UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number (811-23127)

GoodHaven Funds Trust

(Exact name of registrant as specified in charter)

(Exact name of registrant as specified in charter)

374 Millbrun Avenue, Suite 306

Millburn, New Jersey 07041

(Address of principal executive offices) (Zip code)

(Address of principal executive offices) (Zip code)

Larry Pitkowsky

374 Millburn Avenue, Suite 306

Millburn, New Jersey 07041

Millburn, New Jersey 07041

(Name and address of agent for service)

626-914-7363

Registrant's telephone number, including area code

Date of fiscal year end: November 30

Date of reporting period: November 30, 2019

Item 1. Report to Stockholders.

Annual Report

November 30, 2019

GoodHaven Fund

Ticker: GOODX

GoodHaven Capital Management, LLC

Important Notice: The U.S. Securities and Exchange Commission will permit funds to make shareholder reports available electronically

beginning January 1, 2021. Accordingly, paper copies will no longer be mailed. Instead, at that time, the GoodHaven Fund (the “Fund”) will send a notice each time the Fund’s updated report is available on our website

(goodhavenfunds.com/shareholder_reports.html). Investors enrolled in electronic delivery will receive the notice by e-mail with links to the updated report and don’t need to take any action. Investors who are not enrolled in electronic delivery by

January 1, 2021, will receive the notice in the mail. All investors who prefer to receive shareholder reports in a printed format may, at any time, choose that option free of charge by calling 1-855-OK-GOODX or 1-855-654-6639.

GoodHaven Fund

Table of Contents

|

Shareholder Letter

|

1

|

||

|

Portfolio Management Discussion and Analysis

|

10

|

||

|

Sector Allocation

|

15

|

||

|

Historical Performance

|

16

|

||

|

Schedule of Investments

|

17

|

||

|

Statement of Assets and Liabilities

|

20

|

||

|

Statement of Operations

|

21

|

||

|

Statements of Changes in Net Assets

|

22

|

||

|

Financial Highlights

|

23

|

||

|

Notes to Financial Statements

|

24

|

||

|

Report of Independent Registered Public Accounting Firm

|

33

|

||

|

Expense Example

|

34

|

||

|

Investment Advisory Agreement

|

36

|

||

|

Trustees and Executive Officers

|

39

|

||

|

Additional Information

|

41

|

||

|

Privacy Notice

|

42

|

GoodHaven Fund

|

PERFORMANCE as of November 30, 2019 (Unaudited)

|

|

1 Year

|

Since

|

Since

|

|||

|

Calendar

|

Ended

|

5 Years

|

Incept.1

|

Incept.1

|

|

|

Year 2019

|

11/30/19

|

Annualized

|

Cumulative

|

Annualized

|

|

|

GOODX

|

19.03%

|

5.83%

|

-0.06%

|

37.31%

|

3.73%

|

|

S&P 500 Index2

|

31.49%

|

16.11%

|

10.98%

|

183.40%

|

12.80%

|

|

Wilshire 5000 Total Market Index

|

27.72%

|

12.57%

|

8.06%

|

127.11%

|

9.92%

|

|

HFRI Fundamental Growth Index3

|

13.15%

|

6.60%

|

3.30%

|

22.68%

|

2.38%

|

|

HFRI Fundamental Value Index3

|

16.07%

|

7.29%

|

4.30%

|

51.94%

|

4.94%

|

|

CS Hedge Fund Index3

|

9.31%

|

6.30%

|

2.32%

|

31.60%

|

3.22%

|

|

1

|

The Fund commenced operations on April 8, 2011.

|

|

2

|

With dividends reinvested.

|

|

3

|

Hedge Fund Index performance figures are supplied on a month end basis and are provided for illustrative purposes as a broad equity alternative asset class only. Accordingly, “since inception” hedge fund index

performance figures reflect a start date of 3/31/11 and an end date of 11/30/19. Source: Bloomberg Terminal

|

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an

investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month-end may be obtained by calling

1-855-OK-GOODX or 1-855-654-6639. The Fund imposes a 2.00% redemption fee on shares redeemed within 60 days of purchase. Performance data for an individual shareholder will be reduced by redemption fees that apply, if any. Redemption fees are paid

directly into the Fund and do not reduce overall performance of the Fund. The annualized gross expense ratio of the GoodHaven Fund is 1.10%. Please see the Fund’s Financial Highlights in this report for the most recent expense ratio.

|

“You can’t pour water into a cup that’s full. Without humility there is no learning.”

|

|

|

Anonymous

|

January 3, 2020

To Our Fellow Shareholders:

This is the first shareholder letter since the advisor, GoodHaven Capital Management (“GoodHaven” or the “Advisor”), completed its recent consensual reorganization (reorg). In this letter I’ll recap

the reorg, discuss the portfolio and performance, the markets/economic environment and some thoughts on how I think about the Fund going forward. Writing to you is an important responsibility – but writing per se is hardly my passion – expect worse

prose and over time somewhat shorter letters.

In August 2019, the Fund’s independent trustees unanimously approved our new investment advisory agreement. Subsequently, in late November 2019, the Fund’s shareholders approved (with approximately

99.68% of those voting doing so affirmatively) the same. In conjunction with these approvals GoodHaven Capital’s

1

GoodHaven Fund

internal restructuring was completed which resulted in me becoming the sole controlling owner and portfolio manager. I thank our independent trustees and shareholders for

their support. We could not have arrived at this point without the full backing of our long-time minority partner Markel Corporation, led by Tom Gayner and Dan Gertner. As previously disclosed, Markel recently invested an additional $15 million into

the Fund. I’ve run out of accolades to describe what great partners they have been and continue to be. My long-time partner and the firm’s co-founder Keith Trauner maintains a minority ownership stake in the firm, is here to help with the transition

and remains a friend to the firm and to me. Without Keith, there would have been no GoodHaven and his contributions to our list of successes is long.

Change can be invigorating and a plus, but don’t expect major alterations to our core investment philosophy. We remain focused on striving to compound wealth at attractive rates over time while being

mindful of risk. Both markets and the business of money-management have changed in recent years (i.e. gotten harder to navigate). Value investing has been through a protracted period of struggle and many of our brethren have exited the business. But

there are now good reasons to think that period of stress may be ending and our portfolio appears attractively positioned and undervalued.

There is no shortage of well documented industry statistics that you’ve previously read here and elsewhere, detailing the extreme discrepancies recently between the stock price performance of “value”

and “growth” companies – as imperfect as those categories are. The data is obvious, well documented and likely implies an inflection point in sector performance sooner rather than later. But I’m sure you’re a bit tired of reading about this topic,

and I’m a bit tired of penning my name to its discussion – so for this letter, enough said on that topic. By the way, we are always striving for strong long-term performance, whether or not we get help from some mean-reversion in the above trends.

I’d categorize 2019’s performance as solid. For the calendar year we were up about 19%. These are good absolute numbers in a low-rate world, and given that we held a material amount of cash – a drag

on short-term performance in an up period. What’s also important is that I think the portfolio is still undervalued despite the recent gains and that business results across our portfolio companies have been strong. But we didn’t keep up with the

major averages, and given the weak markets in Q3 and Q4 2018 we should have found a few more things to buy then which would have helped 2019 be even stronger.

Let’s discuss the portfolio. Our top five holdings are the same names as when we wrote you last: Barrick Gold, Alphabet, Berkshire Hathaway, Jefferies and WPX Energy.

Barrick was our biggest gainer in fiscal 2019, up about 32%. The wisdom of the Barrick/Randgold merger envisioned by John Thornton and Mark Bristow is now obvious. Recent improvements in production,

costs, non-core asset sales, resolving the Tanzania issues, increasing dividends and a balance-sheet heading towards net debt free are noteworthy. It’s critical to keep in mind how important the price of gold

2

GoodHaven Fund

is to Barrick’s earnings, cash flow and intrinsic value. Barrick also has material exposure to copper mining – and the supply/demand backdrop to copper pricing seems

positive. We trimmed our Barrick holdings during the year, and may do so from time to time, but we remain constructive on the company’s future outlook.

Trading inactivity (not to be confused with research inactivity) usually leads to good compounded investment returns when the underlying business sees its results power ahead AND you paid an

attractive entry price. This has been the case overall with our investment in Alphabet – also a top gainer in fiscal 2019, up about 20%. Since fiscal 2012, Alphabet’s (then Google) earnings per share have gone from about $16/share to a consensus

estimate of about $55/share in 2020. Many other Alphabet financial metrics have seen progress during that period. Along the way the quality of the reported earnings has improved, as has the governance, and material losses in new ventures continue to

mask the true earnings power. We have had some help from a price earnings (P/E) multiple expansion. Material optionality is only now being surfaced in products such as Maps and eCommerce. One only needs to observe the impact Google’s search engine

changes had recently on the results at TripAdvisor and Expedia (negative) to be reminded of Google’s dominance1. Of course, this dominance has led to a more hostile

regulatory climate – which they must navigate, and anything can change over time. I continue to be comfortable with having Alphabet as a top holding while being mindful that P/E multiples can contract as well as expand.

By the way, Sundar Pichai was recently elevated to CEO of the parent company Alphabet in addition to his role at the Google search division. His new compensation plan includes a hurdle for vesting of

his PSU’s (Performance Stock Units) that measure performance of Alphabet vs. the S&P 100 – a positive step in aligning interests with shareholders.

Berkshire continues to be a top holding and surprisingly misunderstood by many commentators. While the stock price only inched forward during the period intrinsic value has progressed at an

acceptable rate. The shares remain undervalued and possess plenty of optionality given the cash hoard. By the way – trends (pricing/terms) in the P&C insurance industry broadly are improving. Succession planning and governance continues to evolve

sensibly at Berkshire and while it’s not going out on a limb to say Mr. Buffett and Mr. Munger will pass away one day, I don’t think that disturbs the investment case for Berkshire today.

Jefferies declined modestly during the period while continuing to thoughtfully increase per share value. The current playbook continues to be to improve the return on equity (ROE) of the core

business while also opportunistically disposing of non-core assets and repurchasing shares – as long as they continue to trade cheaply. Despite robust increases in financial markets since the financial crisis ROE’s across the investment

banking/broker dealer space have been muted in general. The reasons

__________

|

1

|

http://oltnews.com/travel-sites-fault-google-for-revenue-slowdowns

|

3

GoodHaven Fund

are varied by company, including the obvious impact of less leverage and lower interest rates as well as the less obvious impact of more challenging and structural changes in certain lines of business. No one is more

focused on improving the ROE at Jefferies than Rich Handler and Brian Friedman and they have not gotten the credit they deserve for simplifying Jefferies, managing risk well and positioning the company for the future. We remain optimistic about our

investment in Jefferies, which is still priced below tangible book value.

WPX, historically a successful holding for us, declined during the period – though it has now increased materially in the last several weeks – up about 40% since November 30, 2019. I’ll skip

re-hashing what an impressive job Rick Muncrief and team have done here historically. On December 16, 2019, WPX announced a material acquisition of Felix Energy, adding to its strong presence in the Permian Basin. The Felix transaction was struck at

a 60% discount to comparable Permian deals in the past two years and at a discount to WPX’s trading multiple pre-deal. We like the acquisition and its implication for WPX’s key financial metrics. WPX’s stock price materially underperformed the

business progress until the last few weeks – and material upside remains. This is not an easy business, heavy capex is required, assets deplete, and oil prices are a very important component to the business overall. Having said that, we are

comfortable with WPX, which appears undervalued, very well-run and with manageable leverage.

American Airlines was a material detractor during the period despite acceptable results and a cheap stock price that became cheaper – now trading at about 5x 2020 earnings. American continues to

trail some of its brethren (including Delta, which we own as well) in certain key operating metrics. The 737-Max grounding was both bad and good – bad in the material inefficiencies it caused for American’s fleet, good in keeping industry capacity

(pricing) tight. American also continues to struggle to get an acceptable mechanics union contract renewal completed. These two things are likely to self-correct sooner rather than later. Free cash flow at American is about to increase dramatically

– to perhaps $5 billion over the next two years – which compared to their recent market cap of about $12 billion is material, as capital spending declines from peak levels2.

American’s near-term focus is to deleverage. We feel comfortable with our airline industry exposure with both holdings – but especially American – undervalued, while the industry evolves as we’d hoped it would.

Builder’s FirstSource was our second biggest gainer during the period, up about 90%, despite being a moderate sized holding. This is how it works when it works – so let’s examine the backdrop,

outcome and process. Builder’s is the nation’s largest supplier of structural building products and services to the professional market for new residential construction and repair and remodeling. The company was formed through a merger of two

competitors, leaving the company leveraged and with much work to do executing on the promised substantial synergies. This is a consolidating,

__________

|

2

|

https://americanairlines.gcs-web.com/static-files/8a1302c7-8253-46e7-96bf-94ba7af4c294

|

4

GoodHaven Fund

cash generative industry starting to favor the biggest players, and with minimal real disintermediation risks. However, they do operate in a cyclical industry. Starting in mid-2018, single family housing trends

weakened, as a combination of higher home prices and rising mortgage rates tempered demand. Builder’s was progressing well on their post-merger operating plans, ahead of my expectations, despite a volatile environment for lumber prices. However, the

shares found themselves back at $14 in November 2018, trading at about 10x adjusted earnings as the share prices of many companies in/around the housing industry were weak and extrapolating a deeper housing downturn. Our view was that Builder’s stock

price reflected a draconian and unlikely industry outlook, but one they could manage, and that substantial upside existed if conditions were just flattish and management continued to execute. So since then Builder’s leadership, led by COB Paul Levy,

CEO Chad Crowe and CFO Peter Jackson, has performed well. For the period ending September 30, 2019 EBITDA margins are up 100 bps YOY, leverage is down from 3.9x (debt/EBITDA) to 2.5x YOY and single-family housing starts actually saw industry growth

in 2019 after entering the year with the headlines screaming negative. The shares almost doubled during the period, remain attractively priced, and the positive backdrop of a still underbuilt single family housing market and more consolidation

opportunities remains. Our other direct housing related company Lennar Corporation – Class B was also a solid contributor, up about 37% for the annual period.

We added some FNMA common to our FNMA Preferred holdings – this situation is evolving well, has yielded gains so far, but remains volatile with many variables at play.

Rounding things out – Macy’s was a material decliner during the period and unlikely to be a holding for the long-term. HP Inc. was a great turnaround investment for us early on but declined during

the period. Though still cheap I fear we hung around a bit too long as structural industry risks keep appearing in their print division. There is a possible merger with Xerox being pursued by Xerox – we wish them godspeed.

Overall our investment process has been more productive recently: quality new ideas include Store Capital, Delta Air Lines Inc., Lennar Corporation – Class B, Builder’s FirstSource, Hess Midstream,

Mohawk Industries and special situations like the Fannie Mae Pref’s (and now common). In addition, we have avoided “cutting the flowers and watering the weeds” by allowing Berkshire and Alphabet to become larger holdings. Today’s obvious excesses

and a confusing and noisy macro backdrop will not distract us from searching far and wide for new and sensible investments that have both potential for gain and a margin of safety. Along those lines we’ve just started buying a new and interesting

holding – a smaller, foreign company – more in the next letter.

Further and even with extensive experience, a review of our past process leaves me reminded that: 1) growing high return companies are special; 2) without a catalyst, intrinsic value better be rising

as you sleep; 3) there is no shame in jumping over lower hurdles; and 4) it’s not an IQ test – decision making, insights and position

5

GoodHaven Fund

sizing are critical aspects of performance. Of course, material realized losses are just unacceptable. Despite my insistence that our process always improve it’s also usually

a bad idea when allocating capital to immediately do what you wish you had done three or four years ago.

The economic backdrop continues to be very unusual. The structure of financial markets is also much different than even five or six years ago. Way back in 2015, when discussing very low interest

rates, money printing, and more Berkshire Vice-Chairman Charlie Munger said3:

“I think something so strange and so important is likely to have consequences. I think it’s highly likely that the people who confidently think they know the consequences – none of whom predicated

this – now they know what’s going to happen next? Again, the witch doctors. You ask me what’s going to happen? Hell, I don’t know what’s going to happen. I regard it all as very weird. If interest rates go to zero and all the governments in the world

print money like crazy and prices go down – of course I’m confused. Anybody who is intelligent, who is not confused, doesn’t understand the situation very well. If you find it puzzling, your brain is working correctly.”

The above summary of things is still relevant, and you can add to that very large domestic budget deficits and as the World Bank just warned a greater than 50% increase since 2010 in emerging market

debt levels. Though it’s worth noting that domestic consumer debt seems in good shape. Munger’s caustic style aside I think he makes important points not only about the unusual economic set of circumstances but also about the difficulty in accurately

predicting the effect these things have had and will have on markets. I am always reminded that it’s not what you don’t know that often gets you in trouble, it’s in not knowing what you don’t know that does.

Plenty has been written about the current structural makeup of today’s domestic financial markets – but it’s worthy of a few more comments. While the exact number is unknown, commentators have

estimated that around 75% of today’s domestic stock market trading is in the hands of automated/electronic strategies of one sort or another. This is a very different market structure than only five or six years ago, much less fifteen. Those

strategies often have very little in common with one another. But what they might one day have in common is a desire to, at similar times, be net sellers of stocks, begetting more selling and so on. Many of these strategies do not make trading

decisions based on the fundamentals or the economic outlook of what they are selling (or buying). The dramatic declines we saw in Q3 and Q4 of 2018 were only a taste of the market volatility we may experience periodically. I have no interest in

pontificating about any of these different automated approaches to investing. Some make sense to me even if it’s not my skill set, some don’t – in fact I wish I had bought some Blackrock Inc. stock years ago for us. But today’s market structure does

remind me that while it has always been critical for a fundamental investor to be able to ignore stock price movements in the short-term and focus on business fundamentals – this is more important than ever, and harder. Many say they do it, many

fewer do.

__________

|

3

|

https://www.forbes.com/sites/phildemuth/2015/03/26/quote-of-the-year/#732c9d1322f4

|

6

GoodHaven Fund

At present the domestic economy seems, for lack of a more sophisticated phrase, OK. Let us recall that it was only a year ago that the S&P 500 Index had its worst monthly performance (December

2018) since the Depression and that it was a foregone conclusion by many (including people I admire) that a recession was upon us. This is not to say that yours truly knew that the economy would improve, or that the Fed would return to a more

accommodative monetary stance. I did not. While I’m sure we’ll have recessions in the future I’m also sure I can’t predict when or how long one will last and the depth etc. I’m also suspect that even if your crystal ball told you the timing and

duration of the next recession you should pass on an investment that met all your criteria and looked like an attractive risk adjusted future compounded return.

A few closing comments. The competitive dynamics in many industries is more unforgiving than in the recent past – technology and more are amongst the culprits – but many formally acceptable second

and third tier companies look more challenged than ever. It’s also true that the real economy is more impacted by financial market volatility than historically – everyone checking their portfolios 24/7 has seen to that. These are just part of today’s

investment and business landscape.

I thank you all for your continued confidence and support of the reorg. I have added to my Fund holdings this past year and have made certain sacrifices within the business to help facilitate the

recent reorg. I remain confident and excited about our future.

Sincerely,

Larry

Mutual fund investing involves risk. Principal loss is possible. The Fund is non-diversified, meaning it may concentrate its assets in fewer individual

holdings than a diversified fund. Therefore, the Fund is more exposed to individual stock volatility than a diversified fund. The Fund invests in midcap and smaller capitalization companies, which involve additional risks such as limited liquidity

and greater volatility. The Fund may invest in foreign securities which involve political, economic and currency risks, greater volatility and differences in accounting methods. These risks are enhanced in emerging markets. The Fund may invest in

REITs, which are subject to additional risks associated with direct ownership of real property including decline in value, economic conditions, operating expenses, and property taxes. Investments in debt securities typically decrease in value when

interest rates rise. This risk is usually greater for longer-term debt securities. Investments in lower-rated, non-rated and distressed securities present a greater risk of loss to principal and interest than higher-rated securities.

The opinions expressed are those of Larry Pitkowsky through the end of the period for this report, are subject to change, and are not intended to be a forecast of future events, a guarantee of future results, nor

investment advice. This material may include statements that constitute “forward-looking statements” under the U.S. securities laws. Forward-looking statements include, among other things, projections,

7

GoodHaven Fund

estimates, and information about possible or future results related to the Fund, market or regulatory developments. The views expressed herein are not guarantees of future performance or economic results and involve

certain risks, uncertainties and assumptions that could cause actual outcomes and results to differ materially from the views expressed herein. The views expressed herein are subject to change at any time based upon economic, market, or other

conditions and GoodHaven undertakes no obligation to update the views expressed herein. While we have gathered this information from sources believed to be reliable, GoodHaven cannot guarantee the accuracy of the information provided. Any discussions

of specific securities or sectors should not be considered a recommendation to buy or sell those securities. The views expressed herein (including any forward-looking statement) may not be relied upon as investment advice or as an indication of the

Fund’s trading intent. Information included herein is not an indication of the Fund’s future portfolio composition.

References to other mutual funds should not be interpreted as an offer of these securities.

Must be preceded or accompanied by a prospectus. It is not possible to invest directly in an index.

Cash flow is generally defined as the cash a company generates from its business operations, before capital or securities investments.

Free cash flow is generally defined as cash revenues less all normal operating expenses (including interest expense) and less an estimate of the capital spending necessary to maintain the business in its current state.

Tangible Book Value represents the accounting value remaining after a corporation’s liabilities are subtracted from its assets (but excluding the value of any intangible assets, such as goodwill).

P/E Ratio: Valuation ratio calculated by dividing current stock price of a company by its earnings per share

Return on Equity: A measure of financial performance calculated by dividing net income by shareholder’s equity (assets minus liabilities)

Basis Point: One hundredth of a percent (0.01%)

The S&P 500 Index is a capitalization weighted index of 500 large capitalization stocks which is designed to measure broad domestic securities markets.

The Wilshire 5000 Total Market Index (full-cap) measures the performance of all U.S. equity securities with readily available price data. Over 5,000 capitalization weighted security returns are used to adjust the

index.

HFRI Fundamental Growth strategies employ analytical techniques in which the investment thesis is predicated on assessment of the valuation characteristics on the underlying companies which are expected to have

prospects for earnings growth and capital appreciation exceeding those of the broader equity market. Investment theses are focused on characteristics of the firm’s financial statements in both an absolute sense and relative to other similar

securities and more broadly, market indicators. Strategies employ investment processes designed to identify attractive opportunities in securities of companies which are experiencing or expected to experience abnormally high levels of growth compared

with relevant benchmarks growth in earnings, profitability, sales or market share.

HFRI Fundamental Value Index strategies employ investment processes designed to identify attractive opportunities in securities of companies which trade a valuation metrics by which the manager determines them to be

inexpensive and undervalued when compared with relevant benchmarks. Investment theses are focused on characteristics of the firm’s financial statements in both an absolute sense and relative to other similar securities and more broadly, market

indicators. Relative to Fundamental Growth strategies, in which earnings growth and capital appreciation is expected as a function of expanding market share & revenue increases, Fundamental Value strategies typically focus on equities which

currently generate high cash flow, but trade at discounted valuation multiples, possibly as a result of limited anticipated growth prospects or generally out of favor conditions, which may be specific to sector or specific holding.

8

GoodHaven Fund

CS Hedge Fund Index is an asset-weighted hedge fund index derived from the TASS database of more than 5000 funds. The index consists of funds with a minimum of US $10 million under management and a current audited

financial statement. Funds are separated into primary subcategories based on investment style. The index in all cases represents at least 85% of the assets under management in the universe. The index is rebalanced monthly, and funds are reselected on

a quarterly basis. Index NAVs are updated on the 15th of each month.

The GoodHaven Fund is distributed by Quasar Distributors, LLC

9

GoodHaven Fund

|

PORTFOLIO MANAGEMENT DISCUSSION AND ANALYSIS (Unaudited)

|

The Net Asset Value (“NAV”) of the GoodHaven Fund was $24.48 at November 30, 2019 based on 3,851,757 shares outstanding. This compares to the Fund’s NAV of $23.43 at November 30, 2018, an NAV of

$22.07 at May 31, 2019, and an NAV of $20.00 at inception on April 8, 2011. As of December 31, 2019, the date of this manager’s discussion and analysis (MD&A), the Fund’s NAV was $25.32, an approximate 5% increase since the end of the fiscal

period (inclusive of the dividend distributed in December 2019). Although the Fund did not pay a capital gains distribution in 2019, it did pay an income distribution of $0.32201 per share which reduced per share NAV on the ex-dividend date

(December 13, 2019). Shareholders should be aware that the Fund has paid capital gains and income distributions in prior years that reduced NAV by the amount of a distribution on the ex-dividend date. Please note that except where otherwise

indicated, discussions in this MD&A relate to the period ended November 30, 2019.

In late November 2019, the Fund’s shareholders approved a new investment advisory agreement for the Fund in conjunction with a reorganization of the Advisor which has subsequently been completed.

Details of this reorganization have been previously disclosed in a proxy filing dated October 25, 2019. As a result of the reorganization Larry Pitkowsky became the Fund’s sole portfolio manager, Chairman of the Board of Trustees, and the

controlling owner of the Advisor. Keith Trauner is now a minority partner of the Advisor and no longer a portfolio manager of the Fund.

The Fund’s positive absolute 2019 performance for the 2019 fiscal period of up 5.83% was not enough to keep up with an unusually strong increase in the S&P 500 Index of up 16.11%, although a

number of other equity indexes did not perform nearly as well as the S&P 500 Index. The Fund’s substantial cash position acts as a drag on performance in a strong market environment. Please see the portfolio manager’s letter to shareholders for

additional information regarding performance and comparisons to other indexes. All comparisons assume reinvested dividends.

The performance data quoted above represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment

will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent

month-end may be obtained by calling 1-855-OK-GOODX or 1-855-654-6639.

Subsequent to the end of the period, the Fund increased approximately an additional 5% in the month of December (including the dividend of $0.32201 paid on December 13, 2019) . Recent years have

been frustrating for investors that follow a similar “value” investment approach used by the Fund, particularly as the underperformance was juxtaposed by a massive flow of capital into index funds. Our calendar 2019 results, while strong on an

absolute basis lagged on a relative basis. We continue to note that the Fund’s portfolio looks very different than the S&P 500 in

10

GoodHaven Fund

|

PORTFOLIO MANAGEMENT DISCUSSION AND ANALYSIS (Unaudited)

(Continued)

|

composition and concentration and has a number of non-correlated investments and a significant cash holding. As mentioned previously, we note that multiple investment managers, some with outstanding long-term records,

but who have struggled in the last couple of years, recently retired or decided to wind-up their funds.

While the Fund’s record since inception is still colored by a material divergence between mid-2014 and the end of 2015, we continue to believe that the investment manager’s strategy is sound and risk

averse. The portfolio manager continues to be among the largest individual owners of Fund shares and continues to have significant personal assets at risk, aligning with the interests of shareholders. Although we cannot predict when investors will

once more exhibit risk aversion and abandon more aggressive strategies, we continue to believe that regression to the mean is a core characteristic of financial markets. Having said that the advisor is focused on improving the Fund’s performance

regardless of any help from sector mean reversion.

The portfolio manager believes that short-term performance figures are less meaningful than a comparison of longer periods and that a long-term investment strategy should be properly judged over a

period of years rather than weeks or months. Moreover, as we have noted, value investing has been out of favor for an extended period of years. Please note that the S&P 500 Index is an unmanaged index incurring no fees, expenses, or taxes and

is shown solely for the purpose of comparing the Fund’s portfolio to an unmanaged and diversified index of large companies. There are other indexes whose performance may diverge materially from that of the S&P 500 Index. Below is a table of the

Fund’s top ten holdings and categories as of November 30, 2019 (as a percent of net assets).

|

Top 10 Holdings1,3

|

|

%

|

Top Categories2,3

|

|

%

|

|||||

|

Barrick Gold Corp.

|

7.7

|

%

|

Cash and Equivalents

|

23.6

|

%

|

|||||

|

Alphabet Inc. – Class C

|

7.3

|

%

|

Financial Services

|

9.8

|

%

|

|||||

|

Berkshire Hathaway

|

Oil & Gas Exploration

|

|||||||||

|

Inc. – Class B

|

6.9

|

%

|

& Production

|

9.0

|

%

|

|||||

|

Jefferies Financial Group Inc.

|

6.5

|

%

|

Air Transportation

|

7.8

|

%

|

|||||

|

WPX Energy, Inc.

|

5.5

|

%

|

Metals & Mining

|

7.7

|

%

|

|||||

|

American Airlines Group Inc.

|

4.1

|

%

|

Computers & Software

|

7.3

|

%

|

|||||

|

Delta Air Lines, Inc.

|

3.7

|

%

|

Diversified Holding Companies

|

6.9

|

%

|

|||||

|

Builders FirstSource, Inc.

|

3.5

|

%

|

General Building Materials

|

3.5

|

%

|

|||||

|

Spectrum Brands Holdings, Inc.

|

3.5

|

%

|

Consumer Products

|

3.5

|

%

|

|||||

|

Mohawk Industries Inc.

|

3.1

|

%

|

Flooring

|

3.1

|

%

|

|||||

|

Total

|

51.8

|

%

|

82.2

|

%

|

|

1

|

Top ten holdings excludes cash and Government and Agency Obligations.

|

|

2

|

Where applicable, includes short-term Government and Agency Obligations.

|

|

3

|

Fund holdings and/or sector allocations are subject to change at any time and are not recommendations to buy or sell any security.

|

11

GoodHaven Fund

|

PORTFOLIO MANAGEMENT DISCUSSION AND ANALYSIS (Unaudited)

(Continued)

|

The Fund continued to experience net outflows in 2019, although such outflows on a net basis have diminished in recent months and assets appear reasonably stable. Since inception of the Fund, there

have been periods where there were large new shareholder subscriptions and periods with significant net withdrawals. We believe this was primarily caused by shareholders who were attracted by the potential for better performance in a concentrated

value fund but which have been negatively and emotionally affected by volatility in results – resulting in short-term behavior that tends to reduce returns among mutual fund investors.

Material swings in shareholder subscriptions and redemptions have made management of the portfolio more difficult. During the most recent fiscal year, the portfolio managers were able to undertake

actions to avoid creating taxable capital gains during 2019 without materially affecting portfolio values. Although the Fund now has a net gain on its overall portfolio, it retains a loss-carryforward that is available to offset a material portion

of the current unrealized profit in the Fund. The Fund’s investments are stated as of November 30, 2019, and the amounts and rankings of the Fund’s holdings today may vary significantly from the data disclosed above and the managers may have taken

actions that would result in material changes to the portfolio.

The Fund’s investments having the most positive impact on portfolio performance for the year ended November 30, 2019 were: Barrick Gold rose as financial metrics improved post the integration of the

Barrick and Randgold merger and the price of gold advanced during the period. Builder’s FirstSource increased as strong cash flow and earnings growth were coupled with an improving housing market. Alphabet increased as it reported strong growth in

revenues and certain other financial metrics. Lennar Corporation – Class B shares rose as it reported strong results and the housing market improved throughout the period. Fannie Mae preferred shares rose as it appears that some concerted efforts are

underway to craft a plan of recapitalization of the government’s complex control of Fannie Mae which may materially benefit these junior preferred securities. Spectrum Brands shares increased as it reported improving earnings and a more stable

business outlook.

The Fund’s investments having the most negative impact on the portfolio for the year ended November 30, 2019 were: American Airlines, WPX Energy, Birchcliff Energy, HP Inc., Macy’s and

Overstock.com. American fell despite solid earnings and bookings as it was forced to ground its new fleet of 737 Max aircraft and struggled with labor inefficiencies. WPX declined despite strong operating results as the oil/gas sector was very out

of favor throughout the period – but then saw its share price increase materially in December 2019 in conjunction with an acquisition it announced. Birchcliff Energy declined despite strong operating results as the oil/gas sector was very out of

favor throughout the period, however its stock price increased since fiscal year end. HP Inc. declined in response to a shortfall in its replacement ink and toner revenue; and Macy’s declined amidst disappointing financial results. Overstock.com –

previously not disclosed – declined amidst disappointing results, lack of progress on

12

GoodHaven Fund

|

PORTFOLIO MANAGEMENT DISCUSSION AND ANALYSIS (Unaudited)

(Continued)

|

their blockchain initiatives and resignation of their CEO. The position was eliminated during the period. We do not believe that most of these businesses were materially

impaired during the period despite declining share prices.

The manager of the Fund does not believe that a decline in a security price necessarily means that the security is a less attractive investment. The opposite may be the case in that price declines

may represent significant investment opportunities. In the six months ended November 30, 2019, the largest single factor affecting performance was a decline in both energy shares and airline shares (where energy is a primary cost component) – an

unusual combination. The portfolio manager generally does not try to predict macroeconomic or market swings and prefers instead to try to react to what happens.

The Fund’s turnover rate of 8%, a measure of how frequently assets within a fund are bought and sold by the manager, remains at reasonably low levels and is consistent with the strategies, generally

long-term in nature, of GoodHaven Capital Management LLC, the Fund’s investment advisor. Turnover rates remain low and have been modestly influenced by the need to meet shareholder redemptions rather than a change in the portfolio strategy of the

Fund. Importantly, there may be times when turnover rates rise, however, we do not anticipate rapid turnover of the portfolio under normal circumstances.

The portfolio manager believes that a significant liquidity position is an important part of portfolio management. Since inception, the Fund has continued to have significant liquidity available

both in cash holdings as well as short-term fixed income investments. In order to ensure that we have sufficient resources to behave opportunistically, the Fund has sold or reduced certain investments and has held some modest hedges from time to

time. Over time, we expect the Fund’s level of cash to vary significantly and could be higher or lower than shown on the most recent Schedule of Investments.

We continue to believe that having a cash cushion provides a strategic advantage. Had our cash been invested in index funds in recent years, our performance would have been materially higher, however

management of the fund concurs with the portfolio manager that giving up relative performance is not the same as losing money. In an equity downturn, we would expect our liquidity to act as a cushion until redeployed advantageously. Further, our

liquidity has allowed us to meet redemptions in an efficient manner while mostly avoiding forced liquidation of investments.

It is our intention to invest a significant portion of current liquidity in an opportunistic manner when bargains meeting our investment criteria appear. However, it is possible that the Fund may

have a significant cash or cash equivalent position for an extended period of time. At times when liquidity is high, the Fund may underperform a strongly rising stock market. We note that although the Fund had significant liquidity during the

period from Inception in April 2011 through May of 2014 (including a sizeable amount related to a large cash influx due to new Fund share subscriptions), we believe performance was still reasonable by relative and

13

GoodHaven Fund

|

PORTFOLIO MANAGEMENT DISCUSSION AND ANALYSIS (Unaudited)

(Continued)

|

absolute standards over that time frame. The portfolio manager’s letter to shareholders contains additional discussion about performance.

Generally, we do not expect significant realized capital gain or loss from any particular short-term, non-U.S. investments when viewed over an extended period. Certain large multi-national

businesses in the portfolio may be exposed to non-U.S. rules and regulations as well as volatility in currency values.

To reiterate our view on liquidity, the portfolio managers believe that a certain amount of liquidity may benefit shareholders in several ways – by preventing liquidation of securities to meet modest

levels of redemptions, by providing ammunition to purchase existing or new holdings in declining markets without being forced to sell existing holdings, and by lessening the chance that shareholders will blindly seek liquidations during periods of

market stress that could adversely impact the Fund. That said, if bargains meeting our criteria seem plentiful, we are likely to have significantly less liquidity under such conditions than has been the case since inception.

The Fund is subject to certain risks as disclosed in the Prospectus and Statement of Additional Information, both of which may be obtained from the Fund’s website at www.goodhavenfunds.com or by

calling 1-855-654-6639. Some of these risks include, but are not limited to, adverse market conditions that negatively affect the price of securities owned by the Fund, a high level of cash, which may result in underperformance during periods of

robust price appreciation, adverse movements in foreign currency relationships as a number of the Fund’s holdings have earnings resulting from operations outside the United States, and the fact that the Fund is non-diversified, meaning that its

holdings are more concentrated than a diversified Fund and that adverse price movements in a particular security may affect the Fund’s Net Asset Value more negatively than would occur in a more diversified fund.

As of November 30, 2019, the members, officers, and employees of GoodHaven Capital Management, LLC, the investment advisor to the GoodHaven Fund, owned approximately 226,786 shares of the Fund. The

portfolio manager added to his holdings during the fiscal year. It is management’s intention to disclose such holdings (in the aggregate) in this section of the Fund’s Annual and Semi-Annual reports on an ongoing basis.

14

GoodHaven Fund

|

SECTOR ALLOCATION at November 30, 2019 (Unaudited)

|

|

Asset/Sector

|

% of Net Assets

|

|||

|

|

||||

|

U.S. Government Securities

|

21.2

|

%

|

||

|

Financial Services

|

9.8

|

%

|

||

|

Oil & Gas Exploration & Production

|

9.0

|

%

|

||

|

Air Transportation

|

7.8

|

%

|

||

|

Metals & Mining

|

7.7

|

%

|

||

|

Computers & Software

|

7.3

|

%

|

||

|

Diversified Holding Companies

|

6.9

|

%

|

||

|

General Building Materials

|

3.5

|

%

|

||

|

Consumer Products

|

3.5

|

%

|

||

|

Flooring

|

3.1

|

%

|

||

|

Industrial Supplies

|

3.0

|

%

|

||

|

Computer Hardware

|

2.6

|

%

|

||

|

Home Builder

|

2.6

|

%

|

||

|

Cash & Equivalents1

|

2.4

|

%

|

||

|

Telecommunications

|

2.1

|

%

|

||

|

Property/Casualty Insurance

|

2.0

|

%

|

||

|

Marine Services & Equipment

|

1.7

|

%

|

||

|

Government Agency

|

1.5

|

%

|

||

|

Real Estate

|

1.3

|

%

|

||

|

Retail

|

1.0

|

%

|

||

|

Total

|

100.0

|

%

|

||

|

Equities are classified by sector. Debt is classified by asset type.

|

|

|

1

|

Represents cash and other assets in excess of liabilities.

|

15

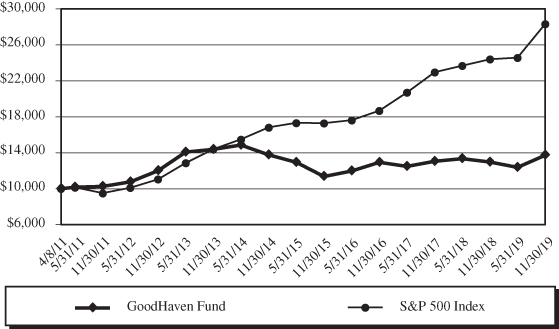

GoodHaven Fund

|

HISTORICAL PERFORMANCE (Unaudited)

|

Value of $10,000 vs. S&P 500 Index

Average Annual Total Returns

Periods Ended November 30, 2019

|

Annualized

|

Value of

|

||||

|

One

|

Three

|

Five

|

Since Inception

|

$10,000

|

|

|

Year

|

Year

|

Year

|

(4/8/2011)

|

(11/30/2019)

|

|

|

GoodHaven Fund

|

5.83%

|

1.99%

|

-0.06%

|

3.73%

|

$13,731

|

|

S&P 500 Index

|

16.11%

|

14.88%

|

10.98%

|

12.80%

|

$28,340

|

This chart illustrates the performance of a hypothetical $10,000 investment made on April 8, 2011 (the Fund’s inception) and is not intended to imply any future performance. The returns shown do not reflect the

deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The chart assumes reinvestment of capital gains, dividends, and return of capital, if applicable, for the Fund and dividends for an index, but

does not reflect redemption fees of 2.00% on shares held less than 60 days.

16

GoodHaven Fund

|

SCHEDULE OF INVESTMENTS at November 30, 2019

|

|

Shares

|

COMMON STOCKS – 75.0%

|

Value

|

|||||

|

Air Transportation – 7.8%

|

|||||||

|

136,000

|

American Airlines Group Inc.

|

$

|

3,908,640

|

||||

|

60,000

|

Delta Air Lines, Inc.

|

3,438,600

|

|||||

|

7,347,240

|

|||||||

|

Computer Hardware – 2.6%

|

|||||||

|

120,400

|

HP Inc.

|

2,417,632

|

|||||

|

Computers & Software – 7.3%

|

|||||||

|

5,310

|

Alphabet Inc. – Class C 1

|

6,929,337

|

|||||

|

Consumer Products – 3.5%

|

|||||||

|

52,464

|

Spectrum Brands Holdings, Inc.

|

3,280,049

|

|||||

|

Diversified Holding Companies – 6.9%

|

|||||||

|

29,400

|

Berkshire Hathaway Inc. – Class B 1

|

6,476,820

|

|||||

|

Financial Services – 9.8%

|

|||||||

|

59,143

|

Federated Investors, Inc. – Class B

|

1,982,474

|

|||||

|

292,512

|

Jefferies Financial Group Inc.

|

6,113,501

|

|||||

|

20,370

|

Brookfield Asset Management Inc.

|

1,189,812

|

|||||

|

9,285,787

|

|||||||

|

Flooring – 3.1%

|

|||||||

|

21,000

|

Mohawk Industries Inc. 1

|

2,926,770

|

|||||

|

General Building Materials – 3.5%

|

|||||||

|

129,400

|

Builders FirstSource, Inc. 1

|

3,288,054

|

|||||

|

Government Agency – 0.1%

|

|||||||

|

50,000

|

Federal National Mortgage Association 1

|

138,500

|

|||||

|

Home Builder – 2.6%

|

|||||||

|

51,946

|

Lennar Corporation – Class B

|

2,450,293

|

|||||

|

Industrial Supplies – 3.0%

|

|||||||

|

122,805

|

Systemax Inc.

|

2,844,164

|

|||||

|

Marine Services & Equipment – 1.7%

|

|||||||

|

130,823

|

Stolt-Nielsen Ltd.

|

1,563,497

|

|||||

|

Metals & Mining – 7.7%

|

|||||||

|

429,650

|

Barrick Gold Corp.

|

7,218,120

|

|||||

The accompanying notes are an integral part of these financial statements.

17

GoodHaven Fund

|

SCHEDULE OF INVESTMENTS at November 30, 2019 (Continued)

|

|

Shares

|

COMMON STOCKS – 75.0% (Continued)

|

Value

|

|||||

|

Oil & Gas Exploration & Production – 9.0%

|

|||||||

|

1,403,100

|

Birchcliff Energy Ltd.

|

$

|

2,323,887

|

||||

|

50,667

|

Hess Midstream Partners LP

|

1,036,140

|

|||||

|

525,046

|

WPX Energy, Inc. 1

|

5,166,453

|

|||||

|

8,526,480

|

|||||||

|

Property/Casualty Insurance – 2.0%

|

|||||||

|

2,400

|

Alleghany Corp. 1

|

1,872,096

|

|||||

|

Real Estate – 1.3%

|

|||||||

|

30,000

|

STORE Capital Corp. – REIT

|

1,221,300

|

|||||

|

Retail – 1.0%

|

|||||||

|

65,000

|

Macy’s Inc.

|

995,800

|

|||||

|

Telecommunications – 2.1%

|

|||||||

|

33,000

|

Verizon Communications Inc.

|

1,987,920

|

|||||

|

TOTAL COMMON STOCKS

|

|||||||

|

(Cost $51,906,460)

|

70,769,859

|

||||||

|

PREFERRED STOCKS – 1.4%

|

|||||||

|

Government Agency – 1.4%

|

|||||||

|

7,750

|

Federal National Mortgage Association,

|

||||||

|

Series E, 5.100% 1,2

|

127,875

|

||||||

|

19,980

|

Federal National Mortgage Association,

|

||||||

|

Series R, 7.625% 1,2

|

189,810

|

||||||

|

27,846

|

Federal National Mortgage Association,

|

||||||

|

Series S, 8.250% 1,2,3

|

296,281

|

||||||

|

71,981

|

Federal National Mortgage Association,

|

||||||

|

Series T, 8.250% 1,2

|

714,052

|

||||||

|

1,328,018

|

|||||||

|

TOTAL PREFERRED STOCKS

|

|||||||

|

(Cost $1,077,942)

|

1,328,018

|

||||||

The accompanying notes are an integral part of these financial statements.

18

GoodHaven Fund

|

SCHEDULE OF INVESTMENTS at November 30, 2019 (Continued)

|

|

Principal

|

|||||||

|

Amount

|

U.S. GOVERNMENT SECURITIES – 21.2%

|

Value

|

|||||

|

United States Treasury Bills – 21.2%

|

|||||||

|

$

|

3,500,000

|

2.054% due 12/19/2019 4

|

$

|

3,497,553

|

|||

|

8,000,000

|

2.020% due 1/9/2020 4

|

7,986,813

|

|||||

|

1,000,000

|

1.851% due 2/6/2020 4

|

997,149

|

|||||

|

7,500,000

|

1.680% due 3/19/2020 4

|

7,465,339

|

|||||

|

19,946,854

|

|||||||

|

TOTAL U.S. GOVERNMENT SECURITIES

|

|||||||

|

(Cost $19,939,599)

|

19,946,854

|

||||||

|

Total Investments

|

|||||||

|

(Cost $72,924,001) – 97.6%

|

92,044,731

|

||||||

|

Cash and Other Assets in

|

|||||||

|

Excess of Liabilities – 2.4%

|

2,227,270

|

||||||

|

TOTAL NET ASSETS – 100.0%

|

$

|

94,272,001

|

|||||

REIT – Real Estate Investment Trust

|

1

|

Non-income producing security.

|

|

2

|

Perpetual maturity.

|

|

3

|

Variable rate dividend; rate shown is rate of last dividend.

|

|

4

|

Rate represents the annualized effective yield to maturity from the purchase price.

|

The accompanying notes are an integral part of these financial statements.

19

GoodHaven Fund

|

STATEMENT OF ASSETS AND LIABILITIES at November 30,

2019

|

|

ASSETS

|

||||

|

Investments in securities, at value

|

||||

|

(Cost $72,924,001) (Note 2)

|

$

|

92,044,731

|

||

|

Cash

|

2,231,634

|

|||

|

Receivables:

|

||||

|

Fund shares sold

|

247

|

|||

|

Dividends and interest

|

81,651

|

|||

|

Total assets

|

94,358,263

|

|||

|

|

||||

|

LIABILITIES

|

||||

|

Payables:

|

||||

|

Fund shares redeemed

|

870

|

|||

|

Management fees

|

69,866

|

|||

|

Support services fees

|

15,526

|

|||

|

Total liabilities

|

86,262

|

|||

|

|

||||

|

NET ASSETS

|

$

|

94,272,001

|

||

|

|

||||

|

COMPONENTS OF NET ASSETS

|

||||

|

Paid-in capital

|

$

|

79,646,276

|

||

|

Total distributable earnings

|

14,625,725

|

|||

|

Net assets

|

$

|

94,272,001

|

||

|

Net Asset Value (unlimited shares authorized):

|

||||

|

Net assets

|

$

|

94,272,001

|

||

|

Shares of beneficial interest issued and outstanding

|

3,851,757

|

|||

|

Net asset value, offering and redemption price per share

|

$

|

24.48

|

||

The accompanying notes are an integral part of these financial statements.

20

GoodHaven Fund

|

STATEMENT OF OPERATIONS For the Year Ended November 30,

2019

|

|

INVESTMENT INCOME

|

||||

|

Dividend income

|

||||

|

(net of $33,660 in foreign withholding taxes)

|

$

|

2,330,590

|

||

|

Interest

|

437,592

|

|||

|

Total investment income

|

2,768,182

|

|||

|

|

||||

|

EXPENSES

|

||||

|

Management fees

|

853,604

|

|||

|

Support services fees

|

189,690

|

|||

|

Legal expense

|

7,396

|

|||

|

Total expenses

|

1,050,690

|

|||

|

Net investment income

|

1,717,492

|

|||

|

|

||||

|

REALIZED AND UNREALIZED GAIN (LOSS)

|

||||

|

ON INVESTMENTS & FOREIGN CURRENCY

|

||||

|

Net realized gain on transactions

|

||||

|

from investments & foreign currency

|

5,551,436

|

|||

|

Net change in unrealized appreciation/depreciation

|

||||

|

on investments & foreign currency

|

(3,017,320

|

)

|

||

|

Net realized and unrealized gain

|

2,534,116

|

|||

|

Net increase in net assets resulting from operations

|

$

|

4,251,608

|

||

The accompanying notes are an integral part of these financial statements.

21

GoodHaven Fund

|

STATEMENTS OF CHANGES IN NET ASSETS

|

|

Year Ended

|

Year Ended

|

|||||||

|

November 30, 2019

|

November 30, 2018

|

|||||||

|

INCREASE (DECREASE) IN NET ASSETS FROM:

|

||||||||

|

|

||||||||

|

OPERATIONS

|

||||||||

|

Net investment income

|

$

|

1,717,492

|

$

|

683,781

|

||||

|

Net realized gain on investments

|

||||||||

|

& foreign currency

|

5,551,436

|

17,823,403

|

||||||

|

Change in unrealized appreciation/

|

||||||||

|

depreciation on investments

|

||||||||

|

& foreign currency

|

(3,017,320

|

)

|

(16,672,566

|

)

|

||||

|

Net increase in net assets

|

||||||||

|

resulting from operations

|

4,251,608

|

1,834,618

|

||||||

|

|

||||||||

|

DISTRIBUTIONS TO SHAREHOLDERS

|

||||||||

|

Net distributions to shareholders

|

(1,267,729

|

)

|

—

|

|||||

|

|

||||||||

|

CAPITAL SHARE TRANSACTIONS

|

||||||||

|

Net decrease in net assets derived from

|

||||||||

|

net change in outstanding shares 1

|

(18,241,715

|

)

|

(100,544,136

|

)

|

||||

|

Total decrease in net assets

|

(15,257,836

|

)

|

(98,709,518

|

)

|

||||

|

|

||||||||

|

NET ASSETS

|

||||||||

|

Beginning of year

|

109,529,837

|

208,239,355

|

||||||

|

End of year

|

$

|

94,272,001

|

$

|

109,529,837

|

||||

| 1 |

Summary of capital share transactions is as follows:

|

|

Year Ended

|

Year Ended

|

||||||||||||||||

|

November 30, 2019

|

November 30, 2018

|

||||||||||||||||

|

Shares

|

Value

|

Shares

|

Value

|

||||||||||||||

|

Shares sold

|

842,755

|

$

|

20,047,847

|

340,822

|

$

|

8,160,387

|

|||||||||||

|

Shares issued in

|

|||||||||||||||||

|

reinvestment

|

|||||||||||||||||

|

of distributions

|

53,217

|

1,129,785

|

—

|

—

|

|||||||||||||

|

Shares redeemed 2

|

(1,719,107

|

)

|

(39,419,347

|

)

|

(4,496,566

|

)

|

(108,704,523

|

)

|

|||||||||

|

Net decrease

|

(823,135

|

)

|

$

|

(18,241,715

|

)

|

(4,155,744

|

)

|

$

|

(100,544,136

|

)

|

|||||||

| 2 |

Net of redemption fees of $243 and $811, respectively.

|

The accompanying notes are an integral part of these financial statements.

22

GoodHaven Fund

|

FINANCIAL HIGHLIGHTS For a capital share outstanding

throughout each year

|

|

|

Year Ended November 30,

|

|||||||||||||||||||

|

|

2019

|

2018

|

2017

|

2016

|

2015

|

|||||||||||||||

|

Net asset value at

|

||||||||||||||||||||

|

beginning of year

|

$

|

23.43

|

$

|

23.58

|

$

|

23.37

|

$

|

20.52

|

$

|

26.77

|

||||||||||

|

|

||||||||||||||||||||

|

INCOME (LOSS) FROM INVESTMENT OPERATIONS:

|

||||||||||||||||||||

|

Net investment

|

||||||||||||||||||||

|

income (loss) 1

|

0.42

|

0.11

|

(0.04

|

)

|

0.02

|

0.01

|

||||||||||||||

|

Net realized and unrealized

|

||||||||||||||||||||

|

gain (loss) on investments

|

0.90

|

(0.26

|

)

|

0.25

|

2.83

|

(4.40

|

)

|

|||||||||||||

|

Total from

|

||||||||||||||||||||

|

investment operations

|

1.32

|

(0.15

|

)

|

0.21

|

2.85

|

(4.39

|

)

|

|||||||||||||

|

|

||||||||||||||||||||

|

LESS DISTRIBUTIONS:

|

||||||||||||||||||||

|

From net investment income

|

(0.27

|

)

|

—

|

—

|

—

|

—

|

||||||||||||||

|

From net realized gain

|

—

|

—

|

—

|

—

|

(1.87

|

)

|

||||||||||||||

|

Total distributions

|

(0.27

|

)

|

—

|

—

|

—

|

(1.87

|

)

|

|||||||||||||

|

Paid-in capital from

|

||||||||||||||||||||

|

redemption fees

|

0.00

|

2

|

0.00

|

2

|

0.00

|

2

|

0.00

|

2

|

0.01

|

|||||||||||

|

|

||||||||||||||||||||

|

Net asset value

|

||||||||||||||||||||

|

at end of year

|

$

|

24.48

|

$

|

23.43

|

$

|

23.58

|

$

|

23.37

|

$

|

20.52

|

||||||||||

|

|

||||||||||||||||||||

|

Total return

|

5.83

|

%

|

(0.64

|

)%

|

0.90

|

%

|

13.89

|

%

|

(17.49

|

)%

|

||||||||||

|

|

||||||||||||||||||||

|

SUPPLEMENTAL DATA/RATIOS:

|

||||||||||||||||||||

|

Net assets at end

|

||||||||||||||||||||

|

of year (millions)

|

$

|

94.3

|

$

|

109.5

|

$

|

208.2

|

$

|

271.6

|

$

|

267.9

|

||||||||||

|

Portfolio turnover rate

|

8

|

%

|

13

|

%

|

14

|

%

|

8

|

%

|

18

|

%

|

||||||||||

|

|

||||||||||||||||||||

|

Ratio of expenses to

|

||||||||||||||||||||

|

average net assets

|

1.11

|

%

|

1.10

|

%

|

1.10

|

%

|

1.10

|

%

|

1.10

|

%

|

||||||||||

|

Ratio of net investment

|

||||||||||||||||||||

|

income (loss) to

|

||||||||||||||||||||

|

average net assets

|

1.81

|

%

|

0.47

|

%

|

(0.16

|

)%

|

0.07

|

%

|

0.06

|

%

|

||||||||||

|

1

|

Calculated using the average shares outstanding method.

|

||||

|

2

|

Does not round to $0.01 or $(0.01), as applicable.

|

||||

The accompanying notes are an integral part of these financial statements.

23

GoodHaven Fund

|

NOTES TO FINANCIAL STATEMENTS November 30, 2019

|

|

NOTE 1 – ORGANIZATION

|

The GoodHaven Funds Trust (the “Trust”) is registered under the Investment Company Act of 1940, as amended (the “1940 Act”) as a non-diversified, open-end investment management

company. The Fund is an investment company and accordingly follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standard Codification Topic 946 “Financial Services –

Investment Companies.” The Fund commenced operations on April 8, 2011.

The Fund’s investment objective is to seek long-term growth of capital.

|

NOTE 2 – SIGNIFICANT ACCOUNTING POLICIES

|

The following is a summary of significant accounting policies consistently followed by the Fund. These policies are in conformity with accounting principles generally accepted in

the United States of America (“U.S. GAAP”).

|

A.

|

Security Valuation. All equity securities, which may include Real Estate Investment Trusts (“REITs”), Business Development Companies (“BDCs”) and Master Limited

Partnerships (“MLPs”), that are traded on U.S. national or foreign securities exchanges are valued at the last reported sale price on the exchange on which the security is principally traded or the exchange’s official closing price, if

applicable. If, on a particular day, an exchange-traded security does not trade, then the mean between the most recent quoted bid and asked prices will be used. All equity securities, which may include REITs, BDCs and MLPs, that are not

traded on a listed exchange are valued at the last sale price in the over-the-counter market. If a non- exchange traded security does not trade on a particular day, then the mean between the last quoted closing bid and asked price will be

used.

|

|

|

Debt securities are valued by using the evaluated mean price supplied by an approved independent pricing service. The independent pricing service may use various valuation methodologies, including matrix

pricing and other analytical pricing models as well as market transactions and dealer quotations. These models generally consider such factors as yields or prices of bonds of comparable quality, type of issue, coupon, maturity, ratings and

general market conditions. In the absence of a price from a pricing service, securities are valued at their respective fair values in accordance with policies approved by the Valuation Committee of the Trust.

|

||

|

Exchange traded options are valued at the composite price, using the National Best Bid and Offer quotes (“NBBO”). NBBO consists of the highest bid price and lowest ask price across any of the exchanges on which

an option is quoted, thus providing a view across the entire U.S. options

|

24

GoodHaven Fund

|

NOTES TO FINANCIAL STATEMENTS November 30, 2019

(Continued)

|

|

marketplace. Composite option pricing calculates the mean of the highest bid price and lowest ask price across the exchanges where the option is traded. If a composite price is not available, then the closing

price will be used.

|

||

|

Securities for which quotations are not readily available are valued at their respective fair values as determined in accordance with policies approved by the Valuation Committee of the Trust. When a security

is “fair valued,” consideration is given to the facts and circumstances relevant to the particular situation, including a review of various factors set forth in the pricing procedures adopted by the Board of Trustees (the “Board”). Fair value

pricing is an inherently subjective process, and no single standard exists for determining fair value. Different funds could reasonably arrive at different values for the same security. The use of fair value pricing by a fund may cause the

net asset value of its shares to differ significantly from the net asset value that would be calculated without regard to such considerations.

|

||

|

As described above, the Fund utilizes various methods to measure the fair value of its investments on a recurring basis. U.S. GAAP establishes a hierarchy that prioritizes inputs to valuation methods. The three

levels of inputs are:

|

|

Level 1 –

|

Unadjusted quoted prices in active markets for identical assets or liabilities that the Fund has the ability to access.

|

||

|

Level 2 –

|

Observable inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly or indirectly. These inputs may include quoted prices for the identical instrument

on an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data.

|

||

|

Level 3 –

|

Unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available, representing the Fund’s own assumptions about the assumptions a market participant would use in

valuing the asset or liability, and would be based on the best information available.

|

|

The availability of observable inputs can vary from security to security and is affected by a wide variety of factors, including, for example, the type of security, whether the security is new and not yet