UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________________________________________________________________________

FORM 10-K

| (Mark One) | |||||

| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the fiscal year ended | |||||

| or | |||||

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

| For the transition period from ____________to ____________ | |||||

Commission File Number: 001-38598

________________________________________________________________________

(Exact name of registrant as specified in its charter)

________________________________________________________________________

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | ||||

| (Address of principal executive offices) | (Zip Code) | ||||

( | |||||

| (Registrant’s telephone number, including area code) | |||||

| Securities registered pursuant to Section 12(b) of the Act: | ||||||||

| Title of Each Class | Trading Symbol(s) | Name of each exchange on which registered | ||||||

Securities registered pursuant to Section 12(g) of the Act: None.

________________________________________________________________________

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes þ No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ¨ No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes þ No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☑

1

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ¨

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No þ

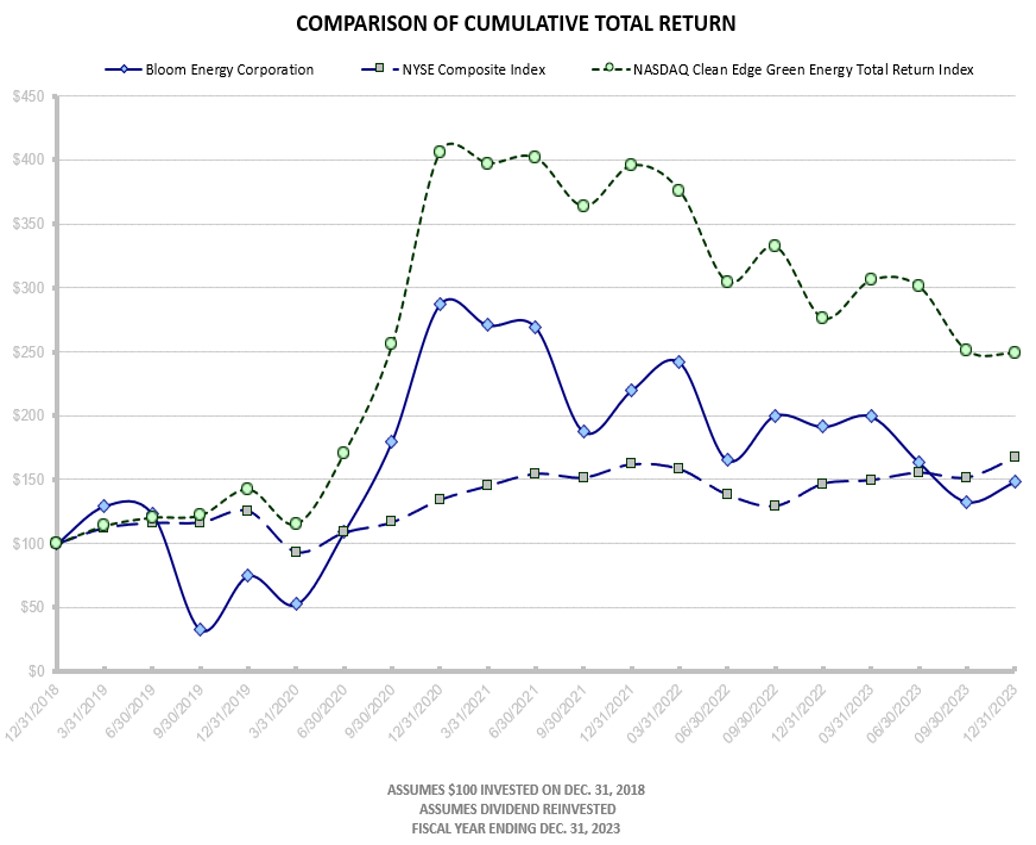

The aggregate market value of the registrant’s Class A common stock held by non-affiliates of the registrant was approximately $2.4 billion based upon the closing price of $16.32 per share of our Class A common stock on the New York Stock Exchange on June 30, 2023 (the last trading day of the registrant’s most recently completed second quarter). Shares of Class A common stock held by each executive officer, director and holder of 10% or more of the outstanding Class A common stock have been excluded in that such persons may be deemed to be affiliates. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

As of February 12, 2024, there were 224,973,118 shares of the registrant’s Class A common stock, $0.0001 par value, outstanding.

________________________________________________________________________

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive proxy statement for the 2024 Annual Meeting of Stockholders (the “2024 Proxy Statement”) are incorporated into Part III of this Annual Report on Form 10-K. The 2024 Proxy Statement will be filed with the U.S. Securities and Exchange Commission (“SEC”) within 120 days after the registrant’s year ended December 31, 2023.

2

Bloom Energy Corporation

Annual Report on Form 10-K for the Year Ended December 31, 2023

Table of Contents

| Page | |||||

| Part I | |||||

Item 1A — Risk Factors | |||||

| Part II | |||||

Consolidated Statements of Stockholders’ Equity (Deficit) | |||||

| Part III | |||||

| Part IV | |||||

Unless the context otherwise requires, the terms “we,” “us,” “our,” “Bloom Energy,” “Bloom” and the “Company” each refer to Bloom Energy Corporation and all of its subsidiaries.

3

SPECIAL NOTE ABOUT FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). All statements contained in this Annual Report on Form 10-K other than statements of historical fact, including statements regarding our future operating results and financial position, our business strategy and plans and our objectives for future operations, are forward-looking statements. The words “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,” “predict,” “project,” “potential,” ”seek,” “intend,” “could,” “would,” “should,” “expect,” “plan” and similar expressions are intended to identify forward-looking statements.

Forward-looking statements in this Annual Report on Form 10-K include, but are not limited to, our plans and expectations regarding future financial results, including our expectations regarding: our ability to expand into and be successful in new markets, including the hydrogen market; our expanded strategic partnership with SK ecoplant; statements about our supply chain; operating results; the sufficiency of our cash and our liquidity; projected costs and cost reductions; development of new products and improvements to our existing products; our manufacturing capacity and manufacturing costs; the adequacy of our agreements with our suppliers; legislative actions and regulatory and environmental compliance; impact of the Inflation Reduction Act (the “IRA”) on our business; competitive position; management’s plans and objectives for future operations; our ability to obtain financing; our ability to comply with debt covenants or cure defaults, if any; our ability to repay our debt obligations as they come due; trends in average selling prices; the success of our customer financing arrangements; capital expenditures; warranty matters; outcomes of litigation; our exposure to foreign exchange, interest and credit risk; general business and economic conditions in our markets; industry trends; the impact of changes in government incentives; risks related to cybersecurity breaches, privacy and data security; the likelihood of any impairment of project assets, long-lived assets and investments; trends in revenue, cost of revenue and gross profit (loss); trends in operating expenses including research and development expense, sales and marketing expense and general and administrative expense and expectations regarding these expenses as a percentage of revenue; future deployment of our Bloom Energy Servers and Bloom Electrolyzers; our ability to expand our business with our existing customers; our ability to increase efficiency of our products; our ability to market our products successfully in connection with the global energy transition and shifting attitudes around climate change; our business strategy and plans and our objectives for future operations; and the impact of recently adopted accounting pronouncements.

You should not rely upon forward-looking statements as predictions of future events. We have based the forward-looking statements contained in this Annual Report on Form 10-K primarily on our current expectations and projections about future events and trends that we believe may affect our business, financial condition, operating results and prospects. The outcome of the events described in these forward-looking statements is subject to risks, uncertainties and other factors including those discussed in Part I, Item 1A, Risk Factors and elsewhere in this Annual Report on Form 10-K. Moreover, we operate in a very competitive and rapidly changing environment. New risks and uncertainties emerge from time to time, and it is not possible for us to predict all risks and uncertainties or the extent to which any factor or combination of factors may cause actual results to differ materially from those contained in any forward-looking statements we may make in this Annual Report on Form 10-K. We cannot assure you that the results, events and circumstances reflected in the forward-looking statements will be achieved or occur. Actual results, events or circumstances could differ materially and adversely from those described or anticipated in the forward-looking statements.

The forward-looking statements made in this Annual Report on Form 10-K relate only to events as of the date on which the statements are made. We undertake no obligation to update any forward-looking statements made in this Annual Report on Form 10-K to reflect events or circumstances after the date of this Annual Report on Form 10-K or to reflect new information or the occurrence of unanticipated events, except as required by law. We may not actually achieve the plans, intentions or expectations disclosed in our forward-looking statements and you should not place undue reliance on our forward-looking statements.

Our actual results and timing of selected events may differ materially from those anticipated in these forward-looking statements as a result of many factors including those discussed under Part I, Item 1A, Risk Factors and elsewhere in this Annual Report on Form 10-K.

4

Part I

ITEM 1 — BUSINESS

Overview

Bloom Energy is uniquely situated to provide innovative technology solutions to customers at an important moment in the world’s transition to a net-zero carbon energy system. We manufacture one of the most advanced and versatile energy platforms, which delivers two products: the Bloom Energy Server® and the Bloom Electrolyzer™. With approximately 1.2 gigawatts of the Energy Servers accepted in more than 1,200 locations and 7 countries, our platform empowers businesses, essential services, critical infrastructure, energy companies, and communities with resilient, reliable, and sustainable energy solutions. Changing the future of energy is no small task, but our diverse group of thinkers, solvers and dreamers are up to the challenge. Our employees are driven by our mission: to make clean, reliable energy affordable for everyone in the world.

The market conditions for our platform are promising. The three most important indicators of a well-functioning, energy transition — cost, reliability, and emissions — are all facing stiff headwinds. Customers are demanding lower carbon and resilient energy today with the flexibility to move to net-zero solutions. Our platform is designed and produced to meet these demands and solve these challenges. Global electricity systems are now facing a range of significant challenges, including threats from extreme weather events, aging transmission and distribution systems, a wave of retiring generation assets, and unprecedented load growth that is far outpacing the installation of new renewable resources. Our time to power solutions and resiliency with 24x7x365 power generation address these needs.

The value propositions for our fuel cell-based power platform are very compelling. Built on the same solid oxide platform, we develop the Energy Server and the Electrolyzer with predominantly the same supply chain, manufacturing, and engineering expertise. These solutions share reliability, cost-down and efficiency advantages. We have driven down our costs due to our relentless commitment to innovation and discipline. By delivering either molecules of fuel or electrons, we can serve two different markets with one platform and that provides us with a diverse customer base. We have made significant progress toward our goal of utilizing our platform in a variety of new applications and we believe we are well-positioned as a core platform in the new energy transition to help organizations and communities achieve their net-zero objectives.

To date, nearly all of our revenue has been attributable to sales of our power generating Energy Server. The Energy Servers can use biogas, hydrogen, natural gas, or a blend of fuels to create quickly deployed resilient, sustainable, and cost-predictable power. The platform’s fuel flexibility combined with a skid mounted and modular package means that Bloom’s Energy Servers are well situated to serve as a rapidly deployable baseload electricity transition technology and solution today, without creating a stranded asset in the future. It can perform at significantly higher efficiencies than traditional, combustion-based resources. It can reduce carbon dioxide and air pollutants through a unique, non-combustion process that uses gas for a fundamentally different reason than any other technology — maximizing the utilization of hydrogen.

Our Energy Servers are inherently designed to deliver reliable electricity. They can provide reliability as a microgrid solution to customers who can’t afford power outages. Our microgrids continue to generate power for our customers even when the grid isn’t available. Our system also operates at a 99%+ availability due to its modular and fault-tolerant design, which includes multiple independent power generation modules that can be concurrently replaced during maintenance to provide uninterrupted service. Our Energy Servers also have the proven resiliency to withstand weather events, cybersecurity attacks, and other grid outages, providing reliable baseload power while the grid is still grappling with the proliferation of intermittent wind and solar generation. Our systems can be installed in a timeline far shorter than building new transmission lines, or any form of large-scale power generation. This ‘Time to Power’ value proposition is particularly meaningful for manufacturers, data centers, hospitals, and retailers, especially when the local utility is unable to provide the additional power to support their load growth or energy goals. We can be onsite and operating in months, while other power providers are quoting deliveries in years. With our Bloom Energy Server, we are also partnering with developers for significant opportunities in waste-to-energy. In some instances, we are providing power solutions to enable lower carbon intensity renewable fuels, and in other cases, we are providing solutions to use biogas for resilient power across dairies, landfills, and wastewater treatment facilities.

5

The Bloom Electrolyzer, which produces hydrogen, opens new markets, partnerships, and geographies for the company. And the twenty plus years of expertise we have accumulated from building, installing and operating fuel cell systems is being leveraged to advance the electrolyzer systems we can deploy. The Bloom Electrolyzer is in the early stages of commercialization. But the results have shown its promise. In 2023, for example, we deployed the world’s largest solid oxide electrolyzer at our NASA Ames Research Center, located in Mountain View, California, and achieved a new record efficiency level of 37.5 kWh of electricity per kilogram of hydrogen generated. At its high efficiency, the Bloom Electrolyzer uses less electricity to produce hydrogen than other electrolyzers, thereby potentially lowering the overall cost of producing hydrogen, a critical factor in accelerating the transition to hydrogen as a fuel. The Idaho National Laboratory (INL) has been studying to see how well it could produce hydrogen from electricity and steam from a nuclear facility, and their 2023 results showed that it was the most efficient electrolyzer that they ever tested. The Bloom Electrolyzer diversifies and expands our addressable market to industries with hard-to-abate emissions, such as heavy industries and those seeking zero-carbon transportation fuels. In December 2023, we announced the Electrolyzer sale in South Korea to our partners SK ecoplant Co., Ltd. (“SK ecoplant”, formerly known as SK Engineering & Construction Co., Ltd.), a subsidiary of the SK Group, with the technology to be deployed in a government-led project to deploy hydrogen as an energy source in a large-scale green hydrogen for use as transport fuel.

We are growing our research and manufacturing capabilities based in the United States and South Korea to meet the opportunities in the global markets. As of December 31, 2023, we have 325 active patents in the U.S. and 145 active patents internationally. In 2023, we scaled up production at our multi-gigawatt factory in Fremont, California, while streamlining and consolidating operations from our Sunnyvale, California, facility to our Fremont facility. The consolidation and ramp in production capacity during 2023 enabled us to produce our Energy Server platforms more efficiently. The plans provide for an additional ramp up in production with incremental investments. We invested in our Newark, Delaware, factory during 2023 to increase production capacity, including a high volume electrolyzer manufacturing line for commercial deployment in North America and Europe. Our Delaware team celebrated its 10th anniversary, growing from one employee in 2013 to nearly 800 in 2023, with installed production capacity at two gigawatts per year. Moreover, our joint venture with SK ecoplant is now capable of full assembly.

The U.S. is currently our largest market in terms of revenue and installed base of the Energy Servers. Our major customers include companies in industries such as utilities, data centers, agriculture, retail, hospitals, higher education, biotech, and manufacturing. Many of our customers look to solve “time to power” issues where they cannot get energy fast enough from the grid or current energy providers to meet their commercial objectives. Moreover, our resilient technology provides secure power to critical facilities, including data centers, hospitals and high-tech manufacturing, while also serving to reduce greenhouse gas (“GHG”) emissions. We also work with several global financing and distribution partners who purchase and deploy our systems at end-customers’ facilities to provide “electricity-as-a-service.”

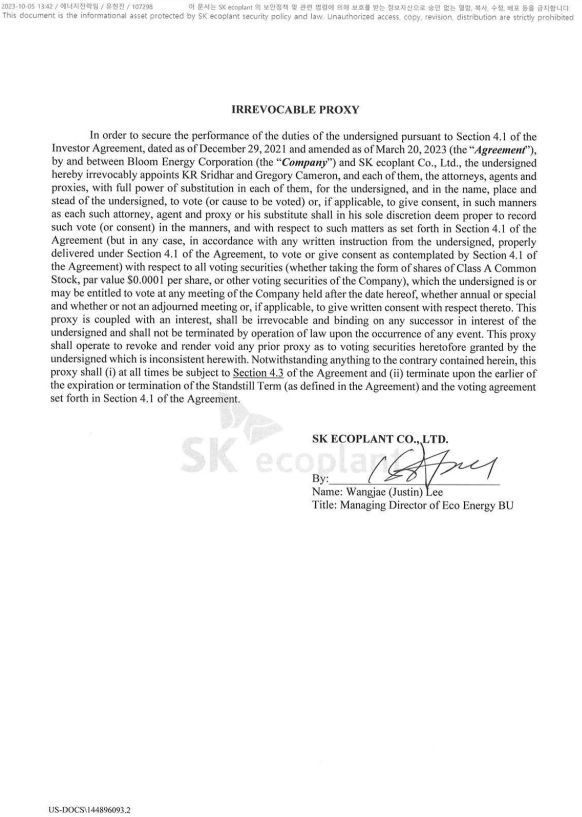

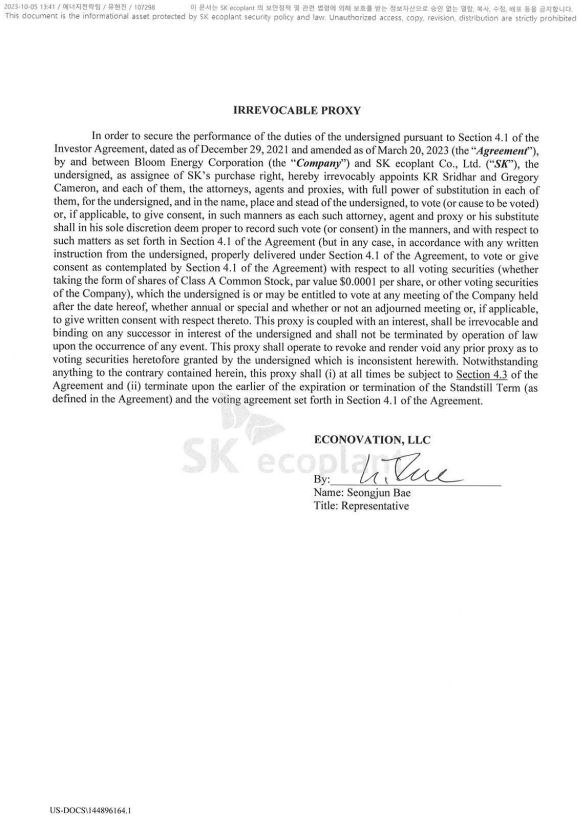

Our second-largest market in terms of revenue and installed base of the Energy Servers is South Korea, a world leader in the deployment of fuel cells for utility-scale electric power generation. We began commercial operation in South Korea in 2018 and have grown our footprint to more than 492 megawatts of deployed Energy Servers across South Korea. SK ecoplant serves as the primary distributor of our systems in the Republic of Korea. In October 2021, we announced an expansion of our existing partnership with SK ecoplant, which included purchase commitments of at least 500 megawatts of power for our Energy Servers between 2022 and 2024 on a take-or-pay basis, the creation of hydrogen innovation centers to advance green hydrogen commercialization, and an equity investment in Bloom Energy. In September 2023, upon automatic conversion of all 13,491,701 shares of the Series B redeemable convertible preferred stock into shares of our Class A common stock, SK ecoplant became a related party to us with beneficial ownership of 10.5% of our outstanding Class A common stock. On December 21, 2023, we expanded our partnership with SK ecoplant through an incremental purchase commitment of 250 megawatts through 2027 and extended the timing of delivery of the remaining take-or-pay commitment to a minimum purchase commitment under the original agreement. For additional information, please see Part II, Item 8, Note 11 — Related Party Transactions, and Note 17 — SK ecoplant Strategic Investment.

In fiscal 2023, we expanded our presence in the European market by signing contracts with customers in Italy, the U.K., Germany, and Belgium. We also strengthened our presence in Asia by signing additional contracts in Taiwan and Thailand. We are also operating smaller deployments in India and Japan with commercial customers, with additional projects in development in other Southeast Asia locations and Australia. We plan to continue our efforts to increase our operations internationally in 2024.

6

Power-Related Industry Sectors

•Distributed Electricity Generation:

There are numerous challenges facing the traditional system for producing and delivering electricity. We believe overcoming these challenges will transform how electricity is produced, delivered, and consumed. We believe this transformation will be similar to the seismic shifts seen in the computer and telecommunications industries, where centralized mainframe computing and landline telephone systems ultimately gave way to the more distributed technologies seen today, and the reimagining of business processes, culture, and customer experiences. As further described below, this could position us to provide a unique solution to meet customers’ challenges during this energy transition, especially with increasing power demands from the growth of artificial intelligence (AI) driven business services.

Providing a resilient energy solution is now a strategic imperative. The rising frequency and intensity of natural disasters and extreme weather in recent years underscores a critical need for greater grid resilience. According to the National Centers for Environmental Information, 2023 was the year with the most frequent billion-dollar weather and climate disaster events (28) ever recorded, including severe storms, tropical cyclones, flooding, winter storms, and wildfires.

Stakeholders across industries grapple with how to continue providing energy during more frequent and intense natural disasters while maintaining a course toward their climate targets. An increasing concern over the threat of cyber-attacks and physical sabotage to the centralized grid infrastructure compounds these climate threats. These acute issues add to a chronic concern; the fragility of decades-old energy system elements that have suffered from deferred maintenance and replacement. In an increasingly electrified world, power supply and reliability are critical. We believe distributed generation and microgrids can play an important role in improving the resilience of both businesses and the grid. As outages increase, businesses consider the “cost of not having power” instead of just the “cost of power.” Energy resilience is becoming an issue business leaders can no longer afford to neglect — both from a strategic and financial perspective.

There is a rise in centralized capacity constraints. The traditional centralized grid model is increasingly showing weaknesses. According to the North American Electric Reliability Corporation’s (“NERC”) 2022 Long-Term Reliability Assessment, more than half of the U.S. has a high or elevated risk of insufficient electricity supply over the next five years. Simultaneously, consumer and business demand for electricity is increasing rapidly. Electrification of transportation, increasing data center build out, and industrial decarbonization are expected to lead to a rapid increase in power demand. The expected capacity constraints in combination with increasing demands for electricity in the U.S. reflect two of the many reasons why microgrids, localized energy systems that can operate alongside a central grid or disconnect and operate autonomously, are playing an increasingly important role, providing a critical, twenty-four hours a day and seven days a week (“24x7”), always-on energy solution, powering critical infrastructure, offsetting demand on the grid, and supplying power to the grid when it is most needed.

There is an increasing focus on reducing harmful local emissions. Air pollution is a leading risk factor for mortality worldwide, and the economic impacts of poor air quality are substantial. Recent estimates find that every dollar invested in air pollution control since the passage of the Clean Air Act in the U.S. has produced an economic benefit of $30: a return on investment of 30:1. These benefits reflect the increased economic productivity of healthier, longer-lived citizens and reduced health care costs.

•Clean Hydrogen Production:

Clean hydrogen is gaining considerable attention as a flexible zero-carbon fuel and energy storage medium. It can be stored and utilized in various industrial, transportation, and power generation applications. We believe clean hydrogen will be a critical factor in the energy industry of the future, a truly clean alternative for both natural gas and transportation fuels and an alternative means to store energy. The International Energy Agency (IEA) forecasts hydrogen demand will increase by 1.5X current demand by 2030 to reach more than 150 (Mt), with some forecasts setting the demand to be as high as 600 Mt by 2050. (Deloitte’s 2023 Global Green Hydrogen Outlook).

Hydrogen is one of the keys to a zero-carbon future. Hydrogen’s unique advantages — incredibly high energy density, zero carbon emissions, and being the most abundant element on earth — make it an especially attractive investment opportunity for those interested in a zero-carbon energy mix. The key limiting factor in using hydrogen, which does not readily exist in nature as a separate molecule, is that it cannot be mined, extracted or otherwise produced in its desired state without a manufacturing process. As the transportation and the electricity sectors transition to a zero-carbon future, there will be increasing demand for technologies that can both efficiently generate power using hydrogen and produce clean hydrogen at scale.

7

In December 2023, we announced a sale to SK ecoplant of Bloom’s electrolyzer technology to deploy hydrogen as an energy source in a large-scale green hydrogen demonstration involving the local government. The first-of-its-kind demonstration for South Korea, which will commence in late 2025, includes 1.8 megawatts of Bloom’s industry leading solid oxide electrolyzer cells (“SOEC”) technology to develop green hydrogen at scale for use as transport fuel. For this project, Bloom and SK ecoplant will combine the Bloom Electrolyzer with SK ecoplant’s engineered infrastructure to produce hydrogen ready to be used as transport fuel.

Products & Services

Our solid oxide fuel cell technology platform is the foundation for our Energy Servers and Electrolyzers. Solid oxide fuel cells are more efficient than other fuel cell structures because they run at higher temperatures than other fuel cell technologies.

Bloom Energy Server

Our power generation platform, the Bloom Energy Server, is designed to deliver reliable, resilient, clean and affordable energy for utilities and organizations alike. Suitable to operate parallel with the grid, independent of the grid, or as part of a larger microgrid ecosystem, the Bloom Energy Server is based on our proprietary solid oxide technology that converts fuel, such as natural gas, biogas, hydrogen, or a blend of these fuels, into electricity through an electrochemical process without combustion. The electrical output of our Energy Server is designed to be connected to the customer’s main electrical feed, thereby avoiding the transmission and distribution losses associated with a centralized grid system. The modular nature of our solution enables any number of the Energy Servers to be clustered together in various configurations, providing solutions from hundreds of kilowatts to hundreds of megawatts. The Energy Server is designed to be easily integrated into community environments due to its aesthetically attractive design, compact space requirement, minimal noise profile and near-zero criteria air pollutants.

The Energy Server platform can be utilized in the following applications:

•Carbon capture. Our Energy Servers, when combined with carbon capture technology, can provide zero-carbon electricity. Our natural gas or biogas-fueled Energy Server vents CO2 into the atmosphere as a byproduct. When used to facilitate carbon capture, the Energy Server is configured to vent CO2 for consolidation, compression, and processing for sequestration or other industrial applications. The compression and processing of the anode exhaust can be done by industrial gas companies. Bloom’s anode exhaust, once dried, has 95% purity of CO2. This makes it one of the purest streams of CO2 out of any power generation technology using natural gas, making it comparatively simple and inexpensive to capture.

•Combined heat & power (“CHP”). High-temperature cathode exhaust from the Energy Server can be channeled, allowing the resulting exhaust heat to be fed to one or more heat recovery devices, such as a water heater or an absorption chiller to support air conditioning, refrigeration, and/or process fluid cooling for use in commercial buildings or other industrial plant. We released a combined heat and power offering that increases the efficiency of our technology to 85% with a goal of reaching, through continuous improvement, the 90% threshold. Compared to combustion technologies and other fuel cell products, the Bloom Energy Server has one of the highest electrical efficiencies in the industry.

•Waste to Energy. Bloom Energy’s solid oxide fuel cells (“SOFCs”) provide an electrochemical pathway to convert biogas to electricity without combustion, producing carbon-neutral electricity with near zero air pollution and water usage. Bloom Energy Servers can utilize proven, off-the-shelf gas conditioning equipment to process raw biogas into a suitable fuel for power generation.

•Marine Fuel Cells. Bloom’s platform is well positioned to address impending emissions regulations and offer higher efficiency than traditional power sources. Marine fuel cell powered ships can obtain immediate emissions reductions for the cleanest and most efficient operation by utilizing liquefied natural gas (“LNG”) as the primary fuel source.

Energy Server Competition

We primarily compete against gas engines, combined heat and power systems, and utility grids; we compete with diesel generators for grid-independent operations. Our solutions are based on superior reliability, resiliency, cost savings, predictability, and sustainability, all of which can be customized to the needs of individual customers. Customers do not currently have alternative solutions that provide all of these important attributes in one platform. As we work to drive costs

8

down and make technological improvements, we expect our value proposition to become more competitive relative to grid power in additional markets.

Other sources of competition — and the attributes that differentiate us — include:

•Intermittent solar power paired with storage. Solar power is intermittent and best suited for addressing daytime peak power requirements, while our Energy Servers are designed to provide stable baseload generation. Storage technology is intended to address the intermittency of solar power. However, the low power density of the combined technologies and the challenges of extended poor weather events that sharply decrease solar power production and battery recharging make the solution impractical for most commercial and industrial customers looking for on-site solutions to offset a significant amount of power. As a point of comparison, to provide the same power output as our Energy Servers, a photovoltaic solar installation will require 125 times more space. This allows us to serve a bigger portion of a customer’s energy requirements based on their available and typically limited space.

•Intermittent wind power. Power from wind turbines is intermittent, similar to solar power. Typically, wind power is deployed for utility-side, grid-scale applications in remote locations but not as a customer-side, distributed power alternative due to prohibitive space requirements and permitting issues. Where distributed wind power is available, it can be combined with storage, with similar benefits and challenges to solar-and-storage combinations. Remote wind farms feeding into the grid do not help end customers avoid the vulnerabilities and costs of the transmission and distribution system.

•Traditional co-generation systems. These systems deliver a combination of electric power and heat from combustion sources. We believe we compete favorably because of our non-combustion platform, superior electrical efficiencies, significantly less complex deployment (avoiding heating systems integration and requiring less space), superior availability, aesthetic appeal, and reliability. Unlike these systems, which depend on the full and concurrent utilization of waste heat to achieve high efficiencies, we can provide highly efficient systems to any customer based solely on their power needs.

•Traditional backup equipment. As our Energy Servers deliver reliable power, particularly in grid-independent configurations where our Energy Servers can operate during grid outages, they can prevent the need for traditional backup equipment, such as diesel generators. By providing combustion-free power 24x7 rather than just as a backup, we generally offer a better integrated, more reliable, cleaner, and more cost-effective solution than these grid-plus-backup systems.

•Other commercially available fuel cells. Our Energy Server uses advanced solid oxide fuel cell technology, which produces electricity directly from oxidizing fuel. The advantages of our technology include higher efficiency, long-term stability, elimination of the need for an external fuel reformer, ability to use biogas, natural gas, or hydrogen as a fuel, low emissions, and relatively low cost. There are a variety of fuel cell technologies, characterized by their electrolyte material, including:

◦Proton exchange membrane fuel cells (“PEM”). PEM fuel cells are typically used in onboard transportation applications, such as powering forklifts, because of their compactness and ability for quick starts and stops. However, PEM technology requires an expensive platinum catalyst, which is susceptible to poisoning by trace amounts of impurities in the fuel or exhaust products. These fuel cells require high-cost fuel input energy sources or an external fuel reformer, which adds to the product’s cost, complexity, and electrical inefficiency. As a result, they are not typically an economically viable option for stationary baseload power generation.

◦Molten carbonate fuel cells (“MCFC”). MCFCs are high-temperature fuel cells that use an electrolyte composed of a molten carbonate salt mixture suspended in a porous, chemically inert ceramic matrix of beta-alumina solid electrolyte. The primary disadvantages of current MCFC technology are durability and lower electrical efficiency compared to solid oxide fuel cells. Current versions of the product are built for 300 kilowatt systems and are monolithic rather than modular. Smaller sizes are typically not economically viable. In many applications where the heat produced by these fuel cells is not commercially or internally useable continuously, mitigating the heat buildup also becomes a liability.

◦Phosphoric acid fuel cells (“PAFC”). PAFCs use liquid phosphoric acid as an electrolyte. Developed in the mid-1960s and field-tested since the 1970s, they were the first fuel cells to be commercialized. PAFCs have been used for stationary power generators with output in the 100 kilowatts to 400 kilowatts range. PAFCs are best suited to combined heat and power output applications that require carefully matching and constant

9

monitoring of power and heat requirements (heat is typically not required all year long thus significant efficiency is lost), often making the technology difficult to implement. Further, disadvantages include low power density and poor system output stability.

Value Proposition

•Resiliency. Our Energy Servers avoid the vulnerabilities of conventional transmission and distribution lines by generating power on-site. The system operates at very high availability due to its modular and fault-tolerant design, which includes multiple independent power generation modules that can be hot-swapped to provide uninterrupted service. Unlike traditional combustion generation, Bloom Energy Servers can be serviced and maintained without powering down the system. Importantly, Bloom Energy Servers that utilize existing natural gas infrastructure rely on a redundant underground mesh network, intended to provide for extremely high fuel availability that is protected from the natural disasters that often disrupt the power grid.

•Sustainability. Our Energy Servers uniquely address both the causes and consequences of climate change. Our projects lower carbon emissions by displacing less-efficient fossil fuel generation on the grid, which improves air quality, including in vulnerable communities, by generating electricity without combustion, offsetting combustion from grid resources as well as eliminating the need for dirtier diesel backup power solutions. Our microgrid deployments provide customers with critical resilience to grid instability, including disruptions caused by climate-related extreme weather events. Our Energy Servers are designed to achieve this while emitting near-zero criteria pollutants, consuming no water during steady-state operation, and minimizing land use impacts due to our high-power density.

•Predictability. In contrast to the rising and unpredictable cost outlook for grid electricity, we offer our customers the ability to lock in the cost of electric power over the long term. Unlike the grid price of electricity, which reflects the cost to maintain and update the entire transmission and distribution system, our price to our customers is based solely on their individual projects. In regions where most of our Energy Servers are deployed, we provide electricity to our customers at a cost that is competitive with the grid price of electricity. Our solution provides greater cost predictability versus rising grid prices. Whereas grid prices are subject to frequent change based on the utility’s underlying costs, customers can contract with us for a known price in each year of their contract. Moreover, we provide customers with a solution that offers all of the fixed equipment and maintenance costs for the life of the contract. Our Energy Servers are designed to deliver 24x7 power with very high availability, mission-critical reliability and grid-independent capabilities.

•Time to Power. Our Energy Servers were designed to provide ‘quick time to power’ — the ability to be deployed and generate power in weeks – an important value proposition for customers needing to ramp up power quickly. This capability is ideal for customers who need critical power but face utility capacity constraints, delays, or additional costs. The modularity, quick deployment, ease of installation, and small footprint of our Energy Servers facilitate ease of accessibility to power.

Bloom Electrolyzer

We believe we are uniquely positioned for the hydrogen future of tomorrow. The Bloom Electrolyzer is designed to produce scalable and cost-effective hydrogen solutions based on the same solid oxide platform as our Energy Server. The Bloom Electrolyzer is ideal for applications across gas, utilities, nuclear, concentrated solar, ammonia and heavy industries. Our solid oxide, higher-temperature Electrolyzer is designed to produce hydrogen onsite more efficiently than lower-temperature PEM and alkaline electrolyzers. Because it operates at higher temperatures, the Bloom Electrolyzer is designed to require less electric energy to break up water molecules and produce hydrogen. As electricity accounts for nearly 80 percent of the cost of producing hydrogen from electrolysis, using less electricity improves the economics of hydrogen production and helps bolster adoption. The Bloom Electrolyzer is designed to produce green hydrogen when using low- or zero-carbon electric power. The hydrogen produced onsite at a customer’s facility can be used as fuel or stored for consumption at a later point.

Value Proposition

•Higher Efficiency. Fuel (steam) supplied to the Bloom Electrolyzer undergoes an electrochemical reaction at 700-900 degrees Celsius which is higher than other currently available technologies. This leads to a fundamental efficiency advantage to produce hydrogen by consuming less electricity.

10

•Scale. Bloom has reached scale in the Energy Server by growing revenues at a 30% compound annual growth rate over the last decade. Our commercial field experience in fuel cells directly transfers to our hydrogen production products, as we build upon the same core platform, supply chain, manufacturing process, partners, and advanced remote software monitoring across all our products and applications. Our experience as a developer of fuel cell projects, in addition to our role as an original equipment manufacturer (“OEM”), enables us to engage with customers and deliver turnkey projects.

•Modular Design. As with the Bloom Energy Server, Bloom’s modular design allows for targeted maintenance in individual electrolyzer modules while the rest of the facility continues to operate. This helps to avoid lengthy and costly shutdowns.

Electrolyzer Competition

Given that the green hydrogen industry is at an early stage, no single technology has gained a leadership position. In electrolysis, electrical efficiency is a function of temperature, with higher efficiency favored by higher temperature due to better reaction kinetics at higher temperatures and lower polarization losses. The Bloom Electrolyzer, which uses SOEC, is differentiated from Alkaline, PEM, and Anion Exchange Membrane (“AEM”) electrolysis which are low temperature electrolysis methodologies using liquid water. With high temperature electrolysis, water needs to be heated, vaporized, and brought to operating temperature. The thermal energy requirements are reduced by using steam at or near operating temperature as the input to the Electrolyzer. Integrating SOEC with another process with available waste heat to provide thermal energy provides additional efficiency gains.

Research and Development

Our research and development organization has addressed complex applied materials, processing and packaging challenges by inventing many proprietary advanced material science solutions. Over more than a decade, Bloom has built a world-class team of solid oxide fuel cell scientists and technology experts. Our team comprises technologists with degrees in Materials Science, Electrical Engineering, Chemical Engineering, Mechanical Engineering, Civil Engineering and Nuclear Engineering, and includes 57 PhDs within these or related fields. This team has continued to develop innovative technological improvements for our Energy Servers. Since our first-generation technology, we have reduced the costs, increased the output of our systems, and increased the life of our fuel cells by over two and half times.

We have invested and plan to continue to invest a significant amount in research and development. See our discussion of research and development expenses in Part II, Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operations of this Annual Report on Form 10-K for further information.

Intellectual Property

Intellectual property is an essential differentiator for our business, and we seek to protect our intellectual property through a combination of patents, copyrights, trade secrets, trademarks, employee and third-party non-disclosure agreements, and other contractual restrictions.

We have developed a significant patent portfolio to protect elements of our proprietary technology. As of December 31, 2023, we had 325 active patents and 141 patent applications pending in the U.S., and we had an international patent portfolio comprising 145 active patents and 414 patent applications pending. Our U.S. patents are expected to expire between 2022 and 2042. While patents are an essential element of our intellectual property strategy, our business is not dependent on any one patent or pending patent application.

We regularly review our development efforts to assess the existence and patentability of new intellectual property. We pursue the registration of our domain names, trademarks, and service marks in the U.S. and some international locations. “Bloom Energy” and the “BE” logos are our registered trademarks in certain countries for use with the Energy Servers and our other products. We also hold registered trademarks for, among others, “Bloom Box,” “BloomConnect,” “BloomEnergy,” and “Energy Server” in certain countries. In an effort to protect our brand, as of December 31, 2023, we had 7 registered trademarks and 1 pending application in the U.S. and 46 registered trademarks and 15 pending applications across Australia, Brazil, Canada, Chile, China, the European Union, India, Israel, Japan, Mexico, Oman, Singapore, South Africa, Republic of Korea, Saudi Arabia, Taiwan, the United Arab Emirates, and the United Kingdom.

11

When appropriate, we enforce our intellectual property rights against other parties. For more information about risks related to our intellectual property, please see the risk factors set forth under the caption Part I, Item 1A, Risk Factors — Risks Related to Our Intellectual Property.

Manufacturing Facilities

Our primary manufacturing facilities for Energy Servers and Electrolyzers assembly are in Fremont, California, and Newark, Delaware. We own our 178,000 square-foot manufacturing facility in Newark, which was our first purpose-built Bloom Energy manufacturing center and was designed specifically for copy-exact duplication as we expand, which we believe will help us scale more efficiently. Our Newark facility includes an additional 25 acres available for factory expansion and/or the co-location of supplier plants.

In September 2023, as part of the approved restructuring plan (the “Restructuring Plan”), we initiated a closure of our 50,000 square-foot manufacturing, warehousing, research and development (“R&D”) facility in Sunnyvale, California, which lease expired in December 2023. Under the Restructuring Plan, we are consolidating the Sunnyvale facility with our manufacturing facility in Fremont, California, and performing an optimization of our manufacturing workforce. The restructuring activities are expected to be completed in the first half of fiscal 2024, subject to local law and consultation requirements, as well as our business needs. For more information about the restructuring, please see Part II, Item 8, Note 12 — Restructuring.

We lease various manufacturing facilities in California and Delaware. We leased an 89,000 square-foot R&D and manufacturing facility in Fremont, California, which became operational in April 2021. The lease terms of our Repair & Overhaul (“R&O”) manufacturing facilities in Newark, Delaware, with a total area of 56,000 square feet expire in December 2026 and April 2027. In September 2023, according to the Restructuring Plan, we approved the relocation of a portion of our R&O department of our Newark manufacturing and warehousing facility to Mexico. We expect the relocation to be completed in the fourth quarter of fiscal 2024.

Additionally, we leased a 164,000 square-foot manufacturing facility in Fremont, California that expires in February 2036. In July 2022 we announced the grand opening of this multi-gigawatt manufacturing facility, which represented a $200 million investment. This followed the expansion of the Company’s global headquarters in San Jose in June 2021 as well as the opening, in June 2022, of a new research and technical center and a global hydrogen development facility in Fremont with a total space of 73,000 square feet.

In 2020, we established a light-assembly facility in the Republic of Korea, in connection with our efforts to develop a local supplier ecosystem through a joint venture with SK ecoplant. Operations began in early July 2020. Based on the expanded relationship between us and SK ecoplant, the joint venture was further extended in 2022-2023.

Please see Part I, Item 2, Properties for additional information regarding our facilities.

Supply Chain

Our supply chain has been developed, since our founding, with a group of high-quality suppliers that support automotive, semiconductors and other traditional manufacturing organizations. The production of fuel cells requires rare earth elements, precious metals, scarce alloys and industrial commodities. Our operations require raw materials, and in certain cases, third-party services that require special manufacturing processes. We generally have multiple sources of supply for our raw materials and services except in cases where we have specialized technology and material property requirements. Our supply base is spread around many geographies in Asia, Europe and India, consisting of suppliers with multiple areas of expertise in compaction, sintering, brazing and dealing with specialty material manufacturing techniques. Where possible, we responsibly source components like interconnects and balance of system components from various manufacturers on both a contracted and a purchase order basis. We have multi-year supply agreements with some of our supply partners for supply continuity and pricing stability. We are working with our suppliers and partners along all steps of the value chain to reduce costs by improving manufacturing technologies and expanding economies of scale.

12

There have been a number of disruptions throughout the global supply chain; demand for certain components has outpaced the return of the global supply chain to full production. Though the supply constraints for a majority of our raw materials and components are expected to ease in 2024, we have experienced an increase in lead times with respect to the delivery of some of our components due to a variety of factors, including supply shortages, shipping delays and labor shortages. Though we experienced delays from certain vendors and suppliers as a result of these factors, we were able to mitigate the impact so that we did not experience significant delays in the manufacture of our Energy Servers. For additional information on our supply chain, please see Part II, Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operations — Overview — Certain Factors Affecting our Performance.

Services

We provide operations and maintenance agreements (“O&M Agreements”) for all of our Energy Servers, which are typically renewable at the election of the customer on an annual basis. The customer agrees to pay an ongoing service fee, and in return, we monitor, maintain, and operate the Energy Servers systems on the customer’s or owner’s behalf. We currently service and maintain every installed Energy Server worldwide.

As of December 31, 2023, our in-house service organization had 136 dedicated field service personnel distributed across multiple locations in both the U.S. and internationally. Our standard O&M Agreements include full remote monitoring and 24x7 operational capability over the systems as well as scheduled and unscheduled maintenance, which in practice includes preventative maintenance, such as filter and adsorbents replacements and on-site part and periodic fuel cell replacements.

Our two Remote Monitoring and Control Centers (“RMCC”) provide 24x7 coverage of every Energy Server installation worldwide. By situating our RMCC centers in the U.S. and India, we are able to provide 24x7 coverage cost effectively and also provide a dual redundant system with either site able to operate continuously should an issue arise. Each Energy Server we ship includes instrumentation and a secure telemetry connection that enables RMCC to monitor over 500 system performance parameters in real time. This comprehensive monitoring capability enables the RMCC operators to have a detailed understanding of the internal operation of our Energy Servers. Using proprietary, internally developed software, the RMCC operators can detect changes and override the onboard automated control systems to remotely adjust parameters to maintain optimum system performance. In addition, we undertake advanced predictive analytics to identify potential issues before they arise and undertake adjustments prior to a failure occurring.

Our services organization also has a dedicated R&O facility, which is currently based in Delaware. As discussed in section Manufacturing Facilities, in September 2023 as part of the Restructuring Plan we approved the relocation of the R&O Department to Mexico. This will help to realign our operational focus to support our multi-year growth, scale the business, and improve our cost structure and operating margins. The facility undertakes full refurbishment of returned fuel cells with the capability to restore them to full power, efficiency, and life with a less than three-week turnaround.

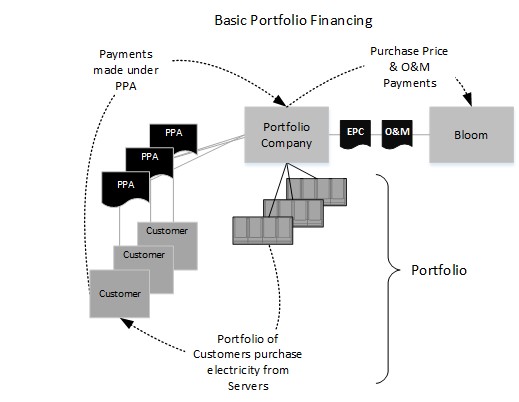

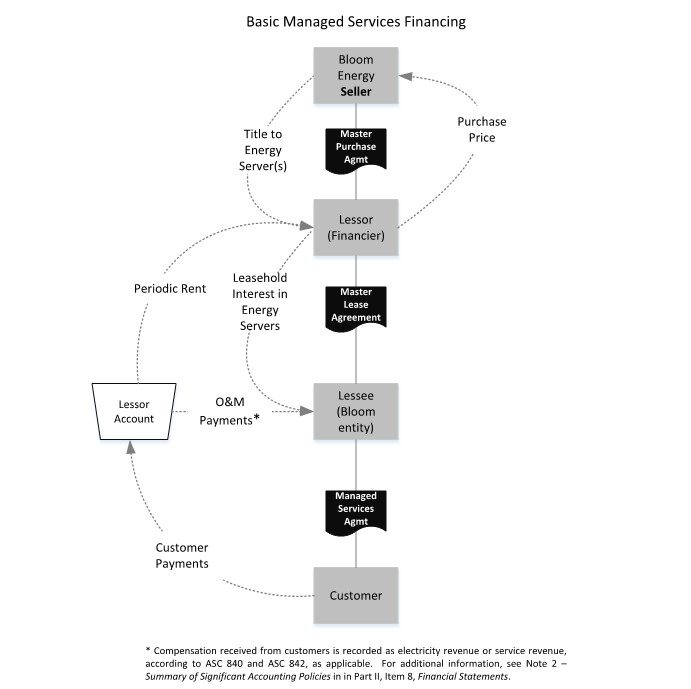

Purchase and Financing Options

In order to appeal to the largest variety of customers, we make available several options to them. Both in the U.S. and internationally, we sell our Energy Servers directly to customers. In the U.S., we also enable customers’ use of the Energy Servers through a Power Purchase Agreement (as defined below) and a Managed Services Agreement (as defined below) (whereby we sell and lease back the Energy Servers in order to supply energy to our customers), each made possible through third-party financing arrangements.

Often, our offerings are designed to take advantage of local incentives. In the U.S., our financing arrangements are structured to optimize both federal and local incentives, including the Investment Tax Credit (the “ITC”) and accelerated depreciation. Internationally, our sales are made primarily to distributors who sell to, and install for, customers; these deals are also structured to use local incentives applicable to our Energy Servers. Increasingly, we use trusted installers and other sourcing collaborations in the U.S. to generate transactions.

With respect to the third-party financing options in the U.S., a customer may choose a contract for the use of the Energy Servers in exchange for a capacity-based flat payment (a “Managed Services Agreement”) or one for the purchase of electricity generated by the Energy Servers in exchange for a scheduled dollars per kilowatt hour rate (a “Power Purchase Agreement” or “PPA”.)

PPAs are typically financed on a portfolio basis whereby we make direct sales of PPAs to investors.

13

For additional information about our different financing options, please see Part II, Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operations — Purchase and Financing Options.

Sales, Marketing and Partnerships

We sell our products through a combination of direct and indirect sales channels. At present, most of our U.S. sales are through our direct sales force, which is segmented by vertical and type of account. We are expanding our relationship with utilities and other commercial customers across the U.S.. We have developed a network of strategic advisors that originate new opportunities and referrals to Bloom Energy, which has been a valuable source of high-quality leads.

We pursue relationships with other companies in areas where collaboration can produce product advancement and acceleration of entry into new geographic and vertical markets. The objectives and goals of these relationships can include one or more of the following: technology exchange, joint sales and marketing, installation, customer financing or service.

As we have cultivated sales as well as strategic and financing partners over the past several years, our sales have been concentrated among a few large customers and distributors each year. During the year ended December 31, 2023, revenue from two customers accounted for approximately 37% and 26% of our total revenue, respectively. Please see Part II, Item 8, Note 1 — Nature of Business, Liquidity and Basis of Presentation — Concentration of Risk — Customer Risk.

SK ecoplant in the Republic of Korea is our strategic power generation and distribution partner. In October 2021, we announced an expansion of our existing partnership with SK ecoplant, that includes purchase commitments for at least 500 megawatts of our Energy Servers between 2022 and 2024 on a take-or-pay basis, the creation of hydrogen innovation centers in the U.S. and the Republic of Korea to advance green hydrogen commercialization, and an equity investment in Bloom Energy. In September 2023, SK ecoplant became a related party to us with the beneficial ownership of 10.5% of our outstanding Class A common stock. On December 21, 2023, we further expanded our business partnership with SK ecoplant through the increase of SK ecoplant’s purchase commitments for Bloom Energy products of 250 megawatts through 2027 and extended the timing of delivery of the remaining take-or-pay commitment under the original agreement. For additional information, please see Part II, Item 8, Note 17 — SK ecoplant Strategic Investment.

Sustainability

We are driven by the promise of our contribution to the transformation and decarbonization of energy and transportation sectors globally. We are working to make our technology available across a growing list of applications including biogas, carbon capture, hydrogen, marine, combined heat and power, and microgrid projects critical to aligning with a 1.5 degree warming trajectory. Our natural gas-based Energy Servers are also an important source of near-term emission reductions, and we are committed to evolving the gas sector through our technology development and leading market-based activity.

Bloom Energy Servers produce clean, reliable energy without combustion that provide greenhouse gas, air quality, water, land-use and resilience benefits for customers and the communities they serve. The Bloom Electrolyzer is based upon the same solid oxide technology platform in a highly efficient and cost-effective hydrogen production process. Our innovative solid oxide fuel cell platform technology offers modular and flexible solutions configurable to address both the causes and consequences of climate change.

As a manufacturer, our commitment to sustainability is reflected not only through the impacts of our products in operation but also through our internal commitment to resource efficiency, responsible design, materials management and recycling. We endeavor to consistently increase our supply chain responsibility and approach to human capital management in ways that help us to continue to deliver products that add long-term societal value.

We take a cradle-to-grave perspective on product design and use. We strive to reuse components and recoverable materials where feasible and use conflict-free, non-toxic new resources where needed. We design our equipment so that components can be refurbished as needed instead of requiring new equipment. Finally, we seek to cover as many materials and components as practicable during end-of-life management, reusing these materials and components. From an approximately 30,000-pound Bloom Energy Server, the weight of components that go to the landfill without a recycling or refurbishment stream comprises approximately 510 pounds, or approximately less than 2% of the total Energy Server weight.

In 2023, we continued our responsibly sourced gas program by acquiring and retiring MiQ+ Equitable Origin certified-low-leak natural gas certificates, representing reduced release of harmful methane emissions stemming from upstream gas production. The program provides a validated leak rate that can be used to inform lifecycle carbon accounting and reinforces

14

our commitment to environmental stewardship and gas sector transformation. Use of certified natural gas helps us take an immediate and impactful step to help eliminate harmful methane emissions as we lay the foundation for a net-zero future.

U.S. & Global Climate Issues

Climate change and resulting extreme weather are having significant economic, environmental and social impacts in the U.S. and around the world. These effects and anticipated future impacts have resulted in a wide array of market and regulatory responses, and we expect that these types of responses will continue. Our business can be impacted by climate change, and by those market and regulatory responses, in a variety of ways. We closely follow the impacts of climate change on the energy system, as well as the regulatory, policy and voluntary measures taken in response to those impacts, so that we may understand and respond to changing conditions that may affect our Company, our customers, and our investors and business partners. We are responsive to the recommendations from the Task Force on Climate-related Financial Disclosures (“TCFD”), as well as disclosure guidance from the Sustainability Accounting Standards Board (“SASB”). We issued our first TCFD and SASB-aligned Sustainability Report in 2021 covering 2020 followed by additional annual reports covering activities in 2021 and 2022. We plan to issue a sustainability report annually.

The direct impacts of climate change on energy systems, including the increased risk they pose to energy service disruption, may provide an opportunity for our extremely reliable and resilient energy generation. New or more stringent international accords, national or state legislation, or regulation of GHG emissions may increase demand for our bioenergy and hydrogen-based products, but they may also make it more expensive or impractical to deploy natural gas-fueled Energy Servers in some markets, notwithstanding their enhanced environmental performance relative to combustion-based technologies or may cause the loss of regulatory or policy incentives for those deployments. Examples include an anticipated GHG standard for participation in favorable fuel cell tariffs in California, new climate emissions restrictions or the introduction of carbon pricing, and the adoption of bans or restrictions on new natural gas interconnections by some local jurisdictions. For more on climate and environmental related risks, see Part I, Item 1A, Risk Factors — Risks Related to Legal Matters and Regulations.

Permits and Approvals

Each Energy Server and Electrolyzer installation must be designed, constructed and operated in compliance with applicable federal, state, international and local regulations, codes, standards, guidelines, policies and laws. To operate our systems, we, our customers and our partners are each required to obtain applicable permits and approvals for the installation of the Energy Servers and the Electrolyzers, which may include federal, state, and local authority approvals; for the interconnection systems with the local electrical utility; and, where the gas distribution system is used, the gas utility as well.

Government Policies and Incentives

There are varying policy frameworks across the U.S. and internationally designed to support and accelerate the adoption of clean and/or reliable distributed power generation and hydrogen technologies, such as the manufacturing and deployment of our Energy Servers and our Electrolyzers. These policy initiatives often come in the form of tax incentives, cash grants, performance incentives, environmental attribute credits, permitting regimes, interconnection policies and/or applicable gas or electric tariffs.

The U.S. federal government provides businesses with the ITC under Section 48 of the Internal Revenue Code, available to the owners of our Energy Servers for the tax year in which the systems are placed into service. On August 7, 2022, the IRA under the fiscal year 2022 budget reconciliation instructions. On August 16, 2022, the IRA was signed into law. The IRA includes numerous investments in climate protection, and, among them, an extension and expansion of the ITC and the Production Tax Credit under Section 45 of the Internal Revenue Code, the addition of expanded tax credits for other technologies and for manufacturing of clean energy equipment, as well as terms allowing parties to more easily monetize the tax credits. The IRA contains a multi-tiered credit-amount structure for many applicable tax credits. Specifically, many of the credits have a lower base credit amount that can be increased up to five times if the taxpayer can satisfy applicable prevailing wage or apprenticeship requirements. The IRA also creates certain bonus tax credit amounts relevant to projects involving Bloom products that are placed in service, or of which construction begins, in 2023 and 2024 and that satisfy domestic content criteria and/or are located within an “energy community.” The IRA also creates tax credits for the production of hydrogen and carbon capture, as well as incentives for clean energy manufacturing. By implementing the IRA, the U.S. federal government aims to make an impact on energy markets so that cleaner options are more affordable to consumers.

Our Energy Servers are currently installed at customer sites in twelve states in the U.S., each of which has its own enabling policy framework. Some states have utility procurement programs and/or renewables portfolio standards for which our technology is eligible. Our Energy Servers currently qualify for a variety of benefits and incentives, such as tax exemptions,

15

interconnection benefits, relief from utility charges and other forms of economic and energy benefits, in 21 states including Connecticut, New Jersey, Maryland, Massachusetts, New York, Pennsylvania, Rhode Island, Illinois, Indiana, Michigan, Ohio, West Virginia, Tennessee, Virginia, North Carolina, Delaware, Kentucky, Washington, New Hampshire, Vermont, and Maine. These policy provisions are subject to change.

Some municipal jurisdictions are considering or have recently enacted building codes or local ordinances that limit access to the natural gas pipeline distribution network, primarily in California and the Northeast. Specific policies vary widely as to whether or not they impact our ability to do business in a given jurisdiction and the vast majority apply only to new, rather than existing, buildings. While these jurisdictions comprise a small minority of our current and prospective business footprint, local consideration of such codes and ordinances continues to evolve.

Government Regulations

Our business is subject to a changing patchwork of energy and environmental laws and regulations that prevail at the federal, state, regional and local level as well as in those foreign jurisdictions in which we operate. Most existing energy and environmental laws and regulations preceded the introduction of our innovative fuel cell technology and were adopted to apply to technologies existing at the time, namely large coal, oil or gas-fired power plants, and more recently solar and wind plants.

Although we generally are not regulated as a utility, existing and future federal, state, international and local government statutes and regulations concerning electricity heavily influence the market for our Energy Servers and services. These statutes and regulations often relate to electricity pricing, net metering, incentives, taxation, competition with utilities, the interconnection of customer-owned electricity generation, interconnection to the gas distribution system, and other issues relevant to the deployment and operation of our products, as applicable. Federal, state, international and local governments continuously modify these statutes and regulations. Governments, often acting through state utility or public service commissions, change and adopt or approve different requirements for regulated entities and rates for commercial customers on a regular basis. These changes can have a positive or negative impact on our ability to deliver cost savings to customers.

At the federal level, the Federal Energy Regulatory Commission (the “FERC”) has authority to regulate, under various federal energy regulatory laws, wholesale sales of electric energy, capacity, and ancillary services, and the delivery of natural gas in interstate commerce. Some investment vehicles who own Bloom Energy Servers are subject to regulation under the FERC with respect to market-based sales of electricity, which requires us to file notices and make other periodic filings with the FERC. In addition, our project with Delmarva Power & Light Company is subject to laws and regulations relating to electricity generation, transmission, and sale at the federal level and in Delaware. To operate our systems, we obtain interconnection agreements from the applicable local primary electricity and gas utilities. In almost all cases, interconnection agreements are standard form agreements that have been pre-approved by the state or local public utility commission or other regulatory bodies with jurisdiction over interconnection agreements. As such, no additional regulatory approvals are typically required for deployment of our systems once interconnection agreements are signed, although they may be required for the export and subsequent sale of electricity or other regulated products.

Product safety standards for stationary fuel cell generators have been established by the American National Standards Institute (the “ANSI”). These standards are known as ANSI/CSA FC-1. Our products are designed to meet these standards. Further, we utilize the Underwriters’ Laboratory, or UL, to certify compliance with these standards. The Energy Server installation guidance is provided by NFPA 853: Standard for the Installation of Stationary Fuel Cell Power Systems. Installations at sites are carried out to meet the requirements of these standards.

Environmental laws and regulations can give rise to liability for administrative oversight costs, cleanup costs, property damage, bodily injury, fines, and penalties. Capital and operating expenses needed to comply with environmental laws and regulations can be significant, and violations may result in substantial fines and penalties or third-party damages. In addition, maintaining compliance with applicable environmental laws, such as the Comprehensive Environmental Response, Compensation and Liability Act in the U.S., requires significant time and management resources.

Several states and regions in which we currently operate require permits where emissions of air pollutants would exceed applicable thresholds. In most states and regions where this is the case, permits have only been required for larger Energy Server installations. Other states and regions in which we operate, including New York, New Jersey and North Carolina, have specific air permitting exemptions for fuel cells.

For more information about the regulations to which we are subject and the risks to our costs and operations related thereto, please see the risk factors set forth under the caption Part I, Item 1A, Risk Factors — Risks Related to Legal Matters and Regulations.

16

Backlog

The timing of delivery and installations of our products has a significant impact on the timing of the recognition of our product and installation revenues. Many factors can cause a lag between the time a customer signs a contract and our recognition of product revenue. These factors include the number of our Energy Servers installed per site, local permitting and utility requirements, environmental, health and safety requirements, weather, and customer facility construction schedules. Many of these factors are unpredictable and their resolution is often outside of our or our customers’ control. Customers may also ask us to delay an installation for reasons unrelated to the foregoing, including delays in their financing arrangements. Further, due to unexpected delays, deployments may require unanticipated expenses to expedite delivery of materials or labor to ensure the installation meets our timing objectives. These unexpected delays and expenses can be exacerbated in periods in which we deliver and install a larger number of smaller projects. In addition, if even relatively short delays occur, there may be a significant shortfall between the revenue we expect to generate in a particular period and the revenue that we are able to recognize. For our installations, revenue and cost of revenue can fluctuate significantly on a periodic basis depending on the timing of acceptance and the type of financing used by the customer.

Human Capital

We are committed to attracting and retaining exceptional talent. Investing in and inspiring our people to do their best work is critical for our success. As of December 31, 2023, we had 2,377 full-time employees worldwide, of which 1,948 were located in the U.S., 383 were located in India, and 46 were located in other countries. During 2023, our workforce decreased by 6% as compared to fiscal 2022, predominantly because of the restructuring actions we initiated in September 2023 with one of the goals being an optimization of our workforce across multiple functions. For additional information, please see Part II, Item 8, Note 12 — Restructuring.

In order to attract and retain our employees, we strive to maintain an inclusive, diverse and safe workplace, with opportunities for our employees to grow and develop in their careers. This is supported by strong compensation, benefits, and health and wellness programs. We are mission driven and hire and develop talent with a passion toward achieving our mission.

Inclusion and Diversity

Our cultural foundation is that of innovation, results, respect, and doing the right thing. One of our greatest strengths is a very talented and diverse employee population. We believe diverse talent leads to better decision making and best positions us to meet the needs of our customers, stockholders, and the communities in which we live and work.

We continuously evolve our hiring strategies, track our progress and hold ourselves accountable to advancing global diversity. We seek to hire employees from a broad pool of talent with diverse backgrounds, perspectives and abilities, and we believe diverse leaders serve as role models for our inclusive workforce. In fiscal 2023, we continued with our Effective Interviewing course for hiring managers and interviewers, which covered unconscious bias, legal questions, and a positive candidate experience.

Our continued engagement with organizations that partner with diverse communities have been essential to our efforts to increase women, veteran, and minority representation in our workforce. We are actively engaged with local community leaders to broaden our reach to underserved communities. One example is establishing the Smart Manufacturing Technology Earn and Learn program with Ohlone College, Fremont CA. Through the program we hired 8 interns and converted 3 to full time employees. We also partner with several veteran search firms to identify talent leaving the military. In fiscal 2023, we filled with veterans 40% of Bloom’s field service and remote monitoring service roles. In Delaware State, we have worked with the Dover Air Force base and Delaware National Guard for hiring events. Bloom was awarded the Warrior Friendly Business award for 2023 by the Delaware National Guard.

Finally, our University/Early Careers Program has allowed the company to focus on hiring a diverse early careers workforce. We are also partnering with City College of New York/Colin Powell School to identify summer intern talent. These are students from underrepresented minorities, with the majority of them being the first to attend college in their family. We also have partnerships with a number of HBCUs, including Delaware State University and Howard University. The result of these outreach commitments was that 64% of our interns were ethnically diverse and 40% were women. The City College of New York collaboration will be continuing in 2024 with more interns.

Our continued engagement with organizations that work with diverse communities has been vital to our efforts to increase women and minority representation in our workforce. Our “Careers at Bloom Silicon Valley” campaign targets recruiting diverse talent from underserved communities for hourly manufacturing roles. To promote inclusivity, we advertise

17

our jobs in multiple languages and participate in community job fairs giving equal access to opportunities Bloom held numerous job fairs in the community including underserved areas around Fremont, Stockton, Salinas, Soledad, Seaside, Marina, Gilroy and Alameda in California State. To help preserve jobs in the community, Bloom partnered with local companies doing layoffs to hire manufacturing talent. Cepheid being one such organization that we hired 171 employees from.

Employee Demographics

We believe that our statistics are strong, our culture of inclusivity is stronger (as of December 31, 2023):

•66% of our employee population in the U.S. is ethnically diverse

•Women make up 25% of our employee population globally

•Our senior leadership team of eleven individuals included on December 31, 2023 seven ethnically diverse individuals and two women

•Women make up 16% of our leadership population (Director-level and above)

•Ethnic minorities represent 43% of our leadership (Director-level and above)

Compensation and Benefits