DEF 14AFALSE000166591800016659182023-01-012023-12-300001665918usfd:FlitmanMember2023-01-012023-12-300001665918usfd:IacobucciMember2023-01-012023-12-300001665918usfd:IacobucciMember2022-01-022022-12-310001665918usfd:SatrianoMember2021-01-032022-01-010001665918usfd:SatrianoMember2022-01-022022-12-310001665918usfd:SatrianoMember2019-12-292021-01-02iso4217:USD00016659182022-01-022022-12-3100016659182021-01-032022-01-0100016659182019-12-292021-01-02000166591812023-01-012023-12-300001665918usfd:PietroSatrianoMember2022-01-022022-12-310001665918usfd:PietroSatrianoMember2021-01-032022-01-010001665918usfd:PietroSatrianoMember2019-12-292021-01-020001665918usfd:FlitmanMemberusfd:PensionValueReportedInSCTMemberecd:PeoMember2023-01-012023-12-300001665918usfd:PensionValueReportedInSCTMemberusfd:IacobucciMemberecd:PeoMember2023-01-012023-12-300001665918usfd:PensionValueReportedInSCTMemberecd:NonPeoNeoMember2023-01-012023-12-300001665918usfd:PensionValueReportedInSCTMemberusfd:PietroSatrianoMemberecd:PeoMember2022-01-022022-12-310001665918usfd:PensionValueReportedInSCTMemberusfd:IacobucciMemberecd:PeoMember2022-01-022022-12-310001665918usfd:PensionValueReportedInSCTMemberecd:NonPeoNeoMember2022-01-022022-12-310001665918usfd:PensionValueReportedInSCTMemberusfd:PietroSatrianoMemberecd:PeoMember2021-01-032022-01-010001665918usfd:PensionValueReportedInSCTMemberecd:NonPeoNeoMember2021-01-032022-01-010001665918usfd:PensionValueReportedInSCTMemberusfd:PietroSatrianoMemberecd:PeoMember2019-12-292021-01-020001665918usfd:PensionValueReportedInSCTMemberecd:NonPeoNeoMember2019-12-292021-01-020001665918usfd:FlitmanMemberecd:PeoMemberusfd:PensionValueAttributableToServiceInCurrentYearAndAnyChangeInPensionValueAttributableToPlanAmendmentsMadeInTheCurrentYearMember2023-01-012023-12-300001665918usfd:IacobucciMemberecd:PeoMemberusfd:PensionValueAttributableToServiceInCurrentYearAndAnyChangeInPensionValueAttributableToPlanAmendmentsMadeInTheCurrentYearMember2023-01-012023-12-300001665918ecd:NonPeoNeoMemberusfd:PensionValueAttributableToServiceInCurrentYearAndAnyChangeInPensionValueAttributableToPlanAmendmentsMadeInTheCurrentYearMember2023-01-012023-12-300001665918usfd:PietroSatrianoMemberecd:PeoMemberusfd:PensionValueAttributableToServiceInCurrentYearAndAnyChangeInPensionValueAttributableToPlanAmendmentsMadeInTheCurrentYearMember2022-01-022022-12-310001665918usfd:IacobucciMemberecd:PeoMemberusfd:PensionValueAttributableToServiceInCurrentYearAndAnyChangeInPensionValueAttributableToPlanAmendmentsMadeInTheCurrentYearMember2022-01-022022-12-310001665918ecd:NonPeoNeoMemberusfd:PensionValueAttributableToServiceInCurrentYearAndAnyChangeInPensionValueAttributableToPlanAmendmentsMadeInTheCurrentYearMember2022-01-022022-12-310001665918usfd:PietroSatrianoMemberecd:PeoMemberusfd:PensionValueAttributableToServiceInCurrentYearAndAnyChangeInPensionValueAttributableToPlanAmendmentsMadeInTheCurrentYearMember2021-01-032022-01-010001665918ecd:NonPeoNeoMemberusfd:PensionValueAttributableToServiceInCurrentYearAndAnyChangeInPensionValueAttributableToPlanAmendmentsMadeInTheCurrentYearMember2021-01-032022-01-010001665918usfd:PietroSatrianoMemberecd:PeoMemberusfd:PensionValueAttributableToServiceInCurrentYearAndAnyChangeInPensionValueAttributableToPlanAmendmentsMadeInTheCurrentYearMember2019-12-292021-01-020001665918ecd:NonPeoNeoMemberusfd:PensionValueAttributableToServiceInCurrentYearAndAnyChangeInPensionValueAttributableToPlanAmendmentsMadeInTheCurrentYearMember2019-12-292021-01-020001665918usfd:FlitmanMemberusfd:ImpactOfAdjustmentsForDefinedBenefitAndActuarialPlansMemberecd:PeoMember2023-01-012023-12-300001665918usfd:ImpactOfAdjustmentsForDefinedBenefitAndActuarialPlansMemberusfd:IacobucciMemberecd:PeoMember2023-01-012023-12-300001665918usfd:ImpactOfAdjustmentsForDefinedBenefitAndActuarialPlansMemberecd:NonPeoNeoMember2023-01-012023-12-300001665918usfd:ImpactOfAdjustmentsForDefinedBenefitAndActuarialPlansMemberusfd:PietroSatrianoMemberecd:PeoMember2022-01-022022-12-310001665918usfd:ImpactOfAdjustmentsForDefinedBenefitAndActuarialPlansMemberusfd:IacobucciMemberecd:PeoMember2022-01-022022-12-310001665918usfd:ImpactOfAdjustmentsForDefinedBenefitAndActuarialPlansMemberecd:NonPeoNeoMember2022-01-022022-12-310001665918usfd:ImpactOfAdjustmentsForDefinedBenefitAndActuarialPlansMemberusfd:PietroSatrianoMemberecd:PeoMember2021-01-032022-01-010001665918usfd:ImpactOfAdjustmentsForDefinedBenefitAndActuarialPlansMemberecd:NonPeoNeoMember2021-01-032022-01-010001665918usfd:ImpactOfAdjustmentsForDefinedBenefitAndActuarialPlansMemberusfd:PietroSatrianoMemberecd:PeoMember2019-12-292021-01-020001665918usfd:ImpactOfAdjustmentsForDefinedBenefitAndActuarialPlansMemberecd:NonPeoNeoMember2019-12-292021-01-020001665918usfd:SCTAmountsMemberusfd:FlitmanMemberecd:PeoMember2023-01-012023-12-300001665918usfd:SCTAmountsMemberusfd:IacobucciMemberecd:PeoMember2023-01-012023-12-300001665918usfd:SCTAmountsMemberecd:NonPeoNeoMember2023-01-012023-12-300001665918usfd:SCTAmountsMemberusfd:PietroSatrianoMemberecd:PeoMember2022-01-022022-12-310001665918usfd:SCTAmountsMemberusfd:IacobucciMemberecd:PeoMember2022-01-022022-12-310001665918usfd:SCTAmountsMemberecd:NonPeoNeoMember2022-01-022022-12-310001665918usfd:SCTAmountsMemberusfd:PietroSatrianoMemberecd:PeoMember2021-01-032022-01-010001665918usfd:SCTAmountsMemberecd:NonPeoNeoMember2021-01-032022-01-010001665918usfd:SCTAmountsMemberusfd:PietroSatrianoMemberecd:PeoMember2019-12-292021-01-020001665918usfd:SCTAmountsMemberecd:NonPeoNeoMember2019-12-292021-01-020001665918usfd:FlitmanMemberusfd:ValueOfEquityGrantedDuringFiscalYearUnvestedAsOfEndOfFiscalYearMemberecd:PeoMember2023-01-012023-12-300001665918usfd:IacobucciMemberusfd:ValueOfEquityGrantedDuringFiscalYearUnvestedAsOfEndOfFiscalYearMemberecd:PeoMember2023-01-012023-12-300001665918ecd:NonPeoNeoMemberusfd:ValueOfEquityGrantedDuringFiscalYearUnvestedAsOfEndOfFiscalYearMember2023-01-012023-12-300001665918usfd:PietroSatrianoMemberusfd:ValueOfEquityGrantedDuringFiscalYearUnvestedAsOfEndOfFiscalYearMemberecd:PeoMember2022-01-022022-12-310001665918usfd:IacobucciMemberusfd:ValueOfEquityGrantedDuringFiscalYearUnvestedAsOfEndOfFiscalYearMemberecd:PeoMember2022-01-022022-12-310001665918ecd:NonPeoNeoMemberusfd:ValueOfEquityGrantedDuringFiscalYearUnvestedAsOfEndOfFiscalYearMember2022-01-022022-12-310001665918usfd:PietroSatrianoMemberusfd:ValueOfEquityGrantedDuringFiscalYearUnvestedAsOfEndOfFiscalYearMemberecd:PeoMember2021-01-032022-01-010001665918ecd:NonPeoNeoMemberusfd:ValueOfEquityGrantedDuringFiscalYearUnvestedAsOfEndOfFiscalYearMember2021-01-032022-01-010001665918usfd:PietroSatrianoMemberusfd:ValueOfEquityGrantedDuringFiscalYearUnvestedAsOfEndOfFiscalYearMemberecd:PeoMember2019-12-292021-01-020001665918ecd:NonPeoNeoMemberusfd:ValueOfEquityGrantedDuringFiscalYearUnvestedAsOfEndOfFiscalYearMember2019-12-292021-01-020001665918usfd:FlitmanMemberusfd:ChangeInFairValueOfEquityOutstandingAtBeginningAndEndOfFiscalYearMemberecd:PeoMember2023-01-012023-12-300001665918usfd:ChangeInFairValueOfEquityOutstandingAtBeginningAndEndOfFiscalYearMemberusfd:IacobucciMemberecd:PeoMember2023-01-012023-12-300001665918ecd:NonPeoNeoMemberusfd:ChangeInFairValueOfEquityOutstandingAtBeginningAndEndOfFiscalYearMember2023-01-012023-12-300001665918usfd:PietroSatrianoMemberusfd:ChangeInFairValueOfEquityOutstandingAtBeginningAndEndOfFiscalYearMemberecd:PeoMember2022-01-022022-12-310001665918usfd:ChangeInFairValueOfEquityOutstandingAtBeginningAndEndOfFiscalYearMemberusfd:IacobucciMemberecd:PeoMember2022-01-022022-12-310001665918ecd:NonPeoNeoMemberusfd:ChangeInFairValueOfEquityOutstandingAtBeginningAndEndOfFiscalYearMember2022-01-022022-12-310001665918usfd:PietroSatrianoMemberusfd:ChangeInFairValueOfEquityOutstandingAtBeginningAndEndOfFiscalYearMemberecd:PeoMember2021-01-032022-01-010001665918ecd:NonPeoNeoMemberusfd:ChangeInFairValueOfEquityOutstandingAtBeginningAndEndOfFiscalYearMember2021-01-032022-01-010001665918usfd:PietroSatrianoMemberusfd:ChangeInFairValueOfEquityOutstandingAtBeginningAndEndOfFiscalYearMemberecd:PeoMember2019-12-292021-01-020001665918ecd:NonPeoNeoMemberusfd:ChangeInFairValueOfEquityOutstandingAtBeginningAndEndOfFiscalYearMember2019-12-292021-01-020001665918usfd:FlitmanMemberusfd:ChangeInValueForAwardsVestedInFiscalYearMemberecd:PeoMember2023-01-012023-12-300001665918usfd:ChangeInValueForAwardsVestedInFiscalYearMemberusfd:IacobucciMemberecd:PeoMember2023-01-012023-12-300001665918usfd:ChangeInValueForAwardsVestedInFiscalYearMemberecd:NonPeoNeoMember2023-01-012023-12-300001665918usfd:ChangeInValueForAwardsVestedInFiscalYearMemberusfd:PietroSatrianoMemberecd:PeoMember2022-01-022022-12-310001665918usfd:ChangeInValueForAwardsVestedInFiscalYearMemberusfd:IacobucciMemberecd:PeoMember2022-01-022022-12-310001665918usfd:ChangeInValueForAwardsVestedInFiscalYearMemberecd:NonPeoNeoMember2022-01-022022-12-310001665918usfd:ChangeInValueForAwardsVestedInFiscalYearMemberusfd:PietroSatrianoMemberecd:PeoMember2021-01-032022-01-010001665918usfd:ChangeInValueForAwardsVestedInFiscalYearMemberecd:NonPeoNeoMember2021-01-032022-01-010001665918usfd:ChangeInValueForAwardsVestedInFiscalYearMemberusfd:PietroSatrianoMemberecd:PeoMember2019-12-292021-01-020001665918usfd:ChangeInValueForAwardsVestedInFiscalYearMemberecd:NonPeoNeoMember2019-12-292021-01-020001665918usfd:ForfeitedAwardsInFiscalYearMemberusfd:FlitmanMemberecd:PeoMember2023-01-012023-12-300001665918usfd:ForfeitedAwardsInFiscalYearMemberusfd:IacobucciMemberecd:PeoMember2023-01-012023-12-300001665918usfd:ForfeitedAwardsInFiscalYearMemberecd:NonPeoNeoMember2023-01-012023-12-300001665918usfd:ForfeitedAwardsInFiscalYearMemberusfd:PietroSatrianoMemberecd:PeoMember2022-01-022022-12-310001665918usfd:ForfeitedAwardsInFiscalYearMemberusfd:IacobucciMemberecd:PeoMember2022-01-022022-12-310001665918usfd:ForfeitedAwardsInFiscalYearMemberecd:NonPeoNeoMember2022-01-022022-12-310001665918usfd:ForfeitedAwardsInFiscalYearMemberusfd:PietroSatrianoMemberecd:PeoMember2021-01-032022-01-010001665918usfd:ForfeitedAwardsInFiscalYearMemberecd:NonPeoNeoMember2021-01-032022-01-010001665918usfd:ForfeitedAwardsInFiscalYearMemberusfd:PietroSatrianoMemberecd:PeoMember2019-12-292021-01-020001665918usfd:ForfeitedAwardsInFiscalYearMemberecd:NonPeoNeoMember2019-12-292021-01-020001665918usfd:ImpactOfAdjustmentsForStockAndOptionAwardsMemberusfd:FlitmanMemberecd:PeoMember2023-01-012023-12-300001665918usfd:ImpactOfAdjustmentsForStockAndOptionAwardsMemberusfd:IacobucciMemberecd:PeoMember2023-01-012023-12-300001665918usfd:ImpactOfAdjustmentsForStockAndOptionAwardsMemberecd:NonPeoNeoMember2023-01-012023-12-300001665918usfd:ImpactOfAdjustmentsForStockAndOptionAwardsMemberusfd:PietroSatrianoMemberecd:PeoMember2022-01-022022-12-310001665918usfd:ImpactOfAdjustmentsForStockAndOptionAwardsMemberusfd:IacobucciMemberecd:PeoMember2022-01-022022-12-310001665918usfd:ImpactOfAdjustmentsForStockAndOptionAwardsMemberecd:NonPeoNeoMember2022-01-022022-12-310001665918usfd:ImpactOfAdjustmentsForStockAndOptionAwardsMemberusfd:PietroSatrianoMemberecd:PeoMember2021-01-032022-01-010001665918usfd:ImpactOfAdjustmentsForStockAndOptionAwardsMemberecd:NonPeoNeoMember2021-01-032022-01-010001665918usfd:ImpactOfAdjustmentsForStockAndOptionAwardsMemberusfd:PietroSatrianoMemberecd:PeoMember2019-12-292021-01-020001665918usfd:ImpactOfAdjustmentsForStockAndOptionAwardsMemberecd:NonPeoNeoMember2019-12-292021-01-020001665918usfd:FlitmanMemberecd:PeoMember2023-01-012023-12-300001665918usfd:IacobucciMemberecd:PeoMember2023-01-012023-12-300001665918ecd:NonPeoNeoMember2023-01-012023-12-300001665918usfd:PietroSatrianoMemberecd:PeoMember2022-01-022022-12-310001665918usfd:IacobucciMemberecd:PeoMember2022-01-022022-12-310001665918ecd:NonPeoNeoMember2022-01-022022-12-310001665918usfd:PietroSatrianoMemberecd:PeoMember2021-01-032022-01-010001665918ecd:NonPeoNeoMember2021-01-032022-01-010001665918usfd:PietroSatrianoMemberecd:PeoMember2019-12-292021-01-020001665918ecd:NonPeoNeoMember2019-12-292021-01-02000166591822023-01-012023-12-30000166591832023-01-012023-12-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

PROXY STATEMENT PURSUANT TO SECTION 14(a)

OF THE SECURITIES EXCHANGE ACT OF 1934

(AMENDMENT NO. __)

| | | | | | | | | | | | | | |

| ☑ Filed by the Registrant | ☐ Filed by a Party other than the Registrant |

| Check the appropriate box: |

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14A-6(e)(2)) |

| ☑ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material under §240.14a-12 |

US FOODS HOLDING CORP.

(Name of the Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| | | | | | | | | | | | | | |

| Payment of Filing Fee (Check all boxes that apply): |

| ☑ | No fee required. |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

April 2, 2024

DEAR STOCKHOLDERS

| | | | | |

On behalf of the Board of Directors, I am pleased to invite you to attend US Foods’ 2024 Annual Meeting of Stockholders on Wednesday, May 15, 2024, at 8:00 a.m. Central Daylight Time. We will once again host a completely virtual meeting this year, building off the success of last year’s annual meeting to ensure expanded access for as many stockholders as possible. Details of the business to be conducted at the Annual Meeting are included in the attached Notice of Annual Meeting and Proxy Statement. Whether or not you plan to attend the virtual Annual Meeting, the representation of your shares and your vote at the Annual Meeting are very important. I encourage you to review this Proxy Statement and submit your vote today. You can find the instructions for voting your shares in the Proxy Statement. Throughout 2023, the dedicated US Foods team relentlessly focused on delivering best-in-class service to customers and executing on strategic long-range plan initiatives. The Board continued its oversight of the Company’s growth strategy, prudent allocation of capital, and corporate sustainability initiatives. The most significant change for US Foods in 2023 was the arrival of Dave Flitman as Chief Executive Officer and member of the Board. After a thoughtful and thorough search for the leader of this great company, the Board was thrilled to welcome Dave to US Foods. He is a highly accomplished executive, who has already made a meaningful impact on the organization by driving safety, operational excellence, profitable growth, shareholder returns, and a high-performing culture. The Board is confident in Dave’s leadership in driving the Company’s next chapter of growth. We thank those of you who met with the Company over the past year and provided valuable feedback on broad-ranging topics such as the CEO transition; environmental, social, and governance matters; human capital management; Board refreshment and composition; and the Company’s executive compensation program structure. The information received during this engagement helped to inform the Board’s and its Committees’ agendas and priorities for the year. We are committed to continuing the dialogue with the Company’s stockholders and appreciate your engagement. It is a privilege to serve as your Chair and I greatly value your support of US Foods. On behalf of the Board and everyone at US Foods, we are grateful for your continued trust and support. Thank you for being a US Foods stockholder. Sincerely, ROBERT M. DUTKOWSKY Chair of the Board |

| “Throughout 2023, the dedicated US Foods team relentlessly focused on delivering best-in-class service to customers and executing on strategic long-range plan initiatives.” | |

|

April 2, 2024 | | | | | |

| | “After more than a full year with this great company, I am even more confident and excited about our future.” | |

DEAR FELLOW STOCKHOLDER

In January 2023, I had the honor of joining US Foods as Chief Executive Officer. After more than a full year with this great company, I am even more confident and excited about our future. I attribute this confidence to the strong momentum we created by delivering against our long-range plan and to our 30,000 dedicated associates who bring their foodservice expertise and tireless dedication to work every day.

At US Foods, our promise is to help our customers Make It. We achieve this by focusing on four key strategic pillars that I announced in 2023 to drive value for our customers, associates and you, our stockholders.

Culture

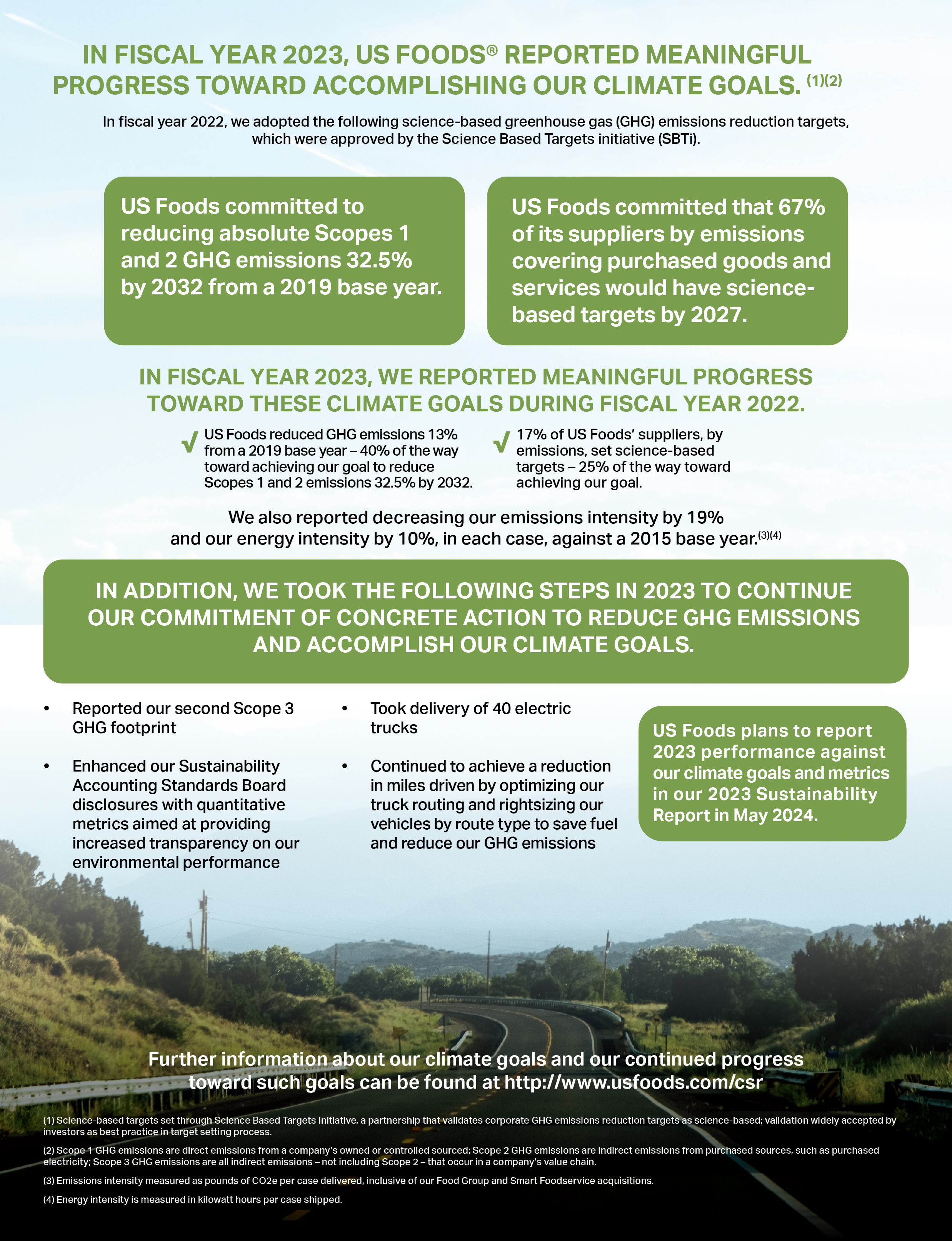

We are committed to the safety of our associates and made significant strides in 2023 to reduce the number of vehicle accidents and associate injuries across our facilities, improving overall safety performance by 23%. Creating a supportive and inclusive workplace is also key to our success, and we increased our diverse talent pipeline by filling 51% of new or open leadership roles with women or persons of color, exceeding our 40% goal. We also remain steadfast and responsible stewards of our planet, including our commitment to reducing absolute Scope 1 and Scope 2 greenhouse gas (GHG) emissions by 32.5% by 2032 from our 2019 climate goal base year and offering more sustainable and well-being Exclusive Brands products and Serve Good® responsible disposable products.

Service

We are dedicated to providing our customers with services that are reliable, efficient and easy to use. Our customer service levels are now in line with pre-Covid levels as we worked closely with our vendors to deliver consistent service. We are also taking proactive steps to further improve routing efficiency and reduce miles driven, while increasing cases per mile. In fact, in 2023, we delivered our best cases per mile in company history. Importantly, we boosted our digital leadership position through our new MOXēTM ecommerce platform that enables customers to place orders, manage inventory and check invoices all from the palm of their hand, while freeing up time for our sales teams to further accelerate growth. We have now embedded the MOXēTM platform across 100% of our local restaurant business and approximately 50% of our national chain business.

Growth

In 2023, we drove Net Sales growth of 4.5% to $35.6 billion. We exceeded 1.5x restaurant market growth and grew independent cases by 6.9% in 2023, consistently gaining share with independent restaurants enabled by technology and our service model advantages. And, we also grew share in both Healthcare and Hospitality, largely by converting our pipeline of customers into new business through innovation, such as our VITALS platform for acute care and senior living facilities. To bolster our footprint in key markets, we executed two tuck-in acquisitions — Renzi Foodservice and Saladino’s. And we continued to differentiate ourselves through our fresh, on-trend and labor-saving ScoopTM product innovations and unique team-based selling model featuring our expert chefs and restaurant operations consultants.

Profit

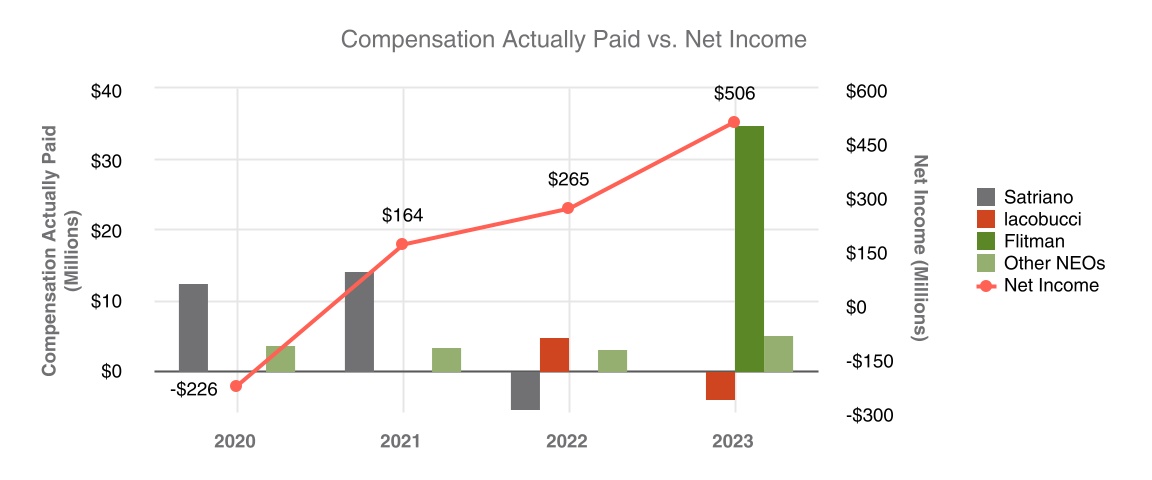

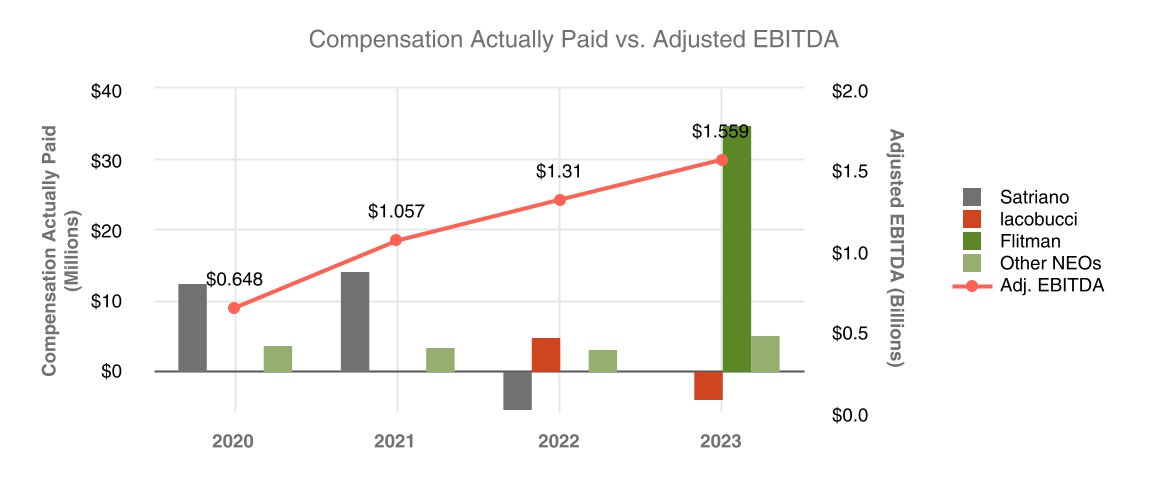

Driving margin, productivity and optimization are the key tenets of our Profit pillar. We are focused on growing our Exclusive Brands to drive margin expansion. And our new flexible schedules in our distribution centers are reducing costs associated with turnover and helping us accelerate productivity. Addressing cost of goods sold, managing pricing to help neutralize commodity volatility, optimizing indirect spend and enhancing our Supply Chain operations also contributed to increased Gross Profit of 11.9% to $6.1 billion in 2023. As a result of our strategies, we grew Net Income to $506 million, an increase of 90.9%, and grew Adjusted EBITDA* to $1.56 billion, an increase of 19.0%.

We also maintain a disciplined approach to capital deployment. We reduced Total Debt to $4.67 billion, a decrease of $180 million, and reduced Net Debt* to $4.4 billion, a decrease of $238 million. This resulted in a reduction of our Net Debt* to Adjusted EBITDA* leverage ratio to 2.8 times, well within our stated range of 2.5-3.0 times. And we made significant progress in our $500 million share repurchase program, purchasing approximately $300 million in 2023.

In closing, I am pleased with our progress in 2023 as we executed the four pillars of our strategy, which is driving increased safety, productivity, and profitability – all as we live our Cultural Beliefs as a company. Even with this tremendous progress, we have a long runway of profitable growth and shareholder returns in front of us. I look forward to even greater success as we complete our current long-range plan by the end of 2024 and embark on our next exciting long-range plan that we will share in June.

I invite you to attend our virtual US Foods 2024 Annual Meeting on Wednesday, May 15, 2024, at 8:00 a.m. Central Daylight Time. And please submit your vote today – your vote matters! Meeting details and voting instructions are included in the attached Notice of Annual Meeting and Proxy Statement.

It is a true honor to serve as CEO of this great company and I greatly value your support. We are in a strong position today, and I believe we have sustainable competitive advantages to outperform the market well into the future as we continue to do what we do best — helping our customers Make It every day. Thank you for your continued trust and confidence in US Foods.

Sincerely,

Dave Flitman

Chief Executive Officer

*Note: An asterisk denotes a non-GAAP measure. All reconciliations to non-GAAP financial measures can be found in Appendix A.

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

Wednesday, May 15, 2024

8:00 a.m. (Central Daylight Time)

We are pleased to provide notice of the 2024 Annual Meeting of Stockholders of US Foods Holding Corp. (including any adjournments, postponements, or continuations thereof, the “Annual Meeting”). This year’s Annual Meeting will be a completely virtual meeting of stockholders. You will be able to attend and participate in the virtual Annual Meeting by visiting www.virtualshareholdermeeting.com/USFD2024, where you will be able to listen to the meeting live, submit questions, and vote.

MEETING AGENDA

As described in the proxy statement detailing the business to be conducted at the Annual Meeting (the “Proxy Statement”), the holders of our Common Stock, par value $0.01 per share (“Common Stock”), will be asked to:

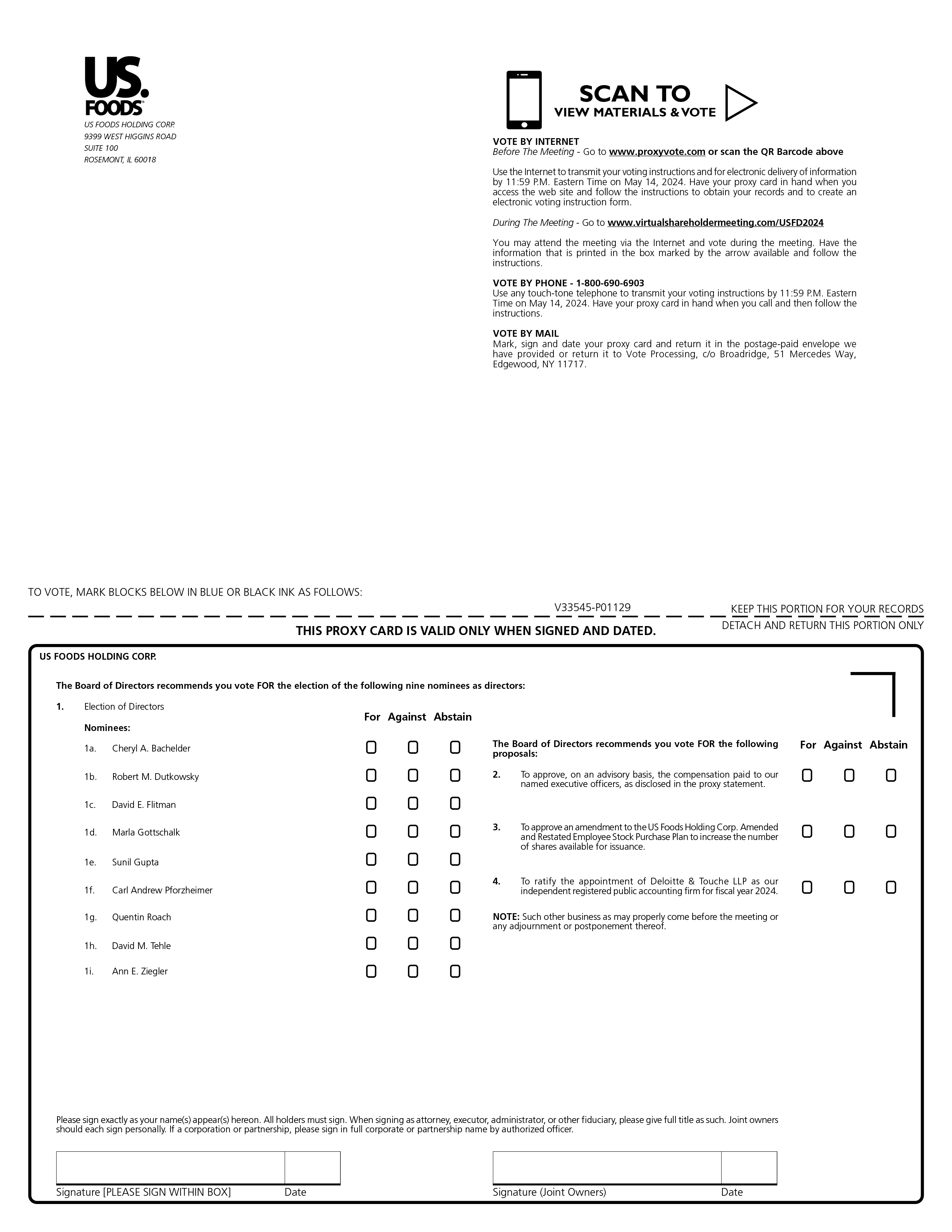

1.Elect nine director nominees to our board of directors (our “Board”);

2.Approve, on an advisory basis, the compensation paid to our named executive officers, as disclosed in the Proxy Statement;

3.Approve an amendment to the US Foods Holding Corp. Amended and Restated Employee Stock Purchase Plan;

4.Ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for fiscal year 2024; and

5.Transact such other business that may properly come before the Annual Meeting.

RECORD DATE

Stockholders of record at the close of business on March 18, 2024, are entitled to notice of, and to vote at, the Annual Meeting.

ONLINE PROXY DELIVERY AND VOTING

As permitted by the Securities and Exchange Commission, we are making this Proxy Statement and the Company’s annual report to stockholders available to our stockholders electronically via the Internet. We believe electronic delivery expedites your receipt of materials, reduces the environmental impact of our Annual Meeting, and reduces costs significantly. Beginning on or about April 2, 2024, a Notice of Internet Availability of Proxy Materials (“Notice”) was mailed to each of our stockholders of record as of March 18, 2024. The Notice contains instructions on how you can access the proxy materials and vote online. If you received the Notice by mail, you will not receive a printed copy of the proxy materials unless you request one in accordance with the instructions provided in the Notice. As more fully described in the Notice, all stockholders may choose to access these materials online or may request printed or emailed copies.

We encourage you to vote your shares as soon as possible. Specific instructions for voting over the internet or by telephone or mail are included in the Notice. If you attend the virtual Annual Meeting and vote electronically during the meeting, your vote will replace any earlier vote.

By Order of the Board of Directors,

| | |

MARTHA HA Executive Vice President, General Counsel and Corporate Secretary |

Access The Proxy Statement And Vote In One of Four Ways: | | | | | | | | | | | |

| | | |

Internet Visit the website on your proxy or voting instruction form | Telephone Call the telephone number on your proxy or voting instruction card | Mail Sign, date, and return your proxy or voting instruction card in the enclosed envelope | At the Meeting Attend the virtual Annual Meeting at www.virtualshareholdermeeting.com/USFD2024 |

Please refer to the Notice or the information forwarded by your bank, broker, or other nominee to see which voting methods are available to you.

| | | | | | | | |

| | |

| Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders to Be Held on May 15, 2024. The Proxy Statement and our 2023 Annual Report are available free of charge at www.virtualshareholdermeeting.com/USFD2024 and under the Annual Report and Proxy Statements tab in the Financial Information section of our Investor Relations website (https://ir.usfoods.com/investors/financial-information/annual-reports). | |

| | |

TABLE OF CONTENTS

This proxy statement (this “Proxy Statement”) is furnished in connection with the solicitation of proxies by the Board of Directors (the “Board”) of US Foods Holding Corp., a Delaware corporation (“US Foods,” the “Company,” “we,” “us” or “our”), for the Annual Meeting of Stockholders scheduled to be held on May 15, 2024 (including any adjournments, postponements, or continuations thereof, the “Annual Meeting”) at 8:00 a.m. Central Daylight Time. You will be able to attend and participate in the virtual Annual Meeting by visiting www.virtualshareholdermeeting.com/USFD2024 where you will be able to listen to the meeting live, submit questions, and vote. This Proxy Statement and accompanying form of proxy card were first mailed to stockholders on or about April 2, 2024.

FORWARD-LOOKING STATEMENTS

Statements in this Proxy Statement which are not historical in nature are “forward-looking statements” within the meaning of the federal securities laws. These statements often include words such as “believe,” “expect,” “project,” “anticipate,” “intend,” “plan,” “outlook,” “estimate,” “target,” “seek,” “will,” “may,” “would,” “should,” “could,” “forecast,” “mission,” “strive,” “more,” “goal,” or similar expressions (although not all forward-looking statements may contain such words) and are based upon various assumptions and our experience in the industry, as well as historical trends, current conditions, and expected future developments. However, you should understand that these statements are not guarantees of performance or results and there are a number of risks, uncertainties and other important factors that could cause our actual results to differ materially from those expressed in the forward-looking statements, including, among others: economic factors affecting consumer confidence and discretionary spending and reducing the consumption of food prepared away from home; cost inflation/deflation and commodity volatility; competition; reliance on third party suppliers and interruption of product supply or increases in product costs; changes in our relationships with customers and group purchasing organizations; our ability to increase or maintain the highest margin portions of our business; achievement of expected benefits from cost savings initiatives; increases in fuel costs; changes in consumer eating habits; cost and pricing structures; the impact of climate change or related legal, regulatory or market measures; impairment charges for goodwill, indefinite-lived intangible assets or other long-lived assets; the impact of governmental regulations; product recalls and product liability claims; our reputation in the industry; labor relations and increased labor costs and continued access to qualified and diverse labor; indebtedness and restrictions under agreements governing our indebtedness; interest rate increases; disruption of existing technologies and implementation of new technologies; cybersecurity incidents and other technology disruptions; risks associated with intellectual property, including potential infringement; effective integration of acquired businesses; potential costs associated with stockholder activism; changes in tax laws and regulations and resolution of tax disputes; certain provisions in our governing documents; health and safety risks to our associates and related losses; adverse judgments or settlements resulting from litigation; extreme weather conditions, natural disasters and other catastrophic events; and management of retirement benefits and pension obligations.

For a detailed discussion of these risks, uncertainties and other factors that could cause our results to differ materially from those anticipated or expressed in any forward-looking statements, see the section entitled “Risk Factors” in our Annual Report on Form 10-K for the fiscal year ended December 30, 2023 filed with the SEC on February 15, 2024. Additional risks and uncertainties are discussed from time to time in current, quarterly, and annual reports filed by the Company with the SEC, which are available on the SEC’s website at www.sec.gov. Additionally, we operate in a highly competitive and rapidly changing environment; new risks and uncertainties may emerge from time to time, and it is not possible to predict all risks nor identify all uncertainties. The forward-looking statements contained in this Proxy Statement speak only as of the date of this Proxy Statement and are based on information and estimates available to us at this time. We undertake no obligation to update or revise any forward-looking statements, except as may be required by law.

WEBSITES

Links to websites included in this Proxy Statement are provided solely for convenience. Information contained on websites, including on our website, is not, and will not be deemed to be, a part of this Proxy Statement or incorporated by reference into any of our other filings with the SEC.

ABOUT US FOODS

US FOODS AT A GLANCE(1)

US Foods is one of America’s great food companies and a leading foodservice distributor, providing restaurants, healthcare, hospitality, governmental and educational institutions with broad and innovative food offerings, a comprehensive suite of e-commerce, technology and business solutions, and omni-channel solutions that enable our customers to receive product in ways that best suit their needs. Our success is powered by our talented associates who come to work every day with one goal in mind — to help our customers Make It.

| | | | | | | | | | | | | | |

| | | | |

| 70+ | ~90 | $35.6B | 6,500+ | ~4,000 |

| Distribution Facilities | CHEF’STORE® Locations | Net Sales | Trucks in Our Fleet | Sales Associates |

| | | | |

| 150+ | ~30,000 | 400,000+ | ~6,000 | ~250,000 |

| Years in Business | Associates | Products | Suppliers | Customers |

FISCAL YEAR 2023 PERFORMANCE HIGHLIGHTS(2)

| | | | | | | | | | | | | | | | | |

| Delivered Net Sales of $35.6 billion, up 4.5% | Grew total case volume 4.4%; independent case volume 6.9% | Increased Gross Profit 11.9% to $6.1 billion | Grew Net Income to $506 million, up 90.9% | Grew Adjusted EBITDA* to $1.56 billion, up 19% | Grew Diluted EPS 100.0% to $2.02; Adjusted Diluted EPS* 22.9% to $2.63 |

WHERE YOU CAN LEARN MORE

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | |

| LEARN MORE ABOUT US | |

| You can learn more about US Foods, by visiting our website at www.usfoods.com or by viewing our social media content on the platforms noted below. | |

| | | @usfoods | | us_foods | | US Foods | | US Foods | | |

| | | | | | | | | | | |

(1)Information provided above is as of fiscal year end 2023.

(2)An asterisk denotes a non-GAAP measure. For more information, including reconciliations of our non-GAAP measures to the comparable GAAP measures, see Appendix A to this Proxy Statement. All percentages noted above are increases over fiscal year 2022.

PROXY SUMMARY

INFORMATION ABOUT THE ANNUAL MEETING

You have received these proxy materials because the Board is soliciting your proxy to vote your shares during the Annual Meeting. This summary highlights information contained elsewhere in this Proxy Statement. This summary does not contain all of the information that you should consider in deciding how to vote your shares, and you should read the entire Proxy Statement carefully before voting. Page references are supplied to help you find further information in this Proxy Statement.

| | | | | |

| Time and Date: | 8:00 a.m. (Central Daylight Time) on Wednesday, May 15, 2024 |

| Location: | Virtual Meeting (www.virtualshareholdermeeting.com/USFD2024) |

| Record Date: | The close of business on March 18, 2024 (the “Record Date”) |

MATTERS TO BE VOTED UPON

At the Annual Meeting, the holders of our Common Stock, par value $0.01 per share (“Common Stock”), will be asked to vote upon the following matters:

| | | | | | | | | | | |

| Board Recommendation | Page |

| | | |

| | | |

Proposal 1 – Election of nine director nominees | | FOR EACH OF OUR BOARD NOMINEES | |

| | | |

| | | |

Proposal 2 – Advisory approval of the compensation paid to our named executive officers, as disclosed in the Proxy Statement | | FOR | |

| | | |

| | | |

Proposal 3 – Amendment to Employment Stock Purchase Plan to increase the number of authorized shares | | FOR | |

| | | |

| | | |

Proposal 4 – Ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for fiscal year 2024 | | FOR | |

| | | |

STOCKHOLDERS ENTITLED TO VOTE

Stockholders entitled to vote at the Annual Meeting are those who owned Common Stock at the close of business on the Record Date. As of the Record Date, there were 245,274,867 shares of Common Stock outstanding. Each share of Common Stock entitles the holder thereof to one vote.

| | | | | |

| US FOODS HOLDING CORP. | 2024 PROXY STATEMENT | 1 |

DIRECTOR NOMINEES

The following table provides summary information about our nine director nominees. Each director nominee was, during the entirety of fiscal year 2023, and continues to be, independent in accordance with applicable New York Stock Exchange (“NYSE”) listing standards, other than David E. Flitman, who has served as the Company’s Chief Executive Officer since January 5, 2023. Court Carruthers, Nathaniel Taylor, Scott D. Ferguson, James J. Barber, Jr., and David A. Toy, each of whom served as a director during all or part of fiscal year 2023, were also determined to be independent in accordance with the NYSE listing standards. All current members of the Board, except for Mr. Barber and Mr. Toy, are standing for election for a one-year term, expiring at the next annual meeting of stockholders and until their respective successors are duly elected and qualified or until their earlier death, resignation, retirement, disqualification, or removal. Mr. Barber and Mr. Toy were not nominated by the Board to stand for election at the Annual Meeting.

| | | | | | | | | | | | | | | | | |

| Name | Age | Director Since | Gender or Racial Diversity | Independent(1) | Compliance with Stock Ownership Guidelines(2) |

| | | | | |

Cheryl A. Bachelder Former Chief Executive Officer of Popeyes Louisiana Kitchen, Inc. and Pier 1 Imports | 67 | 2018 | ü | ü | ü |

Robert M. Dutkowsky Chair of the Board and Former Chief Executive Officer of Tech Data | 69 | 2017 | | ü | ü |

David E. Flitman Chief Executive Officer of US Foods | 59 | 2023 | | | ü |

Marla Gottschalk Former Chief Executive Officer of The Pampered Chef, Ltd. | 63 | 2022 | ü | ü | ü |

Sunil Gupta Edward W. Carter Professor of Business Administration at Harvard Business School | 65 | 2018 | ü | ü | ü |

Carl Andrew Pforzheimer Former Co-Chief Executive Officer of Tastemaker Acquisition Corporation | 62 | 2017 | | ü | ü |

Quentin Roach Senior Vice President and Chief Procurement Officer at Estée Lauder Companies | 57 | 2022 | ü | ü | ü |

David M. Tehle Former Executive Vice President and Chief Financial Officer of Dollar General Corporation | 67 | 2016 | | ü | ü |

Ann E. Ziegler Former Senior Vice President and Chief Financial Officer of CDW Corporation | 65 | 2018 | ü | ü | ü |

(1)All directors are independent in accordance with the standards of the NYSE, except for Mr. Flitman, our CEO.

(2)All directors were in compliance with (or were on track to be in compliance with) the Company’s stock ownership guidelines at the end of 2023.

| | | | | |

2 | US FOODS HOLDING CORP. | 2024 PROXY STATEMENT |

CORPORATE GOVERNANCE HIGHLIGHTS

The Company has a long-standing commitment to strong corporate governance, which promotes the long-term interests of our stockholders, strengthens Board and management accountability, and helps build trust in the Company. The Board has adopted policies and processes that foster effective Board and Committee oversight of critical matters including strategy, enterprise risk management, financial and other controls, cybersecurity and data security, compliance and ethics, corporate sustainability, Board diversity and refreshment, and management succession planning. The Board and its Committees regularly review the Company’s corporate governance documents, policies, and processes in the context of current governance trends, recognized best practices, and legal and regulatory changes. The following sections provide an overview of our corporate governance structure, policies, and processes, including key aspects of our Board’s and its Committees’ operations.

| | | | | | | | |

| | |

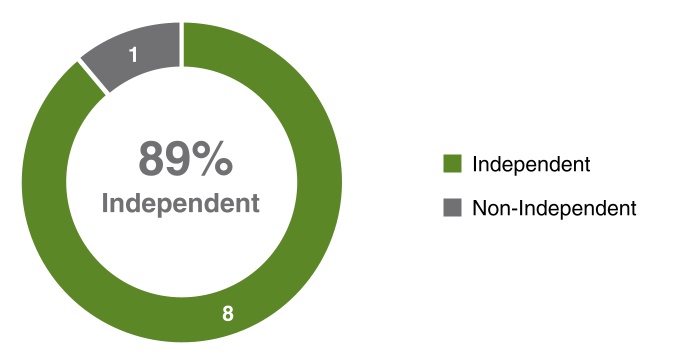

| Independence | ü | Independent Chair of the Board |

| ü | Eight of nine director nominees are independent |

| ü | Regular executive sessions of independent directors |

| ü | Fully independent Board Committees |

| Accountability | ü | Annual election of all directors |

| ü | Simple majority vote standard in uncontested elections |

| ü | One class of voting stock with equal voting rights |

| Evaluation and Effectiveness | ü | Annual Board and Committee self-evaluation process |

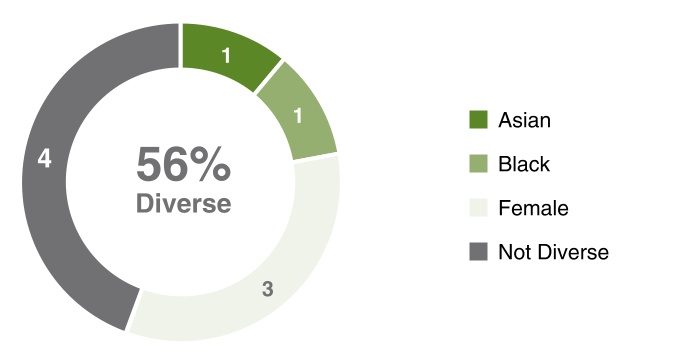

| Diversity and Refreshment | ü | 22% of director nominees self-identify as persons of color and 33% self-identify as female |

| ü | 50% of Board Committees chaired by directors who self-identify as female |

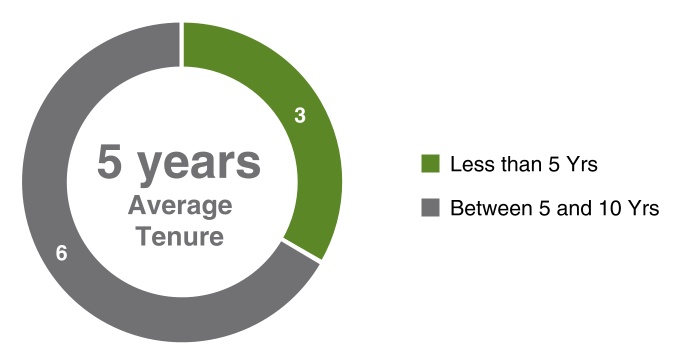

| ü | Balance of new and experienced directors, with an average tenure of five years for director nominees |

| Active Oversight and Engagement | ü | Robust oversight of risks related to the Company’s business, including comprehensive and strategic approach to enterprise risk management |

| ü | Audit Committee oversight of cybersecurity matters |

| ü | Nominating and Corporate Governance Committee oversight of corporate sustainability |

| ü | Compensation and Human Capital Committee oversight of diversity and inclusion |

| Alignment with Stockholder Interests | ü | No stockholder rights plan (poison pill) |

| ü | Executive officer and independent director stock ownership requirements |

| ü | Double-trigger cash severance |

| Compensation Policies | ü | Dodd-Frank compliant clawback policy |

| ü | Anti-hedging policy |

| ü | Anti-pledging policy |

| Commitment to Stockholder Rights and Robust Stockholder Engagement | ü | Annual say-on-pay advisory votes |

| ü | Stockholders can amend charter or bylaws by a simple majority vote |

| ü | Proactive year-round engagement with stockholders |

| ü | Incorporation of stockholder input informs our Board and Committee agendas, as well as our strategies and programs |

| | | | | |

| US FOODS HOLDING CORP. | 2024 PROXY STATEMENT | 3 |

BOARD MEMBERSHIP AND DIVERSITY

US Foods is proactive in seeking to ensure that its Board possesses, in the aggregate, the strategic, managerial and financial skills and experience necessary to fulfill its duties and to achieve its objectives while at the same time seeking to ensure that the Board is comprised of directors who have broad and diverse backgrounds, perspectives and experiences. The Board believes that a diverse Board is best able to effectively oversee our management and strategy and position US Foods to deliver long-term value for our stockholders. The Board actively seeks highly qualified individuals with varying backgrounds, expertise and experiences including individuals from underrepresented groups, as well as non-traditional backgrounds as part of its director search process. Additionally, with the assistance of the Nominating and Corporate Governance Committee, the Board regularly reviews trends in board composition, including on director diversity. We believe the current composition of our director nominees, illustrated below, reflects a directorship with differentiated professional backgrounds and personal characteristics, who combine a broad spectrum of experience and expertise with a reputation for integrity. We believe our director nominees have the right mix of expertise to provide the Company with effective oversight.

| | | | | |

| INDEPENDENCE | GENDER/ETHNIC DIVERSITY |

| | | | | |

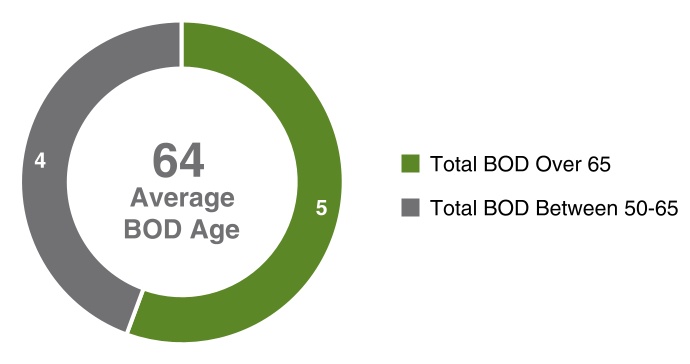

| AGE | BALANCED DIRECTOR TENURE |

Note: The above statistics assume all director nominees are elected at the Annual Meeting and give effect to the resignation from the Board of Scott D. Ferguson on February 28, 2024, and the Board’s decision not to renominate James J. Barber, Jr. and David A. Toy.

COMMITMENT TO BOARD REFRESHMENT

In the past two years, we have refreshed our board positions and, in the process, added two new directors. The Board believes that a degree of refreshment is important to align Board composition with the changing needs of the Company and the Board, and regularly considers fresh viewpoints and perspectives. The Board also believes that directors develop an understanding of the Company and an ability to work effectively as a group over time and, therefore, a significant degree of continuity year-over-year should be expected.

| | | | | |

4 | US FOODS HOLDING CORP. | 2024 PROXY STATEMENT |

QUALIFICATIONS AND RELEVANT EXPERIENCE

The Board is comprised of individuals with experience in key areas relevant to US Foods. Each director nominee was nominated based on the unique experience, qualifications, and skills that he or she brings to the Board. This blend of diverse backgrounds provides the Board with the benefit of a broad array of perspectives. The table below highlights some of the experience and skills (as defined below) embodied by our director nominees. If an individual is not listed as having a particular attribute, it does not signify a director’s lack of ability to contribute in such area.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Director | Bachelder | Dutkowsky | Flitman | Gottschalk | Gupta | Pforzheimer | Roach | Tehle | Ziegler |

| | | | | | | | | |

Committee Membership1 |

| | | | | | | | | | |

| Audit Committee | | | | l | | l | | l | |

| Compensation and Human Capital Committee | l | | | | | | l | l | |

| Executive Committee | l | l | | | | | | l | l |

| Nominating and Corporate Governance Committee | | | | l | l | | | | l |

| Knowledge, Skills, and Experience |

| | | | | | | | | | |

| Food Industry | ü | | ü | ü | | ü | ü | ü | ü |

| Supply Chain and Logistics | | ü | ü | | | | ü | | |

| CEO Leadership | ü | ü | ü | ü | | ü | | | |

| Sustainability and Corporate Responsibility | | ü | ü | | ü | ü | ü | | ü |

| Accounting/Finance | ü | | | « | ü | | | « | ü |

| Risk Management | ü | ü | ü | ü | ü | ü | ü | ü | ü |

| Technology | | ü | | | ü | | ü | ü | ü |

| Marketing and Strategy | ü | ü | ü | ü | ü | | | | |

| Human Capital Management | ü | ü | ü | ü | ü | ü | ü | ü | ü |

| Other Public Company Board(s) | ü | ü | ü | ü | | ü | | ü | ü |

| Demographics |

| | | | | | | | | | |

| GENDER |

| Male | | ü | ü | | ü | ü | ü | ü | |

| Female | ü | | | ü | | | | | ü |

| RACE/ETHNICITY |

| American Indian or Alaska Native | | | | | | | | | |

| Asian | | | | | ü | | ü | | |

| Black or African American | | | | | | | ü | | |

| Hispanic or Latino | | | | | | | | | |

| Native Hawaiian or Other Pacific Islander | | | | | | | | | |

| White / Caucasian | ü | ü | ü | ü | | ü | | ü | ü |

« = director designated as an audit committee “financial expert”

(1)Committee membership assumes all director nominees are elected at the Annual Meeting and gives effect to the resignation from the Board of Mr. Ferguson and the departure of Mr. Barber and Mr. Toy. Mr. Barber, who currently serves on the Compensation and Human Capital Committee, and Mr. Toy, who currently serves on the Audit Committee, are not included in the above table as they were not nominated for reelection by the Board.

| | | | | |

| US FOODS HOLDING CORP. | 2024 PROXY STATEMENT | 5 |

| | | | | |

| WHAT THESE SKILLS BRING TO US FOODS: |

| |

| |

| Food Industry | Experience in the food industry provides the Board with an enhanced understanding of the industry and is highly important to strategic planning and risk oversight of our business and operations. |

| |

| |

| Supply Chain and Logistics | Experience in supply chain management and logistics provides the Board with an enhanced understanding of a crucial aspect of the Company’s operations and is important to overseeing risk in our supply chain and operations. |

| |

| |

| CEO Leadership | CEO leadership experience brings different perspectives into the boardroom and is important for monitoring strategy, developing a high-performing executive leadership team, and capital allocation. |

| |

| |

| Sustainability and Corporate Responsibility | Sustainability and corporate responsibility experience is important for monitoring the environmental and corporate sustainability issues that are relevant to our Company, the sustainability of the communities in which we operate, and our related strategies and priorities. |

| |

| |

| Accounting/ Finance | Accounting and finance experience is important in overseeing our financial reporting, internal controls, and capital allocation, which are critical to our success. |

| |

| |

| Risk Management | Experience in risk management is critical in overseeing the risks we face today and anticipating emerging risks that could impact us in the future. |

| |

| |

| Technology | Experience in technology is important to assess the tools we utilize to support our business infrastructure, supply chain and customer service, and also to oversee cybersecurity and information security risks. |

| |

| |

| Marketing and Strategy | Marketing and strategy experience is important in understanding our growth strategy and customer-centric focus. |

| |

| |

| Human Capital Management | Human capital management experience is important for a large workforce like ours to assess compensation practices, diversity mix, talent, training programs, and corporate culture which we depend upon to attract and retain key personnel, to maintain good relationships with our associates, including the unions that represent some of our associates, and to motivate our associates to perform and create long-term shareholder value. |

| |

| |

| Other Public Company Board(s) | Experience in public company governance, expertise in the purpose and functioning of a board, and oversight of strategic planning and management team performance are all important to understanding and protecting stockholders’ interests. |

| |

| | | | | |

6 | US FOODS HOLDING CORP. | 2024 PROXY STATEMENT |

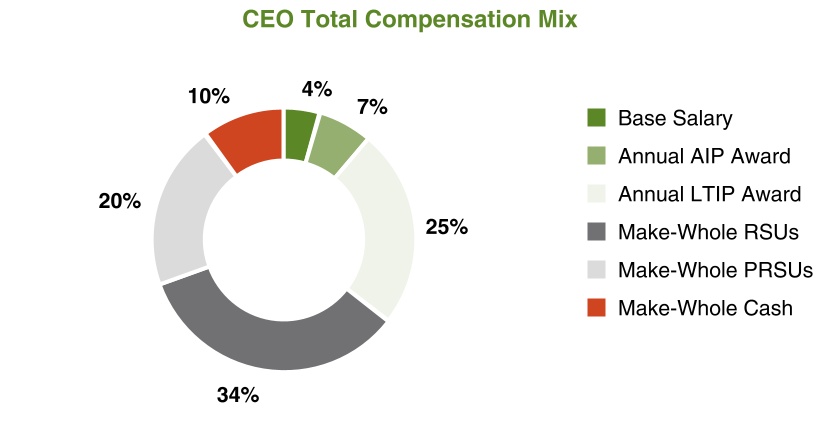

EXECUTIVE COMPENSATION HIGHLIGHTS

After reviewing market trends, evaluating our Say-on-Pay vote results, and receiving feedback from stockholders, the Compensation and Human Capital Committee determined that our fiscal year 2023 plan annual and long-term incentive plans should follow a similar structure to our fiscal year 2022 compensation design. The fiscal year 2023 plan design emphasized our strategic and operational priorities, and focused the Company and its management team on critical drivers of the Company’s future success.

| | | | | | | | | | | | | | | | | |

| | | | | |

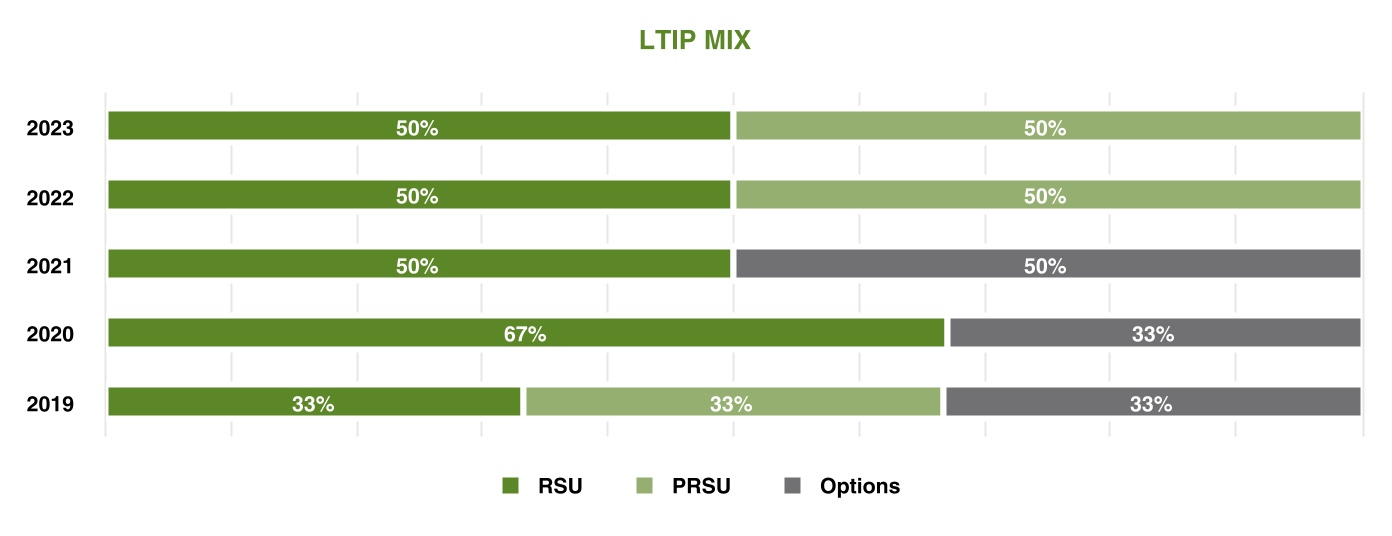

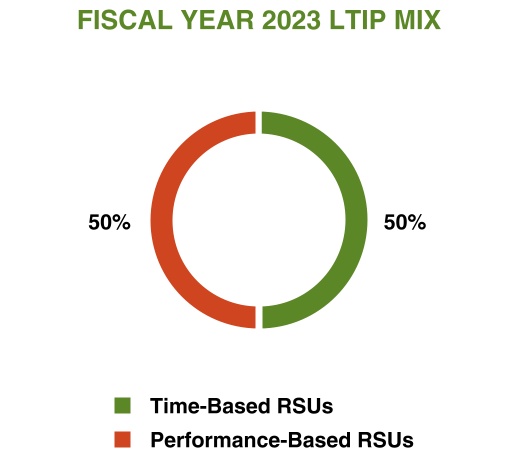

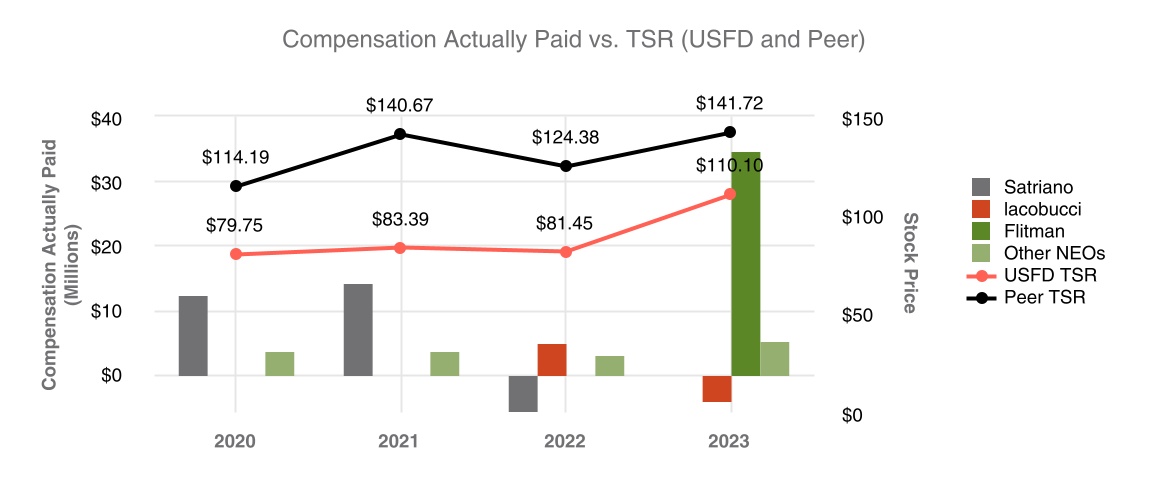

| 2023 Base Salary Highlights. No annual merit-based salary increases were provided to our executive officers in fiscal year 2023. Mr. Locascio, Mr. Tonnison, and Mr. Guberman were granted base salary increases in March 2023 to align their respective compensation levels to competitive market practices. 2023 Long-Term Equity Incentive Plan (“LTIP”) Highlights. Our 2023 LTIP equity grants consisted of a mix of time-based restricted stock units (“RSUs”) (50%) and performance-based RSUs (“PRSUs”) (50%). The 2023 PRSUs are subject to performance goals related to Adjusted EBITDA growth rate (70%) and Return on Invested Capital (“ROIC”) (30%). These performance metrics are directly linked to our long-term growth strategy, which we believe will drive shareholder value. Due to difficulty in establishing a single target annual growth rate for Adjusted EBITDA and ROIC for the 2023-2025 performance period, the 2023 PRSUs consist of different growth targets for each year in the three-year performance period (2023, 2024, and 2025). The ultimate vesting and payout at the end of the 2023-2025 performance period will be determined by a simple average of each year’s payout percentages. | | | 2023 Annual Incentive Plan (“AIP”) Highlights. In fiscal year 2023, our AIP performance goals were designed to highlight the Company’s need for continued top line growth and cost control, while sending a strong signal to the entire organization that operational improvements would be critical to the achievement of our long-range plan. Specifically, while maintaining the primary metric of Adjusted EBITDA (80%), the Compensation and Human Capital Committee replaced the secondary metric of local and national share improvement with a secondary metric based on improvement to our distribution cost per case (20%), calculated based on the Company’s variable and fixed costs excluding fuel (“Distribution Cost Per Case”). The Compensation and Human Capital Committee retained discretion to reduce or eliminate AIP bonus payments if, regardless of achievement against the performance metrics, the Company’s financial performance did not warrant such payments. Leadership Transition and Related Compensation Arrangements. In connection with Mr. Flitman’s appointment as CEO, we entered into compensation arrangements with Mr. Flitman. We also modified compensation arrangements with Mr. Iacobucci and Mr. Locascio, in order to compensate Mr. Iacobucci and Mr. Locascio for leadership and performance during a period of transition, and to ensure compensation aligned to their respective roles and tenure at the Company. | |

| | | | | |

IMPORTANT DATES FOR 2025 ANNUAL MEETING

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| Deadline to include stockholder proposals in our Proxy Statement On or before December 3, 2024 | | | Period to submit stockholder proposals not included in our Proxy Statement Between January 15, 2025 and February 14, 2025 | | | Period for stockholders to nominate director candidates for election Between January 15, 2025 and February 14, 2025 | |

| | | | | | | | |

| | | | | |

| US FOODS HOLDING CORP. | 2024 PROXY STATEMENT | 7 |

| | | | | | | | | | | | | | | | | |

| | | | | |

| PROPOSAL 1 | | | | ELECTION OF DIRECTORS Our business and affairs are managed under the direction of the Board. The Board is currently comprised of 11 directors, 10 of whom are independent under the corporate governance standards of the NYSE. All of our directors are subject to annual election. James J. Barber, Jr. and David A. Toy were not nominated to stand for election by the Board at the Annual Meeting. Based upon the recommendation of the Nominating and Corporate Governance Committee, the Board has nominated nine individuals to serve for one-year terms until the 2025 annual meeting of stockholders and until their respective successors are duly elected and qualified (or their earlier death, resignation, retirement, disqualification, or removal). Proxies solicited by the Board will be exercised for the election of each of the following nine nominees: Cheryl A. Bachelder, Robert M. Dutkowsky, David E. Flitman, Marla Gottschalk, Sunil Gupta, Carl Andrew Pforzheimer, Quentin Roach, David M. Tehle, and Ann E. Ziegler, unless you vote “against” one or more of the nominees or elect to abstain from voting |

| | | | |

| | | | |

| | | | |

| The Board of Directors recommends a VOTE FOR each of the Board’s director nominees on the proxy card. | | | |

| | | | |

| | | | |

| | | | | |

8 | US FOODS HOLDING CORP. | 2024 PROXY STATEMENT |

SKILLS, EXPERIENCE, AND COMMITMENT TO DIVERSITY

US Foods is proactive in seeking to ensure that its Board possesses, in the aggregate, the strategic, managerial, and financial skills and experience necessary to fulfill its duties and to achieve its objectives, while at the same time seeking to ensure that the Board is comprised of directors who have broad and diverse backgrounds, perspectives and experiences. The Board believes that a diverse Board is best able to effectively oversee our management and strategy and position US Foods to deliver long-term value for our stockholders. The Board actively seeks highly qualified individuals with varying backgrounds, expertise and experiences including individuals from underrepresented groups, as well as non-traditional backgrounds as part of its director search process. Additionally, with the assistance of the Nominating and Corporate Governance Committee, the Board regularly reviews trends in board composition, including on director diversity. We believe the current composition of the Board reflects a directorship with differentiated professional backgrounds and personal characteristics, who combine a broad spectrum of experience and expertise with a reputation for integrity.

Our Board is currently comprised of current and former chief executive officers, former chief financial officers, a current chief procurement officer, private equity investors, and a tenured business school professor. In the past two years, we have refreshed our Board positions with two new independent directors and, in the process, added diverse directors. Currently, three of our directors self-identify as female and two of our directors self-identify as racially or ethnically diverse.

Our Corporate Governance Guidelines provide that individuals will be considered for nomination to the Board based on their business and professional experience, judgment, sexual orientation, gender or gender identity, race and ethnicity, skills, background, and other unique characteristics as the Board deems appropriate. Accordingly, the Board is committed to actively seeking out highly qualified women and individuals from underrepresented groups as well as candidates with diverse or non-traditional backgrounds, skills, and experiences as part of the director search process.

Director candidates are required to demonstrate a reputation for integrity, strong values, discipline, high ethical standards, a commitment to full participation on the Board and its Committees, and relevant career experience, along with other skills and characteristics that meet the current needs of the Board. In selecting directors to our Board, the Nominating and Corporate Governance Committee and the Board consider whether candidates meet applicable independence standards where appropriate and evaluate any potential conflicts of interest with respect to each candidate.

Each nominee has consented to stand for election, and the Board does not anticipate that any nominee will be unavailable to serve. If a director nominee should become unavailable to serve at the time of the Annual Meeting, shares of Common Stock represented by proxy may be voted for the election of a substitute nominee to be designated by the Board. Alternatively, in lieu of designating a substitute, the Board may reduce the size of the Board accordingly.

| | | | | |

| US FOODS HOLDING CORP. | 2024 PROXY STATEMENT | 9 |

BACKGROUND AND EXPERIENCE OF DIRECTORS

The professional background and experience of each of the Company’s director nominees is provided below. We believe that our director nominees collectively provide an appropriate mix of experience and skills relevant to the size and nature of our business.

Nine nominees for election as directors with a term expiring at the 2025 Annual Meeting, to be elected by the holders of our Common Stock.

| | | | | |

| THE BOARD OF DIRECTORS RECOMMENDS A VOTE FOR EACH OF THE FOLLOWING NINE DIRECTOR NOMINEES. |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | |

| Cheryl A. Bachelder | | | | | | | Robert M. Dutkowsky | | | |

| | | | | | | | | |

| INDEPENDENT | | | | | | INDEPENDENT | | |

| | | | | | | | | | | |

| Age: 67 Director since: 2018 Committees: Compensation and Human Capital (Chair) Executive | | Other Current Public Company Directorships: None Past Public Company Directorships: Pier 1 Imports, Inc. | | | | | Age: 69 Director since: 2017 Committees: Executive (Chair) Other Current Public Company Directorships: Raymond James Financial, Inc. The Hershey Company | | Past Public Company Directorships: Pitney Bowes Inc. (Non-Executive Chair) Tech Data Corporation (Chairman) | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Ms. Bachelder is the retired Chief Executive Officer of Popeyes Louisiana Kitchen, Inc., a multinational restaurant operator and franchisor, serving in this role from October 2007 to March 2017, and Interim Chief Executive Officer of Pier 1 Imports, Inc., a home furnishings and decor retailer, serving in this role from December 2018 to November 2019. Pier 1 Imports filed for Chapter 11 bankruptcy in February 2020. Prior to her role with Popeyes and Pier 1 Imports, Ms. Bachelder served as President and Chief Concept Officer of KFC restaurants, a division of Yum! Brands, Inc. Ms. Bachelder’s earlier career included brand leadership roles at Domino’s Pizza, RJR Nabisco, Gillette, and Procter & Gamble. Ms. Bachelder currently serves on the board of directors, as Lead Director, of Chick-fil-A, Inc., a family-owned and privately held restaurant chain. | | | | | Mr. Dutkowsky has led our Board as Chair since February 2022, including serving as our Executive Chairman from May 2022 to January 2023. Mr. Dutkowsky is the former Executive Chairman of Tech Data Corporation, a technology distributor, serving in the role from 2018 to 2020. Mr. Dutkowsky previously served as Chief Executive Officer and Chairman of Tech Data from 2017 to 2018 and, prior to that, was Chief Executive Officer of Tech Data from 2006-2016. Prior to joining Tech Data, Mr. Dutkowsky served as President, Chief Executive Officer, and Chairman of the Board of Directors of Egenera, Inc., a software company, from 2004 until 2006; President, Chief Executive Officer, and Chairman of the Board of Directors of J.D. Edwards & Co., Inc., a software company, from 2002 until 2004; and President, Chief Executive Officer, Chairman of the Board of Directors of GenRad, Inc., an electric equipment manufacturer, from 2000 until 2002. Mr. Dutkowsky also served as both Executive Vice President, Markets and Channels from 1997 to 1999 and President, Data General in 1999, at EMC Corporation, a data storage manufacturer. Mr. Dutkowsky began his career at IBM, a technology company, where he served in several senior management positions. | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Skills and Qualifications: ■Ms. Bachelder is an accomplished executive, with extensive experience in the food industry and a track record of creating strong brand value. ■Her expertise provides valuable insights as US Foods executes on its Great Food. Made Easy.® strategy. ■She is an experienced public company director, with expertise in human capital management, including oversight of incentive compensation. | | | | | Skills and Qualifications: ■Mr. Dutkowsky has substantial senior executive leadership experience. ■He also has substantial experience in distribution, providing valuable governance perspectives based on his experience as a board member and chairman of numerous public and private companies across a wide range of industries. ■He also brings human capital management expertise to the Board, including oversight of incentive compensation. | |

| | | | | |

10 | US FOODS HOLDING CORP. | 2024 PROXY STATEMENT |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | |

| David E. Flitman | | | | | | | Marla Gottschalk | | | |

| | | | | | | | | |

| | | | | | | INDEPENDENT | | |

| | | | | | | | | | | |

| Age: 59 Director since: 2023 Committees: None Other Current Public Company Directorships: None | | Past Public Company Directorships: Veritiv Corporation Builders FirstSource, Inc. BMC Stock Holdings, Inc. | | | | | Age: 63 Director since: 2022 Committees: Audit Nominating and Corporate Governance | | Other Current Public Company Directorships: Reynolds Consumer Products Inc. Big Lots, Inc. Past Public Company Directorships: Potbelly Corporation | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Mr. Flitman has served as the Chief Executive Officer since January 2023. Prior to joining US Foods, Mr. Flitman was President and Chief Executive Officer of Builders FirstSource, the largest U.S. supplier of building products, prefabricated components, and value-added services with annual revenues of approximately $20 billion, serving from April 2021 to November 2022. Mr. Flitman also served as President and Chief Executive Officer of BMC Stock Holdings, from September 2018 until the merger of the two companies. Prior to BMC, Mr. Flitman served as Executive Vice President of Performance Food Group Company, a family of leading foodservice distributors, and President and Chief Executive Officer of its Performance Foodservice division from January 2015 to September 2018. Prior to Performance Food Group, Mr. Flitman served as Chief Operating Officer and President, USA & Mexico of Univar Corporation, a global chemical distributor, from January 2014 to December 2014 after joining Univar in December 2012 as President USA with additional responsibility for Univar’s Global Supply Chain & Export Services teams. He had also served as Executive Vice President and President, Water and Process Services at Ecolab Inc., the global leader in water, hygiene and energy technologies and services, from November 2011 to September 2012, and previously Senior Executive Vice President of Nalco Holding Company from August 2008 until it was acquired by Ecolab in November 2011. From February 2005 to July 2008, Mr. Flitman served as President of Allegheny Power System, an electric utility that served customers in Pennsylvania, West Virginia, Virginia, and Maryland. Prior to this, Mr. Flitman had nearly 20 years in operational, commercial, and global business leadership positions at DuPont, a science and technology-based company. | | | | | Ms. Gottschalk is the former Chief Executive Officer of The Pampered Chef Ltd., the premiere direct seller of high-quality kitchen and entertaining products, serving in the role from 2006 to 2013. Prior to her role as Chief Executive Officer, Ms. Gottschalk served as President and Chief Operating Officer of The Pampered Chef from 2003 to 2006. Prior to The Pampered Chef, Ms. Gottschalk served in a variety of senior roles at Kraft Foods, one of the largest global food and beverage companies, including as Senior Vice President of Financial Planning and Investor Relations, Executive Vice President and General Manager of the Post Cereal division, and Vice President of Marketing and Strategy of the Kraft Cheese Division. Ms. Gottschalk currently serves as a member of the board

of directors of privately held UL Solutions Inc., a global leader in

applied safety science delivering testing, inspection, certification

and software services, and as a member of the board of directors of two publicly traded companies — Reynolds Consumer Products Inc. and Big Lots, Inc. | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Skills and Qualifications: ■As an experienced public company CEO, Mr. Flitman brings a wealth of global business leadership experience, executive management skills and extensive commercial distribution experience across multiple industries, including food distribution. ■Mr. Flitman has a proven track record of driving operational excellence, profitable growth, shareholder returns and a people-centric, high-performing culture. | | | | | Skills and Qualifications: ■Ms. Gottschalk is an accomplished executive with more than 25 years of experience in Consumer Products. ■Ms. Gottschalk is a Chartered Professional Accountant and is designated as a financial expert (for Audit Committee purposes). ■Ms. Gottschalk is an experienced public company director.

| |

| | | | | |

| US FOODS HOLDING CORP. | 2024 PROXY STATEMENT | 11 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | |

| Sunil Gupta | | | | | | | Carl Andrew Pforzheimer | | | |

| | | | | | | | | |

| INDEPENDENT | | | | | | INDEPENDENT | | |

| | | | | | | | | | | |

| Age: 65 Director since: 2018 Committees: Nominating and Corporate Governance | | Other Current Public Company Directorships: None Past Public Company Directorships: None | | | | | Age: 62 Director since: 2017 Committees: Audit Other Current Public Company Directorships: None | | Past Public Company Directorships: Tastemaker Acquisition Corp | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Prof. Gupta is the Edward W. Carter Professor of Business Administration at Harvard Business School, serving in the role since 2007. Prof. Gupta currently serves as Co-Chair of the Driving Digital Strategy executive program at Harvard Business School, serving in the role since 2013. Prof. Gupta previously served as the Chair of the General Management Program for senior executives at Harvard Business School from 2013 to 2019 and, prior to that, served as the Chair of Harvard Business School’s Marketing Department from 2008 to 2013. Before joining Harvard Business School, Prof. Gupta held a number of positions at Columbia University’s Graduate School of Business, including serving as the Meyer Feldberg Professor of Business from 2000 to 2006. | | | | | Mr. Pforzheimer is a lecturer at Harvard Business School, where he teaches a course on the restaurant industry. Prior to that,

Mr. Pforzheimer was the co-Chief Executive Officer of Tastemaker Acquisition Corp., a special-purpose corporation formed to make investments in the restaurant and hospitality industry. Previously, Mr. Pforzheimer founded Barteca Holdings, LLC, a multi-location restaurant group, where he served as Chief Executive Officer from 1995 until August 2016. Mr. Pforzheimer previously served on the board of directors of Tastemaker Acquisition Corp. from August 2020 until June 2023, and previously served as Chairman of the Board of Directors of Barteca from March 2012 until 2018. Mr. Pforzheimer currently serves, and has served, on the boards of directors of several private restaurant companies throughout the United States, including as Lead Director at Wisely, Inc., a restaurant technology company serving leading fast casual and full-service restaurant chains across the country, until its acquisition by Olo Inc., a leading on-demand commerce platform, at the end of 2021. Mr. Pforzheimer is a member of the Education Policy Committee of the Culinary Institute of America and has also served on the board of directors of the Connecticut Restaurant Association. | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Skills and Qualifications: ■Prof. Gupta has over 30 years of research, teaching, and consulting experience in marketing and strategy, including over 10 years in digital marketing, and brings expertise in finance and risk assessment to the Board. ■He has a Ph.D. in Marketing from Columbia University. ■Prof. Gupta’s current research is in the area of digital technology and its impact on consumer behavior and firm strategy. | | | | | Skills and Qualifications: ■Mr. Pforzheimer is a successful restaurateur with significant food industry leadership and customer service experience, providing the Board with unique insights into the restaurant and hospitality industries. ■He has substantive experience in sustainability, risk management and human capital management and provides the Board with valuable perspectives in these areas and others based on his executive leadership experience with independent restaurants. ■Mr. Pforzheimer provides our Board with unique insights into the restaurant and hospitality industries. | |

| | | | | |

12 | US FOODS HOLDING CORP. | 2024 PROXY STATEMENT |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | |

| Quentin Roach | | | | | | | David M. Tehle | | | |

| | | | | | | | | |

| INDEPENDENT | | | | | | INDEPENDENT | | |

| | | | | | | | | | | |

| Age: 57 Director since: 2022 Committees: Compensation and Human Capital | | Other Current Public Company Directorships: None Past Public Company Directorships: None | | | | | Age: 67 Director since: 2016 Committees: Audit (Chair) Compensation and Human Capital Executive | | Other Current Public Company Directorships: National Vision Holdings, Inc. Past Public Company Directorships: Genesco Inc. Jack in the Box Inc. | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Mr. Roach is the Senior Vice President and Chief Procurement Officer at the Estée Lauder Companies, Inc., a leading prestige beauty company with a worldwide reputation for elegance, luxury and superior quality, working across the Global Value Chain (Supply Chain Management and Research and Development) and leading luxury brands to deliver innovation, customer enthusiasm and sustainable value-creation. Previously, Mr. Roach served as Senior Vice President and Chief Procurement Officer at Mondelēz International, Inc., an American multinational confectionery, food, holding, and beverage and snack food company, from 2020-2022, overseeing company-wide expenditures, working capital management, risk mitigation processes, supply chain ESG initiatives, supplier performance management and innovation improvements. Prior to that, he was the Chief Procurement Officer and Senior Vice President of Global Supplier Management and Workplace Enterprise Services at Merck & Co., Inc., a publicly traded pharmaceutical company, serving in the role from 2016-2020, and various other leadership roles at Merck & Co., from 2011-2016, the Senior Vice President and Chief Procurement Officer at Bristol Myers Squibb, a publicly traded pharmaceutical company, serving in the role from 2008 to 2011. From 2002 to 2008, Mr. Roach served in positions of increasing responsibility, including those related to supply chain management, at Bausch & Lomb, Strong Health, Delphi Corporation and General Motors Corporation. | | | | | Mr. Tehle is the retired Executive Vice President and Chief Financial Officer of Dollar General Corporation, a publicly traded retailer, serving in the role from 2004 to 2015 to. Prior to Dollar General, Mr. Tehle was Chief Financial Officer of Haggar Corporation from 1997 to 2004 and held finance positions at several companies, including Ryder System, Inc., a transportation and logistics company, and Texas Instruments Incorporated, a semiconductor design and manufacturing company. Mr. Tehle currently serves on the board of directors of National Vision Holdings, Inc., a publicly traded optical retail company. He previously served on the boards of directors of Genesco, Inc., a publicly traded footwear focused specialty retail company, and Jack in the Box, Inc., a publicly traded quick service burger chain. | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Skills and Qualifications: ■Mr. Roach has substantial executive leadership experience across a number of industries and sectors. ■He has deep expertise in supplier relationship management, sourcing strategies and material procurement. ■Mr. Roach has extensive knowledge of risk management and business planning to improve organizational growth prospects. | | | | | Skills and Qualifications: ■Mr. Tehle has extensive knowledge of financial reporting, internal controls and procedures, and risk management. He also has experience with human capital management, including compensation oversight. ■He brings significant public company experience to the Board in addition to significant experience as chief financial officer of a public company. Mr. Tehle is designated as a financial expert (for Audit Committee purposes). | |

| | | | | |

| US FOODS HOLDING CORP. | 2024 PROXY STATEMENT | 13 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | |

| Ann E. Ziegler | | | | | | | | | | |

| | | | | | | | | |

| INDEPENDENT | | | | | | | | |

| | | | | | | | | | | |

| Age: 65 Director since: 2018 Committees: Nominating and Corporate Governance (Chair) Executive Other Current Public Company Directorships: Reynolds Consumer Products Inc. Wolters Kluwer N.V. | | Past Public Company Directorships: Groupon, Inc. Hanesbrands Inc. | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Ms. Ziegler is the former Senior Vice President and Chief Financial Officer of CDW Corporation, a technology solutions provider, serving in the role from 2008 to 2017. From 2005 until 2008, Ms. Ziegler served as Senior Vice President, Administration and Chief Financial Officer of Sara Lee Food and Beverage, a division of Sara Lee Corporation, a global consumer goods company. From 2003 until 2005, Ms. Ziegler served as Chief Financial Officer of Sara Lee Bakery Group. From 2000 until 2003, Ms. Ziegler served as Senior Vice president, Corporate Development of Sara Lee. Prior to joining Sara Lee, Ms. Ziegler was a corporate attorney at the law firm Skadden, Arps, Slate, Meagher & Flom. Ms. Ziegler has served on the boards of directors of Reynolds Consumer Products Inc., a leading provider of household products and publicly traded company, since 2020, as well as the Supervisory Board of Wolters Kluwer N.V., a global provider of information software and services, since 2017. Ms. Ziegler also serves on the Board of Governors of the Smart Museum of Art of the University of Chicago. Ms. Ziegler previously served on the board of directors of Groupon, Inc., a publicly traded local marketplace company, and Hanesbrands, Inc., a publicly traded apparel company. | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Skills and Qualifications: ■Ms. Ziegler brings significant executive leadership experience in the food and technology industries. ■She has extensive knowledge of financial reporting, internal controls and procedures, risk management, corporate development, and mergers and acquisitions. ■She brings significant public company experience to the Board, in addition to significant experience as a chief financial officer of a public company. | | | | | | |

| | | | | |

14 | US FOODS HOLDING CORP. | 2024 PROXY STATEMENT |

DIRECTOR NOMINATING PROCESS

The Nominating and Corporate Governance Committee recommends candidates to the Board it believes are qualified and suitable to become members of the Board. The Nominating and Corporate Governance Committee also considers the performance of incumbent directors in determining whether to recommend them for reelection. Recommendations may be received by the Nominating and Corporate Governance Committee from various sources, including current and former directors, a search firm retained by the Nominating and Corporate Governance Committee, stockholders, Company executives, and candidates themselves.

In the case of a vacancy on the Board, including a vacancy created by an increase in the size of the Board, the Nominating and Corporate Governance Committee will recommend to the Board an individual to fill the vacancy.

STOCKHOLDER NOMINATIONS

Stockholders who wish to identify director candidates for consideration by the Nominating and Corporate Governance Committee should write to the address provided in the section entitled “Communications with Our Directors” on page 24. Stockholders may also nominate directors for election to the Board as described in the section entitled “Stockholder Proposals for the 2025 Annual Meeting” on page 82. All submissions should comply with the requirements set forth in our Bylaws. The Nominating and Corporate Governance Committee does not have a separate, formal policy on the consideration of director candidates recommended by stockholders. The Board believes that it is more appropriate to provide the Nominating and Corporate Governance Committee flexibility in evaluating stockholder recommendations. In the event that a director nominee is recommended by a stockholder, the Nominating and Corporate Governance Committee will give due consideration to the director nominee and will use the same criteria used for evaluating individuals nominated by the Board, in addition to considering the information relating to the director nominee provided by the stockholder.

| | | | | |

| US FOODS HOLDING CORP. | 2024 PROXY STATEMENT | 15 |

CORPORATE GOVERNANCE

OUR CORPORATE GOVERNANCE PRINCIPLES