P5D11230002100026700027000284000false--12-31FY2019000165521000.00015000000006951350615764940200000005000000600000049000000.1590.0410000.00010.00015000005000000000P10YP10YP5YP5Y00P48MP4YP12MP24MP2Y25.0025.001.50.00010.00010.00010.00010.00010.00010.00010.00010.00010.00010.00010.00010.00010.00010.00010.00013333500480226080766438713207474053148667765140257420969300000000000000003333500468056580766368713201470144948667585114786207521600000000200000

0001655210

2019-01-01

2019-12-31

0001655210

2019-06-28

0001655210

2020-03-18

0001655210

2019-12-31

0001655210

2018-12-31

0001655210

us-gaap:SeriesEPreferredStockMember

2018-12-31

0001655210

us-gaap:SeriesGPreferredStockMember

2018-12-31

0001655210

us-gaap:SeriesDPreferredStockMember

2018-12-31

0001655210

us-gaap:SeriesBPreferredStockMember

2018-12-31

0001655210

us-gaap:SeriesHPreferredStockMember

2019-12-31

0001655210

us-gaap:SeriesBPreferredStockMember

2019-12-31

0001655210

us-gaap:SeriesEPreferredStockMember

2019-12-31

0001655210

us-gaap:SeriesGPreferredStockMember

2019-12-31

0001655210

us-gaap:SeriesAPreferredStockMember

2018-12-31

0001655210

us-gaap:SeriesCPreferredStockMember

2019-12-31

0001655210

us-gaap:SeriesFPreferredStockMember

2019-12-31

0001655210

us-gaap:SeriesHPreferredStockMember

2018-12-31

0001655210

us-gaap:SeriesAPreferredStockMember

2019-12-31

0001655210

us-gaap:SeriesDPreferredStockMember

2019-12-31

0001655210

us-gaap:SeriesFPreferredStockMember

2018-12-31

0001655210

us-gaap:SeriesCPreferredStockMember

2018-12-31

0001655210

2017-01-01

2017-12-31

0001655210

2018-01-01

2018-12-31

0001655210

us-gaap:SeriesGPreferredStockMember

2017-01-01

2017-12-31

0001655210

us-gaap:RetainedEarningsMember

2018-01-01

2018-12-31

0001655210

us-gaap:AdditionalPaidInCapitalMember

2017-12-31

0001655210

bynd:LoanstoRelatedPartiesMember

2019-09-28

0001655210

us-gaap:CommonStockMember

2017-12-31

0001655210

2017-12-31

0001655210

2019-09-28

0001655210

us-gaap:AdditionalPaidInCapitalMember

2017-01-01

2017-12-31

0001655210

us-gaap:CommonStockMember

2019-01-01

2019-12-31

0001655210

us-gaap:CommonStockMember

2018-12-31

0001655210

us-gaap:CommonStockMember

2018-01-01

2018-12-31

0001655210

us-gaap:AdditionalPaidInCapitalMember

2016-12-31

0001655210

us-gaap:CommonStockMember

2016-12-31

0001655210

us-gaap:SeriesFPreferredStockMember

2017-01-01

2017-12-31

0001655210

us-gaap:RetainedEarningsMember

2016-12-31

0001655210

us-gaap:AdditionalPaidInCapitalMember

2018-01-01

2018-12-31

0001655210

us-gaap:RetainedEarningsMember

2018-12-31

0001655210

us-gaap:RetainedEarningsMember

2017-12-31

0001655210

us-gaap:AdditionalPaidInCapitalMember

2019-01-01

2019-12-31

0001655210

us-gaap:CommonStockMember

us-gaap:IPOMember

2019-01-01

2019-12-31

0001655210

us-gaap:RetainedEarningsMember

2017-01-01

2017-12-31

0001655210

us-gaap:IPOMember

2019-01-01

2019-12-31

0001655210

us-gaap:RetainedEarningsMember

2019-09-28

0001655210

us-gaap:SeriesGPreferredStockMember

2018-01-01

2018-12-31

0001655210

us-gaap:CommonStockMember

bynd:SecondaryPublicOfferingMember

2019-01-01

2019-12-31

0001655210

us-gaap:CommonStockMember

2017-01-01

2017-12-31

0001655210

us-gaap:CommonStockMember

2019-09-28

0001655210

bynd:LoanstoRelatedPartiesMember

2018-12-31

0001655210

2016-12-31

0001655210

bynd:LoanstoRelatedPartiesMember

2018-01-01

2018-12-31

0001655210

us-gaap:RetainedEarningsMember

2019-01-01

2019-12-31

0001655210

us-gaap:AdditionalPaidInCapitalMember

2019-09-28

0001655210

us-gaap:AdditionalPaidInCapitalMember

bynd:SecondaryPublicOfferingMember

2019-01-01

2019-12-31

0001655210

us-gaap:SeriesHPreferredStockMember

2018-01-01

2018-12-31

0001655210

bynd:SecondaryPublicOfferingMember

2019-01-01

2019-12-31

0001655210

us-gaap:AdditionalPaidInCapitalMember

2018-12-31

0001655210

bynd:LoanstoRelatedPartiesMember

2016-12-31

0001655210

us-gaap:AdditionalPaidInCapitalMember

us-gaap:IPOMember

2019-01-01

2019-12-31

0001655210

bynd:LoanstoRelatedPartiesMember

2017-12-31

0001655210

bynd:SecondaryPublicOfferingMember

2019-12-31

0001655210

us-gaap:IPOMember

2019-12-31

0001655210

us-gaap:SeriesFPreferredStockMember

2018-01-01

2018-12-31

0001655210

us-gaap:SeriesHPreferredStockMember

2019-01-01

2019-12-31

0001655210

us-gaap:SeriesFPreferredStockMember

2019-01-01

2019-12-31

0001655210

us-gaap:SeriesHPreferredStockMember

2017-01-01

2017-12-31

0001655210

us-gaap:SeriesGPreferredStockMember

2019-01-01

2019-12-31

0001655210

us-gaap:IPOMember

2019-05-06

2019-05-06

0001655210

bynd:SecondaryPublicOfferingMember

2019-08-05

0001655210

bynd:SecondaryPublicOfferingMember

2019-08-05

2019-08-05

0001655210

us-gaap:IPOMember

2019-05-06

0001655210

us-gaap:CommonStockMember

us-gaap:IPOMember

2019-05-06

0001655210

us-gaap:OverAllotmentOptionMember

2019-08-05

0001655210

bynd:CommonStockWarrantsMember

us-gaap:FairValueInputsLevel2Member

us-gaap:FairValueMeasurementsRecurringMember

2018-12-31

0001655210

us-gaap:FairValueInputsLevel2Member

us-gaap:FairValueMeasurementsRecurringMember

2018-12-31

0001655210

bynd:PreferredStockWarrantsMember

us-gaap:FairValueMeasurementsRecurringMember

2018-12-31

0001655210

bynd:CommonStockWarrantsMember

us-gaap:FairValueInputsLevel3Member

us-gaap:FairValueMeasurementsRecurringMember

2018-12-31

0001655210

bynd:CommonStockWarrantsMember

us-gaap:FairValueInputsLevel1Member

us-gaap:FairValueMeasurementsRecurringMember

2018-12-31

0001655210

bynd:PreferredStockWarrantsMember

us-gaap:FairValueInputsLevel1Member

us-gaap:FairValueMeasurementsRecurringMember

2018-12-31

0001655210

us-gaap:FairValueInputsLevel1Member

us-gaap:FairValueMeasurementsRecurringMember

2018-12-31

0001655210

bynd:PreferredStockWarrantsMember

us-gaap:FairValueInputsLevel3Member

us-gaap:FairValueMeasurementsRecurringMember

2018-12-31

0001655210

bynd:PreferredStockWarrantsMember

us-gaap:FairValueInputsLevel2Member

us-gaap:FairValueMeasurementsRecurringMember

2018-12-31

0001655210

us-gaap:FairValueInputsLevel3Member

us-gaap:FairValueMeasurementsRecurringMember

2018-12-31

0001655210

us-gaap:FairValueMeasurementsRecurringMember

2018-12-31

0001655210

bynd:CommonStockWarrantsMember

us-gaap:FairValueMeasurementsRecurringMember

2018-12-31

0001655210

us-gaap:ShippingAndHandlingMember

2019-01-01

2019-12-31

0001655210

2015-12-01

2015-12-31

0001655210

bynd:DistributorOneMember

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

2017-01-01

2017-12-31

0001655210

bynd:BonusforServicesMember

srt:ExecutiveOfficerMember

2019-01-01

2019-12-31

0001655210

srt:MaximumMember

bynd:AmendedAdvisorAgreementMember

srt:AffiliatedEntityMember

2016-12-01

2016-12-31

0001655210

bynd:AmendedAdvisorAgreementMember

srt:AffiliatedEntityMember

2016-02-01

2016-02-28

0001655210

srt:MaximumMember

srt:ScenarioForecastMember

us-gaap:AccountingStandardsUpdate201602Member

bynd:CumulativeEffectPeriodOfAdoptionAdjustmentMember

2020-01-01

0001655210

bynd:ConsultingAgreementMember

srt:ExecutiveOfficerMember

2017-01-01

2017-12-31

0001655210

bynd:AmendedAdvisorAgreementMember

srt:AffiliatedEntityMember

2017-01-01

2017-12-31

0001655210

bynd:ConsultingAgreementMember

srt:ExecutiveOfficerMember

2018-01-01

2018-12-31

0001655210

bynd:SVBCreditFacilitiesMember

us-gaap:LineOfCreditMember

us-gaap:CommonStockMember

2019-05-05

0001655210

us-gaap:ShippingAndHandlingMember

us-gaap:ContractTerminationMember

2017-01-01

2017-12-31

0001655210

us-gaap:ShippingAndHandlingMember

us-gaap:ContractTerminationMember

2018-01-01

2018-12-31

0001655210

us-gaap:IPOMember

2018-01-01

2018-12-31

0001655210

bynd:DistributorTwoMember

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

2019-01-01

2019-12-31

0001655210

us-gaap:NonUsMember

us-gaap:SalesRevenueNetMember

us-gaap:GeographicConcentrationRiskMember

2019-01-01

2019-12-31

0001655210

us-gaap:ShippingAndHandlingMember

2018-01-01

2018-12-31

0001655210

bynd:DistributorOneMember

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

2019-01-01

2019-12-31

0001655210

bynd:ConsultingAgreementMember

srt:ExecutiveOfficerMember

2019-04-08

2019-04-08

0001655210

us-gaap:SeriesBPreferredStockMember

2019-05-05

0001655210

bynd:DistributorThreeMember

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

2018-01-01

2018-12-31

0001655210

bynd:DistributorOneMember

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

2018-01-01

2018-12-31

0001655210

us-gaap:SeriesEPreferredStockMember

2019-05-05

0001655210

bynd:DistributorTwoMember

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

2018-01-01

2018-12-31

0001655210

bynd:DonaldThompsonMember

2018-01-01

2018-12-31

0001655210

bynd:AmendedAdvisorAgreementMember

srt:AffiliatedEntityMember

2016-12-01

2016-12-31

0001655210

srt:MinimumMember

srt:ScenarioForecastMember

us-gaap:AccountingStandardsUpdate201602Member

bynd:CumulativeEffectPeriodOfAdoptionAdjustmentMember

2020-01-01

0001655210

bynd:DistributorThreeMember

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

2017-01-01

2017-12-31

0001655210

bynd:NonqualifiedStockOptionMember

bynd:AmendedAdvisorAgreementMember

srt:AffiliatedEntityMember

2016-02-01

2016-02-28

0001655210

us-gaap:ShippingAndHandlingMember

2017-01-01

2017-12-31

0001655210

us-gaap:NonUsMember

us-gaap:SalesRevenueNetMember

us-gaap:GeographicConcentrationRiskMember

2017-01-01

2017-12-31

0001655210

bynd:AmendedAdvisorAgreementMember

srt:AffiliatedEntityMember

2019-01-01

2019-12-31

0001655210

2015-12-31

0001655210

srt:MinimumMember

bynd:AdvisorAgreementMember

srt:AffiliatedEntityMember

2015-10-01

2015-10-31

0001655210

bynd:AdvisorAgreementMember

srt:AffiliatedEntityMember

2015-10-01

2015-10-31

0001655210

bynd:ConsultingAgreementMember

srt:ExecutiveOfficerMember

2019-01-01

2019-12-31

0001655210

us-gaap:NonUsMember

us-gaap:SalesRevenueNetMember

us-gaap:GeographicConcentrationRiskMember

2018-01-01

2018-12-31

0001655210

bynd:DistributorTwoMember

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

2017-01-01

2017-12-31

0001655210

bynd:AmendedAdvisorAgreementMember

srt:AffiliatedEntityMember

2018-01-01

2018-12-31

0001655210

us-gaap:MeasurementInputRiskFreeInterestRateMember

2017-12-31

0001655210

us-gaap:MeasurementInputExercisePriceMember

2018-12-31

0001655210

us-gaap:MeasurementInputExpectedDividendRateMember

2017-12-31

0001655210

us-gaap:MeasurementInputExpectedDividendRateMember

2018-12-31

0001655210

us-gaap:MeasurementInputPriceVolatilityMember

2017-12-31

0001655210

us-gaap:MeasurementInputPriceVolatilityMember

2018-12-31

0001655210

us-gaap:MeasurementInputExercisePriceMember

2017-12-31

0001655210

us-gaap:MeasurementInputRiskFreeInterestRateMember

2018-12-31

0001655210

us-gaap:SoftwareAndSoftwareDevelopmentCostsMember

2019-01-01

2019-12-31

0001655210

us-gaap:VehiclesMember

2019-01-01

2019-12-31

0001655210

us-gaap:FurnitureAndFixturesMember

2019-01-01

2019-12-31

0001655210

us-gaap:SalesChannelDirectlyToConsumerMember

2018-01-01

2018-12-31

0001655210

us-gaap:SalesChannelDirectlyToConsumerMember

2019-01-01

2019-12-31

0001655210

us-gaap:SalesChannelDirectlyToConsumerMember

2017-01-01

2017-12-31

0001655210

us-gaap:SalesChannelThroughIntermediaryMember

2017-01-01

2017-12-31

0001655210

us-gaap:SalesChannelThroughIntermediaryMember

2019-01-01

2019-12-31

0001655210

us-gaap:SalesChannelThroughIntermediaryMember

2018-01-01

2018-12-31

0001655210

bynd:FrozenMember

2018-01-01

2018-12-31

0001655210

bynd:FreshMember

2018-01-01

2018-12-31

0001655210

bynd:FrozenMember

2017-01-01

2017-12-31

0001655210

bynd:FreshMember

2017-01-01

2017-12-31

0001655210

bynd:FreshMember

2019-01-01

2019-12-31

0001655210

bynd:FrozenMember

2019-01-01

2019-12-31

0001655210

srt:MinimumMember

bynd:ResearchAndDevelopmentEquipmentMember

2019-01-01

2019-12-31

0001655210

srt:MinimumMember

us-gaap:EquipmentMember

2019-01-01

2019-12-31

0001655210

srt:MaximumMember

bynd:ResearchAndDevelopmentEquipmentMember

2019-01-01

2019-12-31

0001655210

srt:MaximumMember

us-gaap:EquipmentMember

2019-01-01

2019-12-31

0001655210

us-gaap:ShippingAndHandlingMember

us-gaap:ContractTerminationMember

2019-01-01

2019-12-31

0001655210

bynd:DonaldThompsonMember

2017-01-01

2017-12-31

0001655210

2019-01-02

2019-01-02

0001655210

bynd:DonaldThompsonMember

2019-01-01

2019-12-31

0001655210

srt:MinimumMember

bynd:AmendedAdvisorAgreementMember

srt:AffiliatedEntityMember

2016-12-01

2016-12-31

0001655210

us-gaap:ContractTerminationMember

2017-01-01

2017-12-31

0001655210

us-gaap:SellingGeneralAndAdministrativeExpensesMember

2017-01-01

2017-12-31

0001655210

us-gaap:AssetUnderConstructionMember

2019-12-31

0001655210

us-gaap:SoftwareAndSoftwareDevelopmentCostsMember

2019-12-31

0001655210

bynd:ResearchAndDevelopmentEquipmentMember

2019-12-31

0001655210

us-gaap:VehiclesMember

2018-12-31

0001655210

bynd:ResearchAndDevelopmentEquipmentMember

2018-12-31

0001655210

us-gaap:AssetsHeldUnderCapitalLeasesMember

2019-12-31

0001655210

us-gaap:LeaseholdImprovementsMember

2019-12-31

0001655210

us-gaap:FurnitureAndFixturesMember

2019-12-31

0001655210

us-gaap:LeaseholdImprovementsMember

2018-12-31

0001655210

us-gaap:VehiclesMember

2019-12-31

0001655210

us-gaap:FurnitureAndFixturesMember

2018-12-31

0001655210

us-gaap:EquipmentMember

2018-12-31

0001655210

us-gaap:AssetUnderConstructionMember

2018-12-31

0001655210

us-gaap:EquipmentMember

2019-12-31

0001655210

us-gaap:SoftwareAndSoftwareDevelopmentCostsMember

2018-12-31

0001655210

us-gaap:AssetsHeldUnderCapitalLeasesMember

2018-12-31

0001655210

us-gaap:ResearchAndDevelopmentExpenseMember

2018-01-01

2018-12-31

0001655210

us-gaap:SellingGeneralAndAdministrativeExpensesMember

2019-01-01

2019-12-31

0001655210

us-gaap:CostOfSalesMember

2018-01-01

2018-12-31

0001655210

us-gaap:ResearchAndDevelopmentExpenseMember

2017-01-01

2017-12-31

0001655210

us-gaap:CostOfSalesMember

2019-01-01

2019-12-31

0001655210

us-gaap:SellingGeneralAndAdministrativeExpensesMember

2018-01-01

2018-12-31

0001655210

us-gaap:ResearchAndDevelopmentExpenseMember

2019-01-01

2019-12-31

0001655210

us-gaap:CostOfSalesMember

2017-01-01

2017-12-31

0001655210

bynd:A2018TermLoanFacilityMember

us-gaap:DebtInstrumentRedemptionPeriodOneMember

us-gaap:LineOfCreditMember

2018-06-01

2018-06-30

0001655210

bynd:EquipmentLoanFacilityMember

us-gaap:LineOfCreditMember

2018-01-01

2018-12-31

0001655210

us-gaap:InterestExpenseMember

2018-01-01

2018-12-31

0001655210

us-gaap:RevolvingCreditFacilityMember

us-gaap:LineOfCreditMember

2019-12-31

0001655210

bynd:EquipmentLoanFacilityMember

us-gaap:LineOfCreditMember

2018-09-29

0001655210

us-gaap:ConvertibleSubordinatedDebtMember

2017-11-30

0001655210

bynd:EquipmentLoanFacilityMember

us-gaap:DebtInstrumentRedemptionPeriodFourMember

us-gaap:LineOfCreditMember

2018-09-29

0001655210

us-gaap:InterestExpenseMember

2019-01-01

2019-12-31

0001655210

bynd:EquipmentLoanFacilityMember

us-gaap:LineOfCreditMember

2019-12-31

0001655210

bynd:EquipmentLoanFacilityMember

bynd:DebtInstrumentPrepaymentPenaltyFirstTwoYearsMember

us-gaap:LineOfCreditMember

2018-09-01

2018-09-29

0001655210

us-gaap:RevolvingCreditFacilityMember

us-gaap:LineOfCreditMember

2018-06-01

2018-06-30

0001655210

bynd:A2018TermLoanFacilityMember

us-gaap:DebtInstrumentRedemptionPeriodOneMember

us-gaap:LineOfCreditMember

2018-06-30

0001655210

us-gaap:OtherExpenseMember

us-gaap:ConvertibleSubordinatedDebtMember

2017-01-01

2017-12-31

0001655210

bynd:SVBCreditFacilitiesMember

us-gaap:LineOfCreditMember

2017-01-01

2017-12-31

0001655210

us-gaap:ConvertibleSubordinatedDebtMember

us-gaap:SeriesGPreferredStockMember

2017-11-30

0001655210

srt:MaximumMember

us-gaap:RevolvingCreditFacilityMember

us-gaap:LineOfCreditMember

2018-06-01

2018-06-30

0001655210

bynd:SVBCreditFacilitiesMember

us-gaap:LineOfCreditMember

us-gaap:CommonStockMember

2019-12-31

0001655210

bynd:EquipmentLoanFacilityMember

us-gaap:LineOfCreditMember

2018-09-01

2018-09-29

0001655210

bynd:EquipmentLoanFacilityMember

bynd:DebtInstrumentPrepaymentPenaltyFirstTwoYearsMember

us-gaap:LineOfCreditMember

2018-09-29

0001655210

us-gaap:MediumTermNotesMember

2017-01-01

2017-12-31

0001655210

bynd:EquipmentLoanFacilityMember

bynd:DebtInstrumentPaymentsBeginning18MonthsafterLoanDrawMember

us-gaap:LineOfCreditMember

2018-09-01

2018-09-29

0001655210

bynd:SVBCreditFacilitiesMember

us-gaap:LineOfCreditMember

2019-01-01

2019-12-31

0001655210

bynd:TwoPurchasersMember

us-gaap:SeriesGPreferredStockMember

2017-11-30

0001655210

bynd:SVBCreditFacilitiesMember

us-gaap:LineOfCreditMember

2018-01-01

2018-12-31

0001655210

bynd:SVBCreditFacilitiesMember

us-gaap:LineOfCreditMember

us-gaap:CommonStockMember

2018-06-01

2018-06-30

0001655210

bynd:EquipmentLoanFacilityMember

us-gaap:LineOfCreditMember

2018-12-31

0001655210

bynd:A2018TermLoanFacilityMember

us-gaap:DebtInstrumentRedemptionPeriodTwoMember

us-gaap:LineOfCreditMember

2018-06-30

0001655210

bynd:A2018TermLoanFacilityMember

us-gaap:LineOfCreditMember

2019-12-31

0001655210

us-gaap:MediumTermNotesMember

2013-12-20

0001655210

bynd:EquipmentLoanFacilityMember

us-gaap:LineOfCreditMember

2017-01-01

2017-12-31

0001655210

srt:MinimumMember

us-gaap:RevolvingCreditFacilityMember

us-gaap:LineOfCreditMember

2018-06-01

2018-06-30

0001655210

us-gaap:SeriesGPreferredStockMember

2017-11-01

2017-11-30

0001655210

us-gaap:ConvertibleSubordinatedDebtMember

2017-11-01

2017-11-30

0001655210

us-gaap:InterestExpenseMember

us-gaap:ConvertibleSubordinatedDebtMember

2017-01-01

2017-12-31

0001655210

bynd:EquipmentLoanFacilityMember

bynd:DebtInstrumentPrepaymentPenaltyThereafterMember

us-gaap:LineOfCreditMember

2018-09-29

0001655210

us-gaap:InterestExpenseMember

2017-01-01

2017-12-31

0001655210

bynd:A2018TermLoanFacilityMember

us-gaap:DebtInstrumentRedemptionPeriodThreeMember

us-gaap:LineOfCreditMember

2018-06-30

0001655210

us-gaap:RevolvingCreditFacilityMember

us-gaap:DebtInstrumentRedemptionPeriodOneMember

us-gaap:LineOfCreditMember

2018-06-30

0001655210

bynd:EquipmentLoanFacilityMember

us-gaap:LineOfCreditMember

2019-01-01

2019-12-31

0001655210

bynd:EquipmentLoanFacilityMember

bynd:DebtInstrumentPaymentsBeginningSixMonthsafterLoanDrawMember

us-gaap:LineOfCreditMember

2018-09-01

2018-09-29

0001655210

bynd:A2018TermLoanFacilityMember

us-gaap:LineOfCreditMember

2018-12-31

0001655210

us-gaap:RevolvingCreditFacilityMember

us-gaap:LineOfCreditMember

2018-12-31

0001655210

2019-05-06

0001655210

2019-08-05

0001655210

us-gaap:CommonStockMember

2019-12-31

0001655210

us-gaap:RestrictedStockMember

2017-01-01

2017-12-31

0001655210

us-gaap:EmployeeStockOptionMember

us-gaap:ShareBasedCompensationAwardTrancheOneMember

2019-01-01

2019-12-31

0001655210

us-gaap:RestrictedStockMember

2019-01-01

2019-12-31

0001655210

us-gaap:RestrictedStockMember

us-gaap:ShareBasedPaymentArrangementNonemployeeMember

bynd:A2018EquityIncentivePlanMember

2019-04-18

2019-04-18

0001655210

us-gaap:RestrictedStockUnitsRSUMember

bynd:A2018EquityIncentivePlanMember

2018-12-31

0001655210

bynd:A2018EmployeeStockPurchasePlanMember

us-gaap:EmployeeStockMember

2018-11-15

2018-11-15

0001655210

srt:ExecutiveOfficerMember

us-gaap:ShareBasedPaymentArrangementEmployeeMember

bynd:A2018EquityIncentivePlanMember

2019-08-01

2019-08-01

0001655210

bynd:A2018EquityIncentivePlanMember

2019-12-31

0001655210

us-gaap:RestrictedStockUnitsRSUMember

us-gaap:ShareBasedPaymentArrangementNonemployeeMember

2019-10-31

2019-10-31

0001655210

srt:ExecutiveOfficerMember

us-gaap:ShareBasedPaymentArrangementEmployeeMember

bynd:A2018EquityIncentivePlanMember

2019-04-18

2019-04-18

0001655210

srt:ExecutiveOfficerMember

us-gaap:ShareBasedPaymentArrangementEmployeeMember

bynd:A2018EquityIncentivePlanMember

2019-06-10

2019-06-10

0001655210

us-gaap:EmployeeStockOptionMember

2017-01-01

2017-12-31

0001655210

srt:MaximumMember

us-gaap:RestrictedStockMember

2018-10-01

2018-10-31

0001655210

us-gaap:RestrictedStockUnitsRSUMember

2019-01-01

2019-12-31

0001655210

us-gaap:EmployeeStockOptionMember

us-gaap:ShareBasedCompensationAwardTrancheTwoMember

2019-01-01

2019-12-31

0001655210

us-gaap:RestrictedStockMember

2018-10-31

0001655210

us-gaap:RestrictedStockUnitsRSUMember

us-gaap:ShareBasedPaymentArrangementNonemployeeMember

us-gaap:ShareBasedCompensationAwardTrancheThreeMember

2019-10-31

2019-10-31

0001655210

bynd:A2018EquityIncentivePlanMember

2018-12-31

0001655210

us-gaap:ShareBasedPaymentArrangementEmployeeMember

bynd:A2018EquityIncentivePlanMember

2019-04-29

2019-04-29

0001655210

us-gaap:RestrictedStockMember

us-gaap:ShareBasedPaymentArrangementNonemployeeMember

bynd:A2018EquityIncentivePlanMember

2019-04-18

0001655210

us-gaap:RestrictedStockUnitsRSUMember

us-gaap:ShareBasedPaymentArrangementEmployeeMember

bynd:A2018EquityIncentivePlanMember

2019-10-31

2019-10-31

0001655210

us-gaap:RestrictedStockUnitsRSUMember

us-gaap:ShareBasedPaymentArrangementEmployeeMember

bynd:A2018EquityIncentivePlanMember

2019-10-31

0001655210

us-gaap:RestrictedStockUnitsRSUMember

bynd:A2018EquityIncentivePlanMember

2019-08-01

2019-08-01

0001655210

us-gaap:CommonStockMember

2018-07-31

0001655210

bynd:Beginning2020FiscalYearMember

bynd:A2018EquityIncentivePlanMember

2019-04-30

2019-04-30

0001655210

bynd:A2018EmployeeStockPurchasePlanMember

us-gaap:EmployeeStockMember

2018-11-15

0001655210

srt:ExecutiveOfficerMember

us-gaap:RestrictedStockUnitsRSUMember

us-gaap:ShareBasedPaymentArrangementEmployeeMember

bynd:A2018EquityIncentivePlanMember

2019-10-31

2019-10-31

0001655210

us-gaap:CommonStockMember

2018-07-01

2018-07-31

0001655210

us-gaap:EmployeeStockOptionMember

2019-01-01

2019-12-31

0001655210

us-gaap:RestrictedStockUnitsRSUMember

us-gaap:ShareBasedCompensationAwardTrancheOneMember

2019-01-01

2019-12-31

0001655210

us-gaap:ShareBasedPaymentArrangementEmployeeMember

bynd:A2018EquityIncentivePlanMember

2019-04-03

2019-04-03

0001655210

srt:ExecutiveOfficerMember

us-gaap:ShareBasedPaymentArrangementEmployeeMember

bynd:A2018EquityIncentivePlanMember

2019-05-01

2019-05-01

0001655210

us-gaap:RestrictedStockUnitsRSUMember

us-gaap:ShareBasedPaymentArrangementEmployeeMember

bynd:A2018EquityIncentivePlanMember

2019-06-10

2019-06-10

0001655210

bynd:A2018EquityIncentivePlanMember

2011-04-11

2019-12-31

0001655210

us-gaap:RestrictedStockMember

2019-04-30

0001655210

us-gaap:RestrictedStockMember

2019-12-31

0001655210

us-gaap:RestrictedStockUnitsRSUMember

bynd:A2018EquityIncentivePlanMember

2019-12-31

0001655210

us-gaap:CommonStockMember

2019-01-01

2019-12-31

0001655210

us-gaap:RestrictedStockMember

2015-12-01

2015-12-31

0001655210

us-gaap:RestrictedStockMember

2019-04-30

2019-04-30

0001655210

bynd:ExecutiveOfficerTwoMember

us-gaap:ShareBasedPaymentArrangementEmployeeMember

bynd:A2018EquityIncentivePlanMember

2019-10-31

2019-10-31

0001655210

us-gaap:RestrictedStockUnitsRSUMember

us-gaap:ShareBasedCompensationAwardTrancheTwoMember

2019-01-01

2019-12-31

0001655210

us-gaap:RestrictedStockUnitsRSUMember

2018-01-01

2018-12-31

0001655210

us-gaap:ShareBasedPaymentArrangementEmployeeMember

bynd:A2018EquityIncentivePlanMember

2019-10-31

2019-10-31

0001655210

us-gaap:EmployeeStockOptionMember

2018-01-01

2018-12-31

0001655210

us-gaap:RestrictedStockUnitsRSUMember

bynd:A2018EquityIncentivePlanMember

2019-08-01

0001655210

us-gaap:RestrictedStockUnitsRSUMember

us-gaap:ShareBasedPaymentArrangementEmployeeMember

bynd:A2018EquityIncentivePlanMember

2019-06-10

0001655210

srt:MinimumMember

us-gaap:RestrictedStockMember

2018-10-01

2018-10-31

0001655210

us-gaap:RestrictedStockMember

2019-04-01

2019-04-30

0001655210

us-gaap:RestrictedStockMember

2018-01-01

2018-12-31

0001655210

bynd:A2018EquityIncentivePlanMember

2019-04-30

0001655210

us-gaap:RestrictedStockMember

2018-10-01

2018-10-31

0001655210

us-gaap:RestrictedStockUnitsRSUMember

2017-01-01

2017-12-31

0001655210

us-gaap:EmployeeStockOptionMember

2019-12-31

0001655210

bynd:A2018EquityIncentivePlanMember

2011-04-11

2018-12-31

0001655210

us-gaap:RestrictedStockUnitsRSUMember

2019-12-31

0001655210

2016-01-01

2016-12-31

0001655210

us-gaap:RestrictedStockMember

2017-12-31

0001655210

us-gaap:RestrictedStockMember

2018-12-31

0001655210

us-gaap:RestrictedStockUnitsRSUMember

2018-12-31

0001655210

srt:ExecutiveOfficerMember

us-gaap:EmployeeStockOptionMember

us-gaap:ShareBasedPaymentArrangementEmployeeMember

2019-10-31

2019-10-31

0001655210

us-gaap:RestrictedStockUnitsRSUMember

us-gaap:ShareBasedPaymentArrangementNonemployeeMember

2019-08-01

2019-08-01

0001655210

srt:ExecutiveOfficerMember

us-gaap:RestrictedStockUnitsRSUMember

us-gaap:ShareBasedPaymentArrangementEmployeeMember

2019-10-31

2019-10-31

0001655210

srt:ExecutiveOfficerMember

us-gaap:EmployeeStockOptionMember

us-gaap:ShareBasedPaymentArrangementEmployeeMember

2019-08-01

2019-08-01

0001655210

srt:ExecutiveOfficerMember

us-gaap:RestrictedStockUnitsRSUMember

us-gaap:ShareBasedPaymentArrangementEmployeeMember

2019-08-01

2019-08-01

0001655210

bynd:FormerCoManufacturerComplaintMember

us-gaap:PendingLitigationMember

us-gaap:SubsequentEventMember

2020-01-24

2020-01-24

0001655210

bynd:FormerCoManufacturerComplaintMember

us-gaap:PendingLitigationMember

2018-10-01

2018-10-31

0001655210

srt:MaximumMember

2019-12-31

0001655210

srt:MinimumMember

2019-12-31

0001655210

us-gaap:StateAndLocalJurisdictionMember

2018-12-31

0001655210

us-gaap:ResearchMember

2019-12-31

0001655210

us-gaap:ResearchMember

2018-12-31

0001655210

srt:RestatementAdjustmentMember

us-gaap:AccountingStandardsUpdate201609Member

2018-12-31

0001655210

us-gaap:DomesticCountryMember

2018-12-31

0001655210

us-gaap:StateAndLocalJurisdictionMember

2019-12-31

0001655210

us-gaap:DomesticCountryMember

2019-12-31

0001655210

srt:RestatementAdjustmentMember

us-gaap:AccountingStandardsUpdate201609Member

2018-01-01

2018-03-31

0001655210

us-gaap:ConvertiblePreferredStockMember

2017-01-01

2017-12-31

0001655210

us-gaap:RestrictedStockUnitsRSUMember

2018-01-01

2018-12-31

0001655210

us-gaap:RestrictedStockUnitsRSUMember

2017-01-01

2017-12-31

0001655210

us-gaap:EmployeeStockOptionMember

2017-01-01

2017-12-31

0001655210

us-gaap:WarrantMember

2017-01-01

2017-12-31

0001655210

us-gaap:WarrantMember

2018-01-01

2018-12-31

0001655210

us-gaap:WarrantMember

2019-01-01

2019-12-31

0001655210

us-gaap:EmployeeStockOptionMember

2019-01-01

2019-12-31

0001655210

us-gaap:RestrictedStockUnitsRSUMember

2019-01-01

2019-12-31

0001655210

us-gaap:ConvertiblePreferredStockMember

2019-01-01

2019-12-31

0001655210

us-gaap:ConvertiblePreferredStockMember

2018-01-01

2018-12-31

0001655210

us-gaap:EmployeeStockOptionMember

2018-01-01

2018-12-31

0001655210

us-gaap:SubsequentEventMember

2020-01-10

2020-01-20

0001655210

us-gaap:SubsequentEventMember

2020-01-10

0001655210

us-gaap:SubsequentEventMember

2020-03-16

2020-03-16

0001655210

2019-09-29

2019-12-31

0001655210

2018-09-30

2018-12-31

0001655210

2019-01-01

2019-03-30

0001655210

2018-07-01

2018-09-29

0001655210

2019-03-31

2019-06-29

0001655210

2018-01-01

2018-03-31

0001655210

2019-06-30

2019-09-28

0001655210

2018-04-01

2018-06-30

xbrli:shares

iso4217:USD

bynd:segment

iso4217:USD

xbrli:shares

xbrli:pure

bynd:purchaser

bynd:defendant

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

|

| |

☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES AND EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2019

OR

|

| |

☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number: 001-38879

BEYOND MEAT, INC.

(Exact name of registrant as specified in its charter)

|

| |

Delaware | 26-4087597 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

119 Standard Street

El Segundo, CA 90245

(Address, including zip code, of principal executive offices)

(866) 756-4112

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act: |

| | | | |

Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

Common Stock, $0.0001 par value | | BYND | | The Nasdaq Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act:

|

| | | | | |

Large accelerated filer | | ☐ | Accelerated filer | | ☐ |

| | | | | |

Non-accelerated filer | | ☒ | Smaller reporting company | | ☐ |

| | | Emerging growth company | | ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of June 28, 2019, the aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant, based on the closing sales price of the registrant’s common stock as reported on the Nasdaq Global Select Market on such date, was $7.2 billion.

As of March 18, 2020, the registrant had 61,845,096 shares of common stock, $0.0001 par value per share, outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive proxy statement relating to its 2020 Annual Meeting of Stockholders to be filed with the Securities and Exchange Commission within 120 days after the end of the fiscal year ended December 31, 2019 are incorporated herein by reference in Part III where indicated.

Note Regarding Forward-Looking Statements

This report includes forward-looking statements within the meaning of the federal securities laws. We have based these forward-looking statements largely on our current opinions, expectations, beliefs, plans, objectives, assumptions and projections about future events and financial trends affecting the operating results and financial condition of our business. Forward-looking statements should not be read as a guarantee of future performance or results, and will not necessarily be accurate indications of the times at, or by, which such performance or results will be achieved. Forward-looking statements are based on information available at the time those statements are made and/or management’s good faith belief as of that time with respect to future events, and are subject to risks and uncertainties that could cause actual performance or results to differ materially from those expressed in or suggested by the forward-looking statements. Important factors that could cause such differences include, but are not limited to:

| |

• | estimates of our expenses, future revenues, capital expenditures, capital requirements and our needs for additional financing; |

| |

• | our ability to effectively manage our growth; |

| |

• | the impact of adverse and uncertain economic conditions in the U.S. and international markets; |

| |

• | the effects of global outbreaks of pandemics or contagious diseases or fear of such outbreaks, such as the recent coronavirus (COVID-19) pandemic, including on our supply chain, the demand for our products, our ability to expand and produce in new geographic markets or the timing of such expansion efforts, and on overall economic conditions and consumer confidence and spending levels; |

| |

• | our estimates of the size of our market opportunities; |

| |

• | our ability to effectively expand our manufacturing and production capacity; |

| |

• | our ability to accurately forecast demand for our products and manage our inventory; |

| |

• | our ability to successfully enter new geographic markets, manage our international expansion and comply with any applicable laws and regulations; |

| |

• | the effects of increased competition from our market competitors and new market entrants; |

| |

• | the success of our marketing initiatives and the ability to grow brand awareness, maintain, protect and enhance our brand, attract and retain new customers and grow our market share; |

| |

• | our ability to attract, maintain and effectively expand our relationships with key strategic restaurant and foodservice partners; |

| |

• | our ability to attract and retain our suppliers, distributors, co-manufacturers and customers; |

| |

• | our ability to procure sufficient high quality, raw materials to manufacture our products; |

| |

• | the availability of pea protein that meets our standards; |

| |

• | our ability to diversify the protein sources used for our products; |

| |

• | the volatility associated with ingredient and packaging costs; |

| |

• | real or perceived quality or health issues with our products or other issues that adversely affect our brand and reputation; |

| |

• | changes in the tastes and preferences of our consumers; |

| |

• | our ability to accurately predict consumer taste preferences, trends and demand and successfully introduce and commercialize new products and improve existing products, including in new geographic markets; |

| |

• | significant disruption in, or breach in security of our information technology systems and resultant interruptions in service and any related impact on our reputation; |

| |

• | the attraction and retention of qualified employees and key personnel and our ability to maintain our corporate culture as we continue to grow; |

| |

• | the effects of natural or man-made catastrophic events particularly involving our or any of our co-manufacturers’ manufacturing facilities or our suppliers’ facilities; |

| |

• | the impact of marketing campaigns aimed at generating negative publicity regarding our products, brand and the plant-based industry category; |

| |

• | the effectiveness of our internal controls; |

| |

• | changes in laws and government regulation affecting our business, including the U.S. Food and Drug Administration (“FDA”) and the U.S. Federal Trade Commission (“FTC”) governmental regulation, and state, local and foreign regulation; |

| |

• | changes in laws, regulations or policies of governmental agencies or regulators relating to the labeling of our products, including, in the United States, new federal or state legislation affecting plant-based meat that could impact how we name our products or our brand name; |

| |

• | the financial condition of, and our relationships with our suppliers, co-manufacturers, distributors, retailers, and restaurant and foodservice customers, and their future decisions regarding their relationships with us; |

| |

• | the ability of our suppliers and co-manufacturers to comply with food safety, environmental or other laws or regulations; |

| |

• | the sufficiency of our cash and cash equivalents to meet our liquidity needs and service our indebtedness; |

| |

• | economic conditions and the impact on consumer spending; |

| |

• | outcomes of legal or administrative proceedings; |

| |

• | our, our suppliers’ and our co-manufacturers’ ability to protect our proprietary technology, intellectual property and trade secrets adequately; and |

| |

• | the risks discussed in Part I, Item 1A, “Risk Factors,” included elsewhere herein, and those discussed in other documents we file from time to time with the Securities and Exchange Commission (“SEC”). |

In some cases, you can identify forward-looking statements by the use of words such as “believe,” “may,” “will,” “will continue,” “could,” “will likely result,” “estimate,” “continue,” “anticipate,” “intend,” “plan,” “predict,” “project,” “expect,” “potential” and variations of these terms and similar expressions, or the negative of these terms or similar expressions. These forward-looking statements are based on our current expectations and assumptions that are subject to risks and uncertainties, which could cause our actual results to differ materially from those anticipated or implied in the forward-looking statements.

All forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by the cautionary statements set forth above. Forward-looking statements speak only as of the date of this report. You should not put undue reliance on any forward-looking statements. We assume no obligation to publicly update or revise any forward-looking statements because of new information, future events, changes in assumptions or otherwise, except to the extent required by applicable laws. If we update one or more forward-looking statements, no inference should be drawn that we will make additional updates with respect to those or other forward-looking statements.

PART I

ITEM 1. BUSINESS.

Overview

Beyond Meat, Inc., a Delaware corporation (including its subsidiaries unless the context otherwise requires, “Beyond Meat,” “we,” “us,” “our” or the “Company”), is one of the fastest growing food companies in the United States, offering a portfolio of revolutionary plant-based meats. We build meat directly from plants, an innovation that enables consumers to experience the taste, texture and other sensory attributes of popular animal-based meat products while enjoying the nutritional and environmental benefits of eating our plant-based meat products. Our brand commitment, “Eat What You Love,” represents a strong belief that by eating our plant-based meats, consumers can enjoy more, not less, of their favorite meals, and by doing so, help to address concerns related to human health, climate change, resource conservation and animal welfare. The success of our breakthrough innovation model and products has allowed us to appeal to a broad range of consumers, including those who typically eat animal-based meats, positioning us to compete directly in the $1.4 trillion global meat industry.

To capture this broad market opportunity, we have developed three core plant-based product platforms that align with the largest meat categories globally: beef, pork and poultry. The primary components of animal-based meat—amino acids, lipids, carbohydrates, trace minerals, and water—are not exclusive to animals and are plentiful in plants. We create our plant-based products using proprietary scientific processes that determine the architecture of the animal-based meat we are seeking to replicate and then we assemble it using plant-derived amino acids, lipids, carbohydrates, trace minerals and water. We are focused on continuously improving our products so that they are, to the human sensory system, indistinguishable from their animal-based counterparts.

Our flagship product is the Beyond Burger, the world’s first 100% plant-based burger merchandised in the meat case of grocery stores in the United States. The Beyond Burger is designed to look, cook and taste like a traditional beef burger. We also sell a range of other plant-based meat products, including Beyond Sausage, Beyond Beef, Beyond Breakfast Sausage, and Beyond Beef Crumbles, as well as Beyond Fried Chicken and Beyond Meatball, which are currently sold to certain quick service restaurant (“QSR”) partners. All of our products are antibiotic-free, hormone-free, GMO-free and are certified Kosher and Halal, and all of our products other than Beyond Fried Chicken and Beyond Meatball are gluten-free. As of December 31, 2019, our products were available in approximately 77,000 retail and restaurant and foodservice outlets in more than 65 countries, across mainstream grocery, mass merchandiser, club and convenience store, and natural retailer channels, direct to consumer, and various food-away-from-home channels, including restaurants, foodservice outlets and schools. We enjoy a strong base of well-known retail and foodservice customers that we expect will continue to grow.

Research, development and innovation are core elements of our business strategy, and we believe they represent a critical competitive advantage for us. Through our Beyond Meat Rapid and Relentless Innovation Program, our team of scientists and engineers focuses on making continuous improvements to our existing product formulations and developing new products across our plant-based beef, pork and poultry platforms. Our state-of-the-art Manhattan Beach Project Innovation Center in El Segundo, California brings together leading scientists from chemistry, biology, material science, food science, and biophysics disciplines who work together with process engineers and culinary specialists to pursue our vision of perfectly building plant-based meat.

We continue to experience strong sales growth over prior periods. Net revenues increased to $297.9 million in 2019 from $87.9 million in 2018 and $32.6 million in 2017, representing a 202% compound annual growth rate. The Beyond Burger accounted for approximately 64%, 70% and 48% of our gross revenues in 2019, 2018 and 2017, respectively. We believe that sales of the Beyond Burger will continue to constitute a significant portion of our revenues, income and cash flow for the foreseeable future. In 2019, gross revenues from the Beyond Burger, all Beyond Sausage flavors, Beyond Beef and Beyond Beef Crumbles were approximately 64%, 23%, 8% and 5%, respectively, compared to approximately 70%,12%, 0% and 9%, respectively, in 2018. We have generated losses since inception. Net loss in 2019, 2018, and 2017 was $12.4 million, $29.9 million, and $30.4 million, respectively, as we invested in innovation and growth of our business. Going forward, we intend to continue to invest in innovation, supply chain capabilities, manufacturing and marketing initiatives as

we believe the demand for our products will continue to accelerate across both retail and restaurant and foodservice channels as well as internationally.

Our Mission

We are a mission-driven business with long-standing core values. We strive to operate in an honest, socially responsible and environmentally sustainable manner and are committed to help solve the major health and global environmental issues which we believe are caused by an animal-based protein diet and existing meat industry practices. We believe our authentic and long-standing commitment to these causes better positions us to build loyalty and trust with current consumers and helps attract new ones. Our corporate culture embodies these values and, as a result, we enjoy a highly motivated and skilled work force committed to our mission and our enterprise.

The Beyond Meat Strategic Difference

| |

• | Unique Approach to the Product |

We employ a revolutionary and unique approach to create our products, with a goal of delivering the same satisfying taste, aroma and texture as the animal-based meats we seek to replicate. In our Manhattan Beach Project Innovation Center, our scientists and engineers work to continuously improve our products to replicate the sensory experience of animal-based meat. Through our investment in innovation, we have grown our portfolio to include new products including Beyond Beef, Beyond Breakfast Sausage, Beyond Fried Chicken and Beyond Meatball. In 2019, we also introduced a new version of the flagship Beyond Burger, designed to have a meatier taste and texture. Each product is designed to not only closely replicate the taste and sensory experience of its animal protein equivalent, but to also provide the nutritional and environmental benefits of plant-based meat.

We start by analyzing the composition and design of relevant animal-based meats at the molecular and structural level. The primary components, other than water, comprising animal-based meats are amino acids, lipids, carbohydrates, and trace minerals, which are not exclusive to animals and are present in abundance in plants. The amino acids that form the proteins which represent the muscle of animal-based meat can be sourced from plants. We use proteins primarily extracted from yellow peas, as well as mung beans, fava beans, brown rice and other plant stock, through a physical process to separate protein and fiber. We then apply heating, cooling and pressure at rapid and varied intervals to weave the protein into a fibrous structure to create woven protein. Once we have the woven protein, we then add the remaining ingredients, such as water, lipids, carbohydrates, flavor, color, trace minerals, and vitamins.

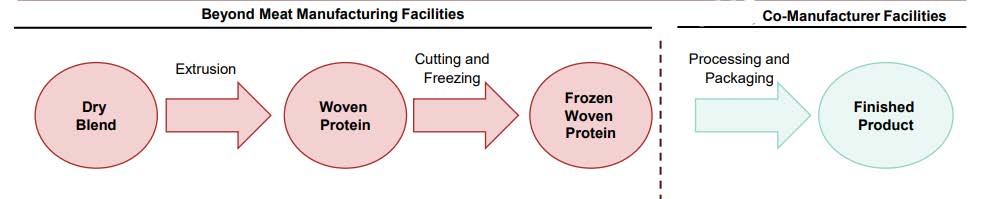

We operate approximately 90,000 square feet of production space in two facilities in Columbia, Missouri where we produce our woven protein. This woven protein is then converted according to our formulas and specifications into a packaged product by our network of co-manufacturers. Our proprietary blends of flavor systems and binding systems are also assembled in our facilities in Columbia, Missouri and shipped to our co-manufacturers.

This capital efficient production model allows us to scale more quickly to service the rapidly increasing demand for our products. We plan to expand our own internal production facilities domestically and abroad to produce our woven proteins, blends of flavor systems and binding systems, and potentially convert our woven proteins into packaged products, while forming additional strategic relationships with co-manufacturers.

| |

• | Unique Approach to the Market |

Our breakthrough product innovations have enabled a paradigm shift in both marketing and target audience—tapping into the enthusiastic pull from mainstream consumers for delicious and satisfying, yet better-for-you plant-based meats. This approach is summed up in our brand promise—“Eat What You Love.” When we launched our flagship Beyond Burger in 2016, we approached the marketplace in an unprecedented way. Instead of marketing and merchandising the Beyond Burger to vegans and vegetarians, we requested that the product be sold in the meat case at grocery retailers where meat-loving consumers are accustomed to shopping

for center-of-plate proteins. We believe merchandising in the meat case in the retail channel has helped drive greater brand awareness with our end consumers.

Reflecting the strength and value of the Beyond Meat brand to its partners, many of our restaurant and foodservice customers choose to prominently feature our brand name on their menu and within item descriptions, in addition to displaying Beyond Meat branded signage throughout the venue. We believe that we have established our brand as one with “halo” benefits to our partners as evidenced by the speed of adoption by strategic partners. Our foodservice business not only functions as a form of paid trial for our products, helping to drive additional retail demand, but also creates even greater brand awareness for Beyond Meat through the on-menu and in-store publicity we receive.

| |

• | Unique Approach to Our Brand |

Our mission is to create nutritious plant-based meats that taste delicious and deliver a consumer experience that is indistinguishable from that provided by animal-based meats. We believe our brand commitment, “Eat What You Love,” encourages consumers to eat more, not less, of the traditional dishes they enjoy by using our products, while feeling great about the health, sustainability, and animal welfare benefits associated with consuming plant-based protein. Our approach of bringing to market the best innovations each year is a strategy that engages the consumer and provides feedback from which we iterate and improve. This approach is one of the reasons we worked for and obtained Non-GMO Project Verified certification for all of our current U.S. retail products.

Our brand awareness has been driven by strong social marketing. Consumers and the media are enthusiastic about the concept of authentically meaty tasting plant-based proteins. The viral nature of our marketing and brand-building has been enhanced by both the network of brand ambassadors we have developed throughout the United States and abroad, and our strong following by celebrities from the worlds of sports and entertainment who help promote the benefits of a plant-based diet and the Beyond Meat brand.

We launched the GO BEYOND marketing campaign in February 2019, which seeks to mobilize our ambassadors to help raise brand awareness and make our products aspirational. We are focused on scaling the GO BEYOND campaign to new levels globally, using celebrity activation to welcome consumers to the brand, define the category and remain its leader.

Our Industry and Market Opportunity

We operate in the large and global meat industry, which is comprised of fresh and packaged animal-based meats for human consumption. According to data from Fitch Solutions Macro Research, the meat industry is the largest category in food and in 2017 generated estimated sales across retail and foodservice channels of approximately $270 billion in the United States and approximately $1.4 trillion globally. We believe our revenue growth will allow us to capture an increased share of the broader U.S. meat category, supported by a number of key drivers, including the authentic comparability and sensory experience of our products to their animal-based meat equivalents, continued mainstream acceptance of our products with the traditional animal-based meat consumer, heightened consumer awareness of the role that food and nutrition, particularly plant-based foods, play in long-term health and wellness, and growing concerns related to the negative environmental and animal-welfare impacts of animal-based meat consumption. As a market leader in the plant-based meats category, we believe we are well-positioned to capture and drive a significant amount of this category growth.

Our Competitive Strengths

We believe that the following strengths position us to generate significant growth and pursue our objective to become a leader in the global meat category.

| |

• | Dedicated Focus on Innovation |

We invest significant resources in our innovation capabilities to develop plant-based meat alternatives to popular animal-based meat products. Our innovation team, comprised of approximately 104 scientists, engineers, researchers, technicians and chefs, as of December 31, 2019, has delivered several unique plant-based meat breakthroughs, as well as continuous improvements to existing products. We are able to leverage what we learn about taste, texture, aroma and appearance across our plant-based beef, pork and poultry platforms and apply this knowledge to each of our product offerings. In our Manhattan Beach Project Innovation Center, we have a strong pipeline of products in development, and can more rapidly transition our research from benchtop to scaled production. As our knowledge and expertise deepens, our pace of innovation is accelerating, allowing for reduced time between new product launches. We expect this faster pace of product introductions and meaningful enhancements to existing products to continue as we innovate within our core plant-based platforms of beef, pork and poultry.

| |

• | Brand Mission Aligned with Consumer Trends |

We believe our brand is uniquely positioned to capitalize on growing consumer interest in great-tasting, nutritious, convenient, higher protein content and plant-based foods. We have also tapped into growing public awareness of major issues connected to animal protein, including human health, climate change, resource conservation and animal welfare. Simply put, our products aim to enable consumers to “Eat What You Love” without the downsides of conventional animal protein.

We have built a powerful brand with broad demographic appeal and a passionate consumer base. Our brand awareness is driven by strong social marketing. Our audience continues to grow from the attention generated by our large following of celebrities, influencers and brand ambassadors who identify with our mission.

| |

• | Product Portfolio Generates Significant Demand Across Channels |

Rapidly growing sales of our products by both our retail and restaurant and foodservice partners have helped us foster strong relationships in a relatively short period of time. We provide our retailers with exciting new products in the meat case, where innovation rarely occurs. Many of our retail customers have experienced increasing levels of velocity of our products, measured by units sold per month per store, as well as repeat purchases.

Our restaurant and foodservice customers are excited by the opportunity to differentiate their menu offering and attract new customers by partnering with Beyond Meat, and are seeking new ways to further promote our product, for example through mass media advertising campaigns inclusive of TV, radio, out of home and digital channels. We believe our customers’ choice to feature Beyond Meat demonstrates the marketing power of our brand and overall consumer excitement for our product. This type of demand for our products has been a driving force in building strong ties with customers who have been continually impressed by the impact our brand can make on their business.

| |

• | Experienced and Passionate Executive Management Team |

We are led by a proven and experienced executive management team. Prior to founding Beyond Meat, Ethan Brown, our President and Chief Executive Officer, spent over a decade in the clean energy industry working for hydrogen fuel cell leader, Ballard Power Systems, rising from an entry level manager to reporting directly to the Chief Executive Officer. Mr. Brown’s significant experience in clean tech, coupled with a natural appreciation for animal agriculture, led him to start a plant-based food company. Our management team plays an integral role in Beyond Meat’s success by instilling a culture committed to innovation, customer satisfaction and growth. Over time, we have grown our executive management team with carefully selected individuals who possess substantial industry experience and share our core values. The other members of our executive management team have an average of 21 years of industry experience, including at both consumer packaged goods companies and high growth businesses. We believe this blend of talent gives us tremendous insights and capabilities to create demand and fulfill it in a scalable, profitable and sustainable way.

Our Growth Strategy

| |

• | Pursue Top-line Growth Across our Distribution Channels |

We believe there is a significant opportunity to continue to expand Beyond Meat beyond our retail and restaurant and foodservice footprint of approximately 77,000 outlets in more than 65 countries worldwide as of December 31, 2019. In addition to further growth within retail, we are selling more of our product in restaurants and other foodservice locations and developing and expanding relationships with international partners. We believe increased distribution will lead more consumers to purchase our products and increase the overall size of the plant-based protein category as more consumers shift their diets away from animal-based proteins.

We have developed a strategy to pursue growth within the following distribution channels:

• Retail: We have a significant opportunity to grow our sales within U.S. retail by focusing on increasing sales at our existing outlets, as well as increasing sales of new products. We also expect to grow our U.S. retail distribution by establishing commercial relationships with new customers. In March 2019, we introduced Beyond Beef, which is designed to have the meaty taste and texture and replicate the versatility of ground beef. In May 2019, we began selling the Beyond Burger in retail stores across Canada. In June 2019, we introduced the new Beyond Burger and Beyond Beef at retailers across the U.S. As of December 31, 2019, our products were available in approximately 28,000 retail outlets in the United States and Canada.

• Restaurant and Foodservice: We plan to continue to expand our network of restaurant and foodservice partners, including large full service restaurant (“FSR”) and QSR customers in the United States and abroad, with increased penetration across this channel reflecting a desire by restaurant and foodservice establishments to add plant-based products to their menus and to highlight these offerings. As of December 31, 2019, our products were available in approximately 36,000 restaurant and foodservice outlets in the United States and Canada.

• International: We believe there is significant demand for our products globally in retail and restaurant and foodservice channels and expect to increase production for those regions in 2020. As of December 31, 2019, our products were available in approximately 13,000 international retail and restaurant and foodservice outlets (excluding Canada). We have established and seek to establish additional relationships with distributors across channels globally.

| |

• | Invest in Infrastructure and Capabilities |

We are committed to prioritizing investment in our infrastructure and capabilities in order to support our strategic expansion plans. As a fast-growing company, we are making significant investments in hiring the best people, maximizing our supply chain capabilities, investing in innovation, sales and marketing, and optimizing our systems in order to establish a sustainable market-leading position for the long-term future.

We have plans to unlock additional capacity both domestically and internationally. In 2019, we entered into relationships with additional co-manufacturers to significantly increase our production capacity. In response to growing international demand for our products, in 2019 we commenced co-manufacturing in Canada, and also expanded our partnership with one of our distributors to co-manufacture our innovative plant-based meats at a new co-manufacturing facility built by our distributor in the Netherlands, construction of which was completed in the first quarter of 2020.

We are continually reviewing opportunities to increase and/or leverage manufacturing capacity across our network, identifying opportunities to increase overall equipment effectiveness, and identifying opportunities to leverage our co-manufacturers for new products to give us flexibility. We are also investing in new technology to drive higher yield and/or flexibility to better adjust our capacity to our customer demands.

| |

• | Expand Our Product Offerings |

The successes of our products have confirmed our belief that there is significant demand for additional plant-based meat products. We intend to strengthen our product offerings by improving the formulations for our existing portfolio of products and by creating new products that expand the portfolio. We are continually refining our products to improve their taste, texture, aroma and appearance. In addition, we are committed to increasing our investment in research and development to continue to innovate within our core plant-based platforms of beef, pork and poultry to create exciting new product lines and improve the formulations for our existing portfolio of products. New product launches in the last twelve months include Beyond Beef, Beyond Breakfast Sausage, a new version of the Beyond Burger, designed to have a meatier taste and texture, as well as Beyond Fried Chicken and Beyond Meatball, which are currently sold to certain QSR partners.

| |

• | Continue to Grow Our Brand |

We intend to continue to develop our brand and increase awareness of Beyond Meat. We plan on highlighting our “GO BEYOND” message and the global benefits that come with eating our products. We also plan to continue to create relevant content with our network of celebrities, influencers and brand ambassadors, who have successfully built significant brand awareness for us by supporting our mission and products and incorporating Beyond Meat into their daily lifestyle. We also intend to expand our field marketing efforts to sample products directly with consumers in stores and at relevant events.

Our Products

We sell a range of products across the three core plant-based platforms of beef, pork and poultry. They are offered in ready-to-cook formats (generally merchandised at retail in the meat case), which we refer to as our “fresh” platform, and ready-to-heat formats (merchandised at retail in the freezer), which we refer to as our “frozen” platform. Though the original line of Beyond Meat products were ready-to-heat, our ready-to-cook offerings, such as the Beyond Burger and Beyond Sausage, have been the chief drivers of our growth. All of our products are free of GMOs and, other than Beyond Fried Chicken and Beyond Meatball, are 100% free of gluten. All of our products are also lower in saturated fats than their animal-based equivalents. We are focused on making them nutritionally dense, with minimal negative attributes.

Beyond Burger: The Beyond Burger, our flagship product, was our first product merchandised in the meat case of grocery stores in the United States. The Beyond Burger is designed to look, cook and taste like traditional ground beef. It is made from a blend of pea, mung bean and rice proteins. The Beyond Burger’s primary source of protein comes from peas, providing 20 grams of protein, has no soy, gluten or GMOs and is certified Kosher and Halal.

Beyond Beef: Beyond Beef is designed to have the meaty taste and texture of ground beef and replicate the versatility of ground beef. It has 25% less saturated fat than 80/20 beef or six grams per four-ounce serving. Like animal-based ground beef, Beyond Beef can be used in a variety of dishes, such as tacos and meatballs. It is made from a blend of pea, mung bean and rice proteins, has no soy, gluten or GMOs and is certified Kosher and Halal.

Beyond Sausage: Beyond Sausage is a ready-to-cook sausage designed to look, cook and taste like a pork sausage. Beyond Sausage is made from a blend of pea, fava bean and rice proteins. Beyond Sausage’s primary source of protein comes from peas, providing 16 grams of protein and three grams of fiber per serving, has no soy, gluten or GMOs and is certified Kosher and Halal. Beyond Sausage currently comes in three flavors across foodservice: Brat Original, Hot Italian and Sweet Italian. It currently comes in two flavors across retail: Brat Original and Hot Italian, with Sweet Italian scheduled to launch in March 2020.

Beyond Breakfast Sausage: Beyond Breakfast Sausage is designed to replicate a classic breakfast sausage patty. Beyond Breakfast Sausage is made from a blend of pea, mung bean and rice proteins, seasoned with notes of sage and black pepper. It provides 10 grams of plant-based protein per serving, has no soy, gluten or GMOs and is certified Kosher and Halal. Beyond Breakfast Sausage was available in our restaurant and foodservice channel as of December 31, 2019, and is expected to be launched in U.S. retail in the first quarter of 2020.

Beyond Fried Chicken: Beyond Fried Chicken is a plant-based chicken made with simple, non-GMO ingredients and soy protein, designed to deliver on the taste and texture of whole muscle chicken. It has 6 grams of protein per serving. Beyond Fried Chicken is currently available at certain KFC locations.

Beyond Meatball: The Beyond Meatball integrates our plant-based protein blend made from peas, brown rice and mung beans in a breadcrumb mixture. The Beyond Meatball has 3 grams of protein per serving, is made with simple, non-GMO ingredients, and is certified Kosher and Halal.

| |

• | Ready-to-heat (“Frozen”) |

Beyond Beef Crumbles. Beyond Beef Crumbles are ready-to-heat products designed to look and satisfy like minced or ground beef. Beyond Beef Crumbles’ primary source of protein comes from peas, providing approximately 14 grams of protein and one gram of fiber per serving, has no soy, gluten or GMOs and is certified Kosher and Halal. Beyond Beef Crumbles currently come in two flavors for retail: Beefy and Feisty. The four flavors available for foodservice are Plain, Beefy, Feisty and Italian Sausage.

Customers and Distributors

| |

• | Retail and Restaurant and Foodservice |

Since the success of the Beyond Burger, we have created a strong presence at leading food retailers across the United States. As of December 31, 2019, our products were available in approximately 28,000 retail outlets in the United States and Canada. Net revenues from sales through our retail channel in 2019 increased $94.0 million, or 185.2%, as compared to the prior year.

As of December 31, 2019, our products were available in approximately 36,000 restaurant and foodservice outlets in the United States and Canada. We continue to expand our partnerships with restaurant and foodservice customers, including large FSR and QSR customers in the United States and abroad. Our products are also available in prominent entertainment and hospitality vendors and sports venues. Net revenues from sales through our restaurant and foodservice channel in 2019 increased $115.9 million, or 312.0%, as compared to the prior year.

We sell to a variety of customers in the retail and restaurant and foodservice channels throughout the United States and internationally primarily through distributors who purchase, store, sell, and deliver our products. Because such distributors function in an intermediary role, we do not consider them to be direct customers. In addition, we sell directly to customers in the retail and restaurant and foodservice channels who handle their own distribution.

For 2019, our largest distributors in terms of their respective percentage of our gross revenues included the following: DOT Foods, Inc. (“DOT”), 17% and United Natural Foods, Inc. (“UNFI”), 16%. For 2018, our largest distributors in terms of their respective percentage of our gross revenues included the following: UNFI, 32%; DOT, 21%; and Sysco Merchandising and Supply Chain Services, Inc., 13%. For 2017, our largest distributors in terms of their respective percentage of our gross revenues included the following: UNFI, 38%; KeHE

Distributors, LLC, 10%; and DOT, 10%. No other distributor or customer accounted for more than 10% of our gross revenues in 2019, 2018 or 2017.

We distribute our products internationally, using distributors. Our international net revenues (which exclude revenues from Canada) are included in our retail and restaurant and foodservice channels and were approximately 16%, 8% and 1%, respectively, of our net revenues in 2019, 2018 and 2017.

Our Supply Chain

The principal ingredients used to manufacture our products include pea protein and our plant-based flavors. We procure the raw materials for our woven protein from a number of different suppliers. Although most of the raw materials we require are typically readily available from multiple sources, we currently have three suppliers for the pea protein used in our fresh products and one supplier for the pea protein used in our Beyond Beef Crumbles.

Our one-year pea protein supply agreement with Roquette America, Inc., expired on December 31, 2019 and was replaced by a multi-year sales agreement with Roquette Frères (“Roquette”) pursuant to which Roquette will provide the Company with plant-based protein. The agreement expires on December 31, 2022; however it can be terminated after 18 months under certain circumstances. This agreement increases the amount of plant-based protein to be supplied by Roquette in each of 2020, 2021 and 2022 compared to the amount supplied 2019. The total annual amount purchased each year by us must be at least the minimum amount specified in the agreement, which totals in the aggregate $154.1 million over the term of the agreement. See Note 12, Subsequent Events, to the Notes to Financial Statements included elsewhere in this report. We also have a three-year supply agreement with PURIS Proteins, LLC, or Puris, (the “Puris Agreement”) under which we may purchase domestically sourced pea protein. The Puris Agreement expires on December 31, 2021. We obtain protein under the Puris Agreement on a purchase order basis. We have the right to cancel purchase orders if we provide timely written notice; however, the total amount purchased in each year must be at least either the minimum volume specified for that year in the agreement or an amount based on a formula. We also have the right to be indemnified by Puris and must indemnify Puris in certain circumstances.

We continually seek additional sources of pea protein and other plant-based protein for our products that meet our criteria.

Flavors consist of product flavors that have been developed by our innovation team in collaboration with our supply partners exclusively for us. The formulas are then produced by our suppliers for use in our products. Ingredients in our flavors are qualified through trials to ensure manufacturability. Upon receipt of the ingredients, we receive Certificates of Analysis from our suppliers in our quality control process to confirm that our rigorous standards have been met. Flavors are extensively tested prior to introduction to ensure finished product attributes such as taste, texture, aroma and appearance are not negatively impacted.