As Filed with the Securities and Exchange Commission on March 21, 2016

Registration No. 333-___________

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

| PRECIOUS METALS EXPLORATION CORP. |

| (Exact name of registrant as specified in its charter) |

| Nevada |

| (State or other jurisdiction of incorporation or organization) |

| 1000 |

| (Primary Standard Industrial Classification Code Number) |

| 47-3636050 |

| (I.R.S. Employer Identification Number) |

| 6 Rietfontein Road, Edenburg, Rivonia, Sandton, 2128, Republic of South Africa; Telephone Number - (27-11) 234-7976 |

| (Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices) |

| Registered

Agents of America, Inc. 311 West Third Street, Carson, NV 89703; Telephone: (775) 888-4070 |

| (Name, address, including zip code, and telephone number, including area code, of agent for service) |

| Please send copies of all communications to: |

| Donald

P. Hateley, Esq. Hateley & Hampton 201 Santa Monica Blvd., Suite 300 Santa Monica, California 90401 (310) 576-4758 |

| As soon as practical after the effective date of this registration statement |

| (Approximate date of commencement of proposed sale to the public) |

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box [X]

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer [ ] | Accelerated filer [ ] |

| Non-accelerated filer [ ] (Do not check if a smaller reporting company) | Smaller reporting company [X] |

Calculation of Registration Fee

| Title of Each Class of Securities to be Registered | Amount

to be Registered(1) | Proposed Maximum Offering Price per Unit(1) | Proposed Maximum Aggregate Offering Price(2) | Amount

of Registration Fee(3) | ||||||||||

| Common stock, $0.0000001 par value per share | 3,000,000 shares | $ | 0.05 | $ | 150,000 | $ | 15.11 | |||||||

| (1) | 3,000,000 shares are being offered by a direct offering at the price of $0.05 per share. |

| (2) | The costs of the offering are estimated to be $50,000, which, would result in net proceeds to the Company of $100,000. |

| (3) | Estimated solely for the purpose of calculating the registration fee in accordance with Rule 457(o) of the Securities Act, based upon the fixed price of the direct offering. |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until this registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

PRELIMINARY PROSPECTUS

THE INFORMATION CONTAINED IN THIS PRELIMINARY PROSPECTUS IS NOT COMPLETE AND MAY BE CHANGED. WE MAY NOT SELL THESE SECURITIES UNTIL THE REGISTRATION STATEMENT FILED WITH THE SECURITIES AND EXCHANGE COMMISSION IS EFFECTIVE. THIS PROSPECTUS IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT SOLICITING AN OFFER TO BUY THESE SECURITIES IN ANY STATE WHERE THE OFFER OR SALE IS NOT PERMITTED. THERE IS NO MINIMUM PURCHASE REQUIREMENT FOR THE OFFERING TO PROCEED.

PRECIOUS METALS EXPLORATION CORP.

3,000,000 SHARES OF COMMON STOCK

$0.05 per share

Precious Metals Exploration Corp. (the “Company,” “we,” or “our”) is offering on a self-underwritten, best-efforts basis a maximum of 3,000,000 shares of its common stock at a price of $0.05 per share. This is our initial offering of common stock and no public market exists for the securities we are offering. There is no minimum number of shares that must be sold by us for the offering to proceed, and we will retain the proceeds from the sale of any of the offered shares. The proceeds from the sale of the offered shares will not be placed in escrow or a trust account and will be immediately available to us. We are offering the shares on a “self-underwritten,” best-efforts, directly through our officers and directors. The shares will be offered at a fixed price of $0.05 per share for a period not to exceed 180 days from the date of this prospectus. There is no minimum number of shares an investor is required to purchase. Robert Russell, our officer and director and Sean Meadon, our other officer, intend to sell the shares directly. No commission or other compensation related to the sale of the shares will be paid to our officers and director and they will not participate in the offering. In offering the securities on our behalf, they will rely on the safe harbor from broker-dealer registration set out in Rule 3a4-1 under the Securities and Exchange Act of 1934. Our intended methods of communication include, without limitations, telephone and personal contact. For more information, see the section of this prospectus entitled “Plan of Distribution.”

The offering shall terminate on the earlier of (i) the date when the sale of all 3,000,000 shares of common stock registered in this registration statement is completed or (ii) when the offering period ends (180 days from the effective date of this prospectus); or (iii) when the Board of Directors decides it is in our best interest to terminate the offering prior to completion of the sale of all 3,000,000 shares registered under the Registration Statement of which this Prospectus is part. We will not extend the offering period beyond one hundred eighty (180) days from the effective date of this prospectus.

There is currently no public or established market for our shares. Consequently, our shareholders will not be able to sell their shares in any organized market place and may be limited to selling their shares privately. Accordingly, an investment in us is an illiquid investment.

We are an “emerging growth company” as defined in the Jumpstart Our Business Startups Act (“JOBS Act”).

BEFORE PURCHASING ANY OF THE SHARES COVERED BY THIS PROSPECTUS, CAREFULLY READ AND CONSIDER THE RISK FACTORS INCLUDED IN THE SECTION ENTITLED “RISK FACTORS” BEGINNING ON PAGE 9. YOU SHOULD BE PREPARED TO ACCEPT ANY AND ALL OF THE RISKS ASSOCIATED WITH PURCHASING THE SHARES, INCLUDING A LOSS OF ALL OF YOUR INVESTMENT.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED THESE SECURITIES OR PASSED UPON THE ACCURACY OR ADEQUACY OF THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

| Number of Shares | Offering Price | Underwriting Discounts & Commissions | Proceeds to the Company | |||||||||||||

| Per Share | 1 | $ | 0.05 | $ | 0.00 | $ | 0.05 | |||||||||

| Maximum | 3,000,000 | $ | 0.05 | $ | 0.00 | $ | 150,000 | |||||||||

THE INFORMATION IN THIS PROSPECTUS IS NOT COMPLETE AND MAY BE CHANGED. WE MAY NOT SELL THESE SECURITIES UNTIL THE REGISTRATION STATEMENT FILED WITH THE U.S. SECURITIES AND EXCHANGE COMMISSION IS EFFECTIVE. THIS PROSPECTUS IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT SOLICITING AN OFFER TO BUY THESE SECURITIES IN ANY STATE WHERE THE OFFER OR SALE IS NOT PERMITTED.

SUBJECT TO COMPLETION, DATED MARCH 21, 2016

| 2 |

Table of Contents

Through and including April 15, 2016 (the 25th day after the date of this prospectus), all dealers that effect transactions in these securities, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to the dealers’ obligation to deliver a prospectus when acting as underwriters and with respect to their unsold allotments or subscriptions.

We have not authorized anyone to provide any information or to make any representations other than those contained in this prospectus or in any free writing prospectuses we have prepared. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. This prospectus is an offer to sell only the shares offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this prospectus is current on as of its date.

| 3 |

This summary provides an overview of selected information contained elsewhere in this prospectus. It does not contain all the information you should consider before making a decision to purchase the shares we are offering. You should very carefully and thoroughly read the following summary together with the more detailed information in this prospectus and review our financial statements and related notes that appear elsewhere in this prospectus. In this prospectus, unless the context otherwise denotes, references to “we,” “us,” “our” and “Company” refer to Precious Metals Exploration Corp. As of the date of our most recent audit, December 31, 2015, we had $3,516 in total assets.

PRECIOUS METALS EXPLORATION CORP.

Organization

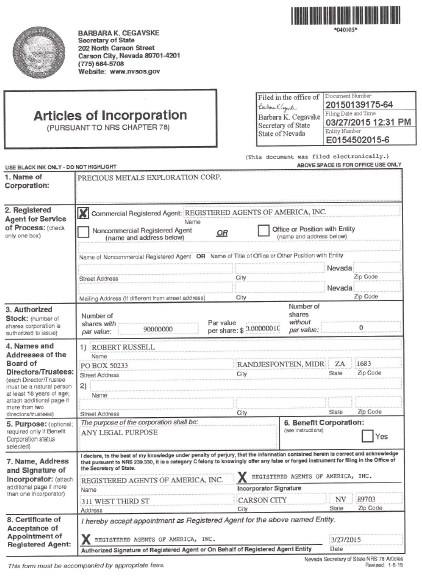

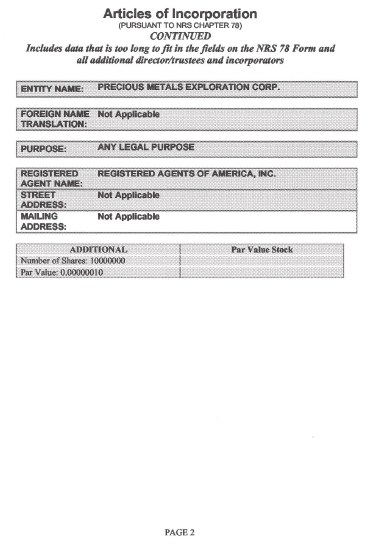

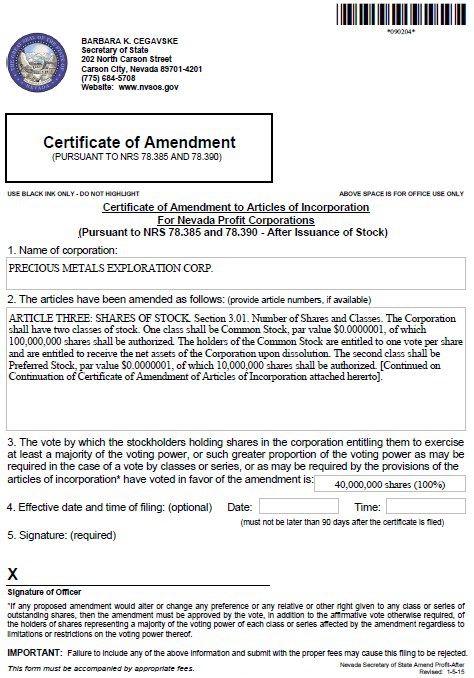

We were incorporated in the State of Nevada as a for-profit company on March 27, 2015, under the name Precious Metals Exploration Corp. and our incorporator appointed Robert Russell, our sole director. On March 27, 2016, Mr. Russell was appointed as the Company’s Chief Executive Officer, President, Treasurer and Chief Financial Officer. Mr. Russell appointed Sean Meadon, to fill a vacancy on the board and Mr. Meadon was appointed as the Company’s Chief Operating Officer and Secretary. To date, we have limited operations and are implementing our business plan to set up a surface clean-up and retreatment operation to set up a primary washing and screening plant in South Africa in order to process surface and near surface mineral deposits which will minimize the capital mining companies require to commence mining operations. The target minerals are the gold and platinum group metals (“PGM”). We have established a fiscal year end of December 31. On March 31, 2015, we acquired a 74% interest in Anganna Investments 143 (Pty) Ltd., a South African corporation, which is our subsidiary. On March 17, 2016, we amended our Articles of Incorporation to add additional provisions to them.

On March 27, 2015, we issued 40,000,000 shares of our $0.0000001 par value common stock, valued at $0.0001 per share, to our 2 initial shareholders, which includes 20,000,000 common shares to Robert Russell, in exchange for organizational services incurred in our formation, which our sole director valued at $0.0001 per share, or $2,000 for preformation services rendered to develop our organization, and business model. On March 27, 2015, we also issued 20,000,000 shares of our $0.0000001 par value common shares to our other initial shareholder, Sean Meadon, our chief operating officer and secretary, in exchange for organizational services incurred in our formation, which our sole director valued at $0.0001 per share, or $2,000 for preformation services rendered to us for assisting in our organization. As of December 31, 2015, we have incurred $30,308 in operational expenses. We anticipate our burn rate will be approximately $1,000 per month. We believe that our present capital is insufficient to cover our monthly burn rate for the next 12 months. We believe that we will require approximately $150,000 in cash to accomplish the goals set out in our plan of operation, which is to develop our mine surface clean-up and retreatment operation. To the extent we are unable to accomplish our goals with the proceeds from the issuance of our common stock, then we intend to raise additional capital from investors through the sale of our common stock or from loans or advances from our majority shareholders.

Our principal business, executive and registered statutory office is located at 6 Rietfontein Road, Edenburg, Rivonia, Sandton, 2128, Republic of South Africa and our telephone number is (27-11) 234-7976, fax is (27-11) 234-7976 and email contact is robert@preciousmetalsexploration.com. Our URL address is www.preciousmetalsexploration.com.

Business

We are a newly formed company that commenced operations on March 27, 2015. Our activities have been limited to organizational and business development activities. On December 12, 2014, Oelofsen Anna Catharina established Anganna Investments 143 (Proprietary) Limited (“Anganna”), a South African corporation under section 14 of the Companies Act, 2008. Ms. Catharina was Anganna’s incorporator and its initial director. On January 30, 2015, Ms. Catharina appointed Robert Russell, one of our director and chief executive officer as Anganna’s sole director and Ms. Catharina resigned. On January 20, 2015, Mr. Russell issued 26 shares of Anganna’s stock to The Magwe Trust IT: 8009/02 (“The Magwe Trust”), which is a Black Economic Empowerment partner for $26. On March 31, 2015, Anganna issued 74 shares to us representing 74% of Anganna’s ownership for $74. Under South African law, we are required to have a Black Economic Empowerment partner to conduct our operations. Anganna has applied for a South African precious metals deposit with the South African Department of Mineral Resources. Other than the formation and issuance of its shares, Anganna does not have an operating history or any assets.

Anganna Investments 143 (Proprietary) Limited has applied for a South African surface mining permit with the South African Department of Mineral Resources.

We are currently focused on setting up a surface clean-up and retreatment operation, targeting both in-house and third party surface deposits. We intend to raise capital to set up a primary washing and screening plant and then plan to add on a crushing and gravity recovering circuit.

We intend to fund the application phase, exploration phase and working capital needs through the sale of our common stock.

| 4 |

The Market Opportunity

We intend, through our surface clean up, retreatment plant and allied services, to exploit the demise of Johannesburg’s 125 year old gold mining industry by tapping into the mine dumps or surface tailings that scar much of the city’s East and West Rand and intend to extract their leftover bullion. South African’s gold industry in its current form is declining and we believe the next logical step is for mines to close.

Tailings consist of ground rock and process effluents that are generated in a mine processing plant. Mechanical and chemical processes are used to extract the desired product from the run of the mine ore and produce a waste stream known as tailings. This process of product extraction is never 100% efficient, nor is it possible to reclaim all reusable and expended processing reagents and chemicals. The unrecoverable and uneconomic metals, minerals, chemicals, organics and process water are discharged, normally as slurry, to a final storage area commonly known as a Tailings Management Facility (TMF) or Tailings Storage Facility (TSF).

Tailings are generally stored on the surface either within retaining structures or in the form of piles (dry stacks) but can also be stored underground in mined out voids by a process commonly referred to as backfill.

South African surface tailings typically contain around 0.3g/ton of leftover gold, which has become profitable to mine thanks to improved technology, low overheads and a gold price that is currently near $1,228/oz.

The commercial incentive for extracting this gold from South Africa’s mine dumps, many of which are more than 60-years old, is one way to mitigate job losses at deep-level mines where the cost of mining as deep as 3km below surface is fast becoming prohibitive. We believe that we can play an important role in reducing the likelihood that the cost of rehabilitating surface tailings could one day be shifted to the tax payer if traditional mining companies disappear.

We are currently in negotiations for a surface mining permit which will give us the rights to surface tailings for gold and other associated metals at a property located at Boksburg, (Greater Johannesburg) where previously existing mines are on the Witwatersrand East Rand in South Africa.

There are additional platinum group metals (“PGM”) located on the Western and Northern Limbs of the Bushveld Igneous Complex. These deposits consist of surface and shallow deposits which are available and within the scope of our business plan. As of the date of this registration statement, we have not applied for the gold mining permits.

As of the date of this Prospectus, we have 40,00,000 shares of $0.0000001 par value common stock issued and outstanding, which is owned by 2 shareholders. The aggregate market value of our common stock based on the offering price of $0.05 per share is $2,000,000. Our stockholders’ deficit as of our most recent audit is ($30,308).

Competition

We compete for industry participants with other companies that offer similar services.

While there is no clear leader or one distinct competitor in the South African marketplace that provides turnkey solutions to the surface mining and tailings rehabilitation industry We intend to continue to develop services that we believe will be valuable to clients. We believe that we can become a market dominant brand, but there can be no assurance that we will be successful in accomplishing our business initiatives, or that we will be able to maintain significant levels of revenues, or recognize net income for providing our services.

We are offering for sale a total of 3,000,000 shares of common stock at a fixed price of $0.05 per share. There is no minimum number of shares that must be sold by us for the offering to proceed, and we will retain the proceeds from the sale of any of the offered shares. The proceeds from the sale of the offered shares will not be placed in escrow or a trust account and will be immediately available to us. The offering is being conducted on a self-underwritten, best efforts, basis, which means our chief executive officer and director, Robert Russell and our chief operating office and secretary, Sean Meadon, will attempt to sell the shares. This prospectus will permit them to sell the shares directly to the public, with no commission or other remuneration payable to them for any shares they may sell. Robert Russell and and Sean Meadon will sell the shares and intend to offer them to friends, family members and business acquaintances. In offering the securities on our behalf, they will rely on the safe harbor from broker-dealer registration set out in Rule 3a4-1 under the Securities and Exchange Act of 1934 (the “Exchange Act”). The intended methods of communication include, without limitations, telephone and personal contact.

| 5 |

The following is a brief summary of this offering. Please see the “Plan of Distribution” section for a more detailed description of the terms of the offering.

| The Issuer: | Precious Metals Exploration Corp. | |

| Securities being Offered: | 3,000,000 shares of common stock, $0.0000001 par value. | |

| Offering Price per Share: | $0.05 | |

| Offering Period: | The shares will be offered for a period of one hundred and eighty (180) days from the effective date of this prospectus. The offering shall terminate on the earlier of (i) when the offering period ends (180 days from the effective date of this prospectus), (ii) the date when the sale of all 3,000,000 shares is completed, (iii) when the Board of Directors decides that it is in the best interest of the Company to terminate the offering prior the completion of the sale of all 3,000,000 shares registered under the Registration Statement of which this Prospectus is part. | |

| Subscriptions | All subscriptions once accepted by us are irrevocable. The proceeds from the sale of the offered shares will not be placed in escrow or a trust account and will be immediately available to us. | |

| Registration Costs: | We estimate our total offering registration costs to be approximately $50,000 | |

| Risk Factors | The purchase of our common stock involves a high degree of risk. The common shares we offer in this prospectus are for investment purposes only and currently no market for our common stock exists. Please refer to the section entitled “Risk Factors” and “Dilution” before making an investment in our stock. | |

| Trading Market: | None. We will seek a market maker to file a Rule 211 application with the Financial Industry Regulatory Authority (“FINRA”) in order to apply for the inclusion of our common stock in the Over-the-Counter Bulletin Board (“OTCBB”); however, such efforts may not be successful and our shares may never be quoted and owners of our common stock may not have a market in which to sell the shares. Also, no estimate may be given as to the time that this application process will require.

Even if our common stock is quoted or granted listing, a market for the common shares may not develop. | |

| Gross Proceeds to Us: | $150,000 in the event all 3,000,000 shares are sold. | |

| Use of Proceeds | We intend to use the proceeds to expand our business operations. | |

| Number of Shares Outstanding Before the Offering: | 40,000,000 common shares | |

| Number of Shares Outstanding After the Offering assuming all 3,000,000 shares are sold: | 43,000,000 common shares |

The offering price of the common stock bears no relationship to any objective criterion of value and has been arbitrarily determined. The price does not bear any relationship to our assets, book value, historical earnings, or net worth.

We will apply the proceeds from the offering to pay for accounting fees, legal and professional fees, office supplies, sales and marketing materials and general working capital.

The following financial information summarizes the more complete historical financial information as indicated in the audited financial statements we are filing with this prospectus.

SUMMARY OF FINANCIAL INFORMATION

The following table sets forth summary financial information derived from our financial statements for the periods stated. The accompanying notes are an integral part of these financial statements and should be read in conjunction with the financial statements, related notes thereto and other financial information included elsewhere in this prospectus.

| 6 |

| Balance Sheet Data: | December 31, 2015 | |||

| Current assets | $ | 3,516 | ||

| Total assets | $ | 3,516 | ||

| Current liabilities | $ | 29,824 | ||

| Total liabilities | $ | 29,824 | ||

| Shareholders’ deficit | $ | (26,308 | ) | |

| Operating Data: | For the period from March 27, 2015 (inception) to December 31, 2015 | |||

| Revenue, net | $ | - | ||

| Operating expenses | $ | 30,308 | ||

| Net loss | $ | (30,308 | ) | |

| Non-controlling interest | 2 | |||

| Net loss to our shareholders | (30,306 | ) | ||

| Net income (loss) per share per common share – basic and diluted | $ | (0.00 | ) | |

| Weighted average number of shares outstanding – basic and diluted | 40,000,000 | |||

As shown in the financial statements accompanying this prospectus, we have had limited revenues to date and have achieved minimal income since our inception and our accountants have issued us a “going concern” opinion, based upon our reliance upon the sale of our common stock as the sole source of funds for our future operations.

| 7 |

We are subject to those financial risks generally associated with start-up enterprises. We are also subject to risk factors specific to our business strategy and the mining and clean up industry.

An investment in these securities involves an exceptionally high degree of risk and is extremely speculative in nature. If any of the following risks occur, our business, operating results and financial condition could be seriously harmed and you could lose all or part of your investment. In addition to the other information regarding us contained in this prospectus, you should consider many important factors in determining whether to purchase shares. Following are what we believe are all of the material risks involved if you decide to purchase shares in this offering.

RISKS ASSOCIATED WITH OUR COMPANY AND INDUSTRY

We are a newly organized enterprise that was incorporated in March 27, 2015 and for the period from March 27, 2015 (inception) through December 31, 2015 we did not generate any revenues. We have a limited operating history upon which an evaluation of our future prospects can be made. From March 27, 2015 (our inception) to December 31, 2015, we have incurred a net loss of ($30,308). Such prospects must be considered in light of the substantial risks, expenses and difficulties encountered by new entrants into the mining cleanup industry. Our ability to achieve and maintain profitability and positive cash flow is highly dependent upon a number of factors, including our ability to offer services at prices that allow us to generate at a profit. Based upon current plans, we expect to incur operating expense in future periods as we incur expenses associated with our business. Further, we cannot guarantee that we will be successful in realizing future revenues or in achieving or sustaining positive cash flow at any time in the future. Any such failure could result in the possible closure of our business or force us to seek additional capital through loans or additional sales of our equity securities to continue business operations, which would dilute the value of any shares you purchase in this offering.

As a public company, we will have to comply with numerous financial reporting and legal requirements, including those pertaining to audits and internal control. The costs of this compliance could be significant. If our revenues are insufficient, and/or we cannot satisfy many of these costs through the issuance of our shares, we may be unable to satisfy these costs in the normal course of business that would result in our being unable to continue as a going concern.

Our independent registered auditors’ report includes an explanatory paragraph stating that there is substantial doubt about our ability to continue as a going concern.

Our auditor’s report on our December 31, 2015 financial statements express an opinion that substantial doubt exits as to whether we can continue as an ongoing business. Moreover, our officers may be unable or unwilling to loan or advance us any funds. See “Audited Financial Statements – Auditors Report.”

We have incurred a loss since inception and our future is dependent upon us obtaining additional financing and our ability to achieve profitability

We had a net loss of $30,308 for the period from March 27, 2015 (inception) to December 31, 2015. Our future is dependent upon our ability to obtain financing and upon future profitable operations from the sale of our services. We plan to seek additional funds through private placements of our common stock. Private placements of our common stock may involve substantial dilution to our existing shareholders. Our financial statements do not include any adjustments relating to the recoverability and classification of recorded assets, or the amounts of and classification of liabilities that might be necessary in the event we cannot continue in existence.

Key management personnel may leave us, which could adversely affect our ability to continue operations.

We are entirely dependent on the efforts of Robert Russell, our president and director, and Sean Meadon, chief operating officer and secretary and other director. The loss of our officers and directors, or of other key personnel hired in the future, could have a material adverse effect on the business and its prospects. There is currently no employment contract by and between any officers/directors and us; however, Robert Russell, and Sean Meadon intend to enter into employment agreements in the future. As of now, there is no guarantee that replacement personnel, if any, will help us to operate profitably. They each have been, and continue to expect to be, able to commit approximately 40 hours per week of their time, to the continued implementation of our business plan. If management were required to spend additional time with outside employment, they may not have sufficient time to devote to us and we would be unable to continue to implement our business plan resulting in the business failure.

We do not maintain key person life insurance on our officer and directors.

| 8 |

Because some of our assets are located outside of the United States and Robert Russell and Sean Meadon, our directors and officers, reside outside of the United States, it may be difficult for an investor to enforce any right based on U.S. federal securities laws against us and/or Messers. Russell and Meadon, or to enforce a judgment rendered by a United States court against us or Messers. Russell and Meadon.

While we are incorporated in the United States, our principal office and operations are located in South Africa and Messers. Russell and Meadon, our officers and directors, are non-residents of the United States. Therefore, it may be difficult to effect service of process on Messers. Russell and Meadon in the United States, and it may be difficult to enforce any judgment rendered against Messers. Russell and Meadon. As a result, it may be difficult or impossible for an investor to bring an action against Messers. Russell and Meadon in the event that an investor believes that such investor’s rights have been infringed under the U.S. securities laws, or otherwise. Even if an investor is successful in bringing an action of this kind, the laws of South Africa or Ireland may render that investor unable to enforce a judgment against the assets of Messers. Russell and Meadon. As a result, our shareholders may have more difficulty in protecting their interests through actions against our management, director or major shareholder, compared to shareholders of a corporation whose officers and directors reside within the United States.

Additionally, because some of our assets are located outside of the United States, they may be outside of the jurisdiction of United States courts to administer, if we become subject of an insolvency or bankruptcy proceeding. As a result, if we declare bankruptcy or insolvency, our shareholders may not receive the distributions on liquidation that they would otherwise be entitled to if our assets were all to be located within the United States under United States bankruptcy laws. A foreign judgment is not directly enforceable in South Africa, but constitutes a cause of action which will be enforced by South African courts provided that:

| ● | the court that pronounced the judgment had jurisdiction to entertain the case according to the principles recognized by South African law with reference to the jurisdiction of foreign courts; | |

| ● | the judgment is final and conclusive; | |

| ● | the judgment has not lapsed; | |

| ● | the recognition and enforcement of the judgment by South African courts would not be contrary to public policy, including observance of the rules of natural justice which require that the documents initiating the United States proceeding were properly served on the defendant and that the defendant was given the right to be heard and represented by counsel in a free and fair trial before an impartial tribunal; | |

| ● | the judgment does not involve the enforcement of a penal or revenue law; and | |

| ● | the enforcement of the judgment is not otherwise precluded by the provisions of the Protection of Business Act 99 of 1978, as amended, of the Republic of South Africa. |

If we are unable to obtain additional funding our business operation will be harmed, and if we do obtain additional funding, our then existing shareholders may suffer substantial dilution.

We have limited financial resources. As of December 31, 2015, we had $0 in cash on hand and $3,516 in assets. In 2015, Mr. Russell has advanced us an additional $25,694 to cover the expenses of this Offering. If we are unable to develop our business or secure additional funds our business would fail and our shares may be worthless. We may seek to obtain debt financing as well. There is no assurance that we will not incur debt in the future, that we will have sufficient funds to repay any indebtedness, or that we will not default on our debt obligations, jeopardizing our business viability. Furthermore, we may not be able to borrow or raise additional capital in the future to meet our needs, or to otherwise provide the capital necessary to conduct our business. There can be no assurance that financing will be available in amounts or on terms acceptable to us, if at all. The inability to obtain additional capital will restrict our ability to grow and may reduce our ability to continue to conduct business operations. If we are unable to obtain additional financing, we will likely be required to curtail our business plans and possibly cease our operations. Any additional equity financing may involve substantial dilution to our then existing shareholders.

General domestic and international economic conditions could have a material adverse effect on our operating results and common stock price and our ability to obtain additional financing.

As a result of the current economic downturn and macro-economic challenges currently affecting the economy of South Africa and other parts of the world, we may suffer delays or postponement of our planned operations until the economy strengthens, which could in turn effect our ability to obtain additional financing. We anticipate our revenues to be derived from the sale of our products and services, which could be suffer if customers are suffering from the economic downturn. During weak economic conditions, we may not experience any growth if we are unable to obtain financing to enable us to market and offer our services. If the domestic and/or international economy were to weaken, the demand for any consulting services we may desire to offer could decline, which could have a material adverse effect on our operating results and stock price.

| 9 |

In the future we may seek additional financing through the sale of our common stock resulting in dilution to existing shareholders.

The most likely source of future financing presently available to us is through the sale of shares of our common stock. Any sale of common stock will result in dilution of equity ownership to existing shareholders. This means that, if we sell shares of our common stock, more shares will be outstanding and each existing shareholder will own a smaller percentage of the shares then outstanding, which will result in a reduction in the value of an existing shareholder’s interest. To raise additional capital, we may have to issue additional shares, which may substantially dilute the interests of existing shareholders. Alternatively, we may have to borrow large sums, and assume debt obligations that require us to make substantial interest and capital payments.

We cannot guarantee we will be successful in generating revenue in the future or be successful in raising funds through the sale of shares to pay for our business plan and expenditures. As of the date of this registration statement of which this prospectus is a part, we have earned minimal revenue. Failure to generate additional revenue will cause us to go out of business, which will result in the complete loss of your investment.

We do not have any intellectual property and, if we develop any, may not be able to adequately protect it from infringement by third parties.

Our business plan is significantly dependent upon setting up a surface treatment and clean up operation. We do not currently have any intellectual property although we believe that as we develop our systems, we will eventually develop trade secrets and other types of intellectual property. In the event that we develop intellectual property in the future, there can be no assurance that we will be able to control all of the rights for all of our future intellectual property or trade secrets that we may develop. We may not have the resources necessary to assert infringement claims against third parties who may infringe upon these future intellectual property rights. Litigation can be costly and time consuming and divert the attention and resources of management and key personnel. We cannot assure you that we can adequately protect any future intellectual property or successfully prosecute potential infringement of any future intellectual property rights. Also, we cannot assure you that others will not assert rights in, or ownership of, trademarks and other proprietary rights that we may obtain, or that we will be able to successfully resolve these types of conflicts to our satisfaction. Our failure to protect any future intellectual property rights may result in a loss of revenue and could materially adversely affect our operations and financial condition.

No Official Confirmation of Mineral Reserves

We rely on information relating to tailings and deposits from results of our prospection and evaluation activities and the historical production information related to the designated operating areas. As such, the actual future production volumes may differ from actual results and impact on overall revenues and profitability.

The mining service we provide might be more expensive to provide than we anticipate.

We expect that future financing that we may obtain will provide the capital required to expand our personnel and provide us the resources to offer additional or more sophisticated surface treatment and clean up services. Expenses associated with acquiring or training personnel to provide the services to our potential customers could increase beyond projected costs because of a range of factors such as an escalation in compensation rates or because of problems or difficulties with technology and equipment used by our personnel.

Competition in the mining cleanup industry is strong. If we cannot successfully compete, our business may be adversely affected.

The marketplace in which we compete is intensely competitive and subject to rapid change. Our competitors include well-established enterprises. Some of these competitors are based globally. We anticipate that we will face additional competition from new entrants that may offer significant performance, price, creative or other advantages over those offered by us. Many of these competitors have greater name recognition and resources than us.

Additionally, potential competitors with established market shares and greater financial resources might introduce competing surface treatment or cleanup services. Thus, there can be no assurance that we will be able to compete successfully in the future or that competition will not have a material adverse affect on our operations. Increased competition could result in lower than expected operating margins or loss of the ability to attract customers, either of which would materially and adversely affect our business, results of operation and financial condition.

| 10 |

Our operations in South Africa are subject to water use licenses, which could impose significant costs.

Under South African law, our local operations are subject to water use licenses that govern each operation’s water use. These licenses require, among other issues, that mining operations achieve and maintain certain water quality limits for all water discharges, where these apply. Our South African operation will be a lawful user with existing water permits in terms of the Water Act of 1954. Nevertheless, the South African operations will apply to the relevant regional directors for water use licenses in terms of the National Water Act, 1998. Submissions will be made in 2016 and we will work closely with the regional directors in the review process.

We anticipate that the conditions of the licenses may require us to consider and implement alternate water management measures that may have a significant cost implication for our business. Any failure on our part to achieve or maintain compliance with the requirements of these licenses for any of our operations may result in us being subject to penalties, fees and expenses or business interruption due to revoked water licenses. Any of these could have a material effect on our business, operating results and financial condition.

We are subject to extensive environmental regulations.

As a gold mining clean up company, we are subject to extensive environmental regulation. We expect the trend of rising costs due to compliance with South African environmental laws and regulations to continue.

The MPRDA, certain other environmental legislation and the administrative policies of the South African government regulate the impact of the Company’s operations on the environment. Our clients, on On the suspension, cancellation, termination or lapsing of a prospecting permit or mining authorization, will remain liable for compliance with the provisions of various relevant regulations, including any rehabilitation obligations until a closure certificate is issued by the DMR. This liability for our clients will continue until the appropriate authorities have 1) certified that the client has complied with such provisions or 2) authorized the transfer of liability to a competent party.

Estimates of ultimate closure and rehabilitation costs are significant and are based principally on current legal and regulatory requirements that may change materially. Environmental provisions are accrued when they become known, probable and can be reasonably estimated based on industry good practice. In future, our clients may incur significant costs for compliance with increasingly stringent requirements being imposed under new legislation. This may include the need to increase and accelerate expenditure on environmental rehabilitation and to alter environmental provisions, which could have a material effect on their results and financial condition. Our clients may also face increased environmental costs should other mines in the vicinity fail to meet their obligations on the pumping or treatment of water, which could impact their ability to pay us.

The South African government has reviewed requirements imposed on mining companies to ensure environmental restitution. For example, following the introduction of an environmental rights clause in South Africa’s constitution, a number of environmental legislative reform processes have been initiated. Legislation passed as a result of these initiatives has tended to be materially more onerous than previous laws in South Africa. Examples of such legislation include the MPRDA, the National Nuclear Regulator Act 1999, the National Water Act of 1998 and the National Environmental Management Act 1998, which include stringent ‘polluter pays’ provisions. The adoption of these or additional or more comprehensive and stringent requirements, particularly for the management of hazardous waste, pollution of ground and groundwater systems and duty to rehabilitate closed mines, may result in additional costs and liabilities.

Our operations are subject to various laws and regulations relating to protection of the environment.

If we are unable to obtain customers for our services, our business will suffer and likely fail.

Because we lack the resources to advertise our services in traditional publications, we plan to enter into arrangements with other marketers to market our services. As a result, we may be unable to secure marketing agreements before funds are spent on personnel or other forms of advertising. We cannot provide any assurance that we will be able to secure any favorable marketing agreements, or if we were able to, under terms that would allow us to be profitable. If we are unable to obtain adequate marketing, we may not have the ability to generate revenue.

We operate in a regulated industry and changes in regulations or violations of regulations may result in increased costs or sanctions that could reduce our revenues and profitability.

The surface treatment and cleanup industry is subject to a variety of South African laws and regulations related to the type of services that we could provide, the conduct of operations, and payment for services. If we fail to comply with the laws and regulations that are directly applicable to our business, we could suffer civil and/or criminal penalties or be subject to injunctions and delays in providing our services to clients.

| 11 |

The South African government may regulate the services that we offer. Our ability to cost effectively provide these services could be affected by such regulations. The implementation of unfavorable regulations or unfavorable interpretations of existing regulations by courts or regulatory bodies could require us to incur significant compliance costs, cause the development of the affected markets to become impractical and otherwise have a material adverse effect on our business, results of operations and financial condition.

Our officers and directors lack experience in operating a public company, which could prevent us from successfully implementing our business plan and impede our ability to earn revenue.

While our offices and directors have extensive experience in the mining industry, they lack experience in operating a public company. Their lack of experience in operating a public company could hinder their ability to successfully comply with the reporting and other requirements imposed on public companies. It is likely that our management’s inexperience with operating a public company will hinder our ability to earn revenue and comply with various reporting requirements. Each potential investor must carefully consider the lack of experience of our officers and directors before purchasing our common stock.

Our officer and directors may have conflicts in allocating their time to our business

Our officers and directors are required to commit time to our affairs and, accordingly, may have conflicts of interest in allocating management time among various business activities. In the course of other business activities, they may become aware of business opportunities that may be appropriate for presentation to us, as well as the other entities with which they are affiliated.

In an effort to resolve such potential conflicts of interest, our officers and directors have agreed that any opportunities that they are aware of independently or directly through their association with us (as opposed to disclosure to them of such business opportunities by management or consultants associated with other entities) would be presented by them solely to us.

We cannot provide assurances that our efforts to eliminate the potential impact of conflicts of interest will be effective.

We intend to become subject to the periodic reporting requirements of the Exchange Act that will require us to incur audit fees and legal fees in connection with the preparation of such reports. These additional costs could reduce or eliminate our ability to earn a profit.

Following the effective date of our registration statement of which this prospectus is a part, we will be required to file periodic reports with the SEC pursuant to the Exchange Act and the rules and regulations promulgated thereunder. In order to comply with these requirements, our independent registered public accounting firm will have to review our financial statements on a quarterly basis and audit our financial statements on an annual basis. Moreover, our legal counsel will have to review and assist in the preparation of such reports. The costs charged by these professionals for such services cannot be accurately predicted at this time because factors such as the number and type of transactions that we engage in and the complexity of our reports cannot be determined at this time and will have a major affect on the amount of time to be spent by our auditors and attorneys. However, the incurrence of such costs will obviously be an expense to our operations and thus have a negative effect on our ability to meet our overhead requirements and earn a profit. We may be exposed to potential risks resulting from any new requirements under Section 404 of the Sarbanes-Oxley Act of 2002. If we cannot provide reliable financial reports or prevent fraud, our business and operating results could be harmed, investors could lose confidence in our reported financial information, and the trading price of our common stock, if a market ever develops, could drop significantly.

Our internal controls may be inadequate, which could cause our financial reporting to be unreliable and lead to misinformation being disseminated to the public.

Our management is responsible for establishing and maintaining adequate internal control over financial reporting. As defined in Exchange Act Rule 13a-15(f), internal control over financial reporting is a process designed by, or under the supervision of, the principal executive and principal financial officer and effected by the board of directors, management and other personnel, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles and includes those policies and procedures that:

| ● | pertain to the maintenance of records that in reasonable detail accurately and fairly reflect the transactions and dispositions of our assets; | |

| ● | provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with generally accepted accounting principles, and that our receipts and expenditures are being made only in accordance with authorizations of management and/or our directors; and | |

| ● | provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use or disposition of our assets that could have a material effect on the financial statements. |

| 12 |

Our internal controls may be inadequate or ineffective, which could cause our financial reporting to be unreliable and lead to misinformation being disseminated to the public. Investors relying upon this misinformation may make an uninformed investment decision.

Our directors have significant control over us and we have not established committees comprised of independent directors.

We have two directors. Accordingly, we cannot establish board committees comprised of independent members to oversee functions like compensation or audit issues. In addition, since we have two directors, they have significant control over all corporate issues. We do not have an audit or compensation committee comprised of independent directors. Our directors perform these functions and are not independent directors. Thus, there is a potential conflict in that our directors are also engaged in management and participate in decisions concerning management compensation and audit issues that may affect management performance.

Until we have a larger board of directors that would include some independent members, if ever, there will be limited oversight of our directors’ decisions and activities and little ability for minority shareholders to challenge or reverse those activities and decisions, even if they are not in the best interests of minority shareholders.

The socio-economic framework in the regions in which we will operate may have an adverse effect on our operations and profits.

Our operations are in South Africa. As a result, changes to or instability in the economic or political environment in this country or in neighboring countries could affect an investment in us. These risks could include terrorism, civil unrest, nationalization, renegotiation or nullification of existing contracts, leases, permits or other agreements, restrictions on repatriation of earnings or capital and changes in laws and policy, as well as other unforeseeable risks.

It is difficult to predict the future political, social and economic direction in South Africa, or any neighboring country, and the impact government decisions may have on our business.

We are an “emerging growth company,” and we cannot be certain if the reduced reporting requirements applicable to emerging growth companies will make our common stock less attractive to investors.

As an “Emerging Growth Company” under The Jobs Act, we are permitted to rely on exemptions from certain disclosure requirements

We qualify as an “emerging growth company” under the JOBS Act. As a result, we are permitted to, and intend to, rely on exemptions from certain disclosure requirements. For so long as we are an emerging growth company, we will not be required to:

| ● | have an auditor report on our internal controls over financial reporting pursuant to Section 404(b) of the Sarbanes-Oxley Act; | |

| ● | provide an auditor attestation with respect to management’s report on the effectiveness of our internal controls over financial reporting; | |

| ● | comply with any requirement that may be adopted by the Public Company Accounting Oversight Board regarding mandatory audit firm rotation or a supplement to the auditor’s report providing additional information about the audit and the financial statements (i.e., an auditor discussion and analysis); | |

| ● | submit certain executive compensation matters to shareholder advisory votes, such as “say-on-pay” and “say-on-frequency;” and | |

| ● | disclose certain executive compensation related items such as the correlation between executive compensation and performance and comparisons of the Chief Executive’s compensation to median employee compensation. |

In addition, Section 107 of the JOBS Act also provides that an emerging growth company can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. In other words, an emerging growth company can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We have elected to take advantage of the benefits of this extended transition period. Our financial statements may therefore not be comparable to those of companies that comply with such new or revised accounting standards.

We will remain an “emerging growth company” for up to five years, or until the earliest of (i) the last day of the first fiscal year in which our total annual gross revenues exceed $1 billion, (ii) the date that we become a “large accelerated filer” as defined in Rule 12b-2 under the Securities Exchange Act of 1934, which would occur if the market value of our ordinary shares that is held by non-affiliates exceeds $700 million as of the last business day of our most recently completed second fiscal quarter or (iii) the date on which we have issued more than $1 billion in non-convertible debt during the preceding three year period. Even if we no longer qualify for the exemptions for an emerging growth company, we may still be, in certain circumstances, subject to scaled disclosure requirements as a smaller reporting company. For example, smaller reporting companies, like emerging growth companies, are not required to provide a compensation discussion and analysis under Item 402(b) of Regulation S-K or auditor attestation of internal controls over financial reporting.

| 13 |

Until such time, however, we cannot predict if investors will find our common stock less attractive because we may rely on these exemptions. If some investors find our common stock less attractive as a result, there may be a less active trading market for our common stock and our stock price may be more volatile.

Please see “Management’s Discussion and Analysis of Financial Condition and Results of Operations – Critical Accounting Policies” on page 25 for a further discussion of this exemption.

RISKS ASSOCIATED WITH THIS OFFERING

The offering price of our common stock has been determined arbitrarily.

The $0.05 per share price of our common stock in this offering has not been determined by any independent financial evaluation, market mechanism or by our auditors, and is therefore, to a large extent, arbitrary. Our audit firm has not reviewed management’s valuation and, therefore, expresses no opinion as to the fairness of the offering price as determined by our management. As a result, the price of the common stock in this offering may not reflect the value perceived by the market. There can be no assurance that the shares offered hereby are worth the price for which they are offered and investors may, therefore, lose a portion or all of their investment

We are selling this offering on a self-underwritten, best efforts basis and will retain the proceeds of any shares we sell; and without an underwriter, we may be unable to sell any shares.

This offering is self-underwritten on a best-efforts, basis, that is, we are not going to engage the services of an underwriter to sell the shares; we intend to sell them through Messrs. Russell and Meadon, our officers and directors, who will receive no commissions. They will offer the shares to friends, acquaintances and relatives; however, there is no guarantee that they will be able to sell any of the shares or all of the shares and there is no minimum amount of shares we require to be sold for this offering to proceed. The proceeds from the sale of the offered shares will not be placed in escrow or a trust account and will be immediately available to us. We will retain the proceeds of any of the shares we sell. If we raise only a nominal amount of proceeds, then we may be unable to implement our business plan and we may have to suspend or cease operations and you may lose your investment in us.

Investors may lose their entire investment if we fail to implement our business plan.

We expect to face substantial risks, uncertainties, expenses and difficulties. We were formed on March 27, 2015. We have a no demonstrable operations record, on which you can evaluate our business and prospects. We commenced operations in March 2015. As of the date of this prospectus, we have had only limited start-up operations and have not generated any revenues. We cannot guarantee that we will be successful in accomplishing our objectives.

Participation is subject to risks of investing in micro capitalization companies.

Micro capitalization companies generally have limited product lines, markets, market shares and financial resources. The securities of such companies, if traded in the public market, may trade less frequently and in more limited volume than those of more established companies. Additionally, in recent years, the stock market has experienced a high degree of price and volume volatility for the securities of micro capitalization companies. In particular, micro capitalization companies that trade in the over-the-counter markets have experienced wide price fluctuations not necessarily related to the operating performance of such companies.

| 14 |

Currently, there is no established public market for our securities, and there can be no assurances that any established public market will ever develop or that our common stock will be quoted for trading and, even if quoted, it is likely to be subject to significant price fluctuations.

Prior to the date of this prospectus, there has not been any established trading market for our common stock, and there is currently no established public market whatsoever for our securities. We have not entered into any agreement with a market maker to file an application with FINRA on our behalf so as to be able to quote the shares of our common stock on the OTCBB maintained by FINRA commencing upon the effectiveness of our registration statement. There can be no assurance that we will subsequently identify a market maker and, to the extent that we identify one, enter into an agreement with it to file an application with FINRA or that the market maker’s application will be accepted by FINRA. We cannot estimate the time period that the application will require for FINRA to approve it. We are not permitted to file such application on our own behalf. If the application is accepted, there can be no assurances as to whether

| i. | any market for our shares will develop; | |

| ii. | the prices at which our common stock will trade; or | |

| iii. | the extent to which investor interest in us will lead to the development of an active, liquid trading market. Active trading markets generally result in lower price volatility and more efficient execution of buy and sell orders for investors. |

If we become able to have our shares of common stock quoted on the OTCBB, we will then try, through a broker-dealer and its clearing firm, to become eligible with the Depository Trust Company (“DTC”) to permit our shares to trade electronically. If an issuer is not “DTC-eligible,” then its shares cannot be electronically transferred between brokerage accounts, which, based on the realities of the marketplace as it exists today (especially the OTCBB), means that shares of a company will not be traded (technically the shares can be traded manually between accounts, but this takes days and is not a realistic option for companies relying on broker dealers for stock transactions - like all companies on the OTCBB. What this boils down to is that while DTC-eligibility is not a requirement to trade on the OTCBB), it is a necessity to process trades on the OTCBB if a company’s stock is going to trade with any volume. There are no assurances that our shares will ever become DTC-eligible or, if they do, how long it will take.

In addition, our common stock is unlikely to be followed by any market analysts, and there may be few institutions acting as market makers for our common stock. Either of these factors could adversely affect the liquidity and trading price of our common stock. Until our common stock is fully distributed and an orderly market develops in our common stock, if ever, the price at which it trades is likely to fluctuate significantly. Prices for our common stock will be determined in the marketplace and may be influenced by many factors, including the depth and liquidity of the market for shares of our common stock, developments affecting our business, including the impact of the factors referred to elsewhere in these Risk Factors, investor perception of us and general economic and market conditions. No assurances can be given that an orderly or liquid market will ever develop for the shares of our common stock.

Because of the anticipated low price of the securities being registered, many brokerage firms may not be willing to effect transactions in these securities. Purchasers of our securities should be aware that any market that develops in our stock would be subject to the penny stock restrictions. See “Plan of Distribution” and “Risk Factors.”

Any market that develops in shares of our common stock will be subject to the penny stock regulations and restrictions pertaining to low priced stocks that will create a lack of liquidity and make trading difficult or impossible.

The trading of our securities, if any, will be in the over-the-counter market, which is commonly referred to as the OTCBB as maintained by FINRA. As a result, an investor may find it difficult to dispose of, or to obtain accurate quotations as to the price of our securities.

Rule 3a51-1 of the Exchange Act establishes the definition of a “penny stock,” for purposes relevant to us, as any equity security that has a minimum bid price of less than $4.00 per share or with an exercise price of less than $4.00 per share, subject to a limited number of exceptions that are not available to us. It is likely that our shares will be considered to be penny stocks for the immediately foreseeable future. This classification severely and adversely affects any market liquidity for our common stock.

For any transaction involving a penny stock, unless exempt, the penny stock rules require that a broker or dealer approve a person’s account for transactions in penny stocks and the broker or dealer receive from the investor a written agreement to the transaction setting forth the identity and quantity of the penny stock to be purchased. In order to approve a person’s account for transactions in penny stocks, the broker or dealer must obtain financial information and investment experience and objectives of the person and make a reasonable determination that the transactions in penny stocks are suitable for that person and that that person has sufficient knowledge and experience in financial matters to be capable of evaluating the risks of transactions in penny stocks.

The broker or dealer must also deliver, prior to any transaction in a penny stock, a disclosure schedule prepared by the SEC relating to the penny stock market, which, in highlight form, sets forth:

| ● | the basis on which the broker or dealer made the suitability determination, and | |

| ● | that the broker or dealer received a signed, written agreement from the investor prior to the transaction. |

Disclosure also has to be made about the risks of investing in penny stock in both public offerings and in secondary trading and commissions payable to both the broker-dealer and the registered representative, current quotations for the securities and the rights and remedies available to an investor in cases of fraud in penny stock transactions. Additionally, monthly statements have to be sent disclosing recent price information for the penny stock held in the account and information on the limited market in penny stocks.

| 15 |

Because of these regulations, broker-dealers may not wish to engage in the above-referenced necessary paperwork and disclosures and/or may encounter difficulties in their attempt to sell shares of our common stock, which may affect the ability of selling shareholders or other holders to sell their shares in any secondary market and have the effect of reducing the level of trading activity in any secondary market. These additional sales practice and disclosure requirements could impede the sale of our securities, if and when our securities become publicly traded. In addition, the liquidity for our securities may decrease, with a corresponding decrease in the price of our securities. Our shares, in all probability, will be subject to such penny stock rules for the foreseeable future and our shareholders will, in all likelihood, find it difficult to sell their securities.

The market for penny stocks has experienced numerous frauds and abuses that could adversely impact investors in our stock.

Our management believes that the market for penny stocks has suffered from patterns of fraud and abuse. Such patterns include:

| ● | Control of the market for the security by one or a few broker-dealers that are often related to the promoter or issuer; | |

| ● | Manipulation of prices through prearranged matching of purchases and sales and false and misleading press releases; | |

| ● | “Boiler room” practices involving high-pressure sales tactics and unrealistic price projections by sales persons; | |

| ● | Excessive and undisclosed bid-ask differentials and markups by selling broker-dealers; and | |

| ● | Wholesale dumping of the same securities by promoters and broker-dealers after prices have been manipulated to a desired level, along with the inevitable collapse of those prices with consequent investor losses. |

Any trading market that may develop may be restricted by virtue of state securities “Blue Sky” laws that prohibit trading absent compliance with individual state laws. These restrictions may make it difficult or impossible to sell shares in those states.

There is currently no established public market for our common stock, and there can be no assurance that any established public market would develop in the foreseeable future. Transfer of our common stock may also be restricted under the securities or securities regulations laws promulgated by various states and foreign jurisdictions, commonly referred to as “Blue Sky” laws. Absent compliance with such individual state laws, our common stock may not be traded in such jurisdictions. Because the securities registered hereunder have not been registered for resale under the blue sky laws of any state, the holders of such shares and persons who desire to purchase them in any trading market that might develop in the future, should be aware that there may be significant state blue sky law restrictions upon the ability of investors to sell the securities and of purchasers to purchase the securities. These restrictions prohibit the secondary trading of our common stock. We currently do not intend to and may not be able to qualify securities for resale in at least 17 states which do not offer manual exemptions (or may offer manual exemptions but may not to offer one to us if we are considered to be a shell company at the time of application) and require shares to be qualified before they can be resold by our shareholders. Accordingly, investors should consider the secondary market for our securities to be a limited one. See also “Plan of Distribution-State Securities-Blue Sky Laws.”

You will bear a substantial risk of loss due to immediate and substantial dilution of the price you pay for your shares.

Our existing shareholders acquired their shares at a cost substantially less than that which you will pay for the shares you purchase in this Offering. Accordingly, any investment you make in these shares will result in the immediate and substantial dilution of the net tangible book value of those shares from the $0.05 you pay for them. Upon completion of the Offering, assuming all the 3,000,000 shares are sold, the net tangible book value of your shares will be $0.003 per share, $0.047 per share less than what you paid for them. Therefore, investors in this Offering will bear a substantial portion of the risk of loss. Additional sales of our common stock in the future could result in further dilution. Please refer to the section titled “Dilution” herein.

We have no committed source of financing. Wherever possible, our directors will attempt to use non-cash consideration to satisfy obligations. In many instances, we believe that the non-cash consideration will consist of restricted shares of our common stock. Our directors have the authority, without action or vote of the shareholders, to issue all or part of the authorized (90,000,000 shares) but unissued (47,000,000 shares) assuming the sale of 3,000,000 shares in this offering. In addition, if a trading market develops for our common stock, we may attempt to raise capital by selling shares of our common stock, possibly at a discount to market. These actions will result in dilution of the ownership interests of existing shareholders may further dilute common stock book value, and that dilution may be material.

| 16 |

Because insiders control our activities, they may cause us to act in a manner that is most beneficial to them and not to outside shareholders, which could cause us not to take actions that outside investors might view favorably and which could prevent or delay a change in control.

Robert Russell, our director and chief executive officer, owns 20,000,000 or 50% of our common stock and Sean Meadon, our director, chief operating officer and secretary owns 20,000,000 or 50% of our common stock. As a result, they effectively control all matters requiring director and stockholder approval, including the election of directors, the approval of significant corporate transactions, such as mergers and related party transactions as well as their compensation. These insiders also have the ability to delay or perhaps even block, by their ownership of our stock, an unsolicited tender offer. This concentration of ownership could have the effect of delaying, deterring or preventing a change in control of our company that you might view favorably.

The interests of shareholders may be hurt because we can issue shares of our common stock to individuals or entities that support existing management with such issuances serving to enhance existing management’s ability to maintain control of us.

Our directors have authority, without action or vote of the shareholders, to issue all or part of the authorized but unissued common shares. Such issuances may be issued to parties or entities committed to supporting existing management and the interests of existing management which may not be the same as the interests of other shareholders. Our ability to issue shares without shareholder approval serves to enhance existing management’s ability to maintain control of us.

Our articles of incorporation provide for indemnification of officers and directors at our expense and limit their liability that may result in a major cost to us and hurt the interests of our shareholders because corporate resources may be expended for the benefit of officers and/or directors. [Should Amend]

Our Articles of Incorporation at Article Nine provides for indemnification as follows: “Every person who was or is a party to, or is threatened to be made a party to, or is involved in any action, suit, or proceeding, whether civil, criminal, administrative, or investigative, by reason of the fact that he, or a person of whom he is the legal representative, is or was a Director or Officer of the Corporation, or is or was serving at the request of the Corporation as a Director or Officer of another Corporation, or as its representative in a partnership, joint venture, trust, or other enterprise, shall be indemnified and held harmless to the fullest extent legally permissible under the laws of the State of Nevada from time to time against all expenses, liability, and loss (including attorneys’ fees judgments, fines, and amounts paid or to be paid in settlement) reasonably incurred or suffered by him in connection therewith. Such right of indemnification shall be a contract right, which may be enforced in any manner desired by such person. The expenses of Officers and Directors incurred in defending a civil or criminal action, suit, or proceeding must be paid by the Corporation as they are incurred and in advance of the final disposition of the action, suit, or proceeding, upon receipt of an undertaking by or on behalf of the Director or Officer to repay the amount if it is ultimately determined by a court of competent jurisdiction that he is not entitled to be indemnified by the Corporation. Such right of indemnification shall not be exclusive of any other right which such Directors, Officers, or representatives may have or hereafter acquire, and, without limiting the generality of such statement, they shall be entitled to their respective rights of indemnification under any bylaw, agreement, vote of Stockholders, provision of law, or otherwise, as well as their rights under this Article. Without limiting the application of the foregoing, the Stockholders or Board of Directors may adopt bylaws from time to time with respect to indemnification, to provide at all times the fullest indemnification permitted by the laws of the State of Nevada, and may cause the Corporation to purchase and maintain insurance on behalf of any person who is or was a Director or Officer of the Corporation, or is or was serving at the request of the Corporation as a Director or Officer of another Corporation, or as its representative in a partnership, joint venture, trust, or other enterprise against any liability asserted against such person and incurred in any such capacity or arising out of such status, whether or not the Corporation would have the power to indemnify such person. The indemnification provided in this Article shall continue as to a person who has ceased to be a Director, Officer, Employee, or Agent, and shall inure to the benefit of the heirs, executors and administrators of such person.”

We have been advised that, in the opinion of the SEC, indemnification for liabilities arising under federal securities laws is against public policy as expressed in the Securities Act of 1933 and is, therefore, unenforceable. In the event that a claim for indemnification for liabilities arising under federal securities laws, other than the payment by us of expenses incurred or paid by a director, officer or controlling person in the successful defense of any action, suit or proceeding, is asserted by a director, officer or controlling person in connection with our activities, we will (unless in the opinion of our counsel, the matter has been settled by controlling precedent) submit to a court of appropriate jurisdiction, the question whether indemnification by us is against public policy as expressed in the Securities Act and will be governed by the final adjudication of such issue. The legal process relating to this matter if it were to occur is likely to be very costly and may result in us receiving negative publicity, either of which factors is likely to materially reduce the market and price for our shares, if such a market ever develops.