Exhibit 99.1

HIGHLIGHTS

|

RESULT

|

EBITDA1 for the second quarter of 2019 was USD 40.6m (2018, same period: USD 29.4m). The profit before tax amounted to USD 5.2m (2018, same period:

loss of USD 8.6m). Cash flow from operating activities was positive at USD 37.6m in the second quarter of 2019 (2018, same period: USD 25.1m), and earnings per share (EPS) was 7 cents (2018, same period: loss per share of 12 cents). Return

on Invested Capital2 (RoIC) was 3.9% (2018, same period: 0.1%).

EBITDA for the half year ended 30 June 2019 was USD 102.1m (2018, same period: USD 66.7m). The profit before tax for the first six months of 2019 amounted to USD

28.7m (2018, same period: loss of USD 7.5m). Cash flow from operating activities was positive with USD 93.0m in the first six months of 2019 (2018, same period: USD 43.0m), and earnings per share (EPS) was 38 cents (2018, same period: loss

per share of 12 cents). Return on Invested Capital (RoIC) was 6.2% (2018, same period: 1.2%).

The Board of Directors has considered the Company’s options and believes that at this time the continued modernization of the fleet through newbuildings,

purchase of modern second-hand tonnage and scrubber installations will provide for the optimal capital allocation.

|

|

MARKET CONDITIONS

|

In the second quarter of 2019, TORM achieved TCE rates of USD/day 15,405 (2018, same period: USD/day 12,944). The product tanker freight rates started the first

quarter of 2019 at strong levels, last seen in 2016, before softening throughout the quarter as spring refinery maintenance gained pace. Refinery maintenance in the second quarter was particularly pronounced, and coupled with a series of

unplanned outages, the volume of global refinery capacity that was offline was 23% higher than during the same period last year.

|

1 See Glossary on pages 24-28 for a definition of EBITDA.

2 See Glossary on pages 24-28 for a definition of RoIC.

|

TORM INTERIM RESULTS FOR THE SECOND QUARTER AND HALF YEAR ENDED 30 JUNE 2019

|

1

|

HIGHLIGHTS

|

VESSEL TRANSACTIONS AND FINANCING

|

During the second quarter of 2019, TORM has purchased four modern 2011-built MR vessels for a total consideration of USD 83m. The vesselsare expected to be

delivered during August 2019. To finance the purchase and to support TORM’s solid capital structure, TORM has entered into six sale and leaseback transactions, which are expected to be executed during the third quarter of 2019. The

transactions cover:

• Four recently purchased

2011-built MR vessels providing proceeds of USD 66m. The transaction is with a Chinese counterpart and includes a purchase obligation in 2025

• The MR vessels TORM Torino and

TORM Titan (both 2016-built) are providing total proceeds of USD 52m, and in connection with the transactions, USD 18m of the existing debt will be repaid. The transactions are with two separate Japanese counterparts and include a

purchase obligation in 2024 for TORM Torino and in 2026 for TORM Titan

TORM also took delivery of two MR newbuildings during the second quarter of 2019, sold the MR vessel TORM Gunhild (built in 1999) for a consideration of USD 6m

and repaid debt of USD 4m in connection with the vessel sale. The vessel has been delivered to the new owners. After the quarter ended on 30 June 2019, TORM has taken delivery of one MR newbuilding and sold two additional vessels, the MR

vessel TORM San Jacinto (built in 2002) and the Handy vessel TORM Saone (built in 2004), for a total consideration of USD 16m. TORM will repay debt of USD 9m in connection with the vessel sales and expects to deliver the vessels to the new

owners during the third quarter of 2019.

|

|

IMO 2020 SULFUR REGULATION

|

The implementation deadline for the IMO 2020 sulfur regulation is approaching, and the shipping industry has to comply with the new regulation either by reducing

sulfur emissions with scrubbers or by using compliant fuels. TORM’s joint venture ME Production China, a joint venture with ME Production, a leading scrubber manufacturer, and Guangzhou Shipyard International (GSI), which is part of the

China State Shipbuilding Corporation Group, has provided us with the flexibility to make timely decisions on retrofit installations as we developed our compliance strategy. With close to half of the fleet being retrofitted with scrubbers

and half of the fleet using compliant fuels, TORM has a balanced approach to the new regulation. We have developed customized schedules for the vessels that will be using compliant fuels from 1 January 2020. As of 15 August 2019, TORM has

conducted six scrubber installations, and by 1 January 2020, 28 out of 34 scheduled installations are expected to be finalized, with the remaining six consisting of three newbuilding deliveries and three retrofit installations.

|

|

VESSEL VALUES

|

Based on broker valuations, TORM’s fleet including newbuildings and recently purchased second-hand vessels had a market value of USD 1,735.6m as of 30 June 2019. Compared to broker valuations as of 31 March 2019, the market value of the fleet increased by USD 75m (~5%), when adjusted for sold and purchased vessels.

|

|

TORM INTERIM RESULTS FOR THE SECOND QUARTER AND HALF YEAR ENDED 30 JUNE 2019

|

2

|

HIGHLIGHTS

|

LIQUIDITY

|

As of 30 June 2019, TORM’s available liquidity was USD 366.9m consisting of USD 106.4m in cash, USD 214.6m in undrawn credit facilities and USD 45.9m in undrawn

credit facilities subject to documentation. This excludes the estimated impact of USD 99.0m from the six sale and leaseback transactions to be concluded in the third quarter of 2019. As of 30 June 2019, net interest-bearing debt3

amounted to USD 622.7m, and TORM's net loan-to-value (LTV)4 ratio was 51%.

|

|

ORDER BOOK AND CAPEX

|

The book value of TORM’s fleet was USD 1,471.6m as of 30 June 2019 excluding outstanding installments on newbuildings of USD 271.4m. The outstanding installments

include payments for scrubbers related to these vessels. TORM also has CAPEX commitments of USD 32.5m for retrofit scrubber installations. As of 30 June 2019, TORM’s order book stood at 11 vessels, including seven newbuildings – two LR1 and

five MR vessels – and four MR second-hand vessels. The newbuildings are expected to be delivered in 2019 and the first quarter of 2020.

|

|

NAV AND EQUITY

|

Based on broker valuations as of 30 June 2019, TORM’s Net Asset Value (NAV5) excluding charter commitments was estimated at USD 897m corresponding to

a NAV/share6 of USD 12.1 or DKK 79.8. TORM’s book equity amounted to USD 864m as of 30 June 2019 corresponding to a book equity/share7 of USD 11.7 or DKK 76.9. During the second quarter of 2019, TORM has upon request

from certain warrantholders cancelled 10,089 warrants. TORM now has 4,701,864 warrants outstanding.

|

|

MANAGEMENT AND BOARD UPDATE

|

Mr. Kim Balle has been appointed Chief Financial Officer (CFO) of TORM A/S. Mr. Balle has a

background from the financial sector, where he held a position as Head of Corporate Banking in Danske Bank. In addition, Mr. Balle has been Group CFO in DLG and currently holds a position as Group CFO in the private equity-owned CASA A/S.

Mr. Balle will take up the position as CFO of TORM on 1 December 2019. In addition, TORM has appointed Ms. Annette Malm Justad as Board Observer. Ms. Justad has significant managerial experience and has previously served as CEO of Eitzen

Maritime Services. Ms. Justad currently holds several director positions including Chairman of American Shipping Company ASA and Board member of Awilco LNG. As Board Observer, Ms. Justad will attend the Board meetings from August 2019.

|

|

COVERAGE

|

As of 30 June 2019, 11% of the remaining total earning days in 2019 were covered at an average rate of USD/day 15,197. As of 12 August 2019, 60% of the total

earning days in the third quarter of 2019 were covered at USD/day 13,636. 31% of the total earning days in the second half of 2019 were covered at USD/day 13,738.

|

3 See Glossary on pages 24-28 for a definition of net interest-bearing debt.

4 See Glossary on pages 24-28 for a definition of loan-to-value.

5 See Glossary on pages 24-28 for a definition of NAV.

6 See Glossary on pages 24-28 for a definition of NAV/share.

7 See Glossary on pages 24-28 for a definition of Book equity/share.

|

TORM INTERIM RESULTS FOR THE SECOND QUARTER AND HALF YEAR ENDED 30 JUNE 2019

|

3

|

|

SAFE HARBOR STATEMENTS AS TO

THE FUTURE

Matters discussed in this release may

constitute forward-looking statements. Forward-looking statements reflect our current views with respect to future events and financial performance and may include statements concerning plans, objectives, goals, strategies, future events

or performance, and underlying assumptions and statements other than statements of historical facts. The words “believe,” “anticipate,” “intend,” “estimate,” “forecast,” “project,” “plan,” “potential,” “may,” “should,” “expect,” “pending”

and similar expressions generally identify forward-looking statements.

The forward-looking statements in this release

are based upon various assumptions, many of which are based, in turn, upon further assumptions, including without limitation, management’s examination of historical operating trends, data contained in our records and other data available

from third parties. Although the Company believes that these assumptions were reasonable when made, because these assumptions are inherently subject to significant uncertainties and contingencies that are difficult or impossible to

predict and are beyond our control, the Company cannot guarantee that it will achieve or accomplish these expectations, beliefs or projections.

|

Important factors that, in our view, could cause actual results to differ materially from those discussed in the forward-looking statements include the strength of the world economy and currencies, general

market conditions, including fluctuations in charter hire rates and vessel values, changes in demand for “ton-miles” of oil carried by oil tankers and changes in demand for tanker vessel capacity, the effect of changes in OPEC’s petroleum

production levels and worldwide oil consumption and storage, changes in demand that may affect attitudes of time charterers to scheduled and unscheduled dry-docking, changes in TORM’s operating expenses, including bunker prices,

dry-docking and insurance costs, changes in the regulation of shipping operations, including actions taken by regulatory authorities, potential liability from pending or future litigation, domestic and international political conditions,

potential disruption of shipping routes due to accidents, political events including “trade wars,” or acts by terrorists.

|

In light of these risks and uncertainties, you

should not place undue reliance on forward-looking statements contained in this release because they are statements about events that are not certain to occur as described or at all. These forward-looking statements are not guarantees of

our future performance, and actual results and future developments may vary materially from those projected in the forward-looking statements.

Except to the extent required by applicable law

or regulation, the Company undertakes no obligation to release publicly any revisions or updates to these forward-looking statements to reflect events or circumstances after the date of this release or to reflect the occurrence of

unanticipated events. Please see TORM’s filings with the U.S. Securities and Exchange Commission for a more complete discussion of certain of these and other risks and uncertainties.

|

|

TORM INTERIM RESULTS FOR THE SECOND QUARTER AND HALF YEAR ENDED 30 JUNE 2019

|

4

|

KEY FIGURES

|

USDm

|

Q2 2019

|

Q2 2018

|

Q1-Q2 2019

|

Q1-Q2 2018

|

FY 2018

|

|

INCOME STATEMENT

|

|||||

|

Revenue

|

166.3

|

163.3

|

352.7

|

326.3

|

635.4

|

|

Time charter equivalent earnings (TCE) ¹⁾

|

98.3

|

90.4

|

214.9

|

186.7

|

352.4

|

|

Gross profit ¹⁾

|

55.0

|

41.9

|

128.9

|

90.7

|

169.5

|

|

EBITDA ¹⁾

|

40.6

|

29.4

|

102.1

|

66.7

|

120.5

|

|

Operating profit (EBIT)

|

14.2

|

0.5

|

46.4

|

9.5

|

2.8

|

|

Financial items

|

-9.0

|

-9.1

|

-17.7

|

-17.0

|

-36.0

|

|

Profit/(loss) before tax

|

5.2

|

-8.6

|

28.7

|

-7.5

|

-33.2

|

|

Net profit/(loss) for the year/period

|

5.2

|

-8.9

|

28.4

|

-8.2

|

-34.8

|

|

BALANCE SHEET

|

|||||

|

Non-current assets

|

1,484.5

|

1,452.2

|

1,484.5

|

1,452.2

|

1,445.1

|

|

Total assets

|

1,718.2

|

1,743.5

|

1,718.2

|

1,743.5

|

1,714.4

|

|

Equity

|

864.3

|

882.2

|

864.3

|

882.2

|

847.2

|

|

Total liabilities

|

853.9

|

861.4

|

853.9

|

861.4

|

867.2

|

|

Invested capital ¹⁾

|

1,482.2

|

1,475.1

|

1,482.2

|

1,475.1

|

1,469.4

|

|

Net interest-bearing debt ¹⁾

|

622.7

|

598.4

|

622.7

|

598.4

|

627.3

|

|

Cash and cash equivalents

|

106.4

|

159.1

|

106.4

|

159.1

|

127.4

|

|

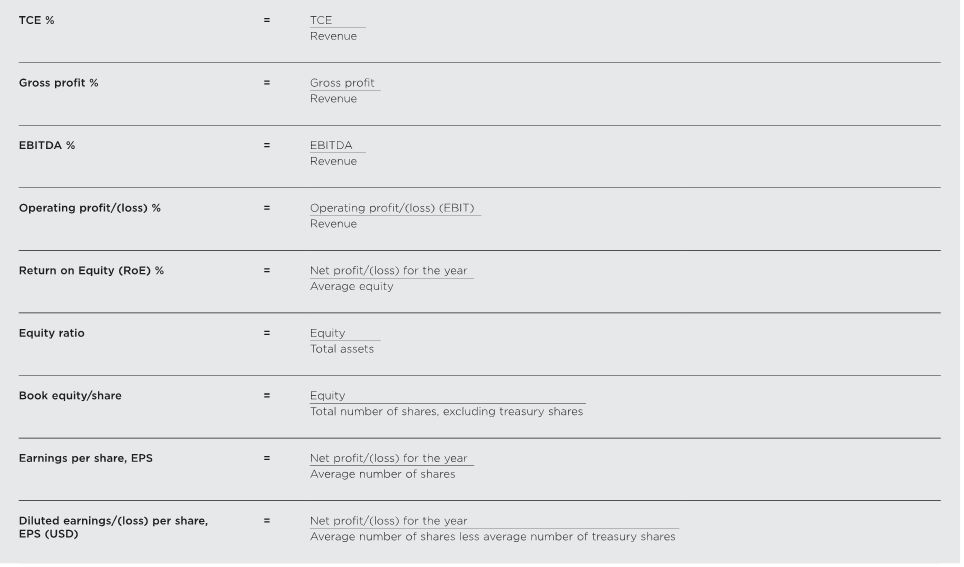

¹⁾ For definition of the calculated key figures, please refer

to the glossary on pages 24-28.

|

|||||

|

Q2 2019

|

Q2 2018

|

Q1-Q2 2019

|

Q1-Q2 2018

|

FY 2018

|

|

|

KEY FINANCIAL FIGURES ¹⁾

|

|||||

|

Margins:

|

|||||

|

TCE

|

59.1%

|

55.4%

|

60.9%

|

57.2%

|

55.4%

|

|

Gross profit

|

33.1%

|

25.7%

|

36.5%

|

27.8%

|

26.6%

|

|

EBITDA

|

24.4%

|

18.0%

|

28.9%

|

20.4%

|

19.1%

|

|

Operating profit

|

8.5%

|

0.3%

|

13.2%

|

2.9%

|

0.5%

|

|

Return on Equity (RoE)

|

2.4%

|

-4.3%

|

6.6%

|

-2.0%

|

-4.3%

|

|

Return on Invested Capital (RoIC)

|

3.9%

|

0.1%

|

6.2%

|

1.2%

|

0.1%

|

|

Equity ratio

|

50.3%

|

50.6%

|

50.3%

|

50.6%

|

49.4%

|

|

SHARE-RELATED KEY FIGURES ¹⁾

|

|||||

|

Basic earnings/(loss) per share

|

0.07

|

-0.12

|

0.38

|

-0.12

|

-0.48

|

|

Diluted earnings/(loss) per share

|

0.07

|

-0.12

|

0.38

|

-0.12

|

-0.48

|

|

Net Asset Value per share (NAV/share) ²⁾

|

12.1

|

11.4

|

12.1

|

11.4

|

11.6

|

|

Stock price in DKK, end of period ³⁾

|

57.0

|

50.3

|

57.0

|

50.3

|

43.9

|

|

Number of shares end of period (million) ⁴⁾

|

73.9

|

73.9

|

73.9

|

73.9

|

73.9

|

|

Number of shares weighted avg. (million) ⁴⁾

|

73.9

|

73.9

|

73.9

|

68.0

|

73.1

|

|

¹⁾ For definition of the calculated key figures, please refer

to the Glossary on pages 24-28.

|

|||||

|

²⁾ Based on broker valuations as of 30 June 2019, excluding

charter commitments.

|

|||||

|

³⁾ Stock price on Nasdaq in Copenhagen.

|

|||||

|

⁴⁾ Excluding treasury shares.

|

|||||

|

TORM INTERIM RESULTS FOR THE SECOND QUARTER AND HALF YEAR ENDED 30 JUNE 2019

|

5

|

THE PRODUCT TANKER MARKET

Product tanker freight rates softened in the second quarter of 2019 particularly due to heavy refinery maintenance and unplanned outages. In general, freight rates

were slightly stronger in the eastern than in the western hemisphere.

In the second quarter of 2019, the demand for oil products was affected by weaker macroeconomic activity. Diesel demand was also impacted by lower agricultural demand

in the US due to floodings. Refinery maintenance was particularly pronounced, and coupled with a series of unplanned outages, the volume of global refinery capacity that was offline was 23% higher than in the same period last year. While

refineries in the US gradually returned from maintenance, maintenance peaked in Asia, being 47% higher year on year. In Europe, offline capacity was up 34% also impacted by a number of unplanned outages. Refinery margins remained under seasonal

averages throughout the quarter, with Asia in particular seeing strong downside pressure from newbuilt refineries commencing crude runs.

Product tanker freight rates in the western markets were volatile, affected by a series of unplanned refinery outages on both sides of the Atlantic Basin. The second

quarter started with healthy transatlantic gasoline flows, supported by unplanned outages at several gasoline producing units in the US. In mid-April, a crude oil contamination in the Druzhba pipeline in Russia disrupted work at a number of

Eastern and Central European refineries, resulting in tightness in gasoline markets with negative impacts for the product tanker market. As gasoline was drawn from the Amsterdam-Rotterdam-Antwerp (ARA) area to inland, the gasoline arbitrage

window between Europe and the US closed (and even reversed). At the end of the quarter, a fire at the largest refinery on the US East Coast and the subsequent announcement of permanent clousure

of the refinery pushed gasoline prices

higher in New York and once again opened the transatlantic gasoline arbitrage, which impacted the product tanker market positively. On the longer-haul flows, gasoline flows from Europe to the East were low as a result of a combination of limited

cargo availability in Europe and abundant supply in Asia.

In the East, long-haul diesel flows from East Asia to West of Suez dropped significantly from the record levels seen in the first quarter, driven by a heavy refinery

maintenance season in Asia. This was partly offset by increased CPP exports from the Middle East as refineries in the region returned from maintenance. However, crude newbuildings continued to take a significant part of the East to West diesel

trade in June, and attacks on vessels near the Strait of Hormuz increased the geopolitical tensions in the Middle East and disrupted vessel traffic in and out of the area. The uncertainty surrounding supplies and logistics as well as increasing

shipping cost from the Middle East due to war risk insurance and other precautionary measures by owners resulted in a slowdown in Middle East exports.

The global product tanker fleet (above 25,000 dwt) grew by 1.2% in the second quarter of 2019 (source: TORM). This was down from the 1.6% pace in the first quarter.

During the second quarter of 2019, TORM’s product tanker fleet realized average TCE earnings of USD/day 15,405 (19% up year on year), and split per vessel class:

| • |

LR2 fleet at USD/day 17,894 (26% up year on year)

|

| • |

LR1 fleet at USD/day 14,582 (28% up year on year)

|

| • |

MR fleet at USD/day 15,163 (17% up year on year)

|

|

|

| • |

Handysize fleet at USD/day 12,882 (8% up year on year)

|

TORM’s gross profit for the second quarter of 2019 was USD 55.0m (2018, same period: USD 41.9m).

Outlook

| • |

As of 30 June 2019, TORM had covered 11% of the remaining earning days in 2019 at USD/day 15,197

|

| • |

As of 12 August 2019, TORM had covered 60% of the remaining earning days in the third quarter of 2019 at USD/day 13,636 and 31% of the remaining earning days in 2019 at

USD/day 13,738

|

| • |

As 9,063 earning days in 2019 are unfixed as of 12 August 2019, a change in freight rates of USD/day 1,000 will impact the full-year profit before tax by USD 9.1m

|

Coverage data and operational data per vessel type are shown in the tables on the following two pages.

|

TORM INTERIM RESULTS FOR THE SECOND QUARTER AND HALF YEAR ENDED 30 JUNE 2019

|

6

|

|

COVERED AND CHARTERED-IN DAYS IN TORM – DATA AS OF 30 JUNE 2019

|

|

2019

|

2020

|

2021

|

|

|

Owned days

|

|||

|

LR2

|

1,894

|

3,962

|

3,936

|

|

LR1

|

1,213

|

3,274

|

3,265

|

|

MR

|

8,830

|

19,851

|

20,027

|

|

Handysize

|

890

|

1,795

|

1,815

|

|

Total

|

12,827

|

28,882

|

29,044

|

|

Charter-in and leaseback days at fixed rate

|

|||

|

LR2

|

183

|

324

|

363

|

|

LR1

|

-

|

-

|

-

|

|

MR

|

366

|

668

|

726

|

|

Handysize

|

-

|

-

|

-

|

|

Total

|

549

|

993

|

1,089

|

|

Total physical days

|

|||

|

LR2

|

2,077

|

4,286

|

4,299

|

|

LR1

|

1,213

|

3,274

|

3,265

|

|

MR

|

9,196

|

20,519

|

20,753

|

|

Handysize

|

890

|

1,795

|

1,815

|

|

Total

|

13,376

|

29,875

|

30,133

|

Fair value of freight rate contracts that are mark-to-market in the income statement:

Contracts not included above: USD -0.5m

Contracts included above: USD -0.1m

|

2019

|

2020

|

2021

|

|

|

Covered, %

|

|||

|

LR2

|

26%

|

16%

|

2%

|

|

LR1

|

4%

|

0%

|

0%

|

|

MR

|

9%

|

1%

|

0%

|

|

Handysize

|

8%

|

1%

|

0%

|

|

Total

|

11%

|

3%

|

0%

|

|

Covered days

|

|||

|

LR2

|

533

|

697

|

69

|

|

LR1

|

53

|

-

|

-

|

|

MR

|

861

|

274

|

-

|

|

Handysize

|

75

|

10

|

-

|

|

Total

|

1,521

|

980

|

69

|

|

Coverage rates, USD/day

|

|||

|

LR2

|

14,495

|

16,143

|

15,800

|

|

LR1

|

11,100

|

-

|

-

|

|

MR

|

15,922

|

21,906

|

-

|

|

Handysize

|

14,733

|

27,168

|

-

|

|

Total

|

15,197

|

17,860

|

15,800

|

Actual no. of days can vary from projected no. of days primarily due to vessel sales and delays of vessel deliveries.

|

TORM INTERIM RESULTS FOR THE SECOND QUARTER AND HALF YEAR ENDED 30 JUNE 2019

|

7

|

EARNINGS DATA

|

USD

|

Q2 2018

|

Q3 2018

|

Q4 2018

|

Q1 2019

|

Q2 2019

|

Change Q2 18 - Q2 19

|

12-month avg.

|

|

LR2 vessels

|

|||||||

|

Available earning days

|

1,089

|

917

|

1,009

|

1,045

|

1,069

|

-2%

|

|

|

Spot rates ¹⁾

|

11,393

|

12,930

|

15,492

|

23,431

|

18,604

|

63%

|

18,008

|

|

TCE per earning day ²⁾

|

14,190

|

15,420

|

17,162

|

22,469

|

17,894

|

26%

|

18,333

|

|

Operating days

|

1,154

|

1,034

|

1,090

|

1,080

|

1,092

|

-5%

|

|

|

Operating expenses per operating day ³⁾

|

6,765

|

6,081

|

6,230

|

6,392

|

6,698

|

-1%

|

6,354

|

|

LR1 vessels

|

|||||||

|

Available earning days

|

628

|

640

|

587

|

590

|

589

|

-6%

|

|

|

Spot rates ¹⁾

|

11,805

|

10,126

|

15,403

|

17,991

|

15,365

|

30%

|

14,567

|

|

TCE per earning day ²⁾

|

11,403

|

11,485

|

14,534

|

18,089

|

14,582

|

28%

|

14,606

|

|

Operating days

|

637

|

644

|

644

|

630

|

637

|

0%

|

|

|

Operating expenses per operating day ³⁾

|

7,166

|

6,807

|

6,328

|

6,508

|

6,627

|

-8%

|

6,568

|

|

MR vessels

|

|||||||

|

Available earning days

|

4,624

|

4,502

|

4,564

|

4,414

|

4,267

|

-8%

|

|

|

Spot rates ¹⁾

|

12,272

|

9,569

|

14,072

|

16,768

|

15,429

|

26%

|

13,911

|

|

TCE per earning day ²⁾

|

13,005

|

10,051

|

13,993

|

16,765

|

15,163

|

17%

|

13,964

|

|

Operating days

|

4,732

|

4,784

|

4,683

|

4,453

|

4,402

|

-7%

|

|

|

Operating expenses per operating day ³⁾

|

6,434

|

6,173

|

6,160

|

6,473

|

6,564

|

2%

|

6,336

|

|

Handy vessels

|

|||||||

|

Available earning days

|

637

|

643

|

524

|

450

|

453

|

-29%

|

|

|

Spot rates ¹⁾

|

11,708

|

7,070

|

9,497

|

19,492

|

12,864

|

10%

|

11,627

|

|

TCE per earning day ²⁾

|

11,887

|

6,669

|

9,306

|

18,875

|

12,882

|

8%

|

11,351

|

|

Operating days

|

637

|

644

|

562

|

454

|

455

|

-29%

|

|

|

Operating expenses per operating day ³⁾

|

6,665

|

6,080

|

6,090

|

6,251

|

6,390

|

-4%

|

6,186

|

|

Tanker segment

|

|||||||

|

Available earning days

|

6,978

|

6,702

|

6,684

|

6,499

|

6,378

|

-9%

|

|

|

Spot rates ¹⁾

|

12,193

|

9,919

|

13,961

|

17,897

|

15,652

|

28%

|

14,263

|

|

TCE per earning day ²⁾

|

12,944

|

10,598

|

14,152

|

17,949

|

15,405

|

19%

|

14,489

|

|

Operating days

|

7,160

|

7,106

|

6,979

|

6,617

|

6,586

|

-8%

|

|

|

Operating expenses per operating day ³⁾

|

6,573

|

6,209

|

6,181

|

6,448

|

6,580

|

0%

|

6,349

|

|

¹⁾ Spot rates = Time Charter Equivalent Earnings for all charters

with less than six months' duration = Gross freight income less bunker, commissions and port expenses.

|

|||||||

|

²⁾ TCE = Time Charter Equivalent Earnings = Gross freight income

less bunker, commissions and port expenses.

|

|||||||

|

³⁾ Operating expenses are related to owned vessels.

|

|||||||

|

TORM INTERIM RESULTS FOR THE SECOND QUARTER AND HALF YEAR ENDED 30 JUNE 2019

|

8

|

TORM FLEET DEVELOPMENT

TORM FLEET DEVELOPMENT

The table shows TORM’s operating fleet. In addition to the 70 owned product tankers on the water, TORM has as of 30 June 2019 leased and chartered-in three product

tankers.

As of 30 June 2019, TORM had seven newbuildings on order including two LR1 vessels and five MR vessels with expected delivery in 2019 and the first quarter of 2020. In

addition, TORM has four second-hand vessels on order with expected delivery in August 2019. The four second-hand vessels will be financed through sale and leaseback structures.

Subsequent to the end of the second quarter of 2019, TORM has sold one MR vessel and one Handy vessel and entered into two sale and leaseback agreements for existing

MR vessels. These transactions are all reflected in the table.

|

Q1 2019

|

Changes

|

Q2 2019

|

Changes

|

2019

|

Changes

|

2020

|

Changes

|

2021

|

|

|

Owned vessels

|

|||||||||

|

LR2

|

11

|

-

|

11

|

-

|

11

|

-

|

11

|

-

|

11

|

|

LR1

|

7

|

-

|

7

|

1

|

8

|

1

|

9

|

-

|

9

|

|

MR

|

47

|

-

|

47

|

-

|

47

|

2

|

49

|

-

|

49

|

|

Handysize

|

5

|

-

|

5

|

-1

|

4

|

-

|

4

|

-

|

4

|

|

Total

|

70

|

-

|

70

|

-

|

70

|

3

|

73

|

-

|

73

|

|

Sale and leaseback vessels

|

|||||||||

|

LR2

|

1

|

-

|

1

|

-

|

1

|

-

|

1

|

-

|

1

|

|

LR1

|

-

|

-

|

-

|

-

|

-

|

-

|

-

|

-

|

-

|

|

MR

|

2

|

-

|

2

|

6

|

8

|

-

|

8

|

-

|

8

|

|

Handysize

|

-

|

-

|

-

|

-

|

-

|

-

|

-

|

-

|

-

|

|

Total

|

3

|

-

|

3

|

6

|

9

|

-

|

9

|

-

|

9

|

|

Total fleet

|

73

|

-

|

73

|

6

|

79

|

3

|

82

|

-

|

82

|

|

TORM INTERIM RESULTS FOR THE SECOND QUARTER AND HALF YEAR ENDED 30 JUNE 2019

|

9

|

FINANCIAL REVIEW

INCOME STATEMENT

The gross profit for the six months ended 30 June 2019 was USD 128.9m (2018, same period: USD 90.7m). The increase was due to higher freight rates along with lower

operating expenses partly offset by less earning days. Average TCE rate for the six months ended 30 June 2019 was USD/day 16,689 compared to USD/day 13,575 in the same period in 2018. Available earning days were 12,877 compared to 13,756 in the

same period in 2018.

Administrative expenses for the six months ended 30 June 2019 were USD 24.7m (2018, same period: USD 24.3m).

Other operating expenses for the six months ended 30 June 2019 were USD 2.4m (2018, same period: USD 0.5). The increase is

mainly due to a one-off provision covering an exposure related to the operations.

The result before depreciation (EBITDA) for the six months ended 30 June 2019 was a profit of USD 102.1m (2018, same period: USD 66.7m). The increase is mainly due to

higher freight rates.

Depreciation for the six months ended 30 June 2019 was USD 53.0m (2018, same period: USD 57.2m). The decrease in depreciation was mainly due to increased residual

values on the vessels as a consequence of increased steel prices (approx. USD 3m).

The primary operating result (EBIT) for the six months ended 30 June 2019 was a profit of USD 46.4m (2018, same period: profit of USD 9.5m). The increase was mainly

due to higher freight rates along with lower operating expenses.

Financial expenses for the six months ended 30 June 2019 were USD 19.9m (2018, same period: USD 19.0m).

The result after tax for the six months ended 30 June 2019 was a profit of USD 28.4m (2018, same period: loss of USD 8.2m).

OTHER COMPREHENSIVE INCOME

Other comprehensive income for the six months ended 30 June 2019 was a loss of USD 12.2m (2018, same period: income of USD 2.0m). The decrease is mainly due to a

negative fair value adjustment of hedging instruments – primarily related to interest swaps. Total comprehensive income for the six months ended 30 June 2019 is an income of USD 16.2m (2018, same period: a loss of USD 6.2m). The development in

total comprehensive income is primarily driven by an increase in the net profit for the period partly offset by a negative fair value adjustment on hedging instruments.

ASSETS

As of 30 June 2019, total assets amounted to USD 1,718.2m.

The carrying value of the fleet including prepayments was USD 1,471.6m as of 30 June 2019, excluding outstanding installments on the LR1 and MR vessels under

construction and the four MR second-hand vessels of USD 271.4m. Based on broker valuations, TORM’s fleet including newbuildings and resale vessels had a market value of USD 1,735.6m as of 30 June 2019.

DEBT

As of 30 June 2019, net interest-bearing debt amounted to USD 622.7m. As of 30 June 2019, TORM was in compliance with the financial covenants.

EQUITY

As of 30 June 2019, TORM’s equity was USD 864.3m, and TORM held treasury shares equivalent to 0.4% of the Company's share capital.

LIQUIDITY

As of 30 June 2019, TORM’s available liquidity was USD 366.9m and consisted of cash and cash equivalents of USD 106.4m and undrawn credit facilities of USD 260.5m. The

undrawn credit facilities consisted of a USD 75.0m working capital facility, an available facility of USD 65.9m to finance one new MR vessel and another two MR vessels under construction, a USD 73.7m facility financing two LR1 and one MR vessels

under construction and a USD 45.9m facility subject to documentation financing two MR vessels under construction. The available liquidity excludes the estimated impact of USD 99m from sale and leaseback transactions related to two existing MR

vessels and four second-hand MR vessels that TORM has purchased.

As of 30 June 2019, TORM had CAPEX commitments of USD 271.4m all related to the LR1 and MR vessels under construction, including scrubbers related to these vessels and

the four second-hand vessels. In addition, TORM has CAPEX commitments of USD 32.5m for retrofit scrubber installations.

|

TORM INTERIM RESULTS FOR THE SECOND QUARTER AND HALF YEAR ENDED 30 JUNE 2019

|

10

|

CASH FLOW

Cash flow from operating activities for the six months ended 30 June 2019 amounted to USD 93.0m (2018, same period: USD 43.0m). The increase is primarily driven by a

higher operating profit.

Cash flow from investing activities for the six months ended 30 June 2019 was USD -78.3m (2018, same period: USD -118.9m). The change is mainly driven by a lower

newbuilding CAPEX and sale of vessels.

Cash flow from financing activities for the six months ended 30 June 2019 was USD -42.5m (2018, same period: USD 101.8m). The main reason for the high amount in Q1-Q2

2018 was the January 2018 capital increase (USD 100m) along with a lower amount of net borrowing.

RELATED PARTY TRANSACTIONS

During the six months ended 30 June 2019, TORM’s transactions with its joint ventures covered CAPEX of a total of USD 11.0m. All transactions were carried out at arm’s

length and the outstanding balance as of 30 June 2019 was USD 0.5m.

RISKS AND UNCERTAINTIES

There are a number of potential risks and uncertainties which could have a material impact on the Group’s performance over the remaining six months of 2019. Risks and

uncertainties, along with the mitigation measures put in place to reduce risks, remain unchanged from those published in the Annual Report 2018 and are summarized below:

| • |

Tanker freight rates – The risk of sustained low tanker freight rates or of TORM not being able to predict and act on the development of these. Furthermore, TORM is active in

the cyclical product tanker industry where earnings may also be affected by seasonality

|

| • |

Bunker price – The risk of unexpected bunker price increases not covered by corresponding freight rate increases

|

| • |

Timing of sale and purchase of vessels – The risk of TORM not selling and purchasing vessels timely relative to market developments and business requirements

|

For further information and a detailed description of the most significant risks, please refer to Note 19 of the Annual Report 2018.

DIVIDENDS

The Board of Directors has considered the Company’s options and believes that at this time the continued modernization of the fleet through newbuildings, purchase of

modern second-hand tonnage and scrubber installations will provide for the optimal capital allocation. Considering the benefit of the Company’s combined shareholder and stakeholder base, it has therefore been decided not to distribute dividends

for the first six months of 2019.

On behalf of TORM plc

Christopher H. Boehringer

Chairman of the Board of Directors

15 August 2019

|

TORM INTERIM RESULTS FOR THE SECOND QUARTER AND HALF YEAR ENDED 30 JUNE 2019

|

11

|

RESPONSIBILITY STATEMENT

We confirm that to the best of our knowledge:

| • |

The condensed consolidated set of financial statements has been prepared in accordance with IAS 34 Interim Financial Reporting as adopted by the EU and as issued by the

International Accounting Standards Board (”IASB”)

|

| • |

The interim management report includes a fair review of the information required by DTR 4.2.7R (indication of events during the first three months and description of principal

risks and uncertainties for the remaining six months of the year); and

|

| • |

The interim management report includes a fair review of the information required by DTR 4.2.8R (disclosure of related party transactions and changes therein)

|

By order of the Board of Directors

Jacob Meldgaard

Executive Director

15 August 2019

Disclaimer

The interim report has been prepared solely to provide additional information to shareholders to assess the Group’s strategies and the potential for those strategies

to succeed. The interim report should not be relied on by any other party or for any other purpose.

The interim report contains certain forward-looking statements. These statements are made by the Directors in good faith based on the information available to them up

to the time of their approval of this report. Such statements should be treated with caution due to the inherent uncertainties, including both economic and business risk factors, underlying any such forward-looking statements.

|

TORM INTERIM RESULTS FOR THE SECOND QUARTER AND HALF YEAR ENDED 30 JUNE 2019

|

12

|

Consolidated Financial Statements

|

CONDENSED CONSOLIDATED INCOME STATEMENT

|

|

USDm

|

Note

|

Q2 2019

|

Q2 2018

|

Q1-Q2 2019

|

Q1-Q2 2018

|

FY 2018

|

|

Revenue

|

166.3

|

163.3

|

352.7

|

326.3

|

635.4

|

|

|

Port expenses, bunkers and commissions

|

-68.0

|

-72.9

|

-137.8

|

-139.6

|

-283.0

|

|

|

Charter hire

|

-

|

-1.4

|

-

|

-2.8

|

-2.5

|

|

|

Operating expenses

|

1

|

-43.3

|

-47.1

|

-86.0

|

-93.2

|

-180.4

|

|

Profit from sale of vessels

|

0.2

|

-

|

0.3

|

0.6

|

0.8

|

|

|

Administrative expenses

|

1, 2

|

-12.3

|

-12.1

|

-24.7

|

-24.3

|

-47.8

|

|

Other operating expenses

|

-2.3

|

-0.6

|

-2.4

|

-0.5

|

-2.0

|

|

|

Share of profit/(loss) from joint ventures

|

-

|

0.2

|

-

|

0.2

|

0.2

|

|

|

Impairment losses on tangible and intangible assets

|

2, 4

|

-0.1

|

-

|

-2.7

|

-

|

-3.2

|

|

Depreciation

|

2

|

-26.3

|

-28.9

|

-53.0

|

-57.2

|

-114.5

|

|

Operating profit/(loss) (EBIT)

|

14.2

|

0.5

|

46.4

|

9.5

|

2.8

|

|

|

Financial income

|

1.1

|

0.5

|

2.2

|

2.0

|

3.3

|

|

|

Financial expenses

|

-10.1

|

-9.6

|

-19.9

|

-19.0

|

-39.3

|

|

|

Profit/(loss) before tax

|

5.2

|

-8.6

|

28.7

|

-7.5

|

-33.2

|

|

|

Tax

|

-

|

-0.3

|

-0.3

|

-0.7

|

-1.6

|

|

|

Net profit/(loss) for the period

|

5.2

|

-8.9

|

28.4

|

-8.2

|

-34.8

|

|

|

EARNINGS PER SHARE

|

||||||

|

Basic earnings/(loss) per share (USD)

|

0.07

|

-0.12

|

0.38

|

-0.12

|

-0.48

|

|

|

Diluted earnings/(loss) per share (USD)

|

0.07

|

-0.12

|

0.38

|

-0.12

|

-0.48

|

|

TORM INTERIM RESULTS FOR THE SECOND QUARTER AND HALF YEAR ENDED 30 JUNE 2019

|

13

|

|

CONDENSED CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

|

|

USDm

|

Q2 2019

|

Q2 2018

|

Q1-Q2 2019

|

Q1-Q2 2018

|

FY 2018

|

|

Net profit/(loss) for the year

|

5.2

|

-8.9

|

28.4

|

-8.2

|

-34.8

|

|

Other comprehensive income/(loss):

|

|||||

|

Items that may be reclassified to profit or loss:

|

|||||

|

Exchange rate adjustment arising from translation of entities using a functional currency different from USD

|

0.1

|

-0.2

|

0.5

|

-0.3

|

-0.3

|

|

Fair value adjustment on hedging instruments

|

-7.0

|

-0.4

|

-11.7

|

4.8

|

-6.7

|

|

Fair value adjustment on hedging instruments transferred to income statement

|

-0.8

|

-1.1

|

-0.9

|

-2.5

|

-0.3

|

|

Items that may not be reclassified to profit or loss:

|

|||||

|

Remeasurements of net pension and other post-retirement benefit liability or asset

|

-0.1

|

-

|

-0.1

|

-

|

-

|

|

Other comprehensive income/(loss) after tax ¹⁾

|

-7.8

|

-1.7

|

-12.2

|

2.0

|

-7.4

|

|

Total comprehensive income/(loss) for the year

|

-2.6

|

-10.6

|

16.2

|

-6.2

|

-42.2

|

|

¹⁾ No income tax was incurred relating to other comprehensive income/(loss) items.

|

|||||

|

TORM INTERIM RESULTS FOR THE SECOND QUARTER AND HALF YEAR ENDED 30 JUNE 2019

|

14

|

|

CONDENSED CONSOLIDATED BALANCE SHEET

|

|

30 June

|

30 June

|

31 December

|

||

|

USDm

|

Note

|

2019

|

2018

|

2018

|

|

ASSETS

|

||||

|

NON-CURRENT ASSETS

|

||||

|

Tangible fixed assets

|

||||

|

Land and buildings

|

8.7

|

-

|

-

|

|

|

Vessels and capitalized dry-docking

|

2

|

1,418.1

|

1,399.5

|

1,396.6

|

|

Prepayments on vessels

|

3

|

53.5

|

50.3

|

45.5

|

|

Other plant and operating equipment

|

3.9

|

2.3

|

3.0

|

|

|

Total tangible fixed assets

|

1,484.2

|

1,452.1

|

1,445.0

|

|

|

Financial assets

|

||||

|

Investments in joint ventures

|

0.3

|

0.1

|

0.1

|

|

|

Total financial assets

|

0.3

|

0.1

|

0.1

|

|

|

Total non-current assets

|

1,484.5

|

1,452.2

|

1,445.1

|

|

|

CURRENT ASSETS

|

||||

|

Bunkers

|

36.2

|

40.3

|

39.4

|

|

|

Freight receivables

|

82.1

|

71.6

|

86.0

|

|

|

Other receivables

|

4.9

|

16.9

|

7.5

|

|

|

Prepayments

|

4.1

|

3.4

|

2.9

|

|

|

Cash and cash equivalents

|

106.4

|

159.1

|

127.4

|

|

|

Current assets, excluding assets held-for-sale

|

233.7

|

291.3

|

263.1

|

|

|

Assets held-for-sale

|

4

|

-

|

-

|

6.2

|

|

Total current assets

|

233.7

|

291.3

|

269.3

|

|

|

TOTAL ASSETS

|

1,718.2

|

1,743.5

|

1,714.4

|

|

30 June

|

30 June

|

31 December

|

||

|

USDm

|

Note

|

2019

|

2018

|

2018

|

|

EQUITY AND LIABILITIES

|

||||

|

EQUITY

|

||||

|

Common shares

|

0.7

|

0.7

|

0.7

|

|

|

Share premium

|

97.1

|

97.1

|

97.1

|

|

|

Treasury shares

|

-2.9

|

-2.9

|

-2.9

|

|

|

Hedging reserves

|

-12.3

|

9.6

|

0.3

|

|

|

Translation reserves

|

0.4

|

-

|

-0.1

|

|

|

Retained profit

|

781.3

|

777.7

|

752.1

|

|

|

Total equity

|

864.3

|

882.2

|

847.2

|

|

|

LIABILITIES

|

||||

|

NON-CURRENT LIABILITIES

|

||||

|

Deferred tax liability

|

44.9

|

45.0

|

44.9

|

|

|

Mortgage debt and bank loans

|

5

|

605.5

|

635.7

|

633.0

|

|

Lease liabilities

|

29.5

|

23.8

|

22.1

|

|

|

Total non-current liabilities

|

679.9

|

704.5

|

700.1

|

|

|

CURRENT LIABILITIES

|

||||

|

Mortgage debt and bank loans

|

5

|

86.0

|

89.6

|

91.3

|

|

Lease liabilities

|

3.3

|

3.0

|

3.2

|

|

|

Trade payables

|

38.2

|

32.6

|

35.1

|

|

|

Current tax liabilities

|

1.2

|

1.5

|

1.0

|

|

|

Other liabilities

|

45.3

|

30.0

|

36.5

|

|

|

Deferred income

|

-

|

0.2

|

0.1

|

|

|

Total current liabilities

|

174.0

|

156.9

|

167.1

|

|

|

Total liabilities

|

853.9

|

861.4

|

867.2

|

|

|

TOTAL EQUITY AND LIABILITIES

|

1,718.2

|

1,743.5

|

1,714.4

|

|

|

Contingent liabilities

|

6

|

|||

|

Contractual obligations and rights

|

7

|

|||

|

Post balance sheet date events

|

8

|

|||

|

Accounting policies

|

9

|

|

TORM INTERIM RESULTS FOR THE SECOND QUARTER AND HALF YEAR ENDED 30 JUNE 2019

|

15

|

|

CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

1 JANUARY-30 JUNE

|

|

USDm

|

Common shares

|

Share premium

|

Treasury shares

|

Hedging reserves

|

Translation reserves

|

Retained profit

|

Total

|

|

Equity as of 1 January 2019

|

0.7

|

97.1

|

-2.9

|

0.3

|

-0.1

|

752.1

|

847.2

|

|

Comprehensive income/loss for the period

|

|||||||

|

Net profit/(loss) for the period

|

-

|

-

|

-

|

-

|

-

|

28.4

|

28.4

|

|

Other comprehensive income/(loss) for the period

|

-

|

-

|

-

|

-12.6

|

0.5

|

-0.1

|

-12.2

|

|

Total comprehensive income/(loss) for the period

|

-

|

-

|

-

|

-12.6

|

0.5

|

28.3

|

16.2

|

|

Share-based compensation

|

-

|

-

|

-

|

-

|

-

|

0.9

|

0.9

|

|

Total changes in equity for the period

|

-

|

-

|

-

|

-12.6

|

0.5

|

29.2

|

17.1

|

|

Equity as of 30 Juni 2019

|

0.7

|

97.1

|

-2.9

|

-12.3

|

0.4

|

781.3

|

864.3

|

|

USDm

|

Common shares

|

Share premium

|

Treasury shares

|

Hedging reserves

|

Translation reserves

|

Retained profit

|

Total

|

|

Balance as of 1 January 2018, as shown in the consolidated financial statements

|

0.6

|

-

|

-2.9

|

7.3

|

0.3

|

785.8

|

791.1

|

|

Effect as of 1 January 2018 of IFRS 15 implementation

|

-

|

-

|

-

|

-

|

-

|

-0.9

|

-0.9

|

|

Equity as of 1 January 2018

|

0.6

|

-

|

-2.9

|

7.3

|

0.3

|

784.9

|

790.2

|

|

Comprehensive income/(loss) for the period:

|

|||||||

|

Net profit/(loss) for the period

|

-

|

-

|

-

|

-

|

-

|

-8.2

|

-8.2

|

|

Other comprehensive income/(loss) for the period

|

-

|

-

|

-

|

2.3

|

-0.3

|

-

|

2.0

|

|

Total comprehensive income/(loss) for the period

|

-

|

-

|

-

|

2.3

|

-0.3

|

-8.2

|

-6.2

|

|

Capital increase

|

0.1

|

99.9

|

-

|

-

|

-

|

-

|

100.0

|

|

Transaction costs capital increase

|

-

|

-2.8

|

-

|

-

|

-

|

-

|

-2.8

|

|

Share-based compensation

|

-

|

-

|

-

|

-

|

1.1

|

1.1

|

|

|

Total changes in equity for the period

|

0.1

|

97.1

|

-

|

2.3

|

-0.3

|

-7.1

|

92.1

|

|

Equity as of 30 Juni 2018

|

0.7

|

97.1

|

-2.9

|

9.6

|

-

|

777.7

|

882.2

|

|

TORM INTERIM RESULTS FOR THE SECOND QUARTER AND HALF YEAR ENDED 30 JUNE 2019

|

16

|

CONDENSED CONSOLIDATED CASHFLOW STATEMENT

|

USDm

|

Q1-Q2 2019

|

Q1-Q2 2018

|

FY 2018

|

|

CASH FLOW FROM OPERATING ACTIVITIES

|

|||

|

Net profit/(loss) for the period

|

28.4

|

-8.2

|

-34.8

|

|

Adjustments:

|

|||

|

Reversal of profit from sale of vessels

|

-0.3

|

-0.6

|

-0.7

|

|

Reversal of amortization and depreciation

|

53.0

|

57.2

|

114.5

|

|

Reversal of impairment loss on tangible assets

|

2.7

|

-

|

3.2

|

|

Reversal of share of profit/(loss) from joint ventures

|

-

|

-0.2

|

-0.2

|

|

Reversal of financial income

|

-2.2

|

-2.0

|

-3.3

|

|

Reversal of financial expenses

|

19.9

|

19.0

|

39.3

|

|

Reversal of tax expenses

|

0.3

|

0.7

|

1.6

|

|

Reversal of other non-cash movements

|

0.5

|

1.2

|

2.0

|

|

Dividends received from joint ventures

|

-

|

0.4

|

0.4

|

|

Interest received and realized exchange gains

|

1.7

|

1.6

|

2.7

|

|

Interest paid and realized exchange losses

|

-19.4

|

-20.1

|

-39.8

|

|

Income taxes paid

|

-0.1

|

-0.3

|

-1.6

|

|

Change in bunkers, receivables and payables, etc.

|

8.5

|

-5.7

|

-12.7

|

|

Net cash flow from operating activities

|

93.0

|

43.0

|

70.8

|

|

USDm

|

Q1-Q2 2019

|

Q1-Q2 2018

|

FY 2018

|

|

CASH FLOW FROM INVESTING ACTIVITIES

|

|||

|

Investment in tangible fixed assets

|

-104.8

|

-126.1

|

-202.4

|

|

Investments in joint ventures

|

-0.3

|

-

|

-

|

|

Sale of tangible fixed assets

|

26.8

|

7.2

|

26.8

|

|

Net cash flow from investing activities

|

-78.3

|

-118.9

|

-175.6

|

|

CASH FLOW FROM FINANCING ACTIVITIES

|

|||

|

Borrowing, mortgage debt

|

22.0

|

57.2

|

114.5

|

|

Repayment, mortgage debt

|

-55.0

|

-52.2

|

-110.8

|

|

Repayment, lease liabilities

|

-2.7

|

-1.4

|

-2.9

|

|

Capital increase

|

-

|

100.0

|

100.0

|

|

Transaction costs capital increase

|

-

|

-2.8

|

-2.8

|

|

Change in restricted cash

|

-6.8

|

1.0

|

-2.0

|

|

Net cash flow from financing activities

|

-42.5

|

101.8

|

96.0

|

|

Net cash flow from operating, investing and financing activities

|

-27.8

|

25.9

|

-8.8

|

|

Cash and cash equivalents, beginning balance

|

124.1

|

132.9

|

132.9

|

|

Cash and cash equivalents, ending balance

|

96.3

|

158.8

|

124.1

|

|

Restricted cash equivalents

|

10.1

|

0.3

|

3.3

|

|

Cash and cash equivalents including restricted cash, ending balance

|

106.4

|

159.1

|

127.4

|

|

TORM INTERIM RESULTS FOR THE SECOND QUARTER AND HALF YEAR ENDED 30 JUNE 2019

|

17

|

|

NOTES

|

NOTE 1 – STAFF COSTS

|

USDm

|

Q2 2019

|

Q2 2018

|

Q1-Q2 2019

|

Q1-Q2 2018

|

FY 2018

|

|

Included in operating expenses

|

2.0

|

2.2

|

4.0

|

4.6

|

9.3

|

|

Included in administrative expenses

|

9.8

|

9.5

|

19.4

|

19.4

|

36.9

|

|

Total staff costs

|

11.8

|

11.7

|

23.4

|

24.0

|

46.2

|

NOTE 2 – VESSELS AND CAPITALIZED DRY-DOCKING

Included in the carrying amount for "Vessels and capitalized dry-docking" are capitalized dry-docking costs in the amount of USD 55.1m (30 June 2018: USD 62.1m, 31

December 2018: USD 67.5m).

The depreciation expense for the six months ended 30 June 2019 related to "Other plant and operating equipment" of USD 0.5m is included in the “Administrative

expenses” (30 June 2018: USD 0.5m, 31 December 2018: USD 1.1m).

Impairment assessment

For determination of the vessel values, TORM has carried out an impairment indicator assessment of the most significant assumptions used in the fair value and value in

use calculations for the Annual Report as of 31 December 2018 (please refer to Note 7 in the Annual Report 2018). Based on this, TORM has assessed that there are no impairment indicators noted as there were no significant changes in the

assumptions to either the fair value or the value in use, and therefore TORM does not find any need to reassess the recoverable amount as of 30 June 2019.

The impairment loss of USD 2.7m relates to specific vessels which have been reclassified to assets held-for-sale to be delivered to the buyers during Q1 and Q2 2019.

These vessels have been written down to their net selling price.

NOTE 2 – continued

|

30 June

|

30 June

|

31 December

|

|

|

USDm

|

2019

|

2018

|

2018

|

|

Cost:

|

|||

|

Balance as of beginning of period

|

1,886.3

|

1,726.6

|

1,726.6

|

|

Additions

|

27.9

|

97.8

|

162.7

|

|

Disposals

|

-8.0

|

-4.9

|

-30.2

|

|

Transferred from prepayments

|

67.6

|

63.9

|

81.8

|

|

Transferred to assets held-for-sale

|

-44.2

|

-

|

-54.6

|

|

Balance

|

1,929.6

|

1,883.4

|

1,886.3

|

|

Depreciation:

|

|||

|

Balance as of beginning of period

|

327.6

|

264.8

|

264.8

|

|

Disposals

|

-8.0

|

-4.9

|

-30.2

|

|

Depreciation for the period

|

51.4

|

56.7

|

113.4

|

|

Transferred to assets held-for-sale

|

-17.3

|

-

|

-20.4

|

|

Balance

|

353.7

|

316.6

|

327.6

|

|

Impairment:

|

|||

|

Balance as of beginning of period

|

162.1

|

167.3

|

167.3

|

|

Impairment losses on tangible fixed assets

|

2.7

|

-

|

3.2

|

|

Transferred to assets held-for-sale

|

-7.0

|

-

|

-8.4

|

|

Balance

|

157.8

|

167.3

|

162.1

|

|

Carrying amount

|

1,418.1

|

1,399.5

|

1,396.6

|

|

Of which right-of-use assets, end of period

|

25.6

|

27.5

|

26.5

|

|

TORM INTERIM RESULTS FOR THE SECOND QUARTER AND HALF YEAR ENDED 30 JUNE 2019

|

18

|

NOTE 3 – PREPAYMENTS ON VESSELS

|

30 June

|

30 June

|

31 December

|

|

|

USDm

|

2019

|

2018

|

2018

|

|

Balance as of beginning of period

|

45.5

|

88.4

|

88.4

|

|

Additions

|

75.6

|

25.8

|

38.9

|

|

Transferred to vessels

|

-67.6

|

-63.9

|

-81.8

|

|

Carrying amount

|

53.5

|

50.3

|

45.5

|

NOTE 4 – ASSETS HELD-FOR-SALE AND NON-CURRENT ASSETS SOLD DURING THE PERIOD

During the first two quarters of 2019, TORM sold three vessels, of which two were delivered to the new owner during the first quarter of 2019 and the third vessel in

Q2 2019. The sales resulted in a profit from sale of USD 0.3m and an impairment loss on tangible assets of USD 2.7m.

NOTE 5 – MORTGAGE DEBT AND BANK LOANS

|

30 June

|

30 June

|

31 December

|

|

|

USDm

|

2019

|

2018

|

2018

|

|

Mortgage debt and bank loans to be repaid as follows:

|

|||

|

Falling due within one year

|

87.1

|

90.4

|

92.2

|

|

Falling due between one and two years

|

87.1

|

86.0

|

87.6

|

|

Falling due between two and three years

|

374.2

|

86.0

|

343.4

|

|

Falling due between three and four years

|

26.9

|

381.9

|

96.9

|

|

Falling due between four and five years

|

11.3

|

21.8

|

10.0

|

|

Falling due after five years

|

109.8

|

64.8

|

99.4

|

|

Total

|

696.4

|

730.9

|

729.5

|

The presented amounts to be repaid do not include directly related costs arising from the issuing of the loans of USD 4.8m (30 June 2018: USD 5.4m, 31 December 2018:

USD 5.1m), which are amortized over the term of the loans.

As of 30 June 2019, TORM was in compliance with the financial covenants. TORM expects to remain in compliance with the financial covenants in the remaining period of

2019.

During the first six months of 2019, TORM signed a financing agreement with ABN AMRO to increase the existing facility of USD 70.0m by USD 3.7m to finance scrubber

installations on newbuildings.

The main conditions in the agreements are in line with the Company's existing loan agreements.

NOTE 6 – CONTINGENT LIABILITIES

The Group is involved in certain legal proceedings and disputes. It is Management’s opinion that the outcome of these proceedings and disputes will not have any

material impact on the Group’s financial position, results of operations and cash flows.

The Group operates in a wide variety of jurisdictions, in some of which the company and individual tax law is subject to varying interpretations and potentially

inconsistent enforcement. As a result, there can be practical uncertainties in applying tax legislation to the Group’s activities. Whilst the Group considers that it operates in accordance with applicable company and individual tax law, there

are concrete potential tax exposures in respect of its operations, which are being investigated further. Based on current legal advice, these exposures are not considered to be material.

|

TORM INTERIM RESULTS FOR THE SECOND QUARTER AND HALF YEAR ENDED 30 JUNE 2019

|

19

|

NOTE 7 – CONTRACTUAL OBLIGATIONS AND RIGHTS

As of 30 June 2019, TORM has contractual obligations regarding investment commitments including newbuilding and second-hand commitments and chartered-in vessels of USD

271.4m and USD 0.0m respectively (30 June 2018: USD 306.4m and USD 0.1m, 31 December 2018: USD 258.0m and USD 0.0m).

NOTE 8 – POST BALANCE SHEET DATE EVENTS

In July 2019, TORM has agreed sale and leaseback transactions on the MR vessels TORM Torino and TORM Titan (both built in 2016) with two Japanese counterparties. These

transactions will provide proceeds of USD 52m, and USD 18m of existing bank debt will be repaid in connection with the transactions. The lease agreements include a purchase obligation in 2024 for TORM Torino and in 2026 for TORM Titan.

For accounting purposes, the sale and leaseback transactions will be treated as financing arrangements, whereby the vessels will remain on the balance sheet with

unchanged values, and the obligations under the leasing contracts will be reflected as lease liabilities on the balance sheet.

After the quarter ended 30 June 2019, TORM has sold two additional vessels, the MR vessel TORM San Jacinto (built in 2002) and the Handy vessel TORM Saone (built in

2004), for a total consideration of USD 16m. TORM will repay debt of USD 9m in connection with the vessel sales and expects to deliver the vessels to the new owners during the third quarter of 2019.

NOTE 9 – ACCOUNTING POLICIES

General information

The information for the year ended 31 December 2018 does not constitute statutory accounts as defined in section 435 of the Companies Act 2006. A copy of the statutory

accounts for that year has been delivered to the Registrar of Companies. The auditor's report on those accounts was not qualified, did not include a reference to any matters to which the auditors drew attention by way of emphasis without

qualifying the report and did not contain statements under section 498(2) or (3) of the Companies Act 2006.

Significant accounting policies

The interim report for the period 1 January-30 June 2019 is presented in accordance with IAS 34 "Interim Financial Reporting" as adopted by the EU and as issued by the

IASB. The interim report has been prepared using the accounting policies of TORM plc that are consistent with the accounting policies of the Annual Report 2018 and additional IFRS standards endorsed by the EU and as issued by the IASB effective

for accounting periods beginning after 1 January 2019. New standards have not had any material effect on the interim report other than mentioned below. The accounting policies are described in more detail in the Annual Report 2018. The interim

report for the period 1 January-30 June 2019 is not audited or reviewed, in line with normal practice.

Implementation of IFRS 16

IFRS 16 “Leases” became effective as of 1 January 2019, and the standard has been implemented using the modified retrospective approach, where comparative information

is not restated. TORM has in the past accounted for leaseback vessels as finance leases, and the implementation of IFRS 16 does not change the accounting for these vessels, which are presented as part of “Vessels and capitalized dry-docking” on

the balance sheet. The impact of

introducing IFRS 16 in TORM is limited to leasing agreements regarding office buildings and other administrative assets such as cars, office equipment, etc. The

implementation of IFRS 16 requires capitalization of the related lease agreements, and the effect as of 1 January 2019 is a recognition of a right-of-use asset and leasing liability of USD 11.4m. The right-of-use assets are shown as part of

“Land and buildings” and “Other plant and operating equipment” on the balance sheet. The implementation of IFRS 16 will only have a minor negative effect on the “Profit and Loss” in 2019 but will improve the Alternative Performance Measure

(APM) “EBITDA” by estimated USD 2.8m of which USD 2.5m will be reclassified from the line item “Administrative expenses” to “Depreciation” and approx. USD 0.3m will be reclassified from “Administrative expenses” to “Financial expenses”.

Going concern

The Group monitors its funding position throughout the year to ensure that it has access to sufficient funds to meet its forecasted cash requirements, including

newbuildings and loan commitments, and to monitor compliance with the financial covenants in its loan facilities. As of 30 June 2019, TORM’s available liquidity including undrawn facilities was USD 367m, TORM’s net debt was USD 623m and the net

debt loan-to-value ratio was 51%. TORM performs sensitivity calculations to reflect different scenarios including, but not limited to, future freight rates and vessel valuations in order to identify risks to future liquidity and covenant

compliance and to enable Management to take corrective actions, if required. The principal risks and uncertainties facing the Group are set out on page 11.

The Board of Directors has considered the Group’s cash flow forecast and the expected compliance with the Company’s financial covenants for a period of not less than

12 months from the date of approval of these financial statements. Based on this review, the Board of Directors has a reasonable expectation, taking reasonable changes in trading performance and vessel valuations into account, that the Group

will be able to continue in operational existence and comply with its financial covenants for the next 12 months. Accordingly, the Group continues to adopt the going concern principle in preparing its financial statements.

|

TORM INTERIM RESULTS FOR THE SECOND QUARTER AND HALF YEAR ENDED 30 JUNE 2019

|

20

|

CONDENSED CONSOLIDATED INCOME STATEMENT PER QUARTER

|

USDm

|

Q2 2019

|

Q1 2019

|

Q4 2018

|

Q3 2018

|

Q2 2018

|

|

Revenue

|

166.3

|

186.4

|

168.6

|

140.4

|

163.3

|

|

Port expenses, bunkers and commissions

|

-68.0

|

-69.8

|

-74.0

|

-69.5

|

-72.9

|

|

Charter hire

|

-

|

-

|

-

|

0.4

|

-1.4

|

|

Operating expenses

|

-43.3

|

-42.7

|

-43.1

|

-44.1

|

-47.1

|

|

Profit from sale of vessels

|

0.2

|

0.1

|

0.2

|

-

|

-

|

|

Administrative expenses