Exhibit 99.1

DEED OF TRANSFER OF VIMPELCOM ADSs, ISSUANCE OF DEPOSITARY RECEIPTS AND FUNDING

THIS DEED (this “Deed”) is made on 29 March 2016

BETWEEN:

|

(1)

|

Stichting Administratiekantoor Mobile Telecommunications Investor, a foundation (stichting) incorporated under the laws of the Netherlands, registered with the Dutch trade register under registration number 65286936, with its registered address at Herikerbergweg 238, Luna ArenA, 1101 CM Amsterdam (the “Foundation”); and

|

|

(2)

|

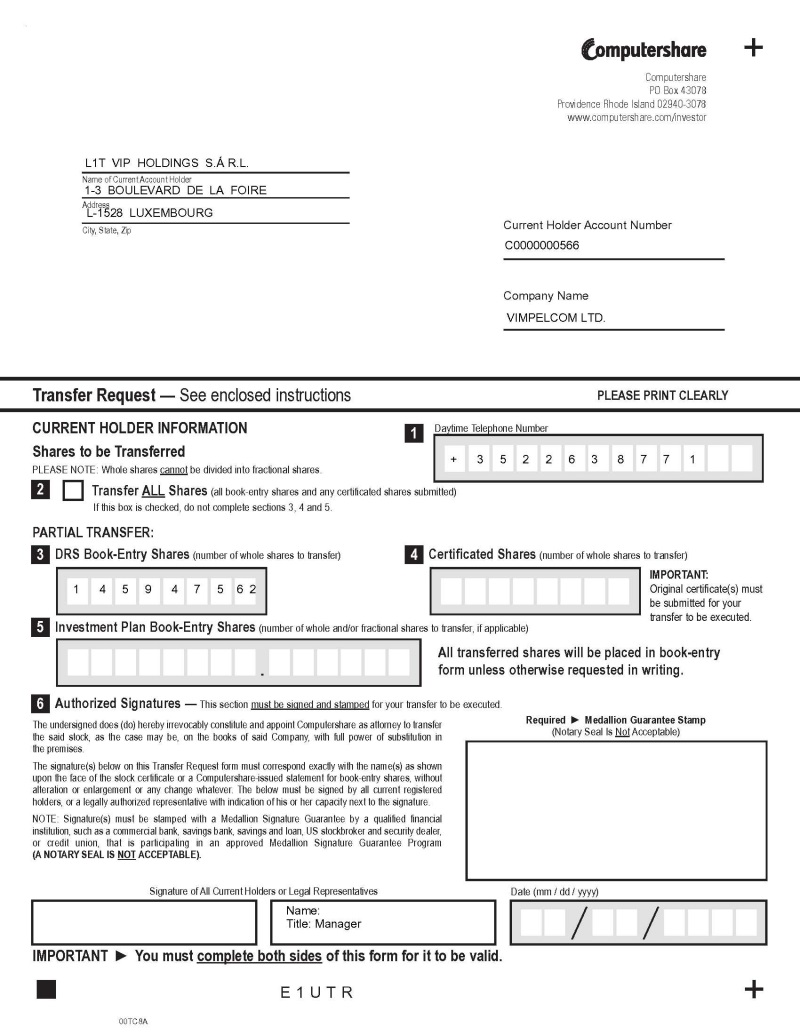

L1T VIP Holdings S.à r.l., a société à responsibilité limitée incorporated under the laws of Luxembourg, registered with the Luxembourg Chamber of Commerce (Registre de commerce et des sociétés) under registration number B200215, with its registered address at 1-3 Boulevard de la Foire, L-1528, Luxembourg (“L1T”),

|

each a “Party”, and collectively, the “Parties”.

WHEREAS

|

(A)

|

L1T wishes to transfer the VimpelCom ADSs (as defined below) to the Foundation.

|

|

(B)

|

The Foundation has agreed to acquire the VimpelCom ADSs against issuance of Depositary Receipts (as defined below) and to administer the VimpelCom ADSs pursuant to and in accordance with the Constitutional Documents (each as defined below).

|

|

(C)

|

This Deed governs the contractual aspects relating to, title to, and the transfer of the VimpelCom ADSs, and the transfer of the legal and beneficial ownership of the VimpelCom ADSs shall be effected pursuant to this Deed.

|

|

(D)

|

In furtherance of the above, the Parties also wish to set forth in this Deed the terms and conditions of the support that L1T will provide to the Foundation in an effort to procure the proper continued operation of the Foundation and certain continuing obligations of the Foundation and L1T in respect of the VimpelCom ADSs.

|

NOW, THEREFORE, in consideration of the mutual covenants and agreements hereinafter set forth, the Parties hereby agree as follows:

|

1.

|

Interpretation

|

1.1 Capitalized terms used in this Deed shall have the meanings ascribed to them below, unless the context requires otherwise:

|

“Articles of Association”

|

shall mean the articles of association (statuten) of the Foundation, as may be amended from time to time;

|

|

|

“Board Member”

|

shall mean a member of the board of the Foundation;

|

| “Bye-laws” | shall mean the bye-laws of VimpelCom (as may be amended from time to time); | |

|

“Conditions of Administration”

|

shall mean the terms and conditions (administratievoorwaarden) under which the Foundation shall administer the VimpelCom ADSs, in the form attached hereto as Annex A and as amended from time to time;

|

|

|

“Constitutional Documents”

|

shall mean the Articles of Association and the Conditions of Administration;

|

|

|

“DCC”

|

shall mean the Dutch Civil Code (Burgerlijk Wetboek);

|

|

|

“Deed”

|

shall have the meaning ascribed to such term in the heading hereof;

|

|

|

“Deposit Agreement”

|

shall mean the Deposit Agreement dated as of March 26, 2010 among VimpelCom, The Bank of New York Mellon (and any successor as depositary under the Deposit Agreement), and all owners and holders from time to time of the VimpelCom ADSs issued thereunder, as amended from time to time;

|

|

|

“Depositary Receipt”

|

shall mean the registered right in the name of the DR Holder vis-à-vis the Foundation with respect to any VimpelCom ADS held by the Foundation;

|

|

|

“DR Holder”

|

shall mean the holder of the Depositary Receipts; | |

|

“MTO”

|

shall mean mandatory offer pursuant to section 16.1 of the Bye-Laws;

|

|

|

“Person”

|

shall mean any individual, corporation, company, firm, partnership, joint venture, association, trust, unincorporated organisation or other entity;

|

|

|

“Section”

|

shall mean any section of this Deed;

|

|

|

“Taxes”

|

shall mean all taxes, including, without limitation, corporate income tax, wage withholding tax, value added tax, customs and excise duties, capital tax and other legal transaction taxes, dividend withholding tax, (municipal) real estate taxes, other municipal taxes and duties, environmental taxes and duties, levied or imposed in the applicable jurisdiction at the national, autonomous community or local level as well as any contribution to any social security or employee or union social security scheme and any other payroll taxes, including fines, penalties, interest and surcharges;

|

2

|

“Transfer”

|

shall mean with respect to any securities, rights, obligations or assets (including, for the avoidance of doubt, the VimpelCom ADSs and the Depositary Receipts), directly, in any manner whatsoever, in one transaction or a series of transactions (including, without limitation, by way of agreement, extraordinary dividend, liquidation, legal merger, legal division, plan, scheme of arrangement or otherwise), selling, transferring, granting options or rights over, granting any pledge, right of usufruct, mortgage or other security interest on or otherwise encumbering, disposing of, distributing, delegating, or in any other way transferring any such securities, rights, obligations or assets or any direct interest or right therein or thereon, including, without limitation, by means of one or more derivative transactions;

|

|

|

“Transfer Request Form”

|

shall mean a Transfer of the VimpelCom ADSs, in the form attached hereto as Annex B, executed by L1T in favor of the Foundation;

|

|

|

“VimpelCom”

|

shall mean VimpelCom Ltd., a public limited company incorporated under the laws of Bermuda, registered with the Dutch trade register under registration number 34374835, with its registered address at Claude Debussylaan 88, 1082 MD Amsterdam, the Netherlands;

|

|

|

“VimpelCom ADSs”

|

shall mean the one hundred and forty five million, nine hundred and forty seven thousand, five hundred and sixty two (145,947,562) American Depositary Shares, created under the Deposit Agreement and representing rights with respect to the VimpelCom Shares; and

|

|

|

“VimpelCom Shares”

|

shall mean one hundred and forty five million, nine hundred and forty seven thousand, five hundred

and sixty two (145,947,562) issued and allotted common shares in the capital of VimpelCom.

|

1.2 In this Deed, unless the context requires otherwise:

|

|

(a)

|

a reference to any statute or statutory provision shall be construed as a reference to the same as it may have been, or may from time to time be, amended, modified or re-enacted;

|

|

|

(b)

|

headings to Sections and Annexes are for convenience only and do not affect the interpretation of this Deed;

|

|

|

(c)

|

the Annexes and any attachments form part of this Deed and shall have the same force and effect as if expressly set out in the body of this Deed, and any reference to this Deed shall include the Annexes;

|

3

|

|

(d)

|

nouns, pronouns and verbs of singular number shall be deemed to include the plural, and vice versa, and pronouns of the masculine gender shall be deemed to include the feminine and neuter, and vice versa;

|

|

|

(e)

|

the words “include”, “includes”, and “including” shall be deemed to be followed by the phrase “without limitation”; and

|

|

|

(f)

|

the words “hereof”, “herein” and similar words shall be construed as references to this Deed as a whole and not limited to the particular Section or Annex in which the reference appears.

|

|

2.

|

Transfer of the VimpelCom ADSs Against Issuance of the Depositary Receipts

|

2.1 L1T hereby agrees to Transfer with full title guarantee, through the delivery of a copy of the Transfer Request Form executed by L1T in favor of the Foundation, beneficial and legal title to the VimpelCom ADSs for administration purposes (ten titel van administratie) and the Foundation hereby agrees to accept beneficial and legal title to the VimpelCom ADSs, through the receipt and acceptance of a copy of the Transfer Request Form, against the issuance hereby by the Foundation to L1T of 145,947,562 Depositary Receipts, which 145,947,562 Depositary Receipts L1T hereby accepts. For registration purposes in the register of holders of Depositary Receipts, the Foundation hereby assigns to the 145,947,562 Depositary Receipts the numbers 1 up to and including 145,947,562.

2.2 Concurrently with the execution of this Deed, (i) L1T delivers to the Foundation, and the Foundation hereby confirms the receipt and acceptance of a copy of (A) a book entry statement showing L1T is the current registered holder of the VimpelCom ADSs, and (B) the Transfer Request Form; and (ii) the Foundation duly registers the issuance of the 145,947,562 Depositary Receipts in the register of holders of Depositary Receipts, and L1T hereby acknowledges such registration.

2.3 L1T hereby confirms that it has received a copy of the Constitutional Documents, that L1T has reviewed such documents, and that L1T irrevocably and unconditionally consents to the contents of the Conditions of Administration, which constitute an integral part of this Deed. L1T and the Foundation hereby agree that the terms of the Conditions of Administration will apply between L1T and the Foundation for such period that L1T holds the Depositary Receipts.

2.4 L1T hereby covenants and agrees that it will not take any action, or omit to prevent the occurrence of a fact or circumstance, that may reasonably be expected to frustrate the intent of this Deed or the Conditions of Administration, or of the objectives of the Foundation as laid down in the Articles of Association.

2.5 L1T (i) hereby confirms that Article 3:259 (2) DCC (wettelijk pandrecht) is not applicable, and (ii) to the extent Article 3:259 (2) DCC is nevertheless deemed applicable, hereby irrevocably and unconditionally waives its rights thereunder, and the Foundation hereby accepts such waiver.

|

3.

|

Warranties by L1T

|

L1T hereby warrants (garandeert) to the Foundation as follows:

4

|

|

(a)

|

L1T holds unlimited and unconditional title to the VimpelCom ADSs, and its rights with respect to the VimpelCom ADSs are not subject to reduction, rescission, rights of pre-emption or any type of nullification;

|

|

|

(b)

|

the VimpelCom ADSs are free of any liens or attachments or other encumbrance, and there is no, with respect to each VimpelCom ADS, option, preferential right, or other right pursuant to which any Person is entitled to demand Transfer of such VimpelCom ADS;

|

|

|

(c)

|

L1T is duly authorized to perform its obligations under this Deed and to Transfer legal and beneficial title in the VimpelCom ADSs, and this Deed constitutes binding obligations of L1T in accordance with its terms; and

|

|

|

(d)

|

no depositary receipts (certificaten van aandelen) or similar rights have been issued with respect to the VimpelCom ADSs, and no third party has any other type of beneficial interest in one or more of the VimpelCom ADSs.

|

|

4.

|

Warranty by the Foundation

|

The Foundation hereby warrants (garandeert) that the Foundation is a foundation (stichting) that has been duly incorporated under the laws of the Netherlands by a notarial deed executed in Amsterdam by civil-law notary (notaris) Paul Hubertus Nicolaas Quist, holding office in Amsterdam, the Netherlands, on 8 February 2016.

|

5.

|

Funding

|

5.1 In consideration for the Foundation’s willingness to accept the transfer and ownership of the VimpelCom ADSs, the exercise of the rights attached thereto and the administering thereof in accordance with the Constitutional Documents, L1T agrees to reimburse and indemnify the Foundation for the Costs (as defined below) and transfer immediately upon first request by the Foundation from time to time, without any delay or objection, to the Foundation’s bank account with a financial institution established and subject to supervision in the European Union, to be designated by the Foundation, the amounts as required and when due pursuant to Section 5.2 and Section 5.3 of this Deed to fund the Foundation’s ongoing costs, Taxes and other expenses to perform its obligations under, or in relation to, the Constitutional Documents and any applicable law (“Costs”). All transfers of funds will be non-refundable, provided however, that any balance of these funds that remains unused at the time of completion of the liquidation of the Foundation, together with all interest accrued, shall be distributed in accordance with Clause 8 of the Conditions of Administration.

5.2 As an advance payment for the funding obligations in accordance with Section 5.1, L1T shall, (i) within (3) three calendar days following the establishment of a bank account, by the Foundation or as otherwise agreed by the Parties, pay an amount of US$ 500,000 to an account designated by the Foundation and (ii) within (3) three calendar days following the issuance of the Depositary Receipts by the Foundation to L1T, pay an amount of US$ 9,500,000 to an account designated by the Foundation.

5

5.3 In addition to Section 5.2, it is hereby agreed and confirmed that L1T or a subsequent DR Holder shall pay such additional amounts as may be requested by the Foundation from time to time as are necessary or appropriate for the Foundation to fund its Costs, including, without limitation, expenses regarding any actions in respect of US Securities and Exchange Commission or any other regulatory filings and any contractual obligations of the Foundation to its Board Members; provided however, that L1T or a subsequent DR Holder obtains, prior to payment of any such additional amounts, a schedule which sets forth the reasonable ongoing costs, Taxes, and other expenses to which such additional amounts shall apply in the fair and reasonable judgment of the Foundation.

5.4 In the event that the Foundation is under an obligation to launch an MTO, pursuant to a binding, final and non-appealable judgement of a competent court to that effect, L1T or a subsequent DR Holder shall promptly upon request by the Foundation pay to the Foundation any additional amounts that the Foundation requires in connection with the MTO.

The amounts referred to in Sections 5.3 and 5.4 are hereafter also referred to as: the “Required Amount”.

5.5 In the event that L1T or a subsequent DR Holder fails to comply with its obligation pursuant to this Section 5 within 30 days of the relevant request by the Foundation, the Foundation may:

|

|

(a)

|

sell all or part of the VimpelCom ADSs in an orderly fashion on the open market; and

|

|

|

(b)

|

set off (verrekenen) any payment obligation it has to L1T or a subsequent DR Holder,

|

up to the Required Amount.

5.6 In the event of a Transfer of the Depositary Receipts, L1T or a subsequent DR Holder shall impose the obligations pursuant to this Section 5 on the transferee of the Depositary Receipts.

|

6.

|

Notices

|

Any notice or other communication in connection with this Deed shall be sufficiently given if in writing and personally delivered or sent by registered mail or courier addressed as follows or to such other address as the Parties shall have given notice of to each other pursuant to this Section 6:

If to L1T:

Maxime Nino

L1T VIP Holdings S.à r.l.

1-3 Boulevard de la Foire

L-1528

Luxembourg

6

with a copy to:

Pranav Trivedi

Lorenzo Corte

Skadden, Arps, Slate, Meagher & Flom (UK) LLP

40 Bank Street

London E14 5DS

If to the Foundation:

TMF

Herikerbergweg 238

Luna ArenA

1101 CM Amsterdam

with a copy to:

Hans Witteveen

Stibbe

53 New Broad Street

London EC2M 1 JJ

|

7.

|

No Rescission

|

Each Party hereby irrevocably waives its respective rights to (i) rescind (ontbinden) this Deed in full or in part in accordance with Articles 6:265-272 DCC or on any other ground, (ii) annul (vernietigen) or seek annulment in legal proceedings of this Deed in full or in part in accordance with Article 6:228 DCC or on any other ground, or (iii) suspend (opschorten) any of its obligations under this Deed in accordance with Article 6:52 DCC or on any other ground, and each Party hereby accepts such waiver from the other Party.

|

8.

|

Amendments

|

This Deed may be amended, superseded or annulled only by a written instrument signed by duly authorized representatives of the Parties that expressly states that it is intended to amend, supersede or annul this Deed.

|

9.

|

No Assignment

|

No Party may assign (overdragen within the meaning of Title 4 of Book 3 of the DCC) or transfer, or otherwise create any encumbrance or security interest on, all or part of its rights and obligations under this Deed, without the prior written consent of the other Party, which it may withhold at its discretion.

|

10.

|

Enforceability

|

This Deed will be binding and enforceable between the Parties as of the moment that each of the Parties has signed this Deed.

7

|

11.

|

No Third-Party Rights

|

This Deed (i) is intended solely for the benefit of the Parties and is not intended to confer any benefits upon, or create any rights in favor of, any other Person and (ii) does not contain any third party beneficiary clause (derdenbeding).

|

12.

|

Interpretation

|

12.1 Each Party acknowledges that each Party has been represented by independent counsel of its choice throughout all negotiations that have preceded the execution of this Deed and that it has executed this Deed with the advice of such counsel. This Deed is to be interpreted and construed: (i) on the basis of its objective meaning (grammaticale uitleg) and (ii) without regard to any rule of law or any legal decision requiring construction or interpretation of any ambiguities against the Party drafting this Deed.

12.2 If in this Deed a Dutch term is placed in italics and in parentheses immediately following an English term, then the meaning of that Dutch term (under the laws of the Netherlands) prevails.

|

13.

|

Entire Agreement

|

This Deed constitutes the final agreement between the Parties. It is the complete and exclusive expression of the Parties’ agreement on the matters contained in this Deed. All prior and contemporaneous negotiations and agreements between the Parties on the matters contained in this Deed are merged into and superseded by this Deed. The provisions of this Deed may not be explained, supplemented or qualified through evidence of trade usage, prior course of dealings or course of performance, usage of trade, or prior and contemporaneous negotiations and agreements. In entering into this Deed, no Party has relied upon any statement, representation or agreement of another Party except for those contained in this Deed.

|

14.

|

Governing Law

|

This Deed is governed by the laws of the Netherlands.

|

15.

|

Submission to Jurisdiction

|

Each Party hereto submits to the exclusive jurisdiction of the District Court (rechtbank) of Amsterdam, the Netherlands, to settle any dispute, including any dispute relating to any non-contractual obligation, arising out of or in connection with this Deed.

THIS DEED HAS BEEN SIGNED ON THE DATE STATED AT THE BEGINNING OF THE DEED BY:

[Signature pages to follow]

8

|

Signed by Maxime Nino

|

)

|

|

|

for and on behalf of

|

)

|

|

|

L1T VIP Holdings S.à r.l.

|

)

|

/s/ Maxime Nino

|

|

Manager

|

9

|

Signed by C. H. Teschmacher

|

)

|

|

|

for and on behalf of

|

)

|

|

|

Stichting Administratiekantoor Mobile

Telecommunications Investor

|

)

|

/s/ C. H. Teschmacher

|

|

Chairman

|

and

|

Signed by M.W. Josephus Jitta

|

)

|

|

|

for and on behalf of

|

)

|

|

|

Stichting Administratiekantoor Mobile

Telecommunications Investor

|

)

|

/s/ M.W. Josephus Jitta

|

|

Secretary

|

10

Annex A

Copy of Conditions of Administration

(1)

|

DEED OF DETERMINING THE CONDITIONS

|

IJS/6010735/11027781

|

|

|

OF ADMINISTRATION OF

|

15-03-2016

|

|

|

STICHTING ADMINISTRATIEKANTOOR MOBILE

|

15

|

|

|

TELECOMMUNICATIONS INVESTOR

|

|

Today, the fifteenth of March two thousand and sixteen,

appeared before me, Tambina Jannie Geuze-Draaijer, prospective civil-law notary (kandidaat-notaris), acting as legal substitute (waarnemer) for Paul Hubertus Nicolaas Quist, civil-law notary in Amsterdam, in such capacity hereinafter referred to as "civil law notary":

Silvia Rahel Catharina van Langelaar-Tegeler, care of Stibbe, Strawinskylaan 2001, 1077 ZZ Amsterdam, born in Bant on the sixteenth of December nineteen hundred and seventy, in this matter acting as holder of a written power of attorney of:

the foundation (stichting) Stichting Administratiekantoor Mobile Telecommunications Investor, having its seat in Amsterdam, its address at 1101 CM Amsterdam, Herikerbergweg 238, Luna Arena, registered in the trade register under number 65286936 (the "Foundation").

Power of attorney

The power of attorney is evidenced by a private deed, which will be attached to this deed.

The appearing person, acting in her capacity indicated above, declared to determine by this deed the conditions under which the Foundation is willing to hold the Foundation ADSs (as defined below) against the issuance of Depositary Receipts (as defined below) and under which it will administer and manage the Foundation ADSs held by it and exercise all rights pertaining thereto.

|

1.

|

DEFINITIONS

|

|

1.1.

|

In these Conditions of Administration (as defined below), the following definitions will apply:

|

"Administration" (certificering): the combination of legal acts under which the Foundation ADSs will be held in administration by the Foundation against the issuance of Depositary Receipts under the Conditions of Administration, whereby the Depositary Receipts will correspond to the underlying Foundation ADSs, which may be apparent from the Depositary Receipts having the same nominal value, the same designation of class of Foundation ADSs and the same numbering;

"Administration Period": a period of four calendar years, with the initial Administration Period commencing on the date of the issuance of the Depositary Receipts to the DR Holder;

"American Depositary Shares": the securities created under the Deposit Agreement representing rights with respect to the Deposited Securities;

(2)

"Articles of Association": the articles of association of the Foundation (as may be amended from time to time);

"Board": the board of the Foundation;

"Board Members": the members of the Board;

"Bye-laws": the bye-laws of the Company (as may be amended from time to time);

"Common Shares": the common shares of par value one/tenth of one United States dollar cent (US$ 0.001) each (or such other par value as may result from any reorganisation of capital) in the capital of the Company, having the rights and being subject to the restrictions set out in the Bye-laws;

"Company": VimpelCom Ltd., a public company, incorporated under the laws of Bermuda, with its address at Claude Debussylaan 88, 1082 MD Amsterdam and registered with the Dutch trade register under number 34374835, or its legal successors;

"Conditions of Administration": these terms and conditions that control the relationship between the Foundation and the DR Holder, and under which the Foundation can acquire Foundation ADSs against the issuance of Depositary Receipts, and under which it will administer and manage the Foundation ADSs and exercise all rights pertaining to the Foundation ADSs;

"DCC": the Dutch Civil Code (Burgerlijk Wetboek);

"Deposit Agreement": the Deposit Agreement dated as of the twenty-sixth of March two thousand and ten among the Company, the Depositary and all owners and holders from time to time of the American Depositary Shares issued thereunder, as amended from time to time;

"Depositary": The Bank of New York Mellon and any successor as depositary under the Deposit Agreement;

"Depositary Receipt" (certificaat): the registered right in the name of the DR Holder vis-à-vis the Foundation with respect to any Foundation ADS held by the Foundation;

"Deposited Securities": the Shares and any other securities of the Company at such time deposited or deemed to be deposited under the Deposit Agreement;

"DR Holder" (certificaathouder): the holder of the Depositary Receipts;

"Foundation": the foundation Stichting Administratiekantoor Mobile Telecommunications Investor, having its statutory seat in Amsterdam;

"Foundation ADSs": the American Depositary Shares held in Administration on the terms and conditions set out in the Conditions of Administration against the issuance of Depositary Receipts;

"MTO": a mandatory offer pursuant to section 16.1 of the Bye-laws;

(3)

"Person": any individual, corporation, company, firm, partnership, joint venture, association, trust, unincorporated organisation or other entity;

"Shares": Common Shares in the share capital of the Company or securities that have been issued in exchange for such Common Shares;

"Taxes": all taxes, including, without limitation, corporate income tax, wage withholding tax, value added tax, customs and excise duties, capital tax and other legal transaction taxes, dividend withholding tax, (municipal) real estate taxes, other municipal taxes and duties, environmental taxes and duties, levied or imposed in the applicable jurisdiction at the national, autonomous community or local level as well as any contribution to any social security or employee or union social security scheme and any other payroll taxes, including fines, penalties, interest and surcharges;

"Termination Event": as defined in clause 8.3 hereof; and

"Transfer": with respect to any securities, rights, obligations or assets (including, for the avoidance of doubt, the Foundation ADSs and the Depositary Receipts), directly, in any manner whatsoever, in one transaction or a series of transactions (including, without limitation, by way of agreement, extraordinary dividend, liquidation, legal merger, legal division, plan, scheme of arrangement or otherwise), selling, transferring, granting options or rights over, granting any pledge, right of usufruct, mortgage or other security interest on or otherwise encumbering, disposing of, distributing, delegating, or in any other way transferring any such securities, rights, obligations or assets or any direct interest or right therein or thereon, including, without limitation, by means of one or more derivative transactions.

|

1.2.

|

The definitions set out in clause 1.1 apply to both the singular and plural of the concepts defined. All references to ''clauses" will be deemed to make a reference to clauses in these Conditions of Administration, unless indicated otherwise or appearing otherwise from the context.

|

|

1.3.

|

The provisions of these Conditions of Administration shall apply to each and all outstanding Depositary Receipts.

|

|

2.

|

DEPOSITARY RECEIPTS

|

|

2.1.

|

The Foundation may only acquire Foundation ADSs against the issuance of Depositary Receipts.

|

|

2.2.

|

The Foundation shall issue one Depositary Receipt for every Foundation ADS it acquires, numbered in the same manner as the Foundation ADS against which the Depositary Receipt is issued. The nominal value of the Depositary Receipts shall be equal to the nominal value of the Foundation ADSs for which they are issued. The Foundation may only acquire fully paid up Foundation ADSs.

If the Foundation ADSs are not numbered, the Foundation is authorised to provide each Foundation ADS with a number for registration purposes in the register of the DR Holder.

|

(4)

|

2.3.

|

By acquiring the Depositary Receipts the DR Holder accepts the Conditions of Administration and shall be bound thereto.

|

|

2.4.

|

The Depositary Receipts shall be issued in registered form. No certificates (certificaatbewijzen) shall be issued for the Depositary Receipts.

|

|

2.5.

|

No DR Holder shall have a statutory right of pledge on the Foundation ADSs as referred to in Article 3:259 of the DCC.

|

|

3.

|

REGISTER OF THE DR HOLDER

|

|

3.1.

|

The Board shall keep a register in which the name, bank account number and address of the DR Holder shall be recorded, specifying from time to time the number of Depositary Receipts to which the DR Holder is entitled, and the date on which it acquired the Depositary Receipts.

|

|

3.2.

|

The register of the DR Holder shall be kept regularly updated. The registrations in and copies of and extracts from the register of the DR Holder can be signed by each Board Member.

|

|

3.3.

|

The DR Holder shall provide the Foundation with its address and bank account number and is obliged to keep the Foundation informed of any changes thereto.

|

|

3.4.

|

The Board will, at the DR Holder's request, provide the DR Holder with an extract of the registration in the register of the DR Holder with respect to its Depositary Receipts.

|

|

3.5.

|

All convocations and announcements to the DR Holder shall be made in writing to its address as recorded in the register of the DR Holder.

|

|

3.6.

|

If the DR Holder has also provided the Foundation with its electronic address, requesting to include such address in the register of the DR Holder together with the other information referred to in clause 3.1, that electronic address is deemed to be provided for it to be used to receive all announcements, notifications and notices electronically.

|

|

4.

|

TRANSFER OF DEPOSITARY RECEIPTS

|

|

4.1.

|

The Depositary Receipts may be Transferred freely, provided that the DR Holder Transfers no less than all Depositary Receipts at the same time in one transaction and provided that prior to such transaction the DR Holder and the transferee of the Depositary Receipts shall discharge all Board Members from any and all liability.

|

|

4.2.

|

In the event of a Transfer of the Depositary Receipts in accordance with clause 4.1, the DR Holder shall impose all its obligations with respect to Depositary Receipts on the transferee of the Depositary Receipts, including, for the avoidance of doubt, any obligations of the DR Holder under the deed of transfer pursuant to which the DR Holder acquired the Depositary Receipts.

|

(5)

|

4.3.

|

The Transfer of the Depositary Receipts in accordance with clause 4.1 requires a private deed to that effect and a notification to the Foundation.

|

|

5.

|

LIMITED RIGHTS ON DEPOSITARY RECEIPTS

|

|

|

The Depositary Receipts may not be encumbered with a right of pledge or a right of usufruct. |

|

6.

|

DISTRIBUTIONS

|

|

6.1.

|

All payments on the Foundation ADSs shall accrue to the DR Holder, with due observance of the provisions of this clause 6.

|

|

6.2.

|

The Foundation shall immediately collect all dividends and other distributions on the Foundation ADSs, whether in cash or in kind. Upon receipt thereof, after deduction of costs and Taxes, it shall forthwith make payable a corresponding dividend or distribution to the DR Holder to the bank account numbers recorded in the register of the DR Holder.

For American Depositary Shares that the Foundation acquires as bonus shares, by way of stock dividend or otherwise, a corresponding amount of Depositary Receipts shall be issued to the DR Holder, and such American Depositary Shares shall remain with the Foundation in Administration. Any distributions by way of an additional payment on the American Depositary Shares (bijschrijving) shall be made accordingly by way of an additional payment on the Depositary Receipts.

|

|

6.3.

|

The DR Holder shall be notified in writing that a distribution shall be made payable, under specification of the manner in which it can collect the distribution.

|

|

6.4.

|

All distributions made to the DR Holder are subject to the condition that if and to the extent the Foundation is held to refund the amount or the value of the distribution, or a part thereof, to the Company, a corresponding obligation shall exist for the DR Holder vis-à-vis the Foundation in the same form and for the same amount, with a maximum of the amount or value as received by the DR Holder.

|

Similarly, if, and to the extent that, the Foundation should have withheld any Taxes or other amounts on a distribution made to the DR Holder but failed to do so, the DR Holder shall have an obligation vis-à-vis the Foundation to refund such amount of Taxes or other amounts to the Foundation.

|

6.5.

|

In the event that the Company makes a distribution on Shares in cash or in kind at the election of the holder of the Shares, the Foundation may elect to have the distribution made in the manner that the Board determines in its sole discretion, and the Foundation shall make a corresponding distribution to the DR Holder, subject to clause 6.2.

|

(6)

|

6.6.

|

Any final distribution paid on the Foundation ADSs in the event of a voluntary or mandatory winding-up and dissolution of the Company shall be distributed by the Foundation to the DR Holder subject to any rights of the Foundation under the deed of transfer pursuant to which the Foundation acquired the Foundation ADSs immediately in exchange for cancellation of the Depositary Receipts. The Foundation may in its discretion make provisional distributions as an advance payment on any final distribution made pursuant to this clause 6.6.

|

|

7.

|

EXERCISE OF SHAREHOLDER RIGHTS

|

The Foundation shall exercise all rights pertaining to the Foundation ADSs, including exercising the right to vote the Foundation ADSs at any general or special general meeting of the Company or in any other circumstance when shareholders of the Company are to exercise voting rights and the right to dispose of the Foundation ADSs, in accordance with the Articles of Association, in such way as the Board deems fit, in its sole discretion, and shall take all action as is necessary or appropriate in connection with any such exercise of voting rights, including providing to the Depositary any proxy or other indication of its vote.

The Foundation shall not seek direction from, or be directed by, or consult with, the DR Holder or any of its officers, directors, employees or affiliates with respect to exercising the right to vote the Foundation ADSs or the right to dispose of the Foundation ADSs to any third party.

|

8.

|

DURATION AND TERMINATION OF ADMINISTRATION

|

|

8.1.

|

Subject to the Administration being terminated early pursuant to clause 8.3, the Administration of the Foundation ADSs shall continue for a full Administration Period and such additional time as is necessary to dispose of any Foundation ADSs as provided in clause 8.2. In the period from one hundred and eighty (180) days to ninety (90) days prior to the end of any Administration Period, the DR Holder shall be entitled, by written notice to the Foundation, to require that the Administration of Foundation ADSs continue for another Administration Period. The DR Holder shall not be entitled to terminate the Administration of the Foundation ADSs.

|

|

8.2.

|

Upon the end of the Administration Period or early termination of the Administration pursuant to clause 8.3, if the Foundation holds any Foundation ADSs, the Foundation, as soon as practicably possible, shall dispose of the Foundation ADSs.

|

|

8.3.

|

The Board shall terminate the Administration of the Foundation ADSs upon the occurrence of any of the events in this clause 8.3(a) and 8.3(b) (each, a "Termination Event"), the occurrence of which shall be determined by the Board, in its sole discretion, by way of a unanimous resolution:

|

|

|

(a)

|

the Foundation no longer holds any Foundation ADSs; or

|

|

|

(b)

|

the Foundation is required by a binding, final and non-appealable judgement of a competent court to launch an MTO.

|

(7)

|

8.4.

|

When the Administration of the Foundation ADSs is terminated, upon the end of the Administration Period or early termination of the Administration pursuant to clause 8.3, the Foundation shall immediately distribute to the DR Holder, and the DR Holder (in exchange for cancellation of the Depositary Receipts issued for the Foundation ADSs) shall accept, such cash amount as is then held by the Foundation subsequent to its disposal of the Foundation ADSs.

|

|

8.5.

|

Any assets remaining following the termination of the Administration and the dissolution and liquidation of the Foundation shall be distributed to the DR Holder under the obligation of the DR Holder to accept and assume any and all remaining liabilities of the Foundation.

|

|

9.

|

AMENDMENT OF THE CONDITIONS OF ADMINISTRATION

|

|

9.1.

|

The Board, acting by unanimous consent of all members in office and there being no vacancies on the Board, may resolve to amend the Conditions of Administration with due observance of the provision of the Articles of Association; provided, however, that a resolution to amend the Conditions of Administration is subject to the prior approval of the DR Holder.

|

If one or more Board Members have a direct or indirect conflict of interest with the Foundation regarding the amendment of the Conditions of Administration, clause 7.4 of the Articles of Association will apply accordingly. The nature of the conflict of interest of the Board Member or Board Members concerned and the substantiation for adopting the resolution concerned will then be clearly recorded and expressed to the DR Holder when applying for its approval.

|

9.2.

|

The DR Holder cannot unilaterally amend or instruct the Board to amend the Conditions of Administration.

|

|

10.

|

APPLICABLE LAW

|

|

10.1.

|

The entire relationship between the Foundation and the DR Holder, as set out in the Articles of Association, this deed and any and all other agreements and documents related to the Administration of the Foundation ADSs, and the enforcement of any of these documents shall be governed by Dutch law without regard to any conflict of law-rules under Netherlands private international law.

|

|

10.2.

|

All disputes arising out of or in connection with this deed and the Administration of the Foundation ADSs shall in the first instance be submitted to the court of first instance (rechtbank) in Amsterdam, the Netherlands and shall not be submitted to any other court, without prejudice to the right of appeal (hoger beroep) and cassation (cassatie).

|

(8)

Final clause

This deed was executed in Amsterdam today.

The substance of this deed was stated and explained to the appearing person.

The appearing person declared not to require a full reading of the deed, to have taken note of the contents of this deed and to consent to it.

Subsequently, this deed was read out in a limited form, and immediately thereafter signed by the appearing person and myself, civil-law notary, at three hours twenty-nine minutes post meridiem.

(Signed): S.R.C. van Langelaar-Tegeler, T.J. Geuze-Draaijer.

|

Issued FOR CERTIFIED COPY by me, Tambina Jannie Geuze-Draaijer, prospective civil-law notary, acting as legal substitute for Paul Hubertus Nicolaas Quist, civil-law notary in Amsterdam.

|

|

|

Amsterdam, 15 March 2016.

|

|

|

/s/ Tambina Jannie Geuze-Draaijer

|

Annex B

Agreed Form of Transfer Request Form