Use these links to rapidly review the document

TABLE OF CONTENTS

INDEX TO CONSOLIDATED FINANCIAL STATEMENTS

As filed with the Securities and Exchange Commission on November 28, 2016

Registration No. 333-214685

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 1

TO

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Cotiviti Holdings, Inc.

(Exact name of registrant as specified in its charter)

| Delaware (State or Other Jurisdiction of Incorporation or Organization) |

7389 (Primary Standard Industrial Classification Code Number) |

46-0595918 (I.R.S. Employer Identification Number) |

115 Perimeter Center Place

Suite 700

Atlanta, GA 30346

(770) 379-2800

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant's Principal Executive Offices)

J. Douglas Williams

Chief Executive Officer

115 Perimeter Center Place

Suite 700

Atlanta, GA 30346

(770) 379-2800

(Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent For Service)

| Copies to: | ||||

Alexander D. Lynch, Esq. Weil, Gotshal & Manges LLP 767 Fifth Avenue New York, New York 10153 (212) 310-8000 (Phone) (212) 310-8007 (Fax) |

Jonathan Olefson, Esq. Senior Vice President, General Counsel and Secretary 115 Perimeter Center Place Suite 700 Atlanta, GA 30346 (770) 379-2800 |

Peter M. Labonski, Esq. Keith L. Halverstam, Esq. Latham & Watkins LLP 885 Third Avenue New York, NY 10022 (212) 906-1200 (Phone) (212) 751-4864 (Fax) |

||

Approximate date of commencement of proposed sale to the public:

As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. o

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

Large accelerated filer o |

Accelerated filer o | Non-accelerated filer ý | Smaller reporting company o |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Information in this preliminary prospectus is not complete and may be changed. The selling stockholders may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED NOVEMBER 28, 2016

PRELIMINARY PROSPECTUS

10,000,000 Shares

Cotiviti Holdings, Inc.

Common Stock

The selling stockholders named in this prospectus are offering 10,000,000 shares of our common stock. We will not receive any proceeds from the sale of common stock to be offered by the selling stockholders. See "Use of Proceeds." Our common stock is listed on the New York Stock Exchange (the "NYSE") under the symbol "COTV." On November 25, 2016, the last sale price of our common stock as reported on the NYSE was $31.88 per share.

We are an "emerging growth company" as defined under the federal securities laws and, as such, will be subject to reduced public company reporting requirements. See "Prospectus Summary—Implications of Being an Emerging Growth Company."

Investing in our common stock involves a high degree of risk. See "Risk Factors" beginning on page 18 of this prospectus.

|

PER SHARE | TOTAL |

|||||

| | | | | | | | |

Public offering price |

$ | $ | |||||

Underwriting discounts and commissions(1) |

$ | $ | |||||

Proceeds to the selling stockholders, before expenses |

$ | $ |

- (1)

- We refer you to "Underwriting" beginning on page 152 of this prospectus for additional information regarding underwriter compensation.

Certain of the selling stockholders named in this prospectus have granted to the underwriters an option for a period of 30 days to purchase up to an additional 1,500,000 shares of common stock from such selling stockholders at the public offering price less underwriting discounts and commissions. We will not receive any proceeds from the sale of shares of our common stock by the selling stockholders if the underwriters exercise their option to purchase additional shares of our common stock.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

Delivery of the shares is expected to be made on or about , 2016.

| Goldman, Sachs & Co. | J.P. Morgan | |||

| Barclays | Citigroup | Credit Suisse | Morgan Stanley | SunTrust Robinson Humphrey |

| Baird | William Blair | Leerink Partners |

Prospectus dated , 2016.

You should rely only on the information contained in this prospectus or in any free writing prospectus we may specifically authorize to be delivered or made available to you. Neither we, the selling stockholders nor the underwriters (or any of our or their respective affiliates) have authorized anyone to provide any information other than that contained in this prospectus or in any free writing prospectus prepared by or on behalf of us or to which we have referred you. Neither we, the selling stockholders nor the underwriters (or any of our or their respective affiliates) take any responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. We, the selling stockholders and the underwriters (or any of our or their respective affiliates) are not making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. Persons outside the United States who come into possession of this prospectus and any free writing prospectus must inform themselves about, and observe any restrictions relating to, the offering of the shares of common stock and the distribution of this prospectus outside the United States. See "Underwriting." You should assume that the information appearing in this prospectus or any free writing prospectus is only accurate as of its date, regardless of its time of delivery or the time of any sale of shares of our common stock. Our business, financial condition, results of operations and prospects may have changed since that date.

Trademarks and Trade Names

We own or have the rights to use various trademarks, service marks and trade names referred to in this prospectus, including, among others, CotivitiSM, Connolly®, iHealth Technologies® and their respective logos. Solely for convenience, we refer to trademarks, service marks and trade names in this prospectus without the TM, SM and ® symbols. Such references are not intended to indicate, in any way, that we will not assert, to the fullest extent permitted by law, our rights to our trademarks, service marks and trade names. Other trademarks, service marks or trade names appearing in this prospectus are the property of their respective owners.

Market and Industry Information

Unless otherwise indicated, market data and industry information used throughout this prospectus is based on management's knowledge of the industry and the good faith estimates of management. We also relied, to the extent available, upon management's review of independent industry surveys and publications, other publicly available information prepared by a number of sources, including the Centers for Medicare and Medicaid Services ("CMS"), the Centers for Disease Control and Prevention, the Federal Bureau of Investigation, Atlantic Information Systems' Directory of Health Plans, the National Retail Federation, the Kaiser Family Foundation Report, SNL Financial and the RAND Corporation. All of the market data and industry information used in this prospectus involves a number of assumptions and limitations. You are cautioned not to give undue weight to such market data, industry information or estimates. Although we believe that these sources are reliable, neither we nor the underwriters can guarantee the accuracy or completeness of this information and neither we nor the underwriters have independently verified this information. While we believe the estimated market position, market opportunity and market size information included in this prospectus is generally reliable, such information, which is derived in part from management's estimates and beliefs, is inherently uncertain and imprecise. Projections, assumptions and estimates of our future performance and the future performance of the industry in which we operate are necessarily subject to a high degree of uncertainty and risk due to a variety of factors, including those described in "Risk Factors," "Cautionary Note Regarding Forward-Looking Statements" and elsewhere in this prospectus. These and other factors could cause results to differ materially from those expressed in our estimates and beliefs and in the estimates prepared by independent parties.

This summary highlights information appearing elsewhere in this prospectus. This summary is not complete and does not contain all of the information that you should consider before making a decision to participate in this offering. You should carefully read the entire prospectus, including the information presented under "Risk Factors," "Management's Discussion and Analysis of Financial Condition and Results of Operations," "Unaudited Pro Forma Consolidated Financial Statements" and the consolidated financial statements and notes related thereto included elsewhere in this prospectus, before making an investment decision. Unless the context requires otherwise, references to "our company," "we," "us," "our" and "Cotiviti" refer to Cotiviti Holdings, Inc. and its direct and indirect subsidiaries on a consolidated basis.

Overview

Cotiviti is a leading provider of analytics-driven payment accuracy solutions, focused primarily on the healthcare sector. Our integrated solutions help clients enhance payment accuracy in an increasingly complex healthcare environment. We leverage our robust technology platform, configurable analytics, proprietary information assets and expertise in healthcare reimbursement to help our clients enhance their claims payment accuracy. We help our healthcare clients identify and correct payment inaccuracies, which resulted in over $2.7 billion in savings in 2015. We work with over 40 healthcare organizations, including eight of the ten largest U.S. commercial, Medicare and Medicaid managed health plans, as well as CMS. We are also a leading provider of payment accuracy solutions to over 35 retail clients, including eight of the ten largest retailers in the United States.

Timely and accurate healthcare claims processing is critical to the U.S. healthcare system. The administration of healthcare claims is complex and payment inaccuracies can occur for many reasons. Changes in the healthcare industry, such as increasingly complex reimbursement models, increased coding complexity, changing demographics, the shift to managed care plans within government healthcare and increased healthcare coverage, are expected to further increase the complexity of healthcare payments. We support healthcare payers in managing these complexities in the claims payment process. Our analytics-driven solutions review claims for accuracy with respect to billing accuracy, contract compliance, payment responsibility and clinical appropriateness before and after claims are paid.

We were formed in May 2014 through the merger (the "Connolly iHealth Merger") of Connolly Superholdings, Inc. ("Connolly"), a leader in retrospective payment (post-payment) accuracy solutions for the healthcare and retail sectors and iHealth Technologies, Inc. ("iHealth Technologies"), a leader in prospective payment (pre-payment) accuracy solutions for the healthcare sector. Through the merger, we significantly broadened our suite of payment accuracy solutions, expanded our client base, enhanced our subject matter expertise and positioned ourselves for continued growth.

We have multiple strategies for achieving this continued growth. There are significant opportunities to grow our business within our existing client base by increasing the volume of claims we review with our solutions, expanding the utilization of our solutions within these claims and cross-selling our prospective and retrospective solutions. As a result of the Connolly iHealth Merger, we have cross-sell opportunities across more than half of our healthcare client base. We have a long history of innovation in improving our existing solutions, developing new solutions and expanding the scope of our services. We intend to expand our client base by targeting healthcare payers who utilize competing third party or internal payment accuracy solutions. Additionally, we plan to selectively pursue acquisitions and strategic partnerships in payment accuracy and adjacent markets.

As a result of the meaningful savings we deliver to our clients, we have increased our client base and strengthened our long-standing relationships with many of the leading healthcare payers in the United States. The average length of our relationships with our ten largest healthcare clients is approximately 11 years, and since January 1, 2013, we have successfully retained all of our healthcare clients except one, who represented less than 2% of our revenue. We have also substantially increased the annual savings captured by our healthcare clients over time. As a result, we believe our revenue is highly recurring and we have strong visibility into our revenue.

We are also a leading provider of payment accuracy solutions to the retail market. Retailers process and validate extremely high volumes of transactions with disparate suppliers on varying terms. We work with retail clients in the United States, Canada and the United Kingdom to realize their negotiated allowances, concessions, rebates and other incentives associated with merchandise procurement, logistics and other service transactions. In 2015, we generated over $500 million in savings for our retail clients.

Our track record of consistently delivering value for our clients has enabled strong growth in our revenue and profitability, especially within our core healthcare payer client base. For the nine months ended September 30, 2016 and the year ended December 31, 2015, our total revenue was $457.3 million and $541.3 million, respectively. In these same periods, we generated Adjusted EBITDA of $175.3 million and $203.4 million, respectively, representing 38.3% and 37.6% of revenue, respectively, and net income of $23.6 million and $13.9 million, representing 5.2% and 2.6% of revenue, respectively. For a reconciliation of Adjusted EBITDA, a non-GAAP measure, to our net income (loss), see "—Summary Historical Consolidated Financial and Other Data."

We operate in two segments, (i) Healthcare and (ii) Global Retail and Other. Through our Healthcare segment, we offer prospective and retrospective claims accuracy solutions to healthcare payers in the United States. We also provide analytics based solutions unrelated to our healthcare payment accuracy solutions, on a limited basis in the United States. Through our Global Retail and Other segment, we provide retrospective claims accuracy solutions to retailers primarily in the United States, Canada and the United Kingdom, as well as solutions that improve efficiency and effectiveness of payment networks for a limited number of clients. We derived 88.3% and 86.4% of our revenue for the nine months ended September 30, 2016 and 2015, respectively, and 86.3% and 81.6% of our revenue for the years ended December 31, 2015 and 2014, respectively, from our Healthcare segment. The remaining 11.7% and 13.6% of our revenue for the nine months ended September 30, 2016 and 2015, respectively, and the remaining 13.7% and 18.4% of our revenue for the years ended December 31, 2015 and 2014, respectively, were derived from our Global Retail and Other segment.

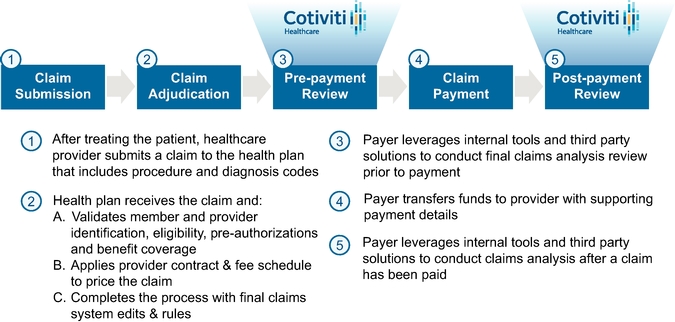

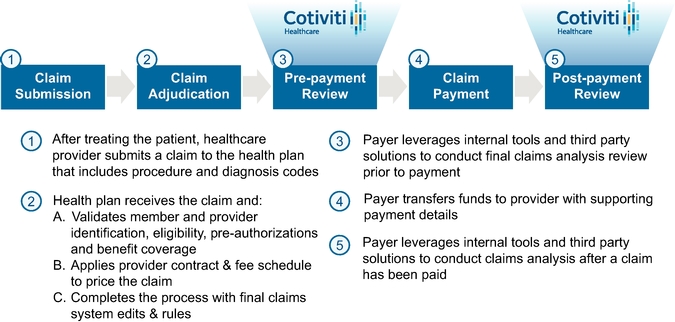

The Payment Process

Timely and accurate healthcare claims processing is critical to the U.S. healthcare system. This process is complicated and involves applying specific codes, policies and contracts, cross-referencing disparate data sources, and, in many cases, adhering to regulatory requirements. To ensure prompt and accurate claims reimbursement, payers utilize internal processes and systems and third party solutions to review claims and apply analytics throughout the claims payment process. The following graphic represents the healthcare claims payment process.

2

After delivering care, a provider initiates the claims payment process by submitting a claim for reimbursement to the patient's health insurance carrier (Step 1). After the insurance carrier (payer) uses internal and external tools to conform the claim to its claims processing system, it validates that the patient is a member, that the services provided were eligible under the member's benefits and that appropriate prior authorizations were in place, if necessary. The payer then adjudicates the claim by applying the provider's contract and fee schedule to the claim along with any claim system edits (Step 2). During this adjudication process, the payer uses payment accuracy solutions to perform claim reviews for information discrepancies between the provider's submission and the payer's payment policies. These reviews range in complexity and can be executed by the payer or by third party solutions. After the claim has been adjudicated but before the claim is paid, the payer may utilize advanced, automated analytical solutions, such as those we provide, to review the claim to identify additional discrepancies (Step 3). If the prepayment review identifies a claim inaccuracy, the payer makes the correction and pays the corrected claim (Step 4).

After payment is made and additional information becomes available, the payer and third party solutions such as Cotiviti's continue to identify, select and evaluate claims for payment accuracy (Step 5). If this retrospective payment review identifies a payment inaccuracy, the payer makes the correction and recovers overpayments through offsets against future claims or by seeking reimbursement from the provider.

We apply our analytics-driven payment accuracy solutions at multiple points across the client's claims processing cycle. Our extensive library of complex payment analytics is designed to identify, select and make recommendations for correct application of contracts and coding to meet client payment policies.

Our Solutions

The following is a description of our payment accuracy solutions:

Prospective Claims Accuracy Solutions. Our prospective claims accuracy solutions help our healthcare clients identify and address claim discrepancies immediately following claim adjudication and before a claim is paid to a healthcare provider. We help our clients ensure that claims payments meet regulatory, compliance, industry and health plan requirements based on correct coding and clinical guidelines. We customize, configure and integrate our payment policy

3

algorithms to enhance our clients' claims payment systems and automatically and efficiently review our clients' adjudicated claims. By directly interfacing with our clients' systems, our solutions analyze claims either in real-time or in batch processes. Our algorithms apply our proprietary library of current payment policies including industry, regulatory and medical specialty coding requirements as well as customized health plan rules. We review claims on a transactional as well as longitudinal basis, evaluating against our accumulated claims data, to make accurate payment policy recommendations. We believe that our differentiated content library, configurable algorithms and other post-adjudication software tools provide our clients with a more thorough and client-specific analysis of claims than other claims adjudication systems, creating more value for our clients. In 2015, our prospective claims accuracy solutions analyzed over $65 billion in claims.

Retrospective Claims Accuracy Solutions. Our retrospective claims accuracy solutions help health insurers identify and resolve payment inaccuracies after a claim has been paid to a healthcare provider. These solutions utilize sophisticated analytics and data mining tools to identify potential inaccuracies. Our claim analytics include longitudinal reviews of data to identify discrepancies that may span multiple claims and time periods. Our analytics are configurable to our clients' claims payment processes and enable us to prioritize areas of review based on our clients' operational and financial objectives. If expert validation is required, our claims analysts conduct a deeper review of more complex reimbursement issues. In analyzing claims retrospectively, we leverage additional information sources and broader data sets beyond the claims files, many of which only become accessible post-payment. These data and retrospective analytics enable reviews of a variety of payment accuracy categories, including issues relating to coordination of benefits, member eligibility and provider adherence to complex contract conditions. We also can provide clinical chart validation for our clients, in which our certified clinical and coding specialists review the clinical documentation associated with a claim. Clinical chart validation provides our clients with broader payment accuracy reviews beyond claims files analysis, including more complex clinical appropriateness and payment policies. We believe that our combination of retrospective analytics and clinical and coding expertise provides our clients with more thorough and configurable solutions than they are able to develop on their own, leading to increased savings for our clients. In 2015, our retrospective claims accuracy solutions analyzed over $442 billion in claims.

Other Services. Beyond our prospective and retrospective claims accuracy solutions, we provide analytics and support to our clients in optimizing their operations and enterprise-wide claims payments and trends. These offerings include selective anti-fraud, waste and abuse analytics to identify abnormal patterns in coding and billing practices. We also provide our clients with ongoing surveillance and longitudinal analytics by reviewing claims submissions and payments across multiple dimensions, including provider, plan-type, procedure and others. In addition, clients engage us for comprehensive claims history analytics to identify necessary areas for direct interaction, as well as to identify policy and program changes that can improve future payment accuracy.

Healthcare Industry Overview

The market for payment accuracy solutions is large and growing, driven by increasing healthcare costs and payment complexities. From 2004 to 2014, healthcare costs in the United States grew at a 4.8% compounded annual growth rate ("CAGR") to $3.0 trillion and are projected to total $3.2 trillion in 2015. According to CMS, healthcare costs are expected to continue to grow at an average annual rate of 5.8% through 2025. The introduction of new reimbursement models, the increase in coding complexity and the shift to managed care plans within government healthcare are expected to further increase the complexity of healthcare payments.

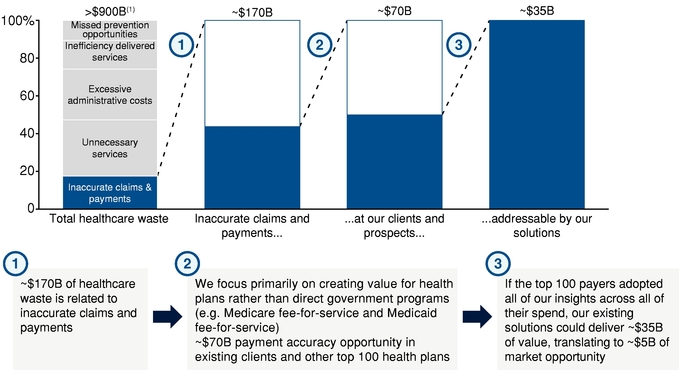

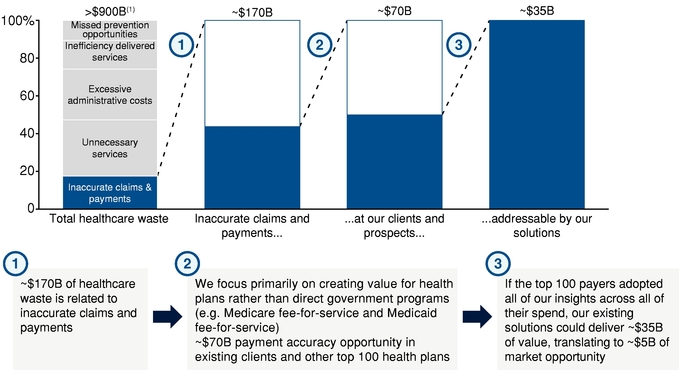

We believe that there is substantial opportunity for continued growth in the payment accuracy solutions market. We estimate that there was approximately $900 billion in unnecessary or wasteful

4

spending in the U.S. healthcare system in 2015. The U.S. federal government estimates that inaccurate provider claim submissions totaled between 3% and 10% of annual healthcare spend and we estimate that there were approximately $170 billion of inaccurate provider claim submissions in 2015. Healthcare payers will continue to invest in payment accuracy solutions in an effort to identify and resolve these inaccurate billings. We estimate that the relevant savings opportunity addressable by our current payment accuracy solutions is approximately $35 billion, for a total addressable market of approximately $5 billion. Approximately 75% of our addressable market is within our existing client base and the balance is new client prospects across the 100 largest health plans.

Cotiviti's potential savings impact and addressable market opportunity

- (1)

- Source: Institute of Medicine and CMS

Our Strengths

Our operational and financial success is based on the following key strengths:

Broad suite of specialized solutions. We offer a broad suite of analytics-driven payment accuracy solutions that deliver measurable value to our clients and are highly configurable across provider settings and claim types. Our suite of solutions includes prospective and retrospective analytics that review billing accuracy, contract compliance, payment responsibility and clinical appropriateness. We believe that the breadth of our solutions across multiple points in the claims payment process and the depth of our expertise and capabilities are difficult for any single healthcare payer to replicate.

Large and expanding library of information and knowledge assets. Our robust library of information assets includes proprietary algorithms and concepts developed by our research teams over 15 years. We believe that our library of accumulated information and unique knowledge assets is a differentiator that is difficult to replicate by current or potential competitors and provides a

5

competitive advantage. We continuously expand and improve the quality of our library by regularly incorporating new claims data and up-to-date algorithms and concepts. We also have a team of full-time, dedicated, doctors, nurses, claims coders, forensic auditors and other experts focused on developing new proprietary algorithms and analytics assets for our payment accuracy solutions. Additionally, our team of specialists monitors hundreds of content sources on medical and payment policy to ensure our algorithms and concepts incorporate the latest standards.

Advanced and proprietary technology platform and analytics capabilities. Our advanced proprietary platform and analytics capabilities are the result of significant investment in our technology infrastructure and applications. We are continually developing and improving our scalable technology platform to deliver the speed, integrity and quality necessary for client-specific business solutions. In addition, our focus on analytics, automation and knowledge-sharing allows us to quickly and accurately implement existing algorithms and concepts as well as solutions for newly identified reimbursement discrepancies. We believe that our proprietary technology platform is a key driver of our leading market position.

Aligned financial model that delivers measureable return. Our financial performance is directly tied to the savings we deliver to our clients. The majority of our contracts are structured such that we receive a percentage of the savings that we help our clients achieve. We have consistently generated a high return on investment for our clients of approximately 4 to 1 as a result of our aligned financial model. The savings we deliver are incremental to our clients' internal payment accuracy capabilities. As a result, we can provide a substantial contribution to our clients' earnings and create strong alignment and durability in our client relationships. In 2015 and 2014, our commercial healthcare clients realized over $2.5 billion and over $2.0 billion, respectively, in savings using our solutions.

Long-standing and expanding client relationships. Our client base includes the largest and most recognized healthcare organizations in the United States, including eight of the ten largest U.S. commercial, Medicare and Medicaid managed health plans, as well as CMS. The average length of our relationships with our top ten healthcare clients is approximately 11 years. We also have strong, long-standing relationships with over 35 retail clients, including eight of the ten largest U.S. retailers. We believe our robust client relationships and strong client retention rates reflect a high level of satisfaction with our solutions. Over time, we have expanded the breadth and depth of our existing client relationships, thus further integrating us into our clients' payment accuracy processes.

Attractive operating model. We believe we have an attractive operating model due to the recurring nature of our revenue, the scalability of our solutions and the low capital intensity/high free cash flow conversion of our business. Since January 1, 2013, we have successfully retained all of our healthcare clients except one, who represented less than 2% of our revenue. We believe our client retention rate reflects strong satisfaction with our solutions. Additionally, our information asset and technology platform is highly scalable, which allows us to accommodate significant additional transaction volumes with limited incremental costs. We have low capital needs that allow us to generate strong cash flow. Our capital expenditures as a percentage of revenue were 4.9% and 4.2% during the nine months ended September 30, 2016 and the year ended December 31, 2015, respectively. We believe our recurring revenue, combined with our scalable solutions and low capital intensity, will continue to contribute to our long-term growth, strong operating margins and flexibility in allocating capital.

History of innovation. We have a long history of developing innovative solutions which we continuously incorporate into our suite of offerings. Many of our solutions have been generated as a response to complex client issues. This development process has continually enhanced our solutions, thereby optimizing the value we deliver to our clients over time and allowing us to thrive

6

in an ever-changing and increasingly complex healthcare environment. Our track record of innovation is strengthened by the diverse backgrounds of our clinical and coding specialists who continually and consistently update and develop our content library and analytical algorithms and identify new ways to accelerate our value creation for our clients.

Experienced management team with a track record of performance. Our leadership team brings extensive and relevant expertise in the payment accuracy market. Our management has a proven track record in adapting to clients' needs and developing innovative analytical solutions to drive growth and profitability. With our talented management team, we believe we are positioned for long-term growth.

Our Growth Strategies

We believe we are well positioned to benefit from the expected growth in claims processing complexity, healthcare spend and healthcare insurance coverage, which we expect will drive continued demand for payment accuracy solutions among healthcare payers. Our strategies for achieving growth include:

Expand within our existing client base. We have significant opportunities to expand our business within our existing client base through the following strategies:

- •

- Increase the volume of claims reviewed by our

solutions. When our clients initially implement our solutions, they typically start by having us review a subset of their claims. As we

demonstrate success and deliver value, our clients often increase the volume of claims we review. We have significant opportunities to evaluate additional claim types, plan types, geographic regions

and/or provider settings. In 2015, we reviewed approximately 15% and 61% of the healthcare claims of our clients who used our prospective and retrospective solutions, respectively.

- •

- Expand the utilization of our

solutions. When our clients initially implement our solutions, they typically start with a subset of our algorithms and analytical tools. As we

demonstrate success and deliver value, our clients often expand the utilization of our algorithms and analytical tools. The opportunity to expand the utilization of our solutions is significant.

- •

- Cross-sell between prospective and retrospective solutions. We believe we have a significant opportunity to further cross-sell our solutions to existing clients. As a result of the Connolly iHealth Merger, we have cross-sell opportunities across more than half of our healthcare client base. We are actively engaging with existing clients to cross-sell our solutions.

Expand our client base. There is a significant opportunity to increase our client base of healthcare payers by targeting new relationships. The top 100 healthcare payers that are not our existing clients made approximately $240 billion in payments in 2015. We are pursuing these healthcare payers as potential new clients by leveraging our proven value proposition, leadership position, track record of performance and the strong references provided by our diversified client base of leading health plans.

Continue to innovate. We plan to enhance our existing solutions by developing new concepts and analytical algorithms and improving our information assets to allow us to expand our value creation for our clients. We also plan to continue to improve our processes and upgrade our technology infrastructure to improve the efficiency with which we deliver our solutions. Additionally, we will continue to monitor the evolution of the healthcare environment and develop new solutions in anticipation of increasing complexity in reimbursement models to supplement our core payment accuracy solutions.

7

Selectively pursue acquisitions and strategic partnerships. We plan to selectively pursue acquisitions and strategic partnerships to (i) accelerate the pace of innovation and expansion of our core solutions, (ii) provide cross-sell opportunities, (iii) offer complementary data, technologies or industry expertise to our existing analytics-driven payment accuracy solutions or (iv) expand our addressable market beyond payment accuracy to address other dimensions of healthcare waste, potentially including missed prevention opportunities, inefficiently delivered services, excessive administrative costs and unnecessary services. We have a successful track record of identifying, acquiring and integrating high-quality solutions providers that complement and enhance the value of our existing solutions, as demonstrated by the Connolly iHealth Merger.

Our Initial Public Offering

On May 25, 2016, we priced our initial public offering ("IPO") of 12,500,000 shares of our common stock. On May 26, 2016, our common stock began trading on the NYSE under the ticker symbol "COTV." In addition, on June 29, 2016, the underwriters of our IPO exercised their option to purchase an additional 436,038 shares of common stock from us. As a result, 12,936,038 shares of common stock were issued and sold at a price of $19.00 per share. We received net proceeds from our IPO (including the exercise of the underwriters' option) of $227.0 million, after deducting the underwriting discounts and commissions and other offering expenses of approximately $18.9 million. We used the net proceeds from our IPO to repay a portion of our outstanding borrowings under the Initial Second Lien Credit Facility (as defined below) and the remainder for working capital.

Our Refinancing

On September 28, 2016, our subsidiary Cotiviti Corporation ("Cotiviti Corp.") and certain other of our subsidiaries entered into an Amended and Restated First Lien Credit Agreement ("Restated Credit Agreement") pursuant to which the lenders party thereto agreed to provide first lien credit facilities ("First Lien Credit Facilities") consisting of (a) first lien term A loans (the "First Lien Term A Loans") in the original principal amount of $250.0 million, (b) first lien term B loans (the "First Lien Term B Loans") in the original principal amount of $550.0 million (together with the First Lien Term A Loans, the "First Lien Term Loans") and (c) a $100.0 million revolving credit facility (the "Revolver"). In connection with entering into the Restated Credit Agreement, we refinanced our outstanding first lien credit facilities (the "Initial First Lien Credit Facilities") and second lien credit facility (the "Initial Second Lien Credit Facility" and together with the Initial First Lien Credit Facilities, the "Initial Secured Credit Facilities").

Implications of Being an Emerging Growth Company

As a company with less than $1.0 billion in gross revenue during our last fiscal year, we qualify as an "emerging growth company" as defined in the Jumpstart Our Business Startups Act of 2012 (the "JOBS Act"). An emerging growth company may take advantage of specified reduced reporting and other regulatory requirements for up to five years that are otherwise applicable generally to public companies. These provisions include, among other matters:

- •

- requirement to present only two years of audited financial statements and only two years of related Management's Discussion and Analysis of

Financial Condition and Results of Operations;

- •

- exemption from the auditor attestation requirement on the effectiveness of our system of internal control over financial reporting pursuant to the Sarbanes-Oxley Act of 2002, as amended (the "Sarbanes-Oxley Act");

8

- •

- exemption from the adoption of new or revised financial accounting standards until they would apply to private companies;

- •

- exemption from compliance with any new requirements adopted by the Public Company Accounting Oversight Board requiring mandatory audit firm

rotation or a supplement to the auditor's report in which the auditor would be required to provide additional information about the audit and the financial statements of the issuer;

- •

- an exemption from the requirement to seek non-binding advisory votes on executive compensation and golden parachute arrangements; and

- •

- reduced disclosure about executive compensation arrangements.

We will remain an emerging growth company until the last day of the fiscal year following the fifth anniversary of the completion of our IPO unless, prior to that time, we have more than $1.0 billion in annual gross revenue, have a market value for our common stock held by non-affiliates of more than $700 million as of the last day of our second fiscal quarter of the fiscal year and a determination is made that we are deemed to be a "large accelerated filer," as defined in Rule 12b-2 promulgated under the Securities Exchange Act of 1934, as amended (the "Exchange Act") or issue more than $1.0 billion of non-convertible debt over a three-year period, whether or not issued in a registered offering. We have availed ourselves of the reduced reporting obligations with respect to audited financial statements and related Management's Discussion and Analysis of Financial Condition and Results of Operations and executive compensation disclosure in this prospectus, and expect to continue to avail ourselves of the reduced reporting obligations available to emerging growth companies in future filings with the Securities and Exchange Commission (the "SEC").

In addition, Section 107 of the JOBS Act also provides that an emerging growth company can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act of 1933, as amended (the "Securities Act") for complying with new or revised accounting standards. An emerging growth company can, therefore, delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. However, we are choosing to "opt out" of that extended transition period and, as a result, we plan to comply with new and revised accounting standards on the relevant dates on which adoption of those standards is required for non-emerging growth companies. Section 107 of the JOBS Act provides that our decision to opt out of the extended transition period for complying with new or revised accounting standards is irrevocable.

As a result of our decision to avail ourselves of certain provisions of the JOBS Act, the information that we provide may be different than what you may receive from other public companies in which you hold an equity interest. In addition, it is possible that some investors will find our common stock less attractive as a result of our elections, which may cause a less active trading market for our common stock and more volatility in our stock price.

Risks Associated with Our Business

Investing in our common stock involves a number of risks. These risks represent challenges to the successful implementation of our strategy and the growth of our business. Some of these risks are:

- •

- Our business and future growth depend on our ability to successfully expand the scope of claims reviewed for, and cross-sell additional

solutions to, our existing client base.

- •

- Internal improvements to healthcare claims and retail billing processes by our clients could reduce the need for, or revenue generated by, our solutions.

9

- •

- Healthcare spending fluctuations, simplification of the healthcare delivery and reimbursement system, programmatic changes to the scope of

benefits and limitations to payment integrity initiatives could reduce the need for and the price of our solutions.

- •

- We may be materially adversely affected if our clients do not renew their agreements with us, renew at lower performance fee levels, choose to

reduce the number of claims reviewed by our solutions, or prematurely terminate their agreements with us, and we are unable to replace any related lost revenue.

- •

- If we are unable to develop new client relationships, it could have a material adverse effect on our business, financial condition and results

of operations.

- •

- We may face system interruptions or failures, including cyber-security breaches and other disruptions that could compromise our information.

- •

- We may be adversely affected if we fail to innovate and develop new solutions for our clients or if any such solutions are not adopted by

existing and potential clients.

- •

- Any failure to comply with current and future regulatory requirements, including applicable privacy, security and data laws, regulations and

standards, could have a material adverse effect on our business, financial condition and results of operations.

- •

- We face significant competition for our solutions and we expect competition to increase.

- •

- Our outstanding indebtedness could adversely affect our financial condition.

- •

- We are controlled by Advent, as defined below, whose interests may differ from those of our public stockholders.

- •

- We have elected to take advantage of the "controlled company" exemption to the corporate governance rules for publicly-listed companies, which could make our common stock less attractive to some investors or otherwise harm our stock price.

For a discussion of these and other risks you should consider before making an investment in our common stock, see the section entitled "Risk Factors."

Our Private Equity Sponsor

Founded in 1984, Advent International Corporation ("Advent") has invested in more than 315 private equity transactions in 40 countries and, as of June 30, 2016, had $40.4 billion in assets under management. With offices on four continents, the Advent team includes more than 190 investment professionals across North America, Europe, Latin America and Asia. Advent focuses on investments in five core sectors, including business and financial services; healthcare; industrial; retail, consumer and leisure; and technology, media and telecom.

Following the closing of this offering, funds managed by Advent (the "Advent Funds") are expected to own approximately 56.0% of our outstanding common stock, or 54.5%, if the underwriters' option to purchase additional shares is fully exercised. As a result, Advent will be able to exercise significant voting influence over fundamental and significant corporate matters and transactions. See "Risk Factors—Risks Relating to This Offering and Ownership of Our Common Stock" and "Principal and Selling Stockholders."

Corporate Information

We were incorporated in Delaware on June 4, 2012, under the name "Husky-C&W Superholdings, Inc." On July 26, 2012, we changed our name to "Strident Superholding, Inc." and on January 28, 2014, we changed our name to "Connolly Superholdings, Inc." On May 14, 2014,

10

we acquired the stock of iHealth Technologies, resulting in the Connolly iHealth Merger, and on September 24, 2015, we changed our name to "Cotiviti Holdings, Inc." Our principal executive offices are located at 115 Perimeter Center Place, Suite 700 Atlanta, GA 30346, and our telephone number is (770) 379-2800. Our corporate website address is www.cotiviti.com. Our website and the information contained on, or that can be accessed through, the website is not deemed to be incorporated by reference in, and is not considered part of, this prospectus. You should not rely on any such information in making your decision whether to purchase our common stock.

11

Common stock offered by the selling stockholders |

10,000,000 shares of common stock (11,500,000 shares if the underwriters' option to purchase additional shares is exercised in full). | |

Common stock to be outstanding after this offering |

90,170,462 shares of common stock (without giving effect to the completion of the Concurrent Option Exercise (as defined below) under the 2012 Plan (as defined below)). |

|

Option to purchase additional shares of common stock |

The underwriters have an option to purchase an additional 1,500,000 shares of common stock from the selling stockholders. The underwriters can exercise this option at any time within 30 days from the date of this prospectus. |

|

Use of proceeds |

We will not receive any proceeds from the sale of shares of common stock by the selling stockholders. See "Use of Proceeds." |

|

Dividend policy |

We do not anticipate paying any dividends on our common stock for the foreseeable future; however, we may change this policy in the future. See "Dividend Policy." |

|

Controlled company exemption |

After completion of this offering, we will continue to be considered a "controlled company" for the purposes of the NYSE listing requirements. See "Management—Director Independence and Controlled Company Exemption." |

|

Risk factors |

Investing in our common stock involves a high degree of risk. See the "Risk Factors" section of this prospectus beginning on page 18 for a discussion of factors you should carefully consider before deciding to purchase shares of our common stock. |

|

Listing |

Our shares are listed on the NYSE under the symbol "COTV." |

Except as otherwise indicated, the number of shares of our common stock to be outstanding after this offering is based on 90,170,462 shares outstanding as of September 30, 2016 and:

- •

- excludes an aggregate of 6,664,794 shares of our common stock issuable upon the exercise of 6,601,890 issued and outstanding stock options

(including 77,434 shares to be issued upon exercise of vested stock options by certain directors, officers and employees concurrently with this offering, and to be sold in this offering (the

"Concurrent Option Exercise")) and the vesting of 62,904 issued and outstanding restricted stock units ("RSUs"); and

- •

- excludes an aggregate of 5,248,202 shares of common stock that will be available for future equity awards under our Cotiviti

Holdings, Inc. 2012 Equity Incentive Plan (the "2012 Plan") and our Cotiviti Holdings, Inc. 2016 Incentive Equity Plan (the "2016 Plan" and together with the 2012 Plan, the "Equity

Plans").

- •

- Unless otherwise indicated, all information in this prospectus assumes no exercise of the underwriters' option to purchase from selling stockholders up to 1,500,000 additional shares of our common stock.

12

SUMMARY HISTORICAL CONSOLIDATED FINANCIAL AND OTHER DATA

The following tables set forth our summary historical consolidated financial and other data for the periods as of the dates indicated. We derived the summary consolidated statement of operations data for the years ended December 31, 2015 and 2014 and the balance sheet data as of December 31, 2015 from the audited consolidated financial statements and related notes thereto included elsewhere in this prospectus. We derived the summary consolidated statement of operations data for the nine months ended September 30, 2016 and 2015 and the balance sheet data as of September 30, 2016 from our unaudited consolidated financial statements and related notes thereto included elsewhere in this prospectus. The unaudited consolidated financial statements have been prepared on a basis consistent with our audited consolidated financial statements included in this prospectus and, in the opinion of management, reflect all adjustments, consisting only of normal recurring adjustments, necessary to fairly state our financial position as of September 30, 2016 and results of operations and cash flows for the nine months ended September 30, 2016 and 2015. The interim results are not necessarily indicative of results for the year ended December 31, 2016 or for any other period.

On May 14, 2014, we acquired the stock of iHealth Technologies, resulting in the Connolly iHealth Merger. The results of operations of iHealth Technologies have been included in our consolidated financial statements as of and since the date of the Connolly iHealth Merger. As a result, the consolidated financial statements that include periods prior to such date are not comparable to subsequent periods. For further details, see "Management's Discussion and Analysis of Financial Condition and Results of Operations—Factors Affecting the Comparability of our Results of Operations—Connolly iHealth Merger," "Unaudited Pro Forma Consolidated Financial Statements" and Note 1 to our audited consolidated financial statements included elsewhere in this prospectus.

Our historical results are not necessarily indicative of future operating results. You should read the information set forth below together with "Selected Historical Consolidated Financial Data," "Management's Discussion and Analysis of Financial Condition and Results of Operations," "Unaudited Pro Forma Consolidated Financial Statements," "Capitalization" and our consolidated financial statements and the related notes thereto included elsewhere in this prospectus.

13

|

Nine Months Ended September 30, |

Year Ended December 31, |

|||||||||||

| | | | | | | | | | | | | | |

(in thousands, except share and per share |

2016 | 2015 | 2015 | 2014 |

|||||||||

| | | | | | | | | | | | | | |

|

(unaudited) | ||||||||||||

Consolidated Statement of Operations Data: |

|||||||||||||

Net revenue |

$ | 457,250 | $ | 389,880 | $ | 541,343 | $ | 441,372 | |||||

Cost of revenue |

184,594 | 147,557 | 204,617 | 179,088 | |||||||||

Selling, general and administrative expenses |

118,934 | 97,009 | 136,745 | 92,537 | |||||||||

Depreciation and amortization |

60,482 | 55,526 | 74,162 | 59,771 | |||||||||

Transaction-related expenses |

909 | 354 | 1,469 | 5,745 | |||||||||

Impairment of intangible assets |

— | 27,826 | 27,826 | 74,034 | |||||||||

| | | | | | | | | | | | | | |

Operating income |

92,331 | 61,608 | 96,524 | 30,197 | |||||||||

Other expense (income) |

55,991 | 53,555 | 68,819 | 72,826 | |||||||||

Income tax expense (benefit) |

12,780 | 3,932 | 14,401 | (16,804 | ) | ||||||||

Gain on discontinued operations, net of tax |

— | (559 | ) | (559 | ) | — | |||||||

| | | | | | | | | | | | | | |

Net income (loss) |

$ | 23,560 | $ | 4,680 | $ | 13,863 | $ | (25,825 | ) | ||||

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Earnings (loss) per share: |

|||||||||||||

Basic |

$ | 0.28 | $ | 0.06 | $ | 0.18 | $ | (0.40 | ) | ||||

Diluted |

$ | 0.27 | $ | 0.06 | $ | 0.18 | $ | (0.40 | ) | ||||

Weighted average shares outstanding: |

|||||||||||||

Basic |

83,275,206 | 77,211,354 | 77,216,133 | 65,253,954 | |||||||||

Diluted |

86,857,926 | 77,714,945 | 77,641,385 | 65,253,954 | |||||||||

Statement of Cash Flow Data: |

|||||||||||||

Net cash provided by (used in): |

|||||||||||||

Operating activities |

$ | 108,345 | $ | 30,408 | $ | 63,154 | $ | 95,728 | |||||

Investing activities |

(21,397 | ) | (10,616 | ) | (22,581 | ) | (1,091,520 | ) | |||||

Financing activities |

(192,158 | ) | (6,951 | ) | (8,976 | ) | 1,025,872 | ||||||

Other Data: |

|||||||||||||

Operating margin(1) |

20.2 | % | 15.8 | % | 17.8 | % | 6.8 | % | |||||

Adjusted EBITDA(2) |

$ | 175,266 | $ | 146,938 | $ | 203,380 | $ | 172,239 | |||||

|

As of September 30, 2016 |

|||

| | | | | |

|

(unaudited) | |||

Consolidated Balance Sheet Data: |

||||

Cash and cash equivalents |

$ | 43,770 | ||

Total assets |

2,005,553 | |||

Total long-term debt(3) |

784,042 | |||

Total liabilities |

1,097,112 | |||

Working capital |

25,327 | |||

Total stockholders' equity |

908,441 |

- (1)

- Represents

operating income as a percentage of net revenue.

- (2)

- We report our financial results in accordance with U.S. generally accepted accounting principles ("GAAP"). To supplement this information, we also use Adjusted EBITDA, a

14

- •

- Adjusted EBITDA does not reflect our cash expenditures or future requirements for capital expenditures or contractual commitments;

- •

- Adjusted EBITDA does not reflect changes in, or cash requirements for, our working capital needs;

- •

- although depreciation is a non-cash charge, the assets being depreciated will often have to be replaced in the future, and Adjusted EBITDA does

not reflect any cash requirements for such replacements;

- •

- Adjusted EBITDA does not reflect the impact of stock-based compensation upon our results of operations;

- •

- Adjusted EBITDA does not reflect the significant interest expense, or the cash requirements necessary to service interest or principal payments

on our debt;

- •

- Adjusted EBITDA does not reflect our income tax expense (benefit) or the cash requirements to pay our income taxes; and

- •

- other companies in our industry may calculate Adjusted EBITDA differently than we do, limiting its usefulness as a comparative measure.

non-GAAP financial measure, in this prospectus. Adjusted EBITDA represents net income (loss) before depreciation and amortization, impairment of intangible assets, interest expense, other non-operating (income) expense such as foreign currency translation, income tax expense (benefit), gain on discontinued operations, transaction-related expenses, stock-based compensation and loss on extinguishment of debt. See "Management's Discussion and Analysis of Financial Condition and Results of Operations" for additional information regarding these adjustments. Management believes Adjusted EBITDA is useful because it provides meaningful supplemental information about our operating performance and facilitates period-to-period comparisons without regard to our financing methods, capital structure or other items that we believe are not indicative of our ongoing operating performance. By providing this non-GAAP financial measure, management believes we are enhancing investors' understanding of our business and our results of operations, as well as assisting investors in evaluating how well we are executing our strategic initiatives. In addition, the determination of Adjusted EBITDA is consistent with the definition of a similar measure in our First Lien Credit Facilities other than adjustments for severance costs and non-income based taxes permitted by the First Lien Credit Facilities but not considered by management in evaluating our performance using Adjusted EBITDA.

Our presentation of Adjusted EBITDA is intended as a supplemental measure of our performance that is not required by, or presented in accordance with, U.S. GAAP. Adjusted EBITDA should not be considered as an alternative to operating income (loss), net income (loss), earnings per share or any other performance measures derived in accordance with U.S. GAAP as measures of operating performance or operating cash flows or as measures of liquidity. Our presentation of Adjusted EBITDA should not be construed to imply that our future results will be unaffected by these items. Adjusted EBITDA is included in this prospectus because it is a key metric used by management to assess our operating performance.

Although Adjusted EBITDA is not necessarily a measure of liquidity or our ability to fund our operations, we understand that it is frequently used by securities analysts, investors and other interested parties as a supplemental measure of financial performance within our industry.

Adjusted EBITDA has important limitations as an analytical tool and you should not consider it in isolation or as a substitute for analysis of our results as reported under U.S. GAAP. Some of these limitations are:

15

In evaluating Adjusted EBITDA, you should be aware that in the future we may incur expenses similar to those eliminated in this presentation.

The following table reconciles net income (loss) to Adjusted EBITDA for the periods presented:

|

Nine Months Ended September 30, |

Year Ended December 31, |

||||||||||||||

| | | | | | | | | | | | | | | | | |

(in thousands) |

2016 | 2015 | 2015 | 2014 | 2014 Pro Forma(a) |

|||||||||||

| | | | | | | | | | | | | | | | | |

|

(unaudited) | |||||||||||||||

Net income (loss) |

$ |

23,560 |

$ |

4,680 |

$ |

13,863 |

$ |

(25,825 |

) |

$ |

(18,752 |

) |

||||

Depreciation and amortization |

60,482 | 55,526 | 74,162 | 59,771 | 76,885 | |||||||||||

Impairment of intangible assets(b) |

— | 27,826 | 27,826 | 74,034 | 74,034 | |||||||||||

Interest expense |

40,345 | 49,855 | 65,561 | 51,717 | 69,103 | |||||||||||

Other non-operating (income) expense(c) |

(771 | ) | (384 | ) | (826 | ) | (415 | ) | (1,082 | ) | ||||||

Income tax expense (benefit) |

12,780 | 3,932 | 14,401 | (16,804 | ) | (13,927 | ) | |||||||||

Gain on discontinued operations, net of tax(d) |

— | (559 | ) | (559 | ) | — | — | |||||||||

Transaction-related expenses(e) |

909 | 354 | 1,469 | 5,745 | — | |||||||||||

Stock-based compensation(f) |

21,544 | 1,624 | 3,399 | 2,492 | 2,492 | |||||||||||

Loss on extinguishment of debt(g) |

16,417 | 4,084 | 4,084 | 21,524 | 21,524 | |||||||||||

| | | | | | | | | | | | | | | | | |

Adjusted EBITDA |

$ | 175,266 | $ | 146,938 | $ | 203,380 | $ | 172,239 | $ | 210,277 | ||||||

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

- (a)

- Refer

to "Unaudited Pro Forma Consolidated Financial Statements" included elsewhere in this prospectus for further discussion.

- (b)

- Represents

a $74,034 impairment charge for the year ended December 31, 2014 due to the change in the estimated fair value of our customer

relationship intangible asset related to our Medicare Recovery Audit Contractor ("Medicare RAC") contract. Also represents a $27,826 impairment charge during the year ended December 31, 2015 as

a result of our rebranding and the related impact to our tradenames. Refer to the notes to our consolidated financial statements included elsewhere in this prospectus for further discussion.

- (c)

- Represents

other non-operating (income) expense that consists primarily of gains and losses on transactions settled in foreign currencies. Income

received for certain sub-leases is included herein.

- (d)

- Represents

payment on a $900 note receivable ($559 net of taxes) related to a business that was disposed of in 2012. This note receivable had been

reported in the loss on discontinued operations in 2012 upon the sale of that business. Since the date of sale, we have elected to fully reserve the note receivable as the collectability was

determined to be uncertain.

- (e)

- Represents

transaction-related expenses that consist primarily of professional services associated with the Connolly iHealth Merger in 2014 and

certain expenses associated with the preparation for our IPO and certain corporate development activity.

- (f)

- Represents expense related to stock-based compensation awards granted to certain employees, officers and non-employee directors as long-term incentive compensation. We recognize the related expense for these awards ratably over the vesting period. During the nine months ended September 30, 2016, performance awards vested resulting in stock compensation expense of $15,898.

16

- (g)

- Represents loss on extinguishment of debt that consists primarily of fees paid and write-offs of unamortized debt issuance costs and original issue discount in connection with the financings of our long-term debt in 2014, the repricing of our long-term debt in 2015, the early repayment of a portion of our long-term debt in 2016 and the refinancing of our long-term debt in 2016.

- (3)

- Includes the current portion of our long-term debt and is net of debt issuance costs.

17

Investing in our common stock involves a high degree of risk. You should consider carefully the following risks and all of the information in this prospectus, including our historical financial statements and related notes thereto, included elsewhere in this prospectus, before purchasing our common stock. If any of the following risks actually occur, our business, financial condition and results of operations could be materially adversely affected. In that case, the trading price of our common stock could decline, perhaps significantly and you may lose all or part of your investment.

Risks Relating to Our Business

Our business and future growth depend on our ability to successfully expand the scope of claims reviewed for, and cross-sell additional solutions to, our existing client base.

We expect a significant portion of our future revenue growth to come from expanding the scope of claims we review for, and cross-selling additional solutions to, our existing clients. Our efforts to do so may not be successful. If we are unable to successfully expand the scope of payments reviewed by our solutions for or cross-sell additional solutions to our existing clients, it could have a material adverse effect on our growth and on our business, financial condition and results of operations.

Internal improvements to healthcare claims and retail billing processes by our clients could reduce the need for, and revenue generated by, our solutions, which could have a material adverse effect on our business, financial condition and results of operations.

We provide solutions that help our clients enhance payment accuracy in an increasingly complex environment. If our clients improve their healthcare claims and retail billing processes, demand for our solutions could be reduced. Since most of our contracts are performance fee based, enhancement of client internal billing processes could reduce the revenue generated by our solutions. With enough time and investment, many of our clients may be able to reduce or resolve recurring payment process complexities and resulting payment inaccuracies. In addition, many of our clients also utilize third party or internal technology, systems and personnel that review transactions before we do, all of which are constantly updated and improved. As the skills, experience and resources of such technology, systems and personnel improve, they may be able to identify payment inaccuracies before using our solutions, which would reduce the payment inaccuracies identified by our solutions and our ability to generate related revenue, which could have a material adverse effect on our business, financial condition and results of operations.

Healthcare spending fluctuations, simplification of the healthcare delivery and reimbursement system, programmatic changes to the scope of benefits and limitations to payment integrity initiatives could reduce the need for and the price of our solutions, which could have a material adverse effect on our business, financial condition and results of operations.

Our solutions improve our clients' ability to accurately pay healthcare claims and prevent or recover inaccurate payments, which often are a result of complexities in the healthcare claims payment system. Although the healthcare benefit and payment system continues to grow in complexity due to factors such as increased regulation and increased healthcare enrollment, the need for our solutions, the price clients are willing to pay for them and/or the scope and profitability of the solutions that we provide to our clients could be negatively affected by, among other things:

- •

- simplification of the U.S. healthcare delivery and reimbursement systems, either through shifts in the commercial healthcare marketplace or through legislative or regulatory changes at the federal or state level;

18

- •

- reductions in the scope of private sector or government healthcare benefits (for example, decisions to eliminate coverage of certain services);

- •

- the transition of healthcare beneficiaries from fee-for-service plans to value-based plans;

- •

- the adoption of healthcare plans with significantly higher deductibles;

- •

- limits placed on payment integrity initiatives, including the Medicare RAC program; and

- •

- lower than projected growth in private health insurance or the various Medicare and Medicaid programs, including Medicare Advantage.

Any of these developments could have a material adverse effect on our business, financial condition and results of operations.

If our existing clients do not renew their agreements with us, renew at lower performance fee levels, choose to reduce the number of claims reviewed by our solutions, or prematurely terminate their agreement with us, and we are unable to replace any related lost revenue, it could have a material adverse effect on our business, financial condition and results of operation.

We historically have derived, and expect in the future to derive, a significant portion of our revenue from our existing clients and, accordingly, we are reliant on ongoing renewals of our agreements with existing clients. As a result, maintaining a high renewal rate is critical to our future growth and our business, financial condition and results of operations. We may experience significantly more difficulty than we anticipate in renewing our existing client agreements. Factors that may affect the renewal rate for our services and our ability to sell additional solutions include:

- •

- the price, performance and functionality of our solutions;

- •

- the availability, price, performance and functionality of competing solutions;

- •

- our clients' perceived ability to review claims accurately using their internal resources;

- •

- our ability to develop complementary solutions;

- •

- our continued ability to access the data necessary to enable us to effectively develop and deliver new solutions to clients;

- •

- the stability and security of our platform;

- •

- changes in healthcare laws, regulations or trends; and

- •

- the business environment of our clients.

Contracts with our clients generally have stated terms of one to five years. Our clients have no obligation to renew their contracts for our services after the term expires. In addition, our clients may negotiate terms less advantageous to us upon renewal, may renew with a reduced scope of services, may choose to discontinue one or more services under an existing contract, may exercise flexibilities within their contracts to adjust service volumes, or may terminate the agreement prior to its contracted completion date, if any, which could reduce our revenue from these clients. If our clients fail to renew their agreements, renew their agreements upon less favorable terms, at lower performance fee levels or for fewer services, fail to purchase new services from us, or terminate their agreements with us, and we are unsuccessful in generating significant revenue from new or other existing clients to replace any lost revenue, our growth may be constrained and our revenue may decline which could have a material adverse effect on our business, financial condition and results of operations.

19

If we are unable to develop new client relationships, it could have a material adverse effect on our business, financial condition and results of operations.

As part of our strategy, we seek to develop new client relationships, principally among healthcare payers. Our ability to develop new relationships depends on a variety of factors, including the quality and performance of our solutions, as well as the ability to market and sell our solutions effectively and differentiate ourselves from our competitors. We may not be successful in developing new client relationships. If we are unable to develop new client relationships, it could have a material adverse effect on our business, financial condition and results of operations.

We have long sales and implementation cycles for many of our solutions and if we fail to close sales after expending time and resources on the sales process, or if we experience delays in implementing the solutions we sell, it could have a material adverse effect on our business, financial condition and results of operations.

Potential clients generally perform a thorough evaluation of available payment accuracy solutions and require us to expend time, effort and money educating them as to the value of our solutions prior to entering into a contract with them. We may expend significant funds and management resources during the sales cycle and ultimately fail to close the sale. Our sales cycle may be extended due to our clients' budgetary constraints or for other reasons. In addition, following a successful sale, the implementation of our systems frequently involves a lengthy process, as we integrate our technology with the new client's technology and learn the new client's business, operations and billing processes and preferences. If we are unsuccessful in closing sales after expending funds and management resources or if we experience delays in such sales or in implementing our solutions, it could have a material adverse effect on our business, financial condition and results of operations.

System interruptions or failures could expose us to liability and have a material adverse effect on our business, financial condition and result of operations.

Our data and operations centers are essential to our business, which depends on our ability to maintain and protect our information systems. In addition, our operations are spread across the United States, Canada, the United Kingdom and India and we rely heavily on technology to communicate internally and efficiently perform our services. We have implemented measures that are designed to mitigate the potential adverse effects of a disruption, relocation or change in operating environment; however, we cannot provide assurance that the situations we plan for and the amount of insurance coverage that we maintain will be adequate in any particular case. In addition, despite system redundancy and security measures, our systems and operations are vulnerable to damage or interruption from, among other sources:

- •

- power loss, transmission cable cuts and telecommunications failures;

- •

- damage or interruption caused by fire, earthquake and other natural disasters;

- •

- attacks by hackers or nefarious actors;

- •

- human error;

- •

- computer viruses and other malware, or software defects; and

- •

- physical break-ins, sabotage, intentional acts of vandalism, terrorist attacks and other events beyond our control.

If we encounter a business interruption, if we fail to effectively maintain our information systems, if it takes longer than we anticipate to complete required upgrades, enhancements or integrations or if our business continuity plans and business interruption insurance do not effectively

20

compensate on a timely basis, we could suffer operational disruptions, disputes with clients, civil or criminal penalties, regulatory problems, increases in administrative expenses, loss of our ability to produce timely and accurate financial and other reports or other adverse consequences, any of which could have a material adverse effect on our business, financial condition and results of operations.

We obtain and process a large amount of sensitive data. Our systems and networks may be subject to cyber-security breaches and other disruptions that could compromise our information. Any real or perceived improper use of, disclosure of, or access to such data could harm our reputation as a trusted brand, as well as have a material adverse effect on our business, financial condition and results of operations.

We use, obtain and process large amounts of confidential, sensitive and proprietary data, including protected health information ("PHI") subject to regulation under the Health Insurance Portability and Accountability Act of 1996, as amended by the Health Information Technology for Economic and Clinical Health Act of 2009, and personally identifiable information ("PII") subject to state and federal privacy, security and breach notification laws. The secure processing and maintenance of this information is critical to our operations and business strategy. We face risks associated with new and untested personnel, processes and technologies which have recently been implemented to augment our security and privacy management programs. If our security measures or those of the third party vendors we use who have access to this information are inadequate or are breached as a result of third party action, employee error, malfeasance, malware, phishing, hacking attacks, system error, trickery or otherwise, and, as a result, someone obtains unauthorized access to sensitive information, including PHI and PII, on our systems or our providers' systems, our reputation and business could be damaged. We cannot guarantee that our security efforts will prevent breaches or breakdowns to our or our third party vendors' databases or systems. The occurrence of any of these events could cause our solutions to be perceived as vulnerable, cause our clients to lose confidence in our solutions, negatively affect our ability to attract new clients and cause existing clients to terminate or not renew our solutions. If the information is lost, improperly disclosed or threatened to be disclosed, we could incur significant liability and be subject to regulatory scrutiny and penalties. Furthermore, we could be forced to expend significant resources in response to a security breach, including investigating the cause of the breach, repairing system damage, increasing cyber-security protection costs by deploying additional personnel and protection technologies, notifying and providing credit monitoring to affected individuals, paying regulatory fines and litigating and resolving legal claims and regulatory actions, all of which could increase our expenses and divert the attention of our management and key personnel away from our business operations.