UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

(Mark One)

|

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended

OR

|

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE TRANSITION PERIOD FROM TO |

Commission File Number

(Exact name of Registrant as specified in its Charter)

|

|

|

|

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

|

|

|

|

(Address of principal executive offices) |

(Zip Code) |

Registrant’s telephone number, including area code: (

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

|

|

|

|

|

|

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES ☐ NO ☒

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. YES ☐ NO ☒

Indicate by check mark whether the Registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES ☒ NO ☐

Indicate by check mark whether the Registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit such files). YES ☒ NO ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer |

|

☐ |

|

Accelerated filer |

|

☐ |

|

|

|

|

|

|||

|

|

|

☒ |

|

Smaller reporting company |

|

|

|

|

|

|

|

|

|

|

|

Emerging growth company |

|

|

|

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). YES

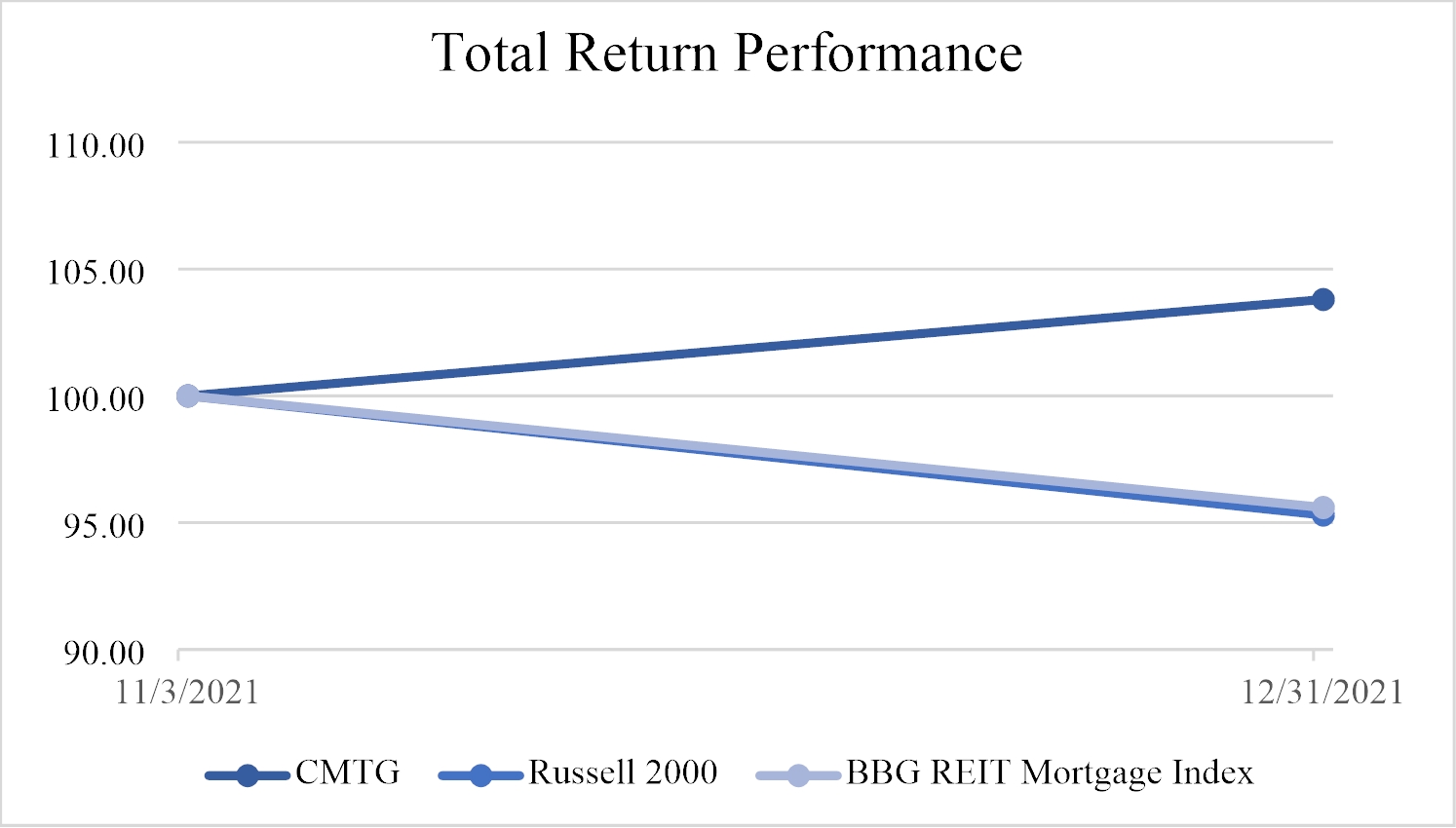

As of June 30, 2021, the last business day of the Registrant’s most recently completed second fiscal quarter, the Registrant’s common stock was not listed on any exchange or over-the counter market. The Registrant’s common stock began trading on the New York Stock Exchange on November 3, 2021. On December 31, 2021, the last business day of the Registrant’s most recently completed fourth fiscal quarter, the aggregate market value of the Registrant’s common stock held by non-affiliates of the Registrant was $

The number of shares of Registrant’s Common Stock outstanding as of March 1, 2022 was

DOCUMENTS INCORPORATED BY REFERENCE

Table of Contents

|

|

|

Page |

|

PART I |

|

|

|

Item 1. |

7 |

|

|

Item 1A. |

15 |

|

|

Item 1B. |

66 |

|

|

Item 2. |

66 |

|

|

Item 3. |

66 |

|

|

Item 4. |

67 |

|

|

|

|

|

|

PART II |

|

|

|

Item 5. |

68 |

|

|

Item 6. |

69 |

|

|

Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

70 |

|

Item 7A. |

90 |

|

|

Item 8. |

93 |

|

|

Item 9. |

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure |

93 |

|

Item 9A. |

94 |

|

|

Item 9B. |

94 |

|

|

Item 9C. |

Disclosure Regarding Foreign Jurisdictions that Prevent Inspections |

94 |

|

|

|

|

|

PART III |

|

|

|

Item 10. |

95 |

|

|

Item 11. |

95 |

|

|

Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

95 |

|

Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

95 |

|

Item 14. |

95 |

|

|

|

|

|

|

PART IV |

|

|

|

Item 15. |

96 |

|

|

Item 16 |

102 |

2

EXPLANATORY NOTE

Except where the context suggests otherwise, the terms the “Company,” “we,” “us,” “our” and “CMTG” refer to Claros Mortgage Trust, Inc., a Maryland corporation, individually and together with its subsidiaries as the context may require; our “Manager” refers to Claros REIT Management LP, a Delaware limited partnership, our external manager and an affiliate of MRECS; and “MRECS” refers to Mack Real Estate Credit Strategies, L.P., the CRE lending and debt investment business affiliated with Mack Real Estate Group, LLC, which we refer to as the “Mack Real Estate Group” or “MREG.” Although MRECS and MREG are distinct legal entities, for convenience, references to our “Sponsor” in this Annual Report on Form 10-K are deemed to include reference to MRECS and MREG, individually or collectively, as appropriate for the context and unless otherwise indicated. References to “CRE” throughout this Annual Report on Form 10-K means commercial real estate.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

We make forward-looking statements in this annual report that are subject to risks and uncertainties. These forward-looking statements include information about possible or assumed future results of our business, financial condition, liquidity, results of operations, plans and objectives. When we use the words “believe,” “expect,” “anticipate,” “estimate,” “plan,” “continue,” “intend,” “should,” “may” or similar expressions, we intend to identify forward-looking statements. Statements regarding the following subjects, among others, may be forward-looking:

|

• |

our business and investment strategy; |

|

• |

our projected operating results; |

|

• |

the timing of cash flows, if any, from our investments; |

|

• |

the state of the U.S. and global economy generally or in specific geographic regions; |

|

• |

the duration and the severity of the COVID-19 pandemic, actions that may be taken by governmental authorities to contain the COVID-19 pandemic or to treat its impact and the adverse impacts that the COVID 19 pandemic has had, and will likely continue to have, on the global economy and on our business, financial condition, liquidity, results of operations and prospects and on our ability to service our debt and pay dividends to our stockholders, including as a result of the COVID-19 pandemic’s adverse impact on the net worth, liquidity and other ability of borrowers or any guarantors to honor their obligations to us; |

|

• |

defaults by borrowers in paying debt service on outstanding loans; |

|

• |

governmental actions and initiatives and changes to government policies; |

|

• |

the amount of commercial mortgage loans requiring refinancing; |

|

• |

our ability to obtain financing arrangements on attractive terms, or at all; |

|

• |

current and prospective financing costs and advance rates for our target assets; |

|

• |

our expected leverage; |

|

• |

general volatility of the securities markets in which we may invest; |

|

• |

the impact of a protracted decline in the liquidity of credit markets on our business; |

|

• |

the uncertainty surrounding the strength of the global economy; |

|

• |

the return on or impact of current and future investments, including our loan portfolio and real estate owned investment; |

|

• |

allocation of investment opportunities to us by our Manager and our Sponsor; |

|

• |

changes in interest rates and the market value of our investments; |

|

• |

effects of hedging instruments on our target assets; |

3

|

• |

rates of default or decreased recovery rates on our target assets and related impairment charges, including as it relates to our real estate owned investment; |

|

• |

the degree to which our hedging strategies may or may not protect us from interest rate volatility; |

|

• |

changes in governmental regulations, tax law and rates, and similar matters (including interpretation thereof); |

|

• |

our ability to maintain our qualification as a real estate investment trust “REIT”; |

|

• |

our ability to maintain our exclusion from registration under the 1940 Act; |

|

• |

availability and attractiveness of investment opportunities we are able to originate in our target assets; |

|

• |

the ability of our Manager to locate suitable investments for us, monitor, service and administer our investments and execute our investment strategy; |

|

• |

availability of qualified personnel from our Sponsor and its affiliates, including our Manager; |

|

• |

estimates relating to our ability to pay dividends to our stockholders in the future; |

|

• |

our understanding of our competition; |

|

• |

impact of increased competition on projected returns; and |

|

• |

market trends in our industry, interest rates, real estate values, the debt markets generally, the CRE debt market or the general economy. |

The forward-looking statements are based on our beliefs, assumptions and expectations of our future performance, taking into account all information currently available to us. You should not place undue reliance on these forward-looking statements. These beliefs, assumptions and expectations can change as a result of many possible events or factors, not all of which are known to us. Factors that could cause or contribute to these differences include, but are not limited to, those identified below and those discussed in the section titled “Risk Factors” of this filing. If a change occurs, our business, financial condition, liquidity, results of operations and prospects may vary materially from those expressed in our forward-looking statements. Any forward-looking statement speaks only as of the date on which it is made. New risks and uncertainties arise over time, and it is not possible for us to predict those events or how they may affect us. Except as required by law, we are not obligated to, and do not intend to, update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

SUMMARY OF MATERIAL RISKS

There are a number of risks, uncertainties and other important factors that could cause our actual results to differ materially from the forward-looking statements contained in this Annual Report on Form 10-K. Such risks, uncertainties and other important factors include, among others, the risks, uncertainties and factors set forth under Part I, Item 1A. "Risk Factors" in this Annual Report on Form 10-K. Such risks and uncertainties include, but are not limited to, the following:

|

• |

The COVID-19 pandemic has had an adverse effect on us and may have a material adverse effect on us in the future and any other pandemic, epidemic or outbreak of an infectious disease in the markets in which we operate may have a material adverse effect on us in the future. |

|

• |

We operate in a competitive market for the origination and acquisition of attractive investment opportunities and competition may limit our ability to originate or acquire attractive risk-adjusted investments in our target assets, which could have a material adverse effect on us. |

|

• |

Loans on properties in transition often involve a greater risk of loss than loans on stabilized properties, including the risk of cost overruns on and noncompletion of the construction or renovation of or other capital improvements to the properties underlying the loans we originate or acquire, and the risk that a borrower may fail to execute the business plan underwritten by us, potentially making it unable to refinance our loan at maturity, each of which could materially and adversely affect us. |

4

|

• |

Our investments are and may be concentrated in certain markets, property types and borrowers, among other factors, and will be subject to risk of default. |

|

• |

We will allocate our available capital without input from our stockholders. |

|

• |

The lack of liquidity in certain of the assets in our loan portfolio and our target assets generally may materially and adversely affect us. |

|

• |

In the event of borrower distress or a default, we may lack the liquidity necessary to protect our investment or avoid a corresponding default on any obligations we may have in connection with our own financing. |

|

• |

We may be unable to refinance debt incurred to finance our loans, thereby increasing the amount of equity capital risk we bear with respect to particular loans or preventing us from deploying our equity capital in the optimal manner. |

|

• |

As a result of our real estate owned investment, we are subject to the risks commonly associated with real estate owned holdings, including risks related to ownership of hotel properties in New York, New York which vary from the risks associated with lending. |

|

• |

Difficult conditions in the commercial mortgage and real estate market, the financial markets and the economy generally could materially and adversely affect us. |

|

• |

If our Manager overestimates the yields or incorrectly prices the risks of our investments, we may experience losses. |

|

• |

Investments in subordinated mortgage interests, mezzanine loans and other assets that are subordinated or otherwise junior in a borrower’s capital structure may expose us to greater risk of loss. |

|

• |

CRE-related investments that are secured, directly or indirectly, by CRE are subject to potential delinquency, foreclosure and loss, which could materially and adversely affect us. |

|

• |

An increase in interest rates may cause a decrease in the demand for certain of our target assets, which could adversely affect our ability to originate or acquire target assets that satisfy our investment objectives to generate income and pay dividends. |

|

• |

We have a significant amount of debt outstanding, and may incur a significant amount of additional debt in the future, which subjects us to increased risk of loss, which could materially and adversely affect us. |

|

• |

We depend or may depend on bank credit agreements and facilities, repurchase facilities and structured financing arrangements, public and private debt issuances and derivative instruments, in addition to transaction- or asset- specific financing arrangements and other sources of financing to execute our business plan, and our inability to access financing on favorable terms could have a material adverse effect on us. |

|

• |

Interest rate fluctuations could increase our financing costs, which could materially and adversely affect us. |

|

• |

The planned discontinuance of LIBOR has affected and will continue to affect financial markets generally, and may adversely affect our interest income, interest expense, or both. |

|

• |

Our business strategy is focused on lending against assets primarily in major U.S. markets which have been, and in the future may continue to be, subject to protests, riots or other forms of civil unrest. |

|

• |

Our investment strategy, our investment guidelines, our target assets and our financing strategy may be changed without stockholder consent. |

|

• |

Changes in laws or regulations governing our operations or those of our competitors, or changes in the interpretation thereof, or newly enacted laws or regulations, could result in increased competition for our target assets, require changes to our business practices and collectively could adversely impact our revenues and impose additional costs on us, which could materially and adversely affect us. |

|

• |

Our future success depends on our Manager and its access to the key personnel and investment professionals of our Sponsor and its affiliates. |

5

|

• |

We may compete with other investment vehicles managed by our Sponsor or its affiliates, including our Manager, or have other conflicts of interest with our Sponsor or its affiliates, including our Manager, which may result in decisions that are not in the best interests of our stockholders. |

|

• |

Our Manager is responsible for the management of our business as well as the business of our 51%-owned joint venture, CMTG/TT Mortgage REIT LLC, a Delaware limited liability company (the “JV”), and an affiliate of our Manager is responsible for the management of the business of a private high yield real estate credit fund (the “High Yield Fund”), which could result in conflicts in allocating its investment opportunities, time, resources and services among us, the High Yield Fund and other vehicles or accounts managed by our Sponsor or its affiliates. |

|

• |

The structure of our Manager’s fees may not create effective incentives and may cause our Manager to make riskier investments. |

|

• |

Termination of the Management Agreement would be costly. |

|

• |

We have not established a minimum dividend payment level, and we may be unable to generate sufficient cash flows from our operations to pay dividends to our stockholders at any time in the future at a particular level, or at all, which could materially and adversely affect us. |

|

• |

Failure to maintain our qualification as a REIT would materially and adversely affect us and the market price of our common stock. |

|

• |

Complying with REIT requirements may force us to liquidate, restructure or forego otherwise attractive investments. |

6

PART I

Item 1. Business.

Our Company

We are a CRE finance company focused primarily on originating senior and subordinate loans on transitional CRE assets located in major U.S. markets, including mortgage loans secured by a first priority or subordinate mortgage on transitional CRE assets, and subordinate loans including mezzanine loans secured by a pledge of equity ownership interests in the direct or indirect property owner rather than directly in the underlying commercial properties. These loans are subordinate to a mortgage loan but senior to the property owner’s equity ownership interests. Transitional CRE assets are properties that require repositioning, renovation, rehabilitation, leasing, development or redevelopment or other value-added elements in order to maximize value. We believe our Sponsor’s real estate development, ownership and operations experience and infrastructure differentiates us in lending on these transitional CRE assets. Our objective is to be a premier provider of debt capital for transitional CRE assets and, in doing so, to generate attractive risk-adjusted returns for our stockholders over time, primarily through dividends. We strive to create a diversified investment portfolio of CRE loans that we generally intend to hold to maturity. We focus primarily on originating loans ranging from $50 million to $300 million on transitional CRE assets located in major U.S. markets with attractive fundamental characteristics supported by macroeconomic tailwinds.

We were organized as a Maryland corporation on April 29, 2015 and commenced operations on August 25, 2015. We have elected and believe we have qualified to be taxed as a REIT for U.S. federal income tax purposes commencing with our taxable year ended December 31, 2015. We are externally managed and advised by our Manager, an investment adviser registered with the SEC pursuant to the Advisers Act. We operate our business in a manner that permits us to maintain our exclusion from registration under the Investment Company Act of 1940, as amended (the “1940 Act”).

Our principal executive offices are located at c/o Mack Real Estate Credit Strategies, L.P., 60 Columbus Circle, 20th Floor, New York, New York 10023. Our website is www.clarosmortgage.com. The information found on, or otherwise accessible through, our website is not incorporated by reference into, nor does it form a part of, this Annual Report on Form 10-K,

Our Manager and Our Sponsor

We are externally managed by our Manager, an affiliate of MRECS, which was founded in 2014 to focus on CRE credit investments as a core business affiliated with the broader MREG platform. Our Sponsor owns, develops, invests in and manages real estate equity, debt and securities on behalf of third‑party institutional and high net worth investors, and the members of our Sponsor’s senior management team have, on average, more than 25 years of real estate and finance experience. We leverage our Sponsor’s platform to originate, underwrite, structure and asset manage a portfolio of loan assets that align with our differentiated investment strategy. In particular, we believe that MREG’s experience and infrastructure in the areas of real estate ownership, development and property management strengthens our ability to lend on transitional CRE assets which involve a level of borrower execution risk that traditional lenders and other debt market participants without our expertise may be unable or unwilling to adequately underwrite.

In performing its duties to us, our Manager benefits from the resources, relationships, fundamental real estate underwriting and management expertise of our Sponsor’s broad group of real estate professionals. Our Manager is led by Richard Mack, Michael McGillis, Kevin Cullinan, Priyanka Garg and other members of our Sponsor’s senior management team. Pursuant to a management agreement between our Manager and us (the “Management Agreement”), our Manager is responsible for executing our loan origination, capital markets, portfolio management, asset management and monitoring activities and managing our day‑to‑day operations. To perform its role in a flexible and efficient manner, our Manager leverages professionals employed by our Sponsor whose services are made available to our Manager and, in turn, to us. We believe our Manager benefits from access to individuals with extensive experience in identifying, analyzing, acquiring, financing, hedging, managing and operating real estate investments across investment cycles, geographies, property types, investment types and strategies, including debt and equity interests, controlling and non‑controlling investments, corporate and securities investments (including CMBS) and a variety of joint ventures. We believe that this experience of our Sponsor and its affiliates enables our Manager to underwrite, originate and manage loans that facilitate the successful transition of CRE assets, with an appropriate level

7

of execution risk and, in its judgment, relatively limited basis risk. Neither we nor our Manager employs personnel directly. In performing its duties to us, our Manager is at all times subject to the supervision, direction and management of our board of directors.

Our Investment Strategy

We seek primarily to originate, co-originate and acquire senior and subordinate loans on transitional CRE assets located in major U.S. markets and generally intend to hold our loans to maturity. Together, we refer to the following types of investments as our target assets. In addition to our primary focus on major U.S. markets, we are also seeking to originate senior and subordinate loans on transitional CRE assets located in other markets that we be believe demonstrate favorable demographic trends as a result of, among other factors, de‑urbanization, migration to states with lower tax rates, and perceived higher quality of life. We believe that our investment strategy currently provides significant opportunities for us to generate attractive risk‑adjusted returns over time for our stockholders. However, to capitalize on the investment opportunities at different points in the economic and real estate investment cycle, we may modify or expand our investment strategy without our stockholders’ consent. We believe that the flexibility of our strategy supported by our Sponsor’s significant CRE experience and its extensive resources will allow us to take advantage of changing market conditions to maximize total returns for our stockholders.

Our financing strategy and investment process are discussed in more detail in “Our Financing Strategy” and “Investment Guidelines” below.

Our Target Assets

We originate, co‑originate and acquire senior and subordinate loans on transitional CRE assets located primarily in major U.S. markets. Together, we refer to the following types of investments as our target assets:

Senior Loans: We focus primarily on originating senior loans on transitional CRE assets, including:

Mortgage Loans. Mortgage loans secured by a first priority or subordinate mortgage on transitional CRE assets. These loans are non‑amortizing, require a balloon payment of principal at maturity (and in some cases, earlier pay downs in the case of loans that provide for partial releases of collateral upon the occurrence of specified events, such as the sale of condominium units) and are typically structured to be floating rate. Some of our loan commitments include a mixture of up‑front and future funding obligations, with future fundings subject to the borrower achieving conditions precedent specified in the loan documents, such as meeting certain construction milestones and leasing thresholds.

Participations in Mortgage Loans.Participations in the mortgage loans we co‑originate or acquire, for which other participations have been or are expected to be syndicated to other investors.

Contiguous Subordinate Loans.Under certain circumstances, we may structure our investment on a property to include both a senior mortgage and a subordinate loan component, which we refer to as a contiguous subordinate loan. In these cases, we believe the subordinate loan component of the investment, when taken together with its related senior mortgage loan component, renders the entire investment most similar to our other senior loans in comparison to other loan types given its overall credit quality and risk profile.

Subordinate Loans: We also invest in mezzanine loans, which are primarily originated or co‑originated by us, and are usually secured by a pledge of equity ownership interests in the direct or indirect property owner rather than directly by the underlying commercial properties. These loans are subordinate to a mortgage loan but senior to the property owner’s equity ownership interests. These loans may be tranched into senior and junior mezzanine loans. Rights under these loans are generally governed by intercreditor agreements which typically include the right to cure defaults under senior loans. Subordinate loans may also include subordinated mortgage interests, which are mortgage loan interests that are subordinate to senior mortgage loans but senior to the property owner’s equity interests.

8

The allocation of our capital among our target assets will depend on prevailing market conditions at the time we invest and may change over time in response to changes in prevailing market conditions, including with respect to interest rates and general economic and credit market conditions as well as local economic conditions in markets where we are active. In addition, in the future we may invest in assets other than our target assets, in each case subject to maintaining our qualification as a REIT for U.S. federal income tax purposes and our exclusion from registration under 1940 Act.

Our Portfolio

We began operations in August 2015 and, as of December 31, 2021, had a $6.6 billion diversified loan portfolio, based on unpaid principal balance, of senior and subordinate loans. We believe our current loan portfolio, comprised of loans that we view as representative of our target assets and investment philosophy, validates our ability to execute on our investment strategy, including lending to experienced and well‑capitalized sponsors against high‑quality transitional CRE assets primarily in major U.S. markets with attractive fundamental characteristics supported by macroeconomic tailwinds.

The below table summarizes our loan portfolio as of December 31, 2021 (dollars in thousands):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted Average(3) |

|

|||||||||

|

|

|

Number of Investments(1) |

|

|

Number of Loans(1) |

|

|

Loan Commitment(2) |

|

|

Unpaid Principal Balance |

|

|

All-In Yield(4) |

|

|

Term to Fully Extended Maturity(5) |

|

|

LTV(7) |

|

|||||||

|

Senior loans(6) |

|

|

55 |

|

|

|

93 |

|

|

$ |

7,426,332 |

|

|

$ |

6,343,758 |

|

|

|

5.5 |

% |

|

|

3.3 |

|

|

|

67.5 |

% |

|

Subordinate loans |

|

|

5 |

|

|

|

6 |

|

|

|

263,006 |

|

|

|

259,046 |

|

|

|

10.4 |

% |

|

|

2.7 |

|

|

|

68.2 |

% |

|

Total / Weighted Average |

|

|

60 |

|

|

|

99 |

|

|

$ |

7,689,338 |

|

|

$ |

6,602,804 |

|

|

|

5.7 |

% |

|

|

3.3 |

|

|

|

67.6 |

% |

|

(1) |

Certain investments include multiple loans for which we made commitments to the same borrower or affiliated borrowers on the same date. The loan portfolio table excludes our one real estate owned investment. |

|

(2) |

Loan commitment represents initial loan commitments, as adjusted by commitment reductions, less principal repayments and transfers which qualified for sale accounting under GAAP. |

|

(3) |

Weighted averages are based on unpaid principal balance. |

|

(4) |

All-in yield represents the weighted average annualized yield to initial maturity of each loan within our loan portfolio, inclusive of coupon, origination fees, exit fees, and extension fees received, based on the applicable floating benchmark rate (if applicable), including LIBOR floors (if applicable), as of December 31, 2021. |

|

(5) |

Term to fully extended maturity is measured in years. Fully extended maturity assumes all extension options are exercised by the borrower upon satisfaction of the applicable conditions. |

|

(6) |

Includes contiguous subordinate loans (i.e., loans for which we also hold the mortgage loan) representing loan commitments of $831.7 million, and aggregate unpaid principal balance of $723.6 million as of December 31, 2021. |

|

(7) |

LTV represents “loan-to-value” or “loan-to-cost”, which is calculated as our total loan commitment from time to time, as if fully funded, plus any financings that are pari passu with or senior to our loan, divided by our estimate of either (1) the value of the underlying real estate, determined in accordance with our underwriting process (typically consistent with, if not less than, the value set forth in a third-party appraisal) or (2) the borrower’s projected, fully funded cost basis in the asset, in each case as we deem appropriate for the relevant loan and other loans with similar characteristics. Underwritten values and projected costs should not be assumed to reflect our judgment of current market values or project costs, which may have changed materially since the date of origination including, without limitation, as a result of the COVID-19 pandemic. LTV is updated only in connection with a partial loan paydown and/or release of collateral, material changes to expected project costs, the receipt of a new appraisal (typically in connection with financing or refinancing activity) or a change in our loan commitment. |

In February 2021, we foreclosed on a portfolio of seven limited-service hotel properties located in New York, New York that secured a mezzanine loan with an unpaid principal balance of $103.9 million as of February 8, 2021 that we originated in February 2018. Neither the prior mezzanine loan nor the portfolio of hotel properties is included in the table above. Our real estate owned investment at the time of foreclosure was encumbered by a securitized senior mortgage, which we assumed on February 8, 2021 with a principal balance of $300.0 million. On June 2, 2021, the

9

terms of the securitized senior mortgage were modified, which included the repayment of $10.0 million of principal and extension of its maturity date by an additional three years to February 9, 2024, among other items. At December 31, 2021, the outstanding balance of our debt related to real estate owned was $290.0 million.

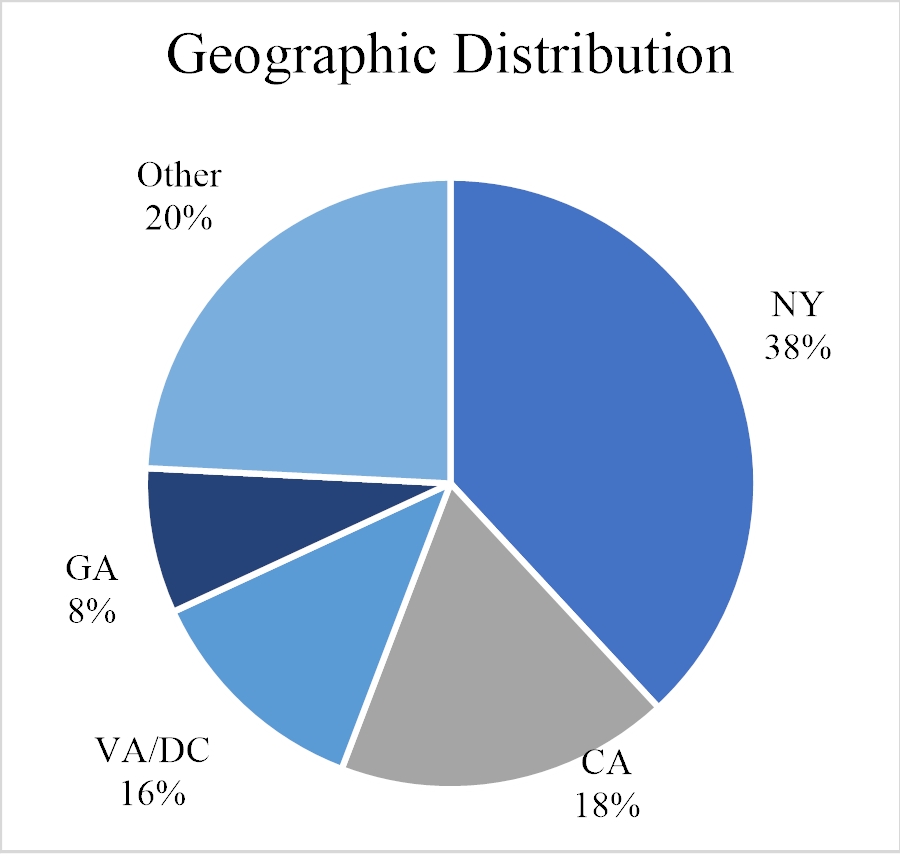

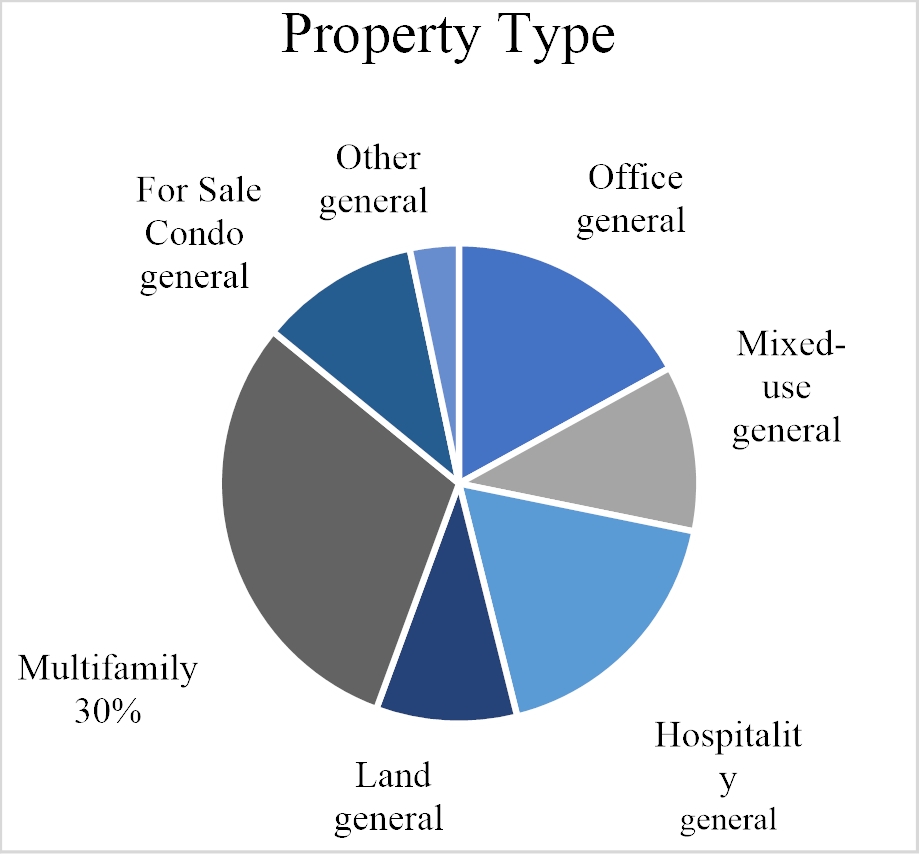

The following charts illustrate the diversification of our loan portfolio based on location and underlying property type, excluding our real estate owned investment, as of December 31, 2021, based on unpaid principal balance:

For additional information about our loan portfolio, refer to Item 7 – “Management Discussion and Analysis of Financial Condition and Results of Operations – II. Our Portfolio” in this Annual Report on Form 10-K.

Our Financing Strategy

We use diverse financing sources as part of a disciplined financing strategy. To date, we have financed our business through a combination of common stock issuances, repurchase facilities, asset-specific financing structures and borrowings under our $762.7 million secured term loan (the “Secured Term Loan”). The amount and type of leverage we may employ for particular loans will depend on our Manager’s assessment of such loan’s characteristics, including the level of in place, if any, and projected stabilized operating cash flow, credit quality, liquidity, price volatility and other risks of the underlying collateral as well as the availability and attractiveness of particular types of financing at the relevant time. We seek to minimize the risks associated with recourse borrowings and generally seek to match-fund our investments by minimizing the differences between the durations and indices of our investments and those of our liabilities, respectively, including in certain cases the potential use of derivatives; however, under certain circumstances, we may determine not to do so or we may otherwise be unable to do so. We also seek to diversify our financing counterparties.

As of December 31, 2021, we had $4.3 billion of capacity under our repurchase facilities, of which $3.5 billion was drawn. We currently have master repurchase agreements with six counterparties, and the weighted average remaining term, including extensions, of our repurchase facilities, based on unpaid principal balance, was 3.3 years as of December 31, 2021.

We also utilize multiple asset-specific financing structures, with certain terms that are typically matched to the underlying loan asset. As of December 31, 2021, we had total capacity and unpaid principal balance of $216.3 million related to asset‑specific financing structures. The asset‑specific financing structures we utilize include notes payable arrangements and syndications of senior participations in the whole loans we originate, which may take the form of an A‑Note (where we would retain the subordinated mortgage interest) or mortgage (where we would retain the mezzanine loan), among other financing structures. An A‑Note is a senior participation interest in a mortgage loan secured by CRE assets.

10

Under certain circumstances, we utilize asset‑specific financing structures that are considered non‑consolidated senior interests, and therefore not reflected on our balance sheet. As of December 31, 2021, we had $1.1 billion of non‑consolidated senior interests. Such financing structures typically arise as a result of a subordinate, or mezzanine, loan held by us, and a first mortgage loan held by a third party.

As of December 31, 2021, we had amounts outstanding under our Secured Term Loan totaling $762.7 million. At December 31, 2021, the outstanding balance of our debt related to real estate owned was $290.0 million.

Over time, in addition to these types of financings, we may also use other forms of leverage, such as secured and unsecured credit facilities, structured financings such as CMBS and CLOs, derivative instruments and public and private secured and unsecured debt issuances by us or our subsidiaries, as well as issuances of public and private equity and equity-related securities.

As of December 31, 2021, our net debt‑to‑equity ratio was 1.7x. As of December 31, 2021, our total leverage ratio was 2.1x, and we expect that, going forward, our Total Leverage Ratio will range from 2.0x and 3.0x.

Investment Guidelines

Our Board has established the following investment guidelines:

|

• |

No investment will be made that would cause the Company to fail to qualify as a REIT for U.S. federal income tax purposes; |

|

• |

No investment will be made that would require the Company to register as an investment company under the 1940 Act; |

Prior to the deployment of capital into investments, our Manager may cause the capital of the Company to be invested in any interest‑bearing short‑term investments, including money market funds, bank accounts, overnight repurchase agreements with primary federal reserve bank dealers collateralized by direct U.S. government obligations and other instruments or investments reasonably determined by our Manager to be of high quality. Our investment guidelines may be changed from time to time by our Board without our stockholders’ consent.

Subject to maintaining our qualification as a REIT for U.S. federal income tax purposes and our exclusion from registration under the 1940 Act, we typically seek to originate or acquire loans with initial terms of between two and four years. We intend to hold our loans to maturity. However, in order to maximize returns and manage portfolio risk while remaining opportunistic, we may dispose of loans earlier than anticipated or hold loans longer than anticipated if we determine it to be appropriate depending upon prevailing market conditions or factors regarding a loan or broader portfolio management factors. Additionally, our intention is that no more than 25% of our book value will be attributed to investments located outside of the U.S. To date, we have only invested in the U.S.

Operating and Regulatory Structure

REIT Qualification

We have elected and believe we have qualified to be taxed as a REIT for U.S. federal income tax purposes commencing with our taxable year ended December 31, 2015. We believe that we have been organized and have operated in conformity with the requirements for qualification and taxation as a REIT under the Code, and that our intended manner of operation will enable us to meet the requirements for qualification and taxation as a REIT. To qualify as a REIT, we must meet on a continuing basis, through our organization and actual investment and operating results, various requirements under the Code relating to, among other things, the sources of our gross income, the composition and values of our assets, our dividend levels and the diversity of ownership of shares of our stock. If we fail to qualify as a REIT in any taxable year and do not qualify for certain statutory relief provisions, we will be subject to U.S. federal income tax at regular corporate rates and may be precluded from qualifying as a REIT for the subsequent four taxable years following the year during which we failed to qualify as a REIT. Even if we qualify for

11

taxation as a REIT, we may be subject to some U.S. federal, state and local taxes on our income or property. For more information regarding our election to qualify as a REIT, please see “Item 1A. Risk Factors—U.S. Federal Income Tax Risks.”

1940 Act

We intend to conduct our operations so that neither we nor any of our subsidiaries are required to register as an investment company under the 1940 Act. Section 3(a)(1)(A) of the 1940 Act defines an investment company as any issuer that is, or holds itself out as being, engaged primarily, or proposes to engage primarily, in the business of investing, reinvesting or trading in securities. Section 3(a)(1)(C) of the 1940 Act defines an investment company as any issuer that is engaged or proposes to engage in the business of investing, reinvesting, owning, holding or trading in securities, and owns or proposes to acquire investment securities having a value exceeding 40% of the value of such issuer’s total assets (exclusive of U.S. government securities and cash items) on an unconsolidated basis, which we refer to as the 40% test. Excluded from the term “investment securities,” among other things, are U.S. government securities and securities issued by majority-owned subsidiaries that are not themselves investment companies and are not relying on the exception from the definition of “investment company” set forth in Section 3(c)(1) or Section 3(c)(7) of the 1940 Act.

We are organized as a holding company and conduct our businesses primarily through our subsidiaries. We intend to conduct our operations so that we comply with the 40% test. The securities issued by any wholly-owned or majority-owned subsidiaries that we may form in the future that are excepted from the definition of “investment company” based on Section 3(c)(1) or Section 3(c)(7) of the 1940 Act, together with any other investment securities we may own, may not have a value in excess of 40% of the value of our total assets (exclusive of U.S. government securities and cash items) on an unconsolidated basis. We will monitor our holdings to ensure continuing and ongoing compliance with this test. In addition, we believe that we will not be considered an investment company under Section 3(a)(1)(A) of the 1940 Act because we will not engage primarily or hold ourselves out as being engaged primarily in the business of investing, reinvesting or trading in securities. Rather, through our subsidiaries, we are primarily engaged in non-investment company businesses related to real estate.

The determination of whether an entity is a majority-owned subsidiary of our company is made by us. The 1940 Act defines a majority-owned subsidiary of a person as a company 50% or more of the outstanding voting securities of which are owned by such person, or by another company which is a majority-owned subsidiary of such person. The 1940 Act further defines voting securities as any security presently entitling the owner or holder thereof to vote for the election of directors of a company. Generally, we treat companies in which we own at least a majority of the outstanding voting securities as majority-owned subsidiaries for purposes of the 40% test. We have not requested that the SEC or its staff approve our treatment of any company as a majority-owned subsidiary, and neither the SEC nor its staff has done so. If the SEC or its staff were to disagree with our treatment of one or more companies as majority-owned subsidiaries, we would need to adjust our strategy and our assets in order to continue to pass the 40% test. Any such adjustment in our strategy or assets could have a material adverse effect on us.

We expect that most of our majority-owned subsidiaries will not be relying on either Section 3(c)(1) or Section 3(c)(7) of the 1940 Act. As a result, we expect that our interests in these subsidiaries (which we expect will constitute a substantial majority of our assets) will not constitute “investment securities” for purposes of the 40% test. Consequently, we expect to be able to conduct our operations so that we are not required to register as an investment company under the 1940 Act.

We expect certain of our subsidiaries to qualify for the exclusion from the definition of “investment company” pursuant to Section 3(c)(5)(C) of the 1940 Act, which is available for certain entities “primarily engaged in the business of purchasing or otherwise acquiring mortgages and other liens on and interests in real estate.” To qualify for the exclusion pursuant to Section 3(c)(5)(C), based on positions set forth by the staff of the SEC, each such subsidiary generally is required to hold (i) at least 55% of its assets in qualifying real estate assets and (ii) at least 80% of its assets in qualifying real estate assets and real estate-related assets. For our majority- or wholly-owned subsidiaries that will maintain this exclusion or another exclusion or exception under the 1940 Act (other than Section 3(c)(1) or Section 3(c)(7) thereof), our interests in these subsidiaries will not constitute “investment securities.” We expect each of our subsidiaries relying on Section 3(c)(5)(C) to rely on guidance published by the SEC staff or on our analyses of guidance published with respect to other types of assets to determine which assets are qualifying real estate assets and real estate-related assets.

Specifically, based on certain no-action letters and other guidance issued by the SEC staff, we expect to treat certain mortgage loans, mezzanine loans, subordinated mortgage interests and certain other assets that represent an

12

actual interest in CRE or are a loan or lien fully secured by CRE as qualifying real estate assets. On the other hand, we expect to treat certain other types of mortgages, securities of REITs and certain other indirect interests in CRE as real estate-related assets. The SEC staff has not, however, published guidance with respect to the treatment of some of these assets under Section 3(c)(5)(C). To the extent the SEC staff publishes new or different guidance with respect to these matters, we may be required to adjust our strategy or assets accordingly. There can be no assurance that we will be able to maintain this exclusion from registration for certain of our subsidiaries. In addition, we may be limited in our ability to make certain investments, and these limitations could result in a subsidiary holding assets we might wish to sell or selling assets we might wish to hold.

We may hold a portion of our investments through partnerships, joint ventures, securitization vehicles or other entities with third-party investors. In connection with any such investment, and consistent with no-action letters and other guidance issued by the SEC staff addressing the classification of such investments for 1940 Act purposes, we generally intend to be active in the management and operation of any such entity and have the right to approve major decisions. We will not participate in joint ventures or similar arrangements in which we do not have or share control to the extent that we believe such participation would potentially threaten our ability to conduct our operations so that we comply with the 40% test or would otherwise potentially render any of our subsidiaries seeking to rely on Section 3(c)(5)(C) unable to rely on such exclusion.

It is possible that some of our subsidiaries may seek to rely on the 1940 Act exemption provided to certain structured financing vehicles by Rule 3a-7. Any such subsidiary would need to be structured to comply with any guidance that may be issued by the Division of Investment Management of the SEC on the restrictions contained in Rule 3a-7. In certain circumstances, compliance with Rule 3a-7 may require, among other things, that the indenture governing the subsidiary include limitations on the types of assets the subsidiary may sell or acquire out of the proceeds of assets that mature, are refinanced or otherwise sold, on the period of time during which such transactions may occur, and on the level of transactions that may occur. We expect that the aggregate value of our interests in subsidiaries that may in the future seek to rely on Rule 3a-7, if any, will comprise less than 20% of our total assets on an unconsolidated basis.

As a consequence of our seeking to avoid the need to register under the 1940 Act on an ongoing basis, we and/or our subsidiaries may be restricted from making certain investments or may structure investments in a manner that would be less advantageous to us than would be the case in the absence of such requirements. For example, these restrictions will limit the ability of our subsidiaries to invest directly in CMBS that represent less than the entire ownership in a pool of mortgage loans, debt and equity tranches of securitizations and certain asset-backed securities, and equity interests in real estate companies or in assets not related to real estate. Further, the mortgage-related investments that we acquire are limited by the provisions of the 1940 Act and the rules and regulations promulgated thereunder. We also may be required at times to adopt less efficient methods of financing certain of our mortgage-related investments, and we may be precluded from acquiring certain types of mortgage-related investments. Additionally, Section 3(c)(5)(C) of the 1940 Act prohibits us from issuing redeemable securities. If we fail to qualify for an exemption from registration as an investment company under the 1940 Act or an exclusion from the definition of an investment company, our ability to use leverage would be substantially reduced, and we would not be able to conduct our business as described in this Annual Report on Form 10-K.

No assurance can be given that the SEC staff will concur with our classification of our or our subsidiaries’ assets or that the SEC staff will not, in the future, issue further guidance that may require us to reclassify those assets for purposes of qualifying for an exclusion or exemption from registration under the 1940 Act. To the extent that the SEC staff provides more specific guidance regarding any of the matters bearing upon the definition of “investment company” and the exclusions or exceptions to that definition, we may be required to adjust our investment strategies accordingly.

Additional guidance from the SEC staff could provide additional flexibility to us, or it could further inhibit our ability to pursue the investment strategies we have chosen. If the SEC or its staff take a position contrary to our view with respect to the characterization of any of the assets or securities we invest in, we may be deemed an unregistered investment company. Therefore, in order not to be required to register as an investment company, we may need to dispose of a significant portion of our assets or securities or acquire significant other additional assets that may have lower returns than our expected portfolio, or we may need to modify our business plan to register as an investment company, which would result in significantly increased operating expenses and would likely entail significantly reducing our indebtedness, which could also require us to sell a significant portion of our assets, which

13

would likely reduce our profitability. We cannot assure you that we would be able to complete these dispositions or acquisitions of assets, or deleveraging, on favorable terms, or at all. Consequently, any modification of our business plan could have a material adverse effect on us.

There can be no assurance that we and our subsidiaries will be able to successfully avoid operating as an unregistered investment company. If the SEC determined that we were an unregistered investment company, there would be a risk that we would be subject to monetary penalties and injunctive relief in an action brought by the SEC, that we would potentially be unable to enforce contracts with third parties and that third parties could seek to obtain rescission of transactions undertaken during the period for which it was established that we were an unregistered investment company. Any of these results would have a material adverse effect on us. Since we will not be subject to the 1940 Act, we will not be subject to its substantive provisions, including but not limited to, provisions requiring diversification of investments, limiting leverage and restricting investments in illiquid assets. See “Item 1A. Risk Factors—Risks Related to Our Organization and Structure.”

Competition

Our success depends, in part, on our ability to originate, acquire or manage assets at favorable spreads over our borrowing costs. In originating, acquiring and managing our target assets, we compete with other REITs, specialty finance companies, savings and loan associations, banks, mortgage bankers, insurance companies, mutual funds, institutional investors, investment banking firms, financial institutions, governmental bodies and other entities. In addition, there are numerous REITs and non-banking commercial lending platforms with similar asset origination, acquisition and management objectives and others may be organized in the future. These lenders will increase competition for the available supply of CRE debt on transitional assets suitable for purchase, origination and management. Many of our anticipated competitors are significantly larger than we are and have considerably greater financial, technical, marketing and other resources than we do. Some competitors may have a lower cost of funds and access to financing sources that are not available to us, such as the U.S. Government and the FHLB system. Many of our competitors are not subject to the operating constraints associated with REIT tax compliance or maintenance of an exclusion from registration under the 1940 Act. In addition, some of our competitors may have higher risk tolerances or different risk assessments, which could allow them to consider a wider variety of investments and establish more relationships than us. Current market conditions, as well as changing marketing conditions from time to time, may attract more competitors, which may increase the supply of financing sources, which could adversely affect the volume and cost of our loans, and thereby adversely affect the market price of our common stock. In the face of this competition, we have access to our Manager’s and our Sponsor’s professionals and their industry expertise, which may provide us with a competitive advantage and help us assess investment risks and determine appropriate terms for certain potential investments. We believe these relationships enable us to compete more effectively for attractive investment opportunities. However, we may not be able to achieve our business goals or expectations due to the competitive risks that we face. For additional information concerning these competitive risks, refer to “Item 1A: Risk Factors—Risks Related to Our Investments—We operate in a competitive market for the origination and acquisition of attractive investment opportunities and competition may limit our ability to originate or acquire attractive risk‑adjusted investments in our target assets, which could have a material adverse effect on us.”

Staffing

We are externally managed and advised by our Manager pursuant to the Management Agreement between our Manager and us. Our executive officers also serve as officers of our Sponsor. Our Manager has ongoing access to our Sponsor’s senior management team as part of the services agreement between MRECS and our Manager. We and our Manager do not have any employees.

Legal Proceedings

From time to time, we and our Manager are or may become party to legal proceedings, which arise in the ordinary course of our respective businesses. Neither we nor our Manager is currently subject to any legal proceedings that we or our Manager consider reasonably likely to have a material impact on our respective financial conditions.

14

Website Access to Reports

We maintain a website at www.clarosmortgage.com. We are providing the address to our website solely for the information of investors. The information on our website is not a part of, nor is it incorporated by reference into this report. Through our website, we make available, free of charge, our annual proxy statement, annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(e) or 15(d) of the Securities and Exchange Act of 1934, as amended, as soon as reasonably practicable after we electronically file such material with, or furnish them to, the SEC. The SEC maintains a website that contains these reports at www.sec.gov.

Item 1A. Risk Factors.

Set forth below are some (but not all) of the risk factors that could adversely affect our business, financial condition, liquidity, results of operations and prospects and our ability to service our debt and pay dividends to our stockholders (which we refer to collectively as “materially and adversely affecting us” or having “a material adverse effect on us,” and comparable phrases) and the market price of our common stock. Some statements in this report, including statements in the following risk factors, constitute forward-looking statements. Please refer to the section entitled “Forward-Looking Statements.”

Risks Related to the COVID-19 Pandemic

The COVID-19 pandemic has had an adverse effect on us and may have a material adverse effect on us in the future and any other pandemic, epidemic or outbreak of an infectious disease in the markets in which we operate may have a material adverse effect on us in the future.

As the COVID-19 pandemic has evolved from its emergence in early 2020, so has its global impact. Many countries have re-instituted, or strongly encouraged, varying levels of quarantines and restrictions on travel and have at times ceased or limited operations of certain businesses and taken other restrictive measures designed to help slow the spread of COVID-19 and its variants. Governments and businesses have also instituted vaccine mandates and testing requirements for employees. While vaccine availability and uptake have increased, the longer-term macroeconomic effects on global supply chains, inflation, labor shortages and wage increases continue to impact many industries, including U.S. CRE and the collateral underlying certain of our loans and the business operations of our borrowers. Moreover, with the potential for new strains of COVID-19 to emerge, governments and businesses may re-impose aggressive measures to help slow its spread in the future. For this reason, among others, as the COVID-19 pandemic continues, the potential global impacts are uncertain and difficult to assess.

We have experienced and may experience negative impacts to our business as a result of the COVID-19 pandemic that could have significant adverse impacts on our business, financial condition, results of operations, cash flows, liquidity and ability to satisfy our debt service obligations and to pay dividends and distributions to security holders in a variety of ways that are difficult to predict. Such adverse impacts include:

|

|

• |

the inability of our borrowers to generate operating cash flow sufficient to fund debt service, which, when combined with a decline in underlying asset values, may lead to loan losses; |

|

|

• |

our need to enter into loan modifications with borrowers, which loan modifications may require approval of our financing counterparties. Obtaining such approvals has required in the past and may require in the future reduction of advance rates on financing, increased borrowing costs, increase recourse or a combination thereof, which could have an adverse impact on our returns on equity and reduce our liquidity. In addition, such loan modifications have reduced, and may reduce in the future, interest income payments received in the near term, or result in paydowns of loans receivable, and lower levels of financing against certain assets, all of which are expected to reduce our returns on equity; |

|

|

• |

some of our borrowers and/or their tenants operate in industries that have been materially impacted by COVID-19, including but not limited to hospitality, office, and other property types and in markets such as New York, New York, and such persons may face continued operational and financial hardships resulting from the spread of COVID-19 and related governmental measures, such as the closure of stores, restrictions on travel, quarantines or stay-at-home orders.; |

15

|

|

• |

the inability of our borrowers’ tenants to pay rent on their leases or our borrowers’ inability to re-lease space that becomes vacant; |

|

|

• |

the inability of borrowers under our construction loans to continue or complete construction as planned (timing and cost), which may affect their ability to complete construction and lease space, collect rent or sell units and, consequently, their ability to pay principal or interest on our construction loans; |

|

|

• |

fluctuations in equity market prices, interest rates and credit spreads limiting our ability to raise or deploy capital on a timely basis and affecting our overall liquidity, which may require us to continue to curtail our originations; |

|

|

• |

the greater risk of loss to which we are exposed in connection with subordinated mortgage interests, mezzanine loans, and other assets that are subordinated or otherwise junior in a borrower’s capital structure and that involve privately negotiated structures; |

|

|

• |

risks associated with loans on properties in transition or construction; |

|

|

• |

impairment of our investments and harm to our operations from a prolonged economic slowdown, a lengthy or severe recession or declining real estate values; |

|

|

• |

the concentration of our loans and investments in terms of geography, asset types and sponsors from time to time, especially during the COVID-19 pandemic; |

|

|

• |

difficulty accessing debt and equity capital on attractive terms, or at all, and a severe disruption and instability in the financial markets or deteriorations in credit and financing conditions, which may affect our ability to access capital necessary to fund our investments, the valuation of financial assets and liabilities and our ability and our borrowers’ ability to make required payments of principal and interest; |

|

|

• |

the extent to which the value of commercial real estate declines and negatively impacts the value of our collateral, which has led or could lead to loan loss reserves or impairments on our investments and, with respect to loans financed on our repurchase facilities, may lead to margin calls or the removal of such loans as collateral; |

|

|

• |

our inability to satisfy any margin calls from our lenders or required loan paydowns under our financings; |

|

|

• |

our need to sell assets, potentially at a loss, which could reduce our earnings and capital base; |

|

|

• |

our inability to ensure operational continuity in the event our business continuity plan is not effective or ineffectually implemented or deployed during a disruption; and |

|

|

• |

the availability of key personnel of our Manager and our service providers as they face changed circumstances and potential illness during the pandemic. |

Although vaccines for COVID-19 have been approved for use that are generally effective, there can be no assurance that efforts to vaccinate the public will be successful in ending the pandemic or that vaccines will be effective against variants. The rapid development and fluidity of this situation continues to preclude any prediction as to the ultimate adverse impact of the COVID-19 pandemic on economic and market conditions, and, as a result, present material uncertainty and risk with respect to us and the performance of our investments. The full extent of the impact and effects of the COVID-19 pandemic will depend on future developments, including, among other factors, the duration and the severity of the COVID-19 pandemic, including variants, potential resurgences of COVID-19, along with the related travel advisories, quarantines and business restrictions, the need for, and availability of, booster vaccines, the effectiveness and efficiency of distribution of vaccines, the recovery time of the disrupted supply chains and industries, the impact of the labor market interruptions, the impact of government interventions, uncertainty with respect to the duration or the severity of the global economic slowdown, and the performance or valuation outlook for CRE markets and certain property types. The COVID-19 pandemic and the current financial, economic and capital markets environment, and future developments in these and other areas present uncertainty and risk and have had an adverse effect on us and may have a material adverse effect on us in the future.

16

Risks Related to Our Investments

We operate in a competitive market for the origination and acquisition of attractive investment opportunities and competition may limit our ability to originate or acquire attractive risk-adjusted investments in our target assets, which could have a material adverse effect on us.

We operate in a competitive market for the origination and acquisition of attractive risk-adjusted investment opportunities. A number of entities compete with us to make the types of investments that we originate or acquire. Our success depends, in large part, on our ability to originate or acquire our target assets on attractive terms. In originating our target assets, we will compete with a variety of institutional lenders and investors, including other commercial mortgage REITs, specialty finance companies, public and private funds (including funds that our Manager or its affiliates may in the future sponsor, advise and/or manage), commercial and investment banks, commercial finance and insurance companies and other financial institutions. A number of entities have raised, or are expected to raise, significant amounts of capital pursuing strategies similar to ours, and may have investment objectives that overlap with ours, which may create additional competition for investment opportunities. Many of our competitors are significantly larger than we are and have considerably greater financial, technical, marketing and other resources than we do. Some competitors may have a lower cost of funds and access to financing sources that are not available to us. Many of our competitors are not subject to the operating constraints associated with REITs or maintenance of our exclusion from registration under the 1940 Act. In addition, some of our competitors may have higher risk tolerances or different risk assessments, which could allow them to consider a wider variety of investments, deploy more aggressive pricing or financing strategies and establish more relationships than us. Increased competition in our markets could result in a decrease in origination volumes, which would adversely affect our business, financial condition, liquidity, results of operations and prospects. Furthermore, competition for investments in our target assets may lead to the price of these assets increasing or return on investment declining, which may further limit our ability to generate desired returns. Also, as a result of this competition, desirable investments in our target assets may be limited in the future, and we may not be able to take advantage of attractive risk-adjusted investment opportunities from time to time. In addition, reduced CRE transaction volume could increase competition for available investment opportunities. We can provide no assurance that we will be able to continue to identify and make investments that are consistent with our investment objectives, or that the competitive pressures we face will not have a material adverse effect on us.

Furthermore, changes in the financial regulatory regime could decrease the current restrictions on banks and other financial institutions and allow them to compete for opportunities that were previously not available to them, or subject to significant capital requirements. See “—Risks Related to Our Company—Changes in laws or regulations governing our operations or those of our competitors, or changes in the interpretation thereof, or newly enacted laws or regulations, could result in increased competition for our target assets, require changes to our business practices and collectively could adversely impact our revenues and impose additional costs on us, which could materially and adversely affect us.”

Loans on properties in transition often involve a greater risk of loss than loans on stabilized properties, including the risk of cost overruns on and noncompletion of the construction or renovation of or other capital improvements to the properties underlying the loans we originate or acquire, and the risk that a borrower may fail to execute the business plan underwritten by us, potentially making it unable to refinance our loan at maturity, each of which could materially and adversely affect us.

We originate and acquire loans on transitional CRE properties to borrowers who are typically seeking capital for repositioning, renovation, rehabilitation, leasing, development, redevelopment or construction. The typical borrower under a loan on a transitional asset has usually identified an undervalued asset that has been under-managed and/or is located in an improving market. If the market in which the asset is located fails to materialize according to the borrower’s projections, or if the borrower fails to improve the quality of the asset’s management and/or the value of the asset, or if it costs the borrower more than estimated or takes longer to execute its business plan than estimated, including as a result of supply chain disruptions or stop work orders due to the COVID-19 pandemic, the borrower may not receive a sufficient return on the asset to satisfy our loan or may experience a prolonged reduction of net operating income and may not be able to make payments on our loan on a timely basis or at all, which could materially and adversely affect us. Other risks may include: environmental risks, delays in legal and other approvals (e.g., certificates of occupancy), other construction and renovation risks and subsequent leasing of the property not being

17

completed on schedule. Accordingly, we bear the risk that we may not recover some or all of our loan unpaid principal balance and interest thereon.

Furthermore, borrowers usually use the proceeds of permanent financing to repay a loan on a transitional property after the CRE property is stabilized. Loans on transitional CRE properties are therefore subject to risks of a borrower’s inability to obtain permanent financing to repay our loan. Our loans are also subject to risks of borrower defaults, bankruptcies, fraud and losses. In the event of any default under our loans, we bear the risk of loss of principal and non-payment of interest and fees to the extent of any deficiency between the value of the underlying asset and the principal amount and unpaid interest and fees of our loan. To the extent we suffer losses with respect to our loans, it could have a material adverse effect on us.

Our investments are and may be concentrated in certain markets, property types and borrowers, among other factors, and will be subject to risk of default.

While we intend to diversify our loan portfolio of investments in the manner described in this report, we are not required to observe specific diversification criteria, and we have criteria outlined in our investment guidelines that can only be changed with approval of our Board. Therefore, our portfolio of target assets is and may be concentrated in certain property types that are subject to higher risk of achieving their stated business plans or other concentration risk, such as from COVID-19, or supported by properties concentrated in a limited number of geographic locations. For example, as of December 31, 2021, our real estate owned investment consisted of seven limited service hotel properties in New York, New York and 38% of our loans are secured by CRE assets (or equity interests relating thereto) located in the New York metropolitan area. Further, as of December 31, 2021, 30% of our loan investments were secured by multi-family properties (or equity interests relating thereto), 18% of our loan investments were secured by hospitality properties (or equity interests relating thereto), 17% of our loan investments were secured by office properties (or equity interests relating thereto), 11% of our loan investments were secured by for sale condominium properties (or equity interests relating thereto), 11% of our loan investments were secured by mixed-use properties (or equity interests relating thereto), 10% of our loan investments were secured by land properties (or equity interests relating thereto), 17% of our loan investments were construction loans and our 15 largest loan investments represented 50% of our loan portfolio, in each case based on unpaid principal balance. Additionally, as a result of the COVID-19 pandemic, the hospitality sector has been materially and adversely impacted by closures or decreasing occupancy and room rates, and the for sale condominium sector has been adversely impacted by decreased access to property viewings leading to a decline in demand and corresponding decrease in sales. Furthermore, construction projects have received stop work orders in certain regions as a means to slow the spread of COVID-19, which has resulted in project delays for construction loans we have funded, and will likely result in cost overruns to complete such projects.

On February 6, 2018, we originated a mezzanine loan with an initial principal balance of $85.0 million secured by a portfolio of seven limited service hotel properties located in New York, New York, which was subordinate to a $300.0 million securitized senior mortgage. Following the onset of the COVID-19 pandemic, the hotels were forced to close, causing the borrower to experience financial difficulty which resulted in the borrower not paying debt service on the loan. Beginning in June 2020, we began funding debt service on the $300.0 million securitized senior mortgage as protective advances on our loan, which totaled $18.9 million through February 8, 2021. On February 8, 2021, we foreclosed on the portfolio of seven limited service hotel properties through a Uniform Commercial Code foreclosure. The hotel portfolio now appears as real estate owned, net on our balance sheet and as of December 31, 2021, was encumbered by a $290.0 million securitized senior mortgage, which is included as a liability on our balance sheet.

As of December 31, 2021, there were 6 investments that were on non-accrual status, representing $366.5 million of unpaid principal balance, or 5.6% of our portfolio (based on unpaid principal balance), of which there were 4 investments on non-accrual status, representing $273.6 million of unpaid principal balance, or 4.1% of our loan portfolio (based on unpaid principal balance), as a result of interest payments becoming 90 days past due.

In the land sector, we have granted, and expect we may in the future grant, loan extensions as a result of the COVID-19 pandemic adversely impacting our borrowers’ ability to close construction loan financing. Although the completed loan modifications discussed throughout this report have resulted and may continue to result in delays of certain required payments to us, those borrowers are treated as current during any applicable deferral or extension periods. To the extent that our portfolio is concentrated in particular geographic regions, types of properties or

18

borrowers, downturns affecting those geographic regions, types of properties or borrowers may result in defaults on a number of our investments within a short period of time, which may reduce our operating results and the market price of our common stock and, accordingly, have a material adverse effect on us.

We will allocate our available capital without input from our stockholders.