Table of Contents

Index to Financial Statements

Confidential Draft No. 7 Submitted to the Securities and Exchange Commission on January 19, 2018

As filed with the Securities and Exchange Commission on , 2018

Registration No.

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

Under

the Securities Act of 1933

BLOOM ENERGY CORPORATION

(Exact name of Registrant as specified in its charter)

| Delaware | 3620 | 77-0565408 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

1299 Orleans Drive

Sunnyvale, California 94089

(408) 543-1500

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

KR Sridhar

Chief Executive Officer

Bloom Energy Corporation

1299 Orleans Drive

Sunnyvale, California 94089

(408) 543-1500

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| Gordon K. Davidson, Esq. Sayre E. Stevick, Esq. Jeffrey R. Vetter, Esq. Fenwick & West LLP Silicon Valley Center 801 California Street Mountain View, California 94041 (650) 988-8500 |

Shawn M. Soderberg, Esq. Bloom Energy Corporation 1299 Orleans Drive Sunnyvale, California 94089 (408) 543-1500 |

Alan F. Denenberg, Esq. Davis Polk & Wardwell LLP 1600 El Camino Real Menlo Park, CA 94025 (650) 752-2000 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |||

| Non-accelerated filer | ☒ (Do not check if a smaller reporting company) | Smaller reporting company | ☐ | |||

| Emerging Growth Company | ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided to Section 7(a)(2)(B) of the Securities Act. ☐

CALCULATION OF REGISTRATION FEE

|

| ||||

| Title of Each Class of Securities to be Registered |

Proposed Maximum Aggregate Offering Price(1)(2) |

Amount of Registration Fee | ||

| Common Stock, par value $0.0001 per share |

||||

|

| ||||

|

| ||||

| (1) | Estimated solely for the purpose of computing the amount of the registration fee pursuant to Rule 457(o) under the Securities Act of 1933, as amended. |

| (2) | Includes the aggregate offering price of additional shares the underwriters have the right to purchase from the Registrant, if any. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a) may determine.

Table of Contents

Index to Financial Statements

Subject to Completion, dated , 2018

Preliminary Prospectus

SHARES

COMMON STOCK

This is an initial public offering of Bloom Energy Corporation’s shares of common stock. We are offering to sell shares in this offering. The selling stockholders identified in this prospectus are offering an additional shares. We will not receive any of the proceeds from the sale of the shares being sold by the selling stockholders.

Prior to this offering, there has been no public market for the common stock. It is currently estimated that the initial public offering price per share will be between $ and $ .

We intend to list the common stock on the under the symbol “BE.”

We are an “emerging growth company” as defined under federal securities laws and, as such, will be subject to reduced public company reporting requirements. Investing in our common stock involves risks. See “Risk Factors” on page 18 to read about factors you should consider before buying shares of common stock.

| Per Share |

Total | |||||||

| Initial public offering price |

$ | $ | ||||||

| Underwriting discount(1) |

$ | $ | ||||||

| Proceeds, before expenses, to us |

$ | $ | ||||||

| Proceeds, before expenses, to the selling stockholders |

$ | $ | ||||||

| (1) | See “Underwriting” for a description of the compensation payable to the underwriters. |

To the extent that the underwriters sell more than shares of common stock, the underwriters have the option to purchase up to an additional shares of common stock from us and the selling stockholders at the initial public offering price less the underwriting discount within 30 days from the date of this prospectus.

Neither the Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the shares against payment in New York, New York on , 2018.

| J.P. Morgan | Morgan Stanley |

|

Credit Suisse

|

KeyBanc Capital Markets

|

|

BofA Merrill Lynch

| ||||

| Baird | Cowen | HSBC | Raymond James |

Prospectus dated , 2018

Table of Contents

Index to Financial Statements

| Page | ||||

| 1 | ||||

| 18 | ||||

| 41 | ||||

| 42 | ||||

| 43 | ||||

| 43 | ||||

| 44 | ||||

| 47 | ||||

| 53 | ||||

| Management’s discussion and analysis of financial condition and results of operations |

61 | |||

| 122 | ||||

| 142 | ||||

| 150 | ||||

| 159 | ||||

| 162 | ||||

| 166 | ||||

| 174 | ||||

| Material U.S. federal income tax considerations for non-U.S. holders |

177 | |||

| 182 | ||||

| 192 | ||||

| 192 | ||||

| 192 | ||||

| F-1 | ||||

We are responsible for the information contained in this prospectus and in any free writing prospectus filed with the Securities and Exchange Commission. We, the underwriters and the selling stockholders have not authorized anyone to provide you with additional information or information different from that contained in this prospectus or in any free writing prospectus filed with the Securities and Exchange Commission. We, the underwriters and the selling stockholders are offering to sell, and seeking offers to buy, shares of our common stock only in jurisdictions where offers and sales are permitted. The information in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or any sale of shares of our common stock.

Neither we, the selling stockholders, nor any of the underwriters have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who obtain this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the shares of common stock and the distribution of this prospectus outside of the United States.

Through and including , 2018 (the 25th day after the date of this prospectus), all dealers effecting transactions in these securities, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to a dealer’s obligation to deliver a prospectus when acting as an underwriter and with respect to an unsold allotment or subscription.

i

Table of Contents

Index to Financial Statements

This summary highlights information contained elsewhere in this prospectus. This summary does not contain all of the information you should consider before buying shares in this offering. Therefore, you should read this entire prospectus carefully, including “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and our consolidated financial statements and the related notes contained elsewhere in this prospectus. Unless the context requires otherwise, the words “we,” “us,” “our” and “Bloom Energy” refer to Bloom Energy Corporation and its subsidiaries.

BLOOM ENERGY CORPORATION

Overview

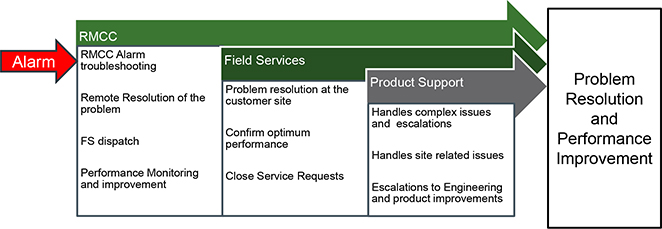

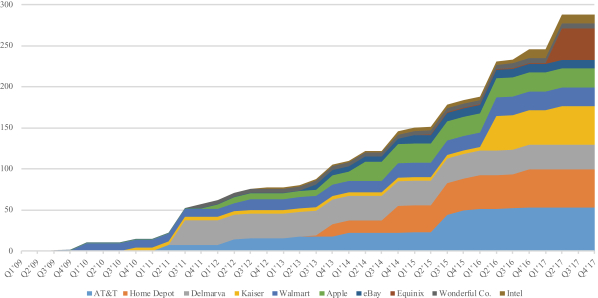

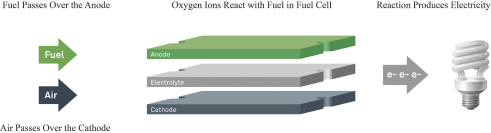

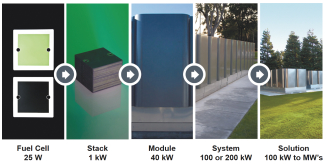

Our mission is to make clean, reliable, and affordable energy for everyone in the world. To fulfill this mission, we have developed a distributed, on-site electric power solution that is redefining the $2.4 trillion electric power market and transforming how power is generated and delivered. The commercial and industrial (C&I) segments are our initial focus. Our solution, the Bloom Energy Server, is a stationary power generation platform built for the digital age and capable of delivering highly reliable, uninterrupted, 24x7 constant (or base load) power that is also clean and sustainable. The Bloom Energy Server converts standard low-pressure natural gas or biogas into electricity through an electrochemical process without combustion, resulting in very high conversion efficiencies and lower harmful emissions than conventional fossil fuel generation. A typical configuration produces 250 kilowatts of power in a footprint roughly equivalent to that of half of a standard 30 foot shipping container, or approximately 125 times more space-efficient than solar power generation. 250 kilowatts of power is roughly equivalent to the constant power requirement of a typical big box retail store. Any number of these Energy Server systems can be clustered together in various configurations to form solutions from hundreds of kilowatts to many tens of megawatts. As a result, our solution has been adopted by some of the largest companies in the world, including 25 of the Fortune 100 companies as of September 30, 2017 such as Apple, AT&T, Coca-Cola, Disney, FedEx, Google, Home Depot, Johnson & Johnson and Walmart.

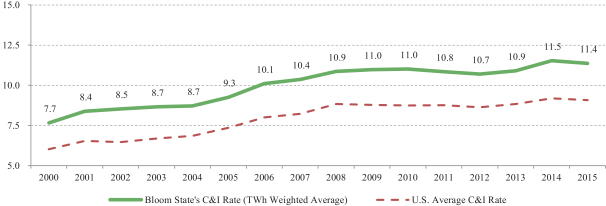

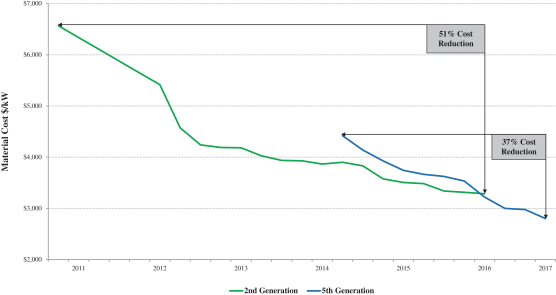

Grid power prices continue to rise in most regions where we serve customers. The traditional centralized electric grid infrastructure requires significant investment for its maintenance, upgrade and operation, which has been continually driving up the cost of grid power. The U.S. Energy Information Administration (EIA) projects that grid power prices for all classes of customers including commercial and industrial are expected to increase by over 40% through 2026 in the U.S. By contrast, in the regions where the majority of our Energy Servers are deployed, our solution typically provides a lower cost of electricity to our customers than traditional grid power. In addition, our solution provides greater cost predictability versus rising grid prices. Through a relentless focus on cost reduction, we have driven down materials cost of our Energy Servers by 75% since 2009. This cost reduction, coupled with the use of abundant, low-cost natural gas as a fuel source and very high conversion efficiencies, has allowed us to expand our market opportunity.

The traditional grid is vulnerable to natural disasters as well as cyber-attacks and physical sabotage, which have become more frequent. The topology of the centralized grid has a tendency to cascade outages rather than to contain them. Because our on-site stationary power systems are located at the point of consumption, our Energy Servers, when configured to provide uninterruptible power, largely avoid the existing electric power grid’s inherent vulnerability to outages from weather events and other threats, as well as the additional losses of efficiency associated with the transmission of power over long distances. Our Energy Servers are able to deliver this very high level of availability to our customers in part because they are modular, redundant, and can be “hot swapped,” or serviced without interruption.

The electric grid typically delivers power generated by sources with a high carbon footprint, and there is increasing pressure to reduce resulting carbon dioxide and other harmful emissions. There is also a rising demand

1

Table of Contents

Index to Financial Statements

for clean electric power solutions that overcome the challenges of the traditional grid, and can address the requirements of the digital economy by delivering 24x7 electric power, with very high availability and quality. Our Energy Servers address these requirements and operate on-site at very high efficiencies using natural gas or biogas, offering significant emissions reductions, and, unlike prevalent renewable technologies such as wind and solar, provide a viable alternative to the constant base load electricity generated by a central power plant.

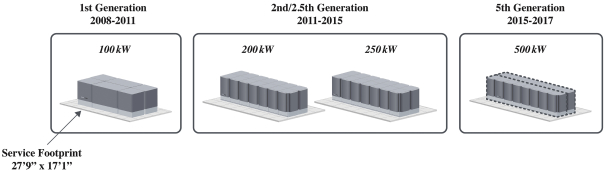

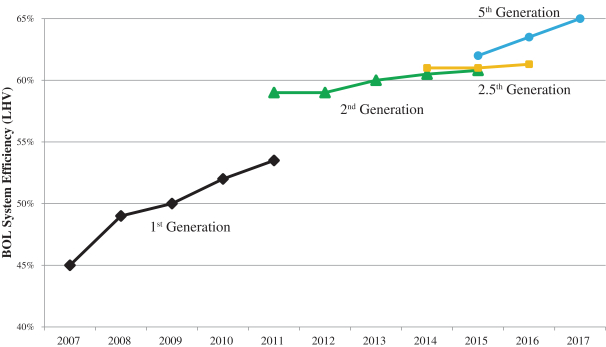

We have continuously innovated and evolved our technology over time. The latest generation Energy Server delivers five times the energy output of the first generation in a constant footprint. Similarly, we have also improved the beginning-of-life electrical efficiency (the rate at which fuel is converted into electricity) of our Energy Servers from 45% to 65% today, representing the highest delivered power efficiency of any commercially available power solution. In addition, we have expanded the range of available accessories which extend the capability and functionality of our Energy Servers to meet additional customer requirements, such as an uninterruptable power capability. Our team has decades of experience in the various specialized disciplines and systems engineering concepts unique to this technology. We had 195 issued patents in the United States and 80 issued patents internationally as of September 30, 2017.

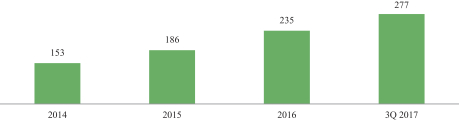

Our solution is capable of addressing customer needs across a wide range of industry verticals, including banking and financial services, cloud services and technology, communications and media, consumer packaged goods and consumables, education, government, healthcare and life sciences, hospitality, logistics, manufacturing, real estate, retail and utilities. We believe that, thus far we are capturing only a small percentage of our largest customers’ total energy spend, which gives us a significant opportunity for expansion and growth. Moreover, as the price of our products decreases and the price of grid power increases, more markets will become available for our products. As of September 30, 2017, we had 277 megawatts in total deployed systems, representing an average annual growth rate of approximately 22% since 2014. In addition, as of December 31, 2016, we had an additional product sales backlog of 87.1 megawatts.

Industry Background

People around the world depend upon access to reliable and affordable electric power for a healthy, functioning economy and for delivery of essential services. According to Marketline, the market for electric power is one of the largest sectors of the global economy with total revenues of $2.4 trillion in 2016, and is projected to continue to grow at a compound annual growth rate of 4.3% to $2.9 trillion in 2021. There are numerous challenges driving a transformation in how electricity is produced, delivered and consumed. We believe that this transformation will be similar to the seismic shifts seen in the computer and telecommunications industries, from centralized mainframe computing and landline telephone systems to ubiquitous and highly personalized distributed technologies. Some of the key challenges facing the electric power market are:

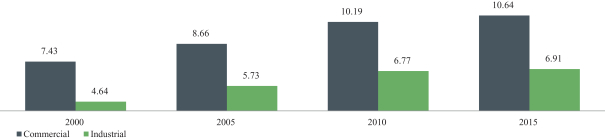

Increasing costs to maintain and operate the existing electric grid

The U.S. Department of Energy has described the U.S. electricity grid as “aging, inefficient, congested, and incapable of meeting the future energy needs of the information economy,” while the American Society of Civil Engineers gave the U.S. energy infrastructure a grade of D+ in 2017. The electric power grid has suffered from insufficient investment in critical infrastructure as a result of complexities surrounding the ownership, operation and regulation of grid infrastructure, compounded by the challenges of large capital costs and lack of adequate innovation. The Edison Electric Institute estimated that between 2017 and 2019, U.S. investor-owned electric utilities will need to make total capital expenditure investments of approximately $346 billion. U.S. EIA data demonstrates that the average commercial and industrial electricity prices have both increased at 2.4% and 2.7% CAGR from 2000 to 2015, respectively. According to this data, the average commercial and industrial electricity prices are expected to continue to rise.

2

Table of Contents

Index to Financial Statements

Inherent vulnerability of existing grid design

The existing electric grid architecture features centralized, monolithic power plants and mostly above-ground transmission and distribution wires. This design has numerous points of failure and limited redundancy, and the daisy-chain topology can cascade outages rather than contain them. For example, in 2003, an initial failure blamed on a tree branch in Ohio set off outages that cascaded across eight states and parts of Canada, cutting power for 50 million people. Similarly, in 2011, a dropped transmission line in Arizona cascaded and created a massive outage across Southern California.

Furthermore, the limits of this design, coupled with aging and underinvested infrastructure, leaves the grid vulnerable to natural disasters such as hurricanes, earthquakes, drought, wildfires, flooding and extreme temperatures. According to data from the U.S. Department of Energy (DOE), the United States electric grid loses power 285% more often than in 1984, when data collections on blackouts began. These outages result in an annual loss to American businesses of as much as $150 billion, with weather-related disruptions costing the most per event.

In addition to potential disruptions to the grid, there is also an increasing concern over the threat of cyber-attack and physical sabotage to the centralized grid infrastructure. In 2017, Accenture Consulting published the report “Outsmarting Grid Security Threats,” which stated that “57% of utility executives believe their countries could see interruption of electricity supply due to cyber-attacks within five years” and that “only 48% of utility executives think they are well prepared for the challenges of an interruption from cyber-attack”.

Intermittent generation sources such as wind and solar are negatively impacting grid stability

Electricity generation from wind and solar has grown dramatically over recent years and is expected to account for a greater percentage of total generation going forward. While these renewable sources help to reduce greenhouse gas emissions, they provide only intermittent power to the grid, which compromises the grid’s ability to deliver 24x7 reliable electric power. As the penetration of these resources increases, balancing real-time supply and demand becomes more challenging and costly.

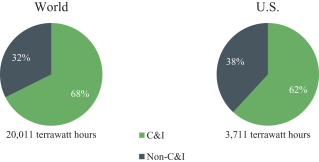

Due to these challenges, solutions are needed which provide constant base load 24x7 electric power which is reliable, clean and without the shortcomings of the existing grid infrastructure or intermittent sources such as wind or solar. This need is especially acute in the C&I segments, representing 68% of global electricity consumption, according to Marketline, where cost and reliability have a direct impact on profitability and business sustainability.

Increasing focus on reducing harmful emissions

In response to rising concern over harmful emissions, the 2015 United Nations Climate Change Conference, or COP 21, climate talks resulted in a global consensus that the rate of release of carbon dioxide and other greenhouse gases must be reduced with an increased sense of urgency. The electric power sector, which today produces more greenhouse gases than any other sector of the global economy, is under increasing pressure to do its part. Policy initiatives to reduce harmful emissions from power generation are widespread, including the adoption of renewable portfolio standards or mandated targets for low-or zero-carbon power generation.

Lack of access to affordable and reliable electricity in developing countries

According to the United Nations Development Programme, 1.3 billion people worldwide live without electricity—more than one in five people around the globe. For developing countries to grow their economies, they must expand access to reliable and affordable electric power. Building a centralized grid system, in addition

3

Table of Contents

Index to Financial Statements

to its inherent limitations, can also be infeasible due to the lack of adequate capital for upfront investment. Moreover, in dense urban areas, the costs of building this infrastructure are compounded by a lack of urban planning. In rural areas, using the centralized model to transmit and distribute electricity to low-density populations is economically unviable. As a result, we believe these countries are likely to develop a hybrid solution consisting of both centralized and distributed electrical power infrastructure to accelerate availability of power.

Our Solution

The Bloom Energy Server delivers reliable, resilient, clean and affordable energy, particularly in areas of high electricity costs, by its advanced distributed power generation system that is customizable, always-on and a source of primary base load power.

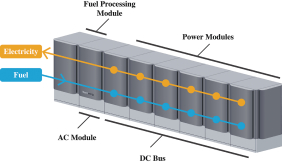

The Bloom Energy Server is based on our proprietary solid oxide fuel cell technology, which converts fuel into electricity through an electrochemical process without combustion. The primary input to the system is standard low-pressure natural gas or biogas from local gas lines. The high-quality electrical output of the Energy Server is connected to the customer’s main electrical feed, which avoids the transmission and distribution losses associated with the centralized grid system. Each Bloom Energy Server is modular and composed of independent 50 kilowatt power modules. A typical configuration includes multiple power modules in a single Energy Server, which produces 250 kilowatts of power in a footprint roughly equivalent to that of half a standard 30 foot shipping container, or approximately 125 times more space-efficient than solar power generation. Any number of these Energy Server systems can be clustered together in various configurations to form solutions from hundreds of kilowatts to many tens of megawatts. The Bloom Energy Server parallels the example of smart phones – a single core platform that can be highly personalized to the needs of its user through the addition of any of a wide variety of applications that extend features and provide benefits to the user. Like a smart phone, the Bloom Energy Server is easily customizable and upgradeable to add new energy accessories and capabilities. The Bloom Energy Server is easily integrated into corporate environments due to its aesthetically attractive design, compact space requirement, minimal noise profile and lack of harmful emissions.

Our Value Proposition

Our value proposition has five key elements which allow us to deliver a better electron: reliability, resiliency, cost savings and predictability, sustainability and personalization. While the relative importance of these attributes can vary by customer, our ability to deliver these attributes is a significant differentiator for us in the marketplace. We provide a complete, integrated “behind-the-meter” solution including installation, equipment, service, maintenance and, in some cases, bundled fuel. The five elements of our value proposition emphasize those areas where there is a strong customer need and where we believe we can deliver superior performance.

Reliability. Our Energy Servers deliver always-on, 24x7 base load power. The output of our Energy Servers is designed to meet the requirements of the digital economy, with very high availability of power, mission-critical reliability and grid-independent capabilities. Bloom provides power quality, voltage, and current, which can be tuned to specific customer requirements. The Bloom Energy Server can be configured to eliminate the need for traditional backup power equipment such as diesel generators, batteries or uninterruptible power systems (UPS).

Resiliency. Our Energy Servers avoid the vulnerabilities of conventional transmission and distribution lines by generating power on-site, where the electricity is consumed. The system operates at very high availability due to its modular and fault-tolerant design, which includes multiple independent power generation modules that can be hot swapped. Importantly, our systems utilize the natural gas infrastructure, which is a mesh network buried underground, unlike the above-ground electric grid architecture. A failure at one point in the natural gas system does not necessarily cause the same kind of cascading failure that can occur on the electrical grid.

4

Table of Contents

Index to Financial Statements

Cost Savings and Predictability. In contrast to the rising and unpredictable cost outlook for grid electricity, we offer our customers the ability to lock in cost for electric power (other than the price of natural gas) over the long-term. In the regions where the majority of our Energy Servers are deployed, our solution typically provides a lower cost of electricity to our customers than traditional grid power. In addition, our solution provides greater cost predictability versus rising grid prices. Moreover, we provide customers with a solution that includes all of the fixed equipment and maintenance costs for the life of the contract. With the addition of an optional integrated storage solution, Bloom can also help customers to load shift and peak shave – reducing their exposure to peak power costs from the grid. We also enable our customers to scale from a few hundred kilowatts to many megawatts on a “pay-as-you-grow” basis.

Sustainability. Bloom Energy Servers provide clean power and because they are fuel-flexible, customers can choose the fuel source that best fits their needs based on availability, cost and carbon footprint. Bloom Energy Servers deployed since 2012 running on natural gas produce nearly 60% less carbon emissions compared to the average of U.S. combustion power generation. Bloom Energy Servers can also utilize renewable biogas to generate carbon-neutral electricity. As of September 30, 2017, approximately 8% of our deployed fleet of Energy Servers, by megawatts deployed, utilized biogas. In both cases, our Energy Servers emit virtually no criteria air pollutants, including NOx or SOx. Bloom Energy Servers also use virtually no water in normal operation. By comparison, to produce one megawatt per hour for a year, thermoelectric power generation for the U.S. grid withdraws approximately 156 million gallons of water more than Bloom Energy Servers.

Personalization. The Bloom Energy Server is designed as a platform which can be customized to the needs of each individual customer delivering the level of reliability, resiliency, sustainability as well as cost savings and predictability required by that customer. Analogous to a smart phone, the base Energy Server platform can easily accommodate accessories that extend capabilities and provide for customization. For example, the Energy Server can be customized with uninterruptible power components to deliver higher levels of reliability and grid independent operation, or storage can be added to reduce peak power consumption and improve the predictability of economics for the customer.

Our Market Opportunity

Economic growth and development worldwide will increasingly be powered by electricity. Global electricity demand is forecasted to rise by 60% between 2015 and 2040, accounting for 55% of the world’s energy demand growth. In addition, as the world consistently accelerates the adoption of digital technologies (i.e., widespread deployment of data centers, electric and autonomous cars, intelligent home systems, additive manufacturing), overall energy use will continue to increase. These facts offer challenges alongside opportunities, and will alter the global energy landscape. The retail electricity market represents the market for power delivered to the end-customers or the consumer of electricity. The price of retail electricity generally reflects the cost of generation, transmission and distribution. Generating power onsite (i.e., at the point of consumption, rather than centrally) eliminates the cost, complexity, interdependencies, and inefficiencies associated with electrical transmission and distribution.

According to data from MarketLine, the total addressable market (TAM) for electricity at the point of customer consumption was approximately $2.4 trillion in 2016. Of this market, MarketLine determined that 68% consisted of commercial, industrial and public services (CI&P), or $1.6 trillion.

We believe that the current global serviceable addressable market (SAM) for Bloom is the retail electricity market for CI&P customers in the world’s ten largest electricity markets. These markets include, in order of decreasing size, the United States, India, Japan, Germany, Canada, Brazil, South Korea, France, the United Kingdom and Mexico. We do not include China or Russia in calculating our SAM due to a lack of reliable market data in these markets. Based on country-by-country generation data from the U.S. EIA and publically-available retail power prices in each of these countries, we believe that our SAM is approximately $800 billion.

5

Table of Contents

Index to Financial Statements

Bloom primarily participates in the retail market for CI&P customers, and on that basis has calculated the TAM and SAM. From time to time, Bloom also selectively participates in wholesale market opportunities which have not been incorporated into this TAM and SAM analysis.

We currently have installations or purchase orders in eleven states in the United States (California, Connecticut, Delaware, Maryland, Massachusetts, North Carolina, New Jersey, New York, Pennsylvania, Utah and Virginia) as well as in Japan, India and Korea. According to the EIA, the total size of the retail markets for C&I customers in these U.S. states is approximately $76 billion. In addition, we estimate that the combined retail market for C&I customers in Japan, the Indian state of Karnataka (the state in India where we currently have deployed our solution) and the available market for new-build fuel cell generation in Korea is approximately $99 billion. Collectively, we estimate that the size of our current market is approximately $175 billion.

Our Customers

To date, the breadth, depth and scale of Bloom’s commercial customer adoption is significant for a new product in the electric power industry. As of September 30, 2017, we have installed 277 megawatts of Bloom Energy Servers at customer sites across the U.S., Japan and India.

Factors Driving Customer Adoption

Key factors that are driving the rapid adoption of our solution include:

Customers are driving a growing requirement for customized, high-quality and reliable power in the increasingly pervasive digital economy. The proliferation of cloud services and big data, and the associated rapid increase in demand for computing power, is reshaping the type and quality of power demanded by the digital economy. For providers and users of cloud services, uninterruptible, high-quality power is essential—requirements that the legacy grid is struggling to meet. Our highly available and scalable solution can replace the current patchwork of solutions, which include batteries, UPS and back-up generators.

Customers are seeking an alternative to the unpredictable and rising price of grid power. Grid costs in the United States have been rising for decades and are expected to continue to rise over the long-term. In the shorter-term, grid prices can be volatile, driven by regulatory judgments, commodity prices and the impact of external events such as weather. In contrast, we offer a complete turn-key solution, including equipment, installation, operations and maintenance that can provide customers with a competitive and predictable cost for their electricity for periods of up to 20 years. The only component of cost of Bloom’s solution that is not fixed at time of contracting is fuel supply—usually natural gas, which typically represents about 25% of Bloom’s delivered cost of electricity to the customer. However, even if there are significant variations in natural gas commodity prices, wholesale prices of electricity are also highly dependent on the price of natural gas and our current generation Energy Server is 14% to 31% more efficient than natural gas power plants. Customers also have the option to enter into long-term natural gas contracts at fixed prices for up to ten years, which is not an option available for grid electricity.

According to the U.S. EIA, the average commercial and industrial electricity rate increased at a 2.7% CAGR from 2000 to 2015. According to data from the EIA, the average C&I electricity prices will continue to rise. As a result, we expect Bloom’s market opportunity to continue to expand.

Our technology is proven with industry-leading customers. Our approach to innovation is evolutionary—every generation of our technology builds on a proven core and factors in lessons learned from our broadly deployed fleet. Our systems have been deployed with Fortune 500 customers since 2008 and have reached 277 megawatts in total as of September 30, 2017. The Bloom Energy Server has performed for our customers without disruption through natural disasters such as Hurricane Sandy and the 6.0 Richter scale earthquake near Napa, California in 2014.

6

Table of Contents

Index to Financial Statements

The natural gas revolution has provided an economically attractive means for achieving carbon reduction. Natural gas is now in abundant supply at economically attractive prices. This abundance, coupled with new technologies such as our Energy Servers that convert this fuel into electricity at high efficiency, will play a major role in replacing high-carbon fuels such as coal and oil. The United States’ abundant supply of recoverable natural gas is expected to last over 80 years, according to data from the Potential Gas Committee and the U.S. EIA.

Our Growth Strategy

Our growth strategies include:

Maintain technology leadership and leverage first-mover advantage

Our technology leadership is considerable and we have a well-established track record of continuous improvement. Our priority is to continue to advance our technology and build on this leadership position.

Significant and sustained improvements in “power density.” We have continually added more generation capacity into the same footprint and expect to continue to do so with successive generations of our technology. Today’s Bloom Energy Servers are capable of delivering five times the power of our first-generation system introduced only nine years ago, while staying within approximately the same service footprint.

Continual increases in electrical efficiency. Efficiency is defined as the percentage of the energy in the fuel that is converted to electricity. The higher the efficiency, the less fuel used to generate a given unit of electric power output, resulting in lower fuel costs. Today, our Energy Servers are significantly more efficient than the average of the U.S. grid. The latest generation of our Energy Servers, which began shipping in 2015, is capable of beginning-of-life (BOL) efficiencies of 65%, and we expect to further improve the efficiency in succeeding generations. While the Bloom Energy Server is capable of operating at peak efficiency, typically efficiency of the latest generation of Energy Servers can range from 53% to 65% over the project term depending on environmental conditions and the age of the power modules. We have the flexibility to maintain efficiency at specific levels to comply with customer sustainability, regulatory compliance, or other requirements by managing the replacement cycle of the power modules in the Energy Server.

Expanded feature sets and sizing options to address new market opportunities. The Bloom Energy Server was designed as a technology platform which can support extended capabilities from Bloom and other suppliers. The Bloom Energy Server platform provides the hardware and software building blocks that can be deployed in different configurations to provide customer-specific solutions. For example, we are now offering the option of adding a storage solution provided by PowerSecure (a unit of The Southern Company) to help customers avoid peak grid electricity power rates, and to provide greater resiliency to grid outages. We may also provide smaller or custom solutions which could allow us to address additional markets, such as powering cell sites in the mobile telephony market and franchise retail, in the future. Our current offering is well suited for multi-tenant housing, a segment that we intend to address in emerging economies as we expand to international markets. The platform components can also be configured to provide larger systems for utility or large industrial applications.

Acquire new customers and grow wallet share with existing customers

We currently target industry leading Fortune 500 companies, along with public and private organizations that are large consumers of electric power. Our success in landing industry leading customers has encouraged other new customers—companies and organizations in those industries, with similar scale and electricity demand—to follow suit. We employ a “land and expand” model through our direct sales force, which recognizes that new customers typically pilot a limited scale solution initially to gain experience with our fuel cell solutions. As we prove the value of Bloom solutions through these pilot projects, our customers will often expand their

7

Table of Contents

Index to Financial Statements

Bloom deployments by adding more capacity at existing sites and by adding new facilities from across their real estate portfolio. Our sales mix illustrates this dynamic: Since 2011, over half of our sales contracts, or the number of purchase orders signed, are with new customers, while approximately three quarters of our sales volume has been derived from repeat customers as they utilize our Energy Servers as a larger share of their energy wallet and create more value across more of their facilities over time. These repeat orders provide better visibility into our sales pipeline and also lower our cost of sales. The quality and staying power of our customers are important factors contributing to our confidence in this strategy. Since we target customers with very significant electric power spend, we view the current low penetration rate as a significant opportunity for growth.

Drive production cost reductions to expand our market

Since our initial commercial deployments eight years ago, we have continually reduced the production cost of our systems, enabling us to expand into new markets. We believe our technology innovation will drive further cost reductions as each successive generation of Bloom Energy Servers builds on the design and field experience of all previous generations. In addition, increased production volumes should lead to further cost reductions based on economies of scale, enabling market expansion and improved margins. On a per unit basis, which we measure in dollars-per-kilowatt, we have reduced our material costs by over 75% from the first generation Energy Server to our current generation Energy Server. We drove these material costs per unit down by over 50% over the life of our second generation system and by over 35% over the life of our fifth generation system to date. With each successive new generation, we have been able to reduce the material costs compared to the prior generation’s material costs.

Expand into international markets and new fast-growing segments

International. Most of our current and target customers have global footprints, which we expect will be another avenue for growth while also lowering the cost and risk of new market entry. Today, we have installations in the United States, Japan and India, and we are actively targeting additional international markets such as South Korea, Australia and Great Britain.

We also target fast-growing segments where we believe we can deliver significant value including data centers and critical facilities such as distribution centers, which cannot suffer even a momentary disruption to power without significant negative consequences.

Data Centers. When configured to provide uninterruptible power, we can provide primary power for data centers with up to Tier III availability and reliability without reliance on traditional back up or power conditioning equipment. A customer-commissioned study by the University of Illinois, Champaign-Urbana projects that a Bloom Energy solution configured to provide mission-critical power would be significantly more reliable than a traditional topology of grid power plus uninterruptible power systems and diesel backup. According to Technavio, a leading market research company, the global data center power market was valued at $9.9 billion in 2014 and is expected to reach $18.7 billion by 2019, growing at a compound annual growth rate of 14%.

Microgrids. As communities and organizations look to mitigate the risk of grid power outages, there is significant and growing interest in microgrids, which combine distributed power generation and storage into a network that can be isolated from the larger grid. Our flexible architecture allows integration of our systems with other distributed generation sources and technologies, such as solar and storage, while Bloom provides the stable always-on primary power—a key requirement for a microgrid solution. According to Technavio, the global microgrid market was valued at $9.2 billion in 2014 and is expected to reach $21.8 billion by 2019, growing at a compound annual growth rate of 19%.

8

Table of Contents

Index to Financial Statements

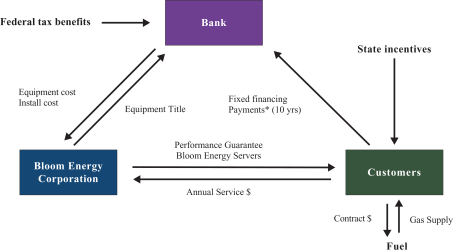

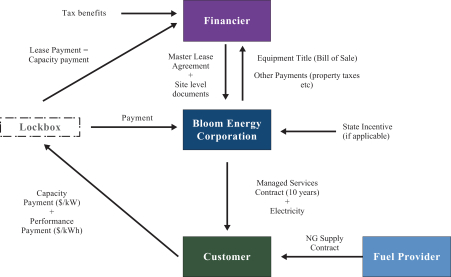

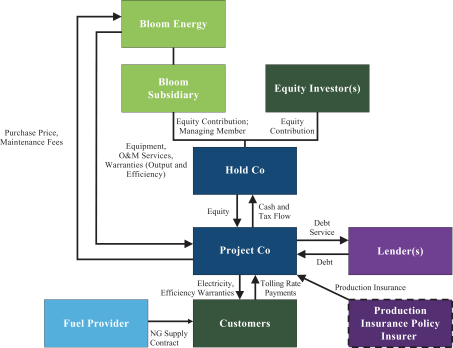

Provide innovative financing options to our customers

We intend to continue to assist our customers by providing innovative financing options to purchase our solution and grow our market opportunity. We have developed multiple options for our customers to acquire the power our Energy Servers produce. These offerings provide a range of options that enable customers to do business with us and secure power best customized to their needs. Our customers can purchase our systems outright, with operations and maintenance services contracts, or purchase the electricity that our Energy Servers produce without any upfront costs through various financing vehicles, including leases and power purchase agreements (PPAs), that combine the cost of our systems, warranty and service, financing, and in some cases fuel into monthly payments based on the electricity produced.

RISK FACTORS

Our business is subject to many risks and uncertainties, as more fully described under “Risk Factors” and elsewhere in this prospectus. For example, you should be aware of the following before investing in our common stock:

| • | our limited operating history and our nascent industry makes evaluating our business and future prospects difficult; |

| • | the distributed generation industry is an emerging market and distributed generation may not receive widespread market acceptance; |

| • | we have incurred significant losses in the past and we do not expect to be profitable for the foreseeable future; |

| • | our Energy Servers have significant upfront costs, and we will need to attract investors to help customers finance purchases; |

| • | if our Energy Servers contain manufacturing defects, our business and financial results could be harmed; |

| • | if our estimates of useful life for our Energy Servers are inaccurate or we do not meet service and performance warranties and guarantees, our business and financial results could be harmed; |

| • | our business currently depends on the availability of rebates, tax credits and other tax benefits, and other financial incentives. The reduction, modification, or elimination of government economic incentives could cause our revenue to decline and harm our financial results; |

| • | it will be difficult for us to raise additional debt financing; |

| • | we rely on tax equity financing arrangements to realize the benefits provided by investment tax credits and accelerated tax depreciation; |

| • | we derive a substantial portion of our revenue and backlog from a limited number of customers, and the loss of, or a significant reduction in orders from, a large customer could have a material adverse effect on our operating results and other key metrics; |

| • | our products involve a lengthy sales and installation cycle, and if we fail to close sales on a regular and timely basis it could harm our business; |

| • | our business is subject to risks associated with construction, cost overruns and delays, including those related to obtaining government permits, and other contingencies that may arise in the course of completing installations; |

| • | the failure of our suppliers to continue to deliver necessary raw materials or other components of our Energy Servers in a timely manner could prevent us from delivering our products within required time frames, and could cause installation delays, cancellations, penalty payments and damage to our reputation; |

| • | our financial condition and results of operations and other key metrics are likely to fluctuate on a quarterly basis in future periods, which could cause our results for a particular period to fall below expectations, resulting in a severe decline in the price of our common stock; |

9

Table of Contents

Index to Financial Statements

| • | we must maintain customer confidence in our liquidity and long-term business prospects in order to grow our business; and |

| • | a material decrease in the retail price of utility-generated electricity or an increase in the price of natural gas would affect demand for our Energy Servers. |

Corporate Information

We were incorporated in the State of Delaware on January 18, 2001 as Ion America Corporation. On September 20, 2006, we changed our name to Bloom Energy Corporation. Our principal executive offices are located at 1299 Orleans Drive, Sunnyvale, California 94089, and our telephone number is (408) 543-1500. Our website address is www.bloomenergy.com. The information on, or that can be accessed through, our website is not part of this prospectus and the inclusion of our website address in this prospectus is an inactive textual reference only.

“Bloom Energy” is our registered trademark in the United States and is registered in Japan, India, Australia, the European Union and under the Madrid Protocol. Our other registered trademarks and service marks in the United States include: Energy Server, Bloom Electrons, Bloomconnect, Bloomenergy, Bloom Box and BE. This prospectus also contains trademarks, service marks and trade names of other companies. We do not intend for our use or display of other companies’ trade names, trademarks or service marks to imply a relationship with, or endorsement or sponsorship of, us by these other companies.

Implications of Being an Emerging Growth Company

As a company with less than $1.07 billion in revenue during our last completed fiscal year, we qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. An emerging growth company may take advantage of specified reduced reporting requirements that are otherwise applicable generally to public companies. These reduced reporting requirements include:

| • | an exemption from compliance with the auditor attestation requirement on the effectiveness of our internal control over financial reporting; |

| • | an exemption from compliance with any requirement that the Public Company Accounting Oversight Board may adopt regarding mandatory audit firm rotation or a supplement to the auditor’s report providing additional information about the audit and the financial statements; |

| • | reduced disclosure about our executive compensation arrangements; |

| • | an exemption from the requirements to obtain a non-binding advisory vote on executive compensation or a stockholder approval of any golden parachute arrangements; and |

| • | extended transition periods for complying with new or revised accounting standards. |

We will remain an emerging growth company until the earliest to occur of: (1) the end of the first fiscal year in which our annual gross revenue is $1.07 billion or more; (2) the end of the first fiscal year in which we are deemed to be a “large accelerated filer,” as defined in the Securities Exchange Act of 1934, as amended, or the Exchange Act; (3) the date on which we have, during the previous three-year period, issued more than $1.0 billion in non-convertible debt securities; and (4) the end of the fiscal year during which the fifth anniversary of this offering occurs. We may choose to take advantage of some, but not all, of the available benefits under the JOBS Act. We intend to take advantage of the exemptions discussed above. Accordingly, the information contained herein may be different than the information you receive from other public companies in which you hold stock.

10

Table of Contents

Index to Financial Statements

THE OFFERING

| Common stock offered by us |

shares |

| Common stock offered by the selling stockholders |

shares |

| Total common stock offered |

shares |

| Common stock outstanding after this offering |

shares |

| Option to purchase additional shares of our common stock from us |

shares |

| Option to purchase additional shares of our common stock from the selling stockholders |

shares |

| Use of proceeds |

We estimate that the net proceeds from the sale of shares of our common stock that we are selling in this offering will be approximately $ million, based on an assumed initial public offering price of $ per share, which is the midpoint of the price range set forth on the cover page of this prospectus, after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us. We will not receive any proceeds from the sale of shares of common stock by the selling stockholders. |

| We intend to use the net proceeds from this offering for general corporate purposes, including research and development and sales and marketing activities, general and administrative matters and capital expenditures. See “Use of Proceeds.” |

| Proposed symbol |

“BE” |

| Risk factors |

See “Risk Factors” and other information included in this prospectus for a discussion of factors you should carefully consider before deciding to invest in shares of our common stock. |

The number of shares of our common stock to be outstanding after this offering is based on 133,031,641 shares of our common stock outstanding as of September 30, 2017, and excludes:

| • | 16,211,790 shares of our common stock issuable upon exercise of outstanding stock options as of September 30, 2017 with a weighted average exercise price of $17.36 per share under our 2002 Equity Incentive Plan and 2012 Equity Incentive Plan; |

| • | 4,703,856 shares of our common stock issuable upon settlement of restricted stock units (RSUs) outstanding as of September 30, 2017 under our 2012 Equity Incentive Plan; |

| • | 50,000 shares of our common stock issuable upon the exercise of outstanding warrants to purchase common stock as of September 30, 2017, with an exercise price of $25.76 per share; |

11

Table of Contents

Index to Financial Statements

| • | 1,141,184 shares of our common stock issuable upon the exercise of outstanding warrants to purchase Series F convertible preferred stock and Series G convertible preferred stock as of September 30, 2017, with a weighted average exercise price of $21.18 per share, which, if not exercised prior to the completion of this offering, shall convert in accordance with their terms into warrants to purchase common stock; |

| • | up to 216,000 shares of our common stock issuable to one of our customers on the occurrence of certain installation milestones; |

| • | 200,000 shares of common stock issuable 180 days from the date of this prospectus. These shares will be issued as part of a dispute settlement with a securities placement agent as described in “Description of Capital Stock—Securities Acquisition Agreement”; |

| • | shares of our common stock issuable upon the conversion of our outstanding 6.0% Convertible Senior Secured PIK Notes due 2020 (6% Notes) as of September 30, 2017, based on an assumed initial public offering price of $ per share, which is the midpoint of the price range set forth on the cover page of this prospectus, which notes will be convertible at the option of the holders thereof following the completion of this offering (for each $1.00 increase or decrease in the public offering price per share, the number of shares issuable upon such conversion would increase or decrease, as applicable, by shares); and |

| • | shares of common stock reserved for future issuance under our equity-based compensation plans, consisting of 2,796,947 shares of common stock reserved for issuance under our 2012 Equity Incentive Plan as of September 30, 2017, shares of common stock reserved for issuance under our 2016 Equity Incentive Plan, and shares of common stock reserved for issuance under our 2016 Employee Stock Purchase Plan, and excluding shares that become available under the 2016 Equity Incentive Plan and 2016 Employee Stock Purchase Plan pursuant to provisions of these plans that automatically increase the share reserves each year, as more fully described in “Executive Compensation—Employee Benefit Plans.” |

Because the conversion price of the 6% Notes will depend upon the actual initial public offering price per share in this offering, the actual number of shares issuable upon such conversion will likely differ from the number of shares set forth above. In this regard, a $1.00 increase in the assumed initial public offering price of $ per share, which is the midpoint of the price range set forth on the cover page of this prospectus, would decrease the number of shares of our common stock issuable on conversion of the 6% Notes by shares. A $1.00 decrease in the assumed initial public offering price would increase the number of shares of our common stock issuable on conversion of the 6% Notes by shares. See “Management’s Discussion and Analysis of Financial Condition and Results of Operation—Liquidity and Capital Resources—Credit Facilities—Bloom Energy Indebtedness” for more information.

Except as otherwise indicated, all information in this prospectus assumes:

| • | the automatic conversion of all outstanding shares of our convertible redeemable preferred stock into an aggregate of 107,610,244 shares of common stock, effective upon the closing of this offering; |

| • | the automatic conversion of all of our outstanding 8% Subordinated Secured Convertible Promissory Notes (8% Notes) into shares of our Series G convertible redeemable preferred stock at a per share price of $25.76 as of September 30, 2017, and the subsequent automatic conversion of such shares of Series G convertible redeemable preferred stock into an aggregate of 9,310,857 shares of common stock effective upon the closing of this offering; |

| • | no issuance of shares upon the exercise or settlement of outstanding stock options, warrants or restricted stock units subsequent to September 30, 2017, except for an aggregate of 150,000 shares of |

12

Table of Contents

Index to Financial Statements

| common stock that we expect to issue upon the exercise of outstanding warrants exercisable for shares of our Series F convertible preferred stock, which warrants would otherwise expire immediately prior to the completion of this offering; |

| • | the issuance and exercise of warrants to purchase 469,333 shares of our common stock at an exercise price of $0.01 per share to certain purchasers of our 6% Notes, as described in “Description of Capital Stock—6.0% Convertible Senior Secured PIK Notes due 2020,” which warrants will automatically be deemed exercised pursuant to their terms immediately prior to the completion of this offering; |

| • | the filing of our amended and restated certificate of incorporation and adoption of our amended and restated bylaws immediately prior to the closing of this offering; and |

| • | the underwriters will not exercise their option to purchase additional shares of common stock from us and the selling stockholders in this offering. |

13

Table of Contents

Index to Financial Statements

SUMMARY CONSOLIDATED FINANCIAL AND OTHER DATA

You should read the summary consolidated financial data set forth below in conjunction with our consolidated financial statements, the notes to our consolidated financial statements and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” contained elsewhere in this prospectus.

The summary consolidated statements of operations data for the years ended December 31, 2015 and 2016 are derived from our audited consolidated financial statements included elsewhere in this prospectus. We derived the summary consolidated statements of operations data for the nine months ended September 30, 2016 and 2017, and the summary consolidated balance sheet data as of September 30, 2017 from our unaudited consolidated financial statements included elsewhere in this prospectus. You should read the following selected consolidated financial data below in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the consolidated financial statements, related notes and other financial information included elsewhere in this prospectus. Our historical results are not necessarily indicative of the results to be expected in the future. The selected consolidated financial data in this section are not intended to replace the consolidated financial statements and are qualified in their entirety by the consolidated financial statements and related notes included elsewhere in this prospectus.

Please see the section titled “Selected Consolidated Financial Data—Key Operating Metrics” for information regarding how we define our product accepted during the period, megawatts deployed, billings for product accepted in the period, billings for installation on product accepted, billings for annual maintenance services agreements, product costs of product accepted, period costs of manufacturing related expenses not included in product costs and installation costs on product accepted.

| Years Ended December 31, |

Nine Months Ended September 30, |

|||||||||||||||

| 2015 | 2016 | 2016 | 2017 | |||||||||||||

| (in thousands, except for per share data) | ||||||||||||||||

| (unaudited) | ||||||||||||||||

| Consolidated Statements of Operations |

||||||||||||||||

| Revenue |

||||||||||||||||

| Product |

$ | 61,853 | $ | 76,478 | $ | 49,185 | $ | 112,855 | ||||||||

| Installation |

18,781 | 16,584 | 9,853 | 41,625 | ||||||||||||

| Service |

54,952 | 67,622 | 49,644 | 56,977 | ||||||||||||

| Electricity |

37,303 | 47,856 | 34,588 | 41,288 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total revenue |

172,889 | 208,540 | 143,270 | 252,745 | ||||||||||||

| Cost of revenue |

||||||||||||||||

| Product |

163,278 | 103,283 | 74,341 | 140,323 | ||||||||||||

| Installation |

24,589 | 17,725 | 10,776 | 42,996 | ||||||||||||

| Service |

135,508 | 155,034 | 114,630 | 69,585 | ||||||||||||

| Electricity |

31,198 | 35,987 | 26,260 | 29,935 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total cost of revenue |

354,573 | 312,029 | 226,007 | 282,839 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Gross profit (loss) |

(181,684 | ) | (103,489 | ) | (82,737 | ) | (30,094 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Operating expenses |

||||||||||||||||

| Research and development |

43,933 | 46,848 | 34,094 | 35,965 | ||||||||||||

| Sales and marketing |

19,543 | 29,101 | 20,813 | 23,069 | ||||||||||||

| General and administrative |

58,976 | 61,545 | 46,883 | 40,856 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total operating expenses |

122,452 | 137,494 | 101,790 | 99,890 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Loss from operations |

(304,136 | ) | (240,983 | ) | (184,527 | ) | (129,984 | ) | ||||||||

14

Table of Contents

Index to Financial Statements

| Years Ended December 31, |

Nine Months Ended September 30, |

|||||||||||||||

| 2015 | 2016 | 2016 | 2017 | |||||||||||||

| (in thousands, except for per share data) | ||||||||||||||||

| (unaudited) | ||||||||||||||||

| Interest expense |

(40,633 | ) | (81,190 | ) | (57,391 | ) | (78,816 | ) | ||||||||

| Other income (expense), net |

(2,891 | ) | (379 | ) | (175 | ) | 93 | |||||||||

| Gain (loss) on revaluation of warrant liabilities and embedded derivatives |

2,686 | (13,035 | ) | (3,898 | ) | 119 | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net loss before income taxes |

(344,974 | ) | (335,587 | ) | (245,991 | ) | (208,588 | ) | ||||||||

| Income tax provision |

707 | 729 | 653 | 756 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net loss |

(345,681 | ) | (336,316 | ) | (246,644 | ) | (209,344 | ) | ||||||||

| Net loss attributable to noncontrolling interests and redeemable noncontrolling interests |

(4,678 | ) | (56,658 | ) | (44,440 | ) | (14,506 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net loss attributable to common stockholders |

$ | (341,003 | ) | $ | (279,658 | ) | $ | (202,204 | ) | $ | (194,838 | ) | ||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net loss per share attributable to common stockholders, basic and diluted: |

$ | (23.34 | ) | $ | (18.56 | ) | $ | (13,45 | ) | $ | (12.71 | ) | ||||

|

|

|

|

|

|

|

|

|

|||||||||

| Weighted average shares used to compute net loss per share attributable to common stockholders, basic and diluted |

14,611 | 15,069 | 15,036 | 15,330 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Pro forma net loss per share attributable to common stockholders basic and diluted (unaudited) |

$ | (2.13 | ) | $ | (1.47 | ) | ||||||||||

|

|

|

|

|

|||||||||||||

| Pro forma weighted average shares used to compute pro forma net loss per share attributable to common stockholders basic and diluted (unaudited) |

131,386 | 132,251 | ||||||||||||||

Key operating metrics:

| Years Ended December 31, |

Nine Months Ended September 30, |

|||||||||||||||

| 2015 | 2016 | 2016 | 2017 | |||||||||||||

| Product accepted during the period (in 100 kilowatt systems) |

349 | 687 | 483 | 421 | ||||||||||||

| Megawatts deployed as of period end |

186 | 235 | 220 | 277 | ||||||||||||

| Years Ended December 31, |

Nine Months Ended September 30, |

|||||||||||||||

| 2015 | 2016 | 2016 | 2017 | |||||||||||||

| (in thousands) | ||||||||||||||||

| Billings for product accepted in the period |

$ | 258,075 | $ | 522,543 | $ | 370,585 | $ | 169,456 | ||||||||

| Billings for installation on product accepted in the period |

47,004 | 114,680 | 80,258 | 68,936 | ||||||||||||

| Billings for annual maintenance services agreements |

60,586 | 67,820 | 46,077 | 56,752 | ||||||||||||

15

Table of Contents

Index to Financial Statements

| Three Months Ended | ||||||||||||||||||||||||||||

| Mar. 31, 2016 |

Jun. 30, 2016 |

Sep. 30, 2016 |

Dec. 31, 2016 |

Mar. 31, 2017 |

Jun. 30, 2017 |

Sep. 30, 2017 |

||||||||||||||||||||||

| Product costs of product accepted in the period (per kilowatt) |

$ | 5,086 | $ | 4,809 | $ | 4,383 | $ | 3,826 | $ | 3,999 | $ | 3,121 | $ | 3,386 | ||||||||||||||

| Period costs of manufacturing related expenses not included in product costs (in thousands) |

4,302 | 4,586 | 6,869 | 6,143 | 7,397 | 8,713 | 7,152 | |||||||||||||||||||||

| Installation costs on product accepted in the period (per kilowatt) |

1,280 | 1,481 | 1,056 | 1,170 | 1,974 | 1,306 | 1,263 | |||||||||||||||||||||

For a discussion of these key operating metrics, see “Summary Consolidated Financial and Other Data—Key Operating Metrics” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Key Operating Metrics”.

Our consolidated balance sheet as of September 30, 2017 is presented on:

| • | an actual basis; |

| • | a pro forma basis to give effect to (i) the automatic conversion of all outstanding shares of our preferred stock into 107,610,244 shares of common stock immediately prior to the closing of this offering, (ii) the automatic conversion of all outstanding 8% Notes to Series G convertible preferred stock at a per share price of $25.76, and the conversion of such Series G convertible preferred stock into 9,310,857 shares of common stock immediately prior to the completion of this offering, (iii) the issuance and exercise of warrants to purchase 469,333 shares of our common stock at an exercise price of $0.01 per share to certain purchasers of our 6% Notes, as described in “Description of Capital Stock—6.0% Convertible Senior Secured PIK Notes due 2020,” which warrants will automatically be deemed exercised pursuant to their terms immediately prior to the completion of this offering, and (iv) the effectiveness of our amended and restated certificate of incorporation immediately prior to the completion of this offering; and |

| • | a pro forma as adjusted basis to give effect to (i) the pro forma adjustments set forth above, (ii) the issuance of 150,000 shares of common stock that we expect to issue upon the exercise of warrants that would expire if not exercised prior to the completion of this offering, and (iii) the sale and issuance of shares of common stock by us in this offering at an assumed initial public offering price of $ per share, which is the midpoint of the price range on the cover of this prospectus, and after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us. |

| As of September 30, 2017 | ||||||||||||

| Actual | Pro Forma | Pro Forma As Adjusted(1) |

||||||||||

| (in thousands) | ||||||||||||

| Consolidated balance sheet data: |

||||||||||||

| Cash and cash equivalents |

$ | 123,688 | $ | 123,688 | $ | |||||||

| Working capital |

110,341 | 110,341 | ||||||||||

| Total assets |

1,238,959 | 1,238,959 | ||||||||||

| Long term portion of debt |

861,089 | 621,241 | ||||||||||

| Total liabilities |

1,673,772 | 1,432,103 | ||||||||||

| Convertible redeemable preferred stock |

1,465,841 | — | ||||||||||

| Redeemable noncontrolling interest and noncontrolling interest |

220,022 | 220,022 | ||||||||||

| Stockholders’ deficit |

(2,120,676 | ) | (413,166 | ) | ||||||||

16

Table of Contents

Index to Financial Statements

| (1) | Each $1.00 increase or decrease in the assumed initial public offering price of $ per share, the midpoint of the price range on the cover of this prospectus, would increase or decrease, as applicable, our cash and cash equivalents, working capital, total assets and stockholders’ deficit by approximately $ million, assuming that the number of shares we offer, as stated on the cover page of this prospectus, remains the same and after deducting the estimated underwriting discounts and commissions. |

17

Table of Contents

Index to Financial Statements

Investing in our common stock involves a high degree of risk. You should carefully consider these risk factors, together with all of the other information included in this prospectus, including the section titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the consolidated financial statements and related notes, before you decide to purchase shares of our common stock. While we believe the risks and uncertainties described below include all material risks currently known by us, it is possible that these may not be the only ones we face. If any of the risks actually occur, our business, financial condition, operating results and prospects could be materially and adversely affected. In that event, the market price of our common stock could decline, and you could lose part or all of your investment.

Risks Relating to Our Business and Industry

Our limited operating history and our nascent industry makes evaluating our business and future prospects difficult.

From our inception in 2001 through 2008, we were focused principally on research and development activities relating to our Energy Server technology. We did not deploy our first Energy Server and did not recognize any revenue until 2008. As a result, we have a limited history operating our business at its current scale, and therefore a limited history upon which you can base an investment decision.

Our Energy Server is a new type of product in the nascent distributed energy industry. Predicting our future revenue and appropriately budgeting for our expenses is difficult, and we have limited insight into trends that may emerge and affect our business. If actual results differ from our estimates or we adjust our estimates in future periods, our operating results and financial position could be materially and adversely affected. You should consider our prospects in light of the risks and uncertainties emerging companies encounter when introducing a new product into a nascent industry.

The distributed generation industry is an emerging market and distributed generation may not receive widespread market acceptance.

The distributed generation industry is still relatively nascent, and we cannot be sure that potential customers will accept distributed generation more broadly, or our Energy Server products more specifically. Enterprises may be unwilling to adopt our solution over traditional or competing power sources for any number of reasons including the perception that our technology is unproven, lack of confidence in our business model, unavailability of back-up service providers to operate and maintain the Energy Servers, and lack of awareness of our product. Because this is an emerging industry, broad acceptance of our products and service is subject to a high level of uncertainty and risk. If the market develops more slowly than we anticipate, our business will be harmed.

We have incurred significant losses in the past and we do not expect to be profitable for the foreseeable future.

Since our inception in 2001, we have incurred significant net losses and have used significant cash in our business. As of September 30, 2017, we had an accumulated deficit of $2.3 billion. We expect to continue to expand our operations, including by investing in manufacturing, sales and marketing, research and development, staffing systems and infrastructure to support our growth. We anticipate that we will incur net losses for the foreseeable future. Our ability to achieve profitability in the future will depend on a number of factors, including:

| • | growing our sales volume; |

| • | increasing sales to existing customers and attracting new customers; |

| • | attracting and retaining financing partners who are willing to provide financing for sales on a timely basis and with attractive terms; |

18

Table of Contents

Index to Financial Statements

| • | continuing to improve the useful life of our fuel cell technology and reducing our warranty servicing costs; |

| • | reducing the cost of producing our Energy Servers; |

| • | improving the efficiency and predictability of our installation process; |

| • | improving the effectiveness of our sales and marketing activities; and |

| • | attracting and retaining key talent in a competitive marketplace. |

Even if we do achieve profitability, we may be unable to sustain or increase our profitability in the future.

Our Energy Servers have significant upfront costs, and we will need to attract investors to help customers finance purchases.

Our Energy Servers have significant upfront costs. In order to assist our customers in obtaining financing for our products, we have leasing programs with two leasing partners who have prequalified our product and provide financing for customers both in the form of traditional leasing and in sale-leaseback sublease arrangements we refer to as managed services. In addition to the leasing model, we also offer power purchase agreements (PPAs) in which the cost of the Energy Server is funded by an investment entity which is financed by us and/or third-party investors (PPA entities).

We will need to grow committed financing capacity with existing partners, or attract additional partners to support our growth. Generally, at any point in time, the deployment of a portion of our backlog is contingent on securing available financing. Our ability to attract third-party financing depends on many factors that are outside of our control, including the investors’ ability to utilize tax credits and other government incentives, our perceived creditworthiness and the condition of credit markets generally. Our financing of customer purchases of our Energy Servers is subject to conditions such as the customer’s credit quality and the expected minimum internal rate of return on the customer engagement, and if these conditions are not satisfied, we may be unable to finance purchases of our Energy Servers, which would have an adverse effect on our revenue in a particular period. If we are unable to help our customers arrange financing for our Energy Servers, our business will be harmed.

If our Energy Servers contain manufacturing defects, our business and financial results could be harmed.

Our Energy Servers are complex products, and they may contain undetected or latent errors or defects. In the past, we have experienced latent defects, only discovered once the Energy Server is deployed in the field. Field conditions such as the quality of the natural gas supply and utility processes which vary by region have affected the performance of our Energy Servers and are not always possible to predict until the Energy Server is in operation. Although we believe we have designed new generations of Energy Servers to better withstand the variety of field conditions we have encountered, as we move into new geographies, we may encounter new and unanticipated field conditions. Changes in our supply chain or the failure of our suppliers to otherwise provide us with components or materials that meet our specifications could also introduce defects into our products. In addition, as we grow our manufacturing volume, the chance of manufacturing defects could increase. Any manufacturing defects or other failures of our Energy Servers to perform as expected could cause us to incur significant re-engineering costs, divert the attention of our engineering personnel from product development efforts and significantly and adversely affect customer satisfaction, market acceptance and our business reputation.

If our estimates of useful life for our Energy Servers are inaccurate or we do not meet service and performance warranties and guarantees, our business and financial results could be harmed.