UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C., 20549

FORM 10-K

ý ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2017 | Commission File Number: 001-37758 |

Moleculin Biotech, Inc.

(Exact name of registrant as specified in its charter)

Delaware | 2834 | 47-4671997 | ||

(State or Other Jurisdiction of | (Primary Standard Industrial | (I.R.S. Employer | ||

Incorporation or Organization) | Classification Code Number) | Identification Number) | ||

2575 West Bellfort, Suite 333

Houston, Texas 77054

(713) 300-5160

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

Securities registered pursuant to Section 12(b) of the Act:

Common Stock, par value $0.001 per share NASDAQ Capital Market

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES ¨ NO ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. YES ¨ NO ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter periods as the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. YES ý NO ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). YES ý NO ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ý

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and "emerging growth company" in Rule 12b-2 of the Exchange Act. (check one)

Large accelerated filer o | Accelerated filer o | ||

Non-accelerated filer o | Smaller reporting company x | ||

Emerging growth company x | |||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. x

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). YES ¨ NO ý

The aggregate market value of the registrant’s voting equity held by non-affiliates of the registrant, computed by reference to the price at which the common stock was last sold as of the last business day of the registrant’s most recently completed second fiscal quarter, was $32,242,351. In determining the market value of the voting equity held by non-affiliates, securities of the registrant beneficially owned by directors, officers and 10% or greater shareholders of the registrant have been excluded. This determination of affiliate status is not necessarily a conclusive determination for other purposes. The number of shares of the registrant’s common stock outstanding as of March 16, 2018 was 25,768,861.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of this registrant’s definitive proxy statement for its 2018 Annual Meeting of Stockholders to be filed with the SEC no later than 120 days after the end of the registrant’s fiscal year are incorporated herein by reference in Part III of this Annual Report on Form 10-K.

Table of Contents

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

The Securities and Exchange Commission, referred to herein as the SEC, encourages companies to disclose forward-looking information so that investors can better understand a company’s future prospects and make informed investment decisions. Certain statements that we may make from time to time, including, without limitation, statements contained in this report constitute “forward- looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995.

We make forward-looking statements under the “Risk Factors,” “Business,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and in other sections of this report. In some cases, you can identify these statements by forward-looking words such as “may,” “might,” “should,” “would,” “could,” “expect,” “plan,” “anticipate,” “intend,” “believe,” “estimate,” “predict,” “potential” or “continue,” and the negative of these terms and other comparable terminology. These forward-looking statements, which are subject to known and unknown risks, uncertainties and assumptions about us, may include projections of our future financial performance based on our growth strategies and anticipated trends in our business. These statements are only predictions based on our current expectations and projections about future events. There are important factors that could cause our actual results, level of activity, performance or achievements to differ materially from the results, level of activity, performance or achievements expressed or implied by the forward-looking statements. In particular, you should consider the numerous risks and uncertainties described under “Risk Factors.”

While we believe we have identified material risks, these risks and uncertainties are not exhaustive. Other sections of this report describe additional factors that could adversely impact our business and financial performance. Moreover, we operate in a very highly regulated, competitive and rapidly changing environment. New risks and uncertainties emerge from time to time, and it is not possible to predict all risks and uncertainties, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements.

Although we believe the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, level of activity, performance or achievements. Moreover, neither we nor any other person assumes responsibility for the accuracy or completeness of any of these forward-looking statements. You should not rely upon forward-looking statements as predictions of future events. We are under no duty to update any of these forward-looking statements after the date of this report to conform our prior statements to actual results or revised expectations, and we do not intend to do so.

Forward-looking statements include, but are not limited to, statements about:

• | our ability to obtain additional funding to develop our product candidates; |

• | the need to obtain regulatory approval of our product candidates; |

• | the success of our clinical trials through all phases of clinical development; |

• | our ability to complete our clinical trials in a timely fashion and within our expected budget; |

• | compliance with obligations under intellectual property licenses with third parties; |

• | any delays in regulatory review and approval of product candidates in clinical development; |

• | our ability to commercialize our product candidates; |

• | market acceptance of our product candidates; |

• | competition from existing products or new products that may emerge; |

• | potential product liability claims; |

• | our dependency on third-party manufacturers to supply or manufacture our products; |

• | our ability to establish or maintain collaborations, licensing or other arrangements; |

• | our ability and third parties’ abilities to protect intellectual property rights; |

• | our ability to adequately support future growth; and |

• | our ability to attract and retain key personnel to manage our business effectively. |

We caution you not to place undue reliance on the forward-looking statements, which speak only as of the date of this Form 10-K in the case of forward-looking statements contained in this Form 10-K.

1

PART I

References in this Annual Report on Form 10-K to “MBI” or “the Company”, “we”, “our” and “us” are used herein to refer to Moleculin Biotech, Inc.

ITEM 1. BUSINESS

Overview

MBI is a clinical-stage pharmaceutical company organized as a Delaware corporation in July 2015 to focus on the development of oncology drug candidates, all of which are based on license agreements with The University of Texas System on behalf of the M.D. Anderson Cancer Center, which we refer to as “MD Anderson”. MBI has three core drug technologies: a uniquely designed anthracycline (Annamycin), a portfolio of STAT3 inhibitors (WP1066 Portfolio) and a collection of inhibitors of glycolysis (WP1122 Portfolio). Our clinical stage drugs are Annamycin, an anthracycline designed to avoid multidrug resistance mechanisms with little to no cardiotoxicity being studied for the treatment of relapsed or refractory acute myeloid leukemia, more commonly referred to as AML, and WP1066, an immuno-stimulating STAT3 inhibitor targeting brain tumors, pancreatic cancer and AML. We are also engaged in preclinical development of additional drug candidates, including additional STAT3 inhibitors and compounds targeting the metabolism of tumors through the inhibition of glycolysis.

Our lead drug candidate is liposomal Annamycin, which we refer to as Annamycin, an anthracycline being studied for the treatment of relapsed or refractory acute myeloid leukemia, or AML. Annamycin has been in clinical trials pursuant to an IND, that had been filed with the FDA. Due to a lack of development activity by a prior drug developer, this IND was terminated. To permit the renewed investigation of Annamycin, we submitted a new IND for a Phase I/II trial for the treatment of relapsed or refractory AML in August 2017, which was subsequently allowed by the FDA in September 2017. We have two other drug development projects: (i) one involving a library of small molecules, which we refer to as the WP1066 Portfolio, a collection of STAT3 inhibitors, some of which also have immuno-stimulating capability, targeting brain tumors, pancreatic cancer and AML, and (ii) the WP1122 Portfolio, a library of small molecules targeting the metabolic processes involved in cancer in general and glioblastoma (the most aggressive and most common form of brain tumor) and pancreatic cancer in particular through the inhibition of glycolysis. A physician-sponsored IND for a Phase I trial of WP1066 in patients with recurrent malignant glioma and brain metastasis from melanoma was allowed by the FDA in December 2017. We also continue to sponsor ongoing research at MD Anderson in order to improve and expand our drug development pipeline.

We have been granted royalty-bearing, worldwide, exclusive licenses for the patent and technology rights related to all of our drug technologies, as these patent rights are owned by MD Anderson. The Annamycin drug substance is no longer covered by any existing patent protection, however, we intend to submit patent applications for formulation, synthetic process and reconstitution related to our Annamycin drug product candidate, although there is no assurance that we will be successful in obtaining such patent protection. Independently from potential patent protection, we have received Orphan Drug designation from the FDA for Annamycin for the treatment of AML, which would entitle us to market exclusivity of 7 years from the date of approval of a New Drug Application (“NDA”) in the United States. We may then benefit from Orphan Drug exclusivity, during which period FDA generally could not approve another Annamycin product for the same use. We also intend to apply for similar status in the European Union (“EU”) where market exclusivity extends to 10 years from the date of Marketing Authorization Application (“MAA”). Separately, the FDA may also grant market exclusivity of 5 years for newly approved new chemical entities (of which Annamycin would be one), but there can be no assurance that such exclusivity will be granted.

With regard to additional potential clinical activity, we submitted in October 2017 a request for Clinical Trial Authorization (“CTA”) in Poland which, if allowed, will enable a Phase I/II clinical trial to study Annamycin for the treatment of relapsed or refractory AML in Poland. This will be in addition to the previously announced allowance of our IND in the United States. In December 2017, the Ethics Committee in Poland approved our Phase I/II clinical trial of Annamycin. The CTA remains subject to final approval by the Polish National Office. Furthermore, in September 2017 we engaged a contract research organization (“CRO”) to prepare for a proof-of-concept clinical trial in Poland to study our drug candidate WP1220, a part of the WP1066 portfolio, for the topical treatment of cutaneous T-cell lymphoma (“CTCL”).

Our Drug Candidates

Annamycin

Our lead product candidate is Annamycin, for which FDA has allowed an IND for a Phase I/II trial for the treatment of relapsed or refractory AML and granted Orphan Drug designation for the treatment of AML. We intend to conduct Phase I/II clinical trials for Annamycin as a monotherapy for the treatment of relapsed or refractory AML in the United States and in Poland.

2

We took over the development of Annamycin from a prior drug development company that ceased development work on Annamycin because it believed the clinical data did not support further clinical evaluation of L-Annamycin as a single agent to treat relapsed or refractory adult acute leukemia patients, leading to the termination of its IND by the FDA. The basis for our decision to proceed notwithstanding the prior developer’s determination is that we believe the actual clinical data as reported by Dr. Robert Shepard, our Chief Medical Officer and who was the prior developer’s Chief Medical Officer at the time of the clinical trials, to the 2009 Annual Meeting of the American Society of Clinical Oncology, and as further reported by the Principal Investigators of the clinical trials in a peer-reviewed journal article (Clin Lymphoma Myeloma Leuk. 2013 August; 13(4): 430-434. doi:10.1016/j.clml.2013.03.015.), supports further clinical evaluation. In addition, the conclusion published in the 2013 Clinical Lymphoma, Myeloma & Leukemia journal article was that “Single agent nanomolecular liposomal annamycin appears to be well-tolerated and [demonstrates] evidence of clinical activity as a single agent in refractory adult ALL.” As reported in both the ASCO presentation and the 2013 journal article referenced, the definition of efficacy is based on the following Response Criteria: “Response criteria were achievement of CR defined as ≤5% blasts, granulocyte count of ≥1×109/L, and a platelet count of ≥100×109/L. Partial remission was defined the same as CR, except for the presence of 6% to 25% blasts. Hematologic improvement was defined as for CR but platelet count <100×109/L.” The summary of patient response from the 2013 journal article reads: “After determining the MTD, a 10-patient phase IIA was conducted. Eight of the patients completed one cycle of the three days of treatment at the MTD. Of these, five (62%) demonstrated encouraging anti-leukemic activity with complete clearing of circulating peripheral blasts. Three of these subjects also cleared bone marrow blasts with one subsequently proceeding onto successful stem cell transplantation. The other two developed tumor lysis syndrome and unfortunately expired prior to response assessment.” In our review of these trials, we confirmed that the activity demonstrated in this summary corresponds with a “Partial remission” as described in the Response Criteria and that the three subjects who “cleared bone marrow blasts” correspond with “CR” (Complete Response).

Market for Annamycin

Leukemia is a cancer of the white blood cells and acute forms of leukemia can manifest quickly and leave patients with limited treatment options. AML is the most common type of acute leukemia in adults. It occurs when a clone of leukemic progenitor white blood cells proliferates in the bone marrow, suppressing the production of normal blood cells. Currently, the only viable option for acute leukemia patients is a bone marrow transplant, also known as a hematopoietic stem cell transplant or “HSCT”, which is successful in a significant number of patients. However, in order to qualify for a bone marrow transplant, the patient’s leukemia cells must be decreased to a sufficiently low level. This usually began with a therapy referred to as “7+3,” which consisted of combining seven injections of Cytarbine with 3 infusions of an anthracycline to induce remission (a complete response, or “CR”). This therapy had not improved since it was first used in the 1970s and we estimate that this induction therapy had a success rate of about 20% to 25%. A revision to this therapy was recently approved in the form of a drug called Vyxeos, which involves combining Cytarabine and an anthracycline (daunorubicin) into a single liposomal injection given 3 times. This improvement appears to have increased the level of CRs to 34% and the overall survival by 3.5 months. Unfortunately, the current clinically approved anthracyclines (including Vyxeos) are cardiotoxic (i.e., can damage the heart), which can limit the dosage amount that may be administered to patients. Additionally, the tumor cells often present de novo or develop resistance to the first line anthracycline, through what is called “multidrug resistance,” enabling the tumor cells to purge themselves of the available anthracyclines. Consequently, there remains no effective therapy for inducing remission in the majority of these patients sufficient to enable a curative bone marrow transplant and unfortunately most will succumb quickly to their leukemia. If a patient’s leukemia reappears before they can be prepared for a bone marrow transplant, they are considered to have “relapsed.” If a patient fails to achieve a sufficient response from the induction therapy to qualify for a bone marrow transplant, they are considered to be “refractory” (resistant to therapy). Together, this group of relapsed and refractory AML patients constitutes our primary focus for treatment with Annamycin and our intent is to pursue FDA approval for Annamycin as a second-line induction therapy for adult relapsed or refractory AML patients.

We believe that pursuing approval as a second line induction therapy for adult relapsed or refractory AML patients is the shortest path to regulatory approval, but we also believe that one of the most important potential uses of Annamycin is in the treatment of children with either AML or ALL (acute lymphoblastic leukemia, which is more common in children). Accordingly, we also intend to pursue approval for pediatric use in these conditions when practicable.

Of the estimated 21,380 U.S. cases of acute myeloid leukemia diagnosed in 2017, an estimated 97% were adult and although exact numbers are not available, we estimate that 70% to 80% (approximately 14,000 to 16,000 patients) were expected to relapse or be resistant to first-line therapy.

Prior Clinical Trials for Annamycin

3

Annamycin is a liposome formulated anthracycline (also referred to in literature as “L-Annamycin”). It has been tested in 6 prior clinical trials and 114 patients with little to no reported cardiotoxicity and, in the two clinical trials focused on leukemia, with fewer dose-limiting toxicities than are normally expected with doxorubicin (one of the leading first-line anthracyclines used for induction therapy). Each of these trials was conducted by a prior developer of Annamycin, and not by our company. Annamycin demonstrated significant activity in 8 of 16 patients in a Phase I study in adult relapsed or refractory AML and ALL patients, with 6 of 14 patients completely clearing leukemic bone marrow blasts. The reason only 14 (rather than 16) patients were tested for leukemic bone marrow blasts is that 2 of the 16 patients succumbed to their disease before bone marrow testing could be completed. In a 30-patient dose-ranging Phase I/II study in ALL, 3 of 8 patients treated with the maximum tolerable dose cleared their leukemic blasts to a level sufficient to qualify for a bone marrow transplant. One of these patients went on to receive a successful curative bone marrow transplant. The other two of these three patients died of tumor lysis syndrome, a condition resulting from the overloading of their system with the debris from leukemic blast cells destroyed by the induction therapy. Armed with the knowledge of this potential, prophylactic pretreatment intended to protect patients from the effects of tumor lysis syndrome will be deployed where appropriate in future trials. Based on the results of the above clinical trials, we believe Annamycin may be different from currently approved induction therapy drugs in four key ways: (i) it has demonstrated clinical activity in a patient population for whom there are currently no effective therapies, (ii) it appears to be capable of avoiding the “multi-drug resistance” mechanisms that have been associated with limiting the effectiveness of currently approved anthracyclines; (iii) it has been shown to be non-cardiotoxic in animal models and little to no cardiotoxicity has been reported from the use of Annamycin in 114 patients; and (iv) in certain AML cell lines, it has been shown to be more potent than one of the leading approved anthracyclines.

Based on initial conversations with the FDA, because of the serious unmet medical need, we believe Annamycin may qualify for accelerated approval based on our planned clinical trials. In order to facilitate our communication with the FDA, we requested access to and reviewed in detail the available data supporting the dose-ranging Phase I/II clinical trial discussed above, which was conducted by a previous developer of Annamycin. In October 2016, we announced that we had identified some positive findings from this review, which gave rise to a modification of our own clinical development plan. We had indicated that our plan was to conduct a detailed review of the clinical results generated by that prior developer, and then to use those results to reestablish an IND in order to continue clinical trials of Annamycin. However, in the course of our review, we identified that Annamycin may have greater potential for efficacy than we originally believed, based on an unexpected potential opportunity to increase the drug’s Maximum Tolerable Dose (“MTD”).

In particular, the Dose Limiting Toxicities (“DLTs”) reported in the previous trial that led to the establishment of the current MTD of 150 mg/m2 were all from patients who had an unusually high number of induction therapy failures prior to being treated with Annamycin. Specifically, of the three patients in the last clinical trial who experienced these DLTs, one of them had failed nineteen prior induction therapy attempts, another had failed sixteen and the other had failed fifteen before being enrolled in the trial. We concluded from our review of this data that, if the heavily treated patients are excluded from the data set, the MTD may have been higher than the level that was actually set by this previous trial.

Planned Clinical Trials for Annamycin

With the discovery that we may be able to increase our MTD, we adjusted our clinical strategy by adding in a Phase I arm to our trial, which will add expense to our development effort. We believe this change in strategy will add several months to the eventual final approval of the drug, if the drug is approved.

Because the prior developer of Annamycin allowed their IND to lapse, we were required to submit a new IND for continued clinical trials with Annamycin. We filed our IND application for Annamycin, with the clinical strategy of increasing the MTD mentioned above, on February 10, 2017. In subsequent discussions with us, FDA requested certain revisions to the protocol, additional information, and additional data related to Chemistry, Manufacturing and Controls (“CMC”). We made the requested revisions to the protocol, and included the CMC data in our re-submission of the IND in August 2017 and the FDA allowed this IND in September 2017.

In August 2017, we met with the European Medicines Agency (“EMA”) to discuss a CTA in Europe for the study of Annamycin for the treatment of AML. As a result of that meeting, we decided to proceed with an application in October 2017 for a CTA for Annamycin in Poland. Unlike in the United States, the process for beginning a clinical trial in Poland requires a hospital contract before a request for CTA can be made. We obtained the required hospital contract, which allowed the formal request for Polish approval. In December 2017, the Ethics Committee in Poland approved our Phase I/II trial of Annamycin for the treatment of relapsed or refractory AML. A final approval is required by the Polish National Office. In March we received requests for and provided additional information to the Polish National Office. We expect a response from the Polish National Office in the first half of 2018 and at the earliest mid-April 2018. The start of clinical trials in Poland remains subject to

4

confirmation and approval of the CTA by the Polish National Office. We can provide no assurance that we will receive such confirmation on a timely basis, if at all.

We have appointed a CRO in both the United States and Poland. In addition, we continue to recruit and contract clinics both in the United States and Poland. In the US, we have one site - University Hospitals Cleveland Medical Center (“UHCMC”) - recruiting patients and active with drug ready to provide treatments. A patient has been enrolled with anticipated treatment to occur in the near term. We can provide no assurance treatment will occur on a timely basis, if at all.

On March 21, 2017, we received notice that FDA had granted Orphan Drug designation for Annamycin for the treatment of AML, effective March 20, 2017.

Little to No Cardiotoxicity

One of the key dose-limiting toxicities associated with currently available anthracyclines (including the anthracycline in Vyxeos) is their propensity to induce life-threatening heart damage. This is especially problematic for pediatric leukemia patients whose life spans can be severely shortened by the very induction therapy designed to cure them of acute leukemia. In the animal model relied upon by the FDA as an indicator of human cardiotoxicity, the non-liposomal (free) form of Annamycin has been shown to be significantly less likely than doxorubicin to create heart lesions in mice, and the liposomal formulation (L-Annamycin) has been shown in these same models to have reduced cardiotoxicity to the point where it is unlikely to cause harm to human patients. This possible lack of human cardiotoxicity means L-Annamycin may be able to be used more aggressively in helping patients achieve remission. This would be especially valuable in the case of pediatric acute leukemia (both AML and ALL) where long-term survival can be greatly impacted by cardiotoxicity. In our current Phase I/II trial for Annamycin, we will collect data to further validate the design intent of Annamycin to have little or no cardiotoxicity. Unless otherwise noted, all of our references to Annamycin refer to the liposomal form (L-Annamycin).

Circumventing Multidrug Resistance

In addition to cardiotoxicity, the effectiveness of currently approved anthracyclines is limited by their propensity for succumbing to “multidrug resistance,” whereby transmembrane proteins acting as transporters (one type of which is referred to as a “P-glycoprotein pump”) develop on the outer surface of cells to expel drugs like anthracyclines as a natural defense mechanism. The dosing of current therapies cannot be increased in an attempt to overcome multidrug resistance because of the likelihood of cardiotoxicity and other serious side effects. This limitation prevents adequate dosing of current anthracyclines to produce lasting remission in most patients. A laboratory study has suggested that Annamycin may resist being expelled by P-glycoprotein pumps and other similar tested multidrug resistance transporters, which may mean the drug circumvents multidrug resistance. This characteristic has been shown in pre-clinical testing to allow for higher drug uptake in diseased cells, which we believe could allow for more effective induction therapy with less risk to the patient.

In order for anthracyclines to provide effective induction therapy, they must be allowed to accumulate in leukemic cells sufficiently to enter the cell’s nucleus, where they damage the cell’s DNA and induce apoptosis (cell death). As induction therapy progresses, however, the targeted cells can develop a natural defense mechanism to prevent the anthracycline activity. The graphic below provides a simplified depiction of the formation of a P-glycoprotein pump on the outer surface (membrane) of a leukemic cell. As typical anthracyclines enter the cell, they are attracted to such pumps and are expelled (referred to as “efflux”) before they can accumulate sufficiently to serve their purpose. In contrast, Annamycin appears to avoid such pumps, thereby being allowed to accumulate sufficiently to destroy the leukemia cell despite the presence of the multidrug resistance mechanisms.

5

The WP1066 Portfolio

We have a license agreement with MD Anderson pursuant to which we have been granted a royalty-bearing, worldwide, exclusive license for the patent and technology rights related to our WP1066 Portfolio and its close analogs, molecules targeting the modulation of key oncogenic transcription factors.

Clinical Testing of WP1066 Portfolio

In vitro testing has shown a high level of activity for WP1066 against a wide range of solid tumors, and in vivo testing has shown significant activity against head and neck, pancreatic, stomach, and renal cancers, as well as metastatic melanoma and glioblastoma, among others. In vivo testing in mouse tumor models has shown that WP1066 inhibits tumor growth, blocks angiogenesis (a process that leads to the formation of blood vasculature needed for tumor growth) and increases survival.

With respect to our WP1066 Portfolio, we collaborated with a clinician at MD Anderson who submitted an IND for WP1066 treatment of brain tumors to the FDA. In December 2017, the FDA allowed this application for a Phase I trial of WP1066 in patients with recurrent malignant glioma and brain metastasis from melanoma.

This Phase I trial with WP1066 drug will receive $2 million in private grant funding at MD Anderson which is in addition to two Specialized Programs of Research Excellence or (SPORE) peer reviewed grants awarded by the National Cancer Institute. We believe the rigorous peer-review process applied to SPORE grant applications represents an important additional measure of independent assessment and validation of the research connected with our approach to using WP1066/STAT3 for the treatment of cancer. The grants described here do not flow through Moleculin's financial statements, but instead are applied to the cost of preclinical and clinical activities at and conducted by MD Anderson.

We estimate that this physician-sponsored Phase I trial will begin treating patients in the first half of 2018. However, as this is a physician-sponsored clinical trial, we have limited influence on the process in beginning clinical trials and, as such, any disruptions to this process may delay the treatment of patients with WP1066, which may delay the commencement of this trial beyond the first half of 2018.

An analog of WP1066, referred to as WP1220, was previously the subject of an IND (WP1220 was referred to as “MOL4239” for purposes of this IND) related to use of the molecule in the topical treatment of psoriasis. Clinical trials were commenced on WP1220 in the US, but were terminated early due to limited efficacy in the topical treatment of psoriatic plaques. Notwithstanding its limitations in treating psoriasis, our pre-clinical research in multiple cutaneous T-cell lymphoma (“CTCL”) cell lines has suggested that WP1220 may be effective in inhibiting CTCL. Based on this data, we are collaborating with a Polish drug development company, Dermin, which has received Polish government grant money to develop WP1220 in Poland for the topical treatment of early stage CTCL patients. CTCL is a potentially deadly form of skin cancer for which there are limited treatment options.

In September 2017, we engaged a CRO to prepare a proof-of-concept clinical trial in Poland to study WP1220 for the topical treatment of CTCL.

6

We also conducted a Phase II clinical trial for WP1066 for the topical treatment of psoriasis, using a longer treatment period as compared with the WP1220 psoriasis trial, however this trial was terminated early as a significant number of patients experienced a non-permanent worsening of their psoriatic plaques after extended use of the drug, suggesting that its use as a topical agent for non-life-threatening diseases such as psoriasis will require further study to optimize dosing and scheduling regimens.

Scientific Rationale for WP1066 Portfolio

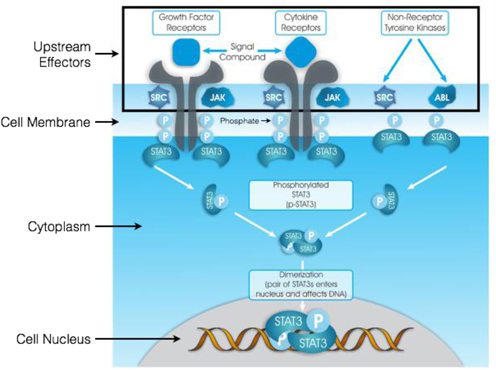

Cellular biology depends upon signaling mechanisms to regulate functions such as cell growth, death and adaptation. Signal “transduction” is such a mechanism that converts an upstream stimulus to a cell into a specific cellular response. Signal transduction starts with a signal to a receptor or via a compound capable of passing through the cell membrane and ends with a change in cell function. The end result of this signal is often the activation of “transcription,” whereby genetic information is expressed and, in the case of oncogenic transcription, disease processes are initiated or maintained.

Receptors span the cell membrane, with part of the receptor outside and part inside the cell. When a chemical signal represented by a specific protein binds to the outer portion of the receptor, it conveys another signal inside the cell. Often there is a cascade of signals within the cell, wherein an upstream inducer starts a chain of events that resembles a domino effect. Collectively, this sequence is referred to as a “signaling pathway.” Eventually, the signal creates a change in the cell function by changing the expression of specific genes and production of specific proteins within the cell, and again, in the case of tumor development, such expression results in unwanted oncogenic processes.

Importantly, while normal healthy cell function relies on signaling mechanisms, diseases are capable of co-opting these mechanisms with negative consequences. Oncogenic processes (including inflammation and proliferation) depend upon signaling pathways that are responsible for coordinating functions such as cell growth, survival and cell differentiation. A particular class of proteins referred to as Signal Transducers and Activators of Transcription (such proteins are “STATs”) regulates the process of disease cell survival and proliferation, angiogenesis and immune system function and is persistently activated in a large number of human inflammatory processes and in hyper-proliferating diseases. Because certain of these proteins are known to be co-opted by tumor cells, we refer to them as “oncogenic transcription factors,” of which certain STATs are a subset.

Some STATs, such as STAT3, can be activated by any one of many different upstream inducers, making them very difficult to target by blocking just one or more of these upstream inducers. We believe that blocking a targeted STAT directly rather than via its multiple upstream inducers should result in greater efficacy with lower toxicity.

In the diagram shown below, any one of many different pathways (categorized as Growth Factor Receptors, Cytokine Receptors and Non-Receptor Tyrosine Kinases) triggers the activation of STAT3 proteins in a process called “phosphorylation”. In this process, phosphates attach to corresponding receptors on STAT3 and, eventually, two phosphorylated STAT3 proteins (“p-STAT3”) bind together in a pair referred to as a “dimer.” Once the dimer is formed, it enters the cell nucleus and triggers gene transcription. Conversely, if we reduce the presence of p-STAT3 before dimers can be formed, we can prevent the triggering of gene transcription and effectively inhibit the disease process.

7

The upstream effectors shown in the above diagram (SRC, JAK and ABL) are just some of those capable of activating STAT3 once they themselves are activated by a variety of signal compounds. The complexity and diversity of pathways capable of activating STAT3 make it very difficult to develop effective drugs that attempt to target the upstream effectors. Furthermore, many of these upstream pathways are necessary for normal healthy cell function, so blocking them indiscriminately can lead to unwanted toxicities.

Published research has identified STAT3 as a master regulator of a wide range of tumors and linked STAT3 activation with the progression of these tumors. For this reason, it is believed that direct inhibition of p-STAT3 may be an effective way to reduce or eliminate the progression of these diseases.

Many research efforts have been directed toward development of specific methods to control activation of STAT3, but most have focused on targeting the upstream effectors of these pathways like growth factors, cytokines, and specific kinases including Janus kinases (“JAKs”). However, we believe that the multifactorial nature of the activation of STAT3 limits the effectiveness of such upstream approaches. Because the activity of p-STAT3 is a final and determinative step in triggering unwanted transcription, we believe it is preferable to inhibit p-STAT3 more directly and independently from upstream effectors.

We believe the WP1066 Portfolio represents a novel class of agents capable of hitting multiple targets, including p-STAT3, regardless of their upstream method of activation. Numerous preclinical tests involving a wide range of tumor cells suggest that by inhibiting the presence of p-STAT3, WP1066 directly attacks tumor cells. We believe the effectiveness of WP1066 is not only the result of attacking tumors directly, but also indirectly by stimulating the immune system, increasing the patient’s natural ability to fight off tumor development. STAT1 is believed to stimulate T-cell activity and thereby the immune system responsible for fighting tumors. WP1066 has been shown to increase the activity of STAT1 at the same time it inhibits the activity of p-STAT3. We believe this dual activity makes WP1066 a uniquely promising oncology drug candidate, although we recognize that substantial additional preclinical and clinical research remains to be done, and may not bear out these early results and our optimism.

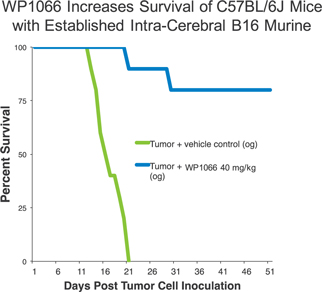

We believe the combination of the direct and indirect effects of WP1066 may ultimately be shown to provide significant tumor suppression and increased survival in a number of in vitro cancer models. Below is one example of an animal model suggesting an increase in survival by treating mice with metastatic melanoma with WP1066.

8

Recent Developments in the WP1066 Portfolio

In February 2018, we announced that, pursuant to our continued collaboration with MD Anderson we had developed and licensed what we believe, based on preclinical testing, is a potential breakthrough - WP1732, a new molecule in the WP1066 portfolio - in our effort to develop a new cancer treatment that selectively kills highly resistant tumors. We believe this new discovery could improve our ability to treat a broader range of the most difficult cancers, and especially pancreatic cancer. Specifically, we have preclinical data to suggest this new molecule is capable of controlling a process known as 'ubiquitination' to block the activated form of STAT3, an important oncogenic transcription factor.

In developing our current lead STAT3 inhibitor, WP1066, for brain tumors, we have focused on its oral bioavailability and brain uptake but at the same time we have continued to expand this portfolio by creating alternative inhibitors with increased bioavailability and altered tissue and organ distribution that are not affected by first-pass metabolism. The lead molecule resulting from this new discovery - WP1732 - not only appears to share the same key mechanistic properties with WP1066, it has markedly different organ distribution and its dramatically increased solubility makes it ideal for administration via standard IV injection. In addition, preclinical testing has also shown that WP1732's properties make it a promising candidate for treating pancreatic cancer, one of the most resistant and deadly forms of cancer.

We have begun planning and performing the necessary pre-clinical work required to submit an IND for WP1732.

The WP1122 Portfolio

We have a license agreement with MD Anderson pursuant to which we have been granted a royalty-bearing, worldwide, exclusive license for the patent and technology rights related to our WP1122 Portfolio and similar molecules targeting the treatment of glioblastoma multiforme (“GBM”) and related central nervous system malignancies.

We believe this technology has the potential to target a wide variety of solid tumors, which eventually become resistant to all treatments, and thereby provide a large and important opportunity for novel drugs. Notwithstanding this potential, we are focused on the treatment of central nervous system malignancies and especially GBM. Although less prevalent than some larger categories of solid tumors, cancers of the central nervous system are particularly aggressive and resistant to treatment. The prognosis for such patients can be particularly grim and the treatment options available to their physicians are among the most limited of any cancer.

The American Cancer Society has estimated 23,770 new cases of brain and other nervous system cancers will occur in the United States in 2016, resulting in 16,050 deaths. Despite the severity and poor prognosis of these tumors, there are few FDA-approved drugs on the market.

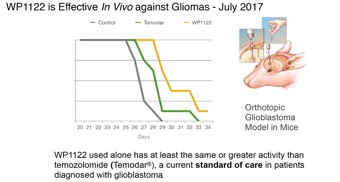

We have preliminary preclinical data for WP1122, including in vitro activity against cancer cell lines, as well as data on survival of animals subjected to xenografts of human brain tumors, including data regarding biodistribution and pharmacokinetics. In non-optimal doses and treatment regimes, WP1122 performed equal to or better than the current market leader, temozolomide and provided for superior survival for animals treated in combination with temozolomide.

9

Notwithstanding these early results, we recognize that substantial additional preclinical and clinical research remains to be done, and may not support these initial findings or their translation into activity in humans.

Scientific Rationale for WP1122

Science has recognized that many cancer cells have a unique metabolism, distinct from that of normal cells. Dubbed the “Warburg Effect” after its discoverer, tumors rely preferentially on glycolysis for the metabolism of glucose, even in the presence of abundant oxygen, for energy (adenosine triphosphate (“ATP”) production. This alternative form of energy production makes cancer cells as much as 17 times more dependent on glucose than normal cells.

The fundamental mechanism for imaging actively growing tumors using positron emission tomography (“PET scans”) is the Warburg Effect. A radiolabeled glucose decoy called F18DG accumulates disproportionately in tumors because of their dramatically increased rate of glucose uptake and accumulation.

Researchers have theorized that if a tumor’s access to glucose could be blocked, the tumor could be starved out of existence. Previous attempts at targeting the metabolism of tumor cells have failed due to the rapid metabolism and short half-life (minutes) of the drugs being investigated. Efforts to target tumor metabolism in the brain were further thwarted by the inability to get glycolytic inhibitors into the brain in sufficient/therapeutic amounts due to the presence of what is called the “blood brain barrier.”

We believe WP1122 has the potential for developing into a technology platform for enabling increased cellular uptake, increased drug half-life and, importantly, an increased ability to cross the blood brain barrier, enabling greater uptake in the brain. Our approach was inspired by the same principle that distinguishes morphine from heroin. Heroin is chemically the diacetyl ester of morphine. While morphine has a limited ability to cross the blood brain barrier (making it a good candidate for pain killing without impairing mental function), its diacetyl form, heroin, has the ability to accumulate in the brain by 10 to 100 times more than morphine. Once across the blood brain barrier, the acetyl groups are cleaved off by natural enzyme esterases, leaving pure morphine to accumulate in the brain. Similarly, we believe, based on pre-clinical testing, that WP1122, the diacetyl form of a glucose analog and decoy known as “2-DG,” crosses the blood brain barrier where its acetyl groups are cleaved off, allowing the resulting 2-DG to accumulate in the brain at a much higher rate than free 2-DG can do by itself.

Adding to the difficulty in getting free 2-DG in circulation (reaching a sufficient plasma level) and to cross the blood brain barrier in therapeutic quantities is the relatively short half-life of 2-DG. The free form of 2-DG is rapidly metabolized causing typically observed 2-DG plasma levels to be generally lower than desired to achieve sufficient therapeutic potential.

In contrast, WP1122 -generated 2-DG has significantly increased half-life and observed levels of 2-DG in plasma are substantially higher, making it much more feasible to deliver 2-DG to tumors in quantities adequate to produce a therapeutic effect. In addition, based on preliminary data, we believe WP1122 may represent an improvement to current PET scan diagnostics techniques because of its unique ability to reach tumors protected by the blood brain barrier in greater amounts than the glucose decoys currently used for PET scans. Significant additional development is required to determine if these findings are valid and if they will translate into the desired activity in humans.

In October 2016, we announced promising initial results of the preclinical toxicology work on WP1122, our unique inhibitor of glucose metabolism, an important driver of glycolytic brain tumor progression and survival. We view this as an important step toward future clinical trials for WP1122. We indicated that preliminary escalating single dose toxicity testing in mice (oral administration) was successfully completed and even at the highest possible dose, no toxic death was observed. In multiple therapeutic doses, WP1122 was well tolerated during intense twice-daily oral dosing.

In June 2017, we announced the discovery of a metabolic inhibitor with the potential to treat pancreatic cancer. In pre-clinical testing, WP1234, a modification to WP1122, has shown improved in-vitro drug characteristics and a 20 to 50-fold greater ability to kill pancreatic cancer cell lines when compared with WP1122. We know that pancreatic cancer thrives even in a reduced oxygen environment, and is highly dependent on glycolysis to proliferate and survive. We believe WP1234 may be a promising drug candidate to be studied for the treatment of pancreatic cancer.

10

Pancreatic cancer is still considered largely untreatable, so even modest gains in treating this disease could represent a significant clinical benefit. In pre-clinical testing, WP1234 improves on known inhibitors for glycolysis by increasing drug circulation time, which should increase the potential for drug uptake by and destruction of tumor cells. We intend to pursue development opportunities with WP1234 for the treatment of pancreatic cancer and compare its activity with our other inhibitors, including WP1122.

Overview of the market for our oncology drugs

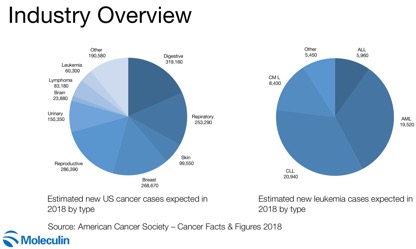

Cancer is the second leading cause of death in the United States behind heart disease. In 2016, an estimated 15.5 million people in the United States were living with a past or current diagnosis of cancer and, in 2018, the National Institutes of Health estimated that nearly 1.7 million new cases will be diagnosed and over 600,000 Americans will die from cancer.

Source: American Cancer Society - Cancer Facts & Figures 2018

Digestive, reproductive, breast and respiratory cancers comprise 65% of expected cancer diagnoses in 2018, while cancers like leukemia and brain tumors are considered “rare diseases.” Leukemia in particular, can be divided into acute, chronic and other, with acute lymphoblastic leukemia (ALL) and acute myeloid leukemia (“AML”) comprising 26,900 of the estimated 60,300 new cases expected in the United States in 2018.

11

The worldwide cancer drug business has been estimated to represent approximately $100 billion in annual sales. Our lead drug candidate, Annamycin, is in a class of drugs referred to as anthracyclines, which are chemotherapy drugs designed to destroy the DNA of targeted cancer cells. The most common approved anthracyclines are daunorubicin and doxorubicin and, prior to the expansion of their generic equivalents, annual revenues generated from anthracyclines have been estimated in the range of $600 million. Acute leukemia is one of a number of cancers that are treated with anthracyclines. One industry report estimates that annual drug revenues generated from the demand for AML-related therapies in the United States, United Kingdom, France, Germany, Italy and Spain were in the range of $151 million in 2012, and we believe that this number may increase if and when improved AML treatments are available.

Our other two active development projects have applications (among others) in the treatment of brain tumors, another rare disease for which there are few available treatments. The leading brain tumor drug is temozolomide, a drug introduced under the brand name Temodar. In 2012, one industry source reported annual revenues of approximately $882 million for Temodar before the expiration of its patent protection, at which point generic versions of the drug began to enter the market and reduce prices.

The Orphan Drug Act and other legislative initiatives provide incentives, including market exclusivity and accelerated approval pathways, for companies that pursue the development of treatments for rare diseases and serious diseases for which there are few or no acceptable available treatment alternatives. Over the last 10 years, an increasing number of companies have begun using these designations to obtain new drug approvals for drugs where patent coverage has expired and/or where accelerated approval appears possible. An IMS Health report estimated that, in 2013, the sale of drugs with full or partial Orphan Drug exclusivity represented approximately $29 billion in revenue. We consider obtaining Orphan Drug exclusivity and accelerated approval to be an important part of our development strategy for our drug candidates. Notwithstanding these potential opportunities, we can provide no assurance that our drugs will receive Orphan Drug designation (other than Annamycin, which recently received such designation) or, if approved, exclusivity or any other special designation that could, among other things, provide for accelerated approval.

Our License Agreements

Sponsored Research Agreements with MD Anderson

On January 9, 2017, we amended our Sponsored Laboratory Study Agreement with MD Anderson whereby we paid $302,500 in 2017, and the agreement was extended to October 31, 2018. On December 4, 2017, we extended this Agreement until October 31, 2019 for a total of payments of $346,687 spread over that period of time. Of this amount, $236,687 was paid in the first quarter of 2018. The final payment of $110,000 is due on July 31, 2018.

Annamycin

As of August 2015, we obtained the rights and obligations of Annamed under a June 2012 Patent and Technology Development and License Agreement by and between Annamed and Dermin (the “Annamed Agreement”). Therefore, certain intellectual property rights, including rights, if any, covering the potential drug product, Annamycin have been licensed to Dermin and Dermin has been granted a royalty-bearing, exclusive license to manufacture, have manufactured, use, import, offer to sell and/or sell products in the field of human therapeutics under the licensed intellectual property in the countries of Poland, Ukraine, Czech Republic, Hungary, Romania, Slovakia, Belarus, Lithuania, Latvia, Estonia, Netherlands, Turkey, Belgium, Switzerland, Austria, Sweden, Greece, Portugal, Norway, Denmark, Ireland, Finland, Luxembourg, Iceland, Kazakhstan, Russian Federation, Uzbekistan, Georgia, Armenia, Azerbaijan and Germany (“Annamed licensed territories”). We are obligated to develop and provide a dossier containing data related to the licensed subject matter to Dermin. In consideration, Dermin will pay a royalty for the sale of any licensed product in the Annamed licensed territories and pay all out-of-pocket expenses incurred by us in filing, prosecuting and maintaining the licensed patents for which the license has been granted. Dermin also agrees to provide a percentage of certain consideration that Dermin receives pursuant to sublicense agreements. On June 29, 2017, the Company entered into an agreement with MD Anderson licensing certain technology related to the method of preparing Liposomal Annamycin. The agreement includes a one-time license documentation fee of $40,000, annual maintenance fees of $25,000 until the first sale of drug and has the following the milestone payments: (i) commencement of Phase III Study for first licensed drug/product - $125,000; (ii) submission of the first NDA within the United States - $175,000; and (iii) receipt of first marketing approval for sale of a license product in the United States - $225,000.

WP1066 Portfolio

The rights and obligations to a June 2010 Patent and Technology License Agreement entered into by and between Moleculin LLC and MD Anderson (the “Moleculin Agreement”) have been assigned to us. Therefore, we have obtained a

12

royalty-bearing, worldwide, exclusive license to intellectual property rights, including patent rights, related to our WP1066 drug product candidate. In consideration, we must make payments to MD Anderson including an up-front payment, milestone payments and minimum annual royalty payments for sales of products developed under the license agreement. Annual maintenance fee payments will no longer be due upon marketing approval in any country of a licensed product. One-time milestone payments are due upon commencement of the first Phase III study for a licensed product within the United States, Europe, China or Japan; upon submission of the first NDA for a licensed product in the United States; and upon receipt of the first marketing approval for sale of a licensed product in the United States. The rights we have obtained pursuant to the assignment of the Moleculin Agreement are made subject to the rights of the U.S. government to the extent that the technology covered by the licensed intellectual property was developed under a funding agreement between MD Anderson and the U.S. government. The agreement, as amended, has the following the milestone payments: (i) commencement of Phase III Study for first licensed drug/product within the United States, Europe, China or Japan - $150,000; (ii) submission of the first NDA within the United States - $500,000; and (iii) receipt of first marketing approval for sale of a license product in the United States - $600,000.

We entered into an out-licensing agreement with Houston Pharmaceuticals, Inc. (“HPI”), pursuant to which we have granted certain intellectual property rights to HPI, including rights covering the potential drug candidate, WP1066 (“HPI Out-Licensing Agreement”). Under the HPI Out-Licensing Agreement, we must make quarterly payments totaling $0.75 million for the first twelve quarters following the effective date of the HPI Out-Licensing Agreement, or May 2, 2016, in consideration for the right to development data related to the development of licensed products. Notwithstanding our obligation to make the foregoing payments, the HPI Out-Licensing Agreement does not obligate HPI to conduct any research or to meet any milestones. Upon payment in the amount of $1.0 million to HPI within three years of the effective date of the HPI Out-Licensing Agreement we will regain all rights to the licensed subject matter and rights to any and all development data and any regulatory submissions including any IND, NDA or ANDA related to the licensed subject matter and can end the license without any other obligation other than the aforementioned quarterly payments. In the event that we do not exercise our right to regain our rights to the licensed subject matter within three years of the effective date of the HPI Out-Licensing Agreement, the license granted to HPI shall convert to an exclusive license upon HPI’s written notice and we shall be obligated to transfer all existing data relating to licensed subject matter including any development data and any IND to HPI.

In February 2018, we entered into a license agreement covering a new group of molecules recently discovered in connection with research we have been sponsoring at MD Anderson Cancer Center called WP1732, a part of the WP1066 Portfolio. In consideration, we must make payments to MD Anderson including an up-front payment, license documentation fee, annual maintenance fee, milestone payments and minimum annual royalty payments for sales of products developed under the license agreement. Under the agreement, annual maintenance fees are $10,000 on the effective date of the agreement and increase by $5,000 per year up to a maximum of $50,000 per year. Under the agreement, we are required to make royalty payments ranging from 3% to 5% of Net Sales, depending on the intended use, each quarter upon the commencement of sales, with a minimum of $200,000 per year. Additional payments are due upon the commencement of a Phase II study ($150,000), submission of an New Drug Application ($500,000), and the receipt of marketing approval of a licensed product ($600,000).

WP1122 Portfolio

The rights and obligations to an April 2012 Patent and Technology License Agreement entered into by and between IntertechBio and MD Anderson (the “IntertechBio Agreement”) have been assigned to us. Therefore, we have obtained a royalty-bearing, worldwide, exclusive license to intellectual property, including patent rights, related to our WP1122 Portfolio and to our drug product candidate, WP1122. In consideration, we must make payments to MD Anderson including an up-front payment, license documentation fee, annual maintenance fee, milestone payments and minimum annual royalty payments for sales of products developed under the license agreement. Under the agreement, annual maintenance fees are $10,000 on the first anniversary of the effective date of the agreement, $20,000 on the second anniversary of the effective date of the agreement, $40,000 on the third anniversary of the effective date of the agreement, $60,000 on the fourth anniversary of the effective date of the agreement, $80,000 on the fifth anniversary of the effective date of the agreement and $100,000 on the sixth anniversary of the effective date of the agreement, except that such payments will no longer be due upon the first sale of a licensed product. Under the assignment, we agreed to make a minimum annual royalty payment in the amount of $200,000 for the first anniversary following the first sale of a licensed product, $400,000 for the second anniversary following the first sale of a licensed product, and $600,000 for the third year following the first sale of a licensed product.

One-time milestone payments are due as follows: 1) Upon commencement of a Phase II study for a licensed product - $200,000; 2) Upon commencement of a Phase III study for a licensed product - $250,000; 3) Upon filing of a New Drug Application (“NDA”) for a licensed product - $400,000; and 4) Upon receipt of market approval for sale of a licensed product - $500,000. The rights we have obtained pursuant to the assignment of the IntertechBio Agreement are made subject to the rights

13

of the U.S. government to the extent that the technology covered by the licensed intellectual property was developed under a funding agreement between MD Anderson and the U.S. government.

Corporate History

We were founded in 2015 by Walter Klemp (our chairman and CEO), Dr. Don Picker (our Chief Science Officer) and Dr. Waldemar Priebe of MD Anderson (Chairman of our Scientific Advisory Board) in order to combine and consolidate development efforts that include several MD Anderson oncology technologies. Dr. Priebe is a Professor of Medicinal Chemistry in the Department of Experimental Therapeutics, Division of Cancer Medicine, at the University of Texas MD Anderson Cancer Center. This effort began with the acquisition of the Annamycin development project from AnnaMed, Inc., or AnnaMed, followed by the acquisition of the license rights to the WP1122 Portfolio from IntertechBio Corporation, or IntertechBio. Further, we undertook an effort to gain control of the WP1066 Portfolio, which culminated with the merger of Moleculin, LLC and MBI and the establishment of a co-development agreement with Houston Pharmaceuticals, Inc., or HPI, coincident with our IPO.

AnnaMed, a company controlled by Mr. Klemp, was formed in 2012 to take over the development of Annamycin from a prior drug development company. In 2012, AnnaMed out-licensed development rights in a limited territory to a Polish special purpose drug development company called Dermin in exchange for Dermin’s development work based on its successful effort to obtain Polish government grant funding to assist in the development of Annamycin. In August 2015, we entered into a rights transfer agreement with AnnaMed pursuant to which, in exchange for our common stock, AnnaMed agreed to transfer any and all data it had regarding the development of Annamycin and the Annamycin IND, including all trade secrets, know-how, confidential information and other intellectual property rights held by AnnaMed.

IntertechBio was formed in 2009 to license and begin development on the WP1122 Portfolio. The WP1122 Portfolio was also out-licensed to Dermin, which was awarded a Polish government grant to assist in drug development efforts. In August 2015, IntertechBio agreed to assign all license rights to us in exchange for our common stock. Drs. Priebe and Picker are shareholders of IntertechBio and control the voting and dispositive power over the shares of our common stock held by IntertechBio.

Moleculin, LLC was formed in 2006 and had been working to develop the WP1066 Portfolio it licensed from MD Anderson. As a part of the formation of Moleculin, LLC, an agreement was reached with HPI to limit Moleculin, LLC’s development efforts to uses in dermatology only, leaving non-dermatology indications to HPI.

Prior to our IPO, Moleculin, LLC was merged with and into our company. Dr. Priebe, Mr. Klemp and Dr. Picker were members of Moleculin, LLC and received shares of our common stock as a result of the merger. In addition, Mr. Klemp and Dr. Picker were members of the board of Moleculin, LLC. The merger agreement contains mutual representations and warranties between the parties. Pursuant to the merger agreement, we agreed for a period of six years to indemnify and hold harmless each present and former director and/or officer of Moleculin, LLC whom Moleculin, LLC would have had the power to indemnify under Delaware law that is made a party or threatened to be made a party to any threatened, pending or completed proceeding or claim by reason of the fact that he or she was a director or officer of the Moleculin, LLC prior to the effective time of the merger and arising out of actions or omissions of the indemnified party in any such capacity occurring at or prior to the effective time of the merger against any losses or damages reasonably incurred in connection with any claim. To our knowledge, no such proceeding or claim exists or has been threatened on the date hereof and Moleculin, LLC made representations to this effect in the merger agreement as of the date of such agreement. As additional consideration payable to the Moleculin, LLC unit holders, we agreed pursuant to the merger agreement that if drugs for dermatology indications are successfully developed by us (or our successors) using any of the Existing IP Assets, then the Moleculin, LLC unit holders, in the aggregate, will be entitled to receive a 2.5% royalty on the net revenues generated by such drugs. Any such net revenues would include a deduction for license fees or royalty obligations payable to MD Anderson for such Existing IP Assets. The merger agreement defined “Existing IP Assets” to mean all intellectual property, licensed by us and Moleculin, LLC as of the time of the merger, including, without limitation, the intellectual property licensed from MD Anderson under the Patent and Technology License Agreement entered into by and between IntertechBio Corporation and MD Anderson dated April 2, 2012, as amended, and the Patent and Technology License Agreement dated June 21, 2010, as amended, between MD Anderson and Moleculin, LLC, but excluding any intellectual property relating to Annamycin. The right to receive the contingent royalty payments described herein are for drugs developed only for dermatology indications, and do not include drugs developed for any other indications. We have no obligation of any nature to pursue the development of any drugs for dermatology indications.

Prior to our IPO, we entered into a co-development agreement with HPI whereby HPI is continuing its grant-funded research and making all resulting data available for our use in exchange for a development fee. We may buy HPI out of its co-development rights in the WP1066 Portfolio at our option. Please see the section “Business - License Agreements” for a

14

description of our agreement with HPI. Drs. Priebe and Picker are shareholders of HPI, and Dr. Priebe has the voting and dispositive power over the shares of our common stock held by HPI.

Competition

We operate in a highly competitive segment of the pharmaceutical market, which market is highly competitive as a whole. We face competition from numerous sources including commercial pharmaceutical and biotechnology enterprises, academic institutions, government agencies, and private and public research institutions. Many of our competitors may have significantly greater financial, product development, manufacturing and marketing resources. Additionally, many universities and private and public research institutes are active in cancer research, and some may be in direct competition with us. We may also compete with these organizations to recruit scientists and clinical development personnel. Smaller or early-stage companies may also prove to be significant competitors, particularly through collaborative arrangements with large and established companies.

The unmet medical need for more effective cancer therapies is such that oncology drugs are, by far, the leading class of drugs in development. These include a wide array of products against cancer targeting many of the same indications as our drug candidates. While the introduction of newer targeted agents may result in extended overall survival, induction therapy regimens are likely to remain a cornerstone of cancer treatment in the foreseeable future.

There are a number of established therapies that may be considered competitive for the cancer indications for which we intend to develop our lead product, Annamycin. A key consideration when treating AML patients is whether the patient is suitable for intensive therapy. The standard of care for the treatment of newly diagnosed AML patients who can tolerate intensive therapy is cytarabine in combination with an anthracycline (e.g., doxorubicin or daunorubicin), typically referred to as a “7+3” regimen. For some patients, primarily those less than 60 years of age, a stem cell transplant could also be considered if the induction regimen is effective in attaining a CR (Complete Response). The 7+3 regimen of cytarabine in combination with an anthracycline has been the standard of care for decades. A patient not suitable for intensive therapy may be offered the option for low-intensity therapy such as low-dose cytarabine, azacitidine or decitabine. It should be noted that, in the United States, these are not approved by the FDA for the treatment of AML patients and there remains no effective therapy for these patients or for relapsed or refractory AML, with the exception of some recently approved targeted therapies that have demonstrated a low level of activity for limited subgroups of AML patients. The initial focus for Annamycin development is in patients for whom the standard induction regimen has failed. Also, several major pharmaceutical companies and biotechnology companies are aggressively pursuing new cancer development programs for the treatment of AML.

A number of attempts have been made or are under way to provide an improved treatment for AML. Celator Pharmaceuticals reported Phase III clinical trial results for a new combined formulation of cytarabine and daunorubicin (commonly used induction therapy drugs) they call Vyxeos. This new liposome formulation provides a 5:1 ratio of cytarabine and daunorubicin in each of three injections. When compared with patients receiving 7 injections of cytarabine and 3 injections of daunorubicin (traditional 7+3 induction therapy), patients receiving Vyxeos achieved an average increase in overall survival of approximately 3.5 months (9.5 months compared with 6 months). Despite this extension of overall survival, Vyxeos did not reduce the toxic side effects of daunorubicin (including cardiotoxicity) and it failed to qualify a significant majority of patients for curative bone marrow transplant. With these results, Jazz Pharmaceuticals acquired Celator in 2016 and recently obtained FDA approval, making Vyxeos the new first line standard of care for the treatment of AML

Drugs attempting to target a subset of AML patients who present with specific gene mutations, such as one referred to as FLT3, have recently received FDA approval, but by definition serve only subsets of the AML population. Other targeted therapies are currently in clinical trials, as well as other approaches that include immunotherapy relying on other biomarkers, other attempts at improved chemotherapy and alternative approaches to radiation therapy. Other approaches to improve the effectiveness of induction therapy are in early stage clinical trials and, although they do not appear to address the underlying problems with anthracyclines, we can provide no assurance that such improvements, if achieved, would not adversely impact the need for improved anthracyclines. A modified version of doxorubicin designed to reduce cardiotoxicity is in clinical trials for the treatment of sarcoma and, although this drug does not appear to address multidrug resistance and is not currently intended for the treatment of acute leukemia, we can provide no assurance that it will not become a competitive alternative to Annamycin. Although we are not aware of any other single agent therapies in clinical trials that would directly compete against Annamycin in the treatment of relapsed and refractory AML, we can provide no assurance that such therapies are not in development, will not receive regulatory approval and will reach market before our drug candidate Annamycin. In addition, any such competing therapy may be more effective and/or cost-effective than ours.

Government Regulation

15

Government authorities in the US, at the federal, state and local level, and in other countries extensively regulate, among other things, the research, development, testing, manufacture, quality control, approval, labeling, packaging, storage, record-keeping, promotion, advertising, distribution, post-approval monitoring and reporting, marketing and export and import of products such as those we are developing. The pharmaceutical drug product candidates that we develop must be approved by the FDA before they may be marketed and distributed.

In the United States, the FDA regulates pharmaceutical products under the Federal Food, Drug, and Cosmetic Act, and implementing regulations. Pharmaceutical products are also subject to other federal, state and local statutes and regulations. The process of obtaining regulatory approvals and the subsequent compliance with appropriate federal, state, local and foreign statutes and regulations require the expenditure of substantial time and financial resources. Failure to comply with the applicable U.S. requirements at any time during the product development process, approval process or after approval, may subject an applicant to administrative or judicial sanctions. FDA and related enforcement activity could include refusal to approve pending applications, withdrawal of an approval, a clinical hold, warning letters, product recalls, product seizures, total or partial suspension of production or distribution injunctions, fines, refusals of government contracts, restitution, disgorgement or civil or criminal penalties. Any agency or judicial enforcement action could have a material adverse effect on us. The process required by the FDA before a pharmaceutical product may be marketed in the US generally involves the following:

•Completion of preclinical laboratory tests, animal studies and formulation studies according to Good Laboratory Practices or other applicable regulations;

•Submission to the FDA of an Investigational New Drug application, or IND, which must become effective before human clinical studies may begin;

•Performance of adequate and well-controlled human clinical studies according to the FDA’s current good clinical practices (“GCP”), to establish the safety and efficacy of the proposed pharmaceutical product for its intended use;

•Submission to the FDA of an NDA for a new pharmaceutical product;

•Satisfactory completion of an FDA inspection of the manufacturing facility or facilities where the pharmaceutical product is produced, to assess compliance with current good manufacturing practices (“cGMP”), to assure that the facilities, methods and controls are adequate to preserve the pharmaceutical product’s identity, strength, quality and purity;

•Potential FDA audit of the preclinical and clinical study sites that generated the data in support of the NDA; and

•FDA review and approval of the NDA.

The lengthy process of seeking required approvals and the continuing need for compliance with applicable statutes and regulations require the expenditure of substantial resources and approvals, and continued compliance are inherently uncertain.

Before testing any compounds with potential therapeutic value in humans, the pharmaceutical product candidate enters the preclinical testing stage. Preclinical tests include laboratory evaluations of product chemistry, toxicity and formulation, as well as animal studies to assess the potential safety and activity of the pharmaceutical product candidate. These early proof-of-principle studies are done using sound scientific procedures and thorough documentation. The conduct of the single and repeat dose toxicology and toxicokinetic studies in animals must comply with federal regulations and requirements including good laboratory practices. The sponsor must submit the results of the preclinical tests, together with manufacturing information, analytical data, any available clinical data or literature and a proposed clinical protocol, to the FDA as part of the IND. The IND automatically becomes effective 30 days after receipt by the FDA, unless the FDA has concerns and notifies the sponsor. In such a case, the IND sponsor and the FDA must resolve any outstanding concerns before the clinical study can begin. If resolution cannot be reached within the 30-day review period, either the FDA places the IND on clinical hold or the sponsor withdraws the application. The FDA may also impose clinical holds on a pharmaceutical product candidate at any time before or during clinical studies for various reasons. Accordingly, we cannot be sure that submission of an IND will result in the FDA allowing clinical studies to begin, or that, once begun, issues will not arise that suspend or terminate such clinical study.

Clinical studies involve the administration of the pharmaceutical product candidate to healthy volunteers or patients under the supervision of qualified investigators, generally physicians not employed by or under the clinical study sponsor’s control. Clinical studies are conducted under protocols detailing, among other things, the objectives of the clinical study, dosing

16

procedures, subject selection and exclusion criteria, how the results will be analyzed and presented and the parameters to be used to monitor subject safety. Each protocol must be submitted to the FDA as part of the IND. Clinical studies must be conducted in accordance with GCP. Further, each clinical study must be reviewed and approved by an independent institutional review board (“IRB”) at, or servicing, each institution at which the clinical study will be conducted. An IRB is charged with protecting the welfare and rights of study participants and considers such items as whether the risks to individuals participating in the clinical studies are minimized and are reasonable in relation to anticipated benefits. The IRB also approves the informed consent form that must be provided to each clinical study subject or his or her legal representative and must monitor the clinical study until completed.