UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington D.C. 20549

FORM 20-F

☐ REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended June 30, 2019

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

OR

☐ SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of event requiring this shell company report

Commission file number 000-38104

IMMURON LIMITED

(Exact name of Registrant as specified in

its charter

and translation of Registrant’s name into English)

Australia

(Jurisdiction of incorporation or organization)

Level 3, 62 Lygon Street, Carlton South, Victoria, 3053, Australia

(Address of principal executive offices)

Dr. Gary S. Jacob, Chief Executive Officer

Level 3, 62 Lygon Street, Carlton South, Victoria, 3053, Australia

+61 (0)3 9824 5254 (phone); +61 (0)3 9822 7735 (fax)

(Name, telephone, e-mail and/or facsimile number and address of company contact person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| Title of each class | Name of each exchange on which registered | |

| American Depositary Shares, each representing 40 Ordinary Shares |

The NASDAQ Stock Market LLC | |

| Warrants (expiring June 2022) | The NASDAQ Stock Market LLC |

Securities registered or to be registered pursuant to Section 12(g) of the Act: None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report:

Ordinary Shares, as of June 30, 2019 163,215,706

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ☐ No ☒

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15 (d) of the Securities Exchange Act of 1934.

Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§2232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☐ |

| Emerging growth company ☒ | Non-accelerated filer ☒ |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act. ☐

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| U.S. GAAP ☐ | International Financial Reporting Standards as issued by the International Accounting Standards Board ☒ | Other ☐ |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow:

Item 17 ☐ Item 18 ☐

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ☐ No ☒

INTRODUCTION

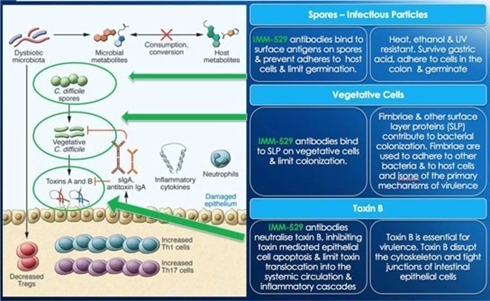

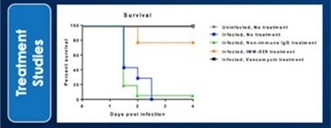

We are a commercial and clinical-stage biopharmaceutical company with a proprietary technology platform focused on the development and commercialization of a novel class of specifically targeted polyclonal antibodies that we believe can address significant unmet medical needs. Our oral polyclonal antibodies offer delivery within the gastrointestinal (“GI”) track and essentially do not cross into the bloodstream, potentially leading to much improved safety and tolerability, without sacrificing efficacy. We believe that our two lead drug candidates, IMM-124E and IMM-529, currently in clinical development, have the potential to transform the existing treatment paradigms for travelers’ diarrhea and for C. difficile infections, respectively. We currently market our flagship commercial product Travelan® in Australia, where it is a listed medicine on the Australian Register for Therapeutic Goods, as an over-the-counter product indicated to reduce the risk of travelers’ diarrhea. We also market Travelan® in Canada where it is licensed as a natural health product indicated to reduce the risk of travelers’ diarrhea, and presently market Travelan® in the U.S. as a dietary supplement for digestive tract protection.

Our American Depositary Shares (each, an “ADS” and, collectively the “ADSs”) and warrants (each, a “Warrant” and collectively, the “Warrants”)) are listed on The NASDAQ Capital Market under the symbols “IMRN” and “IMRNW”, respectively. Each ADS represents 40 of our ordinary shares, no par value. Each Warrant has a per ADS exercise price of US$10.00 and expires five years from the date of issuance. Our ordinary shares are also listed on the Australian Securities Exchange under the symbol “IMC.”

Our consolidated financial statements appearing in this annual report are prepared in Australian dollars and in accordance with the International Financial Reporting Standards, or IFRS, as issued by the International Accounting Standards Board, or IASB. Our consolidated financial statements appearing in this annual report comply with the IFRS.

In this annual report, all references to “U.S. dollars” or “US$” are to the currency of the United States, and all references to “Australian dollars”, “A$” or “AUD$” are to the currency of Australia. Unless otherwise indicated or the context implies otherwise, all references to “we,” “us,” or “our” refers to Immuron Limited, an Australian corporation.

Statements made in this annual report concerning the contents of any contract, agreement or other document are summaries of such contracts, agreements or documents and are not complete descriptions of all of their terms. If we filed any of these documents as an exhibit to this annual report or to any registration statement or annual report that we previously filed, you may read the document itself for a complete description of its terms.

Except for the historical information contained in this annual report, the statements contained in this annual report are “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act, and the Private Securities Litigation Reform Act of 1995, as amended, with respect to our business, financial condition and results of operations. Such forward-looking statements reflect our current view with respect to future events and financial results. We urge you to consider that statements which use the terms “anticipate,” “believe,” “expect,” “plan,” “intend,” “estimate,” or the negative of these terms or other comparable terminology. are intended to identify forward-looking statements. We remind readers that forward-looking statements are merely predictions and therefore inherently subject to uncertainties and other factors and involve known and unknown risks that could cause the actual results, performance, levels of activity, or our achievements, or industry results, to be materially different from any future results, performance, levels of activity, or our achievements expressed or implied by such forward-looking statements. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. Except as required by applicable law, including the securities laws of the United States, we undertake no obligation to publicly release any update or revision to any forward-looking statements to reflect new information, future events or circumstances, or otherwise after the date hereof. We have attempted to identify significant uncertainties and other factors affecting forward-looking statements in the Risk Factors section that appears in Item 3.D. “Key Information-Risk Factors.”

i

TABLE OF CONTENTS

ii

iii

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

Not applicable.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not applicable.

A. Selected Consolidated Financial Data

The tables below as of and for the five years ended June 30, 2019 set forth selected consolidated financial data, which is derived from our audited consolidated financial statements. The audited consolidated financial statements as of June 30, 2019 and, 2018 appear in this annual report. The consolidated income statement data for the years ended June 30, 2019, 2018 and 2017 and the consolidated balance sheet data as of June 30, 2019 and 2018 are derived from our audited consolidated financial statements included in “ITEM 18: Financial Statements”. The consolidated financial data as of June 30, 2017, 2016 and 2015 and for the years ended June 30, 2016 and 2015 have been derived from our audited consolidated financial statements which are not included in this annual report. The selected consolidated financial data set forth below should be read in conjunction with and is qualified entirely by reference to Item 5. “Operating and Financial Review and Prospects” and our consolidated financial statements and notes thereto included elsewhere in this annual report.

Statement of Comprehensive Income:

| For the year ended June 30, | ||||||||||||||||||||

2019 AUD$ | 2018 AUD$ | 2017 AUD$ | 2016 AUD$ | 2015 AUD$ | ||||||||||||||||

| Consolidated Statement of Profit or Loss and Other Comprehensive Income Data: | ||||||||||||||||||||

| Revenue from contracts with customers | 2,387,426 | 1,842,909 | 1,396,197 | 1,001,077 | 1,002,380 | |||||||||||||||

| Cost of Goods Sold | (667,371 | ) | (418,693 | ) | (337,546 | ) | (301,435 | ) | (316,128 | ) | ||||||||||

| Gross Profit | 1,720,055 | 1,424,216 | 1,058,651 | 699,642 | 686,252 | |||||||||||||||

| Other Income | 532,050 | 1,849,163 | 1,605,987 | 1,526,872 | 1,494,387 | |||||||||||||||

| Other gains/(losses) – net | 38,413 | 95,167 | (375,479 | ) | (221,112 | ) | (70,190 | ) | ||||||||||||

| Expenses: | ||||||||||||||||||||

| General and administrative expenses | (5,014,128 | ) | (3,412,576 | ) | (3,109,845 | ) | (4,337,686 | ) | (1,654,026 | ) | ||||||||||

| Research and development expenses | (1,044,528 | ) | (2,257,224 | ) | (4,630,674 | ) | (3,623,961 | ) | (3,018,294 | ) | ||||||||||

| Selling and marketing expenses | (864,644 | ) | (686,714 | ) | (1,271,526 | ) | (751,805 | ) | (226,583 | ) | ||||||||||

| Operating loss | (4,632,782 | ) | (2,987,968 | ) | (6,722,886 | ) | (6,708,050 | ) | (2,788,454 | ) | ||||||||||

| Finance income | 39 | 1,238 | 8,386 | 12,143 | 96,634 | |||||||||||||||

| Finance expenses | — | (24,199 | ) | (89,654 | ) | (372,860 | ) | — | ||||||||||||

| Finance costs - net | 39 | (22,961 | ) | (81,268 | ) | (360,717 | ) | 96,634 | ||||||||||||

| Loss before income tax | (4,632,743 | ) | (3,010,929 | ) | (6,804,154 | ) | (7,068,767 | ) | (2,691,820 | ) | ||||||||||

| Income Tax Expense | — | — | — | — | — | |||||||||||||||

| Loss for the period | (4,632,743 | ) | (3,010,929 | ) | (6,804,154 | ) | (7,068,767 | ) | (2,691,820 | ) | ||||||||||

| Other comprehensive income | ||||||||||||||||||||

| Items that may be reclassified to profit or loss: | ||||||||||||||||||||

| Exchange differences on translation of foreign operations | 61,846 | (79,599 | ) | 40,017 | 8,846 | (12,581 | ) | |||||||||||||

| Total Comprehensive Loss for the Period | (4,570,897 | ) | (3,090,528 | ) | (6,764,137 | ) | (7,059,921 | ) | (2,704,401 | ) | ||||||||||

| Loss per share, basic and diluted (in cents per share) | (3.20 | ) | (2.25 | ) | (6.40 | ) | (9.248 | ) | (3.592 | ) | ||||||||||

| Weighted-average number of shares outstanding, basic and diluted | 144,740,535 | 133,660,556 | 105,866,110 | 76,435,993 | 74,935,902 | |||||||||||||||

1

| As of June 30, | ||||||||||||||||||||

2019 AUD$ | 2018 AUD$ | 2017 AUD$ | 2016 AUD$ | 2015 AUD$ | ||||||||||||||||

| Consolidated Statement of Financial Position Data: | ||||||||||||||||||||

| Cash and cash equivalents | 5,119,887 | 4,727,430 | 3,994,924 | 2,290,639 | 3,116,074 | |||||||||||||||

| Total current assets | 6,682,444 | 7,050,437 | 8,267,654 | 8,809,421 | 5,998,898 | |||||||||||||||

| Total assets | 8,561,647 | 9,242,688 | 8,286,491 | 8,827,484 | 6,018,412 | |||||||||||||||

| Total current liabilities | 1,195,531 | 803,338 | 1,711,565 | 3,886,921 | 1,207,810 | |||||||||||||||

| Total liabilities | 1,210,511 | 803,338 | 1,711,565 | 3,886,921 | 1,207,810 | |||||||||||||||

| Total equity | 7,351,136 | 8,439,350 | 6,574,926 | 4,940,563 | 4,810,602 | |||||||||||||||

B. Capitalization and Indebtedness

Not applicable.

C. Reasons for the Offer and Use of Proceeds

Not applicable.

2

Investing in our ADSs involves a high degree of risk and uncertainty. You should carefully consider the risks and uncertainties described below before investing in our ADSs. Additional risks and uncertainties not presently known to us or that we believe to be immaterial may also adversely affect our business. If any of the following risks actually occurs, our business, prospects, financial condition and results of operations could be harmed. In that case, the price of our ADSs could decline, and you could lose all or part of your investment.

Risks Related to Our Financial Condition

As a company predominantly focused on the research and development activities of our existing patent portfolio pipeline we have incurred operating losses; we expect to continue to incur operating losses for the foreseeable future and may never achieve or maintain profitability.

We have incurred losses in every period since we began operations in 1994 and we have reported net losses of A$4,632,743, A$3,010,929, A$6,804,154, A$7,068,767 and A$2,691,820 during the fiscal years ended June 30, 2019, 2018, 2017, 2016 and 2015, respectively. As of June 30, 2019, our accumulated deficit was A$56,860,523. We are budgeting to continue to incur additional operating losses for the next several years as we expand our research and development activities for the treatment of infectious diseases, commence new trials for our product candidate IMM-529 for C. difficile, and potential other assets/indications. We may never be able to achieve or maintain profitability.

Our actual cash requirements may vary materially from those now planned and will depend upon numerous factors, including:

| ● | the continued progress of our research and development programs; |

| ● | the timing, scope, results and costs of pre-clinical studies and clinical trials; |

| ● | the cost, timing and outcome of regulatory submissions and approvals; |

| ● | determinations as to the commercial potential of our product candidates; |

| ● | spending on our marketed assets; |

| ● | our ability to successfully expand our contract manufacturing services; |

| ● | our ability to establish and maintain collaborative arrangements; and |

| ● | the status and timing of competitive developments. |

As of June 30, 2019, we had A$5,119,887 in cash and cash equivalents. Developing prescription products is expensive and we will need to secure additional financing in order to continue to meet our longer-term business objectives, including advancement of our research and development programs. We may also require additional funds to pursue regulatory clearances, defend our intellectual property rights, establish commercial scale manufacturing facilities, develop marketing and sales capabilities and fund operating expenses. We intend to seek such additional funding through public or private financings and/or through licensing of our assets or strategic alliances or other arrangements with corporate partners. The global economic climate could adversely impact our ability to obtain such funding, license our assets or enter into alliances or other arrangements with corporate partners. Any shortfall in funding could result in our having to curtail or cease our operations, including our research and development activities, which would be expected to adversely affect our business, financial condition and results of operations.

We have never generated any revenue from prescription product sales and this area of our business may never be profitable.

Our ability to generate significant revenue from prescription products and achieve profitability depends on our ability to, alone or with strategic collaboration partners, successfully complete the development of and obtain the regulatory approvals for our prescription product candidates, to manufacture sufficient supply of our product candidates, to establish a sales and marketing organization or suitable third-party alternative for the marketing of any approved products and to successfully commercialize any approved products on commercially reasonable terms. All of these activities will require us to raise sufficient funds to finance business activities. Currently, we do not expect any milestone payments from our collaborative partners to be significant in the foreseeable future. However, we are actively pursuing potential partner collaboration. In addition, we do not anticipate generating revenue from commercializing product candidates for the foreseeable future, if ever.

3

Our ability to generate future revenues from commercializing our intellectual property (“IP”) assets depends heavily on our success in:

| ● | establishing proof of concept in preclinical studies and clinical trials for our product candidates; |

| ● | successfully completing clinical trials of our product candidates; |

| ● | obtaining regulatory and marketing approvals for product candidates for which we complete clinical trials; |

| ● | maintaining, protecting and expanding our intellectual property portfolio, and avoiding infringing on intellectual property of third parties; |

| ● | establishing and maintaining successful licenses, collaborations and alliances with third parties; |

| ● | developing a sustainable, scalable, reproducible and transferable manufacturing process for our product candidates; |

| ● | establishing and maintaining supply and manufacturing relationships with third parties that can provide products and services adequate, in amount and quality, to support clinical development and commercialization of our product candidates, if approved; |

| ● | launching and commercializing any product candidates for which we obtain regulatory and marketing approval, either by collaborating with a partner or, if launched independently, by establishing a sales, marketing and distribution infrastructure; |

| ● | obtaining market acceptance of any product candidates that receive regulatory approval as viable treatment options; |

| ● | obtaining favorable coverage and reimbursement rates for our products from third-party payors; |

| ● | addressing any competing technological and market developments; |

| ● | identifying and validating new product candidates; and |

| ● | negotiating favorable terms in any collaboration, licensing or other arrangements into which we may enter. |

The process of developing product candidates for the prevention and treatment of gut mediated pathogens contains a number of inherent risks and uncertainties, including clinical and regulatory risks.

Even if one or more of our product candidates is approved for commercial sale, we may incur significant costs associated with commercializing any approved product candidate. As one example, our expenses could increase beyond expectations if we are required by the Food and Drug Administration, or FDA, or other regulatory agencies, domestic or foreign, to perform clinical and other studies in addition to those that we currently anticipate. Even if we are able to generate revenues from the sale of any approved products, we may not become profitable and may need to obtain additional funding to continue operations, which could have an adverse effect on our business, financial condition, results of operations and prospects.

We are a development stage company and our success is uncertain.

We are a clinical development stage company and our pharmaceutical products are designed to treat a range of infectious diseases. Other than our Travelan and Protectyn products, we have not sufficiently advanced the development of any of our products, including our current lead product candidate, IMM-124E, to market or generate revenues from their commercial application. Our current or any future product candidates, if successfully developed, may not generate sufficient or sustainable revenues to enable us to be profitable.

We receive Australian government research and development income tax concession refunds. If our research and development expenditures are not deemed eligible for the refund, we may encounter difficulties in the funding of future research and development projects, which could harm our operating results.

We have historically received, and expect to continue to receive, refunds from the Australian Federal Government’s Research and Development Tax Incentive program, under which the government provides a cash refund for the 43.5% of eligible research and development expenditures by small to medium size Australian entities during the year ended June 30, 2019, which are defined as Australian entities with less than A$20 million in revenue, having a tax loss.

The Research and Development Tax Incentive refunds are made by the Australian federal government for eligible research and development purposes based on the filing of an annual application and subsequent income tax returns for the fiscal year. We recognized Research and Development Tax Concession Incentive refunds in the fiscal years ended June 30, 2018, June 30, 2017, June 30, 2016 and June 30, 2015 of A$1,849,123 A$1,575,315, A$1,512,840, and A$1,478,581, respectively, and we have recognized A$531,005 for the fiscal year ended June 30, 2019, that includes an estimate of the receipt for the claim yet to be filed.

4

These refunds are available to fund our ongoing activities including our research and development activities in Australia, as well as activities in Europe, the U.S. and Israel to the extent such overseas-based expenses relate to our activities in Australia, do not exceed half the expenses for the relevant activities and are approved by the Australian government. To the extent our research and development expenditures are deemed to be “ineligible,” then our refunds would decrease. In addition, the Australian government may in the future modify the requirements of or reduce the amounts or percentage claimable in turn reducing the refunds available under the Research and Development Tax Incentive program, or discontinue the incentive program entirely. Any such change in the Research and Development Tax Incentive program would have a negative effect on our future cash flows and our potential associated future expenditures.

Risks Related to Our Business

We are faced with uncertainties related to our research.

Our research programs are based on scientific hypotheses and experimental approaches that may not lead to desired results. In addition, the timeframe for obtaining proof of principle and other results may be considerably longer than originally anticipated, or may not be possible given time, resource, financial, strategic and collaborator scientific constraints. Success in one stage of testing is not necessarily an indication that the particular program will succeed in later stages of testing and development. It is not possible to predict whether any of the drugs designed for these programs will prove to be safe, effective, and suitable for human use. Each drug will require additional research and development, scale-up, formulation and extensive clinical testing in humans. Unsatisfactory results obtained from a particular study relating to a program may cause us to abandon our commitment to that program or to the lead compound or product candidate being tested. The discovery of toxicities, lack of sufficient efficacy, unacceptable pharmacology, inability to increase scale of manufacture, market attractiveness, regulatory hurdles, competition, as well as other factors, may make our targets, lead therapies or product candidates unattractive for further development or unsuitable for human use, and we may abandon our commitment to that program, target, lead therapy or product candidate. Any delay in obtaining or failure to obtain required approvals could materially and adversely affect our ability to generate revenue from the particular product candidate, which likely would result in significant harm to our financial position and adversely impact the price of the ADS. Furthermore, any regulatory approval to market a product may be subject to limitations on the indicated uses for which we may market the product. These limitations may limit the size of the market for the product.

Clinical trials are expensive and time consuming, and their outcome is uncertain.

In order to obtain approvals to market a new drug product, we or our potential partners must demonstrate proof of safety and efficacy in humans. To meet these requirements, we or our potential partners will have to conduct extensive preclinical testing and “adequate and well- controlled” clinical trials. Conducting clinical trials is a lengthy, time-consuming and expensive process. The length of time may vary substantially according to the type, complexity, novelty and intended use of the product candidate, and often can be several years or more per trial. Even if we obtain positive results from preclinical or initial clinical trials, we may not achieve the same success in future trials. Clinical trials may not demonstrate statistically sufficient safety and effectiveness to obtain the requisite regulatory approvals for product candidates employing our technology. The failure of clinical trials to demonstrate safety and efficacy for a particular desired indication could harm development of that product candidate for other indications as well as other product candidates.

We expect to commence new clinical trials from time to time in the course of our business as our product development work continues. Any change in, or termination of, our clinical trials could materially harm our business, financial condition and results of operations.

We rely on third parties to conduct our preclinical studies and clinical trials. If these third parties do not meet our deadlines or otherwise conduct the studies as required, we may be delayed in progressing, or ultimately may not be able to progress, product candidates to clinical trials, our clinical development programs could be delayed or unsuccessful, and we may not be able to commercialize or obtain regulatory approval for our product candidates when expected, or at all.

We do not have the ability to conduct all aspects of our preclinical testing or clinical trials ourselves. We are dependent on third parties to conduct the clinical trials for IMM-124E and IMM-529, and preclinical studies for our other product candidates, and therefore the timing of the initiation and completion of these trials and studies is reliant on third parties and may occur at times substantially different from our estimates or expectations.

5

If we cannot contract with acceptable third parties on commercially reasonable terms, or if these third parties do not carry out their contractual duties, satisfy legal and regulatory requirements for the conduct of preclinical studies or clinical trials or meet expected deadlines, our clinical development programs could be delayed or discontinued.

We may experience delays in one or any of our clinical trial programs that could have an adverse effect on our business and operations, and future commercialization opportunities of our clinical pipeline.

To the extent we do our best to plan and mitigate against known risk aspects of our clinical trial programs, we do not know with any certainty whether the planned clinical trials will begin on time, whether we will complete any of our clinical trials on schedule, or at all, or within the forecasted budget. Our ability to commence and complete clinical trials may be delayed by many factors, including, but not limited to:

| ● | government or regulatory delays, including delays in obtaining approvals from applicable hospital ethics committees and internal review boards; |

| ● | slower than expected patient enrollment; |

| ● | our inability to manufacture sufficient quantities of our new proprietary compound or our other product candidates or matching controls; |

| ● | unforeseen safety issues; or |

| ● | lack of efficacy or unacceptable toxicity during the clinical trials or non-clinical studies. |

Patient enrollment is a function of, among other things, the nature of the clinical trial protocol, the existence of competing protocols, the size and longevity of the target patient population, and the availability of patients who comply with the eligibility criteria for the clinical trial. Delays in planned patient enrollment may result in increased costs, delays or termination of the clinical trials. Moreover, we rely on third parties such as clinical research organizations to assist us in clinical trial management functions including clinical trial database management, statistical analyses, site management and monitoring. Any failure by these third parties to perform under their agreements with us may cause the trials to be delayed or result in a failure to complete the trials.

If we experience delays in testing, in gaining the receipt of necessary approvals, or if we need to perform more, larger or more complex clinical trials than planned, our product development costs may increase. Significant delays could adversely affect the commercial prospects of our product candidates and our business, financial condition and results of operations.

We may not be successful in obtaining or maintaining other rights necessary for the development of our pipeline through acquisitions and in-licenses.

Our product candidates may require specific formulations to work effectively, and efficiently, and rights to such formulations may be held by others. We may be unable to acquire or in-license any compositions, methods of use, processes or other third-party intellectual property rights from third parties that we identify on terms that we find acceptable, or at all. The licensing and acquisition of third-party intellectual property rights is a competitive area, and a number of more established companies are also pursuing strategies to license or acquire third-party intellectual property rights that we may consider attractive. These established companies may have a competitive advantage over us due to their size, cash resources and greater clinical development and commercialization capabilities.

For example, we sometimes collaborate with U.S. and foreign academic institutions to accelerate our preclinical research or development under written agreements with these institutions. Typically, these institutions provide us with an option to negotiate a license to any of the institution’s rights in technology resulting from the collaboration. Regardless of such right of first negotiation for intellectual property, we may be unable to negotiate a license within the specified time frame or under terms that are acceptable to us. If we are unable to do so, the institution may offer the intellectual property rights to other parties, potentially blocking our ability to pursue our program.

In addition, companies that perceive us to be a competitor may be unwilling to assign or license rights to us. We also may be unable to license or acquire third-party intellectual property rights on terms that would allow us to make an appropriate return on our investment. If we are unable to successfully obtain rights to required third-party intellectual property rights, our business, financial condition and prospects for growth could suffer.

6

We rely on research institutions to conduct our clinical trials and we may not be able to secure and maintain research institutions to conduct our future trials.

Our reliance upon research institutions, including public and private hospitals and clinics, provides us with less control over the timing and cost of clinical trials, clinical study management personnel and the ability to recruit subjects. If we are unable to reach agreements with suitable research institutions on acceptable terms, or if any resulting agreement is terminated, we may be unable to secure, maintain, or quickly replace the research institution with another qualified institution on acceptable terms.

We grant licenses to our collaborators to use our hyper-immune colostrum technology exclusively for the development of product candidates for certain conditions.

We may out-license to our collaborators the right to use our hyper-immune colostrum technology for the development of product candidates for certain conditions, so long as our collaborators comply with certain requirements. That means that once our technology is licensed to a collaborator for a specified condition, we are generally prohibited from developing product candidates for that condition and from licensing to any third party for that condition. The limitations imposed by these exclusive licenses could prevent us from expanding our business and increasing our development of product candidates with new collaborators, both of which could adversely affect our business and results of operations.

We may not be able to complete the development of IMM-124E, IMM-529 or develop other pharmaceutical products.

We may not be able to progress with the development of our current, or any future, pharmaceutical product candidates to a stage that will attract a suitable collaborative partner for the development of any current or future pharmaceutical product candidates. The projects initially specified in connection with any such collaboration and any associated funding may change or be discontinued as a result of changing interests of either the collaborator or us, and any such change may change the budget for the projects under the collaboration. Additionally, our research may not lead to the discovery of additional product candidates, and any of our current and future product candidates may not be successfully developed, prove to be safe and efficacious in clinical trials, meet applicable regulatory standards and receive regulatory approval, be capable of being produced in commercial quantities at reasonable costs, or be successfully or profitably marketed, either by us or a collaborative partner. The products we develop may not be able to penetrate the potential market for a particular therapy, or indication, or gain market acceptance among health care providers, patients and third-party payers. We cannot predict if or when the development of IMM-124E, IMM-529 or any future pharmaceutical product will be completed or commercialized, whether funded by us, as part of a collaboration or through a grant.

We may need to prioritize the development of our most promising candidates at the expense of the development of other products.

We may need to prioritize the allocation of development resources and/or funds towards what we believe to be our most promising product or products. The nature of the drug development process is such that there is a constant availability of new information and data that could positively or adversely affect any of our products in development. We cannot predict how such new information and data may impact in the future the prioritization of the development of our current or future product candidates or that any of our products, regardless of its development stage or the investment of time and funds in its development, will continue to be funded or developed.

Our research and development efforts will be seriously jeopardized if we are unable to retain key personnel and cultivate key academic and scientific collaborations.

Our future success depends to a large extent on the continued services of our senior management and key scientific personnel, including Dr. Gary S Jacob who is currently our Chief Executive Officer. The loss of the services from Dr. Jacob could negatively affect our business.

Competition among biotechnology and pharmaceutical companies for qualified employees is intense, including competition from larger companies with greater resources, and we may not be able to continue to attract and retain qualified management, technical and scientific personnel critical to our success. Our success is highly dependent on our ability to develop and maintain important relationships with leading academic institutions and scientists who conduct research at our request or assist us in formulating our research and development strategies. These academic and scientific collaborators are not our employees and may have commitments to, or consulting or advisory contracts with, other entities that may limit their availability to us. In addition, these collaborators may have arrangements with other companies to assist such companies in developing technologies that may prove competitive to ours.

7

If we are unable to successfully keep pace with technological change or with the advances of our competitors, our technology and products may become obsolete or non-competitive.

The biotechnology and pharmaceutical industries are subject to rapid and significant technological change. Our competitors are numerous and include major pharmaceutical companies, biotechnology firms, universities and other research institutions. These competitors may develop technologies and products that are more effective than any that we are developing, or which would render our technology and products obsolete or non-competitive. Many of these competitors have greater financial and technical resources and manufacturing and marketing capabilities than we do. In addition, many of our competitors have much more experience than we do in pre-clinical testing and human clinical trials of new or improved drugs, as well as in obtaining regulatory approvals.

We know that competitors are developing or manufacturing various technologies or products for the treatment of diseases that we have targeted for product development. Some of these competitive products use therapeutic approaches that compete directly with our product candidates. Our ability to further develop our products may be adversely affected if any of our competitors were to succeed in obtaining regulatory approval for their competitive products sooner than us.

Acceptance of our products in the marketplace is uncertain, and failure to achieve market acceptance will negatively impact our business and operations.

Our current or future products may not achieve market acceptance even if they are approved by regulatory authorities. The degree of market acceptance of such products will depend on a number of factors, including:

| ● | the receipt and timing of regulatory approvals for the uses that we are studying; |

| ● | the establishment and demonstration to the medical community of the safety, clinical efficacy or cost-effectiveness of our product candidates and their potential advantages over existing therapeutics and technologies; and |

| ● | the pricing and reimbursement policies of governments and third-party payors. |

Physicians, patients, third-party payors or others in the medical community may not be receptive to our product candidates, and we may not generate any future revenue from the sale or licensing of our product candidates.

Even if we obtain approval for a product candidate, we may not generate or sustain revenue from sales of the product if the product cannot be sold at a competitive cost or if it fails to achieve market acceptance by physicians, patients, third-party payors or others in the medical community. These market participants may be hesitant to adopt a novel treatment based on hyper-immune colostrum technology, and we may not be able to convince the medical community and third-party payors to accept and use, or to provide favorable reimbursement for, any product candidates developed by us or our existing or future collaborators. Market acceptance of our product candidates will depend on, among other factors:

| ● | the safety and efficacy of our product candidates; |

| ● | our ability to offer our products for sale at competitive prices; |

| ● | the relative convenience and ease of administration of our product candidates; |

| ● | the prevalence and severity of any adverse side effects associated with our product candidates; |

| ● | the terms of any approvals and the countries in which approvals are obtained; |

| ● | limitations or warnings contained in any labeling approved by the FDA or comparable foreign regulatory authorities; |

| ● | conditions upon the approval imposed by FDA or comparable foreign regulatory authorities, including, but not limited to, a Risk Evaluation and Mitigation Strategy (“REMS”); |

| ● | the willingness of patients to try new treatments and of physicians to prescribe these treatments; |

| ● | the availability of government and other third-party payor coverage and adequate reimbursement; and |

| ● | availability of alternative effective treatments for the disease indications our product candidates are intended to treat and the relative risks, benefits and costs of those treatments. |

Additional risks apply in relation to any disease indications we pursue which are classified as rare diseases and allow for orphan drug designation by regulatory agencies in major commercial markets, such as the U.S. or European Union. If pricing is not approved or accepted in the market at an appropriate level for any approved product for which we pursue and receive an orphan drug designation, such product may not generate enough revenue to offset costs of development, manufacturing, marketing and commercialization despite any benefits received from the orphan drug designation, such as market exclusivity, for a period of time. Orphan exclusivity could temporarily delay or block approval of one of our products if a competitor obtains orphan drug designation for its product first. However, even if we obtain orphan exclusivity for one of our products upon approval, our exclusivity may not block the subsequent approval of a competitive product that is shown to be clinically superior to our product.

8

Market size is also a variable in disease indications not classified as rare. Our estimates regarding potential market size for any indication may be materially different from what we discover to exist at the time we commence commercialization, if any, for a product, which could result in significant changes in our business plan and have a material adverse effect on our business, financial condition, results of operations and prospects.

We face competition from entities that have developed or may develop product candidates for our target disease indications, including companies developing novel treatments and technology platforms based on modalities and technology similar to ours. If these companies develop technologies or product candidates more rapidly than we do or their technologies, including delivery technologies, are more effective, our ability to develop and successfully commercialize product candidates may be compromised.

The development and commercialization of pharmaceutical products is highly competitive. We compete with a variety of multinational pharmaceutical companies and specialized biotechnology companies, as well as technology being developed at universities and other research institutions. Our competitors have developed, are developing or could develop product candidates and processes competitive with our product candidates. Competitive therapeutic treatments include those that have already been approved and accepted by the medical community, patients and third-party payors, and any new treatments that enter the market.

We believe that a significant number of products are currently under development, and may become commercially available in the future, for the treatment of conditions for which we are developing, and may in the future try to develop, product candidates. We are aware of multiple companies that are working in the field of fatty-liver diseases and C. difficile therapeutics, including Intercept, Gilead, Genfit, Tobira, Galmed which are all developing therapeutics for fatty-liver diseases and Seres, Synthetic Biotechnology and Assembly Biotechnology for C. difficile.

We have limited large scale manufacturing experience with our product candidates. Delays in manufacturing sufficient quantities of such materials to the required standards for pre-clinical and clinical trials may negatively impact our business and operations.

While we have extensive experience in producing therapeutic colostrum, we may not be able to manufacture sufficient quantities of our product candidates in a cost-effective or timely manner. Manufacturing includes the production, formulation and stability testing of an active pharmaceutical ingredient and its formulation into pharmaceutical products, such as capsules or tablets. Any delays in production would delay our pre-clinical and human clinical trials, which could adversely affect our business, financial condition and operations.

We may be required to enter into contracting arrangements with third parties to manufacture our product candidates for large-scale, pre- clinical and/or clinical trials. We may not be able to make the transition from laboratory-scale to development-scale or from development-scale to commercial production. We may need to develop additional manufacturing resources, enter into collaborative arrangements with other parties who have established manufacturing capabilities, or have third parties manufacture our products on a contract basis. We may not have access on acceptable terms to the necessary and substantial financing that would be required to scale-up production and develop effective commercial manufacturing processes and technologies. We may not be able to enter into collaborative or contracting arrangements on acceptable terms with parties that will meet our requirements for quality, quantity and timeliness.

If we are not able to obtain an acceptable purity for any product candidate or an acceptable product specification, pre-clinical and clinical trials would be delayed, which could adversely affect the priority of the development of our product candidates, our business, financial condition and results of operations. This may adversely impact the cost of goods or feasibility of market scale.

9

Our product candidates and the process for administering our product candidates may cause undesirable side effects or have other properties that could delay or prevent their regulatory approval, limit the commercial profile of an approved label, or result in significant negative consequences following any potential marketing approval.

Treatment with our product candidates may produce undesirable side effects or adverse reactions or events. If any such adverse events occur, our clinical trials could be suspended or discontinued, and the FDA or comparable foreign regulatory authorities could order us to cease further development or deny approval of our product candidates for any or all targeted indications. The product-related side effects could affect patient recruitment or the ability of enrolled patients to complete the trial. If we elect or are required to delay, suspend or discontinue any clinical trial of any of our product candidates, the commercial prospects of such product candidates will be harmed and our ability to generate product revenues from any of these product candidates will be delayed or eliminated. Any of these occurrences may harm our business, financial condition and prospects significantly.

We currently depend upon a sole manufacturer of our lead compound and on a sole manufacturer to produce finished drug products and could incur significant costs and delays if we are unable to promptly find a replacement for either of them.

At this time, we are relying on a single manufacturer to develop Good Manufacturing Practice (“GMP”), processes for our lead compound. Our lead compound, IMM-124E, is manufactured by Synlait Milk Limited based in New Zealand. This manufacturer enables efficient large-scale manufacture of colostrum to provide drug substance for our current and prospective trials in fatty-liver patients. We also rely on contract manufacturers such as Mayne Pharma International, to produce all of our marketed products and Pharmaceutical Packaging Professionals and Australian Blister Sealing to package our investigational drug products. We are actively seeking additional and back-up manufacturers but may be unsuccessful in our efforts or may incur material additional costs and substantial delays.

The failure to establish sales, marketing and distribution capability would materially impair our ability to successfully market and sell our pharmaceutical products.

We currently have limited experience in the marketing, sales or distribution of pharmaceutical products. If we develop any commercially marketable pharmaceutical products and decide to perform our own sales and marketing activities, we will require additional resources and, will need to hire sales and marketing personnel which will require additional capital. Qualified personnel may not be available in adequate numbers or at a reasonable cost. Furthermore, our sales staff may not achieve success in their marketing efforts. Alternatively, we may be required to enter into marketing arrangements with other parties who have established appropriate marketing, sales and distribution capabilities. We may not be able to enter into marketing arrangements with any marketing partner, or if such arrangements are established, our marketing partners may not be able to commercialize our products successfully. Other companies offering similar or substitute products may have well-established and well-funded marketing and sales operations in place that will allow them to market their products more effectively. Failure to establish sufficient marketing capabilities would materially impair our ability to successfully market and sell our pharmaceutical products.

If healthcare insurers and other organizations do not pay for our products, or impose limits on reimbursement, our future business may suffer.

The drugs we hope to develop may be rejected by the marketplace due to many factors, including cost. The continuing efforts of governments, insurance companies, health maintenance organizations and other payors of healthcare costs to contain or reduce healthcare costs may affect our future revenues and profitability and those of our potential customers, suppliers and collaborative partners, as well as the availability of capital. In Australia and certain foreign markets, the pricing or profitability of prescription pharmaceuticals is already subject to government control. We expect initiatives for similar government control at both the state and federal level to continue in the U.S. and elsewhere. The adoption of any such legislative or regulatory proposals could adversely affect our business and prospects.

Our ability to commercially exploit our products successfully will depend in part on the extent to which reimbursement for the cost of our products and related treatment will be available from government health administration authorities, private health coverage insurers and other organizations. Third-party payors, such as government and private health insurers, are increasingly challenging the price of medical products and services. Uncertainty exists as to the reimbursement status of newly approved health care products and in foreign markets, including the U.S. If third-party coverage is not available to patients for any of the products we develop, alone or with collaborators, the market acceptance of these products may be reduced, which may adversely affect our future revenues and profitability. In addition, cost containment legislation and reductions in government insurance programs may result in lower prices for our products and could materially adversely affect our ability to operate profitably.

10

We may be exposed to product liability claims, which could harm our business.

The testing, marketing, and sale of human health care products also entail the inherent risk of product liability. We may incur substantial liabilities or be required to limit development or commercialization of our products if we cannot successfully defend ourselves against product liability claims. We have historically obtained no fault compensation insurance for our clinical trials and will continue to obtain similar coverage for all future clinical trials. Such coverage may not be available in the future on acceptable terms, or at all. This may result in our inability to pursue further clinical trials or to obtain adequate protection in the event of a successful claim. We may not be able to obtain product liability insurance in the event of the commercialization of a product or such insurance may not be available on commercially reasonable terms. Even if we have adequate insurance coverage, product liability claims, or recalls could result in negative publicity or force us to devote significant time, attention and financial resources to those matters.

Breaches of network or information technology security, natural disasters or terrorist attacks could have an adverse effect on our business.

Cyber-attacks or other breaches of network or information technology (“IT”) security, natural disasters, terrorist acts or acts of war may cause equipment failures or disrupt our research and development operations. In particular, both unsuccessful and successful cyber-attacks on companies have increased in frequency, scope and potential harm in recent years. Such an event may result in our inability, or the inability of our partners, to operate the research and development facilities, which even if the event is for a limited period of time, may result in significant expenses and/or significant damage to our experiments and trials. In addition, a failure to protect employee confidential data against breaches of network or IT security could result in damage to our reputation. Any of these occurrences could adversely affect our results of operations and financial condition.

To date, we have not had any such occurrence of cyber-attacks to our networks and IT infrastructure through cyber-attack, malware, computer viruses and other means of unauthorized access or other cyber incidents, individually or in the aggregate; however, should this occur in the future, it may result in a material impact to our operations or financial condition.

We expect to expand our drug development, regulatory and business development capabilities, and as a result, we may encounter difficulties in managing our growth, which could disrupt our operations.

We expect to experience significant growth in the number of our employees and consultants and the scope of our operations, particularly in the areas of drug development, regulatory affairs and business development. To manage our anticipated future growth, we must continue to implement and improve our managerial, operational and financial systems, expand our facilities and continue to recruit and train additional qualified personnel. Due to our limited financial resources and the limited experience of our management team in managing a company with such anticipated growth, we may not be able to effectively manage the expansion of our operations or recruit and train additional qualified personnel. The expansion of our operations may lead to significant costs and may divert our management and business development resources. Any inability to manage growth could delay the execution of our business plans or disrupt our operations and have a materially adverse effect on our business.

Positive results from preclinical studies of our product candidates are not necessarily predictive of future results of planned clinical trials of our product candidates.

Positive results in preclinical proof-of-concept and animal studies of our product candidates may not result in positive results in clinical trials in humans. Many companies in the pharmaceutical and biotechnology industries have suffered significant setbacks in clinical trials after achieving positive results in preclinical development or early stage clinical trials, and we cannot be certain that we will not face similar setbacks. These setbacks have been caused by, among other things, preclinical findings made while clinical trials were underway or safety or efficacy observations made in clinical trials, including adverse events. Moreover, preclinical and clinical data are often susceptible to varying interpretations and analyses, and many companies that believed their product candidates performed satisfactorily in preclinical studies and clinical trials nonetheless failed to obtain FDA or other regulatory authority approval. If we fail to produce positive results in our clinical trials of our product candidates, the development timeline and regulatory approval and commercialization prospects for our product candidates, and, correspondingly, our business and financial prospects, would be negatively impacted.

11

Our future prospects may also be dependent on our or our collaborators’ ability to successfully develop a pipeline of additional product candidates, and we and our collaborators may not be successful in efforts to use our platform technologies to identify or discover additional product candidates.

The success of our business depends primarily upon our ability to identify, develop and commercialize products based on our platform technology. We only have two product candidates currently in clinical development, IMM-124E and IMM-529.

Our other product candidates derived from our platform technology may not successfully complete IND-enabling studies, and our research programs may fail to identify other potential product candidates for clinical development for a number of reasons. Our and our collaborators’ research methodology may be unsuccessful in identifying potential product candidates, our potential product candidates may not demonstrate the necessary preclinical outcomes to progress to clinical studies, or our product candidates may be shown to have harmful side effects or may have other characteristics that may make the products unmarketable or unlikely to receive marketing approval.

If any of these events occur, we may be forced to discontinue our development efforts for a program or programs. Research programs to identify new product candidates require substantial technical, financial and human resources. We may focus our efforts and resources on potential programs or product candidates that ultimately prove to be unsuccessful.

We may not be able to obtain orphan drug exclusivity for some of our product candidates.

Of our current product candidates, the only one designed for treatment of an indication that would likely qualify for rare disease status is IMM-529 for the treatment of recurrent C. difficile. Regulatory authorities in some jurisdictions, including the U.S. and the European Union, may designate drugs or biological products for relatively small patient populations as orphan drugs. Under the Orphan Drug Act, the FDA may designate a product as an orphan drug if it is a product intended to treat a rare disease or condition, which is generally defined as a patient population of fewer than 200,000 individuals annually in the U.S. The FDA may also designate a product as an orphan drug if it is intended to treat a disease or condition of more than 200,000 individuals in the U.S. and there is no reasonable expectation that the cost of developing and making a drug or biological product available in the U.S. for this type of disease or condition will be recovered from sales of the product candidate. Under the European Union orphan drug legislation, a rare disease or condition means a disease or condition which affects not more than five in ten thousand persons in the European Union at the time of the orphan drug designation application.

Generally, if a product with an orphan drug designation subsequently receives the first marketing approval for the indication for which it has such designation, the product is entitled to a period of marketing exclusivity, which precludes the FDA from approving another marketing application for the same drug for that time period. During the marketing exclusivity period, in the European Union, the European Medicines Agency, or the EMA, is precluded from approving a similar drug with an identical therapeutic indication. The applicable period is seven years in the U.S. and ten years in the European Union. The European Union exclusivity period can be reduced to six years if a drug no longer meets the criteria for orphan drug designation or if the drug is sufficiently profitable so that market exclusivity is no longer justified. Orphan drug exclusivity may be lost if the FDA or EMA determines that the request for designation was materially defective or if the manufacturer is unable to assure sufficient quantity of the drug to meet the needs of patients with the rare disease or condition.

Even if we obtain orphan drug exclusivity for a product, that exclusivity may not effectively protect the product from competition because different drugs can be approved for the same condition, and the same drug could be approved for a different condition. Even after an orphan drug is approved, the FDA can subsequently approve the same drug, made by a competitor, for the same condition if the FDA concludes that the competitive product is clinically superior in that it is shown to be safer, more effective or makes a major contribution to patient care. In the European Union, the EMA can approve a competitive product if the orphan drug no longer meets the criteria for orphan designation (including sufficient profitability), if the competitive product is safer, more effective or otherwise clinically superior, or if the orphan drug cannot be supplied in sufficient quantities.

12

We have not entered into agreements with any third-party manufacturers to support commercialization of our pharmaceutical product candidates. Additionally, no manufacturers have experience producing our product candidates at commercial levels, and any manufacturer that we work with may not achieve the necessary regulatory approvals or produce our product candidates at the quality, quantities, locations and timing needed to support commercialization.

We have not yet secured manufacturing capabilities for commercial quantities of our product candidates or established facilities in the desired locations to support commercialization of our product candidates. We intend to rely on third-party manufacturers for commercialization, and currently we have only entered into agreements with such manufacturers to support our clinical trials for IMM-124E. We may be unable to negotiate agreements with third-party manufacturers to support our commercialization activities on commercially reasonable terms.

We may encounter technical or scientific issues related to manufacturing or development that we may be unable to resolve in a timely manner or with available funds. Currently, we do not have the capacity to manufacture our product candidates on a commercial scale. In addition, our product candidates are novel, and no manufacturer currently has experience producing our product candidates on a large scale. If we are unable to engage manufacturing partners to produce our product candidates on a larger scale on reasonable terms, our commercialization efforts will be harmed.

Even if we timely develop a manufacturing process and successfully transfer it to the third-party manufacturers of our product candidates, if such third-party manufacturers are unable to produce the necessary quantities of our product candidates, or do so in compliance with Current Good Manufacturing Practice (“cGMP”) or with pertinent foreign regulatory requirements, and within our planned time frame and cost parameters, the development and sales of our product candidates, if approved, may be impaired.

Risks Related to Government Regulation

If we do not obtain the necessary governmental approvals, we will be unable to commercialize our pharmaceutical products.

Our ongoing research and development activities are, and the production and marketing of our pharmaceutical product candidates derived from such activities will be, subject to regulation by numerous international regulatory authorities. Prior to marketing, any therapeutic product developed must undergo rigorous pre-clinical testing and clinical trials and, to the extent that any of our pharmaceutical products under development are marketed abroad, by the relevant international regulatory authorities. For example, in Australia, principally the Therapeutics Goods Administration (“TGA”), the FDA in the U.S.; the Medicines and Healthcare products Regulatory Agency, (“MHRA”) in the United Kingdom; the Medical Products Agency (“MPA”) in Sweden; and the EMA in Europe. These regulatory processes can take many years and require the expenditure of substantial resources. Governmental authorities may not grant regulatory approval due to matters arising from pre-clinical animal toxicology, safety pharmacology, drug formulation and purity, clinical side effects or patient risk profiles, or medical contraindications. Failure or delay in obtaining regulatory approvals would adversely affect the development and commercialization of our pharmaceutical product candidates. We may not be able to obtain the clearances and approvals necessary for clinical testing or for manufacturing and marketing our pharmaceutical product candidates.

We will not be able to commercialize any current or future product candidates if we fail to adequately demonstrate their safety, efficacy and superiority over existing therapies.

Before obtaining regulatory approvals for the commercial sale of any of our pharmaceutical products, we must demonstrate through pre- clinical testing and clinical studies that our product candidates are safe and effective for use in humans for each target indication. Results from early clinical trials may not be predictive of results obtained in large-scale, later-stage clinical testing. Even though a potential drug product shows promising results in clinical trials, regulatory authorities may not grant the necessary approvals without sufficient safety and efficacy data.

We may not be able to undertake further clinical trials of our current and future product candidates as therapies for fatty-liver disease, C. difficile or other indications or to demonstrate the safety and efficacy or superiority of any of these product candidates over existing therapies or other therapies under development, or enter into any collaborative arrangement to commercialize our current or future product candidates on terms acceptable to us, or at all. Clinical trial results that show insufficient safety and efficacy could adversely affect our business, financial condition and results of operations.

13

Even if we obtain regulatory approval for a product candidate, our products may remain subject to regulatory scrutiny.

Even if we obtain regulatory approval in a jurisdiction, the regulatory authority may still impose significant restrictions on the indicated uses or marketing of our product candidates or impose ongoing requirements for potentially costly post-approval studies or post-market surveillance. For example, the holder of an approved biologics license application (“BLA”) is obligated to monitor and report to the FDA adverse events and any failure of a product to meet the specifications in the BLA. The holder of an approved BLA must also submit new or supplemental applications and obtain FDA approval for certain changes to the approved product, product labeling or manufacturing process.

Advertising and promotional materials must comply with FDA rules and are subject to FDA review, in addition to other potentially applicable foreign, federal and state laws.

If we fail to comply with applicable regulatory requirements following approval of any of our product candidates, a regulatory agency may:

| ● | issue a warning letter asserting that we are in violation of the law; |

| ● | seek an injunction or impose civil or criminal penalties or monetary fines; |

| ● | suspend or withdraw regulatory approval; |

| ● | suspend any ongoing clinical trials; |

| ● | refuse to permit government reimbursement of our product by government-sponsored third-party payors; |

| ● | refuse to approve a pending BLA or supplements to a BLA submitted by us for other indications or new product candidates; |

| ● | seize our product; or |

| ● | refuse to allow us to enter into or continue supply contracts, including government contracts. |

Any government investigation of alleged violations of law could require us to expend significant time and resources in response and could generate negative publicity. The occurrence of any event or penalty described above may inhibit our ability to commercialize our product candidates and generate revenues.

Healthcare reform measures and other statutory or regulatory changes could adversely affect our business.

In both the United States and certain foreign jurisdictions, there have been a number of legislative and regulatory proposals to change the healthcare system in ways that could impact our business. For example, the Patient Protection and Affordable Care Act and the Health Care and Education Affordability Reconciliation Act of 2010 (collectively, the “ACA”), enacted in March 2010, substantially changed the way healthcare is financed by both governmental and private insurers, and significantly impacts the pharmaceutical industry. With regard to pharmaceutical products, among other things, the ACA is expected to expand and increase industry rebates for drugs covered under Medicaid programs and make changes to the coverage requirements under the Medicare D program.

If we fail to comply with our reporting and payment obligations under the Medicaid program or other governmental pricing programs, we could be subject to additional reimbursement requirements, penalties, sanctions and fines which could have a material adverse effect on our business, financial condition, results of operations and growth prospects.

If we obtain FDA approval for any of our product candidates and begin commercializing those products in the United States, our operations may be directly or indirectly through our customers, subject to various federal and state fraud and abuse laws, including, without limitation, the federal Anti-Kickback Statute, the federal False Claims Act, and physician sunshine laws and regulations.

The pharmaceutical and biotechnology industries are subject to extensive regulation, and from time to time legislative bodies and governmental agencies consider changes to such regulations that could have significant impact on industry participants. For example, in light of certain highly-publicized safety issues regarding certain drugs that had received marketing approval, the U.S. Congress has considered various proposals regarding drug safety, including some which would require additional safety studies and monitoring and could make drug development costlier. Additional legislation or regulation, if any, relating to the implementation of cost containment measures or other aspects of drug development may prevent us from being able to generate revenue, attain profitability, or commercialize our products. Such reforms could have an adverse effect on anticipated revenues from product candidates that we may successfully develop and for which we may obtain regulatory approval and may affect our overall financial condition and ability to develop product candidates. In addition, it is possible that there will be further legislation or regulation that could harm our business, financial condition and results of operations.

14

Our product candidates are based on our hyper-immune colostrum technology. Currently, no prescription product candidates utilizing our technology have been approved for commercial sale and our approach to the development of our technology may not result in safe, effective or marketable products.

We have concentrated our product research and development efforts on our hyper-immune colostrum technology, and our future success depends on successful clinical development of this technology. We plan to develop a pipeline of product candidates using our technology and deliver therapeutics for a number of infectious and life-threatening conditions, including C. difficile Infections (“CDI”), Shigellosis (bacillary dysentery) and Traveler’s Diarrhea.

The scientific research that forms the basis of our efforts to develop product candidates is based on the pre-clinical and clinical data in conditions such as CDI, Shigellosis (bacillary dysentery) and Traveler’s Diarrhea, and the identification, optimization and delivery of hyper-immune colostrum- based product candidates is relatively new. The scientific evidence to support the feasibility of successfully developing therapeutic treatments based on our technology is preliminary and limited. There can be no assurance that any development and technical problems we experience in the future will not cause significant delays or unanticipated costs, or that such development problems can be solved. We may be unable to reach an agreement on favorable terms, or at all, with providers of vectors needed to optimize delivery of our product candidates to target disease cells and we may also experience unanticipated problems or delays in expanding our manufacturing capacity or transferring our manufacturing process to commercial partners, any of which may prevent us from completing our clinical trials or commercializing our products on a timely or profitable basis, if at all.

Only a few product candidates based on our technology have been tested in either animals or humans. We may discover that the applications of IMM-124E and IMM-529 do not possess properties required for a therapeutic benefit, such as the ability to sufficiently suppress the immune system for the period of time required to be approved as a NASH or CDI therapeutic. In addition, application of hyper-immune- based products in humans may result in safety problems. We currently have only limited long-term data, and no conclusive evidence, to suggest that we can effectively produce efficacious therapeutic treatments using our hyper-immune colostrum technology.

We are early in our product development efforts and have only two product candidates in early-stage (Phase I) and mid-stage (Phase II) clinical trials. All of our other current product candidates are still in preclinical development. We have no late-stage clinical trials (post-proof of concept) and may not be able to obtain regulatory approvals for the commercialization of some or all of our product candidates.

The research, testing, manufacturing, labeling, approval, selling, marketing and distribution of biologics is subject to extensive regulation by the FDA and other regulatory authorities, and these regulations differ from country to country. We do not have any prescription products on the market and are early in our development efforts. We have two product candidates in clinical trials and all of our other product candidates are in preclinical development. All of our current and future product candidates are subject to the risks of failure typical for development of biologics. The development and approval process is expensive and can take many years to complete, and its outcome is inherently uncertain. In addition, the outcome of preclinical testing and early clinical trials may not be predictive of the success of later clinical trials, and interim results of a clinical trial do not necessarily predict final results.