Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 10-K

(Mark One)

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Fiscal Year Ended December 31, 2018

OR

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File Number: 001-37906

ORGANOGENESIS HOLDINGS INC.

(Exact Name of Registrant as Specified in Its Charter)

| Delaware | 98-1329150 | |

| (State or Other Jurisdiction of | (I.R.S. Employer | |

| Incorporation or Organization) | Identification No.) |

85 Dan Road

Canton, MA 02021

(Address of Principal Executive Offices, Including Zip Code)

(781) 575-0775

(Registrant’s Telephone Number, Including Area Code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of class |

Name of exchange on which registered | |

| Class A Common Stock, $0.0001 par value | NASDAQ Capital Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☒ | |||

| Non-accelerated filer | ☐ | Smaller reporting company | ☐ | |||

| Emerging growth company | ☒ | |||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The aggregate market value of the voting common shares held by non-affiliates of the registrant was approximately $310.93 million, computed by reference to the closing sale price of the common stock as reported by The Nasdaq Capital Market on June 30, 2018, the last trading day of the registrant’s most recently completed second fiscal quarter. The Company has no non-voting common shares.

The number of shares of the registrant’s common stock outstanding as of March 1, 2019 was 92,009,737.

DOCUMENTS INCORPORATED BY REFERENCE

Certain information required to be provided in Part III of this Annual Report on Form 10-K will be provided by a Definitive Proxy Statement for our 2018 Annual Meeting of Stockholders (the “Proxy Statement”) to be filed with the Securities and Exchange Commission on or before April 30, 2019.

Table of Contents

ORGANOGENESIS HOLDINGS INC.

ANNUAL REPORT ON FORM 10-K

FOR FISCAL YEAR ENDED DECEMBER 31, 2018

Table of Contents

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K, including the sections entitled “Business,” “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” contains forward-looking statements. These statements may relate to, but are not limited to, expectations of our future results of operations, business strategies and operations, financing plans, potential growth opportunities, potential market opportunities and the effects of competition, as well as assumptions relating to the foregoing. Forward-looking statements are inherently subject to risks and uncertainties, some of which cannot be predicted or quantified. These risks and other factors include, but are not limited to, those listed under “Risk Factors.” In some cases, you can identify forward-looking statements by terminology such as “may,” “will,” “should,” “could,” “expect,” “plan,” “anticipate,” “believe,” “estimate,” “predict,” “intend,” “potential,” “might,” “would,” “continue” or the negative of these terms or other comparable terminology. These statements are only predictions. Actual events or results may differ materially.

As used herein, except as otherwise indicated by context, references to “we,” “us,” “our,” “the Company,” “Organogenesis” and “ORGO” will refer to Organogenesis Holdings Inc. and its subsidiaries.

| ITEM 1. |

Overview

Organogenesis is a leading regenerative medicine company focused on the development, manufacture and commercialization of solutions for the Advanced Wound Care and Surgical & Sports Medicine markets. Our products have been shown through clinical and scientific studies to support and in some cases accelerate tissue healing and improve patient outcomes. We are advancing the standard of care in each phase of the healing process through multiple breakthroughs in tissue engineering and cell therapy. Our solutions address large and growing markets driven by aging demographics and increases in comorbidities such as diabetes, obesity, cardiovascular and peripheral vascular disease and smoking. We offer our differentiated products and in-house customer support to a wide range of health care customers including hospitals, wound care centers, government facilities, ASCs and physician offices. Our mission is to provide integrated healing solutions that substantially improve medical outcomes and the lives of patients while lowering the overall cost of care.

We offer a comprehensive portfolio of products in the markets we serve that address patient needs across the continuum of care. We have and intend to continue to generate data from clinical trials, real world outcomes and health economics research that validate the clinical efficacy and value proposition offered by our products. The majority of the existing and pipeline products in our portfolio have PMA approval, BLA approval or 510(k) clearance from the FDA. Given the extensive time and cost required to conduct clinical trials and receive FDA approvals, we believe that our data and regulatory approvals provide us a strong competitive advantage. Our product development expertise and multiple technology platforms provide a robust product pipeline, which we believe will drive future growth.

Historically we have concentrated our efforts in the Advanced Wound Care market. In 2017, we acquired NuTech Medical which further expanded our wound care portfolio and broadened our addressable market to include the Surgical & Sports Medicine market. We believe the expanded product portfolio facilitated by this acquisition is enhancing the ability of our sales representatives to reach and penetrate customer accounts, contributing to strong growth over time.

In the Advanced Wound Care market, we focus on the development and commercialization of advanced wound care products for the treatment of chronic and acute wounds, primarily in the outpatient setting. We have a comprehensive portfolio of regenerative medicine products, capable of supporting patients from early in the

1

Table of Contents

wound healing process through to wound closure regardless of wound type. Our Advanced Wound Care products include Apligraf for the treatment of VLUs and DFUs; Dermagraft for the treatment of DFUs; PuraPly AM to address biofilm across a broad variety of wound types; and Affinity and NuShield to address a variety of wound sizes and types. We have a highly trained and specialized direct wound care sales force paired with exceptional customer support services.

In the Surgical & Sports Medicine market, we focus on products that support the healing of musculoskeletal injuries, including degenerative conditions such as OA and tendonitis. We are leveraging our regenerative medicine capabilities in this attractive, adjacent market. Our Surgical & Sports Medicine products include ReNu for in-office joint and tendon applications; NuCel for bony fusion in the spine and extremities; NuShield and Affinity for surgical application in targeted soft tissue repairs; and PuraPly AM for surgical treatment of open wounds. We currently sell these products through independent agencies and our growing direct sales force.

On December 10, 2018, Avista Healthcare Public Acquisition Corp., our predecessor company (“AHPAC”), consummated the previously announced business combination (the “Business Combination”) pursuant to that certain Agreement and Plan of Merger, dated as of August 17, 2018 (as amended, the “Avista Merger Agreement”), by and among AHPAC, Avista Healthcare Merger Sub, Inc., a Delaware corporation and a direct wholly owned subsidiary of AHPAC (“Avista Merger Sub”) and Organogenesis Inc., a Delaware corporation. As a result of the Business Combination and the other transactions contemplated by the Avista Merger Agreement, Avista Merger Sub merged with and into Organogenesis Inc., with Organogenesis Inc. surviving the merger (the “Avista Merger”). In addition, in connection with the Business Combination, and in accordance with Section 388 of the Delaware General Corporation Law and the Cayman Islands Companies Law (2018 Revision), AHPAC redomesticated as a Delaware corporation (the “Domestication”). After the Domestication, AHPAC changed its name to “Organogenesis Holdings Inc.” As a result of the Avista Merger, Organogenesis Inc. became a wholly owned direct subsidiary of Organogenesis Holdings Inc.

As of December 31, 2018, we had approximately 700 employees worldwide. For the year ended December 31, 2018, we generated revenue of $193.4 million and we incurred operating expenses of $176.2 million.

Competitive Strengths

We believe we have several unique strengths that have been instrumental to our success and position us well for future growth:

| • | Leader in Regenerative Medicine Technology with Strong Brand Recognition. Given our extensive history in regenerative medicine, we have strong brand recognition and market leading positions across our portfolio, which includes flagship products Apligraf, Dermagraft and PuraPly AM, as well as our amniotic products NuCel, NuShield, ReNu and Affinity. Organogenesis is well recognized as an innovator that has advanced the science of regenerative medicine, as well as the methodology to manufacture living technology at large commercial scale and ship it worldwide. We first entered the market in 1998 with Apligraf, which is still considered one of the major breakthroughs of the Company in the regenerative medicine market, and a leader in the VLU market. In addition, our product, Dermagraft, has been on the market for over 15 years and is a well-known brand in the global regenerative medicine market. NuTech Medical has an established track record in the regenerative medicine category of the Surgical & Sports Medicine market and its products have a strong presence in this market. |

| • | Well-Positioned in Large, Attractive and Growing Global Markets—Advanced Wound Care and Surgical & Sports Medicine. We believe both markets will continue to see accelerated growth given favorable global demographics that include an aging population and the greater incidence of comorbidities such as diabetes, obesity, and cardiovascular and peripheral vascular disease and smoking. We believe there is growing adoption of regenerative medicine products by the physician |

2

Table of Contents

| community due to their clinical superiority and cost effectiveness for all major stakeholders compared to traditional products. |

| • | Comprehensive Suite of Products to Address the Clinical and Economic Needs of Wound Care Patients and Providers. Our comprehensive portfolio of wound care products allows physicians to personalize solutions to meet the needs of individual wound care patients. We engage with the physician at the earliest incidence of the patient’s healing process with our PuraPly AM product, which has antimicrobial properties that are beneficial for most types of wounds. If the underlying healing issues persist, we offer an array of bioactive products customizable for various sizes and types of wounds. The breadth of our portfolio gives us flexibility to offer products at various prices to accommodate both the clinical and economic factors that may impact purchasing decisions. Our products can address varying reimbursement levels depending on the type of wound, the payer, and geographic differences in payer payment rates. Our experienced wound care sales force is highly trained to assist clinicians to effectively deploy the full complement of our wound care products. |

| • | Large and Growing Body of Clinical Data and FDA Approved Products. We have a deep body of scientific, clinical and real world outcomes data, including over 200 publications that review the technical and clinical attributes of our products. The majority of the existing and pipeline products in our product portfolio have FDA regulatory approval, including PMA approval, BLA approval or 510(k) clearance. Given the extensive time and cost required to conduct clinical trials and receive FDA approval, we believe our data and regulatory approvals provide us a strong competitive advantage. |

| • | Robust and Extensive Relationships Across the Continuum of Care. We have established robust and extensive customer relationships across the entire continuum of care including hospitals, wound care centers, government facilities, ASCs and physician offices to sell our broad portfolio of products. We serve more than 4,000 health care facilities, hospital systems, IDNs and GPOs. In addition, we have developed important relationships with physicians, nurses, and other key decision makers as well as third-party payers. Given these relationships across the continuum of care, we believe we are well positioned to increase our penetration in the Advanced Wound Care market and leverage those relationships in the Surgical & Sports Medicine market. |

| • | Differentiated In-house Customer Support Capabilities Including Third-Party Reimbursement Support. We strengthen our customer relationships with extensive in-house customer support capabilities. Through our dedicated team of experienced professionals, our “Circle of Care” program provides in-house third-party reimbursement, medical and technical support. We believe our customer support capabilities differentiate us from many of our competitors who may outsource these critical services to third parties. |

| • | Established and Scalable Regulatory, Manufacturing and Commercial Infrastructure. We have developed significant in-house expertise on the regulatory approval process that is based on our successful management of multiple products through various FDA approval pathways including PMA approval, BLA approval and 510(k) clearance. We have also developed rigorous and proven FDA compliant manufacturing, distribution and logistics capabilities. We pair our operational capabilities with a strong commercial team of sales and marketing professionals. Our established regulatory, operational and commercial infrastructure provides a firm foundation for growth as we continue to scale our business. |

| • | Extensive Executive Management Experience in Regenerative Medicine. Our executive management team has extensive experience in the regenerative medicine industry, boasting over 70 years of collective experience in the space. This experience allows us to operate from a deep understanding of the underlying trends in regenerative medicine and the intertwined scientific, clinical, regulatory, commercial and manufacturing issues that drive success in the industry. |

3

Table of Contents

Our Business Strategy

We believe the following strategies will play a critical role in our future growth:

| • | Drive Penetration in the Fast Growing Advanced Wound Care Market. We intend to leverage our comprehensive product portfolio and relationships with key constituents to deepen our presence in the Advanced Wound Care market. In addition, with the acquisition of NuTech Medical, we acquired products that give us access to the rapidly growing amniotic category of the wound care market. We believe the breadth and flexibility of the portfolio we now offer will allow us to address a wide variety of wound types, sizes, and reimbursement levels, offering significant new opportunities for growth. Furthermore, we believe our expanded product portfolio is enhancing the ability of our sales representatives to reach and penetrate customer accounts, contributing to strong growth over time. Additionally, we believe there is significant room for expansion of the Advanced Wound Care market as a whole and our wound biologics product category in particular as more physicians and payers are educated about the benefits of regenerative medicine technologies versus traditional therapies. We continue to invest to support physician and payer education as well as preclinical and clinical trials, real-world evidence, and other research to confirm the benefits of our products. We will continue to seek expanded payer coverage for all of our products, particularly PuraPly AM, NuShield and Affinity for which we do not yet have the broad commercial payer coverage enjoyed by Apligraf and Dermagraft. |

| • | Expand into Surgical & Sports Medicine Market. We entered the Surgical & Sports Medicine market with the acquisition of NuTech Medical and its established and leading presence in amniotic products. We plan to accelerate penetration into this market by leveraging our established commercial and operational infrastructure and building out our direct sales force to supplement our independent sales agencies. We also expect there are significant opportunities to cross-sell within our established customer bases in both the Advanced Wound Care and Surgical & Sports Medicine markets. We believe that the potential of regenerative medicine in the Surgical & Sports Medicine market, particularly with respect to chronic inflammatory and degenerative conditions, presents a strong long-term opportunity. Given our experience in the Advanced Wound Care market and regenerative medicine in general, we believe we are well positioned to capture this opportunity. |

| • | Launch Robust Pipeline of Products and Drive Innovation With a Proven Research and Development Platform. We have a robust pipeline of products in both the Advanced Wound Care and Surgical & Sports Medicine markets that we expect to launch in the near term. We expect these products will deepen our portfolios and allow us to address additional clinical applications. In addition, we anticipate our ongoing efforts to complete clinical studies and publish research regarding our products will further enhance physician and payer receptiveness to our products over time. Our proven research and development capabilities and established technology platforms also support a robust and adaptable product pipeline for future applications. |

| • | Expand Sales Force and Increase Sales Productivity and Geographic Reach. We plan to expand the reach and penetration of our products by growing our sales organization to serve the Advanced Wound Care and Surgical & Sports Medicine markets. This expansion should allow us to achieve more focused and effective sales coverage for specific market categories, broaden our geographic footprint, and leverage our expanding relationships with large hospital systems and GPOs. We also plan to increase our focus on sales outside of the United States, including the European Union, Asia and the Middle East. Currently, substantially all of our sales are in the United States. |

| • | Supplement Organic Growth Through Selective Acquisitions. We have demonstrated our ability to successfully identify and integrate assets that complement our strategy through the acquisitions of Dermagraft and TransCyte from Shire and our amniotic products from NuTech Medical. We continue to evaluate tuck-in acquisitions which complement our existing portfolios in both the Advanced Wound Care and Surgical & Sports Medicine markets and will leverage our established commercial and manufacturing infrastructure. |

4

Table of Contents

Industry Overview

We focus our efforts on medical conditions that involve difficult to heal wounds and musculoskeletal injuries. Healing difficulties may arise from a variety of causes and in various types of tissue and anatomic areas. Impaired healing is commonly associated with an inability to move beyond the inflammatory stages of healing, resulting in a chronic wound or injury, an ongoing inflammatory cycle, and an inability to achieve normal tissue healing. Biofilm and other infectious conditions also play a key role in disrupting wound healing processes. Regenerative medicine is a collection of technologies aimed at generating tissue as close as possible to native or natural tissue, to replace damaged tissue and to fill or replace defects. Demand for these technologies is increasing as physician understanding of the underlying wound healing processes grows and as demographic and population health trends result in the increased prevalence of systemic comorbidities that contribute to healing problems throughout the body.

Our products use regenerative medicine technologies to provide solutions in the Advanced Wound Care and Surgical & Sports Medicine markets.

Key drivers of growth in these two markets include:

| • | favorable global demographics and aging population; |

| • | greater incidence of comorbidities that contribute to impaired healing, such as diabetes, obesity, cardiovascular and peripheral vascular disease and smoking; and |

| • | increasing acceptance of advanced technologies to treat complex wounds and musculoskeletal injuries. |

Advanced Wound Care Market

Wounds represent a large and growing burden on the public health as well as a significant cost to the health care system. Wounds are divided into two primary types, chronic and acute. It is estimated that approximately 80 million patients suffer from chronic and acute wounds globally each year, excluding surgical incisions. Chronic wounds account for most of the expense due to their complexity and length of treatment.

Chronic Wounds

Chronic wounds are wounds that have not appropriately closed after four weeks of treatment with traditional treatment such as dressings. Chronic wounds include:

| • | VLUs: wounds that occur in the leg veins when blood does not circulate properly to the heart. |

| • | DFUs: open sores or wounds that occur in patients with diabetes and are commonly located on the bottom of the foot. |

| • | Pressure Ulcers: localized injuries to the skin and/or underlying tissues as a result of pressure or pressure in combination with shear. |

| • | Surgical Wounds: acute wounds caused by surgical incisions that become chronic wounds if they do not heal properly. |

While the underlying etiology of these chronic wounds are different, at a cellular level many of the problems that result in failed healing are the same. These include uncontrolled inflammatory processes, shortages of cell types and growth factors secreted by cells that are critical to healing, and that result in disrupted cell signaling pathways.

Acute Wounds

An acute wound is an injury that causes a rapid break in the skin and sometimes the underlying tissue. Acute wounds can be traumatic wounds, such as abrasions, lacerations, penetrating injuries and burns, or surgical

5

Table of Contents

wounds from surgical incisions. In contrast to chronic wounds, which would normally heal but stall due to biologic factors, acute wounds are so severe that they overwhelm the body’s normal healing capacity. Biofilm and other infectious conditions, particularly in acute wounds with a high risk of infection such as open fractures, may also pose challenges to the healing of acute wounds. According to BioMed GPS, in 2016 there were approximately 430,000 open traumatic wounds. In 2016, it is estimated that there were more than 500,000 burns that required medical treatment and approximately 40,000 burns required hospitalization.

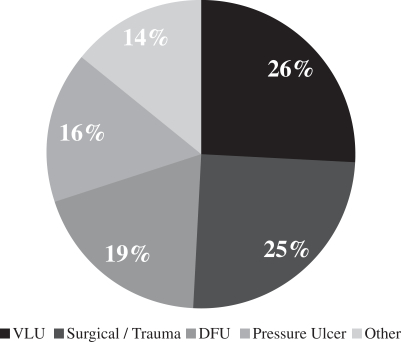

Relative Prevalence of Wounds

Our customers in outpatient wound care facilities are faced with a wide variety of types of wounds with different anatomical locations and underlying causes. Based on a retrospective cohort study of data from wound care centers from June 2008 and June 2012, the distribution of wound types in hospital outpatient wound care centers is detailed below:

Distribution of Wound Types*

| * | Based on a September 2013 JAMA Dermatology published retrospective cohort study. |

Due to the breadth of our wound care portfolio, our products are able to address both chronic and acute wounds across all of these wound types.

Our Solution

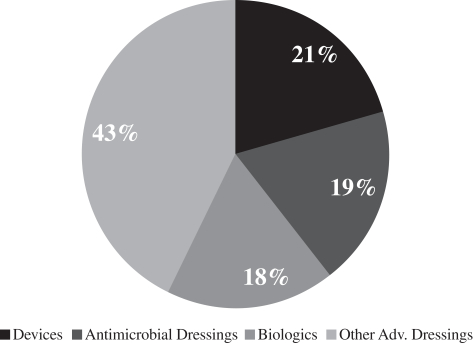

The wound care market includes traditional dressings such as bandages, gauzes and ointments and advanced wound care products such as mechanical devices, advanced dressings and biologics. These advanced wound care products target chronic and acute wounds not adequately addressed by traditional therapies. Our products are primarily classified as skin substitutes, which fall within the biologics category of the Advanced Wound Care market.

6

Table of Contents

According to MedMarket Diligence, the global Advanced Wound Care market was estimated to be approximately $7.3 billion in 2014 and consists of several product categories including advanced dressings, antimicrobial dressings, devices such as negative pressure wound therapy, or NPWT, and biologics such as skin substitute and growth factors. The approximate breakdown for these product categories in 2014 is set forth below.

Advanced Wound Care Market

According to MedMarket Diligence, the overall Advanced Wound Care market is expected to grow at a compound annual growth rate, or CAGR, of 7.7% through 2024.

Wound biologics represents one of the smallest segments of the Advanced Wound Care market, but is the fastest growing and has seen the highest level of innovation. The worldwide wound biologics market, which includes skin substitutes and growth factors, was estimated by Technavio to be approximately $1.2 billion in 2016, of which skin substitute products are estimated to represent almost $700 million.(9) Skin substitutes, bioengineered or biologic grafts that cover skin defects and support healing, are one of the fastest growing categories of the Advanced Wound Care market. This market grew from almost $600 million in 2015 to almost $700 million in 2016 at an annual growth rate of 14.3%. Going forward, the skin substitute market is projected to grow at a CAGR of more than 14.5% between 2016 and 2020, reaching $1.15 billion by 2020, as patients with hard to heal wounds transition from other therapies to skin substitute treatment.

We expect this market to continue to grow at a rapid rate as physicians are educated about the use of these products and understand the benefits as compared to other currently marketed products, payers incentivize doctors to use more cost effective treatments, patients demand more effective treatment solutions and advanced wound care becomes more common outside of the United States. We also believe that adoption of these products will increase as clinical evidence supporting the benefits of skin substitutes over traditional therapies continues to

| (9) | Technavio (2016), Global Bioactive Wound Care Market Report, retrieved September 13, 2017, from EMIS Professional Database |

7

Table of Contents

grow. Skin substitutes have demonstrated improved chronic and acute wound healing rates at a lower overall cost than the current standard of care. In a matched cohort study we commissioned, Medicare treatment costs for DFUs treated with Apligraf were $5,253 (p=0.49) lower per patient than the standard of care and for DFUs treated with Dermagraft, these costs were $6,991 (p=0.84) lower per patient than the standard of care.

Our products compete with other skin substitutes as well as other advanced wound care products such as NPWT and growth factors. Due to its market position as a skin substitute with antimicrobial properties appropriate for the treatment of wounds with biofilm or otherwise at high risk of infection, our PuraPly AM product also competes with antimicrobial dressings. Antimicrobial wound products have historically represented a more than $1 billion annual market. We are a market leader in the antimicrobial skin substitute market, and have supported the expansion of that market with our comprehensive marketing and educational campaigns.

Finally, the skin substitute market remains substantially underpenetrated. According to BioMed GPS, over 8.3 million wounds require medical care in the United States each year, and over 3.3 million of those wounds are difficult to heal wounds where traditional therapies are unlikely to succeed. Despite this vast need and the proven advantages of advanced wound care products in general and skin substitutes in particular, only 135,000 patients, or less than five percent, are treated with skin substitutes each year. Our internal estimates indicate that if the potentially addressable market were completely penetrated today, annual skin substitute revenue in the United States alone could exceed $9 billion.

We believe that we are well positioned in the skin substitute market as adoption continues to increase. According to BioMed GPS, we are one of the three largest skin substitute companies in the United States and we have an experienced and established sales force with deep relationships with clinicians, wound care centers and hospitals. We also have a diverse array of products to address the different varieties of wounds throughout the wound healing process.

Surgical & Sports Medicine Market

The same demographic trends that are driving the growth of the wound care market are also driving growth in the Surgical & Sports Medicine market. This market has seen an increase in surgical volumes in part due to a higher incidence of comorbidities and chronic inflammatory and degenerative conditions, such as OA and tendonitis. This volume increase is fostering increased interest in regenerative medicine products, as they can help support healing and improve outcomes in older and more challenging patient populations.

While our products have applicability across a wide variety of surgical specialties, our immediate surgical focus in addition to wound care is in regenerative orthobiologics, an area in which NuTech Medical has an established presence. Orthobiologics are substances that orthopedic surgeons use to help injuries to bones, tendons and ligaments heal more quickly. Orthobiologic products are used to treat people with long-term disabling musculoskeletal disorders and injuries.

We believe our multiple regenerative technology platforms will allow us to build a broad portfolio covering the full range of needs in the Surgical & Sports Medicine market. We also plan to leverage these platforms to expand into adjacent surgical markets in the near term. In the long-term, we plan to deepen our focus on chronic inflammatory and degenerative conditions, in particular OA. We intend to address patient needs in the inpatient hospital, ASC and clinic settings. We estimate the immediate addressable Surgical & Sports Medicine market for our products to be approximately $4.7 billion and is expected to grow at a CAGR of 10% from 2016 to 2020. This market is growing rapidly due to an increase in spinal fusions, bone reconstruction surgeries and musculoskeletal injuries and degenerative conditions.

Bone Fusion

Spine fusion surgery involves the use of grafting material to cause two vertebral bodies to grow together into one. In the United States, medical facilities performed 667,400 spinal fusion surgeries in 2013, of which

8

Table of Contents

398,300 were lumbar operations. Trauma and extremities applications, including ankle arthrodesis, now represent a bone fusion market nearly as large as the spine market. With improving fixation methods, success rates have improved across these applications. However, nonunion due to inadequate bone healing remains one of the leading causes of failure for fusion procedures. Fusion is especially challenging in patients with comorbidities such as diabetes, obesity, and smoking who have underlying healing deficiencies. According to Technavio, the annual market for orthobiologic products to aid in fusion exceeds $1.7 billion worldwide, excluding demineralized bone matrix, or DBM, and conventional allograft.(10)

Tendon and Ligament Injuries

Tendon and ligament injuries are common orthopedic conditions in an active and aging population. There are approximately 250,000 rotator cuff repairs performed in the United States annually. Additionally, in 2015, there were approximately 40,000 outpatient Achilles tendon repairs in the United States. Re-rupture and reoperation continue to be a significant source of concern with non-operative management, occurring in 4.8% of Achilles tendon repair cases and as many as 25% or more rotator cuff repair cases. Comorbidities such as diabetes and obesity, as well as age, are correlated with higher risk of failed healing and re-rupture. Regenerative tissue scaffolds may be used to support the healing of tendons, ligaments and other soft tissues. According to Technavio, the annual regenerative tissue scaffold market is estimated to exceed $1 billion.(11)

Chronic Inflammatory and Degenerative Conditions

Chronic inflammatory and degenerative orthopedic conditions are increasingly prevalent, driven in part by an aging demographic and higher levels of comorbidities such as diabetes and obesity. OA is the most common chronic condition of the joints, affecting approximately 27 million individuals in the United States. OA can affect multiple joints in the body, with arthritis of the knee being the most commonly treated. One in two adults will develop symptoms of knee OA during their lives. Other chronic inflammatory conditions such as Achilles and rotator cuff tendinosis and plantar fasciitis are also increasingly common. Similar to many of the other conditions that we seek to address, chronic inflammatory and degenerative orthopedic conditions are often correlated with smoking, obesity and diabetes, among other factors. Collectively, these and other related conditions were treated with an estimated 9 million injections in 2016, including steroids and hyaluronic acid, or HA. According to Technavio, the global HA market exceeded $2 billion in 2015.(12)

Our Solution

Conventional surgical approaches rely on mechanical fixation to temporarily approximate damaged tissues, assuming that the natural healing process will then result in a permanent repair. Patients with impaired healing may be unable to generate the necessary tissue structures, resulting in unacceptable failure rates over time.

In the case of bony fusion, autograft bone marrow has historically been used as a biologic to support bone healing. However, the use of autograft suffers from a number of short-comings that include donor site morbidity and varied outcomes due to the underlying health condition of the patient. Furthermore, it is a more invasive procedure leading to potentially slower healing times and side effects for the patient.

OA and other degenerative conditions, as well as soft tissue injuries such as tendinosis and fasciitis, are currently treated by injection with steroids or HA. However, steroids offer pain relief for only a limited period

| (10) | Technavio (2015), Global Orthobiologics Market Report, retrieved September 25, 2017, from EMIS Professional Database. |

| (11) | Technavio (2015), Global Regenerative Medicine Market Report, retrieved September 26, 2017, from EMIS Professional Database. |

| (12) | Technavio (2015), Global Orthobiologics Market Report, retrieved September 25, 2017, from EMIS Professional Database. |

9

Table of Contents

and have been shown to further degrade some types of tissues over time, worsening the underlying condition. The evidence of HA’s efficacy has been questioned, and it is clear that a significant percentage of patients do not respond to HA treatment. Patients who fail these less invasive therapies have limited options and may require surgical intervention, including total joint replacement.

Orthobiologics has been shown to be an effective alternative to traditional treatments. Due to their anti-inflammatory and pro-healing effects, they go beyond mechanical intervention to support the healing process in the damaged tissue and often result in faster healing times and shorter hospital stays. The orthobiologics market includes bone morphogenetic protein, viscosupplementation with HA, synthetic bone graft substitutes and stem cell therapy, in addition to DBM and allograft. The majority of our current and planned products in the Surgical & Sports Medicine space are based on amniotic technologies. There is a rapidly growing body of clinical and scientific evidence indicating the potential of these products in surgical applications, particularly in orthobiologics, resulting in increased adoption of these products. According to estimates from BioMed GPS, the amniotic orthobiologics market was $88 million in 2016 and is projected to grow at a CAGR of more than 22% through 2021.

Our Products

Advanced Wound Care

In the Advanced Wound Care market, we focus on the development and commercialization of a broad portfolio of cellular and acellular wound care offerings that treat patients from the earliest indication of impaired healing to wound closure. Our suite of products helps treat a wide range of wounds, including, but not limited to, chronic wounds such as VLUs, DFUs, and pressure ulcers and acute wounds such as traumatic wounds and burns.

The breadth and depth of our portfolio allows physicians to tailor solutions to meet the needs of individual wound care patients. Wounds of all types normally progress through predictable phases of healing, starting with inflammation, progressing to cell proliferation and finally remodeling to form normal skin. Wounds may stall during this process, typically in the inflammatory phase, for a variety of reasons. These reasons include biofilm or infection, uncontrolled inflammatory processes, shortages of cell types and growth factors secreted by cells that are critical to healing and disrupted cell signaling pathways.

It is increasingly recognized that addressing biofilm is an important step in healing any wound. Biofilm is generated by densely packed microbial communities that are attached to the wound surface and enclosed in a matrix of self-produced extracellular polymeric substance, or EPS. Biofilm is present in at least 78% of chronic wounds and can inhibit healing of all wound types. We engage with the physician at the earliest indication of impaired healing with our PuraPly AM product, which helps control biofilm via the broad spectrum antimicrobial PHMB. If reduction of biofilm and control of the excessive inflammatory response is sufficient to result in healing, as is often the case, PuraPly AM may be the only product required to achieve wound closure. If underlying healing issues persist, we offer an array of bioactive products tailored for a wide variety of wound sizes and types.

10

Table of Contents

Our advanced wound care products are used predominantly in wound clinics that are located in an outpatient hospital setting as well as in physician offices and ASCs. Our products that are used to treat burns are used predominantly in the inpatient hospital setting. The table below summarizes our comprehensive advanced wound care product suite:

| Product (Launch Year) |

Description |

Regulatory |

Clinical Application | |||

| Affinity (2014)†

|

Fresh amniotic membrane containing many types of viable cells, growth factors/cytokines, and ECM proteins | 361 HCT/P | Chronic and acute wounds | |||

| Apligraf (1998)

|

Bioengineered living cell therapy that contains two living cell types, keratinocytes and fibroblasts, that produce a broad spectrum of cytokines and growth factors | PMA | VLUs; DFUs | |||

| Dermagraft (2001)*

|

Bioengineered product with living human fibroblasts, seeded on a bioabsorbable scaffold, that produce human collagen, ECM, proteins, cytokines, and growth factors | PMA | DFUs | |||

| NuShield (2010)†

|

Dehydrated placental tissue graft preserved to retain all layers of the native tissue including both the amnion and chorion membranes, with the epithelial layer and the spongy/intermediate layer intact | 361 HCT/P | Chronic and acute wounds | |||

| PuraPly AM (2016)

|

Purified native collagen matrix with broad-spectrum polyhexamethylene biguanide, or PHMB, antimicrobial agent | 510(k) | Chronic and acute wounds (except 3rd degree burns) | |||

| † | Launched by NuTech Medical; acquired by Organogenesis in 2017. |

| * | Launched by Smith & Nephew; acquired by Organogenesis in 2014. |

Affinity

Affinity is the only available fresh, amniotic allograft for application in the care of chronic and acute wounds or surgical implantation in spine, orthopedic and sports medicine applications. We believe Affinity is one of only a few amniotic tissue products containing viable amniotic cells, and is unique in that it undergoes our proprietary AlloFresh process that hypothermically stores the product in its fresh state, never dried or frozen, which retains its native benefits and structure. Regulated as a human cells, tissues, and cellular and tissue-based

11

Table of Contents

product, or HCT/P, under Section 361 of the PHSA these products are referred to as Section 361 HCT/Ps, or simply 361 HCT/Ps. Affinity’s native cellular properties support cell and tissue growth making it an excellent option to support wound and soft tissue healing. Affinity was launched in 2014 by NuTech Medical and acquired by us in 2017.

Apligraf

Apligraf is a bioengineered bi-layered skin substitute that is the only product that has, to date, received PMA approval for the treatment of both VLUs and DFUs. Launched in 1998, Apligraf drives faster healing and more complete wound closure through its tissue engineered structure, which includes an outer layer of protective skin cells (human epidermal keratinocytes), and an inner layer of cells (human dermal fibroblasts) contained within a collagen matrix. Apligraf is the leading skin substitute product for the treatment of VLUs, and its effectiveness has been established based on an extensive clinical history with approximately 850,000 units shipped. We believe Apligraf is also the first and only wound-healing therapy to demonstrate in a randomized controlled trial, or RCT, a significant change in patients’ VLU wound tissue, showing a shift from a non-healing gene profile to a healing-profile. Apligraf plays an active role in healing by providing the wound with living human skin cells, growth factors and other proteins produced by the cells, and a collagen matrix.

Dermagraft

Dermagraft is a dermal substitute grown from human dermal fibroblasts and has received PMA approval for the treatment of DFUs. Launched in 2001 by Smith & Nephew and acquired by us in 2014, this product helps to restore the compromised wound bed to facilitate healing. The living cells in Dermagraft produce many of the same proteins and growth factors that support the healing response in healthy skin. In addition to an FDA-monitored RCT demonstrating its superiority to conventional therapy in the healing of DFUs, studies based on real world electronic health records and Medicare data have demonstrated its superior clinical efficacy and value as compared to competitive wound care products and conventional therapy. Dermagraft can be applied weekly (up to eight times) over a twelve-week period and does not need to be removed from the wound during this period because it contains a temporary mesh fabric that is dissolvable and becomes part of the body’s own healing processes.

NuShield

NuShield is a dehydrated placental tissue graft that is topically or surgically applied to the target tissue to support healing. Regulated as a 361 HCT/P, NuShield is processed using our proprietary BioLoc process, which preserves the native structure of the amnion and chorion membranes, including the intermediate or spongy layer, and their reservoir of growth factors and other proteins. NuShield is available in multiple sizes, can be used to help support healing of chronic and acute wounds of many sizes, and can be stored at room temperature with a five year shelf life. NuShield was launched in 2010 by NuTech Medical and acquired by us in 2017.

PuraPly Antimicrobial

PuraPly Antimicrobial, or PuraPly AM, was developed to address the challenges posed by bioburden and excessive inflammation in the wound. Functioning as a skin substitute, PuraPly AM is a purified native porcine type I collagen matrix embedded with polyhexamethylene biguanide, or PHMB, a localized broad spectrum antimicrobial. PuraPly AM was launched in 2016 and has received 510(k) clearance for the management of multiple wound types, including partial and full-thickness wounds, pressure ulcers, venous ulcers, diabetic ulcers, chronic vascular ulcers, tunneled/undermined wounds, surgical wounds, trauma wounds, draining wounds, and first- and second-degree burns. The combination of PHMB with a native collagen matrix helps manage bioburden while supporting healing across a wide variety of wound types, regardless of severity or duration. We also developed and received 510(k) clearance for PuraPly without PHMB, which we refer to as “PuraPly,” for those patients who do not require an antimicrobial agent.

12

Table of Contents

Surgical & Sports Medicine

In the Surgical & Sports Medicine market, we focus on the development and commercialization of products that support the healing of musculoskeletal injuries, including chronic degenerative conditions such as OA and tendonitis. Our products in this market are used predominantly in the inpatient and outpatient hospital and ASC settings. The table below summarizes the principal products in our Surgical & Sports Medicine product suite:

| Product (Launch Year) |

Description |

Regulatory |

Clinical Application | |||

| Affinity (2014)†

|

Fresh amniotic membrane containing many types of viable cells, growth factors/cytokines, and ECM proteins | 361 HCT/P | Tendon, ligament and other soft tissue injuries | |||

| NuCel (2009)†*

|

Cellular suspension, stem cell-containing allograft derived from human amnion tissue and amniotic fluid | 361 HCT/P | Orthopedic surgical procedures including bony fusion | |||

| NuShield (2010)†

|

Dehydrated placental tissue graft preserved to retain all layers of the native tissue including both the amnion and chorion membranes, with the epithelial layer and the spongy / intermediate layer intact | 361 HCT/P | Tendon, ligament and other soft tissue injuries | |||

| PuraPly AM (2016)

|

Purified native collagen matrix with broad-spectrum PHMB antimicrobial agent | 510(k) | Surgical treatment of open wounds | |||

| ReNu (2015)†*

|

Cryopreserved suspension of amniotic fluid cells and morselized amnion tissue from the same donor | 361 HCT/P | Chronic inflammatory and degenerative conditions; soft tissue injuries such as tendinosis and fasciitis | |||

| † | Launched by NuTech Medical; acquired by Organogenesis in 2017. |

| * | Initially commercialized as a 361 HCT/P but may require BLA approval pursuant to recent 361 HCT/P Guidance from the FDA. |

13

Table of Contents

NuCel

NuCel is a surgically implanted allograft derived from human amniotic tissue and amniotic fluid. NuCel is used primarily in spinal and orthopedic surgical applications to support tissue healing, including bone growth and fusion. The amniotic tissue harvesting process protects key biologic characteristics of the tissue that support healing. Several published clinical studies have demonstrated the clinical efficacy of NuCel, particularly in patients with significant comorbidities such as diabetes and obesity. While NuCel is currently regulated as a 361 HCT/P, clinical efforts are ongoing to secure BLA-approval for the product. NuCel was launched in 2009 by NuTech Medical and acquired by us in 2017.

ReNu

ReNu is a cryopreserved suspension derived from human amniotic tissue and amniotic fluid, formulated for office use. It can be used to support healing of soft tissues, particularly in degenerative conditions such as OA and joint and tendon injuries such as tendinosis and fasciitis. A pilot clinical study of ReNu for knee OA has been published, which we believe is indicative of its safety. The results of this study also suggest potential efficacy for a period of more than a year, significantly longer than available alternatives. While ReNu is currently regulated as a 361 HCT/P, clinical efforts are ongoing to secure BLA-approval for the product. Management believes BLA-approval may facilitate a significant incremental sales opportunity for ReNu. ReNu was launched in 2015 by NuTech Medical and acquired by us in 2017.

Affinity, NuShield and PuraPly AM

We also market our Affinity and NuShield products for surgical and orthopedic applications. Both products may be used as an adhesion barrier or as an on-lay or wrap in soft tissue repairs. The biological characteristics of these amniotic tissues may help support the healing of soft tissue defects, particularly in difficult-to-heal locations or challenging patient populations. In addition, we market our PuraPly AM product for the surgical treatment of open wounds.

Bone Allograft Products

Our bone allograft products, which are derived from donated human cadaveric bone, include OsteoIN, FiberOS and OCMP. Each of these products is used as a bone void filler, primarily in orthopedic and neurosurgical applications requiring bony fusion, such as spinal fusions and foot and ankle fusions. OsteoIN is a demineralized bone matrix putty that can be molded and pressed into bone voids as a filler. FiberOS is a blend of demineralized cortical fibers, mineralized cortical powder, and demineralized cortical powder and OCMP is a freeze-dried allograft cancellous (spongy or mesh-like) and demineralized cortical mixture. Both FiberOS and OCMP have osteoconductive and osteoinductive properties and are derived from the same donor. These products are typically sold as an ancillary product together with our amniotic product NuCel.

Trial and Study Results for FDA-Approved Products

We believe gathering robust and comprehensive clinical and real world outcomes data is an essential component of developing a competitive product portfolio and driving further penetration in the markets where we compete. We have accumulated a significant body of clinical evidence demonstrating the efficacy of Apligraf and Dermagraft. We continue to invest in generating similar data for other Advanced Wound Care and Surgical & Sports Medicine products, and believe such data enhances sales efforts with physicians and reimbursement dynamics with payers over time. Our product Apligraf is the only product that has obtained FDA approval for the treatment of both VLUs and DFUs. Our product Dermagraft has also received FDA approval for DFUs. Below is a summary of the primary data supporting each product, and a description of the clinical studies that are currently in progress. As used herein, p value is a measure of statistical significance. The lower the p value, the more likely it is that the results of a clinical trial or study are statistically significant rather than an experimental anomaly. Generally, to be considered statistically significant, such results must have a p value <0.05.

14

Table of Contents

Apligraf

Two pivotal studies were initially conducted with Apligraf demonstrating the safety and efficacy of the product in the treatment of full- and partial-thickness VLUs and DLUs. As a result, Apligraf obtained FDA approval for these indications. We have conducted a number of additional studies that provide further clinical evidence of the safety and efficacy of the product, including recent comparative effectiveness, cost effectiveness and mechanism of action studies.

Pivotal FDA Registration Trials

For the DFU indication, a multi-center prospective RCT of Apligraf for the treatment of DFUs versus standard of care was conducted. Two hundred eight patients with Type 1 and 2 diabetes were enrolled, who had a plantar DFU of full- or partial-thickness. Patients with a chronic wound that exhibited less than 30% healing prior to treatment were eligible for the clinical trial. All patients’ ulcers were off-loaded using either crutches or a wheelchair for the first six weeks, followed by customized pressure-relieving footwear for at least four weeks post closure. Mean ulcer size was 2.97 cm2 and 2.83 cm2 in the Apligraf and the control group, respectively. Mean duration of the ulcer was 12 months in the Apligraf group and 11 months in the control group.

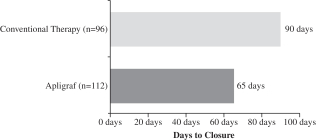

Apligraf was significantly more effective than conventional therapy for the incidence of complete wound closure over time. By 12 weeks of treatment, 56% (63 of 112 patients) of DFUs treated with Apligraf plus conventional therapy (debridement, saline dressings, total off-loading) were 100% closed, compared to 38% (36 of 96 subjects) of ulcers treated with conventional therapy alone (p=.0042). The median time to 100% wound closure was 65 days for DFUs treated with Apligraf plus conventional therapy versus 90 days for ulcers treated with conventional therapy alone (p=.0026).

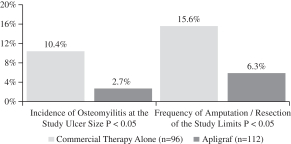

Recurrence is an important measure of healing durability, and in the study 96% of ulcers treated with Apligraf remained closed at six months versus 87% in the control group. An important outcome of the study was an observed reduction in the incidence of reported adverse events of osteomyelitis and amputations/resections. Patients receiving Apligraf had a statistically significant (p<.05) lower incidence of osteomyelitis at the study ulcer site (2.7% vs. 10.4%) compared to patients treated with conventional therapy at six months. Apligraf-treated patients required significantly fewer amputations or resections of the study limb (6.3% vs. 15.6%) (p <.05) compared to patients treated with conventional therapy at six months. The primary results of the study are presented in the figures below.

| Incidence of 100% Wound Closure | Median Time to 100% Wound Closure | |

|

|

|

15

Table of Contents

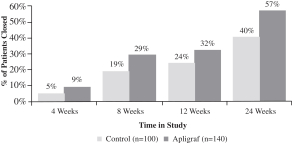

Reduction in Osteomyelitis and Amputation / Resection

For the VLU pivotal trial, the efficacy of Apligraf was evaluated in a prospective, parallel-group, randomized, controlled, multi-center study involving 240 patients with VLUs. Subjects receiving Apligraf in combination with compression therapy were compared with an active treatment concurrent control of zinc paste gauze and compression therapy. Apligraf plus compression therapy was more effective in achieving complete wound closure by week 24 (57% vs 40%, p=.022). In patients with long-standing VLUs with greater than one year’s duration (n=120), Apligraf plus compression therapy was more than twice as effective in achieving complete wound closure by week 24 (47% vs 19%, p=.002). The primary results of the study are presented in the figures below.

All Patients Achieving 100% Closure

Comparative Effectiveness and Economic Studies

We conducted three comparative effectiveness studies with Apligraf utilizing our proprietary access to data collected in Net Health’s WoundExpert® Electronic Medical Record, or EMR, database. Net Health’s wound care software is utilized by more than 1,000 wound care centers across the United States. In collaboration with statistical experts and leading clinicians, we analyzed outcomes of treatment with Apligraf versus other skin substitutes including EpiFix (owned by MiMedx), Theraskin (owned by Solsys Medical, LLC) and Oasis (owned by Smith & Nephew). All three studies showed that Apligraf improved overall healing rates as well as time to healing. For example, patients treated with Apligraf showed a 53% relative improvement in healing over patients treated with EpiFix at 24 weeks. All three studies have been published in peer-reviewed journals.

The Analysis Group, a private economics consulting firm, conducted a study to evaluate the economic outcomes of Medicare patients receiving Apligraf and Dermagraft, assessing the real-world medical services utilization and associated costs compared to patients receiving conventional care. Data for 502 matched Apligraf and conventional care patient pairs and 222 matched Dermagraft and conventional care patient pairs were analyzed. Increased costs associated with outpatient service utilization relative to matched conventional care patients were offset by lower amputation rates, fewer days hospitalized and fewer emergency department visits among Apligraf and Dermagraft patients. Consequently, Apligraf and Dermagraft patients with DFUs had per-patient average healthcare costs during the 18-month follow-up period that were lower than their respective

16

Table of Contents

matched conventional care counterparts (Apligraf was $5,253 (p=0.49), lower per patient, while Dermagraft was $6,991 (p=0.84) lower). These findings suggest that use of Apligraf and Dermagraft for treatment of DFU may lower overall medical costs through reduced utilization of costly healthcare services.

Mechanism of Action Clinical Study

To elucidate the mechanisms through which Apligraf promotes healing of chronic VLUs, the University of Miami Miller School of Medicine Department of Dermatology & Cutaneous Surgery conducted an RCT in which 24 patients with non-healing VLUs were treated with either standard of care (compression therapy) or Apligraf together with standard of care. Tissue biopsies were collected from the VLU edge before and one week after treatment, and the samples underwent comprehensive analysis of gene expression and protein analyses. The analyses conducted suggest that Apligraf induced a shift from a non-healing to a healing tissue response, involving modulation of inflammatory and growth factor signaling, keratinocyte activation, and attenuation of signaling involved in the chronic ulcer impaired state. In these ways, Apligraf application orchestrated a shift from the chronic non-healing ulcer microenvironment to a distinctive healing milieu resembling that of an acute, healing wound.

Dermagraft

Dermagraft was approved as a Class III medical device for the treatment of DFUs based on the results of a large pivotal clinical trial. Three hundred fourteen patients were enrolled in a prospective RCT to evaluate the safety and efficacy of Dermagraft in conjunction with conventional therapy compared to a control arm of conventional therapy alone. Conventional therapy involved the sharp debridement and cleaning of the ulcer, application of a wet-to-dry gauze and the use of therapeutic, pressure-reducing footwear. Patients were eligible to be screened for the trial if they had a plantar DFU on the heel or forefoot that was greater than 1cm2 and less than 20cm2. At the screening visit, the patients began receiving conventional therapy. If the DFU had not decreased in size by more than 50% during the next two weeks and the patient met all other inclusion and exclusion criteria, the patient was randomized into one of two treatment groups: Dermagraft plus conventional therapy or conventional therapy alone. Patients in the Dermagraft group received a weekly application of Dermagraft and conventional therapy for up to eight weeks. The primary endpoint for the trial was superiority in complete DFU closure by 12 weeks.

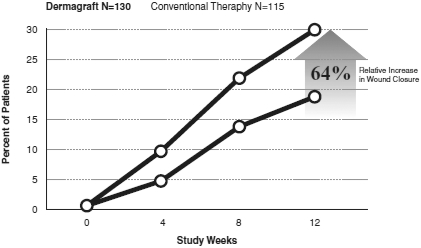

Pivotal FDA Registration Trial

In the pivotal clinical trial, the weekly application of Dermagraft and conventional therapy for up to eight weeks increased the proportion of DFUs that achieved 100% closure at 12 weeks by 64%, when compared to the use of conventional therapy alone. Patients treated in the Dermagraft group were 1.7 times more likely to achieve 100% closure than patients receiving conventional therapy alone. These results demonstrated statistically significant improvements. The incidence of adverse events among the Dermagraft and control groups were generally consistent across both groups, with the most common adverse events being infection at the DFU site, infection not at the DFU site, accidental injury and skin dysfunction/blister. However, the percentage of patients who developed an infection at the DFU site was significantly lower in the Dermagraft treatment group as compared with the control group, 10.4% versus 17.9%, respectively. No adverse laboratory findings were associated with the use of Dermagraft and no adverse device effects were reported in the trial. In addition, no immunological responses or rejections from patients that received Dermagraft were reported in this trial or in patients treated to date. The primary healing data for the trial is presented in the figure below.

17

Table of Contents

Percent of Patients with Complete Healing by 12 Weeks

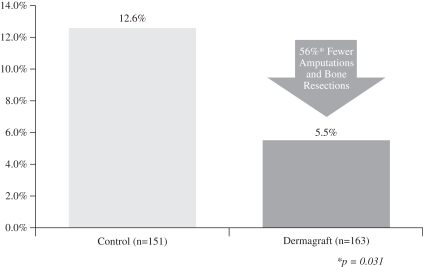

In a post-hoc analysis, it was determined that in patients treated with Dermagraft there was a significant reduction in incidence of amputations or bone resections, as compared to the control group (12.6% versus 5.5%, respectively, p=0.031). No adverse laboratory findings were associated with the use of Dermagraft and no adverse device effects were reported in the trial. In addition, no immunological responses or rejections from patients that received Dermagraft were reported in this trial or in patients treated to date. The amputation or bone resection data is presented in the figure below.

Frequency of Patients Experiencing a Study Ulcer-Related Amputation or

Bone Resection at 12 Weeks

Comparative Effectiveness and Economic Studies

We have conducted one comparative effectiveness study with Dermagraft, which utilizes our proprietary access to data collected in the EMR database. This study, which was published in a peer-reviewed journal, compared Dermagraft outcomes to EpiFix (owned by MiMedx), and showed a 52% relative improvement in healing over EpiFix by week 24.

18

Table of Contents

The economic study of Dermagraft in a Medicare population conducted by the Analysis Group is described under the heading “—Our Products—Clinical Trial Results—Apligraf—Comparative Effectiveness and Economic Studies” above.

Product Pipeline

We have a robust pipeline of products under development for both the Advanced Wound Care and Surgical & Sports Medicine markets. We believe our pipeline efforts will deepen our comprehensive portfolio of offerings as well as allow us to address additional clinical applications. Several products in our pipeline have already received FDA approval or clearance, and we expect to commercialize them in the near term.

TransCyte

TransCyte is a bioengineered tissue scaffold that promotes burn healing, and has received PMA approval for the treatment of second- and third-degree burns. TransCyte complements our portfolio to address all severities of burn wounds. TransCyte is a flexible, durable product that provides bioactive dermal components, an outer protective barrier, increased re-epithelialization and pain relief for patients suffering from burns. We believe TransCyte will address a sizable market opportunity with limited competition, with only one other PMA approved product that would be directly competitive to TransCyte currently on the market. We plan to commercially launch TransCyte, which was acquired from Shire and previously marketed by Smith & Nephew, in 2020.

PuraForce

PuraForce is a bioengineered porcine collagen surgical matrix for use in soft tissue reinforcement applications that is intended for 510(k) indications for the reinforcement of all tendons in the body. PuraForce has high biomechanical strength per unit thickness, making it ideal for extremities applications. We plan to commercially launch this product in the first half of 2019.

PuraPly XT

PuraPly XT is a version of PuraPly AM with enhanced thickness and PHMB content that allows for sustained presence of the antimicrobial barrier in the wound. Like PuraPly AM, PuraPly XT is intended for 510(k) indications for the treatment of chronic and acute wounds (other than 3rd degree burns) and the surgical treatment of open wounds. We plan to commercially launch this product in 2019.

PuraPly MZ

PuraPly MZ is a micronized particulate version of PuraPly that allows application in powder or gel form to deep and tunneling wounds. Like PuraPly, PuraPly MZ is intended for 510(k) indications for the treatment of chronic and acute wounds (other than 3rd degree burns) and the surgical treatment of open wounds. We plan to commercially launch this product in 2019.

Novachor

Novachor is a fresh chorionic membrane containing viable cells, growth factors/cytokines, and extracellular matrix (ECM) protein for the treatment of chronic and acute wounds that is currently regulated as a 361 HCT/P. We expect to commercially launch this product in the first quarter of 2020.

Gintuit

Gintuit is a surgically applied bioengineered bi-layered living cellular tissue that supports the healing of oral soft tissue. It is currently the only BLA approved product based on cultured allograft cells and it is indicated for

19

Table of Contents

the treatment of mucogingival conditions in adults. Gintuit consists of a cellular sheet comprised of human fibroblasts, keratinocytes, human ECM proteins, and bovine collagen that produce a wide array of cytokines and growth factors to support the regeneration of tissue. Gintuit is not currently marketed, but we plan to commercialize Gintuit in the future via a partnership in the oral surgery market.

Sponsors of products for which the FDA has approved a BLA are obligated by the PREA to carry out clinical trials of the products in pediatric populations, unless those requirements are waived. In 2012, we obtained FDA approval of a BLA for an oral tissue-engineered product to be marketed under the trade name Gintuit. Although Gintuit was not intended to be used in pediatric populations, the FDA imposed a requirement to conduct a pediatric study following approval. We originally planned to complete these studies within the timeframes established in the Gintuit approval letter. However, in 2014, we made a business decision to suspend commercialization of Gintuit, and all manufacturing, commercial and clinical activities for the product were discontinued. At that time, we informed the FDA of this decision and requested suspension of the pediatric study requirement, at which time the FDA placed Gintuit on its discontinued products list. Notwithstanding our request that the pediatric study requirement be suspended, we were notified by the FDA on June 29, 2017 that the FDA had determined that we had not complied with its PREA obligations. We responded and submitted a formal request for an extension for the pediatric study requirement for Gintuit; however, we were notified on October 5, 2017 that the request had been denied. Although we believe that, because Gintuit is not on the market and there is accordingly no foreseeable use of the product in pediatric populations, we are not currently subject to penalties for noncompliance. Should we decide to go to market with Gintuit, the product could be viewed as misbranded and subject to seizure or other enforcement action if marketing is resumed without completion of the required study.

Platform Technologies

Our proven research and development capabilities and established technology platforms support a robust and adaptable product pipeline for future applications. The platform technologies in which we have deep experience include:

| • | Bioengineered Cultured Cellular Products: The development and production of bioengineered cultured cellular products has been a core competency of Organogenesis since its founding. Our Apligraf, Dermagraft, TransCyte and Gintuit products all draw from our expertise in this area. |

| • | Collagen Biomaterial Technology Platform: Our porcine collagen biomaterial technology platform incorporates patented tissue cleaning processes and allows us to bioengineer products for specific applications by controlling thickness, strength and remodeling rates. We currently hold 510(k) clearances for a number of products in this platform with indications ranging from tendon reinforcement to plastic surgery and general surgery applications. We plan to commercially launch our PuraForce product from this platform in the second quarter of 2019. |

| • | Amniotic and Placental Products: Our current amniotic products are based on significant expertise in the processing of placental tissues and fluids to yield products with desirable characteristics. We have expertise using the full array of available tissue types and multiple processing methodologies, including our proprietary AlloFresh and BioLoc processing methods. Our proprietary AlloFresh process hypothermically stores our Affinity product in its fresh state, never dried or frozen, which retains its native benefits and structure. Our proprietary BioLoc process technology preserves the native structure of the amnion and chorion membranes, optimized to provide excellent strength, flexibility, and handling. |

Commercial Infrastructure

Sales and Marketing

We have dedicated substantial resources to establish a multi-faceted sales capability in the United States. Our current Advanced Wound Care portfolio is sold throughout the Unites States via an experienced direct sales

20

Table of Contents

force, which focuses its efforts on outpatient wound care. We use a mix of direct sales representatives and independent agencies to service the Surgical & Sports Medicine market. As of December 31, 2018, we had approximately 215 direct sales representatives and approximately 130 independent agencies who have substantial medical device sales experience in our target end markets. These sales representatives are supported by teams of professionals focused on sales management, sales operations and effectiveness, ongoing training, analytics and marketing.

We have historically focused our market development and commercial activities on the United States, but we have obtained marketing registrations, developed commercial and distribution capabilities, and we are currently selling products in several countries outside of the United States. Our Apligraf product is currently distributed by our direct sales force in Switzerland, and through independent sales agents in Saudi Arabia and Kuwait. Our NuShield product is also distributed by our direct sales force in Switzerland, and through independent sales agents in Kuwait. We have obtained marketing registration for our Dermagraft product in Mexico , but we are not currently distributing it. We are evaluating independent agency relationships to sell the product in Mexico. Additionally, we are evaluating the regulatory pathways and market potential for our products in other major markets, including the European Union and Japan. Sales generated by our direct sales forces in the United States have represented, and we anticipate will continue to represent, a majority of our revenues.

Customer Support Services

We offer our customers in-house customer support services, including services provided by our experienced reimbursement support team, our medical and technical support team and our field-based medical science liaison team. We believe that we have a competitive advantage by providing these essential support services in-house in that we are able to align the support services closely with our sales efforts as appropriate and improve the customer’s overall experience.

Research and Development

Our research and development team has extensive experience in developing regenerative medicine products, and works to design products that are intended to improve patient outcomes, simplify techniques, shorten procedures, reduce hospitalization and rehabilitation times and, as a result, reduce costs. We have recruited and retained staff with significant experience and skills, gained through both industry experience and training at leading colleges and universities with regenerative medicine graduate programs. In addition to our internal staff, our external network of development labs, testing labs and physicians aid us in our research and development process.

The majority of our product portfolio, including Apligraf, our PuraPly product family, Gintuit, our collagen biomaterial technology platform product family and all of our amniotic products, were developed by our legacy and NuTech Medical research and development team. We have proven competencies to bring products to market via a broad range of regulatory classifications, as evidenced by FDA approval or clearance of our products via PMA approval of a Class III medical device; BLA approval of a biologics product; and 510(k) clearance of a Class II medical device, in addition to our 361 HCT/P allograft products and several products for which we have obtained international registrations.

Manufacturing and Suppliers

We manufacture our non-amniotic products and use third-party manufacturers for our amniotic products. We have significant expansion capabilities in our in-house manufacturing facilities and we believe that our contract manufacturers are well positioned to support future expansion.

We have robust internal compliance processes to maintain the high quality and reliability of our products. We use annual internal audits, combined with external audits by regulatory agencies to monitor our quality

21

Table of Contents

control practices. We are registered with the FDA as a medical device manufacturing establishment and a HCT/P registered establishment. We are also accredited by the AATB and licensed with several states per their tissue banks regulations. All of our contract manufacturers are registered with the FDA as HCT/P establishments and are AATB accredited.

We utilize third-party raw material suppliers to support our internal manufacturing processes. We select all of our suppliers through a rigorous process to ensure high quality and reliability with the capacity to support our expanding production levels. Only raw material from approved suppliers is used in the manufacture of our products. To confirm quality and identify any risks, our approved suppliers are audited at pre-determined intervals. Historically, we have not experienced any significant difficulty locating and obtaining the suppliers or materials necessary to fulfill our production requirements. In the first quarter of 2019, however, we suspended production of our product Affinity due to production issues at one of our suppliers. As this was our sole supplier of Affinity, it will result in a disruption of our production capabilities. We have identified an alternate supplier and expect production from the new supplier to commence in the fourth quarter of 2019. As a result, the disruption in our production capabilities will continue until either our current supplier is able to take corrective action to satisfactorily remediate the deficiencies or our alternate supplier has commenced full-scale production.

Manufacture of our products is dependent on the availability of sufficient quantities of source tissue, which is the primary components of our products. Source tissue includes donated human tissue, porcine tissue and bovine tissue. We acquire donated human tissue directly through institutional review board approved protocols at multiple hospitals, as well as through tissue procurement firms engaged by us or by our contract manufacturers. We have two qualified porcine tissue suppliers, and currently one source of bovine tissue. Our processing of these tissues is, and our supplier sources are required to be, compliant with applicable FDA current Good Tissue Practice, or cGTP, regulations, AATB standards and U.S. Department of Agriculture, or USDA, requirements.

Reimbursement

Overview

Our customers primarily consist of hospitals, wound care centers, government facilities, ASCs and physician offices, all of whom rely on coverage and reimbursement for our products by Medicare, Medicaid and other third-party payers. Governmental insurance programs, such as Medicare and Medicaid, typically have published and defined coverage criteria and published reimbursement rates for medical products, services and procedures that are established by law or regulation. Non-government payers have their own coverage criteria and often negotiate payment rates for medical products, services and procedures. Many also require prior authorization as a prerequisite to coverage. In addition, in the United States, an increasing percentage of insured individuals are receiving their medical care through managed care programs, which monitor and also may require prior authorization for the products and services that a member receives. Coverage and reimbursement from government and commercial payers is not assured and is subject to change.