UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

for

the Fiscal Year Ended

or

Commission File

Number:

(Exact Name of Registrant as Specified in its Charter)

| (State or Other Jurisdiction of Incorporation or Organization) | (I.R.S. Employer Identification No.) | |

| (Address of Principal Executive Offices) | (Zip Code) | |

(Registrant’s Telephone Number, Including Area Code)

| Title of each class | Trading Symbol | Name of each exchange on which registered | ||

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐

Indicate

by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act.

Yes ☐

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities

Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports),

and (2) has been subject to such filing requirements for the past 90 days.

Indicate

by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant

to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant

was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☐ | |

| Smaller reporting company | ||

| Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate

by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness

of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered

public accounting firm that prepared or issued its audit report.

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No

The

aggregate market value of the voting and non-voting stock held by non-affiliates of the registrant, based on the adjusted closing price

on January 31, 2022 (the last business day of the registrant’s most recently completed second fiscal quarter) of the Class B common

stock of $7.56 per share, as reported on the New York Stock Exchange, was approximately $

As of November 10, 2022, the registrant had outstanding

DOCUMENTS INCORPORATED BY REFERENCE

The definitive proxy statement relating to the registrant’s Annual Meeting of Stockholders, to be held January 18, 2023, is incorporated by reference into Part III of this Form 10-K to the extent described therein.

Index

Zedge, Inc.

TABLE OF CONTENTS

i

PART I

As used in this Annual Report, unless the context otherwise requires, the terms the “Company,” “Zedge,” “we,” “us,” and “our” refer to Zedge, Inc., a Delaware corporation, and its subsidiaries, collectively. Our fiscal year runs from August 1 through July 31. Each reference to a fiscal year in this Annual Report refers to the fiscal year ending in the calendar year indicated (for example, fiscal 2022 refers to the fiscal year ended July 31, 2022).

Item 1. Business

Company Overview

Zedge builds digital marketplaces and friendly competitive games around content that people use to express themselves. Our leading products include Zedge Ringtones and Wallpapers, a freemium digital content marketplace offering mobile phone wallpapers, video wallpapers, ringtones, and notification sounds which historically was branded as Zedge Premium, and GuruShots, a skill-based photo challenge game. Our vision is to connect creators who enjoy friendly competitions with a community of prospective consumers in order to drive commerce.

We are part of the ‘Creator Economy,’ where over 1 billion people create and share their content across social platforms, mobile, and video games, and content marketplaces. Within this group of individuals, over 200 million identify as creators, people who use their influence, skill, and creativity to amass an audience and monetize it. Furthermore, approximately 12% of full-time creators earn more than $50,000 per year, and 10% of influencers earn more than $100,000 per year. We view the Creator Economy as an untapped opportunity for Zedge to expand its business, especially as we execute by connecting our gamers with our marketplace.

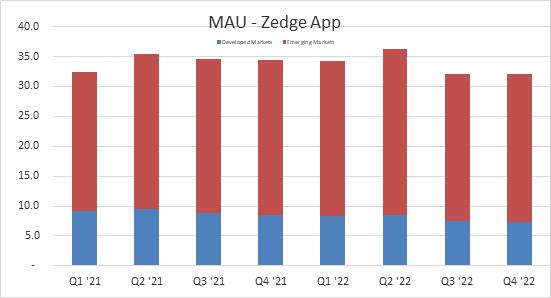

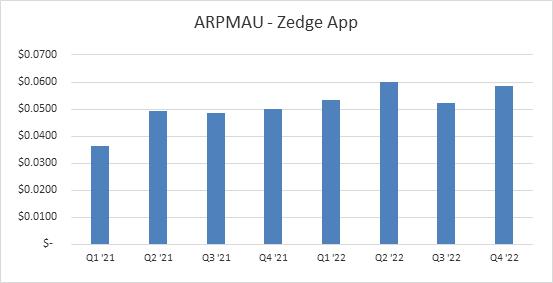

The Zedge Ringtones and Wallpapers app (which is named “Zedge Wallpapers” in the App Store), which we refer to as our “Zedge App,” is a marketplace offering a wide array of mobile personalization content including wallpapers, video wallpapers, ringtones, and notification sounds, and is available both in Google Play and the App Store. As of July 31, 2022, our Zedge App has been installed nearly 569 million times since inception and, over the past two years, has had between 32.0 and 36.3 million monthly active users (“MAU”). MAU is a key performance indicator (“KPI”) that captures the number of unique users that used our Zedge App during the final 30 days of the relevant period. Our platform allows creators to upload content to our marketplace and avail it to our users either for free or for a price, via ‘Zedge Premium.’ In turn, our users utilize the content to personalize their phones and express their individuality.

In fiscal 2022 we introduced several new customer facing product features including ‘NFTs Made Easy’ and social and community features, all meant to improve customer engagement, MAU, and revenue growth over the long term. In addition, due to developments outside of our control, we migrated to a new ad mediation platform - Applovin MAX -, which monopolized internal resources and delayed the completion of other product initiatives we had planned for in fiscal 2022. Applovin paid us a one-time $2 million integration bonus and their performance has been on-par or better than our prior platform. Following the transition, work resumed on the delayed development and most have been rolled out as of September 30, 2022.

The Zedge App’s monetization stack consists of advertising revenue generated when users view advertisements when using the Zedge App or surfing our website, the in-app sale of Zedge Credits, our virtual currency, that is used to purchase Zedge Premium content, and a paid-subscription offering that provides an ad-free experience to users that purchase a monthly or annual subscription. As of July 31, 2022, we had 692,000 active paying subscribers.

In late 2021 we introduced NFT functionality to a limited number of Zedge Premium creators via ‘NFTs Made Easy’. Over time we believe this product enhancement has the potential to drive significant artist growth and revenue production. ‘NFTs Made Easy’ is an eco-friendly platform that enables artists and consumers to sell and purchase NFTs within the Zedge App even though they may lack deep knowledge and proficiency in the crypto space. All transactions are made using Zedge Credits.

1

In April 2022, we acquired GuruShots Ltd (“GuruShots”) a recognized category leader focused on gamifying the photography vertical. GuruShots offers a platform spanning iOS, Android, and the web that provides a fun, educational and structured way for amateur photographers to compete in a wide variety of contests showcasing their photos while gaining recognition with votes, badges, and awards. We estimate that the total addressable market of amateur photographers using their smartphones to take and publicly share artistic photos is 30-40 million people per month and that the market is still in its infancy. Every month, GuruShots stages more than 300 competitions that result in players uploading in excess of 1 million photographs and casting close to 4.5+ billion “perceived votes,” which are calculated by multiplying the number of votes that each player casts by a weighting factor based on various factors related to that user. To improve engagement, GuruShots has adopted a set of retention dynamics focused on individual, team and community dynamics that create a sense of belonging, inspiration, recognition, improvement, and competition.

Today, GuruShots utilizes a ‘Free-to-Play’ business model that leads to strong monetization with the purchase of resources that are used to give paying players an edge while still maintaining a fair and competitive experience for all participants. Over the past six years, the monthly average paying player spend has increased in excess of 14% annually to more than $55 per player.

As we look to the future, we are advancing several initiatives that we expect will drive user growth, increase engagement, drive in-app purchases, and advance our in-game economy. Some of these include:

| ● | On-Boarding. Revamping the customer onboarding experience in order to maximize first time purchasers by immediately drawing new players into simplified photo competitions that are limited to a small audience taking place in a short time duration. | |

| ● | Subscriptions. Introducing value-adds that we can bundle into a subscription. For example, we started testing a feed of short and engaging instructional videos that offer players techniques for improving their photographs. If users engage with this content, we expect to bundle it into a paid subscription. | |

| ● | Economy. Evolving the game economy by maturing the game’s progression mechanics and features, earn and spend dynamics, and introducing soft and premium currencies tied to resources and benefits. Furthermore, we hope to introduce an advertising layer in the monetization stack in the future. |

We market GuruShots to prospective players, primarily via paid user acquisition channels, and utilize a host of creative formats including static and video ads in order to promote the game. Our marketing team invests material resources in analyzing all attributes of a campaign ranging from the creative assets, offer acquisition channel, and platform (i.e., iOS, Android, and web), just to name a few, with the goal of determining whether a specific campaign is likely to yield a profitable customer. When we unearth a successful combination of these variables we scale up until we experience diminishing returns. Ultimately, we believe that the efforts we are making to advance the product coupled with the investment in user acquisition can significantly increase GuruShots’ player base.

Beyond our commitment to growing both the Zedge App and GuruShots on a standalone basis, we believe that there are many potential synergies that we can capitalize on that exist between the two businesses. Specifically, we plan to enable the ability for GuruShots players to become Zedge Premium artists and sell their photos to our audience of 30+ million MAU as standard digital images or NFTs. In addition, we look to benefit from the experience that the GuruShots team possesses and test gamifying the Zedge App. We believe that successful gamification can contribute to increasing engagement, retention, and lifetime value, all critical KPIs for our business. Longer term, we believe that there are complementary content verticals that lend themselves to gamification.

In August 2021, we acquired Emojipedia Pty Ltd (“Emojipedia”), the world’s leading authority dedicated to providing up-to-date and well-researched emoji definitions, information, and news as well as World Emoji Day and the annual World Emoji Awards, and Emojitracker, which provides real time visualization of all emoji symbols used on Twitter. Emojipedia receives approximately 46.4 million monthly page views and has approximately 7.6 million monthly active users of which approximately 45.19% are located in well-developed markets. It is the top resource for all things emoji, offering insights into data and cultural trends. As a voting member of the Unicode Consortium, the standards body responsible for approving new emojis, Emojipedia works alongside major emoji creators including Apple, Google, Facebook, and Twitter.

2

We believe that Emojipedia provides growth potential to the Zedge App, and it was immediately accretive to earnings. In the past year, we have made many changes to Emojipedia including migrating to a new ad mediation platform, redesigning the Emojipedia website, and introducing localized versions of Emojipedia in Spanish, French, German, Italian, and Portuguese. We will continue to enhance this offering and are exploring new features including a native mobile offering as well as additional monetization opportunities.

Our Strategy

Our vision is to connect creators who enjoy friendly competitions with a community of prospective consumers in order to drive commerce.

Our Strategic Flywheel

Our long-term strategy calls for creating a flywheel that leverages the synergies of a “gaming and marketplace” dynamic across our portfolio, engaging communities of consumers with content that can function on a multitude of online and mobile platforms including social networks, messaging, and gaming. This is unlike the existing dynamic that many gaming platforms offer to players, who can create and sell virtual goods that are valuable only within the context of that particular ecosystem. Although the foundation of our strategy is currently centered around the Zedge App and GuruShots, over time we expect to expand into other content verticals that have relevance beyond gameplay.

Using our current products as an example, GuruShots is a skill-based game that attracts creators (mainly, amateur photographers) with friendly photo competitions in which they compete to gain recognition and pedigree. We believe that adding the ability to sell their content to the Zedge App’s 30+ million MAU is an attractive benefit that enables players not only to have fun, but also to earn money while doing so. This dual purpose will likely improve user growth, engagement, retention, and monetization while simultaneously expanding our relevance to a broader community interested in high-quality photographs. If our assumptions are correct, we will have a flywheel that drives the aforementioned KPIs while also enabling us to expand into new verticals (through internal development or acquisition), gamify them, and add new content to our marketplace.

Executing this strategy calls for concentrating our efforts on the following goals:

| ● | Continue growing our user base, profitably. We expect to continue devoting resources to growing our user base profitably by: | |

| ○ | studying our users’ needs and enhancing our products to meet those needs; | |

| ○ | developing and offering new features and services that are attractive to both new and existing users; | |

| ○ | investing in paid user acquisition campaigns that yield profitable customers, based on empirical data and focused, primarily, on well-developed markets; and | |

| ○ | expanding our reach by collaborating with strategic partners. |

3

| ● | Improve monetization. Continue developing monetization methods that will help us grow, including advancements of the in-app economy, NFTs, subscription models, e-commerce, and new advertising products, implementations, and optimizations. We believe that our products and customer base are attractive to advertisers, brands, artists, and players and will yield new monetization opportunities. In addition, we expect that we will be able to capitalize on cross marketing our suite of products to this customer base. | |

| ● | Ongoing product and technology investment in and across our product suite. We plan to make continued, selected investments in product feature sets and functionality in order to both maintain our existing user base and attract new users. In addition, we envision applying our product expertise to verticals that we currently do not have in our portfolio, as well as gamifying the Zedge App. | |

| ● | Better utilize data to improve user acquisition and customer engagement. We plan to better utilize data to scale profitable user acquisition and improve the use of our product through personalized recommendations and content feeds, enhanced search and content discovery, and optimized pricing. | |

| ● | Building our marketplace into a best-of-breed platform for artists and creators. Our goal is to build our marketplace into one that artists view as prioritizing their needs and addressing all aspects of their marketing and revenue generation goals including, but not limited to, ease in managing their virtual storefront, promotion, education, reporting, and distribution. | |

| ● | Increase our marketing efforts for our Zedge App. Historically, we haven’t invested materially in marketing initiatives for our Zedge App. Going forward, we envision the need to better promote our Zedge App and to amplify our Zedge App’s value proposition to artists and individual creators. We envisage these creators and influencers and brands self-promoting their availability on our Zedge App in order to extend their reach, generate incremental income and drive more end-user traffic to our platform. Furthermore, we also plan to scale up paid user acquisition focusing on users that we believe can yield profitable customers, and also continue to invest in app store optimization, search, marketing automation, social marketing, and community management in order to retain and expand our Zedge App’s customer base. | |

| ● | Diversify our revenue stack. Historically, the majority of our revenue has been derived from advertising. We plan to diversify our revenue by developing a subscription offer and introducing advertising into GuruShots. Furthermore, we expect to further our NFT offering, opening up the potential for trading revenue as well as revisiting print on demand, particularly with GuruShots’ player’s content. We also have a set of product initiatives specific to Emojipedia that will enable new revenue streams from this asset. | |

| ● | Selectively pursue strategic investments, partnerships, and acquisitions. On a selective basis, we will look to invest in, partner with, or purchase entities that can provide synergistic growth opportunities for our Zedge App and otherwise. For example, in April 2022 we acquired GuruShots and in August 2021 we acquired Emojipedia. Each of these acquisitions offers new growth opportunities both on a stand-alone basis as well as on an integrated and synergistic basis that we believe can impact our business in a materially positive fashion. |

Our Competitive Advantages

We believe that the following competitive strengths will drive the growth of our business:

| ● | Large, global customer base. We benefit from having a large customer base. As of July 31, 2022, we had approximately 40 million MAU spanning across all of our products, of which approximately 27% were in well-developed markets and 73% were in emerging markets. Typically, customers in well-developed markets monetize at a material premium when compared to those in emerging markets. The Android version of our Zedge App is available in 17 languages and Emojipedia is available in 19 languages. We possess a highly diversified portfolio of content and attribute this in part to our global reach which makes us attractive to creators interested in meeting various customer tastes and preferences. In addition, our diverse customer base attracts advertisers seeking customers that have adequate disposable income to purchase their products and services. Our Zedge App’s large customer base is also a draw to artists and brands looking to market their content to a critical mass of users. |

4

| ● | Leading global provider of mobile personalization content. Our Zedge App has a global customer base of approximately 32 million MAU, enabling users to easily personalize their mobile phones with a wide variety of free, high-quality ringtones, wallpapers, notification sounds, video wallpapers, custom app icons (only available for iOS), and NFTs. We believe that our Zedge App is well positioned for continued leadership in the personalization space. | |

| ● | Deep Knowledge of Gaming. We have leaders with years of experience in building and operating games of skill across digital platforms including iOS, Android, and web. We intimately understand game design, onboarding, game mechanics, LiveOps, feedback loops, in-game resource balancing, scarcity, and how to make a game fun, challenging, and fair. | |

| ● | Combining Gaming and a Real-world Activity. We have years of experience in combining game dynamics with a real-world activity. In the case of GuruShots the real-world activity is photography. Successfully combining these is non-trivial and requires a great deal of expertise and understanding that the team has acquired over the years. | |

| ● | High-quality products. We do our best to provide our customers with high-quality products and superior user experiences. We prioritize our customers’ needs and believe that this focus is critical for our long-term growth and expansion. We invest significant resources in product development, design, and usability. We beta test product enhancements extensively and closely monitor customer feedback to ensure that we meet users’ needs. To date, our Zedge App has received more than 11 million reviews in Google Play where it boasts a 4.6 star rating out of a maximum of 5 stars. GuruShots has a 4.5 star rating in the App Store albeit from a universe of several thousand reviews. | |

| ● | Human Capital. We have a team of highly experienced professionals that take pride and ownership in their work product. Our diverse employee base is passionate about our product suite and its mission to build a tightly coupled ecosystem of “games and marketplaces.” Our culture is founded on respect and empowerment which are critical in light of us having offices in four different countries with a hybrid in-person work attendance policy. We strive to create an environment where our employees can be autonomous and creative. Our people possess deep expertise in product design and management, development, marketing, monetization, data and analytics and operations. | |

| ● | Management team. We have an experienced management team with longstanding tenure with the company and deep knowledge of the mobile app landscape who are highly focused on execution. Our core management team possesses a solid understanding of the mobile app industry, product design and development, operations, and monetization. Collectively, our management team has a proven ability in building and scaling a business and pursuing opportunities with a manageable risk profile. | |

| ● | Large and diverse content catalog. Our large and diverse catalog of content includes wallpapers, ringtones, notification sounds, video wallpapers, photographs, and emojis. With artists and contributors spanning the globe, we have assembled a vast array of both User Generated (UGC) and licensed content to meet the needs of our users. | |

| ● | Technology and infrastructure. Our products are built upon scalable technology and infrastructure that reliably serves tens of millions of MAU, globally. We use a combination of off-the-shelf and proprietary technologies and infrastructure solutions that scale efficiently to meet the needs of our large customer base. |

5

Competition

We face competition in all aspects of our business and especially from other digital marketplaces and gaming companies. In running our business, we need to account for:

| ● | Consumers. We compete for consumers’ leisure time, attention, and spending versus alternative forms of entertainment that are available to them as well as against online platforms and marketplaces that offer utility and content for mobile phone personalization. | |

| ● | Content creators. There are many online platforms that offer content creators an eco-system in which they can make their content available to consumers. Some of these platforms may have better incentives, paid or other, that may potentially make them more attractive than our marketplace. | |

| ● | Advertisers. We face significant competition in securing spend from advertisers. | |

| ● | Other Game Developers. Game developers that offer more engaging and interesting games. These competitors, many of whom we may not be aware of, may be more proficient at capitalizing on user acquisition channels in order to gain access to large user bases and their network effects to expand virally and quickly. | |

| ● | Alternative options and products for mobile personalization and emojis. There are many other marketplaces and platforms that offer mobile personalization content, games, and emoji resources, some of whom are better funded than we are. We believe that we possess a competitive advantage because of our: | |

| ○ | large user base; | |

| ○ | “one-stop shop” approach to mobile personalization, which avails customers of ringtones, wallpapers, notification sounds, and video wallpapers within the same Android app; | |

| ○ | flexibility that allows the customer to selectively choose what they would like to personalize without handing over the core elements of the native operating system to a third party and overwhelming the user with a myriad of complex options; | |

| ○ | large content catalog; | |

| ○ | recognized and well-respected brands; | |

| ○ | proprietary recommendation engine; and | |

| ○ | market ranking and longevity. | |

| ● | Rapid-Paced and Changing World of Mobile App Development. The mobile app eco-system changes quickly and regularly with new apps capturing massive audiences competing for consumer’s time, mindshare, and money. This is an ongoing competitive threat requiring us to do our best to adapt as necessary to remain relevant and meaningful. |

Our History

In 2003, Tom Arnoy, Kenneth Sundnes, and Paul Shaw launched a consumer website at www.zedge.net that people used to upload and download ringtones.

6

In December 2006, IDT Corporation acquired 90% of Zedge. Zedge Holdings, Inc. was incorporated in Delaware in 2008, and our name was changed to Zedge, Inc. in 2016.

In 2009, we introduced the Android version of our Zedge App. The Zedge App provided ease of use by negating the need for customers to first download a ringtone or wallpaper to their computer and then upload that content to their mobile phone.

We launched the iOS version of our Zedge App in 2013, followed by the launch of the Windows Mobile Zedge App in 2014.

During 2014 and 2015, our Zedge App introduced app icons, social sharing features, and marketing automation capabilities, and expanded the number of languages supported.

In 2016, IDT Corporation spun off our stock to its stockholders, and our Class B Common Stock was listed on the NYSE American with the ticker symbol “ZDGE”.

In March 2018, we completed the launch of Zedge Premium, a section of our marketplace where artists can launch a virtual store and market, distribute, and sell their digital content, including wallpapers, video wallpapers, ringtones, and notification sounds to our users.

In January 2019, we started offering freemium Zedge App Android users the ability to convert into paying subscribers in exchange for removing unsolicited advertisements from our Zedge App. As of July 31, 2022, we had approximately 692,000 active subscribers. In fiscal 2023, we expect to launch subscriptions on iOS.

In August 2020, Jonathan Reich was promoted to Chief Executive Officer, and Yi Tsai was promoted to Chief Financial Officer.

On August 1, 2021, we acquired Emojipedia, the world’s leading authority dedicated to providing up-to-date and well-researched emoji definitions, information, and news as well as World Emoji Day and the annual World Emoji Awards, and Emojitracker, which provides real time visualization of all emoji symbols used on Twitter.

On December 14, 2021, we launched ‘NFTs Made Easy’ an NFT offering for artists and consumers that provides ease of use and negates the need for cryptocurrency experience and know-how. An artist only needs to upload their content as they normally would in the Zedge Premium Creator’s Portal, check the NFT option, and Zedge handles the rest seamlessly, from minting to gas fees. Additionally, consumers can buy the NFTs simply by using Zedge Credits purchased in their local currency.

On April 12, 2022, we acquired GuruShots, a recognized category leader that fuses photography with mobile gaming. GuruShots, headquartered in Israel, offers a platform spanning iOS, Android, and the web that gamifies photography by providing a fun, educational, and structured way for amateur photographers - essentially anyone with a mobile phone - to compete in a wide variety of contests showcasing their photos while gaining recognition with votes, badges, and awards. On a monthly basis, GuruShots users currently cast close to 4.5 billion “perceived votes” in more than 300 competitions. GuruShots currently generates revenue from selling digital resources that, if used skillfully, can provide additional visibility to competitors’ photographs, a critical factor in securing votes for competitive ranking.

7

Our Technology

Our eco-system is powered by a scalable distributed platform that is comprised of both open source and proprietary technologies centered on content management and discovery, web and app development, data mining and analytics, deep learning, mobile content/device compatibility, advertising, and reporting. We have built a robust platform that allows us to ideate, test, and launch where warranted by the outcome and we have embraced machine learning throughout our technology stack in order to improve content recommendations and relevancy. From an end user’s perspective, our platform minimizes response latency while maximizing content relevancy and discoverability. We optimize our platform by utilizing systems, algorithms, and heuristics that organize our content based on real user data and that renders the content in a relevant fashion. With GuruShots, we have added open source and proprietary technologies around gamification, including ranking algorithms that ensure fair exposure to all content in a competition, and real-time voting/ranking functionality at scale. Our infrastructure provides a fully redundant production environment in a cloud-hosted, virtual-server environment.

Intellectual Property

Our trademarks, copyrights, domain names, proprietary technology, know-how, and other intellectual property are vital to our success. We seek to protect our intellectual property rights by relying on federal, state, and common law rights in the United States and other countries, as well as contractual restrictions. We enter into confidentiality and nondisclosure agreements with our employees and business partners. The agreements we enter into with our employees also provide that all software, inventions, developments, works of authorship, and trade secrets created by them during the course of their employment are our property.

We have been granted trademark protection for “Zedge” in the United States, European Union, United Kingdom, India, and Canada, “Tonesync” in the European Union and the United Kingdom, “We Make Phones Personal,” and “Zedge, Everything You” in the United States and a stylized “D” logo in the European Union and the United Kingdom. We also have applied for trademark protection for “Tattoo your phone,” and “NFTs Made Easy” in the United States, a stylized “D” logo in the United States, Canada and India, and have obtained a copyright registration for our flagship app, Zedge. In addition, we have registered, amongst others, the following domain names: www.zedge.net and www.zedge.com.

On August 1, 2021, we acquired Emojipedia. As part of this acquisition, we acquired trademark registrations for “Emojipedia” in the United States, the European Union, the United Kingdom, and Australia, and trademark registrations for “World Emoji Day” in the United States and the United Kingdom. We also acquired the following domain name registrations: www.emojipedia.com and www.emojipedia.org.

On April 12, 2022, we acquired GuruShots Ltd. As part of this acquisition, we acquired, all intellectual property rights associated with, and encompassed within the GuruShots mobile and web-based applications, including the following domain name: GuruShots.com. In addition, we have applied for trademark protection for “GuruShots” in the United States, and have filed copyright applications for the GuruShots mobile and web-based applications.

Human Capital

Our headcount totaled 93 as of July 31, 2022, including 32 added from the GuruShots acquisition.

8

Facilities

As a result of the COVID-19 pandemic, we ceased having a physical office in the United States in 2020. Yet, we still address commercial operations including accounting and finance, and business development from the New York area. In 2021, our Norwegian operations moved into a smaller Trondheim, Norway facility, with approximately 3,800 square feet of space, accommodates our product, design, and technology teams, and is under lease through March 2024. In May of 2022, we entered into a one-year sublease agreement for approximately 2,300 square feet of space for our team in Vilnius, Lithuania. We lease 1,550 square feet of space in Tel Aviv, Israel that accommodates the GuruShots team. That lease is due to expire in October 2024. Our servers are hosted in leased data centers in different geographic locations in the United States.

Item 1A. Risk Factors

Our business, operating results or financial condition could be materially adversely affected by any of the following risks associated with any one of our businesses, as well as the other risks highlighted elsewhere in this document, particularly the discussions about competition. The trading price of our Class B common stock could decline due to any of these risks.

Risk Factor Summary

Our business operations are subject to numerous risks and uncertainties, including those outside of our control, that could cause our business, financial condition or operating results to be harmed, including, but not limited to, risks regarding the following:

| ● | We offer a suite of freemium apps and we may not be successful in adding new users or in retaining existing users, or if our users decrease their level of engagement with our products or do not make optional purchases of tokens, resources, or content, or convert into paying subscribers and renew their paid subscriptions our revenue, financial results and business may be significantly harmed. |

| ● | We may not be successful in acquiring a sufficient number of users that become purchasers or retain existing users who generate profitable revenue for our apps. |

| ● | We may not manage our in-app economy well and as a result, disincentivize users from making in-app purchases. Any failure to do so could adversely affect our business, financial condition, and results of operations. |

| ● | If we fail to attract advertisers or if advertisers reduce their spend with us, our revenues, profitability and prospects may be materially and adversely affected. |

| ● | The digital advertising market may deteriorate or develop more slowly than expected, which could materially harm our business and results of operations. |

| ● | A material amount of our revenue is generated from a limited number of geographies and third-party advertising demand partners. Any change to this mix could result in negatively impacting our business, financial condition, and results of operations. |

| ● | Our apps’ user base is heavily weighted to the Android operating system and our revenues and profitability may suffer if the market demand for Android smartphones decreases. |

9

| ● | We rely on third-party platforms, such as the iOS App Store, Facebook, and Google Play Store, to distribute our apps and collect revenues generated on these platforms. If these platforms adopt policies including those relating to advertising, privacy, or monetization that are counter to our strategy it could result in materially and adversely affecting our business. |

| ● | Zedge Premium, the section of our marketplace where we offer premium content (i.e. for purchase), may not yield the strategic goals and objectives that we envision, and our revenues, profitability and prospects may be materially and adversely negatively affected. |

| ● | If we fail to maintain and enhance our various brands, or if we incur excessive expenses in this effort, our business, results of operations and prospects may be materially and adversely affected. |

| ● | We may not be able to effectively manage our growth or implement our future business strategies, in which case our business and results of operations may be materially and adversely affected. |

| ● | If we fail to keep up with rapid technological changes in the internet and smartphone industries and adapt our products and services accordingly, our results of operations and future growth may be adversely affected. |

| ● | We have offices and other significant operations located in Lithuania, Israel, and Norway, and, therefore, our results may be adversely affected by political, economic and military instability in these countries. |

| ● | Zedge may be unable to successfully integrate GuruShots into Zedge |

| ● | Data privacy and security laws and regulations in the jurisdictions in which we do business subject us to possible sanctions, civil lawsuits (including class action or similar representative lawsuits) and other penalties in the event of non-compliance, additionally the need to observe these regulations increases the cost of doing business and these laws and regulations are continually evolving. Compliance failure either by us or our partners, or vendors could harm our business. |

| ● | Our business depends on our ability to collect and effectively use data to serve relevant advertising, deliver suitable content, and identify appropriate customer prospects, and any limitation on the collection and use of this data could significantly diminish the value of our services, cause us to lose clients, make us less attractive to prospective customers and revenues. |

| ● | Security breaches or computer virus attacks could have a material adverse effect on our business prospects and results of operations. |

| ● | We are controlled by our majority stockholder, which limits the ability of other stockholders to affect our management. |

10

RISKS RELATED TO OUR BUSINESS AND INDUSTRY

Certain of our offerings, including GuruShots’ participation in gallery exhibitions, are sensitive to consumer spending and economic conditions.

Consumer purchases of discretionary retail items and specialty retail products, as well as participation in gallery events, may be adversely affected by national and regional economic, market and other conditions such as employment levels, salary and wage levels, the availability of consumer credit, inflation, high interest rates, high tax rates, high fuel prices, the threat of a pandemic or other health crisis (such as COVID-19) and consumer confidence with respect to current and future economic, market and other conditions. Consumer purchases may decline during recessionary periods or at other times when unemployment is higher or disposable income is lower. Consumer willingness to make discretionary purchases may decline, may stall or may be slow to increase due to national and regional economic conditions. GuruShots derives revenues form arranging for certain of its users to display their photographs in art galleries. There remains considerable uncertainty and volatility in the national and global economy. Further or future slowdowns or disruptions in the economy, market and other conditions could adversely affect us and our business strategy. We may not be able to sustain or increase our current net sales if there is a decline in consumer spending.

The market prices of many digital assets, including NFTs, have experienced significant declines in recent periods and may continue to do so. Further declines in the market prices of digital assets, could have a material adverse effect on our NFTs Made Easy offering, our financial performance, and results of our operations.

The market prices of many digital assets, including NFTs, experienced significant declines in the fourth quarter of 2021 and to date in 2022. Despite the increased popularity of NFTs in 2021, sales volumes of NFTs declined consistently throughout 2022, dropping by as much as 60% in the third quarter of 2022 as compared to the previous quarter, according to some market analysts. Further declines in the market prices of digital assets, could have a material adverse effect on our NFTs Made Easy offerings, our financial performance, and results of our operations.

The value of NFTs is uncertain and may subject us to unforeseeable risks.

We allow our creators to offer NFTs for sale. NFTs are unique, one-of-a-kind, or limited series, digital assets made possible by certain digital asset network protocols. Because of their non-fungible nature, NFTs introduce digital scarcity and have become popular as online “collectibles,” similar to physical rare collectible items, such as trading cards or art. Like real world collectibles, the value of NFTs may be prone to “boom and bust” cycles as popularity increases and subsequently subsides. If any of these bust cycles were to occur, it could adversely affect the value of certain of our future strategies.

The prices of digital assets are extremely volatile, and such volatility may have a material adverse effect on our NFTs Made Easy offering.

The market prices of many digital assets, including NFTs, have experienced extreme volatility in recent periods and may continue to do so. For instance, there were steep increases in the value of certain digital assets over the course of 2017, and multiple market observers asserted that digital assets were experiencing a “bubble.” These increases were followed by steep drawdowns throughout 2018 in digital asset trading prices. These drawdowns notwithstanding, digital asset prices, increased significantly again during 2019, decreased significantly again in the first quarter of 2020 amidst broader market declines as a result of the novel coronavirus outbreak and increased significantly again over the remainder of 2020 and the first quarter of 2021. Digital asset prices continued to experience significant and sudden changes throughout 2021 followed by steep drawdowns in the fourth quarter of 2021 and to date in 2022.

Decreases in the price of even a single other digital asset may cause volatility in the entire digital asset industry and may affect the value of other digital assets, including our NFTs Made Easy offering. For example, a security breach or any other incident or set of circumstances that affects purchaser or user confidence in a well-known digital asset may affect the industry as a whole and may also cause the price of other digital assets, including NFTs, to fluctuate.

Extreme volatility may persist and the value of NFTs may significantly decline in the future without recovery. Moreover, digital asset platforms are relatively new and the digital asset markets may still be experiencing a bubble or may experience a bubble again in the future. For example, in the first half of 2022, each of Celsius Network, Voyager Digital Ltd., and Three Arrows Capital declared bankruptcy, resulting in a loss of confidence in participants of the digital asset ecosystem and negative publicity surrounding digital assets more broadly.

Extreme volatility in the future could have a material adverse effect on the value of NFTs Made Easy offering. Furthermore, negative perception, a lack of stability and standardized regulation in the digital asset economy may reduce confidence in the digital asset economy and may result in greater volatility in the price of NFTs and other digital assets, including a depreciation in value.

11

We offer a suite of freemium apps and we may not be successful in adding new users or in retaining existing users, or if our users decrease their level of engagement with our products or do not make optional purchases of tokens, resources, or content, or convert into paying subscribers and renew their paid subscriptions our revenue, financial results and business may be significantly harmed.

The size of our user base and our users’ level of engagement and paid conversion are fundamental to our success. Our financial performance has been and will continue to be dependent by our ability to successfully add new users, retain and engage existing users and convert them into paying users and/or subscribers. Over the past several years, we have experienced periods of growth and contraction, as well as a shift of users from well developed markets to emerging markets and we expect that the size of our user base will fluctuate over time. If consumers and/or creators do not perceive our products as useful, effective, entertaining, reliable, and/or trustworthy, we may not be able to attract or keep users or otherwise maintain or increase the frequency and duration of their engagement or the percentage of users that are converted into paying subscribers. There is no guarantee that we will not experience a decline in our user base or engagement levels. User engagement can be difficult to measure, particularly as we introduce new and different products and services and as various privacy regulations evolve. Any number of factors can negatively affect user growth, engagement and conversion, including:

| ● | users opt to utilize other competitive products or services instead of our own; | |

| ● | user behavior changes with respect to our products and services resulting in a decrease of engagement and/or session time; | |

| ● | users decrease their engagement, session time, or uninstall our apps because of product decisions that we make with respect to introducing new features, feature enhancements, an/or monetization techniques; | |

| ● | users lose confidence in how we utilize user data and/or or privacy policy; | |

| ● | users cease making in-app purchases or in paying for subscriptions; | |

| ● | users have difficulty accessing our products and services as a result of our actions or those of third parties that we rely on to distribute our products and deliver our services; | |

| ● | we fail to introduce new features, products or services that users want or enhance the existing products and services with improvements that users are interested in; | |

| ● | we are unable to acquire users through cost-effective marketing efforts, including both organic and paid channels; | |

| ● | initiatives designed to attract and maintain users and increase engagement are unsuccessful because of errors that we make or policies instituted by third parties that we use to distribute our products or deliver our services; | |

| ● | adopting terms, policies or procedures related to areas such as privacy, user data, content ownership, or monetization techniques that are received negatively by our users or creators; | |

| ● | inability to offer relevant content to our users; | |

| ● | poor support for our users and creators; | |

| ● | outages or other technical problems that result in making our products and services inaccessible, unreliable or that result in a poor user experience; | |

| ● | actions by governments that affect accessibility to our products and services in any market; or | |

| ● | regulations and/or litigation that result in users not accepting our terms of use because of measures that we have taken in order to ensure compliance. |

12

Certain of these factors have, at various times, negatively impacted user and creator growth, MAU and engagement. If we are unable to maintain or increase our user base and user engagement, our revenue and financial results may be materially adversely affected.

We may not experience growth or engagement in certain geographic locations due to local factors.

We may not experience rapid user growth or continued engagement in countries that have unreliable telecommunications infrastructure or in countries where mobile and internet usage are expensive. Any decrease in user growth or engagement may have a material and adverse impact on our popularity, revenue, business, reputation, financial condition, and results of operations.

We may not be successful in acquiring a sufficient number of users that become purchasers or retain existing users who generate profitable revenue for our apps.

Revenues of freemium apps and websites typically rely on a small percentage of users that convert into paying users by making in-app purchases of digital goods and/or paid subscriptions; however, the vast majority of users play for free or only occasionally make purchases or opt-in for paid subscription. Accordingly, only a small percentage of our users are paying users. In addition, a small portion of paying users generate a disproportionate percentage of revenue. Because of this, it is imperative for us to both retain these valuable customers and to maintain or increase their spend over time. In fiscal 2022, we experienced a 3.7% decline in in-app purchases and paid subscriptions. Conversely, over the past six years, GuruShots has successfully increased the compounded annual growth rate of monthly spending per paying player by around 14%. There can be no assurance that we will be able to continue to retain paying users or that paying users will maintain or increase their spending. We may experience a net decline in paying players resulting in a decrease in revenue resulting in a materially adverse outcome for our business and financial results.

We may not manage our in-app economy well and as a result, disincentivize users from making in-app purchases. Any failure to do so could adversely affect our business, financial condition, and results of operations.

Our apps are available to players for free and each brand generates a material portion of its revenue by selling digital goods and/or paid subscriptions. The perceived value of these digital goods and/or paid subscriptions can be impacted by various factors including their price, discounting policies, etc. If we fail to manage our economy well we risk confusing or upsetting users to the point that they reduce their purchases which could negatively hurt the business.

If we fail to attract advertisers or if advertisers reduce their spend with us, our revenues, profitability and prospects may be materially and adversely affected.

In fiscal 2022, approximately 76% of our revenues (excluding GuruShots) were generated from selling advertising inventory. We anticipate that our growth and profitability will continue to depend on our ability to sell our advertising inventory. Companies that advertise with us may choose to utilize other advertising channels or may reduce or eliminate their marketing altogether for a variety of reasons, many of which are out of our control, including, without limitation, if the demand for mobile phone personalization industry declines or otherwise falls out of favor with advertisers or consumers.

If the size of the digital advertising market does not increase from current levels, or if our digital brands are unable to capture and retain a sufficient share of that market, our ability to maintain or increase our current level of advertising revenues and our revenues, profitability and prospects could be materially and adversely affected.

13

The digital advertising market may deteriorate or develop more slowly than expected, which could materially harm our business and results of operations.

We generate the substantial majority of our revenue from selling advertising inventory. We anticipate that our growth and profitability will continue to depend on our ability to sell advertising inventory across some if not all of our digital brands.

Mobile connected devices, especially smartphones, are a relatively new advertising medium. Advertisers have historically spent a smaller portion of their advertising budgets on mobile media as compared to traditional advertising methods, such as television, newspapers, radio and billboards, or online advertising over the internet, such as placing banner ads on websites.

Future demand and market acceptance for mobile advertising is uncertain. Many advertisers still have limited experience with mobile advertising and may continue to devote larger portions of their advertising budgets to more traditional offline or online personal computer-based advertising, instead of shifting additional advertising resources to mobile advertising.

Further, our advertisers’ ability to effectively target their advertising to our user’s interests may be negatively impacted by the degree to which our privacy control measures that we have implemented or may implement in the future in connection with regulations, regulatory actions, the user experience, or otherwise, and our advertising revenue may decrease or otherwise be curtailed as a result. Changes to operating systems’ practices and policies, such as Apple’s deprecating the Identifier for Advertisers (“IDFA”) and Google’s expected deprecation of “tracking cookies” may also reduce the quantity and quality of the data and metrics that can be collected or used by us and our partners. These limitations may adversely affect our advertisers’ ability to effectively target advertisements and measure their performance, which could reduce the demand and pricing for our advertising products and harm our business. As such, our digital property’s current and potential advertiser clients may ultimately find digital advertising to be less effective than traditional advertising media or marketing methods or other technologies for promoting their products and services, and they may even reduce their spending on mobile advertising from current levels as a result or for other reasons.

If the market for mobile advertising deteriorates, or develops more slowly than we expect, we may not be able to increase our revenues or our revenues and profitability could decline materially.

A material amount of our revenue is generated from a limited number of geographies and third-party advertising demand partners. Any change to this mix could result in negatively impacting our business, financial condition, and results of operations.

In fiscal 2022, revenue from well developed economies accounted for approximately 73% of our total revenues and 83% of our total revenues were generated by four advertising demand partners. While our end users are located around the world, the revenue is generated in the United States from our advertising partners. During the past five years, we have experienced a shift in our Zedge App’s regional customer make-up with the percentage of our total MAU from emerging markets increasing, while the portion from well-developed markets is decreasing. In fiscal 2022, 77% our Zedge App’s users were located in emerging markets with 23% of users in well-developed regions compared to 75% and 24% respectively in fiscal 2021. India comprised 28% of our MAU as of July 31, 2022. This shift has negatively impacted revenues because well-developed markets command materially higher advertising rates when compared to those in emerging markets. Although we are investing in reversing this trend, we may not be successful in this effort which may result in lower revenues and profitability. Although, GuruShots’ and Emojipedia’s user bases are more heavily weighted to well-developed economies, we are still exposed to the impact of a shift in our Zedge App’s user base toward emerging markets.

Three advertising demand partners, mainly, Google, Facebook and Applovin were responsible for 63% of overall revenue in fiscal 2022. If any of these advertising demand partners were to alter their spend on our digital properties the outcome could result in lowering revenues and profitability.

14

Our apps’ user base is heavily weighted to the Android operating system and our revenues and profitability may suffer if the market demand for Android smartphones decreases.

Our apps’ user base is heavily weighted to smartphones running the Android operating system, which constituted approximately 96% of our MAU (excluding Emojipedia) as of July 31, 2022, and most of our revenues for fiscal 2022. Any significant downturn in the overall demand for Android smartphones or the use of Android smartphones could significantly and adversely affect the demand for our products and services and would materially affect our revenues.

Although the Android smartphone market has grown rapidly in recent years, it is uncertain whether the Android smartphone market will continue growing at a similar rate in the future. In addition, due to the constantly evolving nature of the smartphone industry, another operating system for smartphones may eclipse the Android operating system and result in a decline in its popularity, which would likely adversely affect our apps’ popularity. To the extent that our products and services continue operating on Android smartphones and to the extent that our future revenues substantially depend on the use and sales of Android smartphones, our business and financial results would be vulnerable to any downturns in the Android smartphone market.

We may not be successful in diversifying our revenue mix in order to reduce our significant dependence on third-party advertisers.

In fiscal 2022, approximately 80% of our revenues excluding GuruShots were generated from advertising sales. We cannot assure you that we will be successful in diversifying our revenue mix by identifying new revenue drivers that complement our advertising-heavy business. Although the Zedge App had initial success in converting freemium users into paid subscribers, starting with zero in January 2019 and ending fiscal 2021 with approximately 752,000, we ended fiscal 2022 with 692,000 subscribers, an 8% decline and there is no guarantee that we will be successful in improving subscriber base growth or in maintaining our current subscriber base. To date, Zedge Premium has taken longer to scale than we originally anticipated, and our ‘NFTs Made Easy’ offering is still in the early stages of development. Furthermore, we are still integrating GuruShots and have not achieved its expected growth trajectory or realized synergies between GuruShots and our legacy operations. Finally, Android users constitute approximately 96% of our overall MAU and are prone to spend less money in apps than iOS and web users. Even if our new initiatives are successful on one platform we may not be able to replicate that success across other platforms.

Our revenues may fluctuate materially due to increases and decreases of new mobile device sales, or other factors, over which we have no control.

Our revenue may be materially negatively impacted by a decrease or slowdown in new mobile device sales. Demand for mobile devices highly correlates to installs of our apps and associated usage and revenue generation.

Initially the COVID-19 pandemic negatively impacted new user growth. New smartphone sales suffered as a result of retail business closures, negatively impacting new user growth, especially in well-developed markets. Any e-retail business rebound will be subject to many factors including the state of the global and local economies.

If new mobile device sales decrease or slowdown, our products and services will likely experience fewer installations which will negatively impact our revenue and operations.

We rely on third-party platforms, such as the iOS App Store, Facebook, and Google Play Store, to distribute our apps and collect revenues generated on these platforms. If these platforms adopt policies including those relating to advertising, privacy, or monetization that are counter to our strategy it could result in materially and adversely affecting our business.

Our products and services depend on mobile app stores and other third parties such as data center service providers, as well as third party payment aggregators, computer systems, internet transit providers and other communications systems and service providers. Our mobile applications are almost exclusively accessed through and depend on the Google Play store and Apple’s App Store. While our mobile applications are generally free to download, we offer our users the opportunity to make in-app purchases and/or purchase paid subscriptions. In certain instances, we determine the prices at which these items and subscriptions are sold. These purchases are processed by Google’s and Apple’s in-app payment and subscription systems. As of July 31, 2022 we paid Google and Apple, approximately 16% of the revenue we generated across their respective platforms. Our cashflow may be negatively impacted if either platform changes that timing of their payments to us. While we do not anticipate any interruption in their distribution platforms or ability to accept customer payments, any such disruptions, even temporary, may have material impacts on our business and operations.

15

We are subject to the standard policies and terms of service of third-party platforms, which govern the marketing, promotion, distribution, content and operation of our apps on their platforms. Each platform provider has the discretion to make changes to its operating system, payment services, manner in which their mobile operating system operates as well as change and interpret the terms and conditions of its developer policies. These changes may be harmful to our business and result in a negative outcome. For example, in September 2019, our Zedge App was temporarily removed from Google Play because they asserted that the Zedge App violated their malicious behavior policy. As a result, prospective Android users were prevented from installing our Zedge App, freemium users were unable to convert into paying subscribers and existing users we unable to purchase Zedge Credits. Shortly after the notice was issued, two of our major advertising suppliers ceased serving advertisements to our Zedge App. In addition, Google Play sent a notification to users that had the problematic version of the app on their phone recommending that they uninstall it. We identified the source of the problem as buggy code from a long-term, third-party advertising partner’s standard technology integration in our app. We corrected the problem by removing the offensive code, releasing a new version of our app and our Zedge App was reinstated after approximately 72 hours and concurrently the two major advertising suppliers resumed purchasing our advertising inventory. We estimate the immediate financial impact of the suspension resulted in approximately $100,000 in lost revenue and a material decline in MAU with the majority of uninstalls in emerging markets.

Such changes could:

| ● | make our products and services inaccessible or limit their accessibility; | |

| ● | curtail our ability to distribute and update our applications as we see fit across their platforms; | |

| ● | impose changes in the way in which we monetize our users; | |

| ● | limit the scope of feature enhancements or new features; | |

| ● | decrease or eliminate our ability to market to prospective and existing users; or | |

| ● | cease our ability to collect certain data about users and their respective usage. |

Google and Apple are able to terminate our distribution agreements with them, without cause, with 30 days prior written notice (to the extent allowed by applicable local law). They also may terminate our agreements with them immediately (unless a longer period is required by applicable law) under certain circumstances, including upon our uncured breach of such agreements. To the extent that they or any other third party platform provider on which we rely make such changes or terminates our agreements with them, our business, financial condition and results of operations could be materially adversely affected.

A platform provider may also change its fee structure to our disadvantage, change how we are able to advertise on the platform, limit how user information is made available to developers, curtail how personal information is used for advertising purposes, or restrict how users can share information with their friends on the platform or across platforms. For example, in April 2021 Apple released iOS 14 which started requiring users to opt in to share their IDFA with app developers, on an app-by-app basis. As a consequence, the ability of advertisers to accurately target and measure their advertising campaigns at the user level become significantly more difficult typically resulting in higher user acquisition costs.

If we violate, or a platform provider believes we have violated, its terms of service, the platform provider reserves the right to limit or cease access to their platform. If we are unable to maintain a productive working relationship with any platform distribution and access to our products and services could also be curtailed or permanently disabled. This is especially true in instances where we are dependent on single source providers for their respective services. Any limitation or discontinuation of access to any platform could significantly reduce our ability to distribute and/or provide access to our products to users and would like result in materially and adversely affecting our business, financial condition and results of operations.

Our business depends on the availability of mobile app stores and other third party platforms and any outages that these parties experience will likely have a negative impact on our business, financial condition, results of operations or reputation.

If technologies designed to block the display of advertisements are adopted en masse, or if web browsers limit or block behavioral targeting technologies our revenues may be adversely affected.

Our digital products and services may suffer negative consequences, including a material reduction of revenue, with mass adoption of website ad blocking technologies or other technologies that limit the ability to personalize advertisements, including, without limitation, if the price for this advertising inventory declines.

Activities of our advertiser clients and/or users could damage our reputation or give rise to legal claims against us.

Our advertisers and/or users may not comply with international or domestic laws, including, but not limited to, laws and regulations relating to mobile communications. Failure of our advertisers and/or users to comply with laws or our policies could damage our reputation and expose us to liability under these laws. We may also be liable to third parties for content in the advertisements or content we deliver or distribute if the artwork, text or other content involved violates copyrights, trademarks or other intellectual property rights of third parties or if the content is defamatory, unfair and deceptive, or otherwise in violation of applicable laws. Although we generally receive assurance from our advertising partners and users that their advertisements and content, respectively, are lawful and that they have the right to use any copyrights, trademarks or other intellectual property included in an advertisement or content, and although we are normally indemnified by the advertisers, a third party or regulatory authority may still file a claim against us. Any such claims could be costly and time consuming to defend and could also hurt our reputation within the mobile advertising industry. Further, if we are exposed to legal liability, we could be required to pay substantial fines or penalties, redesign our business methods, discontinue some of our services or otherwise expend significant resources.

16

We may not be able to continually meet our users’ expectations and retain or expand our user base, and our revenues, profitability and prospects may be materially and adversely affected.

Although we constantly monitor and research our users’ expectations, we may be unable to meet them on an ongoing basis or anticipate future user needs. A decrease in the number of users engaging with our products and services may have a material and adverse effect on our ability to sell advertising, digital goods and resources, and subscriptions and on our business, financial condition and results of operations. In order to attract and retain users and remain competitive, we must continue to innovate our products and services, improve user experience, and implement new technologies and functionalities.

The internet business is characterized by constant changes, including but not limited to rapid technological evolution, continual shifts in user expectations, frequent introductions of new products and services and constant emergence of new industry standards and practices. As a result, our users may leave us for our competitors’ products and services more quickly than in other sectors. Thus, our success will depend, in part, on our ability to respond to these changes in a timely and cost-effective basis, including improving and marketing our existing products and services and developing and pricing new products and services in response to evolving user needs. Our ability to successfully retain or expand our user base will depend on our ability to achieve the following, among others:

| ● | anticipate and effectively respond to the growing number of internet users in general and our users in particular; | |

| ● | attract, retain and motivate talent, including but not limited to application developers, visual designers, product and program managers and engineers who have experience developing consumer facing digital products or other mobile internet products and services; | |

| ● | effectively market our existing and new products and services in response to evolving user needs; | |

| ● | develop in a timely fashion and launch new products and features, and develop and launch other internet products cost-effectively; | |

| ● | funnel our existing users and prospects into new products that we develop, independent of our current product suite, and convert them into recurring users of these new products; | |

| ● | successfully recruit new users, artists, individual creators and brands that offer their content to our users; | |

| ● | further improve our platform to provide a compelling and optimal user experience through integration of products and services provided by existing and new third-party developers or business partners; and | |

| ● | continue to provide quality content to attract and retain our users and advertisers. |

We cannot assure you that our existing products and services, will remain sufficiently popular with our users. We may be unsuccessful in adding compelling new features and enhancements; products and services to further diversify these product offerings. Unexpected technical, commercial or operational problems could delay or prevent the introduction of one or more of our new products or services to our users. Moreover, we cannot be sure that any of our new products and services, will achieve widespread market acceptance or generate incremental revenue the way our existing products and services have. If we fail in earning user satisfaction through our products or services or if our products and services fail to meet our expectation to maintain and expand our user base, our business, results of operations and financial condition will be materially and adversely affected.

Zedge Premium, the section of our marketplace where we offer premium content (i.e. for purchase), may not yield the strategic goals and objectives that we envision, and our revenues, profitability and prospects may be materially and adversely negatively affected.

Although we believe that Zedge Premium will act as an important driver in helping our platform become a leading platform for professional artists, individual creators and brands looking to distribute their work to consumers looking for an easy, entertaining and unique way to express their voice, individuality and essence, it’s premature to conclude this as being the case.

17

Although Zedge Premium’s gross transaction revenue has shown modest growth it is still too early to state with conviction that Zedge Premium will have a materially positive impact on our business. In order to do so, we still need, among other things, to:

| ● | demonstrate that a critical mass of artists, individual creators and brands will offer their content to our Zedge App’s users; | |

| ● | continue to add new premium content verticals, with ample content in each vertical, to secure end-user demand and consumption; | |

| ● | create a reliable and attractive web-based offering and successfully market it to both creators and consumers; | |

| ● | continue to ensure that we build best-of-breed tools for Zedge Premium content creators that, amongst other things, meet their needs and properly address marketing, distribution, monetization, reporting, support, and ease of use; | |

| ● | continue to develop a wide array of monetization mechanisms Zedge Premium creators in order to optimize revenue generation; | |

| ● | continue evolving ‘NFTs Made Easy’, our NFT platform, in order to meet the needs of both creators and consumers; | |

| ● | successfully market Zedge Premium to the creative community and secure their adoption as a must-have in their omnichannel distribution mix; | |

| ● | effectively market and convert GuruShots’ players into Zedge Premium artists; | |

| ● | establish that Zedge Premium can be valuable to a sufficient number of creators in achieving their marketing and monetization objectives; and | |

| ● | continue to offer an excellent and differentiated consumer experience in Zedge Premium, including all end-user facing attributes ranging from the user interface to customer support. |

If Zedge Premium fails to yield the strategic goals and objectives that we envision, our business, results of operations and financial condition will be materially and adversely affected.

We may fail to develop popular new features or expand into new verticals, successfully, negatively impacting our ability to attract new users or retain existing users, which could negatively impact our business, financial condition, and result of operations.

18

RISKS RELATED TO FINANCIAL AND ACCOUNTING MATTERS

Our limited operating history makes it difficult to evaluate our business with past results not necessarily being indicative for future operating results and may increase your investment risk.

We have only a limited operating history, especially with respect to Emojipedia and GuruShots, upon which you can evaluate our business and prospects. Although we experienced impressive year-over-year revenue growth of 36% and 107% in fiscal 2022 and 2021 respectively, our growth in fiscal 2020 was moderate and even declined in fiscal 2019. Impacting the growth figures is the inclusion of Emojipedia for fiscal 2022 and GuruShots for the final two months of fiscal 2022. We have encountered and will encounter risks and difficulties frequently experienced by early-stage companies in rapidly evolving industries, like mobile apps, digital marketplaces and gaming, including the need to:

| ● | accurately forecast our revenue and plan our operating expenses; | |

| ● | hire, integrate, and retain key personnel; | |

| ● | successfully integrate and realize the benefits of the acquisitions that we have made; | |

| ● | develop a scalable technology infrastructure that can efficiently and reliably address increased usage, as well as new features and services; | |

| ● | comply with existing and new laws and regulations applicable to our business; | |

| ● | anticipate and effectively respond to the global economy and the markets in which we operate; | |

| ● | establish and expand our various digital brands; | |

| ● | maintain our reputation and build trust with users, artists, advertisers and employees; | |

| ● | offer competitive economics to advertisers and users alike; | |

| ● | maintain and expand revenue producing initiatives including ad sales, in-app purchases and subscriptions; | |

| ● | deliver superior experiences and results for users, artists and advertisers alike; | |

| ● | identify, attract, retain and motivate new user and artists; and | |

| ● | manage our expanding operations. |

If we do not successfully address any or all of these risks, our business, revenues and profitability could be materially adversely affected.

Although we had positive cash flow from operating activities and net earnings in fiscal 2021 and 2022, we had previously incurred, and may once again incur, net losses and experience negative cash flow from operating activities in the future and may not be able to obtain additional capital in a timely manner or on acceptable terms, or at all.