Investor Presentation Claros Mortgage Trust, Inc. (CMTG) September 2024 The properties above are not representative of all transactions.

CMTG Snapshot $6.8 billion Loan Portfolio 1 $2.2 billion Equity Book Value $191 million Total Liquidity 2 2.4x Net Debt / Equity Ratio 3 9.0% Weighted Average All-In Yield 4 98% Floating Rate Loans 1 98% Senior Loans 1,5 69.3% Weighted Average Portfolio Adjusted LTV 6 See Endnotes in the Appendix.

Integrated real estate investor, operator, developer and lender Mack Real Estate Group The firm’s principals have decades of global real estate investing experience Invests institutional and high net worth capital in real estate equity and debt assets

Mack Real Estate Group Businesses Real Estate Credit (“MRECS”) Direct lending (first mortgage, mezzanine, preferred equity) and other debt investments Property Management (“MPM”) Property management of MREG and third-party owned residential and commercial assets Comprehensive Property Management Services ~5,400 units 3.4M SF under management of commercial and industrial space under management 150+ staff located across the U.S. As of June 30, 2024. Not intended to represent the legal structure of MREG or MRECS. Includes businesses related by common control. Includes realized investments. Unit count, square footage, and other figures concerning development characteristics reflect assets in various stages of development, including actual unit count for completed construction as well as estimated unit count for development projects that are not yet completed or in some cases begun. Such estimated figures are based on expectations, estimates, and projections and no party provides any guarantee or assurance that these projections are accurate. Actual results may vary significantly from those reflected or contemplated. Similarly, there is no guarantee that MREG will ultimately develop the assets in accordance with the development plans contemplated herein, or at all. Real Estate Equity (“MREG”) Development and ownership of multifamily, industrial, office, retail, and other asset classes Multifamily and Industrial Investments a 31 investments ~11,600 potential units b ~7.2 million industrial SF b High Yield Levered Transitional Credit Investments Levered Transitional Credit Investments ~$3.0B $18.0B of investor capital raised since inception of credit investments originated, co-originated or acquired ~$900M $2.0B Unlevered Transitional Credit Investments $450M $146.5M of investor capital raised since inception of credit investments originated, co-originated or acquired of investor capital raised since inception of credit investments originated, co-originated or acquired

MREG National Presence Includes employees across the firm’s credit, equity, and property management business as of the date on this presentation. Integrated platform with investment, development, property management and lending activities across the United States WA NV CA AZ CO TX IL MI TN NC FL VA PA New York City CT MA Raleigh Seattle Phoenix GA NY MD 5 offices 250+ employees Mack Real Estate Group, LLC Office MREG / MRECS Investments and/or Mack Property Management, L.P. (MPM) Presence UT Miami

CMTG Overview KEY DIFFERENTIATORS “Ownership mindset” investment approach Well-capitalized, institutional borrowers Markets with local intelligence / experience / expertise Proactive asset management with a focus on staying ahead of the borrower Focus on downside protection; highly structured loans with credit support Utilize modest leverage PLATFORM Roots in real estate development and operations dating back to the 1960s Managed by experienced operator with integrated credit, equity, development and property management business Established and scaled platform with demonstrated track record Focus on transitional loan opportunities secured by high quality CRE assets, generally with institutional-grade sponsorship, located in major U.S. markets where MREG has infrastructure and / or experience

Loan Portfolio Overview Key Portfolio Metrics7,a June 30, 2024 March 31, 2024 Loan Portfolio1 $6.8Bn $6.7Bn Total Loan Commitments8 $7.7Bn $7.7Bn Number of Loans 62 62 LTV6 69.3% 69.2% Average Commitment Size ~$120MM ~$120MM Weighted Average All-In Yield4 9.0% 9.1% Floating Rate Loans1 98% 98% Senior Loans1,5 98% 98% b Excludes loans held-for-sale. At June 30, 2024, mixed-use comprises of 4% office, 2% retail, 2% multifamily, 1% hospitality, and immaterial amounts of for sale condo. Mixed-use allocations are based upon allocable square footage except where another method is deemed more appropriate under the applicable facts and circumstances. Collateral Diversification1,7 Geographical Diversification1,7

Loan Portfolio Overview (cont’d) Totals may not foot due to rounding. At June 30, 2024, mixed-use comprises of 4% office, 2% retail, 2% multifamily, 1% hospitality, and immaterial amounts of for sale condo. Mixed-use allocations are based upon allocable square footage except where another method is deemed more appropriate under the applicable facts and circumstances. Includes four loans secured by a portfolio of build-to-rent homes, representing $134 million in loan commitments and $113 million in unpaid principal balance. $ amounts in millions Region Exposure by Carrying Value and as a % of Total Carrying Value Collateral Type Number of Loans Carrying Value 1 % of Total Carrying Value West Northeast Southeast Mid Atlantic Southwest Midwest Other Multifamily 21 $2,721 40% $1,269 / 19% $390 / 6% - $266 / 4% $513 / 8% $284 / 4% - Hospitality 8 $1,233 18% $614 / 9% $335 / 5% $285 / 4% - - - - Office 9 $975 14% $257 / 4% $273 / 4% $233 / 3% - $88 / 1% $125 / 2% - Mixed-use a 5 $605 9% - $195 / 3% $103 / 2% $307 / 4% - - - Land 6 $519 8% - $368 / 5% $30 / 0% $120 / 2% - - - For Sale Condo 2 $215 3% $209 / 3% $6 / 0% - - - - - Other b 11 $567 8% $98 / 1% $197 / 3% $112 / 2% $83 / 1% - $74 / 1% $2 / 0% Total 62 $6,835 100% $2,446 / 36% $1,764 / 26% $764 / 11% $777 / 11% $601 / 9% $483 / 7% $2 / 0%

Financial Overview Key Financial Metrics 2Q-2024 1Q-2024 YTD 2024 GAAP Net Loss ($MM) Per Share $(11.6) $(0.09) $(52.8) $(0.39) $(64.3) $(0.48) Distributable Earnings (Loss) ($MM)9 Per Share $28.9 $0.20 $(16.8) $(0.12) $12.2 $0.08 Distributable Earnings prior to realized losses ($MM)9 Per Share $30.4 $0.21 $27.7 $0.20 $58.1 $0.41 Dividends ($MM) Per Share $35.5 $0.25 $35.6 $0.25 $71.2 $0.50 Book Value ($MM) Per Share Adjusted Book Value per Share10 $2,171.4 $15.27 $16.44 $2,215.9 $15.55 $16.47 Net Debt / Equity Ratio3 Total Leverage Ratio11 2.4x 2.8x 2.4x 2.8x GAAP net loss of $11.6 million, or $0.09 per share; distributable earnings of $28.9 million, or $0.20 per share; and distributable earnings prior to realized losses of $30.4 million, or $0.21 per share 9 Paid a cash dividend of $0.25 per share for the second quarter of 2024

Loan Portfolio Activity and Loan Maturity $103 Net Change in UPB UPB at March 31, 2024 Fundings Repayments UPB at June 30, 2024 Total Commitments $7,677 Total Commitments $7,716 Q2 2024 – Loan Activity Totals may not foot due to rounding. Excludes $538 million of loans in maturity default as of June 30, 2024. For 2026 and 2028, amounts include $30 million and $38.4 million, respectively, of unpaid principal balance for loans whose fully extended maturities were extended subsequent to June 30, 2024. Loan Maturity Schedule 12,a During the quarter, funded $143 million on existing loan commitments and received $41 million in loan repayments; net increase in unpaid principal balance of $103 million Average loan commitment of ~$120 million 83% of loans with maturities 2026 or later 12,a

During the second quarter, we significantly expanded and restructured our relationship with our largest financing counterparty, resulting in a realignment of certain of our assets to this facility Stable leverage levels; leverage ratios have remained unchanged since Q4 2023 Including $34 million in Q2 2024, we have made $473 million in voluntary delevering payments since Q1 2023 Financing Activity and Leverage $(128) Net Change in UPB Leverage Ratios 3,11 Q2 2024 – Financing Activity UPB at March 31, 2024 Advances Repayments UPB at June 30, 2024 Voluntary Repayments Totals may not foot due to rounding.

Financing Mix Total financing capacity of $7.1 billion decreased from $7.2 billion at March 31, 2024; undrawn capacity of $1.7 billion unchanged from March 31, 2024 13 Weighted average spread of 3.01% at June 30, 2024, decreased from 3.03% at March 31, 2024 Summary of Outstanding Financing $ amounts in millions Capacity UPB at June 30, 2024 Weighted Average Spread 14 Repurchase agreements and term participation facility $5,626 $3,991 2.69% Asset Specific Financing $460 $348 3.67% Secured Term Loan $722 $722 4.50% Debt Related to REO $280 $280 2.90% Total as of 2Q-2024 $7,088 $5,340 3.01% Financing Balances and weighted average spreads Financing Composition and Mark-to-Market % Mark-to-Market At June 30, 2024, of $3.6 billion UPB under repurchase agreements, $2.4 billion relates to facilities with credit and limited capital markets mark-to-market provisions and $1.2 billion relates to facilities with credit only mark-to-market provisions

Real Estate Owned In Q1 2021, we acquired legal title to a portfolio of seven limited service hotels located in New York, NY Underlying asset performance continues to be strong, exceeding pre-COVID levels Hospitality Portfolio In Q2 2023, we acquired legal title to a mixed-use property located in New York, NY The mixed-use property contains office, retail and signage components Mixed-Use Image not representative of all hotels in portfolio. Net of accumulated depreciation and amortization. Excludes impact accumulated depreciation and amortization. Acquisition Date February 2021 Location New York, NY Keys 1,087 Gross Cost $419 million Net Cost a $391 million Debt Outstanding $280 million Net Equity b $139 million Acquisition Date June 2023 Location New York, NY NSF 142K (Office) + 33K (Retail) Gross Cost $149 million Net Cost a $146 million Debt Outstanding - Net Equity b $149 million

Appendix A The properties above are not representative of all transactions.

Dave Germond** MD, Head of Capital Raising and Investor Relations, MREG Barden Gale* Vice Chairman, MREG Paul Keller*** Vice Chairman, MREG Richard Mack* CEO and Chairman, CMTG; Co-Founder and CEO, MREG Mike McGillis* President and CFO, CMTG; President, MREG Priyanka Garg* Executive Vice President, CMTG; MD, Head of Credit Strategies J.D. Siegel** Executive Vice President, CMTG; General Counsel and COO, MREG As of June 30, 2024. * Voting member of MRECS Investment Committee. ** Non-voting member of MRECS Investment Committee. *** Special Adviser to MRECS Investment Committee, Development and Construction Loans. CMTG Leadership and Select MREG Personnel Co-founded MREG in 2013 and MRECS in 2014 Formerly at AREA Property Partners and Shearson Lehman Hutton Joined MRECS in 2015 Formerly at J.E. Robert Companies, Freddie Mac, and AEW Capital Management Joined MRECS in 2020 Formerly at Treeview Real Estate Advisors, Westbrook Partners, and Goldman Sachs Joined MREG in 2015 Formerly at Aetos Capital Real Estate, Centerbridge Partners, and Sherman & Sterling Joined MRECS in 2016 Formerly at Tishman Speyer and Prudential Real Estate Investors Joined MREG in 2014 Formerly at J.E. Robert Companies, Starwood Capital Group, and ABP Investments Joined MREG in 2013 Formerly at Mack Urban, Urban Partners, and Keller Equity Group

Portfolio Overview Investment Carrying Value 1 Unpaid Principal Balance Loan Commitment 8 Origination Date Property Type Location Loan Type Construction Risk Rating Investment 1 400.9 402.2 405.0 Dec-21 Multifamily CA Senior N 4 Investment 2 389.8 390.0 390.0 Nov-19 Multifamily NY Senior N 3 Investment 3 256.3 255.0 255.0 Jul-18 Hospitality NY Senior N 3 Investment 4 225.3 225.0 225.0 Jul-21 Hospitality GA Senior N 3 Investment 5 220.7 221.4 227.0 Jun-22 Hospitality CA Senior N 3 Investment 6 213.2 213.8 235.0 Aug-22 Hospitality CA Senior N 3 Investment 7 208.9 208.9 247.3 Oct-19 For Sale Condo CA Senior N 4 Investment 8 187.8 187.9 193.1 Oct-19 Mixed-Use DC Senior N 3 Investment 9 186.4 186.4 319.9 Sep-19 Office GA Senior N 4 Investment 10 183.2 183.0 183.0 Sep-18 Land NY Senior N 3 Investment 11 169.7 170.2 193.4 Apr-22 Multifamily MI Senior N 3 Investment 12 169.7 170.0 170.0 Jan-22 Multifamily CO Senior N 3 Investment 13 154.4 155.0 160.0 Sep-22 Multifamily AZ Senior N 3 Investment 14 120.1 152.2 152.2 Jan-18 Land VA Senior N 5 Investment 15 150.0 150.0 150.0 Feb-19 Office CT Senior N 4 Investment 16 136.3 136.5 136.5 Dec-21 Multifamily PA Senior N 3 Investment 17 135.8 136.4 151.7 Apr-22 Multifamily TX Senior N 4 Investment 18 129.8 130.0 130.0 Dec-21 Multifamily VA Senior N 3 Investment 19 124.8 125.0 125.0 Dec-21 Office IL Subordinate N 3 Investment 20 122.8 123.3 127.3 Jun-22 Multifamily TX Senior N 3 CMTG Portfolio Summary by Unpaid Principal Balance as of June 30, 2024 ($ amounts in millions)

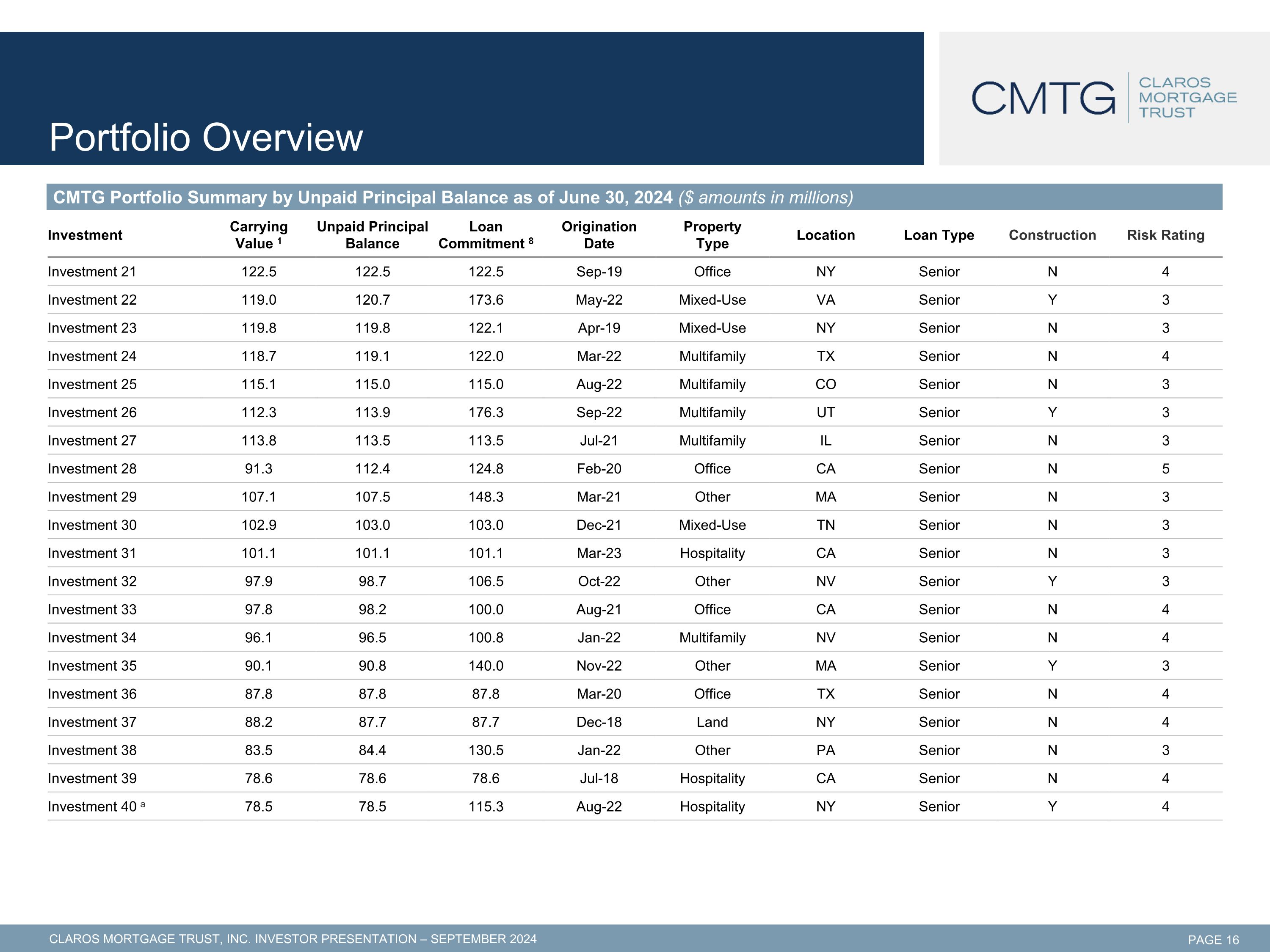

Portfolio Overview Investment Carrying Value 1 Unpaid Principal Balance Loan Commitment 8 Origination Date Property Type Location Loan Type Construction Risk Rating Investment 21 122.5 122.5 122.5 Sep-19 Office NY Senior N 4 Investment 22 119.0 120.7 173.6 May-22 Mixed-Use VA Senior Y 3 Investment 23 119.8 119.8 122.1 Apr-19 Mixed-Use NY Senior N 3 Investment 24 118.7 119.1 122.0 Mar-22 Multifamily TX Senior N 4 Investment 25 115.1 115.0 115.0 Aug-22 Multifamily CO Senior N 3 Investment 26 112.3 113.9 176.3 Sep-22 Multifamily UT Senior Y 3 Investment 27 113.8 113.5 113.5 Jul-21 Multifamily IL Senior N 3 Investment 28 91.3 112.4 124.8 Feb-20 Office CA Senior N 5 Investment 29 107.1 107.5 148.3 Mar-21 Other MA Senior N 3 Investment 30 102.9 103.0 103.0 Dec-21 Mixed-Use TN Senior N 3 Investment 31 101.1 101.1 101.1 Mar-23 Hospitality CA Senior N 3 Investment 32 97.9 98.7 106.5 Oct-22 Other NV Senior Y 3 Investment 33 97.8 98.2 100.0 Aug-21 Office CA Senior N 4 Investment 34 96.1 96.5 100.8 Jan-22 Multifamily NV Senior N 4 Investment 35 90.1 90.8 140.0 Nov-22 Other MA Senior Y 3 Investment 36 87.8 87.8 87.8 Mar-20 Office TX Senior N 4 Investment 37 88.2 87.7 87.7 Dec-18 Land NY Senior N 4 Investment 38 83.5 84.4 130.5 Jan-22 Other PA Senior N 3 Investment 39 78.6 78.6 78.6 Jul-18 Hospitality CA Senior N 4 Investment 40 a 78.5 78.5 115.3 Aug-22 Hospitality NY Senior Y 4 CMTG Portfolio Summary by Unpaid Principal Balance as of June 30, 2024 ($ amounts in millions)

Portfolio Overview Investment Carrying Value 1 Unpaid Principal Balance Loan Commitment 8 Origination Date Property Type Location Loan Type Construction Risk Rating Investment 41 75.4 75.5 76.0 Jul-22 Multifamily UT Senior N 3 Investment 42 75.5 75.5 75.5 Apr-19 Mixed-Use NY Senior N 3 Investment 43 74.2 74.3 79.6 Jun-21 Other MI Senior N 3 Investment 44 71.8 72.0 83.9 Dec-21 Multifamily TX Senior N 4 Investment 45 46.7 71.5 84.8 Aug-21 Office GA Senior N 5 Investment 46 67.6 68.2 90.0 Feb-22 Office WA Senior N 3 Investment 47 67.0 67.0 67.0 Jul-19 Land NY Senior N 4 Investment 48 59.6 59.8 73.7 Jan-22 Hospitality TN Senior N 3 Investment 49 59.7 59.8 60.3 Nov-21 Multifamily NV Senior N 3 Investment 50 50.0 50.2 53.3 Mar-22 Multifamily AZ Senior N 4 Investment 51 43.8 44.1 54.0 Feb-22 Other GA Senior Y 3 Investment 52 39.1 39.3 44.8 Feb-22 Multifamily TX Senior N 4 Investment 53 35.2 36.3 112.1 Dec-22 Multifamily WA Senior Y 3 Investment 54 30.4 30.2 30.2 Jul-21 Land FL Subordinate N 3 Investment 55 29.9 30.0 30.0 Apr-19 Land MA Senior N 3 Investment 56 26.3 26.6 32.1 Feb-22 Other FL Senior Y 3 Investment 57 24.8 24.9 28.5 Feb-22 Multifamily TX Senior N 4 Investment 58 22.5 22.6 23.4 Apr-22 Other GA Senior Y 3 Investment 59 19.7 19.9 24.2 Apr-22 Other GA Senior Y 3 Investment 60 5.9 5.7 5.7 Aug-19 For Sale Condo NY Senior N 3 CMTG Portfolio Summary by Unpaid Principal Balance as of June 30, 2024 ($ amounts in millions)

Portfolio Overview Investment Carrying Value 1 Unpaid Principal Balance Loan Commitment 8 Origination Date Property Type Location Loan Type Construction Risk Rating Investment 61 1.9 1.9 1.9 Jul-19 Other Other Senior N 5 Investment 62 0.0 0.9 0.9 Aug-18 Other NY Subordinate N 5 Total / Wtd. Average 15 $6,835.0 $6,928.3 $7,677.3 12% Investment in unconsolidated joint venture a $42.4 Real Estate Owned – Hospitality, net 391.1 Real Estate Owned – Mixed-Use, net b 145.5 Portfolio Total $7,414.0 CMTG Portfolio Summary by Unpaid Principal Balance as of June 30, 2024 ($ amounts in millions) Comprised of loans backed by the same property. Total carrying value includes acquired lease intangibles, net of accumulated depreciation and amortization.

($ amounts in thousands) June 30, 2024 March 31, 2022 March 31, 2024 March 31, 2022 Assets Cash and cash equivalents $ 148,212 $ 232,514 Restricted cash 21,185 19,256 Loans receivable held-for-investment 6,913,273 6,806,606 Less: current expected credit loss reserve (203,756) (171,335) Loans receivable held-for-investment, net 6,709,517 6,635,271 Loans receivable held-for-sale - 172,177 Equity method investment 42,397 42,439 Real estate owned, net 518,719 521,025 Other assets 144,547 133,135 Total assets $ 7,584,577 $ 7,755,817 Liabilities and Equity Repurchase agreements $ 3,620,694 $ 3,601,284 Term participation facility 370,193 497,225 Loan participations sold, net 100,759 100,633 Notes payable, net 244,018 262,164 Secured term loan, net 711,177 711,876 Debt related to real estate owned, net 278,600 277,550 Other liabilities 43,182 44,370 Dividends payable 35,541 35,622 Management fee payable – affiliate 9,011 9,210 Total liabilities $ 5,413,175 $ 5,539,934 Equity Common stock 1,390 1,387 Additional paid-in capital 2,732,228 2,729,617 Accumulated deficit (562,216) (515,121) Total equity 2,171,402 2,215,883 Total liabilities and equity $ 7,584,577 $ 7,755,817 Consolidated Balance Sheets June 30, 2024 and March 31, 2024 Source: CMTG financials.

Consolidated Statements of Operations For the Three Months Ended June 30, 2024 and March 31, 2024 Source: CMTG financials. Three Months Ended Three Months Ended Three Months Ended Three Months Ended Three Months Ended ($ amounts in thousands, except share and per share data) March 31, 2022 June 30, 2024 March 31, 2022 March 31, 2024 March 31, 2022 Revenue Interest and related income $ 155,131 $ 160,845 Less: interest and related expense 113,225 115,931 Net interest income 41,906 44,914 Revenue from real estate owned 22,581 13,911 Total net revenue 64,487 58,825 Expenses Management fees – affiliate 9,011 9,210 General and administrative expenses 4,845 3,877 Stock-based compensation expense 3,999 4,353 Real estate owned: Operating expenses 13,859 12,880 Interest expense 6,869 6,329 Depreciation and amortization 2,623 2,599 Total expenses 41,206 39,248 Proceeds from interest rate cap 228 865 Unrealized loss on interest rate cap (94) (998) Loss from equity method investment (42) (35) Loss on extinguishment of debt (999) (2,244) Provision for current expected credit loss reserve (33,928) (69,960) Net loss $ (11,554) $ (52,795) Net loss per share of common stock Basic and diluted $ (0.09) $ (0.39) Weighted-average shares of common stock outstanding Basic and diluted 139,078,117 138,791,113

Reconciliation of GAAP Net Income (Loss) to Distributable Earnings (Loss) Refer to page 23 for definition of Distributable Earnings. Represents an adjustment to previously recognized gain on foreclosure of real estate owned in 2021. Totals may not foot or cross-foot due to rounding. Distributable Earnings (Loss) Reconciliation Q2 2024 Q1 2024 Total 2024 b Q4 2023 Q3 2023 Q2 2023 Q1 2023 Total 2023 b Net income (loss) attributable to common stock: ($11,554) ($52,795) ($64,349) $34,043 ($68,947) $4,253 $36,678 $6,027 Adjustments: Non-cash stock-based compensation expense 3,999 4,353 8,352 4,469 4,369 4,395 3,366 16,599 Provision for (reversal of) current expected credit loss reserve 33,928 69,960 103,888 5,247 110,198 41,476 (3,239) 153,682 Depreciation and amortization expense 2,623 2,599 5,222 2,579 2,558 2,092 2,058 9,287 Amortization of above and below market lease values, net 354 354 708 354 354 - - 708 Unrealized loss on interest rate cap 94 998 1,092 1,835 1,659 259 1,404 5,157 Loss on extinguishment of debt 999 2,244 3,243 - - - - - Gain on extinguishment of debt - - - - - (2,217) - (2,217) Gain on sale of loan - - - - (575) - - (575) Gain on foreclosure of real estate owned a - - - (4,162) - - - (4,162) Distributable Earnings prior to realized gains and losses $30,443 $27,713 $58,156 $44,365 $49,616 $50,258 $40,267 $184,506 Gain on sale of loan - - - - 575 - - 575 Loss on extinguishment of debt (999) (2,244) (3,243) - - - - - Gain on extinguishment of debt - - - - - 2,217 - 2,217 Principal charge-offs (561) (42,266) (42,827) (7,468) (72,957) (66,935) - (147,361) Distributable Earnings (Loss) $28,883 ($16,797) $12,086 $36,897 ($22,766) ($14,460) $40,267 $39,937 Weighted average diluted shares - Distributable Earnings (Loss) 142,276,031 141,403,825 141,839,928 141,321,572 141,469,161 141,648,701 140,568,979 141,254,760 Diluted Distributable Earnings per share prior to realized gains and losses $0.21 $0.20 $0.41 $0.31 $0.35 $0.35 $0.29 $1.31 Diluted Distributable Earnings (Loss) per share $0.20 ($0.12) $0.08 $0.26 ($0.16) ($0.10) $0.29 $0.28

Book Value per share Reconciliation Q2 2024 Q1 2024 Q4 2023 Q3 2023 Q2 2023 Q1 2023 ($ in 000’s except for per share data) Equity $ 2,171,402 $ 2,215,883 $ 2,299,900 $ 2,296,669 $ 2,400,426 $ 2,444,154 Number of shares of common stock outstanding and RSUs 142,164,611 142,486,624 141,313,339 141,321,693 141,687,697 141,632,654 Book Value per share a $ 15.27 $ 15.55 $ 16.28 $ 16.25 $ 16.94 $ 17.26 Add back: accumulated depreciation on real estate owned and accumulated amortization of related lease intangibles 0.22 0.20 0.18 0.16 0.14 0.12 Add back: general CECL reserve 0.95 0.72 0.57 0.59 0.56 0.58 Adjusted Book Value per share $ 16.44 $ 16.47 $ 17.03 $ 17.00 $ 17.64 $ 17.96 Net Debt-to-Equity and Total Leverage Reconciliation Q2 2024 Q1 2024 Q4 2023 Q3 2023 Q2 2023 Q1 2023 Asset-specific debt $ 4,614,264 $ 4,738,856 $ 4,964,874 $ 4,935,633 $ 5,162,229 $ 5,182,328 Secured term loan, net 711,177 711,876 712,576 713,276 713,975 736,190 Total debt 5,325,441 5,450,732 5,677,450 5,648,909 5,876,204 5,918,518 Less: cash and cash equivalents (148,212) (232,514) (187,301) (307,367) (253,055) (426,503) Net Debt $ 5,177,229 $ 5,218,218 $ 5,490,149 $ 5,341,542 $ 5,623,149 $ 5,492,015 Total Equity $ 2,171,402 $ 2,215,883 $ 2,229,900 $ 2,296,669 $ 2,400,426 $ 2,444,154 Net Debt-to-Equity Ratio 2.4x 2.4x 2.4x 2.3x 2.3x 2.2x Non-consolidated senior loans 887,300 887,300 887,300 887,300 916,616 915,623 Total Leverage $ 6,064,529 $ 6,105,518 $ 6,377,449 $ 6,228,842 $ 6,539,765 $ 6,407,638 Total Leverage Ratio 2.8x 2.8x 2.8x 2.7x 2.7x 2.6x Adjusted Book Value per share, Net Debt-to-Equity and Total Leverage Calculations Calculated as (i) total equity divided by (ii) number of shares of common stock outstanding and RSUs at period end.

Important Notices The information herein generally speaks as of the date hereof or such earlier date referred to on specific pages herein. In furnishing this document, Claros Mortgage Trust, Inc. and its consolidated subsidiaries (the “Company” or “CMTG”) do not undertake to update the information herein. No legal commitment or obligation shall arise by the provision of this presentation. All financial information is provided for general reference purposes only and is superseded by, and is qualified in its entirety by reference to, CMTG’s financial statements. No Offer or Solicitation This document does not constitute (i) an offer to sell or a solicitation of an offer to purchase any securities in CMTG, (ii) a means by which any other investment may be offered or sold or (iii) advice or an expression of our view as to whether an investment in CMTG is suitable for any person. Portfolio Metrics; Basis of Accounting The performance information set forth in this document has generally been prepared on the basis of generally accepted accounting principles in the United States (U.S. GAAP). The basis on which CMTG’s operating metrics are presented in this document may vary from other reports or documents that CMTG prepares from time to time for internal or external use. Net Debt / Equity Ratio, Total Leverage Ratio, and Distributable Earnings (Loss) Net Debt / Equity Ratio, Total Leverage Ratio, and Distributable Earnings (Loss) are non-GAAP measures used to evaluate the Company’s performance excluding the effects of certain transactions, non-cash items and GAAP adjustments, as determined by our Manager. Net Debt / Equity Ratio is a non-GAAP measure, which the Company defines as the ratio of asset-specific debt and Secured Term Loan, less cash and cash equivalents, to total equity. Total Leverage Ratio is a non-GAAP measure, which the Company defines as the ratio of asset-specific debt and Secured Term Loan, plus non-consolidated senior interests held by third parties, less cash and cash equivalents, to total equity. Distributable Earnings (Loss) is a non-GAAP measure, which the Company defines as net income (loss) in accordance with GAAP, excluding (i) non-cash stock-based compensation expense, (ii) real estate owned depreciation and amortization, (iii) any unrealized gains or losses from mark-to-market valuation changes (other than permanent impairments) that are included in net income (loss) for the applicable period, (iv) one-time events pursuant to changes in GAAP and (v) certain non-cash items, which in the judgment of our Manager, should not be included in Distributable Earnings (Loss). Furthermore, the Company presents Distributable Earnings prior to realized gains and losses, which includes principal charge-offs, as the Company believes this more easily allows our Board, Manager, and investors to compare our operating performance to our peers, to assess our ability to declare and pay dividends, and to determine our compliance with certain financial covenants. Pursuant to the Management Agreement, we use Core Earnings, which is substantially the same as Distributable Earnings (Loss) excluding incentive fees, to determine the incentive fees we pay our Manager. The Company believes that Net Debt / Equity Ratio and Total Leverage Ratio provide meaningful information to consider in addition to the Company’s total liabilities and balance sheets. Net Debt / Equity Ratio and Total Leverage Ratio are used to evaluate the Company’s financial leverage. The Company believes that Distributable Earnings (Loss) and Distributable Earnings prior to realized gains and losses provide meaningful information to consider in addition to our net income (loss) and cash flows from operating activities in accordance with GAAP. Distributable Earnings (Loss) and Distributable Earnings prior to realized gains and losses do not represent net income (loss) or cash flows from operating activities in accordance with GAAP and should not be considered as an alternative to GAAP net income (loss), an indication of our cash flows from operating activities, a measure of our liquidity or an indication of funds available for our cash needs. In addition, the Company’s methodology for calculating these non-GAAP measures may differ from the methodologies employed by other companies to calculate the same or similar supplemental performance measures and, accordingly, the Company’s reported Distributable Earnings (Loss) and Distributable Earnings prior to realized gains and losses may not be comparable to the Distributable Earnings (Loss) and Distributable Earnings prior to realized gains and losses reported by other companies. In order to maintain the Company’s status as a REIT, the Company is required to distribute at least 90% of its REIT taxable income, determined without regard to the deduction for dividends paid and excluding net capital gain, as dividends. Distributable Earnings (Loss), Distributable Earnings prior to realized gains and losses, and other similar measures, have historically been a useful indicator over time of a mortgage REIT’s ability to cover its dividends, and to mortgage REITs themselves in determining the amount of any dividends to declare. Distributable Earnings (Loss) and Distributable Earnings prior to realized gains and losses are key factors, among others, considered by the Board in determining the dividend each quarter and as such the Company believes Distributable Earnings (Loss) and Distributable Earnings prior to realized gains and losses are also useful to investors. While Distributable Earnings (Loss) excludes the impact of our provision for or reversal of current expected credit loss reserve, principal charge-offs are recognized through Distributable Earnings (Loss) when deemed non-recoverable. Non-recoverability is determined (i) upon the resolution of a loan (i.e., when the loan is repaid, fully or partially, or when the Company acquires title in the case of foreclosure, deed-in-lieu of foreclosure, or assignment-in-lieu of foreclosure), or (ii) with respect to any amount due under any loan, when such amount is determined to be uncollectible. Determinations of Loan-to-Value / Loan-to-Cost Adjusted LTV represents “loan-to-value” or “loan-to-cost” upon origination and updated only in connection with a partial loan paydown and/or release of collateral, material changes to expected project costs, the receipt of a new appraisal (typically in connection with financing or refinancing activity) or a change in our loan commitment. LTV determined upon origination is calculated as our total loan commitment upon origination, as if fully funded, plus any financings that are pari passu with or senior to our loan, divided by our estimate of either (1) the value of the underlying real estate, determined in accordance with our underwriting process (typically consistent with, if not less than, the value set forth in a third-party appraisal) or (2) the borrower’s projected, fully funded cost basis in the asset, in each case as we deem appropriate for the relevant loan and other loans with similar characteristics. Adjusted LTV, origination LTV, underwritten values, and/or project costs should not be assumed to reflect our judgment of current market values or project costs, which may have changed materially since the date of the most recent determination of LTV and/or origination. Weighted average adjusted LTV is based on loan commitment, including non-consolidated senior interests and pari passu interests, and includes risk rated 5 loans. Loans with specific CECL reserves are reflected as 100% LTV.

Important Notices (cont’d) Forward-Looking Statements This document and oral statements made in connection therewith contain forward-looking statements within the meaning of U.S. federal securities laws. Forward-looking statements express CMTG’s views regarding future plans and expectations. They include statements that include words such as “may,” “could,” “would,” “should,” “believe,” “expect,” “anticipate,” “plan,” “estimate,” “target,” “project,” “plan,” “intend” and similar words or expressions. Forward-looking statements in this presentation include, but are not limited to, statements regarding future operations, business strategy, cash flows, income, costs, expenses, liabilities and profits of CMTG. These statements are based on numerous assumptions and are subject to risks, uncertainties or change in circumstances that are difficult to predict or quantify. Actual future results may vary materially from those expressed or implied in these forward-looking statements, and CMTG’s business, financial condition and results of operations could be materially and adversely affected by numerous factors, including such known and unknown risks and uncertainties. As a result, forward-looking statements should be understood to be only predictions and statements of our current beliefs, and are not guarantees of performance. Statements regarding the following subjects, among others, may be forward-looking: our business and investment strategy; changes in interest rates and their impact on our borrowers and on the availability and cost of our financing; our projected operating results; defaults by borrowers in paying debt service on outstanding loans; the timing of cash flows, if any, from our investments; the state of the U.S. and global economy generally or in specific geographic regions; reduced demand for office, multifamily or retail space, including as a result of the increase in remote and/or hybrid work trends which allow work from remote locations other than the employer’s office premises; governmental actions and initiatives and changes to government policies; the amount of commercial mortgage loans requiring refinancing; our ability to obtain and maintain financing arrangements on attractive terms, or at all; our ability to maintain compliance with covenants under our financing arrangements; current and prospective financing costs and advance rates for our target assets; our expected leverage; general volatility of the capital markets and the markets in which we may invest and our borrowers operate in; the impact of a protracted decline in the liquidity of capital markets on our business; the state of the regional, national, and global banking systems; the uncertainty surrounding the strength of the national and global economies; the return on or impact of current and future investments, including our loan portfolio and real estate owned investments; allocation of investment opportunities to us by our Manager and our Sponsor; changes in the market value of our investments; effects of hedging instruments on our target assets; rates of default, decreased recovery rates, and/or increased loss severity rates on our target assets and related impairment charges, including as it relates to our real estate owned investments; the degree to which our hedging strategies may or may not protect us from interest rate volatility; changes in governmental regulations, tax law and rates, and similar matters (including interpretation thereof); our ability to maintain our qualification as a real estate investment trust; our ability to maintain our exclusion from registration under the Investment Company Act of 1940; availability and attractiveness of investment opportunities we are able to originate in our target assets; the ability of our Manager to locate suitable investments for us, monitor, service and administer our investments and execute our investment strategy; availability of qualified personnel from our Sponsor and its affiliates, including our Manager; estimates relating to our ability to pay dividends to our stockholders in the future; our understanding of our competition; impact of increased competition on projected returns; geopolitical or economic conditions or uncertainty, which may include military conflicts and activities (including the military conflicts between Russia and Ukraine, Israel and Hamas, and elsewhere throughout the Middle East and North Africa more broadly), tensions involving Russia, China, and Iran, political instability, social unrest, civil disturbances, terrorism, natural disasters and pandemics; and market trends in our industry, interest rates, real estate values, the debt markets generally, the CRE debt market or the general economy. The forward-looking statements are based on beliefs, assumptions, and expectations about future performance, taking into account all information currently available. You should not place undue reliance on these forward-looking statements. These beliefs, assumptions, and expectations can change as a result of many possible events or factors, not all of which are known. If a change occurs, CMTG’s business, financial condition, liquidity, and results of operations may vary materially from those expressed in any forward-looking statements. Any forward-looking statement speaks only as of the date on which it is made. New risks and uncertainties arise over time, and it is not possible to predict those events or how they may affect CMTG. Except as required by law, CMTG is not obligated to, and does not intend to, update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Endnotes Based on carrying value net of specific CECL reserves; excludes loans held-for-sale if applicable. Total Liquidity includes cash and approved and undrawn credit capacity based on existing collateral. Net Debt / Equity Ratio is calculated as the ratio of asset-specific debt and Secured Term Loan, less cash and cash equivalents, to total equity. For further information, please refer to Item 7 (MD&A) of our 10-Ks and Item 2 (MD&A) of our 10-Qs. All-in yield represents the weighted average annualized yield to initial maturity of each loan held-for-investment, inclusive of coupon and contractual fees, based on the applicable floating benchmark rate/floors (if applicable), in place as of June 30, 2024. For loans placed on non-accrual, the annualized yield to initial maturity used in calculating the weighted average annualized yield to initial maturity is 0%. Senior loans include senior mortgages and similar credit quality loans, including related contiguous subordinate loans (if any), and pari passu participations in senior mortgage loans. See Important Notices beginning on page 23 for additional information on this metric. Excludes our real estate owned (REO) investments, unless otherwise noted. Loan commitment represents principal outstanding plus remaining unfunded loan commitments. Refer to page 21 for a reconciliation of net income (loss) to distributable earnings (loss) and distributable earnings prior to realized gains and losses. Adjusted book value per share includes general CECL reserves and accumulated depreciation. For further detail on a reconciliation to GAAP, please refer to Item 7 (MD&A) of our 10-K filings and Item 2 (MD&A) of our 10-Qs. Total Leverage Ratio is calculated as the ratio of asset-specific debt and Secured Term Loan, plus non-consolidated senior interests held by third parties, less cash and cash equivalents, to total equity. For further information, please refer to Item 7 (MD&A) of our 10-Ks and Item 2 (MD&A) of our 10-Qs. Fully extended maturity assumes all extension options are exercised by the borrower upon satisfaction of the applicable conditions. Subject to approval of financing counterparty as well as pledging of additional unencumbered assets. Weighted average spreads exclude SOFR floors. Based on total loan commitments.