| THE SECURITIES ACT OF 1933 | ☒ |

| Pre-Effective Amendment No. | ☐ |

| Post-Effective Amendment No. 166 | ☒ |

| THE INVESTMENT COMPANY ACT OF 1940 | ☒ |

| Amendment No. 167 | ☒ |

3500 Lacey Road, Suite 700, Downers Grove, Illinois 60515

| Alan P. Goldberg Stradley Ronon Stevens & Young LLP 191 North Wacker Drive, Suite 1601 Chicago, Illinois 60606 | Eric S. Purple Stradley Ronon Stevens & Young LLP 2000 K Street, NW, Suite 700 Washington, DC 20006 |

| It is proposed that this filing will become effective (check appropriate box) | |

| ☐ | immediately upon filing pursuant to paragraph (b) |

| ☒ | on |

| ☐ | 60 days after filing pursuant to paragraph (a) |

| ☐ | on (date) pursuant to paragraph (a) |

| ☐ | 75 days after filing pursuant to paragraph (a)(2) |

| ☐ | on (date) pursuant to paragraph (a)(2) of rule 485 |

| If appropriate, check the following box: | |

| ☐ | This post-effective amendment designates a new effective date for a previously filed post-effective amendment. |

| | |

| | Invesco Bloomberg Pricing Power ETF (formerly, Invesco Defensive Equity ETF) | NYSE Arca, Inc. |

| Management Fees1 | % |

| | |

| Other Expenses1 | |

| | |

| Total Annual Fund Operating Expenses1 | |

| | |

|

1 Year

|

3 Years

|

5 Years

|

10 Years

|

| $ |

$ |

$ |

$ |

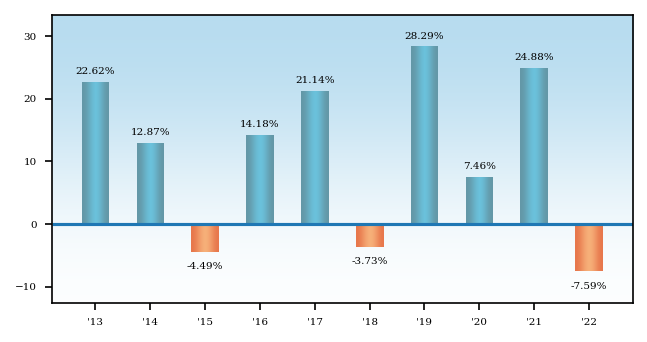

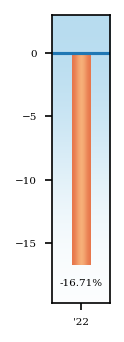

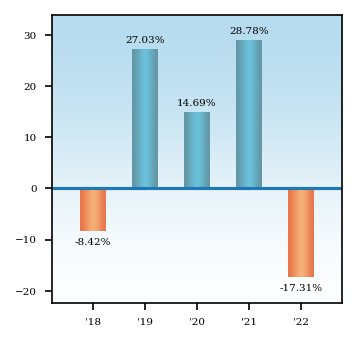

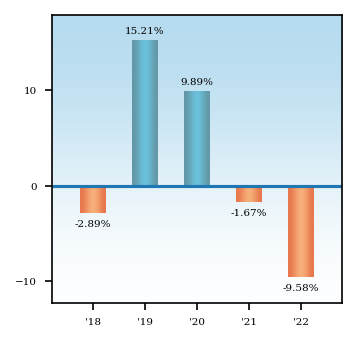

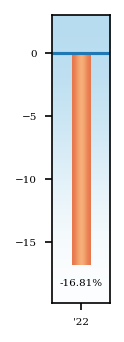

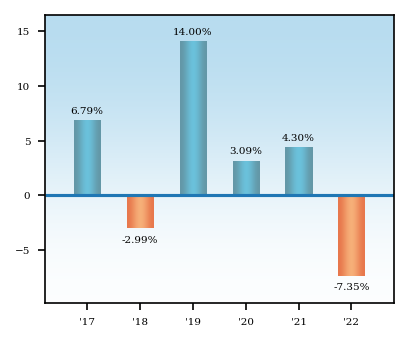

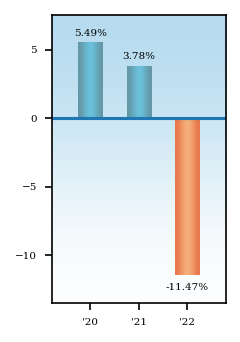

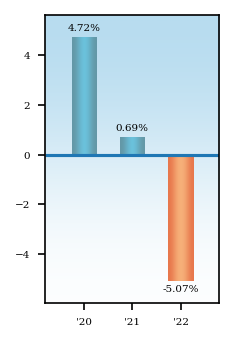

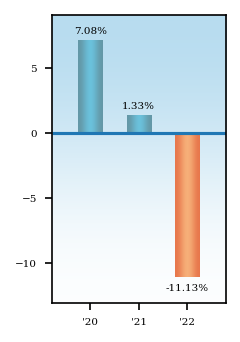

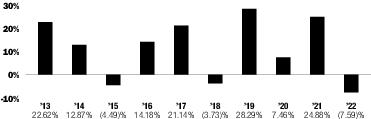

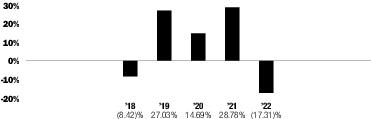

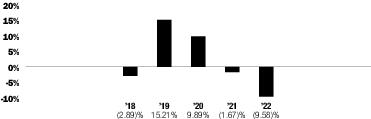

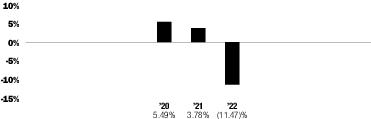

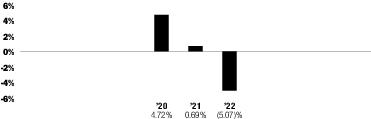

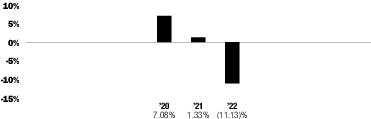

| | Period Ended | Returns |

| | | - |

| | | |

| | | - |

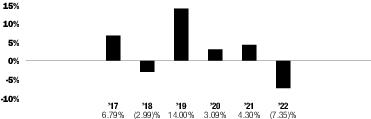

Average Annual Total Returns (for the periods ended December 31, 2022)

| | Inception Date | 1 Year | 5 Years | 10 Years |

| Return Before Taxes | | - % | % | % |

| Return After Taxes on Distributions | | - | | |

| Return After Taxes on Distributions and Sale of Fund Shares | | - | | |

| | ||||

| Bloomberg Pricing Power Index | | |||

| | ||||

| Invesco Defensive Equity Index (reflects no deduction for fees, expenses or taxes)2 | | - | | |

| | ||||

| Blended-Invesco Defensive Equity Index (reflects no deduction for fees, expenses or taxes)3 | | - | | |

| | ||||

| S&P 500® Index (reflects no deduction for fees, expenses or taxes) | | - | | |

| | ||||

| Name | Title with Adviser/Trust | Date Began Managing the Fund |

| Peter Hubbard | Head of Equities and Director of Portfolio Management of the Adviser; Vice President of the Trust | April 2018 |

| | ||

| Michael Jeanette | Senior Portfolio Manager of the Adviser | April 2018 |

| | ||

| Pratik Doshi, CFA | Portfolio Manager of the Adviser | December 2019 |

| | ||

| Tony Seisser | Portfolio Manager of the Adviser | April 2018 |

| | ||

Additional Information About the Fund’s Strategies and Risks

Tax Structure of ETFs

Portfolio Holdings

Management of the Fund

How to Buy and Sell Shares

Frequent Purchases and Redemptions of Shares

Dividends, Other Distributions and Taxes

Distributor

Net Asset Value

Fund Service Providers

Financial Highlights

| | Years Ended August 31, | ||||

| | 2023 | 2022 | 2021 | 2020 | 2019 |

| Per Share Operating Performance: | | | | | |

| Net asset value at beginning of year | $65.62 | $69.50 | $56.99 | $53.27 | $49.47 |

| Net investment income(a) | 1.03 | 0.92 | 0.64 | 0.75 | 0.68 |

| Net realized and unrealized gain (loss) on investments | 3.10 | (4.02) | 12.66 | 3.62 | 3.73 |

| Total from investment operations | 4.13 | (3.10) | 13.30 | 4.37 | 4.41 |

| Distributions to shareholders from: | | | | | |

| Net investment income | (0.98) | (0.78) | (0.79) | (0.65) | (0.61) |

| Net asset value at end of year | $68.77 | $65.62 | $69.50 | $56.99 | $53.27 |

| Market price at end of year(b) | $68.79 | $65.68 | $69.47 | $57.08 | $53.30 |

| Net Asset Value Total Return(c) | 6.36% | (4.54)% | 23.61% | 8.22% | 9.27% |

| Market Price Total Return(c) | 6.29% | (4.40)% | 23.36% | 8.34% | 9.20% |

| Ratios/Supplemental Data: | | | | | |

| Net assets at end of year (000’s omitted) | $217,317 | $265,114 | $300,920 | $307,735 | $245,052 |

| Ratio to average net assets of: | | | | | |

| Expenses | 0.53% | 0.54% | 0.55% | 0.53% | 0.55% |

| Net investment income | 1.54% | 1.35% | 1.05% | 1.42% | 1.37% |

| Portfolio turnover rate(d) | 195% | 134% | 121% | 136% | 145% |

| (a) | Based on average shares outstanding. |

| (b) | The mean between the last bid and ask prices. |

| (c) | Net asset value total return is calculated assuming an initial investment made at the net asset value at the beginning of the period, reinvestment of all dividends and distributions at net asset value during the period, and redemption at net asset value on the last day of the period. Net asset value total return includes adjustments in accordance with accounting principles generally accepted in the United States of America and as such, the net asset value for financial reporting purposes and the returns based upon those net asset values may differ from the net asset value and returns for shareholder transactions. Market price total return is calculated assuming an initial investment made at the market price at the beginning of the period, reinvestment of all dividends and distributions at market price during the period, and sale at the market price on the last day of the period. Total investment returns calculated for a period of less than one year are not annualized. |

| (d) | Portfolio turnover rate is not annualized for periods less than one year, if applicable, and does not include securities received or delivered from processing creations or redemptions. For the year ended August 31, 2023, the portfolio turnover calculation includes the value of securities purchased and sold in the effort to realign the Fund’s portfolio holdings due to the underlying index change. |

Index Provider

Disclaimers

Premium/Discount Information

Other Information

| Call: | Invesco Distributors, Inc. at 1-800-983-0903 Monday through Friday 8:00 a.m. to 5:00 p.m. Central Time |

| Write: | Invesco Exchange-Traded Self-Indexed Fund Trust c/o Invesco Distributors, Inc. 11 Greenway Plaza Houston, Texas 77046-1173 |

| Visit: | www.invesco.com/ETFs |

| | Invesco International Developed Dynamic Multifactor ETF | Cboe BZX Exchange, Inc. |

|

Management Fees

|

% |

|

|

|

|

Other Expenses

|

|

|

|

|

|

Total Annual Fund Operating Expenses

|

|

|

|

|

|

1 Year

|

3 Years

|

5 Years

|

10 Years

|

| $ |

$ |

$ |

$ |

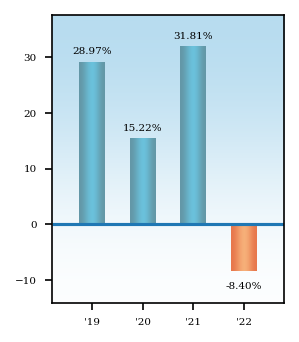

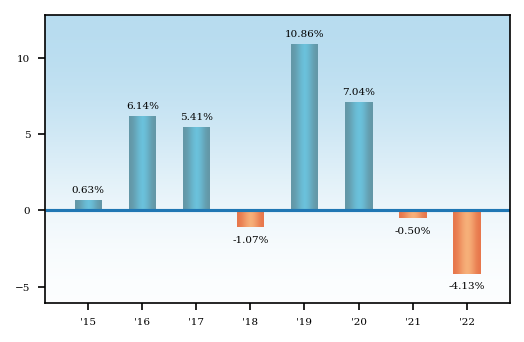

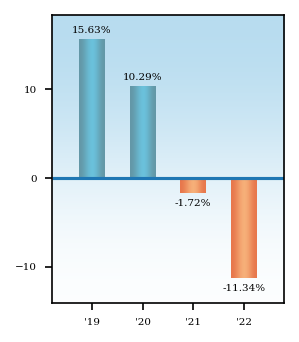

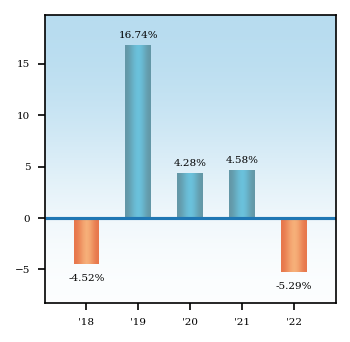

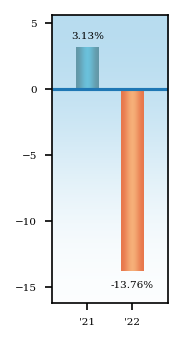

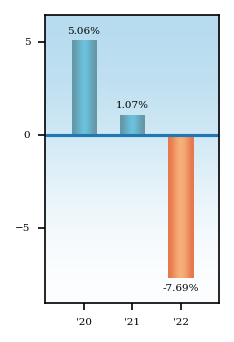

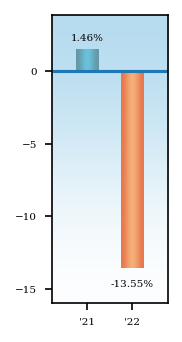

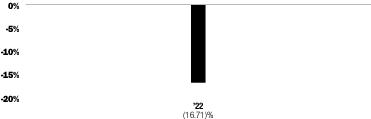

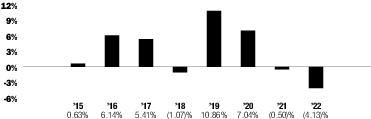

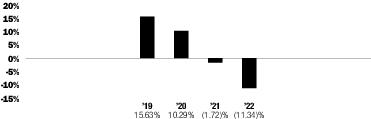

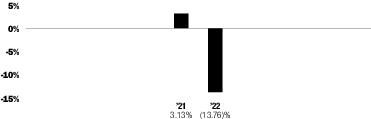

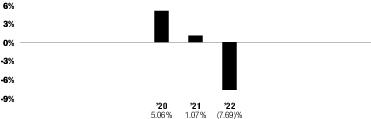

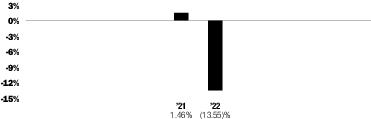

| | Period Ended | Returns |

| | | |

| | | |

| | | - |

Average Annual Total Returns (for the period ended December 31, 2022)

| | Inception Date | 1 Year | Since Inception |

| Return Before Taxes | | - % | - % |

| Return After Taxes on Distributions | | - | - |

| Return After Taxes on Distributions and Sale of Fund Shares | | - | - |

| | |||

| FTSE Developed ex US Invesco Dynamic Multifactor Index (Net) taxes, but reflects no deduction for fees, expenses or other taxes) | | - | - |

| | |||

| FTSE Developed ex US Index (Net) (reflects reinvested dividends net of withholding taxes, but reflects no deduction for fees, expenses or other taxes) | | - | - |

| | |||

| Name | Title with Adviser/Trust | Date Began Managing the Fund |

| Peter Hubbard | Head of Equities and Director of Portfolio Management of the Adviser; Vice President of the Trust | February 2021 |

| | ||

| Michael Jeanette | Senior Portfolio Manager of the Adviser | February 2021 |

| | ||

| Pratik Doshi, CFA | Portfolio Manager of the Adviser | February 2021 |

| | ||

| Tony Seisser | Portfolio Manager of the Adviser | February 2021 |

| | ||

Additional Information About the Fund’s Strategies and Risks

Tax Structure of ETFs

Portfolio Holdings

Management of the Fund

How to Buy and Sell Shares

Frequent Purchases and Redemptions of Shares

Dividends, Other Distributions and Taxes

Distributor

Net Asset Value

Fund Service Providers

Financial Highlights

| | Years Ended August 31, | For the Period February 22, 2021(a) Through August 31, 2021 | |

| | 2023 | 2022 | |

| Per Share Operating Performance: | | | |

| Net asset value at beginning of period | $19.95 | $27.05 | $25.00 |

| Net investment income(b) | 0.67 | 0.71 | 0.53 |

| Net realized and unrealized gain (loss) on investments | 4.11 | (6.62) | 1.81 |

| Total from investment operations | 4.78 | (5.91) | 2.34 |

| Distributions to shareholders from: | | | |

| Net investment income | (0.65) | (0.95) | (0.29) |

| Net realized gains | - | (0.24) | - |

| Total distributions | (0.65) | (1.19) | (0.29) |

| Net asset value at end of period | $24.08 | $19.95 | $27.05 |

| Market price at end of period(c) | $24.09 | $19.75 | $27.16 |

| Net Asset Value Total Return(d) | 24.43% | (22.54)% | 9.37%(e) |

| Market Price Total Return(d) | 25.74% | (23.63)% | 9.81%(e) |

| Ratios/Supplemental Data: | | | |

| Net assets at end of period (000’s omitted) | $237,152 | $103,717 | $135,253 |

| Ratio to average net assets of: | | | |

| Expenses | 0.34% | 0.34% | 0.34%(f) |

| Net investment income | 3.02% | 2.98% | 3.76%(f) |

| Portfolio turnover rate(g) | 341% | 337% | 73% |

| (a) | Commencement of investment operations. |

| (b) | Based on average shares outstanding. |

| (c) | The mean between the last bid and ask prices. |

| (d) | Net asset value total return is calculated assuming an initial investment made at the net asset value at the beginning of the period, reinvestment of all dividends and distributions at net asset value during the period, and redemption at net asset value on the last day of the period. Net asset value total return includes adjustments in accordance with accounting principles generally accepted in the United States of America and as such, the net asset value for financial reporting purposes and the returns based upon those net asset values may differ from the net asset value and returns for shareholder transactions. Market price total return is calculated assuming an initial investment made at the market price at the beginning of the period, reinvestment of all dividends and distributions at market price during the period, and sale at the market price on the last day of the period. Total investment returns calculated for a period of less than one year are not annualized. |

| (e) | The net asset value total return from Fund Inception (February 24, 2021, the first day of trading on the exchange) to August 31, 2021 was 9.41%. The market price total return from Fund Inception to August 31, 2021 was 7.90%. |

| (f) | Annualized. |

| (g) | Portfolio turnover rate is not annualized for periods less than one year, if applicable, and does not include securities received or delivered from processing creations or redemptions. |

Index Provider

Disclaimers

Premium/Discount Information

Other Information

| Call: | Invesco Distributors, Inc. at 1-800-983-0903 Monday through Friday 8:00 a.m. to 5:00 p.m. Central Time |

| Write: | Invesco Exchange-Traded Self-Indexed Fund Trust c/o Invesco Distributors, Inc. 11 Greenway Plaza Houston, Texas 77046-1173 |

| Visit: | www.invesco.com/ETFs |

| | Invesco RAFITM Strategic US ETF | The Nasdaq Stock Market LLC |

|

Management Fees

|

% |

|

|

|

|

Other Expenses

|

|

|

|

|

|

Total Annual Fund Operating Expenses

|

|

|

|

|

|

1 Year

|

3 Years

|

5 Years

|

10 Years

|

| $ |

$ |

$ |

$ |

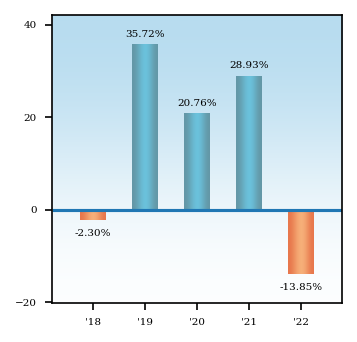

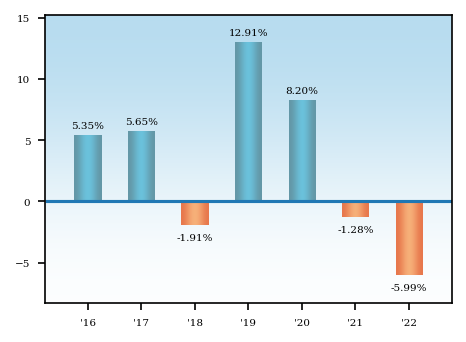

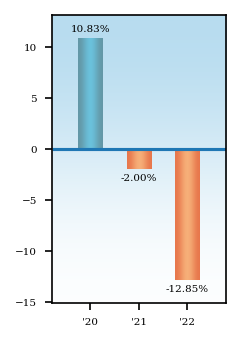

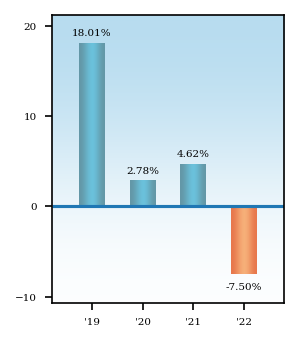

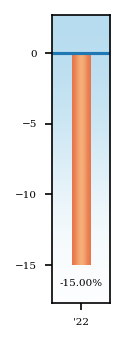

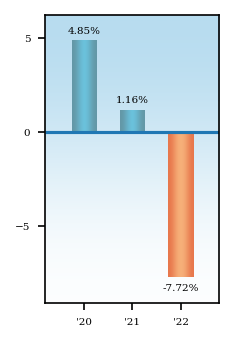

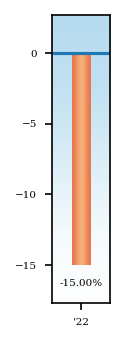

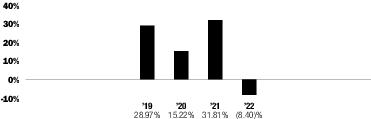

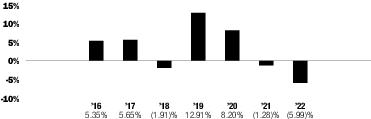

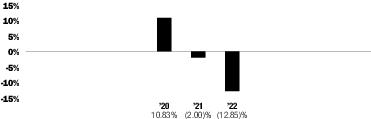

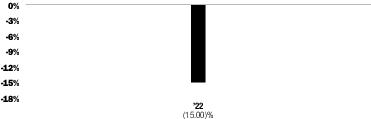

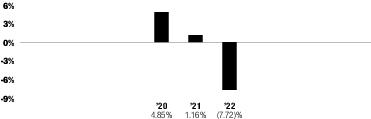

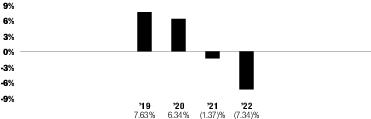

| | Period Ended | Returns |

| | | |

| | | |

| | | - |

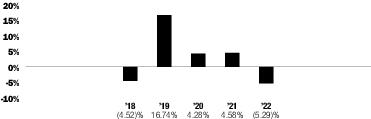

Average Annual Total Returns (for the periods ended December 31, 2022)

| | Inception Date | 1 Year | Since Inception |

| Return Before Taxes | | - % | % |

| Return After Taxes on Distributions | | - | |

| Return After Taxes on Distributions and Sale of Fund Shares | | - | |

| | |||

| Invesco Strategic US Index expenses or taxes) | | - | |

| | |||

| Russell 1000® Index (reflects no deduction for fees, expenses or taxes) | | - | |

| | |||

| Name | Title with Adviser/Trust | Date Began Managing the Fund |

| Peter Hubbard | Head of Equities and Director of Portfolio Management of the Adviser; Vice President of the Trust | September 2018 |

| | ||

| Michael Jeanette | Senior Portfolio Manager of the Adviser | September 2018 |

| | ||

| Pratik Doshi, CFA | Portfolio Manager of the Adviser | December 2019 |

| | ||

| Tony Seisser | Portfolio Manager of the Adviser | September 2018 |

| | ||

Additional Information About the Fund’s Strategies and Risks

Tax Structure of ETFs

Portfolio Holdings

Management of the Fund

How to Buy and Sell Shares

Frequent Purchases and Redemptions of Shares

Dividends, Other Distributions and Taxes

Distributor

Net Asset Value

Fund Service Providers

Financial Highlights

| | Years Ended August 31, | For the Period September 10, 2018(a) Through August 31, 2019 | |||

| | 2023 | 2022 | 2021 | 2020 | |

| Per Share Operating Performance: | | | | | |

| Net asset value at beginning of period | $36.75 | $38.50 | $28.08 | $24.93 | $25.00 |

| Net investment income(b) | 0.69 | 0.64 | 0.56 | 0.54 | 0.58 |

| Net realized and unrealized gain (loss) on investments | 4.55 | (1.72) | 10.40 | 3.13 | (0.26) |

| Total from investment operations | 5.24 | (1.08) | 10.96 | 3.67 | 0.32 |

| Distributions to shareholders from: | | | | | |

| Net investment income | (0.65) | (0.67) | (0.54) | (0.52) | (0.39) |

| Net asset value at end of period | $41.34 | $36.75 | $38.50 | $28.08 | $24.93 |

| Market price at end of period(c) | $41.34 | $36.79 | $38.52 | $28.14 | $24.94 |

| Net Asset Value Total Return(d) | 14.46% | (2.84)% | 39.47% | 15.17% | 1.45%(e) |

| Market Price Total Return(d) | 14.34% | (2.78)% | 39.25% | 15.38% | 1.50%(e) |

| Ratios/Supplemental Data: | | | | | |

| Net assets at end of period (000’s omitted) | $222,220 | $151,601 | $180,010 | $143,213 | $117,188 |

| Ratio to average net assets of: | | | | | |

| Expenses | 0.19% | 0.19% | 0.19% | 0.19% | 0.20%(f) |

| Net investment income | 1.81% | 1.65% | 1.69% | 2.09% | 2.41%(f) |

| Portfolio turnover rate(g) | 13% | 10% | 15% | 15% | 8% |

| (a) | Commencement of investment operations. |

| (b) | Based on average shares outstanding. |

| (c) | The mean between the last bid and ask prices. |

| (d) | Net asset value total return is calculated assuming an initial investment made at the net asset value at the beginning of the period, reinvestment of all dividends and distributions at net asset value during the period, and redemption at net asset value on the last day of the period. Net asset value total return includes adjustments in accordance with accounting principles generally accepted in the United States of America and as such, the net asset value for financial reporting purposes and the returns based upon those net asset values may differ from the net asset value and returns for shareholder transactions. Market price total return is calculated assuming an initial investment made at the market price at the beginning of the period, reinvestment of all dividends and distributions at market price during the period, and sale at the market price on the last day of the period. Total investment returns calculated for a period of less than one year are not annualized. |

| (e) | The net asset value total return from Fund Inception (September 12, 2018, the first day of trading on the exchange) to August 31, 2019 was 0.92%. The market price total return from Fund Inception to August 31, 2019 was 0.97%. |

| (f) | Ratios are annualized except for non-recurring costs associated with a proxy statement of 0.02%. |

| (g) | Portfolio turnover rate is not annualized for periods less than one year, if applicable, and does not include securities received or delivered from processing creations or redemptions. |

Index Provider

Disclaimers

Premium/Discount Information

Other Information

| Call: | Invesco Distributors, Inc. at 1-800-983-0903 Monday through Friday 8:00 a.m. to 5:00 p.m. Central Time |

| Write: | Invesco Exchange-Traded Self-Indexed Fund Trust c/o Invesco Distributors, Inc. 11 Greenway Plaza Houston, Texas 77046-1173 |

| Visit: | www.invesco.com/ETFs |

| | Invesco Russell 1000® Dynamic Multifactor ETF | Cboe BZX Exchange, Inc. |

|

Management Fees

|

% |

|

|

|

|

Other Expenses

|

|

|

|

|

|

Total Annual Fund Operating Expenses

|

|

|

|

|

|

1 Year

|

3 Years

|

5 Years

|

10 Years

|

| $ |

$ |

$ |

$ |

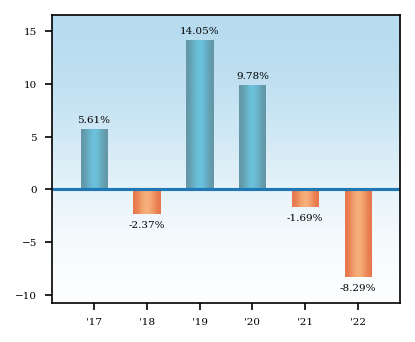

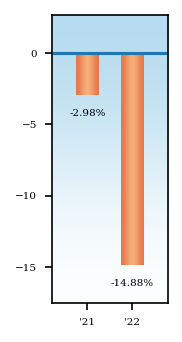

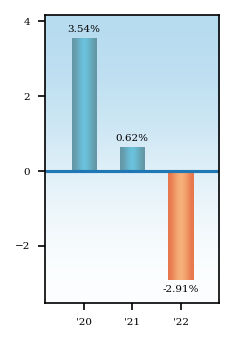

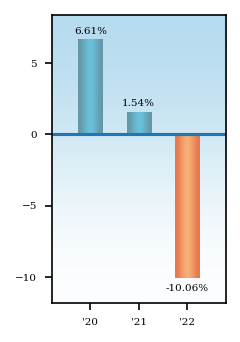

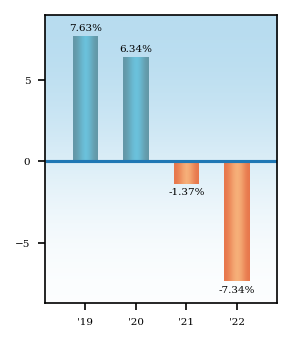

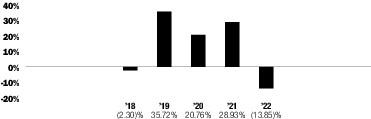

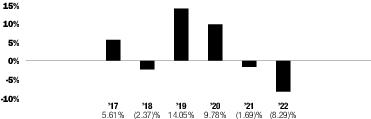

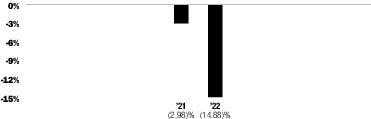

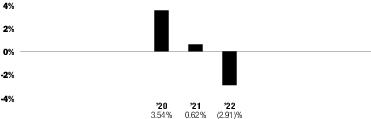

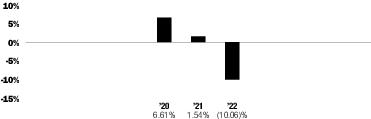

| | Period Ended | Returns |

| | | |

| | | |

| | | - |

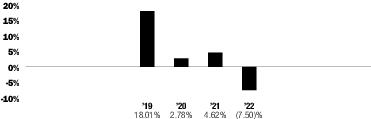

Average Annual Total Returns (for the periods ended December 31, 2022)

| | Inception Date | 1 Year | 5 Years | Since Inception |

| Return Before Taxes | | - % | % | % |

| Return After Taxes on Distributions | | - | | |

| Return After Taxes on Distributions and Sale of Fund Shares | | - | | |

| | ||||

| Russell 1000® Invesco Dynamic Multifactor Index expenses or taxes) | | - | | |

| | ||||

| Russell 1000® Index (reflects no deduction for fees, expenses or taxes) | | - | | |

| | ||||

| Name | Title with Adviser/Trust | Date Began Managing the Fund |

| Peter Hubbard | Head of Equities and Director of Portfolio Management of the Adviser; Vice President of the Trust | May 2019 |

| | ||

| Michael Jeanette | Senior Portfolio Manager of the Adviser | May 2019 |

| | ||

| Pratik Doshi, CFA | Portfolio Manager of the Adviser | October 2019 |

| | ||

| Tony Seisser | Portfolio Manager of the Adviser | May 2019 |

| | ||

Additional Information About the Fund’s Strategies and Risks

Tax Structure of ETFs

Portfolio Holdings

Management of the Fund

How to Buy and Sell Shares

Frequent Purchases and Redemptions of Shares

Dividends, Other Distributions and Taxes

Distributor

Net Asset Value

Fund Service Providers

Financial Highlights

| | Years Ended August 31, | Two Months Ended August 31, 2019 | Year Ended June 30, 2019 | |||

| | 2023 | 2022 | 2021 | 2020 | ||

| Per Share Operating Performance: | | | | | | |

| Net asset value at beginning of period | $42.19 | $48.24 | $32.22 | $29.77 | $29.71 | $26.65 |

| Net investment income(a) | 0.76 | 0.67 | 0.52 | 0.55 | 0.07 | 0.54 |

| Net realized and unrealized gain (loss) on investments | 6.76 | (6.18) | 16.10 | 2.44 | (0.01) | 2.99 |

| Total from investment operations | 7.52 | (5.51) | 16.62 | 2.99 | 0.06 | 3.53 |

| Distributions to shareholders from: | | | | | | |

| Net investment income | (0.75) | (0.54) | (0.60) | (0.54) | - | (0.47) |

| Net asset value at end of period | $48.96 | $42.19 | $48.24 | $32.22 | $29.77 | $29.71 |

| Market price at end of period(b) | $48.96 | $42.24 | $48.24 | $32.26 | $29.79 | $29.71 |

| Net Asset Value Total Return(c) | 18.05% | (11.48)% | 52.12% | 10.23% | 0.20% | 13.37% |

| Market Price Total Return(c) | 17.91% | (11.37)% | 51.93% | 10.29% | 0.27% | 13.32% |

| Ratios/Supplemental Data: | | | | | | |

| Net assets at end of period (000's omitted) | $4,774,410 | $1,957,279 | $1,704,452 | $990,733 | $1,052,542 | $998,325 |

| Ratio to average net assets of: | | | | | | |

| Expenses | 0.29% | 0.29% | 0.29% | 0.29% | 0.29%(d) | 0.29% |

| Net investment income | 1.65% | 1.45% | 1.24% | 1.76% | 1.48%(d) | 1.92% |

| Portfolio turnover rate(e) | 350% | 336% | 126% | 321% | 83% | 138% |

| (a) | Based on average shares outstanding. |

| (b) | The mean between the last bid and ask prices. |

| (c) | Net asset value total return is calculated assuming an initial investment made at the net asset value at the beginning of the period, reinvestment of all dividends and distributions at net asset value during the period, and redemption at net asset value on the last day of the period. Net asset value total return includes adjustments in accordance with accounting principles generally accepted in the United States of America and as such, the net asset value for financial reporting purposes and the returns based upon those net asset values may differ from the net asset value and returns for shareholder transactions. Market price total return is calculated assuming an initial investment made at the market price at the beginning of the period, reinvestment of all dividends and distributions at market price during the period, and sale at the market price on the last day of the period. Total investment returns calculated for a period of less than one year are not annualized. |

| (d) | Ratios are annualized except for non-recurring costs associated with a proxy statement of less than 0.005%. |

| (e) | Portfolio turnover rate is not annualized for periods less than one year, if applicable, and does not include securities received or delivered from processing creations or redemptions. |

Index Provider

Disclaimers

Premium/Discount Information

Other Information

| Call: | Invesco Distributors, Inc. at 1-800-983-0903 Monday through Friday 8:00 a.m. to 5:00 p.m. Central Time |

| Write: | Invesco Exchange-Traded Self-Indexed Fund Trust c/o Invesco Distributors, Inc. 11 Greenway Plaza Houston, Texas 77046-1173 |

| Visit: | www.invesco.com/ETFs |

| | Invesco Russell 2000® Dynamic Multifactor ETF | Cboe BZX Exchange, Inc. |

|

Management Fees

|

% |

|

|

|

|

Other Expenses

|

|

|

|

|

|

Total Annual Fund Operating Expenses

|

|

|

|

|

|

1 Year

|

3 Years

|

5 Years

|

10 Years

|

| $ |

$ |

$ |

$ |

| | Period Ended | Returns |

| | | |

| | | |

| | | - |

Average Annual Total Returns (for the periods ended December 31, 2022)

| | Inception Date | 1 Year | 5 Years | Since Inception |

| Return Before Taxes | | - % | % | % |

| Return After Taxes on Distributions | | - | | |

| Return After Taxes on Distributions and Sale of Fund Shares | | - | | |

| | ||||

| Russell 2000® Invesco Dynamic Multifactor Index expenses or taxes) | | - | | |

| | ||||

| Russell 2000® Index (reflects no deduction for fees, expenses or taxes) | | - | | |

| | ||||

| Name | Title with Adviser/Trust | Date Began Managing the Fund |

| Peter Hubbard | Head of Equities and Director of Portfolio Management of the Adviser; Vice President of the Trust | May 2019 |

| | ||

| Michael Jeanette | Senior Portfolio Manager of the Adviser | May 2019 |

| | ||

| Pratik Doshi, CFA | Portfolio Manager of the Adviser | October 2019 |

| | ||

| Tony Seisser | Portfolio Manager of the Adviser | May 2019 |

| | ||

Additional Information About the Fund’s Strategies and Risks

Tax Structure of ETFs

Portfolio Holdings

Management of the Fund

How to Buy and Sell Shares

Frequent Purchases and Redemptions of Shares

Dividends, Other Distributions and Taxes

Distributor

Net Asset Value

Fund Service Providers

Financial Highlights

| | Years Ended August 31, | Two Months Ended August 31, 2019 | Year Ended June 30, 2019 | |||

| | 2023 | 2022 | 2021 | 2020 | ||

| Per Share Operating Performance: | | | | | | |

| Net asset value at beginning of period | $34.67 | $40.51 | $24.92 | $25.61 | $26.82 | $27.12 |

| Net investment income(a) | 0.59 | 0.51 | 0.31 | 0.31 | 0.03 | 0.43 |

| Net realized and unrealized gain (loss) on investments | 1.56 | (5.94) | 15.59 | (0.64) | (1.24) | (0.29) |

| Total from investment operations | 2.15 | (5.43) | 15.90 | (0.33) | (1.21) | 0.14 |

| Distributions to shareholders from: | | | | | | |

| Net investment income | (0.62) | (0.41) | (0.31) | (0.36) | - | (0.44) |

| Net asset value at end of period | $36.20 | $34.67 | $40.51 | $24.92 | $25.61 | $26.82 |

| Market price at end of period(b) | $36.28 | $34.68 | $40.50 | $24.94 | $25.65 | $26.82 |

| Net Asset Value Total Return(c) | 6.31% | (13.45)% | 64.12% | (1.13)% | (4.51)% | 0.63% |

| Market Price Total Return(c) | 6.51% | (13.41)% | 63.95% | (1.20)% | (4.36)% | 0.59% |

| Ratios/Supplemental Data: | | | | | | |

| Net assets at end of period (000's omitted) | $352,627 | $144,553 | $130,035 | $43,602 | $12,807 | $12,071 |

| Ratio to average net assets of: | | | | | | |

| Expenses | 0.39% | 0.39% | 0.39% | 0.39% | 0.41%(d) | 0.39% |

| Net investment income | 1.67% | 1.32% | 0.86% | 1.27% | 0.87%(d) | 1.62% |

| Portfolio turnover rate(e) | 336% | 265% | 127% | 282% | 64% | 189% |

| (a) | Based on average shares outstanding. |

| (b) | The mean between the last bid and ask prices. |

| (c) | Net asset value total return is calculated assuming an initial investment made at the net asset value at the beginning of the period, reinvestment of all dividends and distributions at net asset value during the period, and redemption at net asset value on the last day of the period. Net asset value total return includes adjustments in accordance with accounting principles generally accepted in the United States of America and as such, the net asset value for financial reporting purposes and the returns based upon those net asset values may differ from the net asset value and returns for shareholder transactions. Market price total return is calculated assuming an initial investment made at the market price at the beginning of the period, reinvestment of all dividends and distributions at market price during the period, and sale at the market price on the last day of the period. Total investment returns calculated for a period of less than one year are not annualized. |

| (d) | Ratios are annualized except for non-recurring costs associated with a proxy statement of 0.02%. |

| (e) | Portfolio turnover rate is not annualized for periods less than one year, if applicable, and does not include securities received or delivered from processing creations or redemptions. |

Index Provider

Disclaimers

Premium/Discount Information

Other Information

| Call: | Invesco Distributors, Inc. at 1-800-983-0903 Monday through Friday 8:00 a.m. to 5:00 p.m. Central Time |

| Write: | Invesco Exchange-Traded Self-Indexed Fund Trust c/o Invesco Distributors, Inc. 11 Greenway Plaza Houston, Texas 77046-1173 |

| Visit: | www.invesco.com/ETFs |

| | Invesco BulletShares 2024 Corporate Bond ETF | The Nasdaq Stock Market LLC |

|

Management Fees

|

% |

|

|

|

|

Other Expenses

|

|

|

|

|

|

Total Annual Fund Operating Expenses

|

|

|

|

|

|

1 Year

|

3 Years

|

5 Years

|

10 Years

|

| $ |

$ |

$ |

$ |

| | Period Ended | Returns |

| | | |

| | | |

| | | - |

Average Annual Total Returns (for the periods ended December 31, 2022)

| | Inception Date | 1 Year | 5 Years | Since Inception |

| Return Before Taxes | | - % | % | % |

| Return After Taxes on Distributions | | - | | |

| Return After Taxes on Distributions and Sale of Fund Shares | | - | | |

| | ||||

| Nasdaq BulletShares® USD Corporate Bond 2024 Index expenses or taxes) | | - | | |

| | ||||

| Bloomberg US Corporate Index (reflects no deduction for fees, expenses or taxes) | | - | | |

| | ||||

| Name | Title with Adviser/Trust | Date Began Managing the Fund |

| Peter Hubbard | Head of Equities and Director of Portfolio Management of the Adviser; Vice President of the Trust | April 2018 |

| | ||

| Cynthia Madrigal | Portfolio Manager of the Adviser | December 2021 |

| | ||

| Gregory Meisenger | Portfolio Manager of the Adviser | September 2018 |

| | ||

| Jeremy Neisewander | Portfolio Manager of the Adviser | April 2018 |

Additional Information About the Fund’s Strategies and Risks

Tax Structure of ETFs

Portfolio Holdings

Management of the Fund

How to Buy and Sell Shares

Frequent Purchases and Redemptions of Shares

Dividends, Other Distributions and Taxes

Distributor

Net Asset Value

Fund Service Providers

Financial Highlights

| | Years Ended August 31, | ||||

| | 2023 | 2022 | 2021 | 2020 | 2019 |

| Per Share Operating Performance: | | | | | |

| Net asset value at beginning of year | $20.69 | $22.16 | $22.26 | $21.44 | $20.15 |

| Net investment income(a) | 0.57 | 0.41 | 0.44 | 0.58 | 0.68 |

| Net realized and unrealized gain (loss) on investments | (0.03)(b) | (1.45) | (0.09) | 0.83 | 1.30 |

| Total from investment operations | 0.54 | (1.04) | 0.35 | 1.41 | 1.98 |

| Distributions to shareholders from: | | | | | |

| Net investment income | (0.57) | (0.39) | (0.45) | (0.59) | (0.69) |

| Net realized gains | - | (0.04) | - | - | - |

| Total distributions | (0.57) | (0.43) | (0.45) | (0.59) | (0.69) |

| Net asset value at end of year | $20.66 | $20.69 | $22.16 | $22.26 | $21.44 |

| Market price at end of year(c) | $20.67 | $20.67 | $22.18 | $22.28 | $21.50 |

| Net Asset Value Total Return(d) | 2.67% | (4.76)% | 1.59% | 6.72% | 10.08% |

| Market Price Total Return(d) | 2.81% | (4.93)% | 1.59% | 6.51% | 10.11% |

| Ratios/Supplemental Data: | | | | | |

| Net assets at end of year (000’s omitted) | $3,892,632 | $3,299,476 | $1,632,038 | $1,085,251 | $575,698 |

| Ratio to average net assets of: | | | | | |

| Expenses | 0.10% | 0.10% | 0.10% | 0.10% | 0.10% |

| Net investment income | 2.79% | 1.93% | 2.00% | 2.70% | 3.29% |

| Portfolio turnover rate(e) | 3% | 11% | 7% | 6% | 5% |

| (a) | Based on average shares outstanding. |

| (b) | Net realized and unrealized gain (loss) on investments per share may not correlate with the Fund’s net realized and unrealized gain (loss) due to timing of shareholder transactions in relation to the fluctuating market values of the Fund’s investments. |

| (c) | The mean between the last bid and ask prices. |

| (d) | Net asset value total return is calculated assuming an initial investment made at the net asset value at the beginning of the period, reinvestment of all dividends and distributions at net asset value during the period, and redemption at net asset value on the last day of the period. Net asset value total return includes adjustments in accordance with accounting principles generally accepted in the United States of America and as such, the net asset value for financial reporting purposes and the returns based upon those net asset values may differ from the net asset value and returns for shareholder transactions. Market price total return is calculated assuming an initial investment made at the market price at the beginning of the period, reinvestment of all dividends and distributions at market price during the period, and sale at the market price on the last day of the period. Total investment returns calculated for a period of less than one year are not annualized. |

| (e) | Portfolio turnover rate is not annualized for periods less than one year, if applicable, and does not include securities received or delivered from processing creations or redemptions. |

Index Provider

Disclaimers

Premium/Discount Information

Other Information

| Call: | Invesco Distributors, Inc. at 1-800-983-0903 Monday through Friday 8:00 a.m. to 5:00 p.m. Central Time |

| Write: | Invesco Exchange-Traded Self-Indexed Fund Trust c/o Invesco Distributors, Inc. 11 Greenway Plaza Houston, Texas 77046-1173 |

| Visit: | www.invesco.com/ETFs |

| | Invesco BulletShares 2025 Corporate Bond ETF | The Nasdaq Stock Market LLC |

|

Management Fees

|

% |

|

|

|

|

Other Expenses

|

|

|

|

|

|

Total Annual Fund Operating Expenses

|

|

|

|

|

|

1 Year

|

3 Years

|

5 Years

|

10 Years

|

| $ |

$ |

$ |

$ |

| | Period Ended | Returns |

| | | |

| | | |

| | | - |

Average Annual Total Returns (for the periods ended December 31, 2022)

| | Inception Date | 1 Year | 5 Years | Since Inception |

| Return Before Taxes | | - % | % | % |

| Return After Taxes on Distributions | | - | | |

| Return After Taxes on Distributions and Sale of Fund Shares | | - | | |

| | ||||

| Nasdaq BulletShares® USD Corporate Bond 2025 Index expenses or taxes) | | - | | |

| | ||||

| Bloomberg US Corporate Index (reflects no deduction for fees, expenses or taxes) | | - | | |

| | ||||

| Name | Title with Adviser/Trust | Date Began Managing the Fund |

| Peter Hubbard | Head of Equities and Director of Portfolio Management of the Adviser; Vice President of the Trust | April 2018 |

| | ||

| Cynthia Madrigal | Portfolio Manager of the Adviser | December 2021 |

| | ||

| Gregory Meisenger | Portfolio Manager of the Adviser | September 2018 |

| | ||

| Jeremy Neisewander | Portfolio Manager of the Adviser | April 2018 |

Additional Information About the Fund’s Strategies and Risks

Tax Structure of ETFs

Portfolio Holdings

Management of the Fund

How to Buy and Sell Shares

Frequent Purchases and Redemptions of Shares

Dividends, Other Distributions and Taxes

Distributor

Net Asset Value

Fund Service Providers

Financial Highlights

| | Years Ended August 31, | ||||

| | 2023 | 2022 | 2021 | 2020 | 2019 |

| Per Share Operating Performance: | | | | | |

| Net asset value at beginning of year | $20.40 | $22.30 | $22.44 | $21.41 | $19.89 |

| Net investment income(a) | 0.64 | 0.41 | 0.41 | 0.60 | 0.70 |

| Net realized and unrealized gain (loss) on investments | (0.25) | (1.88) | (0.13) | 1.05 | 1.51 |

| Total from investment operations | 0.39 | (1.47) | 0.28 | 1.65 | 2.21 |

| Distributions to shareholders from: | | | | | |

| Net investment income | (0.62) | (0.39) | (0.42) | (0.62) | (0.69) |

| Net realized gains | - | (0.04) | - | - | - |

| Total distributions | (0.62) | (0.43) | (0.42) | (0.62) | (0.69) |

| Net asset value at end of year | $20.17 | $20.40 | $22.30 | $22.44 | $21.41 |

| Market price at end of year(b) | $20.18 | $20.37 | $22.31 | $22.45 | $21.44 |

| Net Asset Value Total Return(c) | 1.99% | (6.63)% | 1.25% | 7.86% | 11.39% |

| Market Price Total Return(c) | 2.19% | (6.81)% | 1.25% | 7.75% | 11.14% |

| Ratios/Supplemental Data: | | | | | |

| Net assets at end of year (000’s omitted) | $2,846,919 | $1,664,398 | $1,056,865 | $632,834 | $311,561 |

| Ratio to average net assets of: | | | | | |

| Expenses | 0.10% | 0.10% | 0.10% | 0.10% | 0.10% |

| Net investment income | 3.20% | 1.93% | 1.85% | 2.77% | 3.42% |

| Portfolio turnover rate(d) | 1% | 10% | 8% | 9% | 3% |

| (a) | Based on average shares outstanding. |

| (b) | The mean between the last bid and ask prices. |

| (c) | Net asset value total return is calculated assuming an initial investment made at the net asset value at the beginning of the period, reinvestment of all dividends and distributions at net asset value during the period, and redemption at net asset value on the last day of the period. Net asset value total return includes adjustments in accordance with accounting principles generally accepted in the United States of America and as such, the net asset value for financial reporting purposes and the returns based upon those net asset values may differ from the net asset value and returns for shareholder transactions. Market price total return is calculated assuming an initial investment made at the market price at the beginning of the period, reinvestment of all dividends and distributions at market price during the period, and sale at the market price on the last day of the period. Total investment returns calculated for a period of less than one year are not annualized. |

| (d) | Portfolio turnover rate is not annualized for periods less than one year, if applicable, and does not include securities received or delivered from processing creations or redemptions. |

Index Provider

Disclaimers

Premium/Discount Information

Other Information

| Call: | Invesco Distributors, Inc. at 1-800-983-0903 Monday through Friday 8:00 a.m. to 5:00 p.m. Central Time |

| Write: | Invesco Exchange-Traded Self-Indexed Fund Trust c/o Invesco Distributors, Inc. 11 Greenway Plaza Houston, Texas 77046-1173 |

| Visit: | www.invesco.com/ETFs |

| | Invesco BulletShares 2026 Corporate Bond ETF | The Nasdaq Stock Market LLC |

|

Management Fees

|

% |

|

|

|

|

Other Expenses

|

|

|

|

|

|

Total Annual Fund Operating Expenses

|

|

|

|

|

|

1 Year

|

3 Years

|

5 Years

|

10 Years

|

| $ |

$ |

$ |

$ |

| | Period Ended | Returns |

| | | |

| | | |

| | | - |

Average Annual Total Returns (for the periods ended December 31, 2022)

| | Inception Date | 1 Year | 5 Years | Since Inception |

| Return Before Taxes | | - % | % | % |

| Return After Taxes on Distributions | | - | | |

| Return After Taxes on Distributions and Sale of Fund Shares | | - | | |

| | ||||

| Nasdaq BulletShares® USD Corporate Bond 2026 Index expenses or taxes) | | - | | |

| | ||||

| Bloomberg US Corporate Index (reflects no deduction for fees, expenses or taxes) | | - | | |

| | ||||

| Name | Title with Adviser/Trust | Date Began Managing the Fund |

| Peter Hubbard | Head of Equities and Director of Portfolio Management of the Adviser; Vice President of the Trust | April 2018 |

| | ||

| Cynthia Madrigal | Portfolio Manager of the Adviser | December 2021 |

| | ||

| Gregory Meisenger | Portfolio Manager of the Adviser | September 2018 |

| | ||

| Jeremy Neisewander | Portfolio Manager of the Adviser | April 2018 |

Additional Information About the Fund’s Strategies and Risks

Tax Structure of ETFs

Portfolio Holdings

Management of the Fund

How to Buy and Sell Shares

Frequent Purchases and Redemptions of Shares

Dividends, Other Distributions and Taxes

Distributor

Net Asset Value

Fund Service Providers

Financial Highlights

| | Years Ended August 31, | ||||

| | 2023 | 2022 | 2021 | 2020 | 2019 |

| Per Share Operating Performance: | | | | | |

| Net asset value at beginning of year | $19.26 | $21.56 | $21.75 | $20.57 | $18.84 |

| Net investment income(a) | 0.65 | 0.43 | 0.43 | 0.57 | 0.66 |

| Net realized and unrealized gain (loss) on investments | (0.34) | (2.31) | (0.18) | 1.20 | 1.71 |

| Total from investment operations | 0.31 | (1.88) | 0.25 | 1.77 | 2.37 |

| Distributions to shareholders from: | | | | | |

| Net investment income | (0.64) | (0.42) | (0.44) | (0.58) | (0.66) |

| Net realized gains | - | (0.00)(b) | - | (0.02) | (0.00)(b) |

| Total distributions | (0.64) | (0.42) | (0.44) | (0.60) | (0.66) |

| Transaction fees(a) | - | - | - | 0.01 | 0.02 |

| Net asset value at end of year | $18.93 | $19.26 | $21.56 | $21.75 | $20.57 |

| Market price at end of year(c) | $18.94 | $19.21 | $21.58 | $21.78 | $20.62 |

| Net Asset Value Total Return(d) | 1.64% | (8.79)% | 1.16% | 8.85% | 13.05% |

| Market Price Total Return(d) | 1.95% | (9.11)% | 1.11% | 8.73% | 13.07% |

| Ratios/Supplemental Data: | | | | | |

| Net assets at end of year (000’s omitted) | $1,982,408 | $1,178,455 | $578,885 | $293,682 | $132,679 |

| Ratio to average net assets of: | | | | | |

| Expenses | 0.10% | 0.10% | 0.10% | 0.10% | 0.10% |

| Net investment income | 3.42% | 2.17% | 2.01% | 2.76% | 3.42% |

| Portfolio turnover rate(e) | 1% | 4% | 2% | 7% | 4% |

| (a) | Based on average shares outstanding. |

| (b) | Amount represents less than $0.005. |

| (c) | The mean between the last bid and ask prices. |

| (d) | Net asset value total return is calculated assuming an initial investment made at the net asset value at the beginning of the period, reinvestment of all dividends and distributions at net asset value during the period, and redemption at net asset value on the last day of the period. Net asset value total return includes adjustments in accordance with accounting principles generally accepted in the United States of America and as such, the net asset value for financial reporting purposes and the returns based upon those net asset values may differ from the net asset value and returns for shareholder transactions. Market price total return is calculated assuming an initial investment made at the market price at the beginning of the period, reinvestment of all dividends and distributions at market price during the period, and sale at the market price on the last day of the period. Total investment returns calculated for a period of less than one year are not annualized. |

| (e) | Portfolio turnover rate is not annualized for periods less than one year, if applicable, and does not include securities received or delivered from processing creations or redemptions. |

Index Provider

Disclaimers

Premium/Discount Information

Other Information

| Call: | Invesco Distributors, Inc. at 1-800-983-0903 Monday through Friday 8:00 a.m. to 5:00 p.m. Central Time |

| Write: | Invesco Exchange-Traded Self-Indexed Fund Trust c/o Invesco Distributors, Inc. 11 Greenway Plaza Houston, Texas 77046-1173 |

| Visit: | www.invesco.com/ETFs |

| | Invesco BulletShares 2027 Corporate Bond ETF | The Nasdaq Stock Market LLC |

|

Management Fees

|

% |

|

|

|

|

Other Expenses

|

|

|

|

|

|

Total Annual Fund Operating Expenses

|

|

|

|

|

|

1 Year

|

3 Years

|

5 Years

|

10 Years

|

| $ |

$ |

$ |

$ |

| | Period Ended | Returns |

| | | |

| | | |

| | | - |

Average Annual Total Returns (for the periods ended December 31, 2022)

| | Inception Date | 1 Year | 5 Years | Since Inception |

| Return Before Taxes | | - % | % | % |

| Return After Taxes on Distributions | | - | | |

| Return After Taxes on Distributions and Sale of Fund Shares | | - | | |

| | ||||

| Nasdaq BulletShares® USD Corporate Bond 2027 Index expenses or taxes) | | - | | |

| | ||||

| Bloomberg US Corporate Index (reflects no deduction for fees, expenses or taxes) | | - | | |

| | ||||

| Name | Title with Adviser/Trust | Date Began Managing the Fund |

| Peter Hubbard | Head of Equities and Director of Portfolio Management of the Adviser; Vice President of the Trust | April 2018 |

| | ||

| Cynthia Madrigal | Portfolio Manager of the Adviser | December 2021 |

| | ||

| Gregory Meisenger | Portfolio Manager of the Adviser | September 2018 |

| | ||

| Jeremy Neisewander | Portfolio Manager of the Adviser | April 2018 |

Additional Information About the Fund’s Strategies and Risks

Tax Structure of ETFs

Portfolio Holdings

Management of the Fund

How to Buy and Sell Shares

Frequent Purchases and Redemptions of Shares

Dividends, Other Distributions and Taxes

Distributor

Net Asset Value

Fund Service Providers

Financial Highlights

| | Years Ended August 31, | ||||

| | 2023 | 2022 | 2021 | 2020 | 2019 |

| Per Share Operating Performance: | | | | | |

| Net asset value at beginning of year | $19.37 | $22.01 | $22.06 | $20.99 | $19.13 |

| Net investment income(a) | 0.68 | 0.46 | 0.47 | 0.60 | 0.71 |

| Net realized and unrealized gain (loss) on investments | (0.39) | (2.64) | (0.05) | 1.08 | 1.84 |

| Total from investment operations | 0.29 | (2.18) | 0.42 | 1.68 | 2.55 |

| Distributions to shareholders from: | | | | | |

| Net investment income | (0.66) | (0.45) | (0.47) | (0.61) | (0.72) |

| Net realized gains | (0.01) | (0.01) | - | (0.01) | - |

| Total distributions | (0.67) | (0.46) | (0.47) | (0.62) | (0.72) |

| Transaction fees(a) | - | - | - | 0.01 | 0.03 |

| Net asset value at end of year | $18.99 | $19.37 | $22.01 | $22.06 | $20.99 |

| Market price at end of year(b) | $19.00 | $19.29 | $22.04 | $22.07 | $21.05 |

| Net Asset Value Total Return(c) | 1.53% | (9.99)% | 1.94% | 8.25% | 13.87% |

| Market Price Total Return(c) | 2.01% | (10.48)% | 2.04% | 7.98% | 14.01% |

| Ratios/Supplemental Data: | | | | | |

| Net assets at end of year (000’s omitted) | $1,062,506 | $479,527 | $353,298 | $231,616 | $72,410 |

| Ratio to average net assets of: | | | | | |

| Expenses | 0.10% | 0.10% | 0.10% | 0.10% | 0.11%(d) |

| Net investment income | 3.60% | 2.26% | 2.15% | 2.83% | 3.64%(d) |

| Portfolio turnover rate(e) | 1% | 4% | 2% | 7% | 3% |

| (a) | Based on average shares outstanding. |

| (b) | The mean between the last bid and ask prices. |

| (c) | Net asset value total return is calculated assuming an initial investment made at the net asset value at the beginning of the period, reinvestment of all dividends and distributions at net asset value during the period, and redemption at net asset value on the last day of the period. Net asset value total return includes adjustments in accordance with accounting principles generally accepted in the United States of America and as such, the net asset value for financial reporting purposes and the returns based upon those net asset values may differ from the net asset value and returns for shareholder transactions. Market price total return is calculated assuming an initial investment made at the market price at the beginning of the period, reinvestment of all dividends and distributions at market price during the period, and sale at the market price on the last day of the period. Total investment returns calculated for a period of less than one year are not annualized. |

| (d) | Ratios include non-recurring costs associated with a proxy statement of 0.01%. |

| (e) | Portfolio turnover rate is not annualized for periods less than one year, if applicable, and does not include securities received or delivered from processing creations or redemptions. |

Index Provider

Disclaimers

Premium/Discount Information

Other Information

| Call: | Invesco Distributors, Inc. at 1-800-983-0903 Monday through Friday 8:00 a.m. to 5:00 p.m. Central Time |

| Write: | Invesco Exchange-Traded Self-Indexed Fund Trust c/o Invesco Distributors, Inc. 11 Greenway Plaza Houston, Texas 77046-1173 |

| Visit: | www.invesco.com/ETFs |

| | Invesco BulletShares 2028 Corporate Bond ETF | The Nasdaq Stock Market LLC |

|

Management Fees

|

% |

|

|

|

|

Other Expenses

|

|

|

|

|

|

Total Annual Fund Operating Expenses

|

|

|

|

|

|

1 Year

|

3 Years

|

5 Years

|

10 Years

|

| $ |

$ |

$ |

$ |

| | Period Ended | Returns |

| | | |

| | | |

| | | - |

Average Annual Total Returns (for the periods ended December 31, 2022)

| | Inception Date | 1 Year | Since Inception |

| Return Before Taxes | | - % | % |

| Return After Taxes on Distributions | | - | |

| Return After Taxes on Distributions and Sale of Fund Shares | | - | |

| | |||

| Nasdaq BulletShares® USD Corporate Bond 2028 Index | | - | |

| | |||

| Bloomberg US Corporate Index (reflects no deduction for fees, expenses or taxes) | | - | |

| | |||

| Name | Title with Adviser/Trust | Date Began Managing the Fund |

| Peter Hubbard | Head of Equities and Director of Portfolio Management of the Adviser; Vice President of the Trust | August 2018 |

| | ||

| Cynthia Madrigal | Portfolio Manager of the Adviser | December 2021 |

| | ||

| Gregory Meisenger | Portfolio Manager of the Adviser | August 2018 |

| | ||

| Jeremy Neisewander | Portfolio Manager of the Adviser | August 2018 |

Additional Information About the Fund’s Strategies and Risks

Tax Structure of ETFs

Portfolio Holdings

Management of the Fund

How to Buy and Sell Shares

Frequent Purchases and Redemptions of Shares

Dividends, Other Distributions and Taxes

Distributor

Net Asset Value

Fund Service Providers

Financial Highlights

| | Years Ended August 31, | ||||

| | 2023 | 2022 | 2021 | 2020 | 2019 |

| Per Share Operating Performance: | | | | | |

| Net asset value at beginning of year | $20.03 | $23.17 | $23.25 | $22.11 | $20.06 |

| Net investment income(a) | 0.76 | 0.47 | 0.52 | 0.64 | 0.77 |

| Net realized and unrealized gain (loss) on investments | (0.38) | (3.13) | (0.09)(b) | 1.12 | 1.97 |

| Total from investment operations | 0.38 | (2.66) | 0.43 | 1.76 | 2.74 |

| Distributions to shareholders from: | | | | | |

| Net investment income | (0.73) | (0.47) | (0.51) | (0.65) | (0.76) |

| Net realized gains | - | (0.01) | - | (0.00)(c) | - |

| Total distributions | (0.73) | (0.48) | (0.51) | (0.65) | (0.76) |

| Transaction fees(a) | - | - | - | 0.03 | 0.07 |

| Net asset value at end of year | $19.68 | $20.03 | $23.17 | $23.25 | $22.11 |

| Market price at end of year(d) | $19.69 | $19.96 | $23.18 | $23.25 | $22.17 |

| Net Asset Value Total Return(e) | 1.97% | (11.62)% | 1.90% | 8.33% | 14.38% |

| Market Price Total Return(e) | 2.38% | (11.96)% | 1.95% | 8.03% | 14.51% |

| Ratios/Supplemental Data: | | | | | |

| Net assets at end of year (000’s omitted) | $720,429 | $273,454 | $225,925 | $129,018 | $36,483 |

| Ratio to average net assets of: | | | | | |

| Expenses | 0.10% | 0.10% | 0.10% | 0.10% | 0.12%(f) |

| Net investment income | 3.86% | 2.20% | 2.24% | 2.89% | 3.74%(f) |

| Portfolio turnover rate(g) | 1% | 7% | 2% | 3% | 1% |

| (a) | Based on average shares outstanding. |

| (b) | Net realized and unrealized gain (loss) on investments per share may not correlate with the Fund’s net realized and unrealized gain (loss) due to timing of shareholder transactions in relation to the fluctuating market values of the Fund’s investments. |

| (c) | Amount represents less than $0.005. |

| (d) | The mean between the last bid and ask prices. |

| (e) | Net asset value total return is calculated assuming an initial investment made at the net asset value at the beginning of the period, reinvestment of all dividends and distributions at net asset value during the period, and redemption at net asset value on the last day of the period. Net asset value total return includes adjustments in accordance with accounting principles generally accepted in the United States of America and as such, the net asset value for financial reporting purposes and the returns based upon those net asset values may differ from the net asset value and returns for shareholder transactions. Market price total return is calculated assuming an initial investment made at the market price at the beginning of the period, reinvestment of all dividends and distributions at market price during the period, and sale at the market price on the last day of the period. Total investment returns calculated for a period of less than one year are not annualized. |

| (f) | Ratios include non-recurring costs associated with a proxy statement of 0.02%. |

| (g) | Portfolio turnover rate is not annualized for periods less than one year, if applicable, and does not include securities received or delivered from processing creations or redemptions. |

Index Provider

Disclaimers

Premium/Discount Information

Other Information

| Call: | Invesco Distributors, Inc. at 1-800-983-0903 Monday through Friday 8:00 a.m. to 5:00 p.m. Central Time |

| Write: | Invesco Exchange-Traded Self-Indexed Fund Trust c/o Invesco Distributors, Inc. 11 Greenway Plaza Houston, Texas 77046-1173 |

| Visit: | www.invesco.com/ETFs |

| | Invesco BulletShares 2029 Corporate Bond ETF | The Nasdaq Stock Market LLC |

|

Management Fees

|

% |

|

|

|

|

Other Expenses

|

|

|

|

|

|

Total Annual Fund Operating Expenses

|

|

|

|

|

|

1 Year

|

3 Years

|

5 Years

|

10 Years

|

| $ |

$ |

$ |

$ |

| | Period Ended | Returns |

| | | |

| | | |

| | | - |

Average Annual Total Returns (for the periods ended December 31, 2022)

| | Inception Date | 1 Year | Since Inception |

| Return Before Taxes | | - % | - % |

| Return After Taxes on Distributions | | - | - |

| Return After Taxes on Distributions and Sale of Fund Shares | | - | - |

| | |||

| Nasdaq BulletShares® USD Corporate Bond 2029 Index | | - | - |

| | |||

| Bloomberg US Corporate Index (reflects no deduction for fees, expenses or taxes) | | - | - |

| | |||

| Name | Title with Adviser/Trust | Date Began Managing the Fund |

| Peter Hubbard | Head of Equities and Director of Portfolio Management of the Adviser; Vice President of the Trust | September 2019 |

| | ||

| Cynthia Madrigal | Portfolio Manager of the Adviser | December 2021 |

| | ||

| Gregory Meisenger | Portfolio Manager of the Adviser | September 2019 |

| | ||

| Jeremy Neisewander | Portfolio Manager of the Adviser | September 2019 |

Additional Information About the Fund’s Strategies and Risks

Tax Structure of ETFs

Portfolio Holdings

Management of the Fund

How to Buy and Sell Shares

Frequent Purchases and Redemptions of Shares

Dividends, Other Distributions and Taxes

Distributor

Net Asset Value

Fund Service Providers

Financial Highlights

| | Years Ended August 31, | For the Period September 10, 2019(a) Through August 31, 2020 | ||

| | 2023 | 2022 | 2021 | |

| Per Share Operating Performance: | | | | |

| Net asset value at beginning of period | $18.22 | $21.37 | $21.51 | $20.00 |

| Net investment income(b) | 0.69 | 0.43 | 0.42 | 0.51 |

| Net realized and unrealized gain (loss) on investments | (0.38) | (3.15) | (0.14) | 1.47 |

| Total from investment operations | 0.31 | (2.72) | 0.28 | 1.98 |

| Distributions to shareholders from: | | | | |

| Net investment income | (0.64) | (0.43) | (0.42) | (0.51) |

| Net realized gains | - | (0.00)(c) | - | - |

| Total distributions | (0.64) | (0.43) | (0.42) | (0.51) |

| Transaction fees(b) | - | - | - | 0.04 |

| Net asset value at end of period | $17.89 | $18.22 | $21.37 | $21.51 |

| Market price at end of period(d) | $17.90 | $18.14 | $21.39 | $21.51 |

| Net Asset Value Total Return(e) | 1.79% | (12.84)% | 1.31% | 10.29%(f) |

| Market Price Total Return(e) | 2.29% | (13.30)% | 1.41% | 10.28%(f) |

| Ratios/Supplemental Data: | | | | |

| Net assets at end of period (000’s omitted) | $394,520 | $128,462 | $112,209 | $25,815 |

| Ratio to average net assets of: | | | | |

| Expenses | 0.10% | 0.10% | 0.10% | 0.10%(g) |

| Net investment income | 3.85% | 2.19% | 1.98% | 2.55%(g) |

| Portfolio turnover rate(h) | 1% | 6% | 0%(i) | 1% |

| (a) | Commencement of investment operations. |

| (b) | Based on average shares outstanding. |

| (c) | Amount represents less than $0.005. |

| (d) | The mean between the last bid and ask prices. |

| (e) | Net asset value total return is calculated assuming an initial investment made at the net asset value at the beginning of the period, reinvestment of all dividends and distributions at net asset value during the period, and redemption at net asset value on the last day of the period. Net asset value total return includes adjustments in accordance with accounting principles generally accepted in the United States of America and as such, the net asset value for financial reporting purposes and the returns based upon those net asset values may differ from the net asset value and returns for shareholder transactions. Market price total return is calculated assuming an initial investment made at the market price at the beginning of the period, reinvestment of all dividends and distributions at market price during the period, and sale at the market price on the last day of the period. Total investment returns calculated for a period of less than one year are not annualized. |

| (f) | The net asset value total return from Fund Inception (September 12, 2019, the first day of trading on the exchange) to August 31, 2020 was 10.96%. The market price total return from Fund Inception to August 31, 2020 was 10.45%. |

| (g) | Annualized. |

| (h) | Portfolio turnover rate is not annualized for periods less than one year, if applicable, and does not include securities received or delivered from processing creations or redemptions. |

| (i) | Amount represents less than 0.5%. |

Index Provider

Disclaimers

Premium/Discount Information

Other Information

| Call: | Invesco Distributors, Inc. at 1-800-983-0903 Monday through Friday 8:00 a.m. to 5:00 p.m. Central Time |

| Write: | Invesco Exchange-Traded Self-Indexed Fund Trust c/o Invesco Distributors, Inc. 11 Greenway Plaza Houston, Texas 77046-1173 |

| Visit: | www.invesco.com/ETFs |

| | Invesco BulletShares 2030 Corporate Bond ETF | The Nasdaq Stock Market LLC |

|

Management Fees

|

% |

|

|

|

|

Other Expenses

|

|

|

|

|

|

Total Annual Fund Operating Expenses

|

|

|

|

|

|

1 Year

|

3 Years

|

5 Years

|

10 Years

|

| $ |

$ |

$ |

$ |

| | Period Ended | Returns |

| | | |

| | | |

| | | - |

Average Annual Total Returns (for the periods ended December 31, 2022)

| | Inception Date | 1 Year | Since Inception |

| Return Before Taxes | | - % | - % |

| Return After Taxes on Distributions | | - | - |

| Return After Taxes on Distributions and Sale of Fund Shares | | - | - |

| | |||

| Nasdaq BulletShares® USD Corporate Bond 2030 Index | | - | - |

| | |||

| Bloomberg US Corporate Index (reflects no deduction for fees, expenses or taxes) | | - | - |

| | |||

| Name | Title with Adviser/Trust | Date Began Managing the Fund |

| Peter Hubbard | Head of Equities and Director of Portfolio Management of the Adviser; Vice President of the Trust | September 2020 |

| | ||

| Cynthia Madrigal | Portfolio Manager of the Adviser | December 2021 |

| | ||

| Gregory Meisenger | Portfolio Manager of the Adviser | September 2020 |

| | ||

| Jeremy Neisewander | Portfolio Manager of the Adviser | September 2020 |

Additional Information About the Fund’s Strategies and Risks

Tax Structure of ETFs

Portfolio Holdings

Management of the Fund

How to Buy and Sell Shares

Frequent Purchases and Redemptions of Shares

Dividends, Other Distributions and Taxes

Distributor

Net Asset Value

Fund Service Providers

Financial Highlights

| | Years Ended August 31, | For the Period September 14, 2020(a) Through August 31, 2021 | |

| | 2023 | 2022 | |

| Per Share Operating Performance: | | | |

| Net asset value at beginning of period | $16.48 | $19.77 | $20.00 |

| Net investment income(b) | 0.65 | 0.45 | 0.36 |

| Net realized and unrealized gain (loss) on investments | (0.45) | (3.32) | (0.27) |

| Total from investment operations | 0.20 | (2.87) | 0.09 |

| Distributions to shareholders from: | | | |

| Net investment income | (0.64) | (0.42) | (0.32) |

| Net asset value at end of period | $16.04 | $16.48 | $19.77 |

| Market price at end of period(c) | $16.03 | $16.38 | $19.79 |

| Net Asset Value Total Return(d) | 1.27% | (14.67)% | 0.45%(e) |

| Market Price Total Return(d) | 1.82% | (15.27)% | 0.55%(e) |

| Ratios/Supplemental Data: | | | |

| Net assets at end of period (000’s omitted) | $257,396 | $101,365 | $26,691 |

| Ratio to average net assets of: | | | |

| Expenses | 0.10% | 0.10% | 0.10%(f) |

| Net investment income | 4.06% | 2.60% | 1.89%(f) |

| Portfolio turnover rate(g) | 0% | 3% | 3% |

| (a) | Commencement of investment operations. |

| (b) | Based on average shares outstanding. |

| (c) | The mean between the last bid and ask prices. |

| (d) | Net asset value total return is calculated assuming an initial investment made at the net asset value at the beginning of the period, reinvestment of all dividends and distributions at net asset value during the period, and redemption at net asset value on the last day of the period. Net asset value total return includes adjustments in accordance with accounting principles generally accepted in the United States of America and as such, the net asset value for financial reporting purposes and the returns based upon those net asset values may differ from the net asset value and returns for shareholder transactions. Market price total return is calculated assuming an initial investment made at the market price at the beginning of the period, reinvestment of all dividends and distributions at market price during the period, and sale at the market price on the last day of the period. Total investment returns calculated for a period of less than one year are not annualized. |

| (e) | The net asset value total return from Fund Inception (September 16, 2020, the first day of trading on the exchange) to August 31, 2021 was 0.55%. The market price total return from Fund Inception to August 31, 2021 was 0.55%. |

| (f) | Annualized. |

| (g) | Portfolio turnover rate is not annualized for periods less than one year, if applicable, and does not include securities received or delivered from processing creations or redemptions. |

Index Provider

Disclaimers

Premium/Discount Information

Other Information

| Call: | Invesco Distributors, Inc. at 1-800-983-0903 Monday through Friday 8:00 a.m. to 5:00 p.m. Central Time |

| Write: | Invesco Exchange-Traded Self-Indexed Fund Trust c/o Invesco Distributors, Inc. 11 Greenway Plaza Houston, Texas 77046-1173 |

| Visit: | www.invesco.com/ETFs |

| | Invesco BulletShares 2031 Corporate Bond ETF | The Nasdaq Stock Market LLC |

|

Management Fees

|

% |

|

|

|

|

Other Expenses

|

|

|

|

|

|

Total Annual Fund Operating Expenses

|

|

|

|

|

|

1 Year

|

3 Years

|

5 Years

|

10 Years

|

| $ |

$ |

$ |

$ |

| | Period Ended | Returns |

| | | |

| | | |

| | | - |

Average Annual Total Returns (for the period ended December 31, 2022)

| | Inception Date | 1 Year | Since Inception |

| Return Before Taxes | | - % | - % |

| Return After Taxes on Distributions | | - | - |

| Return After Taxes on Distributions and Sale of Fund Shares | | - | - |

| | |||

| Nasdaq BulletShares® USD Corporate Bond 2031 Index | | - | - |

| | |||

| Bloomberg US Corporate Index (reflects no deduction for fees, expenses or taxes) | | - | - |

| | |||

| Name | Title with Adviser/Trust | Date Began Managing the Fund |

| Peter Hubbard | Head of Equities and Director of Portfolio Management of the Adviser; Vice President of the Trust | September 2021 |

| | ||

| Cynthia Madrigal | Portfolio Manager of the Adviser | December 2021 |

| | ||

| Gregory Meisenger | Portfolio Manager of the Adviser | September 2021 |

| | ||

| Jeremy Neisewander | Portfolio Manager of the Adviser | September 2021 |

Additional Information About the Fund’s Strategies and Risks

Tax Structure of ETFs

Portfolio Holdings

Management of the Fund

How to Buy and Sell Shares

Frequent Purchases and Redemptions of Shares

Dividends, Other Distributions and Taxes

Distributor

Net Asset Value

Fund Service Providers

Financial Highlights

| | Year Ended August 31, 2023 | For the Period September 13, 2021(a) Through August 31, 2022 |

| Per Share Operating Performance: | | |

| Net asset value at beginning of period | $16.36 | $20.00 |

| Net investment income(b) | 0.73 | 0.47 |

| Net realized and unrealized gain (loss) on investments | (0.62) | (3.68) |

| Total from investment operations | 0.11 | (3.21) |

| Distributions to shareholders from: | | |

| Net investment income | (0.70) | (0.43) |

| Net asset value at end of period | $15.77 | $16.36 |

| Market price at end of period(c) | $15.77 | $16.30 |

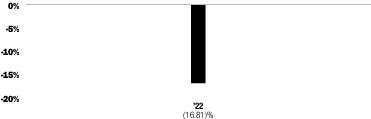

| Net Asset Value Total Return(d) | 0.73% | (16.17)%(e) |

| Market Price Total Return(d) | 1.10% | (16.48)%(e) |

| Ratios/Supplemental Data: | | |

| Net assets at end of period (000’s omitted) | $193,984 | $39,269 |

| Ratio to average net assets of: | | |

| Expenses | 0.10% | 0.10%(f) |

| Net investment income | 4.63% | 2.81%(f) |

| Portfolio turnover rate(g) | 0% | 1% |

| (a) | Commencement of investment operations. |

| (b) | Based on average shares outstanding. |

| (c) | The mean between the last bid and ask prices. |

| (d) | Net asset value total return is calculated assuming an initial investment made at the net asset value at the beginning of the period, reinvestment of all dividends and distributions at net asset value during the period, and redemption at net asset value on the last day of the period. Net asset value total return includes adjustments in accordance with accounting principles generally accepted in the United States of America and as such, the net asset value for financial reporting purposes and the returns based upon those net asset values may differ from the net asset value and returns for shareholder transactions. Market price total return is calculated assuming an initial investment made at the market price at the beginning of the period, reinvestment of all dividends and distributions at market price during the period, and sale at the market price on the last day of the period. Total investment returns calculated for a period of less than one year are not annualized. |

| (e) | The net asset value total return from Fund Inception (September 15, 2021, the first day of trading on the exchange) to August 31, 2022 was (16.25)%. The market price total return from Fund Inception to August 31, 2022 was (16.60)%. |

| (f) | Annualized. |

| (g) | Portfolio turnover rate is not annualized for periods less than one year, if applicable, and does not include securities received or delivered from processing creations or redemptions. |

Index Provider

Disclaimers

Premium/Discount Information

Other Information

| Call: | Invesco Distributors, Inc. at 1-800-983-0903 Monday through Friday 8:00 a.m. to 5:00 p.m. Central Time |

| Write: | Invesco Exchange-Traded Self-Indexed Fund Trust c/o Invesco Distributors, Inc. 11 Greenway Plaza Houston, Texas 77046-1173 |

| Visit: | www.invesco.com/ETFs |

| | Invesco BulletShares 2032 Corporate Bond ETF | The Nasdaq Stock Market LLC |

|

Management Fees

|

% |

|

|

|

|

Other Expenses

|

|

|

|

|

|

Total Annual Fund Operating Expenses

|

|

|

|

|

|

1 Year

|

3 Years

|

5 Years

|

10 Years

|

| $ |

$ |

$ |

$ |

| Name | Title with Adviser/Trust | Date Began Managing the Fund |

| Peter Hubbard | Head of Equities and Director of Portfolio Management of the Adviser; Vice President of the Trust | September 2022 |

| | ||

| Cynthia Madrigal | Portfolio Manager of the Adviser | September 2022 |

| | ||

| Gregory Meisenger | Portfolio Manager of the Adviser | September 2022 |

| | ||

| Jeremy Neisewander | Portfolio Manager of the Adviser | September 2022 |

Additional Information About the Fund’s Strategies and Risks

Tax Structure of ETFs

Portfolio Holdings

Management of the Fund

How to Buy and Sell Shares

Frequent Purchases and Redemptions of Shares

Dividends, Other Distributions and Taxes

Distributor

Net Asset Value

Fund Service Providers

Financial Highlights

| | For the Period September 6, 2022(a) Through August 31, 2023 |

| Per Share Operating Performance: | |

| Net asset value at beginning of period | $20.00 |

| Net investment income(b) | 0.99 |

| Net realized and unrealized gain (loss) on investments | (0.25) |

| Total from investment operations | 0.74 |

| Distributions to shareholders from: | |

| Net investment income | (0.88) |

| Net asset value at end of period | $19.86 |

| Market price at end of period(c) | $19.86 |

| Net Asset Value Total Return(d) | 3.74%(e) |

| Market Price Total Return(d) | 3.75%(e) |

| Ratios/Supplemental Data: | |

| Net assets at end of period (000’s omitted) | $143,018 |

| Ratio to average net assets of: | |

| Expenses | 0.10%(f) |

| Net investment income | 5.08%(f) |

| Portfolio turnover rate(g) | 7% |

| (a) | Commencement of investment operations. |

| (b) | Based on average shares outstanding. |

| (c) | The mean between the last bid and ask prices. |

| (d) | Net asset value total return is calculated assuming an initial investment made at the net asset value at the beginning of the period, reinvestment of all dividends and distributions at net asset value during the period, and redemption at net asset value on the last day of the period. Net asset value total return includes adjustments in accordance with accounting principles generally accepted in the United States of America and as such, the net asset value for financial reporting purposes and the returns based upon those net asset values may differ from the net asset value and returns for shareholder transactions. Market price total return is calculated assuming an initial investment made at the market price at the beginning of the period, reinvestment of all dividends and distributions at market price during the period, and sale at the market price on the last day of the period. Total investment returns calculated for a period of less than one year are not annualized. |

| (e) | The net asset value total return from Fund Inception (September 8, 2022, the first day of trading on the exchange) to August 31, 2023 was 3.40%. The market price total return from Fund Inception to August 31, 2023 was 3.43%. |

| (f) | Annualized. |

| (g) | Portfolio turnover rate is not annualized for periods less than one year, if applicable, and does not include securities received or delivered from processing creations or redemptions. |

Index Provider

Disclaimers

Premium/Discount Information

Other Information

| Call: | Invesco Distributors, Inc. at 1-800-983-0903 Monday through Friday 8:00 a.m. to 5:00 p.m. Central Time |

| Write: | Invesco Exchange-Traded Self-Indexed Fund Trust c/o Invesco Distributors, Inc. 11 Greenway Plaza Houston, Texas 77046-1173 |

| Visit: | www.invesco.com/ETFs |

| | Invesco BulletShares 2024 High Yield Corporate Bond ETF | The Nasdaq Stock Market LLC |

|

Management Fees

|

% |

|

|

|

|

Other Expenses

|

|

|

|

|

|

Acquired Fund Fees and Expenses1

|

|

|

|

|

|

Total Annual Fund Operating Expenses

|

|

|

|

|

|

1 Year

|

3 Years

|

5 Years

|

10 Years

|

| $ |

$ |

$ |

$ |

| | Period Ended | Returns |

| | | |

| | | |

| | | - |

Average Annual Total Returns (for the periods ended December 31, 2022)

| | Inception Date | 1 Year | 5 Years | Since Inception |

| Return Before Taxes | | - % | % | % |

| Return After Taxes on Distributions | | - | - | |

| Return After Taxes on Distributions and Sale of Fund Shares | | - | | |

| | ||||

| Nasdaq BulletShares® USD High Yield Corporate Bond 2024 Index deduction for fees, expenses or taxes) | | - | | |

| | ||||

| Bloomberg US Corporate High Yield Index (reflects no deduction for fees, expenses or taxes) | | - | | |

| | ||||

| Name | Title with Adviser/Trust | Date Began Managing the Fund |

| Peter Hubbard | Head of Equities and Director of Portfolio Management of the Adviser; Vice President of the Trust | April 2018 |

| | ||

| Cynthia Madrigal | Portfolio Manager of the Adviser | December 2021 |

| | ||

| Gregory Meisenger | Portfolio Manager of the Adviser | September 2018 |

| | ||

| Jeremy Neisewander | Portfolio Manager of the Adviser | April 2018 |

Additional Information About the Fund’s Strategies and Risks

Tax Structure of ETFs

Portfolio Holdings

Management of the Fund

How to Buy and Sell Shares

Frequent Purchases and Redemptions of Shares

Dividends, Other Distributions and Taxes

Distributor

Net Asset Value

Fund Service Providers

Financial Highlights

| | Years Ended August 31, | ||||

| | 2023 | 2022 | 2021 | 2020 | 2019 |

| Per Share Operating Performance: | | | | | |

| Net asset value at beginning of year | $22.20 | $25.09 | $24.34 | $25.20 | $24.85 |

| Net investment income(a) | 1.34 | 1.00 | 1.06 | 1.17 | 1.34 |

| Net realized and unrealized gain (loss) on investments | 0.31 | (2.91) | 0.75 | (0.87) | 0.39 |

| Total from investment operations | 1.65 | (1.91) | 1.81 | 0.30 | 1.73 |

| Distributions to shareholders from: | | | | | |

| Net investment income | (1.34) | (0.98) | (1.06) | (1.18) | (1.37) |

| Net realized gains | - | - | - | - | (0.05) |

| Total distributions | (1.34) | (0.98) | (1.06) | (1.18) | (1.42) |

| Transaction fees(a) | - | - | - | 0.02 | 0.04 |

| Net asset value at end of year | $22.51 | $22.20 | $25.09 | $24.34 | $25.20 |

| Market price at end of year(b) | $22.54 | $22.14 | $25.10 | $24.34 | $25.22 |

| Net Asset Value Total Return(c) | 7.70% | (7.76)% | 7.60% | 1.45% | 7.44% |

| Market Price Total Return(c) | 8.13% | (8.04)% | 7.64% | 1.38% | 7.22% |

| Ratios/Supplemental Data: | | | | | |

| Net assets at end of year (000’s omitted) | $652,921 | $481,782 | $363,855 | $175,241 | $98,261 |

| Ratio to average net assets of: | | | | | |

| Expenses, after Waivers | 0.42% | 0.42% | 0.42% | 0.42% | 0.42%(d) |

| Expenses, prior to Waivers | 0.42% | 0.42% | 0.42% | 0.42% | 0.43%(d) |

| Net investment income | 6.01% | 4.24% | 4.26% | 4.84% | 5.43%(d) |

| Portfolio turnover rate(e) | 78% | 58% | 52% | 34% | 22% |

| (a) | Based on average shares outstanding. |

| (b) | The mean between the last bid and ask prices. |