentially dilutive stock options using the treasury stock method, unless the effect of such increase is anti-dilutive.

The rights of holders of Class A common stock and Class B common stock are identical except for certain voting and conversion rights and restrictions on transferability. As such, the Company is not required to break out earnings per share by class.

| Three Months Ended | Six Months Ended | |||||||||||||||

| January 31, | January 31, | |||||||||||||||

| 2024 | 2023 | 2024 | 2023 | |||||||||||||

| Basic weighted-average number of shares | ||||||||||||||||

| Effect of dilutive securities: | ||||||||||||||||

| Stock options | ||||||||||||||||

| Non-vested restricted Class B common stock | ||||||||||||||||

| Deferred stock units | ||||||||||||||||

| Diluted weighted-average number of shares | ||||||||||||||||

| Three Months Ended | Six Months Ended | |||||||||||||||

| January 31, | January 31, | |||||||||||||||

| 2024 | 2023 | 2024 | 2023 | |||||||||||||

| Stock options | ||||||||||||||||

| Non-vested restricted Class B common stock | ||||||||||||||||

| Deferred stock units | ||||||||||||||||

| Shares excluded from the calculation of diluted earnings per share | ||||||||||||||||

For the three and six months ended January 31, 2024, the diluted earnings per share equals basic earnings per share because the Company incurred a net loss during those periods and the impact of the assumed exercise of stock options and vesting of restricted stock and DSUs would have been anti-dilutive.

13

Note 9—Commitments and Contingencies

Commitments

In connection with the acquisition of GuruShots,

the Company (i) committed to a retention pool of $

At the end of the first quarter of fiscal 2024, the Company and the prior owners of GuruShots agreed to withdraw and settle claims related to the purchase agreement pursuant to which the Company purchased the equity of GuruShots, including any dispute about minimum user acquisition spend for GuruShots, any right of the prior owners to an earnout payment and the Company’s claim for indemnification related to alleged misrepresentations in the agreement.

Legal Proceedings

The Company may from time to time be subject to other legal proceedings that arise in the ordinary course of business. Although there can be no assurance in this regard, the Company does not expect any of those legal proceedings to have a material adverse effect on the Company’s results of operations, cash flows or financial condition.

Note 10—Term Loan and Revolving Credit Facility

As of September 27, 2016, the Company entered into

a loan and security agreement with WAB for a revolving credit facility of up to $

Pursuant to the Amended Loan Agreement, the Company

discontinued the then existing $

Pursuant to the Amended Loan Agreement, $

Interest accrued under the Amended Loan Agreement

is due monthly, and the Company shall make monthly interest-only payments related to the term loan through the eighteen (18) month anniversary

of the closing date. From the nineteen (19) month anniversary of the Closing Date through the maturity date, the Company shall repay each

outstanding term loan by paying the Applicable Term Advance Amortization Payment equal to 1/12th of

On November 15, 2023, the Company elected to prepay

the entire principal amount of $

14

The Amended Loan Agreement may also require early repayments if certain conditions are met. Borrowings under the Amended Loan Agreement is secured by substantially all of the assets of the Company, its subsidiaries, and certain of its affiliates.

The Amended Loan Agreement includes the following financial covenants:

| a) | Debt

Service Coverage Ratio. Zedge shall maintain, at all times, a Debt Service Coverage Ratio of no less than |

| b) | Maximum Debt to EBITDA. Zedge shall maintain, at all times, a ratio of (a) indebtedness owed by Zedge to WAB, to (b) Zedge’s EBITDA for the trailing twelve (12) month period ended on such date of determination, shall not be greater than the amount set forth under the heading “Maximum Debt to EBITDA Ratio” as of, and for each of the dates appearing adjacent to such Maximum Debt to EBITDA Ratio”. |

| Maximum Debt to Quarter Ending | EBITDA Ratio | |

| October 31, 2022 | ||

| January 31, 2023 | ||

| April 30, 2023 | ||

| July 31, 2023 | ||

| October 31, 2023 | ||

| January 31, 2024 | ||

| April 30, 2024 | ||

| July 31, 2024 | ||

| Thereafter | To be agreed upon |

The Amended Loan Agreement also includes customary negative covenants, subject to exceptions, which limit transfers, capital expenditures, indebtedness, certain liens, investments, acquisitions, dispositions of assets, restricted payments and the business activities of the Company, as well as customary representations and warranties, affirmative covenants and events of default, including cross defaults and a change of control default.

As of November 16, 2016, the Company entered into

a Foreign Exchange Agreement with WAB to allow the Company to enter into foreign exchange contracts not to exceed

Note 11—Segment and Geographic Information

Segment Information

Operating segments are components of an enterprise about which separate financial information is available that is evaluated regularly by the chief operating decision maker (“CODM”), or decision-making group, in deciding how to allocate resources and in assessing performance. The Company’s chief operating decision maker is its Chief Executive Officer as of January 31, 2024.

Beginning in the first quarter of fiscal 2023,

the Company revised the presentation of segment information to align with changes to how the Company’s CODM manages the business,

allocates resources and assesses operating performance reports operating results based on

15

| Three Months Ended January 31, | Six Months Ended January 31, | |||||||||||||||

| 2024 | 2023 | 2024 | 2023 | |||||||||||||

| Revenue: | ||||||||||||||||

| Zedge Marketplace | $ | $ | $ | $ | ||||||||||||

| GuruShots | ||||||||||||||||

| Total Revenue | $ | $ | $ | $ | ||||||||||||

| Segment income (loss) from operations: | ||||||||||||||||

| Zedge Marketplace | $ | $ | $ | $ | ||||||||||||

| GuruShots | ( | ) | ( | ) | ( | ) | ( | ) | ||||||||

| Total (loss) income from operations: | $ | ( | ) | $ | $ | ( | ) | $ | ||||||||

The CODM does not evaluate operating segments using asset information and, accordingly, the Company does not report asset information by segment.

Geographic Information

| United States | Foreign | Total | ||||||||||

| Long-lived assets, net: | ||||||||||||

| January 31, 2024 | $ | $ | $ | |||||||||

| July 31, 2023 | $ | $ | $ | |||||||||

| Total assets: | ||||||||||||

| January 31, 2024 | $ | $ | $ | |||||||||

| July 31, 2023 | $ | $ | $ | |||||||||

Note 12— Operating Leases

The Company has operating leases primarily for

office space. Operating lease right-of-use assets recorded and included in other assets were $

There were no material changes in the Company’s operating and finance leases in the six months ended January 31, 2024, as compared to the disclosure regarding such leases in the Company’s 2023 Form 10-K.

Note 13—Income Taxes

The Company’s tax provision or benefit from income taxes for interim periods has generally been determined using an estimate of its annual effective tax rate applied to year-to-date income and records the discrete tax items in the period to which they relate. In each quarter, the Company updates the estimated annual effective tax rate and makes a year-to-date adjustment to the tax provision as necessary.

16

The Company’s estimated annual effective tax rate for the fiscal year ending July 31, 2024 differs from the U.S. federal statutory tax rate due to certain items primarily related to stock-based compensation expense, jurisdictional mix of earnings, foreign derived intangible income deduction, global intangible low-taxed income and the change in basis differences associated with tax deductible goodwill.

As of January 31, 2024,

the Company had $

The Company is subject to taxation in the United States and certain foreign jurisdictions. Earnings from non-U.S. activities are subject to local country income tax. The material jurisdictions where the Company is subject to potential examination by tax authorities include the United States, Norway, Lithuania and Israel.

Note 14—Subsequent Event

| Settlement Date | U.S. Dollar Amount | NOK Amount | ||||||

| Jun-24 | ||||||||

| Jul-24 | ||||||||

| Aug-24 | ||||||||

| Sep-24 | ||||||||

| Oct-24 | ||||||||

| Nov-24 | ||||||||

| Total | ||||||||

| Settlement Date | U.S. Dollar Amount | EUR Amount | ||||||

| Jun-24 | ||||||||

| Jul-24 | ||||||||

| Aug-24 | ||||||||

| Sep-24 | ||||||||

| Oct-24 | ||||||||

| Nov-24 | ||||||||

| Total | ||||||||

17

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

The following information should be read in conjunction with the accompanying unaudited condensed consolidated financial statements and the associated notes thereto of this Quarterly Report, and the audited consolidated financial statements and the notes thereto and our Management’s Discussion and Analysis of Financial Condition and Results of Operations contained in our Annual Report on Form 10-K for the fiscal year ended July 31, 2023 (the “2023 Form 10-K”), as filed with the U.S. Securities and Exchange Commission (the “SEC”).

As used below, unless the context otherwise requires, the terms “the Company,” “Zedge,” “we,” “us,” and “our” refer to Zedge, Inc., a Delaware corporation and its subsidiaries, GuruShots Ltd., Zedge Europe AS and Zedge Lithuania UAB, collectively.

Forward-Looking Statements

This Quarterly Report on Form 10-Q contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, including statements that contain the words “believes,” “anticipates,” “expects,” “plans,” “intends,” and similar words and phrases. These forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially from future results. Factors that may cause such differences include, but are not limited to: (1) economic, geopolitical and market conditions can adversely affect our business, results of operations and financial condition, including our revenue growth and profitability, which in turn could adversely affect our stock price; (2) our ability to successfully make acquisitions and/or successfully integrate acquisitions that we have made into Zedge without incurring unanticipated costs or without being subject to other integration issues that may disrupt our existing operations; (3) delay or failure to realize the expected synergies and benefits of the GuruShots acquisition; (4) the impact of the Covid-19 pandemic on our employees, customers, partners, and the global financial markets; (5) Russia’s invasion of Ukraine, and the international community’s response; and (6) recent attack by Hamas and other terrorist organizations from the Gaza Strip and Israel’s war against them. For further information regarding risks and uncertainties associated with our business, please refer to Item 1A to Part I “Risk Factors” in the 2023 Form 10-K. The forward-looking statements are made as of the date of this report and we assume no obligation to update the forward-looking statements, or to update the reasons why actual results could differ from those projected in the forward-looking statements. Investors should consult all of the information set forth in this report and the other information set forth from time to time in our reports filed with the SEC pursuant to the Securities Act of 1933 and the Securities Exchange Act of 1934, including the 2023 Form 10-K.

Geo-Political and Macroeconomic Conditions and the COVID-19 Pandemic

We are subject to risks and uncertainties caused by events with significant macroeconomic impacts, including but not limited to, rising interest rates, actions taken to counter inflation, reduced consumer confidence, supply side disruptions, the COVID-19 pandemic, Russia’s invasion of Ukraine and the Israel-Hamas war. The future and full impact that these factors may have on our business, financial condition, and results of operations is unclear. The risks related to our business are further described in the section titled “Risk Factors” in Part II, Item 1A of this Quarterly Report on Form 10-Q and those discussed under Item 1A to Part I “Risk Factors” in the 2023 Form 10-K.

Impact of Russia’s Invasion of Ukraine

We are closely monitoring the current and potential impact on our business, our people, and our users/customers as Russia’s war with Ukraine evolves. We have taken steps to comply with applicable domestic and international regulatory restrictions on international trade and financial transactions. Revenues associated with our users/customers in Russia and Belarus are not material to our consolidated financial results, and we anticipate that blocking Russian and Belarus users/customers’ access to our mobile app and web platforms will not have a material impact on our business. Management and our Board of Directors are monitoring the regional and global ramifications of the continuing events.

Impact of Israel-Hamas War

Given our operations in Israel, the impact of economic, political, geopolitical, and military conditions in the region directly affects us, including conflicts involving missile strikes, infiltrations, and terrorism. Notably, on October 7, 2023, Hamas launched attacks in southern Israel, resulting in casualties and military engagement. In addition, Hezbollah, another terrorist organization based in Lebanon has been indiscriminately shelling Israel. The extent and duration of this conflict remain uncertain, potentially involving other groups. Israel’s response led to the mobilization of reservists, affecting our workforce. Prior to this, proposed changes to Israel’s judicial system had already raised concerns about the business environment, compounded by recent events, potentially impacting foreign investment, currency fluctuations, credit ratings, interest rates, and security markets. Furthermore, regional political unrest and threats from extremist groups, notably Iran, pose additional risks. Management and our Board of Directors are closely monitoring the situation in Israel to address potential business disruptions and implications and cannot reasonably estimate the impact to the consolidated financial statements at this time.

18

COVID-19 Update

Although the World Health Organization declared in early May of 2023 that COVID-19 no longer constitutes a public health emergency we continue to actively monitor the COVID-19 developments and potential impact on our employees, business and operations. The effects of COVID-19 did not have a material impact on our result of operations or financial condition for the fiscal year ended July 31, 2023. However, given the evolution of the COVID-19 situation, and the global responses to curb its spread, we are not able to estimate the effects COVID-19 may have on our future results of operations or financial condition.

Overview

Zedge, Inc. (“Zedge”) builds digital marketplaces and friendly competitive games around content that people use to express themselves. Our leading products include Zedge Ringtones and Wallpapers, which we refer to as our Zedge App, a freemium digital content marketplace offering mobile phone wallpapers, video wallpapers, ringtones, and notification sounds as well as pAInt, a generative AI wallpaper maker, GuruShots, a skill-based photo challenge game, and Emojipedia, the #1 trusted source for ‘all things emoji’. Our vision is to enable and connect creators who enjoy friendly competitions with a community of prospective consumers in order to drive commerce.

We are part of the ‘Creator Economy,’ where over 1 billion people create and share their content across social platforms, mobile, and video games, and content marketplaces. According to Linktree, over 200 million identify as creators, people who use their influence, skill, and creativity to amass an audience and monetize it. Furthermore, TechCrunch reports that 12% of full-time creators earn more than $50,000 per year, while Influencer Hub reports 10% of influencers earn more than $100,000 per year. We view the Creator Economy as an opportunity for Zedge to expand its business, especially as we execute by connecting our gamers with our marketplace.

The Zedge Ringtones and Wallpapers app (which is named “Zedge Wallpapers” in the App Store), which we refer to as our “Zedge App,” offers a wide array of mobile personalization content including wallpapers, video wallpapers, ringtones, and notification sounds, and is available both in Google Play and the App Store. As of January 31, 2024, our Zedge App has been installed nearly 648 million times since inception and had 28.8 million monthly active users (“MAU”) as of January 31, 2024. MAU is a key performance indicator (“KPI”) that captures the number of unique users that used our Zedge App during the final 30 days of the relevant period. Our platform allows creators to upload content to our marketplace and avail it to our users either for free or for a price, via ‘Zedge Premium,’ the section of our marketplace where we offer premium content (i.e., for purchase). In turn, our users utilize the content to personalize their phones and express their individuality.

In fiscal 2023, we introduced pAInt, a generative AI wallpaper maker in the Zedge App. A generative AI wallpaper maker is an implementation of artificial intelligence software that can create images from text descriptions. To interface with a generative AI image maker, a user enters a text description of the image they want to create, and the software generates an image based on that description. In addition, we upgraded Zedge+, our paid subscription offering, by bundling together an ad-free experience with value adds making the offering more compelling.

In fiscal 2022, we introduced several new customer-facing product features and social and community features, all meant to improve customer engagement, MAU, and revenue growth over the long term.

The Zedge Marketplace monetization stack consists of advertising revenue generated when users view advertisements when using the Zedge App (and the related functionality under the zedge.net website), the in-app (or web-based) sale of Zedge Credits, our virtual currency, that is used to purchase Zedge Premium content, and a paid-subscription offering that provides an ad-free experience to users that purchase a weekly, monthly, annual or lifetime subscription. In April 2023, we introduced a subscription tier in the iOS version of the app. As of January 31, 2024, we had approximately 648,000 active subscribers.

19

We often refer to our freemium ringtones and wallpapers, our subscription offering, the functionality for creators to market their products and ancillary offering and features both in our Zedge App and website, as our Zedge Marketplace.

In April 2022, we acquired GuruShots, a recognized category leader focused on gamifying the photography vertical. GuruShots offers a platform spanning iOS, Android, and the web that provides a fun, educational and structured way for amateur photographers to compete in a wide variety of contests showcasing their photos while gaining recognition with votes, badges, and awards. We estimate that the total addressable market of amateur photographers using their smartphones to take and publicly share artistic photos is 30-40 million people per month and that the market is still in its infancy. Every month, GuruShots stages more than 300 competitions that result in players uploading in excess of 700,000 photographs and casting close to 3.5 billion “perceived votes, which are calculated by multiplying the number of votes that each player casts by a weighting factor based on various factors related to that user. To improve engagement, GuruShots has adopted a set of retention dynamics focused on individual, team and community dynamics that create a sense of belonging, inspiration, recognition, improvement, and competition.

Today, GuruShots utilizes a ‘Free-to-Play’ business model that leads to strong monetization with the purchase of resources that are used to give paying players an edge while still maintaining a fair and competitive experience for all participants.

As we look to the future, we are advancing several initiatives that we expect will drive user growth, increase engagement, drive in-app purchases, and advance our in-game economy. Some of these include:

| ● | New Gameplay Experiences. Introducing a new hybrid-casual gameplay experience that enables users to compete in short-duration photo and image competitions that are limited in size. |

| ● | On-Boarding. Revamping the customer onboarding experience in order to maximize first time purchasers by immediately drawing new players into simplified photo competitions that are limited to a small audience taking place in a short time duration. |

| ● | Economy. Evolving the game economy by maturing the game’s progression mechanics and features, earn and spend dynamics, and introducing soft and premium currencies tied to resources and benefits. Furthermore, we have started preliminary testing of advertising on web and expect to extend that to the mobile apps during the summer. |

We market GuruShots to prospective players, primarily via paid user acquisition channels, and utilize a host of creative formats including static and video ads in order to promote the game. Our marketing team invests material resources in analyzing all attributes of a campaign ranging from the creative assets, offer acquisition channel, and platform (i.e., iOS, Android, and web), just to name a few, with the goal of determining whether a specific campaign is likely to yield a profitable customer. When we unearth a successful combination of these variables we scale up until we experience diminishing returns. Ultimately, we believe that the efforts we are making to advance the product coupled with the investment in user acquisition can significantly increase GuruShots’ player base.

Beyond our commitment to growing both the Zedge App and GuruShots on a standalone basis, we believe that there are many potential synergies that we can capitalize on that exist between the two businesses. Specifically, we plan to enable the ability for GuruShots players to become Zedge Premium artists and sell their photos to our audience of 28+ million MAU as standard digital images or NFTs. In addition, we look to benefit from the experience that the GuruShots team possesses and test gamifying the Zedge App. We believe that successful gamification can contribute to increasing engagement, retention, and lifetime value, all critical KPIs for our business. Longer term, we believe that there are complementary content verticals that lend themselves to gamification. To this end we have been developing a new hybrid casual title, ‘AI Art Master,’ which enables players to create generative AI images and compete in themed based competitions with these images. Our new mobile game, AI Art Master, is presently in its soft-launch phase across the Philippines, Poland, and India. Based on analyzing user data and performing extensive user testing, we expect to refine the user experience and game mechanics to better convert installs into engaged players, enhance retention, and develop a robust in-game economy and make determinations as to further investment.

In August 2021, we acquired the assets of Emojipedia Pty Ltd (“Emojipedia”), including Emojipedia.org the world’s leading authority dedicated to providing up-to-date and well-researched emoji definitions, information, and news as well as World Emoji Day and the annual World Emoji Awards. In January 2024, Emojipedia received approximately 32 million monthly page views and has approximately 8.7 million monthly active users as of January 31, 2024 of which approximately 50.2% are located in well-developed markets. It is the top resource for all things emoji, offering insights into data and cultural trends. As a member of the Unicode Consortium, the standards body responsible for approving new emojis, Emojipedia works alongside major emoji creators including Apple, Google, Meta, and X, formally known as Twitter.

20

We believe that Emojipedia provides growth potential to the Zedge App, and it was immediately accretive to earnings post acquisition in August 2021. In the past year, we have made many changes to Emojipedia including migrating to a new ad mediation platform, overhauling its backend, and redesigning the Emojipedia website. We will continue to enhance this offering and are exploring new features including a native mobile offering as well as additional monetization opportunities.

Critical Accounting Policies

Our unaudited condensed consolidated financial statements and accompanying notes are prepared in accordance with accounting principles generally accepted in the United States of America, or U.S. GAAP. Our significant accounting policies are described in Note 1 to the consolidated financial statements included in the 2023 Form 10-K. The preparation of financial statements requires management to make estimates and assumptions that affect the reported amounts of assets, liabilities, revenues and expenses as well as the disclosure of contingent assets and liabilities. Critical accounting policies are those that require application of management’s most subjective or complex judgments, often as a result of matters that are inherently uncertain and may change in subsequent periods. Our critical accounting policies include those related to revenue recognition, business combination, intangible assets and goodwill, capitalized software and technology development costs, and stock-based compensation. Management bases its estimates and judgments on historical experience and other factors that are believed to be reasonable under the circumstances. Actual results may differ from these estimates under different assumptions or conditions. For additional discussion of our critical accounting policies, see our Management’s Discussion and Analysis of Financial Condition and Results of Operations in the 2023 Form 10-K.

Recently Issued Accounting Pronouncements

Please refer to Note 1 to the unaudited condensed consolidated financial statements included in Item 1 to Part I of this Quarterly Report on Form 10-Q.

Key Performance Indicators (KPIs)

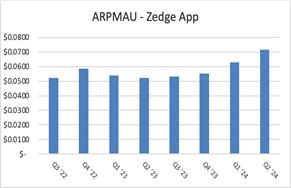

Zedge App-MAU and ARPMAU

The presentation of our results of operations related to our Zedge App includes disclosure of two key performance indicators – Monthly Active Users (MAU) and Average Revenue Per Monthly Active User (ARPMAU). MAU is a key performance indicator that we define as the number of unique users that used our Zedge App during the previous 30-day period, which is important to understanding the size of our active user base which is a main driver of our revenue. Changes and trends in MAU are useful for measuring the general health of our business, gauging both present and potential users/customers’ experience, assessing the efficacy of product improvements and marketing campaigns and overall user engagement.

ARPMAU is defined as (i) the total revenue derived from Zedge App in a monthly period, divided by (ii) MAU in that same period. ARPMAU for a particular time period longer than one month is the average ARPMAU for each month during that period. ARPMAU is valuable because it provides insight into how well we monetize our users and, changes and trends in ARPMAU are indications of how effective our monetization investments are.

MAU decreased 10.6% in the three ended January 31, 2024 when compared to the same period a year ago, primarily attributable to lackluster year-over-year growth in global new mobile phone purchases. Additionally, we have experienced a continuing shift in our regional customer make-up with MAU in emerging markets (particularly India) representing an increasing portion of our user base. As of January 31, 2024, users in emerging markets represented about 78.1% of our MAU, as compared to 77.0% from the same period a year ago. ARPMAU for the three months ended January 31, 2024 increased 36.7% when compared to the same period a year ago, primarily due to the increase in price per advertising impression from the same period a year ago which was negatively impacted by the geopolitical and macroeconomic conditions in fiscal 2023 as well as strong year-over-year subscription revenue growth.

21

The following tables present the MAU – Zedge App and ARPMAU – Zedge App for the three months ended January 31, 2024 as compared to the same period in the prior year:

| Three Months Ended January 31, | ||||||||||||

| (in millions, except ARPMAU - Zedge App) | 2024 | 2023 | % Change | |||||||||

| MAU- Zedge App | 28.8 | 32.2 | -10.6 | % | ||||||||

| Developed Markets MAU - Zedge App | 6.3 | 7.4 | -14.9 | % | ||||||||

| Emerging Markets MAU - Zedge App | 22.5 | 24.8 | -9.3 | % | ||||||||

| Emerging Markets MAU - Zedge App/Total MAU - Zedge App | 78.1 | % | 77.0 | % | 1.4 | % | ||||||

| ARPMAU - Zedge App | $ | 0.0715 | $ | 0.0523 | 36.7 | % | ||||||

The following charts present the MAU – Zedge App and ARPMAU – Zedge App for the consecutive eight fiscal quarters ended January 31, 2024:

|

|

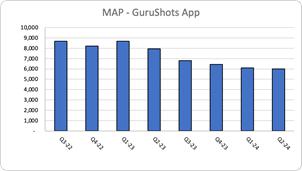

GuruShots-MAPs and ARPMAP

The presentation of our results of operations related to our GuruShots segment includes disclosure of two key performance indicators as discussed below:

Monthly Active Payers (“MAPs”). We define a MAP as a unique active user on the GuruShots app or GuruShots.com in a month that completed at least one in-app purchase (“IAP”) during that time period. MAPs for a time period longer than one month are the average MAPs for each month during that period. We estimate the number of MAPs by aggregating certain data from third-party attribution platforms. MAP is a key performance indicator because it shows the size of our active paying user base which is a main driver of our revenue. Changes and trends in MAP are useful for measuring the general health of GuruShots’ business, gauging both present and potential users/customers’ experience, assessing the efficacy of product improvements and marketing campaigns and overall user engagement.

Average Revenue Per Monthly Active Payer (“ARPMAP”). We define ARPMAP as (i) the total revenue from IAPs derived from GuruShots and GuruShots.com in a monthly period, divided by (ii) MAPs in that same period. ARPMAP for a particular time period longer than one month is the average ARPMAP for each month during that period. ARPMAP shows how efficiently we are monetizing each MAP.

MAP decreased 24.3% in the three months ended January 31, 2024 when compared to the same period a year ago, primarily attributable to Apple’s App Tracking Transparence (“ATT”) framework which impedes our ability to invest in paid user acquisition (“PUA”) campaigns profitably in terms of return on ad spend or (“ROAS”). As such, we continued to scale back our PUA spend for GuruShots while testing new campaigns and creatives in order to unearth attractive ROAS scaling opportunities. ARPMAP decreased 3.8% to $50.4 in the three months ended January 31, 2024 from $52.4 in the three months ended January 31, 2023.

22

The following table shows our MAP and ARPMAP for the three and six months ended January 31, 2024 and 2023.

| Three Months Ended January 31, | ||||||||||||

| 2024 | 2023 | % Change | ||||||||||

| Monthly Active Payers | 6,009 | 7,943 | -24.3 | % | ||||||||

| Average Revenue per Monthly Active Payer | $ | 50.4 | $ | 52.4 | -3.8 | % | ||||||

The following charts present the MAP and ARPMAP – GuruShots for the consecutive eight quarters ended January 31, 2024:

|

|

Our KPIs related to GuruShots are not based on any standardized industry methodology and are not necessarily calculated in the same manner that other companies or third parties may use to calculate these or similarly titled measures. The numbers that we use to calculate MAP and ARPMAP are derived from data that we generate internally. While these numbers are based on what we believe to be reasonable judgments and estimates for the applicable period of measurement, there are inherent challenges in measuring usage and engagement. We regularly review and may adjust our processes for calculating our internal metrics to improve their accuracy.

Results of Operations

The following table summarizes our historical condensed consolidated statements of operations data:

| Three Months Ended | Six Months Ended | |||||||||||||||||||||||

| January 31, | Change | January 31, | Change | |||||||||||||||||||||

| 2024 | 2023 | % | 2024 | 2023 | % | |||||||||||||||||||

| (in thousands, except percentages) | ||||||||||||||||||||||||

| Revenues | $ | 7,771 | $ | 6,983 | 11.3 | % | $ | 14,852 | $ | 13,883 | 7.0 | % | ||||||||||||

| Direct cost of revenues | 458 | 632 | -27.5 | % | 944 | 1,264 | -25.3 | % | ||||||||||||||||

| Selling, general and administrative | 6,523 | 5,871 | 11.1 | % | 12,022 | 11,697 | 2.8 | % | ||||||||||||||||

| Depreciation and amortization | 762 | 815 | -6.5 | % | 1,537 | 1,608 | -4.4 | % | ||||||||||||||||

| Impairment of intangible assets | 11,958 | - | nm | 11,958 | - | nm | ||||||||||||||||||

| Change in fair value of contingent consideration | - | (1,793 | ) | nm | - | (1,943 | ) | nm | ||||||||||||||||

| (Loss) income from operations | (11,930 | ) | 1,458 | nm | (11,609 | ) | 1,257 | nm | ||||||||||||||||

| Interest and other income, net | 165 | 77 | 114.3 | % | 246 | 112 | 119.6 | % | ||||||||||||||||

| Net gain (loss) resulting from foreign exchange transactions | 76 | 160 | -52.5 | % | (143 | ) | 84 | nm | ||||||||||||||||

| Income tax (benefit) provision | (2,459 | ) | 89 | nm | (2,260 | ) | 16 | nm | ||||||||||||||||

| Net (loss) income | $ | (9,230 | ) | $ | 1,606 | nm | $ | (9,246 | ) | $ | 1,437 | nm | ||||||||||||

nm-not meaningful

23

Comparison of Our Results of Operations for the Three and Six Months Ended January 31, 2024 and 2023

Revenues

The following table sets forth the composition of our revenues for the three and six months ended January 31, 2024 and 2023 (in thousands):

| Three Months Ended | Six Months Ended | |||||||||||||||||||||||

| January 31, | January 31, | |||||||||||||||||||||||

| 2024 | 2023 | % Changes | 2024 | 2023 | % Changes | |||||||||||||||||||

| (in thousands, except percentages) | ||||||||||||||||||||||||

| Zedge Marketplace | ||||||||||||||||||||||||

| Advertising revenue | $ | 5,482 | $ | 4,630 | 18.4 | % | $ | 10,421 | $ | 9,120 | 14.3 | % | ||||||||||||

| Paid subscription revenue | 1,088 | 875 | 24.3 | % | 2,064 | 1,766 | 16.9 | % | ||||||||||||||||

| Other revenues | 282 | 230 | 22.6 | % | 504 | 420 | 20.0 | % | ||||||||||||||||

| Total Zedge App revenue | 6,852 | 5,735 | 19.5 | % | 12,989 | 11,306 | 14.9 | % | ||||||||||||||||

| GuruShots | ||||||||||||||||||||||||

| Digital goods and services | 919 | 1,248 | -26.4 | % | 1,863 | 2,577 | -27.7 | % | ||||||||||||||||

| Total revenue | $ | 7,771 | $ | 6,983 | 11.3 | % | $ | 14,852 | $ | 13,883 | 7.0 | % | ||||||||||||

The following table summarizes subscription revenue for the three and six months ended January 31, 2024 and 2023:

| Three Months Ended January 31, | Six Months Ended January 31, | |||||||||||||||||||||||

| 2024 | 2023 | % Change | 2024 | 2023 | % Change | |||||||||||||||||||

| (in thousands, except revenue per subscriber and percentages) | ||||||||||||||||||||||||

| Subscription Revenue | $ | 1,088 | $ | 875 | 24.3 | % | $ | 2,064 | 1,766 | $ | 16.9 | % | ||||||||||||

| Active subscriptions net increase (decrease) | - | (20 | ) | nm | 1 | (38 | ) | nm | ||||||||||||||||

| Active subscriptions at end of period | 648 | 654 | -0.9 | % | 648 | 654 | -0.9 | % | ||||||||||||||||

| Average active subscriptions during the period | 648 | 665 | -2.6 | % | 651 | 674 | -3.4 | % | ||||||||||||||||

| Average monthly revenue per active subscription | $ | 0.56 | $ | 0.44 | 27.3 | % | $ | 0.53 | $ | 0.44 | $ | 20.5 | % | |||||||||||

nm-not meaningful

The following table presents a reconciliation of subscription billings to the most directly comparable GAAP financial measures, for each of the periods indicated. We calculate subscription billings by adding the change in subscription deferred revenue between the start and end of the period to subscription revenue recognized in the same period.

| Three Months Ended January 31, | Six Months Ended January 31, | |||||||||||||||||||||||

| 2024 | 2023 | % Change | 2024 | 2023 | % Change | |||||||||||||||||||

| (in thousands, except percentages) | ||||||||||||||||||||||||

| Subscription Revenue | $ | 1,088 | $ | 875 | $ | 2,064 | $ | 1,766 | ||||||||||||||||

| Changes in subscription deferred revenue | 389 | (45 | ) | 552 | (106 | ) | ||||||||||||||||||

| Subscription Billings (Non-GAAP) | $ | 1,477 | $ | 830 | 78.0 | % | $ | 2,616 | $ | 1,660 | 57.6 | % | ||||||||||||

The following table summarizes Zedge Premium gross and net revenue for the three and six months ended January 31, 2024 and 2023:

| Three Months Ended January 31, | Six Months Ended January 31, | |||||||||||||||||||||||

| 2024 | 2023 | % Changes | 2024 | 2023 | % Changes | |||||||||||||||||||

| (in thousands, except percentages) | ||||||||||||||||||||||||

| Zedge Premium-gross revenue (“GTV”) | $ | 537 | $ | 438 | 22.6 | % | $ | 958 | $ | 750 | 27.7 | % | ||||||||||||

| Zedge Premium-net revenue | 277 | $ | 229 | 21.0 | % | $ | 481 | $ | 416 | 15.6 | % | |||||||||||||

| Gross margin | 52 | % | 52 | % | 50 | % | 55 | % | ||||||||||||||||

24

Three Months Ended January 31, 2024 Compared to Three Months Ended January 31, 2023

For the three months ended January 31, 2024, our advertising revenue increased 18.4% compared to the same period in the prior year primarily due to a higher price per advertising impression which has recovered from the downturn in the global economic conditions in the prior year period. This revenue growth can be attributable in part to the higher paid user acquisition spent during the current period.

For the three months ended January 31, 2024, our subscription revenue increased 24.3% compared to the same period in the prior year primarily due to our iOS subscription offering introduced in April 2023 and the lifetime subscriptions for Android users we rolled out in August 2023. Both initiatives contributed to the 78.0% increase in subscription billings in the three months ended January 31, 2024 compared to the same period in the prior year.

For the three months ended January 31, 2024, our other revenue (primarily Zedge Premium net revenue) increased 22.6% compared to the same period in the prior year primarily due to higher Gross transaction value (the total sales volume transacting through our Zedge Premium platform), or “GTV,” which increased 22.6% in the corresponding period. Zedge Premium net revenue increased 21.0% in the three months ended January 31, 2024 compared to the same period in the prior year.

For the three months ended January 31, 2024 digital goods and services revenue declined 26.4% compared to the same period in the prior year primarily due to the 24.3% decrease in GuruShots’ MAP for the corresponding periods.

Six Months Ended January 31, 2024 Compared to Six Months Ended January 31, 2023

For the six months ended January 31, 2024, our advertising revenue increased 14.3% compared to the same period in the prior year primarily due to higher price per advertising impression which have recovered from the downturn in the global economic conditions in the prior period. This revenue growth can be attributable in part to the higher paid user acquisition spent during the current period.

For the six months ended January 31, 2024, our subscription revenue increased 16.9% compared to the same period in the prior year primarily due to new iOS subscription offering introduced in April 2023 and the lifetime subscriptions for Android users we rolled out in August 2023. Both initiatives contributed to the 57.6% increase in subscription billings in the six months ended January 31, 2024 compared to the same period in the prior year.

For the six months ended January 31, 2024, our other revenue increased 20.0% compared to the same period in the prior year primarily due to higher GTV which increased 27.7% in the corresponding period. Zedge Premium net revenue increased 15.6% in the six months ended January 31, 2024 compared to the same period in the prior year. For the six months ended January 31, 2024, gross margin was 50% compared to 55% for the same period in the prior year primarily due to lower breakage revenue recognized in current period.

For the six months ended January 31, 2024, digital goods and services revenue declined 27.7% compared to the same period in the prior year primarily due to the 27.2% decrease in GuruShots’ MAP for the corresponding periods.

Direct cost of revenues. Direct cost of revenues consists primarily of content hosting and content delivery costs.

| Three Months Ended January 31, | Six Months Ended January 31, | |||||||||||||||||||||||

| 2024 | 2023 | % Change | 2024 | 2023 | % Change | |||||||||||||||||||

| (in thousands, except percentages) | ||||||||||||||||||||||||

| Direct cost of revenues | $ | 458 | $ | 632 | -27.5 | % | $ | 944 | $ | 1,264 | -25.3 | % | ||||||||||||

| As a percentage of revenues | 5.9 | % | 9.1 | % | 6.4 | % | 9.1 | % | ||||||||||||||||

Direct cost of revenues decreased 27.5% in the three months ended January 31, 2024 compared to the same period in the prior year primarily due to the revamping of our backend infrastructure as part of the cost reduction initiatives implemented during fiscal 2023. As a percentage of revenue, direct cost of revenues in the three months ended January 31, 2024 declined to 5.9% from 9.1% for the same period in the prior year.