UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

(Mark One)

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

For the quarterly period ended | |

OR | |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file no:

| ||

(State or other jurisdiction of incorporation) |

| (IRS Employer Identification No.) |

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (

Securities registered pursuant to section 12(b) of the Act:

Title of Each Class |

|

| Trading | Name of each Exchange |

|

| The | ||

The |

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). ⌧

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ◻ | Accelerated filer | ◻ |

|

|

|

|

☒ | Smaller reporting company | ||

|

|

|

|

|

| Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes

The number of shares of Common Stock, $0.01 par value per share, of the registrant outstanding at May 10, 2023 was

Medalist Diversified REIT, Inc.

Quarterly Report on Form 10-Q

For the Quarter Ended March 31, 2023

Table of Contents

2

PART I.FINANCIAL INFORMATION

Item 1. Financial Statements

Medalist Diversified REIT, Inc. and Subsidiaries

Condensed Consolidated Balance Sheets

| March 31, 2023 | December 31, 2022 |

| ||||

(Unaudited) |

| ||||||

ASSETS |

|

|

|

| |||

Investment properties, net | $ | | $ | | |||

Cash |

| |

| | |||

Restricted cash | | | |||||

Rent and other receivables, net of allowance of $ |

| |

| | |||

Unbilled rent |

| |

| | |||

Intangible assets, net |

| |

| | |||

Other assets |

| |

| | |||

Total Assets | $ | | $ | | |||

LIABILITIES |

|

| |||||

Accounts payable and accrued liabilities | $ | | $ | | |||

Intangible liabilities, net |

| |

| | |||

Mortgages payable, net | | | |||||

Mandatorily redeemable preferred stock, net |

| |

| | |||

Total Liabilities | $ | | $ | | |||

EQUITY |

|

|

|

| |||

Common stock, | $ | | $ | | |||

Additional paid-in capital |

| |

| | |||

Offering costs |

| ( |

| ( | |||

Accumulated deficit |

| ( |

| ( | |||

Total Stockholders' Equity |

| |

| | |||

Noncontrolling interests - Hanover Square Property |

| |

| | |||

Noncontrolling interests - Parkway Property | | | |||||

Noncontrolling interests - Operating Partnership |

| |

| | |||

Total Equity | $ | | $ | | |||

Total Liabilities and Equity | $ | | $ | | |||

See notes to condensed consolidated financial statements

3

Medalist Diversified REIT, Inc. and Subsidiaries

Condensed Consolidated Statements of Operations

(Unaudited)

Three Months Ended | |||||||

March 31, | |||||||

| 2023 |

| 2022 |

| |||

REVENUE |

|

|

|

| |||

Retail center property revenues | $ | | $ | | |||

Flex center property revenues | | | |||||

Hotel property room revenues |

| — |

| | |||

Hotel property other revenues |

| — |

| | |||

Total Revenue | $ | | $ | | |||

OPERATING EXPENSES |

|

|

|

| |||

Retail center property operating expenses | $ | | $ | | |||

Flex center property operating expenses | | | |||||

Hotel property operating expenses |

| — |

| | |||

Bad debt expense | | | |||||

Share based compensation expenses |

| — |

| | |||

Legal, accounting and other professional fees |

| |

| | |||

Corporate general and administrative expenses |

| |

| | |||

Loss on impairment |

| |

| | |||

Impairment of assets held for sale | — | | |||||

Depreciation and amortization |

| | | ||||

Total Operating Expenses |

| |

| | |||

Operating loss |

| ( |

| ( | |||

Interest expense |

| |

| | |||

Net Loss from Operations |

| ( |

| ( | |||

Other (loss) income |

| ( |

| | |||

Net Loss |

| ( |

| ( | |||

Less: Net loss attributable to Hanover Square Property noncontrolling interests | ( | ( | |||||

Less: Net (loss) income attributable to Parkway Property noncontrolling interests |

| ( |

| | |||

Less: Net loss attributable to Operating Partnership noncontrolling interests |

| ( |

| ( | |||

Net Loss Attributable to Medalist Common Shareholders | $ | ( | $ | ( | |||

Loss per share from operations - basic and diluted | $ | ( | $ | ( | |||

Weighted-average number of shares - basic and diluted |

| |

| | |||

Dividends paid per common share | $ | | $ | | |||

See notes to condensed consolidated financial statements

4

Medalist Diversified REIT, Inc. and Subsidiaries

Condensed Consolidated Statements of Stockholders’ Equity

For the three months ended March 31, 2023 and 2022

(Unaudited)

For the three months ended March 31, 2023 | |||||||||||||||||||||||||||||

| Common Stock | Noncontrolling Interests | |||||||||||||||||||||||||||

Additional | Offering | Accumulated | Shareholders’ | Hanover Square | Parkway | Operating |

| ||||||||||||||||||||||

Shares |

| Par Value |

| Paid in Capital |

|

| Costs |

| Deficit |

| Equity |

| Property |

| Property |

| Partnership |

| Total Equity | ||||||||||

Balance, January 1, 2023 | | $ | | $ | | $ | ( | $ | ( | $ | | $ | | $ | | $ | | $ | | ||||||||||

| |||||||||||||||||||||||||||||

Net loss |

| — | $ | — | $ | — | $ | — | $ | ( | $ | ( | $ | ( | $ | ( | $ | ( | $ | ( | |||||||||

Dividends and distributions |

| — | — | — | — | ( | ( | — | — | ( | ( | ||||||||||||||||||

Balance, March 31, 2023 |

| |

| $ | |

| $ | |

| $ | ( |

| $ | ( |

| $ | |

| $ | |

| $ | |

| $ | |

| $ | |

For the three months ended March 31, 2022 | |||||||||||||||||||||||||||||

| Common Stock | Noncontrolling Interests | |||||||||||||||||||||||||||

Additional | Offering | Accumulated | Shareholders’ | Hanover Square | Parkway | Operating | |||||||||||||||||||||||

Shares |

| Par Value |

| Paid in Capital |

|

| Costs |

| Deficit |

| Equity |

| Property |

| Property |

| Partnership |

| Total Equity | ||||||||||

Balance, January 1, 2022 | | $ | | $ | | $ | ( | $ | ( | $ | | $ | | $ | | $ | | $ | | ||||||||||

| |||||||||||||||||||||||||||||

Common stock issuances | | $ | | $ | | $ | — | $ | — | $ | | $ | — | $ | — | $ | — | $ | | ||||||||||

Common stock repurchases |

| ( | ( | ( | — | — | ( | — | — | — | ( | ||||||||||||||||||

Share based compensation |

| | | | — | — | | — | — | — | | ||||||||||||||||||

Net (loss) income |

| — | — | — | — | ( | ( | ( | | ( | ( | ||||||||||||||||||

Dividends and distributions |

| — | — | — | — | ( | ( | ( | ( | ( | ( | ||||||||||||||||||

Balance, March 31, 2022 |

| |

| $ | |

| $ | |

| $ | ( |

| $ | ( |

| $ | |

| $ | |

| $ | |

| $ | |

| $ | |

See notes to condensed consolidated financial statements

5

Medalist Diversified REIT, Inc. and Subsidiaries

Condensed Consolidated Statements of Cash Flows

(Unaudited)

Three months ended March 31, | ||||||

| 2023 |

| 2022 | |||

CASH FLOWS FROM OPERATING ACTIVITIES | ||||||

Net Loss | $ | ( | $ | ( | ||

Adjustments to reconcile consolidated net loss to net cash flows from operating activities |

|

| ||||

Depreciation |

| |

| | ||

Amortization |

| |

| | ||

Loan cost amortization |

| |

| | ||

Mandatorily redeemable preferred stock issuance cost and discount amortization | | | ||||

Above (below) market lease amortization, net |

| ( |

| ( | ||

Bad debt expense | | | ||||

Share-based compensation | — | | ||||

Impairment of assets held for sale |

| — |

| | ||

Loss on impairment | | | ||||

Changes in assets and liabilities |

|

| ||||

Rent and other receivables, net |

| |

| | ||

Unbilled rent |

| ( |

| ( | ||

Other assets |

| |

| ( | ||

Accounts payable and accrued liabilities |

| |

| | ||

Net cash flows from operating activities |

| |

| | ||

CASH FLOWS FROM INVESTING ACTIVITIES |

|

| ||||

Capital expenditures | ( | ( | ||||

Net cash flows from investing activities |

| ( |

| ( | ||

CASH FLOWS FROM FINANCING ACTIVITIES |

|

|

|

| ||

Dividends and distributions paid |

| ( |

| ( | ||

Repayment of mortgages payable | ( | ( | ||||

Proceeds from sales of common stock, net of capitalized offering costs | — | | ||||

Repurchases of common stock, including costs and fees |

| — |

| ( | ||

Net cash flows from financing activities |

| ( |

| | ||

(DECREASE) INCREASE IN CASH, CASH EQUIVALENTS AND RESTRICTED CASH |

| ( |

| | ||

CASH, CASH EQUIVALENTS AND RESTRICTED CASH, beginning of period |

| |

| | ||

CASH, CASH EQUIVALENTS AND RESTRICTED CASH, end of period | $ | | $ | | ||

CASH AND CASH EQUIVALENTS, end of period, shown in condensed consolidated balance sheets | | | ||||

RESTRICTED CASH including assets restricted for capital and operating reserves and tenant deposits, end of period, shown in condensed consolidated balance sheets | | | ||||

CASH, CASH EQUIVALENTS AND RESTRICTED CASH, end of period shown in the condensed consolidated statements of cash flows | $ | | $ | | ||

Supplemental Disclosures and Non-Cash Activities: |

|

| ||||

Other cash transactions: |

|

|

|

| ||

Interest paid | $ | | $ | | ||

See notes to condensed consolidated financial statements

6

Medalist Diversified REIT, Inc. and Subsidiaries

Notes to Condensed Consolidated Financial Statements

(Unaudited)

1. Organization and Basis of Presentation and Consolidation

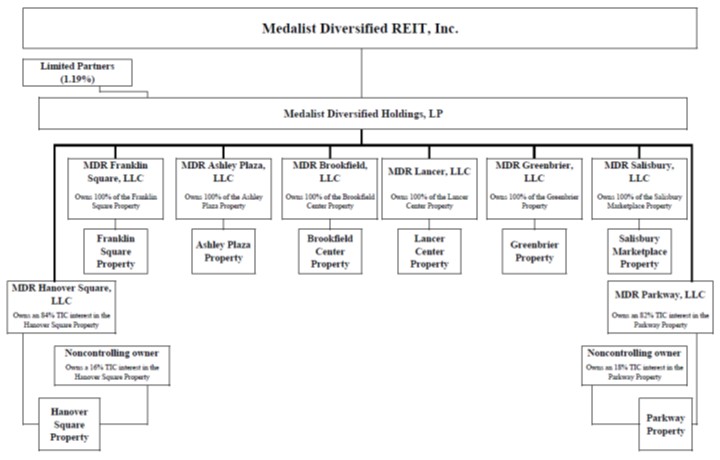

Medalist Diversified Real Estate Investment Trust, Inc. (the “REIT”) is a Maryland corporation formed on September 28, 2015. Beginning with the taxable year ended December 31, 2017, the REIT has elected to be taxed as a real estate investment trust for federal income tax purposes. The REIT serves as the general partner of Medalist Diversified Holdings, LP (the “Operating Partnership”) which was formed as a Delaware limited partnership on September 29, 2015. As of March 31, 2023, the REIT, through the Operating Partnership, owned and operated eight properties, including the Shops at Franklin Square, a

7

The use of the word “Company” refers to the REIT and its consolidated subsidiaries, except where the context otherwise requires. The Company includes the REIT, the Operating Partnership, wholly owned limited liability companies which own or operate the properties and, for the periods presented prior to September 30, 2022, the taxable REIT subsidiary which formerly operated the Clemson Best Western University Inn, a hotel with

The Company was formed to acquire, reposition, renovate, lease and manage income-producing properties, with a primary focus on (i) commercial properties, including flex-industrial, limited-service hotels, and retail properties, and (ii) multi-family residential properties in secondary and tertiary markets in the southeastern part of the United States, with an expected concentration in Virginia, North Carolina, South Carolina, Georgia, Florida and Alabama. The Company may also pursue, in an opportunistic manner, other real estate-related investments, including, among other things, equity or other ownership interests in entities that are the direct or indirect owners of real property, indirect investments in real property, such as those that may be obtained in a joint venture. While these types of investments are not intended to be a primary focus, the Company may make such investments in the discretion of Medalist Fund Manager, Inc. (the “Manager”).

The Company is externally managed by the Manager. The Manager makes all investment decisions for the Company. The Manager and its affiliated companies specialize in acquiring, developing, owning and managing value-added commercial real estate in the Mid-Atlantic and Southeast regions. The Manager oversees the Company’s overall business and affairs and has broad discretion to make operating decisions on behalf of the Company and to make investment decisions. The Company’s stockholders are not involved in its day-to-day affairs.

2. Summary of Significant Accounting Policies

Investment Properties

The Company has adopted Accounting Standards Update (“ASU”) 2017-01, Business Combinations (Topic 805), which clarifies the framework for determining whether an integrated set of assets and activities meets the definition of a business. The revised framework establishes a screen for determining whether an integrated set of assets and activities is a business and narrows the definition of a business, which is expected to result in fewer transactions being accounted for as business combinations. Acquisitions of integrated sets of assets and activities that do not meet the definition of a business are accounted for as asset acquisitions. As a result, all of the Company’s acquisitions to date qualified as asset acquisitions and the Company expects future acquisitions of operating properties to qualify as asset acquisitions. Accordingly, third-party transaction costs associated with these acquisitions have been and will be capitalized, while internal acquisition costs will continue to be expensed.

Accounting Standards Codification (“ASC”) 805 mandates that “an acquiring entity shall allocate the cost of an acquired entity to the assets acquired and liabilities assumed based on their estimated fair values at date of acquisition.” ASC 805 results in an allocation of acquisition costs to both tangible and intangible assets associated with income producing real estate. Tangible assets include land, buildings, site improvements, tenant improvements and furniture, fixtures and equipment, while intangible assets include the value of in-place leases, lease origination costs (leasing commissions and tenant improvements), legal and marketing costs and leasehold assets and liabilities (above or below market leases), among others.

The Company uses independent, third-party consultants to assist management with its ASC 805 evaluations. The Company determines fair value based on accepted valuation methodologies including the cost, market, and income capitalization approaches. The purchase price is allocated to the tangible and intangible assets identified in the evaluation.

8

The Company records depreciation on buildings and improvements utilizing the straight-line method over the estimated useful life of the asset, generally

Acquisition and closing costs are capitalized as part of each tangible asset on a pro rata basis. Improvements and major repairs and maintenance are capitalized when the repair and maintenance substantially extend the useful life, increases capacity or improves the efficiency of the asset. All other repair and maintenance costs are expensed as incurred.

The Company reviews investment properties for impairment on a property-by-property basis whenever events or changes in circumstances indicate that the carrying value of investment properties may not be recoverable, but at least annually. These circumstances include, but are not limited to, declines in the property’s cash flows, occupancy and fair market value. The Company measures any impairment of investment property when the estimated undiscounted cash flows plus its residual value, is less than the carrying value of the property. To the extent impairment has occurred, the Company charges to income the excess of the carrying value of the property over its estimated fair value. The Company estimates fair value using unobservable data such as projected future operating income, estimated capitalization rates, or multiples, leasing prospects and local market information. The Company may decide to sell properties that are held for use and the sale prices of these properties may differ from their carrying values.

Other than the tenant-specific losses on impairment and the impairment of assets held for sale described below, the Company did not record any impairment adjustments to its investment properties resulting from events or changes in circumstances during the three months ended March 31, 2023 and 2022, that would result in the projected value being below the carrying value of the Company’s properties.

Assets Held for Sale

The Company may decide to sell properties that are held as investment properties. The accounting treatment for the disposal of long-lived assets is covered by ASC 360. Under this guidance, the Company records the assets associated with these properties, and any associated mortgages payable, as held for sale when management has committed to a plan to sell the assets, actively seeks a buyer for the assets, and the consummation of the sale is considered probable and is expected within one year. Delays in the time required to complete a sale do not preclude a long-lived asset from continuing to be classified as held for sale beyond the initial one-year period if the delay is caused by events or circumstances beyond an entity’s control and there is sufficient evidence that the entity remains committed to a qualifying plan to sell the long-lived asset.

Properties classified as held for sale are reported at the lower of their carrying value or their fair value, less estimated costs to sell. When the carrying value exceeds the fair value, less estimated costs to sell, an impairment charge is recognized. The Company determines fair value based on the three-level valuation hierarchy for fair value measurement. Level 1 inputs are quoted prices in active markets for identical assets or liabilities. Level 2 inputs are quoted prices for similar assets or liabilities in active markets; quoted prices for identical or similar assets in markets that are not active; and inputs other than quoted prices. Level 3 inputs are unobservable inputs that are supported by little or no market activity and that are significant to the fair value of the assets or liabilities.

During February 2021, the Company committed to a plan for the sale of an asset group associated with the Clemson Best Western Hotel Property that included the land, site improvements, building, building improvements and furniture, fixtures and equipment. As of March 31, 2021, the Company recorded this asset group, and the associated mortgage payable, as held for sale. As of March 31, 2021, the date the Company originally recorded this asset group as held for sale, the Company determined that the fair value of the Clemson Best Western Property exceeded the carrying value of its asset group, and the Company did not record impairment of assets held for sale associated with this asset group.

During subsequent periods since the asset group associated with the Clemson Best Western Property was initially classified as held for sale, the Company continued to follow its disposal plan. Under ASC 360, during subsequent reporting periods after the asset group is classified as held for sale, it is necessary to evaluate the amounts previously used for the estimated fair value of the asset group. Up to and including the reporting periods ending December 31, 2021, the Company reviewed and reassessed the estimated fair value of the asset group and believed that the fair value, less estimated costs to sell, exceeds the Company’s carrying cost in the property.

9

Accordingly, the Company did not record impairment of assets held for sale related to the Clemson Best Western Property for the year ended December 31, 2021.

As of March 31, 2022, the Company determined that the carrying value of the asset group associated with the Clemson Best Western Hotel Property exceeded its fair value, less estimated costs to sell, and recorded impairment of assets held for sale of $

On September 29, 2022, the Company closed on the sale of the Clemson Best Western Hotel Property to an unaffiliated purchaser. See Note 3 for additional details.

Intangible Assets and Liabilities, net

The Company determines, through the ASC 805 evaluation, the above and below market lease intangibles upon acquiring a property. Intangible assets (or liabilities) such as above or below-market leases and in-place lease value are recorded at fair value and are amortized as an adjustment to rental revenue or amortization expense, as appropriate, over the remaining terms of the underlying leases. The Company amortizes amounts allocated to tenant improvements, in-place lease assets and other lease-related intangibles over the remaining life of the underlying leases. The analysis is conducted on a lease-by-lease basis.

The Company reviews its intangible assets for impairment whenever events or changes in circumstances indicate that the carrying value of its intangible assets may not be recoverable, but at least annually. During the three months ended March 31, 2023, a tenant defaulted on its lease and abandoned its premises. The Company determined that the carrying value of the intangible assets and liabilities, net, associated with this lease of $

Details of the deferred costs, net of amortization, arising from the Company’s purchases of its retail center properties and flex center properties are as follows:

March 31, 2023 |

| ||||||

| (unaudited) |

| December 31, 2022 |

| |||

Intangible Assets, net | |||||||

Leasing commissions | $ | | $ | | |||

Legal and marketing costs |

| |

| | |||

Above market leases |

| |

| | |||

Net leasehold asset |

| |

| | |||

$ | | $ | | ||||

Intangible Liabilities, net |

|

| |||||

Below market leases | $ | ( | $ | ( | |||

Capitalized above-market lease values are amortized as a reduction of rental income over the remaining terms of the respective leases. Capitalized below-market lease values are amortized as an increase to rental income over the remaining terms of the respective leases. Adjustments to rental revenue related to the above and below market leases during the three months ended March 31, 2023 and 2022, respectively, were as follows:

10

For the three months ended |

| ||||||

March 31, | |||||||

2023 | 2022 | ||||||

| (unaudited) |

| (unaudited) |

| |||

Amortization of above market leases | $ | ( | $ | ( | |||

Amortization of below market leases |

| |

| | |||

$ | | $ | | ||||

Amortization of lease origination costs, leases in place and legal and marketing costs represent a component of depreciation and amortization expense. Amortization related to these intangible assets during the three months ended March 31, 2023 and 2022, respectively, were as follows:

For the three months ended |

| ||||||

March 31, | |||||||

2023 | 2022 | ||||||

| (unaudited) |

| (unaudited) |

| |||

Leasing commissions | $ | ( | $ | ( | |||

Legal and marketing costs |

| ( |

| ( | |||

Net leasehold asset |

| ( |

| ( | |||

$ | ( | $ | ( | ||||

As of March 31, 2023 and December 31, 2022, the Company’s accumulated amortization of lease origination costs, leases in place and legal and marketing costs totaled $

Future amortization of above and below market leases, lease origination costs, leases in place, legal and marketing costs and tenant relationships is as follows:

| For the | ||||||||||||||||||||

remaining nine | |||||||||||||||||||||

months ending | |||||||||||||||||||||

December 31, | |||||||||||||||||||||

2023 |

| 2024 |

| 2025 |

| 2026 |

| 2027 |

| 2028-2042 |

| Total | |||||||||

Intangible Assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||

Leasing commissions | $ | | $ | | $ | | $ | | $ | | $ | | $ | | |||||||

Legal and marketing costs |

| |

| |

| |

| |

| |

| |

| | |||||||

Above market leases |

| |

| |

| |

| |

| |

| |

| | |||||||

Net leasehold asset |

| |

| |

| |

| |

| |

| |

| | |||||||

$ | | $ | | $ | | $ | | $ | | $ | | $ | | ||||||||

Intangible Liabilities |

|

|

|

|

|

|

| ||||||||||||||

Below market leases, net | $ | ( | $ | ( | $ | ( | $ | ( | $ | ( | $ | ( | $ | ( | |||||||

Conditional Asset Retirement Obligation

A conditional asset retirement obligation represents a legal obligation to perform an asset retirement activity in which the timing and/or method of settlement depends on a future event that may or may not be within the Company’s control. Currently, the Company does not have any conditional asset retirement obligations. However, any such obligations identified in the future would result in the Company recording a liability if the fair value of the obligation can be reasonably estimated. Environmental studies conducted at the time the Company acquired its properties did not reveal any material environmental liabilities, and the Company is unaware of any subsequent environmental matters that would have created a material liability.

The Company believes that its properties are currently in material compliance with applicable environmental, as well as non-environmental, statutory and regulatory requirements. The Company did not record any conditional asset retirement obligation liabilities during the three months ended March 31, 2023 and 2022, respectively.

11

Cash and Cash Equivalents and Restricted Cash

The Company considers all highly liquid investments purchased with an original maturity of 90 days or less to be cash and cash equivalents. Cash equivalents are carried at cost, which approximates fair value. Cash equivalents consist primarily of bank operating accounts and money markets. Financial instruments that potentially subject the Company to concentrations of credit risk include its cash and equivalents and its trade accounts receivable.

The Company places its cash and cash equivalents and any restricted cash held by the Company on deposit with financial institutions in the United States which are insured by the Federal Deposit Insurance Company ("FDIC") up to $

Restricted cash represents (i) amounts held by the Company for tenant security deposits, (ii) escrow deposits held by lenders for real estate tax, insurance, and operating reserves, (iii) an escrow for the first year of dividends on the Company’s mandatorily redeemable preferred stock, and (iv) capital reserves held by lenders for investment property capital improvements.

Tenant security deposits are restricted cash balances held by the Company to offset potential damages, unpaid rent or other unmet conditions of its tenant leases. As of March 31, 2023 and December 31, 2022, the Company reported $

Escrow deposits are restricted cash balances held by lenders for real estate taxes, insurance and other operating reserves. As of March 31, 2023 and December 31, 2022, the Company reported $

Capital reserves are restricted cash balances held by lenders for capital improvements, leasing commissions furniture, fixtures and equipment, and tenant improvements. As of March 31, 2023 and December 31, 2022, the Company reported $

March 31, 2023 | December 31, | ||||||

Property and Purpose of Reserve |

| (unaudited) |

| 2022 | |||

Franklin Square Property - leasing costs | $ | | $ | | |||

Brookfield Center Property - maintenance and leasing cost reserve |

| |

| | |||

Total | $ | | $ | | |||

Share Retirement

ASC 505-30-30-8 provides guidance on accounting for share retirement and establishes two alternative methods for accounting for the repurchase price paid in excess of par value. The Company has elected the method by which the excess between par value and the repurchase price, including costs and fees, is recorded to additional paid in capital on the Company’s condensed consolidated balance sheets. During the three months ended March 31, 2022, the Company repurchased

12

Revenue Recognition

Retail and Flex Center Property Revenues

The Company recognizes minimum rents from its retail center properties and flex center properties on a straight-line basis over the terms of the respective leases which results in an unbilled rent asset being recorded on the condensed consolidated balance sheets. As of March 31, 2023 and December 31, 2022, the Company reported $

The Company’s leases generally require the tenant to reimburse the Company for a substantial portion of its expenses incurred in operating, maintaining, repairing, insuring and managing the shopping center and common areas (collectively defined as Common Area Maintenance or “CAM” expenses). The Company includes these reimbursements, along with other revenue derived from late fees and seasonal events, on the condensed consolidated statements of operations under the captions "Retail center property revenues” and “Flex center property revenues.” (See Recent Accounting Pronouncements, below.) This significantly reduces the Company’s exposure to increases in costs and operating expenses resulting from inflation or other outside factors. The Company accrues reimbursements from tenants for recoverable portions of all these expenses as revenue in the period the applicable expenditures are incurred. The Company calculates the tenant’s share of operating costs by multiplying the total amount of the operating costs by a fraction, the numerator of which is the total number of square feet being leased by the tenant, and the denominator of which is the average total square footage of all leasable buildings at the property. The Company also receives payments for these reimbursements from substantially all its tenants on a monthly basis throughout the year.

The Company recognizes differences between previously estimated recoveries and the final billed amounts in the year in which the amounts become final. Since these differences are determined annually under the leases and accrued as of December 31 in the year earned, no such revenues were recognized during the three months ended March 31, 2023 and 2022.

The Company recognizes lease termination fees in the period that the lease is terminated and collection of the fees is reasonably assured. Upon early lease termination, the Company provides for losses related to unrecovered intangibles and other assets. During the three months ended March 31, 2023 and 2022, respectively, no such termination costs were recognized.

Hotel Property Revenues

Hotel revenues from the Clemson Best Western Property were recognized as earned, which is generally defined as the date upon which a guest occupies a room or utilizes the hotel’s services. Revenues from the Company’s occupancy agreement with Clemson University were recognized as earned, which is as rooms are occupied or otherwise reserved for use by the University. The Clemson University occupancy agreement ended on May 15, 2022 and the Company sold the Clemson Best Western Property on September 29, 2022.

The Clemson Best Western Property was required to collect certain taxes and fees from customers on behalf of government agencies and remit them back to the applicable governmental agencies on a periodic basis. The Clemson Best Western Property had a legal obligation to act as a collection agent. The Clemson Best Western Property did not retain these taxes and fees; therefore, they were not included in revenues. The Clemson Best Western Property recorded a liability when the amounts were collected and relieved the liability when payments were made to the applicable taxing authority or other appropriate governmental agency.

Hotel Property Operating Expenses

All personnel of the Clemson Best Western Property were directly or indirectly employees of Marshall Hotels and Resorts, Inc. (“Marshall”), the Company’s hotel management firm. In addition to fees and services discussed above, the Clemson Best Western Property reimbursed Marshall for all employee related service costs, including payroll salaries and wages, payroll taxes and other employee benefits paid by Marshall on its behalf. The total amounts incurred for payroll salaries and wages, payroll taxes and other employee benefits for the three months ended March 31, 2023 and 2022 were $

13

Rent and other receivables

Rent and other receivables include tenant receivables related to base rents and tenant reimbursements. Rent and other receivables do not include receivables attributable to recording rents on a straight-line basis, which are included in unbilled rent, discussed above. The Company determines an allowance for the uncollectible portion of accrued rents and accounts receivable based upon customer credit worthiness (including expected recovery of a claim with respect to any tenants in bankruptcy), historical bad debt levels, and current economic trends. The Company considers a receivable past due once it becomes delinquent per the terms of the lease. A past due receivable triggers certain events such as notices, fees and other allowable and required actions per the lease. As of March 31, 2023 and December 31, 2022, the Company’s allowance for uncollectible rent totaled $

Income Taxes

Beginning with the Company’s taxable year ended December 31, 2017, the REIT has elected to be taxed as a real estate investment trust for federal income tax purposes under Sections 856 through 860 of the Internal Revenue Code and applicable Treasury regulations relating to REIT qualification. In order to maintain this REIT status, the regulations require the Company to distribute at least

During the three months ended March 31, 2022, the Company's Clemson Best Western TRS entity generated taxable income. The Company believed that the net operating loss carry forward from prior years would offset the taxable income for the three months ended March 31, 2022, so

Management has evaluated the effect of the guidance provided by GAAP on Accounting for Uncertainty of Income Taxes and has determined that the Company had no uncertain income tax positions.

Use of Estimates

The Company has made estimates and assumptions that affect the reported amounts of assets and liabilities, disclosure of contingent assets and liabilities at the date of the condensed consolidated financial statements, and revenues and expenses during the reported period. The Company’s actual results could differ from these estimates.

Noncontrolling Interests

The ownership interests not held by the REIT are considered noncontrolling interests. There are three elements of noncontrolling interests in the capital structure of the Company. These noncontrolling interests have been reported in equity on the condensed consolidated balance sheets but separate from the Company’s equity. On the condensed consolidated statements of operations, the subsidiaries are reported at the consolidated amount, including both the amount attributable to the Company and noncontrolling interests. The Company’s condensed consolidated statements of changes in stockholders’ equity includes beginning balances, activity for the period and ending balances for shareholders’ equity, noncontrolling interests and total equity.

The first noncontrolling interest is in the Hanover Square Property in which the Company owns an

The second noncontrolling interest is in the Parkway Property in which the Company owns an

14

allocated to the noncontrolling ownership interest based on its

The third noncontrolling ownership interest are the units in the Operating Partnership that are not held by the REIT. In 2017,

The Operating Partnership units not held by the REIT represent

During the three months ended March 31, 2023, a weighted average of

Recent Accounting Pronouncements

Since its initial public offering, the Company has elected to be classified as an emerging growth company in its periodic reporting to the U.S. Securities and Exchange Commission (the “SEC”), and accordingly has followed the private company implementation dates for new accounting pronouncements. Effective for the three months ending March 31, 2023, the Company will no longer be classified as an emerging growth company, but will retain its classification as a smaller reporting company and therefore follow implementation dates applicable to smaller reporting companies with respect to new accounting pronouncements. In addition, the Company has elected to follow scaled disclosure requirements applicable to smaller reporting companies.

Recently Adopted Accounting Pronouncements

Accounting for Leases

In February 2016, the Financial Accounting Standards Board (“FASB”) issued ASU 2016-02, Leases (Topic 842). The amendments in this update govern a number of areas including, but not limited to, accounting for leases, replacing the existing guidance in ASC No. 840, Leases. Under this standard, among other changes in practice, a lessee’s rights and obligations under most leases, including existing and new arrangements, must be recognized as assets and liabilities, respectively, on the balance sheets. Other significant provisions of this standard include (i) defining the “lease term” to include the non-cancelable period together with periods for which there is a significant economic incentive for the lessee to extend or not terminate the lease; (ii) defining the initial lease liability to be recorded on the balance sheets to contemplate only those variable lease payments that depend on an index or that are in substance “fixed,” (iii) a dual approach for determining whether lease expense is recognized on a straight-line or accelerated basis, depending on whether the lessee is expected to consume more than an insignificant portion of the leased asset’s economic benefits and (iv) a requirement to bifurcate certain lease and non-lease components. The lease standard was effective for public companies for fiscal years beginning after December 15, 2018 (including interim periods within those fiscal years) and for private companies, fiscal years beginning after December 15, 2019, with early adoption permitted. The FASB subsequently deferred the effective date of ASU 2016-02 for private companies by one year, to fiscal years beginning after December 15, 2020, to provide those companies with additional time to address various implementation challenges and complexities. In June 2020, the FASB further deferred the effective date due to the effects on private companies from business and capital market disruptions caused by the novel coronavirus (“COVID-19”) pandemic. Following those deferrals, ASU 2016-02 became effective for private companies for fiscal years beginning after December 15, 2021, and for

15

interim periods within fiscal years beginning after December 15, 2022. The Company adopted the standard effective on January 1, 2022 using the modified retrospective approach within ASU 2018-11, which allows for the application date to be the beginning of the reporting period in which the entity first applies the new standard. The Company historically has not been and is not currently a “lessee” under any lease agreements, and thus did not have any arrangements requiring the recognition of lease assets or liabilities on its balance sheet.

As a “lessor”, the Company has active lease agreements with over 100 tenants across its portfolio of investment properties. On a prospective and retrospective basis, the accounting for those leases under ASU 2016-02 (ASC No. 842) is substantially unchanged from the previous guidance in ASC No. 840. However, upon the adoption of ASC No. 842, the Company has elected the practical expedient permitting lessors to elect by class of underlying asset to not separate non-lease components (for example, maintenance services, including common area maintenance) from associated lease components (the “non-separation practical expedient”) if both of the following criteria are met: (1) the timing and pattern of transfer of the lease and non-lease component(s) are the same and (2) the lease component would be classified as an operating lease if it were accounted for separately. If both criteria are met, the combined component is accounted for in accordance with ASC No. 842 if the lease component is the predominant component of the combined component; otherwise, the combined component is accounted for in accordance with the revenue recognition standard. Prior to the adoption of ASC No. 842, the Company separated lease-related revenue from its retail center and flex center properties into two components. Fixed rental payments under its leases (recognized on a straight-line basis over the term of the underlying lease) were recorded as retail center property revenues and flex center property revenues. Variable payments under the leases made by tenants for real estate taxes, insurance and common area maintenance (“CAM”) expenses were recorded as retail center and flex center tenant reimbursements. With the adoption of ASC No. 842, the Company determined that its retail center and flex center operating leases qualify for the non-separation practical expedient based on the guidance. As a result, the Company has accounted for and presented the revenues from these leases, including tenant reimbursements, as a single line item on its condensed consolidated statements of operations.

Debt With Conversion Options

In August 2020, the FASB issued ASU 2020-06, Debt - Debt With Conversion and Other Options (Subtopic 470-20) and Derivatives and Hedging - Contracts in an Entity’s Own Equity (Subtopic 815-40): Accounting for Convertible Instruments and Contracts in an Entity’s Own Equity. The objective of ASU 2020-06 is to reduce the current complexity involved in accounting for convertible financial instruments by reducing the number of accounting models applicable to those instruments in the existing guidance. Following the adoption of ASU 2020-06, companies are expected to encounter fewer instances in which a convertible financial instrument must be separated into a debt or equity component and a derivative component for accounting purposes due to the embedded conversion feature. As a result of these revisions, debt instruments issued with a beneficial conversion feature will no longer require separation and thus will be accounted for as a single debt instrument under the updated guidance. In addition to those changes, ASU 2020-06 adds several incremental financial statement disclosures with respect to a company’s convertible financial instruments and makes certain refinements with respect to calculating the effect of those instruments on a company’s diluted earnings per share. ASU 2020-06 is effective for public companies for fiscal years beginning after December 15, 2021 (including interim periods within those fiscal years), and for private companies, fiscal years beginning after December 15, 2022. Early adoption of the guidance is permitted, but no earlier than fiscal years beginning after December 15, 2020. The updated guidance in ASU 2020-06 was adopted effective January 1, 2023, which did not have a material impact on the Company’s condensed consolidated financial statements.

Credit Losses on Financial Instruments

In June 2016, the FASB issued ASU 2016-13, Financial Instruments - Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments. This update enhances the methodology of measuring expected credit losses to include the use of forward-looking information to better calculate credit loss estimates. The guidance applies to most financial assets measured at amortized cost and certain other instruments, such as accounts receivable and loans; however, it does not apply to receivables arising from operating leases accounted for in accordance with ASC Topic 842. ASU 2016-13 requires that the Company estimate the lifetime expected credit loss with respect to applicable receivables and record allowances that, when deducted from the balance of the receivables, represent the net amounts expected to be collected. The Company is also required to disclose information about how it developed the allowances, including changes in the factors that influenced the Company’s estimate of expected credit losses and the reasons for those changes. The Company’s credit losses primarily arise from tenant defaults on amounts due under operating leases. As noted, these losses are not subject to the guidance in ASU 2016-13, and historically have not been significant. The Company adopted the update on the required effective date of January 1, 2023, which did not have a material impact on the Company’s condensed consolidated financial statements.

16

Upcoming Accounting Pronouncements

Effects of Reference Rate Reform

In March 2020, the FASB issued ASU 2020-04, Reference Rate Reform (Topic 848): Facilitation of the Effects of Reference Rate Reform on Financial Reporting. The London Interbank Offered Rate (LIBOR), which is widely used as a reference interest rate in debt agreements and other contracts, was effectively discontinued for new contracts as of December 31, 2021, and its publication for existing contracts is scheduled to be discontinued by June 30, 2023. Financial market regulators in certain jurisdictions throughout the world undertook reference rate reform initiatives to guide the transition and modification of debt agreements and other contracts that are based on LIBOR to the successor reference rate that will replace it. ASU 2020-04 was issued to provide companies that are impacted by these changes with the opportunity to elect certain expedients and exceptions that are intended to ease the potential burden of accounting for or recognizing the effects of reference rate reform on financial reporting. Under ASU 2020-04, companies may generally elect to make use of the expedients and exceptions provided therein for any reference rate contract modifications that occur in reporting periods that encompass the timeline from March 12, 2020 to December 31, 2022. The FASB subsequently issued ASU 2022-06, Reference Rate Reform (Topic 848): Deferral of the Sunset of Topic 848, to extend that timeline from December 31, 2022 to December 31, 2024. The Company’s Parkway Property is financed by a mortgage loan with a corresponding interest rate protection agreement which both use USD LIBOR as the reference interest rate (see Note 5, below). The mortgage loan matures on November 1, 2031, and the interest rate protection agreement expires on December 1, 2026. The Company is continuing to review the guidance in ASU 2020-04 and anticipates that it will use the expedients and exceptions provided therein with respect to the replacement of USD LIBOR as the reference rate in the Parkway Property mortgage loan and corresponding interest rate protection agreement. However, the Company does not expect that any changes under ASU 2020-04 will have a material impact on its condensed consolidated financial statements.

Evaluation of the Company’s Ability to Continue as a Going Concern

Under the accounting guidance related to the presentation of financial statements, the Company is required to evaluate, on a quarterly basis, whether or not the entity’s current financial condition, including its sources of liquidity at the date that the condensed consolidated financial statements are issued, will enable the entity to meet its obligations as they come due arising within one year of the date of the issuance of the Company’s condensed consolidated financial statements and to make a determination as to whether or not it is probable, under the application of this accounting guidance, that the entity will be able to continue as a going concern. The Company’s condensed consolidated financial statements have been presented on a going concern basis, which contemplates the realization of assets and the satisfaction of liabilities in the normal course of business.

In applying applicable accounting guidance, management considered the Company’s current financial condition and liquidity sources, including current funds available, forecasted future cash flows, the Company’s obligations due over the next twelve months as well as the Company’s recurring business operating expenses.

The Company concludes that it is probable that the Company will be able to meet its obligations arising within one year of the date of issuance of these condensed consolidated financial statements within the parameters set forth in the accounting guidance.

17

3. Investment Properties

Investment properties consist of the following:

March 31, 2023 | December 31, | ||||||

| (unaudited) |

| 2022 | ||||

Land | $ | | $ | | |||

Site improvements |

| |

| | |||

Buildings and improvements (1) |

| |

| | |||

Investment properties at cost (2) |

| |

| | |||

Less accumulated depreciation |

| |

| | |||

Investment properties, net | $ | | $ | |

| (1) | Includes tenant improvements (both those acquired as part of the acquisition of the properties and those constructed after the properties’ acquisition), capitalized leasing commissions and other capital costs incurred post-acquisition. |

| (2) | Excludes intangible assets and liabilities (see Note 2, above, for a discussion of the Company's accounting treatment of intangible assets), escrow deposits and property reserves. |

The Company’s depreciation expense on investment properties was $

Capitalized tenant improvements

The Company carries two categories of capitalized tenant improvements on its condensed consolidated balance sheets, both of which are recorded under investment properties, net, on the Company’s condensed consolidated balance sheets. The first category is the allocation of acquisition costs to tenant improvements that is recorded on the Company’s condensed consolidated balance sheet as of the date of the Company’s acquisition of the investment property. The second category are tenant improvement costs incurred and paid by the Company subsequent to the acquisition of the investment property. Both are recorded as a component of investment properties on the Company’s condensed consolidated balance sheets. Depreciation expense on both categories of tenant improvements is recorded as a component of depreciation expense on the Company’s condensed consolidated statement of operations.

The Company generally records depreciation of capitalized tenant improvements on a straight-line basis over the terms of the related leases. Details of these deferred costs, net of depreciation are as follows:

March 31, | |||||||

2023 | December 31, | ||||||

| (unaudited) |

| 2022 | ||||

Capitalized tenant improvements – acquisition cost allocation, net | $ | | $ | | |||

Capitalized tenant improvements incurred subsequent to acquisition, net |

| |

| | |||

Depreciation of capitalized tenant improvements arising from the acquisition cost allocation was $

During the three months ended March 31, 2023 and 2022, the Company recorded $

18

Capitalized leasing commissions

The Company carries two categories of capitalized leasing commissions on its condensed consolidated balance sheets. The first category is the allocation of acquisition costs to leasing commissions that is recorded as an intangible asset (see Note 2, above, for a discussion of the Company’s accounting treatment for intangible assets) on the Company’s condensed consolidated balance sheet as of the date of the Company’s acquisition of the investment property. The second category is leasing commissions incurred and paid by the Company subsequent to the acquisition of the investment property. These costs are carried on the Company’s condensed consolidated balance sheets under investment properties.

The Company generally records depreciation of capitalized leasing commissions on a straight-line basis over the terms of the related leases. Details of these deferred costs, net of depreciation are as follows:

March 31, 2023 | December 31, | ||||||

(unaudited) | 2022 | ||||||

Capitalized leasing commissions, net |

| $ | |

| $ | | |

During the three months ended March 31, 2023 and 2022, the Company recorded $

Sale of investment properties

The Company reports properties that have been either previously disposed or that are currently held for sale in continuing operations in the Company's condensed consolidated statements of operations if the disposition, or anticipated disposition, of the assets does not represent a shift in the Company's investment strategy. The Company's sale of the Clemson Best Western Hotel Property does not constitute a change in the Company's investment strategy, which continues to include limited-service hotels as a targeted asset class.

Operating results of the Clemson Best Western Hotel Property, which was sold on September 29, 2022 and which are included in continuing operations, are as follows:

| For the three months ended |

| |||||

March 31, | |||||||

2023 | 2022 | ||||||

| (unaudited) |

| (unaudited) |

| |||

Hotel property room revenues | $ | — | $ | | |||

Hotel property other revenues |

| — |

| | |||

Total Revenue | — | | |||||

Hotel property operating expenses | — | | |||||

Impairment of assets held for sale |

| — |

| | |||

Total Operating Expenses | — | | |||||

Operating Income | — | | |||||

Interest expense |

| — |

| | |||

Net Income from Operations | — | | |||||

Other income |

| — |

| | |||

Net Income | — | | |||||

Net income attributable to Operating Partnership noncontrolling interests |

| — |

| | |||

Net Income Attributable to Medalist Common Shareholders | $ | — | $ | | |||

2022 Property Acquisitions

On June 13, 2022, the Company completed its acquisition of the Salisbury Marketplace Property, a

19

new mortgage debt. The Company’s total investment was $

Salisbury | |||

Marketplace | |||

| Property | ||

Fair value of assets acquired: | |||

Investment property (a) | $ | | |

Lease intangibles and other assets (b) | | ||

Above market leases (b) | | ||

Below market leases (b) | ( | ||

Fair value of net assets acquired (c) | $ | | |

Purchase consideration: | |||

Consideration paid with cash (d) | $ | | |

Consideration paid with new mortgage debt, net (e) |

| | |

Total consideration (f) | $ | |

| a. | Represents the fair value of the investment property acquired which includes land, buildings, site improvements, tenant improvements and furniture, fixtures and equipment. The fair value was determined using the market approach, the cost approach, the income approach or a combination thereof. Closing and acquisition costs were allocated and added to the fair value of the tangible assets acquired. |

| b. | Represents the fair value of lease intangibles and other assets. Lease intangibles include leasing commissions, leases in place, above market leases, below market leases and legal and marketing costs associated with replacing existing leases. |

| c. | Represents the total fair value of assets and liabilities acquired at closing. |

| d. | Represents cash paid at closing and cash paid for acquisition (including intangible assets), and closing costs paid at closing or directly by the Company outside of closing. |

| e. | Represents allocation of the Wells Fargo Mortgage Facility proceeds used to fund the purchase of the Salisbury Marketplace Property, net of $ |

| f. | Represents the consideration paid for the fair value of the assets and liabilities acquired. |

4. Mandatorily Redeemable Preferred Stock

On February 19, 2020, the Company issued and sold

The mandatorily redeemable preferred stock has an aggregate liquidation preference of $

If outstanding on February 19, 2025, the mandatorily redeemable preferred stock must be redeemed by the Company on that date, the fifth anniversary of the date of issuance. Beginning on February 19, 2022, the second anniversary of the issuance, the Company may redeem the outstanding mandatorily redeemable preferred stock for an amount equal to its aggregate liquidation preference, plus any accrued but unpaid dividends. The holders of the mandatorily redeemable preferred stock may also require the Company to redeem

20

the stock upon a change of control of the Company for an amount equal to its aggregate liquidation preference plus any accrued and unpaid dividends thereon.

Holders of the mandatorily redeemable preferred stock generally have no voting rights. However, if the Company does not pay dividends on the mandatorily redeemable preferred stock for

The Company has classified the mandatorily redeemable preferred stock as a liability in accordance with ASC Topic No. 480, “Distinguishing Liabilities from Equity,” which states that mandatorily redeemable financial instruments should be classified as liabilities and therefore the related dividend payments are treated as a component of interest expense in the accompanying condensed consolidated statements of operations (see Note 5, below, for a discussion of interest expense associated with the mandatorily redeemable preferred stock).

For all periods the mandatorily redeemable preferred stock has been outstanding, the Company has paid a cash dividend on the stock equal to

|

| Amount |

| ||||

Payment Date | Record Date | per share | For the period | ||||

April 27, 2020 | April 24, 2020 | $ | |

| February 19, 2020 - April 27, 2020 | ||

July 24, 2020 | July 22, 2020 |

| |

| April 28, 2020 - July 24, 2020 | ||

October 26, 2020 | October 23, 2020 |

| |

| July 25, 2020 - October 26, 2020 | ||

February 1, 2021 | January 29, 2021 |

| |

| October 27, 2020 - February 1, 2021 | ||

April 30, 2021 | April 26, 2021 | | February 2, 2021 – April 30, 2021 | ||||

July 26, 2021 | July 12, 2021 | | May 1, 2021 - July 26, 2021 | ||||

October 27, 2021 | October 25, 2021 | | July 27, 2021 – October 26, 2021 | ||||

January 20, 2022 | January 13, 2022 | | October 27, 2021 – January 19, 2022 | ||||

April 21, 2022 | April 18, 2022 | | January 20, 2022 - April 20, 2022 | ||||

July 21, 2022 | July 18, 2022 | | April 21, 2022 - July 20, 2022 | ||||

October 20, 2022 | October 17, 2022 | | July 21, 2022 - October 19, 2022 | ||||

January 27, 2023 | January 24, 2023 | | October 20, 2022 - January 19, 2023 | ||||

April 28, 2023 | April 25, 2023 | | January 20, 2023 - April 20, 2023 | ||||

As of March 31, 2023 and December 31, 2022, the Company recorded $

The mandatorily redeemable preferred stock was issued at $

21

Amortization of the discount and deferred financing costs related to the mandatorily redeemable preferred stock totaling $

5. Loans Payable

Mortgages Payable

The Company’s mortgages payables, net consists of the following:

March 31, | ||||||||||||||

Monthly | Interest | 2023 | December 31, | |||||||||||

Property |

| Payment |

| Rate |

| Maturity |

| (unaudited) |

| 2022 | ||||

Franklin Square (a) |

|

| | % | $ | | $ | | ||||||

Hanover Square (b) |

| $ | |

| | % |

| |

| | ||||

Ashley Plaza (c) | $ | |

| | % |

| |

| | |||||

Brookfield Center (d) | $ | | | % | | | ||||||||

Parkway Center (e) | $ | | Variable | | | |||||||||

Wells Fargo Facility (f) | $ | | % | | | |||||||||

Unamortized issuance costs, net | ( | ( | ||||||||||||

Total mortgages payable, net |

|

|

|

| $ | | $ | | ||||||

| (a) | The original mortgage loan for the Franklin Square Property in the amount of $ |

| (b) | The mortgage loan for the Hanover Square Property bore interest at a fixed rate of |

| (c) | The mortgage loan for the Ashley Plaza Property bears interest at a fixed rate of |

| (d) | The mortgage loan for the Brookfield Property bears interest at a fixed rate of |

22

| (e) | The mortgage loan for the Parkway Property bears interest at a variable rate based on LIBOR with a minimum rate of |

| (f) | On June 13, 2022, the Company entered into a mortgage loan facility with Wells Fargo Bank (the “Wells Fargo Mortgage Facility”) in the principal amount of $ |

The Company refinanced the mortgage loan for the Lancer Center Property using proceeds from the Wells Fargo Facility. The Company accounted for this refinancing transaction under debt extinguishment accounting in accordance with ASC 470, and for the year ended December 31, 2022, recorded a loss on extinguishment of debt of $

The Company refinanced the mortgage loan for the Greenbrier Business Center Property using proceeds from the Wells Fargo Facility. The Company accounted for this refinancing transaction under debt extinguishment accounting in accordance with ASC 470, and for the year ended December 31, 2022, recorded a loss on extinguishment of debt of $

Interest rate protection transaction

On October 28, 2021, the Company entered into the Interest Rate Protection Transaction. Under this agreement, the Company’s interest rate exposure is

23

Interest Rate Protection Transaction was $

Wells Fargo Line of Credit

On June 13, 2022, the Company, through its wholly owned subsidiaries, entered into a loan agreement with Wells Fargo Bank for a $

Interest expense

Interest expense, including amortization of capitalized issuance costs consists of the following:

| |||||||||||||||

| For the three months ended March 31, 2023 (unaudited) | ||||||||||||||

|

| Amortization |

| Interest rate |

|

| |||||||||

| Mortgage | of discounts and | protection | Other | |||||||||||

| Interest | capitalized | transaction | interest | |||||||||||

| Expense |

| issuance costs |

| payments |

| expense |

| Total | ||||||

Franklin Square mortgage | $ | |

| $ | |

| $ | — |

| $ | — |

| $ | | |

Hanover Square mortgage |

| |

| |

| — |

| — |

| | |||||

Ashley Plaza mortgage |

| |

| |

| — |

| — |

| | |||||

Brookfield Center mortgage |

| |

| |

| — |

| — |

| | |||||

Parkway Center mortgage | | | ( | — | | ||||||||||

Wells Fargo Mortgage Facility | | | — | — | | ||||||||||

Amortization and preferred stock dividends on mandatorily redeemable preferred stock | — | | — | | | ||||||||||

Total interest expense | $ | | $ | | $ | ( | $ | | $ | | |||||

| ||||||||||||

For the three months ended March 31, 2022 (unaudited) | ||||||||||||

|

| Amortization |

|

| ||||||||

| Mortgage | of discounts and | Other | |||||||||

| Interest | capitalized | interest | |||||||||

| Expense | issuance costs | expense | Total | ||||||||

Franklin Square mortgage | $ | | $ | | $ | — | $ | | ||||

Hanover Square mortgage |

| | | — | | |||||||

Ashley Plaza mortgage |

| | | — | | |||||||

Clemson Best Western mortgage |

| | — | | | |||||||

Brookfield Center mortgage |

| | | — | | |||||||

Lancer Center mortgage | | | — | | ||||||||

Greenbrier Business Center mortgage | | | — | | ||||||||

Parkway Center mortgage | | | — | | ||||||||

Amortization and preferred stock dividends on mandatorily redeemable preferred stock | — | | | | ||||||||

Total interest expense | $ | | $ | | $ | | $ | | ||||

24

Interest accrued and accumulated amortization of capitalized issuance costs consist of the following:

As of March 31, 2023 (unaudited) | As of December 31, 2022 | |||||||||||

|

| Accumulated |

|

| Accumulated | |||||||

amortization of | amortization | |||||||||||

Accrued | capitalized | Accrued | of capitalized | |||||||||

interest | issuance costs | interest | issuance costs | |||||||||

Franklin Square mortgage | $ | | $ | | $ | | $ | | ||||

Hanover Square mortgage |

| |

| |

| |

| | ||||

Ashley Plaza mortgage |

| — |

| |

| |

| | ||||

Brookfield Center mortgage |

| — |

| |

| — |

| | ||||

Parkway Center mortgage | | | | | ||||||||

Wells Fargo Mortgage Facility | — | | — | | ||||||||

Amortization and accrued preferred stock dividends on mandatorily redeemable preferred stock (1) | | | | | ||||||||

Total | $ | | $ | | $ | | $ | | ||||

(1) | Recorded as accrued interest under accounts payable and accrued liabilities on the Company’s condensed consolidated balance sheets as of March 31, 2023 and December 31, 2022, respectively. |

Debt Maturity

The Company’s scheduled principal repayments on indebtedness as of March 31, 2023 are as follows:

For the remaining nine months ending December 31, 2023 |

| $ | |

2024 |

| | |

2025 |

| | |

2026 |

| | |

2027 |

| | |

Thereafter |

| | |

Total principal payments and debt maturities | | ||

Less unamortized issuance costs |

| ( | |

Net principal payments and debt maturities | $ | |

6. Rentals under Operating Leases

Future minimum rents (based on recognizing future rents on the straight-line basis) to be received under noncancelable tenant operating leases for each of the next five years and thereafter, excluding common area maintenance and other expense pass-throughs, as of March 31, 2023 are as follows:

For the remaining nine months ending December 31, 2023 |

| $ | |

2024 |

| | |

2025 |

| | |

2026 |

| | |

2027 |

| | |

Thereafter |

| | |

Total minimum rents | $ | |

7. Equity

The Company has authority to issue

25

at the REIT’s option, Common Shares at a ratio of

Shelf Registration

On June 21, 2021, the Company filed a shelf registration statement on Form S-3 with the SEC. The registration statement is intended to provide the Company additional flexibility to finance future business opportunities through timely and cost-effective access to capital markets. Under the shelf registration statement, the Company may, from time to time, issue common stock up to an aggregate amount of $

Standby Equity Purchase Agreement

On November 17, 2021, the Company entered into a Standby Equity Purchase Agreement (the “SEPA”) with a financing entity. Under this agreement, the Company will be able to sell up to $

Issuance Date |

| Shares Issued |

| Price Per Share |

| Total Proceeds | ||

March 3, 2022 | | $ | | $ | | |||

March 14, 2022 |

| |

| |

| | ||

March 17, 2022 |

| |

| |

| | ||

March 21, 2022 |

| |

| |

| | ||

April 1, 2022 |

| |

| |

| | ||

Total |

| | $ | | $ | | ||

Common Stock Repurchase Plan

In December 2021, the Board approved a program to purchase up to

Purchase (Trade) Date |

| Shares Purchased |

| Price Per Share |

| Total Cost (1) | ||

January 4, 2022 | | $ | | $ | | |||

January 5, 2022 |

| |

| |

| | ||

January 6, 2022 |

| |

| |

| | ||

January 7, 2022 |

| |

| |

| | ||

January 10, 2022 |

| |

| |

| | ||

January 14, 2022 |

| |

| |

| | ||

January 21, 2022 |

| |

| |

| | ||

Total |

| | $ | | $ | | ||

(1) | Total cost before transaction fees. |

26

Common shares and operating partnership units outstanding

As of March 31, 2023 and December 31, 2022, there were

2018 Equity Incentive Plan

The Company’s 2018 Equity Incentive Plan (the “Equity Incentive Plan”) was adopted by the Board on July 27, 2018 and approved by the Company’s shareholders on August 23, 2018. The Equity Incentive Plan permits the grant of stock options, stock appreciation rights, stock awards, performance units, incentive awards and other equity-based awards (including LTIP units of the Company’s Operating Partnership) to its employees or an affiliate (as defined in the Equity Incentive Plan) of the Company and for up to the greater of (i)

On March 2, 2022, the Compensation Committee of the Board (the “Compensation Committee”) approved a grant of

On November 22, 2022, the Compensation Committee approved a grant of

On each January 1 during the term of the Equity Incentive Plan, the maximum number of shares of common stock that may be issued under the Equity Incentive Plan will increase by eight percent (

Earnings per share

Basic earnings per share for the Company’s Common Shares is calculated by dividing income (loss) from continuing operations, excluding the net income (loss) attributable to noncontrolling interests, by the Company’s weighted-average number of Common Shares outstanding during the period. Diluted earnings per share is computed by dividing the net income attributable to common shareholders, excluding the net loss attributable to noncontrolling interests, by the weighted average number of Common Shares, including any dilutive shares. As of March 31, 2023 and 2022,

27

The Company's loss per common share is determined as follows:

| Three months ended March 31, |

| |||||

| 2023 |

| 2022 |

| |||

(unaudited) |

| (unaudited) | |||||

Basic and diluted shares outstanding | |||||||

Weighted average Common Shares – basic | |

| | ||||

Effect of conversion of operating partnership units | |

| | ||||

Weighted average Common Shares – diluted | |

| | ||||

Calculation of earnings per share – basic and diluted |

| ||||||

Net loss attributable to common shareholders | $ | ( | $ | ( | |||

Weighted average Common Shares – basic and diluted |

| |

| | |||

Loss per share – basic and diluted | ( | ( | |||||

Dividends and Distributions

During the three months ended March 31, 2023, dividends in the amount of $

| Three months ended March 31, | |||||

| 2023 |

| 2022 | |||

(unaudited) |

| (unaudited) | ||||

Common shareholders (dividends) | $ | | $ | | ||

Hanover Square Property noncontrolling interest (distributions) |

| — |

| | ||

Parkway Property noncontrolling interest (distributions) |

| — |

| | ||

Operating Partnership unit holders (distributions) |

| |

| | ||

Total dividends and distributions | $ | | $ | | ||

Nasdaq Compliance

On July 11, 2022, the Company received a deficiency letter (the “Deficiency Letter”) from the Nasdaq Listing Qualifications Department (the “Staff”) of the Nasdaq Stock Market LLC notifying the Company that, for the last thirty (30) consecutive business days, the closing bid price for the Company’s common stock had been below the minimum $1.00 per share required for continued listing on the Nasdaq Capital Market (“Nasdaq”) pursuant to Nasdaq Listing Rule 5550 (a)(2) (the “Minimum Bid Price Requirement”). In accordance with Nasdaq Listing Rule 5810(c)(3)(A), the Company was given one hundred and eighty (180) calendar days, or until January 9, 2023, to regain compliance with the Minimum Bid Price Requirement.

On January 10, 2023, the Company received a letter (the “Second Notification”) from the Nasdaq Stock Market LLC notifying the Company that, while the Company had not regained compliance with the Minimum Bid Price Requirement, the Staff determined that the Company is eligible for an additional 180 calendar day period, or until July 10, 2023 (the “Second Compliance Period”), to regain compliance. The Staff’s determination was based on (i) the Company meeting the continued listing requirement for market value of publicly held shares and all other applicable requirements for initial listing on Nasdaq, with the exception of the Minimum Bid Price Requirement, and (ii) the Company’s written notice to the Nasdaq Stock Market LLC of its intention to cure the deficiency during the second compliance period by effecting a reverse stock split, if necessary.

If at any time during the Second Compliance Period, the closing bid price of the Company’s common stock is at least $1.00 per share for a minimum of 10 consecutive business days, the Staff will provide the Company with written confirmation of compliance. If compliance with the Minimum Bid Price Requirement cannot be demonstrated by July 10, 2023, the Staff will provide written notification that the Company’s common stock will be delisted. At that time, the Company may appeal the Staff’s determination to a Hearings Panel.

Neither the Deficiency Letter or the Second Notification had any effect on the listing of the Company’s common stock, and its common stock continues to trade on Nasdaq under the symbol “MDRR”.

28

Reverse Stock Split

See Note 11, Subsequent Events, for a discussion of the reverse stock split that was completed on May 3, 2023.

8. Commitments and Contingencies

Insurance

The Company carries comprehensive liability, fire, extended coverage, business interruption and rental loss insurance covering all of the properties in its portfolio, in addition to other coverages that may be appropriate for certain of its properties. Additionally, the Company carries a directors and officers liability insurance policy that covers such claims made against the Company and its directors and officers. The Company believes the policy specifications and insured limits are appropriate and adequate for its properties given the relative risk of loss, the cost of the coverage and industry practice; however, its insurance coverage may not be sufficient to fully cover its losses.

Concentration of Credit Risk

The Company is subject to risks incidental to the ownership and operation of commercial real estate. These risks include, among others, the risks normally associated with changes in the general economic climate, trends in the retail industry, creditworthiness of tenants, competition for tenants and customers, changes in tax laws, interest rates, the availability of financing and potential liability under environmental and other laws. The Company’s portfolio of properties is dependent upon regional and local economic conditions and is geographically concentrated in the Mid-Atlantic, specifically in South Carolina, North Carolina and Virginia, which represented

Interest Rate Risk

The value of the Company’s real estate is subject to fluctuations based on changes in interest rates, which may affect the Company’s ability to refinance property-level mortgage debt when balloon payments are scheduled. Interest rates are highly sensitive to many factors, including governmental monetary and tax policies, domestic and international economic and political conditions, and other factors beyond our control. An increase in interest rates would likely cause the value of the Company’s assets to decrease. Increases in interest rates may also have an impact on the credit profile of certain tenants.