0001664703PRE 14AFALSE00016647032023-01-012023-12-31iso4217:USDxbrli:pure00016647032022-01-012022-12-3100016647032021-01-012021-12-3100016647032020-01-012020-12-310001664703ecd:PeoMemberbe:EquityAwardsReportedValueMember2023-01-012023-12-310001664703ecd:PeoMemberbe:EquityAwardAdjustmentsMember2023-01-012023-12-310001664703ecd:PeoMemberbe:EquityAwardsGrantedDuringTheYearUnvestedMember2023-01-012023-12-310001664703ecd:PeoMemberbe:EquityAwardsGrantedInPriorYearsUnvestedMember2023-01-012023-12-310001664703be:EquityAwardsGrantedDuringTheYearVestedMemberecd:PeoMember2023-01-012023-12-310001664703ecd:PeoMemberbe:EquityAwardsGrantedInPriorYearsVestedMember2023-01-012023-12-310001664703ecd:PeoMemberbe:EquityAwardsThatFailedToMeetVestingConditionsMember2023-01-012023-12-310001664703be:EquityAwardsValueOfDividendsAndOtherEarningsPaidAdjustmentMemberecd:PeoMember2023-01-012023-12-310001664703ecd:NonPeoNeoMemberbe:EquityAwardsReportedValueMember2023-01-012023-12-310001664703ecd:NonPeoNeoMemberbe:EquityAwardAdjustmentsMember2023-01-012023-12-310001664703ecd:NonPeoNeoMemberbe:EquityAwardsGrantedDuringTheYearUnvestedMember2023-01-012023-12-310001664703ecd:NonPeoNeoMemberbe:EquityAwardsGrantedInPriorYearsUnvestedMember2023-01-012023-12-310001664703be:EquityAwardsGrantedDuringTheYearVestedMemberecd:NonPeoNeoMember2023-01-012023-12-310001664703ecd:NonPeoNeoMemberbe:EquityAwardsGrantedInPriorYearsVestedMember2023-01-012023-12-310001664703ecd:NonPeoNeoMemberbe:EquityAwardsThatFailedToMeetVestingConditionsMember2023-01-012023-12-310001664703ecd:NonPeoNeoMemberbe:EquityAwardsValueOfDividendsAndOtherEarningsPaidAdjustmentMember2023-01-012023-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 (Amendment No. )

| | | | | |

☑ Filed by the Registrant | ☐ Filed by a party other than the Registrant |

CHECK THE APPROPRIATE BOX:

| | | | | |

| |

| | |

| ☑ | Preliminary Proxy Statement |

| |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| | |

| ☐ | Definitive Proxy Statement |

| | |

| ☐ | Definitive Additional Materials |

| | |

| ☐ | Soliciting Material under §240.14a-12 |

Bloom Energy Corp.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

PAYMENT OF FILING FEE (CHECK ALL BOXES THAT APPLY):

| | | | | |

| |

| | |

☑ | No fee required |

| | |

| ☐ | Fee paid previously with preliminary materials |

| | |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-1 1 |

| | | | | |

| |

| Letters To Our Stockholders |

| |

| | | | | | | | | | | |

| | | |

| | | |

It's time to embrace systemic transformation across the energy landscape, and Bloom is ready and able to contribute. We come to you this year with renewed optimism that our collective ambition to transition the energy sector will help us overcome the challenges that lie ahead. Distributed technologies, including our innovative solutions, will propel the next stage of energy sector growth, and Bloom is ready to meet the challenge. KR Sridhar Founder, Chairman and Chief Executive Officer |

| |

Dear Stockholder,

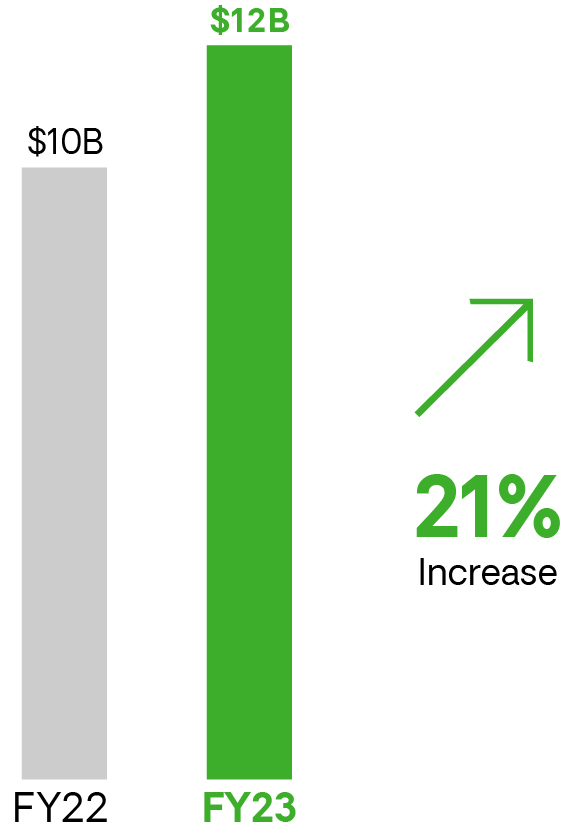

It is my privilege to invite you to our annual stockholder meeting. We look forward to discussing our achievements in 2023, a pivotal year in Bloom Energy’s history, and our ongoing efforts at helping to solve the most pressing energy challenges faced by companies around the world. We are extremely proud of the progress we are making at Bloom Energy. We continue to build our company with a focus on revenue growth, profitability, and balance sheet strength, while continuing to advance our world class technology and customer solutions. In 2023, we achieved an important milestone with profitability in non-GAAP operating income, supported by strong demand for our products, a growing order book, and we overachieved on our cost reduction targets. We are incorporating artificial intelligence (“AI”) into our operations, from supply chain to service. We expect our data-driven mindset, in combination with AI, to lead to greater performance improvements and faster technology innovation. As we continue to expand our global presence, we are making huge strides to deliver solutions that reduce carbon footprints while improving air quality in the communities in which we operate. With the strength of our balance sheet, our technological advancements, and our orderbook of more than $12 billion in product and service revenue, we are well positioned to execute in 2024 and beyond.

As part of our commitment to innovation and our unique understanding of customers’ power needs, we expanded Bloom’s product suite, building on our solid oxide fuel cell platform, with two new solutions that unlock new markets and applications for us. The first is our Combined Heat and Power (“CHP”) solution, which can provide both net-zero steam for hard-to-decarbonize industrial processes as well as net-zero cooling for infrastructure, including data centers. The second is our Be Flexible™ load following solution, which provides a much-needed economical and sustainable solution for variable electricity load and demand, with up to 50% cost savings, 50% carbon reduction at reduced load, and 5x faster power ramp versus legacy solutions like diesel generators or gas turbines. Our Be Flexible solution can solve pain points for utilities for their in-front-of-the-meter applications and for customers such as AI data centers, EV charging stations, or large industrial and commercial sites for their behind-the-meter applications.

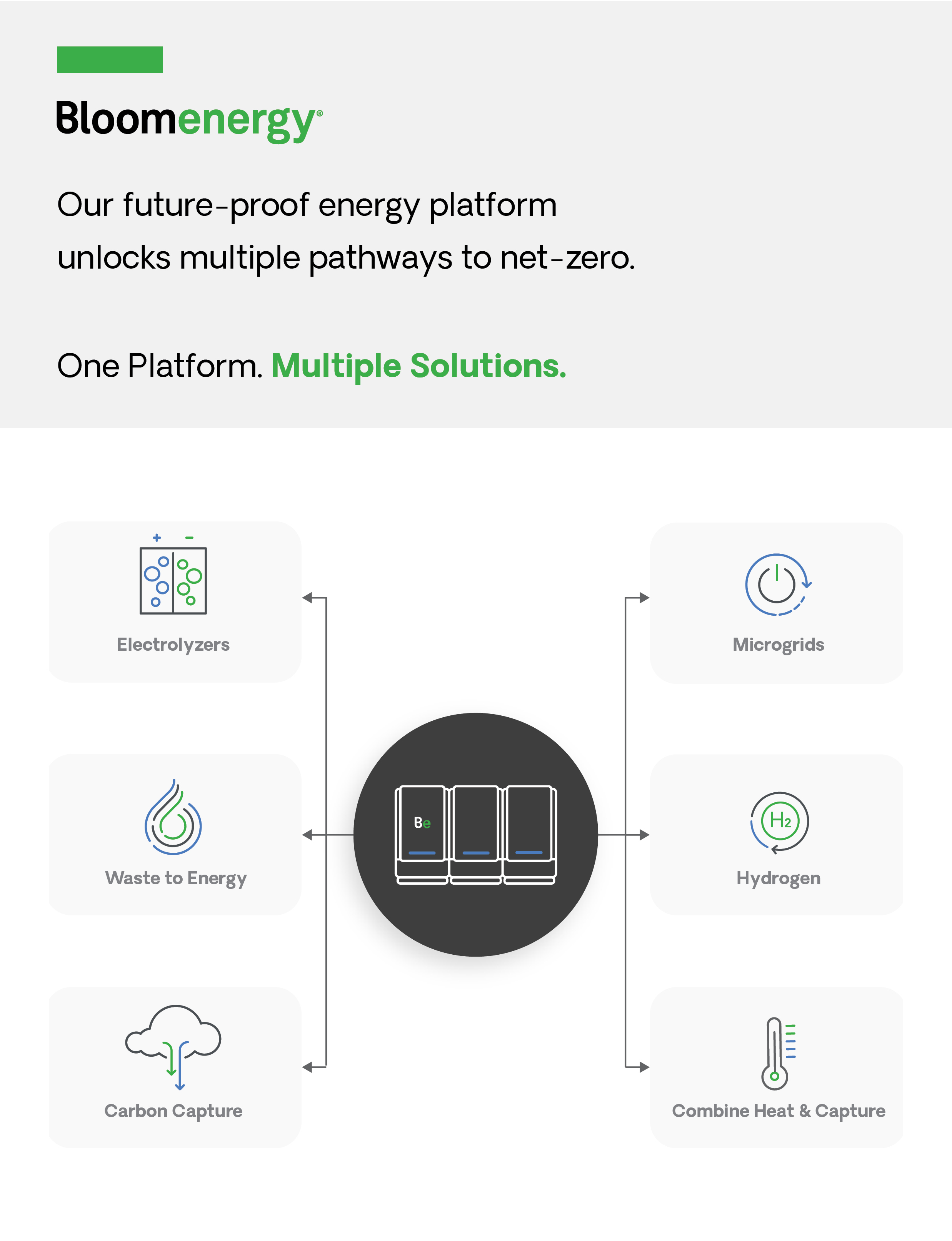

Bloom Energy’s Solutions

At Bloom Energy, we have spent the past two decades continuously innovating new solutions that can help

companies and governments address the challenges of power availability and reduced emissions.

Our Energy Servers are designed to deliver reliable electricity in microgrid configuration to customers who can’t afford power outages. Our system operates at very high availability due to its modular and fault-tolerant design, which includes multiple independent power generation modules that can be concurrently serviced while the system provides uninterrupted power from the other modules. Our Energy Servers also have the proven resiliency to withstand weather events, and other grid outages. Contrast that to the grid, which is still grappling with the increasing frequency and duration of outages caused by a number of systemic and hard to mitigate causes.

Our systems can be installed much faster than either new transmission lines or any form of large-scale power generation. This ‘Time to Power’ value proposition is particularly meaningful for manufacturers, data centers, hospitals, and retailers, especially as the local grid is increasingly unable to provide the additional power to support their growth or onshoring goals. Bloom Energy solutions can be operational in months, whereas other power providers and the grid itself are often unable to serve customers for a period of years.

The Bloom Electrolyzer opens new markets, partnerships, and geographies for us. The fifteen years of expertise we have accumulated from building, installing, and operating fuel cell systems is being leveraged to advance the electrolyzer systems we can deploy. In 2023, we deployed the world’s largest solid oxide electrolyzer at NASA’s Ames Research Center, located in Mountain View, California. At its high efficiency, the Bloom Electrolyzer uses less electricity to produce hydrogen than other electrolyzers, potentially lowering the overall cost of producing hydrogen, a critical factor in accelerating the transition to hydrogen as a fuel. The Idaho National Laboratory (“INL”) analyzed the efficiency of the Bloom Electrolyzer in producing hydrogen from electricity and steam from a nuclear facility and concluded that it was the most efficient electrolyzer that they had ever tested.

Tomorrow’s Energy Landscape

Digital transformation, AI, electric vehicles, the onshoring of manufacturing, and the electrification of everything are all increasing demand for electricity at a rate not seen in decades. By some estimates, these trends may drive demand for electricity up to ten times more than the average annual growth rate that utilities have experienced

during the past four decades. The nationwide forecast for electricity demand shot up from 2.6% to 4.7% growth over the next five years, with grid planners now forecasting a peak demand growth of 38 gigawatts (“GW”) in the next four years alone, requiring rapid planning and construction of new generation and transmission. In California, the lack of generating capacity regularly leads to emergency declarations and requests for residents and businesses to reduce their load and even export power from onsite resources, including the growing fleet of dirty diesel generators. To serve California’s surging energy demand with solar and wind alone, the required amount of storage, transmission, and capacity additions are projected to drive wholesale electricity rates up an additional 65%. In Asia, there are projections that total energy consumption will double from 2020 to 2050, driven by increasing populations and fast-growing economies. As utilities are increasingly unable to meet the surging demand for power, customers will need distributed solutions, independent of the grid, to ensure their power needs can be met with reliability, efficiency, and affordability.

In addition to rapid demand growth, the grid is now facing resiliency challenges as well as shortages of power generation and transmission infrastructure. Threats to grid resiliency include extreme weather events (with more than 20 incidents in the U.S. causing $1 billion or more in damages each in 2023), aging transmission and distribution systems, a wave of retiring generation assets (from both fossil and nuclear fuel sources), and unprecedented load growth that is far outpacing the installation of new renewable resources. In the last 10 years, all new renewable power capacity installed in the U.S. produced less electrical energy than the deficit created by retired coal and nuclear power plants. On the transmission side, while the National Renewable Energy Laboratory estimates that 90,000 miles of high-voltage transmission lines are needed to meet the projected demand growth, less than 700 miles were built in 2022.

For all of these reasons, energy security and power availability are top-of-mind for governments and the CEOs and boards of major companies. We see this reflected in our inbound inquiries and in the conversations that our sales teams are having with customers.

Data Centers: Powering AI

No industry better illustrates the confluence of these supply and demand dynamics than data centers. A recent report by Morgan Stanley estimates that Generative AI power demand will reach 224 terawatt hours by 2027, equivalent to more than 75% of total global data center power use in 2022. This market may not be served by the grid alone, but also by alternative power solutions such as Bloom’s Energy Server. In key data center markets like Northern Virginia and Silicon Valley, the capacity of the local grid has fallen far short of the growing demands of the data center industry.

Bloom’s Energy Server is flexible, rapidly deployable, and scalable. For the past year, Bloom has been engaged with several leading companies in the AI space, actively working with CEOs and their technical teams on design configurations and implementation scenarios for greenfield data center projects where the utility companies have made it clear that they cannot be counted on to provide power in the next several years. Based on this work, and in the absence of reliable and timely power from the grid, we believe Bloom represents

customers' best alternative for fast, flexible, and scalable power. The market in this sector is rapidly evolving, and we will have better visibility on timing as the year progresses, but as I look ahead, I see the data center space as our most exciting growth opportunity.

Energy for the Future

When I joined world leaders, energy executives, and NGO principals in Dubai last November for the United Nations Climate Change Conference, COP28, it was clear there is increasing positive momentum to collaborate to solve global energy needs and climate problems. While progress sometimes appears slow, we are dealing with the huge task of aligning the interests of the world’s biggest industry with the energy consumption needs of more than 8 billion people. The results from this year’s conference show a step change in the willingness of these important stakeholders to harness supply and demand forces to gain further alignment and equilibrium. I have never been more confident that we at Bloom can play an essential role in this transition to lower carbon and zero carbon energy at a global scale.

In the U.S., we must take swifter action at the state and federal levels to ensure clean energy supply growth, including efforts to alleviate the interconnection bottleneck and encourage more distributed energy solutions and microgrids. The good news is that Bloom Energy provides solutions to this potent mix of challenges. Policymakers have long discussed the promise of distributed technologies, now their time has come. Customers that require lower carbon and resilient energy today with the flexibility to move to net-zero solutions in the future are turning to Bloom Energy. Our future-proof platform offers these distributed technologies in a rapidly deployable “time-to-power” offering that unlocks multiple pathways to net zero. In a world challenged by cost and complexity, our Bloom Energy Server and Electrolyzer products provide important answers to these needs. Bloom's efficient, flexible, and resilient solutions available today offer some of the most pragmatic near-term generation options to reduce cost, increase resilience, reduce greenhouse gas emissions, improve air quality, and better conserve water and land, as are the innovative operating models they enable.

It's time to embrace systemic transformation across the energy landscape, and Bloom is ready and able to contribute. We come to you this year with renewed optimism that our collective ambition to transition the energy sector will help us overcome the challenges that lie ahead. Distributed technologies, including our innovative solutions, will propel the next stage of energy sector growth, and Bloom is ready to meet the challenge. Our optimism – indeed, our momentum – will continue to be motivated by our culture’s guiding principles: Be Bold, Be Agile, and Be Inspired. This is the heartbeat of Bloom. Our leadership team is inspired every day by the work of our talented colleagues. We are eager to share our story with you at our annual meeting. I look forward to seeing you there.

Most respectfully yours,

KR Sridhar

Founder, Chairman and Chief Executive Officer

[ ], 2024

Dear Stockholder,

On behalf of the Board of Directors, I am pleased to invite you to the 2024 Annual Meeting of Stockholders. As your lead independent director and having spent almost 40 years investing in energy innovation, it is a privilege to work closely with KR Sridhar, our Chairman and CEO, my fellow Board members, and our senior management team as the Company continues to innovate and advance its solid oxide fuel cell platform to provide solutions to address the energy transition to a decarbonized world.

Our Company had a successful year in 2023. We achieved record revenue, increased our margins, and expanded our core Energy Server product with two new offerings – CHP, our baseload solution with heat capture, and Be Flexible™, our baseload solution with load following. We also strengthened our balance sheet, invested in our people, and enhanced our governance practices.

During the past year, we worked with the Company’s leadership team to complete the sunsetting of the Company’s dual-class shares, giving an equal voice to all stockholders. We also oversaw the restructuring plan intended to scale the business, support the Company’s strategic priorities, and drive multi-year growth.

I am very proud of the Company’s commitment to sound governance practices and the highly-qualified Directors who bring their strong and unique set of skills, perspectives, and experiences as they conduct the Board’s governance and oversight responsibilities. Our Board is comprised of an experienced and diverse group of individuals with qualifications spanning executive leadership, global operations, finance, human capital management, emerging technologies, public policy, strategic business development, sustainability, and the energy industry. I encourage you to review Proposal 1 beginning on page 16 for our Director profiles. As the world transitions to a net-zero carbon energy system and the Company evolves to meet the challenges of this transition, so does our Board. We believe our Board currently reflects the right mix of skills and experiences to guide the Company as we navigate through the energy transition and scale for the future. Through our ongoing Board refreshment process, we will maintain a balance of diverse skills, backgrounds, experiences, and tenure among our Directors. We are focused on ensuring the Board continues to provide effective oversight of business strategy and execution and helps advance our evolving and growing business. In 2023, we welcomed CJ Warner to the Board, a seasoned energy executive with an engineering background and more than 40 years of senior leadership and global operating experience in both traditional and renewable energy; she brings valuable skills and perspectives to the Board as we scale globally, introduce new product solutions, and advance our business development efforts.

The global energy market is vast, dynamic, and can appear slow-moving. But the big themes persist… rapid growth in demand for electricity, broad-based undersupply, and the need for carbon reduction. Today, as always, Bloom Energy is poised to fill the void. As your Lead Independent Director, I am actively engaged with Bloom’s Chairman and CEO, KR Sridhar, helping the Company remain strategically positioned to successfully grow the business.

Over the past year, to foster transparent and effective two-way communication, we continued our ongoing dialogues with stockholders. We value your input and consider it an important part of our governance process. We look forward to continuing our engagement in 2024.

On behalf of my fellow Directors, we are grateful for your support and thank you for your interest and investment in Bloom Energy.

| | | | | |

| Sincerely, Jeffrey Immelt Lead Independent Director [ ], 2024 |

| | | | | |

| |

| Notice of Annual Stockholder Meeting |

| |

| | | | | | | | | | | | | | | | | |

| WHEN

May 7, 2024

9:00 A.M. Pacific Time | | WHERE

Via live audio webcast at

www.virtualshareholdermeeting.com/BE2024 | | RECORD DATE

March 12, 2024 |

Meeting Agenda

| | | | | | | | |

| Proposal | Board Recommendation | More Information |

| | |

| | |

1. To elect the three Class III directors named in the Proxy Statement. | each director nominee | |

| | |

| | |

2. To approve, on an advisory basis, the compensation of our named executive officers, as described in the Proxy Statement. | | |

| | |

| | |

3. To ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2024. | | |

| | |

| | |

4. To approve an amendment to our restated certificate of incorporation to add officer exculpation provisions and eliminate outdated references to Class B common stock | | |

| | |

Stockholders will also transact any other business that may be properly brought before the 2024 Annual Meeting or any adjournment, continuation, or postponement thereof.

Who Can Vote and Attend. Holders of our Class A common stock at the close of business on the Record Date can attend the meeting online and vote on the proposals. Whether or not you expect to attend, we encourage you to read the Proxy Statement and vote using one of the methods described below as soon as possible so that your shares may be represented at the meeting.

Your Vote is Very Important. Holders of Class A common stock are entitled to one vote per share. If you are a registered holder and have questions regarding your stock ownership, you should contact our transfer agent, Equiniti Trust Company, LLC through its website at https://equiniti.com/us/ast-access/individuals or by phone at 1-800-937-5449.

Mailing Date. On or about [ ], 2024, we will mail to most stockholders a Notice of Internet Availability of Proxy Materials with instructions on how to access our proxy materials, including our Proxy Statement and Annual Report.

Meeting Disruptions. In the event of a technical malfunction or other situation that the meeting chair determines may affect the ability of the meeting to satisfy the requirements for a meeting of stockholders to be held by means of remote communication under the Delaware General Corporation Law, or that otherwise makes it advisable to adjourn the meeting, the chair of the meeting will convene the meeting at 9:30 a.m. Pacific Time on the date specified above and at our address at 4353 North First Street, San Jose, CA 95134 solely for the purpose of adjourning the meeting to reconvene at a date, time, and physical or virtual location announced by the meeting chair, and we will post information regarding the announcement on the investors page of our website at https://investor.bloomenergy.com.

By Order of the Board of Directors,

Shawn M. Soderberg

Chief Legal Officer and Corporate Secretary

[ ], 2024

How to Vote

| | | | | | | | | | | | | | | | | |

| BY INTERNET

Before the Meeting:

www.proxyvote.com During the Meeting:

www.virtualshareholdermeeting.

com/BE2024 | | BY TELEPHONE

1-800-690-6903 | | BY MAIL

Mark, sign, date, and promptly mail the enclosed proxy card or voting instruction form (if received) |

| | |

|

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting to be held on May 7, 2024. The Notice, Proxy Statement, and 2023 Annual Report on Form 10-K are available at www.proxyvote.com. |

|

| | | | | |

| |

Bloomenergy | 2024 Proxy Statement | 1 |

| | | | | | | | | | | | | | | | | |

Letter to Our Stockholders from Our Chairman and CEO | | | | |

| | | | Frequently Requested Information | |

Letter to our Stockholders from

Our Lead Independent Director | | | |

| | | |

| | | | | |

| | | | |

| | | | | |

| | | | |

| | | | | |

| | | | |

| | | | | |

| | | | |

| | | | | |

| | | | |

| | | | | |

| | | | |

| | | | | |

| | | | | |

| |

| | | |

| | | | |

| | | | | |

| | | | | |

| | |

| | | | | |

| | |

| | |

| | |

|

|

| | | | |

| | | | | |

| | | | | |

| | | | |

| | | | | |

| | | | |

| | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | |

| | | | | |

| | | | | |

| | | | |

| | | | | |

| | | | |

| | | | | |

| | | | |

| | | | | |

| | | | |

| | | | | |

| | | | |

| | | | | |

| | | | |

Certain statements in this Proxy Statement, other than statements of historical fact, including estimates, projections, statements relating to our business plans, objectives and expected operating results, statements regarding our environmental and other sustainability plans and goals, and the assumptions upon which those statements are based, are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). In some cases, forward-looking statements may be identified by terms such as “believe,” “project,” “expect,” “anticipate,” “estimate,” “intend,” “strategy,” “future,” “opportunity,” “plan,” “may,” “should,” “will,” “would,” “will be,” “will continue,” “will likely result,” and similar expressions. Forward-looking statements are based on current expectations and assumptions that are subject to risks, uncertainties, and other factors, including those identified in our Annual Report on Form 10-K for the year ended December 31, 2023, filed with the U.S. Securities and Exchange Commission (“SEC”) and other subsequent documents we file with the SEC, which may cause actual results and outcomes to differ materially from the forward-looking statements. We undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events, or otherwise. Any standards of measurement and performance made in reference to our environmental and other sustainability plans and goals are developing and based on assumptions that continue to evolve, and no assurance can be given that any such plan, initiative, projection, goal, commitment, expectation, or prospect can or will be achieved. The inclusion of information related to our environmental and other sustainability goals and initiatives is not an indication that such information is material under the SEC’s standards. Website references throughout this document are provided for convenience only, and the content on the referenced websites is not incorporated by reference into this document.

| | | | | |

| |

2 | Bloomenergy | 2024 Proxy Statement |

Company Overview

Our leading solid oxide platform for distributed power generation and hydrogen production is changing the future of energy.

The Future of Energy Starts Here

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | |

Our Mission To make clean, reliable energy affordable for everyone in the world. Our Values Changing the future of energy is no small task, but our diverse group of thinkers, solvers, and dreamers are up to the challenge. Driven by a shared passion for our planet, our employees help design, produce, and distribute unique energy solutions that transform how we power our world. To achieve our mission of energy abundance without compromises, we strive to: BE Bold: We challenge the status quo using a data-driven approach to exceed our customers’ needs and solve their most complex problems. BE Inspired: Our compassion for our planet pushes us to deliver world-leading energy solutions. Our compassion and desire to do the right thing establishes trust and delivers excellence across the products we build and the customers we serve. BE Agile: We learn quickly and embrace entrepreneurship to adapt nascent ideas into best-in-class products that can enable a scalable, low-cost energy transformation. These shared values are what power our team to create a better, more sustainable future. | | Our Value Proposition |

| An unwavering passion for creating a clean, healthy, and energy abundant world. |

| Bloom Energy empowers businesses and communities to responsibly control and manage their energy and choose their path to decarbonization. |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Resilient Uninterrupted power without compromise. | Predictable A fixed power price and high power quality. | Sustainable Addressing both the causes & consequences of climate change. | Deployable Bloom can deploy in a matter of months and reduce customers’ time to power. |

| Empowering the Future Our fuel flexible, upgradable future-proof energy generation platform unlocks multiple pathways to a net-zero future. |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Electrolyzers We’re pioneering solid oxide technology to produce clean hydrogen using less electricity. | Hydrogen Fuel We’re leveraging our proven Energy Server technology to generate carbon-free electricity from hydrogen. | Waste to Energy With our proven Energy Server, we’re harnessing the power of greenhouse gases to create clean energy from methane. |

| | | | | | | | | | | | |

| Microgrids We have powered sites through thousands of power outages and enable customers to expand their operations in grid constrained locations. | Carbon Capture When fueled by natural gas, our Energy Server produces a pure stream of CO2, paving the way for efficient carbon capture. | Combined Heat & Power By adding Heat Capture, total system efficiency can reach efficiency > 90% and improve economics. |

| | | | | | | | | | | | |

| | Be Flexible By combining our load following inverters with the right level of redundancy and battery storage, Bloom’s Be FlexibleTM solution can match the customer's load profile, with the ability to ramp fast and sustain the customer's load dynamic. |

| | | | | | | | | | | | |

| | Reliability Modular design allows our Energy Server to reach up to 99.999% reliability and is available to serve critical customer loads. |

| | | | | | | | | | | | |

| Our innovations have set a path to achieve not only meaningful carbon reductions within our own operations, but also the decarbonization of energy across the globe in dozens of sectors. |

|

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | |

| |

Bloomenergy | 2024 Proxy Statement | 3 |

A Resilient, Energy Conversion Platform Designed for a Net-Zero Future

Our modular, scalable, and configurable solid oxide platform is capable of providing a variety of sustainable power solutions: from the generation of zero-carbon electricity to the production of clean hydrogen. We continue to evolve and expand our offerings as we pursue our mission to make clean, reliable energy affordable for all.

Microgrids

Bloom’s Microgrid and Advanced Bloom Microgrid offerings have grown to become an important solution to an increasingly unreliable centralized power grid. Our microgrids do not depend on transmission lines or the larger distribution system, eliminating the risk of being cut off from power due to natural disasters and have proven resilient during hurricanes, earthquakes, fires, and more. These microgrids can be installed alongside batteries and solar panels to increase flexibility and reliability. Globally, more than 170 Bloom microgrids maintain power supply for hospitals, supermarkets, data centers, high-tech manufacturers, university campuses, and more.

Waste to Energy

The solid oxide fuel cells in the Energy Server provide an electrochemical pathway to convert methane in natural gas or biogas directly into electricity without combustion. We have pioneered the cleanup of biogas as fuel on-site for our Energy Server operation, without the need for pipeline-quality biomethane. On-site biogas use avoids the release, combustion, or flaring of harmful methane. When the Energy Server uses treated biogas as a fuel, it has a similar emission profile as natural gas but a lower, and potentially even negative, lifecycle carbon intensity.

Carbon Capture Utilization & Storage (“CCUS”)

When operating on hydro-carbon fuel like natural gas, the non-combustion nature of Bloom’s Energy Server product generates a relatively pure stream of CO2 devoid of nitrogen oxides, sulfur oxides, and other impurities that are difficult or expensive to separate. Pairing the Energy Server with existing exhaust processing technologies, we can isolate a highly purified stream of CO2 that can be used or sequestered more economically than traditional forms of power generation. CCUS can partially or fully mitigate emissions from natural gas depending on the specific sequestration or utilization technologies and methods being used. When carbon capture is paired with biogas energy generation (bioenergy to carbon capture or “BECCS”) projects, complete or even negative carbon emissions can be achieved.

Combined Heat and Power

The Bloom Energy Server can be enhanced with mechanical exhaust adapters to allow for easy integration to combined heat and power (“CHP”) systems. The high temperature cathode exhaust from the Energy Server can be channeled, allowing the resulting exhaust heat to be

available for use. Once captured, this high temperature heat can be utilized in various applications to further increase the overall combined thermal and electrical efficiency of the system.

Be FlexibleTM

Be Flexible offers customized solutions to address variable power generation needs (when grid connected) or dynamic loads (when grid independent). From supporting the grid operators in smoothing out power oscillations caused by renewable penetration, to taking on challenging load profiles when powering critical loads in a grid independent configuration, Be Flexible is a feature that shifts the classical paradigm by which fuel cells were considered baseload generators only and positions them as the best choice for demanding applications such as AI data centers or EV charging. Our Be Flexible solution is intentionally designed with the flexibility to adapt and meet the unique needs of our customers.

Hydrogen Fuel

As production of hydrogen becomes ubiquitous, Bloom’s Energy Server is hydrogen ready. The Energy Server can operate on a combination of blended hydrogen and natural gas or 100% hydrogen. Bloom’s Energy Server products present a highly-reliable, zero-carbon, or renewable power generation option for customers.

Electrolyzers

Using the same solid oxide platform as our Energy Server, the Bloom Electrolyzer is designed to produce scalable and cost-effective hydrogen solutions more efficiently than proton exchange membrane and alkaline solutions. Our modular design makes the Bloom Electrolyzer ideal for use with both nuclear and renewable power feedstocks and can be sited flexibly to efficiently serve a variety of industrial, transport, and power sector off takers. Because of high operating temperatures and innovation, the Bloom Electrolyzer requires less energy to break up water molecules, thus producing hydrogen more cost effectively.

Reliability

The modularity of the Bloom Energy Server allows for the design of highly reliable configurations suited to a specific site’s reliability and availability needs. Our base model has exceptional reliability through high levels of Mean Time between Failure (“MTBF”) and with concurrent maintenance has low Mean Time to Repair (“MTTR”). High MTBF and low MTTR results in very high availability of power to the customer’s load. Bloom’s base Energy Server for grid-parallel systems has a 99.9% availability which is at par with utility standards. Adding redundancy over our base Energy Server model results in higher availability to the order of 99.999% suited to meet the most critical load requirements on the market.

| | | | | |

| |

4 | Bloomenergy | 2024 Proxy Statement |

Products Designed with Reliability and Sustainability in Mind

No Combustion:

Unlike traditional power generation technologies Bloom does not require combustion, eliminating harmful criteria pollutants

Commercial Trends

There are many factors driving demand for our solid oxide technology across the energy landscape, including:

| | | | | |

| |

Energy security and resilience is now a strategic imperative | The rising frequency of power disruptions caused by more severe natural disasters and extreme weather in recent years underscores a critical need for greater grid resilience. In an increasingly electrified world, power supply and reliability are critical. |

| |

| |

| Centralized systems are facing challenges with increased load demands | According to the North American Electric Reliability Corporation’s (“NERC”) 2022 Long-Term Reliability Assessment, more than half of the U.S. has a high or elevated risk of insufficient electricity supply over the next five years. With increasing penetration of intermittent generation, grid operators are finding it harder to match supply and demand. |

| |

| |

Customers are looking for energy solutions that are flexible and clean | Commercial and industrial customers need technologies that can support their growing and variable energy needs. AI data centers and EV charging stations, for example, will cause significant load growth while also needing solutions that can meet their peak energy demands. These solutions also have to reduce emissions today while positioning them for a net-zero future. |

| |

| |

| Hydrogen is key to a net-zero future | Clean hydrogen is gaining considerable attention as a flexible zero-carbon fuel and energy storage medium. It can be stored and utilized in various industrial, transportation, and power generation applications. We believe clean hydrogen will be a critical factor in the energy industry of the future. |

| |

| | | | | |

| |

Bloomenergy | 2024 Proxy Statement | 5 |

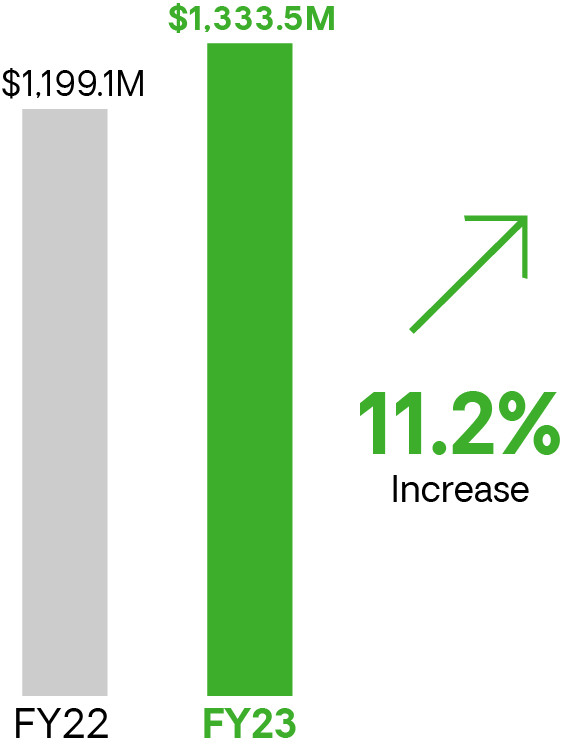

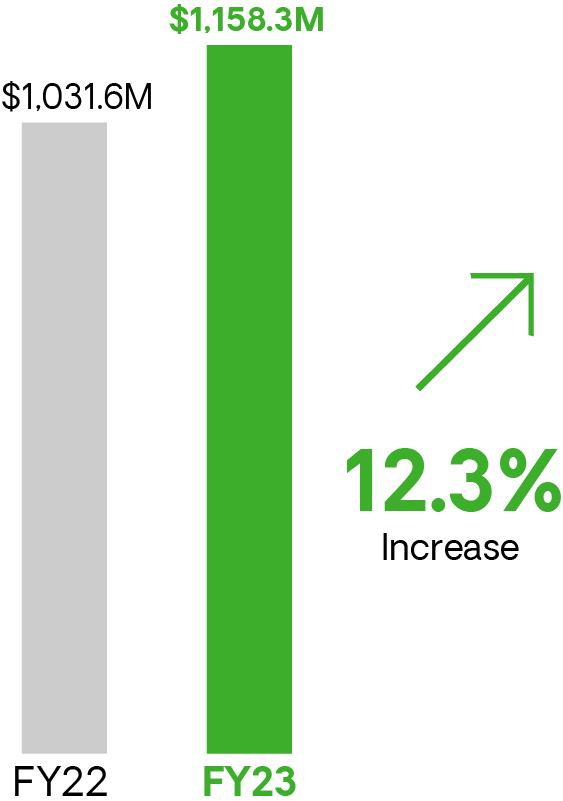

Financial Highlights

| | | | | | | | | | | | | | | | | | | | |

| Revenue | | | Product & Service Revenue | | | Product & Service Backlog |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| Gross Margins | | | Non-GAAP Gross Margins | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | |

| |

6 | Bloomenergy | 2024 Proxy Statement |

2023 Business Highlights

| | | | | | | | |

| | |

| Demonstrated Bloom Electrolyzer capability: We held a successful demonstration of our Bloom Electrolyzer technology, producing 2.4 metric tonnes of hydrogen per day. Our 4 megawatt (“MW”) Bloom Electrolyzer is a high-temperature, high-efficiency unit, producing 20-25% more hydrogen per MW than commercially demonstrated lower temperature electrolyzers such as proton electrolyte membrane (“PEM”) or alkaline. Idaho National Lab testing has shown the Bloom Electrolyzer to be the most efficient technology available at the time of testing. | |

| | |

| | |

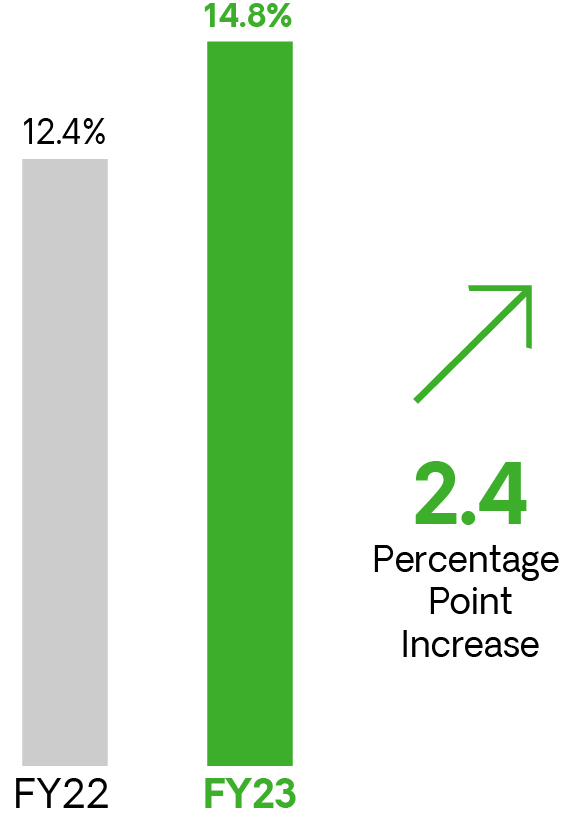

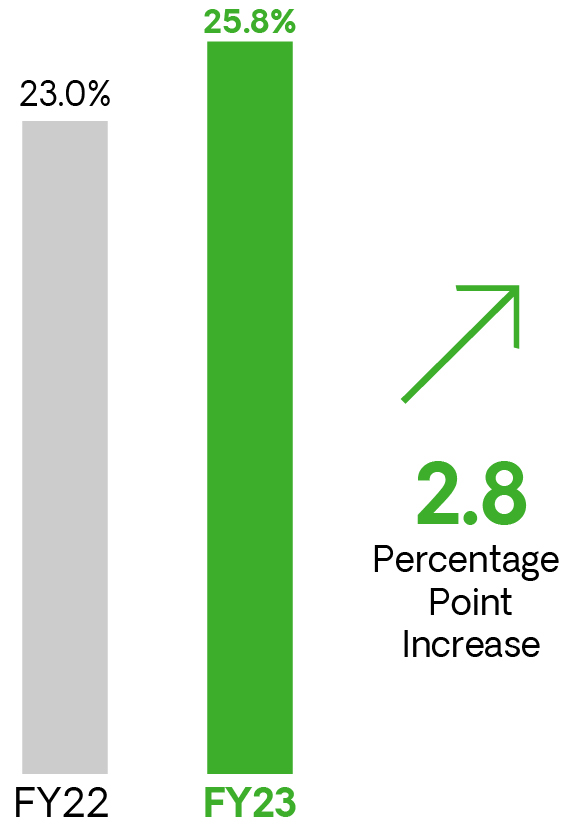

| Strengthening our balance sheet: Our market reach continues to grow, with revenues for 2023 setting a new company record of $1.33 billion, up 11% from 2022. Our focus on cost reductions helped us improve our gross margins to 14.8%, up from 12.4% in 2022 (non-GAAP gross margins were 25.8%, up from 23% in 2022). Our product and service backlog, a key indicator of future growth, grew to $12 billion at the end of 2023, up from $10 billion in 2022. In May, we issued the 3% Green Convertible Senior Notes due June 2028 with an aggregate principal amount of $632.5 million, We also consolidated our production facilities in California at our Fremont, California multi-gigawatt factory. | |

| | |

| | |

| Expanded our relationship with SK ecoplant: In December, we expanded our partnership with SK ecoplant through an incremental purchase commitment of 250MW through 2027 and we extended the timing of delivery of the remaining take-or-pay commitment under the original agreement and changed it to a minimum purchase agreement. | |

| | |

| | |

| Successfully expanded into new international markets: In August, we commissioned a 10MW Energy Server in Taiwan and we also expanded our presence in Asia with a signed contract in Thailand. During 2023, our business development teams completed new market entry milestones in Germany, the United Kingdom, and Northern Europe. | |

| | |

| | |

| Deployed first Fuel Cell CHP plant in Europe: Our versatile energy platform, with its Combined Heat and Power (“CHP”) solution, utilizes a high temperature (>350°C) exhaust stream for industrial steam production and absorption chilling. In partnership with Cefla, we deployed the first fuel cell co-generation plant in Europe to address gas reduction goals in the EU. | |

| | |

| | |

| Indispensable technology in the data center and AI market: The data center market is facing significant growth and power challenges due to the increase of AI and EV loads. Due to our ability to deliver clean, reliable, and onsite power in months instead of years, this sector has become an important component of our pipeline. With the recent announcement of our Be Flexible offering, our products are well-positioned to serve this market with dynamic load following, power stability, and the modularity and fuel flexibility to advance the data center market into the hydrogen-fueled infrastructure of the future. | |

| | |

| | | | | |

| |

Bloomenergy | 2024 Proxy Statement | 7 |

Introduction

The health and well-being of our people, our communities, and our planet matter greatly to Bloom Energy. While our focus is firmly established, our formal processes, strategies, and governance concerning sustainability matters continue to evolve. We are actively engaged in dialogue with various stakeholders regarding their interest in our performance regarding corporate responsibility and sustainability. Our Board of Directors and the Nominating, Governance, and Public Policy Committee (the “Nominating Committee”) of the Board oversee the sustainability program.

We are also committed to transparency with respect to our sustainability initiatives. Since 2021, we have issued an annual Task Force on Climate-related Financial Disclosures (“TCFD”), Sustainability Accounting Standards Board (“SASB”), and Global Reporting Initiative (“GRI”) aligned Sustainability Report. In April 2024, we plan to publish our fourth Sustainability Report, which will be available on our website at bloomenergy.com/sustainability, and provides more information regarding greenhouse gas emissions, workforce diversity reporting, and other topics. Please note that our 2024 Sustainability Report is not a part of our proxy solicitation materials.

| | | | | |

| |

8 | Bloomenergy | 2024 Proxy Statement |

2023 Sustainability Highlights

| | | | | | | | | | | | | | | | | | | | | | | |

Climate | | | Waste | | | Governance | |

| | | | |

| | | | | | | |

992,481 tonnes of avoided carbon emissions from our fuel cell projects 60,000 tonnes of avoided carbon emissions from our certified gas program | | 3,559 tonnes of material recycled through our repair and overhaul operations 99% recycling or reuse rate of our product materials at end of life | | Physical Climate Risks quantified through our first forward scenario exercise and integrated into our enterprise risk management (“ERM”) program |

| | | | | | | |

| | | | | | | |

| Air Quality | | | Supply Chain | | | Community | |

| | | | |

| | | | | | | |

$19-42 million savings to local health-care systems throughout the U.S. by emissions avoided from our non-combustion technology | | 96% of suppliers responded to our conflict minerals supplier survey up from 92% in 2022 | | $337,000 raised through expansion of our Bloom Energy Stars & Strides Community Run/Walk |

| | | | | | | |

| | | | | | | |

| Water | | | Product | | | Employees | |

| | | | |

| | | | | | | |

39 billion gallons of water withdrawal avoided from central station power plants nationally | | 90% Combined efficiency available from our new CHP solution 4MW Bloom electrolyzer demonstration deployed, the world’s largest solid oxide installation | | 66% of U.S. employees are ethnically diverse 10 years of manufacturing excellence in Delaware celebrated |

| | | | | | | |

| | | | | |

| |

Bloomenergy | 2024 Proxy Statement | 9 |

Living Our Purpose

Now, more than ever before, people are looking for purposeful and fulfilling work. At Bloom, we recognize the importance of communicating our mission clearly, living our core values, and connecting our employees to our purpose. This means addressing climate change and its impacts, changing the future of energy by leading the

world’s energy transition and how we power the world, underscoring the important role our employees have in advancing our mission and making the world a better place, as well as doing the right thing for the greater good of our society and our stakeholders.

Taking Care of Our Employees

Our achievements are possible thanks to our global workforce of skilled and diverse workers. We are dedicated to creating a workplace, everywhere in the world, where our employees feel valued and engaged in meaningful work. Just as our people support and advance our mission, we aim to foster a culture of innovation, respect, collaboration, and transparency that enables our employees to thrive and grow their connection to Bloom’s purpose. To attract and build a strong, diverse talent pipeline, we partner with local communities, universities, and industry groups. We strive to maintain a safe, inclusive, and engaging workplace, with opportunities for

our employees to grow in their careers, supported by strong compensation, benefits, and health and wellness programs.

At Bloom, we communicate our mission clearly, live our core values, and connect our employees to our purpose: to make clean, reliable energy affordable for everyone in the world. Building solutions to address decarbonization and energy security requires us to have an employee base that is committed to working in an innovative and collaborative manner and requires management to create a safe, welcoming environment with clear communication of priorities and company direction.

Talent Acquisition and Development

To attract, retain, and diversify our exceptionally talented workforce, we continue to evolve our hiring strategies, track our progress, and hold ourselves accountable to advancing global diversity. These efforts are led by our Human Resources department and overseen by the Board. An important part of our talent acquisition strategy centers on recruiting candidates from underrepresented groups through targeted advertising and localized events.

We have enhanced our talent program through the introduction of a comprehensive Talent Management System designed to link performance and contribution to business results, enabling each employee to make a direct connection between their contributions and the success of Bloom. This comprehensive program includes goal setting, monthly check-ins, feedback solicitation, self-assessments, and an annual contribution assessment conversation meant as much as an opportunity to have career development discussions as to provide constructive feedback. Our Talent Management System provides employees with the resources required to

achieve their goals and engage in meaningful feedback discussions with their managers, leading to development, exposure to new experiences, and real-time learnings.

In 2023, we continued our Effective Interviewing course for hiring managers and interviewers, and provided a series of global employee learning sessions to support our employees’ ability to effectively engage with their managers.

At Bloom, we invest in our employees' progress. This past year we launched Bloom Energy University, an enterprise learning system designed to empower our people and increase their career advancement. The program is designed to promote engagement and equip employees with the skills to help Bloom build a cleaner, more energy-abundant world. In 2023, close to 300 employees went through a management development program and 216 individual contributors went through a series of online trainings. We also held regular Be Inspired sessions to help with business literacy and technology learnings.

| | | | | |

| |

10 | Bloomenergy | 2024 Proxy Statement |

Promoting Inclusion and Diversity

Since our founding, we have been committed to advancing inclusion and diversity across our organization. We endeavor to foster a work environment that values each person and contribution while promoting diversity of thought, positive engagement, and productivity. We recognize that having a multi-faceted team—with a wide array of knowledge, skills, life and professional experience, and viewpoints—fuels our innovation and growth. One of our greatest strengths is the diversity of our employees, and we believe diverse leaders serve as role models for our inclusive workforce.

We continuously evolve our hiring strategies, track our progress, and hold ourselves accountable to advancing global diversity. We seek to hire employees from a broad pool of talent with diverse backgrounds, perspectives, and abilities, and we believe diverse leaders serve as role models for our inclusive workforce. Our Effective Interviewing course for hiring managers and interviewers covers unconscious bias.

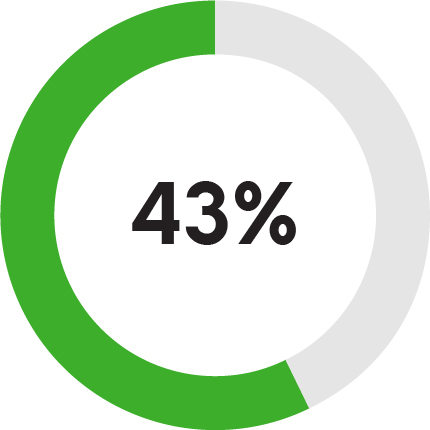

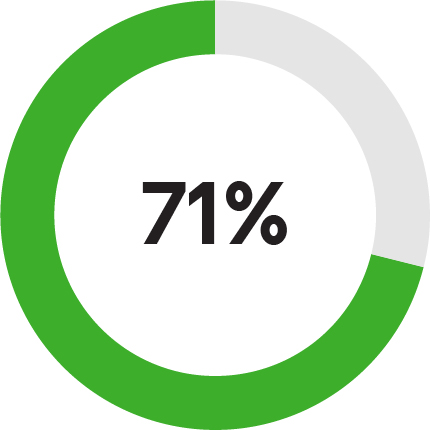

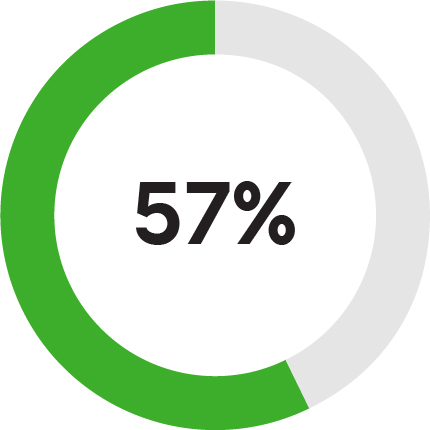

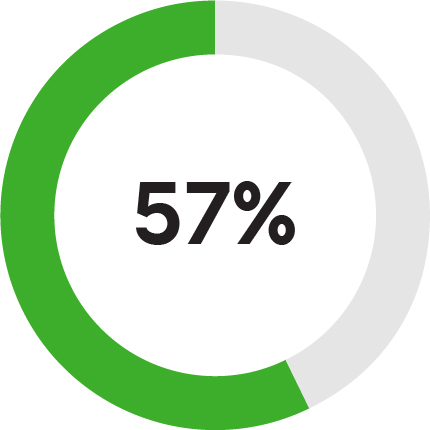

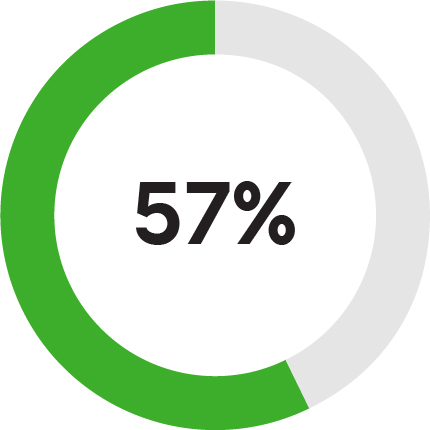

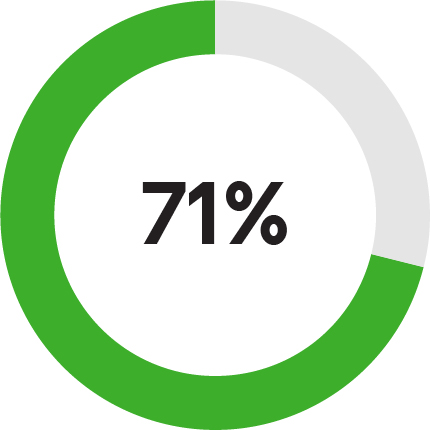

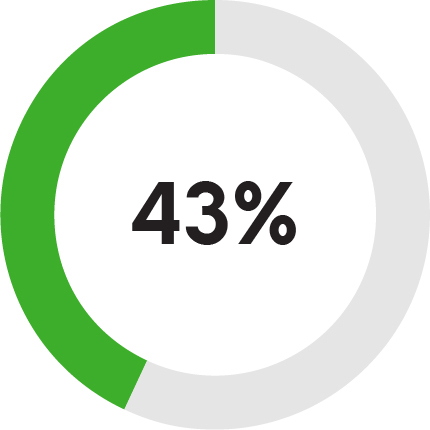

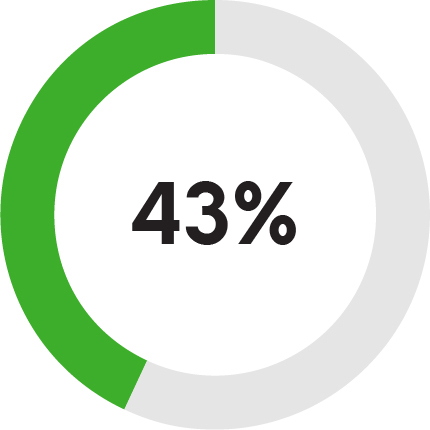

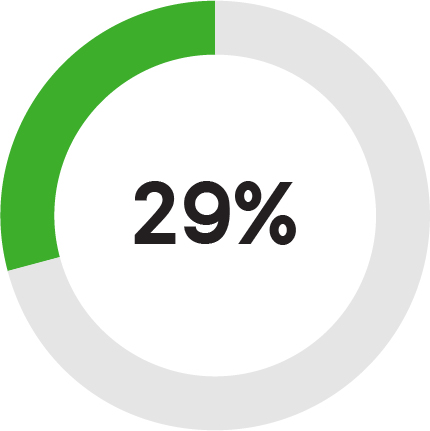

Our continued engagement with organizations that partner with diverse communities have been essential to our efforts to increase women, veteran, and minority representation in our workforce. At the end of 2023, ethnic minorities represented 66% of the Bloom U.S. population and 43% of the leadership population (Directors and above). Bloom Energy Women Leaders (“BEWL”) is an employee group aiming to create and encourage a Bloom culture where women leaders thrive. BEWL is open to all employees and consists of members from all levels of leadership. Women at Bloom represent 25% of the population and BEWL is one example of the efforts the company is engaging in to increase the percentage of women in leadership positions (15%).

| | | | | |

| FEMALE EMPLOYEES | 2023 |

| All Employees | 25 | % |

| Directors and above | 15 | % |

| |

| ETHNICALLY DIVERSE | 2023 |

| All Employees (US only) | 66 | % |

| Directors and above | 43 | % |

We partner with several veteran search firms to identify talent leaving the military. At the end of 2023, 7% of our workforce has a military background, including 33% in the Service organization. In Delaware, we have worked with the Dover Air Force base and the Delaware National Guard for hiring events. Bloom was awarded the Warrior Friendly Business award for 2023 by the Delaware National Guard. Our continued engagement with organizations that work with diverse communities has been vital to our efforts to increase women and minority representation in our workforce. Our “Careers at Bloom Silicon Valley” campaign targets recruiting diverse talent from underserved communities for hourly manufacturing roles. To promote inclusivity, we advertise our jobs in multiple languages and participate in community job fairs giving equal access to opportunities.

In line with our mission, in 2023 we also launched the inaugural Colin Powell - Bloom Energy Innovation Fellowship. We partnered with City College of New York Colin Powell School for Civic and Global Leadership to identify a dozen summer interns. These are students from underrepresented minorities, with the majority of them being the first to attend college in their family. We also have partnerships with a number of historically black colleges and universities, including Delaware State University and Howard University.

| | | | | |

| |

Bloomenergy | 2024 Proxy Statement | 11 |

Our Board at a Glance (learn more on page 23) | | | | | | | | | | | | | | | | | | | | | | | | | | |

Name and Primary Occupation | Career Highlights | Age | Director Since | Committees | Other Current Public Company Boards |

| AC | CC | NC |

| Continuing Class I Directors |

| Mary K. Bush President Bush International, LLC Independent | •30+ years advising U.S. corporations and foreign governments •Held several Presidential appointments in banking and international finance | 75 | 2017 | C* | | | 1 |

| | | | | | | | |

| | | | | | | | |

| KR Sridhar Founder, Chairman & CEO Bloom Energy | •20+ years at Bloom Energy as Founder, Chairman & CEO •Former Professor of Aerospace and Mechanical Engineering •Former advisor to NASA | 63 | 2002 | | | | 1 |

| Continuing Class II Directors |

| Jeffrey Immelt Lead Independent Director Venture Partner New Enterprise Associates, Inc. Former Chairman & CEO General Electric Independent | •15+ years leading GE as CEO/Chair •Named one of the “World’s Best CEOs” 3x by Barron’s •Former Chair of the President’s Council on Jobs and Competitiveness under the Obama Administration | 68 | 2019 | | C | | 3 |

| | | | | | | | |

| | | | | | | | |

| Eddy Zervigon CEO Quantum Xchange Independent | •Former CPA at PwC •15 years as a Managing Director at Morgan Stanley where he worked with us during our early growth stages •CEO of Quantum Xchange, a cybersecurity company | 55 | 2007 | M* | | C | - |

| | | | | | | | |

| Nominees for Election as Class III Directors |

| Michael J. Boskin Professor of Economics & Hoover Institution Senior Fellow Stanford University Independent | •50+ years as Stanford University faculty member •Former chairman of the President’s Council of Economic Advisors •20+ years on ExxonMobil board | 78 | 2019 | M | | M | 1 |

| | | | | | | | |

| | | | | | | | |

| John T. Chambers Founder & CEO JC2 Ventures Former Chairman & CEO Cisco Independent | •20+ years leading Cisco Systems as CEO/ Chair •Global Ambassador of the French Tech •Named a “Best-Performing CEO in the World” from Harvard Business Review and received the “Edison Achievement Award for Innovation.” | 74 | 2018 | | M | | - |

| | | | | | | | |

| | | | | | | | |

| Cynthia (CJ) Warner Former President and CEO Renewable Energy Group Independent | •Former President and CEO of Renewable Energy Group, a leading international producer of low carbon, bio-based diesel •Named “Director of the Year, Corporate Governance” by the Corporate Directors' Forum in 2023 and “Alumni of the Year, 2023” by Vanderbilt University | 65 | 2023 | M* | | M | 2 |

| | | | | | | | |

| | | | | | | | | | | |

| AC | Audit Committee | C | Chair |

| CC | Compensation and Organizational Development Committee (“Compensation Committee”) | M | Member |

| NC | Nominating Committee | * | Audit Committee Financial Expert |

| | | | | |

| |

12 | Bloomenergy | 2024 Proxy Statement |

We maintain an engaged and attentive Board. All directors attended at least 75% of all Board and committee meetings during the period in which he or she was on the Board or committee in 2023, with an average attendance of 99%.

| | | | | | | | | | | |

| 5 | 5 | 4 | 4 |

Board Meetings. Directors also participated on calls in between formal meetings. | Audit Committee Meetings | Compensation and Organizational Development Committee Meetings | Nominating, Governance and Public Policy Committee Meetings |

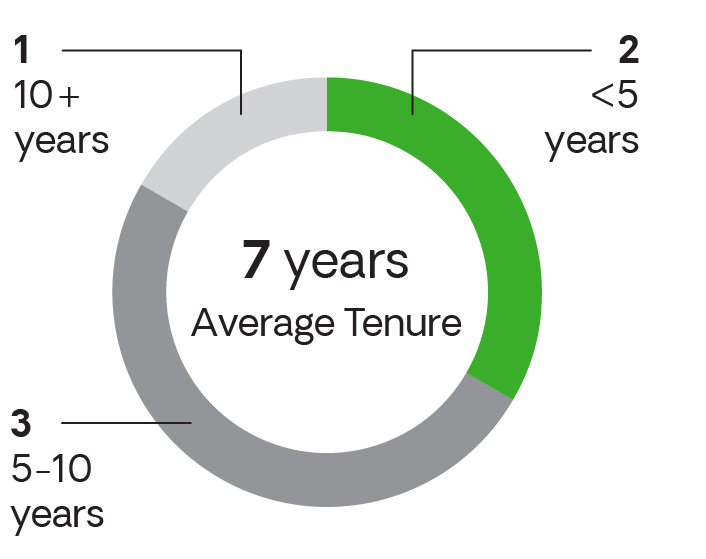

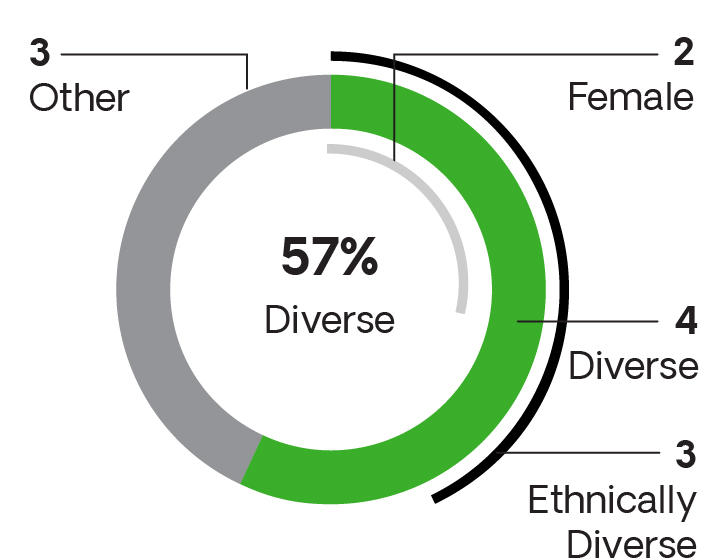

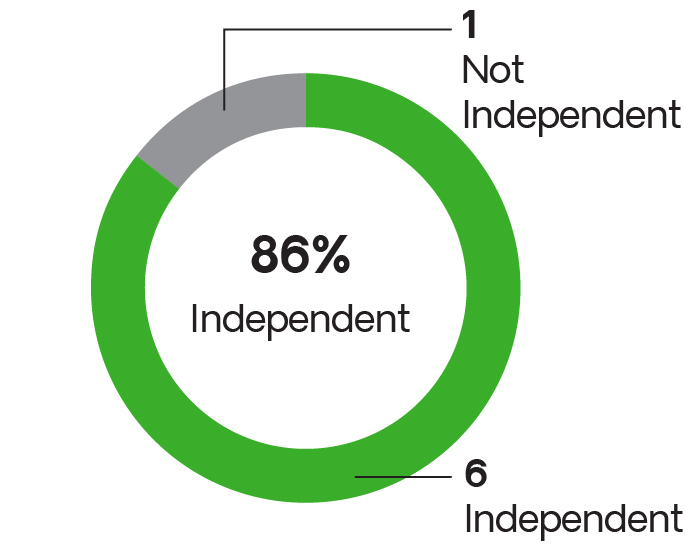

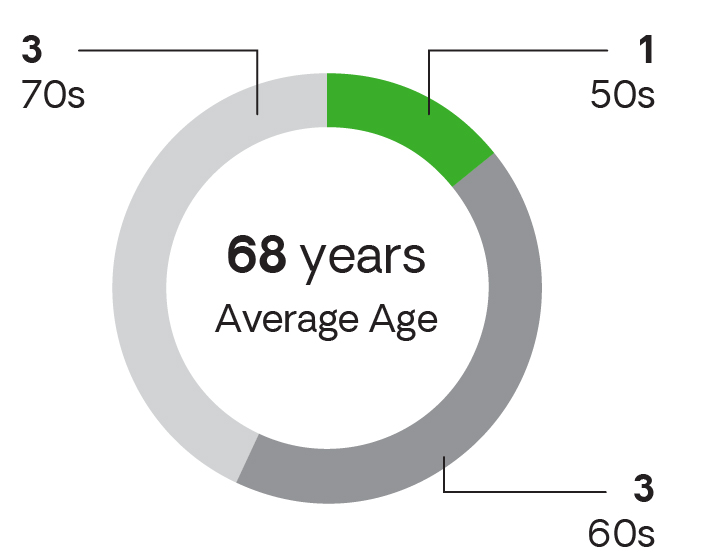

Board Composition (learn more on page 16) Our directors reflect a range of tenures and diverse experiences that support our strategy with relevant expertise.

| | | | | | | | | | | |

Tenure (non-employee directors) | Diversity | Independence | Age |

| | | |

| | | |

Director Experience (learn more on page 17) When selecting directors to join our Board, we seek candidates with:

| | | | | | | | | | | |

| 100% | 100% | 100% | 100% |

| of Directors | of Directors | of Directors | of Directors |

| | | |

Extraordinary Leadership Qualities | High Personal and Professional Integrity and Ethics | Diversity of Thought | Demonstrated Experience in Strategy, Risk Management, and Driving Change and Growth |

| | | | | |

| |

Bloomenergy | 2024 Proxy Statement | 13 |

Governance Practices (learn more on page 30) Our corporate governance practices are designed to support effective Board oversight, the execution of our strategy, and alignment with stockholder interests, including:

Stockholder Engagement (learn more on page 44) We engage with our stockholders on both the portfolio management and stewardship sides. On the portfolio management side, our investor relations team, CEO, and CFO regularly communicate with stockholders and attend conferences. We also host an Investor Conference to share our vision and plans with investors. On the stewardship side, our management team proactively interacts with our stockholders throughout the year to better understand their perspectives on significant issues. The feedback from these meetings, and from our stockholder engagement in general, is shared with our Board and the relevant Board committees.

Stockholder Engagement in Calendar Year 2023

| | | | | | | | | | | |

| Conferences | Bloom Investor Conference | Proactively Contacted for 1-on-1 Meetings | Topics Discussed |

| | | |

9 | 60 | >50% of unaffiliated Shares | Financial Performance Strategic Positioning Operational Priorities Corporate Governance Executive Compensation Sustainability Initiatives |

| Conferences | Investors |

| |

| |

>200 Firms | 3-Hour |

Global | Showcase Event |

| | | |

| | | | | |

| |

14 | Bloomenergy | 2024 Proxy Statement |

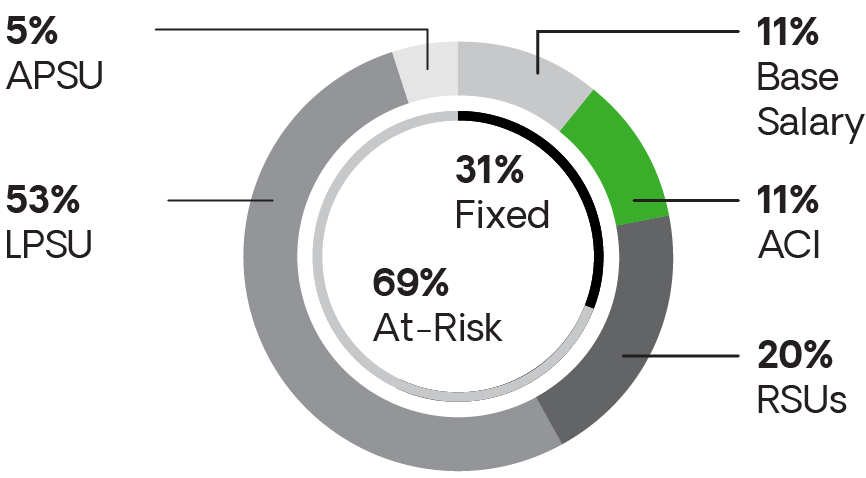

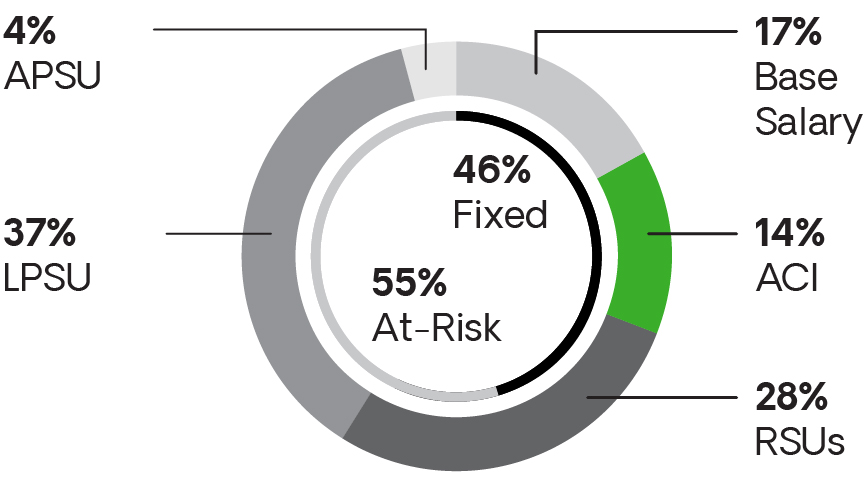

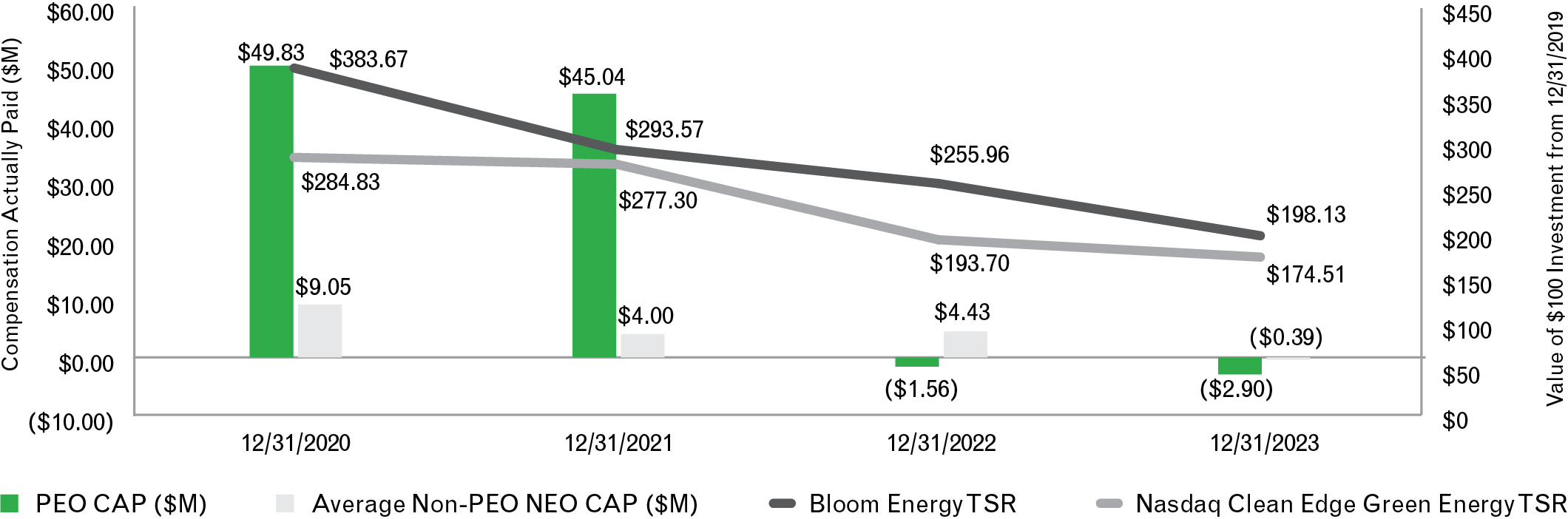

Executive Compensation Highlights (learn more on page 54) Our 2023 executive compensation program emphasized pay for performance. Highlights included:

•Emphasis on Performance-Based Incentives. A majority of the target compensation provided to our named executive officers (“NEOs”) was performance-based and varied based on the achievement of certain operating and financial metrics.

•Challenging Performance Objectives. The Compensation Committee set rigorous goals for our annual cash incentive (“ACI”) plan, which would only be met if we performed at a high level. Based on our performance in 2023, our continuing NEOs received payouts at 81% of their target.

•3-Year Performance Periods for Performance Share Units (“PSUs”). The Compensation Committee introduced long-term PSUs with a 3-year performance period (“LPSUs”), representing at least half to two-thirds of total target equity compensation for our NEOs, based on 3-year Product and Service Revenue compound annual growth rate (“CAGR”) and 3-year average non-GAAP Gross Margin.

•Equity Incentives to Reward Near-Term Operational Execution. In addition to the LPSUs with financial goals, a small portion of equity granted to our NEOs – approximately 8% of the total target equity compensation – was awarded in the form of PSUs with a 1-year performance period based on the achievement of pre-specified operational goals (“APSUs”).

| | | | | |

| |

Bloomenergy | 2024 Proxy Statement | 15 |

| | | | | | | | |

| | |

| PROPOSAL 1 | |

| | |

| | |

Election of Directors |

| | |

The Board of Directors unanimously recommends a vote FOR the election to the Board of Directors of each of the Class III director nominees, Michael Boskin, John Chambers, and Cynthia (CJ) Warner, each for a three-year term. The Board of Directors unanimously recommends a vote FOR the election to the Board of Directors of each of the Class III director nominees, Michael Boskin, John Chambers, and Cynthia (CJ) Warner, each for a three-year term. |

Our Board Structure. Our Board is divided into three classes, each with staggered three-year terms. As a result, only one class of directors is elected at each annual meeting, with the other two classes continuing for the remainder of their respective three-year terms. Each director’s term will continue until their successor is elected and qualified, or until their earlier death, resignation, or removal. The Board has seven members.

Nominees. The Nominating Committee and the Board have carefully considered the qualifications of the nominees and believe they are well qualified to serve on the Board. The nominees possess considerable professional and business experience, and as a group, they have the appropriate skills to exercise their oversight responsibilities.

If a Nominee is Unable to Serve. The nominees have consented to being named as nominees in the Proxy Statement and have agreed to continue serving as directors, if elected. If any nominee becomes unavailable to serve for any reason before the election, which is not anticipated, your proxy authorizes management to vote for another person nominated by the Board or the Board may reduce its size.

Vote Required. Directors will be elected by a plurality of votes cast. That means the three nominees receiving the highest number of votes will be elected. Withhold votes and broker non-votes, if any, will not affect the outcome of the vote.

Board Composition

Board Membership Criteria

The Nominating Committee is responsible for reviewing the skills and experiences desired in directors, in light of the company’s current business conditions, short- and long-term strategic initiatives, and existing competencies and experience on the Board. They also make recommendations regarding the size and composition of the Board.

All directors should have the following attributes:

•The highest personal and professional integrity, ethics, and values, consistent with our Global Code of Business Conduct and Ethics, available on Bloom’s website at www.bloomenergy.com

•A commitment to building stockholder value

•Familiarity with and respect for corporate governance requirements

•Sufficient time to carry out duties as a director

•An appreciation for and an ability to work in a collegial manner with a diversity of backgrounds, experiences, and thoughts

•Has professional skills and experience that align with the needs of Bloom’s current and long-term business strategy and complements the experience represented on the Board.

| | | | | |

| |

16 | Bloomenergy | 2024 Proxy Statement |

Director Skills and Experience

The Board has identified key skills and experiences that are important to be represented on the Board as a whole, in light of the Company’s business strategy and expected future business needs. Listed below are the skills and experience our Board considers important to effectively oversee our current and long-term business strategy, execution, and risk management, including the unique challenges we face as a developer, manufacturer, and provider of new, innovative technology and products in the complex, policy-driven, regulated energy industry that is undergoing substantial change. The table below summarizes how these key skills and experiences are linked to the Company’s core business needs and priorities.

| | | | | | | | | | | |

| | | |

| Public Company

Board Experience | Experience as a board member of another publicly traded company As a relatively new public company, we aspire to high governance standards and seek to have directors with a broad knowledge of corporate governance practices, board management, relations between the board and senior management, agenda setting, and succession planning. This experience supports our goal of board and management accountability, transparency, and protection of stockholder interests. | |

| | | |

| | | |

| Senior

Leadership | Experience serving as the Chief Executive Officer or other senior leadership role of an organization Serving in senior leadership positions, including as CEO, provides a demonstrated record of leadership and a a practical understanding of enterprise structure, operations and management, strategy, risk and risk management, and the methods to drive change and growth. As a company that has and should continue to undergo evolving strategies and growth, leadership experience in a large or complex organization provides experience and expertise to our management team in leading, developing, and scaling the company. | |

| | | |

| | | |

| Global Business/

International | Experience doing business internationally Growing our business outside the U.S. is a key part of our strategy for growth as a global provider of technology solutions for energy. Directors with global business or international experience provide valuable perspectives on diverse business environments, economic conditions, and culture, | |

| | | |

| | | |

| Financial/

Accounting/

Capital Markets | Experience or expertise in financial accounting and reporting, the financial management of an organization, or experience in corporate borrowing and capital markets We seek to have directors with an understanding of accounting, finance, and financial reporting processes to monitor and assess our operating and strategic performance as often characterized in financial metrics and to ensure robust controls and accurate financial reporting as these are critical to our success. We currently have three directors who qualify as audit committee financial experts (per SEC rules) and we expect all of our directors to be financially knowledgeable. Our capital structure and operations include the use of debt instruments and financing arrangements and we regularly engage in project finance to enable our customer’s use of our Energy Servers and other project development. It is important for our directors to have an understanding of the capital markets, financing, and energy project finance structures to advise on, and oversee, our project finance and corporate finance activities. | |

| | | |

| | | | | |

| |

Bloomenergy | 2024 Proxy Statement | 17 |

| | | | | | | | | | | |

| | | |

| Manufacturing/

Operations | Experience in manufacturing, supply chain, and fully integrated companies We both develop and manufacture our products, and supply chain management, factory automation, and global development of our manufacturing and related operations is critical to our ability to scale, achieve operating leverage, and grow. Directors with experience in these areas, particularly with large, global, fully integrated companies, provide valuable perspectives as our manufacturing footprint expands. | |

| | | |

| | | |

| Sales and

Marketing | Experience selling and marketing products globally and through direct and indirect channels It is imperative to our growth that we attract new customers, develop new channel partnerships, and expand the sales and marketing of Energy Servers and our new products into new territories and markets. Directors with experience in the strategy and mechanics of sales, customer acquisition and retention, marketing, channel and partnership models, and building brand awareness can support out efforts to grow our customer and channel partnership base and develop our brand. | |

| | | |

| | | |

| Human Capital

Management | Experience in developing, retaining, and rewarding employees in a global, fully integrated engineering and manufacturing organization We operate in a highly competitive employment market and we hire employees with diverse skills. Directors with experience in attracting, motivating, developing, and retaining qualified personnel in office, manufacturing, and engineering environments and succession planning are particularly important to our future success. In addition, ensuring we continue to evolve our compensation structure, employee practices, and our culture is critical to our global expansion and directors with experience or expertise in compensation practices, organizational design, and managing a diverse employee base provide valuable perspectives to our management team. | |

| | | |

| | | |

| Government/

Public Policy/

Regulatory | Experience working in a heavily regulated industry or an industry heavily influenced by policy and with regulatory and government organizations The energy industry is heavily regulated and directly affected by governmental actions and decisions. Our operations require compliance with a variety of regulatory requirements in numerous countries and involve relationships with various governmental entities throughout the world. Directors with government expertise at the federal and state level and experience developing and implementing policy will help us work constructively with governments around the world, which is critical as we attempt to develop legislation and a regulatory framework to enable adoption of our technology both in the U.S. and in select international markets. Directors who have experience working within a regulatory framework assist the Board with its oversight responsibilities regarding Bloom’s legal and regulatory compliance and its engagement with regulatory authorities. | |

| | | |

| | | |

| Energy | Knowledge or experience in the company’s specific industry Directors with energy industry experience can share with us their insight with respect to strategic and operational matters related to the complex, heavily regulated, and constantly changing energy industry. This includes experience in both the retail and wholesale energy markets and experience with both distributed generation and utilities as we seek to expand both in the U.S. and in select international markets. Knowledge of the competitive landscape provides valuable perspective as we consider partnerships and alliances in our go-to-market activities. | |

| | | |

| | | | | |

| |

18 | Bloomenergy | 2024 Proxy Statement |

| | | | | | | | | | | |

| | | |

| Strategic

Business

Development | Experience driving strategic direction and growth of an organization The energy market is in the middle of a massive transition as countries move to a zero carbon environment. As a provider of innovative power generation and other products for the energy market, the applications and products we chose to develop, the partnerships we engage in, and the product markets and territories we sell in are all strategic decisions we engage in on a regular basis. Directors who have experience developing future direction around new product development, new product markets and territories in an evolving market, and engaging in strategic decision making around future direction and evolution of a business can help guide both the Board and management team in conducting the required diligence and decision-making processes and practices to best enable strategic business development. | |

| | | |

| | | |

| Emerging

Technology/

Business Models | Experience developing a successful market adaptation of a new technology and deriving new business models Our Energy Server is a new and innovative product offering, as is the variety of applications we have developed from its core solid oxide platform. We continue to evolve the various ways in which we sell our products and attendant service offerings to drive additional growth and adapt to new or changing market conditions and requirements. Given the relative newness of our technology and resulting products, we seek directors with experience bringing new products to market and developing business models as this is important for our continued evolution and growth. | |

| | | |

| | | |

| Technology/

Science | Experience or expertise in technology or engineering Knowledge and experience in product development, materials science, chemistry, and hardware development is crucial for our continuing development and innovation with respect to our products and to the evolution of our strategy. As a high tech industrial company and an innovator in the fuel cell industry, we seek directors with technology or engineering backgrounds as our success depends on developing and investing in the continued evolution of our solid oxide platform and its applications. Technology experience will become even more important with the growth of AI and its potential impact on our business. | |

| | | |

| | | |

| Environmental/

Sustainability | Experience with environmental compliance and sustainability development As a technology company serving the energy industry, effective oversight and transparency regarding the risks and opportunities pertaining to climate change and the energy transition is critical to our growth and expected by our stockholders and other stakeholders. In addition, we place a high priority on the health and safety of our workforce, the communities where we operate, and the environment. Directors who have experience analyzing and responding to climate change, as well as assessing environmental compliance obligations and operations, can help us navigate the changing requirements around sustainability and reporting requirements and environmental risk management. | |

| | | |

| | | |

| Cybersecurity/

Information Security | Experience or expertise in cybersecurity, cloud computing, or data analytics As a provider of power generation and other energy applications, we provide a critical infrastructure asset for our customers. We provide remote monitoring of our products at our customer locations. A cyber attack on our products through our remote monitoring system or the grid as well as an attack on our own internal systems that house critical IP could have material adverse effects on our business. Directors who have experience managing cybersecurity and information security risks or who understand the cybersecurity threat landscape can provide valuable knowledge and guidance to the Board in its oversight of our cybersecurity risk management infrastructure. | |

| | | |

| | | | | |

| |

Bloomenergy | 2024 Proxy Statement | 19 |

The below chart shows how the skills and experiences identified by our Board are distributed among each of our directors. We have highlighted below the directors who possess the most expertise in each area. The lack of a mark does not mean the director does not possess that qualification or skill. The Board and the Nominating Committee believe that the combination of the various skills and experiences of the Board would contribute to an effective and well-functioning board capable of providing effective oversight of the business and quality advice and counsel to the Company’s management. The individual biographies beginning on page 23 provide additional information about how each director’s specific skills and experiences align with and further the strategic direction of Bloom. | | | | | | | | | | | | | | | | | | | | | | | | | | |

| SKILLS | Boskin | Bush | Chambers | Immelt | Sridhar | Warner | Zervigon | Total/Average |

| Public Company Board | l | l | l | l | l | l | l | 100% |

| Senior Leadership | l | l | l | l | l | l | l | 100% |

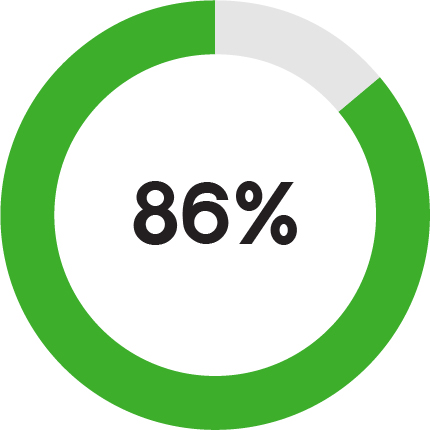

| Global Business/International | l | l | l | l | | l | l | 86% |

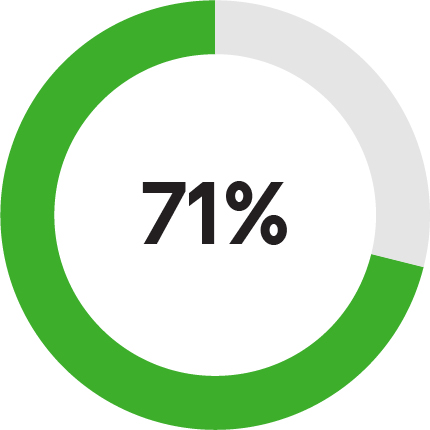

Financial/Accounting/

Capital Markets | l | l | | l | | l | l | 71% |

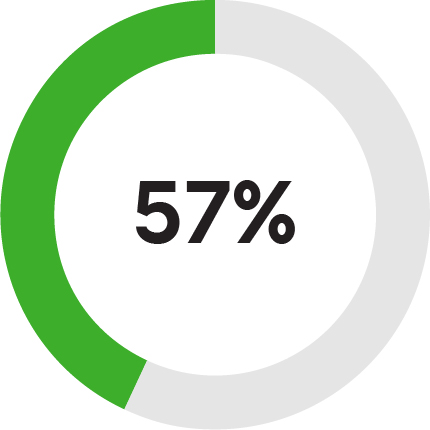

| Manufacturing/Operations | | | l | l | l | l | | 57% |

| Sales and Marketing | | | l | l | | l | | 43% |

| Human Capital Management | | l | l | l | l | l | | 71% |

| Government/Public Policy/Regulatory | l | l | | l | l | | | 57% |

| Energy | l | | | l | l | l | | 57% |

| Strategic Business Development | | l | l | l | | l | | 57% |

| Emerging Technology/Business Model | | | l | l | l | l | l | 71% |

| Science/Technology | | | l | | l | l | | 43% |

| Sustainability | | | | l | l | l | | 43% |

| Cybersecurity/Information Security | | | l | | | | l | 29% |

| INDEPENDENCE AND TENURE | | | | | | | | |

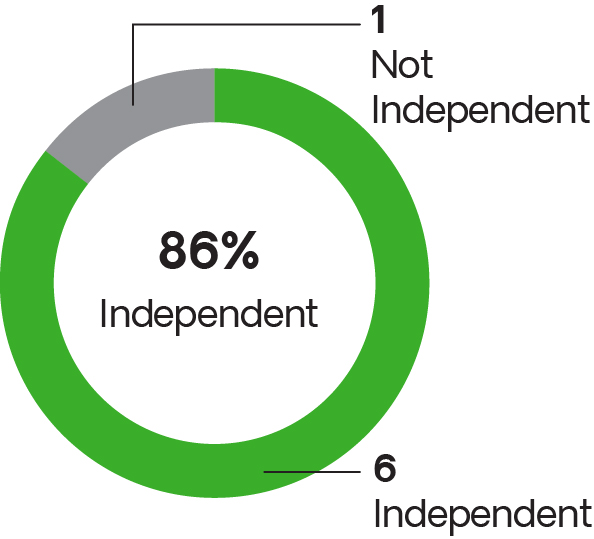

| Independent | l | l | l | l | | l | l | 86% |

| Tenure | 5 | 7 | 6 | 4 | 22 | 1 | 17 | 9 years (6.8 years for Independent Directors) |

| DEMOGRAPHICS | | | | | | | | |

| Age | 78 | 75 | 74 | 68 | 63 | 65 | 55 | 68 |

| Gender Identity | M | W | M | M | M | W | M | 71% M / 29% W |

| African American or Black | | l | | | | | | 14% |

| Asian | | | | | l | | | 14% |

| Hispanic or Latinx | | | | | | | l | 14% |

| White | l | | l | l | | l | | 57% |

| | | | | |

| |

20 | Bloomenergy | 2024 Proxy Statement |

How We Select Directors

Identifying Nominees. The Nominating Committee has the responsibility of establishing criteria, and identifying, evaluating, and recommending candidates for Board membership. The Nominating Committee works closely with the Chairman and other Board members in the identification and evaluation process. The Nominating Committee may also use outside consultants to assist in identifying candidates. In formulating its Board membership recommendations, the Nominating Committee considers advice and recommendations from stockholders, management, and others as it deems appropriate.

Stockholder Nominees. The Nominating Committee considers candidates recommended by stockholders using the same criteria as any other Board nominee candidate. Any stockholder may recommend a person for election as a director by complying with the nomination procedures set forth in the Bylaws. For more information, see the “Stockholder Proposals and Nominations” section. Evaluating Board Nominees. After a nominee is identified, the Board determines whether the nominee’s background, experience, personal characteristics, and skills will advance the Board’s goal of maintaining a Board with a diversity of skills, experiences, backgrounds, and perspectives that can provide effective oversight and governance and help

advance our evolving and growing business and strategic priorities, considering the desired characteristics discussed under “Board Membership Criteria.” For incumbent directors, the Nominating Committee also evaluates whether they should be nominated for re-election to the Board upon expiration of their term, based upon factors established for new director candidates, as well as:

| | |

|

•the extent to which the director’s judgment, skills, qualifications, and experience (including that gained due to tenure on the Board) continue to contribute to the success of the Board; •the director’s length of service on the Board; •feedback from the annual Board evaluation; •attendance and participation at, and preparation for, Board and committee meetings; •independence; •outside board and other affiliations, including any actual or perceived conflicts of interest; and •such other factors as the Nominating Committee deems appropriate. |

|

Board Diversity