szl-202312310001662991FALSE2023FY0.026315790.02631579http://fasb.org/us-gaap/2023#AccountingStandardsUpdate201613Member0.02631579fourteen daysthree days0.02631579fourteen days0.33330.6667fourteen daysP1YP1Y0.026315790.0263157927800016629912023-01-012023-12-3100016629912023-06-30iso4217:USD00016629912024-02-23xbrli:shares00016629912023-12-3100016629912022-12-31iso4217:USDxbrli:shares00016629912023-05-112023-05-11xbrli:pure00016629912022-01-012022-12-310001662991us-gaap:CommonStockMember2021-12-310001662991us-gaap:AdditionalPaidInCapitalMember2021-12-310001662991us-gaap:ReceivablesFromStockholderMember2021-12-310001662991us-gaap:TreasuryStockCommonMember2021-12-310001662991us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-310001662991us-gaap:RetainedEarningsMember2021-12-3100016629912021-12-310001662991us-gaap:AdditionalPaidInCapitalMember2022-01-012022-12-310001662991us-gaap:CommonStockMember2022-01-012022-12-310001662991us-gaap:ReceivablesFromStockholderMember2022-01-012022-12-310001662991us-gaap:TreasuryStockCommonMember2022-01-012022-12-310001662991us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-01-012022-12-310001662991us-gaap:RetainedEarningsMember2022-01-012022-12-310001662991us-gaap:CommonStockMember2022-12-310001662991us-gaap:AdditionalPaidInCapitalMember2022-12-310001662991us-gaap:ReceivablesFromStockholderMember2022-12-310001662991us-gaap:TreasuryStockCommonMember2022-12-310001662991us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310001662991us-gaap:RetainedEarningsMember2022-12-310001662991srt:CumulativeEffectPeriodOfAdoptionAdjustmentMemberus-gaap:RetainedEarningsMember2022-12-310001662991srt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2022-12-310001662991us-gaap:CommonStockMember2023-01-012023-12-310001662991us-gaap:AdditionalPaidInCapitalMember2023-01-012023-12-310001662991us-gaap:TreasuryStockCommonMember2023-01-012023-12-310001662991us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-12-310001662991us-gaap:RetainedEarningsMember2023-01-012023-12-310001662991us-gaap:CommonStockMember2023-12-310001662991us-gaap:AdditionalPaidInCapitalMember2023-12-310001662991us-gaap:ReceivablesFromStockholderMember2023-12-310001662991us-gaap:TreasuryStockCommonMember2023-12-310001662991us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-310001662991us-gaap:RetainedEarningsMember2023-12-31szl:installment0001662991us-gaap:SoftwareAndSoftwareDevelopmentCostsMember2023-12-310001662991us-gaap:SoftwareDevelopmentMember2023-12-310001662991us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:MoneyMarketFundsMember2023-12-310001662991us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:MoneyMarketFundsMember2023-12-310001662991us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:MoneyMarketFundsMember2023-12-310001662991us-gaap:FairValueMeasurementsRecurringMemberus-gaap:MoneyMarketFundsMember2023-12-310001662991us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:MoneyMarketFundsMember2022-12-310001662991us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:MoneyMarketFundsMember2022-12-310001662991us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:MoneyMarketFundsMember2022-12-310001662991us-gaap:FairValueMeasurementsRecurringMemberus-gaap:MoneyMarketFundsMember2022-12-310001662991us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2023-12-310001662991us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001662991us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001662991us-gaap:FairValueMeasurementsRecurringMember2023-12-310001662991us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2022-12-310001662991us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001662991us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001662991us-gaap:FairValueMeasurementsRecurringMember2022-12-310001662991us-gaap:CarryingReportedAmountFairValueDisclosureMember2023-12-310001662991us-gaap:FairValueInputsLevel1Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2023-12-310001662991us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueInputsLevel2Member2023-12-310001662991us-gaap:FairValueInputsLevel3Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2023-12-310001662991us-gaap:EstimateOfFairValueFairValueDisclosureMember2023-12-310001662991us-gaap:CarryingReportedAmountFairValueDisclosureMember2022-12-310001662991us-gaap:FairValueInputsLevel1Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2022-12-310001662991us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueInputsLevel2Member2022-12-310001662991us-gaap:FairValueInputsLevel3Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2022-12-310001662991us-gaap:EstimateOfFairValueFairValueDisclosureMember2022-12-31szl:segment0001662991szl:TransactionIncomeMerchantProcessingFeesMember2023-01-012023-12-310001662991szl:TransactionIncomeMerchantProcessingFeesMember2022-01-012022-12-310001662991szl:TransactionIncomePartnerIncomeMember2023-01-012023-12-310001662991szl:TransactionIncomePartnerIncomeMember2022-01-012022-12-310001662991szl:TransactionIncomeConsumerFeesMember2023-01-012023-12-310001662991szl:TransactionIncomeConsumerFeesMember2022-01-012022-12-310001662991szl:IncomeFromOtherServicesLatePaymentFeesMember2023-01-012023-12-310001662991szl:IncomeFromOtherServicesLatePaymentFeesMember2022-01-012022-12-310001662991szl:TransactionIncomeMember2023-01-012023-12-310001662991szl:TransactionIncomeMember2022-01-012022-12-310001662991szl:SubscriptionRevenueMember2023-01-012023-12-310001662991szl:SubscriptionRevenueMember2022-01-012022-12-310001662991us-gaap:ServiceOtherMember2023-01-012023-12-310001662991us-gaap:ServiceOtherMember2022-01-012022-12-310001662991szl:OneMerchantMemberus-gaap:SalesRevenueNetMemberus-gaap:SupplierConcentrationRiskMember2022-01-012022-12-310001662991szl:ProphetScoreAMember2023-12-310001662991szl:ProphetScoreBMember2023-12-310001662991szl:ProphetScoreCMember2023-12-310001662991szl:NoScoreMember2023-12-310001662991us-gaap:FinancialAssetNotPastDueMember2023-12-310001662991szl:FinancialAsset1To28DaysPastDueMember2023-12-310001662991szl:FinancialAsset29To56DaysPastDueMember2023-12-310001662991szl:FinancialAsset57To90DaysPastDueMember2023-12-310001662991us-gaap:FinancialAssetNotPastDueMember2022-12-310001662991szl:FinancialAsset1To28DaysPastDueMember2022-12-310001662991szl:FinancialAsset29To56DaysPastDueMember2022-12-310001662991szl:FinancialAsset57To90DaysPastDueMember2022-12-310001662991srt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2021-12-310001662991szl:OtherReceivablesLatePaymentMember2023-12-310001662991szl:OtherReceivablesLatePaymentMember2022-12-310001662991szl:OtherReceivablesMerchantReceivablesMember2023-12-310001662991szl:OtherReceivablesMerchantReceivablesMember2022-12-310001662991szl:OtherReceivablesLatePaymentMember2021-12-310001662991szl:OtherReceivablesLatePaymentMember2023-01-012023-12-310001662991szl:OtherReceivablesLatePaymentMember2022-01-012022-12-310001662991szl:MerchantInterestProgramMember2023-12-310001662991szl:MerchantInterestProgramMember2022-12-310001662991szl:MerchantInterestProgramMember2023-03-200001662991szl:MerchantInterestProgramMember2023-03-190001662991szl:MerchantInterestProgramMember2023-01-012023-12-310001662991szl:MerchantInterestProgramMember2022-01-012022-12-310001662991szl:ReceivablesFundingFacilityMemberus-gaap:LineOfCreditMember2023-12-310001662991szl:ReceivablesFundingFacilityMemberus-gaap:LineOfCreditMember2022-12-310001662991szl:ReceivablesFundingFacilityMemberus-gaap:AssetPledgedAsCollateralMemberus-gaap:LineOfCreditMember2023-12-310001662991szl:ReceivablesFundingFacilityMemberus-gaap:AssetPledgedAsCollateralMemberus-gaap:LineOfCreditMember2022-12-310001662991us-gaap:LineOfCreditMember2023-01-012023-12-310001662991us-gaap:LineOfCreditMember2022-01-012022-12-310001662991szl:ReceivablesFundingFacilityMemberus-gaap:LineOfCreditMember2023-01-012023-12-310001662991szl:ReceivablesFundingFacilityMemberus-gaap:LineOfCreditMember2022-01-012022-12-310001662991szl:ReceivablesFundingFacilityMemberus-gaap:LineOfCreditMember2021-02-100001662991szl:ReceivablesFundingFacilityMemberus-gaap:LineOfCreditMemberszl:FICOScoreLessThan580Member2021-02-100001662991szl:BastionFundingIVLLCRevolvingCreditFacilityMemberszl:GoldmanSachsBankUSAMemberus-gaap:LineOfCreditMember2022-07-310001662991szl:SecuredOvernightFinancingRateSOFRMemberszl:BastionFundingIVLLCRevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2022-01-012022-01-010001662991szl:ReceivablesFundingFacilityMemberszl:SecuredOvernightFinancingRateSOFRMemberszl:GoldmanSachsBankUSAMemberus-gaap:LineOfCreditMember2021-02-102021-02-100001662991szl:ReceivablesFundingFacilityMemberszl:SecuredOvernightFinancingRateSOFRMemberszl:GoldmanSachsBankUSAMemberus-gaap:LineOfCreditMember2022-01-012022-07-300001662991szl:ReceivablesFundingFacilityMemberszl:SecuredOvernightFinancingRateSOFRMemberus-gaap:LineOfCreditMemberszl:BastionFundingIVLLCMember2022-01-012022-07-300001662991szl:ReceivablesFundingFacilityMemberszl:SecuredOvernightFinancingRateSOFRMemberus-gaap:LineOfCreditMemberszl:BastionFundingIVLLCMember2021-02-102021-02-100001662991szl:ReceivablesFundingFacilityMemberszl:SecuredOvernightFinancingRateSOFRMemberszl:GoldmanSachsBankUSAMemberus-gaap:LineOfCreditMember2022-07-300001662991szl:ReceivablesFundingFacilityMemberszl:SecuredOvernightFinancingRateSOFRMemberus-gaap:LineOfCreditMemberszl:BastionFundingIVLLCMember2021-02-100001662991szl:SecuredOvernightFinancingRateSOFRMemberszl:BastionFundingIVLLCRevolvingCreditFacilityMemberszl:GoldmanSachsBankUSAMemberus-gaap:LineOfCreditMember2022-07-312022-07-310001662991szl:SecuredOvernightFinancingRateSOFRMemberszl:BastionFundingIVLLCRevolvingCreditFacilityMemberus-gaap:LineOfCreditMemberszl:BastionFundingIVLLCMember2022-07-312022-07-310001662991szl:ReceivablesFundingFacilityMemberus-gaap:LineOfCreditMemberszl:LineOfCreditUsedCapacityRangeOneMember2022-01-012022-12-310001662991szl:LineOfCreditUsedCapacityRangeTwoMemberszl:ReceivablesFundingFacilityMemberus-gaap:LineOfCreditMember2022-01-012022-12-310001662991szl:LineOfCreditUsedCapacityRangeThreeMemberszl:ReceivablesFundingFacilityMemberus-gaap:LineOfCreditMember2022-01-012022-12-310001662991szl:PreviousLineOfCreditMemberus-gaap:LineOfCreditMember2022-10-142022-10-140001662991szl:ReceivablesFundingFacilityMemberus-gaap:LineOfCreditMember2022-10-140001662991szl:SecuredOvernightFinancingRateSOFRMemberszl:BastionFundingIVLLCRevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2022-10-142022-10-140001662991szl:SecuredOvernightFinancingRateSOFRMemberszl:BastionFundingIVLLCRevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2022-10-140001662991szl:ReceivablesFundingFacilityMemberus-gaap:LineOfCreditMember2022-10-142022-10-140001662991szl:BastionFundingIVLLCRevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2023-01-300001662991szl:BastionFundingIVLLCRevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2023-03-300001662991szl:BastionFundingIVLLCRevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2023-03-310001662991szl:LineOfCreditUsedCapacityRangeTwoMemberszl:ReceivablesFundingFacilityMemberus-gaap:LineOfCreditMembersrt:MinimumMember2023-12-310001662991srt:MaximumMemberszl:LineOfCreditUsedCapacityRangeTwoMemberszl:ReceivablesFundingFacilityMemberus-gaap:LineOfCreditMember2023-12-310001662991szl:BastionFundingIVLLCRevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2022-10-142022-10-140001662991us-gaap:WarrantMemberszl:BastionFundingIVLLCMember2022-10-14iso4217:AUDxbrli:shares0001662991us-gaap:LineOfCreditMemberszl:BastionFundingIVLLCMember2022-10-140001662991us-gaap:WarrantMemberszl:BastionFundingIVLLCMember2023-12-310001662991us-gaap:WarrantMemberszl:BastionFundingIVLLCMember2022-12-310001662991us-gaap:WarrantMemberszl:BastionFundingIVLLCMember2023-01-012023-12-310001662991us-gaap:WarrantMemberszl:BastionFundingIVLLCMember2022-01-012022-12-310001662991us-gaap:WarrantMemberszl:BastionFundingIVLLCMember2022-10-142023-12-310001662991us-gaap:DomesticCountryMember2023-12-310001662991us-gaap:StateAndLocalJurisdictionMember2023-12-310001662991us-gaap:ForeignCountryMember2023-12-310001662991szl:CoBrandedAdvertisingSpendMember2023-12-310001662991szl:CoBrandedAdvertisingSpendMember2022-12-310001662991szl:CoBrandedAdvertisingSpendMember2023-01-012023-12-310001662991szl:CoBrandedMarketingAndAdvertisingMember2023-01-012023-12-310001662991szl:CoBrandedMarketingAndAdvertisingMember2022-01-012022-12-310001662991srt:MinimumMember2023-01-012023-12-310001662991srt:MaximumMember2023-01-012023-12-310001662991szl:A2016EmployeeStockOptionPlanMember2023-12-310001662991szl:A2016EmployeeStockOptionPlanMember2022-12-310001662991szl:A2016EmployeeStockOptionPlanMemberus-gaap:RestrictedStockMember2022-12-310001662991szl:A2016EmployeeStockOptionPlanMemberus-gaap:RestrictedStockMember2023-12-310001662991szl:A2016EmployeeStockOptionPlanMember2023-01-012023-12-310001662991szl:A2016EmployeeStockOptionPlanMember2022-01-012022-12-310001662991szl:A2019EquityIncentivePlanMember2023-12-310001662991szl:A2019EquityIncentivePlanMember2022-12-310001662991us-gaap:RestrictedStockMemberszl:A2019EquityIncentivePlanMember2023-12-310001662991us-gaap:RestrictedStockMemberszl:A2019EquityIncentivePlanMember2022-12-310001662991szl:A2019EquityIncentivePlanMember2023-01-012023-12-310001662991szl:A2019EquityIncentivePlanMember2022-01-012022-12-310001662991szl:A2021EquityIncentivePlanMember2023-12-310001662991szl:A2021EquityIncentivePlanMember2022-12-310001662991us-gaap:RestrictedStockMemberszl:A2021EquityIncentivePlanMember2023-12-310001662991us-gaap:RestrictedStockMemberszl:A2021EquityIncentivePlanMember2022-12-310001662991szl:A2021EquityIncentivePlanMember2023-01-012023-12-310001662991us-gaap:CommonStockMemberszl:A2021EquityIncentivePlanMember2022-01-012022-12-310001662991us-gaap:CommonStockMemberszl:A2021EquityIncentivePlanMember2023-01-012023-12-310001662991szl:A2021EquityIncentivePlanMember2022-01-012022-12-3100016629912021-01-012021-12-310001662991szl:EquityIncentivePlanMemberus-gaap:EmployeeStockOptionMember2023-01-012023-12-310001662991szl:EquityIncentivePlanMemberus-gaap:EmployeeStockOptionMember2022-01-012022-12-310001662991szl:EquityIncentivePlanMember2023-01-012023-12-310001662991szl:EquityIncentivePlanMember2022-01-012022-12-310001662991szl:RestrictedStockAndRestrictedStockUnitsMember2022-12-310001662991szl:RestrictedStockAndRestrictedStockUnitsMember2021-12-310001662991szl:RestrictedStockAndRestrictedStockUnitsMember2023-01-012023-12-310001662991szl:RestrictedStockAndRestrictedStockUnitsMember2022-01-012022-12-310001662991szl:RestrictedStockAndRestrictedStockUnitsMember2023-12-310001662991us-gaap:RestrictedStockUnitsRSUMember2023-01-012023-12-310001662991us-gaap:RestrictedStockMember2023-01-012023-12-310001662991us-gaap:RestrictedStockMembersrt:MinimumMember2023-01-012023-12-310001662991srt:MaximumMemberus-gaap:RestrictedStockMember2023-01-012023-12-310001662991us-gaap:RestrictedStockUnitsRSUMember2022-01-012022-12-310001662991us-gaap:RestrictedStockMember2022-01-012022-12-310001662991us-gaap:RestrictedStockMembersrt:MinimumMember2022-01-012022-12-310001662991srt:MaximumMemberus-gaap:RestrictedStockMember2022-01-012022-12-3100016629912022-07-112022-07-110001662991us-gaap:EmployeeStockOptionMember2023-01-012023-12-310001662991us-gaap:EmployeeStockOptionMember2022-01-012022-12-310001662991us-gaap:WarrantMember2023-01-012023-12-310001662991us-gaap:WarrantMember2022-01-012022-12-3100016629912023-10-012023-12-310001662991szl:PaulParadisMember2023-01-012023-12-310001662991szl:PaulParadisMember2023-10-012023-12-310001662991szl:PaulParadisMember2023-12-31

| | | | | | | | |

| | |

| UNITED STATES |

| SECURITIES AND EXCHANGE COMMISSION |

| WASHINGTON, D.C. 20549 | |

| FORM 10-K | |

| | | | | |

| (Mark One) | |

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2023 |

| OR |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the transition period from to |

Commission file number 000-56267 |

SEZZLE INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | | 81-0971660 |

(State or other jurisdiction of

incorporation or organization) | | (I.R.S. Employer Identification No.) |

700 Nicollet Mall, Suite 640, Minneapolis, Minnesota | | 55402 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: +1 651 504 5294

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of Each Class | Trading Symbol(s) | Name of Each Exchange on Which Registered |

| Common Stock, par value $0.00001 per share | SEZL | The Nasdaq Stock Market LLC |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company”, and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | |

Large accelerated filer ☐ | Accelerated filer ☐ | Non-accelerated filer ☒ |

| | | | | |

Smaller reporting company ☒ | Emerging growth company ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The aggregate market value of the voting stock held by non-affiliates of the registrant as of June 30, 2023, was $36,764,617 based on the closing price of A$21.57 per share of Common Stock as reported on the Australian Securities Exchange.

The total number of shares of common stock, par value $0.00001 per share, outstanding at February 23, 2024 was 5,633,172.

DOCUMENTS INCORPORATED BY REFERENCE

The information required by Part III of this Annual Report on Form 10-K, to the extent not set forth herein, is incorporated herein by reference from the registrant’s definitive proxy statement for its 2024 Annual Meeting of Stockholders. Such proxy statement will be filed with the Securities and Exchange Commission within 120 days of the registrant’s fiscal year ended December 31, 2023.

SEZZLE INC.

TABLE OF CONTENTS

FORWARD-LOOKING STATEMENTS

The information in this Annual Report on Form 10-K (“Form 10-K”) includes “forward-looking statements” under Section 27A of the Securities Act and Section 21E of the Exchange Act. All statements, other than statements of historical fact, regarding our strategy, future operations, financial position, estimated revenues and losses, projected costs, prospects, plans and objectives of management included in this Form 10-K are forward-looking statements. When used in this Form 10-K, the words “could,” “believe,” “anticipate,” “intend,” “estimate,” “expect,” “project” and similar expressions (or the negative versions of such words or expressions) are intended to identify forward-looking statements, although not all forward-looking statements contain such identifying words. When considering forward-looking statements, you should keep in mind the risk factors and other cautionary statements described under the heading “Risk Factors” included in this Form 10-K. These forward-looking statements are based on our current expectations and assumptions about future events and are based on currently available information as to the outcome and timing of future events. There is a risk that such predictions, estimates, projections, and other forward-looking statements will not be achieved. Nevertheless, and despite the fact that management’s expectations and estimates are based on assumptions management believes to be reasonable and data management believes to be reliable, our actual results, performance or achievements are subject to future risks and uncertainties, any of which could materially affect our actual performance. Risks and uncertainties that could affect such performance include, but are not limited to:

•impact of the “buy-now, pay-later” (“BNPL”) industry becoming subject to increased regulatory scrutiny;

•impact of operating in a highly competitive industry;

•impact of macro-economic conditions on consumer spending;

•our ability to increase our merchant network, our base of consumers and underlying merchant sales (“UMS”);

•our ability to effectively manage growth, sustain our growth rate and maintain our market share;

•our ability to maintain adequate access to capital in order to meet the capital requirements of our business;

•impact of exposure to consumer bad debts and insolvency of merchants;

•impact of the integration, support and prominent presentation of our platform by our merchants;

•impact of any data security breaches, cyberattacks, employee or other internal misconduct, malware, phishing or ransomware, physical security breaches, natural disasters, or similar disruptions;

•impact of key vendors or merchants failing to comply with legal or regulatory requirements or to provide various services that are important to our operations;

•impact of the loss of key partners and merchant relationships;

•impact of exchange rate fluctuations in the international markets in which we operate;

•impact of our delisting from the Australian Securities Exchange and trading on the Nasdaq Capital Market as our sole trading exchange;

•our ability to protect our intellectual property rights and third party allegations of the misappropriation of intellectual property rights;

•our ability to retain employees and recruit additional employees;

•impact of the costs of complying with various laws and regulations applicable to the BNPL industry in the United States and Canada; and

•our ability to achieve our public benefit purpose and maintain our B Corporation certification.

We caution you that these forward-looking statements are subject to numerous risks and uncertainties, most of which are difficult to predict and many of which are beyond our control. These risks include, but are not limited to, the risks described under “Risk Factors” in this Form 10-K. Should one or more of the risks or uncertainties described in this Form 10-K occur, or should underlying assumptions prove incorrect, our actual results and plans could differ materially from those expressed in any forward-looking statements.

All forward-looking statements, expressed or implied, included in this Form 10-K are expressly qualified in their entirety by these cautionary statements. These cautionary statements should also be considered in connection with any subsequent written or oral forward-looking statements that we or persons acting on our behalf may issue. Except as otherwise required by applicable law, we disclaim any duty to update any forward-looking statements, all of which are expressly qualified by the cautionary statements in this section, to reflect events or circumstances after the date of this Form 10-K.

SUMMARY OF RISK FACTORS

Our business is subject to numerous risks and uncertainties, including those highlighted in Item 1A “Risk Factors,” of this Form 10-K. If any of these risks actually occur, our business, financial condition, or results of operations would likely be materially and adversely affected. In such case, the trading price of our shares of common stock would likely decline, and you may lose all or part of your investment. These risks include, but are not limited to, the following:

Risks Related to Our Industry

•The BNPL industry has become subject to increased regulatory scrutiny.

•We operate in a highly competitive industry.

•Our success is subject to macro-economic conditions that have an impact on consumer spending.

•Our industry may be subject to negative publicity.

Risks Related to Our Strategy and Growth

•We are an early-stage financial technology company with a limited operating history and a history of operating losses.

•Our business depends on our ability to maintain and increase our merchant network, our base of consumers and UMS.

•Our ability to effectively manage growth.

•We may not be able to sustain our growth rate.

•Our ability to promote and maintain our brand.

•We may be unable to profitably manage our ongoing international operations.

•We may require additional capital.

Risks Related to Our Financing Program

•Loans facilitated through our platform involve a high degree of financial risk.

•Merchants may fail to fulfill their obligations to consumers or comply with applicable law.

•Our internet-based loan origination processes may give rise to greater risks than paper-based processes.

•Consumer bad debts and insolvency of merchants may adversely impact our financial success.

•Our ability to comply with the applicable requirements of payment processors.

Risks Related to Our Technology and the Sezzle Platform

•The integration, support and prominent presentation of our platform by our merchants.

•Unanticipated surges or increases in transaction volumes.

•The occurrence of data security breaches, cyberattacks, employee or other internal misconduct, malware, phishing or ransomware, physical security breaches, natural disasters, or similar disruptions.

•Real or perceived software failures or outages.

•Disruption in service on our platform that prevents or delays us from processing transactions.

•Fraudulent activities occurring on our platform.

Other Risks Related to Our Business

•The failure of key vendors or merchants to comply with legal or regulatory requirements or to provide various services that are important to our operations.

•The loss of key partners and merchant relationships.

•Potential inaccuracies in third-party data we use.

•Changes in market interest rates.

•Exchange rate fluctuations between the United States and Canada.

•Our ability to use net operating losses.

•Our ability to protect our intellectual property rights.

•The loss of licenses or any quality issues with third-party technology that support our business operations or are integrated with our products or services.

•Our insurance may not apply or be sufficient.

•Our business is subject to damage or interruption from events beyond our control.

•Our inability to retain employees or recruit additional employees, and risks of employee misconduct.

Risks Related to Our Regulatory Environment

•The costs of complying with various laws and regulations applicable to the BNPL industry in the United States and Canada.

•We are subject to various laws in the United States and Canada concerning lending programs, consumer finance and consumer protection.

•Failure to operate without obtaining necessary licenses.

•Violating applicable federal, state and/or local lending or other laws.

•Litigation, regulatory actions, and compliance issues could subject us to increased costs.

•Privacy and data protection laws could result in claims or harm our business.

Risks Related to Our Corporate Structure

•We do not currently intend to pay dividends on our common stock.

•Our $5 million stock repurchase could affect the price of our stock and increase volatility in the market.

•Our major stockholders own a large percentage of our stock and can exert significant influence over us.

•We are an “emerging growth company,” and the reduced U.S. public company reporting requirements applicable to emerging growth companies may make our shares of common stock less attractive to investors.

•We have and will continue to incur significant costs and are subject to additional regulations and requirements as a public company in the United States traded on the Nasdaq Capital Market.

•Our ability to continue to meet Nasdaq’s continued listing requirements.

•Failure to maintain effective internal control over financial reporting or disclosure controls may adversely affect our ability to report our financial results in a timely and accurate basis.

•Some provisions of our charter documents may have anti-takeover effects, and the exclusive forum designation may limit stockholders’ ability to obtain a favorable judicial forum for disputes with us.

Risks Related to Our Existence as a Public Benefit Corporation and a Certified B Corporation

•As a public benefit corporation, we cannot provide any assurance that we will achieve our public benefit purpose.

•As a public benefit corporation, our focus on providing a public benefit purpose may negatively impact our financial condition.

•Our directors have a fiduciary duty to consider not only our stockholders’ interests, but also our specific public purpose and the interests of other stakeholders affected by our actions.

•Increased derivative litigation concerning our duty to balance stockholder and public benefit interest.

•A loss of our certification as a B Corporation or a decline in our score.

PART I

ITEM 1. BUSINESS

Unless otherwise noted, references in this Form 10-K to “we,” “us,” “our,” “Company,” or “Sezzle” refer to Sezzle Inc.

Our Company

We are a purpose-driven payments company on a mission to financially empower the next generation. Launched in 2017, we built a digital payments platform that allows merchants to offer their consumers a flexible alternative to traditional credit. As of December 31, 2023, our platform serves approximately 2.6 million Active Consumers. Through our products, we aim to enable consumers to take control over their spending, be more responsible, and gain financial freedom. Our vision is to create a digital ecosystem benefiting all of our stakeholders—including merchants, partners, consumers, employees, communities, and investors—while continuing to drive ethical and sustainable growth.

We launched Sezzle amid a backdrop in which digital shopping began to claim a larger share of the retail sector and younger generations (i.e., Gen Z and Millennials) started to demonstrate a need for credit. Gen Z and Millennial consumers, which we define as individuals currently between ages 18–27 and 28–46, respectively, use credit cards less frequently relative to other generations and, in many cases, lack access to traditional credit. These same consumers are tech-savvy, gravitating towards modern, streamlined commerce solutions whether online or in-person. We believe that our platform addresses the shortcomings in legacy payment offerings consumers face by providing a flexible, secure, omnichannel alternative with the structural benefit of “creditizing” traditional debit products. The technology solutions we have designed specifically align with our mission of financially empowering the next generation.

We believe our stakeholder approach gives us a competitive advantage and positions our company for success. Stakeholders want to be affiliated with a purpose-driven partner and, to that extent, we elected to become a Delaware public benefit corporation in June 2020. Public benefit corporations are for-profit corporations intended to produce a public benefit and operate in a responsible and sustainable manner. Under Delaware law, public benefit corporations must identify in their certificate of incorporation the public benefit or benefits they will promote, and their directors have a duty to manage the affairs of the corporation in a manner that balances the pecuniary interests of the stockholders, the best interests of those materially affected by the corporation’s conduct, and the specific public benefit or public benefits identified in the public benefit corporation’s certificate of incorporation. Being a public benefit corporation offers advantages, including:

•public benefit corporation status is a clear differentiator in an increasingly growing, and sometimes crowded, industry;

•we are more likely to become an employer of choice as the younger workforce increasingly seek employment from companies which align with their ethical values;

•further opportunities to conduct business with brands that also care about sustainability;

•the potential to expand our consumer base due to conscious consumers;

•added credibility to our mission statement and potential to grow capital through impact investing; and

•further opportunities for positive public relations and marketing.

Additionally, on March 22, 2021, we became a certified B Corporation by B Lab, an independent non-profit organization, joining a movement of innovative, socially-conscious brands. In order to be designated as a Certified B Corporation, we were required to undertake a comprehensive and objective assessment of our environmental, social, and governance standards for transparency, accountability and commitment to improved performance. Our actions are part of a movement of innovative brands around the world intent on advancing environmental, social, and economic causes. To maintain our status as a certified B Corporation, we must satisfy re-certification requirements every three years. Our status as a B Corporation aligns with our mission to achieve growth, profitability, and returns for our investors while continuing to do right by our surrounding communities and our full set of stakeholders.

We primarily operate in the United States and Canada, and are currently winding down and exiting operations in India and certain countries in Europe.

Our Products

Sezzle Platform

The Sezzle Platform offers a payments solution for consumers that instantly extends credit at the point-of-sale, allowing consumers to purchase and receive the ordered merchandise at the time of sale while paying in installments over time.

The Sezzle Platform can be integrated into merchants’ websites via our direct Application Programming Interface and accessed by our consumers through the Sezzle mobile application or Sezzle website. We are able to rapidly onboard and integrate merchants through an increasingly automated merchant underwriting process, and once integrated, consumers can choose the Sezzle Platform as a payment method at the merchant. The Sezzle Platform is presented alongside other payment options on the merchant’s checkout page. Consumers then select Sezzle as their payment option and, if they are a first-time user, create an account with Sezzle in a quick and streamlined process incorporated into the selected merchant’s checkout.

The Sezzle Platform reviews the transaction and consumer profile in real-time and, if approved, quickly confirms the transaction for both the consumer and the merchant. Once an initial transaction is approved, consumers are granted a spending limit. Our underwriting platform analyzes above-limit purchase attempts and may provide alternative terms so that the consumer is not denied outright. After a transaction is approved and merchant checkout is completed, the merchant ships the item(s) and receives payment, just as if the consumer had paid in cash or used a traditional credit or debit card. The merchant pays us a merchant processing fee, which is subtracted from the sales price when we pay the merchant.

In addition, we periodically offer promotions and incentives for consumers to earn Sezzle Spend at certain merchants. Sezzle Spend are credits issued to consumers and can be applied to future orders made on the Sezzle Platform.

Pay-in-Four

The Sezzle Platform flagship product, “pay-in-four,” allows consumers to pay a fourth of the purchase price up front, and then another fourth of the purchase price every two weeks thereafter over a total of six weeks. Our “pay-in-four” product is completely free to consumers who pay on time and use a bank account to make their installment payments, excluding their first payment. In order to complete their installment payments, consumers receive a notification via email, text message, or the Sezzle iOS or Android app two days prior to the date the installment payment is automatically debited by the Sezzle Platform from the consumer’s payment method provided under the consumer’s account. The consumer is able to review and manage their Sezzle account via the Sezzle Platform’s online dashboard or mobile application. Consumers are also able to reschedule a payment without charge the first time, and may subsequently reschedule a payment up to two additional times for a fee, subject to applicable state laws. Consumers who fail to pay for their purchases on time (or reschedule their payments as permitted above) may incur a late payment fee, which requires the settlement of an outstanding balance (including the late payment fee) before they may use our platform again in the future. We typically do not report delinquent consumer Sezzle accounts to any credit bureaus, unless the consumer has elected to participate in Sezzle Up (as discussed below). As a result, consumer behavior using the “pay-in-four” product has no impact on a consumer’s credit score.

Pay-in-Full

Beginning in 2022, we began offering a “pay-in-full” option to consumers. This option allows consumers to pay for the full value of their order up-front through the Sezzle Platform without the extension of credit. We believe this provides value for both new and existing consumers on the Sezzle Platform. This allows new consumers who are denied credit to complete their order through our platform without the need to re-enter any payment information. For existing consumers with payment information already saved, pay-in-full allows an express checkout option in instances where the consumer may not want to enter into a new installment plan.

Pay-in-Two and Other Alternative Installment Options

In 2023, we also began offering a “pay-in-two” option to certain consumers who are not qualified for our “pay-in-four” product. In “pay-in-two,” a consumer pays half of the value of their order up-front and the second half in two weeks.

In addition, we may offer customized installment terms that differ from our traditional four payment, six week terms with select enterprise merchants. An example of these alternative terms is a four payment, three month product. We offer these special products to consumers through selected merchants at our discretion in situations where alternative terms would provide additional value to both the consumer and merchant, while also better aligning with the typical purchase frequency at these select merchants.

Sezzle Virtual Card

The Sezzle Virtual Card, issued to Sezzle by Sutton Bank, member FDIC, pursuant to a license form Visa U.S.A Inc., allows consumers to access the Sezzle Platform in the form of close-end installment loans and shop with merchants (in-store and online) that are not integrated with Sezzle. The Sezzle Virtual Card bolsters our omnichannel offering and provides a rapid-installation, point-of-sale option for brick-and-mortar retailers through its compatibility with Apple Pay and Google Pay. With the Sezzle Virtual Card solution, consumers can enjoy in-store shopping with the convenience of immediately tapping into the Sezzle Platform with the “tap” of their virtual card at the point-of-sale.

Sezzle Anywhere

In 2023, we launched Sezzle Anywhere—a paid subscription service that allows consumers to use their Sezzle Virtual Card at any merchant online or in-store, subject to certain merchant, product, goods, and service restrictions, for a recurring fee. Consumers enrolled in Sezzle Anywhere also gain access to all the benefits of Sezzle Premium, as well as earning 1% back in Sezzle Spend on pay-in-full transactions.

Sezzle Premium

In 2022, we launched Sezzle Premium—a paid subscription service that allows our consumers to access large, non-integrated “premium merchants” for a recurring fee. Besides being able to use Sezzle online or in-store at these premium merchants, consumers enrolled in Sezzle Premium also gain access to several other benefits, including exclusive deals and discounts, the ability to earn Sezzle Spend back on purchases, and one additional free reschedule per order.

Sezzle Up

Sezzle Up is an opt-in feature of the Sezzle Platform. Consumers who elect to participate in Sezzle Up allow us to report the consumer’s transactions made with the use of the Sezzle Platform to establish a record of payments. Building a record of timely payments on financial obligations is generally positive for a consumer’s credit record. As these consumers pay their financial obligations to us when due, their spending limits on the Sezzle Platform and overall credit score may increase over time.

To qualify for Sezzle Up, consumers must place at least one order and commit to complete installment payments over the Automated Clearing House (“ACH”) network instead of over a card network. Consumers’ initial down payments are still completed over a card network. Using the ACH network benefits us by typically reducing processing fees and, in turn, lowering our transaction costs.

Long-Term Lending — Access to Third-Party Lenders

Through collaboration with third-party lenders, we enable our consumers at participating merchants access to interest-bearing monthly fixed-rate installment-loan products for larger-ticket items (up to $15,000), which extend up to 60 months. We earn a fee from our lending collaborators for marketing and referring the potential consumers to them and processing applications using our proprietary underwriting analysis; however, we do not make final credit decisions or originate or hold the loans in our portfolio, which limits our capital needs and credit risk. We believe providing consumers access to long-term borrowing options has the potential to enhance our relationship with both merchants and consumers, while generating an attractive fee stream with no capital requirements or credit risk for us, and complementing our existing short-term, interest-free offering.

Product Innovation

Outside of our existing Sezzle Platform offerings, we continuously strategize on new products and additional features that would complement our platform and add additional value for our stakeholders. As part of our next round of initiatives in product innovation, we are currently in the early stages of selecting and partnering with a bank sponsor to further expand the suite of products we can offer our consumers.

Our Merchants

We offer a unique and user-friendly platform to our merchants. Our easy integration and seamless onboarding allows most merchants to go live on our platform within one day of activation to quickly realize the benefits of partnering with Sezzle. Our merchants benefit from our platform’s network effects through increased access to a deep pool of consumers equipped with our flexible payment product who would otherwise not be able to finance a transaction. Additionally, we believe that merchants benefit from associating with an innovative, certified B Corporation payments company which shares their consumers’ values across environmental, social, and economic causes. Our merchant segments are small-to-medium–sized businesses (“SMBs”) and enterprise merchants that span numerous verticals.

We also provide our merchants with a toolkit to grow their businesses, which we believe is unmatched among digital payments platforms. All of our merchants are provided complimentary placement in our marketplace presented across both the Sezzle website and mobile app. Additionally, our merchants are offered paid placements in the marketplace to assist with user acquisition efforts. We provide select merchants with incentives to grow their sales and introduce Sezzle into new merchant categories through initiatives such as Sezzle Spend and co-branded marketing. To eligible merchants, Sezzle also facilitates access to working capital loans up to $20 million issued by third-party lenders (“Sezzle Capital”). Loans facilitated by Sezzle through Sezzle Capital are unsecured and repaid based on a percentage of daily sales. To be eligible for a Sezzle Capital loan, merchants must, at minimum, sell a physical product, have at least $10,000 in average monthly sales, have been in business for at least six months, and be incorporated in a country acceptable to the third-party lender.

The continued expansion of our platform should continue to enhance the benefits for our merchants. Our integration into scaled e-commerce platforms is expected to give more merchants the opportunity to seamlessly offer Sezzle as a payment option at checkout. Other products on the Sezzle Platform, such as long-term lending and alternative installment options, further adds to the value of our platform for merchants. This all occurs without any credit risk being transferred to the merchant.

SMBs

SMBs, which we define as merchants with total annual gross sales of less than $500 million, have historically comprised the largest segment of our merchant base. Our fast, easy application process makes onboarding simple, and our user-friendly merchant interface streamlines the integration process. Through Sezzle, these merchants are able to offer their consumers an optimized, effortless checkout process that enables them to complete sales. Included in SMB are a diverse, growing array of “direct-to consumer” brands that are online-first and seek to connect with consumers without the use of secondary retailers, which naturally fits within our core offering. As we build out a larger consumer base, we believe we also enhance our value proposition to this segment by driving increased traffic toward brands that may not otherwise gain exposure through traditional retail channels by creating marketing campaigns designed to increase consumer exposure.

Enterprise Merchants

An ongoing major initiative is greater engagement with enterprise merchants, which we define as merchants with over $500 million in total annual gross sales. The core Sezzle product helps these merchants to facilitate a sale by providing access to credit for a consumer who has limited-to-no credit history. Without our payments platform, the consumer that lacks credit history may otherwise not have completed the purchase, or be rejected after applying for the store’s private label or co-branded credit card. Importantly, we are not competing with a large retailer’s card offering. Instead, we work collaboratively with these retailers to drive sales and over time serve as a lead generator to consumers who are ready to “graduate” to the retailer’s card program.

Merchant and Partner Concentration

For the year ended December 31, 2023, there were no concentrations of total income that exceeded ten percent. For the year ended December 31, 2022, approximately 14% of total income was earned from one merchant.

The concentration of a significant portion of our business and transaction volume with a limited number of scaled e-commerce platforms exposes us disproportionately to any of those partners choosing to no longer partner with us or choosing to partner with a competitor, and to any events, circumstances, or risks affecting such partners. In addition, a material modification in the financial operations of any significant scaled e-commerce partner could affect the results of our operations, financial condition, and future prospects.

Our Consumers

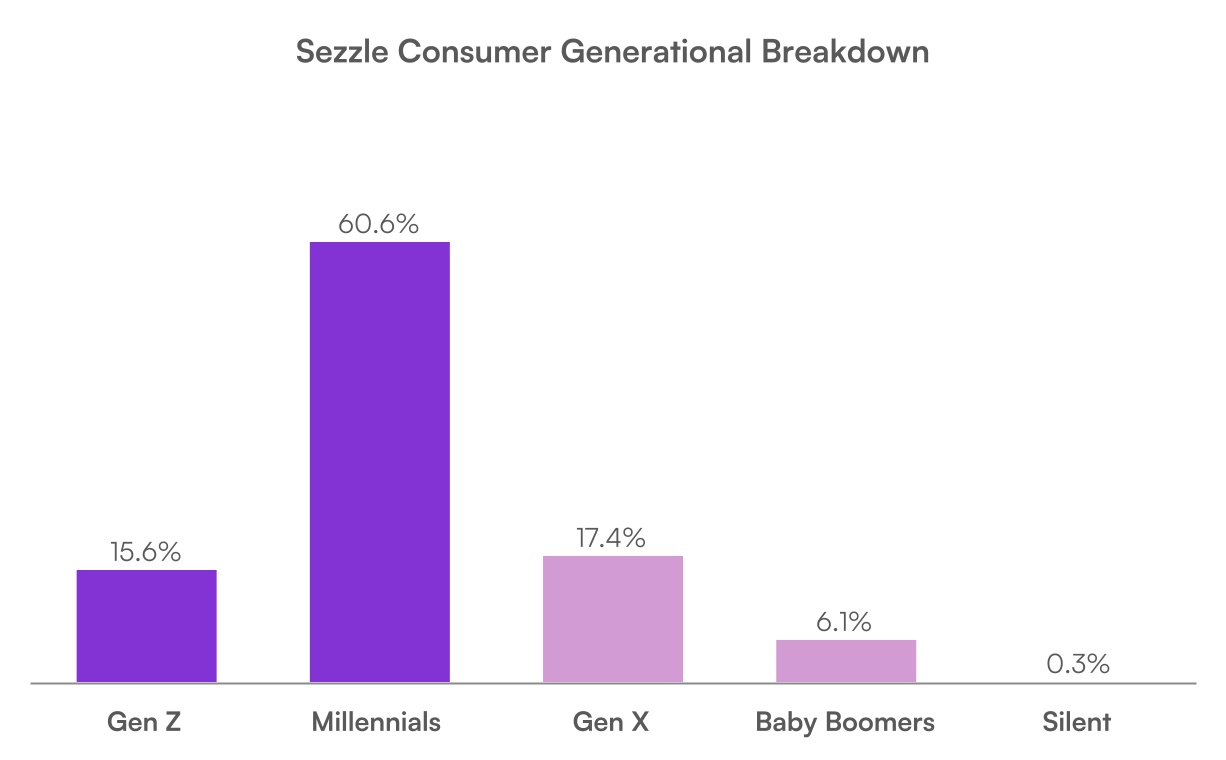

Sezzle focuses on a young consumer base that is tech-savvy, socially-minded, and expects brands to possess ethical and social principles. As of December 31, 2023, 76.2% of our Active Consumers are comprised of members of the Gen Z (18-27) and Millennial (28-46) generations which are generally early in their credit journey. For many of these consumers, we believe Sezzle has provided a way to improve financial responsibility and develop a sense of financial empowerment—not only through enhanced budgeting and payments capabilities, but also through an opportunity to build beneficial credit records with the Sezzle Up feature.

Source: Internal data based on orders placed during 2023 (Gen Z (18-27), Millennials (28-46), Gen X (47-58), Baby Boomers (59-77), and Silent (78 and greater)).

Gen Z and Millennial consumers use credit cards less frequently relative to other generations, and in many cases lack access to traditional credit. As a result, they tend to have fewer viable options for budgeting, achieving financial flexibility, and building credit history. Consumers in these generations also tend to transact frequently across e-commerce and brick-and-mortar retail, but spend less on average per transaction than older generations. In doing so, these consumers prefer to avoid loans that are not transparent or require payments that are not affordable. Sezzle’s core product, the “pay-in-four,” provides these younger generations, who are newer to credit and are likely to move up the FICO score spectrum as they grow older and transact more often, with a unique solution to these payment challenges. In addition, consumers benefit from our platform’s network effects. As our platform grows and we establish more ways to pay, our consumers enjoy a wider variety of shopping options.

Our Employees

Our success to date would not be possible without our dedicated people, who we believe are our greatest asset. Bringing together a team of highly-skilled engineering, product, marketing and business development professionals is imperative to execute our strategy. We do this by creating an inclusive, team-centric culture in which doing the right thing is celebrated. As of December 31, 2023, we had 278 employees (which includes 251 full-time employees) working at Sezzle. None of our workers are represented by a labor union or covered by a collective bargaining agreement. We consider our relations with our employees to be good.

Workplace Culture

We are committed to fostering a diverse work environment of driven employees who believe in our mission of financially empowering the next generation. A strong workplace culture is paramount to a sustainable and successful company. Our People Operations team works to create and execute sustainable hiring practices that span a diverse array of recruiting pipelines to find the best people for Sezzle. For existing employees, or “Sezzlers”, we focus on developing an inclusive and fun culture with many opportunities for career and personal development to reward and retain our talented people. Our Sezzlers exhibit five key values throughout their work:

•Exhibit Strong Character: We do what we say we are going to do. We do the right thing. We are good team members. We are secure enough to praise others.

•Demonstrate Excellent Communication: We communicate openly and honestly. We maintain accountability. We are open-minded. We are good listeners.

•Have Fun: We like working with each other. We have a sense of humor. We keep work issues in perspective.

•Act Like an Owner: We are stakeholder obsessed. We surface solutions, not just problems. We seek responsibility. We work hard and smart.

•Driven to Succeed: We are passionate. We are tenacious. We are competitive.

Diversity, Equity, and Inclusion

Our Sezzlers are more than just brilliant engineers, passionate data enthusiasts, out-of-the-box thinkers, and determined innovators; they are skilled musicians, yogis, cyclists, chefs, golfers, dog-lovers, and rock-climbers. We believe in surrounding ourselves with not only the best and the brightest individuals, but those that are unique and purpose-driven in all that they do. Our culture is not defined by a certain set of perks designed to give the illusion of the traditional startup culture, but rather, it is the visible example living in every employee that we hire. We celebrate uniqueness and believe that diversity and inclusion leads to a more talented workforce, successful product, and engaged consumer.

Remuneration and Benefits

In addition to competitive base pay, a majority of our Sezzlers have equity in the Company via equity awards under our equity incentive plans. We believe that having our employees own a part of the Company makes everyone more engaged and leads to better overall performance. In addition, employees have the opportunity to receive annual bonuses if certain company, team, and individual goals are met during the year. We also offer comprehensive benefits, which includes medical, dental, vision, life insurance, disability insurance, paid time off, volunteer time off, gym membership discounts, commuter benefits, and company-matching retirement plans.

Our Business Model

Revenue

We have built a sustainable, transparent business model in which our success is aligned with the financial success of our merchants and consumers. The Sezzle Platform is completely free to consumers who pay on time and use a bank account to make their installment payments, excluding their first payment. Our primary source of revenue is from merchant processing fees, which are based on a percentage of UMS plus a fixed fee per transaction. We pay our merchants for the transaction value upfront, net of the merchant processing fees owed to Sezzle, and assume all costs associated with consumer payment processing and credit risk. Merchant and partner-related income comprised 62% and 81% of our total revenues for the years ended December 31, 2023 and 2022, respectively.

Another significant portion of our revenue is derived from subscription revenue. We offer our consumers the ability to subscribe to two paid services: Sezzle Premium and Sezzle Anywhere. Sezzle Premium allows consumers to shop at select large, non-integrated premium merchants, along with other benefits, for a recurring fee. Sezzle Anywhere allows consumers to use their Sezzle Virtual Card at any merchant online or in-store, subject to certain merchant, product, goods, and service restrictions, for a recurring fee. Subscription revenue comprised 19% and 4% of our total revenues for the years ended December 31, 2023 and 2022, respectively.

A smaller portion of our revenue is derived from consumer fees. We do not charge our consumers any interest, finance charges, or initiation fees, and do not seek to profit from our consumers’ errors or financial adversity. Any consumer fees that we earn are either from late payment fees charged to a consumer following a failed principal payment, convenience fees when a consumer uses a card for their installment payments (excluding the first payment), or when consumers elect to reschedule a payment. Consumers are not allowed to make any new purchases with us until any past-due principal and fees are paid. If consumers correct a failed payment within 48 hours after the failed payment, we waive their late payment fees. Additionally, consumers are able to reschedule a payment without charge the first time, and can subsequently reschedule a payment up to two additional times for a small fee, subject to applicable state laws. We allow qualifying consumers to have fees waived under our hardship and fee forgiveness program.

Credit Risk

A critical component of our business model is the ability to effectively manage the repayment risk inherent in allowing consumers to pay over time, as we absorb the costs of all core product credit losses from our consumers. Credit losses are a significant component of our operating expenses, and excessive exposure to consumer repayment failure will adversely impact our results of operations. To that end, a team of Sezzle engineers and risk specialists oversee our proprietary systems, identify transactions with an elevated risk of fraud, assess the credit risk of the consumer, assign spending limits, and manage the ultimate lending and receipt of funds. Because consumers primarily settle 25% of the purchase value upfront at the point of sale, we believe repayment risk is more limited relative to other traditional forms of unsecured consumer credit.

We believe our systems and processes are highly effective and allow for predominantly accurate, real-time decisions in connection with the consumer transaction approval process. As our consumer base grows, the availability of data on consumer repayment behavior will also better optimize our systems and ability to make real-time consumer repayment capability decisions over time.

Funding

We have created an efficient funding strategy which has allowed us to scale our business and drive rapid growth. Our products are entirely funded through our $100 million revolving credit facility and merchant account payables, where we pay merchants a fixed interest rate if they elect not to receive transaction proceeds upfront and instead leave their deposits in their merchant account. Due to the short-term nature of our products, we are able to recycle capital quickly and create a multiplier effect on our committed capital. We do not currently require equity to directly fund our lending product.

Our Competition

We operate in a highly competitive and dynamic industry. Our product offerings face competition from a variety of players, including those who enable transactions and commerce via digital payments. The point-of-sale financing market in which we operate includes several types of products, including traditional credit cards that have revolving balances, contactless virtual cards, digital wallets, and other buy now pay later products.

We consider our main competitors to be other BNPL service providers. In the U.S. market, this includes Affirm, Afterpay (a subsidiary of Block), Klarna, PayPal’s Pay in 4, Apple’s “Apple Pay Later,” and Zip (formerly QuadPay). In addition, PayBright by Affirm and Afterpay operate in the Canadian market. We aim to differentiate our business to consumers by providing a product that is more simple, accessible, and consumer friendly than our competitors. This includes offering our product to consumers with little-to-no credit history, allowing consumers to shift their repayment schedule once per order for free, and waiving late payment fees when the consumer corrects a failed payment within 48 hours or qualifies for our hardship program.

We face intense competitive pressure on the fees we charge our merchants, particularly our enterprise merchants. To stay competitive, we may need to adjust our pricing, offer incentives, enter new market segments, adapt to regulatory changes, or expand the use and functionality of our platform—all of which impact our growth and profitability. We have entered into merchant agreements that require us to make marketing, incentive or other payments to the merchant over the term of the agreement. If we are unable to fulfill our obligations under these merchant agreements, including any payments we have agreed to make with merchants, the merchant may terminate or not renew such agreement.

See “Risks Related to Our Industry - We operate in a highly competitive industry, and our inability to compete successfully would materially and adversely affect our business, results of operations, financial condition, and prospects” for further discussion of competition risks.

Our Intellectual Property

Our business depends on our ability to commercially exploit our technology and intellectual property rights, including our technological systems and data processing algorithms. We rely on laws in the United States and Canada relating to trade secrets, copyrights, and trademarks to assist in protecting our proprietary rights. Our capacity to leverage our in-house technological systems, robust data infrastructure and statistical models is pivotal for the commercial viability of our enterprise. These critical assets, including our underwriting platform and the intricate data amassed from consumer transactions, underpin our operations.

The development of our proprietary credit risk and fraud detection models epitomizes our commitment to innovation. Spearheaded by our adept data sciences team, these models harness multifarious data points to discern the probability of our consumer’s ability to repay us or a consumer’s fraudulent activities. Through meticulous analysis of consumer interactions and transactional data, our models furnish invaluable insights. Subsequently, our underwriting platform tailors the amount of appropriate lending for each individual consumer, informed by the aforementioned models and a comprehensive evaluation of internal and external data sources.

Once a consumer places an order with us, we closely monitor the credit quality of their order, and our portfolio in general, to manage and evaluate our related exposure to credit risk. When assessing the credit quality and risk of our portfolio, we monitor a variety of internal risk indicators and consumer attributes that are shown to be predictive of ability and willingness to repay, and combine these factors to establish an internal, proprietary score as a credit quality indicator (the “Prophet Score”).

We do not currently have any issued patents but continue to consider the most effective methods of protecting our intellectual property. We currently hold trademarks in the United States, the United Kingdom, the European Union, Brazil, and India and we have pending trademark applications in Canada. However, continued operations within our existing markets and expansion into new markets could risk conflicts with unrelated companies who may own registered trademarks for and/or otherwise use a similar name. See “Other Risks Related to Our Business – Our efforts to protect our intellectual property rights may not be sufficient.”

Our Regulatory Environment

Overview

Various aspects of our business and services are subject to U.S. federal, state, and local regulation, as well as regulation outside the United States including Canada. Certain of our services also are subject to rules promulgated by various card networks and other authorities, as more fully described below. These descriptions are not exhaustive, and these laws, regulations and rules frequently change and are increasing in number and scope.

BNPL and Consumer Protection Regulation

The BNPL segment of the point-of-sale financing market in which we operate is a developing field. There has recently been an increased focus and scrutiny by regulators in various jurisdictions, including the United States and Canada, with respect to BNPL arrangements. We may become subject to additional legal or regulatory requirements if laws, regulations, or industry standards, or the interpretation of such laws, regulations, or industry standards, change in the future.

United States

In the United States, although we are not a creditor for purposes of the Truth-in-Lending Act ("TILA") and Regulation Z we voluntarily provide relevant and informative disclosure of the terms and conditions of our products to all consumers with whom we conduct business. We are required to comply with Section 5 of the Federal Trade Commission Act (“FTC Act”), which prohibits unfair and deceptive acts or practices (“UDAP”) in or affecting commerce, and analogous provisions in each state; the Consumer Financial Protections Act, which prohibits unfair, deceptive or abusive acts or practices (“UDAAP”) in connection with consumer financial products and services; the Equal Credit Opportunity Act and Regulation B promulgated thereunder, which prohibit creditors from discriminating against credit applicants on the basis of race, color, sex, age, religion, national origin, marital status, the fact that all or part of the applicant’s income derives from any public assistance program, or the fact that the applicant has in good faith exercised any right under the Federal Consumer Credit Protection Act or applicable state law; the Fair Credit Reporting Act (“FCRA”), which promotes the accuracy, fairness, and privacy of information in the files of consumer reporting agencies; the Fair Debt Collection Practices Act (the “FDCPA”), which provides guidelines and limitations concerning the conduct of third-party debt collectors in connection with the collection of consumer debts; and the Telephone Consumer Protection Act (the “TCPA”), which regulates the use of telephone and texting technology to contact customers.

We are also subject to the Holder in Due Course Rule of the Federal Trade Commission (“FTC”), and equivalent state laws, which requires any holder of a consumer credit contract to include a required notice and become subject to all claims and defenses that a borrower could assert against the seller of goods or services; the Electronic Fund Transfer Act, which provides disclosure requirements, guidelines, and restrictions on the electronic transfer of funds from consumers’ bank accounts; the Electronic Signatures in Global and National Commerce Act and similar state laws, which authorize the creation of legally binding and enforceable agreements utilizing electronic records and signatures; the Military Lending Act and similar state laws, which provide obligations and prohibitions relating to loans made to servicemembers and their dependents; and the Servicemembers Civil Relief Act, which allows active duty military members to suspend or postpone certain civil obligations.

We possess certain state lending licenses, and we continuously evaluate whether others are required, which subject us to supervisory oversight from these state license authorities and periodic examinations. The loans we may originate on our platform pursuant to these state licenses are subject to state licensing and interest rate fee restrictions, as well as numerous state requirements regarding consumer protection, interest rate, disclosure, prohibitions on certain activities, and loan term lengths. Our business may become subject to licensing requirements in states in which we currently do not hold licenses. We continue to monitor state licensing regulations and how they may apply to our business, and may be required in the future to apply for additional state licenses.

Canada

In Canada, we are required to comply with the Canada Anti-Spam Law, which regulates the transmittal of commercial email messages, the Canadian Personal Information Protection and Electronic Documents Act and equivalent provincial privacy laws in the provinces of Alberta, British Columbia and Quebec, each of which includes requirements surrounding the use, disclosure, and other processing of certain personal information about Canadian residents. In addition, we are required to comply with the Canadian federal and provincial human rights legislation which prohibits discriminatory practices to deny, deny access to, or to differentiate adversely in relation to any individual in respect of the provision of services customarily available to the general public on the basis of a certain prohibited grounds of discrimination. The Canadian provincial consumer protection and cost of credit disclosure laws prohibit late fees, impose limits on default charges, prohibit unfair practices, and include consumer contract disclosure and related process requirements, among other compliance requirements. We are also subject to Canadian provincial and territorial e-commerce laws.

We believe that we are appropriately licensed as a lender and/or have designed our business activities to avoid a licensing requirement in each of the Canadian provinces that require such licenses. In connection with our business activities, we are also generally subject to consumer protection legislation and other laws and, on that basis, our business is also generally subject to regulatory oversight and supervision from federal and/or provincial regulators in respect of those activities, regardless of whether we have a license. These regulators and enforcement agencies generally act on a complaints-basis and may receive consumer complaints about us. Investigations or enforcement actions may be costly and time consuming. Enforcement actions by such regulators and enforcement agencies could lead to fines, penalties, consumer restitution, the cessation of our business activities in whole or in part, or the assertion of private claims and lawsuits against us.

Payment Regulations

We are subject to the rules, codes of conduct and standards of Visa, Mastercard and other payment networks and their participants. In order to provide our payment processing services, we must be registered either indirectly or directly as service providers with the payment networks that we use. As such, we are subject to applicable card association and payment network rules, standards and regulations, which impose various requirements and could subject us to a variety of fines or penalties that may be levied by such associations or networks for certain acts or omissions. Card associations and payment networks and their member financial institutions regularly update and generally expand expectations and requirements related to the security of consumer data and environments. Failure to comply with the networks’ requirements, or to pay the fees or fines they may impose, could result in the suspension or termination of our registration with the relevant payment networks and therefore require us to limit, suspend or cease providing the relevant payment processing services. We are also subject to the Payment Card Industry Data Security Standard (“PCI DSS”) with respect to the acceptance of payment cards, which provides for security standards relating to the processing of cardholder data and the systems that process such data. The failure of our products to comply with PCI DSS requirements may result in the loss of our status as a PCI DSS certified Service Provider and thereby impact our relationship with our merchant partners and their own ability to comply with PCI DSS.

In Canada, we are required to comply with the Payments Canada Rule H1- Pre-Authorized Debit Rules in respect of the acceptance of payments from Canadian bank accounts and the Quebec Charter of French Language laws which regulates the language of communication in commerce and business and applies to entities carrying on business in Quebec.

Data Privacy and Data Security Laws

We are subject to a number of laws, rules, directives, and regulations relating to the collection, use, retention, security, processing, and transfer of personally identifiable information about our customers, our merchants, and employees in the geographies where we operate. Our business relies on the processing of personal data in several jurisdictions and, in some cases, the movement of data across national borders. As a result, much of the personal data that we process, which may include certain financial information associated with individuals, is subject to one or more privacy and data protection laws in one or more jurisdictions. In many cases, these laws apply not only to third-party transactions, but also to transfers of information between or among us, our subsidiaries, and other parties with which we have commercial relationships.

Regulatory scrutiny of privacy, data protection, cybersecurity practices, and the processing of personal data is increasing around the world. Regulatory authorities are continuously considering numerous legislative and regulatory proposals and interpretive guidelines that may contain additional privacy and data protection obligations. Many jurisdictions in which we operate have adopted, or are in the process of adopting, or amending data privacy legislation or regulation aimed at creating and enhancing individual privacy rights. In addition, the interpretation and application of these privacy and data protection laws in the U.S., Canada, and elsewhere are subject to change and may subject us to increased regulatory scrutiny and business costs.

In the United States, we are subject to the Gramm-Leach-Bliley Act (the “GLBA”) and implementing regulations and guidance thereunder, in addition to applicable privacy and data protection laws in the other jurisdictions in which we carry on business activities or process personal information. Among other requirements, the GLBA imposes certain limitations on the ability to share consumers’ nonpublic personal information with nonaffiliated third parties and requires certain disclosures to consumers about information collection, sharing, and security practices and their right to “opt out” of the institution’s disclosure of their nonpublic personal information to nonaffiliated third parties. Privacy requirements, including notice and opt out requirements, under the GLBA and the FCRA are enforced by the FTC and by the Consumer Financial Protection Bureau (“CFPB”) through UDAAP claims, and are a standard component of CFPB examinations. State entities also may initiate actions for alleged violations of privacy or security compliance under state UDAAP claims, financial privacy, security and other laws. Regulators and enforcement agencies may receive consumer complaints about us. In the United States, these regulators and agencies include the Financial Crimes Enforcement Network (“FinCEN”), which could subject us to burdensome rules and regulations that could increase costs and use of our resources in order to satisfy our compliance obligations.

Most states have in place data security laws requiring companies to maintain certain safeguards with respect to the processing of personal information, and all states require companies to notify individuals or government regulators in the event of a data breach impacting such information. We continue to monitor state data privacy legislation and how they may apply to our business. In addition, most industrialized countries have or are in the process of adopting similar privacy or data security laws enforced through data protection authorities.

Other Applicable Regulations

We are subject to regulations relating to our corporate conduct and the conduct of our business, including securities laws, trade regulations, anti-money laundering (“AML”) laws, and Know-Your-Customer (“KYC”) laws as well as anti-corruption legislation. The United States and certain foreign jurisdictions have taken aggressive stances with respect to such matters and have implemented new initiatives and reforms. AML laws and related KYC requirements generally require certain companies to conduct necessary due diligence to prevent and protect against money laundering. AML enforcement activity could result in criminal and civil proceedings brought against companies and individuals, which could have a material adverse effect on our business.

We are required to comply with the U.S. Foreign Corrupt Practices Act, the Foreign Public Officials Act (Canada), and similar anti-bribery laws in other jurisdictions, which prohibit companies and their intermediaries from making improper payments for the purpose of obtaining or retaining business. Recent years have seen a substantial increase in anti-bribery law enforcement activity with more frequent and aggressive investigations and enforcement proceedings by both the Department of Justice and the SEC, increased enforcement activity by non-U.S. regulators and increases in criminal and civil proceedings brought against companies and individuals.

We are also subject to certain economic and trade sanctions programs including Canadian sanctions laws and the sanctions programs administered by the U.S. Department of the Treasury’s Office of Foreign Assets Control (“OFAC”), which prohibit or restrict transactions or dealings with specified countries, individuals, and entities.

Our Sustainability