UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-23157

(Exact name of registrant as specified in charter)

Brookfield Place

250 Vesey Street, 15th Floor

New York, New York 10281-1023

(Address of principal executive offices) (Zip code)

Brian F. Hurley, Esq.

Brookfield Public Securities Group LLC

Brookfield Place

225 Liberty Street, 35th Floor

New York, New York 10281

(Name and address of agent for service)

(855) 777-8001

Registrant's telephone number, including area code

Date of fiscal year end: December 31

Date of reporting period:

Item 1. Reports to Stockholders.

2023

ANNUAL REPORT

DECEMBER 31, 2023

Brookfield Real Assets

Income Fund Inc.

* Please see inside front cover of the report for important information regarding delivery of shareholder reports.

IN PROFILE

Brookfield Public Securities Group LLC (the "Firm") is an SEC-registered investment adviser and represents the Public Securities platform of Brookfield Asset Management (as defined below). The Firm provides global listed real assets strategies including real estate equities, infrastructure and energy infrastructure equities, multi-real-asset-class strategies and real asset debt. With $22 billion of assets under management as of December 31, 2023, the Firm manages separate accounts, registered funds and opportunistic strategies for institutional and individual clients, including financial institutions, public and private pension plans, insurance companies, endowments and foundations, sovereign wealth funds and high net worth investors. The Firm is an indirect wholly-owned subsidiary of Brookfield Asset Management ULC with $900 billion of assets under management as of December 31, 2023, an unlimited liability company formed under the laws of British Columbia, Canada ("BAM ULC"). Brookfield Corporation, a publicly traded company (NYSE: BN; TSX: BN), holds a 75% interest in BAM ULC, while Brookfield Asset Management Ltd., a publicly traded company (NYSE: BAM; TSX: BAMA) ("Brookfield Asset Management"), holds a 25% interest in BAM ULC. For more information, go to https://publicsecurities.brookfield.com/en.

Brookfield Real Assets Income Fund Inc. (the "Fund") is managed by Brookfield Public Securities Group LLC. The Fund uses its website as a channel of distribution of material company information. Financial and other material information regarding the Fund is routinely posted on and accessible at https://publicsecurities.brookfield.com/en.

As permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Fund's annual and semi-annual shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports. Instead, the reports will be made available on the Fund's website (https://publicsecurities.brookfield.com/en), and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Fund electronically anytime by contacting your financial intermediary (such as a broker, investment adviser, bank or trust company) or, if you are a direct investor, by calling the Fund (toll-free) at 1-855-777-8001 or by sending an e-mail request to the Fund at publicsecurities.enquiries@brookfield.com.

You may elect to receive all future reports in paper free of charge. If you invest through a financial intermediary, you may contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. If you invest directly with the Fund, you may call 1-855-777-8001 or send an email request to publicsecurities.enquiries@brookfield.com to let the Fund know you wish to continue receiving paper copies of your shareholder reports. Your election to receive reports in paper will apply to all funds held in your account if you invest through your financial intermediary or all funds held within the fund complex if you invest directly with the Fund.

TABLE OF CONTENTS

|

Letter to Shareholders |

1 |

||||||

| Management Discussion of Fund Performance |

3 |

||||||

| Portfolio Characteristics |

8 |

||||||

| Schedule of Investments |

9 |

||||||

| Statement of Assets and Liabilities |

28 |

||||||

| Statement of Operations |

29 |

||||||

| Statements of Changes in Net Assets |

30 |

||||||

| Statement of Cash Flows |

31 |

||||||

| Financial Highlights |

32 |

||||||

| Notes to Financial Statements |

33 |

||||||

| Report of Independent Registered Public Accounting Firm |

47 |

||||||

| Tax Information |

48 |

||||||

| Compliance Certification |

49 |

||||||

| Additional Fund Information |

50 |

||||||

| Information Concerning Directors and Officers |

140 |

||||||

| Dividend Reinvestment Plan |

143 |

||||||

| Joint Notice of Privacy Policy |

144 |

||||||

This report is for shareholder information. This is not a Prospectus intended for use in the purchase or sale of Fund shares.

|

NOT FDIC INSURED |

MAY LOSE VALUE |

NOT BANK GUARANTEED |

|||||||||

[THIS PAGE IS INTENTIONALLY LEFT BLANK]

LETTER TO SHAREHOLDERS

Dear Shareholders,

We are pleased to provide the Annual Report for Brookfield Real Assets Income Fund Inc. (the "Fund") for the year ended December 31, 2023.

Global equities and bonds rallied in 2023, after both posted double-digit losses the prior year. The MSCI World Index rose 24.42% and the Barclays Global Aggregate Index returned 5.72% in 2023. In the U.S., large cap stocks, as measured by the S&P 500 Index, gained 26.29%. The 10-year U.S. Treasury yield hit an intra-year closing high of 4.98% in October, but quickly reversed course the remainder of the year amid expectations quantitative tightening measures were close to ending. At December 31, 2023, the 10-year U.S. Treasury yield closed at 3.88%, essentially unchanged from the start of the year. Within commodities, the Bloomberg Commodity Index lost 7.91%, driven largely by oil weakness.

Real asset equities faced headwinds for much of 2023. Tighter monetary policy hampered sentiment for many real estate and infrastructure sectors with longer-duration cash flows. Additionally, elevated input costs and supply chain constraints continued to take a toll on sectors tied to the energy transition. Sentiment shifted quickly in the fourth quarter on optimism that input costs began to roll over and interest rates had peaked. Infrastructure and real estate indexes rallied during the quarter to post positive returns for the year. Some of the more economically sensitive sectors within infrastructure (energy and airports, for example), posted the strongest returns in 2023. And within real estate, both data centers and hotels each returned more than 25% during the period.

In debt markets, real asset investment-grade securities performed roughly in-line with broad-market counterparts, while real asset high yield underperformed its broad-market counterparts modestly. CCC-rated bonds outperformed higher rated segments, while longer duration bonds rebounded during the fourth quarter.

Despite the fourth-quarter rally, we maintain our belief that real asset securities remain well-positioned to generate positive returns. Recent data suggest that inflation is beginning to moderate, which should translate into interest rates returning to a normalized, long-term range. We think this bodes well for real assets securities, which historically tend to perform quite strongly relative to global equities following rate peaks.

At Brookfield, we highlight that the assets in which we invest live at the epicenter of several decades-long megatrends, namely: Decarbonization, Deglobalization and Digitization. Trillions of dollars will be deployed as these trends play out; and across our funds we seek to uncover the highest quality listed equity and debt investment opportunities that stand to benefit from these secular shifts.

Our investment teams see a great amount of opportunity today as we settle into a more normalized macro backdrop. By that, we mean an investment environment driven more by fundamentals, rather than multiple expansion and contraction in response to the direction of monetary policy.

Of course, interest rates are the foundation of how our assets are financed; and the anchor by which we begin to discount future cash flows. However, we think secular demand trends, earnings growth and valuations have returned to center stage. We think our assets are well positioned from this standpoint and we are focused on constructing the highest quality portfolios to generate returns and preserve investor capital.

In addition to performance information and additional discussion on factors impacting the Fund, this report provides the Fund's audited financial statements and schedule of investments as of December 31, 2023.

We welcome your questions and comments and encourage you to contact our Investor Relations team at 1-855-777-8001 or visit us at https://publicsecurities.brookfield.com/en for more information.

Thank you for your support.

2023 Annual Report

1

LETTER TO SHAREHOLDERS (continued)

Sincerely,

|

|

|

||||||

|

Brian F. Hurley |

David W. Levi, CFA |

||||||

|

President |

Chief Executive Officer |

||||||

|

Brookfield Real Assets Income Fund Inc. |

Brookfield Public Securities Group LLC |

||||||

These views represent the opinions of Brookfield Public Securities Group LLC and are not intended to predict or depict the performance of any investment. These views are primarily as of the close of business on December 31, 2023, and subject to change based on subsequent developments.

Past performance is no guarantee of future results.

Investing involves risk. Principal loss is possible. Real assets includes real estate securities, infrastructure securities and natural resources securities. Property values may fall due to increasing vacancies or declining rents resulting from unanticipated economic, legal, cultural or technological developments. Infrastructure companies may be subject to a variety of factors that may adversely affect their business, including high interest costs, high leverage, regulation costs, economic slowdown, surplus capacity, increased competition, lack of fuel availability and energy conservation policies. Natural resources securities may be affected by numerous factors, including events occurring in nature, inflationary pressures and international politics.

Quasar Distributors, LLC provides filing administration for the Brookfield Real Assets Income Fund Inc.

Brookfield Public Securities Group LLC

2

BROOKFIELD REAL ASSETS INCOME FUND INC.

MANAGEMENT DISCUSSION OF FUND PERFORMANCE

For the year ended December 31, 2023, Brookfield Real Assets Income Fund Inc. (NYSE: RA) had a total return based on net asset value (NAV) of 10.52% and a total return based on market price of (8.48)% (total returns assume the reinvestment of dividends and are exclusive of brokerage commissions). Based on the NYSE closing price of $12.81 on December 31, 2023, the Fund's shares had a distribution rate of 11.05% for the year.1

In October 2023, the Fund reset its monthly distribution from $0.1990 per share to $0.1180 per share. Brookfield Public Securities Group LLC ("PSG"), the Fund's investment adviser, believes this adjusted distribution will benefit stockholders as it closely aligns the Fund's distribution with the Fund's expected total return, which PSG believes should support sustainable earnings and distribution coverage. The Fund's investment objective, strategy and process have not changed.

In terms of total return for the year 2023, the Fund's energy midstream equities, preferred sleeves, real asset high yield, securitized credit, infrastructure equities and real estate equities all contributed to returns, slightly offset by negative returns in renewable equities.2 In the next section, we provide further detail on the performance of each asset class, along with our outlook for investing in real asset-related securities.

REAL ASSET HIGH YIELD

The Fund's allocations to real asset high yield returned 12.14%.

Fixed-income performance was strong in 2023. Broad high yield returned 13.54%, as measured by the ICE BofA U.S. High Yield Index, with real asset high yield underperforming modestly compared to its broad-market counterpart. The 10-year U.S. Treasury rose to 5.0% in mid-October before declining to end 2023 at 3.9%, unchanged relative to the prior year-end.

Default activity remained elevated through the year reaching $83.7 billion3. Our analysis indicates just 19.4% of this default activity was within real asset sectors, despite those sectors accounting for approximately 47% of the ICE BofA U.S. High Yield Index debt outstanding. Additionally, while many headlines have highlighted defaults within private real estate debt markets, issuers of corporate bonds within the real estate sector overall have demonstrated resiliency in their ability to access capital markets to manage their balance sheets, with investment grade REITs issuing approximately $20 billion of unsecured bonds in 20234.

We believe issuers within real asset sectors may be better positioned than their non-real asset counterparts for a longer period of high interest rates. This is because of their large amount of fixed rate debt and relatively lower maturities over the next five years.

Spreads within high yield remain near their long-term averages. However, we believe real asset high yield, particularly within the BB-rated segment, is relatively attractive after adjusting for projected credit losses during a potential period of elevated default rates. Within our portfolio, we continue to favor infrastructure debt as well as higher-quality debt.

SECURITIZED CREDIT

The Fund's allocations to residential mortgage-backed securities (RMBS) and commercial mortgage-backed securities (CMBS) returned 8.48% and 6.85%, respectively.

The Fund's RMBS exposure is principally floating rate, legacy securities issued prior to the Global Financial Crisis. As these securities continue to mature, we are actively reinvesting into wider trading, new issue opportunities. While the residential market broadly faces affordability challenges, we believe our holdings will not experience high default rates. The majority of the portfolio is represented by borrowers which have been in their mortgages since 2007 and fundamentals within the existing home market are still healthy as inventory of homes for sale is still near historic lows Additionally, we believe higher rates on new mortgages may keep borrowers with lower rates on existing mortgages reluctant to sell, further limiting inventory.

2023 Annual Report

3

BROOKFIELD REAL ASSETS INCOME FUND INC.

INFRASTRUCTURE EQUITIES

The Fund's allocations to infrastructure equities and renewables equities returned +4.78% and -1.52%, respectively, while energy midstream equities returned +23.15%.

Listed infrastructure equities underperformed for much of 2023, before staging a significant rally in the fourth quarter. The FTSE Global Core Infrastructure 50/50 Index gained 11.11% in the fourth quarter, bringing the year-to-date return to the index positive at 3.10%. Weakness for much of the year can largely be attributed to sectors that are more interest rate sensitive, notably communications, utilities and renewables/electric generation companies. Persistently elevated rates, higher costs of capital and supply chain issues hindered sentiment among these stocks for much of 2023. However, these sectors staged a meaningful recovery in the fourth quarter as the rate environment appeared to have peaked, and input costs began to roll over. Some of the more economically sensitive sectors within infrastructure posted the strongest gains in 2023. U.S. midstream energy (as measured by the Alerian Midstream Energy Index) and global airport stocks posted double-digit gains for the year.5

Recent data suggest that inflation is beginning to moderate, which should translate to interest rates returning to a normalized, long-term range. We think this bodes well for infrastructure stocks, which historically tend to perform quite strongly relative to global equities following rate peaks.

• Utilities: While rates seem a negative catalyst that drove underperformance in 2023, there are additional factors to consider. We are focused on the best security-specific opportunities, with a focus on dynamics around customer bill affordability, cadence of spending on decarbonization initiatives, and companies' balance sheet management. Within the renewables sector, we think positive sentiment is beginning to permeate back into stock prices amidst an improving fundamental backdrop. Economics for new projects have improved as input costs have come down and supply chain headwinds are starting to subside.

• Transports: Passenger traffic continues to rebound; some of the world's largest airports continue to increase forecasts as travel demand remains strong. Key toll road traffic shows strong recovery as well. Rail volumes remain somewhat flat; and margins have eroded due to rising costs, so we remain somewhat cautious given the economic backdrop.

• Communications: We believe asset values should benefit from a moderate interest rate environment. While capital spending among carriers has slowed, U.S. mobile data demand remains quite strong. Coupled with limited new supply of towers, net operating income growth should remain steady in 2024. The valuation reset in tower stocks in 2023 created what we believe are compelling entry points for select companies.

• Energy Infrastructure: We remain focused on natural gas, given the structural need for North American supply to counteract lack of supply from Russia to key developed markets. We think this presents a compelling opportunity, particularly with the European dual mandate of security of supply and decarbonization.

REAL ESTATE EQUITIES

The Fund's allocation to real estate equities returned 2.23%.

After facing headwinds for much of 2023, global real estate securities posted meaningful gains in the fourth quarter of 2023. On the heels of central bank messaging that monetary policy tightening may have peaked, the entire sector

Brookfield Public Securities Group LLC

4

BROOKFIELD REAL ASSETS INCOME FUND INC.

staged a meaningful rally in November and December. The FTSE EPRA Nareit Developed Index returned 15.59% during the three-month period, bringing the index positive for the year at 10.85%. For the year, data centers and hotels were standout performers, each gaining more than 25%. Conversely, office landlords and diversified companies with office portfolios continued to struggle amid fundamental headwinds.

Recent data suggests that inflation is beginning to moderate, which should translate to interest rates returning to a normalized, long-term range. We think real estate is well positioned in a moderating or falling-rate environment. However, as monetary policy normalizes, we believe fundamentals—namely earnings growth and valuations—will return to center stage as market drivers. Despite the recent rally, we think global real estate remains well positioned to produce strong returns. Fundamentals across most property types remain strong. But given the slower macro growth outlook, we prefer a focus on needs based real estate over sectors that could be impacted more by a slowing economy.

If transaction activity picks up in 2024, REITs could be in a good position to take advantage of price dislocations. REIT balance sheets have low levels of leverage; and many locked in long-dated debt at low interest rates. As motivated sellers of high-quality assets emerge, well capitalized REITs can take advantage of capital markets.

In the U.S., we currently favor industrial and net lease landlords. Within retail, we maintain a preference for shopping centers, which we believe could be more defensive and are expected to provide better growth. We have an improving view of the self storage sector, as we believe sentiment could be too negative relative to the fundamental outlook. We also maintain a level of caution within office broadly. If price discovery unfolds, we think lower quality valuations could fall further, but high-quality assets in attractive markets can present opportunity. We maintain a level of caution in Asia Pacific, largely driven by China's slowing economy and related challenges in its property sector. In Hong Kong, we have repositioned holdings for what we believe to be an improved beta-adjusted, risk/return profile. We are starting to see more opportunities across Europe broadly, particularly among residential, retail and industrial landlords, as well as select non-index exposure to communications infrastructure companies.

OVERALL OUTLOOK

We expect growth to slow in 2024. While inflation has trended lower, we believe central banks will hold rates at restrictive levels to ensure that inflation doesn't reaccelerate. As a result, we are defensively positioned within our portfolio, with significant positions in real asset high yield and securitized credit. Elevated Treasury yields continue to make real asset debt attractive on a risk-adjusted basis.

Within equities, we continue to favor infrastructure over real estate due to infrastructure's potential outperformance in down markets and tighter inflation linkage. We also see tailwinds for energy midstream equities, which we believe should benefit from the global push for energy security. Within real estate, lingering concerns around financing and broad negative sentiment around commercial real estate remain. However, if interest rates stabilize over the course of 2024, it may be a year of price discovery for real estate, and we expect investment opportunities to emerge in some subsectors that serve essential needs.

1 Distribution rate is calculated by dividing the last distribution per share (annualized) by the market price. Distributions are subject to re-characterization for tax purposes after the end of the fiscal year. Total returns do not reflect the deduction of management fees and other fund expenses. If management fees and other expenses had been included, returns would be reduced. This calculation does not include any non-income items such as loan proceeds or borrowings. The Fund estimates that it has distributed more than its net investment income and net realized capital gains; therefore, a portion of your distribution may be a return of capital. Year-to-date through December 31, 2023, 64.83% of the Fund's distributions are a return of capital.

2 Performance figures are stated gross of fees

3 JP Morgan Default Monitor

4 Bloomberg Finance L.P.

5 Sector performance represented by sector returns of the Dow Jones Brookfield Global Infrastructure Index.

2023 Annual Report

5

BROOKFIELD REAL ASSETS INCOME FUND INC.

AVERAGE ANNUAL TOTAL RETURNS

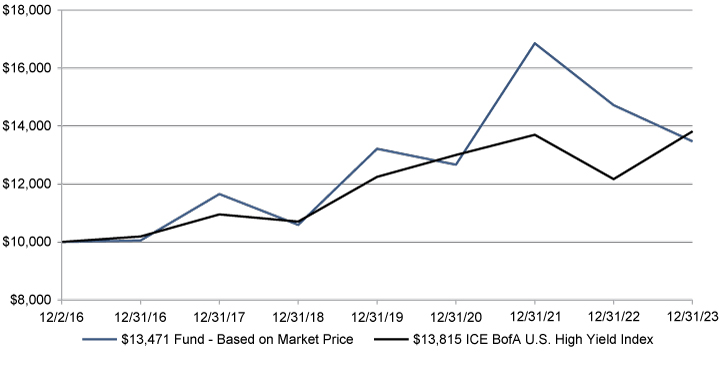

As of December 31, 2023 | 1 Year | 5 Years | Since Inception* | ||||||||||||

Brookfield Real Assets Income Fund Inc. - Based on Net Asset Value | 10.52 | % | 4.74 | % | 4.45 | % | |||||||||

| Brookfield Real Assets Income Fund Inc. - Based on Market Price | (8.48 | )% | 4.93 | % | 4.30 | % | |||||||||

ICE BofA U.S. High Yield Index | 13.54 | % | 5.24 | % | 4.67 | % | |||||||||

* Inception date of December 2, 2016.

The graph below illustrates a hypothetical investment of $10,000 in the Fund—based on market price from the commencement of investment operations on December 5, 2016 to December 31, 2023 compared to the ICE BofAML U.S. High Yield Index.

The table and graphs do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

Disclosure

Past performance is no guarantee of future results.

All returns shown in USD.

ICE BofA U.S. High Yield Index tracks the performance of U.S.-dollar-denominated below-investment-grade corporate debt publicly issued in the U.S. domestic market.

An index does not reflect any fees, expenses or sales charges. It is not possible to invest directly in an index. Index performance is shown for illustrative purposes only and does not predict or depict the performance of the Fund.

The Fund's portfolio holdings are subject to change without notice. The mention of specific securities is not a recommendation or solicitation for any person to buy, sell or hold any particular security. There is no assurance that the Fund currently holds these securities. Please refer to the Schedule of Investments contained in this report for a full listing of fund holdings.

Brookfield Public Securities Group LLC

6

BROOKFIELD REAL ASSETS INCOME FUND INC.

The Fund may utilize leverage to seek to enhance the yield and net asset value of its common stock, as described in the Fund's Prospectus. These objectives will not necessarily be achieved in all interest rate environments. The leverage strategy of the Fund assumes a positive slope to the yield curve (short-term interest rates lower than long-term rates). Otherwise, the benefits of leverage will be reduced or eliminated completely. The use of leverage involves risk, including the potential for higher volatility and greater declines of the Fund's net asset value, fluctuations of dividends and other distributions paid by the Fund and the market price of the Fund's common stock, among others.

This report may contain information obtained from third parties, including ratings from credit ratings agencies such as Standard & Poor's. Reproduction and distribution of third party content in any form is prohibited except with the prior written permission of the related third party. Third party content providers do not guarantee the accuracy, completeness, timeliness or availability of any information, including ratings, and are not responsible for any errors or omissions (negligent or otherwise), regardless of the case, of the results obtained from the use of such content.

THIRD PARTY CONTENT PROVIDERS GIVE NO EXPRESS OR IMPLIED WARRANTIES, INCLUDING, BUT NOT LIMITED TO, ANY WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE. THIRD PARTY CONTENT PROVIDERS SHALL NOT BE LIABLE FOR ANY DIRECT, INDIRECT, INCIDENTAL, EXEMPLARY, COMPENSATORY, PUNITIVE, SPECIAL OR CONSEQUENTIAL DAMAGES, COSTS, EXPENSES, LEGAL FEES, OR LOSSES (INCLUDING LOST INCOME OR PROFITS AND OPPORTUNITY COSTS OR LOSSES CAUSED BY NEGLIGENCE) IN CONNECTION WITH ANY USE OF THEIR CONTENT, INCLUDING RATINGS. Credit ratings are statements of opinions and are not statements of fact or recommendations to purchase, hold or sell securities. They do not address the suitability of securities or the suitability of securities for investment purposes, and should not be relied on as investment advice.

Performance data quoted represents past performance results and does not guarantee future results. Current performance may be lower or higher than the performance data quoted.

Fixed income investing entails credit and interest rate risks. Interest rate risk is the risk that rising interest rates or an expectation of rising interest rates in the near future will cause the values of the Fund's investments to decline. Risks associated with rising interest rates are heightened given that rates in the U.S. are at or near historic lows. When interest rates rise, bond prices generally fall, and the value of the portfolio can fall. Below-investment-grade ("high yield" or "junk") bonds are more at risk of default and are subject to liquidity risk. Mortgage-backed securities are subject to prepayment risk. Foreign investments may be volatile and involve additional expenses and special risks, including currency fluctuations, foreign taxes, regulatory and geopolitical risks. Emerging and developing market investments may be especially volatile. Derivative instruments entail higher volatility and risk of loss compared to traditional stock or bond investments.

These views represent the opinions of Brookfield Public Securities Group LLC and are not intended to predict or depict the performance of any investment. These views are as of the close of business on December 31, 2023 and subject to change based on subsequent developments.

2023 Annual Report

7

BROOKFIELD REAL ASSETS INCOME FUND INC.

Portfolio Characteristics (Unaudited)

December 31, 2023

PORTFOLIO STATISTICS | |||||||

Annualized distribution rate1 | 11.05 | % | |||||

Weighted average coupon | 5.32 | % | |||||

Weighted average life | 2.95 years | ||||||

Percentage of leveraged assets | 16.86 | % | |||||

Total number of holdings | 493 | ||||||

ASSET BY COUPON TYPE DISTRIBUTION2 | |||||||

Corporate Credit | |||||||

| — Real Estate | 17.8 | % | |||||

| — Infrastructure | 31.6 | % | |||||

| — Natural Resources | 9.4 | % | |||||

Total Corporate Credit | 58.8 | % | |||||

Securitized Credit | |||||||

| — Residential Mortgage-Backed Securities | 22.0 | % | |||||

| — Commercial Mortgage-Backed Securities | 10.4 | % | |||||

| — Other | 1.1 | % | |||||

Total Securitized Credit | 33.5 | % | |||||

Equities | |||||||

| — Real Estate | 0.6 | % | |||||

| — Infrastructure | 2.6 | % | |||||

| — Natural Resources | 0.1 | % | |||||

Total Equities | 3.3 | % | |||||

Money Market Fund | 4.4 | % | |||||

Total | 100.0 | % | |||||

FIXED INCOME ASSETS BY CREDIT RATING3 | |||||||

BBB and Above | 22.8 | % | |||||

BB | 36.6 | % | |||||

B | 14.6 | % | |||||

CCC and Below | 5.9 | % | |||||

Unrated | 20.1 | % | |||||

Total | 100.0 | % | |||||

1 The distribution rate referenced above is calculated as the annualized amount of the most recent monthly distribution declared divided by the December 31, 2023 stock price. This calculation does not include any non-income items such as loan proceeds or borrowings. The Fund estimates that it has distributed more than its net investment income and net realized capital gains; therefore, a portion of your distribution may be a return of capital. Year-to-date through December 31, 2023, 64.83% of its distributions are estimated to be a return of capital.

2 Percentages are based on total market value of investments.

3 Percentages are based on total market value of fixed income securities.

Brookfield Public Securities Group LLC

8

BROOKFIELD REAL ASSETS INCOME FUND INC.

Schedule of Investments

December 31, 2023

| Principal Amount | Value | ||||||||||

U.S. GOVERNMENT & AGENCY OBLIGATIONS – 0.2% | |||||||||||

U.S. Government Agency Collateralized Mortgage Obligations – 0.0% | |||||||||||

| Federal National Mortgage Association 6.85%, 1997-79, Class PL, 12/18/27 | $ | 20,876 | $ | 21,201 | |||||||

U.S. Government Agency Pass-Through Certificates – 0.2% | |||||||||||

| Federal Home Loan Mortgage Corporation 7.00%, Pool C69047, 06/01/32 | 119,924 | 126,381 | |||||||||

8.00%, Pool C56878, 08/01/31 | 31,276 | 32,456 | |||||||||

8.00%, Pool C59641, 10/01/31 | 26,322 | 27,329 | |||||||||

8.50%, Pool C55167, 07/01/31 | 30,246 | 31,194 | |||||||||

8.50%, Pool C55169, 07/01/31 | 37,753 | 39,494 | |||||||||

| Federal National Mortgage Association 7.00%, Pool 645913, 06/01/32 | 117,520 | 123,132 | |||||||||

7.00%, Pool 645912, 06/01/32 | 114,593 | 120,298 | |||||||||

7.00%, Pool 650131, 07/01/32 | 124,230 | 130,893 | |||||||||

7.50%, Pool 827853, 10/01/29 | 5,810 | 5,767 | |||||||||

7.50%, Pool 545990, 04/01/31 | 86,425 | 89,356 | |||||||||

7.50%, Pool 255053, 12/01/33 | 36,773 | 39,217 | |||||||||

7.50%, Pool 735576, 11/01/34 | 82,709 | 86,824 | |||||||||

7.50%, Pool 896391, 06/01/36 | 70,549 | 73,371 | |||||||||

8.00%, Pool 735800, 01/01/35 | 107,230 | 116,186 | |||||||||

8.50%, Pool 636449, 04/01/32 | 108,189 | 116,172 | |||||||||

8.61%, Pool 458132, 03/15/31 | 1,761 | 1,756 | |||||||||

9.00%, Pool 545436, 10/01/31 | 89,750 | 98,217 | |||||||||

Total U.S. Government Agency Pass-Through Certificates | 1,258,043 | ||||||||||

| TOTAL U.S. GOVERNMENT & AGENCY OBLIGATIONS (Cost $1,225,906) | 1,279,244 | ||||||||||

SECURITIZED CREDIT – 40.0% | |||||||||||

Commercial Mortgage-Backed Securities – 10.2% | |||||||||||

| ACAM Ltd. 8.22%, 2019-FL1, Class D (CME Term SOFR 1 Month + 2.86%), 11/17/34 (a),(b),(c) | 1,902,000 | 1,882,207 | |||||||||

8.47%, 2019-FL1, Class E (CME Term SOFR 1 Month + 3.11%), 11/17/34 (a),(b),(c) | 2,098,000 | 2,045,038 | |||||||||

| BAMLL Commercial Mortgage Securities Trust 10.48%, 2021-JACX, Class F (CME Term SOFR 1 Month + 5.11%), 09/15/38 (a),(c) | 5,000,000 | 4,093,646 | |||||||||

| BBCMS Mortgage Trust 10.28%, 2021-AGW, Class G (CME Term SOFR 1 Month + 4.91%), 06/15/36 (a),(c) | 4,000,000 | 3,328,746 | |||||||||

| BBCMS Trust 8.48%, 2018-BXH, Class F (CME Term SOFR 1 Month + 3.12%), 10/15/37 (a),(c) | 3,000,000 | 2,852,873 | |||||||||

| Beast Mortgage Trust 9.93%, 2021-1818, Class F (CME Term SOFR 1 Month + 4.56%), 03/15/36 (a),(c) | 1,250,000 | 725,745 | |||||||||

| Benchmark Mortgage Trust 3.10%, 2018-B6, Class E, 10/10/51 (a) | 2,000,000 | 876,905 | |||||||||

| BWAY Mortgage Trust 4.87%, 2022-26BW, Class E, 02/10/44 (a),(b) | 3,000,000 | 1,929,552 | |||||||||

| BX Trust 7.72%, 2021-ARIA, Class E (CME Term SOFR 1 Month + 2.36%), 10/15/36 (a),(c) | 1,000,000 | 939,052 | |||||||||

9.51%, 2021-SDMF, Class J (CME Term SOFR 1 Month + 4.15%), 09/15/34 (a),(c) | 4,796,009 | 4,395,992 | |||||||||

| CGDB Commercial Mortgage Trust 8.47%, 2019-MOB, Class G (CME Term SOFR 1 Month + 3.11%), 11/15/36 (a),(c) | 2,441,000 | 2,275,499 | |||||||||

| Citigroup Commercial Mortgage Trust 10.13%, 2021-KEYS, Class G (CME Term SOFR 1 Month + 4.76%), 10/15/36 (a),(c) | 3,500,000 | 3,392,911 | |||||||||

See Notes to Financial Statements.

2023 Annual Report

9

BROOKFIELD REAL ASSETS INCOME FUND INC.

Schedule of Investments (continued)

December 31, 2023

| Principal Amount | Value | ||||||||||

SECURITIZED CREDIT (continued) | |||||||||||

| CLNC Ltd. 8.67%, 2019-FL1, Class E (CME Term SOFR 1 Month + 3.31%), 08/20/35 (a),(b),(c) | $ | 3,000,000 | $ | 2,858,425 | |||||||

| European Loan Conduit 6.24%, 36A, Class C (3 Month EURIBOR + 2.25%), 02/17/30 (a),(b),(c) | € | 917,367 | 985,672 | ||||||||

| Federal Home Loan Mortgage Corp. 4.33%, K-152, Class X3, 11/25/55 | $ | 5,250,000 | 1,337,285 | ||||||||

| FS Rialto 7.97%, 2019-FL1, Class C (CME Term SOFR 1 Month + 2.61%), 12/16/36 (a),(b),(c) | 2,000,000 | 1,966,044 | |||||||||

| GS Mortgage Securities Corp. II 6.18%, 2021-RENT, Class A (CME Term SOFR 1 Month + 0.81%), 11/21/35 (a),(c) | 899,787 | 897,518 | |||||||||

| GS Mortgage Securities Trust 2.45%, 2020-GC47, Class F, 05/12/53 (a) | 3,500,000 | 1,727,521 | |||||||||

| Hilton USA Trust 4.12%, 2016-SFP, Class C, 11/05/35 (a) | 581,000 | 316,645 | |||||||||

4.19%, 2016-HHV, Class E, 11/05/38 (a) | 11,000,000 | 10,157,742 | |||||||||

4.93%, 2016-SFP, Class D, 11/05/35 (a) | 1,929,000 | 968,127 | |||||||||

5.52%, 2016-SFP, Class E, 11/05/35 (a) | 1,300,000 | 132,028 | |||||||||

| JP Morgan Chase Commercial Mortgage Securities Trust 6.35%, 2007-LD12, Class AJ, 02/15/51 | 30,701 | 29,889 | |||||||||

6.83%, 2008-C2, Class AM, 02/12/51 (d) | 4,900,304 | 2,507,958 | |||||||||

9.74%, 2021-HTL5, Class F (CME Term SOFR 1 Month + 4.38%), 11/15/38 (a),(c) | 3,201,000 | 3,064,905 | |||||||||

10.33%, 2021-1440, Class F (CME Term SOFR 1 Month + 4.96%), 03/15/36 (a),(c),(e) | 2,586,000 | 2,071,645 | |||||||||

| KIND Trust 8.73%, 2021-KIND, Class E (CME Term SOFR 1 Month + 3.36%), 08/15/38 (a),(c) | 1,489,237 | 1,421,490 | |||||||||

9.43%, 2021-KIND, Class F (CME Term SOFR 1 Month + 4.06%), 08/15/38 (a),(c) | 3,049,957 | 2,775,140 | |||||||||

| Last Mile Securities 8.99%, 2021-1A, Class F (3 Month EURIBOR + 5.00%), 08/17/31 (a),(b),(c) | € | 2,037,581 | 2,072,801 | ||||||||

| Morgan Stanley Capital I Trust 2.73%, 2017-HR2, Class D, 12/15/50 | $ | 3,000,000 | 2,164,324 | ||||||||

| Taurus CMBS 7.57%, 2021-UK5, Class E (SONIA + 2.35%), 05/17/31 (b),(c) | £ | 861,000 | 1,031,125 | ||||||||

| TPG Real Estate Finance Issuer Ltd. 9.83%, 2021-FL4, Class E (CME Term SOFR 1 Month + 4.46%), 03/15/38 (a),(b),(c) | $ | 4,000,000 | 3,671,856 | ||||||||

| TTAN 9.68%, 2021-MHC, Class G (CME Term SOFR 1 Month + 4.31%), 03/15/38 (a),(c) | 4,289,866 | 4,026,794 | |||||||||

| VMC Finance LLC 8.97%, 2021-FL4, Class D (CME Term SOFR 1 Month + 3.61%), 06/16/36 (a),(c) | 893,000 | 823,363 | |||||||||

9.42%, 2021-FL4, Class E (CME Term SOFR 1 Month + 4.06%), 06/16/36 (a),(c) | 3,107,000 | 2,704,220 | |||||||||

9.97%, 2021-HT1, Class B (CME Term SOFR 1 Month + 4.61%), 01/18/37 (a),(c) | 5,000,000 | 4,745,697 | |||||||||

| Wachovia Bank Commercial Mortgage Trust 5.79%, 2006-C28, Class E, 10/15/48 | 1,134,160 | 1,130,423 | |||||||||

Total Commercial Mortgage-Backed Securities | 84,326,803 | ||||||||||

Commercial Real Estate – 2.0% | |||||||||||

| 111 Wall Street 14.72% (1 Month US LIBOR + 9.25%), 07/01/25, (Acquired 6/9/2021 – 10/12/2023, cost $4,598,498) (c),(e),(m) | 4,607,206 | 3,776,527 | |||||||||

| 125 West End Office Mezz LLC 15.97% (CME Term SOFR 1 Month + 10.50%), 04/09/26, (Acquired 3/11/2021 – 11/30/2023, cost $3,051,164) (c),(e),(m) | 3,076,925 | 3,076,925 | |||||||||

| 575 Lexington Junior Mezz 30.36% (1 Month US LIBOR + 25.00%), 06/18/25, (Acquired 3/17/2021 – 7/11/2022, cost $4,816,570) (c),(e),(f),(m) | 4,824,484 | 4,392,963 | |||||||||

See Notes to Financial Statements.

Brookfield Public Securities Group LLC

10

BROOKFIELD REAL ASSETS INCOME FUND INC.

Schedule of Investments (continued)

December 31, 2023

| Principal Amount | Value | ||||||||||

SECURITIZED CREDIT (continued) | |||||||||||

| 575 Lexington Senior Mezz 10.75%, 06/18/25, (Acquired 9/20/2023 – 12/20/2023, cost $799,450) (e),(m) | $ | 799,450 | $ | 799,450 | |||||||

| Hyatt Lost Pines 11.96% (CME Term SOFR 1 Month + 6.70%), 09/09/24, (Acquired 9/17/2021, cost $4,993,669) (c),(e),(m) | 5,000,000 | 5,000,000 | |||||||||

Total Commercial Real Estate | 17,045,865 | ||||||||||

Interest-Only Securities – 0.3% | |||||||||||

| Government National Mortgage Association 0.41%, 2010-132, Class IO, 11/16/52 | 184,012 | 469 | |||||||||

| JP Morgan Mortgage Trust 0.23%, 2021-INV1, Class AX1, 10/25/51 (a) | 45,272,068 | 481,559 | |||||||||

0.25%, 2014-5, Class AX4, 10/25/29 (a) | 1,871,509 | 5,256 | |||||||||

0.25%, 2015-4, Class 2X1, 06/25/45 (a) | 36,144,338 | 273,685 | |||||||||

| Mello Mortgage Capital Acceptance 0.11%, 2021-INV1, Class AX1, 06/25/51 (a) | 48,337,820 | 256,205 | |||||||||

| Morgan Stanley Capital I Trust 1.25%, 2016-UBS9, Class XE, 03/15/49 (a) | 14,999,000 | 350,735 | |||||||||

| Vendee Mortgage Trust 0.00%, 1997-2, Class IO, 06/15/27 | 1,531,489 | 1 | |||||||||

| Voyager CNTYW Delaware Trust 44.32%, 2009-1, Class 3QB1, 03/16/30 (a) | 888,737 | 842,650 | |||||||||

Total Interest-Only Securities | 2,210,560 | ||||||||||

Other – 1.1% | |||||||||||

| Lehman ABS Manufactured Housing Contract Trust 6.63%, 2001-B, Class M1, 04/15/40 | 2,818,983 | 2,772,506 | |||||||||

| Mid-State Trust X 7.54%, 10, Class B, 02/15/36 | 1,266,711 | 1,269,310 | |||||||||

| Oakwood Mortgage Investors, Inc. 6.81%, 2001-E, Class A4, 12/15/31 | 2,423,825 | 2,351,811 | |||||||||

6.93%, 2001-D, Class A4, 09/15/31 | 471,060 | 245,054 | |||||||||

| Progress Residential Trust 4.50%, 2023-SFR2, Class D, 10/17/28 (a) | 2,500,000 | 2,304,600 | |||||||||

Total Other | 8,943,281 | ||||||||||

Residential Mortgage-Backed Securities – 26.4% | |||||||||||

| Alternative Loan Trust 0.00%, 2006-41CB, Class 1A14 (CME Term SOFR 1 Month + 5.24%), 01/25/37 (c),(g) | 6,338,184 | 676,156 | |||||||||

4.04%, 2005-84, Class 2A1, 02/25/36 | 9,026,144 | 8,353,739 | |||||||||

5.50%, 2005-10CB, Class 1A1 (CME Term SOFR 1 Month + 0.61%), 05/25/35 (c) | 1,226,279 | 932,747 | |||||||||

5.75%, 2007-2CB, Class 2A11 (CME Term SOFR 1 Month + 0.51%), 03/25/37 (c) | 2,354,174 | 986,679 | |||||||||

5.75%, 2007-12T1, Class A22, 06/25/37 | 1,676,098 | 760,258 | |||||||||

5.75%, 2007-OA3, Class 1A1 (CME Term SOFR 1 Month + 0.39%), 04/25/47 (c) | 5,771,587 | 5,280,864 | |||||||||

5.89%, 2007-HY6, Class A1 (CME Term SOFR 1 Month + 0.53%), 08/25/47 (c) | 2,039,286 | 1,676,985 | |||||||||

5.97%, 2007-16CB, Class 4A5 (CME Term SOFR 1 Month + 0.61%), 08/25/37 (c) | 3,624,695 | 2,257,587 | |||||||||

6.00%, 2006-19CB, Class A9 (CME Term SOFR 1 Month + 0.81%), 08/25/36 (c) | 1,799,955 | 858,011 | |||||||||

6.00%, 2006-29T1, Class 2A5, 10/25/36 | 1,093,856 | 632,799 | |||||||||

6.00%, 2006-45T1, Class 2A5, 02/25/37 | 2,008,559 | 1,095,286 | |||||||||

6.50%, 2006-29T1, Class 2A6, 10/25/36 | 1,716,518 | 1,042,401 | |||||||||

6.52%, 2006-23CB, Class 2A7 (CME Term SOFR 1 Month + 27.94%), 08/25/36 (c),(g) | 1,189,683 | 759,411 | |||||||||

5.75%, 2007-15CB, Class A2, 07/25/37 (b) | 1,629,917 | 973,970 | |||||||||

23.06%, 2006-29T1, Class 3A3 (CME Term SOFR 1 Month + 77.24%), 10/25/36 (c),(g) | 633,327 | 856,196 | |||||||||

6.00%, 2006-41CB, Class 1A7, 01/25/37 (b) | 12,390,398 | 6,625,188 | |||||||||

See Notes to Financial Statements.

2023 Annual Report

11

BROOKFIELD REAL ASSETS INCOME FUND INC.

Schedule of Investments (continued)

December 31, 2023

| Principal Amount | Value | ||||||||||

SECURITIZED CREDIT (continued) | |||||||||||

| Bellemeade Re Ltd. 8.49%, 2021-3A, Class M2 (SOFR30A + 3.15%), 09/25/31 (a),(b),(c) | $ | 1,389,000 | $ | 1,394,677 | |||||||

| BRAVO Residential Funding Trust 5.50%, 2022-NQM3, Class A3, 07/25/62 (a) | 1,692,427 | 1,681,845 | |||||||||

7.49%, 2023-NQM5, Class B1, 06/25/63 (a) | 1,000,000 | 960,614 | |||||||||

| Chase Mortgage Finance Trust 4.11%, 2007-A1, Class 11M1, 03/25/37 | 1,831,770 | 1,656,215 | |||||||||

4.50%, 2005-A2, Class 3A2, 01/25/36 | 688,143 | 598,580 | |||||||||

| CHL Mortgage Pass-Through Trust 5.50%, 2007-5, Class A29, 05/25/37 | 163,312 | 78,708 | |||||||||

6.00%, 2004-21, Class A10, 11/25/34 | 36,462 | 35,304 | |||||||||

6.00%, 2006-20, Class 1A18 (CME Term SOFR 1 Month + 0.76%), 02/25/37 (c) | 3,776,899 | 1,479,333 | |||||||||

6.00%, 2007-18, Class 1A1, 11/25/37 | 188,664 | 92,126 | |||||||||

| CHNGE Mortgage Trust 3.99%, 2022-1, Class M1, 01/25/67 (a) | 2,700,000 | 2,215,169 | |||||||||

4.55%, 2022-1, Class B1, 01/25/67 (a) | 2,500,000 | 1,893,801 | |||||||||

4.62%, 2022-2, Class B1, 03/25/67 (a) | 3,000,000 | 2,133,158 | |||||||||

8.27%, 2023-2, Class M1, 06/25/58 (a) | 3,500,000 | 3,436,845 | |||||||||

8.43%, 2023-4, Class M1, 09/25/58 (a),(b) | 1,641,000 | 1,579,120 | |||||||||

| Citicorp Mortgage Securities Trust 6.37%, 2006-5, Class 1A11 (CME Term SOFR 1 Month + 1.01%), 10/25/36 (c) | 304,222 | 247,873 | |||||||||

| Citigroup Mortgage Loan Trust 4.52%, 2007-AR5, Class 1A2A, 04/25/37 | 374,479 | 338,463 | |||||||||

6.10%, 2009-8, Class 2A2, 04/25/37 (a) | 4,306,108 | 2,204,454 | |||||||||

| CWABS Asset-Backed Certificates 3.98%, 2006-13, Class 1AF4, 01/25/37 | 797,681 | 753,782 | |||||||||

| Deephaven Residential Mortgage Trust 4.33%, 2022-2, Class B1, 03/25/67 (a) | 3,000,000 | 2,295,169 | |||||||||

| Eagle Re Ltd. 9.29%, 2023-1, Class M1B (SOFR30A + 3.95%), 09/26/33 (a),(c) | 5,000,000 | 4,960,501 | |||||||||

| First Horizon Alternative Mortgage Securities Trust 5.50%, 2005-FA8, Class 1A6 (CME Term SOFR 1 Month + 0.76%), 11/25/35 (c) | 1,081,169 | 459,747 | |||||||||

| GCAT Trust 5.75%, 2022-NQM4, Class M1, 08/25/67 (a) | 250,000 | 236,388 | |||||||||

5.73%, 2022-NQM4, Class A3, 08/25/67 (a),(b),(h) | 1,319,444 | 1,318,896 | |||||||||

| GMACM Home Equity Loan Trust 6.05%, 2007-HE2, Class A2, 12/25/37 | 267,184 | 259,057 | |||||||||

6.19%, 2007-HE2, Class A3, 12/25/37 | 514,708 | 500,248 | |||||||||

5.97%, 2005-HE3, Class A2 (CME Term SOFR 1 Month + 0.61%), 02/25/36 (b),(c) | 985,250 | 929,472 | |||||||||

| GSAMP Trust 5.77%, 2006-NC2, Class A2C (CME Term SOFR 1 Month + 0.41%), 06/25/36 (c) | 446,944 | 235,580 | |||||||||

| GSR Mortgage Loan Trust 4.63%, 2006-AR1, Class 2A4, 01/25/36 | 2,038,421 | 1,890,671 | |||||||||

5.77%, 2007-1F, Class 4A1 (CME Term SOFR 1 Month + 0.41%), 01/25/37 (c) | 5,844,281 | 1,407,251 | |||||||||

| Home Equity Asset Trust 5.77%, 2006-7, Class 2A3 (CME Term SOFR 1 Month + 0.41%), 01/25/37 (c) | 3,575,495 | 3,095,605 | |||||||||

| Home RE Ltd. 8.14%, 2021-2, Class M1C (SOFR30A + 2.80%), 01/25/34 (a),(c) | 4,647,000 | 4,660,493 | |||||||||

8.59%, 2021-2, Class M2 (SOFR30A + 3.25%), 01/25/34 (a),(c) | 5,331,000 | 5,303,213 | |||||||||

| Imperial Fund Mortgage Trust 5.39%, 2022-NQM5, Class A1, 08/25/67 (a),(h) | 644,615 | 642,715 | |||||||||

6.12%, 2022-NQM5, Class A2, 08/25/67 (a),(h) | 429,743 | 433,412 | |||||||||

6.25%, 2022-NQM5, Class M1, 08/25/67 (a),(h) | 1,026,000 | 1,025,074 | |||||||||

See Notes to Financial Statements.

Brookfield Public Securities Group LLC

12

BROOKFIELD REAL ASSETS INCOME FUND INC.

Schedule of Investments (continued)

December 31, 2023

| Principal Amount | Value | ||||||||||

SECURITIZED CREDIT (continued) | |||||||||||

| Indymac INDA Mortgage Loan Trust 3.54%, 2007-AR1, Class 1A1, 03/25/37 | $ | 624,556 | $ | 471,521 | |||||||

4.66%, 2007-AR3, Class 1A1, 07/25/37 | 1,534,050 | 1,305,537 | |||||||||

| Irwin Home Equity Loan Trust 6.27%, 2006-1, Class 2A3, 09/25/35 (a),(h) | 261,700 | 260,165 | |||||||||

| JP Morgan Mortgage Trust 4.15%, 2007-A2, Class 3A2, 04/25/37 | 3,705,574 | 2,977,574 | |||||||||

4.75%, 2003-A1, Class B4, 10/25/33, (Acquired 10/29/2004, cost $81,016) (i) | 82,607 | 72,773 | |||||||||

5.31%, 2003-A2, Class B4, 11/25/33, (Acquired 10/29/2004, cost $63,076) (i) | 73,205 | 1 | |||||||||

2.98%, 2021-INV1, Class B5, 10/25/51 (a),(b) | 827,000 | 275,350 | |||||||||

7.84%, 2023-HE3, Class M2 (SOFR30A + 2.50%), 05/25/54 (a),(c) | 1,695,000 | 1,695,000 | |||||||||

| JPMorgan Chase Bank NA 6.64%, 2021-CL1, Class M1 (SOFR30A + 1.30%), 03/25/51 (a),(c) | 458,376 | 437,865 | |||||||||

6.89%, 2021-CL1, Class M2 (SOFR30A + 1.55%), 03/25/51 (a),(c) | 153,761 | 145,981 | |||||||||

8.82%, 2020-CL1, Class M3 (CME Term SOFR 1 Month + 3.46%), 10/25/57 (a),(c) | 161,169 | 162,623 | |||||||||

9.82%, 2020-CL1, Class M4 (CME Term SOFR 1 Month + 4.46%), 10/25/57 (a),(c) | 185,252 | 187,206 | |||||||||

| MASTR Asset Backed Securities Trust 5.67%, 2006-NC3, Class A3 (CME Term SOFR 1 Month + 0.31%), 10/25/36 (c) | 2,597,680 | 1,250,038 | |||||||||

5.79%, 2006-NC3, Class A4 (CME Term SOFR 1 Month + 0.43%), 10/25/36 (c) | 4,382,607 | 2,109,562 | |||||||||

5.95%, 2006-NC2, Class A5 (CME Term SOFR 1 Month + 0.59%), 08/25/36 (c) | 369,303 | 137,996 | |||||||||

| Mello Mortgage Capital Acceptance 2.79%, 2021-INV1, Class B6, 06/25/51 (a) | 352,021 | 107,968 | |||||||||

2.96%, 2021-INV1, Class B4, 06/25/51 (a),(b) | 610,522 | 372,868 | |||||||||

| MFA Trust 3.29%, 2021-INV1, Class B1, 01/25/56 (a) | 700,000 | 608,398 | |||||||||

| New Residential Mortgage Loan Trust 8.09%, 2022-RTL1, Class A1V (SOFR30A + 2.75%), 12/25/26 (a),(c) | 2,000,000 | 2,000,221 | |||||||||

| NewRez Warehouse Securitization Trust 8.72%, 2021-1, Class E (CME Term SOFR 1 Month + 3.36%), 05/25/55 (a),(c) | 866,667 | 865,539 | |||||||||

| Nomura Resecuritization Trust 2.23%, 2014-1R, Class 2A11 (CME Term SOFR 1 Month + 0.24%), 02/26/37 (a),(c) | 22,122,355 | 15,966,080 | |||||||||

3.83%, 2015-11R, Class 4A5, 06/26/37 (a) | 2,896,326 | 2,444,263 | |||||||||

4.44%, 2015-1R, Class 3A7, 03/26/37 (a) | 4,162,080 | 2,543,239 | |||||||||

5.67%, 2015-1R, Class 4A7, 12/26/37 (a) | 1,105,247 | 991,380 | |||||||||

| NRZ Excess Spread-Collateralized Notes 2.98%, 2021-FNT1, Class A, 03/25/26 (a) | 194,167 | 180,364 | |||||||||

3.10%, 2021-FHT1, Class A, 07/25/26 (a) | 737,663 | 682,953 | |||||||||

3.23%, 2021-FNT2, Class A, 05/25/26 (a) | 399,788 | 371,788 | |||||||||

4.21%, 2020-FHT1, Class A, 11/25/25 (a) | 795,417 | 756,221 | |||||||||

| Oaktown Re Ltd. 8.00%, 2019-1A, Class M2 (SOFR30A + 2.66%), 07/25/29 (a),(c) | 2,084,000 | 2,080,604 | |||||||||

8.69%, 2021-2, Class M1C (SOFR30A + 3.35%), 04/25/34 (a),(c) | 3,769,000 | 3,827,976 | |||||||||

| Option One Mortgage Loan Trust 5.66%, 2007-FXD1, Class 3A6, 01/25/37 (h) | 138,472 | 126,469 | |||||||||

| PRKCM Trust 7.09%, 2023-AFC2, Class A3, 06/25/58 (a) | 3,623,009 | 3,637,836 | |||||||||

7.63%, 2023-AFC1, Class B1, 02/25/58 (a) | 1,000,000 | 965,938 | |||||||||

7.88%, 2023-AFC2, Class M1, 06/25/58 (a) | 750,000 | 765,363 | |||||||||

7.91%, 2023-AFC3, Class B1, 09/25/58 (a) | 2,500,000 | 2,433,743 | |||||||||

8.24%, 2023-AFC2, Class B1, 06/25/58 (a) | 1,000,000 | 982,948 | |||||||||

See Notes to Financial Statements.

2023 Annual Report

13

BROOKFIELD REAL ASSETS INCOME FUND INC.

Schedule of Investments (continued)

December 31, 2023

| Principal Amount | Value | ||||||||||

SECURITIZED CREDIT (continued) | |||||||||||

| Progress Residential Trust 3.93%, 2019-SFR4, Class G, 10/17/36 (a) | $ | 2,000,000 | $ | 1,944,561 | |||||||

| PRPM LLC 1.79%, 2021-5, Class A1, 06/25/26 (a),(h) | 674,606 | 646,422 | |||||||||

1.87%, 2021-3, Class A1, 04/25/26 (a),(h) | 331,326 | 311,693 | |||||||||

2.12%, 2021-1, Class A1, 01/25/26 (a) | 2,988,818 | 2,858,592 | |||||||||

2.12%, 2021-2, Class A1, 03/25/26 (a) | 2,492,110 | 2,373,822 | |||||||||

3.72%, 2021-1, Class A2, 01/25/26 (a) | 2,000,000 | 1,905,138 | |||||||||

3.72%, 2022-1, Class A1, 02/25/27 (a),(h) | 1,140,083 | 1,098,998 | |||||||||

3.72%, 2021-5, Class A2, 06/25/26 (a),(h) | 2,500,000 | 2,350,691 | |||||||||

3.77%, 2021-2, Class A2, 03/25/26 (a) | 1,935,000 | 1,844,019 | |||||||||

4.83%, 2021-10, Class A2, 10/25/26 (a),(h) | 3,000,000 | 2,835,456 | |||||||||

5.00%, 2022-2, Class A1, 03/25/27 (a),(h) | 2,412,905 | 2,349,648 | |||||||||

5.36%, 2020-6, Class A1, 11/25/25 (a),(h) | 492,007 | 483,397 | |||||||||

6.29%, 2022-1, Class A2, 02/25/27 (a),(h) | 500,000 | 478,610 | |||||||||

7.70%, 2020-6, Class A2, 11/25/25 (a),(h) | 1,355,291 | 1,284,654 | |||||||||

| Radnor RE Ltd. 7.04%, 2021-1, Class M1B (SOFR30A + 1.70%), 12/27/33 (a),(c) | 175,618 | 175,183 | |||||||||

8.49%, 2021-1, Class M2 (SOFR30A + 3.15%), 12/27/33 (a),(c) | 1,443,000 | 1,444,581 | |||||||||

| RALI Trust 5.79%, 2007-QO3, Class A1 (CME Term SOFR 1 Month + 0.43%), 03/25/47 (c) | 1,065,525 | 958,348 | |||||||||

5.86%, 2006-QO7, Class 2A1 (12 Month US Treasury Average + 0.85%), 09/25/46 (c) | 5,271,553 | 4,266,483 | |||||||||

6.00%, 2006-QS3, Class 1A10, 03/25/36 | 1,499,446 | 1,290,034 | |||||||||

10.13%, 2006-QS14, Class A30 (CME Term SOFR 1 Month + 79.76%), 11/25/36 (c),(g) | 47,751 | 80,567 | |||||||||

| RFMSI Trust 5.50%, 2007-S3, Class 1A5, 03/25/37 | 1,151,207 | 830,945 | |||||||||

| Rithm Capital Corp. 5.44%, 2020-FNT1, Class A, 06/25/25 (a) | 917,823 | 892,839 | |||||||||

| Santander Holdings USA, Inc. 9.49%, 2023-MTG1, Class M1 (SOFR30A + 4.15%), 02/26/52 (a),(c) | 5,497,482 | 5,840,265 | |||||||||

| Seasoned Credit Risk Transfer Trust 4.25%, 2021-1, Class M, 09/25/60 (a) | 2,000,000 | 1,800,207 | |||||||||

4.50%, 2019-4, Class M, 02/25/59 (a) | 1,617,000 | 1,368,142 | |||||||||

4.50%, 2022-1, Class M, 11/25/61 (a) | 3,000,000 | 2,369,951 | |||||||||

| Securitized Asset Backed Receivables LLC Trust 5.77%, 2006-NC3, Class A2B (CME Term SOFR 1 Month + 0.41%), 09/25/36 (c) | 5,281,526 | 1,771,966 | |||||||||

5.77%, 2007-NC1, Class A2B (CME Term SOFR 1 Month + 0.41%), 12/25/36 (c) | 3,270,641 | 1,680,257 | |||||||||

| STAR Trust 8.33%, 2021-SFR2, Class F (CME Term SOFR 1 Month + 2.96%), 01/17/24 (a),(c) | 3,000,000 | 2,866,438 | |||||||||

9.06%, 2022-SFR3, Class E2 (CME Term SOFR 1 Month + 3.70%), 05/17/24 (a),(c) | 3,750,000 | 3,730,151 | |||||||||

| Tricon American Homes 4.88%, 2020-SFR1, Class F, 07/17/38 (a) | 2,382,000 | 2,286,466 | |||||||||

| Verus Securitization Trust 5.83%, 2022-INV1, Class A3, 08/25/67 (a),(h) | 438,595 | 432,311 | |||||||||

5.85%, 2022-INV1, Class M1, 08/25/67 (a) | 500,000 | 482,805 | |||||||||

7.08%, 2023-INV2, Class A3, 08/25/68 (a),(h) | 110,893 | 111,569 | |||||||||

7.35%, 2023-INV2, Class M1, 08/25/68 (a) | 121,000 | 120,071 | |||||||||

7.40%, 2023-4, Class M1, 05/25/68 (a) | 1,500,000 | 1,509,485 | |||||||||

8.16%, 2023-INV2, Class B1, 08/25/68 (a) | 100,000 | 97,217 | |||||||||

8.21%, 2023-4, Class B1, 05/25/68 (a) | 2,000,000 | 1,958,452 | |||||||||

See Notes to Financial Statements.

Brookfield Public Securities Group LLC

14

BROOKFIELD REAL ASSETS INCOME FUND INC.

Schedule of Investments (continued)

December 31, 2023

| Principal Amount | Value | ||||||||||

SECURITIZED CREDIT (continued) | |||||||||||

| Washington Mutual Mortgage Pass-Through Certificates Trust 3.67%, 2007-HY5, Class 1A1, 05/25/37 | $ | 1,737,192 | $ | 1,536,876 | |||||||

3.85%, 2007-HY5, Class 3A1, 05/25/37 | 614,804 | 541,586 | |||||||||

3.86%, 2007-HY1, Class 4A1, 02/25/37 | 4,945,014 | 4,365,954 | |||||||||

4.31%, 2007-HY3, Class 4A1, 03/25/37 | 5,025,734 | 4,468,790 | |||||||||

| Wells Fargo Mortgage Backed Securities Trust 4.60%, 2006-AR1, Class 2A5, 03/25/36 | 998,161 | 938,814 | |||||||||

6.13%, 2006-AR12, Class 2A1, 09/25/36 | 656,852 | 613,405 | |||||||||

| Western Alliance Bank 9.44%, 2021-CL2, Class M3 (SOFR30A + 4.10%), 07/25/59 (a),(c) | 966,080 | 976,636 | |||||||||

10.69%, 2021-CL2, Class M4 (SOFR30A + 5.35%), 07/25/59 (a),(c) | 1,661,341 | 1,673,986 | |||||||||

| Woodward Capital Management 7.98%, 2023-CES1, Class M2, 06/25/43 (a) | 965,000 | 948,832 | |||||||||

8.18%, 2023-CES2, Class M2, 09/25/43 (a) | 1,200,000 | 1,227,280 | |||||||||

Total Residential Mortgage-Backed Securities | 218,825,780 | ||||||||||

| TOTAL SECURITIZED CREDIT (Cost $386,174,688) | 331,352,289 | ||||||||||

CORPORATE CREDIT – 66.8% | |||||||||||

Basic Industrial – 2.0% | |||||||||||

| Cascades, Inc. 5.38%, 01/15/28 (a),(b),(d) | 5,915,000 | 5,722,762 | |||||||||

| Clearwater Paper Corp. 4.75%, 08/15/28 (a) | 3,000,000 | 2,780,781 | |||||||||

| Methanex Corp. 5.25%, 12/15/29 (b),(d) | 1,490,000 | 1,433,603 | |||||||||

| NOVA Chemicals Corp. 4.25%, 05/15/29 (a),(b),(j) | 1,681,000 | 1,415,362 | |||||||||

8.50%, 11/15/28 (a),(b) | 1,405,000 | 1,473,367 | |||||||||

| Tronox, Inc. 4.63%, 03/15/29 (a),(d) | 4,245,000 | 3,758,587 | |||||||||

Total Basic Industrial | 16,584,462 | ||||||||||

Construction & Building Materials – 2.0% | |||||||||||

| Beazer Homes USA, Inc. 5.88%, 10/15/27 (d) | 2,315,000 | 2,261,037 | |||||||||

7.25%, 10/15/29 | 1,067,000 | 1,076,378 | |||||||||

| KB Home 7.25%, 07/15/30 (d) | 2,640,000 | 2,732,002 | |||||||||

| M/I Homes, Inc. 4.95%, 02/01/28 (d) | 2,747,000 | 2,642,806 | |||||||||

| MDC Holdings, Inc. 6.00%, 01/15/43 | 2,928,000 | 2,727,304 | |||||||||

| Summit Materials LLC 7.25%, 01/15/31 (a) | 2,575,000 | 2,709,830 | |||||||||

| Taylor Morrison Communities, Inc. 5.88%, 06/15/27 (a),(d) | 2,645,000 | 2,658,225 | |||||||||

Total Construction & Building Materials | 16,807,582 | ||||||||||

See Notes to Financial Statements.

2023 Annual Report

15

BROOKFIELD REAL ASSETS INCOME FUND INC.

Schedule of Investments (continued)

December 31, 2023

| Principal Amount | Value | ||||||||||

CORPORATE CREDIT (continued) | |||||||||||

Diversified – 0.4% | |||||||||||

| Five Point Operating Co. LP 7.88%, 11/15/25 (a) | $ | 2,500,000 | $ | 2,475,000 | |||||||

| Kennedy Wilson Europe Real Estate Ltd. 3.25%, 11/12/25 (b) | € | 1,000,000 | 998,576 | ||||||||

Total Diversified | 3,473,576 | ||||||||||

Diversified Real Estate – 1.9% | |||||||||||

| Forestar Group, Inc. 5.00%, 03/01/28 (a),(d) | $ | 5,365,000 | 5,164,760 | ||||||||

| The Howard Hughes Corp. 4.38%, 02/01/31 (a),(d) | 3,600,000 | 3,122,100 | |||||||||

5.38%, 08/01/28 (a),(d) | 8,025,000 | 7,713,028 | |||||||||

Total Diversified Real Estate | 15,999,888 | ||||||||||

Energy – 8.8% | |||||||||||

| Antero Resources Corp. 5.38%, 03/01/30 (a),(d) | 4,200,000 | 4,025,238 | |||||||||

| Baytex Energy Corp. 8.50%, 04/30/30 (a),(b) | 2,617,000 | 2,707,661 | |||||||||

8.75%, 04/01/27 (a),(b) | 825,000 | 853,282 | |||||||||

| California Resources Corp. 7.13%, 02/01/26 (a),(d) | 3,447,000 | 3,495,895 | |||||||||

| Callon Petroleum Co. 6.38%, 07/01/26 | 1,191,000 | 1,185,279 | |||||||||

| Civitas Resources, Inc. 8.38%, 07/01/28 (a) | 6,295,000 | 6,572,074 | |||||||||

| CNX Resources Corp. 7.38%, 01/15/31 (a),(d) | 2,533,000 | 2,551,030 | |||||||||

| Comstock Resources, Inc. 6.75%, 03/01/29 (a),(d) | 2,883,000 | 2,637,145 | |||||||||

| Continental Resources, Inc. 5.75%, 01/15/31 (a),(j) | 8,009,000 | 7,962,345 | |||||||||

| Crescent Energy Finance LLC 7.25%, 05/01/26 (a),(d) | 3,135,000 | 3,153,051 | |||||||||

9.25%, 02/15/28 (a) | 2,130,000 | 2,210,024 | |||||||||

| Diamondback Energy, Inc. 6.25%, 03/15/33 | 2,600,000 | 2,781,232 | |||||||||

| EQT Corp. 7.00%, 02/01/30 (d) | 2,331,000 | 2,501,722 | |||||||||

| HF Sinclair Corp. 5.00%, 02/01/28 (a),(d) | 5,582,000 | 5,378,823 | |||||||||

| MEG Energy Corp. 5.88%, 02/01/29 (a),(d) | 4,650,000 | 4,518,148 | |||||||||

| Moss Creek Resources Holdings, Inc. 10.50%, 05/15/27 (a) | 1,640,000 | 1,682,104 | |||||||||

| Occidental Petroleum Corp. 8.88%, 07/15/30 (d) | 5,600,000 | 6,553,142 | |||||||||

| Ovintiv, Inc. 6.25%, 07/15/33 | 2,150,000 | 2,226,619 | |||||||||

| Range Resources Corp. 8.25%, 01/15/29 (j) | 1,750,000 | 1,810,522 | |||||||||

See Notes to Financial Statements.

Brookfield Public Securities Group LLC

16

BROOKFIELD REAL ASSETS INCOME FUND INC.

Schedule of Investments (continued)

December 31, 2023

| Principal Amount | Value | ||||||||||

CORPORATE CREDIT (continued) | |||||||||||

| Southwestern Energy Co. 5.38%, 02/01/29 (d) | $ | 5,565,000 | $ | 5,431,239 | |||||||

| Transocean Titan Financing Ltd. 8.38%, 02/01/28, (Acquired 2/22/2023 – 3/1/2023, cost $2,612,112) (a),(d),(m) | 2,580,000 | 2,676,718 | |||||||||

Total Energy | 72,913,293 | ||||||||||

Health Facilities – 2.3% | |||||||||||

| CHS/Community Health Systems, Inc. 4.75%, 02/15/31 (a),(d) | 6,675,000 | 5,268,578 | |||||||||

8.00%, 03/15/26 (a),(d) | 2,100,000 | 2,093,054 | |||||||||

| Tenet Healthcare Corp. 6.13%, 10/01/28 (d) | 11,800,000 | 11,766,606 | |||||||||

Total Health Facilities | 19,128,238 | ||||||||||

Hotel – 0.4% | |||||||||||

| Hilton Domestic Operating Company, Inc. 3.75%, 05/01/29 (a),(d) | 3,700,000 | 3,431,095 | |||||||||

Infrastructure Services – 0.4% | |||||||||||

| GFL Environmental, Inc. 3.50%, 09/01/28 (a),(b),(d) | 2,910,000 | 2,689,205 | |||||||||

6.75%, 01/15/31 (a),(b) | 273,000 | 281,320 | |||||||||

Total Infrastructure Services | 2,970,525 | ||||||||||

Leisure – 6.1% | |||||||||||

| Boyd Gaming Corp. 4.75%, 06/15/31 (a),(d) | 1,250,000 | 1,148,148 | |||||||||

| Caesars Entertainment, Inc. 7.00%, 02/15/30 (a) | 5,250,000 | 5,381,523 | |||||||||

| Caesars Resort Collection LLC 5.75%, 07/01/25 (a),(d) | 3,137,000 | 3,135,928 | |||||||||

| Cedar Fair LP 6.50%, 10/01/28 (d) | 5,060,000 | 5,030,071 | |||||||||

| Park Intermediate Holdings LLC 5.88%, 10/01/28 (a),(d) | 5,885,000 | 5,787,782 | |||||||||

| RHP Hotel Properties LP 4.50%, 02/15/29 (a),(d) | 5,610,000 | 5,217,528 | |||||||||

| Six Flags Entertainment Corp. 5.50%, 04/15/27 (a),(d) | 2,845,000 | 2,781,176 | |||||||||

7.25%, 05/15/31 (a) | 7,795,000 | 7,819,008 | |||||||||

| Station Casinos LLC 4.50%, 02/15/28 (a),(d) | 6,190,000 | 5,831,057 | |||||||||

4.63%, 12/01/31 (a) | 654,000 | 589,695 | |||||||||

| VICI Properties LP 4.50%, 01/15/28 (a),(d) | 8,150,000 | 7,775,785 | |||||||||

Total Leisure | 50,497,701 | ||||||||||

Media – 8.9% | |||||||||||

| Cable One, Inc. 4.00%, 11/15/30, (Acquired 12/4/2020, cost $4,778,964) (a),(d),(m) | 4,650,000 | 3,764,818 | |||||||||

| CCO Holdings LLC 4.75%, 03/01/30 (a),(d) | 23,025,000 | 21,035,539 | |||||||||

6.38%, 09/01/29 (a),(d) | 3,360,000 | 3,314,055 | |||||||||

See Notes to Financial Statements.

2023 Annual Report

17

BROOKFIELD REAL ASSETS INCOME FUND INC.

Schedule of Investments (continued)

December 31, 2023

| Principal Amount | Value | ||||||||||

CORPORATE CREDIT (continued) | |||||||||||

| CSC Holdings LLC 4.50%, 11/15/31 (a),(d) | $ | 17,399,000 | $ | 13,154,860 | |||||||

4.63%, 12/01/30 (a),(d) | 6,245,000 | 3,762,288 | |||||||||

| Directv Financing LLC 5.88%, 08/15/27 (a),(d) | 5,600,000 | 5,265,230 | |||||||||

| DISH DBS Corp. 5.25%, 12/01/26 (a) | 2,172,000 | 1,860,861 | |||||||||

| DISH Network Corp. 11.75%, 11/15/27 (a) | 2,280,000 | 2,387,021 | |||||||||

| Telenet Finance Luxembourg Notes Sarl 5.50%, 03/01/28 (a),(b) | 3,000,000 | 2,805,000 | |||||||||

| UPC Broadband Finco BV 4.88%, 07/15/31 (a),(b),(d) | 1,698,000 | 1,494,427 | |||||||||

| Videotron Ltd. 3.63%, 06/15/29 (a),(b),(d) | 1,465,000 | 1,329,542 | |||||||||

| Virgin Media Secured Finance PLC 4.50%, 08/15/30 (a),(b),(d) | 4,675,000 | 4,162,152 | |||||||||

| VZ Secured Financing BV 5.00%, 01/15/32 (a) | 5,775,000 | 4,914,460 | |||||||||

| Warnermedia Holdings, Inc. 4.28%, 03/15/32 (d) | 3,115,000 | 2,854,650 | |||||||||

| Ziggo Bond Company BV 5.13%, 02/28/30 (a),(b) | 1,790,000 | 1,496,696 | |||||||||

Total Media | 73,601,599 | ||||||||||

Metals & Mining – 0.2% | |||||||||||

| Cleveland-Cliffs, Inc. 6.75%, 03/15/26 (a),(d) | 2,000,000 | 2,003,778 | |||||||||

Oil Gas T&D – 0.0% | |||||||||||

| Genesis Energy LP 8.25%, 01/15/29 | 100,000 | 102,785 | |||||||||

Oil Gas Transportation & Distribution – 13.4% | |||||||||||

| Antero Midstream Partners LP 5.38%, 06/15/29 (a),(d) | 5,400,000 | 5,196,670 | |||||||||

| Buckeye Partners LP 3.95%, 12/01/26 (d) | 2,500,000 | 2,362,500 | |||||||||

4.13%, 12/01/27 (d) | 3,655,000 | 3,472,250 | |||||||||

| Cheniere Corpus Christi Holdings LLC 2.74%, 12/31/39 (d) | 4,730,000 | 3,768,481 | |||||||||

| DT Midstream, Inc. 4.13%, 06/15/29 (a),(d) | 4,420,000 | 4,066,598 | |||||||||

| Enbridge, Inc. 5.50% (CME Term SOFR 3 Month + 3.68%), 07/15/77 (b),(c) | 2,970,000 | 2,714,755 | |||||||||

7.38% (5 Year CMT Rate + 3.71%), 01/15/83 (c) | 825,000 | 811,266 | |||||||||

| Energy Transfer LP 5.63%, 05/01/27 (a) | 350,000 | 348,805 | |||||||||

6.00%, 02/01/29 (a),(d) | 6,250,000 | 6,306,148 | |||||||||

6.75% (5 Year CMT Rate + 5.13%), Perpetual (c),(d) | 5,869,000 | 5,621,571 | |||||||||

7.13% (5 Year CMT Rate + 5.31%), Perpetual (c),(d) | 2,297,000 | 2,116,636 | |||||||||

8.66% (CME Term SOFR 3 Month + 3.28%), 11/01/66 (c),(d) | 4,770,000 | 3,980,748 | |||||||||

| EnLink Midstream LLC 5.38%, 06/01/29 (d) | 4,975,000 | 4,868,335 | |||||||||

See Notes to Financial Statements.

Brookfield Public Securities Group LLC

18

BROOKFIELD REAL ASSETS INCOME FUND INC.

Schedule of Investments (continued)

December 31, 2023

| Principal Amount | Value | ||||||||||

CORPORATE CREDIT (continued) | |||||||||||

| EnLink Midstream Partners LP 9.76% (CME Term SOFR 3 Month + 4.37%), Perpetual (c),(d) | $ | 4,755,000 | $ | 4,335,088 | |||||||

| Enterprise Products Operating LLC 5.25% (CME Term SOFR 3 Month + 3.29%), 08/16/77 (c) | 1,460,000 | 1,395,713 | |||||||||

| EQM Midstream Partners LP 4.50%, 01/15/29 (a),(d) | 8,660,000 | 8,184,499 | |||||||||

7.50%, 06/01/27 (a) | 500,000 | 514,334 | |||||||||

| Ferrellgas LP 5.38%, 04/01/26 (a) | 1,875,000 | 1,835,893 | |||||||||

| Global Partners LP 7.00%, 08/01/27 (d) | 2,750,000 | 2,688,427 | |||||||||

| Kinetik Holdings LP 5.88%, 06/15/30 (a),(d) | 4,440,000 | 4,356,794 | |||||||||

| NuStar Logistics LP 5.63%, 04/28/27 (d) | 3,255,000 | 3,241,134 | |||||||||

5.75%, 10/01/25 (d) | 2,052,000 | 2,036,610 | |||||||||

| Parkland Corp. 4.50%, 10/01/29 (a),(b),(d) | 3,247,000 | 2,975,778 | |||||||||

| Plains All American Pipeline LP 9.75% (CME Term SOFR 3 Month + 4.37%), Perpetual (c),(d) | 7,920,000 | 7,652,700 | |||||||||

| Suburban Propane Partners LP 5.00%, 06/01/31 (a),(d) | 4,389,000 | 4,011,978 | |||||||||

| Sunoco LP 4.50%, 05/15/29 | 1,981,000 | 1,838,864 | |||||||||

| Tallgrass Energy Partners LP 6.00%, 12/31/30 (a),(d) | 6,169,000 | 5,735,438 | |||||||||

| Targa Resources Partners LP 4.88%, 02/01/31 (d) | 7,000,000 | 6,791,890 | |||||||||

| TransCanada PipeLines Ltd. 7.85% (3 Month LIBOR USD + 2.21%), 05/15/67 (b),(c),(d) | 6,663,000 | 5,336,498 | |||||||||

| Western Midstream Operating LP 4.75%, 08/15/28 (j) | 2,045,000 | 1,996,550 | |||||||||

Total Oil Gas Transportation & Distribution | 110,562,951 | ||||||||||

Real Estate – 6.6% | |||||||||||

| Boston Properties LP 6.50%, 01/15/34 | 1,165,000 | 1,230,872 | |||||||||

| EPR Properties 3.60%, 11/15/31 | 1,846,000 | 1,533,649 | |||||||||

3.75%, 08/15/29 (d) | 6,600,000 | 5,812,425 | |||||||||

| Essential Properties LP 2.95%, 07/15/31 | 5,185,000 | 4,085,097 | |||||||||

| Global Net Lease, Inc. 3.75%, 12/15/27 (a),(d) | 3,705,000 | 3,098,240 | |||||||||

| Highwoods Realty LP 4.20%, 04/15/29 | 3,315,000 | 3,001,887 | |||||||||

| Iron Mountain, Inc. 4.88%, 09/15/29, (Acquired 2/10/2021 – 2/11/2021, cost $4,885,528) (a),(d),(m) | 4,750,000 | 4,498,839 | |||||||||

| Kilroy Realty LP 4.75%, 12/15/28 | 2,920,000 | 2,773,583 | |||||||||

| Lennar Corp. 5.00%, 06/15/27 (d) | 2,719,000 | 2,730,083 | |||||||||

See Notes to Financial Statements.

2023 Annual Report

19

BROOKFIELD REAL ASSETS INCOME FUND INC.

Schedule of Investments (continued)

December 31, 2023

| Principal Amount | Value | ||||||||||

CORPORATE CREDIT (continued) | |||||||||||

| LXP Industrial Trust 6.75%, 11/15/28 | $ | 3,000,000 | $ | 3,155,700 | |||||||

| Piedmont Operating Partnership LP 2.75%, 04/01/32 | 4,160,000 | 2,893,066 | |||||||||

9.25%, 07/20/28 | 2,970,000 | 3,137,823 | |||||||||

| PulteGroup, Inc. 7.88%, 06/15/32 | 1,454,000 | 1,711,322 | |||||||||

| RLJ Lodging Trust LP 3.75%, 07/01/26 (a),(d) | 4,180,000 | 3,960,526 | |||||||||

| Service Properties Trust 4.50%, 03/15/25 | 4,075,000 | 3,978,219 | |||||||||

| SITE Centers Corp. 4.70%, 06/01/27 | 2,845,000 | 2,801,329 | |||||||||

| Starwood Property Trust, Inc. 3.63%, 07/15/26 (a),(d) | 2,475,000 | 2,344,518 | |||||||||

| STORE Capital Corp. 2.70%, 12/01/31 | 1,998,000 | 1,516,028 | |||||||||

Total Real Estate | 54,263,206 | ||||||||||

Telecommunication Services – 4.9% | |||||||||||

| Altice France SA 5.50%, 01/15/28 (a),(b),(d),(j) | 15,555,000 | 12,810,810 | |||||||||

| Cogent Communications Group, Inc. 3.50%, 05/01/26 (a),(d),(j) | 3,390,000 | 3,245,467 | |||||||||

| Consolidated Communications, Inc. 6.50%, 10/01/28 (a),(d) | 3,410,000 | 2,939,761 | |||||||||

| Frontier Communications Holdings LLC 8.75%, 05/15/30 (a) | 1,000,000 | 1,028,709 | |||||||||

| Level 3 Financing, Inc. 10.50%, 05/15/30 (a) | 4,000,000 | 3,878,739 | |||||||||

| Northwest Fiber LLC Finance Sub, Inc. 4.75%, 04/30/27 (a) | 1,430,000 | 1,365,650 | |||||||||

| Rogers Communications, Inc. 5.25% (5 Year CMT Rate + 3.59%), 03/15/82 (a),(b),(c) | 6,900,000 | 6,621,330 | |||||||||

| T-Mobile USA, Inc. 3.50%, 04/15/31 (d),(j) | 6,537,000 | 5,971,858 | |||||||||

| Windstream Escrow LLC / Windstream Escrow Finance Corp. 7.75%, 08/15/28 (a) | 3,200,000 | 2,803,149 | |||||||||

Total Telecommunication Services | 40,665,473 | ||||||||||

Transportation – 0.1% | |||||||||||

| BNSF Funding Trust I 6.61% (3 Month LIBOR USD + 2.35%), 12/15/55 (c),(d) | 675,000 | 657,201 | |||||||||

Utility – 8.4% | |||||||||||

| Atlantica Sustainable Infrastructure PLC 4.13%, 06/15/28 (a),(b),(d) | 4,845,000 | 4,540,694 | |||||||||

| Calpine Corp. 5.13%, 03/15/28 (a),(d) | 7,405,000 | 7,100,249 | |||||||||

| Clearway Energy Operating LLC 3.75%, 02/15/31 (a),(d) | 5,297,000 | 4,661,958 | |||||||||

| CMS Energy Corp. 4.75% (5 Year CMT Rate + 4.12%), 06/01/50 (c) | 1,765,000 | 1,593,673 | |||||||||

See Notes to Financial Statements.

Brookfield Public Securities Group LLC

20

BROOKFIELD REAL ASSETS INCOME FUND INC.

Schedule of Investments (continued)

December 31, 2023

| Principal Amount |

Value |

||||||||||

|

CORPORATE CREDIT (continued) |

|||||||||||

| Dominion Energy, Inc. 4.65% (5 Year CMT Rate + 2.99%), Perpetual (c) |

$ |

4,850,000 |

$ |

4,609,088 |

|||||||

| Duke Energy Corp. 4.88% (5 Year CMT Rate + 3.39%), Perpetual (c) |

1,285,000 |

1,265,192 |

|||||||||

| Emera, Inc. 6.75% (3 Month LIBOR USD + 5.44%), 06/15/76 (b),(c),(d) |

7,600,000 |

7,441,588 |

|||||||||

| Fortis, Inc. 3.06%, 10/04/26 (b),(d) |

5,050,000 |

4,785,981 |

|||||||||

| NRG Energy, Inc. 4.45%, 06/15/29 (a),(d) |

2,405,000 |

2,270,933 |

|||||||||

|

6.63%, 01/15/27 |

2,159,000 |

2,163,322 |

|||||||||

|

10.25% (5 Year CMT Rate + 5.92%), Perpetual (a),(c) |

3,750,000 |

3,904,073 |

|||||||||

| Pacific Gas and Electric Co. 6.40%, 06/15/33 |

1,595,000 |

1,681,383 |

|||||||||

| PPL Capital Funding, Inc. 8.27% (CME Term SOFR 3 Month + 2.93%), 03/30/67 (c),(d) |

7,618,000 |

7,102,552 |

|||||||||

| Sempra Energy 4.88% (5 Year CMT Rate + 4.55%), Perpetual (c),(d) |

8,039,000 |

7,865,697 |

|||||||||

| Southern California Edison Co. 9.84% (CME Term SOFR 3 Month + 4.46%), Perpetual (c) |

1,501,000 |

1,504,686 |

|||||||||

| WEC Energy Group, Inc. 7.75% (CME Term SOFR 3 Month + 2.37%), 05/15/67 (c),(d) |

7,663,000 |

6,854,578 |

|||||||||

|

Total Utility |

69,345,647 |

||||||||||

| TOTAL CORPORATE CREDIT (Cost $560,022,550) |

553,009,000 |

||||||||||

|

TERM LOANS – 3.1% |

|||||||||||

| Carnival Corp., First Lien 8.35% (CME Term SOFR 1 Month + 3.00%), 08/09/27 (c) |

2,992,500 |

2,994,984 |

|||||||||

| Cogeco Communications USA II LP, First Lien 8.60% (CME Term SOFR 1 Month + 3.25%), 09/29/30 (c) |

2,000,000 |

1,966,260 |

|||||||||

| Cushman & Wakefield US Borrower LLC, First Lien 9.46% (CME Term SOFR 1 Month + 4.00%), 01/31/30 (c) |

3,000,000 |

2,992,500 |

|||||||||

| Frontier Communications Holdings LLC, First Lien 9.39% (3 Month LIBOR USD + 3.75%), 10/08/27 (c) |

7,213,104 |

7,168,022 |

|||||||||

| GIP II Blue Holding LP, 5.50%, 09/29/28, First Lien 9.97% (CME Term SOFR 1 Month + 4.50%), 09/29/28 (c) |

5,343,126 |

5,358,728 |

|||||||||

| Greystar Real Estate Partners LLC, First Lien 9.11% (CME Term SOFR 1 Month + 3.75%), 08/21/30 (c) |

5,000,000 |

5,000,000 |

|||||||||

| Vistra Energy Corp. 0.00%, 10/31/25 |

25,848 |

333 |

|||||||||

| TOTAL TERM LOANS (Cost $25,285,166) |

25,480,827 |

||||||||||

|

Shares |

Value |

||||||||||

|

PREFERRED STOCKS – 0.9% |

|||||||||||

|

Oil Gas Transportation & Distribution – 0.3% |

|||||||||||

|

NuStar Energy LP, Series B, 11.28% (d) |

71,701 |

1,793,242 |

|||||||||

|

Global Partners LP, Series B, 9.50% (d) |

32,100 |

843,367 |

|||||||||

|

Total Oil Gas Transportation & Distribution |

2,636,609 |

||||||||||

|

Real Estate – 0.1% |

|||||||||||

|

EPR Properties, Series E, 9.00% |

37,000 |

1,040,440 |

|||||||||

See Notes to Financial Statements.

2023 Annual Report

21

BROOKFIELD REAL ASSETS INCOME FUND INC.

Schedule of Investments (continued)

December 31, 2023

|

Shares |

Value |

||||||||||

|

PREFERRED STOCKS (continued) |

|||||||||||

|

Telecommunication Services – 0.2% |

|||||||||||

|

Liberty Broadband Corp., Series A, 7.00% (d) |

73,185 |

$ |

1,613,729 |

||||||||

|

Utility – 0.3% |

|||||||||||

|

SCE Trust V, Series K, 5.45% (d) |

92,789 |

2,258,484 |

|||||||||

| TOTAL PREFERRED STOCKS (Cost $7,173,259) |

7,549,262 |

||||||||||

|

COMMON STOCKS – 3.0% |

|||||||||||

|

Airports – 0.2% |

|||||||||||

|

Aena SME SA (a),(b) |

1,890 |

343,056 |

|||||||||

|

Auckland International Airport Ltd. (b) |

73,450 |

408,597 |

|||||||||

|

Grupo Aeroportuario del Pacifico SAB de CV – Class B (b) |

30,069 |

527,416 |

|||||||||

|

Total Airports |

1,279,069 |

||||||||||

|

Clean Technology – 0.0% |

|||||||||||

|

Nexans SA (b) |

700 |

61,412 |

|||||||||

|

Communications – 0.2% |

|||||||||||

|

American Tower Corp. |

415 |

89,590 |

|||||||||

|

Cellnex Telecom SA (a),(b) |

10,035 |

395,107 |

|||||||||

|

Crown Castle, Inc. (d) |

5,700 |

656,583 |

|||||||||

|

SBA Communications Corp. (d) |

1,867 |

473,640 |

|||||||||

|

Total Communications |

1,614,920 |

||||||||||

|

Construction Materials – 0.1% |

|||||||||||

|

Ferrovial SE (d) |

10,533 |

384,463 |

|||||||||

|

Datacenters – 0.0% |

|||||||||||

|

Digital Realty Trust, Inc. |

62 |

8,344 |

|||||||||

|

Equinix, Inc. (d) |

63 |

50,740 |

|||||||||

|

Total Datacenters |

59,084 |

||||||||||

|

Diversified – 0.0% |

|||||||||||

|

Charter Hall Group (b) |

900 |

7,374 |

|||||||||

|

CK Asset Holdings Ltd. (b) |

1,200 |

6,023 |

|||||||||

|

Mapletree Pan Asia Commercial Trust (b) |

13,789 |

16,382 |

|||||||||

|

Merlin Properties Socimi SA (b) |

850 |

9,438 |

|||||||||

|

Mirvac Group (b) |

10,393 |

14,785 |

|||||||||

|

Sun Hung Kai Properties Ltd. (b) |

1,700 |

18,396 |

|||||||||

|

Total Diversified |

72,398 |

||||||||||

|

Electricity Transmission & Distribution – 0.3% |

|||||||||||

|

CenterPoint Energy, Inc. (d) |

17,170 |

490,547 |

|||||||||

|

Equatorial Energia SA (b) |

51,990 |

382,455 |

|||||||||

|

PG&E Corp. (d) |

28,625 |

516,109 |

|||||||||

|

Sempra Energy (d) |

9,676 |

723,087 |

|||||||||

|

Total Electricity Transmission & Distribution |

2,112,198 |

||||||||||

|

Gas Utilities – 0.1% |

|||||||||||

|

China Resources Gas Group Ltd. (b) |

89,905 |

295,079 |

|||||||||

|

ENN Energy Holdings Ltd. (b) |

26,881 |

198,502 |

|||||||||

|

NiSource, Inc. (d) |

18,626 |

494,520 |

|||||||||

|

Total Gas Utilities |

988,101 |

||||||||||

See Notes to Financial Statements.

Brookfield Public Securities Group LLC

22

BROOKFIELD REAL ASSETS INCOME FUND INC.

Schedule of Investments (continued)

December 31, 2023

|

Shares |

Value |

||||||||||

|

COMMON STOCKS (continued) |

|||||||||||

|

Healthcare – 0.0% |

|||||||||||

|

CareTrust REIT, Inc. (d) |

563 |

$ |

12,600 |

||||||||

|

Ventas, Inc. (d) |

673 |

33,542 |

|||||||||

|

Welltower, Inc. |

140 |

12,624 |

|||||||||

|

Total Healthcare |

58,766 |

||||||||||

|

Hotel – 0.0% |

|||||||||||

|

DiamondRock Hospitality Co. |

950 |

8,921 |

|||||||||

|

Invincible Investment Corp. (b) |

16 |

6,915 |