Exhibit 10.1

THIRD AMENDMENT TO MASTER LEASE

THIS THIRD AMENDMENT TO MASTER LEASE (this “Amendment”) is made and effective as of March 24, 2017 (the “Effective Date”), by and between GOLD MERGER SUB, LLC, a Delaware limited liability company, having an office at c/o Gaming and Leisure Properties, Inc., 845 Berkshire Blvd., Suite 200, Wyomissing, Pennsylvania 19610, as landlord (together with its permitted successors and assigns, “Landlord”), and PINNACLE MLS, LLC, a Delaware limited liability company, having an office at 3980 Howard Hughes Parkway, Las Vegas, Nevada 89169, as tenant (together with its permitted successors and assigns, “Tenant”).

W I T N E S S E T H:

WHEREAS, Pinnacle Entertainment, Inc. (as predecessor by merger to Landlord) (“Pinnacle”), as landlord, and Tenant, as tenant, entered into that certain Master Lease, dated as of April 28, 2016, as amended by that certain First Amendment to Master Lease, dated as of August 29, 2016, by and between Landlord and Tenant, as further amended by that certain Second Amendment to Master Lease, dated as of October 25, 2016, by and between Landlord and Tenant (as amended, the “Master Lease”; capitalized terms used and not otherwise defined herein shall have the respective meanings ascribed to them in the Master Lease);

WHEREAS, pursuant to that certain Merger Agreement, dated as of July 20, 2015, by and among Pinnacle, Landlord, and Gaming and Leisure Properties, Inc. (“GLPI”), as amended by that certain Amendment No. 1 to Agreement and Plan of Merger, dated as of March 25, 2016, by and among Pinnacle, Landlord, and GLPI, Pinnacle merged with and into Landlord on April 28, 2016, and Pinnacle’s interest in the Master Lease was transferred to Landlord by operation of law;

WHEREAS, Pinnacle, PNK Entertainment, Inc. (“PNK”), and GLPI entered into that certain Separation and Distribution Agreement, dated as of April 28, 2016 (the “SDA”), to effect the Reorganization and the Distribution (each as defined in the SDA);

WHEREAS, pursuant to Section 2.5(b) of the SDA, PNK caused its subsidiary, PNK Vicksburg, LLC, to execute and deliver a quitclaim deed, dated as of April 28, 2016 (the “Original Vicksburg Deed”), in favor of Pinnacle Entertainment, Inc. (predecessor-in-interest to Landlord) for certain Pinnacle Real Property (as defined in the SDA) located in the City of Vicksburg, Mississippi;

WHEREAS, a portion of the Pinnacle Real Property located in the City of Vicksburg, Mississippi (the “Additional Vicksburg Property”) was not included in the Original Vicksburg Deed and, pursuant to Section 6.1 of the SDA, PNK caused PNK Vicksburg, LLC to execute and deliver an additional quitclaim deed, dated as of the date hereof, in favor of Landlord for the Additional Vicksburg Property; and

WHEREAS, Landlord and Tenant each desire to amend the Master Lease to amend “Exhibit B” attached thereto to add the legal description of the Additional Vicksburg Property, as more fully described herein.

NOW, THEREFORE, in consideration of the provisions set forth in the Master Lease as amended by this Amendment, including, but not limited to, the mutual representations, warranties, covenants and agreements contained therein and herein, and for other good and valuable consideration, the receipt and sufficiency of which are hereby respectively acknowledged, and subject to the terms and conditions thereof and hereof, the parties, intending to be legally bound, hereby agree that the Master Lease shall be amended as follows:

ARTICLE I

AMENDMENT OF EXHIBIT B TO THE MASTER LEASE

1.1 The parties hereby agree that “Exhibit B” of the Master Lease shall be amended as follows:

(a) On page B-76 of “Exhibit B” and with respect to Ameristar Vicksburg, the following text shall be inserted as a new paragraph after the end of the last paragraph of the legal description on page B-76, and such Land described below shall be Leased Property under the Master Lease:

TRACT FIFTEEN

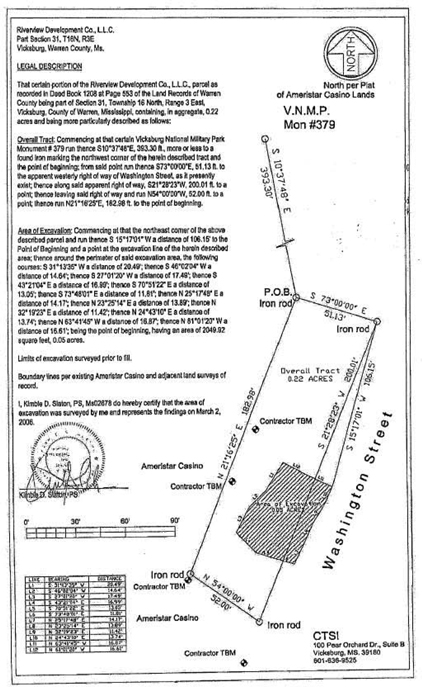

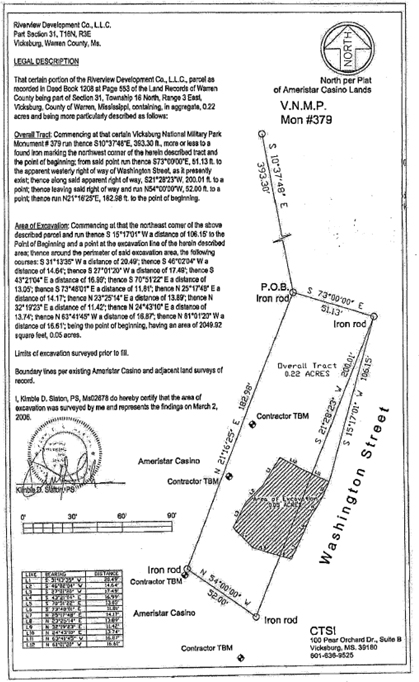

That certain parcel conveyed to Riverview Development Company, LLC by Delta Land Company, Inc. as recorded in Deed Book 1208 at Page 553 of the Land Records of Warren County, being part of Section 31, Township 16 North, Range 3 East, Vicksburg, Warren County, Mississippi, containing in the aggregate 0.22 acres, and being more particularly described as follows:

Commencing at that certain Vicksburg National Military Park Monument #379, run thence South 10 degrees 37 minutes 48 seconds East, 393.30 feet, more or less, to a found iron marking the northwest corner of the herein described tract and the point of beginning; from said point run thence South 73 degrees 00 minutes 00 seconds East, 51.13 feet to the apparent westerly right of way of Washington Street, as it presently exists; thence along said apparent right of way, South 21 degrees 28 minutes 23 seconds West, 200.01 feet to a point; thence leaving said right of way and run North 54 degrees 00 minutes 00 seconds West, 52.00 feet to a point; thence run North 21 degrees 16 minutes 25 seconds East, 182.98 feet to the point of beginning, a plat whereof prepared by CTSI being attached hereto as Schedule 1.1 and incorporated herein in aid of description of the property herein described and conveyed and for all other purposes in the construction of this instrument.

(b) “Exhibit B” to the Master Lease is hereby amended by inserting Schedule 1.1 attached hereto after the last page of “Exhibit B” to the Master Lease.

1.2 For the avoidance of any doubt, the parties hereby agree that the attached Exhibit B incorporates and reflects the amendments set forth in Section 1.1 above and may be attached and affixed to the Master Lease as an amended and restated “Exhibit B”.

2

ARTICLE II

AMENDMENT TO MEMORANDUM OF LEASE

Landlord and Tenant shall enter into one or more amendments to any memorandum of lease which may be been recorded in accordance with Article XXXIII of the Master Lease, in form suitable for recording in each county in which a Leased Property is located which amendment is pursuant to this Amendment. Tenant shall pay all costs and expenses of recording any such amendment to memorandum of lease and shall fully cooperate with Landlord in removing from record any such memorandum of lease upon the expiration or earlier termination of the Term with respect to the applicable Facility.

ARTICLE III

AUTHORITY TO ENTER INTO AMENDMENT

Each party represents and warrants to the other that: (i) this Amendment and all other documents executed or to be executed by it in connection herewith have been duly authorized and shall be binding upon it; (ii) it is duly organized, validly existing and in good standing under the laws of the state of its formation and is duly authorized and qualified to perform this Amendment and the Master Lease, as amended hereby, within the State(s) where any portion of the Leased Property is located, and (iii) neither this Amendment or the Master Lease, as amended hereby, nor any other document executed or to be executed in connection herewith, violates the terms of any other agreement of such party.

ARTICLE IV

MISCELLANEOUS

4.1 Costs and Expenses; Fees. Each party shall be responsible for and bear all of its own expenses incurred in connection with pursuing or consummating this Amendment and the transactions contemplated by this Amendment, including, but not limited to, fees and expenses, legal counsel, accountants, and other facilitators and advisors.

4.2 Choice of Law and Forum Selection Clause. This Amendment shall be construed and interpreted, and the rights of the parties shall be determined, in accordance with the substantive Laws of the State of New York without regard to the conflict of law principles thereof or of any other jurisdiction

4.3 Counterparts; Facsimile Signatures This Amendment may be executed in two or more counterparts, each of which shall be deemed an original, but all of which together shall constitute one and the same instrument. In proving this Amendment, it shall not be necessary to produce or account for more than one such counterpart signed by the party against whom enforcement is sought. Any counterpart may be executed by facsimile or pdf signature and such facsimile or pdf signature shall be deemed an original.

4.4. No Further Modification. Except as modified hereby, the Master Lease remains in full force and effect.

[SIGNATURE PAGE TO FOLLOW]

3

IN WITNESS WHEREOF, this Amendment has been duly executed and delivered by each of the undersigned as of the date first above written.

| LANDLORD: | ||

| GOLD MERGER SUB, LLC | ||

| By: /s/ Brandon J. Moore | ||

| Name: Brandon J. Moore | ||

| Title: Secretary | ||

| TENANT: | ||

| PINNACLE MLS, LLC | ||

| By: /s/ Carlos A. Ruisanchez | ||

| Name: Carlos A. Ruisanchez | ||

| Title: President, Secretary | ||

Signature Page to Third Amendment to Master Lease

Schedule 1.1

EXHIBIT B

LEGAL DESCRIPTIONS

See attached.

Ameristar Casino Black Hawk

Lot 1, St. Moritz Resort and Casino, Filing No. 1, County of Gilpin, State of Colorado, being more particularly described as follows:

A tract of land in the south one-half of Section 7, Township 3 South, Range 72 West of the 6th p.m., City of Black Hawk, County of Gilpin, State of Colorado, being a part of the Huddleston Extension, the Elephant Lode, the Eagle Nest Lode, and certain tracts on the West Side of Richman Street, all being part of the lands described in Book 627, Page 226; and in Book 627, Page 228; and in Book 627, Page 230; and in Book 627, Page 232; and in Book 627, Page 237; and in Book 627, Page 241, and in Book 627, Page 254, and in Book 628, Page 35, more particularly described as follows:

Beginning at a point which bears N 42°06’59” E, a distance of 628.59 feet from Corner No. 21 of the Security Placer, Mineral Survey No. 5664; thence along the following courses: thence S 00°45’35” E., a distance of 177.47 feet to a point; thence on a non-tangent curve to the right containing a central angle of 35°49’51”, a radius of 255.50 feet, an arc length of 159.78 feet, a chord bearing of S. 17°09’20” W., a chord distance of 157.19 feet to a point; thence S. 64°30’00” W., a distance of 75.71 feet to a point; thence on a curve to the right containing a central angle of 10°53’05”, a radius of 1298.20 feet, an arc length of 246.63 feet, a chord bearing of N. 56°49’58” W., a chord distance of 246.26 feet to a point; thence N. 51°27’30” W, a distance of 241.02 feet to a point; thence N. 29°11’40” E., a distance of 12.36 feet to a point; thence N. 53°19’44” W., a distance of 117.41 feet to a point; thence N. 52°30’00” E., a distance of 571.84 feet to a point; thence S. 17°13’38” E., a distance of 79.93 feet to a point; thence on a curve to the left containing a central angle of 10°02’07”, a radius of 219.50 feet, an arc length of 38.45 feet, a chord bearing S. 22°14’42” E., a chord distance of 38.40 feet to a point; thence S. 27°15’45” E, a distance of 181.68 feet to a point; thence on a curve to the right containing a central angle of 26°30’10”, a radius of 180.50 feet, an arc length of 83.49 feet, a chord bearing of S 14°00’40” E., a chord distance of 82.75 feet to the point of beginning,

Excepting therefrom, any portion of the above land conveyed to the City of Black Hawk in the Deed recorded January 5, 2009 at Reception No. 138170,

County of Gilpin, State of Colorado.

Parcel R:

Tract of land situate on the east side of Richman Street in the City of Black Hawk, described as follows: Starting at Highway #119 right-of-way monument station 842+40; thence N. 23°21’40” W., 142.92 feet to the northwest corner of tract described in Book 279 at Page 221; thence N. 13°46’40” E., 125.23 feet to the point of beginning on the north line of tract #4 described in Book 269 at Page 309, hence by record the Jennie Blanche. Mineral Survey No. 551, cor. #4 bears S. 4°07’40” E., 34.8 feet and a wall corner bears east 1.6 feet; thence N 3°03’ W., 66.55 feet along

Ex. B-1

wall line; thence N. 1°40’40” E., 45.44 feet along wall line; thence 90°00’00” E., 100 feet; thence S. 1°40’40” W., 45.44 feet; thence S 3°03’ E., 66.55 feet; thence N 90°00’00” W., 100 feet, more or less, along the north boundary line of tract #4 as described in Book 269 at Page 309, to the Point of Beginning, County of Gilpin, State of Colorado.

Parcel S:

That tract of land as described in Deed recorded August 4, 1970, in Book 267 at Page 402, Gilpin County, Colorado, described as follows:

A tract of land adjoining the easterly side of Richman Street, more particularly described as follows, to wit: Commencing at a point on the northerly side line of Jennie Blanche Lode Mining Claim, U.S. mineral Survey No. 551, 150 feet easterly of corner no. 4 of said claim, thence N 90°00’00” W, to the easterly boundary of said Richman Street; thence southerly along the said boundary of Richman Street to a 1⁄2 inch rebar which bears S. 20°24’ W., 92.7 feet from a capped marked 4/551, being corner no. 4 of said Survey No. 551; thence S 68°06’ E. 77.98 feet to a point of intersection in the westerly end of said Survey No. 551; thence N 19°45’00” W., 122.45 feet to said corner no. 4 of Survey 551; thence easterly along the northerly line of said Survey No. 551 to the Point of Beginning;

Except any portion thereof as maybe in conflict with the Bryan tract, Black Hawk City Title, and which may be included within the Deed recorded January 5, 2009 at Reception No. 138170, County of Gilpin, State of Colorado.

Parcel S-1:

That portion of the Bryan Lode or Tract, as described in Deed recorded November 25, 1898, in Book 135 at Page 274, City of Black Hawk, lying within the boundaries of Parcel S, above, but excepting therefrom, any portion as conveyed to the City of Black Hawk in the deed recorded January 5, 2009 at Reception No. 138170, County of Gilpin, State of Colorado.

Parcel T:

That part of the Jennie Blanche lode Mining Claim, U.S. Mineral Survey No. 551, lying westerly of a line that is parallel to the end lines of said mining claim and intersects the northerly side line thereof at a point 150 feet easterly of corner no. 4 of said Jennie Blanche Lode Mining Claim, except that part described as follows: A tract of land in the south half of Section 7, Township 3 South, Range 72 West of the 6th P.M., City of Black Hawk, County of Gilpin, State of Colorado, being a part of the Jennie Blanche Lode, Mineral Survey No. 551, from which Point of Beginning corner no. 3 of said Jennie Blanche Lode bears S 19°45’00” E., a distance of 11.28 feet, and the west 1⁄4 corner of Section 7, Township 3 South, Range 72 West bears N 72°03’49” W., 3364.64 feet, and corner no.. 21 of the Security Placer, Mineral Survey No. 5864 bears S.

Ex. B-2

75°48’09” W., a distance of 535.15 feet; thence N. 19°45’00” W., along line 3-4 of said Jennie Blanche Lode a distance of 17.17 feet; thence S 87°50’51” E., parallel with and 3 feet northerly of a concrete retaining wall, a distance of 6.15 feet; thence S 1°14’25” W., parallel with and 3 feet easterly of a concrete retaining wall, a distance of 15.93 feet to a point on said line 3-4, the Point of Beginning,

And except any portion thereof lying westerly of the easterly boundary of Richman Street,

And except any portion conveyed to Richman Properties Limited Liability Company by Boundary Settlement and Real Property Trade Agreement recorded June 29, 1998, in Book 644, Page 409,

And except any portion conveyed by Deeds recorded in Book 644 at Pages 402, 405, and 407,

And except any portion conveyed to the City of Black Hawk in the Deed recorded January 5, 2009 at Reception No. 138170,

County of Gilpin, State of Colorado.

Which property, parcels, R, S, S-1 and T, are also described as follows:

A tract of land in the South half of Section 7, Township 3 South, Range 72 West of the 6th P.M., City of Black Hawk, County of Gilpin, State of Colorado, which begins at a point on the east line of Richman Street, and from which point of beginning the west 1⁄4 corner of said Section 7 bears N. 72°30’37” W., 3271.41 feet, and corner no. 21 of the Security Placer, Mineral Survey No. 5864 bears S. 67°10’39” W., a distance of 475.05 feet; thence N. 13°21’00” E., along said east line of Richman Street a distance of 116.56 feet to a point; thence leaving said east line of Richman Street N 90°00’00” E., a distance of 8.06 feet; thence N 3°03’00” W., a distance of 72.83 feet; thence N. 1°40’40” E., a distance of 45.44 feet; thence N 90°00’00” E., a distance of 100.00 feet; thence S 1°40’40” W., a distance of 45.44 feet; thence S. 03°03’00” E., a distance of 72.83 feet; thence N 90°00’00” E., a distance of 44.65 feet to a point on line 4-5 of the Jennie Blanche Lode, Mineral Survey no. 551; thence S. 19°45’00” E., a distance of 150.90 feet to a point on line 2-3 said Jennie Blanche Lode; thence S. 76°30’00” W., along said line 2-3 a distance of 150.00 feet to corner no. 3 of said Jennie Blanche Lode; thence N. 19°45’00” W., along line 3-4 of said Jennie Blanche Lode, a distance of 11.28 feet; thence N. 01°14’25” E., parallel with and 3 feet easterly of a concrete wall, a distance of 15.93 feet; thence N. 87°50’51” W., parallel with and 3 feet north of said wall, a distance of 6.15 feet to a point on said line 3-4 of said Jennie Blanche Lode; thence N. 19°45’00” W., along said line a distance of 8.25 feet; thence N. 68°06’00” W., a distance of 77.99 feet to the Point of Beginning, but excepting any portion thereof conveyed to the City of Black Hawk in the Deed recorded January 5, 2009 at Reception No. 138170,

County of Gilpin, State of Colorado.

Parcel I:

Ex. B-3

A tract of land in the East 1⁄2 and SW 1⁄4 of Section 7, Township 3 South, Range 72 West of the 6th P.M., City of Black Hawk, County of Gilpin, State of Colorado, more particularly described as follows:

Beginning at the East 1⁄4 corner of said Section 7; thence S. 00°12’28” W., along the East line of the SE 1⁄4 of Section 7 a distance of 605.56 feet to a point on the Northwesterly side line of the Libra Lode & Dump Site; thence N. 39°25’00” E., along said Northwesterly line a distance of 483.30 feet to a corner of said Lode; thence East a distanced of 191.00 feet to a corner of said Lode; thence S. 39°25’00” W., along the Southeasterly side line said Lode a distance of 1500.00 feet to a corner said Lode; thence West a distance of 191.00 feet to a corner said lode; thence N. 44°00’00” W., a distance of 101.33 feet to a point on the Southeasterly side line of the Silver Lode; thence 46°00’00” E., along said Southeasterly side line a distance of 250.48 feet to a corner said Lode; thence West along the North line said Silver Lode a distance of 215.98 feet to a corner said Lode; thence N. 61°45’04” W., a distance of 194.02 feet to a corner of the Gertrude Lode; thence S. 62°31’27” W., along the Southeasterly side line said Gertrude Lode a distance of 283.98 feet to a point on the Easterly line of the Chicago Lode; thence S. 9°4’00” E., along the Easterly line said Chicago Lode a distance of 93.60 feet to a corner said Lode; thence S. 80°06’00” W., along the Southeasterly line said Chicago lode a distance of 294.53 feet to a point on the Southeasterly side line said Gertrude Lode; thence S. 62°31’27” W., along said Southeasterly line a distance of 357.62 feet to a point on the Northerly right of way line of Highway No. 119; thence along said right of way line and along the arc of a curve to the left, central angle = 4°57’50”, radius = 2940.00 feet, an arc length of 254.71 feet, the chord of said arc bears S. 89°21’18” W., a distance of 254.63 feet; thence S 86°52’23” W., a distance of 85.40 feet to a point on the Northwesterly side line of said Gertrude Lode; thence N. 62°31’27” E., along said Northwesterly line a distance of 186.79 feet to a point on the Southeasterly side line said Chicago Lode; thence S. 80°06’00” W., along said Southeasterly side line a distance of 444.61 feet to a point on said Northeasterly right of way line Highway No. 119; thence Westerly along said right of way line, along the arc of a curve to the right, central angle = 4°29’00”, radius = 1273.20, an arc length of 99.62 feet to a point on the Southeasterly line of the T.I. Richman Tract, the chord of said arc bears N. 79°36’36” W., a distance of 99.60 feet; thence N. 36°06’00” E., along said Southeasterly line a distance of 91.86 feet to an angle point in said Tract; thence N 4°00’00” W., along the Easterly line of said T.I. Richman tract a distance of 1.66 feet to a point on the Northeasterly side line of said Chicago Lode; thence N. 80°06’00” E., along said Northwesterly side line of a 787.50 feet to a point on the Northwesterly side line of said Gertrude Lode; thence N. 62°31’27” E., along said Northwesterly side line a distance of 739.19 feet to the Northeast corner said Lode; thence N. 45°35’45” W., a distance of 80.09 feet to a point on the Southeasterly side line of the South Jennie Blanche Lode; thence S. 63°59’50” W., along said Southeasterly line a distance of 750.23 feet to corner No. 3 said Lode; thence N. 26°00’00” W., a distance of 117.00 feet to corner No. 4 said Lode which point on the Southeasterly side line of the Jennie Blanche Lode; thence S. 64°00’22” W., along said Southeasterly side line a distance of 361.77 feet to corner No. 2 said Lode; thence S. 76°21’39” W., along said Southeasterly side line

Ex. B-4

a distance of 35.63 feet to a point on the Southeasterly side line of the Gilpin County Tunnel or Lode; thence S. 52°18’00” W., a distance of 36.23 feet to corner No. 2 said Lode; thence N. 37°42’00” W., along the Southwesterly line said Lode a distance of 16.94 feet to a point on the Southeasterly side line of said Jennie Blanche Lode; thence S. 76°31’05“W., along said side line a distance of 263.41 feet to a point on the Easterly line said T.I. Richman Tract; thence N. 4°39’00” W., along said Easterly line a distance of 136.52 feet to an angle point in said Tract; thence N. 84°58’00” W., along the North line said Tract a distance of 96.15 feet; thence N. 3°03’00” W., a distance of 67.72 feet; thence N. 1°40’40” E., a distance of 45.44 feet; thence West distance of 110.85 feet to a point on the East right of way line of Richman Street; thence N. 4°14’00” W., along said East right of way line a distance of 0.43 feet; thence N. 85°46’00” E., a distance of 100.00 feet; thence N04°14’00” W., a distance of 144.00 feet; thence S85°46’00“W., a distance of 11.89 feet to a point on the West line of the Klondyke Lode; thence N. 35°26’00” W., a distance of 8.49 feet; thence N. 65°06’00” E., a distance of 10.53 feet; thence N. 23°49’00” W., a distance of 26.00 feet to a point on the Southeasterly side line of the Leopold Lode; thence N. 54°34’00” E., along said Southeasterly side line a distance of 1076.85 feet to a point of the Southerly side line of the Democrat Lode; thence N. 80°40’00” W., along said Southerly side line a distance of 213.00 feet to a point on the Northwesterly side line of said Leopold Lode; thence S. 54°34’00” W., along said Northwesterly side line a distance of 883.16 feet to a point on the Northeasterly line of the Fullerton Tract; thence S. 31°10’00” E., along said Northeasterly line a distance of 102.90 feet; thence S. 65°06’0” W., along the Southeasterly line said tract a distance of 100.60 feet; thence N. 31°10’00” W., along the Southwesterly line said tract a distance of 109.07 feet to a point on the Southeasterly side line of the Elephant Lode; thence S. 52°30’00” W., along the Southeasterly side line a distance of 10.29 feet to a point on the East right of way line of Richman Street; thence N. 23°49’00” W., along said East right of way line a distance of 154.38 feet to a point on the Northwesterly side line said Elephant Lode; thence N. 52°30’00” E., along said Northwesterly line a distance of 31.19 feet to a point on the Westerly line of the Prince Henry Lode; thence N. 34°08’00” W., along said Westerly line a distance of 68.86 feet to a point on the Southeasterly side line of the Lion Lode; thence S. 54°05’00 W., along said Southeasterly side line a distance of 18.38 feet to a point on said East right of way line of Richman Street; thence N. 23°49’00” W., along said East right of way line a distance of 152.94 feet to a point on the Northwesterly side line of said Lion Lode; thence N. 54°05’00” E., along said Northwesterly line a distance of 180.03 feet to corner No. 4 said Lode; thence S. 69°10’48” E., a distance of 178.85 feet to corner No. 3 said Lode; thence S. 40°09’24” E., a distance of 114.55 feet to a point on the Northwesterly side line of the Black Bear Lode; thence N. 55°52’00” E., along said Northwesterly line a distance of 280.31 feet to a point on the Westerly line of the Missouri Lode; thence S. 45°53’0” E., along said Westerly line a distance of 71.34 feet to a corner said Lode; thence N. 54°14’00” E., along the Southeasterly side line said Lode a distance of 45.56 feet to a point on the West line of the Radical Lode; thence S. 38°12’14” E., a distance of 49.38 to corner No. 4 Radical Lode; thence N. 52°06’43” E., along the southeasterly side line said Radical Lode a distance of 462.47 feet to a point on the North line of the NW 1⁄4 of the SE 1⁄4 of said Section 7; thence N. 86°53’19” E., along said North line a distance of 453.69

Ex. B-5

feet to the Southwest corner of the SE 1⁄4 of the NE 1⁄4 of Section 7; thence N. 1°46’45” W., along the West line said SE 1⁄4 of the NE 1⁄4 a distance of 320.31 feet to a point on the Southeast side line of the Radical Lode; thence N. 52°06’43” E., along said Southeasterly side line a distance of 463.02 feet to corner No. 3 said Radical Lode; thence N. 37°53’00” W., a distance of 50.00 feet to corner 2 said Radical Lode; thence S. 52°06’43” W., along the Northwesterly side line said Radical Lode a distance of 426.56 feet to a point on the West line said SE 1⁄4 of the NE 1⁄4; thence N. 01°46’45” W., along said West line a distance of 512.06 feet to a point on the Southeasterly side line of the Champion Lode; thence N. 56°37’00” E., along said Southeasterly side line a distance of 510.33 feet to a point; thence S. 35°37’00” E., a distance of 1010.36 feet to a point; thence East a distance of 332.26 feet to a point on the East line of the NE 1⁄4 of said Section 7; thence S. 2°43’41” E., along said East line a distance of 283.62 feet, to the East 1⁄4 corner said Section 7, the Point of Beginning, County of Gilpin, State of Colorado.

Excepting therefrom that part of the above described parcel described as commencing at the East 1⁄4 Corner of said Section 7; thence S. 25°56’22” W., a distance of 285.08 feet to the True Point of Beginning; thence S. 24°26’34” W., a distance of 90.00 feet; thence S. 65°33’26” W., a distance of 30.00 feet; thence N. 24°26’34” W., a distance of 90.00 feet; thence N. 65°33’26” E., a distance of 30.00 feet to the True Point of Beginning, as excepted in original conveyance from the City of Black Hawk to Windsor Woodmont LLC, in Deed recorded June 16, 1998, in Book 643 at Page 443, County of Gilpin, State of Colorado, and

Excepting therefrom, that portion described as follows (Tank Site):

A tract of land located in Section 7, Township 3 South, Range 72 West of the 6th Principal Meridian, City of Blackhawk, County of Gilpin, State of Colorado being more particularly described as follows:

Considering the North line of the Northwest Quarter of the Southeast Quarter of said Section 7 as bearing North 86°49’50” East from a found US Department of the Interior comer being a 3 1/2” Aluminum cap marked MS 7626 and being South 86° 49’50” West, 993.31 feet from the East Sixteenth comer of Section 7 being a found 3 1/2” Aluminum cap and with all bearings contained herein relative thereto:

Commencing at said MS 7626 comer;

Thence South 45°37’31” East 819.01 feet to the POINT OF BEGINNING;

Thence North 38°54’52” East, 170.00 feet;

Thence South 85°34’06” East, 157.00 feet;

Thence South 22°29’34” East, 300.00 feet;

Thence South 70°14’05” West, 35.00 feet;

Thence South 75°06’04” West, 50.00 feet;

Thence South 83°40’21” West, 95.00 feet;

Thence South 88°44’40” West, 95.00 feet;

Ex. B-6

Thence North 55°27’53” West, 35.57 feet;

Thence along a non-tangent curve concave to the Northeast having a central angle of 25°05’57” with a radius of 125.00 feet, and an arc length of 54.76 feet and the chord of which bears North 35°21 ‘05” West, 54.32 feet; Thence North 19°43’24” West, 137.99 feet to the Point of Beginning.

Parcel II:

A tract of land in the SE 1⁄4 of the NE 1⁄4 of Section 7, township 3 South. Range 72 West of the 6th P.M., City of Black Hawk, County of Gilpin, State of Colorado, more particularly described as follows:

Beginning at the Northwest corner of said SE 1⁄4 o the NE 1⁄4; thence N. 88°01’24” E., along the North line said SE 1⁄4 of the NE 1⁄4 a distance of 443.14 feet to a point on the Northwesterly side line of the Champion Lode; thence S. 56°17’54” W., along said line a distance of 522.10 feet to a point on the West line said SE 1⁄4 of the NE 1⁄4; thence N. 01°46’45” W, along said West line a distance of 274.55 feet to the point of beginning, County of Gilpin, State of Colorado.

Parcel III:

That part of the Democrat Lode, U.S. Mineral Survey No. 7626 lying within the NW 1⁄4 of the SE 1⁄4 of Section 7, Township 3 South, Range 72 West of the 6th P.M., City of Black Hawk, County of Gilpin, State of Colorado, more particularly described as follows:

Beginning at a point on the North line said NW 1⁄4 SE 1⁄4 which point is the intersection of said North line with the Northwesterly side line of the Radical Lode, U.S. Mineral Survey No. 211; thence S. 52°06’43” W., along said side line a distance of 170.44 to a point on the Southerly side line Democrat Lode; thence N. 80°40’00” W., along said side line a distance of 325.62 feet to a corner No. 4 said Democrat Lode; thence N. 9°20’00” E., along the West line said Democrat Lode a distance of 27.70 feet to a point on said North line of the NW 1⁄4 of the SE 1⁄4; thence N. 86°53’19” E., along said line a distance o 451.99 feet to the Point of Beginning, County of Gilpin, State of Colorado.

Parcel IV:

The Mayflower Tunnel Lode as described in Book 605 at Page 14, City of Black Hawk, County of Gilpin, State of Colorado, being in the SW 1⁄4 of Section 8, Township 3 South, Range 72 West of the 6th P.M., described as follows:

Ex. B-7

Beginning at the most Northerly corner said Lode from which point the West 1⁄4 corner of said Section 8 bears N. 48°48’17” W., a distance of 885.42 feet; thence S. 32°00’00” E., a distance of 151.47 feet to the most Easterly corner said Lode; thence S. 50°00’00” W., a distance of 871.20 feet to the most Southerly corner said Lode; thence N. 32°00’00” W., a distance of 151.47 feet to the most Westerly corner said Lode; thence N. 50°00’00” E., a distance of 871.20 feet to the Point of Beginning, County of Gilpin, State of Colorado.

Parcel V:

That part of the Democrat Lode, U.S. Mineral Survey No. 7626, the Silver Dime Lode, City Title and the Prince Henry Lode, City Title lying in the SE 1⁄4 of the NE 1⁄4 of Section 7, Township 3 South, Range 72 West of the 6th P.M., County of Gilpin, State of Colorado, which begins at the intersection of the South line of said SE 1⁄4 of the NE 1⁄4 with line 4-1 said Democrat Lode, from which point corner No. 4 said Democrat Lode bears S. 9°20’00” W., a distance of 27.70 feet; thence N. 9°20’00” E., along said Line 4-1 and along the Westerly line of said Silver Dime Lode a distance of 247.30 feet to the Northwest corner said Silver Dime Lode; thence S. 80°40’00” E., along the Northerly line said Silver Dime Lode a distance of 338.92 feet to the intersection with the Northerly line of said Prince Henry Lode; thence N. 54°09’22” E., along said Northerly line a distance of 437.51 feet to the Northeasterly corner said Prince Henry Lode; thence S. 34°08’00” E., a distance of 22.47 feet to a point on the Northerly line of the Missouri Lode, City Title; thence S 44°07’00” W., along said Northerly line a distance of 121.76 feet to an angle point in said Northerly line; thence S. 54°14’00” W., along said Northerly line a distance of 273.89 feet to a point on the Northerly line of said Silver Dime Lode; thence S. 80°40’00” E., along said Northerly line a distance of 180.09 feet to a point on the Northerly line of the Radical Lode, Mineral Survey No. 211; thence S. 52°06’43” W., along said Northerly line a distance of 204.23 feet to a point on the South line said SE 1⁄4 of the NE 1⁄4 of Section 7; thence S. 86°53’19” W., along said South line a distance of 452.99 feet to the point of beginning, County of Gilpin, State of Colorado.

Parcel VI:

That part of the Silver Dollar Lode, City Title and the Black Bear Lode, City Title lying in the SE 1⁄4 of the NE 1⁄4 of Section 7, Township 3 South, Range 72 West of the 6th P.M., County of Gilpin, State of Colorado, which begins at the intersection of the South line said SE 1⁄4 of the NE 1⁄4 and the Southerly line of the Radical Lode Mineral Survey No. 211; thence N. 52°06’43” E., along said Southerly line a distance of 415.95 feet to a point on the Northerly line said Silver Dollar Lode; thence N. 84°09’00” E., along said Northerly line a distance of 117.83 feet to a point on the East line said SE 1⁄4 of the NE 1⁄4; thence S. 01°46’45” E., along said East line a distance of 150.38 feet to a point on the Southerly line said Silver Dollar Lode; thence S. 84°09’00” W., along said Southerly line a distance of 60.07 feet to a point on the Northeasterly line of the Leopold Lode, City Title; thence N. 35°26’00” W., along said Northeasterly line a

Ex. B-8

distance of 107.97 feet to the most Northerly corner said Leopold Lode; thence S. 54°34’00” W., along the Northwesterly line said Leopold Lode a distance of 338.35 feet to a point on the South line of the SE 1⁄4 of the NE 12/4; thence S. 86°53’19” W., along said South line a distance of 52.19 feet to the point of beginning, County of Gilpin, State of Colorado.

Parcel VII:

That part of the Klondyke Lode, City Title lying within the SE 1⁄4 of the NE 1⁄4 of Section 7, Township 3 South, Range 72 West of the 6th P.M., County of Gilpin, State of Colorado, which begins at a point on the South line said SE 1⁄4 of the NE 1⁄4 from which point the Southeast corner said SE 1⁄4 NE 1⁄4 bears N. 86°53’19” E., a distance of 1.12 feet; thence S. 86°53’19” W., along said South line a distance of 119.85 feet to a point on the Northwesterly line of said Klondyke Lode; thence N. 54°34’00” E., along said Northwesterly line a distance of 101.28 feet to the most Northerly corner said Klondyke Lode; thence S. 35°26’00” E., along the Northeasterly line said Klondyke Lode a distance of 64.08 feet to the point of beginning, County of Gilpin, State of Colorado.

Parcel VIII:

A tract of land located within the South Half of Section 7, Township 3 South, Range 72 West of the Sixth Principal Meridian, City of Black Hawk, County of Gilpin, State of Colorado, more particularly described as follows:

Commencing at the East Quarter Corner of said Section 7, whence the East Line of said Section is assumed to bear S 00°12’28” W with all bearings contained herein relative thereto, thence S 58°32’18” W, 2081.46 feet to the Northwest corner of the South Jennie Blanche Lode and the True Point of Beginning; thence along the Westerly and Southerly lines of said South Jennie Blanche Lode S 26°00’00” E, 117.00 feet; thence N 63°59’50” E, 750.23 feet; thence S 45°35’45” E, 80.09 feet to a point along the Northerly line of the Gertrude Lode; thence along said Northerly line S 62°31’27” W, 739.19 feet to a point along the Northerly line of the Chicago Lode; thence along said Northerly line S 80°06’00” W, 787.50 feet; thence N 04°39’00” W, 71.32 feet to a point along the Southerly line of the Jennie Blanche Lode M.S. 551; thence along said Southerly line N 76°31’05” E, 263.41 feet to a point along the Westerly line of the Gilpin County Tunnel; thence along the Westerly and Southerly lines of the Gilpin County Tunnel S 37°42’00” E, 16.28 feet; thence N 52°18’00” E, 36.23 feet to a point along the Southerly line of the Jennie Blanche Lode M.S. 551; thence along said Southerly line the following two (2) courses:

| 1. | N76°21’39”E, 35.63 feet; |

| 2. | Thence N 64°00’22” E, 361.77 feet to the True Point of Beginning |

Parcel IX:

Ex. B-9

Easement for ingress, egress and roadway purposes as conveyed and described in Grant of Easement and Right of First Refusal recorded April 29, 1998, in Book 640, Page 79, over, under, upon and across those portions of the Leopold Lode, Black Hawk City Title, said Leopold Lode is as described in Deed recorded July 11, 1902, in Book 150, Page 42, County of Gilpin, State of Colorado.

Parcel X:

Non-exclusive easement for air space over Richmond Street as more particularly described in the Air Space Easement Agreement recorded November 4, 2009 at Reception No. 140361, County of Gilpin, State of Colorado.

Parcel XI:

Non-exclusive easement for Slope Stabilization purposes, as more particularly described in the Slope Stabilization

Easement Agreement recorded November 4, 2009 at Reception No. 140362, County of Gilpin, State of Colorado.

Parcel XII:

A tract of land in the SE 1/4 of the SE 1/4 of Section 17, Township 2 South, Range 72 West of the 6th

P.M., described as follows:

Beginning at a point on the West line of said SE 1/4 of the SE 1/4, which Point of Beginning lies 370 feet

North of the Southwest Corner of said SE 1/4 of the SE 1/4 of Section 17, and which Point of Beginning

is also the Southeast Corner of Lot 9, Colorado Sierra Subdivision Alpha, Unit 1;

thence S 82°31’ E, a distance of 502.98 feet to a point on the Westerly line of Colorado State Highway

No. 119;

thence S 7°24’ W, along the Westerly right of way line of said Highway No. 119, a distance of 306.4 feet,

more or less, to a point on the South line of said SE 1/4 of the SE 1/4;

thence S 89°57’ W, along said South line of the SE 1/4 of the SE 1/4, a distance of 464.8 feet to the

Ex. B-10

Southwest Corner of said SE 1/4 of the SE 1/4;

thence N 00°39’ E, along the West line of said Se 1/4 of the SE 1/4, a distance of 370 feet to the Point of

beginning, County of Gilpin, State of Colorado.

Ex. B-11

Cactus Pete’s

PARCEL 1:

LOT 2 OF THE REVISED FIRST ADDITION, TOWN OF JACKPOT, AS SHOWN ON THE OFFICIAL MAP THEREOF FILED IN THE OFFICE OF THE COUNTY OF RECORDER OF ELKO COUNTY, STATE OF NEVADA, ON MARCH 29, 1976, AS FILE NO. 97220.

TOGETHER WITH THAT PORTION OF SECTION 1, TOWNSHIP 47 NORTH, RANGE 64 EAST, MDB&M., WHICH LIES ADJACENT AND CONTIGUOUS TO SAID LOT 2 DESCRIBED ABOVE AND ALSO TO THAT PARCEL WHICH IS DESCRIBED IMMEDIATELY FOLLOWING THIS PARAGRAPH, AS ABANDONED BY RESOLUTION OF ABANDONMENT DATED OCTOBER 19, 1961, EXECUTED BY THE STATE OF NEVADA, DEPARTMENT OF TRANSPORTATION, AND RECORDED FEBRUARY 08, 1982, IN BOOK 381, PAGE 636, OFFICIAL RECORDS, ELKO COUNTY, NEVADA.

ALSO TOGETHER WITH THAT PORTION OF SECTION 1, TOWNSHIP 47 NORTH, RANGE 64 EAST, MDB&M., WHICH IS SITUATE NORTH OF LOT 2 AS SHOWN ON THE REVISED FIRST ADDITION, TOWN OF JACKPOT AND WHICH IS SITUATE SOUTH OF DICE ROAD AS SHOWN ON THAT MAP ENTITLED MAP OF LOTS 2, 2-A AND 3 REVISED FIRST ADDITION FILED IN THE OFFICE OF THE COUNTY RECORDER OF ELKO COUNTY, ON MARCH 19, 1985, AS FILE NO. 202802.

EXCLUDING THAT PORTION OF SECTION 1, TOWNSHIP 47 NORTH, RANGE 64 EAST, MDB&M., WHICH IS SITUATE WITHIN DICE ROAD AS SHOWN ON THAT MAP ENTITLED MAP OF LOTS 2, 2A AND 3, REVISED FIRST ADDITION FILED IN THE OFFICE OF THE COUNTY RECORDER OF ELKO COUNTY, ON MARCH 19, 1985, AS FILE NO. 202802.

PARCEL 2-A:

LOT 2-A OF THE REVISED FIRST ADDITION, TOWN OF JACKPOT, AS SHOWN ON THE OFFICIAL MAP THEREOF FILED IN THE OFFICE OF THE COUNTY RECORDER OF ELKO COUNTY, STATE OF NEVADA, ON MARCH 29, 1976, AS FILE NO. 97220.

TOGETHER WITH THAT PORTION OF SECTION 1, TOWNSHIP 47 NORTH, RANGE 64 EAST, MDB&M., WHICH LIES ADJACENT AND CONTIGUOUS TO SAID LOT 2-A DESCRIBED ABOVE, LESS THOSE PARCELS WHICH ARE EXCEPTED IMMEDIATELY FOLLOWING, AS ABANDONED BY RESOLUTION OF ABANDONMENT DATED OCTOBER 19, 1981, EXECUTED BY THE STATE OF NEVADA, DEPARTMENT OF TRANSPORTATION, AND RECORDED FEBRUARY 08, 1982, IN BOOK 381, PAGE 636, OFFICIAL RECORDS, ELKO COUNTY, NEVADA.

EXCEPTING THEREFROM ALL THAT PORTION OF SAID LOT LYING WITHIN THE NORTH HALF (N 1/2) OF THE NORTHWEST QUARTER (NW 1/4) OF THE

Ex. B-12

SOUTHWEST QUARTER (SW 1/4) OF THE SOUTHWEST QUARTER (SW 1/4) OF SECTION 1, TOWNSHIP 47 NORTH, RANGE 64 EAST, MDB&M.

ALSO TOGETHER WITH THOSE PORTIONS OF SECTION 1, TOWNSHIP 47 NORTH, RANGE 64 EAST, MDB&M., WHICH IS SITUATE SOUTH OF AND WITHIN DICE ROAD AS SHOWN ON THAT MAP ENTITLED MAP OF LOTS 2, 2-A AND 3 REVISED FIRST ADDITION FILED IN THE OFFICE OF THE COUNTY RECORDER OF ELKO COUNTY, ON MARCH 19, 1985 AS FILE NO. 202802.

PARCEL 2-B:

THAT PORTION OF LOT 2-A OF THE REVISED FIRST ADDITION, TOWN OF JACKPOT, AS SHOWN ON THE OFFICIAL MAP THEREOF FILED IN THE OFFICE OF THE COUNTY RECORDER OF ELKO COUNTY, STATE OF NEVADA, ON MARCH 29, 1976, AS FILE NO. 97220, LYING WITHIN THE NORTH HALF (N 1/2) OF THE NORTHWEST QUARTER (NW 1/4) OF THE SOUTHWEST QUARTER (SW 1/4) OF THE SOUTHWEST QUARTER (SW 1/4) OF SECTION 1, TOWNSHIP 47 NORTH, RANGE 64 EAST, MDB&M.

PARCEL 3:

LOTS 13 AND 13-A OF THE REVISED FIRST ADDITION, TOWN OF JACKPOT AS SHOWN ON THE OFFICIAL MAP THEREOF FILED IN THE OFFICE OF THE COUNTY RECORDER OF ELKO COUNTY, STATE OF NEVADA, ON MARCH 29, 1976, AS FILE NO. 97220.

TOGETHER WITH THAT PORTION OF ABANDONED ACE ROAD, LYING NORTH AND SOUTH OF THE ABOVE DESCRIBED LOTS AND BOUNDED BY THE EXTENSION OF THE EASTERLY AND WESTERLY BOUNDARY LINES OF SAID ABOVE MENTIONED LOTS

PARCEL 4:

LOT 15 OF THE REVISED FIRST ADDITION, TOWN OF JACKPOT, AS SHOWN ON THE OFFICIAL MAP THEREOF FILED IN THE OFFICE OF THE COUNTY RECORDER OF ELKO COUNTY, STATE OF NEVADA, ON MARCH 29, 1976, AS FILE NO. 97220.

PARCEL 5:

LOT 17 OF THE REVISED FIRST ADDITION, TOWN OF JACKPOT, AS SHOWN ON THE OFFICIAL MAP THEREOF FILED IN THE OFFICE OF THE COUNTY RECORDER OF ELKO COUNTY, STATE OF NEVADA, ON MARCH 29, 1976, AS FILE NO. 97220.

TOGETHER WITH THAT PORTION OF SECTION 1, TOWNSHIP 47 NORTH, RANGE 64 EAST, MDB&M., WHICH LIES ADJACENT AND CONTIGUOUS TO SAID LOT 2-A DESCRIBED ABOVE, LESS THOSE PARCELS WHICH ARE EXCEPTED IMMEDIATELY FOLLOWING THIS PARAGRAPH, AS ABANDONED BY RESOLUTION OF ABANDONMENT DATED OCTOBER 19, 1981, EXECUTED BY THE STATE OF

Ex. B-13

NEVADA, DEPARTMENT OF TRANSPORTATION, AND RECORDED FEBRUARY 08, 1982, IN BOOK 381, PAGE 636, OFFICIAL RECORDS, ELKO COUNTY, NEVADA.

EXCEPTING THEREFROM THAT CERTAIN PARCEL OF LAND CONVEYED TO THE UNINCORPORATED TOWN OF JACKPOT BY DEED RECORDED MARCH 18, 1976, IN BOOK 226, PAGE 441, OFFICIAL RECORDS, ELKO COUNTY, NEVADA.

FURTHER EXCEPTING THEREFROM THAT PORTION OF LOT 17 WHICH IS SITUATE WITHIN THE 60.00 FOOT RIGHT OF WAY, ALONG AND CONTIGUOUS TO THE EASTERLY BOUNDARY OF U.S. HIGHWAY 93, AS CONVEYED TO THE STATE OF NEVADA BY DEED RECORDED FEBRUARY 08, 1982, IN BOOK 381, PAGE 642, OFFICIAL RECORDS, ELKO COUNTY, NEVADA.

PARCEL 6:

LOT 17B OF THE REVISED FIRST ADDITION, TOWN OF JACKPOT, AS SHOWN ON THE OFFICIAL MAP THEREOF FILED IN THE OFFICE OF THE COUNTY RECORDER OF ELKO COUNTY, STATE OF NEVADA, ON MARCH 29, 1976, AS FILE NO. 97220.

PARCEL 7:

TOWNSHIP 47 NORTH, RANGE 64 EAST, MDB&M.

SECTION 12: NORTH HALF (N 1/2) OF THE NORTHEAST QUARTER (NE 1/4) OF THE NORTHWEST QUARTER (NW 1/4) OF THE NORTHWEST QUARTER (NW 1/4); AND THE NORTHWEST QUARTER (NW 1/4) OF THE NORTHWEST QUARTER (NW 1/4) OF THE NORTHEAST QUARTER (NE 1/4) OF THE NORTHWEST QUARTER (NW 1/4);

TOGETHER WITH THAT PORTION OF SECTION 12 LYING ADJACENT AND CONTIGUOUS TO THE ABOVE DESCRIBED PARCELS OF LAND AS ABANDONED BY RESOLUTION OF ABANDONMENT DATED OCTOBER 19, 1981, EXECUTED BY THE STATE OF NEVADA, DEPARTMENT OF TRANSPORTATION AND RECORDED FEBRUARY 08, 1982, IN BOOK 381, PAGE 636, OFFICIAL RECORDS, ELKO COUNTY, NEVADA.

EXCEPTING THEREFROM THAT CERTAIN PARCEL OF LAND CONVEYED TO THE UNINCORPORATED TOWN OF JACKPOT BY DEED RECORDED JUNE 24, 1982, IN BOOK 394, PAGE 107, OFFICIAL RECORDS, ELKO COUNTY, NEVADA.

PARCEL 8:

LOT 1 OF THE REVISED FIRST ADDITION, TOWN OF JACKPOT, AS SHOWN ON THE OFFICIAL MAP THEREOF FILED IN THE OFFICE OF THE COUNTY RECORDER OF ELKO COUNTY, STATE OF NEVADA, ON MARCH 29, 1976, AS FILE NO. 97220.

TOGETHER WITH THAT PORTION OF SECTION 1, TOWNSHIP 47 NORTH, RANGE 64 EAST, MDB&M., WHICH LIES ADJACENT AND CONTIGUOUS TO THE ABOVE DESCRIBED PARCEL, AS ABANDONED BY RESOLUTION OF ABANDONMENT

Ex. B-14

DATED OCTOBER 19, 1981, EXECUTED BY THE STATE OF NEVADA, DEPARTMENT OF TRANSPORTATION AND RECORDED FEBRUARY 08, 1982, IN BOOK 381, PAGE 636, OFFICIAL RECORDS, ELKO COUNTY, NEVADA.

PARCEL 9:

LOT 17-A OF THE REVISED FIRST ADDITION, TOWN OF JACKPOT, AS SHOWN ON THE OFFICIAL MAP THEREOF FILED IN THE OFFICE OF THE COUNTY RECORDER OF ELKO COUNTY, STATE OF NEVADA, ON MARCH 29, 1976, AS FILE NO. 97220.

TOGETHER WITH THAT PORTION OF SECTION 1, TOWNSHIP 47 NORTH, RANGE 64 EAST, MDB&M., WHICH LIES ADJACENT AND CONTIGUOUS TO THE ABOVE DESCRIBED PARCEL, AS ABANDONED BY RESOLUTION OF ABANDONMENT EXECUTED BY THE STATE OF NEVADA, DEPARTMENT OF TRANSPORTATION AND RECORDED FEBRUARY 08, 1982, IN BOOK 381, PAGE 636, OFFICIAL RECORDS, ELKO COUNTY, NEVADA.

FURTHER EXCEPTING THEREFROM THAT PORTION OF LOT 17-A WHICH IS SITUATE WITHIN THE 60.00 FOOT RIGHT OF WAY, ALONG AND CONTIGUOUS TO THE EASTERLY BOUNDARY OF U.S. HIGHWAY 93, AS CONVEYED TO THE STATE OF NEVADA BY DEED RECORDED FEBRUARY 08, 1982, IN BOOK 381, PAGE 642, OFFICIAL RECORDS, ELKO COUNTY, NEVADA.

NOTE: ALL THE ABOVE METES AND BOUNDS DESCRIPTIONS PREVIOUSLY APPEARED IN THAT CERTAIN DOCUMENT RECORDED APRIL 18, 2011 AS INSTRUMENT 639017 ELKO COUNTY OFFICIAL RECORDS.

PARCEL 10:

LOT 16 OF THE REVISED FIRST ADDITION, TOWN OF JACKPOT, AS SHOWN ON THE OFFICIAL MAP THEREOF FILED IN THE OFFICE OF THE COUNTY RECORDER OF ELKO COUNTY, STATE OF NEVADA, ON MARCH 29, 1976, AS FILE NO. 97220.

Ex. B-15

Belterra Resort

Tract 1:

A part of Section 1, Township 1 North, Range 2 West, located in York Township of Switzerland County, Indiana, described as follows: Commencing at the Northwest corner, fractional Section 1, Township 1 North, Range 2 West; thence South 88 degrees 41 minutes 00 seconds East 2801.00 feet (deed); thence South 02 degrees 55 minutes 00 West 1265.00 feet (deed) to an iron bar found being the actual Point of Beginning; thence continuing South 02 degrees 55 minutes 00 seconds West 270.00 feet to a P.K. Nail found in the centerline of State Road 156; thence along said centerline North 88 degrees 41 minutes 00 seconds West, 175.00 feet to a P.K. Nail set; thence North 02 degrees 55 minutes 00 seconds East, 270.00 feet to a T-Bar set; thence South 88 degrees 41 minutes 00 seconds East 175.00 feet to the Point of Beginning.

Tract 2:

Being a part of fractional Section 1, Township 1 North, Range 2 West in Switzerland County, Indiana; beginning on the North-South Quarter Section line at a United States Army Corps of Engineers Marker that is 1,266.73 feet South of its intersection with the center line of State Highway No. 156, running thence South 77 degrees West 198 feet along the U.S. Government property and marked by an iron stake; thence North 8 degrees West 143 feet to an iron stake in a garden fence; thence South 90 degrees East, 214 feet to the Quarter Section line; thence South 90 feet to the Place of Beginning.

Together with right of ingress and egress over the present existing highway leading to and from the above-described tract of land to Indiana State Highway No. 156.

Tract 3:

Being a part of fractional Section 1, Township 1 North, Range 2 West and part of Section 36, Township 2 North, Range 2 West of the First Principal Meridian located in York Township of Switzerland County, Indiana, and being part of Tract 3 of the Daniel Vincent Dufour Real Estate Partition as recorded in the complete record of the Probate Court of Switzerland County, Indiana, in Order Book from September term 1850 to July term 1853 in pages 51, 52, 53 and 54 and further described as follows: Commencing at an iron pin at the Northwest corner of Section 1, Township 1 North, Range 2 West, thence North 89 degrees 49 minutes 48 seconds East with the North line of said Section 1, 398.91 feet to a rebar in the line dividing Tract 3 and Tract 4 of the Daniel Vincent Dufour real estate partition and the true Point of Beginning; thence North 00 degrees 26 minutes 26 seconds West with the prolongation of the line dividing Tract 3 and Tract 4 of said Dufour’s partition, and along the West boundary of the parent tract of land (Hunt

Ex. B-16

D.R. 88, P. 50), 14.94 feet to a rebar; thence severing said parent tract of land the following eight courses and distances: North 52 degrees 09 minutes 19 seconds East, 204.19 feet to a rebar; thence South 86 degrees 28 minutes 37 seconds East, 69.95 feet to a rebar; thence South 86 degrees 18 minutes 27 seconds East, 49.04 feet to a rebar; thence South 24 degrees 23 minutes 06 seconds East, 38.12 feet to a rebar; thence South 00 degrees 06 minutes 26 seconds West, 129.95 feet to a rebar; thence South 43 degrees 29 minutes 26 seconds East, 212.31 feet to a rebar; thence South 85 degrees 14 minutes 06 seconds East, 360.23 feet to a rebar; thence North 83 degrees 22 minutes 31 seconds East, 151.68 feet to a rebar in the line dividing Tract 2 and 3 of said Dufour’s partition, said point along being in the boundary of said Hunt parent Tract of land; thence with the boundary of said parent Tract of land the following three courses: South 00 degrees 03 minutes 18 seconds East, 428.78 feet to rebar; thence South 89 degrees 49 minutes 57 seconds West, 942.57 feet to a rebar in the line dividing Tract 3 and Tract 4 of said Dufour’s partition; thence North 00 degrees 26 minutes 28 seconds West with said line, 646.46 feet to the Point of Beginning.

Tract 4:

Being a part of fractional Section 1 and fractional Section 2, Township 1 North, Range 2 West and part of Section 35, Township 2 North, Range 2 West of the first principal meridian and located in York Township of Switzerland County, Indiana, and being part of Tract 4 of the Daniel Vincent Dufour’s real estate partition as recorded in the complete record of the Probate Court of Switzerland County, Indiana, in Order Book from September term 1850 to July term 1853 in pages 51, 52, 53 and 54 and further described as follows:

Beginning at an iron pin at the Northwest corner of Section 1, Township 1 North, Range 2 West, thence with the boundary of the Thomas J. and Christine R. McClain property (D.R. 88, P. 175) the following six courses and distances: North 89 degrees 49 minutes 48 seconds East with the North line of said Section 1 and the North line of said Tract 4, 398.91 feet to a rebar; thence South 00 degrees 26 minutes 28 seconds East with the East line of said Tract 4 and the East line of said McClain property, 327.11 feet to a rebar; thence South 89 degrees 46 minutes 06 seconds West, 957.20 feet to a rebar; thence North 00 degrees 26 minutes 28 seconds West, 324.55 feet to a rebar; thence South 84 (89 degrees per survey) degrees 27 minutes 40 seconds West, 189.39 feet to a rebar; thence North 00 degrees 12 minutes 39 seconds East, 783.23 feet to the center of a creek; thence with the center of said creek the following four courses: South 74 degrees 45 minutes 05 seconds East, 339.67 feet; thence South 74 degrees 10 minutes 51 seconds East 165.15 feet; thence North 47 degrees 44 minutes 59 seconds East 328.51 feet; thence North 75 degrees 25 minutes 39 seconds East, 19.27 feet, thence South 00 degrees 14 minutes 28 seconds West with the East line of said Section 35 and continuing along the boundary of said McClain Tract, 867.58 feet to the Point of Beginning.

Ex. B-17

Tract 5:

Being a part of fractional Section 1, Township 1 North, Range 2 West of the First Principal Meridian, and located in York Township of Switzerland County, Indiana and being part of Tract 4 of the Daniel Vincent Dufour real estate partition as recorded in the complete record of the Probate Court of Switzerland County, Indiana, in Order Book from September term 1850 to July term 1853 in pages 51, 52, 53 and 54 and further described as follows:

Commencing at an iron pin at the Northwest corner of Section 1, Township 1 North,

Range 2 West, thence North 89 degrees 49 minutes 48 seconds East with the North line of said Section 1 and the North line of said Tract 4, 398.91 feet to a rebar at the Northeast corner of said Tract 4; thence South 00 degrees 26 minutes 28 seconds East with the East line of said Tract 4, 327.11 feet to the Point of Beginning; thence continuing South 00 degrees 26 minutes 28 seconds East with the East line of said Tract 4 and the East line of the Tom McClain property (D.R. 91, P. 146), 282.00 feet to a rebar; thence with the Southerly and Westerly boundary of said McClain property the following three courses and distances: North 75 degrees 07 minutes 18 seconds West, 156.62 feet to a rebar; thence North 35 degrees 26 minutes 28 seconds West, 103.81 feet to a rebar; thence North 00 degrees 26 minutes 28 seconds West, 156.35 feet to a rebar; thence North 89 degrees 46 minutes 06 seconds East with the Northerly line of said McClain property, 210.60 feet to the Point of Beginning.

Tract 6:

Being a part of the Northeast Quarter of fractional Section 1, Township 1 North, Range 2 West, York Township, Switzerland County, Indiana, described as follows: Commencing at a corner post at the Northwest corner of fractional Section 1; thence South 88 degrees 41 minutes 00 seconds East (assumed bearing), 2801.00 feet to a point in the center of Log Lick Creek; thence South 02 degrees 55 minutes 00 seconds West, 1168.00 feet to a corner post and the actual Point of Beginning; thence South 88 degrees 41 minutes 00 seconds East, 237.00 feet to a stake; thence South 02 degrees 55 minutes 00 seconds West, 367.00 feet to a steel nail in the centerline of State Highway No. 156; thence with the highway centerline, North 88 degrees 41 minutes 00 seconds West 237.00 feet to a steel nail; thence leaving the road, North 02 degrees 55 minutes 00 seconds East, 367.00 feet to the Point of Beginning.

Tract 7:

Ex. B-18

Being a part of fractional Section 1 and fractional Section 2, Township 1 North, Range 2 West of the First Principal Meridian located in York Township of Switzerland County, Indiana, and a part of Tract No. 3 and Tract No. 4 of the partition of the real estate of Daniel Vincent Dufour among his children as recorded in the complete record of the Probate Court of Switzerland County, Indiana, in Order Book from September term 1850 to July term 1853 in pages 51, 52, 53 and 54 and further described as follows:

Commencing at a concrete monument found in place at the Northeast corner of said Section 1, Township 1 North, Range 2 West; thence South 89 degrees 49 minutes 48 seconds West a distance of 3996.57 feet, passing through an iron pin with cap in line at 2165.72 feet, with the North line of said Section 1 to an iron pin and cap at the Northwest corner of Tract 2 of said Daniel Vincent Dufour partition; thence South 00 degrees 03 minutes 18 seconds East a distance of 646.50 feet along a common line dividing Tract 2 and Tract 3 in said Daniel Vincent Dufour partition to an iron pin with cap and the true Point of Beginning; thence continuing South 00 degrees 03 minutes 18 seconds East a distance of 929.20 feet along a common line dividing Tract 2 and Tract 3 in said Daniel Vincent Dufour partition to a railroad spike in the centerline of Indiana State Road 156; thence continuing South 00 degrees 03 minutes 18 seconds East a distance of 1412.39 feet with said common line dividing Tract 2 and Tract 3 to an existing Corps of Engineers concrete monument in the Northern line of the lands of the United States of America, Deed Book 54, page 144; thence South 88 degrees 39 minutes 24 seconds West a distance of 726.36 feet with the Northern line of the Land of the United States of America to an iron pin with cap; thence North 81 degrees 12 minutes 36 seconds West a distance of 203.14 feet with said Northern line to an existing Corps of engineers concrete monument; thence North 00 degrees 26 minutes 28 seconds West a distance of 1399.32 feet along a common line with the Webster Family Limited Partnership, Deed Book 104, page 79, and the Diuguid Family Limited Partnership, Deed Book 104, page 80, and passing through a steel T-Bar found in place 963.58 feet at the Southeast corner of a 2.0000 acre Tract, to a Steel Nail (P.K.) found in place in the center of Indiana State Road 156; thence North 88 degrees 44 minutes 40 seconds West a distance of 957.62 feet to a Steel Nail set in the center of Indiana State Road 156; thence North 00 degrees 26 minutes 28 seconds West a distance of 1220.07 feet passing through an iron pin with cap set in line at 30.00 feet, and continuing along a common line with the Webster Family Limited Partnership, Deed Book 104, page 79 and the Diuguid Family Limited Partnership, Deed Book 104, page 80, and the line dividing Tract 4 and Tract 5 in said Daniel Vincent Dufour Partition, to an iron pin with cap set by a stone (broken) found in place; thence North 89 degrees 46 minutes 06 seconds East a distance of 746.60 feet along a common line with Thomas J. McClain and Christine R. McClain Deed Book 86, page 175 to an iron pin with cap set in the center of a gravel township road; thence along a common line with other lands of said McClain, Deed Book 91, page 146, the following (3) courses and distances; South 00 degrees 26 minutes 28 seconds East a distance of 156.35 feet to an iron pin with cap; South 35 degrees 26 minutes 28 seconds East a distance of 103.81 feet to an iron pin with cap; South 75 degrees 07 minutes 18

Ex. B-19

seconds East a distance of 156.62 feet to an iron pin with cap on the East side of said township road; thence South 00 degrees 26 minutes 28 seconds East a distance of 37.39 feet along a common line with David and Cassandra Hunt, Deed Book 88, page 50 and the common line dividing Tract 3 and Tract 4 in said Daniel Vincent Dufour partition to an iron pin with cap; thence North 89 degrees 49 minutes 48 seconds East a distance of 942.57 feet along a line common with said David and Cassandra Hunt to an iron pin with cap and the Point of Beginning.

Excepting therefrom that portion thereof conveyed to “Hoosier Energy Rural Electric Cooperative, Inc., an Indiana Corporation”, by Warranty Deed recorded April 7, 2000 in Deed Book 110, page 171, being a part of Fractional Section 2, Township 1 North Range 2 West, First Principal Meridian, York Township, Switzerland County, Indiana, more particularly described as follows:

Commencing at an iron pin found at the Northeast corner of Section 2, Township 1 North, Range 2 West, Switzerland County, Indiana; thence South 00 degrees 26 minutes 28 seconds East 327.55 feet to the North line of a 76.268 acre Tract as described in Deed Record 109, page 132 in the Office of the Recorder; thence with the North line of said 76.268 acre tract, South 89 degrees 46 minutes 06 seconds West 558.30 feet to an iron pin found next to a stone; thence with the West line of said 76.268 acre Tract; South 00 degrees 26 minutes 28 seconds East, 1220.07 feet (passing an iron pin found at 1190.07 feet) to a nail found in the centerline of State Road 156; thence with the centerline of said road South 88 degrees 44 minutes 40 seconds East 15.00 feet to the Place of Beginning; thence North 00 degrees 26 minutes 28 seconds West 330.00 feet (passing a 5/8” rebar with cap set at 30.01 feet) to a 5/8” rebar with cap set; thence South 88 degrees 44 minutes 40 seconds East 140.00 feet to a 5/8” rebar with cap set; thence South 00 degrees 26 minutes 28 seconds East 180.00 feet to a 5/8” rebar with cap set; thence North 88 degrees 44 minutes 40 seconds West 90.00 feet to a 5/8” rebar with cap set; thence South 00 degrees 26 minutes 28 seconds East 150.00 feet (passing a 5/8” rebar with cap set at 119.99 feet) to the centerline of State Road 156; thence with said centerline, North 88 degrees 44 minutes 40 seconds West 50.00 feet to the Place of Beginning.

Tract 8:

A part of Section 1, Township 1 North, Range 2 West, York Township, Switzerland County, Indiana, described as follows:

Beginning in the centerline of State Road 156 at the Northeast corner of the Southwest Quarter, Section 1, Township 1 North, Range 2 West; hence South 01 degree 33 minutes 32 seconds West 1064.75 feet to a railroad spike found; thence North 89 degrees 00 minutes 00 seconds West 214.00 feet to a rebar set; thence

Ex. B-20

South 08 degrees 00 minutes 00 seconds East 143.00 feet to a rebar set; thence South 75 degrees 57 minutes 47 seconds West 210.10 feet; thence South 81 degrees 32 minutes 12 seconds West 550.62 feet to a concrete monument; thence South 86 degrees 25 minutes 25 seconds West 568.58 to a concrete monument; thence North 01 degree 24 minutes 35 seconds East 1412.95 feet to a nail set in the centerline of State Road 156; thence along said centerline South 88 degrees 22 minutes 08 seconds East 1504.80 feet to the Point of Beginning.

Tract 9:

Being part of the Northwest Quarter of fractional Section 1, Township North, Range 2 West, York Township, Switzerland County, Indiana, described as follows: Commencing at a corner post at the Northwest corner of said fractional Section 1, thence South 88 degrees 41 minutes East, (assumed bearing), 2801.00 feet to a point in the center of Log Lick Creek; thence South 02 degrees 55 minutes West, 1265.00 feet to a stake in a fence line and the actual Place of Beginning; thence continuing South 02 degrees 55 minutes West, 270.00 feet to a steel nail in the centerline of State Highway No. 156; thence with the center of said Highway North 88 degrees 41 minutes West, 350.00 feet to a steel nail; thence leaving the highway North 02 degrees 55 minutes East, 270.00 feet to a stake; thence South 88 degrees 41 minutes East, 350.00 feet to the Place of Beginning.

Excepting therefrom, a part of Section 1, Township 1 North, Range 2 West, located in York Township of Switzerland County, Indiana, described as follows: Commencing at the Northwest corner, fractional Section 1, Township 1 North, Range 2 West; thence South 88 degrees 41 minutes 00 seconds East 2801.00 feet (deed); thence South 02 degrees 55 minutes 00 seconds West 1265.00 feet (deed), to an iron bar found being the actual Point of Beginning; thence continuing South 02 degrees 55 minutes 00 seconds West 270.00 feet to a P.K. Nail found in the centerline of State Road 156; thence along said centerline North 88 degrees 41 minutes 00 seconds West 175.00 feet to a P.K. Nail set; thence North 02 degrees 55 minutes 00 seconds East 270.00 feet to a T-Bar set; thence South 88 degrees 41 minutes 00 seconds East 175.00 feet to the Point of Beginning.

Tract 10:

Leasehold estate pursuant to a certain lease dated December 11, 1998 by and between the Webster Family Limited Partnership and The Diuguid Family Limited Partnership as landlord and Pinnacle Gaming Development Corp. as tenant as set out in a memorandum of lease recorded December 30, 1998 in Miscellaneous Record AA, page 148, as assigned to Belterra Resort Indiana, LLC by assignment recorded December 15, 2000 in Miscellaneous Record CC, page 182 with respect to the following real estate:

Ex. B-21

Being part of fractional Section 1, Township 1, North, Range 2 West of the first principal meridian located in York Township of Switzerland County, Indiana and a part of Tract No. 1 of the partition of the real estate of Daniel Vincent Dufour among his children as recorded in the complete record of the Probate Court of Switzerland County, Indiana, in Order Book from September term 1850 to July term 1853 in pages 51, 52, 53 and 54 and is further described as follows:

Commencing at a concrete monument found in place at the Northeast corner of said Section 1, Township 1 North, Range 2 West; thence South 89 degrees 49 minutes 48 seconds West a distance of 1140.71 feet with the North line of said Section 1 to a point; thence South 00 degrees 00 minutes 27 seconds East a distance of 350.47 feet to a point in the center of Log Lick Creek and the true Point of Beginning; thence continuing South 00 degrees 00 minutes 27 seconds East a distance of 3093.92 feet, passing through concrete monuments found in line at 33.25 feet, 708.25 feet, 1202.08 feet, 1773.20 feet, 2393.28 feet respectively and through an iron pin with cap found in line at 1262.08 feet and a stone found in line at 2747.80 feet, along a common line in part with the lands now or formerly owned by William L. Martin and Vernon Martin, Deed Book 89, page 154 in the Records of Switzerland County, Indiana, and along a common line in part with the lands now or formerly owned by James O. Chaskel Deed Book 90, page 292 in said records, to a point in the Ohio River and in the Indiana-Kentucky Stateline as established by the Supreme Court of the United States, October term 1985, No. 81, (see Kentucky’s V. Indiana, Orig. No. 81 joint Exhibit No. 50); thence downstream with said Indiana-Kentucky stateline the following three courses and distances; South 75 degrees 07 minutes 19 seconds West a distance of 211.68 feet to a point; South 72 degrees 59 minutes 38 seconds West a distance of 708.68 feet to a point; South 72 degrees 37 minutes 29 seconds West a distance of 159.59 feet to a point; thence North 00 degrees 00 minutes 27 seconds West a distance of 1125.10 feet, passing through a concrete monument found in line at 974.79 feet along a common line with the lands of the United States of America, Deed Book 55, page 7 in said records, to a Corps of Engineers concrete monument; thence South 70 degrees 43 minutes 28 seconds West a distance of 336.38 feet along a common line with said lands of the United States of America to a Corps of Engineers concrete monument; thence North 00 degrees 00 minutes 27 seconds West a distance of 1155.39 feet along a common line in part with the lands of Walter and Thelma Earls, Deed Book 95, page 111 in said records and then in line with the lands of John and Dorothy Keaton, Deed Book 96, page 353 in said records, passing through a railroad spike found in line at 90.00 feet and an iron pin with cap found in line at 1125.39 feet to a point in the center of Indiana State Road 156; thence along common lines with the lands of Raymond and and Evelyn Hatton, Deed Book 82, page 320 in said records the following three (3) courses and distances: North 89 degrees 55 minutes 36 seconds East a distance of 237.00 feet, passing through a steel nail found at 1.08 feet to a point in the center of said highway North 00 degrees 00 minutes 27 seconds West a distance of 367.00 feet, passing through a monument found in line

Ex. B-22

at 30.00 feet, to a found iron pin; South 89 degrees 55 minutes 36 seconds West a distance of 237.00 feet to a found concrete monument; thence North 00 degrees 00 minutes 27 seconds West a distance of 1169.05 feet along a common line with the lands of Webster, Dirguid and Showers, Deed Book 99, page 150, Deed Book 101, Page 162 and Deed Book 107 page 112 in said records, passing through a concrete monument found in line at 433.40 feet, an iron pin and cap found in line at 870.84 feet, a concrete monument found in line at 1134.34 feet, to a point in the center of Log Lick Creek; thence upstream with the center of Log Lick Creek and its meanders and along a common line in part with said Webster, Dirguid and Showers and along a common line in part with Brichto and Stewart, Deed Book 106, page 276, the following twelve (12) courses and distances; North 88 degrees 44 minutes 27 seconds East a distance of 103.41 feet to a point; South 36 degrees 27 minutes 11 seconds East a distance of 183.51 feet to a point; North 87 degrees 03 minutes 47 seconds East a distance of 83.49 feet to a point; North 49 degrees 37 minutes 18 seconds East a distance of 138.52 feet to a point; South 73 degrees 53 minutes 44 seconds East a distance of 205.55 feet to a point; South 68 degrees 56 minutes 45 seconds East a distance of 254.82 feet to a point; South 22 degrees 22 minutes 14 seconds East a distance of 247.58 feet to a point; South 46 degrees 36 minutes 50 seconds East a distance of 69.18 feet to a point; South 88 degrees 32 minutes 11 seconds East a distance of 51.50 feet to a point; North 36 degrees 59 minutes 31 seconds East a distance of 150.14 feet to a point; North 63 degrees 41 minutes 37 seconds East a distance of 74.63 feet to a point; North 82 degrees 08 minutes 29 seconds East a distance of 164.08 feet to the point of beginning.

Tract 11:

Leasehold estate pursuant to a certain lease dated December 11, 1998 by and between Daniel Webster, Marsha S. Webster and William G. Diuguid, Sarah T. Diuguid, J.R. Showers III and Carol A. Showers as landlord and Pinnacle Gaming Development Corp. as tenant as set out in a memorandum of lease recorded December 30, 1998 in Miscellaneous Record AA, page 149, as assigned to Belterra Resort Indiana, LLC by assignment recorded December 15, 2000 in Miscellaneous Record CC, page 181 with respect to the following real estate:

Being part of fractional Section 1 Township 1 North, Range 2 West of the first principal meridian located in York Township of Switzerland County, Indiana, and a part of Tract No. 1 and Tract No. 2 of the partition of the real estate of Daniel Vincent Dufour among his children as recorded in the complete record of the Probate Court of Switzerland County, Indiana, in Order Book from September term 1850 to July term 1853 in pages 51, 52, 53 and 54 and is further described as follows:

Commencing at a concrete monument found in place at the Northeast corner of said Section 1, Township 1 North, Range 2 West; thence South 89 degrees 49 minutes 48 seconds West a distance of 2165.72 feet with the North line of said

Ex. B-23

Section 1 to an iron pin and cap at the true Point of Beginning; thence South 00 degrees 12 minutes 24 seconds West a distance of 159.92 feet along a line common with Brichto and Stewart, Deed Book 106, page 276 in the records of Switzerland County, Indiana, and passing through an iron pin and cap set in line at 110.00 feet, to a point in the center of Log Lick Creek; thence downstream with the meanders of said creek and along a line in common with the Webster Family Limited Partnership, Deed Book 104, page 79 (Parcel One) and the Diuguid Family Limited Partnership, Deed Book 104, page 80 (Parcel One) the following four (4) courses and distances; South 49 degrees 37 minutes 18 seconds West a distance of 40.64 feet to a point; South 87 degrees 03 minutes 47 seconds West a distance of 83.49 feet to a point; North 36 degrees 27 minutes 11 seconds West a distance of 183.51 feet to a point; South 88 degrees 44 minutes 27 seconds West a distance of 103.47 feet to a point; thence leaving said creek and in part along a line common with the lands of said Webster Family and Diugiud Family Partnerships and in part along a line common with the lands of Raymond and Evelyn Hatton, Deed Book 82, page 320 in said records, South 00 degrees 00 minutes 27 seconds East a distance of 1266.05 feet, passing through concrete monuments found in line on the South bank of the creek at 34.66 feet, an iron pin with cap at 298.06 feet, a concrete monument at 735.65 and a concrete monument at 1169.05 feet at the Northwest corner of the lands of said Raymond and Evelyn Hatton, to an iron pin with cap set in line with said Hatton and at the Northeast corner of the lands of Theresa and Mitchell Barnes, Deed Book 107, page 31 in said records; thence North 89 degrees 59 minutes 45 seconds West a distance of 350.00 feet in part along a common line with the lands of said Barnes and in part along a common line with the lands of John and Carolyn Hendrickson, Deed Book 99, page 48 in said records to an iron pin with cap at the Northwest corner of said lands of Hendrickson; thence South 00 degrees 00 minutes 27 seconds East a distance of 270.00 feet along a line common with the lands of said Hendrickson to a steel nail set in the center of Indiana State Road 156 in the North line of the lands of John and Dorothy Keeton, Deed Book 96, page 353 in said records; thence North 89 degrees 59 minutes 45 seconds West a distance of 1152.19 feet along a line common with the lands of said Keeton to a railroad spike set in the center of said Indiana State Road 156 at the Northwest corner of the lands of said Keeton and in the Eastern line of the lands of Harold and Delores Fletcher, Deed Book 96, page 115 in said records and also in the line common to Tract No. 2 and Tract No. 3 of aforesaid Daniel Vincent Dufour partition; thence North 00 degrees 03 minutes 18 seconds West a distance of 1575.70 feet along a line common with said Tract No. 2 and Tract No. 3 and in part along a common line with the lands of said Fletcher and in part along a line common with the lands of David and Cassandra Hunt, Deed Book 88, page 50, to an iron pin with cap in the North line of aforesaid Section 1; thence North 89 degrees 49 minutes 48 seconds East a distance of 1830.85 feet with the North line of said Section 1 and in part along a common line with the lands of said David and Cassandra Hunt and in part along a common line with the lands of Miles and Betty Hunt, Deed Book 106, page 236, to the Point of Beginning.

Ex. B-24

Ex. B-25

Ogle Haus

TRACT I:

A part of Fractional Section 23, Township 2 North, Range 3 West of the First Principal Meridian, located in Jefferson Township of Switzerland County, Indiana described as follows:

Commencing at the Northwest corner of Section 23, Township 2 North, Range 3 West; thence South 910.80 feet (See Deed Record 71, page 154) to a reference point; thence South 33 degrees 07 minutes 02 seconds East 706.20 feet to a railroad spike, found this survey, marking the Northwest corner of the McCae Corporation property (Deed Record 84, page 4); thence North 58 degrees 05 minutes 00 seconds East along the centerline of State Road Number 56 and the Northern line of the McCae tract 363.00 feet to a railroad spike, found this survey, marking the Northeast corner of the McCae tract and being the true point of beginning of this survey; thence North 58 degrees 05 minutes 00 seconds East, continuing along said centerline, 349.20 feet to a p.k. nail set this survey; thence South 31 degrees 52 minutes 19 seconds East, coincident with the West line of the David Hankins property (Deed Record 74, page 107) 791.77 feet to the low water mark (elevation 421.00 feet) of the Ohio River; thence South 54 degrees 49 minutes 22 seconds West with the low water line of said river (being the 421.00 feet in elevation contour line) 331.95 feet; thence North 33 degrees 07 minutes 47 seconds West with the East line of the McCae tract 810.80 feet to the point of beginning, containing 6.261 acres, more or less.

TRACT II:

A part of the Fractional Section 23, Township 2 North, Range 3 West of the First Principal Meridian located in Jefferson Township of Switzerland County, Indiana, described as follows:

Commencing at the Northwest corner of Section 23, Township 2 North, Range 3 West; thence South 910.00 feet; thence South 33 degrees 07 minutes 02 seconds East 706.20 feet; thence North 58 degrees 05 minutes 00 seconds East with the centerline of State Road 56, 712.20 feet to a p.k. nail, the point of beginning; thence continuing with said centerline North 58 degrees 05 minutes 00 seconds East 182.10 feet to a nail; thence South 31 degrees 49 minutes 20 seconds East 781.45 feet; thence South 54 degrees 49 minutes 42 seconds West with the low water line of the Ohio River 181.72 feet; thence North 31 degrees 52 minutes 19 seconds West 791.77 feet to the point of beginning, containing 3.2822 acres, more or less.

Ex. B-26

Ameristar Council Bluffs

Parcel 1:

A parcel of land being part of Government Lots 2 and 3 and the adjacent abandoned River Road right of way, all located in Section 4, Township 74N, Range 44W of the 5th P.M., Pottawattamie County, Iowa, in the City of Council Bluffs, Iowa, which is more particularly described as follows:

Commencing at the center of said Section 4, thence N 88°08’15” W 597.51 feet to the point of beginning; thence along a meander of the ordinary high water of the Missouri River on the following four courses: (1) N 13°15’15” W 14.59 feet; (2) N 16°42’15” W 500.00 feet; (3) N 20°17’15” W 51.41 feet; and (4) N 19°50’45” W 159.07 feet; thence N 51°01’40” E 875.20 feet to a point on the Westerly right of way line of the Council Bluffs Levee; thence S 38°58’20” E 581.47 feet to a point on the Westerly right of way line of Interstate Highway 29; thence S 2°34’15” W 30.10 feet, along said highway right of way line; thence Southeasterly, along said highway right of way line, 303.57 feet along a 421.40 foot radius curve to the left; thence S 38°42’15” E 3.30 feet, thence S 36°47’45” E 334.04 feet, along said highway right of way line to a point on the Northerly right of way line of Nebraska Avenue, thence S 53°12’15” W 229.99 feet, along said right of way line of Nebraska Avenue; thence S 36°47’45” E 97.52 feet, along the Westerly right of way line of River Road; thence Southeasterly along said right of way line of River Road, 49.52 feet along a 246.48 foot radius curve to the right; thence S 53°12’15” W 96.07 feet; thence N 88°08’15” W 924.85 feet; thence N 13°15’15” W 81.06 feet to the point of beginning.

Parcel 2:

A parcel of land being part of Government Lots 1 and 2 and the adjacent abandoned River Road right of way, all located in Section 4, Township 74N, Range 44W of the 5th P.M., Pottawattamie County, Iowa, in the City of Council Bluffs, which is more particularly described as follows: