United

States Securities and Exchange Commission

Washington, D.C. 20549

FORM N-CSR

Certified

Shareholder Report of Registered Management Investment Companies

Investment Company Act file number 811-23121

Clayton Street Trust

(Exact name of registrant as specified

in charter)

151 Detroit Street, Denver, Colorado 80206

(Address of principal

executive offices) (Zip code)

Cara Owen, 151 Detroit Street, Denver, Colorado 80206

(Name

and address of agent for service)

Registrant's telephone number, including area code: 303-333-3863

Date of fiscal year end: 12/31

Date of reporting period: 12/31/22

Item 1 - Reports to Shareholders

ANNUAL REPORT December 31, 2022 | |||

Protective Life Dynamic Allocation Series - Conservative Portfolio | |||

Clayton Street Trust | |||

HIGHLIGHTS · Portfolio management perspective · Investment strategy behind your portfolio · Portfolio

performance, characteristics |

Table of Contents

Protective Life Dynamic Allocation Series - Conservative Portfolio

Protective Life Dynamic Allocation Series - Conservative Portfolio (unaudited)

Zoey Zhu co-portfolio manager | Benjamin Wang co-portfolio manager | Scott M. Weiner co-portfolio manager | |||

PERFORMANCE OVERVIEW

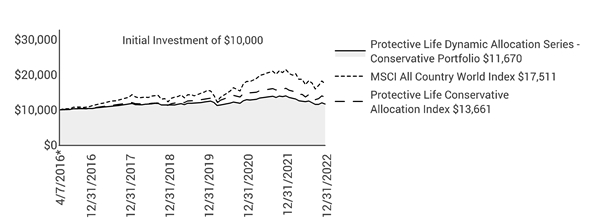

For the 12-month period ended December 31, 2022, the Protective Life Dynamic Allocation Series – Conservative Portfolio returned -16.70%. This compares with a return of -18.36% for its primary benchmark, the MSCI All Country World IndexSM, and -15.48% for its secondary benchmark, the Protective Life Conservative Allocation Index (our internally calculated blended benchmark of 50% MSCI All Country World Index and 50% Bloomberg U.S. Aggregate Bond Index).

MARKET ENVIRONMENT

Global financial markets lost considerable ground in 2022. The driving force was an acceleration of inflation that had initially been dismissed as “transitory.” Once it became apparent that inflation was reaching levels that could severely impact consumers’ purchasing power, monetary authorities were forced to pivot toward a hawkish stance by aggressively raising interest rates. The scale of rate hikes hit both bonds and equities, with the former reacting directly to monetary action and the latter pricing in both a slowing economy and higher discount rates’ impact on stock valuations.

PERFORMANCE DISCUSSION

The Portfolio outperformed its primary, all-equity benchmark but underperformed its secondary, blended benchmark. Proving most resilient within the Portfolio – though still generating losses in absolute terms – were Asia ex Japan equities along with an allocation toward shorter-duration global bonds. Most of the negative returns, however, were concentrated in the Portfolio’s allocation to the U.S. fixed income market and to large-cap U.S. equities. With respect to the former, the rise in interest rates across tenors – with inflation pushing up longer-dated yields and aggressive rate hikes impacting the front end of the yield curve – meant there was no place to hide from capital losses within the fixed income space. Large-cap U.S. stocks, meanwhile, faced the dual headwinds of a higher discount rate impacting their valuation multiples and the rising expectation of higher rates weighing on economic growth.

Thank you for investing in Protective Life Dynamic Allocation Series – Conservative Portfolio.

Asset Allocation - (% of Net Assets) | |||||

Investment Companies | 89.9% | ||||

Investments Purchased with Cash Collateral from Securities Lending | 8.8% | ||||

Repurchase Agreements | 1.6% | ||||

Other | (0.3)% | ||||

100.0% | |||||

Clayton Street Trust | 1 |

Protective Life Dynamic Allocation Series - Conservative Portfolio (unaudited)

Performance

See important disclosures on the next page. |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| |

Average Annual Total Return - for the periods ended December 31, 2022 |

|

| Prospectus Expense Ratios | ||||||

|

| One

| Five

| Since

|

|

| Total Annual Fund

| Net

Annual Fund | |

Protective Life Dynamic Allocation Series - Conservative Portfolio |

| -16.70% | 0.20% | 2.32% |

|

| 1.09% | 0.90% | |

MSCI All Country World Index |

| -18.36% | 5.23% | 8.68% |

|

|

|

| |

Protective Life Conservative Allocation Index |

| -15.48% | 2.94% | 4.74% |

|

|

|

| |

Morningstar Quartile - Class S Shares |

| 4th | 4th | 4th |

|

|

|

| |

Morningstar Ranking - based on total returns for Insurance Allocation--30% to 50% Equity Funds |

| 160/169 | 161/165 | 154/159 |

|

|

|

| |

Returns quoted are past performance and do not guarantee future results; current performance may be lower or higher. Investment returns and principal value will vary; there may be a gain or loss when shares are sold. For the most recent month-end performance call 800.456.6330.

Net expense ratios reflect expense waivers, if any, contractually agreed to through at least May 1, 2023. See Financial Highlights for actual expense ratios during the reporting period.

Investing involves risk and it is possible to lose money by investing. Investment return and value will fluctuate in response to issuer, political, market and economic developments, which can affect a single issuer, issuers within an industry, economic sector or geographic region, or the market as a whole. Please see the prospectus for more information about risks, holdings and other details.

Performance of the Dynamic Allocation Series Portfolios depends on that of the underlying funds. They are subject to risk with respect to the aggregation of holdings of underlying funds which may result in increased volatility as a result of indirectly having concentrated assets in a particular industry, geographical sector or single company.

No assurance can be given that the investment strategy will be successful under all or any market conditions. Although it is designed to achieve the Portfolio’s investment objective, there is no guarantee that it will achieve the desired results. Because Janus Henderson Investors US LLC is the adviser to the Portfolio and to certain affiliated funds that may be held within the Portfolio, it is subject to certain potential conflicts of interest.

Returns do not reflect the deduction of fees, charges or expenses of any insurance product or qualified plan. If applied, returns would have been lower.

2 | DECEMBER 31, 2022 |

Protective Life Dynamic Allocation Series - Conservative Portfolio (unaudited)

Performance

Returns include reinvestment of all dividends and distributions and do not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or redemptions of Portfolio shares. The returns do not include adjustments in accordance with generally accepted accounting principles required at the period end for financial reporting purposes.

Certain expenses waived or reimbursed during the first three years of operation may be recovered within three years of such waiver or reimbursement amount, if the expense ratio falls below certain limits.

When an expense waiver is in effect, it may have a material effect on the total return, and therefore the ranking for the period.

© 2022 Morningstar, Inc. All Rights Reserved.

There is no assurance that the investment process will consistently lead to successful investing.

See Notes to Schedule of Investments and Other Information for index definitions.

Index performance does not reflect the expenses of managing a portfolio as an index is unmanaged and not available for direct investment.

See “Useful Information About Your Portfolio Report.”

*The Portfolio’s inception date – April 7, 2016

‡ As stated in the prospectus. See Financial Highlights for actual expense ratios during the reporting period.

Clayton Street Trust | 3 |

Protective Life Dynamic Allocation Series - Conservative Portfolio (unaudited)

Expense Examples

As a shareholder of the Portfolio, you incur two types of costs: (1) transaction costs and (2) ongoing costs, including management fees; 12b-1 distribution and shareholder servicing fees; transfer agent fees and expenses payable pursuant to the Transfer Agency Agreement; and other Portfolio expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Portfolio and to compare these costs with the ongoing costs of investing in other mutual funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. The example is based upon an investment of $1,000 invested at the beginning of the period and held for the six-months indicated, unless noted otherwise in the table and footnotes below.

Actual Expenses

The information in the table under the heading “Actual” provides information about actual account values and actual expenses. You may use the information in these columns, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during the period.

Hypothetical Example for Comparison Purposes

The information in the table under the heading “Hypothetical (5% return before expenses)” provides information about hypothetical account values and hypothetical expenses based upon the Portfolio’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Portfolio’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Portfolio and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. Additionally, for an analysis of the fees associated with an investment in the Portfolio or other similar funds, please visit www.finra.org/fundanalyzer.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs, such as any charges at the separate account level or contract level. These fees are fully described in the Portfolio’s prospectus. Therefore, the hypothetical examples are useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transaction costs were included, your costs would have been higher.

|

|

|

|

|

|

|

|

| ||

|

|

| Actual |

| Hypothetical

|

| ||||

| Beginning | Ending | Expenses |

| Beginning | Ending | Expenses | Net Annualized | ||

| $1,000.00 | $948.30 | $4.22 |

| $1,000.00 | $1,020.87 | $4.38 | 0.86% | ||

† | Expenses Paid During Period is equal to the Net Annualized Expense Ratio multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). Expenses in the examples include the effect of applicable fee waivers and/or expense reimbursements, if any. Had such waivers and/or reimbursements not been in effect, your expenses would have been higher. Please refer to the Notes to Financial Statements or the Portfolio’s prospectus for more information regarding waivers and/or reimbursements. | |||||||||

4 | DECEMBER 31, 2022 |

Protective Life Dynamic Allocation Series - Conservative Portfolio

Schedule of Investments

December 31, 2022

Shares

or | Value | ||||||

Investment Companies– 89.9% | |||||||

Exchange-Traded Funds (ETFs) – 89.9% | |||||||

Franklin FTSE Japan# | 47,349 | $1,138,270 | |||||

Franklin FTSE United Kingdom# | 102,127 | 2,336,666 | |||||

Invesco NASDAQ 100# | 13,954 | 1,528,381 | |||||

iShares Core U.S. Aggregate Bond | 223,580 | 21,685,024 | |||||

JPMorgan BetaBuilders Developed Asia ex-Japan# | 22,816 | 1,116,615 | |||||

Vanguard FTSE Europe# | 43,836 | 2,430,268 | |||||

Vanguard S&P 500 | 17,917 | 6,294,959 | |||||

Vanguard Small-Cap# | 12,822 | 2,353,350 | |||||

Total Investment Companies (cost $41,349,198) | 38,883,533 | ||||||

Repurchase Agreements– 1.6% | |||||||

ING Financial Markets LLC, Joint repurchase agreement, 4.2600%, dated 12/30/22, maturing 1/3/23 to be repurchased at $700,331 collateralized by $821,878 in U.S. Treasuries 0.2500% - 5.3750%, 6/15/24 - 5/15/52 with a value of $714,338((cost $700,000) | $700,000 | 700,000 | |||||

Investments Purchased with Cash Collateral from Securities Lending– 8.8% | |||||||

Investment Companies – 7.0% | |||||||

Janus Henderson Cash Collateral Fund LLC, 4.1397%ºº,£ | 3,044,970 | 3,044,970 | |||||

Time Deposits – 1.8% | |||||||

Royal Bank of Canada, 4.3100%, 1/3/23 | $761,242 | 761,242 | |||||

Total Investments Purchased with Cash Collateral from Securities Lending (cost $3,806,212) | 3,806,212 | ||||||

Total Investments (total cost $45,855,410) – 100.3% | 43,389,745 | ||||||

Liabilities, net of Cash, Receivables and Other Assets – (0.3)% | (145,009) | ||||||

Net Assets – 100% | $43,244,736 | ||||||

See Notes to Schedule of Investments and Other Information and Notes to Financial Statements. | |

Clayton Street Trust | 5 |

Protective Life Dynamic Allocation Series - Conservative Portfolio

Schedule of Investments

December 31, 2022

Schedules of Affiliated Investments – (% of Net Assets)

Dividend Income | Realized Gain/(Loss) | Change in Unrealized Appreciation/ Depreciation | Value at 12/31/22 | |||||||

Investment Companies - N/A | ||||||||||

Exchange-Traded Funds (ETFs) - N/A | ||||||||||

Janus Henderson Short Duration Income | $ | 74,443 | $ | (131,701) | $ | 7,236 | $ | - | ||

Investments Purchased with Cash Collateral from Securities Lending - 7.0% | ||||||||||

Investment Companies - 7.0% | ||||||||||

Janus Henderson Cash Collateral Fund LLC, 4.1397%ºº | 15,432∆ | - | - | 3,044,970 | ||||||

Total Affiliated Investments - 7.0% | $ | 89,875 | $ | (131,701) | $ | 7,236 | $ | 3,044,970 | ||

Value at 12/31/21 | Purchases | Sales Proceeds | Value at 12/31/22 | |||||||

Investment Companies - N/A | ||||||||||

Exchange-Traded Funds (ETFs) - N/A | ||||||||||

Janus Henderson Short Duration Income | 1,180,033 | 18,218,791 | (19,274,359) | - | ||||||

Investments Purchased with Cash Collateral from Securities Lending - 7.0% | ||||||||||

Investment Companies - 7.0% | ||||||||||

Janus Henderson Cash Collateral Fund LLC, 4.1397%ºº | - | 71,991,796 | (68,946,826) | 3,044,970 | ||||||

Offsetting of Financial Assets and Derivative Assets | |||||||||

Gross Amounts | |||||||||

of Recognized | Offsetting Asset | Collateral | |||||||

Counterparty | Assets | or Liability(a) | Pledged(b) | Net Amount | |||||

ING Financial Markets LLC | $ | 700,000 | $ | — | $ | (700,000) | $ | — | |

JPMorgan Chase Bank, National Association | 3,705,957 | — | (3,705,957) | — | |||||

Total | $ | 4,405,957 | $ | — | $ | (4,405,957) | $ | — | |

(a) | Represents the amount of assets or liabilities that could be offset with the same counterparty under master netting or similar agreements that management elects not to offset on the Statement of Assets and Liabilities. | ||||||||

(b) | Collateral pledged is limited to the net outstanding amount due to/from an individual counterparty. The actual collateral amounts pledged may exceed these amounts and may fluctuate in value. | ||||||||

See Notes to Schedule of Investments and Other Information and Notes to Financial Statements. | |

6 | DECEMBER 31, 2022 |

Protective Life Dynamic Allocation Series - Conservative Portfolio

Notes to Schedule of Investments and Other Information

MSCI All Country World IndexSM | MSCI All Country World IndexSM reflects the equity market performance of global developed and emerging markets. |

Protective Life Conservative Allocation Index | Protective Life Conservative Allocation Index is an internally-calculated, hypothetical combination of total returns from the MSCI All Country World IndexSM (50%) and the Bloomberg U.S. Aggregate Bond Index (50%). |

LLC | Limited Liability Company |

ºº | Rate shown is the 7-day yield as of December 31, 2022. |

# | Loaned security; a portion of the security is on loan at December 31, 2022. |

£ | The Portfolio may invest in certain securities that are considered affiliated companies. As defined by the Investment Company Act of 1940, as amended, an affiliated company is one in which the Portfolio owns 5% or more of the outstanding voting securities, or a company which is under common ownership or control. |

∆ | Net of income paid to the securities lending agent and rebates paid to the borrowing counterparties. |

The following is a summary of the inputs that were used to value the Portfolio’s investments in securities and other financial instruments as of December 31, 2022. See Notes to Financial Statements for more information. | ||||||||||||

Valuation Inputs Summary | ||||||||||||

Level 2 - | Level 3 - | |||||||||||

Level 1 - | Other Significant | Significant | ||||||||||

Quoted Prices | Observable Inputs | Unobservable Inputs | ||||||||||

Assets | ||||||||||||

Investments In Securities: | ||||||||||||

Investment Companies | $ | 38,883,533 | $ | - | $ | - | ||||||

Repurchase Agreements | - | 700,000 | - | |||||||||

Investments Purchased with Cash Collateral from Securities Lending | - | 3,806,212 | - | |||||||||

Total Assets | $ | 38,883,533 | $ | 4,506,212 | $ | - | ||||||

Clayton Street Trust | 7 |

Protective Life Dynamic Allocation Series - Conservative Portfolio

Statement of Assets and Liabilities

December 31, 2022

|

|

|

|

|

|

|

Assets: |

|

|

|

| ||

| Unaffiliated investments, at value (cost $42,110,440)(1) |

| $ | 39,644,775 |

| |

| Affiliated investments, at value (cost $3,044,970) |

|

| 3,044,970 |

| |

| Repurchase agreements, at value (cost $700,000) |

|

| 700,000 |

| |

| Cash |

|

| 99,816 |

| |

| Receivables: |

|

|

|

| |

|

| Investments sold |

|

| 3,707,955 |

|

|

| Interest |

|

| 331 |

|

| Other assets |

|

| 8,761 |

| |

Total Assets |

|

| 47,206,608 |

| ||

Liabilities: |

|

|

|

| ||

| Collateral for securities loaned (Note 2) |

|

| 3,806,212 |

| |

| Payables: |

|

| — |

| |

|

| Portfolio shares repurchased |

|

| 39,322 |

|

|

| Investments purchased |

|

| 38,266 |

|

|

| Professional fees |

|

| 34,171 |

|

|

| 12b-1 Distribution and shareholder servicing fees |

|

| 9,784 |

|

|

| Advisory fees |

|

| 7,341 |

|

|

| Transfer agent fees and expenses |

|

| 4,166 |

|

|

| Custodian fees |

|

| 720 |

|

|

| Trustees' fees and expenses |

|

| 655 |

|

|

| Affiliated portfolio administration fees payable |

|

| 188 |

|

|

| Accrued expenses and other payables |

|

| 21,047 |

|

Total Liabilities |

|

| 3,961,872 |

| ||

Net Assets |

| $ | 43,244,736 |

| ||

Net Assets Consist of: |

|

|

|

| ||

| Capital (par value and paid-in surplus) |

| $ | 46,160,485 |

| |

| Total distributable earnings (loss) |

|

| (2,915,749) |

| |

Total Net Assets |

| $ | 43,244,736 |

| ||

Net Assets |

| $ | 43,244,736 |

| ||

| Shares Outstanding, $0.001 Par Value (unlimited shares authorized) |

|

| 4,181,217 |

| |

Net Asset Value Per Share |

| $ | 10.34 |

| ||

(1) Includes $3,705,957 of securities on loan. See Note 2 in Notes to Financial Statements. |

See Notes to Financial Statements. | |

8 | DECEMBER 31, 2022 |

Protective Life Dynamic Allocation Series - Conservative Portfolio

Statement of Operations

For the year ended December 31, 2022

|

|

|

|

|

|

Investment Income: |

|

|

| ||

| Dividends | $ | 748,339 |

| |

| Interest |

| 116,654 |

| |

| Dividends from affiliates |

| 74,443 |

| |

| Affiliated securities lending income, net |

| 15,432 |

| |

| Unaffiliated securities lending income, net |

| 2,939 |

| |

Total Investment Income |

| 957,807 |

| ||

Expenses: |

|

|

| ||

| Advisory fees |

| 178,023 |

| |

| 12b-1 Distribution and shareholder servicing fees |

| 111,197 |

| |

| Transfer agent administrative fees and expenses |

| 44,506 |

| |

| Other transfer agent fees and expenses |

| 973 |

| |

| Professional fees |

| 41,909 |

| |

| Non-affiliated portfolio administration fees |

| 40,540 |

| |

| Trustees’ fees and expenses |

| 9,548 |

| |

| Shareholder reports expense |

| 5,867 |

| |

| Custodian fees |

| 3,482 |

| |

| Affiliated portfolio administration fees |

| 2,553 |

| |

| Registration fees |

| 12 |

| |

| Other expenses |

| 8,718 |

| |

Total Expenses |

| 447,328 |

| ||

Less: Excess Expense Reimbursement and Waivers |

| (70,247) |

| ||

Net Expenses |

| 377,081 |

| ||

Net Investment Income/(Loss) |

| 580,726 |

| ||

Net Realized Gain/(Loss) on Investments: |

|

|

| ||

| Investments |

| (205,619) |

| |

| Investments in affiliates |

| (131,701) |

| |

Total Net Realized Gain/(Loss) on Investments |

| (337,320) |

| ||

Change in Unrealized Net Appreciation/Depreciation: |

|

|

| ||

| Investments |

| (8,615,848) |

| |

| Investments in affiliates |

| 7,236 |

| |

Total Change in Unrealized Net Appreciation/Depreciation |

| (8,608,612) |

| ||

Net Increase/(Decrease) in Net Assets Resulting from Operations | $ | (8,365,206) |

| ||

|

|

|

|

|

|

See Notes to Financial Statements. | |

Clayton Street Trust | 9 |

Protective Life Dynamic Allocation Series - Conservative Portfolio

Statements of Changes in Net Assets

|

|

|

|

|

|

|

|

|

|

|

| Year

ended |

| Year ended |

| ||

Operations: |

|

|

|

|

|

| ||

| Net investment income/(loss) | $ | 580,726 |

| $ | 441,063 |

| |

| Net realized gain/(loss) on investments |

| (337,320) |

|

| 2,507,737 |

| |

| Change in unrealized net appreciation/depreciation |

| (8,608,612) |

|

| 928,586 |

| |

Net Increase/(Decrease) in Net Assets Resulting from Operations |

| (8,365,206) |

|

| 3,877,386 |

| ||

Dividends and Distributions to Shareholders: |

|

|

|

|

|

| ||

| Dividends and Distributions to Shareholders |

| (1,579,613) |

|

| (410,491) |

| |

Net Decrease from Dividends and Distributions to Shareholders |

| (1,579,613) |

|

| (410,491) |

| ||

Capital Shares Transactions |

| 4,094,443 |

|

| 4,498,120 |

| ||

Net Increase/(Decrease) in Net Assets |

| (5,850,376) |

|

| 7,965,015 |

| ||

Net Assets: |

|

|

|

|

|

| ||

| Beginning of period |

| 49,095,112 |

|

| 41,130,097 |

| |

| End of period | $ | 43,244,736 |

| $ | 49,095,112 |

| |

|

|

|

|

|

|

|

|

|

See Notes to Financial Statements. | |

10 | DECEMBER 31, 2022 |

Protective Life Dynamic Allocation Series - Conservative Portfolio

Financial Highlights

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For a share outstanding during the year ended December 31 |

| 2022 |

|

| 2021 |

|

| 2020 |

|

| 2019 |

|

| 2018 |

| |||

| Net Asset Value, Beginning of Period |

| $12.88 |

|

| $11.95 |

|

| $11.73 |

|

| $11.04 |

|

| $11.42 |

| ||

| Income/(Loss) from Investment Operations: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||

|

| Net investment income/(loss)(1) |

| 0.14 |

|

| 0.12 |

|

| 0.12 |

|

| 0.21 |

|

| 0.17 |

| |

|

| Net realized and unrealized gain/(loss) |

| (2.27) |

|

| 0.92 |

|

| 0.28 |

|

| 0.87 |

|

| (0.40) |

| |

| Total from Investment Operations |

| (2.13) |

|

| 1.04 |

|

| 0.40 |

|

| 1.08 |

|

| (0.23) |

| ||

| Less Dividends and Distributions: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||

|

| Dividends (from net investment income) |

| (0.13) |

|

| (0.11) |

|

| (0.14) |

|

| (0.18) |

|

| (0.14) |

| |

|

| Distributions (from capital gains) |

| (0.28) |

|

| — |

|

| (0.04) |

|

| (0.21) |

|

| (0.01) |

| |

| Total Dividends and Distributions |

| (0.41) |

|

| (0.11) |

|

| (0.18) |

|

| (0.39) |

|

| (0.15) |

| ||

| Net Asset Value, End of Period |

| $10.34 |

|

| $12.88 |

|

| $11.95 |

|

| $11.73 |

|

| $11.04 |

| ||

| Total Return* |

| (16.70)% |

|

| 8.72% |

|

| 3.50% |

|

| 9.97% |

|

| (1.99)% |

| ||

| Net Assets, End of Period (in thousands) |

| $43,245 |

|

| $49,095 |

|

| $41,130 |

|

| $31,433 |

|

| $27,986 |

| ||

| Average Net Assets for the Period (in thousands) |

| $44,536 |

|

| $46,209 |

|

| $33,389 |

|

| $29,980 |

|

| $25,401 |

| ||

| Ratios to Average Net Assets**: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||

|

| Ratio of Gross Expenses(2) |

| 1.00% |

|

| 1.03% |

|

| 1.17% |

|

| 1.27% |

|

| 1.24% |

| |

|

| Ratio of Net Expenses (After Waivers and Expense Offsets)(2) |

| 0.85% |

|

| 0.84% |

|

| 0.83% |

|

| 0.79% |

|

| 0.79% |

| |

|

| Ratio of Net Investment Income/(Loss)(2) |

| 1.30% |

|

| 0.95% |

|

| 1.11% |

|

| 1.85% |

|

| 1.48% |

| |

| Portfolio Turnover Rate |

| 207% |

|

| 49% |

|

| 112% |

|

| 135% |

|

| 73% |

| ||

* Total return includes adjustments in accordance with generally accepted accounting principles required at the year or period end and are not annualized for periods of less than one full year. Total return does not include fees, charges, or expenses imposed by the variable annuity contracts for which Clayton Street Trust serves as an underlying investment vehicle. ** Annualized for periods of less than one full year. (1) Per share amounts are calculated based on average shares outstanding during the year or period. (2) Ratios do not include indirect expenses of the underlying funds and/or investment companies in which the Portfolio invests. |

See Notes to Financial Statements. | |

Clayton Street Trust | 11 |

Protective Life Dynamic Allocation Series - Conservative Portfolio

Notes to Financial Statements

1. Organization and Significant Accounting Policies

Protective Life Dynamic Allocation Series - Conservative Portfolio (the “Portfolio”) is a series of Clayton Street Trust (the “Trust”), which is organized as a Delaware statutory trust and is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end management investment company, and therefore has applied the specialized accounting and reporting guidance in Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 946. The Portfolio operates as a “fund of funds,” meaning substantially all of the Portfolio’s assets may be invested in exchange-traded funds (the “underlying funds”). The Trust offers three portfolios with differing investment objectives and policies. The Portfolio seeks total return through income and growth of capital, balanced by capital preservation. The Portfolio is classified as diversified, as defined in the 1940 Act. Janus Henderson Investors US LLC is the investment adviser (the “Adviser”) to the Portfolio.

The Portfolio currently offers one class of shares. The shares are offered in connection with investment in and payments under variable annuity contracts issued exclusively by Protective Life Insurance Company and its affiliates ("Protective Life").

Shareholders, including participating insurance companies, as well as accounts, may from time to time own (beneficially or of record) a significant percentage of the Portfolio’s Shares and can be considered to “control” the Portfolio when that ownership exceeds 25% of the Portfolio’s assets (and which may differ from control as determined in accordance with United States of America generally accepted accounting principles ("US GAAP")).

Underlying Funds

During the period, the Portfolio invested in a dynamic portfolio of exchange-traded funds across seven different equity asset classes, as well as fixed-income investments, and a short duration allocation that may be comprised of cash, money market instruments and short duration exchange-traded funds. The equity asset classes are adjusted weekly based on market conditions pursuant to a proprietary, quantitative-based allocation program. Over the long term, and when fully invested, the Portfolio seeks to maintain an asset allocation of approximately 50% global equity investments and 50% fixed income investments. Additional details and descriptions of the investment objectives of each of the potential underlying funds are available in the Portfolio's prospectus.

The following accounting policies have been followed by the Portfolio and are in conformity with US GAAP.

Investment Valuation

Portfolio

holdings are valued in accordance with policies and procedures established by the Adviser pursuant to

Rule 2a-5 under the 1940 Act and approved by and subject to the oversight of the

Trustees (the “Valuation Procedures”). Equity securities, including shares of exchange-traded funds,

traded on a domestic securities exchange are generally valued at readily available market quotations,

which are (i) the official close prices or (ii) last sale prices on the primary market or exchange in

which the securities trade. If such price is lacking for the trading period immediately preceding the

time of determination, such securities are valued at their current bid price. Equity securities that

are traded on a foreign exchange are generally valued at the closing prices on such markets. In the event

that there is no current trading volume on a particular security in such foreign exchange, the bid price

from the primary exchange is generally used to value the security. Foreign securities and currencies

are converted to U.S. dollars using the current spot USD dollar exchange rate in effect at the close

of the New York Stock Exchange (“NYSE”). The Portfolio will determine the market value of individual

securities held by it by using prices provided by one or more approved professional pricing services

or, as needed, by obtaining market quotations from independent broker-dealers. Most debt securities are

valued in accordance with the evaluated bid price supplied by the Adviser-approved pricing service that

is intended to reflect market value. The evaluated bid price supplied by the pricing service is an evaluation

that may consider factors such as security prices, yields, maturities, and ratings. Certain short-term

securities maturing within 60 days or less may be evaluated and valued on an amortized cost basis provided

that the amortized cost determined approximates market value. Securities for which market quotations

or evaluated prices are not readily available or deemed unreliable are valued at fair value determined

in good faith by the Adviser pursuant to the Valuation Procedures. Circumstances in which fair valuation

may be utilized include, but are not limited to: (i) a significant event that may affect the securities

of a single issuer, such as a merger, bankruptcy, or significant issuer-specific development; (ii) an

event that may affect an entire market, such as a natural disaster or significant governmental action;

(iii) a nonsignificant event such as a market closing early or not opening, or a security trading halt;

and (iv) pricing of a non-valued security and a restricted or nonpublic security. Special valuation considerations

may apply with respect to “odd-lot” fixed-income transactions which, due to their small size, may

receive evaluated prices by pricing

12 | DECEMBER 31, 2022 |

Protective Life Dynamic Allocation Series - Conservative Portfolio

Notes to Financial Statements

services which reflect a large block trade and not what actually could be obtained for the odd-lot position. The valuation policies provide for the use of systematic fair valuation models provided by independent pricing services to value foreign equity securities in order to adjust for stale pricing, which may occur between the close of certain foreign exchanges and the close of the NYSE.

Valuation Inputs Summary

FASB ASC 820, Fair Value Measurements and Disclosures (“ASC 820”), defines fair value, establishes a framework for measuring fair value, and expands disclosure requirements regarding fair value measurements. This standard emphasizes that fair value is a market-based measurement that should be determined based on the assumptions that market participants would use in pricing an asset or liability and establishes a hierarchy that prioritizes inputs to valuation techniques used to measure fair value. These inputs are summarized into three broad levels:

Level 1 – Unadjusted quoted prices in active markets the Portfolio has the ability to access for identical assets or liabilities.

Level 2 – Observable inputs other than unadjusted quoted prices included in Level 1 that are observable for the asset or liability either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data.

Assets or liabilities categorized as Level 2 in the hierarchy generally include: debt securities fair valued in accordance with the evaluated bid or ask prices supplied by a pricing service; securities traded on OTC markets and listed securities for which no sales are reported that are fair valued at the latest bid price (or yield equivalent thereof) obtained from one or more dealers transacting in a market for such securities or by a pricing service approved by the Portfolio’s Trustees; and certain short-term debt securities with maturities of 60 days or less that are fair valued at amortized cost. Other securities that may be categorized as Level 2 in the hierarchy include, but are not limited to, preferred stocks, bank loans, swaps, investments in unregistered investment companies, options, and forward contracts.

Level 3 – Unobservable inputs for the asset or liability to the extent that relevant observable inputs are not available, representing the Portfolio’s own assumptions about the assumptions that a market participant would use in valuing the asset or liability, and that would be based on the best information available.

The Portfolio classifies each of its investments in underlying funds as Level 1, without consideration as to the classification level of the specific investments held by the underlying funds. There have been no significant changes in valuation techniques used in valuing any such positions held by the Portfolio since the beginning of the fiscal year.

The inputs or methodology used for fair valuing securities are not necessarily an indication of the risk associated with investing in those securities. The summary of inputs used as of December 31, 2022 to fair value the Portfolio’s investments in securities and other financial instruments is included in the “Valuation Inputs Summary” in the Notes to Schedule of Investments and Other Information.

Investment Transactions and Investment Income

Investment transactions are accounted for as of the date purchased or sold (trade date). Dividend income is recorded on the ex-dividend date. Certain dividends from foreign securities held by the underlying funds will be recorded as soon as the Portfolio is informed of the dividend, if such information is obtained subsequent to the ex-dividend date. Dividends from foreign securities may be subject to withholding taxes in foreign jurisdictions. Non-cash dividends, if any, are recorded on the ex-dividend date at fair value. Any distributions from the underlying funds are recorded in accordance with the character of the distributions as designated by the underlying funds. Interest income is recorded daily on the accrual basis and includes amortization of premiums and accretion of discounts. The Portfolio classifies gains and losses on prepayments received as an adjustment to interest income. Debt securities may be placed in non-accrual status and related interest income may be reduced by stopping current accruals and writing off interest receivables when collection of all or a portion of interest has become doubtful. Gains and losses are determined on the identified cost basis, which is the same basis used for federal income tax purposes.

Expenses

The Portfolio bears expenses incurred specifically on its behalf. Additionally, the Portfolio, as a shareholder in the underlying funds, will also indirectly bear its pro rata share of the expenses incurred by the underlying funds.

Clayton Street Trust | 13 |

Protective Life Dynamic Allocation Series - Conservative Portfolio

Notes to Financial Statements

Estimates

The preparation of financial statements in conformity with US GAAP requires management to make estimates and assumptions that affect the reported amount of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements, and the reported amounts of income and expenses during the reporting period. Actual results could differ from those estimates.

Indemnifications

In the normal course of business, the Portfolio may enter into contracts that contain provisions for indemnification of other parties against certain potential liabilities. The Portfolio’s maximum exposure under these arrangements is unknown, and would involve future claims that may be made against the Portfolio that have not yet occurred. Currently, the risk of material loss from such claims is considered remote.

Dividends and Distributions

The Portfolio may make semiannual distributions of substantially all of its investment income and an annual distribution of its net realized capital gains (if any).

Federal Income Taxes

The Portfolio intends to continue to qualify as a regulated investment company and distribute all of its taxable income in accordance with the requirements of Subchapter M of the Internal Revenue Code. Management has analyzed the Portfolio’s tax positions taken for all open federal income tax years, generally a three-year period, and has concluded that no provision for federal income tax is required in the Portfolio’s financial statements. The Portfolio is not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months.

2. Other Investments and Strategies

Additional Investment Risk

The U.S. government and the Federal Reserve, as well as certain foreign governments and central banks, have taken extraordinary actions to support local and global economies and the financial markets in response to the COVID-19 pandemic. This and other government intervention into the economy and financial markets to address the COVID-19 pandemic may not work as intended, particularly if the efforts are perceived by investors as being unlikely to achieve the desired results. Government actions to mitigate the economic impact of the pandemic have resulted in a large expansion of government deficits and debt, the long term consequences of which are not known. The COVID-19 pandemic could adversely affect the value and liquidity of a Portfolio’s investments, impair a Portfolio’s ability to satisfy redemption requests, and negatively impact a Portfolio’s performance. In addition, the outbreak of COVID-19, and measures taken to mitigate its effects, could result in disruptions to the services provided to a Portfolio by its service providers.

Widespread disease, including pandemics and epidemics, and natural or environmental disasters, including those which may be attributable to global climate change, such as earthquakes, fires, floods, hurricanes, tsunamis and weather-related phenomena generally, have been and can be highly disruptive to economies and markets, adversely impacting individual companies, sectors, industries, markets, currencies, interest and inflation rates, credit ratings, investor sentiment, and other factors affecting the value of a Portfolio’s investments. Economies and financial markets throughout the world have become increasingly interconnected, which increases the likelihood that events or conditions in one region or country will adversely affect markets or issuers in other regions or countries, including the United States. These disruptions could prevent a Portfolio from executing advantageous investment decisions in a timely manner and negatively impact a Portfolio’s ability to achieve its investment objective(s). Any such event(s) could have a significant adverse impact on the value of a Portfolio. In addition, these disruptions could also impair the information technology and other operational systems upon which the Portfolio’s service providers, including the Adviser or the subadviser (as applicable), rely, and could otherwise disrupt the ability of employees of the Portfolio’s service providers to perform essential tasks on behalf of the Portfolio. Adverse weather conditions may also have a particularly significant negative effect on issuers in the agricultural sector and on insurance and reinsurance companies that insure or reinsure against the impact of natural disasters.

A number of countries in the European Union (the “EU”) have experienced, and may continue to experience, severe economic and financial difficulties. In particular, many EU nations are susceptible to economic risks associated with high levels of debt. Many non-governmental issuers, and even certain governments, have defaulted on, or been forced to restructure, their debts. Many other issuers have faced difficulties obtaining credit or refinancing existing obligations.

14 | DECEMBER 31, 2022 |

Protective Life Dynamic Allocation Series - Conservative Portfolio

Notes to Financial Statements

Financial institutions have in many cases required government or central bank support, have needed to raise capital, and/or have been impaired in their ability to extend credit. As a result, financial markets in the EU have experienced extreme volatility and declines in asset values and liquidity. These difficulties may continue, worsen, or spread further within the EU. Responses to these financial problems by European governments, central banks, and others, including austerity measures and reforms, may not work, may result in social unrest, and may limit future growth and economic recovery or have other unintended consequences. Among other things, these developments have adversely affected the value and exchange rate of the euro and pound sterling, and may continue to significantly affect the economies of all EU countries, which in turn may have a material adverse effect on the Portfolio’s investments in such countries, other countries that depend on EU countries for significant amounts of trade or investment, or issuers with exposure to debt issued by certain EU countries.

Exchange-Traded Funds

ETFs are typically open-end investment companies, which may be actively managed or passively managed. Passively managed ETFs generally seek to track the performance of a specific index. ETFs are traded on a national securities exchange at market prices that may vary from the net asset value per share (“NAV”) of their underlying investments. Accordingly, there may be times when an ETF trades at a premium or discount to its NAV. As a result, the Portfolio may pay more or less than NAV when it buys ETF shares, and may receive more or less than NAV when it sells those shares. ETFs also involve the risk that an active trading market for an ETF’s shares may not develop or be maintained. Similarly, because the value of ETF shares depends on the demand in the market, the Portfolio may not be able to purchase or sell an ETF at the most optimal time, which could adversely affect the Portfolio’s performance. In addition, ETFs that track particular indices may be unable to match the performance of such underlying indices due to the temporary unavailability of certain index securities in the secondary market or other factors, such as discrepancies with respect to the weighting of securities.

Repurchase Agreements

The Portfolio and other funds advised by the Adviser or its affiliates may transfer daily uninvested cash balances into one or more joint trading accounts. Assets in the joint trading accounts are invested in money market instruments and the proceeds are allocated to the participating funds on a pro rata basis.

Repurchase agreements held by the Portfolio are fully collateralized, and such collateral is in the possession of the Portfolio’s custodian or, for tri-party agreements, the custodian designated by the agreement. The collateral is evaluated daily to ensure its market value exceeds the current market value of the repurchase agreements, including accrued interest. In the event of default on the obligation to repurchase, the Portfolio has the right to liquidate the collateral and apply the proceeds in satisfaction of the obligation. In the event of default or bankruptcy by the other party to the agreement, realization and/or retention of the collateral or proceeds may be subject to legal proceedings.

Counterparties

Portfolio transactions involving a counterparty are subject to the risk that the counterparty or a third party will not fulfill its obligation to the Portfolio (“counterparty risk”). Counterparty risk may arise because of the counterparty’s financial condition (i.e., financial difficulties, bankruptcy, or insolvency), market activities and developments, or other reasons, whether foreseen or not. A counterparty’s inability to fulfill its obligation may result in significant financial loss to the Portfolio. The Portfolio may be unable to recover its investment from the counterparty or may obtain a limited recovery, and/or recovery may be delayed. The extent of the Portfolio’s exposure to counterparty risk with respect to financial assets and liabilities approximates its carrying value. See the "Offsetting Assets and Liabilities" section of this Note for further details.

The Portfolio may be exposed to counterparty risk through its investments in certain securities, including, but not limited to, repurchase agreements and debt securities. The Portfolio intends to enter into financial transactions with counterparties that the Adviser believes to be creditworthy at the time of the transaction. There is always the risk that the Adviser’s analysis of a counterparty’s creditworthiness is incorrect or may change due to market conditions. To the extent that the Portfolio focuses its transactions with a limited number of counterparties, it will have greater exposure to the risks associated with one or more counterparties.

Securities Lending

Under procedures adopted by the Trustees, the Portfolio may seek to earn additional income by lending securities to certain qualified broker-dealers and institutions. JPMorgan Chase Bank, National Association acts as securities lending agent and a limited purpose custodian or subcustodian to receive and disburse cash balances and cash collateral, hold

Clayton Street Trust | 15 |

Protective Life Dynamic Allocation Series - Conservative Portfolio

Notes to Financial Statements

short-term investments, hold collateral, and perform other custodial functions in accordance with the Non-Custodial Securities Lending Agreement. For financial reporting purposes, the Portfolio does not offset financial instruments’ payables and receivables and related collateral on the Statement of Assets and Liabilities. The Portfolio may lend portfolio securities in an amount equal to up to 1/3 of its total assets as determined at the time of the loan origination. There is the risk of delay in recovering a loaned security or the risk of loss in collateral rights if the borrower fails financially. In addition, the Adviser makes efforts to balance the benefits and risks from granting such loans. All loans will be continuously secured by collateral which may consist of cash, U.S. Government securities, domestic and foreign short-term debt instruments, letters of credit, time deposits, repurchase agreements, money market mutual funds or other money market accounts, or such other collateral as permitted by the SEC. If the Portfolio is unable to recover a security on loan, the Portfolio may use the collateral to purchase replacement securities in the market. There is a risk that the value of the collateral could decrease below the cost of the replacement security by the time the replacement investment is made, resulting in a loss to the Portfolio. In certain circumstances individual loan transactions could yield negative returns.

Upon receipt of cash collateral, the Adviser may invest it in affiliated or non-affiliated cash management vehicles, whether registered or unregistered entities, as permitted by the 1940 Act and rules promulgated thereunder. The Adviser currently intends to primarily invest the cash collateral in a cash management vehicle for which the Adviser serves as investment adviser, Janus Henderson Cash Collateral Fund LLC, or in time deposits. An investment in Janus Henderson Cash Collateral Fund LLC is generally subject to the same risks that shareholders experience when investing in similarly structured vehicles, such as the potential for significant fluctuations in assets as a result of the purchase and redemption activity of the securities lending program, a decline in the value of the collateral, and possible liquidity issues. Such risks may delay the return of the cash collateral and cause the Portfolio to violate its agreement to return the cash collateral to a borrower in a timely manner. As adviser to the Portfolio and Janus Henderson Cash Collateral Fund LLC, the Adviser has an inherent conflict of interest as a result of its fiduciary duties to both the Portfolio and Janus Henderson Cash Collateral Fund LLC. Additionally, the Adviser receives an investment advisory fee of 0.05% for managing Janus Henderson Cash Collateral Fund LLC and therefore may have an incentive to allocate collateral to the Janus Henderson Cash Collateral Fund LLC rather than to other collateral management options for which the Adviser does not receive compensation.

The value of the collateral must be at least 102% of the market value of the loaned securities that are denominated in U.S. dollars and 105% of the market value of the loaned securities that are not denominated in U.S. dollars. Loaned securities and related collateral are marked-to-market each business day based upon the market value of the loaned securities at the close of business, employing the most recent available pricing information. Collateral levels are then adjusted based on this mark-to-market evaluation. Additional required collateral, or excess collateral returned, is delivered on the next business day. Therefore, the value of the collateral held may be temporarily less than 102% or 105% value of the securities on loan. The cash collateral invested by the Adviser is disclosed in the Schedule of Investments (if applicable).

Income earned from the investment of the cash collateral, net of rebates paid to, or fees paid by, borrowers and less the fees paid to the lending agent are included as “Affiliated securities lending income, net” on the Statement of Operations. As of December 31, 2022, securities lending transactions accounted for as secured borrowings with an overnight and continuous contractual maturity are $3,705,957. Gross amounts of recognized liabilities for securities lending (collateral received) as of December 31, 2022 is $3,806,212, resulting in the net amount due to the counterparty of $100,255.

Offsetting Assets and Liabilities

The Portfolio presents gross and net information about transactions that are either offset in the financial statements or subject to an enforceable master netting arrangement or similar agreement with a designated counterparty, regardless of whether the transactions are actually offset in the Statement of Assets and Liabilities.

The Offsetting Assets and Liabilities table located in the Schedule of Investments presents gross amounts of recognized assets and/or liabilities and the net amounts after deducting collateral that has been pledged by counterparties or has been pledged to counterparties (if applicable). For corresponding information grouped by type of instrument, see the Portfolio's Schedule of Investments.

All repurchase agreements are transacted under legally enforceable master repurchase agreements that give the Portfolio, in the event of default by the counterparty, the right to liquidate securities held and to offset receivables and payables with the counterparty. For financial reporting purposes, the Portfolio does not offset financial instruments'

16 | DECEMBER 31, 2022 |

Protective Life Dynamic Allocation Series - Conservative Portfolio

Notes to Financial Statements

payables and receivables and related collateral on the Statement of Assets and Liabilities. Repurchase agreements held by the Portfolio are fully collateralized, and such collateral is in the possession of the Portfolio’s custodian or, for tri-party agreements, the custodian designated by the agreement. The collateral is evaluated daily to ensure its market value exceeds the current market value of the repurchase agreements, including accrued interest.

3. Investment Advisory Agreements and Other Transactions with Affiliates

The Portfolio pays the Adviser an investment advisory fee which is calculated daily and paid monthly. The Portfolio’s contractual investment advisory fee rate (expressed as an annual rate) is 0.40% of its average daily net assets.

The Adviser has contractually agreed to waive the advisory fee and/or reimburse operating expenses to the extent that the Portfolio’s normal operating expenses excluding the 12b-1 distribution and shareholder servicing fees, administrative services fees payable pursuant to the Transfer Agency Agreement, brokerage commissions, interest, dividends, taxes and extraordinary expenses, exceed the annual rate of 0.55% of the Portfolio’s average daily net assets. The Adviser has agreed to continue the waivers until at least May 1, 2023. If applicable, amounts reimbursed to the Portfolio by the Adviser are disclosed as “Excess Expense Reimbursement and Waivers” on the Statement of Operations. During the year ended December 31, 2022, the Adviser reimbursed the Portfolio $60,131 of fees and expenses.

The Adviser may recover from the Portfolio fees and expenses previously waived or reimbursed during the period beginning with the Portfolio’s commencement of operations and ending on the third anniversary of the commencement of operations (“Recoupment Period”). The Recoupment Period closed on April 7, 2019. The Adviser may elect to recoup such amounts only if: (i) recoupment is obtained within three years from the date an amount is waived or reimbursed to the Portfolio (“Recoupment Deadline”), and (ii) the Portfolio’s expense ratio at the time of recoupment, inclusive of the recoupment amounts, does not exceed the expense limit at the time of waiver or at the time of recoupment. The Adviser recouped $0 prior to the Recoupment Deadline.

The Adviser has also contractually agreed to waive and/or reimburse a portion of the Portfolio's management fee in an amount equal to the management fee it earns as an investment adviser to any of the affiliated registered mutual funds (including exchange traded funds) in which the Portfolio invests. The Adviser has agreed to continue the waiver through May 1, 2023. The Adviser may not recover amounts previously waived or reimbursed under this agreement. During the period ended December 31, 2022, the Adviser waived $10,116 of the Portfolio’s management fee, attributable to the Portfolio’s investment in the Janus Henderson Short Duration Income ETF.

The Adviser serves as administrator to the Portfolio pursuant to an administration agreement between the Adviser and the Trust. Under the administration agreement, the Adviser is authorized to perform, or cause others to perform certain administration, compliance, and accounting services to the Portfolio, including providing office space for the Portfolio, and is reimbursed by the Portfolio for certain of its costs in providing these services (to the extent the Adviser seeks reimbursement and such costs are not otherwise waived). In addition, employees of the Adviser and/or its affiliates may serve as officers of the Trust. The Portfolio pays for some or all of the salaries, fees, and expenses of the Adviser employees and Portfolio officers, with respect to certain specified administration functions they perform on behalf of the Portfolio. The Portfolio pays these costs based on out-of-pocket expenses incurred by the Adviser, and these costs are separate and apart from advisory fees and other expenses paid in connection with the investment advisory services the Adviser provides to the Portfolio. These amounts are disclosed as “Affiliated Portfolio administration fees” on the Statement of Operations. In addition, some expenses related to compensation payable to the Portfolio’s Chief Compliance Officer and certain compliance staff, all of whom are employees of the Adviser and/or its affiliates are shared with the Portfolio. Total compensation of $73,116 was paid to the Chief Compliance Officer and certain compliance staff by the Trust during the year ended December 31, 2022. The Portfolio's portion is reported as part of “Other expenses” on the Statement of Operations.

Janus Henderson Services US LLC (the “Transfer Agent”), a wholly-owned subsidiary of the Adviser, is the Portfolio’s transfer agent. The Transfer Agent provides or arranges for the provision of shareholder services including, but not limited to, recordkeeping, subaccounting, answering inquiries regarding accounts, order processing, transaction confirmations, the mailing of prospectuses and shareholder reports, and other shareholder services provided to or on behalf of shareholders. These amounts are disclosed as “Transfer agent administrative fees and expenses” on the Statement of Operations.

Clayton Street Trust | 17 |

Protective Life Dynamic Allocation Series - Conservative Portfolio

Notes to Financial Statements

The Transfer Agent receives an administrative services fee at an annual rate of 0.10% of the Portfolio’s average daily net assets for providing, or arranging for the provision by Protective Life of administrative services. The Transfer Agent expects to use this entire fee to compensate Protective Life for providing these services to its customers who invest in the Portfolio. These amounts are disclosed as “Transfer agent administrative fees and expenses” on the Statement of Operations.

Shareholder Services provided by Protective Life may include, but are not limited to, recordkeeping, subaccounting, order processing, providing order confirmations, periodic statements, forwarding prospectuses, shareholder reports, and other materials to existing contract holders, answering inquiries regarding accounts, and other administrative services. Order processing includes the submission of transactions through the National Securities Clearing Corporation (“NSCC”) or similar systems, or those processed on a manual basis with the Adviser.

Under a distribution and shareholder servicing plan (the "Plan") adopted in accordance with Rule 12b-1 under the 1940 Act, the Portfolio may pay the Trust's distributor, Janus Henderson Distributors US LLC (the “Distributor”), a wholly-owned subsidiary of the Adviser, a fee at an annual rate of up to 0.25% of the average daily net assets of the Portfolio. Under the terms of the Plan, the Trust is authorized to make payments to the Distributor for remittance to Protective Life or other intermediaries as compensation for distribution and/or shareholder services performed by Protective Life or its agents, or by such intermediary. Amounts that have been paid are disclosed as “12b-1 Distribution and shareholder servicing fees” on the Statement of Operations.

Any purchases and sales, realized gains/losses and recorded dividends from affiliated investments during the year ended December 31, 2022 can be found in the “Schedules of Affiliated Investments” located in the Schedule of Investments.

The Portfolio is permitted to purchase or sell securities (“cross-trade”) between itself and other funds or accounts managed by the Adviser in accordance with Rule 17a-7 under the Investment Company Act of 1940 (“Rule 17a-7”), when the transaction is consistent with the investment objectives and policies of the Portfolio and in accordance with the Internal Cross Trade Procedures adopted and amended by the Trust’s Board of Trustees. These procedures have been designed to ensure that any cross-trade of securities by the Portfolio from or to another fund or account that is or could be considered an affiliate of the Portfolio under certain limited circumstances by virtue of having a common investment adviser, common Officer, or common Trustee complies with Rule 17a-7. Under these procedures, each cross-trade is effected at the current market price to save costs where allowed. During the year ended December 31, 2022, the Portfolio engaged in cross trades amounting to $949,229 in purchases and $4,030,364 in sales, resulting in a net realized loss of $287,748. The net realized loss is included within the “Net Realized Gain/(Loss) on Investments” section of the Portfolio’s Statement of Operations.

4. Federal Income Tax

The tax components of capital shown in the table below represent: (1) distribution requirements the Portfolio must satisfy under the income tax regulations; (2) losses or deductions the Portfolio may be able to offset against income and gains realized in future years; and (3) unrealized appreciation or depreciation of investments for federal income tax purposes.

Other book to tax differences primarily consist of deferred compensation. The Portfolio has elected to treat gains and losses on forward foreign currency contracts as capital gains and losses, if applicable. Other foreign currency gains and losses on debt instruments are treated as ordinary income for federal income tax purposes pursuant to Section 988 of the Internal Revenue Code.

|

|

|

| Other Book | Net Tax |

|

Undistributed | Undistributed | Accumulated | Loss Deferrals | to Tax | Appreciation/ |

|

$ 276,035 | $ 866,793 | $ - | $ - | $ - | $ (4,058,577) |

|

18 | DECEMBER 31, 2022 |

Protective Life Dynamic Allocation Series - Conservative Portfolio

Notes to Financial Statements

The aggregate cost of investments and the composition of unrealized appreciation and depreciation of investment securities for federal income tax purposes as of December 31, 2022 are noted below. The primary differences between book and tax appreciation or depreciation of investments are wash sale loss deferrals and investments in partnerships.

Federal Tax Cost | Unrealized | Unrealized

| Net Tax Appreciation/ |

$ 47,448,322 | $ 203,678 | $ (4,262,255) | $ (4,058,577) |

Income and capital gains distributions are determined in accordance with income tax regulations that may differ from US GAAP. These differences are due to differing treatments for items such as net short-term gains, deferral of wash sale losses, foreign currency transactions, and capital loss carryovers. Certain permanent differences such as tax returns of capital and net investment losses noted below have been reclassified to capital.

For the year ended December 31, 2022 |

| |||

Distributions |

|

| ||

From Ordinary Income | From Long-Term Capital Gains | Tax Return of Capital | Net Investment Loss |

|

$ 504,807 | $ 1,074,806 | $ - | $ - |

|

For the year ended December 31, 2021 |

| |||

Distributions |

|

| ||

From Ordinary Income | From Long-Term Capital Gains | Tax Return of Capital | Net Investment Loss |

|

$ 410,491 | $ - | $ - | $ - |

|

Permanent book to tax basis differences may result in reclassifications between the components of net assets. These differences have no impact on the results of operations or net assets.

5. Capital Share Transactions

|

|

|

|

|

|

|

|

| Year ended December 31, 2022 |

| Year ended December 31, 2021 | ||

|

| Shares | Amount |

| Shares | Amount |

Shares sold | 1,076,604 | $12,126,147 |

| 1,014,856 | $12,448,372 | |

Reinvested dividends and distributions | 145,375 | 1,579,613 |

| 32,406 | 410,491 | |

Shares repurchased | (851,655) | (9,611,317) |

| (677,461) | (8,360,743) | |

Net Increase/(Decrease) | 370,324 | $ 4,094,443 |

| 369,801 | $ 4,498,120 | |

6. Purchases and Sales of Investment Securities

For the year ended December 31, 2022, the aggregate cost of purchases and proceeds from sales of investment securities (excluding any short-term securities, short-term options contracts, TBAs, and in-kind transactions, as applicable) was as follows:

Purchases of | Proceeds from Sales | Purchases of Long- | Proceeds from Sales |

$79,997,838 | $ 81,255,513 | $ - | $ - |

Clayton Street Trust | 19 |

Protective Life Dynamic Allocation Series - Conservative Portfolio

Notes to Financial Statements

7. Subsequent Event

Management has evaluated whether any events or transactions occurred subsequent to December 31, 2022 and through the date of issuance of the Portfolio’s financial statements and determined that there were no material events or transactions that would require recognition or disclosure in the Portfolio’s financial statements.

20 | DECEMBER 31, 2022 |

Protective Life Dynamic Allocation Series - Conservative Portfolio

Report of Independent Registered Public Accounting Firm

To the Board of Trustees of Clayton Street Trust and Shareholders of Protective Life Dynamic Allocation Series - Conservative Portfolio

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities, including the schedule of investments, of Protective Life Dynamic Allocation Series - Conservative Portfolio (one of the portfolios constituting Clayton Street Trust, referred to hereafter as the "Portfolio") as of December 31, 2022, the related statement of operations for the year ended December 31, 2022, the statements of changes in net assets for each of the two years in the period ended December 31, 2022, including the related notes, and the financial highlights for each of the five years in the period ended December 31, 2022 (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Portfolio as of December 31, 2022, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period ended December 31, 2022 and the financial highlights for each of the five years in the period ended December 31, 2022 in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Portfolio’s management. Our responsibility is to express an opinion on the Portfolio’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Portfolio in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits of these financial statements in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. Our procedures included confirmation of securities owned as of December 31, 2022 by correspondence with the custodian, transfer agent and brokers; when replies were not received from brokers, we performed other auditing procedures. We believe that our audits provide a reasonable basis for our opinion.

Denver, Colorado

February 15, 2023

We have served as the auditor of one or more investment companies in Janus Henderson Funds since 1990.

Janus Clayton Street Trust | 21 |

Protective Life Dynamic Allocation Series - Conservative Portfolio

Additional Information (unaudited)

Proxy Voting Policies and Voting Record

Information regarding how the Portfolio voted proxies related to portfolio securities during the most recent 12-month period ended June 30th and a description of the policies and procedures that the Portfolio uses to determine how to vote proxies relating to its portfolio securities is available without charge: (i) upon request, by calling 1-800-525-0020 (toll free); (ii) on the Portfolio’s website at janushenderson.com/proxyvoting; and (iii) on the SEC’s website at http://www.sec.gov.

Portfolio Holdings

The Portfolio files its complete portfolio holdings (schedule of investments) with the SEC as an exhibit to Form N-PORT within 60 days of the end of the first and third fiscal quarters, and in the annual report and semiannual report to shareholders. The Portfolio’s Form N-PORT filings and annual and semiannual reports: (i) are available on the SEC’s website at http://www.sec.gov; and (ii) are available without charge, upon request, by calling a Janus Henderson representative at 1-877-335-2687 (toll free).

22 | DECEMBER 31, 2022 |

Protective Life Dynamic Allocation Series - Conservative Portfolio

Useful Information About Your Portfolio Report (unaudited)

The Management Commentary in this report includes valuable insight as well as statistical information to help you understand how your Portfolio’s performance and characteristics stack up against those of comparable indices.

If the Portfolio invests in foreign securities, this report may include information about country exposure. Country exposure is based primarily on the country of risk. A company may be allocated to a country based on other factors such as location of the company’s principal office, the location of the principal trading market for the company’s securities, or the country where a majority of the company’s revenues are derived.

Please keep in mind that the opinions expressed in the Management Commentary are just that: opinions. They are a reflection based on best judgment at the time this report was compiled, which was December 31, 2022. As the investing environment changes, so could opinions. These views are unique and are not necessarily shared by fellow employees or by Janus Henderson in general.

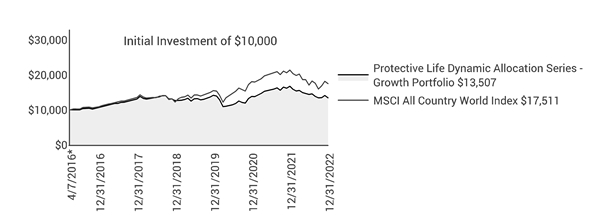

Performance Overviews

Performance overview graphs compare the performance of a hypothetical $10,000 investment in the Portfolio with one or more widely used market indices. When comparing the performance of the Portfolio with an index, keep in mind that market indices are not available for investment and do not reflect deduction of expenses.

Average annual total returns are quoted for a Portfolio with more than one year of performance history. Average annual total return is calculated by taking the growth or decline in value of an investment over a period of time, including reinvestment of dividends and distributions, then calculating the annual compounded percentage rate that would have produced the same result had the rate of growth been constant throughout the period. Average annual total return does not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or redemptions of Portfolio shares.

Cumulative total returns are quoted for a Portfolio with less than one year of performance history. Cumulative total return is the growth or decline in value of an investment over time, independent of the period of time involved. Cumulative total return does not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or redemptions of Portfolio shares.

Pursuant to federal securities rules, expense ratios shown in the performance chart reflect subsidized (if applicable) and unsubsidized ratios. The total annual fund operating expenses ratio is gross of any fee waivers, reflecting the Portfolio’s unsubsidized expense ratio. The net annual fund operating expenses ratio (if applicable) includes contractual waivers of the Adviser and reflects the Portfolio’s subsidized expense ratio. Ratios may be higher or lower than those shown in the “Financial Highlights” in this report.

Schedule of Investments

Following the performance overview section is the Portfolio’s Schedule of Investments. This schedule reports the types of securities held in the Portfolio on the last day of the reporting period. Securities are usually listed by type (common stock, corporate bonds, U.S. Government obligations, etc.) and by industry classification (banking, communications, insurance, etc.). Holdings are subject to change without notice.

The value of each security is quoted as of the last day of the reporting period. The value of securities denominated in foreign currencies is converted into U.S. dollars.

If the Portfolio invests in foreign securities, it will also provide a summary of investments by country. This summary reports the Portfolio exposure to different countries by providing the percentage of securities invested in each country. The country of each security represents the country of risk. The Portfolio’s Schedule of Investments relies upon the industry group and country classifications published by Bloomberg and/or MSCI Inc.

Tables listing details of individual forward currency contracts, futures, written options, swaptions, and swaps follow the Portfolio’s Schedule of Investments (if applicable).

Statement of Assets and Liabilities

This statement is often referred to as the “balance sheet.” It lists the assets and liabilities of the Portfolio on the last day of the reporting period.

Clayton Street Trust | 23 |

Protective Life Dynamic Allocation Series - Conservative Portfolio

Useful Information About Your Portfolio Report (unaudited)