[Final

graph with numbered axes to be included based on the final trust terms].

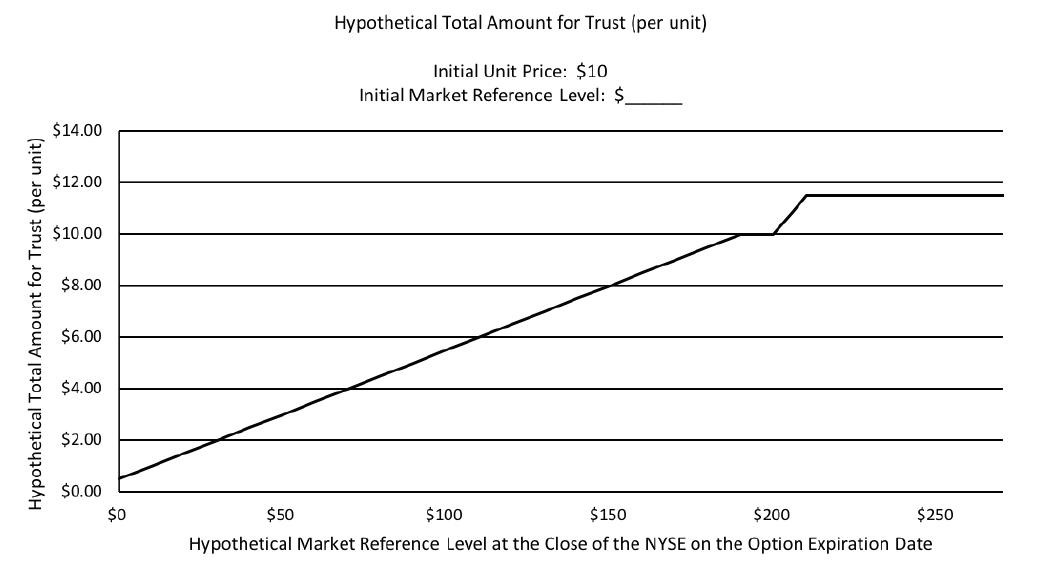

The graph above is a hypothetical

illustration of the mathematical principles underlying the Options and the operation of the trust’s investment strategy. There is no assurance

that the trust will achieve its investment objective through the use of this strategy. Illustrations of the possible returns of the trust’s

investment strategy assuming different Market Reference Levels on the Option Expiration Date appear under “Understanding Your

Investment—Hypothetical Examples” in this prospectus. You may realize a return (including a potential loss) that is higher or lower than the

intended returns as a result of redeeming units prior to the trust’s mandatory termination date and in various circumstances (as described below)

including where Options are otherwise liquidated by the trust prior to their expiration or maturity, if the trust is unable to maintain the

proportional relationship (as described below) of the Options based on the number of Option contracts in the trust’s portfolio, or if there are

increases in expenses of the trust above estimated levels. The Options are intended to be liquidated on the Option Expiration Date, rather than be

exercised, in order to avoid having the trust receive shares of the Market Reference or be obligated to deliver shares of the Market Reference. As a

result, the return actually realized on the Optionsupon liquidation could vary from the returns that would be realized if the Options were exercised

based on the price of shares of the Market Reference as of the close of the market on the Option Expiration Date. The “proportional

relationship” of the Options referred to throughout the prospectus that the trust seeks to maintain refers to the proportion of the particular

types of Options as of the trust’s inception. For example, if the trust’s portfolio included 100 purchased call options (with a particular

strike and expiration) for every 50 written put options (with a particular strike and expiration) at inception, the trust would seek to maintain that

100 contracts to 50 contracts proportional relationship. See “Investment Summary—Portfolio” for the actual number of Option contracts at

inception. As described above, under certain limited circumstances provided in the trust agreement, Options may be liquidated by the trust prior to the

Option Expiration Date or maturity, respectively. These circumstances may include paying expenses, satisfy unit redemptions by unitholders, protecting

the trust in limited circumstances and making required distributions or avoiding imposition of taxes on the trust as described under

“Understanding Your Investment—How Your Trust Works—Changing Your Portfolio”.

4 Investment

Summary

WHO SHOULD

INVEST

You should consider this investment if

you:

• |

|

want to own securities representing interests in written and

purchased option contracts in a single investment. |

• |

|

seek the potential for buffered returns subject to a capped amount

at termination based on the price performance of the Market Reference. |

You should not consider this investment

if you:

• |

|

are uncomfortable with the risks of an unmanaged investment in

written and purchased option contracts. |

• |

|

are uncomfortable with exposure to the risks associated with the

Options. |

• |

|

are uncomfortable with exposure to the price performance of the

Market Reference. |

• |

|

are seeking unlimited capital appreciation potential and do not

want potential returns capped. |

| ESSENTIAL

INFORMATION |

|

| |

Public Offering Price per

|

|

|

|

|

|

|

Unit at Inception* |

|

|

|

|

$_____ |

|

| |

Fee Account Public Offering

Price per Unit at Inception* |

|

|

|

|

$10.000 |

|

| |

Initial Net Asset Value per

Unit at Inception*† |

|

|

|

|

$_____ |

|

| |

Inception date |

|

|

|

|

_________, 2019 |

|

| |

Mandatory Termination Date |

|

|

|

|

_________, ____ |

|

| |

Distribution dates |

|

|

|

|

25th day of

December |

|

Record dates |

|

|

|

|

10th day of

December |

|

| |

Initial distribution date |

|

|

|

|

_________25, 2019 |

|

Initial record date |

|

|

|

|

_________10, 2019 |

|

| |

CUSIP Numbers |

|

|

|

|

|

|

Standard Accounts |

|

|

|

|

_________ |

|

Fee Based Accounts |

|

|

|

|

_________ |

|

| |

Ticker Symbol |

|

|

|

|

_______ |

|

| |

Minimum investment |

|

|

|

|

$1,000/100 units |

|

| |

Tax Structure |

|

|

|

|

Regulated Investment Company |

|

* As of ____________, 2019 and may vary thereafter.

† Investors will not purchase units at the net asset value per unit.

FEES AND

EXPENSES

The amounts below are estimates of the

direct and indirect expenses that you may incur based on a $__ unit price. Actual expenses may vary.

Sales Fee

|

|

|

|

As a %

of $1,000

Invested

|

|

Amount

per 100

Units

|

Transactional sales fee |

|

|

|

|

____% |

|

|

$ |

____ |

|

Creation & development fee |

|

|

|

|

____ |

|

|

|

____ |

|

Maximum sales fee |

|

|

|

|

____% |

|

|

$ |

____ |

|

Organization Costs |

|

|

|

|

____% |

|

|

$ |

____ |

|

Annual operating expenses

|

|

|

|

As a %

of Net

Assets

|

|

Amount

per 100

Units

|

Trustee fee & expenses |

|

|

|

|

_.__% |

|

|

$ |

_____ |

|

Supervisory, evaluation and administration fees |

|

|

|

|

_.__ |

|

|

|

_____ |

|

Total |

|

|

|

|

_.__% |

|

|

$ |

_____ |

|

The transactional sales fee is paid at

the time of a unit purchase and is the difference between the total sales fee (maximum of ____% of the unit offering price) and the total creation and

development fee. The creation and development fee is fixed at $____ per unit and is paid at the end of the initial offering period (anticipated to be

one day). If you purchase units after the creation and development fee is paid, the secondary market transactional sales fee is equal to ______ % of

the public offering price per unit and you will not pay a creation and development fee.

EXAMPLE

This example helps you compare the cost

of this trust with other unit investment trusts and mutual funds. In the example we assume that the expenses do not change and that the trust’s

annual return is 5%. Your actual returns and expenses will vary. Based on these assumptions, you would pay these expenses for every $10,000 you invest

in the trust:

1 year |

|

|

|

$ |

_____ |

|

__ years (approximate life of trust) |

|

|

|

$ |

_____ |

|

These amounts are the same regardless of

whether you sell your investment at the end of a period or continue to hold your investment.

Investment

Summary 5

PRINCIPAL

RISKS

As with all investments, you can lose

money by investing in this trust. The trust also might not perform as well as you expect. This can happen for reasons such as these:

• |

|

The trust’s investment strategy is designed to achieve its

investment objective over the life of the trust. The trust’s investment strategy has not been designed to achieve its objective if units are

bought after the trust’s inception date or redeemed prior to the trust’s mandatory termination date. |

• |

|

Security prices will fluctuate. The value of your

investment may fall over time. An investment in units represents an indirect investment in the Options. Amounts available to distribute to unitholders

at termination will depend primarily on the performance of the Options and are not guaranteed. The units, upon termination of the trust and at any

other point in time, may be worth less than the original investment. |

• |

|

The trust is subject to market risk related to the Market

Reference, the Underlying Index and securities in the Underlying Index held by the Market Reference. The Options represent indirect positions in

the Market Reference and are subject to risks associated with changes in value as the Market Reference Level rises or falls. The investment in the

Options includes the risk that their value may be adversely affected by various factors affecting the Market Reference, the Underlying Index and the

value of the securities in the Underlying Index held by the Market Reference. The Market Reference is an exchange-traded fund that seeks to track the

performance of the Underlying Index which consists of common stock of 500 leading companies in leading industries of the U.S. economy. Stocks are

subject to the risk that their prices will decline. Stock markets tend to move in cycles, with periods of rising prices and periods of falling prices.

The Underlying Index tracks a subset of the U.S. stock market, which could cause the Underlying Index and Market Reference to perform differently from

the overall stock market. In addition, the Underlying Index and Market Reference may, at times, become focused in stocks of a particular market sector,

which would subject the Market Reference and the trust to proportionately higher exposure to the risks of that sector. Although common stocks have

historically generated higher average returns than fixed-income securities over the long term, common stocks also have experienced significantly more

volatile returns. Common stocks are structurally subordinated to preferred stocks, bonds and other debt instruments in a company’s capital

structure, and represent a residual claim on the issuer’s assets that have no value unless such assets are sufficient to cover all other claims.

The value of the Options is based on the value of the Market Reference Level as of the close of the market on the Option Expiration Date only, and will

be substantially determined by market conditions as of such time. |

• |

|

The trust seeks to provide returns related to the price

performance of the Market Reference only, which does not include returns from dividends paid by the Market Reference. The Options reference the

price of shares of the Market Reference only and not dividend payments paid by the Market Reference. |

• |

|

The trust return is subject to a capped upside. The

intended return for units purchased on the trust’s inception date and held for the life of the trust is based on the Market Reference Level and

the value of the Options on the Option Expiration Date and is subject to a capped amount of $____ per trust unit and may represent a return that is

worse than the performance of the Market Reference. Even if there are significant increases in the Market Reference Level, the |

6 Investment

Summary

|

|

amount you may receive is capped

at $ per trust unit. |

• |

|

You may lose all or a portion of your investment. The

trust does not provide principal protection and you may not receive a return of the capital you invest. |

• |

|

You may experience significant losses on your investment up

to an almost total loss on your investment if the price of the Market Reference decreases by greater than % from the Initial Market

Reference Level. You may realize a return (including a loss) that is higher or lower than the intended returns as a result of redeeming

units prior to the trust’s mandatory termination date and in various circumstances including where Options are liquidated by the trust

prior to their expiration, if the trust is unable to maintain the proportional relationship of the Options based on the number of Option

contracts in the trust’s portfolio, or increases in potential tax-related and other expenses of the trust above estimated

levels. |

• |

|

The written Options create an obligation for the trust.

As a result, after the premium is received on the written Options, the written Options will reduce the value of your units. |

• |

|

The values of the Options do not increase or decrease at the

same rate as changes in the price of the Market Reference or the Underlying Index. The Options are all European style options, which

means that they will be exercisable at the strike price only on the Option Expiration Date. Prior to their expiration on the Option

Expiration Date, the value of the Options is determined based upon market quotations, the last asked or bid price in the over-the-counter market

or using other recognized pricing methods. The value of the Options prior to their expiration on the Option Expiration Date may vary

because of factors other than the price of the Market Reference. Factors that may influence the value of the Options include interest rate

changes, implied volatility levels of the Market Reference, the Underlying Index and securities comprising the Underlying Index

and implied dividend levels of the Market Reference, the Underlying Index and securities comprising the Underlying Index,

among others. The value of the Market Reference may not increase or decrease at the same rate as the Underlying Index due to “tracking

error” described below. |

• |

|

Certain features of the Market Reference, which is an

exchange-traded fund, will impact the value of the units. The value of the Market Reference is subject to factors such as the

following: |

o |

|

Passive Investment Risk. The Market Reference is not

actively managed and attempts to track the performance of an unmanaged index of securities. This differs from an actively managed fund,

which typically seeks to outperform a benchmark index. As a result, the Market Reference will hold constituent securities of the Underlying

Index regardless of the current or projected performance on a specific security or particular industry or market sector. Maintaining

investments in the securities regardless of market conditions of the performance of individual securities could cause the Market

Reference’s returns to be lower than if it employed an active strategy. |

o |

|

Index Tracking Risk. While the Market Reference is

intended to track the performance of the Underlying Index, the Market Reference’s returns may not match or achieve a high degree of

correlation with the return of the Underlying Index due to expenses and transaction costs. In addition, it is possible that the Market

Reference may not always fully replicate the performance of the Underlying Index. |

Investment

Summary 7

• |

|

The trust may experience substantial downside from the Options

and option contract positions may expire worthless. |

• |

|

Credit risk is the risk an issuer, guarantor or counterparty of

a security in the trust is unable or unwilling to meet its obligation on the security. The OCC acts as guarantor and central counter-party with

respect to the Options. As a result, the ability of the trust to meet its objective depends on the OCC being able to meet its obligations. |

• |

|

Liquidity risk is the risk that the value of a security will

fall in value if trading in the security is limited or absent. The Options are listed on the CBOE; however, no one can guarantee that a liquid

secondary trading market will exist for the Options. Trading in the Options may be less deep and liquid than certain other securities. The Options may

be less liquid than certain non-customized options. In a less liquid market for the Options, liquidating the Options may require the payment of a

premium (for written Options) or acceptance of a discounted price (for purchased Options) and may take longer to complete. In a less liquid market for

the Options, the liquidation of a large number of options may more significantly impact the price. A less liquid trading market may adversely impact

the value of the Options and your units and result in the trust being unable to achieve its investment objective. |

• |

|

The trust might not achieve its objective in certain

circumstances. Certain circumstances under which the trust might not achieve its objective include if the trust disposes of Options early, if the

trust is unable to maintain the proportional relationship among the Options in the trust’s portfolio or due to adverse tax law or other changes

affecting treatment of the Options. |

• |

|

The cash deposited may be insufficient to meet the expenses of

the trust. If the cash balances in the trust’s accounts are insufficient to provide for expenses and other amounts payable by the trust, the

trust may sell trust property to pay such amounts. These sales may result in losses to unitholders and the inability of the trust to meet its

investment objective. There is no assurance that your investment will maintain its size or composition. |

• |

|

The trustee has the power to terminate your trust early in

limited cases as described under “Understanding Your Investment—How Your Trust Works—Termination of Your Trust” including if the

value of the trust is less than 40% of the original value of the securities in the trust at the time of deposit. If the trust terminates early, the

trust may suffer losses and be unable to achieve its investment objective. This could result in a reduction in the value of units and result in a

significant loss to investors. |

• |

|

An investment in the trust is not a deposit of any bank and is

not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. |

• |

|

We do not actively manage the portfolio. Except in limited

circumstances, the trust will hold, and continue to buy interests in the same securities even if their market value declines. |

8 Investment

Summary

ACE MLTSM, Buffered Portfolio Series

2019-1

(Advisors Disciplined Trust 1682)

Portfolio — As of the

Initial Date of Deposit, ____________, 2019

Description of Options(1)(4)

|

|

|

|

Strike

Price

|

|

Strike Price as

a Percentage

of

the Initial

Market

Reference

Level

|

|

Number

of Option

Contracts(4)

|

|

Market

Value per

Option(2)

|

|

Percentage

of

Aggregate

Offering

Price

|

|

Cost of

Securities

to

Trust(2)

|

OPTIONS — ______%

|

Purchased

Options — ______%

|

Purchased Call Options on the SPDR® S&P 500® ETF Trust, Expiring ____________, 2020

(3) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Purchased Call Options on the SPDR® S&P 500® ETF Trust, Expiring ____________, 2020

(3) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Purchased Put Options on the SPDR® S&P 500® ETF Trust, Expiring ____________, 2020

(3) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Written

Options — ______%

|

Written Call Options on the SPDR® S&P 500® ETF Trust, Expiring ____________, 2020

(3) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Written Put Options on the SPDR® S&P 500® ETF Trust, Expiring ____________, 2020

(3) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

__.__% |

|

|

$ |

______ |

|

See “Notes to Portfolio” |

Investment

Summary 9

Notes to Portfolio

(1) |

|

Securities are represented by contracts to purchase

such securities. |

(2) |

|

Advisors Asset Management, Inc. is the evaluator of

the trust. Capelogic, Inc., an independent pricing service, determined the initial prices of the securities shown in this prospectus at the close of

regular trading on the New York Stock Exchange on the business day before the date of this prospectus. The value of Options is based on the last quoted

sale price for the Options (bid-side for the purchased Options and ask-side for the written Options). Accounting Standards Codification 820, “Fair

Value Measurements” establishes a framework for measuring fair value and expands disclosure about fair value measurements in financial statements

for the trust. The framework under the standard is comprised of a fair value hierarchy, which requires an entity to maximize the use of observable

inputs and minimize the use of unobservable inputs when measuring fair value. The standard describes three levels of inputs that may be used to measure

fair value: |

|

|

Level 1: Quoted prices (unadjusted) for

identical assets or liabilities in active markets that the trust has the ability to access as of the measurement date. |

|

|

Level 2: Significant observable inputs

other than Level 1 prices, such as quoted prices for similar assets or liabilities, quoted prices in markets that are not active, and other inputs that

are observable or can be corroborated by observable market data. |

|

|

Level 3: Significant unobservable inputs

that reflect a trust’s own assumptions about the assumptions that market participants would use in pricing an asset or liability. |

|

|

The cost of the securities to the sponsor and the

sponsor’s profit or (loss) (which is the difference between the cost of the securities to the sponsor and the cost of the securities to the trust)

are $__________ and $__________, respectively. The inputs or methodologies used for valuing securities are not necessarily an indication of the risk

associated with investing those securities. Changes in valuation techniques may result in transfers in or out of an investment’s assigned level as

described above. The following table summarizes the trust’s investments as of ____________, 2019, based on inputs used to value them: |

|

|

|

|

Level 1

|

|

Level 2

|

|

Level 3

|

Purchased Options |

|

|

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

Written

Options |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total |

|

|

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

(3) |

|

This is a non-income producing security. |

(4) |

|

Each Option contract entitles the holder thereof

(i.e. the purchaser) to purchase (for the call options) or sell (for the put options) 100 shares of the Market Reference on the Option Expiration Date

at the Option’s strike price multiplied by 100. |

10 Investment

Summary

UNDERSTANDING YOUR INVESTMENT |

|

|

|

ADDITIONAL INFORMATION

ABOUT THE

PRINCIPAL INVESTMENT STRATEGY

The Options. The

trust’s initial portfolio includes five types of Options including both written and purchased put and call options (as further described below).

The Options are all European style options, which means that they will be exercisable at the strike price only on the Option Expiration Date. The

Options are all FLexible EXchange Options (“FLEX Options”). FLEX Options are customized option contracts available through national

securities exchanges that are guaranteed for settlement by the OCC, a market clearinghouse. The Options are listed on the CBOE. FLEX Options provide

investors with the ability to customize assets and indices referenced by the options, exercise prices, exercise styles (i.e. American-style exercisable

any time prior to the expiration date or European-style exercisable only on the option expiration date) and expiration dates, while achieving price

discovery in competitive, transparent auctions markets and avoiding the counterparty exposure of over-the-counter option positions.

Each Option contract entitles the holder

thereof (i.e. the purchaser of the Option) the option to purchase (for the call options) or sell (for the put options) 100 shares of the Market

Reference as of the close of the market on the Option Expiration Date for the strike price multiplied by 100. The trust is designed so that any amount

owed by the trust on the written Options will be covered by payouts at expiration from the purchased Options. The trust receives premiums in exchange

for the written Options and pays premiums in exchange for the purchased Options. The OCC and securities exchange that the Options are listed on do not

charge ongoing fees to writers or purchasers of the Options during their life for continuing to hold the option contracts.

The OCC guarantees performance by each

of the counterparties to FLEX Options, becoming the “buyer for every seller and the seller for every buyer,” protecting clearing members and

options traders from counterparty risk. Subject to determination by the Securities Committee of the OCC, adjustments may be made to the Options for

certain events (collectively “Corporate Actions”) specified in the OCC’s by-laws and rules: certain stock dividends or

distributions, stock splits, reverse stock splits, rights offerings, distributions, reorganizations, recapitalizations, or reclassifications with

respect to an underlying security, or a merger, consolidation, dissolution or liquidation of the issuer of the underlying security. According to the

OCC’s by-laws, the nature and extent of any such adjustment is to be determined by the OCC’s Securities Committee, in light of the

circumstances known to it at the time such determination is made, based on its judgment as to what is appropriate for the protection of investors and

the public interest, taking into account such factors as fairness to holders and writers (or purchasers and sellers) of the affected options, the

maintenance of a fair and orderly market in the affected options, consistency of interpretation and practice, efficiency of exercise settlement

procedures, and the coordination with other clearing agencies of the clearance and settlement of transactions in the underlying

interest.

The information set forth above relating

to the Options, FLEX Options generally and the OCC has been obtained from the OCC. The description and terms of the Options to be entered into with the

OCC are set forth in the by-laws and rules of the OCC, available at www.optionsclearing.com. Please see www.optionsclearing.com for more information

relating thereto, which websites are not considered part of this prospectus nor are they incorporated by reference herein.

At-The-Money Purchased Call Options

(“ATM Purchased Call Options”). The ATM Purchased Call Options are call options purchased by the trust, each with a strike price of $___

(approximately ___% of the Initial Market Reference

Understanding Your

Investment 11

Level). If the Market Reference

Level is less than or equal to the strike price at the close of the New York Stock Exchange on the Option Expiration Date, the ATM Purchased Call

Options will expire without net proceeds being payable to the trust (i.e. the ATM Purchased Call Options will expire worthless). If the Market

Reference Level is greater than the strike price at the close of the New York Stock Exchange on the Option Expiration Date, then the ATM Purchased Call

Options are intended to collectively provide for per unit dollar amount proceeds of $___ multiplied by ((the Market Reference Level at the close of the

New York Stock Exchange on the Option Expiration Date divided by the Initial Market Reference Level) minus ___%) to the trust on the Option Expiration

Date.

In-The-Money Purchased Call Options

(“ITM Purchased Call Options”). The ITM Purchased Call Options are call options purchased by the trust, each with a strike price of $___

(approximately ___% of the Initial Market Reference Level). If the Market Reference Level is less than or equal to the strike price at the close of the

New York Stock Exchange on the Option Expiration Date, the ITM Purchased Call Options will expire without net proceeds being payable to the trust (i.e.

the ITM Purchased Call Options will expire worthless). If the Market Reference Level is greater than the strike price at the close of the New York

Stock Exchange on the Option Expiration Date, then the ITM Purchased Call Options are intended to collectively provide for per unit dollar amount

proceeds of $___ multiplied by ((the Market Reference Level at the close of the New York Stock Exchange on the Option Expiration Date divided by the

Initial Market Reference Level) minus ___%) to the trust on the Option Expiration Date.

Out-Of-The-Money Written Call Options

(“OTM Written Call Options”). The OTM Written Call Options are call options written by the trust, each with a strike price of $___

(approximately ___% of the Initial Market Reference Level). If the Market Reference Level is less than or equal to the strike price at the close of the

New York Stock Exchange on the Option Expiration Date, the OTM Written Call Options will expire without net proceeds being payable by the trust (i.e.

the OTM Written Call Options will expire worthless). If the Market Reference Level is greater than the strike price at the close of the New York Stock

Exchange on the Option Expiration Date, then the OTM Written Call Options are intended to collectively provide for the trust to deliver proceeds with a

per unit dollar amount of $___ multiplied by ((the Market Reference Level at the close of the New York Stock Exchange on the Option Expiration Date

divided by the Initial Market Reference Level) minus ___%) on the Option Expiration Date.

At-The-Money Purchased Put Options

(“ATM Purchased Put Options”). The ATM Purchased Put Options are put options purchased by the trust, each with a strike price at $___

(approximately ___% of the Initial Market Reference Level). If the Market Reference Level is greater than or equal to the strike price at the close of

the New York Stock Exchange on the Option Expiration Date, the ATM Purchased Put Options will expire without net proceeds being payable to the trust

(i.e. the ATM Purchased Put Options will expire worthless). If the Market Reference Level is less than the strike price at the close of the New York

Stock Exchange on the Option Expiration Date, then the ATM Purchased Put Options are intended to collectively provide for per unit dollar amount

proceeds of $___ multiplied by (___% minus (the Market Reference Level at the close of the New York Stock Exchange on the Option Expiration Date

divided by the Initial Market Reference Level)) to be made to the trust on the Option Expiration Date.

Out-Of-The-Money Written Put Options

(“OTM Written Put Options”). The OTM Written Put Options are put options written by the trust, each with a strike price at $___

(approximately ___% of the Initial Market Reference Level). If the Market Reference Level is greater than or equal to the strike price at the close of

the New York Stock Exchange on the Option

12 Understanding Your

Investment

Expiration Date, the OTM Written Put

Options will expire without net proceeds being payable by the trust (i.e. the OTM Written Put Options will expire worthless). If the Market Reference

Level is less than the strike price at the close of the New York Stock Exchange on the Option Expiration Date, then the OTM Written Put Options are

intended to collectively provide for the trust to deliver proceeds with a per unit dollar amount of $___ multiplied by (___% minus (the Market

Reference Level at the close of the New York Stock Exchange on the Option Expiration Date divided by the Initial Market Reference Level)) on the Option

Expiration Date.

The Market Reference and the

Underlying Index. The summary information below regarding the Market Reference and the Underlying Index comes from the Market Reference’s

filings with the U.S. Securities and Exchange Commission (“SEC”). You are urged to refer to the SEC filings made by the issuer and to

other publicly available information (e.g. the issuer’s annual report) to obtain an understanding of the issuer’s business and financial

prospects. The summary information contained below is not designed to be, and should not be interpreted as, an effort to present information regarding

the financial prospects of any issuer or any trends, events or other factors that may have a positive or negative influence on those prospects or as an

endorsement of any particular issuer or exchange-traded fund. We have not undertaken any independent review or due diligence of the SEC filings of the

issuer of the Market Reference or of any other publicly available information regarding such issuer.

The Market Reference is an

exchange-traded fund that trades on the NYSE Arca, Inc. stock exchange under the ticker symbol “SPY”. We have derived all information

regarding the Market Reference contained in this prospectus from the prospectus for the Market Reference, dated January 29, 2019. Such information

reflects the policies of, and is subject to change by the Market Reference’s sponsor, PDR Services, LLC. Such information is subject to change and

we have not independently verified its accuracy. Information concerning the Market Reference provided to or filed with the SEC can be located by

reference to SEC file numbers 811-06125 and 33-46080. Information from outside sources is not incorporated by reference in, and should not be

considered part of, this prospectus. Information taken directly from the Market Reference’s SEC filing of its 2019 prospectus is included in

quotation marks.

“The [Market Reference] seeks to provide investment results that, before

expenses, correspond generally to the price and yield performance of the S&P 500® Index. The [Market

Reference] seeks to achieve its investment objective by holding a portfolio of the common stocks that are included in

the [Underlying] Index (the “Portfolio”), with the weight of each stock in the Portfolio substantially

corresponding to the weight of such stock in the [Underlying] Index. [T]he term “Portfolio Securities”

refers to the common stocks that are actually held by the [Market Reference] and make up the [Market Reference]’s

Portfolio, while the term “Index Securities” refers to the common stocks that are included in the [Underlying]

Index, as determined by the index provider, S&P Dow Jones Indices LLC (“S&P”). At any time, the Portfolio

will consist of as many of the Index Securities as is practicable. To maintain the correspondence between the composition and

weightings of Portfolio Securities and Index Securities State Street Global Advisors Trust Company (the “Trustee”

[of the Market Reference] or its parent company, State Street Bank and Trust Company (“SSBT”) adjusts the Portfolio

from time to time to conform to periodic changes made by S&P to the identity and/or relative weightings of Index

Securities in the [Underlying] Index. The Trustee or SSBT aggregates certain of these adjustments and makes changes to the

Portfolio at least monthly, or more frequently in the case of significant changes to the [Underlying] Index.

The [Underlying] Index includes five

hundred (500) selected companies, all of which are listed on national stock exchanges and spans over

Understanding Your

Investment 13

25 separate industry groups. As of

December 31, 2018, the five largest industry groups represented in the Index were: Software & Services 10.96%; Pharmaceuticals, Biotechnology &

Life Sciences 8.86%; Media & Entertainment 7.96%; Health Care Equipment & Services 6.68%; and Capital Goods 6.46%. Since 1968, the [Underlying]

Index has been a component of the U.S. Commerce Department’s list of Leading Indicators that track key sectors of the U.S. economy. Current

information regarding the market value of the [Underlying] Index is available from market information services. The [Underlying] Index is determined,

comprised and calculated without regard to the [Market Reference].”

The trust is not sponsored, endorsed,

sold or promoted by SPDR® S&P 500® ETF Trust, PDR Services, LLC or S&P Dow Jones Indices LLC.

SPDR® S&P 500® ETF Trust, PDR Services, LLC and S&P Dow Jones Indices LLC have not passed on the legality or

suitability of, or the accuracy or adequacy of, descriptions and disclosures relating to the trust or the Options. SPDR® S&P

500® ETF Trust, PDR Services, LLC and S&P Dow Jones Indices LLC make no representations or warranties, express or implied,

regarding the advisability of investing in the trust or the Options or results to be obtained by the trust or the Options, unitholders or any other

person or entity from use of the Market Reference. SPDR® S&P 500® ETF Trust, PDR Services, LLC and S&P Dow

Jones Indices LLC have no liability in connection with the management, administration, marketing or trading of the trust or the

Options.

Shares of the Market Reference may be

invested in directly without paying the fees and expenses associated with the trust. There are a variety other investments available that track or

reference the Underlying Index.

HYPOTHETICAL

EXAMPLES

The following table and examples

illustrate the payments on the Options and how the trust’s investment strategy is intended to work.

The table and examples are hypothetical

illustration of the mathematical principles underlying the Options and the trust’s investment strategy. The table and examples are not intended to

predict or project the performance of the Options or the trust. The actual distributions that you receive will vary from these illustrations with

changes in expenses and early liquidation of Options. For an explanation of the Option computations and the trust’s intended returns on a per unit

basis, please refer to the discussion under “Investment Summary—Principal Investment Strategy” and “Understanding Your

Investment—Additional Information about the Principal Investment Strategy—The Options”. The examples assume that units are not sold back

to us or redeemed early. All figures in the table and examples below assume that the Options are held until the applicable Option expiration date and

units of the trust are held until the trust’s mandatory termination date. Unitholders will not purchase units at the Initial Unit Price or Fee

Account Initial Unit Price but at the unit price computed as of the close of the New York Stock Exchange on a unitholder’s date of purchase. No

investors will purchase at the Initial Net Asset Value per Unit as shown under “Essential Information”. Those returns are for illustrative

purposes only and are intended to reflect the intended return on the portfolio without application of sales fees or organization costs. Amounts assume

all proceeds on the Options are received when due and that there are no defaults. Unitholders will pay a sales fee in connection with the purchase of

units which is shown under “Essential Information” but such amounts are not deducted from the amounts shown in the table or examples so are

not reflected in the tables or examples as separate amounts. Unitholders will pay organization costs of the trust which are shown under “Essential

Information” but those amounts are paid by cash deposited at inception so are not reflected in the table or examples as separate amounts.

Unitholders will bear the trust’s annual operating expenses shown under “Essential Information” but those amounts are paid by cash

deposited at inception

14 Understanding Your

Investment

so are not reflected in the table or

examples as separate amounts. Unitholders should review the “Investment Summary—Fees and Expenses” section to understand all fees and

expenses borne by unitholders in an investment in units of the trust.

The following table illustrates the

payments on the Options and examples of hypothetical trust returns (including a loss) for units held from the trust inception date to the scheduled

mandatory termination date of the trust. The amounts shown for the “Hypothetical Total Amount for Trust” reflect proceeds from the Options

The “Hypothetical Returns” based on the “Initial NAV” represents the intended percentage return on the portfolio of Options over

the life of the trust gross of any sales fees or organization costs. It is calculated by taking the amount shown under “Hypothetical Total Amount

for Trust” divided by the Initial NAV of $____. It is for illustrative purposes only and does not represent the price any unitholder will pay for

units or the returns any unitholders will receive. The “Hypothetical Returns” based on the “Initial Unit Price” represents the

percentage return an investor would receive if they bought units at the Initial Unit Price and received the amount shown under “Hypothetical Total

Amount for Trust” on such units. The “Hypothetical Returns” based on the “Fee Account Initial Unit Price” represents the

percentage return an investor would receive if they bought units at the Fee Account Initial Unit Price and received the amount shown under

“Hypothetical Total Amount for Trust” on such units.

The amounts and examples are based on

various hypothetical levels of the “Market Reference Level” on the Option Expiration Date. The “Percentage Change” is the Market

Reference Level at the close of the market on the Option Expiration Date divided by the Market Reference Level at trust inception and is shown for

illustrative purposes only based on these different Market Reference levels. These percentage changes represent the percentage increase or decrease of

the Market Reference levels from the trust’s inception to the close of the New York Stock Exchange on the Option Expiration Date.

The amounts under “Hypothetical

Option Proceeds (per Unit)” for each of the five Options represent the net amounts due or owed, per trust unit, at the Option Expiration Date on

each Option based on the corresponding “Market Reference Level”. The amounts under “Hypothetical Total Amount for Trust” are the

sums of those five amounts. Positive amounts represent an amount to be received by the trust on the Options. Negative amounts represent an amount to be

paid by the trust on the Options. The Options are intended to be liquidated on the Option Expiration Date, rather than be exercised, in order to avoid

having the trust receive shares of the Market Reference or be obligated to deliver shares of the Market Reference. As a result, the return actually

realized on the Options upon liquidation could vary from the returns that would be realized if the Options were exercised based on the price of shares

of the Market Reference as of the close of the market on the Option Expiration Date. For an explanation of the Options including relevant computations,

please refer to the discussion under “Understanding Your Investment—Additional Information about the Principal Investment Strategy—The

Options”.

All figures in the table assume that the

Options are held to Option Expiration Date and units are held until the trust’s mandatory termination date. The actual amounts that you receive or

actual losses that you experience may vary from these estimates with changes in expenses or a change in the proportional relationship of the Options

based on the number of Option contracts. The table and examples below are provided for illustrative purposes only and are hypothetical. The table and

examples do not purport to be representative of every possible scenario concerning the Market Reference. No one can predict the performance of the

Market Reference. The assumptions made in connection with the table and examples may not

Understanding Your

Investment 15

reflect actual events. You should

not take this information as an indication or assurance of the expected performance of the Market Reference, the Options or the return on the trust

units. The actual overall performance of the trust will vary with fluctuations in the value of the Options during the trust’s life, changes in

trust expenses and liquidations of Options during the trust’s life, among other things.

16 Understanding Your

Investment

Hypothetical Examples

Hypothetical

Market

Reference Level |

|

Hypothetical

Option Proceeds (per Unit) |

|

Hypothetical

Returns |

Percentage

Change |

Market

Reference

Level |

|

ATM

Purchased

Call

Options |

ITM

Purchased

Call

Options |

OTM

Written

Call

Options |

ATM

Purchased

Put

Options |

OTM

Written

Put

Options |

Hypothetical

Total

Amount

for Trust |

|

Initial

NAV

( $_____) |

Initial

Unit

Price

( $10) |

Fee

Account

Initial Unit

Price

($______) |

| 35% |

$ |

____ |

|

$ |

____ |

$ |

____ |

$ |

____ |

$ |

____ |

$ |

____ |

$ |

____ |

|

____% |

____% |

____% |

| 30% |

$ |

____ |

|

$ |

____ |

$ |

____ |

$ |

____ |

$ |

____ |

$ |

____ |

$ |

____ |

|

____% |

____% |

____% |

| 25% |

$ |

____ |

|

$ |

____ |

$ |

____ |

$ |

____ |

$ |

____ |

$ |

____ |

$ |

____ |

|

____% |

____% |

____% |

| 20% |

$ |

____ |

|

$ |

____ |

$ |

____ |

$ |

____ |

$ |

____ |

$ |

____ |

$ |

____ |

|

____% |

____% |

____% |

| 15% |

$ |

____ |

|

$ |

____ |

$ |

____ |

$ |

____ |

$ |

____ |

$ |

____ |

$ |

____ |

|

____% |

____% |

____% |

| 10% |

$ |

____ |

|

$ |

____ |

$ |

____ |

$ |

____ |

$ |

____ |

$ |

____ |

$ |

____ |

|

____% |

____% |

____% |

| 5% |

$ |

____ |

|

$ |

____ |

$ |

____ |

$ |

____ |

$ |

____ |

$ |

____ |

$ |

____ |

|

____% |

____% |

____% |

| 3% |

$ |

____ |

|

$ |

____ |

$ |

____ |

$ |

____ |

$ |

____ |

$ |

____ |

$ |

____ |

|

____% |

____% |

____% |

| 0% |

$ |

____ |

|

$ |

____ |

$ |

____ |

$ |

____ |

$ |

____ |

$ |

____ |

$ |

____ |

|

____% |

____% |

____% |

| -3% |

$ |

____ |

|

$ |

____ |

$ |

____ |

$ |

____ |

$ |

____ |

$ |

____ |

$ |

____ |

|

____% |

____% |

____% |

| -5% |

$ |

____ |

|

$ |

____ |

$ |

____ |

$ |

____ |

$ |

____ |

$ |

____ |

$ |

____ |

|

____% |

____% |

____% |

| -10% |

$ |

____ |

|

$ |

____ |

$ |

____ |

$ |

____ |

$ |

____ |

$ |

____ |

$ |

____ |

|

____% |

____% |

____% |

| -15% |

$ |

____ |

|

$ |

____ |

$ |

____ |

$ |

____ |

$ |

____ |

$ |

____ |

$ |

____ |

|

____% |

____% |

____% |

| -20% |

$ |

____ |

|

$ |

____ |

$ |

____ |

$ |

____ |

$ |

____ |

$ |

____ |

$ |

____ |

|

____% |

____% |

____% |

| -25% |

$ |

____ |

|

$ |

____ |

$ |

____ |

$ |

____ |

$ |

____ |

$ |

____ |

$ |

____ |

|

____% |

____% |

____% |

| -30% |

$ |

____ |

|

$ |

____ |

$ |

____ |

$ |

____ |

$ |

____ |

$ |

____ |

$ |

____ |

|

____% |

____% |

____% |

| -35% |

$ |

____ |

|

$ |

____ |

$ |

____ |

$ |

____ |

$ |

____ |

$ |

____ |

$ |

____ |

|

____% |

____% |

____% |

| -40% |

$ |

____ |

|

$ |

____ |

$ |

____ |

$ |

____ |

$ |

____ |

$ |

____ |

$ |

____ |

|

____% |

____% |

____% |

| -45% |

$ |

____ |

|

$ |

____ |

$ |

____ |

$ |

____ |

$ |

____ |

$ |

____ |

$ |

____ |

|

____% |

____% |

____% |

| -50% |

$ |

____ |

|

$ |

____ |

$ |

____ |

$ |

____ |

$ |

____ |

$ |

____ |

$ |

____ |

|

____% |

____% |

____% |

| -55% |

$ |

____ |

|

$ |

____ |

$ |

____ |

$ |

____ |

$ |

____ |

$ |

____ |

$ |

____ |

|

____% |

____% |

____% |

| -60% |

$ |

____ |

|

$ |

____ |

$ |

____ |

$ |

____ |

$ |

____ |

$ |

____ |

$ |

____ |

|

____% |

____% |

____% |

| -65% |

$ |

____ |

|

$ |

____ |

$ |

____ |

$ |

____ |

$ |

____ |

$ |

____ |

$ |

____ |

|

____% |

____% |

____% |

| -70% |

$ |

____ |

|

$ |

____ |

$ |

____ |

$ |

____ |

$ |

____ |

$ |

____ |

$ |

____ |

|

____% |

____% |

____% |

| -75% |

$ |

____ |

|

$ |

____ |

$ |

____ |

$ |

____ |

$ |

____ |

$ |

____ |

$ |

____ |

|

____% |

____% |

____% |

| -80% |

$ |

____ |

|

$ |

____ |

$ |

____ |

$ |

____ |

$ |

____ |

$ |

____ |

$ |

____ |

|

____% |

____% |

____% |

| -85% |

$ |

____ |

|

$ |

____ |

$ |

____ |

$ |

____ |

$ |

____ |

$ |

____ |

$ |

____ |

|

____% |

____% |

____% |

| -90% |

$ |

____ |

|

$ |

____ |

$ |

____ |

$ |

____ |

$ |

____ |

$ |

____ |

$ |

____ |

|

____% |

____% |

____% |

| -95% |

$ |

____ |

|

$ |

____ |

$ |

____ |

$ |

____ |

$ |

____ |

$ |

____ |

$ |

____ |

|

____% |

____% |

____% |

| -100% |

$ |

____ |

|

$ |

____ |

$ |

____ |

$ |

____ |

$ |

____ |

$ |

____ |

$ |

____ |

|

____% |

____% |

____% |

Understanding Your

Investment 17

The following examples illustrate how

payments are designed to operate in different hypothetical scenarios.

Example—The Market

Reference Level at the close of the New York Stock Exchange on the Option Expiration Date is $___ (125% of the Initial Market Reference Level—an

increase of 25%).

Using this set of facts, the total

hypothetical amount per unit over the trust’s life is approximately $___, consisting of the following intended amounts:

• |

|

the trust receiving $___ per unit on the ATM Purchased Call

Options; |

• |

|

the trust receiving $___ per unit on the ITM Purchased Call

Options; |

• |

|

the trust paying $___ per unit on the OTM Written Call Options;

and |

• |

|

no amounts being paid on the OTM Written Put Options or ATM

Purchased Put Options (i.e. expiring worthless). |

Example—The Market

Reference Level at the close of the New York Stock Exchange on the Option Expiration Date is $___ (103% of the Initial Market Reference Level—an

increase of 3%).

Using this set of facts, the total

hypothetical amount per unit over the trust’s life is approximately $___, consisting of the following intended amounts:

• |

|

the trust receiving $___ per unit on the ATM Purchased Call

Options; |

• |

|

the trust receiving $___ per unit on the ITM Purchased Call

Options; and |

• |

|

no amounts being paid on the OTM Written Call Options, OTM Written

Put Options or ATM Purchased Put Options (i.e. expiring worthless). |

Example—The Market

Reference Level at the close of the New York Stock Exchange on the Option Expiration Date is $___ (100% of the Initial Market Reference Level—no

change).

Using this set of facts, the total

hypothetical amount per unit over the trust’s life is approximately $___, consisting of the following intended amounts:

• |

|

the trust receiving a payment of $___ per unit on the ITM

Purchased Call Options; and |

• |

|

no payments being made on the ATM Purchased Call Options, the OTM

Written Call Options, the OTM Written Put Options or the ATM Purchased Put Options (i.e. expiring worthless). |

Example—The Market

Reference Level at the close of the New York Stock Exchange on the Option Expiration Date is $___ (97% of the Initial Market Reference Level—a

decrease of 3%).

Using this set of facts, the total

hypothetical amount per unit over the trust’s life is approximately $___, consisting of the following intended amounts:

• |

|

the trust receiving $___ per unit on the ITM Purchased Call

Options; |

• |

|

the trust receiving $___ per unit on the ATM Purchased Put

Options; and |

• |

|

no amounts being paid on the ATM Purchased Call Options, the OTM

Written Call Options or the OTM Written Put Options (i.e. expiring worthless). |

18 Understanding Your

Investment

Example—The Market

Reference Level at the close of the New York Stock Exchange on the Option Expiration Date is $___ (25% of the Initial Market Reference Level—a

decrease of 75%).

Using this set of facts, the total

hypothetical amount per unit over the trust’s life is approximately $___, consisting of the following intended amounts:

• |

|

the trust receiving $___ per unit on the ITM Purchased Call

Options; |

• |

|

the trust paying $___ per unit on the OTM Written Put

Options; |

• |

|

the trust receiving $___ per unit on the ATM Purchased Put

Options; |

• |

|

no amounts being paid on the ATM Purchased Call Options or OTM

Written Call Options (i.e. expiring worthless). |

Understanding Your

Investment 19

HOW TO BUY

UNITS

You can buy units of a trust on any

business day the New York Stock Exchange is open by contacting your financial professional. Unit prices are available daily on the Internet at

www.AAMlive.com. The public offering price of units includes:

• |

|

the net asset value per unit plus |

• |

|

cash to pay organization costs plus |

The “net asset value per unit”

is the value of the securities, cash and other assets in a trust reduced by the liabilities of a trust divided by the total units outstanding. In

calculating the net asset value per unit, the values of the written Options are netted against the value of the purchased Options. We often refer to

the public offering price of units as the “offer price” or “purchase price.” The offer price will be effective for all orders

received prior to the close of regular trading on the New York Stock Exchange (normally 4:00 p.m. Eastern time). If we receive your order prior to the

close of regular trading on the New York Stock Exchange or authorized financial professionals receive your order prior to that time and properly

transmit the order to us by the time that we designate, then you will receive the price computed on the date of receipt. If we receive your order after

the close of regular trading on the New York Stock Exchange, if authorized financial professionals receive your order after that time or if orders are

received by such persons and are not transmitted to us by the time that we designate, then you will receive the price computed on the date of the next

determined offer price provided that your order is received in a timely manner on that date. It is the responsibility of the authorized financial

professional to transmit the orders that they receive to us in a timely manner. Certain broker-dealers may charge a transaction or other fee for

processing unit purchase orders.

Organization Costs. During

the initial offering period, part of the value of the units represents an amount of cash deposited to pay the costs of creating your trust. These costs

include the costs of preparing the registration statement and legal documents, federal and state registration fees, the initial fees and expenses of

the trustee and the initial audit. Your trust will reimburse us for these costs at the end of the initial offering period or after six months, if

earlier. The value of your units will decline when the trust pays these costs.

Value of the Securities.

We determine the value of the securities as of the close of regular trading on the New York Stock Exchange on each day that exchange is open. We

determine the value of the Options based on our good faith determination of the Options’ fair value. We generally determine the value of the

Options based on the last quoted sale price for the Options where readily available and appropriate. In cases where the Options were not traded on the

valuation date or where the evaluator determines that market quotations are unavailable or inappropriate, the value of the Options is based on the last

asked or bid price in the over-the-counter market if available and appropriate. If market quotes, ask prices and bid prices are unavailable or

inappropriate, each Option’s value is based on the evaluator’s good faith determination of the fair value of the Options at its reasonable

discretion based on the following methods or any combination thereof whichever the evaluator deems appropriate: (a) on the basis of the current ask or

bid price for comparable options, (ii) by determining the valuation of the Option on the ask or bid side of the market by appraisal or (iii) by any

combination of the above. During the initial offering period such determination for the purchased Options is generally on the basis of ask prices and

for the written Options is generally on the basis of bid prices. After the initial offering period ends, such determination for the purchased Options

will generally be on the basis of bid prices and for the written Options will generally be on the basis of ask prices.

20 Understanding Your

Investment

The ask side price generally represents

the price at which dealers, market-makers or investors in the market are willing to sell a security and the bid side evaluation generally represents

the price that dealers, market-makers or investors in the market are willing to pay to buy a security. The bid side evaluation is lower than the ask

side evaluation. As a result of this pricing method, unitholders should expect a decrease in the net asset value per unit on the day following the end

of the initial offering period equal to the difference between the current ask side evaluations and bid side evaluations of the

Options.

Capelogic, Inc., an independent pricing

service, determined the initial prices of the securities shown under “Investment Summary—Portfolio” in this prospectus as described

above at the close of regular trading on the New York Stock Exchange on the business day before the date of this prospectus. On the first day we sell

units we will compute the unit price as of the close of regular trading on the New York Stock Exchange or the time the registration statement filed

with the Securities and Exchange Commission becomes effective, if later.

Transactional Sales Fee.

You pay a fee in connection with purchasing units. We refer to this fee as the “transactional sales fee.” You pay the transactional sales fee

at the time you buy units. The maximum sales fee equals ___% of the public offering price per unit at the time of purchase. The transactional sales fee

is the difference between the total sales fee percentage (maximum of ___% of the public offering price per unit) and the remaining fixed dollar

creation and development fee ($___ per unit during the initial offering period). The transactional sales fee equals ___% of the public offering price

per unit during the initial offering period based on a $__ public offering price per unit, which is the unit price on the day before the trust’s

inception date. Since the transactional sales fee actually equals the difference between the total sales fee and the remaining creation and development

fee, the percentage and dollar amount of the transactional sales fee will vary as the public offering price per unit varies. The transactional sales

fee does not include the creation and development fee which is described under “Fees and Expenses.” If you purchase units after the creation

and development fee is paid, the secondary market transactional sales fee is equal to _____% of the public offering price per unit.

Fee Accounts. Investors

may purchase units through registered investment advisers, certified financial planners or registered broker-dealers who in each case either charge

investor accounts (“Fee Accounts”) periodic fees for brokerage services, financial planning, investment advisory or asset management

services, or provide such services in connection with an investment account for which a comprehensive “wrap fee” charge (“Wrap

Fee”) is imposed. You should consult your financial professional to determine whether you can benefit from these accounts. If units of the

trust are purchased for a Fee Account and the units are subject to a Wrap Fee in such Fee Account (i.e., the trust is “Wrap Fee

Eligible”), then investors may be eligible to purchase units of the trust in these Fee Accounts at a reduced fee. During the initial offering

period, investors may be eligible to purchase units of the trust in these Fee Accounts that are not subject to the transactional sales fee but will be

subject to the creation and development fee that is retained by the sponsor. For example, this table illustrates the sales fee you will pay as a

percentage of a $10 public offering price per unit which is the unit price on the day before the trust’s inception date (the percentage will vary

with the unit price).

Transactional sales fee |

|

|

|

|

0.00% |

|

Creation and development fee |

|

|

|

|

____% |

|

Total sales fee |

|

|

|

|

____% |

|

For units purchased in the secondary

market, investors may be eligible to purchase units of the trust in these Fee Accounts at the public offering price less the regular dealer concession.

Certain Fee Account investors may be assessed transaction or other fees on the purchase and/or redemption of units by their broker-dealer or other

processing organizations for providing

Understanding Your

Investment 21

certain transaction or account

activities. We reserve the right to limit or deny purchases of units in Fee Accounts by investors or selling firms whose frequent trading activity is

determined to be detrimental to the trust.

Minimum Purchase. The

minimum amount you can purchase of the trust appears under “Essential Information”, but such amounts may vary depending on your selling

firm.

Retirement Accounts. The

portfolio may be suitable for purchase in tax-advantaged retirement accounts. You should contact your financial professional about the accounts offered

and any additional fees imposed.

HOW TO SELL

YOUR UNITS

You can sell or redeem your units on any

business day the New York Stock Exchange is open by contacting your financial professional. Unit prices are available daily on the Internet at

www.AAMlive.com or through your financial professional. The sale and redemption price of units is equal to the net asset value per unit,

provided that you will not pay any remaining creation and development fee or organization costs if you sell or redeem units during the initial offering

period. The sale and redemption price is sometimes referred to as the “liquidation price”. Certain broker-dealers may charge a transaction or

other fee for processing unit redemption or sale requests.

Selling Units. We may

maintain a secondary market for units. This means that if you want to sell your units, we may buy them at the current net asset value, provided that

you will not pay any remaining creation and development fee or organization costs if you sell units during the initial offering period. We may then

resell the units to other investors at the public offering price or redeem them for the redemption price. Our secondary market repurchase price is the

same as the redemption price. Certain broker-dealers might also maintain a secondary market in units. You should contact your financial professional

for current repurchase prices to determine the best price available. We may discontinue our secondary market at any time without notice. Even if we do

not make a market, you will be able to redeem your units with the trustee on any business day for the current redemption price.

Redeeming Units.

Unitholders may also redeem units directly with the trustee, The Bank of New York Mellon, on any day the New York Stock Exchange is open. The

redemption price that a unitholder will receive for units is equal to the net asset value per unit, provided that unitholders will not pay any

remaining creation and development fee or organization costs if they redeem units during the initial offering period. A redeeming unitholder will

receive the net asset value for a particular day if the trustee receives the completed redemption request prior to the close of regular trading on the

New York Stock Exchange. Redemption requests received by authorized financial professionals prior to the close of regular trading on the New York Stock

Exchange that are properly transmitted to the trustee by the time designated by the trustee, are priced based on the date of receipt. Redemption

requests received by the trustee after the close of regular trading on the New York Stock Exchange, redemption requests received by authorized

financial professionals after that time or redemption requests received by such persons that are not transmitted to the trustee until after the time

designated by the trustee, are priced based on the date of the next determined redemption price provided they are received in a timely manner by the

trustee on such date. It is the responsibility of authorized financial professionals to transmit redemption requests received by them to the trustee so

they will be received in a timely manner. If a request is not received in a timely manner or is incomplete in any way, the unitholder will receive the

next net asset value computed after the trustee receives your completed request.

If you redeem your units, the trustee

will generally send you a payment for your units no later than seven days after it receives all necessary

22 Understanding Your

Investment

documentation (this will usually

only take two business days). The only time the trustee can delay your payment is if the New York Stock Exchange is closed (other than weekends or

holidays), the Securities and Exchange Commission determines that trading on that exchange is restricted or an emergency exists making sale or

evaluation of the securities not reasonably practicable, and for any other period that the Securities and Exchange Commission permits.

If we repurchase units, we may redeem

such units. When the sponsor redeems units, it is eligible to receive either a cash payment or receive an in-kind distribution. If we receive an

in-kind distribution, the trustee must follow certain requirements set forth in the trust agreement in connection with the redemption. The trust

agreement provides that in these cases (1) we are an affiliated redeeming unitholder and will receive our proportionate share of the trust’s

current net asset value (as all redeeming unitholders are entitled to receive), (2) the securities transferred must be valued in the same manner as

they are valued for computing the net asset value, (3) neither we nor any other party with a pecuniary incentive to influence the transfer or

distribution may select or influence the selection of the transferred securities, (4) the trust must distribute its proportionate share of every asset

in the trust’s portfolio with limited exceptions, (5) the transfer or distribution cannot favor us to the detriment of any other unitholder and

(6) the trustee will monitor each in-kind redemption for compliance with these requirements and maintain records for each transfer or distribution. No

unitholder other than the sponsor is eligible to receive an in-kind distribution in connection with a unit redemption.

Exchange Option. You may

be able to exchange your units for units of our other unit trusts at a reduced sales fee. You can contact your financial professional for more

information about trusts currently available for exchanges. Before you exchange units, you should read the prospectus carefully and understand the

risks and fees. You should then discuss this option with your financial professional to determine whether your investment goals have changed, whether

current trusts suit you and to discuss tax consequences. We may discontinue this option upon sixty days notice.

DISTRIBUTIONS

Distributions. Your trust

generally pays distributions of its net investment income along with any excess capital on each distribution date to unitholders of record on the

preceding record date. The record and distribution dates are shown under “Essential Information” in the “Investment Summary”

section of this prospectus. The trust is not intended to make distributions during its life. In some cases, your trust might pay a special distribution

if it holds an excessive amount of cash pending distribution. The trust will also generally make required distributions or distributions to avoid

imposition of tax at the end of each year because it is structured as a “regulated investment company” for federal tax purposes. The amount

of any distributions will vary from time to time as trust expenses change or due to other factors.

Investors who purchase units between a

record date and a distribution date will receive their first distribution on the second distribution date after the purchase.

Reports. The trustee or

your financial professional will make available to you a statement showing income and other receipts of your trust for each distribution. Each year the

trustee will also provide an annual report on your trust’s activity and certain tax information. You can request copies of security evaluations to

enable you to complete your tax forms and audited financial statements for your trust, if available.

INVESTMENT

RISKS

All investments involve risk. This

section describes the main risks that can impact the value of the securities in your portfolio. You should understand these risks before you invest. If

the value of the securities falls, the value of

Understanding Your

Investment 23

your units will also fall. We cannot

guarantee that your trust will achieve its objective or that your investment return will be positive over any period.

Market Risk. Market risk

is the risk that the value of the securities in your trust will fluctuate. This could cause the value of your units to fall below your original

purchase price. Market values fluctuate in response to various factors. These can include factors such as changes in interest rates, inflation, the

financial condition of a security’s issuer, perceptions of the issuer, or ratings on a security. While the Options are individually related to the

Market Reference Level, the return on the Options depends on the Market Reference Level at the close of the New York Stock Exchange on the Option

Expiration Date. Even though we supervise your portfolio, you should remember that we do not manage your portfolio. Your trust will not liquidate an

asset solely because the market value falls as is possible in a managed fund.

Options Risk. The value of

the Options will be affected by changes in the value of the Market Reference, the Underlying Index and its underlying securities, changes in interest