UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

For the fiscal year ended December 31, 2020

or

Commission file number: 001-38196

(Exact name of registrant as specified in its charter)

| State or other jurisdiction of incorporation or organization | (I.R.S. Employer Identification No.) | |||||||||||||

(Address of Principal Executive Offices) | (Zip Code) | |||||||||||||||||||

(302 ) 774-3034

(Registrant’s Telephone Number, Including Area Code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||

No securities are registered pursuant to Section 12(g) of the Act.

_____________________________________________________

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. þ Yes ¨ No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ¨ Yes þ No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

þ Yes ¨ No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

☑ Yes ¨ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| ☑ | Accelerated filer | ¨ | |||||||||||||||||||||

| Non-accelerated filer | ¨ | Smaller reporting company | |||||||||||||||||||||

| Emerging growth company | |||||||||||||||||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☑

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). ☐ Yes ☑ No

The aggregate market value of the common equity held by non-affiliates of the registrant as of June 30, 2020, (the last day of the registrant's most recently completed second fiscal quarter), was approximately $39 billion based on the New York Stock Exchange closing price on such date. For purposes of this computation, the registrant has assumed that its Directors and Executive Officers are affiliates.

The registrant had 538,089,014 shares of common stock, $0.01 par value, outstanding at February 10, 2021.

DOCUMENTS INCORPORATED BY REFERENCE

Part III: Proxy Statement for the 2021 Annual Meeting of Stockholders to be filed not later than 120 days after the end of the fiscal year covered by this Form 10-K.

DuPont de Nemours, Inc.

ANNUAL REPORT ON FORM 10-K

For the year ended December 31, 2020

TABLE OF CONTENTS

| Page | |||||||||||

3

| DuPont de Nemours, Inc. | ||

Throughout this Annual Report on Form 10-K, except as otherwise noted by the context, the terms "DuPont" or "Company" used herein mean DuPont de Nemours, Inc. and its consolidated subsidiaries. On June 1, 2019, DowDuPont Inc. changed its registered name to DuPont de Nemours, Inc. (“DuPont”) (for certain events prior to June 1, 2019, the Company may be referred to as DowDuPont). Beginning on June 3, 2019, the Company's common stock is traded on the New York Stock Exchange under the ticker symbol "DD."

Effective August 31, 2017, E. I. du Pont de Nemours and Company ("EID") and The Dow Chemical Company ("TDCC") each merged with subsidiaries of DowDuPont Inc. (n/k/a "DuPont”) and, as a result, EID and TDCC became subsidiaries of the Company. On April 1, 2019, the Company completed the separation of the materials science business through the spin-off of Dow Inc., (“Dow”) including Dow’s subsidiary TDCC (the “Dow Distribution”). On June 1, 2019, the Company completed the separation of the agriculture business through the spin-off of Corteva, Inc. (“Corteva”) including Corteva’s subsidiary EID, (the “Corteva Distribution and together with the Dow Distribution, the “DWDP Distributions”).

Following the Corteva Distribution, DuPont holds the specialty products business as continuing operations. The results of operations of DuPont for the 2019 and 2018 periods presented reflect the historical financial results of Dow and Corteva as discontinued operations, as applicable. The cash flows and comprehensive income related to Dow and Corteva have not been segregated and are included in the Consolidated Statements of Cash Flows and Consolidated Statements of Comprehensive Income, respectively, for the applicable period. Unless otherwise indicated, the information in the notes to the Consolidated Financial Statements refer only to DuPont's continuing operations and do not include discussion of balances or activity of Dow or Corteva.

On February 1, 2021, DuPont completed the separation and distribution of the Nutrition & Biosciences business (the “N&B Business”), and merger of Nutrition & Biosciences, Inc. (“N&B”), a DuPont subsidiary formed to hold the N&B Business, with a subsidiary of International Flavors & Fragrances Inc. (“IFF”). The distribution was effected through an exchange offer (the “Exchange Offer”) where, on the terms and subject to the conditions of the Exchange Offer, eligible participating DuPont stockholders had the option to tender all, some or none of their shares of common stock, par value $0.01 per share, of DuPont (the “DuPont Common Stock”) for a number of shares of common stock, par value $0.01 per share, of N&B (the “N&B Common Stock”) and which resulted in all shares of N&B Common Stock being distributed to DuPont stockholders that participated in the Exchange Offer. The consummation of the Exchange Offer was followed by the merger of N&B with a wholly owned subsidiary of IFF, with N&B surviving the merger as a wholly owned subsidiary of IFF (the “N&B Merger” and, together with the Exchange Offer, the “N&B Transaction”). The results of the N&B business are included in the continuing operations of DuPont for all periods presented herein.

DuPontTM and all products, unless otherwise noted, denoted with TM, SM or ® are trademarks, service marks or registered trademarks of affiliates of DuPont de Nemours, Inc.

FORWARD-LOOKING STATEMENTS

This communication contains "forward-looking statements" within the meaning of the federal securities laws, including Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. In this context, forward-looking statements often address expected future business and financial performance and financial condition, and often contain words such as "expect," "anticipate," "intend," "plan," "believe," "seek," "see," "will," "would," "target," and similar expressions and variations or negatives of these words.

Forward-looking statements address matters that are, to varying degrees, uncertain and subject to risks, uncertainties and assumptions, many of which that are beyond DuPont's control, that could cause actual results to differ materially from those expressed in any forward-looking statements. Forward-looking statements are not guarantees of future results. Some of the important factors that could cause DuPont's actual results to differ materially from those projected in any such forward-looking statements include, but are not limited to: (i) ability to achieve anticipated tax treatments in connection with the N&B Transaction or the DWDP Distributions; (ii) changes in relevant tax and other laws; (iii) indemnification of certain legacy liabilities of EID in connection with the Corteva Distribution; (iv) risks and costs related to the DWDP Distributions and the N&B Transaction and potential liability arising from fraudulent conveyance and similar laws; (v) risks and costs related to the performance under and impact of the cost sharing arrangement by and between DuPont, Corteva, Inc. and The Chemours Company related to future eligible PFAS costs; (vi) failure to effectively manage acquisitions, divestitures, alliances, joint ventures and other portfolio changes, including meeting conditions under the Letter Agreement entered in connection with the Corteva Distribution, related to the transfer of certain levels of assets and businesses; (vii) uncertainty as to the long-term value of DuPont common stock; (viii) potential inability or reduced access to the capital markets or increased cost of borrowings, including as a result of a credit rating downgrade; (ix) risks and uncertainties related to the novel coronavirus (COVID-19) and

4

the responses thereto (such as voluntary and in some cases, mandatory quarantines as well as shut downs and other restrictions on travel and commercial, social and other activities) on DuPont’s business, results of operations, access to sources of liquidity and financial condition which depend on highly uncertain and unpredictable future developments, including, but not limited to, the duration and spread of the COVID-19 outbreak, its severity, the actions to contain the virus or treat its impact, and how quickly and to what extent normal economic and operating conditions resume; and x) other risks to DuPont's business, operations; each as further discussed in detail in and results of operations as discussed in in the section titled “Risk Factors” (Part I, Item 1A of this Form 10-K). While the list of factors presented here is considered representative, no such list should be considered a complete statement of all potential risks and uncertainties. Unlisted factors may present significant additional obstacles to the realization of forward-looking statements. Consequences of material differences in results as compared with those anticipated in the forward-looking statements could include, among other things, business disruption, operational problems, financial loss, legal liability to third parties and similar risks, any of which could have a material adverse effect on DuPont’s consolidated financial condition, results of operations, credit rating or liquidity. You should not place undue reliance on forward-looking statements, which speak only as of the date they are made. DuPont assumes no obligation to publicly provide revisions or updates to any forward-looking statements whether as a result of new information, future developments or otherwise, should circumstances change, except as otherwise required by securities and other applicable laws.

5

| DuPont de Nemours, Inc. | ||||||||

| PART I | ||||||||

ITEM 1. BUSINESS

DuPont is a Delaware corporation formed in 2015 (formerly, DowDuPont Inc.), for the purpose of effecting an all-stock merger of equals transactions between The Dow Chemical Company ("TDCC") and E. I. du Pont de Nemours and Company ("EID"). Effective August 31, 2017, pursuant to the merger of equals transaction contemplated by the Agreement and Plan of Merger, dated as of December 11, 2015, as amended on March 31, 2017 ("DWDP Merger Agreement"), TDCC and EID each merged with subsidiaries of DowDuPont Inc. ("DowDuPont") and, as a result, TDCC and EID became subsidiaries of DowDuPont (the "DWDP Merger"). Prior to the DWDP Merger, DowDuPont did not conduct any business activities other than those required for its formation and matters contemplated by the DWDP Merger Agreement. For purposes of DowDuPont's financial statement presentation, TDCC was determined to be the accounting acquirer in the DWDP Merger and EID's assets and liabilities are reflected at fair value as of the DWDP Merger Effectiveness Time.

On April 1, 2019, the Company completed the separation of the materials science business through the spin-off of Dow Inc., (“Dow”) including Dow’s subsidiary TDCC (the “Dow Distribution”). On June 1, 2019, the Company completed the separation of the agriculture business through the spin-off of Corteva, Inc. (“Corteva”) including Corteva’s subsidiary EID, (the “Corteva Distribution and together with the Dow Distribution, the “DWDP Distributions”).

Following the Corteva Distribution, the Company holds the specialty products business. On June 1, 2019, DowDuPont changed its registered name from "DowDuPont Inc." to "DuPont de Nemours, Inc." doing business as "DuPont" (the "Company") Beginning on June 3, 2019, the Company's common stock is traded on the NYSE under the ticker symbol "DD."

DuPont is a global innovation leader with technology-based materials and solutions that help transform industries and everyday life by applying diverse science and expertise to help customers advance their best ideas and deliver essential innovations in key markets including electronics, transportation, building and construction, healthcare and worker safety. At December 31, 2020, the Company has subsidiaries in about 60 countries worldwide and manufacturing operations in about 40 countries. See Note 23 to the Consolidated Financial Statements for details on the location of the Company's sales and property.

On December 15, 2019, the Company entered into definitive agreements to separate and combine the Nutrition & Biosciences business segment (the "N&B Business") with International Flavors & Fragrances Inc. ("IFF") in a tax-efficient Reverse Morris Trust transaction.

On February 1, 2021, DuPont completed the separation and distribution of the N&B Business, and merger of Nutrition & Biosciences, Inc. (“N&B”), a DuPont subsidiary formed to hold the N&B Business, with a subsidiary of IFF. The distribution was effected through an exchange offer (the “Exchange Offer”) where, on the terms and subject to the conditions of the Exchange Offer, eligible participating DuPont stockholders had the option to tender all, some or none of their shares of common stock, par value $0.01 per share, of DuPont (the “DuPont Common Stock”) for a number of shares of common stock, par value $0.01 per share, of N&B (the “N&B Common Stock”) and which resulted in all shares of N&B Common Stock being distributed to DuPont stockholders that participated in the Exchange Offer. The consummation of the Exchange Offer was followed by the merger of N&B with a wholly owned subsidiary of IFF, with N&B surviving the merger as a wholly owned subsidiary of IFF (the “N&B Merger” and, together with the Exchange Offer, the “N&B Transaction”).

On December 31, 2020, DuPont commenced the Exchange Offer which expired at one minute past 11:59 PM ET on January 29, 2021. Pursuant to the Exchange Offer, on February 1, 2021, DuPont accepted approximately 197.4 million shares of DuPont Common Stock in exchange for about 141.7 million shares of N&B Common Stock. The closing of the N&B Merger followed on February 1, 2021 after satisfaction of certain other conditions, including the receipt of a one-time cash payment of approximately $7.3 billion (the “Special Cash Payment”).

In the N&B Merger, each share of N&B common stock was automatically converted into the right to receive one share of IFF common stock, par value $0.125 per share (“IFF Common Stock”). See Note 25 to the Consolidated Financial Statements for more information.

6

BASIS OF PRESENTATION

The Consolidated Financial Statements included in this annual report present the financial position of DuPont as of December 31, 2020 and 2019 and the results of operations of DuPont for the years ended December 31, 2020, 2019, and 2018 giving effect to the DWDP Distributions, with the historical financial results of Dow and Corteva reflected as discontinued operations, as applicable. The cash flows and comprehensive income related to Dow and Corteva have not been segregated and are included in the Consolidated Statements of Cash Flows and Consolidated Statements of Comprehensive Income, respectively, for the year ended December 31, 2019 and 2018. Unless otherwise indicated, the information in the Notes to the Consolidated Financial Statements refer only to DuPont's continuing operations and do not include discussion of balances or activity of Dow or Corteva.

At December 31, 2020, the financial results of the N&B Business are included in continuing operations for all periods presented.

SEGMENT INFORMATION

DuPont’s worldwide operations are managed through global businesses, which are currently reported in five reportable segments: Electronics & Imaging; Nutrition & Biosciences; Transportation & Industrial; Safety & Construction; and Non-Core.

In conjunction with the closing of the N&B Transaction on February 1, 2020, the Company announced changes to its management and reporting structure (the “2021 Segment Realignment”). These changes result in the following:

•Realignment of certain businesses from Transportation & Industrial to Electronics & Imaging

•Dissolution of the Non-Core segment with the businesses to be divested and previously divested reflected in Corporate

•Realignment of the remaining Non-Core businesses to Transportation & Industrial

In addition, the following name changes will occur:

•Electronic & Imaging will be renamed Electronics & Industrial

•Transportation & Industrial will be renamed Mobility & Materials

•Safety & Construction will be renamed Water & Protection

The changes became effective February 1, 2021 and the Company will report financial results under this new structure beginning in the first quarter of 2021.

See Part II, Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operations and Note 23 to the Consolidated Financial Statements for additional information concerning the Company’s operating segments.

7

ELECTRONICS & IMAGING

Electronics & Imaging is a leading global supplier of differentiated materials and systems for a broad range of consumer electronics including mobile devices, television monitors, personal computers and electronics used in a variety of industries. The segment is a leading supplier of key materials for the manufacturing of materials and printing systems to the advanced printing industry, and of materials and solutions for the fabrication of semiconductors and integrated circuits addressing both front-end and back-end of the manufacturing process. The segment offers the broadest portfolio of semiconductor and advanced packaging materials in the market, providing chemical mechanical planarization ("CMP") pads and slurries, photoresists and advanced coatings for lithography, removers and cleaners; dielectric and metallization solutions for back-end-of-line advanced chip packaging; along with silicones for light emitting diode ("LED") packaging and semiconductor applications. Electronics & Imaging also provides permanent and process chemistries for the fabrication of printed circuit boards to include laminates and substrates, electroless and electrolytic metallization solutions, as well as patterning solutions and materials and innovative metallization processes for metal finishing, decorative, and industrial applications. Electronics & Imaging is a leading global supplier in the packaging graphics industry providing photopolymer plates and platemaking systems used in flexographic printing and digital inks for textile, commercial and home-office printing applications. In addition, the segment provides cutting-edge materials for the manufacturing of rigid and flexible displays for organic light emitting diode ("OLED"), and other display applications. Electronics & Imaging addresses these markets by leveraging a strong science and technology base to provide the critical materials and solutions for creating a more connected and digital world.

Divestitures

In the first quarter of 2020, the Company completed the sale of its Compound Semiconductor Solutions business unit to SK Siltron. The proceeds received in the first quarter of 2020 related to the sale of the business were approximately $420 million.

Details on Electronics & Imaging's 2020 net sales, by major product line and geographic region, are as follows:

8

Products

Major applications/market segments and technologies are listed below by major product line:

| Major Product Line | Applications/Market Segments | Technologies | ||||||

| Image Solutions | Flexographic printing and inkjet printing, display materials for mobile devices | Flexographic printing plates and materials, digital inks, OLED and other display process materials | ||||||

| Interconnect Solutions | Printed circuit board, electronic and industrial finishing | Circuit packaging film and laminate materials, interconnect metallization and imaging process chemistries, dry film laminates, polyimide films, and flexible circuit materials | ||||||

| Semiconductor Technologies | Integrated circuit fabrication for memory and logic semiconductors | CMP consumables, photolithography materials, semiconductor fabrication materials, fabrication cleaners and removers, advanced chip packaging materials and thermal management materials and LED encapsuants | ||||||

Key Raw Materials

The major commodities, raw materials and supplies for the Electronics & Imaging segment include: p-acetoxystyrene, monomers, pigments and dyes, styrenic block copolymers, copper foil, diglycolamine, dimethylacetamide, hydroxylamine, oxydianiline, palladium metal, photoactive compounds, polyester and other polymer films, polyurethane resins and pyromellitic dianhydride.

Competitors

Electronics & Imaging's competitors include many large multinational firms as well as a number of regional and local competitors. Key competitors include 3M, CMC Materials, Element Solutions, Entegris, Flint Group, JSR Micro, Merck KGaA, Shin-Etsu and Sun Chemical.

Current and Future Investments

In March 2019, the Company announced plans to invest more than $200 million in its Electronics & Imaging segment to build new production assets at its Circleville, Ohio, plant. The new assets will expand production of KAPTON® polyimide film and PYRALUX® flexible circuit materials to meet growing market demand. At December 31, 2020, the Company had spent approximately $160 million since project start date. The Company anticipates that the new assets will be operational by the end of 2021.

2021 Segment Realignment

In conjunction with the 2021 Segment Realignment, KALREZ®/VESPEL®, and Healthcare and Specialty Lubricants (Medical Silicones and MOLYKOTE® lubricants) will move to Electronics & Imaging from Transportation & Industrial. On February 1, 2021, the segment will be renamed Electronics & Industrial and the Image Solutions product line, which will include the additional technologies, will be renamed Industrial Solutions. The Company will report under this structure beginning in the first quarter of 2021.

9

NUTRITION & BIOSCIENCES

Nutrition & Biosciences is an innovation-driven and customer-focused segment that provides solutions for the global food and beverage, dietary supplements, pharma, home and personal care, energy and animal nutrition markets. The segment is one of the world’s largest producers of specialty ingredients, developing and manufacturing solutions for the global food and beverage, dietary supplements and pharmaceutical markets. Its innovative and broad portfolio of natural-based ingredients marketed under the DANISCO® brand serves to improve health and nutrition as well as taste and texture in a wide range of dairy, beverage, bakery and dietary supplement applications. Its probiotics portfolio, including the HOWARU® brand, is world famous for its extensively documented strains that deliver consumers benefits in digestive and immune health. In addition to serving the global food and beverage market, the segment is one of the world's largest producers of cellulosics and alginates based pharma excipients, which are used to improve the functionality and delivery of pharmaceuticals, and enabling the development of more effective pharma solutions. Additionally, the segment is an industry pioneer and innovator that works with customers to improve the performance, productivity and sustainability of their products and processes, through differentiated technology in ingredients applications, fermentation, biotechnology, chemistry and manufacturing process excellence. The segment offers better, cleaner and safer solutions to a wide range of industries including food & beverages, dietary supplements, animal nutrition, biofuels, cleaning, personal care, pharmaceutical, and oil and gas.

Divestitures

In June 2019, the Company sold the natural colors business, a H&N Business.

Details on Nutrition & Biosciences' 2020 net sales, by product line and geographic region, are as follows:

Products

Major applications and products are listed below by product line:

| Product Line | Applications / Market Segments | Major Products | ||||||

| Food & Beverage | Food and beverage, dietary supplements, infant nutrition, sports nutrition | Soy protein, emulsifiers, sweeteners, texturants and ingredient systems | ||||||

| Health & Biosciences | Dietary supplements, animal nutrition, home & personal care, biofuels production, food and beverage, microbial control solutions for oil and gas production and other industrial preservation markets | Probiotics, fibers, cultures, enzymes, yeast, betaine, direct-fed microbials, antimicrobials, glutaraldehyde | ||||||

| Pharma Solutions | Oral dosage pharmaceuticals excipients | Cellulosic and alginates excipients (immediate and controlled release) and active pharmaceutical ingredients | ||||||

10

Key Raw Materials

The major commodities, raw materials and supplies for the Nutrition & Biosciences segment include: soybeans, gelatin, glycols, cellulose processed grains (including dextrose and glucose), guar, locust bean gum, organic vegetable oils, peels, saccharides, seaweed, sugars and yeasts.

Competitors

Nutrition & Biosciences' competitors include many large multinational nutrition and biosciences companies as well as a number of regional and local competitors. Key competitors include Chr. Hansen, Novozymes, Royal DSM, Kerry, Corbion, Ingredion, CP Kelco, Croda and Tate & Lyle.

Current and Future Investments

In November 2016, EID announced an investment to expand probiotics production capacity in the United States. The announced investment is the second phase of a broader probiotics expansion project. Phase one was complete as of the end of 2017 and increased capacity by about 30 percent. The second phase represented an investment of approximately $100 million and increased DuPont's probiotics production capacity by an additional 70 percent. The construction was completed in the first quarter of 2019, including the installation of new, high-volume fermenters and other processing equipment. Additional and periodic investments were made in the past years to debottleneck some of our assets running at full capacity.

Nutrition & Biosciences Distribution

On February 1, 2021, DuPont completed the previously announced separation and distribution of its N&B Business. The Company will reflect the results of the N&B Business as discontinued operations beginning in the first quarter of 2021.

TRANSPORTATION & INDUSTRIAL

Transportation & Industrial provides high-performance engineering resins, adhesives, silicones, lubricants and parts to engineers and designers in the transportation, electronics, healthcare, industrial and consumer end-markets to enable systems solutions for demanding applications and environments.

The segment delivers a broad range of polymer-based high-performance materials in its product portfolio, including elastomers and thermoplastic and thermoset engineering polymers which are used by customers to fabricate components for mechanical, chemical and electrical systems. In addition, the segment produces innovative engineering polymer solutions, high performance parts, specialty silicones and differentiated adhesive technologies to meet customer specifications in automotive, aerospace, electronics, industrial, healthcare and consumer markets. Transportation & Industrial is a global leader of advanced materials that provide technologies that differentiate customers’ products with improved performance characteristics enabling the transition to hybrid-electric-connected vehicles, high speed high frequency connectivity and smart healthcare.

Details on Transportation & Industrial's 2020 net sales, by major product line and geographic region, are as follows:

Products

Major applications and products are listed below by major product line, all which serve the transportation industry and electronics, medical, industrial and consumer end-markets.

11

| Major Product Line | Major Products | ||||

| Healthcare & Specialty | KALREZ® perfluoroelastomer, VESPEL® parts and shapes, MOLYKOTE® lubricants, LIVEO™ silicone solutions for healthcare, BETASEAL™, BETAMATE™ and BETAFORCE™ structural and elastic adhesives | ||||

| Industrial & Consumer | HYTREL® polyester thermoplastic elastomer resins, DELRIN® acetal resins, VAMAC® ethylene acrylic elastomer, and MULTIBASE™ TPSiV™ silicones for thermoplastics | ||||

| Mobility Solutions | DUPONT™ ZYTEL® nylon resins, CRASTIN® PBT thermoplastic polyester resin, RYNITE® PET polyester resin and TYNEX® filaments | ||||

Key Raw Materials

The major commodities, raw materials and supplies for the Transportation & Industrial segment include: adipic acid, butanediol, carbon black, dimethyl terephthalate, epoxy resins, fiberglass, flame retardants, hexamethylene diamine, methanol, polyethylene terephthalate, purified terephthalic acid and silicones.

Competitors

Transportation & Industrial's competitors include many large multinational chemical firms as well as a number of regional and local competitors. Key competitors include BASF, Celanese, EMS, Henkel, Kluber, Mitsubishi, Royal DSM, Sika, Victrex and Wacker Chemie.

2021 Segment Realignment

In conjunction with the 2021 Segment Realignment, Kalrez®/Vespel®, and Healthcare and Specialty Lubricants (Medical Silicones and Molykote® lubricants) will move from Transportation & Industrial to Electronic & Imaging. Non-Core businesses including TEDLAR® and Microcircuit Materials (previously part of Photovoltaic & Advanced Materials ("PVAM")), and DuPont Teijin Films will shift from the Non-Core Segment to Transportation & Industrial. Major product lines will be reorganized into Engineering Polymers, Performance Resins, and Advanced Solutions and the segment will be renamed Mobility & Materials effective February 1, 2021. The Company will report under this structure beginning in the first quarter of 2021.

SAFETY & CONSTRUCTION

Safety & Construction is the global leader in providing innovative engineered products and integrated systems for a number of industries including, worker safety, water purification and separation, transportation, energy, medical packaging and building materials. Safety & Construction addresses the growing global needs of businesses, governments and consumers for solutions that make life safer, healthier and better.

Innovation is the business imperative. By uniting market-driven science and engineering with the strength of highly regarded brands including KEVLAR® high-strength material, NOMEX® thermal-resistant material, CORIAN® solid surfaces, TYVEK® selective barriers, FILMTEC™ reverse osmosis elements, STYROFOAM™ insulation and GREAT STUFF™ insulating foam sealants, the segment strives to bring new products and solutions to solve customers' needs faster, better and more cost effectively. Safety & Construction is investing in future growth initiatives such as water management solutions, construction productivity solutions, high strength and light weighting composite solutions, and circular ecosystem / zero waste solutions.

Acquisitions

During the fourth quarter of 2019, the Company completed three acquisitions: (1) BASF's Ultrafiltration Membrane business, including inge GmbH, the business’ international workforce, its headquarters and production site in Greifenberg, Germany, and associated intellectual property currently owned by BASF SE; (2) Evoqua Water Technologies Corp.’s MEMCOR® business including ultrafiltration and membrane biofiltration technologies, which together with the acquisition from BASF, add to Safety & Construction’s leading portfolio of water purification and separation technologies including ultrafiltration, reverse osmosis and ion exchange resins; and (3) OxyMem Limited, a company that develops and produces Membrane Aerated Biofilm Reactor technology for the treatment and purification of municipal and industrial wastewater. In the first quarter of 2020, the Company acquired Desalitech Ltd., a closed circuit reverse osmosis (CCRO) company.

12

Details on Safety & Construction's 2020 net sales, by major product line and geographic region, are as follows:

Products

Major applications and products are listed below by major product line:

| Major Product Line | Applications / Market Segments | Major Products / Technologies | ||||||

| Safety Solutions | Industrial personnel protection, military and emergency response, medical devices and packaging, automotive, aerospace and oil and gas | KEVLAR® fiber; NOMEX® fiber and paper; TYVEK® protective materials; TYCHEM® protective suits | ||||||

| Shelter Solutions | Rigid and spray foam insulation, weatherization, waterproofing and air sealing, caulks and sealants, roof coatings, and decorative surface materials | STYROFOAM™ brand insulation products, THERMAX™ exterior insulation, WALOCEL™ cellulose ethers, XENERGY™ high performance insulation, LIQUIDARMOR™ flashing and sealant, GREAT STUFF™ insulating foam sealants and adhesives, CORIAN® design solid and quartz surfaces, TYVEK® weather resistant barriers | ||||||

| Water Solutions | Water filtration and purification technology for residential, municipal and industrial use. Key industries include municipal drinking water and wastewater, power generation, microelectronics, pharmaceuticals, food and beverage, industrial wastewater reuse, metals and mining, and oil and gas segments | AMBERLITE™ ion exchange resins, FILMTEC™ reverse osmosis and nanofiltration elements, INTEGRAFLUX™ ultrafiltration modules, FORTILIFE™ challenging water reverse osmosis membranes, and TAPTEC™ water filtration and purification for drinking water in homes and commercial buildings | ||||||

Key Raw Materials

The major commodities, raw materials and supplies for the Safety & Construction segment include: alumina trihydrate, aniline, benzene, calcium chloride, carbon monoxide, chlorine, divinyl benzene monomers, high-density polyethylene, isophthalic acid, metaphenylenediamine, methyl methacrylate, methylpentanediol, polyester resin, polypropylene, polystyrene, sulfuric acid and terephthalic acid.

Competitors

Safety & Construction's competitors include many large multinational chemical firms as well as a number of regional and local competitors. Key competitors include 3M, Honeywell, Hydranautics, Kingspan, Lanxess, LG Corp, Owens-Corning, Purolite, Royal DSM, Toray and Teijin.

Current and Future Investments

The Company previously announced plans to invest more than $400 million in Safety & Construction to increase capacity for the manufacture of TYVEK® nonwoven materials at its Luxembourg site due to growing global demand. While the Company experienced delays in construction due to COVID-19 in 2020, the expansion for the new operating line of TYVEK® nonwoven materials is expected to be completed in 2023.

13

NON-CORE

The Non-Core segment is a leading global supplier of key materials for the manufacturing of photovoltaic cells and panels, including innovative SOLAMET® metallization pastes, TEDLAR® backsheet materials, and FORTASUN® silicone encapsulants and adhesives. The segment also provides materials used in components and films for consumer electronics, automotive, and aerospace markets. The segment also provides sustainable materials and services for sulfuric acid production and regeneration technologies, alkylation technology for production of clean, high-octane gasoline, and a comprehensive suite of aftermarket service and solutions offerings, including safety consulting and services, to improve the safety, productivity, and sustainability of organizations across a range of industries. The Non-Core segment is also a leading producer of SORONA® specialty biotechnology materials for carpet and apparel markets as well as polyester films for the healthcare, photovoltaics, electronics, packaging and labels, and electrical insulation industries.

Divestitures

The segment historically included the Company's joint venture interests in the Hemlock Semiconductor Corporation Group ("HSC Group"), a U.S.-based group of companies that manufacture and sell polycrystalline silicon products for the photovoltaic and semiconductor industries, as well as its trichlorosilane business (“TCS Business”). In the third quarter of 2020, the Company completed the sale of its ownership interests in both the HSC Group and the TCS Business to The Hemlock Group.

In October 2020, the Company entered into a definitive agreement to sell its Biomaterials business unit, which includes the Company's equity method investment in DuPont Tate & Lyle Bio Products. In January 2021, the Company entered into separate definitive agreements to sell its Clean Technologies and Solamet® businesses. These divestitures, subject to regulatory approval and customary closing conditions, are expected to close in the first half of 2021 and generate in aggregate pre-tax cash proceeds of about $920 million.

In the third quarter of 2019, the Company completed the sale and separation of its Sustainable Solutions business unit, a part of the Non-Core segment, to Gyrus Capital.

2021 Segment Realignment

As part of the 2021 Segment Realignment, the Non-Core segment will be dissolved. TEDLAR® and Microcircuit Materials (both previously part of PVAM), and DuPont Teijin Films will move to Transportation & Industrial. The remaining businesses and historical results of divested businesses will be reported in Corporate. The Company will report under this structure beginning in the first quarter of 2021.

Details on Non-Core's 2020 net sales, by business or major product line and geographic region, are as follows:

14

Products

Major applications and products/services/technologies are listed below by major product line:

| Major Product Line | Applications / Market Segments | Major Products / Services / Technologies | ||||||

| Biomaterials | Carpet, apparel | SORONA® polymer | ||||||

| Clean Technologies | Sulfuric acid, fertilizer, chemicals, refining, scrubbing | STRATCO® alkylation technology, MECS® sulfuric acid & environmental technologies, ISOTHERMING® hydroprocessing technology, BELCO® wet scrubbing technology | ||||||

| DuPont Teijin Films | Healthcare, photovoltaics, electronics, packaging and labels, electrical insulation, dry film resists | MYLAR®, MELINEX® polyester films | ||||||

| Photovoltaic & Advanced Materials | Photovoltaics, aerospace/aircraft, automotive, military, consumer electronics | Metallization pastes (including SOLAMET®), TEDLAR® polyvinyl fluoromaterials, FORTASUN® silicone encapsulants and adhesives | ||||||

Key Raw Materials

The major commodities, raw materials and supplies for the Non-Core segment include propanediol, terephthalic acid, precious metals, silicon metal and hydrochloric acid.

Competitors

Non-Core's competitors include many large multinational chemical firms as well as a number of regional and local competitors. Key competitors include Arkema, Giga Solar Materials, Heraeus, Outotec, Samsung SDI, Yihua Toray Polyester Film, and Zhangjiagang Glory.

INDUSTRY SEGMENTS AND GEOGRAPHIC REGION RESULTS

See Note 4 to the Consolidated Financial Statements for net sales by business or major product line.

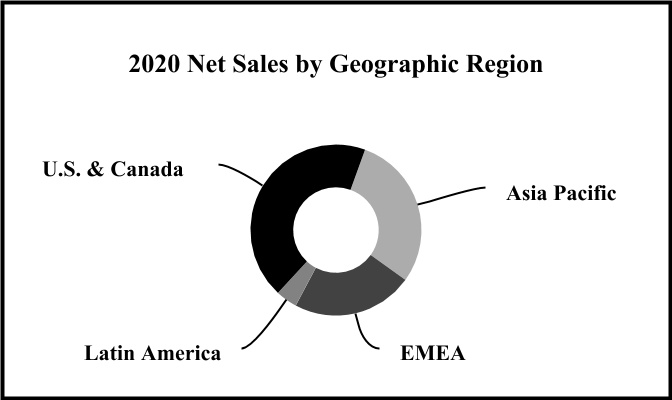

Sales by geographic region are included within Part II, Item 7 "Management's Discussion and Analysis of Financial Condition and Results of Operations", "Results of Operations." See Note 23 to the Consolidated Financial Statements for information regarding total net sales, pro forma net sales, pro forma Operating EBITDA and total assets by segment, as well as net sales and long-lived assets by geographic region.

SIGNIFICANT CUSTOMERS AND COMPETITION

In 2020, no significant portion of the Company's sales was dependent upon a single customer. The markets in which the Company participates compete primarily through technology, range of products and services, performance, quality, reliability, brand, reputation, service and support. The Company provides extensive support, technical services and testing services for its customers, in addition to new product development. The Company believes that its proprietary product and process technologies, robust product and application development pipelines, customer intimacy, global manufacturing capability and local service capability enable it to compete successfully.

Against this competitive backdrop, value-in-use is the primary driver of price for the Company’s products, although price is impacted by many factors including, among others, fluctuations in supply and demand, and availability and cost of key manufacturing inputs including raw materials and energy.

DISTRIBUTION

Most products are marketed primarily through the Company's sales organization, although in some regions, more emphasis is placed on sales through distributors. The Company has a diverse worldwide network which markets and distributes the Company's brands to customers globally. This network consists of the Company's sales and marketing organization partnering with distributors, independent retailers, cooperatives and agents throughout the world.

INTELLECTUAL PROPERTY

The Company’s businesses differentially manage their respective intellectual property estates to support Company strategic priorities, which can include leveraging intellectual property within and across product lines.

15

Trade Secrets: Trade secrets are an important part of the Company's intellectual property. Many of the processes used to make products are kept as trade secrets which, from time to time, may be licensed to third parties. DuPont vigilantly protects all of its intellectual property including its trade secrets. When the Company discovers that its trade secrets have been unlawfully taken, it reports the matter to governmental authorities for investigation and potential criminal action, as appropriate. In addition, the Company takes measures to mitigate any potential impact, which may include civil actions seeking redress, restitution and/or damages based on loss to the Company and/or unjust enrichment.

Patents: The Company applies for and obtains patents in many countries, including the U.S., and has access to a large patent portfolio, both owned and licensed. DuPont’s rights under these patents and licenses, as well as the products made and sold under them, are important to the Company in the aggregate. The protection afforded by these patents varies based on country, scope of individual patent coverage, as well as the availability of legal remedies in each country. The term of these patents is approximately twenty years from the filing date in general, but varies depending on country. This significant patent estate may be leveraged to align with the Company’s strategic priorities within and across product lines. At December 31, 2020, the Company owned about 24,000 patents and patent applications globally, about 9,000 of which are part of the N&B Business. Approximately 80% of the Company’s patent estate has a remaining term of more than 5 years.

Trademarks: The Company owns or licenses many trademarks that have significant recognition at the consumer retail level and/or the product line to product line level. Ownership rights in trademarks do not expire if the trademarks are continued in use and properly protected.

ENVIRONMENTAL MATTERS

Information related to environmental matters is included in several areas of this report: (1) Environmental Proceedings beginning on page 29, (2) Management's Discussion and Analysis of Financial Condition and Results of Operations beginning on page 32, and (3) Notes 1 and 15 to the Consolidated Financial Statements.

HUMAN CAPITAL

Foundational to the Company’s current and future success is its employees, who drive the Company’s strategic vision, manage operations and develop products. The Company focuses significant attention on attracting, motivating, and retaining talent at all levels. Through training and professional development initiatives, promoting a culture of diversity and inclusion, and emphasizing the importance of health, safety, and well-being, the Company’s aim is to create an environment that fully supports the needs of its employees. Annually, an enterprise-wide engagement survey is conducted, which provides insight into employee morale and aspects of workplace culture like core values, communication and employee development.

The Company is committed to creating innovative talent-management opportunities that are aligned to the strategic needs of its workforce. Learning is a continual process, and the Company offers a diverse set of training, education, and development opportunities, both formally and informally, throughout the year. Each segment within the Company has ongoing training programs that are designed specifically to maximize the performance of its employees in meeting business objectives, including better health and safety outcomes. All employees take part in a mix of on-the-job training and appropriate learning and training opportunities focusing on topics that are the most critical and relevant to each employees’ job function.

The Company believes that diversity and inclusion is central to high employee engagement and seeks to foster an environment where employees can bring their authentic selves to work each day. The more perspectives there are, the more ideas that can be generated, which makes diversity, equity, and inclusion (“DE&I”) a driver of innovation, and therefore, integral to the Company’s success. The Company’s employee-led Employee Resource Groups (“ERGs”) help cultivate a culture of acceptance where employees feel not only accepted, but celebrated, at every level. As of December 31, 2020, the Company had eight ERGs - DuPont Corporate Black Employees Network, DuPont Asian Group, DuPont Pride Network, DuPont Latin Network, DuPont Women’s Network, DuPont Veterans Network, DuPont Early Career Network, and DuPont Persons with Disabilities and Allies. Each group is actively sponsored by senior leadership, helping model and promote inclusive values and behaviors. The Company also offers DE&I tools and resources to educate managers and employees in how to utilize diversity as a resource and establish more inclusive work environments. These resources include unconscious bias workshops, networking and mentoring practices, and opportunities for participation in external conferences and events, among others.

The Company’s success also depends on the well-being of employees, including physical, mental and intellectual health. All employees have the support of the Company’s Integrated Health Services (“IHS”) teams, which provides onsite and intranet-based services to support and monitor the health and welfare of employees. The Company’s larger manufacturing and research sites have onsite clinics where employees can get occupational care, first aid treatment, travel vaccinations, and referrals for off-site medical care. The Company continuously strives for zero workplace injuries, occupational illnesses and incidents. The Company’s safety metrics are measured against this goal at least quarterly, and the Company’s Environmental, Health, Safety & Sustainability Committee is charged with driving improvements in the Company's health and safety practices. IHS also

16

assesses health risks across DuPont to find out which health concerns are most important to our employees, and conducts medical surveillance exams based on occupational risks and regulatory compliance priorities flagged by the Company’s Environment, Health and Safety team.

In response to the COVID-19 pandemic, the Company has corporate, regional and local crisis management teams in place actively monitoring, preparing and managing the Company’s response. The Company has implemented safety plans and protocols based on World Health Organization and Centers for Disease Control guidelines. This includes issuing health and safety guidance for sites that have remained open during the pandemic, and encouraging employees to work remotely, when possible.

As of December 31, 2020, the Company had employed approximately 34,000 people worldwide. Approximately 25 percent of employees were in Asia Pacific, 28 percent were in the EMEA, 5 percent were in Latin America, and 42 percent were in the U.S and Canada. Within the United States, about 7,500 employees were in non-exempt or hourly-rate positions.

On February 1, 2021, the Company completed the N&B Transaction. As of December 31, 2020, the N&B Business employed approximately 11,000 people around the world. About 20 percent of N&B Business employees were located in Asia Pacific, 40 percent in EMEA, 10 percent in Latin America, and 30 percent in the United States. Within the United States, about 1,500 employees were in non-exempt or hourly-rate positions.

AVAILABLE INFORMATION

The Company is subject to the reporting requirements under the Securities Exchange Act of 1934. Consequently, the Company is required to file reports and information with the Securities and Exchange Commission ("SEC"), including reports on the following forms: annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934.

The SEC maintains an Internet site at http://www.sec.gov that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC, from which the public may obtain any materials the Company files with the SEC.

The Company's annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports are also accessible on DuPont's website at http://www.investors.dupont.com by clicking on the section labeled "Investors," then on "Filings & Reports." These reports are made available, without charge, as soon as is reasonably practicable after the Company files or furnishes them electronically with the SEC.

17

ITEM 1A. RISK FACTORS

The Company's operations could be affected by various risks, many of which are beyond its control. Based on current information, the Company believes that the following identifies the most material risk factors that could affect its operations. Past financial performance may not be a reliable indicator of future performance and historical trends should not be used to anticipate results or trends in future periods.

Risks Relating to the N&B Transaction and the Dow and Corteva Distributions

The separation and combination of DuPont’s Nutrition & Biosciences business with IFF could result in significant tax liability to DuPont.

Following the N&B Merger, N&B is expected to merge with and into Neptune Merger Sub II LLC (a wholly owned subsidiary of IFF) (“Merger Sub II”), with Merger Sub II surviving as a wholly owned subsidiary of IFF (the “Second Merger,” and together with the N&B Merger, the “Mergers”).

The distribution by DuPont to its stockholders of all the issued and outstanding shares of N&B through the Exchange Offer ("N&B Distribution") and Mergers are expected to be tax-free to DuPont stockholders for U.S. federal income tax purposes (except to the extent that cash is paid to DuPont stockholders in lieu of fractional shares pursuant to the Merger Agreement), and the N&B Contribution, N&B Distribution, and Special Cash Payment are expected to result in no recognition of gain or loss by DuPont for U.S. federal income tax purposes.

DuPont has received an opinion from Skadden, Arps, Slate, Meagher & Flom LLP regarding (i) the qualification of the separation and transfer by DuPont of its N&B Business (the "N&B Contribution"), N&B Distribution, and Special Cash Payment as a “reorganization” within the meaning of Sections 368(a), 361 and 355 of the Internal Revenue Code of 1986 (the “Code”), (ii) the nonrecognition of gain or loss by DuPont on receipt of the Special Cash Payment (subject to certain conditions), (iii) the qualification of the N&B Distribution as a distribution described in Section 355 and to which Section 355(e) does not apply and (iv) the qualification of the Mergers as a “reorganization” within the meaning of Section 368(a) of the Code. This opinion is based upon and rely on, among other things, certain facts and assumptions, as well as certain representations, statements and undertakings of DuPont, N&B, IFF and Merger Sub 1 and Merger Sub II. If any of these representations, statements or undertakings are, or become, inaccurate or incomplete, or if any party breaches any of its covenants in the relevant transaction documents, the opinion may be invalid and the conclusions reached therein could be jeopardized. Notwithstanding the receipt of such opinion, the Internal Revenue Service (the “IRS”) could determine that the separation of DuPont’s Nutrition & Biosciences business should be treated as a taxable transaction if it determines that any of the facts, assumptions, representations, statements or undertakings upon which the opinion of counsel was based are false or have been violated, or if it disagrees with the conclusions in the opinion. An opinion of counsel is not binding on the IRS and there can be no assurance that the IRS will not assert a contrary position.

DuPont has also obtained a private letter ruling from the IRS regarding certain matters impacting the U.S. federal income tax treatment of the N&B Contribution, N&B Distribution, Special Cash Payment and certain related transactions. The conclusions of the IRS private letter ruling were based, among other things, on various factual assumptions DuPont authorized and representations DuPont made to the IRS. If any of assumptions or representations are, or become, inaccurate or incomplete, reliance on the IRS private letter ruling may be affected.

If the N&B Contribution and N&B Distribution failed to qualify for the treatment described above, DuPont would be required to generally recognize taxable gain on the transactions and stockholders of DuPont who receive N&B Common Stock (and subsequently, IFF Common Stock) would be subject to tax on their receipt of the N&B Common Stock. Additionally, if the Special Cash Payment or certain internal transactions related to the separation of the Nutrition & Biosciences business fail to qualify for their intended tax-free treatment under U.S. federal, state, local tax and/or foreign tax law, DuPont could incur additional tax liabilities.

Under the Tax Matters Agreement by and between DuPont with N&B and IFF, N&B or IFF is generally be required to indemnify DuPont for any taxes resulting from the separation of the Nutrition & Biosciences business (and any related costs and other damages) to the extent such amounts resulted from (i) certain actions taken by N&B or IFF involving the capital stock of N&B or IFF or any assets of the N&B group (excluding actions required by the documents governing the proposed transactions), or (ii) any breach of certain representations and covenants made by N&B or IFF.

DuPont is subject to continuing contingent tax-related liabilities of Dow and Corteva following the separations and DWDP Distributions.

After the separations and DWDP Distributions, there are several significant areas where the liabilities of Dow and Corteva may become the Company’s obligations, either in whole or in part. For example, to the extent that any subsidiary of the Company

18

was included in the consolidated tax reporting group of either TDCC or EID for any taxable period or portion of any taxable period ending on or before the effective date of the DWDP Merger, such subsidiary is jointly and severally liable for the U.S. federal income tax liability of the entire consolidated tax reporting group of TDCC or EID, as applicable, for such taxable period. In connection with the separations and DWDP Distributions, DuPont, Dow and Corteva have entered into a Tax Matters Agreement, as amended, that allocates the responsibility for prior period consolidated taxes among Dow, Corteva and DuPont. If Dow or Corteva are unable to pay any prior period taxes for which it is responsible, however, DuPont could be required to pay the entire amount of such taxes, and such amounts could be significant. Other provisions of federal, state, local, or foreign law may establish similar liability for other matters, including laws governing tax-qualified pension plans, as well as other contingent liabilities.

In connection with the separations and DWDP Distributions, certain liabilities are allocated to or retained by DuPont through assumption or indemnification of Dow and/or Corteva, as applicable. If DuPont is required to make payments pursuant to these indemnities to Dow and/or Corteva, DuPont may need to divert cash to meet those obligations, and the Company’s financial results could be negatively impacted. In addition, certain liabilities are allocated to or retained by Dow and/or Corteva through assumption or indemnification, or subject to indemnification by other third parties. These indemnities may not be sufficient to insure the Company against the full amount of liabilities, including PFAS Stray Liabilities, allocated to or retained by it, and Dow, Corteva and/or third parties may not be able to satisfy their respective indemnification obligations in the future.

Pursuant to the DWDP Separation and Distribution Agreement, the DWDP Employee Matters Agreement, and the DWDP Tax Matters Agreement, as amended, (collectively, the “Core Agreements”) with Dow and Corteva, as well as the Letter Agreement between DuPont and Corteva, DuPont has agreed to assume, and indemnify Dow and Corteva for, certain liabilities. (See discussion of the Core Agreements in Note 3 to the Consolidated Financial Statements and Litigation and Environmental Matters in Note 15 to the Consolidated Financial Statements.) Payments pursuant to these indemnities may be significant and could negatively impact the Company’s business, particularly indemnities relating to the Company’s actions that could impact the tax-free nature of the distributions. Third parties could also seek to hold it responsible for any of the liabilities allocated to Dow and Corteva, including those related to EID’s materials science and/or agriculture businesses, or for the conduct of such businesses prior to the distributions, and such third parties could seek damages, other monetary penalties (whether civil or criminal) and/or other remedies. Additionally, DuPont generally assumes and is responsible for the payment of the Company’s share of (i) certain liabilities of DowDuPont relating to, arising out of or resulting from certain general corporate matters of DuPont and (ii) certain separation expenses not otherwise allocated to Corteva or Dow (or allocated specifically to it) pursuant to the Core Agreements, and third parties could seek to hold it responsible for Dow’s or Corteva’s share of any such liabilities. Dow and/or Corteva, as applicable, have agreed to indemnify it for such liabilities; however, such indemnities may not be sufficient to protect it against the full amount of such liabilities or from other remedies, and Dow and/or Corteva, as applicable, may not be able to fully satisfy their indemnification obligations. Even if DuPont ultimately succeeds in recovering from Dow and/or Corteva, as applicable, any amounts for which DuPont are held liable, DuPont may be temporarily required to bear these losses. Each of these risks could negatively affect the Company’s business, financial condition, results of operations and cash flows.

Generally, as described in Litigation and Environmental Matters, losses related from liabilities related to discontinued and/or divested operations and businesses of EID that are not primarily related to its agriculture business or specialty products business, (“Stray Liabilities”), are allocated to or shared by each of Corteva and DuPont. Stray Liabilities include liabilities arising out of actions to the extent related to or resulting from EID’s development, testing, manufacture or sale of per- or polyfluoroalkyl substances, (“PFAS Stray Liabilities”).

Although the Company believes it is remote, there can be no assurance that any such third party would have adequate resources to satisfy its indemnification obligation when due, or, would not ultimately be successful in claiming defenses against payment. Even if recovery from the third party is ultimately successful, DuPont may be temporarily required to bear these losses. Each of these risks could negatively affect the Company’s business, financial condition, results of operations and cash flows. See Note 15 to the Consolidated Financial Statements and the risk factor below regarding the DuPont, Corteva and Chemours cost sharing arrangement related to future eligible PFAS liabilities.

If the completed distribution of Corteva or Dow, in each case, together with certain related transactions, were to fail to qualify for non-recognition treatment for U.S. federal income tax purposes, then the Company could be subject to significant tax and indemnification liability.

The completed distributions of Corteva and Dow were each conditioned upon the receipt of an opinion from Skadden, Arps, Slate, Meagher & Flom LLP, the Company’s tax counsel, regarding the qualification of the applicable distribution along with certain related transactions as a tax-free transaction under Section 355 and Section 368(a)(1)(D) of the Internal Revenue Code of 1986, as amended (the “Code,” and such opinions, collectively, the “Tax Opinions”). The Tax Opinions relied on certain facts, assumptions, and undertakings, and certain representations from the Company, Dow and Corteva, as applicable, as well

19

as the IRS Ruling (as defined below). Notwithstanding the Tax Opinions and the IRS Ruling, the Internal Revenue Service (the “IRS”) could determine on audit that either, or both, of the distributions and certain related transactions should be treated as taxable transactions if it determines that any of these facts, assumptions, representations or undertakings are not correct or have been violated, or that the distributions should be taxable for other reasons, including if the IRS were to disagree with the conclusions of the Tax Opinions.

Even if a distribution otherwise constituted a tax-free transaction to stockholders under Section 355 of the Code, the Company could be required to recognize corporate level tax on such distribution and certain related transactions under Section 355(e) of the Code if the IRS determines that, as a result of the DWDP Merger or other transactions considered part of a plan with such distribution, there was a 50 percent or greater change in ownership in the Company, Dow or Corteva, as relevant. In connection with the DWDP Merger, the Company sought and received a private letter ruling from the IRS regarding the proper time, manner and methodology for measuring common ownership in the stock of the Company, EID and TDCC for purposes of determining whether there was a 50 percent or greater change of ownership under Section 355(e) of the Code as a result of the DWDP Merger (the “IRS Ruling”). The Tax Opinions relied on the continued validity of the IRS Ruling and representations made by the Company as to the common ownership of the stock of TDCC and EID immediately prior to the DWDP Merger, and concluded that there was not a 50 percent or greater change of ownership for purposes of Section 355(e) as a result of the DWDP Merger. Notwithstanding the Tax Opinions and the IRS Ruling, the IRS could determine that a distribution or a related transaction should nevertheless be treated as a taxable transaction to the Company if it determines that any of the Company’s facts, assumptions, representations or undertakings was not correct or that a distribution should be taxable for other reasons, including if the IRS were to disagree with the conclusions in the Tax Opinions that are not covered by the IRS Ruling.

Generally, corporate taxes resulting from the failure of a distribution to qualify for non-recognition treatment for U.S. federal income tax purposes would be imposed on the Company. Under the DWDP Tax Matters Agreement, as amended, that the Company entered into with Dow and Corteva, Dow and Corteva are generally obligated to indemnify the Company against any such taxes imposed on it. However, if a distribution fails to qualify for non-recognition treatment for U.S. federal income tax purposes for certain reasons relating to the overall structure of the DWDP Merger and the distributions, then under the DWDP Tax Matters Agreement, as amended, the Company and Corteva, on the one hand, and Dow, on the other hand, would share the tax liability resulting from such failure in accordance with the relative equity values of the Company and Dow on the first full trading day following the distribution of Dow, and the Company and Corteva would in turn share any such resulting tax liability in accordance with the relative equity values of the Company and Corteva on the first full trading day following the distribution of Corteva. Furthermore, under the terms of the DWDP Tax Matters Agreement, as amended, a party also generally will be responsible for any taxes imposed on the other parties that arise from the failure of either distribution to qualify as tax-free for U.S. federal income tax purposes within the meaning of Section 355 of the Code or the failure of certain related transactions to qualify for tax-free treatment, to the extent such failure to qualify is attributable to actions, events or transactions relating to such party, or such party's affiliates’, stock, assets or business, or any breach of such party's representations made in connection with the IRS Ruling or in any representation letter provided to a tax advisor in connection with certain tax opinions, including the Tax Opinions, regarding the tax-free status of the distributions and certain related transactions. To the extent that the Company is responsible for any liability under the DWDP Tax Matters Agreement, as amended, there could be a material adverse impact on the Company's business, financial condition, results of operations and cash flows in future reporting periods.

The DWDP separations and DWDP Distributions and the N&B Transaction may expose the Company to potential liabilities arising out of state and federal fraudulent conveyance laws and legal distribution requirements.

Although in connection with the DWDP Distributions and in connection with the N&B Transaction DuPont received separate solvency opinions from investment banks confirming that DuPont, Dow, Corteva and N&B would each be adequately capitalized following the separations and DWDP Distributions, and the N&B Transactions as relevant, (the “Transactions”), the Transactions could be challenged under various state and federal fraudulent conveyance laws. Fraudulent conveyances or transfers are generally defined to include transfers made or obligations incurred with the actual intent to hinder, delay or defraud current or future creditors or transfers made or obligations incurred for less than reasonably equivalent value when the debtor was insolvent, or that rendered the debtor insolvent, inadequately capitalized or unable to pay its debts as they become due. Any unpaid creditor could claim that DuPont did not receive fair consideration or reasonably equivalent value in any of the Transactions and that any one or the aggregate of the Transactions left DuPont insolvent or with unreasonably small capital or that DuPont intended or believed DuPont would incur debts beyond the Company’s ability to pay such debts as they mature. If a court were to agree with such a plaintiff, then such court could void the separations and distributions as a fraudulent transfer or impose substantial liabilities on it, which could adversely affect the Company’s financial condition and the Company’s results of operations.

The Transactions are also subject to review under state corporate distribution statutes. Under the Delaware General Corporation Law, a corporation may only pay dividends to its stockholders either (i) out of its surplus (net assets minus capital) or (ii) if there is no such surplus, out of its net profits for the fiscal year in which the dividend is declared and/or the preceding fiscal

20

year. Although DuPont’s Board of Directors made the distributions out of DuPont’s surplus and received an opinion that DuPont had adequate surplus under Delaware law to declare the dividends of Corteva and Dow common stock in connection with the DWDP Distributions there can be no assurance that a court will not later determine that some or all of the distributions were unlawful.

On January 22, 2021, DuPont, Corteva and Chemours entered into a cost sharing arrangement related to future eligible PFAS costs. The Company’s results of operations could be adversely affected by litigation and other commitments and contingencies, including expected performance under and impact of the cost sharing arrangement.

Although by reducing uncertainty, the Company expects to benefit from the cost sharing arrangement related to future PFAS eligible costs, achievement of any such benefits may not be realized and depend on a number of factors and uncertainties that include, but are not limited to: the achievement, terms and conditions of final agreements related to the cost sharing arrangement; the outcome of any pending or future litigation related to PFAS or PFOA, including personal injury claims and natural resource damages claims; the extent and cost of ongoing remediation obligations and potential future remediation obligations; changes in laws and regulations applicable to PFAS chemicals; the performance by each of the parties of their respective obligations under the cost sharing arrangement.

DuPont faces risks arising from various unasserted and asserted litigation matters, including product liability, patent infringement and other intellectual property disputes, contract and commercial litigation, claims for damage or personal injury, antitrust claims, governmental regulations and other actions. An adverse outcome in any one or more of these matters could be material to the Company’s business, results of operations, financial condition and cash flows.

In the ordinary course of business, DuPont may make certain commitments, including representations, warranties and indemnities relating to current and past operations, including those related to divested businesses, and DuPont may issue guarantees of third-party obligations. If DuPont is required to make payments as a result, they could exceed the amounts accrued therefor, thereby adversely affecting the Company’s results of operations.

Risks Relating to DuPont’s Business and Results of Operations

The extent to which the novel coronavirus (COVID-19) and measures taken in response to it, impact DuPont’s business, results of operations, access to sources of liquidity and financial condition depends on future developments, which are highly uncertain and cannot be predicted.

DuPont is actively monitoring the global impacts of COVID-19, including the impacts from responsive measures, and remains focused on its top priorities - the safety and health of its employees and the needs of its customers. The Company’s business and financial condition, and the business and financial condition of the company’s customers and suppliers, have been impacted by the significantly increased economic and demand uncertainties created by the COVID-19 outbreak. In addition, public and private sector responsive measures, such as the imposition of travel restrictions, quarantines, adoption of remote working, and suspension of non-essential business and government services, have impacted the Company’s business and financial condition. Many of DuPont’s facilities and employees are based in areas impacted by the virus. While most DuPont manufacturing sites remain in operation, DuPont has reduced or furloughed certain operations in response to government measures, employee welfare concerns and the impact of COVID-19 on the global demand and supply chain. DuPont’s manufacturing operations may be further adversely affected by impacts from COVID-19 including, among other things, additional government actions and other responsive measures, more and /or deeper supply chain disruptions, quarantines and health and availability of essential onsite personnel. In response, the Company developed site-by-site protocols in 2020 under which the Company continues to operate. These protocols include pre-entrance screening, restricting visitor access, social distancing and masking requirements, additional sanitization and disinfecting requirements, restrictions on all nonessential travel and implementation of work-from-home protocols. The suspension of travel and doing business in-person has increased the Company’s exposure to cybersecurity risks and could negatively impact the Company's innovation and marketing efforts, challenge the ability to deliver against the Company’s strategic priorities and to otherwise transact business in a timely manner, or create operational or other challenges, any of which could harm DuPont’s business. Furthermore, COVID-19 continues to adversely impact the broader global economy, including negatively impacting economic growth and creating disruption and volatility in the global financial and capital markets, which could result in increases in the cost of capital and/or adversely impact the availability of and access to capital, which could negatively affect DuPont’s liquidity. DuPont is unable to predict the extent of COVID-19 related impacts on its business, results of operations, access to sources of liquidity and financial condition which depends on highly uncertain and unpredictable future developments, including, but not limited to, the duration and spread of the COVID-19 outbreak, its severity, the actions to contain the virus or treat its impact, and how quickly and to what extent normal economic and operating conditions resume. DuPont’s financial results may be materially and adversely impacted by a variety of factors that have not yet been determined, including potential impairments of goodwill and other assets. DuPont is taking actions, including reducing costs, restructuring actions, and delaying certain capital expenditures and non-essential spend. In addition, the Company may consider further reductions in or furloughing additional operations in response to further and/or deeper declines in demand and/or or supply chain disruptions. There can be no guaranty that such actions will significantly mitigate the

21

impact of COVID-19 on the company’s business, results of operations, access to sources of liquidity or financial condition. After the COVID-19 outbreak has subsided, DuPont may experience materially adverse impacts to its business, results of operations and financial condition as a result of related global economic impacts, including any recession that has occurred or may occur in the future.

Supply chain disruptions and volatility in energy and raw material costs could have a significant impact on the Company’s sales and earnings.

The Company’s manufacturing processes depend on the continued availability of energy and raw materials, the costs of which are subject to worldwide supply and demand as well as other factors beyond the Company’s control, including potential legislation to address climate change by reducing greenhouse gas emissions, creating a carbon tax or implementing a cap and trade program which could create increases in energy costs and price volatility. Supply chain disruptions, plant and/or power outages, labor disputes and/or strikes, geo-political activity, weather events and natural disasters, including hurricanes or flooding that impact coastal regions, and global health risks or pandemics could seriously harm the Company’s operations as well as the operations of the Company’s customers and suppliers. In addition, the Company’ suppliers may experience capacity limitations in their own operations or may elect to reduce or eliminate certain product lines. To address this risk, generally, the Company seeks to have many sources of supply for key raw materials in order to avoid significant dependence on any one or a few suppliers. In addition, and where the supply market for key raw materials is concentrated, DuPont takes additional steps to manage its exposure to supply chain risk and price fluctuations through, among other things, negotiated long-term contracts some which include minimum purchase obligations. Although there can be no assurance that such mitigation efforts will prevent future difficulty in obtaining sufficient and timely delivery of certain raw materials, DuPont believes it has adequate programs to ensure a reliable supply of key raw materials