be-20210930000166470312/312021Q3FALSEhttp://fasb.org/us-gaap/2021-01-31#AccountingStandardsUpdate202006Member0.0616808P20D00016647032021-01-012021-09-30xbrli:shares0001664703us-gaap:CommonClassAMember2021-10-270001664703us-gaap:CommonClassBMember2021-10-27iso4217:USD00016647032021-09-3000016647032020-12-31iso4217:USDxbrli:shares0001664703us-gaap:CommonClassAMember2020-12-310001664703us-gaap:CommonClassBMember2021-09-300001664703us-gaap:CommonClassAMember2021-09-300001664703us-gaap:CommonClassBMember2020-12-310001664703us-gaap:ProductMember2021-07-012021-09-300001664703us-gaap:ProductMember2020-07-012020-09-300001664703us-gaap:ProductMember2021-01-012021-09-300001664703us-gaap:ProductMember2020-01-012020-09-300001664703be:InstallationMember2021-07-012021-09-300001664703be:InstallationMember2020-07-012020-09-300001664703be:InstallationMember2021-01-012021-09-300001664703be:InstallationMember2020-01-012020-09-300001664703us-gaap:ServiceMember2021-07-012021-09-300001664703us-gaap:ServiceMember2020-07-012020-09-300001664703us-gaap:ServiceMember2021-01-012021-09-300001664703us-gaap:ServiceMember2020-01-012020-09-300001664703us-gaap:ElectricityMember2021-07-012021-09-300001664703us-gaap:ElectricityMember2020-07-012020-09-300001664703us-gaap:ElectricityMember2021-01-012021-09-300001664703us-gaap:ElectricityMember2020-01-012020-09-3000016647032021-07-012021-09-3000016647032020-07-012020-09-3000016647032020-01-012020-09-300001664703be:RedeemableNoncontrollingInterestMember2021-06-300001664703us-gaap:CommonStockMember2021-06-300001664703us-gaap:AdditionalPaidInCapitalMember2021-06-300001664703us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-06-300001664703us-gaap:RetainedEarningsMember2021-06-300001664703us-gaap:ParentMember2021-06-300001664703us-gaap:NoncontrollingInterestMember2021-06-300001664703us-gaap:CommonStockMember2021-07-012021-09-300001664703us-gaap:ParentMember2021-07-012021-09-300001664703us-gaap:AdditionalPaidInCapitalMember2021-07-012021-09-300001664703us-gaap:NoncontrollingInterestMember2021-07-012021-09-300001664703be:RedeemableNoncontrollingInterestMember2021-07-012021-09-300001664703us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-07-012021-09-300001664703us-gaap:RetainedEarningsMember2021-07-012021-09-300001664703be:RedeemableNoncontrollingInterestMember2021-09-300001664703us-gaap:CommonStockMember2021-09-300001664703us-gaap:AdditionalPaidInCapitalMember2021-09-300001664703us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-09-300001664703us-gaap:RetainedEarningsMember2021-09-300001664703us-gaap:ParentMember2021-09-300001664703us-gaap:NoncontrollingInterestMember2021-09-300001664703be:RedeemableNoncontrollingInterestMember2020-06-300001664703us-gaap:CommonStockMember2020-06-300001664703us-gaap:AdditionalPaidInCapitalMember2020-06-300001664703us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-06-300001664703us-gaap:RetainedEarningsMember2020-06-300001664703us-gaap:ParentMember2020-06-300001664703us-gaap:NoncontrollingInterestMember2020-06-300001664703us-gaap:CommonStockMember2020-07-012020-09-300001664703us-gaap:AdditionalPaidInCapitalMember2020-07-012020-09-300001664703us-gaap:ParentMember2020-07-012020-09-300001664703us-gaap:NoncontrollingInterestMember2020-07-012020-09-300001664703be:RedeemableNoncontrollingInterestMember2020-07-012020-09-300001664703us-gaap:RetainedEarningsMember2020-07-012020-09-300001664703be:RedeemableNoncontrollingInterestMember2020-09-300001664703us-gaap:CommonStockMember2020-09-300001664703us-gaap:AdditionalPaidInCapitalMember2020-09-300001664703us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-09-300001664703us-gaap:RetainedEarningsMember2020-09-300001664703us-gaap:ParentMember2020-09-300001664703us-gaap:NoncontrollingInterestMember2020-09-300001664703be:RedeemableNoncontrollingInterestMember2020-12-310001664703us-gaap:CommonStockMember2020-12-310001664703us-gaap:AdditionalPaidInCapitalMember2020-12-310001664703us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-12-310001664703us-gaap:RetainedEarningsMember2020-12-310001664703us-gaap:ParentMember2020-12-310001664703us-gaap:NoncontrollingInterestMember2020-12-3100016647032020-01-012020-12-310001664703us-gaap:AdditionalPaidInCapitalMembersrt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2020-12-310001664703us-gaap:RetainedEarningsMembersrt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2020-12-310001664703srt:CumulativeEffectPeriodOfAdoptionAdjustmentMemberus-gaap:ParentMember2020-12-310001664703us-gaap:CommonStockMember2021-01-012021-09-300001664703us-gaap:AdditionalPaidInCapitalMember2021-01-012021-09-300001664703us-gaap:ParentMember2021-01-012021-09-300001664703us-gaap:NoncontrollingInterestMember2021-01-012021-09-300001664703be:RedeemableNoncontrollingInterestMember2021-01-012021-09-300001664703us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-01-012021-09-300001664703us-gaap:RetainedEarningsMember2021-01-012021-09-300001664703be:RedeemableNoncontrollingInterestMember2019-12-310001664703us-gaap:CommonStockMember2019-12-310001664703us-gaap:AdditionalPaidInCapitalMember2019-12-310001664703us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-12-310001664703us-gaap:RetainedEarningsMember2019-12-310001664703us-gaap:ParentMember2019-12-310001664703us-gaap:NoncontrollingInterestMember2019-12-310001664703us-gaap:CommonStockMember2020-01-012020-09-300001664703us-gaap:AdditionalPaidInCapitalMember2020-01-012020-09-300001664703us-gaap:ParentMember2020-01-012020-09-300001664703us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-01-012020-09-300001664703us-gaap:NoncontrollingInterestMember2020-01-012020-09-300001664703be:RedeemableNoncontrollingInterestMember2020-01-012020-09-300001664703us-gaap:RetainedEarningsMember2020-01-012020-09-3000016647032019-12-3100016647032020-09-30xbrli:pure0001664703be:ConvertiblePromissoryNotesInterestRate10DueDecember2021Memberus-gaap:ConvertibleNotesPayableMember2021-09-300001664703be:ConvertiblePromissoryNotesInterestRate10DueDecember2021Memberus-gaap:ConvertibleNotesPayableMember2020-12-310001664703be:ConvertiblePromissoryNotesInterestRate10DueDecember2021Memberus-gaap:ConvertibleNotesPayableMember2021-01-012021-09-300001664703be:ConvertiblePromissoryNotesInterestRate10DueDecember2021Memberus-gaap:ConvertibleNotesPayableMember2020-01-012020-09-300001664703be:RecourseDebtMember2021-09-300001664703us-gaap:SubsequentEventMember2021-10-232021-10-230001664703us-gaap:SeriesAPreferredStockMemberus-gaap:SubsequentEventMember2021-10-230001664703us-gaap:SubsequentEventMember2021-10-230001664703srt:AsiaPacificMemberus-gaap:SalesRevenueNetMemberus-gaap:GeographicConcentrationRiskMember2021-07-012021-09-300001664703srt:AsiaPacificMemberus-gaap:SalesRevenueNetMemberus-gaap:GeographicConcentrationRiskMember2021-01-012021-09-300001664703srt:AsiaPacificMemberus-gaap:SalesRevenueNetMemberus-gaap:GeographicConcentrationRiskMember2020-07-012020-09-300001664703srt:AsiaPacificMemberus-gaap:SalesRevenueNetMemberus-gaap:GeographicConcentrationRiskMember2020-01-012020-09-300001664703us-gaap:AccountsReceivableMemberbe:SKEcoplantMemberus-gaap:CustomerConcentrationRiskMember2021-01-012021-09-300001664703us-gaap:AccountsReceivableMemberbe:SKEcoplantMemberus-gaap:CustomerConcentrationRiskMember2020-01-012020-12-310001664703us-gaap:AccountsReceivableMemberbe:RADBloomProjectLLCMemberus-gaap:CustomerConcentrationRiskMember2021-01-012021-09-300001664703us-gaap:AccountsReceivableMemberbe:RADBloomProjectLLCMemberus-gaap:CustomerConcentrationRiskMember2020-01-012020-12-310001664703us-gaap:AccountsReceivableMemberbe:BronxCommunityCleanEnergyProjectMemberus-gaap:CustomerConcentrationRiskMember2021-01-012021-09-300001664703us-gaap:AccountsReceivableMemberbe:BronxCommunityCleanEnergyProjectMemberus-gaap:CustomerConcentrationRiskMember2020-01-012020-12-310001664703be:CustomerOneMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2021-07-012021-09-300001664703be:CustomerOneMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2021-01-012021-09-300001664703be:CustomerTwoMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2021-01-012021-09-300001664703srt:MinimumMember2021-01-012021-09-300001664703srt:MaximumMember2021-01-012021-09-300001664703us-gaap:EquityMethodInvesteeMember2021-09-300001664703us-gaap:SeniorNotesMemberbe:GreenConvertibleSeniorNotesMember2020-08-310001664703us-gaap:SeniorNotesMemberus-gaap:AccountingStandardsUpdate202006Memberbe:GreenConvertibleSeniorNotesMember2021-01-0100016647032021-06-3000016647032020-06-300001664703us-gaap:CashMember2021-09-300001664703us-gaap:CashMember2020-12-310001664703us-gaap:MoneyMarketFundsMember2021-09-300001664703us-gaap:MoneyMarketFundsMember2020-12-310001664703srt:ConsolidatedEntityExcludingVariableInterestEntitiesVIEMember2021-09-300001664703srt:ConsolidatedEntityExcludingVariableInterestEntitiesVIEMember2020-12-310001664703us-gaap:VariableInterestEntityPrimaryBeneficiaryMemberbe:PowerPurchaseAgreementsEntitiesMember2021-09-300001664703us-gaap:VariableInterestEntityPrimaryBeneficiaryMemberbe:PowerPurchaseAgreementsEntitiesMember2020-12-310001664703us-gaap:VariableInterestEntityPrimaryBeneficiaryMemberbe:PowerPurchaseAgreementCompany2Member2021-09-300001664703us-gaap:VariableInterestEntityPrimaryBeneficiaryMemberbe:PowerPurchaseAgreementCompany3bMember2021-09-300001664703us-gaap:VariableInterestEntityPrimaryBeneficiaryMemberbe:PowerPurchaseAgreementCompany2Member2020-12-310001664703us-gaap:VariableInterestEntityPrimaryBeneficiaryMemberbe:PowerPurchaseAgreementCompany3bMember2020-12-310001664703us-gaap:FairValueInputsLevel1Memberus-gaap:MoneyMarketFundsMember2021-09-300001664703us-gaap:FairValueInputsLevel2Memberus-gaap:MoneyMarketFundsMember2021-09-300001664703us-gaap:FairValueInputsLevel3Memberus-gaap:MoneyMarketFundsMember2021-09-300001664703us-gaap:FairValueInputsLevel1Member2021-09-300001664703us-gaap:FairValueInputsLevel2Member2021-09-300001664703us-gaap:FairValueInputsLevel3Member2021-09-300001664703us-gaap:FairValueInputsLevel1Memberus-gaap:EmbeddedDerivativeFinancialInstrumentsMember2021-09-300001664703us-gaap:FairValueInputsLevel2Memberus-gaap:EmbeddedDerivativeFinancialInstrumentsMember2021-09-300001664703us-gaap:FairValueInputsLevel3Memberus-gaap:EmbeddedDerivativeFinancialInstrumentsMember2021-09-300001664703us-gaap:EmbeddedDerivativeFinancialInstrumentsMember2021-09-300001664703us-gaap:InterestRateSwapMemberus-gaap:FairValueInputsLevel1Member2021-09-300001664703us-gaap:InterestRateSwapMemberus-gaap:FairValueInputsLevel2Member2021-09-300001664703us-gaap:InterestRateSwapMemberus-gaap:FairValueInputsLevel3Member2021-09-300001664703us-gaap:InterestRateSwapMember2021-09-300001664703us-gaap:FairValueInputsLevel1Memberus-gaap:MoneyMarketFundsMember2020-12-310001664703us-gaap:FairValueInputsLevel2Memberus-gaap:MoneyMarketFundsMember2020-12-310001664703us-gaap:FairValueInputsLevel3Memberus-gaap:MoneyMarketFundsMember2020-12-310001664703us-gaap:FairValueInputsLevel1Member2020-12-310001664703us-gaap:FairValueInputsLevel2Member2020-12-310001664703us-gaap:FairValueInputsLevel3Member2020-12-310001664703us-gaap:FairValueInputsLevel1Memberus-gaap:ForwardContractsMember2020-12-310001664703us-gaap:FairValueInputsLevel2Memberus-gaap:ForwardContractsMember2020-12-310001664703us-gaap:FairValueInputsLevel3Memberus-gaap:ForwardContractsMember2020-12-310001664703us-gaap:ForwardContractsMember2020-12-310001664703us-gaap:FairValueInputsLevel1Memberus-gaap:EmbeddedDerivativeFinancialInstrumentsMember2020-12-310001664703us-gaap:FairValueInputsLevel2Memberus-gaap:EmbeddedDerivativeFinancialInstrumentsMember2020-12-310001664703us-gaap:FairValueInputsLevel3Memberus-gaap:EmbeddedDerivativeFinancialInstrumentsMember2020-12-310001664703us-gaap:EmbeddedDerivativeFinancialInstrumentsMember2020-12-310001664703us-gaap:InterestRateSwapMemberus-gaap:FairValueInputsLevel1Member2020-12-310001664703us-gaap:InterestRateSwapMemberus-gaap:FairValueInputsLevel2Member2020-12-310001664703us-gaap:InterestRateSwapMemberus-gaap:FairValueInputsLevel3Member2020-12-310001664703us-gaap:InterestRateSwapMember2020-12-310001664703us-gaap:NondesignatedMemberus-gaap:EnergyRelatedDerivativeMember2021-07-012021-09-300001664703us-gaap:NondesignatedMemberus-gaap:EnergyRelatedDerivativeMember2020-07-012020-09-300001664703us-gaap:NondesignatedMemberus-gaap:EnergyRelatedDerivativeMember2021-01-012021-09-300001664703us-gaap:NondesignatedMemberus-gaap:EnergyRelatedDerivativeMember2020-01-012020-09-300001664703us-gaap:EnergyRelatedDerivativeMember2019-12-310001664703us-gaap:EmbeddedDerivativeFinancialInstrumentsMember2019-12-310001664703us-gaap:EnergyRelatedDerivativeMember2020-01-012020-12-310001664703us-gaap:EmbeddedDerivativeFinancialInstrumentsMember2020-01-012020-12-310001664703us-gaap:EnergyRelatedDerivativeMember2020-12-310001664703us-gaap:EnergyRelatedDerivativeMember2021-01-012021-09-300001664703us-gaap:EmbeddedDerivativeFinancialInstrumentsMember2021-01-012021-09-300001664703us-gaap:EnergyRelatedDerivativeMember2021-09-300001664703be:LeaseReceivableMemberus-gaap:CarryingReportedAmountFairValueDisclosureMember2021-09-300001664703be:LeaseReceivableMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2021-09-300001664703be:LeaseReceivableMemberus-gaap:CarryingReportedAmountFairValueDisclosureMember2020-12-310001664703be:LeaseReceivableMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2020-12-310001664703us-gaap:NotesPayableOtherPayablesMemberbe:SeniorSecuredNotesDueMarch2027RecourseMember2021-09-300001664703us-gaap:NotesPayableOtherPayablesMemberbe:SeniorSecuredNotesDueMarch2027RecourseMember2020-12-310001664703us-gaap:NotesPayableOtherPayablesMemberbe:SeniorSecuredNotesDueMarch2027RecourseMemberus-gaap:CarryingReportedAmountFairValueDisclosureMember2021-09-300001664703us-gaap:NotesPayableOtherPayablesMemberbe:SeniorSecuredNotesDueMarch2027RecourseMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2021-09-300001664703us-gaap:NotesPayableOtherPayablesMemberbe:SeniorSecuredNotesDueMarch2027RecourseMemberus-gaap:CarryingReportedAmountFairValueDisclosureMember2020-12-310001664703us-gaap:NotesPayableOtherPayablesMemberbe:SeniorSecuredNotesDueMarch2027RecourseMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2020-12-310001664703us-gaap:SeniorNotesMemberbe:GreenConvertibleSeniorNotesMember2021-09-300001664703us-gaap:SeniorNotesMemberbe:GreenConvertibleSeniorNotesMember2020-12-310001664703us-gaap:SeniorNotesMemberbe:GreenConvertibleSeniorNotesMemberus-gaap:CarryingReportedAmountFairValueDisclosureMember2021-09-300001664703us-gaap:SeniorNotesMemberus-gaap:EstimateOfFairValueFairValueDisclosureMemberbe:GreenConvertibleSeniorNotesMember2021-09-300001664703us-gaap:SeniorNotesMemberbe:GreenConvertibleSeniorNotesMemberus-gaap:CarryingReportedAmountFairValueDisclosureMember2020-12-310001664703us-gaap:SeniorNotesMemberus-gaap:EstimateOfFairValueFairValueDisclosureMemberbe:GreenConvertibleSeniorNotesMember2020-12-310001664703us-gaap:SecuredDebtMemberbe:TermLoanDueSeptember2028NonRecourseMember2021-09-300001664703us-gaap:SecuredDebtMemberbe:TermLoanDueSeptember2028NonRecourseMember2020-12-310001664703be:TermLoanDueSeptember2028NonRecourseMemberus-gaap:SecuredDebtMemberus-gaap:CarryingReportedAmountFairValueDisclosureMember2021-09-300001664703be:TermLoanDueSeptember2028NonRecourseMemberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:SecuredDebtMember2021-09-300001664703be:TermLoanDueSeptember2028NonRecourseMemberus-gaap:SecuredDebtMemberus-gaap:CarryingReportedAmountFairValueDisclosureMember2020-12-310001664703be:TermLoanDueSeptember2028NonRecourseMemberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:SecuredDebtMember2020-12-310001664703us-gaap:SeniorNotesMemberbe:SeniorSecuredNotesDueMarch2030NonRecourseMember2020-12-310001664703us-gaap:SeniorNotesMemberbe:SeniorSecuredNotesDueMarch2030NonRecourseMember2021-09-300001664703us-gaap:SeniorNotesMemberbe:SeniorSecuredNotesDueMarch2030NonRecourseMemberus-gaap:CarryingReportedAmountFairValueDisclosureMember2021-09-300001664703us-gaap:SeniorNotesMemberus-gaap:EstimateOfFairValueFairValueDisclosureMemberbe:SeniorSecuredNotesDueMarch2030NonRecourseMember2021-09-300001664703us-gaap:SeniorNotesMemberbe:SeniorSecuredNotesDueMarch2030NonRecourseMemberus-gaap:CarryingReportedAmountFairValueDisclosureMember2020-12-310001664703us-gaap:SeniorNotesMemberbe:SeniorSecuredNotesDueMarch2030NonRecourseMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2020-12-310001664703be:TermLoanDueDecember2021NonRecourseMemberus-gaap:SecuredDebtMember2020-12-310001664703be:TermLoanDueDecember2021NonRecourseMemberus-gaap:SecuredDebtMember2021-09-300001664703us-gaap:SecuredDebtMemberus-gaap:CarryingReportedAmountFairValueDisclosureMemberbe:TermLoanDueDecember2021NonRecourseMember2021-09-300001664703us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:SecuredDebtMemberbe:TermLoanDueDecember2021NonRecourseMember2021-09-300001664703us-gaap:SecuredDebtMemberus-gaap:CarryingReportedAmountFairValueDisclosureMemberbe:TermLoanDueDecember2021NonRecourseMember2020-12-310001664703us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:SecuredDebtMemberbe:TermLoanDueDecember2021NonRecourseMember2020-12-310001664703us-gaap:EnergyEquipmentMember2021-09-300001664703us-gaap:EnergyEquipmentMember2020-12-310001664703be:ComputersSoftwareAndHardwareMember2021-09-300001664703be:ComputersSoftwareAndHardwareMember2020-12-310001664703us-gaap:MachineryAndEquipmentMember2021-09-300001664703us-gaap:MachineryAndEquipmentMember2020-12-310001664703us-gaap:FurnitureAndFixturesMember2021-09-300001664703us-gaap:FurnitureAndFixturesMember2020-12-310001664703us-gaap:LeaseholdsAndLeaseholdImprovementsMember2021-09-300001664703us-gaap:LeaseholdsAndLeaseholdImprovementsMember2020-12-310001664703us-gaap:BuildingMember2021-09-300001664703us-gaap:BuildingMember2020-12-310001664703us-gaap:ConstructionInProgressMember2021-09-300001664703us-gaap:ConstructionInProgressMember2020-12-310001664703us-gaap:PropertyPlantAndEquipmentMember2021-07-012021-09-300001664703us-gaap:PropertyPlantAndEquipmentMember2020-07-012020-09-300001664703us-gaap:PropertyPlantAndEquipmentMember2021-01-012021-09-300001664703us-gaap:PropertyPlantAndEquipmentMember2020-01-012020-09-300001664703us-gaap:VariableInterestEntityPrimaryBeneficiaryMember2021-09-300001664703us-gaap:VariableInterestEntityPrimaryBeneficiaryMember2020-12-310001664703be:TermLoanDueDecember2021NonRecourseMemberus-gaap:SecuredDebtMember2021-01-012021-09-300001664703us-gaap:LetterOfCreditMemberbe:LetterofCreditdueDecember2021NonRecourseMember2021-09-300001664703be:LetterofCreditdueDecember2021NonRecourseMemberus-gaap:LetterOfCreditMember2021-09-300001664703be:NonRecourseDebtMember2021-09-300001664703be:RecourseDebtMember2020-12-310001664703be:TermLoanDueDecember2021NonRecourseMemberus-gaap:SecuredDebtMember2020-01-012020-12-310001664703be:LetterofCreditdueDecember2021NonRecourseMemberus-gaap:LetterOfCreditMember2020-12-310001664703be:NonRecourseDebtMember2020-12-310001664703be:SeniorSecuredNotesDueMarch2027RecourseMember2020-05-010001664703us-gaap:NotesPayableOtherPayablesMemberbe:SeniorSecuredNotesDueMarch2027RecourseMember2020-05-010001664703us-gaap:ConvertibleDebtMembersrt:AffiliatedEntityMemberbe:ConvertiblePromissoryNotesInterestRate6DueDecember2020RecourseMember2021-09-300001664703us-gaap:ConvertibleDebtMemberbe:SeniorSecuredNotesDueMarch2027RecourseMember2020-05-010001664703us-gaap:DebtInstrumentRedemptionPeriodOneMemberbe:SeniorSecuredNotesDueMarch2027RecourseMember2021-01-012021-09-300001664703us-gaap:DebtInstrumentRedemptionPeriodTwoMemberbe:SeniorSecuredNotesDueMarch2027RecourseMember2021-01-012021-09-300001664703us-gaap:DebtInstrumentRedemptionPeriodThreeMemberbe:SeniorSecuredNotesDueMarch2027RecourseMember2021-01-012021-09-300001664703us-gaap:DebtInstrumentRedemptionPeriodFourMemberbe:SeniorSecuredNotesDueMarch2027RecourseMember2021-01-012021-09-300001664703be:SeniorSecuredNotesDueMarch2027RecourseMember2021-01-012021-09-300001664703us-gaap:SeniorNotesMemberbe:GreenConvertibleSeniorNotesMember2020-08-012020-08-310001664703us-gaap:SeniorNotesMemberus-gaap:CommonClassAMemberbe:GreenConvertibleSeniorNotesMember2020-08-310001664703us-gaap:SeniorNotesMemberbe:GreenConvertibleSeniorNotesMember2021-07-012021-09-300001664703us-gaap:SeniorNotesMemberbe:GreenConvertibleSeniorNotesMember2021-01-012021-09-300001664703be:PowerPurchaseAgreementCompany3aMemberus-gaap:SecuredDebtMemberbe:TermLoanDueSeptember2028NonRecourseMember2012-12-310001664703be:PowerPurchaseAgreementCompany3aMemberus-gaap:SecuredDebtMemberbe:TermLoanDueSeptember2028NonRecourseMember2021-09-300001664703be:PowerPurchaseAgreementCompany3aMemberus-gaap:SecuredDebtMemberbe:TermLoanDueSeptember2028NonRecourseMember2020-12-310001664703us-gaap:SeniorNotesMemberbe:PowerPurchaseAgreementCompany4Memberbe:SeniorSecuredNotesDueMarch2030NonRecourseMember2015-12-310001664703us-gaap:SeniorNotesMemberbe:PowerPurchaseAgreementCompany4Memberbe:SeniorSecuredNotesDueMarch2030NonRecourseMember2021-09-300001664703us-gaap:SeniorNotesMemberbe:PowerPurchaseAgreementCompany4Memberbe:SeniorSecuredNotesDueMarch2030NonRecourseMember2020-12-310001664703be:TermLoanDueDecember2021NonRecourseMemberus-gaap:SecuredDebtMemberbe:PowerPurchaseAgreementCompany5Member2015-06-300001664703be:TermLoanDueJune2031NonRecourseMemberus-gaap:SubsequentEventMemberus-gaap:SecuredDebtMemberbe:PowerPurchaseAgreementCompany5Member2021-11-010001664703be:TermLoandueDecember2021YearsOneThroughThreeNonRecourseMemberus-gaap:LondonInterbankOfferedRateLIBORMemberus-gaap:SecuredDebtMemberbe:PowerPurchaseAgreementCompany5Member2021-01-012021-09-300001664703us-gaap:LondonInterbankOfferedRateLIBORMemberus-gaap:SecuredDebtMemberbe:TermLoandueDecember2021AfterYearThreeNonRecourseMemberbe:PowerPurchaseAgreementCompany5Member2021-01-012021-09-300001664703be:TermLoanDueDecember2021NonRecourseMemberus-gaap:SecuredDebtMemberbe:PowerPurchaseAgreementCompany5Member2021-01-012021-09-300001664703us-gaap:LetterOfCreditMemberbe:PowerPurchaseAgreementCompany5Member2015-06-300001664703us-gaap:LetterOfCreditMemberbe:PowerPurchaseAgreementCompany5Member2021-09-300001664703us-gaap:LetterOfCreditMemberbe:PowerPurchaseAgreementCompany5Member2020-12-310001664703us-gaap:InterestRateSwapMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:OtherCurrentLiabilitiesMember2021-09-300001664703us-gaap:InterestRateSwapMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:OtherCurrentLiabilitiesMember2020-12-31be:agreement0001664703us-gaap:InterestRateSwapMemberbe:PPACompanyVMemberus-gaap:CashFlowHedgingMember2015-07-310001664703be:PPACompanyVMemberus-gaap:CashFlowHedgingMemberbe:InterestRateSwapMaturingIn2016Member2015-07-310001664703be:PPACompanyVMemberbe:InterestRateSwapMaturingDecember212021Memberus-gaap:CashFlowHedgingMember2015-07-310001664703be:PPACompanyVMemberbe:InterestRateSwapMaturingSeptember302031Memberus-gaap:CashFlowHedgingMember2015-07-310001664703us-gaap:InterestRateSwapMemberbe:PPACompanyVMemberus-gaap:CashFlowHedgingMember2021-09-300001664703us-gaap:InterestRateSwapMemberbe:PPACompanyVMemberus-gaap:CashFlowHedgingMember2020-12-310001664703us-gaap:AccumulatedNetGainLossFromCashFlowHedgesIncludingPortionAttributableToNoncontrollingInterestMember2021-06-300001664703us-gaap:AccumulatedNetGainLossFromCashFlowHedgesIncludingPortionAttributableToNoncontrollingInterestMember2020-06-300001664703us-gaap:AccumulatedNetGainLossFromCashFlowHedgesIncludingPortionAttributableToNoncontrollingInterestMember2020-12-310001664703us-gaap:AccumulatedNetGainLossFromCashFlowHedgesIncludingPortionAttributableToNoncontrollingInterestMember2019-12-310001664703us-gaap:AccumulatedNetGainLossFromCashFlowHedgesIncludingPortionAttributableToNoncontrollingInterestMember2021-07-012021-09-300001664703us-gaap:AccumulatedNetGainLossFromCashFlowHedgesIncludingPortionAttributableToNoncontrollingInterestMember2020-07-012020-09-300001664703us-gaap:AccumulatedNetGainLossFromCashFlowHedgesIncludingPortionAttributableToNoncontrollingInterestMember2021-01-012021-09-300001664703us-gaap:AccumulatedNetGainLossFromCashFlowHedgesIncludingPortionAttributableToNoncontrollingInterestMember2020-01-012020-09-300001664703us-gaap:InterestRateSwapMember2021-07-012021-09-300001664703us-gaap:InterestRateSwapMember2020-07-012020-09-300001664703us-gaap:InterestRateSwapMember2021-01-012021-09-300001664703us-gaap:InterestRateSwapMember2020-01-012020-09-300001664703us-gaap:AccumulatedNetGainLossFromCashFlowHedgesIncludingPortionAttributableToNoncontrollingInterestMember2021-09-300001664703us-gaap:AccumulatedNetGainLossFromCashFlowHedgesIncludingPortionAttributableToNoncontrollingInterestMember2020-09-30utr:sqft0001664703srt:MinimumMember2021-09-300001664703srt:MaximumMember2021-09-300001664703us-gaap:VariableInterestEntityPrimaryBeneficiaryMemberbe:ManagedServicesMember2021-09-300001664703us-gaap:VariableInterestEntityPrimaryBeneficiaryMemberbe:PortfolioFinancingMember2021-09-300001664703us-gaap:CostOfSalesMember2021-07-012021-09-300001664703us-gaap:CostOfSalesMember2020-07-012020-09-300001664703us-gaap:CostOfSalesMember2021-01-012021-09-300001664703us-gaap:CostOfSalesMember2020-01-012020-09-300001664703us-gaap:ResearchAndDevelopmentExpenseMember2021-07-012021-09-300001664703us-gaap:ResearchAndDevelopmentExpenseMember2020-07-012020-09-300001664703us-gaap:ResearchAndDevelopmentExpenseMember2021-01-012021-09-300001664703us-gaap:ResearchAndDevelopmentExpenseMember2020-01-012020-09-300001664703us-gaap:SellingAndMarketingExpenseMember2021-07-012021-09-300001664703us-gaap:SellingAndMarketingExpenseMember2020-07-012020-09-300001664703us-gaap:SellingAndMarketingExpenseMember2021-01-012021-09-300001664703us-gaap:SellingAndMarketingExpenseMember2020-01-012020-09-300001664703us-gaap:GeneralAndAdministrativeExpenseMember2021-07-012021-09-300001664703us-gaap:GeneralAndAdministrativeExpenseMember2020-07-012020-09-300001664703us-gaap:GeneralAndAdministrativeExpenseMember2021-01-012021-09-300001664703us-gaap:GeneralAndAdministrativeExpenseMember2020-01-012020-09-300001664703us-gaap:EmployeeStockOptionMember2021-07-012021-09-300001664703us-gaap:EmployeeStockOptionMember2020-07-012020-09-300001664703us-gaap:EmployeeStockOptionMember2021-01-012021-09-300001664703us-gaap:EmployeeStockOptionMember2020-01-012020-09-300001664703us-gaap:CommonClassAMember2021-01-012021-09-300001664703us-gaap:CommonClassAMember2021-07-012021-09-300001664703us-gaap:CommonClassAMember2020-01-012020-09-300001664703us-gaap:CommonClassAMember2020-07-012020-09-300001664703us-gaap:RestrictedStockUnitsRSUMember2020-12-310001664703us-gaap:RestrictedStockUnitsRSUMember2021-01-012021-09-300001664703us-gaap:RestrictedStockUnitsRSUMember2021-09-300001664703us-gaap:RestrictedStockUnitsRSUMember2021-07-012021-09-300001664703us-gaap:RestrictedStockUnitsRSUMember2020-07-012020-09-300001664703us-gaap:RestrictedStockUnitsRSUMember2020-01-012020-09-300001664703us-gaap:RestrictedStockUnitsRSUMember2020-09-300001664703be:PerformanceStockUnitsMember2021-01-012021-09-300001664703be:RestrictedStockUnitsAndPerformanceStockUnitsMember2021-09-300001664703be:A2018EmployeeStockPurchasePlanMember2021-01-012021-09-300001664703be:A2018EmployeeStockPurchasePlanMember2020-01-012020-09-300001664703be:A2018EmployeeStockPurchasePlanMember2021-09-300001664703be:A2018EmployeeStockPurchasePlanMember2020-09-30be:financialOption0001664703be:SoftbankCorp.Member2021-07-012021-07-010001664703be:SoftbankCorp.Member2020-07-012020-09-300001664703be:SoftbankCorp.Member2020-01-012020-09-300001664703be:SoftbankCorp.Member2021-01-012021-09-300001664703us-gaap:EquityMethodInvesteeMemberbe:SoftbankCorp.Member2021-09-300001664703be:SKEcoplantMember2021-07-012021-09-300001664703be:SKEcoplantMember2021-01-012021-09-300001664703be:SKEcoplantMember2021-09-300001664703be:SKEcoplantMember2020-01-012020-09-300001664703be:SKEcoplantMember2020-07-012020-09-300001664703be:PowerPurchaseAgreementCompany5Member2021-01-012021-09-300001664703be:PowerPurchaseAgreementCompany5Member2020-01-012020-09-300001664703us-gaap:VariableInterestEntityPrimaryBeneficiaryMemberbe:PowerPurchaseAgreementCompany3bMember2019-12-310001664703us-gaap:VariableInterestEntityPrimaryBeneficiaryMemberbe:PowerPurchaseAgreementCompany3bMember2019-01-012019-12-310001664703us-gaap:VariableInterestEntityPrimaryBeneficiaryMemberbe:PowerPurchaseAgreementCompany3bMember2020-12-012020-12-310001664703be:BloomEnergyJapanMemberbe:SoftbankCorp.Member2021-07-01utr:MW00016647032021-07-0100016647032012-03-310001664703be:ConvertibleNotesMember2021-07-012021-09-300001664703be:ConvertibleNotesMember2020-07-012020-09-300001664703be:ConvertibleNotesMember2021-01-012021-09-300001664703be:ConvertibleNotesMember2020-01-012020-09-300001664703us-gaap:EmployeeStockOptionMember2021-07-012021-09-300001664703us-gaap:EmployeeStockOptionMember2020-07-012020-09-300001664703us-gaap:EmployeeStockOptionMember2021-01-012021-09-300001664703us-gaap:EmployeeStockOptionMember2020-01-012020-09-300001664703be:BloomEnergyJapanMemberbe:SoftbankCorp.Member2021-07-012021-07-010001664703us-gaap:SubsequentEventMemberus-gaap:CommonClassAMember2023-11-302023-11-300001664703us-gaap:SubsequentEventMember2023-11-300001664703us-gaap:SubsequentEventMember2023-11-302023-11-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________________________________________________________________________

FORM 10-Q

| | | | | |

| (Mark One) | |

| ☑ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarter ended September 30, 2021 |

| or |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the transition period from ____________to ____________ |

Commission File Number 001-38598

________________________________________________________________________

BLOOM ENERGY CORPORATION

(Exact name of registrant as specified in its charter)

________________________________________________________________________

| | | | | |

| Delaware | 77-0565408 |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

| |

4353 North First Street, San Jose, California | 95134 |

| (Address of principal executive offices) | (Zip Code) |

| |

(408) 543-1500 |

| (Registrant’s telephone number, including area code) |

| | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: |

Title of Each Class(1) | Trading Symbol | Name of each exchange on which registered |

| Class A Common Stock, $0.0001 par value | BE | New York Stock Exchange |

(1) Our Class B Common Stock is not registered but is convertible into shares of Class A Common Stock at the election of the holder. |

________________________________________________________________________

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes þ No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer þ Accelerated filer ¨ Non-accelerated filer ¨ Smaller reporting company ☐ Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No þ

The number of shares of the registrant’s common stock outstanding as of October 27, 2021 was as follows:

Class A Common Stock, $0.0001 par value 147,730,770 shares

Class B Common Stock, $0.0001 par value 27,734,592 shares

Bloom Energy Corporation

Quarterly Report on Form 10-Q for the Three and Nine Months Ended September 30, 2021

Table of Contents

| | | | | |

| | Page |

| PART I - FINANCIAL INFORMATION | |

| Item 1 - Financial Statements (unaudited) | |

| Condensed Consolidated Balance Sheets | |

| Condensed Consolidated Statements of Operations | |

| Condensed Consolidated Statements of Comprehensive Loss | |

| Condensed Consolidated Statements of Redeemable Noncontrolling Interest, Stockholders' (Deficit) Equity and Noncontrolling Interest | |

| Condensed Consolidated Statements of Cash Flows | |

| Notes to Condensed Consolidated Financial Statements | |

| Item 2 - Management's Discussion and Analysis of Financial Condition and Results of Operations | |

| Item 3 - Quantitative and Qualitative Disclosures About Market Risk | |

| Item 4 - Controls and Procedures | |

| |

| PART II - OTHER INFORMATION | |

| Item 1 - Legal Proceedings | |

| Item 1A - Risk Factors | |

| Item 2 - Unregistered Sales of Equity Securities and Use of Proceeds | |

| Item 3 - Defaults Upon Senior Securities | |

| Item 4 - Mine Safety Disclosures | |

| Item 5 - Other Information | |

| Item 6 - Exhibits | |

| |

| Signatures | |

Unless the context otherwise requires, the terms "we," "us," "our," and "Bloom Energy," each refer to Bloom Energy Corporation and all of its subsidiaries.

Part I

ITEM 1 - FINANCIAL STATEMENTS

Bloom Energy Corporation

Condensed Consolidated Balance Sheets

(in thousands, except share data and par values)

(unaudited)

| | | | | | | | | | | | | | |

| | September 30, | | December 31, |

| | 2021 | | 2020 |

| Assets | | | | |

| Current assets: | | | | |

Cash and cash equivalents1 | | $ | 121,861 | | | $ | 246,947 | |

Restricted cash1 | | 65,315 | | | 52,470 | |

| | | | |

Accounts receivable1 | | 62,066 | | | 96,186 | |

| Contract assets | | 27,745 | | | 3,327 | |

| Inventories | | 182,555 | | | 142,059 | |

| Deferred cost of revenue | | 33,759 | | | 41,469 | |

Customer financing receivable1 | | 5,693 | | | 5,428 | |

Prepaid expenses and other current assets1 | | 31,946 | | | 30,718 | |

| Total current assets | | 530,940 | | | 618,604 | |

Property, plant and equipment, net1 | | 615,514 | | | 600,628 | |

| Operating lease right-of-use assets | | 70,055 | | | 35,621 | |

Customer financing receivable, non-current1 | | 40,981 | | | 45,268 | |

Restricted cash, non-current1 | | 132,725 | | | 117,293 | |

| Deferred cost of revenue, non-current | | 2,918 | | | 2,462 | |

Other long-term assets1 | | 38,593 | | | 34,511 | |

| Total assets | | $ | 1,431,726 | | | $ | 1,454,387 | |

| Liabilities, Redeemable Noncontrolling Interest, Stockholders’ (Deficit) Equity and Noncontrolling Interest | | | | |

| Current liabilities: | | | | |

| Accounts payable | | $ | 101,908 | | | $ | 58,334 | |

| Accrued warranty | | 7,907 | | | 10,263 | |

Accrued expenses and other current liabilities1 | | 85,877 | | | 112,004 | |

Deferred revenue and customer deposits1 | | 81,894 | | | 114,286 | |

| | | | |

| Operating lease liabilities | | 6,206 | | | 7,899 | |

| Financing obligations | | 14,260 | | | 12,745 | |

| Recourse debt | | 6,034 | | | — | |

Non-recourse debt1 | | 7,782 | | | 120,846 | |

| | | | |

| | | | |

| Total current liabilities | | 311,868 | | | 436,377 | |

| | | | |

| | | | |

Deferred revenue and customer deposits, non-current1 | | 67,887 | | | 87,463 | |

| Operating lease liabilities, non-current | | 78,146 | | | 41,849 | |

| | | | |

| Financing obligations, non-current | | 456,315 | | | 459,981 | |

| Recourse debt, non-current | | 285,216 | | | 168,008 | |

Non-recourse debt, non-current1 | | 205,164 | | | 102,045 | |

| | | | |

| | | | |

| Other long-term liabilities | | 26,755 | | | 17,268 | |

| Total liabilities | | 1,431,351 | | | 1,312,991 | |

| | | | |

| Commitments and contingencies (Note 13) | | | | |

| Redeemable noncontrolling interest | | 331 | | | 377 | |

| Stockholders’ (deficit) equity: | | | | |

Preferred stock: 10,000,000 shares authorized and no shares issued and outstanding at September 30, 2021 and December 31, 2020. | | — | | | — | |

Common stock: $0.0001 par value; Class A shares - 600,000,000 shares authorized and 147,320,041 shares and 140,094,633 shares issued and outstanding and Class B shares - 600,000,000 shares authorized and 27,758,020 shares and 27,908,093 shares issued and outstanding at September 30, 2021 and December 31, 2020, respectively. | | 18 | | | 17 | |

| Additional paid-in capital | | 3,183,101 | | | 3,182,753 | |

| Accumulated other comprehensive loss | | (278) | | | (9) | |

| Accumulated deficit | | (3,229,752) | | | (3,103,937) | |

| Total stockholders’ (deficit) equity | | (46,911) | | | 78,824 | |

| Noncontrolling interest | | 46,955 | | | 62,195 | |

| Total liabilities, redeemable noncontrolling interest, stockholders' (deficit) equity and noncontrolling interest | | $ | 1,431,726 | | | $ | 1,454,387 | |

1We have variable interest entities, which represent a portion of the consolidated balances recorded within these financial statement line items in the condensed consolidated balance sheets (see Note 11 - Portfolio Financings).

The accompanying notes are an integral part of these condensed consolidated financial statements.

Bloom Energy Corporation

Condensed Consolidated Statements of Operations

(in thousands, except per share data)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended

September 30, | | Nine Months Ended

September 30, | | |

| | | 2021 | | 2020 | | 2021 | | 2020 | | |

| | | | | | | | | | | |

| Revenue: | | | | | | | | | | |

| Product | | $ | 128,550 | | | $ | 131,076 | | | $ | 413,347 | | | $ | 346,832 | | | |

| Installation | | 22,172 | | | 26,603 | | | 53,710 | | | 73,060 | | | |

| Service | | 39,251 | | | 26,141 | | | 111,375 | | | 77,496 | | | |

| Electricity | | 17,255 | | | 16,485 | | | 51,273 | | | 47,472 | | | |

| Total revenue | | 207,228 | | | 200,305 | | | 629,705 | | | 544,860 | | | |

| Cost of revenue: | | | | | | | | | | |

| Product | | 93,704 | | | 72,037 | | | 289,889 | | | 227,653 | | | |

| Installation | | 25,616 | | | 27,872 | | | 66,756 | | | 86,938 | | | |

| Service | | 39,586 | | | 33,214 | | | 111,269 | | | 92,836 | | | |

| Electricity | | 11,439 | | | 11,195 | | | 32,913 | | | 35,266 | | | |

| Total cost of revenue | | 170,345 | | | 144,318 | | | 500,827 | | | 442,693 | | | |

| Gross profit | | 36,883 | | | 55,987 | | | 128,878 | | | 102,167 | | | |

| Operating expenses: | | | | | | | | | | |

| Research and development | | 27,634 | | | 19,231 | | | 76,602 | | | 61,887 | | | |

| Sales and marketing | | 20,124 | | | 11,700 | | | 62,803 | | | 37,076 | | | |

| General and administrative | | 33,014 | | | 25,428 | | | 90,470 | | | 79,471 | | | |

| Total operating expenses | | 80,772 | | | 56,359 | | | 229,875 | | | 178,434 | | | |

| Loss from operations | | (43,889) | | | (372) | | | (100,997) | | | (76,267) | | | |

| Interest income | | 72 | | | 254 | | | 222 | | | 1,405 | | | |

| Interest expense | | (14,514) | | | (19,902) | | | (43,798) | | | (55,030) | | | |

| Interest expense - related parties | | — | | | (353) | | | — | | | (2,513) | | | |

| Other income (expense), net | | 2,011 | | | (221) | | | 1,948 | | | (4,142) | | | |

| Gain (loss) on extinguishment of debt | | — | | | 1,220 | | | — | | | (12,878) | | | |

| (Loss) gain on revaluation of embedded derivatives | | (184) | | | 1,505 | | | (1,644) | | | 2,201 | | | |

| Loss before income taxes | | (56,504) | | | (17,869) | | | (144,269) | | | (147,224) | | | |

| Income tax provision | | 158 | | | 7 | | | 595 | | | 272 | | | |

| Net loss | | (56,662) | | | (17,876) | | | (144,864) | | | (147,496) | | | |

| Less: Net loss attributable to noncontrolling interest and redeemable noncontrolling interest | | (4,292) | | | (5,922) | | | (13,742) | | | (17,081) | | | |

| Net loss attributable to Class A and Class B common stockholders | | $ | (52,370) | | | $ | (11,954) | | | $ | (131,122) | | | $ | (130,415) | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Net loss per share available to Class A and Class B common stockholders, basic and diluted | | $ | (0.30) | | | $ | (0.09) | | | $ | (0.76) | | | $ | (1.01) | | | |

| Weighted average shares used to compute net loss per share available to Class A and Class B common stockholders, basic and diluted | | 174,269 | | | 138,964 | | | 172,601 | | | 129,571 | | | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

Bloom Energy Corporation

Condensed Consolidated Statements of Comprehensive Loss

(in thousands)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

September 30, | | Nine Months Ended

September 30, | | |

| | | 2021 | | 2020 | | 2021 | | 2020 | | |

| | | | | | | | | | | |

| Net loss | | $ | (56,662) | | | $ | (17,876) | | | $ | (144,864) | | | $ | (147,496) | | | |

| Other comprehensive loss, net of taxes: | | | | | | | | | | |

| Unrealized loss on available-for-sale securities | | — | | | — | | | — | | | (23) | | | |

| Change in derivative instruments designated and qualifying as cash flow hedges | | (763) | | | 573 | | | (4,031) | | | (8,144) | | | |

| Foreign currency translation adjustment | | (299) | | | — | | | (523) | | | — | | | |

| Other comprehensive (loss) income, net of taxes | | (1,062) | | | 573 | | | (4,554) | | | (8,167) | | | |

| Comprehensive loss | | (57,724) | | | (17,303) | | | (149,418) | | | (155,663) | | | |

| Less: Comprehensive loss attributable to noncontrolling interest and redeemable noncontrolling interest | | (3,673) | | | (5,349) | | | (9,964) | | | (25,219) | | | |

| Comprehensive loss attributable to Class A and Class B stockholders | | $ | (54,051) | | | $ | (11,954) | | | $ | (139,454) | | | $ | (130,444) | | | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

Bloom Energy Corporation

Condensed Consolidated Statements of Redeemable Noncontrolling Interest, Stockholders' (Deficit) Equity and Noncontrolling Interest

(in thousands, except share data) (unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, 2021 |

| | Redeemable Noncontrolling Interest | | | Class A and Class B Common Stock | | Additional Paid-In Capital | | Accumulated Other Comprehensive Loss | | Accumulated Deficit | | Total Stockholders' Deficit | | Noncontrolling Interest |

| | | | | Shares | | Amount | | | | | | | | | | |

| Balances at June 30, 2021 | | $ | 334 | | | | 173,402,160 | | | $ | 17 | | | $ | 3,155,917 | | | $ | (124) | | | $ | (3,177,381) | | | $ | (21,571) | | | $ | 51,185 | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Issuance of restricted stock awards | | — | | | | 581,363 | | | — | | | — | | | — | | | — | | | — | | | — | |

| ESPP purchase | | — | | | | 967,797 | | | — | | | 5,319 | | | — | | | — | | | 5,319 | | | — | |

| Exercise of stock options | | — | | | | 126,741 | | | 1 | | | 1,122 | | | — | | | — | | | 1,123 | | | — | |

| Stock-based compensation | | — | | | | — | | | — | | | 20,743 | | | — | | | — | | | 20,743 | | | — | |

| | | | | | | | | | | | | | | | | |

| Change in effective portion of interest rate swap agreement | | — | | | | — | | | — | | | — | | | — | | | — | | | — | | | 763 | |

| Distributions to noncontrolling interests | | (20) | | | | — | | | — | | | — | | | — | | | — | | | — | | | (540) | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Foreign currency translation adjustment | | — | | | | — | | | — | | | — | | | (154) | | | — | | | (154) | | | (145) | |

| Net income (loss) | | 17 | | | | — | | | — | | | — | | | — | | | (52,371) | | | (52,371) | | | (4,308) | |

| Balances at September 30, 2021 | | $ | 331 | | | | 175,078,061 | | | $ | 18 | | | $ | 3,183,101 | | | $ | (278) | | | $ | (3,229,752) | | | $ | (46,911) | | | $ | 46,955 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, 2020 |

| | Redeemable Noncontrolling Interest | | | Class A and Class B Common Stock | | Additional Paid-In Capital | | Accumulated Other Comprehensive Loss | | Accumulated Deficit | | Total Stockholders' Deficit | | Noncontrolling Interest |

| | | | | Shares | | Amount | | | | | | | | | | |

| Balances at June 30, 2020 | | $ | 118 | | | | 130,238,289 | | | $ | 13 | | | $ | 2,747,890 | | | $ | (9) | | | $ | (3,064,846) | | | $ | (316,951) | | | $ | 66,302 | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Conversion of notes | | — | | | | 19,136,313 | | | 1 | | | 160,341 | | | — | | | — | | | 160,342 | | | — | |

| Issuance of convertible note | | — | | | | — | | | — | | | 124,050 | | | — | | | — | | | 124,050 | | | — | |

| | | | | | | | | | | | | | | | | |

| Issuance of restricted stock awards | | — | | | | 3,203,935 | | | 1 | | | — | | | — | | | — | | | 1 | | | — | |

| ESPP purchase | | — | | | | 944,979 | | | — | | | 4,323 | | | — | | | — | | | 4,323 | | | — | |

| Exercise of stock options | | — | | | | 273,056 | | | — | | | 3,235 | | | — | | | — | | | 3,235 | | | — | |

| Stock-based compensation | | — | | | | — | | | — | | | 14,537 | | | — | | | — | | | 14,537 | | | — | |

| | | | | | | | | | | | | | | | | |

| Change in effective portion of interest rate swap agreement | | — | | | | — | | | — | | | — | | | — | | | — | | | — | | | 573 | |

| Distributions to noncontrolling interests | | (18) | | | | — | | | — | | | — | | | — | | | — | | | — | | | (269) | |

| Proceeds from noncontrolling interest | | — | | | | — | | | — | | | — | | | — | | | — | | | — | | | 4,314 | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Net income (loss) | | 89 | | | | — | | | — | | | — | | | — | | | (11,954) | | | (11,954) | | | (6,011) | |

| Balances at September 30, 2020 | | $ | 189 | | | | 153,796,572 | | | $ | 15 | | | $ | 3,054,376 | | | $ | (9) | | | $ | (3,076,800) | | | $ | (22,418) | | | $ | 64,909 | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Nine Months Ended September 30, 2021 |

| | Redeemable Noncontrolling Interest | | | Class A and Class B Common Stock | | Additional Paid-In Capital | | Accumulated Other Comprehensive Loss | | Accumulated Deficit | | Total Stockholders' Equity (Deficit) | | Noncontrolling Interest |

| | | | | Shares | | Amount | | | | | | | | | | |

| Balances at December 31, 2020 | | $ | 377 | | | | 168,002,726 | | | $ | 17 | | | $ | 3,182,753 | | | $ | (9) | | | $ | (3,103,937) | | | $ | 78,824 | | | $ | 62,195 | |

| Cumulative effect upon adoption of Accounting Standards Update 2020-06 (Note 2) | | — | | | | — | | | — | | | (126,799) | | | — | | | 5,308 | | | (121,491) | | | — | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Issuance of restricted stock awards | | — | | | | 2,533,027 | | | — | | | — | | | — | | | — | | | — | | | — | |

| ESPP purchase | | — | | | | 1,945,305 | | | — | | | 10,045 | | | — | | | — | | | 10,045 | | | — | |

| Exercise of stock options | | — | | | | 2,597,003 | | | 1 | | | 62,064 | | | — | | | — | | | 62,065 | | | — | |

| Stock-based compensation expense | | — | | | | — | | | — | | | 55,038 | | | — | | | — | | | 55,038 | | | — | |

| | | | | | | | | | | | | | | | | |

| Change in effective portion of interest rate swap agreement | | — | | | | — | | | — | | | — | | | — | | | — | | | — | | | 4,031 | |

| Distributions to noncontrolling interests | | (37) | | | | — | | | — | | | — | | | — | | | — | | | — | | | (5,285) | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Foreign currency translation adjustment | | — | | | | — | | | — | | | — | | | (269) | | | — | | | (269) | | | (254) | |

| Net loss | | (9) | | | | — | | | — | | | — | | | — | | | (131,123) | | | (131,123) | | | (13,732) | |

| Balances at September 30, 2021 | | $ | 331 | | | | 175,078,061 | | | $ | 18 | | | $ | 3,183,101 | | | $ | (278) | | | $ | (3,229,752) | | | $ | (46,911) | | | $ | 46,955 | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Nine Months Ended September 30, 2020 |

| | Redeemable Noncontrolling Interest | | | Class A and Class B Common Stock | | Additional Paid-In Capital | | Accumulated Other Comprehensive Gain (Loss) | | Accumulated Deficit | | Total Stockholders' Deficit | | Noncontrolling Interest |

| | | | | Shares | | Amount | | | | | | | | | | |

| Balances at December 31, 2019 | | $ | 443 | | | | 121,036,289 | | | $ | 12 | | | $ | 2,686,759 | | | $ | 19 | | | $ | (2,946,384) | | | $ | (259,594) | | | $ | 91,291 | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Conversion of notes | | — | | | | 23,854,441 | | | 2 | | | 201,470 | | | — | | | — | | | 201,472 | | | — | |

| Issuance of convertible note | | — | | | | — | | | — | | | 124,050 | | | — | | | — | | | 124,050 | | | — | |

| Adjustment of embedded derivative for debt modification | | — | | | | — | | | — | | | (24,071) | | | — | | | — | | | (24,071) | | | — | |

| Issuance of restricted stock awards | | — | | | | 6,524,088 | | | 1 | | | | | — | | | — | | | 1 | | | — | |

| ESPP purchase | | — | | | | 1,937,825 | | | — | | | 8,500 | | | — | | | — | | | 8,500 | | | — | |

| Exercise of stock options | | — | | | | 443,929 | | | — | | | 4,243 | | | — | | | — | | | 4,243 | | | — | |

| Stock-based compensation | | — | | | | — | | | — | | | 53,425 | | | — | | | — | | | 53,425 | | | — | |

| Unrealized loss on available for sale securities | | — | | | | — | | | — | | | — | | | (23) | | | — | | | (23) | | | — | |

| Change in effective portion of interest rate swap agreement | | — | | | | — | | | — | | | — | | | (5) | | | — | | | (5) | | | (8,139) | |

| Distributions to noncontrolling interests | | (35) | | | | — | | | — | | | — | | | — | | | — | | | — | | | (5,696) | |

| Contributions from noncontrolling interest | | — | | | | — | | | — | | | — | | | — | | | — | | | — | | | 4,314 | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Net loss | | (219) | | | | — | | | — | | | — | | | — | | | (130,415) | | | (130,415) | | | (16,861) | |

| Balances at September 30, 2020 | | $ | 189 | | | | 153,796,572 | | | $ | 15 | | | $ | 3,054,376 | | | $ | (9) | | | $ | (3,076,800) | | | $ | (22,418) | | | $ | 64,909 | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

Bloom Energy Corporation

Condensed Consolidated Statements of Cash Flows

(in thousands)

(unaudited) | | | | | | | | | | | | | | | | |

| | | Nine Months Ended

September 30, | | |

| | | 2021 | | 2020 | | |

| Cash flows from operating activities: | | | | | | |

| Net loss | | $ | (144,864) | | | $ | (147,496) | | | |

| Adjustments to reconcile net loss to net cash used in operating activities: | | | | | | |

| Depreciation and amortization | | 40,079 | | | 38,888 | | | |

| Non-cash lease expense | | 7,161 | | | 4,419 | | | |

| Write-off of property, plant and equipment, net | | — | | | 36 | | | |

| Impairment of equity method investment | | — | | | 4,236 | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| Revaluation of derivative contracts | | 486 | | | (2,267) | | | |

| Stock-based compensation expense | | 57,309 | | | 57,385 | | | |

| | | | | | |

| Gain on remeasurement of investment | | (1,966) | | | — | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| Loss on extinguishment of debt | | — | | | 11,785 | | | |

| Amortization of debt issuance costs and premium, net | | 2,824 | | | (195) | | | |

| Changes in operating assets and liabilities: | | | | | | |

| Accounts receivable | | 34,291 | | | (4,058) | | | |

| Contract assets | | (24,418) | | | (8,596) | | | |

| Inventories | | (39,953) | | | (22,772) | | | |

| Deferred cost of revenue | | 7,307 | | | 1,562 | | | |

| Customer financing receivable | | 4,022 | | | 3,790 | | | |

| Prepaid expenses and other current assets | | 236 | | | (2,647) | | | |

| Other long-term assets | | (374) | | | (3,217) | | | |

| Accounts payable | | 37,973 | | | 8,704 | | | |

| Accrued warranty | | (2,357) | | | (525) | | | |

| Accrued expenses and other current liabilities | | (26,178) | | | 4,932 | | | |

| Operating lease right-of-use assets and operating lease liabilities | | (7,593) | | | (4,467) | | | |

| Deferred revenue and customer deposits | | (53,181) | | | (15,658) | | | |

| Other long-term liabilities | | 1,289 | | | (3,828) | | | |

| Net cash used in operating activities | | (107,907) | | | (79,989) | | | |

| Cash flows from investing activities: | | | | | | |

| Purchase of property, plant and equipment | | (44,625) | | | (33,066) | | | |

| Net cash acquired from step acquisition | | 3,114 | | | — | | | |

| | | | | | |

| | | | | | |

| Net cash used in investing activities | | (41,511) | | | (33,066) | | | |

| Cash flows from financing activities: | | | | | | |

| Proceeds from issuance of debt | | — | | | 300,000 | | | |

| Proceeds from issuance of debt to related parties | | — | | | 30,000 | | | |

| Repayment of debt | | (11,017) | | | (92,546) | | | |

| Repayment of debt - related parties | | — | | | (2,105) | | | |

| | | | | | |

| Debt issuance costs | | — | | | (13,247) | | | |

| Proceeds from financing obligations | | 7,534 | | | 14,807 | | | |

| Repayment of financing obligations | | (10,174) | | | (7,828) | | | |

| Contribution from noncontrolling interest | | — | | | 4,314 | | | |

| | | | | | |

| Distributions to noncontrolling interests and redeemable noncontrolling interests | | (5,322) | | | (6,103) | | | |

| Proceeds from issuance of common stock | | 72,109 | | | 12,745 | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| Net cash provided by financing activities | | 53,130 | | | 240,037 | | | |

| Effect of exchange rate changes on cash, cash equivalent and restricted cash | | (521) | | | — | | | |

| Net (decrease) increase in cash, cash equivalents and restricted cash | | (96,809) | | | 126,982 | | | |

| Cash, cash equivalents, and restricted cash: | | | | | | |

| Beginning of period | | 416,710 | | | 377,388 | | | |

| End of period | | $ | 319,901 | | | $ | 504,370 | | | |

| | | | | | |

| Supplemental disclosure of cash flow information: | | | | | | |

| Cash paid during the period for interest | | $ | 42,598 | | | $ | 56,607 | | | |

| Cash paid for amounts included in the measurement of lease liabilities: | | | | | | |

| Operating cash flows from operating leases | | 10,332 | | | 39,775 | | | |

| Operating cash flows from financing leases | | 643 | | | 3,684 | | | |

| Cash paid during the period for income taxes | | 372 | | | 353 | | | |

| Non-cash investing and financing activities: | | | | | | |

| | | | | | |

| Increase in recourse debt, non-current upon adoption of ASU 2020-06, net (Note 2) | | $ | 121,491 | | | $ | — | | | |

| Liabilities recorded for property, plant and equipment | | 6,188 | | | 350 | | | |

| Operating lease liabilities arising from obtaining right-of-use assets upon adoption of new lease guidance | | — | | | 39,775 | | | |

| Recognition of operating lease right-of-use asset during the year-to-date period | | 43,660 | | | 3,333 | | | |

| Recognition of financing lease right-of-use asset during the year-to-date period | | 1,961 | | | 351 | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

Conversion of 10% convertible promissory notes into Class A common stock | | — | | | 150,670 | | | |

Conversion of 10% convertible promissory notes to related party into Class A common stock | | — | | | 50,800 | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| Accrued interest for notes | | — | | | 30 | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| Adjustment of embedded derivative related to debt extinguishment | | — | | | 24,071 | | | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

Bloom Energy Corporation

Notes to Unaudited Condensed Consolidated Financial Statements

1. Nature of Business, Liquidity and Basis of Presentation

Nature of Business

We design, manufacture, sell and, in certain cases, install solid-oxide fuel cell systems ("Energy Servers") for on-site power generation. Our Energy Servers utilize an innovative fuel cell technology and provide efficient energy generation with reduced operating costs and lower greenhouse gas emissions as compared to conventional fossil fuel generation. By generating power where it is consumed, our energy producing systems offer increased electrical reliability and improved energy security while providing a path to energy independence.

We continue to monitor and adjust as appropriate our operations in response to the COVID-19 pandemic. There have been a number of supply chain disruptions throughout the global supply chain as countries are in various stages of opening up and demand for certain components increases. Although we were able to find alternatives for many component shortages, we experienced some delays and cost increases with respect to container shortages, ocean shipping and air freight.

Liquidity

We have generally incurred operating losses and negative cash flows from operations since our inception. With the series of new debt offerings, debt extensions and conversions to equity that we completed during 2020, we had $291.3 million of total outstanding recourse debt as of September 30, 2021, $285.2 million of which is classified as long-term debt. Our recourse debt scheduled repayments will commence in June 2022.

On October 23, 2021, we entered into a Securities Purchase Agreement (the “SPA”) with SK ecoplant Co., Ltd. (formerly known as SK Engineering and Construction Co., Ltd.) ("SK ecoplant") in connection with a strategic partnership. Pursuant to the SPA, we have agreed to sell to SK ecoplant 10,000,000 shares of zero coupon, non-voting redeemable convertible Series A preferred stock in Bloom Energy, par value $0.0001 per share, at a purchase price of $25.50 per share or an aggregate purchase price of approximately $255.0 million. For more information about the SPA, please see Note 18 - Subsequent Events, and for more information about our joint venture with SK ecoplant, please see Note 12 - Related Party Transactions.

Our future capital requirements will depend on many factors, including our rate of revenue growth, the timing and extent of spending on research and development efforts and other business initiatives, the rate of growth in the volume of system builds and the need for additional manufacturing space, the expansion of sales and marketing activities both in domestic and international markets, market acceptance of our product, our ability to secure financing for customer use of our Energy Servers, the timing of installations, and overall economic conditions including the impact of COVID-19 on our ongoing and future operations.

In the opinion of management, the combination of our existing cash and cash equivalents and operating cash flows is expected to be sufficient to meet our operational and capital cash flow requirements and other cash flow needs for the next 12 months from the date of issuance of this Quarterly Report on Form 10-Q.

Basis of Presentation

We have prepared the condensed consolidated financial statements included herein pursuant to the rules and regulations of the U.S. Securities and Exchange Commission ("SEC"), and as permitted by those rules, including all disclosures required by generally accepted accounting principles as applied in the United States (“U.S. GAAP”). Certain prior period amounts have been reclassified to conform to the current period presentation.

As disclosed in the 2020 Annual Report on Form 10-K, effective on December 31, 2020, we lost our emerging growth company status which accelerated the adoption of Accounting Standards Codification ("ASC") 842, Leases ("ASC 842"). As a result, we adjusted our previously reported condensed consolidated financial statements effective January 1, 2020.

Principles of Consolidation

These condensed consolidated financial statements reflect our accounts and operations and those of our subsidiaries in which we have a controlling financial interest. We use a qualitative approach in assessing the consolidation requirement for each of our variable interest entities ("VIEs"), which we refer to as a tax equity partnership (each such VIE, also referred to as

our power purchase agreement entities ("PPA Entities")). This approach focuses on determining whether we have the power to direct those activities of the PPA Entities that most significantly affect their economic performance and whether we have the obligation to absorb losses, or the right to receive benefits, that could potentially be significant to the PPA Entities. For all periods presented, we have determined that we are the primary beneficiary in all of our operational PPA Entities, as discussed in Note 11 - Portfolio Financings. We evaluate our relationships with the PPA Entities on an ongoing basis to ensure that we continue to be the primary beneficiary. All intercompany transactions and balances have been eliminated upon consolidation. The sale of an operating company with a portfolio of PPAs in which we do not have an equity interest is called a “Third-Party PPA.” We have determined that, although these entities are VIEs, we do not have the power to direct those activities of the Third-Party PPAs that most significantly affect their economic performance. We also do not have the obligation to absorb losses, or the right to receive benefits, that could potentially be significant to the Third-Party PPAs. Because we are not the primary beneficiary of these activities, we do not consolidate Third-Party PPAs.

Business Combinations

Acquisitions of a business are accounted by using the acquisition method of accounting. Assets acquired and liabilities assumed, including amounts attributed to noncontrolling interests, are recorded at the acquisition date at their fair values. Assigning fair values requires us to make significant estimates and assumptions regarding the fair value of identifiable intangible assets, property, plant and equipment, deferred tax asset valuation allowances and liabilities, such as uncertain tax positions and contingencies. We may refine these estimates if necessary over a period not to exceed one year by taking into consideration new information that, if known at the acquisition date, would have affected the fair values ascribed to the assets acquired and liabilities assumed.

Use of Estimates

The preparation of condensed consolidated financial statements in conformity with U.S. GAAP requires us to make estimates and assumptions that affect the amounts reported in the condensed consolidated financial statements and the accompanying notes. The most significant estimates include the determination of the stand-alone selling price, including material rights estimates, inventory valuation, specifically excess and obsolescence provisions for obsolete or unsellable inventory and, in relation to property, plant and equipment (specifically Energy Servers), assumptions relating to economic useful lives and impairment assessments.

Other accounting estimates include variable consideration relating to product performance guaranties, lease and non-lease components and related financing obligations such as incremental borrowing rates, estimated output, efficiency and residual value of the Energy Servers, product performance warranties and guaranties and extended maintenance, derivative valuations, estimates for recapture of the U.S. Investment Tax Credit ("ITC") and similar federal tax benefits, estimates relating to contractual indemnities provisions, estimates for income taxes and deferred tax asset valuation allowances, stock-based compensation expense and the fair value of contingent consideration related to business combinations. In addition, because the duration and severity of the COVID-19 pandemic remains uncertain, certain of such estimates could require further judgment or modification and therefore carry a higher degree of variability and volatility. Actual results could differ materially from these estimates under different assumptions and conditions.

Concentration of Risk

Geographic Risk - The majority of our revenue and long-lived assets are attributable to operations in the United States for all periods presented. Additionally, we sell our Energy Servers in Japan, India and the Republic of Korea (collectively, the "Asia Pacific region"). In the three and nine months ended September 30, 2021, total revenue in the Asia Pacific region was 36% and 38%, respectively, of our total revenue. In the three and nine months ended September 30, 2020, total revenue in the Asia Pacific region was 24% and 30%, respectively, of our total revenue.

Credit Risk - At September 30, 2021 and December 31, 2020, SK ecoplant, accounted for approximately 22% and 56% of accounts receivable, respectively. At September 30, 2021, RAD Bloom Project Holdco LLC, accounted for approximately 16% of accounts receivable and none at December 31, 2020. At September 30, 2021, Bronx Community Clean Energy Project accounted for approximately 18% of accounts receivable and none at December 31, 2020. To date, we have not experienced any credit losses.

Customer Risk - During the three months ended September 30, 2021, one customer represented 35% of our total revenue. During the nine months ended September 30, 2021, two customers represented 37% and 12% of our total revenue, respectively.

2. Summary of Significant Accounting Policies

Please refer to the accounting policies described in our Annual Report on Form 10-K for the fiscal year ended December 31, 2020.

Revenue Recognition

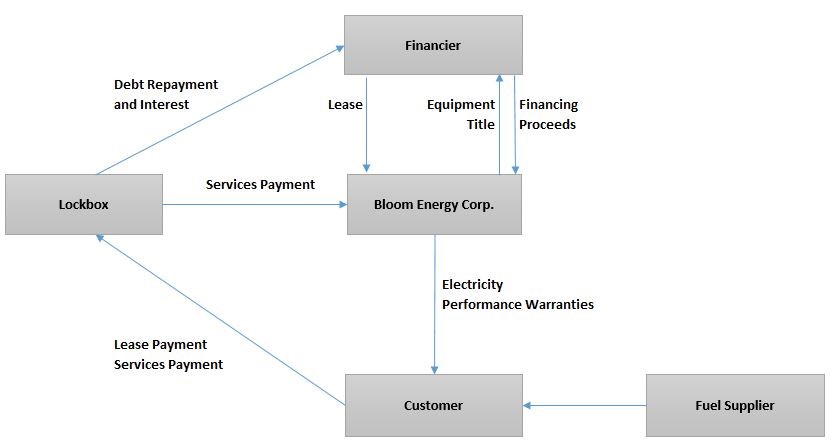

We primarily earn product and installation revenue from the sale and installation of our Energy Servers, service revenue by providing services under operations and maintenance services contracts, and electricity revenue by selling electricity to customers under PPAs and Managed Services Agreements (as defined below). We offer our customers several ways to finance their use of a Bloom Energy Server. Customers, including some of our international channel providers and Third Party PPAs, may choose to purchase our Energy Servers outright. Customers may also enter into contracts with us for the purchase of electricity generated by our Energy Servers (a "Managed Services Agreement"), which is then financed through one of our financing partners ("Managed Services Financings"), or as a traditional lease (as explained in “Managed Service Financing" in Item 2 below). Finally, customers may purchase electricity through our PPA Entities ("Portfolio Financings").

Revenue Recognition under ASC 606 Revenue from Contracts with Customers

In applying Accounting Standards Codification 606, Revenue from Contracts with Customers ("ASC 606"), revenue is recognized by following a five-step process:

Identify the contract(s) with a customer. Evidence of a contract generally consists of a purchase order issued pursuant to the terms and conditions of a distributor, reseller, purchase, use and maintenance agreement, maintenance services agreements or energy supply agreement.

Identify the performance obligations in the contract. Performance obligations are identified in our contracts and include transferring control of an Energy Server, installation of Energy Servers, providing maintenance services and maintenance services renewal options which, in certain situations, provide customers with material rights.

Determine the transaction price. The purchase price stated in an agreed-upon purchase order or contract is generally representative of the transaction price. When determining the transaction price, we consider the effects of any variable consideration, which include performance guarantees that may be payable to our customers.

Allocate the transaction price to the performance obligations in the contract. The transaction price in a contract is allocated based upon the relative standalone selling price of each distinct performance obligation identified in the contract.

Recognize revenue when (or as) we satisfy a performance obligation. We satisfy performance obligations either over time or at a point in time as discussed in further detail below. Revenue is recognized at the time the related performance obligation is satisfied by transferring control of the promised products or services to a customer.

We frequently combine contracts governing the sale and installation of an Energy Server with the related maintenance services contracts and account for them as a single contract at contract inception to the extent the contracts are with the same customer. These contracts are not combined when the customer for the sale and installation of the Energy Server is different to the maintenance services contract customer. We also assess whether any contract terms including default provisions, put or call options result in components of our contracts being accounted for as financing or leasing transactions outside of the scope of ASC 606.

Most of our contracts contain performance obligations with a combination of our Energy Server product, installation and maintenance services. For these performance obligations, we allocate the total transaction price to each performance obligation based on the relative standalone selling price. Our maintenance services contracts are typically subject to renewal by customers on an annual basis. We assess these maintenance services renewal options at contract inception to determine whether they provide customers with material rights that give rise to separate performance obligations.

The total transaction price is determined based on the total consideration specified in the contract, including variable consideration in the form of a performance guaranty payment that represents potential amounts payable to customers. The expected value method is generally used when estimating variable consideration, which typically reduces the total transaction price due to the nature of the performance obligations to which the variable consideration relates. These estimates reflect our historical experience and current contractual requirements which cap the maximum amount that may be paid. The expected value method requires judgment and considers multiple factors that may vary over time depending upon the unique facts and circumstances related to each performance obligation. Depending on the facts and circumstances, a change in variable consideration estimate will either be accounted for at the contract level or using the portfolio method.

We exclude from the transaction price all taxes assessed by governmental authorities that are both (i) imposed on and concurrent with a specific revenue-producing transaction and (ii) collected from customers. Accordingly, such tax amounts are not included as a component of net sales or cost of sales. These tax amounts are recorded in cost of electricity revenue, cost of service revenue, and general and administrative operating expenses.

We allocate the transaction price to each distinct performance obligation based on relative standalone selling prices. Given that we typically sell an Energy Server with a maintenance services agreement and have not provided maintenance services to a customer who does not have use of an Energy Server, standalone selling prices are estimated using a cost-plus approach. Costs relating to Energy Servers include all direct and indirect manufacturing costs, applicable overhead costs and costs for normal production inefficiencies (i.e., variances). We then apply a margin to the Energy Servers, which may vary with the size of the customer, geographic region and the scale of the Energy Server deployment. As our business offerings and eligibility for the ITC evolve over time, we may be required to modify the expected margin in subsequent periods and our revenue could be materially affected. Costs relating to installation include all direct and indirect installation costs. The margin we apply reflects our profit objectives relating to installation. Costs for maintenance services arrangements are estimated over the life of the maintenance contracts and include estimated future service costs and future material costs. Material costs over the period of the service arrangement are impacted significantly by the longevity of the fuel cells themselves. After considering the total service costs, we apply a lower margin to our service costs than to our Energy Servers as it best reflects our long-term service margin expectations and comparable historical industry service margins. As a result, our estimate of our selling price is driven primarily by our expected margin on both the Energy Server and the maintenance services agreements based on their respective costs or, in the case of maintenance services agreements, the estimated costs to be incurred.

We generally recognize product and installation revenue at the point in time that the customer obtains control of the Energy Server. For certain instances, such as bill-and-hold transactions, control of installations transfers to the customer over time, and the related revenue is recognized over time as the performance obligation is satisfied using the cost-to-total cost (percentage-of-completion) method. We use an input measure of progress to determine the amount of revenue to recognize during each reporting period when such revenue is recognized over time, based on the costs incurred to satisfy the performance obligation. We recognize maintenance services revenue, including revenue associated with any related customer material rights, over time as we perform service maintenance activities.

Amounts billed to customers for shipping and handling activities are considered contract fulfillment activities and not a separate performance obligation of the contract. Shipping and handling costs are recorded within cost of revenue.

The following is a description of the principal activities from which we generate revenue. Our four revenue streams are classified as follows:

Product Revenue - All of our product revenue is generated from the sale of our Energy Servers to direct purchase customers, including financing partners on Third-Party PPAs and sale-and-leaseback transactions, international channel providers and traditional lease customers. We generally recognize product revenue from contracts with customers at the point that control is transferred to the customers. This occurs when we achieve customer acceptance, which typically occurs upon transfer of control to our customers, which depending on the contract terms is when the system is shipped and delivered to our customers, when the system is shipped and delivered and is physically ready for startup and commissioning, or when the system is shipped and delivered and is turned on and producing power. Certain customer arrangements include bill-and-hold terms under which transfer of control criteria have been met, including the passing of title and significant risk and reward of ownership to the customers. Therefore, the customers can direct the use of the bill-and-hold product while we retain physical possession of the product until it is delivered to a customer site at a point in time in the future.

Under our traditional lease financing option, we sell our Energy Servers through a direct sale to a financing partner who, in turn, leases the Energy Servers to the customer under a lease agreement. With our sales to our international channel providers, our international channel providers typically sell the Energy Servers to, or sometimes provide a PPA to, an end customer. In both traditional lease and international channel providers transactions, we contract directly with the end customer to provide extended maintenance services after the end of the standard warranty period. As a result, since the customer that purchases the server is a different and unrelated party to the customer that purchases extended warranty services, the product and maintenance services contract are not combined.