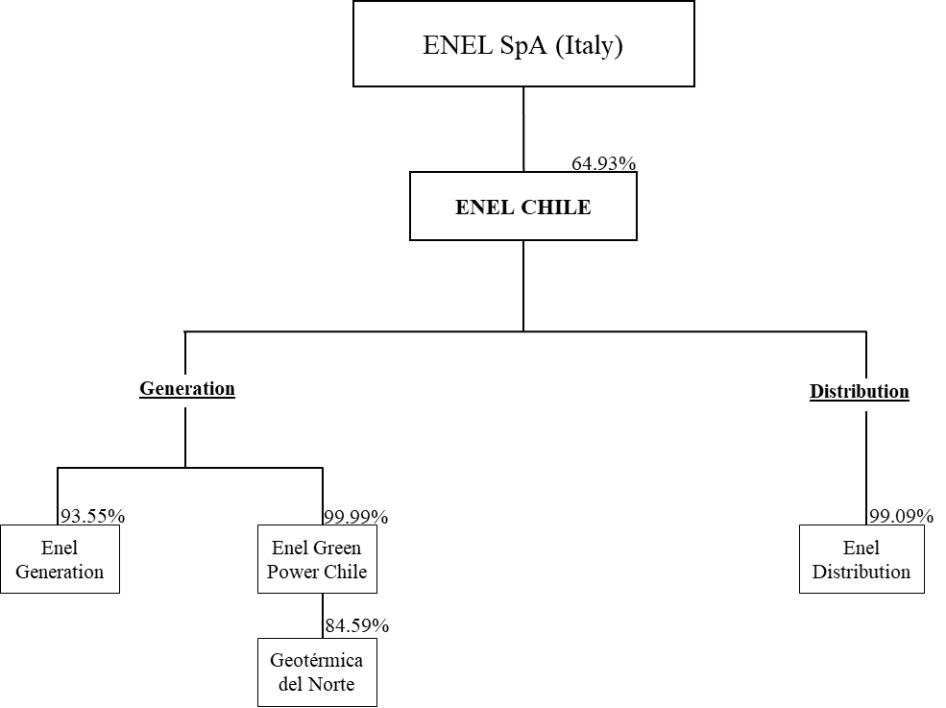

Enel Chile’s Simplified Organizational Structure(1)

As of December 31, 2022

| (1) | Only principal operating consolidated entities are presented here. |

1

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR 12(g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended

OR

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

OR

SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Date of event requiring this shell company report,

Commission file number:

(Exact name of Registrant as specified in its charter)

ENEL CHILE S.A.

(Translation of Registrant’s name into English)

(Jurisdiction of incorporation or organization)

(Address of principal executive offices)

(Name, Telephone, E-mail, and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

Title of Each Class | Trading Symbol(s) | Name of Each Exchange on Which Registered | |

|---|---|---|---|

_____________________

* | Listed, not for trading, but only in connection with the registration of American Depositary Shares, under the Securities and Exchange Commission’s requirements. |

Securities registered or to be registered pursuant to Section 12(g) of the Act: None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report

Shares of Common Stock:

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ☒

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. ☐ Yes ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☒

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Accelerated Filer ☐ | Non-accelerated Filer ☐ Emerging growth company |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards † provided pursuant to Section 13(a) of the Exchange Act. ◻

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ◻

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b) ☐

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

U.S. GAAP ☐ | by the International Accounting Standards Board ☒ | Other ☐ |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.☐ Item 17 ☐ Item 18

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Enel Chile’s Simplified Organizational Structure(1)

As of December 31, 2022

| (1) | Only principal operating consolidated entities are presented here. |

1

TABLE OF CONTENTS

| Page | |

3 | ||

6 | ||

7 | ||

9 | ||

10 | ||

10 | ||

10 | ||

27 | ||

57 | ||

57 | ||

85 | ||

91 | ||

94 | ||

96 | ||

97 | ||

116 | ||

120 | ||

121 | ||

Material Modifications to the Rights of Security Holders and Use of Proceeds | 121 | |

121 | ||

122 | ||

122 | ||

122 | ||

125 | ||

126 | ||

Purchases of Equity Securities by the Issuer and Affiliated Purchasers | 126 | |

126 | ||

126 | ||

127 | ||

Disclosure Regarding Foreign Jurisdictions that Prevent Inspections | 127 | |

128 | ||

128 | ||

128 | ||

2

GLOSSARY

ADR | American Depositary Receipt(s) | A certificate issued by our depositary that represents ADS, or American Depositary Shares. | ||

ADS | American Depositary Share(s) | An equity interest in our company that is issued by Citibank, N.A., as the depositary, in respect of shares of our company held by the depositary. Each ADS represents 50 shares and ADS are traded on the New York Stock Exchange. | ||

AFP | Administradora de Fondos de Pensiones | A legal entity that manages a Chilean pension fund. | ||

CEN | Coordinador Eléctrico Nacional | The Chilean system operator. An autonomous entity in charge of coordinating the efficient operation of the SEN, dispatching generation units to satisfy demand, and known as the National Electricity Coordinator. | ||

Chilean Stock Exchanges | Chilean Stock Exchanges | The two stock exchanges located in Chile: the Santiago Stock Exchange and the Electronic Stock Exchange. | ||

CMF | Comisión para el Mercado Financiero | Chilean Financial Market Commission, the governmental authority that supervises the financial markets. | ||

CNE | Comisión Nacional de Energía | Chilean National Energy Commission, a governmental entity with responsibilities under the Chilean regulatory framework. | ||

EGP Chile | Enel Green Power Chile S.A. | A Chilean corporation engaged in non-conventional renewable electricity generation and a subsidiary of Enel Chile. | ||

Enel | Enel S.p.A. | An Italian company with multinational operations in the power and gas markets, with a 64.93% ownership of Enel Chile as of December 31, 2022, and our ultimate parent company. | ||

Enel Américas | Enel Américas S.A. | An affiliated Chilean publicly held limited liability stock corporation headquartered in Chile, with subsidiaries engaged primarily in the generation, transmission, and distribution of electricity in Argentina, Brazil, Colombia, and Peru, controlled by Enel. | ||

3

Enel Chile | Enel Chile S.A. | Our company, a Chilean publicly held limited liability stock corporation, with subsidiaries engaged primarily in the generation and distribution of electricity in Chile. The registrant of this Report. | ||

Enel Colina | Enel Colina S.A. | A subsidiary of Enel Distribution engaged in electricity distribution in Chile, formerly known as Empresa Eléctrica de Colina Ltda. | ||

Enel Distribution | Enel Distribución Chile S.A. | A Chilean publicly held limited liability stock corporation engaged in electricity distribution and a subsidiary of Enel Chile operating in the Santiago Metropolitan Region. | ||

Enel Generation | Enel Generación Chile S.A. | A Chilean publicly held limited liability stock corporation engaged in electricity generation and a subsidiary of Enel Chile. | ||

Enel Transmission | Enel Transmisión Chile S.A. | A Chilean corporation engaged in electricity transformation and transmission and a former subsidiary of Enel Chile. We sold Enel Transmission on December 9, 2022. | ||

Enel X Chile | Enel X Chile S.p.A. | A Chilean closely held limited liability stock corporation and our wholly-owned subsidiary, engaged in providing services associated with new technologies, with a strategic focus on digitalization, innovation, and sustainability. | ||

IFRS | International Financial Reporting Standards | International Financial Reporting Standards as issued by the International Accounting Standards Board (IASB). | ||

LNG | Liquefied Natural Gas | Liquefied natural gas, a fuel for our thermal power plants. | ||

NCRE | Non-Conventional Renewable Energy | Energy sources continuously replenished by natural processes, such as biomass, geothermal, mini-hydro, solar, tidal, or wind energy. | ||

PMGD | Pequeños Medios de Generación Distribuida | A Chilean regime for distributed generation facilities. | ||

OSM | Ordinary Shareholders’ Meeting | Ordinary Shareholders’ Meeting | ||

4

Pehuenche | Empresa Eléctrica Pehuenche S.A. | A Chilean publicly held limited liability stock corporation engaged in the electricity generation business and a subsidiary of Enel Generation. | ||

SAIDI | System Average Interruption Duration Index | Index of average duration of interruption in the power supply. | ||

SAIFI | System Average Interruption Frequency Index | Index of average frequency of interruptions in the power supply. | ||

SEN | Sistema Eléctrico Nacional | The National Electricity System is the Chilean national interconnected electricity system. | ||

UF | Unidad de Fomento | Chilean inflation-indexed, Chilean peso-denominated monetary unit, equivalent to Ch$ 35,110.98 as of December 31, 2022. | ||

VAD | Valor Agregado de distribución | Value-added from distribution of electricity. |

5

INTRODUCTION

As used in this Report on Form 20-F (“Report”), first-person personal pronouns such as “we,” “us,” or “our,” as well as “Enel Chile” or the “Company,” refer to Enel Chile S.A. and our consolidated subsidiaries unless the context indicates otherwise. Unless otherwise noted, our interest in our principal subsidiaries and jointly controlled companies and associates is expressed in terms of our economic interest as of December 31, 2022.

We are a Chilean publicly held limited liability stock corporation organized on March 1, 2016, under the laws of the Republic of Chile as a result of a corporate reorganization completed in 2016 by the former Enersis S.A., which separated its Chilean businesses from its non-Chilean businesses.

We are engaged in electricity generation and distribution businesses in Chile through our subsidiaries and affiliates. We own 93.55% of Enel Generación Chile S.A. (“Enel Generation”), a Chilean electricity generation company with operations in Chile, 99.99% of Enel Green Power Chile S.A. (“EGP Chile”), a Chilean renewable electricity generation company, and 99.09% of Enel Distribución Chile S.A. (“Enel Distribution”), a Chilean electricity distribution company that operates in the Santiago Metropolitan Region.

As of the date of this Report, Enel S.p.A. (“Enel”), an Italian energy company with multinational operations in the power and gas markets, owns 64.93% of us and is our ultimate controlling shareholder.

6

PRESENTATION OF INFORMATION

Financial Information

In this Report, unless otherwise specified, references to “U.S. dollars” or “US$,” are to dollars of the United States of America (“United States”); references to “pesos” or “Ch$” are to Chilean pesos, the currency of Chile; references to “EUR” or “€” are to Euro, the currency of the European Union and references to “UF” are to Unidades de Fomento. The UF is a Chilean inflation-indexed, a peso-denominated monetary unit that is adjusted daily to reflect changes in the official Consumer Price Index (“CPI”) of the Chilean National Institute of Statistics (Instituto Nacional de Estadísticas or “INE”). The UF is adjusted in monthly cycles. Each day in the period beginning on the tenth day of the current month through the ninth day of the succeeding month, the nominal peso value of the UF is indexed to reflect a proportionate amount of the change in the Chilean CPI during the prior calendar month. As of December 31, 2022, one UF was equivalent to Ch$ 35,110.98. The U.S. dollar equivalent of one UF was US$ 41.02 as of December 31, 2022, using the Observed Exchange Rate reported by the Central Bank of Chile (Banco Central de Chile) as of December 31, 2022, of Ch$ 855.86 per US$ 1.00. The U.S. dollar observed exchange rate (dólar observado) (the “Observed Exchange Rate”), which is reported by the Central Bank of Chile and published daily on its web page, is the weighted-average exchange rate of the previous business day’s transactions in the Formal Exchange Market. Unless the context specifies otherwise, all amounts translated from Chilean pesos to U.S. dollars or vice versa, or from UF to Chilean pesos, have been made at the rates applicable as of December 31, 2022. The Federal Reserve Bank of New York does not report a noon buying rate for Chilean pesos. No representation is made that the Chilean peso or U.S. dollar amounts disclosed in this Report could have been or could be converted into U.S. dollars or Chilean pesos, at such rate or any other rate.

Our consolidated financial statements and, unless otherwise indicated, other financial information concerning us included in this Report are presented in Chilean pesos. We have prepared our consolidated financial statements under International Financial Reporting Standards (“IFRS”), as issued by the International Accounting Standards Board (“IASB”). All our subsidiaries are integrated, and all their assets, liabilities, income, expenses, and cash flows are included in the consolidated financial statements after making the adjustments and eliminations related to intra-group transactions. Our interest in associated companies over which we exercise significant influence is included in our consolidated financial statements using the equity method. For detailed information regarding consolidated entities, jointly controlled entities, and associated companies, see Note 2.4, Note 2.5, and Note 2.6 of the Notes to our consolidated financial statements.

Technical Terms

References to “TW” are to terawatts (1012 watts or a trillion watts); references to “GW” and “GWh” are to gigawatts (109 watts or a billion watts) and gigawatt-hours, respectively; references to “MW” and “MWh” are to megawatts (106 watts or a million watts) and megawatt-hours, respectively; references to “kW” and “kWh” are to kilowatts (103 watts or a thousand watts) and kilowatt-hours, respectively; references to “kV” are to kilovolts, and references to “MVA” are to megavolt amperes. References to “BTU” and “MBTU” are to British thermal unit and million British thermal units, respectively. A “BTU” is an energy unit equal to approximately 1,055 joules. References to “Hz” are to hertz, and references to “mtpa” are to metric tons per annum. Unless otherwise indicated, statistics provided in this Report concerning the installed capacity of electricity generation facilities are expressed in MW. One TW equals 1,000 GW, one GW equals 1,000 MW, and one MW equals 1,000 kW. The installed capacity we present in this Report corresponds to the net installed capacity, which excludes the MW that each power plant consumes for its operation. Prior to 2022, we presented gross installed capacity figures, which did not exclude the MW that each power plant consumes for its operation.

7

Statistics relating to aggregate annual electricity production are expressed in GWh and based on a year of 8,760 hours, except for a leap year like 2020, which is based instead on 8,784 hours. Statistics relating to installed capacity and production of the electricity industry do not include electricity of self-generators.

Energy losses experienced by generation companies during transmission are calculated by subtracting the number of GWh of energy sold from the number of GWh of energy generated (excluding their energy consumption and losses on the part of the power plant) within a given period. Losses are expressed as a percentage of total energy generated.

Energy losses during distribution are calculated as the difference between total energy purchased (GWh of electricity demand, including own generation) and the energy sold excluding tolls and energy consumption not billed (also measured in GWh), within a given period. Distribution losses are expressed as a percentage of the total energy purchased. Losses in distribution arise from illegally tapped energy as well as technical losses.

Calculation of Economic Interest

In this Report, references are made to the “economic interest” of Enel Chile in its related companies. We have direct and/or indirect interests in such companies. In circumstances in which we do not directly own an interest in an affiliated company, our economic interest in such ultimate affiliated company is calculated by multiplying the percentage of economic interest in a directly held affiliated company by the percentage of economic interest of any entity in the ownership chain of such affiliated company. For example, if we directly own a 6% equity stake in an affiliated company and 40% is directly held by our 60%-owned subsidiary, our economic interest in such an associate would be 60% times 40% plus 6%, equal to 30%.

Rounding

Figures included in this Report have been rounded for ease of presentation. Due to rounding, the sums in tables do not always exactly equal the sums of the entries.

8

FORWARD-LOOKING STATEMENTS

This Report contains statements that are or may constitute forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). These statements appear throughout this Report and include statements regarding our intent, belief, or current expectations, including but not limited to any statements concerning:

| ● | our capital investment program; |

| ● | trends affecting our financial condition or results of operations; |

| ● | our dividend policy; |

| ● | the future impact of competition and regulation; |

| ● | political and economic conditions in the countries in which our related companies or we operate or may operate in the future; |

| ● | any statements preceded by, followed by, or that include the words “believes,” “expects,” “predicts,” “anticipates,” “intends,” “estimates,” “should,” “may,” or similar expressions; and |

| ● | other statements contained or incorporated by reference in this Report regarding matters that are not historical facts. |

Because such statements are subject to risks and uncertainties, actual results may differ materially from those expressed or implied by such forward-looking statements. Factors that could cause actual results to differ materially include, but are not limited to:

| ● | demographic developments, political events, social unrest, economic fluctuations, public health crises and pandemics, and interventionist measures by authorities in Chile; |

| ● | water supply, droughts, flooding, and other weather conditions; |

| ● | changes in Chilean environmental regulations and the regulatory framework of the electricity industry; |

| ● | our ability to implement proposed capital expenditures, including our ability to arrange financing where required; |

| ● | the nature and extent of future competition in our principal markets; and |

| ● | the factors discussed below under “Risk Factors.” |

You should not place undue reliance on such statements, which speak only as of the date that they were made. Our independent registered public accounting firm has not examined or compiled the forward-looking statements and, accordingly, does not provide any assurance concerning such statements. You should consider these cautionary statements together with any written or oral forward-looking statements that we may issue in the future. We do not undertake any obligation to release publicly any revisions to forward-looking statements contained in this Report to reflect later events or circumstances or the occurrence of unanticipated events, except as required by law.

For all these forward-looking statements, we claim the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995.

9

PART I

Item 1. Identity of Directors, Senior Management and Advisers

Not applicable.

Item 2. Offer Statistics and Expected Timetable

Not applicable.

Item 3. Key Information

| A. | [Reserved] |

B. Capitalization and Indebtedness.

Not applicable.

C. Reasons for the Offer and Use of Proceeds.

Not applicable.

D. | Risk Factors. |

Risk Related to Our Business

Material Risks Related to Our Business

Our businesses depend heavily on hydrology and are affected by droughts, flooding, storms, ocean currents, and other chronic changes in climatic and weather conditions as a result of climate change.

Climate change is a major global challenge that exposes our businesses to a variety of medium- and long-term risks. Our generation business has been in the past and could be in the future negatively affected by arid hydrological conditions, which has and could negatively affect our ability to dispatch energy from our hydroelectric generation facilities. Our operations and results have been adversely affected when hydrological conditions in Chile have been significantly below average, as has been the case for much of the period since 2007.

Our subsidiary Enel Generation has entered into certain agreements with the Chilean government and local irrigators regarding water use for hydroelectric generation purposes during low water levels. However, if droughts persist, we have and may in the future face increased pressure from the Chilean government or other third parties to further restrict our water use, which could have a material adverse effect on our business and results of operations.

Our distribution business is also affected by inclement weather conditions. With extreme temperatures, demand for electricity can increase significantly within a short period, affecting service and resulting in service outages that has resulted and may in the future result in the imposition of fines on our distribution business. Furthermore, with increased severity and frequency of extreme climate events, such as cyclones and floods, heavy rainfall or snowfall may occur in a short period of time, accompanied by windstorms and lightning. These events may damage our power distribution infrastructure, resulting in service outages. As a result, depending on weather conditions, our distribution business results can vary significantly from year to year. For example,

10

as a result of severe rainstorms in June 2017, with high wind gusts that brought down part of the electric network, 125,000 of our customers, or 7%, were left without electricity. In July 2017, an intense snowstorm over the Santiago Metropolitan Region caused massive damage to the electrical infrastructure, and a blackout affected 342,000, or 18%, of our customers and 17% of our feeders. These events significantly increased our costs in 2017 due to emergency responses implemented, including payments related to damage compensation, fines, line maintenance, and tree trimming programs.

Our operating expenses also increase during drought periods when thermal power plants, which have higher operating costs relative to hydroelectric power plants, are dispatched more frequently to make up the electricity generation deficit from reduced hydroelectric generation. In addition, our thermal power plants generate greenhouse gas (“GHG”) emissions. Depending on our commercial obligations, we may need to buy electricity at higher spot prices to comply with our contractual supply obligations. Beyond increasing our operating costs, the cost of these electricity purchases has exceeded and may in the future exceed our contracted electricity sale prices, thus potentially producing losses from those contracts. For example, in 2022, spot prices reached historic highs, resulting in losses from certain contracts. For further information concerning the effect of hydrology on our business and financial results, please refer to “Item 5. Operating and Financial Review and Prospects — A. Operating Results —1. Discussion of Main Factors Affecting Operating Results and Financial Condition of the Company —a. Generation Business.”

Droughts also indirectly affect the operation of our thermal power plants, principally our facilities that use natural gas or diesel fuel. Our thermal power plants require water for cooling, and droughts may reduce water availability and increase transportation costs. As a result, we may have to purchase water from agricultural areas that are also experiencing water shortages in order to operate our thermal plants. These water purchases have and may continue to increase our operating costs and require us to negotiate further with the local communities. If such negotiations are unsuccessful, we may be unable to obtain the water necessary to operate our thermal power plants.

Recovery from current or future droughts affecting the regions in Chile where most of our hydroelectric power plants are located may take place over an extended period, and there can be no assurance that any recovery will reach pre-drought hydrological conditions or that any recovery will occur at all. Climate change may increase the likelihood of prolonged droughts and exacerbate the risks described above, which would have a further adverse effect on our business, results of operations, and financial condition.

Our non-conventional renewable energy businesses are also subject to physical, operational, and financial risks related to climate change effects.

The electricity generated by our solar and wind generation facilities is highly dependent on climate factors other than hydrology, including suitable solar and wind conditions, which, even under normal operating circumstances, can vary greatly. Climate change may also have long-term effects on wind patterns and the amount of solar energy received at a particular solar facility, reducing electricity generated by these facilities. Although we base our business decisions on solar and wind studies for each renewable energy facility, actual conditions may not conform to the findings of these studies. The solar and wind conditions may be negatively affected by changes in weather patterns, including the potential impact of climate change.

If our renewable energy production falls below anticipated levels, we may have to dispatch electricity from our backup thermal power plants to make up the electricity generation deficit. Our thermal power plants have higher operating costs than our renewable energy facilities and generate GHG emissions. We also have needed and may in the future need to buy electricity in the spot market to fulfill our solar and wind generation facilities’ contractual supply obligations, which may be at prices higher than the contracted electricity sales,

11

thus potentially producing losses from those contracts. These impacts have increased and could in the future increase our costs or result in losses and have a material adverse effect on our business, results of operations, and financial condition.

We depend on distributions from our subsidiaries to meet our payment obligations.

We rely on cash from dividends, loans, interest payments, capital reductions, and other distributions from our subsidiaries to pay our obligations. Such payments and distributions may be subject to legal constraints, such as dividend restrictions, fiduciary obligations, contractual limitations, and foreign exchange controls imposed by local authorities.

Our subsidiaries’ ability to pay dividends or make loan payments or other distributions to us is limited by their operating results. To the extent that any of our subsidiaries’ cash requirements exceed their available cash, they will not be able to make funds available to us. Insufficient cash flows from our subsidiaries may result in their inability to meet debt obligations and the need to seek waivers to comply with some debt covenants. To a limited extent, these subsidiaries may require guarantees or other emergency measures from us as shareholders. For further details regarding financial support provided to our subsidiaries, please refer to “Item 7. Major Shareholders and Related-Party Transactions — B. Related-Party Transactions.”

The inability to obtain distributions from our subsidiaries described above could adversely affect our business, results of operations, and financial condition.

Construction and operation of power plants may encounter significant delays, stoppages, cost overruns, and stakeholder opposition that may damage our reputation and impair our goodwill with stakeholders.

Our power plant projects may be delayed in obtaining regulatory approvals or may face shortages and increases in the price of equipment, materials, or labor. They may be subject to construction delays, strikes, accidents, and human error. Any such event could negatively affect our business, results of operations, and financial condition.

Market conditions may change significantly between the approval and completion of a project, which, in some cases, may decrease its profitability or render it impracticable. Deviations in market conditions, such as estimates of timing and expenditures, may lead to cost overruns and delays in project completion that widely exceed our initial forecasts. In turn, this may have a material adverse effect on our business, results of operations, and financial condition.

We may develop new projects in locations with challenging geographical topography, such as mountain slopes, high altitudes, or other areas with limited access. Additionally, given some projects’ locations, there may be additional inherent risks to archaeological heritage sites. These factors may also lead to significant delays and cost overruns.

The operation of our thermal power plants may also affect our goodwill with stakeholders due to GHG emissions that could adversely affect the environment and local residents. In addition, communities might have their own interests and different perceptions of the company and may be influenced by other stakeholders or motivations unrelated to the project. Therefore, if the company fails to engage with its relevant stakeholders, we may face opposition, which could negatively affect our reputation, impact operations, or lead to litigation threats or actions.

12

Our reputation is the foundation of our relationship with key stakeholders and other constituencies. Any damage to our reputation may exert considerable pressure on regulators, creditors, and other stakeholders, possibly leading to the abandonment of projects and operations, which could cause our share prices to drop and hinder our ability to attract and retain valuable employees. Any of these outcomes could result in an impairment of our goodwill with stakeholders. If we do not effectively manage these sensitive issues, they could adversely affect our business, results of operations, and financial condition.

Our long-term electricity sales contracts are subject to fluctuations in the market prices of certain commodities, energy, and other factors.

We have exposure to fluctuations in certain commodity market prices that affect our long-term electricity sales contracts. These contracts commit our generation subsidiaries to material obligations as selling parties and contain prices indexed to different commodities, exchange rates, inflation, and the market price of electricity. Unfavorable changes to these indices would reduce the rates we can charge under these contracts, which could adversely affect our business, results of operations, and financial condition.

We are subject to incremental risks in distribution markets that are becoming more liberalized.

In our distribution business, some customers who meet certain requirements are free to choose between regulated and unregulated tariffs. Since 2016, some customers who had freely chosen regulated tariffs have switched to the unregulated tariff regime due to lower prices. These customers are tendering their electricity needs, either directly or in association with other customers, because regulated tariffs are currently higher than unregulated tariffs due to the former being based on contracts tendered in the past at higher prices. Lower market prices may reduce the number of customers who choose regulated tariffs as they choose an alternative energy provider, which could adversely affect our business, results of operations, and financial condition.

If third-party electricity transmission facilities, gas pipeline infrastructure, or fuel supply contracts fail to provide us with adequate service, we may be unable to deliver the electricity we sell to our final customers.

We depend on transmission facilities owned and operated by other companies to deliver the electricity we sell. This dependence exposes us to several risks. If the transmission is disrupted, or its capacity is inadequate, we may be unable to sell and deliver our electricity, particularly electricity generated by our solar and wind plants, which requires more flexibility. If a region’s power transmission infrastructure is inadequate, our recovery of sales costs and profits may be insufficient. If restrictive transmission price regulations are imposed, transmission companies that we rely on may not have sufficient incentives to invest in expanding their infrastructure, which could unfavorably affect our results of operations and financial condition or affect our ability to deploy our portfolio of projects under development. The construction of new transmission lines may take longer than in the past, mainly because of sustainability, social, and environmental requirements that create uncertainties regarding project completion timing. As a result, renewable energy generation projects are being completed faster than new transmission projects, creating a backlog of electricity that is difficult to transmit through current transmission systems. Also, our thermal power plants connected to natural gas pipelines are subject to stoppages should material disruptions in the pipeline occur. Stoppages could force us to purchase electricity at spot market prices, which could be higher than the contracted fixed sale price to customers. This scenario could adversely affect our business, results of operations, and financial condition.

13

Labor disputes, our inability to reach satisfactory collective bargaining agreements with our unionized employees or our inability to attract, train and retain key employees could adversely affect our business, results of operations, financial condition, and reputation.

Our business relies on attracting and retaining many highly specialized employees, and a large percentage of our employees are members of unions with whom we have collective bargaining agreements that must be renewed regularly. Our business, results of operations, and financial condition could be unfavorably affected by a failure to reach a collective bargaining agreement with any labor union or by a deal with a labor union that contains terms we view as unfavorable. Chilean law provides legal mechanisms for judicial authorities to impose a collective bargaining agreement if the parties cannot agree. Specific actions such as strikes, walkouts, or work stoppages by these unionized employees could negatively impact our business, results of operations, financial condition, and reputation.

In addition, we may experience shortages of qualified key personnel. In April 2021, we announced an employee Voluntary Retirement Program, open to men at least 60 and women at least 55 years old, with incentives for qualifying employees who accept retirement. This program may reduce our headcount by more than our ability to hire new employees to fill key positions. There can be no assurances that we will be able to attract, train, or retain key personnel or be able to do so without costs or delays, which could adversely affect our business, results of operations, financial condition, and reputation.

We may be unable to enter into suitable acquisitions or successfully integrate businesses that we acquire.

On an ongoing basis, we carry out mergers and review acquisition prospects to expand our operations, which may increase our market coverage or provide synergies with our existing businesses. However, there can be no assurance that we will be able to identify and acquire suitable companies in the future. The acquisition and integration of independent companies that we do not control may be a complicated, costly, and time-consuming process that may strain our resources and relationships with our employees and customers.

These mergers and acquisitions may not ultimately be successful or achieve the expected benefits and may encounter delays or difficulties in connection with the integration of their operations due to several factors, including but not limited to:

| ● | inconsistencies in standards, controls, procedures and policies, business cultures, and compensation structures; |

| ● | difficulties in integrating various business-specific operating procedures and systems, as well as our financial, accounting, information, and other systems; |

| ● | complications in retaining key employees, customers, and suppliers; |

| ● | unexpected transaction costs or failures in the assessed value or a proper projection of the potential benefits and synergies; and |

| ● | diversion of our management’s attention from their other responsibilities. |

Any of these risks encountered in the integration process could have a material adverse effect on our revenues, expenses, results of operations, and financial condition.

14

Interruption in or failure of our information technology, control, and communications systems or cyberattacks to or cybersecurity breaches of these systems could have a material adverse effect on our business, results of operations, and financial condition.

We operate in an industry that requires the continued operation of sophisticated information technology, control, and communications systems (“IT Systems”) and network infrastructure. We use our IT Systems and network infrastructure to create, collect, use, disclose, store, dispose of, and otherwise process sensitive information, including company and customer data and personal information regarding customers, employees and their dependents, contractors, shareholders, and other individuals. IT Systems are critical to controlling and monitoring our power plants’ operations, maintaining generation and network performance, monitoring smart grids, managing billing processes and customer service platforms, achieving operating efficiencies, and meeting our service targets and standards in our generation and distribution businesses. The operation of our generation system is dependent not only on the physical interconnection of our facilities with the electricity network infrastructure but also on communications among the various parties connected to the network. The reliance on IT Systems to manage information and communication among those parties has increased significantly since the implementation of smart meters and intelligent grids in Chile.

Our generation and distribution facilities, IT Systems, and other infrastructure and the information processed in our IT Systems could be affected by cybersecurity incidents, including those caused by human error. Cybersecurity incidents have evolved dramatically in recent years, and the number of incidents and their degree of impact have grown exponentially, making it increasingly difficult to identify their source in a timely manner. Our industry has begun to see an increase in the volume and sophistication of cybersecurity incidents from international activist organizations, nation-states, and individuals. In this context, proper cybersecurity risk management must be addressed with a long-term strategy leveraging a proactive approach and iterative actions performed over time. Approaching cyber-risk with a single initiative cannot be considered an efficient and effective strategy to manage and reduce risks related to cybersecurity.

Cybersecurity incidents could harm our business by limiting our generation and distribution capabilities, delaying our development and construction of new facilities or capital improvement projects to existing facilities, disrupting our customer operations, or exposing us to various events that could increase our liability exposure. Our generation and distribution business systems are part of an interconnected system. Given the role of electricity as a vital resource in modern society, a widespread or prolonged disruption caused by the impact of a cybersecurity incident in the electric transmission grid, network infrastructure, fuel sources, or our third-party service providers’ operations could have broad socio-economic ramifications across households, businesses, and vital institutions, which could unfavorably affect our business.

Our businesses require the collection and storage of personally identifiable information of our customers, employees, and shareholders, who expect that we will adequately protect the privacy of such information. Cybersecurity breaches may expose us to a risk of loss or misuse of confidential and proprietary information. Significant theft, loss, or fraudulent use of information, or other unauthorized disclosure of personal or sensitive data, may lead to high costs to notify and protect the impacted persons. It could cause us to become subject to significant litigation, losses, liability, fines, or penalties, any of which could materially and adversely affect our results of operations and reputation. We may also be required to incur significant costs associated with governmental actions in response to such intrusions or strengthen our information and electronic control systems.

The cybersecurity threat is dynamic, evolving, and increasing in sophistication, magnitude, and frequency. We may be unable to implement adequate preventive measures or accurately assess the likelihood of a cybersecurity incident. We are unable to quantify the potential impact of cybersecurity incidents on our business

15

and reputation. These potential cybersecurity incidents and corresponding regulatory action could result in a material decrease in revenues and high additional costs, such as penalties, third-party claims, repairs, increased insurance expense, litigation, notification and remediation, security, and compliance costs.

Material Risks Related to Regulatory Matters

Governmental regulations may unfavorably affect our businesses, cause delays, impede the development of new projects, or increase the costs of operations and capital expenditures.

Our electricity businesses are subject to extensive regulation, inspections, and audits. The tariffs we charge to our customers are a result of a tariff-setting process defined by regulators, which may negatively affect our profitability. Our business is also exposed to the decision of governmental authorities regarding material rationing policies during droughts or prolonged power outages, or regulatory changes that may unfavorably affect our future operations and profitability.

For example, in the context of the social crisis that began in October 2019, the government enacted Law No. 21,185, which established a transitory mechanism for stabilizing customers’ electricity prices under the regulated price system. The mechanism eliminates the price increase of 9.2% that would have been applied to regulated customers as of July 2019 and defers the price increase for the sale of electricity under contracts between generation and distribution companies that start before 2021. A price stabilization funding program was implemented by the National Energy Commission (“CNE” in its Spanish acronym) and is effectively financed by companies in the generation industry, including our subsidiaries Enel Generation and, to a lesser extent, EGP Chile through accounts receivable that are generated by the differences between the contractual rates and the stabilized rates, which are expected to enable the generation companies to recover the lost revenues by December 31, 2027. We have suffered and expect to continue to suffer a financial loss due to this revenue deferral because generation companies are being asked to finance such deferral until billing differences begin to accrue financial remuneration in 2026.

In December 2019, the Ministry of Energy’s Law No. 21,194 (the “Distribution Tariff Law”) lowered the profitability of distribution companies and modified the electricity distribution tariff process. Among other things, the new law reduced the rate for calculating annual investment costs from 10% to a percentage calculated by the CNE every four years (which will be a yearly after-tax rate of between 6% and 8%) and established that the after-tax rate of return for each distribution company must be between three percentage points below and two percentage points above the rate calculated by the CNE.

In August 2020, in the context of the Covid-19 pandemic, the Ministry of Energy’s Law No. 21,249 (“Ley de Servicios Básicos” or the Basic Services Law) was enacted to prohibit electricity distribution companies from cutting services due to late payment for 90 days following the publication of the law for residential customers, small businesses, hospitals, and firefighters, among others. Unpaid amounts accrued from March 18, 2020, to November 30, 2020, may be paid in up to 12 equal and consecutive monthly installments, beginning in December 2020. The monthly installments may not include fines, interest, or associated expenses. In December 2021, the Chilean association of power distribution companies (“Empresas Eléctricas”) announced that its members (CGE, Chilquinta, Enel Distribution, and Grupo Saesa) would extend until January 31, 2022, the prohibition on cutting service to customers for non-payment of electricity bills, despite the law expiring on December 31, 2021.

On December 29, 2020, Law No. 21,301 was ratified and extended the Basic Services Law, increasing the prohibition on cutting off services from 90 days to 270 days, as well as the maximum number of monthly installments from 12 to 36. On May 13, 2021, Law No. 21,340 was enacted, which extended the effects of the

16

Basic Services Law until December 31, 2021, and increased the maximum number of monthly installments from 36 to 48.

On February 11, 2022, Law No. 21,423 established a payment schedule for all debts arising from the application of Law No. 21,249, through which customers may pay their debt in 48 equal monthly installments, with a maximum limit equivalent to 15% of their average billing. Distribution companies will absorb 50% of all debt not repaid within the 48 monthly installments, and the remaining 50% will be applied to the distribution tariffs in the tariff process that will be carried out after the expiration of the 48-installment period.

In July 2022, the Chilean Congress passed Law No. 21,472, which complements Law No. 21,185 by creating a new stabilization fund program and establishing a new transitory mechanism for stabilizing customers’ electricity prices under the regulated price system. The purpose of the mechanism is to limit the increase in electricity bills for regulated customers during 2022 and to allow such increases to occur gradually over the next 10 years. Other Chilean electricity sector regulations may also affect our generation companies’ ability to collect revenues sufficient to cover their operating costs and adversely affect our future profitability.

As a result of the application of the laws mentioned above as of December 31, 2022, our current and non-current accounts receivables increased, revenues from energy sales decreased, costs from energy purchases decreased, and financial income increased due to lower financial costs. Please see Note 9 and Note 34 of the Notes to our consolidated financial statements for further information.

Our operating subsidiaries are also subject to environmental regulations that, among other things, require us to perform environmental impact studies on future projects and obtain construction and operating permits from local and national regulators. Governmental authorities may withhold or delay the approval of these permits until the completion of environmental impact studies, sometimes unexpectedly. Environmental regulations for existing and future generation capacity have become stricter and require increased capital investments. Any delay in meeting the required emission standards may constitute a violation of environmental regulations. Failure to certify the original implementation and ongoing emission standard requirements of monitoring systems may result in significant penalties and sanctions or legal claims for damages. We expect that more restrictive emission limits will be established in the future. We are also subject to an annual “green tax” based on our GHG emissions in the previous year. Such taxes may increase in the future and discourage thermal electricity generation.

Proposed changes in the regulatory framework are often submitted to legislators and administrative authorities. Some of these changes, if implemented, could have a material adverse effect on our business, results of operations, and financial condition.

Our business faces risks from the Chilean government’s decarbonization efforts.

In June 2019, the Chilean government announced its plan to phase out coal entirely from its energy mix by 2040 and achieve carbon neutrality by 2050. Our subsidiary Enel Generation signed an agreement with the Chilean Ministry of Energy defining the process for the closures of our coal-fired power plants: Tarapacá (158 MW), Bocamina I (128 MW), and Bocamina II (350 MW). We closed the Tarapacá plant in December 2019, the Bocamina I plant in December 2020, and the Bocamina II plant in September 2022, well ahead of the Bocamina II plant’s scheduled deadline of December 31, 2040. In doing so, we became the first generation company in the Chilean electricity sector to completely remove coal from its generation operations. However, our efforts to decarbonize our energy matrix by closing coal-fired power plants might be insufficient if our renewable energy projects suffer delays and do not enter into operation on schedule.

17

Even though the Chilean government’s plan to achieve decarbonization may overlap with our sustainability strategy, the governmental targets’ actual implementation may exert considerable pressure on us and our ability to satisfy our contractual obligations with other cleaner sources. In turn, this may increase our expenses, decrease our profitability, and limit our ability to satisfy fully customers’ electricity demands.

Our business and profitability could be unfavorably affected if water rights are denied, if water concessions are granted with a limited duration, or if the cost of water rights is increased.

The Chilean Water Authority (“Dirección General de Aguas”) grants us water rights for water supply from rivers and lakes near our generation facilities. Currently, these water rights:

| ● | are for an unlimited duration; |

| ● | are absolute and unconditional property rights; and |

| ● | are not subject to further challenge. Chilean generation companies must pay an annual license fee for unused water rights. New hydroelectric facilities are required to obtain water rights, and the conditions of such water rights may affect the design, timing, or profitability of a project. |

Any revocation of or limitations on our current water rights (including as a result of changes to the Chilean constitution), additional water rights, or the duration of our water concessions or increase in the cost of water rights could have a material adverse effect on our hydroelectric development projects and profitability.

We are subject to potential business and financial risks resulting from climate change legislation and regulation to limit GHG emissions.

Climate change legislation and regulation restricting or regulating GHG emissions could increase our operating costs and have a material adverse effect on our business, results of operations, and financial condition. The adoption and implementation of any international treaty, legislation, or regulation imposing new or additional reporting obligations or limiting emissions of GHGs from our operations could require us to incur additional costs to comply with such requirements and possibly require the reduction or limitation of GHG emissions associated with our operations. These higher compliance standards, such as net zero emissions, may require higher levels of investment in new, more efficient technologies. Failure to monitor or delay the adoption of new technologies may jeopardize our ability to adapt to climate change and may involve additional costs to operate and maintain our equipment and facilities, install emission controls, or pay taxes and fees relating to GHG emissions, which could have a material adverse effect on our business, results of operations, and financial condition.

We have experienced and may in the future experience increased interest in our environmental, social, and governance (“ESG”) practices and commitments from our stakeholders, investors, and regulatory bodies. Failure to disclose, meet, or address our ESG practices or commitments could negatively impact our reputation, investment in our common stock and ADSs, or our access to capital markets.

Our goal is to reduce carbon emissions from our electric generation facilities to achieve net-zero CO2 emissions by 2040. We continue to monitor the financial and operational feasibility of taking more aggressive action to further reduce GHG emissions. Our strategic plan to replace older, fossil-fueled generation with zero-carbon emitting renewable generation will contribute to the achievement of our goals related to reducing CO2 emissions. However, our ability to achieve such goals depends on many external factors, including the development of relevant energy technologies and the ability to execute our capital plan. These efforts could

18

impact how we operate our electric generating units and lead to increased competition and regulation, all of which could have a material adverse effect on our operations and financial condition.

Our ability to successfully execute our strategic plan, including the transition of our generation facilities and achievement of our CO2 emissions reduction targets, may affect customers’, investors’, legislators’, and regulators’ opinions and actions. If they have or develop a negative opinion of us due to increasing scrutiny of ESG practices or our failure to meet our announced ESG commitments, this could result in increased costs associated with regulatory oversight and could make it more difficult for our businesses to achieve favorable legislative or regulatory outcomes. In addition, increased focus and activism related to ESG matters may hinder our access to capital, as investors may decide to reallocate capital or to not commit capital as a result of their assessment of our ESG practices. Any of these consequences could adversely affect our reputation, investment in our securities, or our access to capital markets and negatively impact our results of operations, financial position, and liquidity.

Material Risks Related to Chile and Other Global Risks

Fluctuations in the Chilean economy, economic interventionist measures by governmental authorities, political and financial events, or other crises in Chile and other countries may affect our results of operations, financial condition, liquidity, and the value of our securities.

All our operations are in Chile. Accordingly, our consolidated revenues may be affected by the performance of the Chilean economy. We are exposed to political volatility and social unrest in Chile due to the challenges arising from changes in economic conditions, regulatory policies, and laws governing foreign trade, manufacturing, development, investments, and taxation. For example, in July 2022, the government of President Gabriel Boric sent the Chilean Congress a tax reform bill to modify income and value-added taxes, reduce tax exemptions and tax evasion, and introduce new taxes on wealth and mining. The reforms are in the initial stages of consideration and are expected to be discussed in the Chilean Congress during 2023.

Chile is also vulnerable to crises and uncertainties, as well as external shocks in other countries, such as financial and political events, that could cause significant economic difficulties and adversely affect economic growth in Chile. If Chile experiences lower-than-expected economic growth or a recession, it is likely that consumer demand for electricity will decrease and that some of our customers may have difficulties paying their electric bills, possibly increasing our uncollectible accounts, which could adversely affect our results of operations and financial condition.

Future adverse developments in Chile, including political events, financial or other crises, changes to policies regarding foreign exchange controls, regulations, and taxation, may impair our ability to execute our business plan and could adversely affect our growth, results of operations, and financial condition. Inflation, changes in interest rates, devaluation, social instability, and other political, economic, or diplomatic developments could also reduce our profitability. Economic and market conditions in Chilean financial and capital markets may be affected by international events, which could unfavorably affect the value of our securities and our ability to access the capital markets.

Changes to the Chilean Constitution could impact a wide range of rights, including water rights and property rights generally, and could affect our business, results of operations, and financial condition.

Following widespread protests and social unrest throughout Chile in October 2019, the Chilean government introduced several social reforms and implemented a constitutional convention process to draft a new Chilean Constitution to replace the current 1980 Constitution. A September 2022 national plebiscite

19

rejected the proposed new constitution by 62% of the popular vote, leaving the current 1980 Constitution in place. However, widespread political support for a second constitutional process remains, and discussions about how to proceed with a new constitutional reform are ongoing. Any new constitution could alter the Chilean political situation, affect the Chilean economy, its business outlook, change existing rights to exploit natural resources, or change water and property rights, any of which could adversely affect our business, results of operations, and financial condition.

For example, the proposed new Chilean Constitution that was rejected in the September 2022 national plebiscite included a declaration that water is “non-appropriable” and would have significantly changed the current system of water rights if approved. There can be no assurance that a similar declaration would not be included in any new Chilean Constitution coming out of that process. Nor can there be any assurance that these reforms and proposals or a new constitution will resolve the social and economic concerns, or that mass protests or civil unrest will not resume. The long-term effects of this social unrest are hard to predict but could include slower economic growth, which could adversely affect our business, results of operations, and financial condition.

We may be subject to the effects of the armed conflict between Russia and Ukraine.

Global markets are currently operating in a period of economic uncertainty, volatility, and disruption as the armed conflict between Russia and Ukraine, which began in February 2022, continues. The armed conflict and the economic sanctions imposed on Russia and certain Russian citizens and enterprises could have a negative effect on the global economy and are highly uncertain and difficult to predict. Although we do not have direct business transactions with suppliers, clients, or lenders from Russia or Ukraine, our business, results of operations, and financial condition may be impacted by (i) limited access to financial markets; (ii) possible interruptions in the global supply chain; (iii) volatility in commodity prices; and (iv) an increase in inflationary pressures in Chile, which could increase the rates charged to our customers.

We are subject to the adverse effects of worldwide pandemics.

In response to the Covid-19 pandemic, in 2020 the Chilean government declared a state of emergency (“estado de excepción constitucional de catástrofe”), instituted nighttime curfews, mandatory quarantines in affected areas, control of entrance, exit, and traffic within specified zones, the prohibition of mass gatherings, and the closing of public schools, among other measures. The private sector voluntarily took further actions, such as adopting telecommuting wherever possible and closing commercial offices.

All these measures, as well as other government restrictions, temporarily disrupted our business and operations, decreased the electricity demand, destabilized financial markets, negatively affected the global supply chain, and compromised our ability to generate income. These disruptions significantly impacted our 2020 performance.

In 2021 and 2022, the Chilean government lifted many of these restrictions, which increased the demand for electricity and positively impacted our net income in 2021 and 2022. For further information with respect to the pandemic effect on our business and financial results, please refer to “Item 5. Operating and Financial Review and Prospects — A. Operating Results.”

The recent emergence of new Covid-19 variants and increases in infection rates may result in a reimposition of governmental and private sector measures in response. If there is a resurgence of the Covid-19 pandemic or similar outbreaks in the future, our business, results of operations, and financial condition may be materially adversely affected.

20

Foreign exchange risks may unfavorably affect our results and the U.S. dollar value of dividends payable to ADS holders.

Our functional currency is the Chilean peso, which has been subject to devaluations and appreciations against the U.S. dollar and may be subject to significant fluctuations in the future. In 2022, the Chilean peso only depreciated by approximately 1% against the U.S. dollar, but the U.S. dollar Observed Exchange Rate peaked at Ch$ 1,042.97 per US$ 1.00 on July 14, 2022, before ending the year at Ch$ 855.86 per US$ 1.00. We pay our dividends in Chilean pesos, and a substantial portion of our consolidated indebtedness has historically been in U.S. dollars. Although a substantial amount of our operating cash flows is linked to the U.S. dollar, we are exposed to fluctuations in the Chilean peso against the U.S. dollar because of time lags and other limitations to pegging our tariff rates to the U.S. dollar. This exposure can substantially decrease the value of the cash we generate in U.S. dollars due to the peso’s devaluation. Future volatility in the currency exchange rate in which we receive revenues or incur expenditures may adversely affect our business, results of operations, and financial condition.

Material Risks Related to Ownership of Our Shares and ADSs

Our controlling shareholder may influence us and may have a strategic view for our development that differs from that of our minority shareholders.

Enel, our controlling shareholder, owns a beneficial interest of 64.93% of our share capital as of the date of this Report. Under Law No. 18,046 (the “Chilean Corporations Law”), Enel has the power to determine the outcome of all material matters that require a simple majority of shareholders’ votes, such as the election of most of the seats on our board, and, subject to contractual and legal restrictions, the adoption of our dividend policy. Enel also exercises significant influence over our business strategy and operations. However, in some cases, its interests may differ from those of our minority shareholders. Certain conflicts of interest affecting Enel in these matters may be resolved in a manner that is different from the interests of our company or our minority shareholders.

The relative illiquidity and volatility of the Chilean securities markets could unfavorably affect the price of our common stock and ADSs.

Chilean securities markets are substantially smaller and have less liquidity than major securities markets in the United States and other developed countries. The low liquidity of the Chilean markets may impair shareholders’ ability to sell shares, or holders of ADSs to sell shares of our common stock withdrawn from the ADS program, on the Chilean Stock Exchanges in the amount and at the desired price and time.

Lawsuits against us brought outside of Chile, or complaints against us based on foreign legal concepts may be unsuccessful.

All our operations are located outside of the United States. All our directors and officers reside outside of the United States, and substantially all their assets are located outside the United States. If investors were to bring a lawsuit against our directors and officers in the United States, it may be difficult for them to effect service of legal process within the United States upon these persons. It may also be difficult to enforce judgments obtained in the U.S. courts based on civil liability provisions of U.S. federal securities laws against them in U.S. or Chilean courts. There is also doubt about whether an action could be brought successfully in Chile for liability based solely on the civil liability provisions of U.S. federal securities laws.

21

We have in the past identified a material weakness in our internal controls over financial reporting and may experience additional material weaknesses or otherwise fail to maintain an effective system of internal control over financial reporting, which could result in material misstatements of our consolidated financial statements, or cause us to fail to meet our periodic reporting obligations.

In 2020, we identified a material weakness in our internal control over financial reporting, which has been remediated.

If we experience additional material weaknesses or otherwise fail to maintain an effective system of internal control over financial reporting, it could (i) result in a material misstatement in our financial reporting or financial statements that would not be prevented or detected, (ii) cause us to fail to meet our reporting obligations under applicable securities laws, or (iii) cause investors to lose confidence in our financial reporting or financial statements, the occurrence of any of which could materially and adversely affect our business, financial condition, cash flows, results of operations, and the prices of our securities.

General Risk Factors

Our electricity business is subject to risks arising from extreme weather events related to climate change, natural disasters, catastrophic accidents, and acts of vandalism or terrorism, which could unfavorably affect our operations, earnings, and cash flow.

Our primary facilities include power plants and distribution assets that are exposed to damage from the increased severity and frequency of extreme weather events, such as cyclones or floods, due to climate change, catastrophic natural disasters, such as earthquakes and fires, and human causes, such as vandalism, protests, riots, and terrorism. A catastrophic event could cause prolonged unavailability of our assets, disruptions in our business, significant decreases in revenues due to lower demand, or significant additional costs not covered by our business interruption insurance and could require us to incur unplanned capital expenditures. There may be lags between a significant accident or catastrophic event and the final reimbursement from our insurance policies, which typically carry a deductible and are subject to per-event policy maximum amounts.

Any natural or human catastrophic disruption to our electricity assets in Chile could significantly affect our business, results of operations, and financial condition.

We are subject to financing risks, such as those associated with funding our new projects and capital expenditures or refinancing existing obligations.

As of December 31, 2022, our net consolidated debt totaled Ch$ 3.1 trillion consisting of: (i) financial liabilities of Ch$ 2.4 trillion, (ii) accounts payable to related parties of Ch$ 1.6, and (iii) less cash and equivalents and hedge derivatives of Ch$ 0.9 trillion. Please see Notes 20, 10, and 6 of the Notes to our consolidated financial statements for further information on related-party transactions and financial liabilities, respectively.

A significant portion of our financial indebtedness is subject to (i) financial covenants, (ii) affirmative and negative covenants, (iii) events of default, (iv) mandatory prepayments for contractual breaches, (v) change of control clauses for material mergers and divestments, (vi) bankruptcy and insolvency proceeding covenants, and (vii) cross-default provisions, which have varying definitions, criteria, materiality thresholds, and applicability concerning subsidiaries that could result in a cross-default event. Our debt may also become immediately due and payable in cases involving bankruptcy or insolvency proceedings of a significant or material subsidiary.

22

The market conditions prevailing at any time may prevent us from accessing capital markets or satisfying our financial needs to fund new projects. We may also be unable to raise the necessary funds required to finish our projects under development or construction. Likewise, we may be unable to refinance our debt or obtain such refinancing in terms acceptable to us. In the absence of such refinancing, we could be forced to liquidate assets at unfavorable prices to make payments due on our debt. Furthermore, we may be unable to sell our assets at opportune moments or sufficiently high prices to obtain proceeds that would enable us to make such payments.

Our inability to finance new projects or capital expenditures, refinance our existing debt, or comply with our covenants could negatively affect our business, results of operations, and financial condition.

Regulatory authorities may impose sanctions on our subsidiaries due to operational failures or any breach of regulations.

Our electricity businesses may be subject to regulatory sanctions for any breach of current regulations, including failures to supply energy. Local regulatory entities supervise our generation subsidiaries. We may be subject to fines, penalties, or sanctions when the regulator determines that the company is responsible for the operational failures that affect the system’s regular energy supply, including coordination issues. Regulations establish a compensation fee to end customers when energy is interrupted more than the standard allowed time due to events or failures affecting transmission facilities. Please see Note 38 of the Notes to our consolidated financial statements for further information on sanctions.

We are involved in litigation proceedings.

We are involved in various litigation proceedings, including lawsuits and arbitrations, that could result in unfavorable decisions or financial penalties against us. Given the difficulty of predicting the outcome of legal matters, we have no certainty about the most likely outcome of these proceedings or what the eventual fines or penalties related to each litigation may be. Although we intend to defend our positions vigorously, our defense of these litigation proceedings may not be successful and responding to such lawsuits and arbitrations diverts resources and our management’s attention from day-to-day operations.

Our financial condition or results of operations could be unfavorably affected if we are unsuccessful in defending these litigations or other lawsuits and legal proceedings against us. Please see Note 36.3 of the Notes to our consolidated financial statements for further information on our litigation proceedings.

E. Climate Change

General

Climate change is a principal challenge of the 21st century, and we are actively contributing to drive the global energy transition towards zero emissions with actions and strategies aligned with the most ambitious objectives at national and international levels. Our aim is to reduce our vulnerability to the physical impacts of climate change by improving our adaptability while reducing carbon emissions through innovative technologies and processes.

Mitigating the effects of climate change is part of our strategy and is integrated into our existing processes, which allows us to assess climate-related risks and opportunities, thus helping us become more resilient and flexible, as well as improving our capital allocation. An integrated process allows us to assess how climate

23

change impacts our businesses, and then make appropriate adjustments to other areas of risk, such as operational or financial risks.

Our strategy for managing climate change has been developed in line with the recommendations of the Task Force on Climate-related Financial Disclosures (“TCFD”) of the Financial Stability Board. We have established a universal climate change management framework across all business units and continuously monitor metrics and targets.

Identifying and Managing Risks

Climate change risk management affects various business units and processes across the Company, which implies risks and opportunities related to the management of our assets and delivery of services offered to our customers. Risks related to climate change cut across several risk categories classified and defined by the Company, each requiring appropriate metrics and analysis to measure and mitigate its effects, as well as to seize its opportunities.

Climate change produces phenomena that affect our business in the short-, medium-, or long-term, which we classify as:

| ● | Physical acute phenomena affecting, for example, industrial assets in terms of damages and business operation. |

| ● | Physical chronic phenomena affecting both the energy system (e.g., temperature impact on energy demand) and assets (e.g., changes in climate affecting power production). |

| ● | Transition phenomena such as different industrial and business sectors trending towards a green economy (e.g., changes in policy and regulation or in technology and market dynamics). |

We conduct impact assessment using a methodology related to the specific phenomena assessed, allowing for quantitative impact evaluation at the operational, economic, or financial level. The methodology used to assess the physical acute phenomena considers an event probability defined by scenarios. To connect scenarios to impacts, two elements are considered: (1) vulnerability (the value lost upon the occurrence of a given catastrophic event for each location and asset) and (2) exposure (the economic value that could be materially impacted).

To assess physical chronic phenomena, climate scenario metrics (e.g., increase in temperature, increase in rain precipitation, etc.) are applied to calculate the change in relevant key performance indicators (KPIs). Assessing physical impacts requires establishing links between climate variables and the business risks and opportunities. These links enable a quantitative assessment of effects on our business related to a selected climate phenomenon expected in the future.

Similarly, to assess the impact of transition phenomena, internal models weigh the effects of changes in selected variables with the greatest impact on the Company (e.g., price of electricity, power demand, commodity prices, local or global policies, increase in competition, etc.).

The results of the impact assessment are used across all levels and units in the Company and thoroughly integrated into processes and strategic planning. Strategic planning activities consider the consequences of climate change and define events and related risks and opportunities relevant to the Company. These activities also determine how short-, medium-, and long-term scenarios affect our assets and services. Analyzing climate change provides insight and information for direct investments to improve the development and operation and management of the current assets.

24

Effects of Risks on Business and Strategy