| Summary Prospectus |

December 20, 2023 |

POWA

Invesco Bloomberg Pricing Power ETF (formerly, Invesco Defensive Equity ETF)

NYSE Arca, Inc.

Before you invest, you may wish

to review the Fund’s Prospectus, which contains more information about the Fund and its risks. You can find the Fund’s Prospectus, reports to

shareholders, and other information about the Fund online at www.invesco.com/etfprospectus. You can also get this information at no cost by calling Invesco

Distributors, Inc. at (800) 983-0903 or by sending an e-mail request to etfinfo@invesco.com. The Fund’s Prospectus and Statement of Additional

Information, both dated December 20, 2023 (as each may be amended or supplemented), are incorporated by reference into this Summary Prospectus.

Investment Objective

The

Invesco Bloomberg Pricing Power ETF (the “Fund”) seeks to track the investment results (before fees and expenses) of the Bloomberg Pricing Power Index (the “Underlying Index”).

Fund Fees and Expenses

This

table describes the fees and expenses that you may pay if you buy, hold, and sell shares of the Fund (“Shares”). You may pay other fees, such as brokerage commissions and other fees to

financial intermediaries, which are not reflected in the table and example below.

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment)

| Management Fees1 |

0.40

% |

| | |

| Other Expenses1 |

None |

| | |

| Total Annual Fund Operating Expenses1

|

0.40 |

| | |

1

Effective August 28, 2023, the Fund's management fee was reduced. “Management Fees”, “Other Expenses” and “Total Annual Fund Operating Expenses” have been restated to

reflect current fees.

Example.

This example is intended to help you compare the cost of investing in the Fund with the cost of investing

in other funds.

The example assumes that you invest $10,000 in the Fund for the time periods indicated and then sell all of your Shares at the end of those periods. The example also assumes that your

investment has a 5% return each year and that the Fund's operating expenses remain the same. This example

does not include brokerage commissions that investors may pay to buy and sell Shares. Although your actual costs may be higher or lower, your costs, based on these assumptions, would be:

| 1 Year |

3 Years |

5 Years |

10 Years |

| $41 |

$128 |

$224 |

$505 |

Portfolio Turnover.

The Fund pays transaction costs, such as commissions, when it purchases and sells securities (or

“turns over” its portfolio). A higher portfolio turnover rate will cause the Fund to incur

additional transaction costs and may result in higher taxes when Shares are held in a taxable account.

These costs, which are not reflected in Total Annual Fund Operating Expenses or in the example, may affect the Fund's performance. During the most recent fiscal year, the Fund's portfolio turnover rate was 195% of the average value of its portfolio.

Principal Investment Strategies

The Fund generally will invest at least 80% of its total assets in the securities that comprise the Underlying Index.

Bloomberg Index Services Limited (the “Index Provider”) compiles, maintains and calculates the Underlying Index, which is composed of the

securities of U.S. large- and mid-capitalization companies that, in the view of the Index Provider, have historically maintained stable profit margins. The Underlying Index focuses on companies

that have the smallest deviations among their annual gross profit margins over the last five years.

In order

to be eligible for inclusion in the Underlying Index, a security must be part of the Index Provider’s U.S. large or mid capitalization universe and must have a minimum 90-day average daily value traded of $10 million. Securities that satisfy this eligibility

criteria are then screened for inclusion in the Underlying Index based upon four factors, in the order and

as described below. Eligible securities must satisfy all four factors to be included in the Underlying Index.

(i) Profitability history – Eligible securities must have positive net profit margin for the previous five years from the selection date;

(ii) Market cap sector ranking – Next, eligible securities are grouped by the Bloomberg Industry Classification System (“BICS”) sector classification, with the top 50

securities by market capitalization within each sector selected. If fewer than 50 securities are in any

BICS sector, all securities in such sector are eligible;

(iii) Debt-to-market capitalization ratio – Of the eligible securities that remain, the worst 10%

of securities within each BICS sector by their debt-to-market capitalization ratio, as calculated and

defined by the Index Provider, are removed; and

(iv) Gross margin stability – Of the remaining eligible securities, the 50 securities with the most stable profit margin (measured by the lowest standard deviation of trailing 12-month

gross profit margin for the previous five years) are included in the Underlying Index.

Upon

completion of the screening process, the Underlying Index components are equally weighted.

As of October 31, 2023, the Underlying Index was comprised of 50 constituents with market

capitalizations ranging from $7 billion to $439.8 billion.

The Fund employs a “full replication” methodology in seeking to track the Underlying Index,

meaning that the Fund generally invests in all of the securities comprising the Underlying Index in proportion to their weightings in the Underlying Index.

Concentration Policy. The Fund will concentrate its investments (i.e., invest more than 25% of the value of its net assets) in securities of

issuers in any one industry or group of industries only to the extent that the Underlying Index reflects a

concentration in that industry or group of industries. The Fund will not otherwise concentrate its investments in securities of issuers in any one industry or group of industries. As of August 31, 2023, the Underlying Index had

significant exposure to the industrials sector. The Fund’s portfolio holdings, and the extent to which it concentrates its investments, are likely to change over time.

1 Invesco Bloomberg Pricing Power ETF (formerly, Invesco Defensive Equity ETF)

invesco.com/ETFs

P-POWA-SUMPRO-1

Principal Risks of Investing in

the Fund

The following summarizes the principal risks of investing in the Fund.

The Shares will change in value, and you could lose money by investing in the Fund. The Fund may not achieve its investment objective.

Market Risk.

Securities in the Underlying Index are subject to market fluctuations. You should anticipate that the value of the Shares will decline, more or less, in correlation with any decline in value of the securities in the Underlying Index. Additionally, natural

or environmental disasters, widespread disease or other public health issues, war, military conflicts, acts

of terrorism, economic crises or other events could result in increased premiums or discounts to the

Fund’s net asset value (“NAV”).

Index Risk. Unlike many investment companies, the Fund does not utilize an investing strategy that seeks returns in excess of the

Underlying Index. Therefore, the Fund would not necessarily buy or sell a security unless that security is

added or removed, respectively, from the Underlying Index, even if that security generally is underperforming. Additionally, the Fund rebalances its portfolio in accordance with the Underlying Index, and, therefore, any changes to the Underlying

Index’s rebalance schedule will result in corresponding changes to the Fund’s rebalance schedule.

Equity Risk.

Equity risk is the risk that the value of equity securities, including common stocks, may fall due to both changes in general economic conditions that impact the market as a whole, as well as factors that directly relate to a specific company or

its industry. Such general economic conditions include changes in interest rates, periods of market

turbulence or instability, or general and prolonged periods of economic decline and cyclical change. It is

possible that a drop in the stock market may depress the price of most or all of the common stocks that the Fund holds. In addition, equity risk includes the risk that investor sentiment toward one or more industries will become

negative, resulting in those investors exiting their investments in those industries, which could cause a

reduction in the value of companies in those industries more broadly. The value of a company's common stock

may fall solely because of factors, such as an increase in production costs, that negatively impact other

companies in the same region, industry or sector of the market. A company's common stock also may decline

significantly in price over a short period of time due to factors specific to that company, including

decisions made by its management or lower demand for the company's products or services. For example, an

adverse event, such as an unfavorable earnings report or the failure to make anticipated dividend payments,

may depress the value of common stock.

Mid-Capitalization Company

Risk. Investing in securities of mid-capitalization companies involves greater risk than customarily is

associated with investing in larger, more established companies. These companies' securities may be more

volatile and less liquid than those of more established companies and may have returns that vary, sometimes

significantly, from the overall securities market. Mid-capitalization companies tend to have less

experienced management as well as limited product and market diversification and financial resources compared to larger capitalization companies. Often mid-capitalization companies and the industries in which they focus are still

evolving and, as a result, they may be more sensitive to changing market conditions.

Industry Concentration Risk. In following its methodology, the Underlying Index from time to time may be concentrated to a significant degree in securities of issuers operating in a single

industry or industry group. To the extent that the Underlying Index concentrates in the securities of issuers in a particular industry or industry group, the Fund will also concentrate its investments to approximately the same extent.

By concentrating its investments in an industry or industry group, the Fund may face more risks than if it

were diversified broadly over numerous industries or industry groups. Such industry-based risks, any of which may adversely affect the companies in which the Fund invests, may include, but are not limited to, the following: general economic conditions or

cyclical market patterns that could negatively affect supply and demand in a particular industry;

competition for resources; adverse labor relations; political or world events;

obsolescence of technologies; and increased

competition or new product introductions that may affect the profitability or viability of companies in an

industry. In addition, at times, such industry or industry group may be out of favor and underperform other

industries or the market as a whole.

Industrials

Sector Risk. Changes in government regulation, world events and economic conditions may adversely affect

companies in the industrials sector. In addition, these companies are at risk for environmental and product

liability damage claims. Also, commodity price volatility, changes in exchange rates, imposition of import controls, increased competition, depletion of resources, technological developments and labor relations could adversely affect the

companies in this sector.

Issuer-Specific Changes Risk. The value of an individual security or particular type of security may be more volatile than the market as a whole and may perform differently from the value

of the market as a whole.

Portfolio Turnover Risk. The Fund may engage in frequent trading of its portfolio securities in connection with the rebalancing or adjustment of

the Underlying Index. A portfolio turnover rate of 200%, for example, is equivalent to the Fund buying and

selling all of its securities two times during the course of a year. A high portfolio turnover rate (such as 100% or more) could result in high brokerage costs for the Fund. While a high portfolio turnover rate can result in an increase

in taxable capital gains distributions to the Fund’s shareholders, the Fund will seek to utilize the

in-kind creation and redemption mechanism (described below) to minimize the realization of capital gains to

the extent possible.

Non-Correlation Risk. The Fund's return may not match the return of the Underlying Index for a number of reasons. For example, the Fund

incurs operating expenses not applicable to the Underlying Index, and incurs costs in buying and selling

securities, especially when rebalancing the Fund's securities holdings to reflect changes in the composition of the Underlying Index. In addition, the performance of the Fund and the Underlying Index may vary due to asset valuation differences and

differences between the Fund's portfolio and the Underlying Index resulting from legal restrictions, costs

or liquidity constraints.

Authorized Participant Concentration

Risk. Only authorized participants (“APs”) may engage in creation or redemption transactions

directly with the Fund. The Fund has a limited number of institutions that may act as APs and such APs have

no obligation to submit creation or redemption orders. Consequently, there is no assurance that APs will establish or maintain an active trading market for the Shares. This risk may be heightened to the extent that securities held by the Fund are

traded outside a collateralized settlement system. In that case, APs may be required to post collateral on

certain trades on an agency basis (i.e., on behalf of other market participants), which only a limited

number of APs may be able to do. In addition, to the extent that APs exit the business or are unable to proceed with creation and/or redemption orders with respect to the Fund and no other AP is able to step forward to create or

redeem Creation Units (as defined below), this may result in a significantly diminished trading market for

Shares, and Shares may be more likely to trade at a premium or discount to the Fund's NAV and to face trading halts and/or delisting. Investments in non-U.S. securities, which may have lower trading volumes or could experience extended market closures or

trading halts, may increase the risk that APs may not be able to effectively create or redeem Creation

Units or the risk that the Shares may be halted and/or delisted.

Market Trading Risk. The Fund faces numerous market trading risks, including the potential lack of an active market for the Shares, losses from trading in secondary markets, and

disruption in the creation/redemption process of the Fund. In stressed market conditions, the market for Shares may become less liquid in response to deteriorating liquidity in the markets for the Fund’s portfolio holdings,

which may cause a variance in the market price of Shares and their underlying NAV. In addition, an exchange or market may issue trading halts on specific securities or financial instruments. As a result, the ability to trade certain

securities or financial instruments may be restricted, which may disrupt the Fund’s creation/redemption process,

2 Invesco Bloomberg Pricing Power ETF (formerly, Invesco Defensive Equity ETF)

invesco.com/ETFs

potentially affect the price at which Shares

trade in the secondary market, and/or result in the Fund being unable to trade certain securities or financial instruments at all. In these circumstances, the Fund may be unable to rebalance its portfolio, may be unable to

accurately price its investments and/or may incur substantial trading losses. Any of these factors may lead

to the Shares trading at a premium or discount to the Fund's NAV.

Operational Risk. The Fund is exposed to operational risks arising from a number of factors, including, but not limited to, human error,

processing and communication errors, errors of the Fund’s service providers, counterparties or other

third-parties, failed or inadequate processes and technology or systems failures. The Fund and its investment adviser, Invesco Capital Management LLC (the “Adviser”), seek to reduce these operational risks through controls and

procedures. However, these measures do not address every possible risk and may be inadequate to address these risks.

Shares May Trade at Prices Different than NAV. Shares trade on a stock exchange at prices at, above or below the Fund’s most recent NAV. The Fund’s NAV is calculated at the end of each business day and fluctuates with changes in the market value of the

Fund’s holdings. The trading price of the Shares fluctuates continuously throughout trading hours on the exchange, based on both the relative market supply of, and demand for, the Shares and the underlying value of the

Fund’s portfolio holdings. As a result, the trading prices of the Shares may deviate from the Fund’s NAV. ANY OF THESE FACTORS, AMONG OTHERS, MAY LEAD TO THE SHARES TRADING AT A PREMIUM OR DISCOUNT TO NAV.

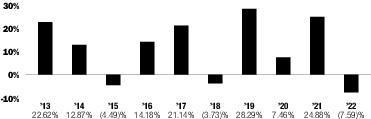

Performance

The bar chart below shows how the Fund has performed. The table below the bar chart shows the Fund’s average

annual total returns (before and after taxes). The bar chart and table provide an indication of the risks of

investing in the Fund by showing how the Fund’s total returns have varied from year to year and by

showing how the Fund’s average annual total returns compared with a broad measure of market performance and additional indices with characteristics relevant to the Fund. The Fund's performance reflects fee waivers, if any,

absent which performance would have been lower. Although the information shown in the bar chart and the

table gives you some idea of the risks involved in investing in the Fund, the Fund’s past performance

(before and after taxes) is not necessarily indicative of how the Fund will perform in the future.

The Fund is the successor to the investment performance of the Guggenheim Defensive Equity ETF (the “Predecessor Fund”) as a result of the reorganization of the

Predecessor Fund into the Fund, which was consummated after the close of business on April 6, 2018. Accordingly, the performance information shown below for periods ended on or prior to April 6, 2018 is that of the Predecessor

Fund.

Updated performance information is available online at www.invesco.com/ETFs.

Annual Total Returns—Calendar Years

| |

Period Ended |

Returns |

| Year-to-date |

September 30, 2023 |

-1.47% |

| Best Quarter |

June 30, 2020 |

15.19% |

| Worst Quarter |

March 31, 2020 |

-19.80% |

Average Annual Total Returns (for the periods ended December 31, 2022)

| |

Inception Date |

1 Year |

5 Years |

10

Years |

| Return Before Taxes |

12/15/2006 |

-7.59 % |

8.90 % |

10.85 % |

| Return After Taxes on Distributions |

|

-7.92 |

8.56 |

10.11 |

| Return After Taxes on Distributions and Sale of Fund Shares |

|

-4.27 |

7.00 |

8.61 |

| | ||||

| Bloomberg Pricing Power Index (reflects no deduction for fees, expenses or taxes)1

|

|

N/A |

N/A |

N/A |

| | ||||

| Invesco Defensive Equity Index (reflects no deduction for fees, expenses or taxes)2

|

|

-7.11 |

9.51 |

— |

| | ||||

| Blended-Invesco Defensive Equity Index (reflects no deduction for fees, expenses or taxes)3

|

|

-7.11 |

9.51 |

11.49 |

| | ||||

| S&P 500® Index (reflects no deduction for fees, expenses or taxes) |

|

-18.11 |

9.42 |

12.56 |

| | ||||

1

Effective after the close of markets on August 25, 2023, the Fund changed its underlying

index from the Invesco Defensive Equity Index to the Bloomberg Pricing Power Index. Performance information

is not available for periods prior to the Bloomberg Pricing Power Index's commencement date of June 29, 2023.

2

Performance information is not available for periods prior to Invesco Defensive Equity

Index's commencement date of July 25, 2016.

3

Blended-Invesco Defensive Equity Index reflects the performance of the Sabrient Defensive

Equity Index, a former underlying index of the Predecessor Fund, prior to October 24, 2016 and the Invesco

Defensive Equity Index thereafter.

After-tax returns in the above table are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor's tax situation and may differ from those shown, and after-tax returns shown are not relevant to investors who

hold Shares through tax-advantaged arrangements, such as 401(k) plans or individual retirement

accounts.

Management of the Fund

Investment Adviser. Invesco

Capital Management LLC (the “Adviser”).

Portfolio Managers

The following individuals are responsible jointly and primarily for the day-to-day management of the Fund’s portfolio:

| Name |

Title with Adviser/Trust |

Date Began

Managing the Fund |

| Peter Hubbard |

Head of Equities and Director of Portfolio Management of the

Adviser; Vice President of the Trust |

April 2018 |

| | ||

| Michael Jeanette |

Senior Portfolio Manager of the

Adviser |

April 2018 |

| | ||

| Pratik Doshi, CFA |

Portfolio Manager of the Adviser |

December 2019 |

| | ||

| Tony Seisser |

Portfolio Manager of the Adviser |

April 2018 |

| | ||

Purchase and Sale of Shares

The Fund issues and redeems Shares at NAV only with APs and only in large blocks of 10,000 Shares (each block of Shares is called a “Creation Unit”) or multiples thereof

(“Creation Unit Aggregations”), generally in exchange for the deposit or delivery of a basket of securities. However, the Fund also reserves the right to permit or require Creation Units to be issued in exchange for cash. Except when aggregated in

Creation Units, the Shares are not redeemable securities of the Fund.

Individual Shares may only be bought and sold in the secondary market (i.e., on a national securities exchange) through a broker or dealer at a market price. Because the Shares trade at

market prices rather than NAV, Shares may trade at a price greater than NAV (at a premium), at NAV, or less

than NAV (at a discount). An investor may incur costs attributable to the difference between the highest

price a buyer is willing to pay to purchase

3 Invesco

Bloomberg Pricing Power ETF (formerly, Invesco Defensive Equity

ETF)

invesco.com/ETFs

Shares (bid) and the lowest price a seller is

willing to accept for Shares (ask) when buying or selling shares in the secondary market (the “bid-ask

spread”).

Recent information, including information on the Fund’s NAV, market price, premiums and discounts, and bid-ask spreads, is available online at www.invesco.com/ETFs.

Tax Information

The Fund’s distributions generally are taxed as ordinary income, capital gains or some combination of both, unless

you are investing through a tax-advantaged arrangement, such as a 401(k) plan or an individual retirement

account, in which case your distributions may be taxed as ordinary income when withdrawn from such account.

Payments to Broker-Dealers and Other Financial Intermediaries

If you purchase

Shares of the Fund through a broker-dealer or other financial intermediary (such as a bank), the Fund’s distributor or its related

companies may pay the intermediary for certain

Fund-related activities, including those that are designed to make the intermediary more knowledgeable

about exchange-traded products, such as the Fund, as well as for marketing, education or other initiatives related to the sale or promotion of Shares. These payments may create a conflict of interest by influencing the broker-dealer or other

intermediary and your salesperson or financial adviser to recommend the Fund over another investment. Ask your salesperson or financial adviser or visit your financial intermediary’s website for more information.

4 Invesco

Bloomberg Pricing Power ETF (formerly, Invesco Defensive Equity

ETF)

invesco.com/ETFs