Exhibit 99.1

Investor Presentation May 2018 Technology Holdings

Disclaimer Important Notice Regarding Forward-Looking Statements and Non-GAAP Measures This presentation contains certain “forward-looking statements” within the meaning of the Securities Act of 1933 and the Securities Exchange Act of 1934, both as amended by the Private Securities Litigation Reform Act of 1995. Statements that are not historical facts, including statements about the pending transaction between M I Acquisitions, Inc. (“M I”) and Priority Holdings, LLC (“Priority”) and the transactions contemplated thereby, and the parties perspectives and expectations, are forward looking statements. Such statements include, but are not limited to, statements regarding the proposed transaction, including the anticipated initial enterprise value and post-closing equity value, the benefits of the proposed transaction, integration plans, expected synergies and revenue opportunities, anticipated future financial and operating performance and results, including estimates for growth, the expected management and governance of the combined company, and the expected timing of the transactions contemplated by the Purchase Agreement. The words “expect,” “believe,” “estimate,” “intend,” “plan” and similar expressions indicate forward-looking statements. These forward-looking statements are not guarantees of future performance and are subject to various risks and uncertainties, assumptions (including assumptions about general economic, market, industry and operational factors), known or unknown, which could cause the actual results to vary materially from those indicated or anticipated. Such risks and uncertainties include, but are not limited to: (i) risks related to the expected timing and likelihood of completion of the pending transaction, including the risk that the transaction may not close due to one or more closing conditions to the transaction not being satisfied or waived, such as regulatory approvals not being obtained, on a timely basis or otherwise, or that a governmental entity prohibited, delayed or refused to grant approval for the consummation of the transaction or required certain conditions, limitations or restrictions in connection with such approvals, or that the required approval of the Purchase Agreement by the stockholders of Priority was not obtained; (ii) risks related to the ability of M I and Priority to successfully integrate the businesses; (iii) the occurrence of any event, change or other circumstances that could give rise to the termination of the Purchase Agreement (including circumstances requiring a party to pay the other party a termination fee pursuant to the Purchase Agreement); (iv) the risk that there may be a material adverse change with respect to the financial position, performance, operations or prospects of Priority or M I; (v) risks related to disruption of management time from ongoing business operations due to the proposed transaction; (vi) the risk that any announcements relating to the proposed transaction could have adverse effects on the market price of M I’s common stock; (vii) the risk that the proposed transaction and its announcement could have an adverse effect on the ability of Priority and M I to retain customers and retain and hire key personnel and maintain relationships with their suppliers and customers and on their operating results and businesses generally; (viii) risks related to successfully integrating the businesses of the companies, which may result in the combined company not operating as effectively and efficiently as expected; (ix) the risk that the combined company may be unable to achieve cost-cutting synergies or it may take longer than expected to achieve those synergies; and (x) risks associated with the financing of the proposed transaction. A further list and description of risks and uncertainties can be found in M I’s Annual Report on Form 10-K for the fiscal year ending December 31, 2017 filed with the SEC, in M I’s quarterly reports on Form 10-Q filed with the SEC subsequent thereto and in the proxy statement on Schedule 14A that will be filed with the SEC by M I in connection with the proposed transaction, and other documents that the parties may file or furnish with the SEC, which you are encouraged to read. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those indicated or anticipated by such forward-looking statements. Accordingly, you are cautioned not to place undue reliance on these forward-looking statements. Forward-looking statements relate only to the date they were made, and M I, Priority, and their subsidiaries undertake no obligation to update forward-looking statements to reflect events or circumstances after the date they were made except as required by law or applicable regulation. Adjusted EBITDA and Earnout Adjusted EBITDA are not calculated in accordance with U.S. GAAP. They are measures that provide supplemental information that M I and Priority believe are useful to analysts and investors to evaluate ongoing results of operations, when considered alongside GAAP measures such as net income, operating income and gross profit. Adjusted EBITDA excludes the financial impact of items management does not consider in assessing the ongoing operating performance of M I, Priority, or the combined company, and thereby facilitates review of its operating performance on a period-to-period basis. Earnout Adjusted EBITDA includes adjustments for, among other things, pro forma effects related to acquired merchant portfolios and residual streams, run rate adjustments for certain contracted savings on an annualized basis and certain operating expenses such as corporate income taxes, which are not included as adjustments to Adjusted EBITDA reported in this presentation. Other companies may have different capital structures or different lease terms, and comparability to the results of operations of M I, Priority or the combined company may be impacted by the effects of acquisition accounting on its depreciation and amortization. As a result of the effects of these factors and factors specific to other companies, M I and Priority believe Adjusted EBITDA and Earnout Adjusted EBITDA provide helpful information to analysts and investors to facilitate a comparison of their operating performance to that of other companies. The presentation of Adjusted EBITDA and Earnout Adjusted EBITDA in these materials should not be construed as an inference that Priority’s future results will be unaffected by unusual or non-recurring items.

Disclaimer (Cont’d) Additional Information and Where to Find It In connection with the transaction described herein, M I has filed a preliminary proxy statement and Schedule 14A with the Securities and Exchange Commission (the “SEC”). Promptly after filing its definitive proxy statement with the SEC, M I will mail the definitive proxy statement and a proxy card to each stockholder entitled to vote at the special meeting relating to the transaction. INVESTORS AND SECURITY HOLDERS OF PRIORITY ARE URGED TO READ THESE MATERIALS (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) AND ANY OTHER RELEVANT DOCUMENTS IN CONNECTION WITH THE TRANSACTION THAT M I WILL FILE WITH THE SEC WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT M I, PRIORITY AND THE TRANSACTION. The preliminary proxy statement, and other relevant materials in connection with the transaction (when they become available), and any other documents filed by M I with the SEC, may be obtained free of charge at the SEC’s website (www.sec.gov) or at M I’s website (www.miacquisitions.com) or by writing to M I, c/o Magna Management LLC, 40 Wall Street, 58th Floor, New York, NY 10005. Participants in Solicitation Priority, M I, and their respective directors, executive officers and employees and other persons may be deemed to be participants in the solicitation of proxies from the holders of M I common stock in respect of the proposed transaction. Information about M I’s directors and executive officers and their ownership of M I’s common stock is set forth in M I’s Annual Report on Form 10-K for the year ended December 31, 2017 filed with the SEC, as modified or supplemented by any Form 3 or Form 4 filed with the SEC since the date of such filing. Other information regarding the interests of the participants in the proxy solicitation will be included in the proxy statement pertaining to the proposed transaction when it becomes available. These documents can be obtained free of charge from the sources indicated above. 1

TABLE OF CONTENTS 1. INTRODUCTION 3 2. COMPANY OVERVIEW 5 3. INDUSTRY OVERVIEW 18 4. TRANSACTION OVERVIEW 21 5. FINANCIAL OVERVIEW 25 6. APPENDIX 28 2

Technology Holdings 1. INTRODUCTION

INTRODUCTION Transaction Overview Background M I Acquisitions, Inc. (NASDAQ: “MACQ”; “M I”) has entered into a definitive agreement to combine via the acquisition of 100% of the equity interests of Priority Holdings, LLC (“Priority”) The combined company will apply to be listed on the NASDAQ as Priority Technology Holdings, Inc. (PRTH) Transaction is expected to close late Q2 / early Q3 2018 Valuation & Structure(1,2,3,4) Enterprise value of approximately $1bn and Equity Value of approximately $690m based on a share price of $10.30 per share subject to adjustment in the event of certain acquisitions by Priority Priority equityholders will roll 100% of their equity, resulting in over 90% pro forma ownership Attractive valuation of 12.5x 2018E Earnout Adj. EBITDA of $80.2m Restructuring of M I private placement units and founder shares Priority will purchase 421,107 private placement units and 453,210 founder shares from M I for an aggregate purchase price of approximately $2.1m M I will forfeit 174,863 founder shares at close, which may be reissued if one of the earnout targets described herein is achieved Payable in common shares or in cash at the election of the go-forward company Payable in first year Priority receives earnout consideration Earnout(5) Additional 9.8m share consideration to Priority equityholders and certain other individuals and / or organizations pursuant to an incentive plan in the event business performance and stock price exceed certain threshold targets. Earnout Adj. EBITDA targets: $82.5m in fiscal year ended Dec. 31, 2018; $91.5m in fiscal year ended Dec. 31, 2019 Stock price thresholds: $12.00 for any 20-trading days within any consecutive 30-trading day period during fiscal years Dec. 31, 2018 & 2019; $14.00 for any 20-trading days within any consecutive 30-trading day period during fiscal years Dec. 31, 2019 & 2020 If the first earnout targets are not met, the entire 9.8 million shares may be issued if the second earnout targets are met (1) Based on fully diluted shares outstanding. Excludes outstanding out-of-the money warrants exercisable at a share price of $11.50 per share, 300,000 unit purchase option exercisable at a share price of $12.00 per share and Thomas Priore’s call option on all or a portion of M I Sponsor shares post-close. (2) Assumes no redemptions from existing M I shareholders. (3) Anticipated initial enterprise value based on cash in trust price of $10.30 per share (not including interest earned on the trust account and any funds deposited in the trust account to extend the time M I has to complete a business combination) and expected cash and debt balances at close. (4) See pages 29 & 30 for reconciliation of estimated net income to estimated Earnout Adj. EBITDA. (5) See page 28 for full earnout detail. 3

INTRODUCTION Investment Highlights Large Market Opportunity Coupled with Strong Secular Tailwinds(1,2) Electronic consumer payment volume in the U.S. is projected to increase from $7.5tn in 2016 to $10.0tn by 2021, representing a 5.9% compound annual growth rate (“CAGR”) The larger B2B market is somewhat less penetrated with card and other electronic payments, and we believe is poised for growth 2014 volume of $16.5tn projected to increase to $23.1tn by 2020, representing a 5.8% CAGR We believe the long-term trend toward electronic payments and growth of SMBs provide strong tailwinds for the Company Scalable, Innovative Technology Platform Delivering Compelling Value(3) Purpose-built, agile technology provides merchants and resellers with a fully customizable suite of applications and solutions to help manage critical workflows Results in attrition well below industry average Integrated processing ecosystem with direct connections to card networks Technology agnostic, developer friendly software Predictable, High Growth Business with Strong Free Cash Flow(1,4,5) Priority has demonstrated significant growth in processing volume, leaping from the 38th-largest acquirer in 2013 to the 13th-largest in 2017; currently the 6th largest non-bank acquirer in the U.S. 12.4% Pro Forma Net Revenue CAGR and 19.2% Earnout Adj. EBITDA CAGR from 2015A 2019E 46.8% Earnout Adj. EBITDA margin in 2018E High free cash flow conversion of 91.6% in 2018E Platform for Organic & Non-Organic Growth We believe there are multi-faceted growth opportunities supported by our purpose-built infrastructure Priority views public currency as an avenue to increase M&A activity Attractive Valuation(6) Valuation of 12.5x 2018E Earnout Adj. EBITDA is ~17% below the median for public merchant acquirers 2018 and 2019 earnouts align management and shareholders’ interests (1) Source: The Nilson Report. (2) Deloitte “B2B Payments Market is a Significant Untapped Opportunity” and Business Insider: “THE B2B PAYMENTS EXPLAINER: Why business payments have been slow to digitize, and what’s changing that in 2017.” (3) Source: Adil Consulting. (4) See pages 29 & 30 for Earnout Adj. EBITDA bridge. (5) Free cash flow = (Earnout Adj. EBITDA capex) / Earnout Adj. EBITDA. (6) Source: Capital IQ as of 4/27/2018. See page 22 for detail. 4

Technology Holdings 2. COMPANY OVERVIEW

COMPANY OVERVIEW Company Overview PRIORITY IS A LEADING PROVIDER OF MERCHANT ACQUIRING AND COMMERCIAL PAYMENT SOLUTIONS, OFFERING UNIQUE PRODUCT CAPABILITIES TO ITS MERCHANT AND DISTRIBUTION PARTNERS Priority operates two main business segments: Consumer Payments and Commercial Payments & Managed Services Consumer Payments full-service payment processing solutions for business-to-consumer (“B2C”) transactions, through Independent Sales Organizations (“ISOs”), Financial Institutions, Independent Software Vendors (“ISVs”) and other Referral Partners Commercial Payments & Managed Services AP automation solutions and curated managed services to industry leading financial institutions and networks such as Citi, MasterCard and AMEX Priority’s solutions are delivered via its internally-developed MX and CPX product platforms MX Merchant customizable virtual terminal with proprietary business management tools and add-on “apps” MX Connect portfolio and customer relationship management system for Priority’s reseller partners Commercial Payments Exchange (“CPX”) buyer / supplier payment enablement platform Priority generates revenue primarily from volume-based payment processing fees, as well as product subscription fees and management and performance fees for facilitating AMEX and MasterCard B2B services By the Numbers 6th $34bn+ Largest U.S. Bankcard Volume Non-Bank Acquirer(1) Processed 174K 4K Merchants New Boards per Serviced Month in 2017 Historical Losses (As % of total bankcard volume) 0.01% 0.01% 0.01% 2015A 2016A 2017A Net Revenue(2) ($ millions) 14% CAGR $186.5 $171.5 $149.2 $127.7 $110.7 2015A 2016A 2017A 2018E 2019E Bankcard Volume(3) ($ billions) 14% CAGR $44.4 $39.8 $34.7 $30.4 $26.4 2015A 2016A 2017A 2018E 2019E Priority vs. Industry Attrition Rates(4) 23% 12% Industry Priority (1) The Nilson Report. (2) Net revenue = gross revenue less interchange, network and association fees and residual and commission expenses; includes the anticipated full-year impact of $9m of identified acquisitions. (3) Excludes $771,940,340 of pro forma volume related to the ACCPC acquisition. (4) Source: Adil Consulting. 5

COMPANY OVERVIEW Company Evolution FORWARD THINKING AND EXECUTION HAVE TRANSFORMED PRIORITY INTO A LEADING PAYMENT SERVICES PROVIDER IN THE U.S. 2005 Founded by experienced payments executives 2006 Launched MX ISO/Agent ISO/Agent 2008 SaaS version launched AMEX commercial payments programs launched 2010 4 Rings & Resolve service standard 2011 Commercial Payments hits 100 employees with launch of AMEX Merchant Finance 2012 Vortex Curated Cloud Launched 2013 COMMERCIAL PAYMENTS MasterCard commercial payments programs launched 2014 Cynergy Merger 2016 Released next-gen MX Merchant 2017 Connect MX Connect launched Priority Commercial Payments becomes VISA issuer Priority ranked 6th largest non-bank merchant acquirer in the U.S.(1) (1) The Nilson Report. 6

COMPANY OVERVIEW Experienced Management Team Led by Industry Veterans PRIORITY’S LEADERSHIP TEAM HAS OVER 150 YEARS OF INDUSTRY EXPERIENCE Name Tom John Bruce Sean Afshin Cindy David Priore Priore Mattox Kiewiet Yazdian O’Neill McMiller Chief Chief Chief President of President of President of Executive Title Executive Financial Technology Priority Commercial Managed Chairman Officer Officer Officer Payments Payments Services Years of 26 26 31 21 17 26 37 Experience Prior Experience 7

COMPANY OVERVIEW Vortex Infrastructure: Foundation for Growth CURATED CLOUD AND API DRIVEN OPERATING SYSTEM BUILT FOR SCALE AND AGILITY Vortex Cloud Layer Audit VDI Telephony VSI Custom Dev Vortex OS Layer Payments Security (Crypto) Data Eventing Neural (AI) Storage Vortex UI Layer MX Connect ACH.com CPXchange MX Merchant Shared Common Services Risk & Underwriting Payment & Settlement Ops Marketing & Investor Service Accounting & Finance Legal & HR IT Support & Development Payment Enabled Technology Partnerships Healthcare Hospitality Data & Analytics Education Real Estate Lending Retail Wholesale eComm ISV Networks FIs Corps. Dedicated Sales, Revenue Activation and Client Service Teams 8

COMPANY OVERVIEW Differentiated Technology Platform for Merchants and Distribution Partners PRIORITY’S PURPOSE-BUILT VORTEX INFRASTRUCTURE SUPPORTS DISCRETE APPLICATIONS AND DELIVERS DIFFERENTIATED CUSTOMER EXPERIENCES MX Product Platform CPX Product Platform Merchant Portal Electronic payment processing across all channels Operates on a standalone basis or integrates into third-party software Customizable virtual terminal Omni-channel payment acceptance Transaction monitoring and reporting Technology “agnostic” architecture Business management tools and add-on “apps” Connect Portal Fully customizable CRM for resellers Secure, feature-rich suite of APIs Actively manage pricing and client services matters on merchant portfolios Detailed merchant processing reporting Manage downstream commissions Automated onboarding to multiple backend processors Priority brand licensing Commercial Payments Exchange Portal CPX Access - Interactive buyer and supplier portal to promote the payment and data exchange between parties CPX Payments - complete suite of traditional and transitional payment solutions to completely automate AP files Supports one-time virtual card, P-Card, electronic fund transfer, ACH and check payment CPX Gateway - accepts single payment files and intelligently routes each transaction via the optimal payment method CPX Commercial Acceptance - optimizes payment programs with a full suite of targeted solutions and outreach campaign management MX creates an integrated and “stickier” relationship, reflecting the following benefits: 1 Drives additional volume by meeting resellers and merchants’ omni-channel payment acceptance needs 2 Allows Priority to become more integrated in a merchant’s workflow, creating “sticky” relationships and industry-low attrition rates 3 Add-on “apps” differentiate Priority from other providers with less expansive workflow tools 4 Technology “agnostic” architecture enables integration with current payment tools reducing “friction” for merchants Complete commercial solution that monetizes payments while maximizing automation 1 B2B solution that maximizes supplier sophistication 2 Seamlessly integrates into existing platform 3 Expert pre-sales support for spend analytics 4 Consultative approach with proven supplier enablement programs 9

COMPANY OVERVIEW Consumer Payments Overview PRIORITY’S CONSUMER PAYMENTS SEGMENT PROVIDES FULL-SERVICE PAYMENT PROCESSING SOLUTIONS FOR B2C TRANSACTIONS Overview(1) Priority enables merchants to accept electronic payments (e.g. credit, debit) at the point-of-sale (“POS”), online and via mobile payment technologies The Company provides a full suite of agile tools for both resellers and merchants via its SaaS based MX platform ~123,000 of Priority’s merchants are integrated with MX Merchant, eCommerce or ISVs; represents ~67% of processing volume Results in high retention of merchants and resellers; with attrition rates well below the industry average Bankcard Volume ($ billions) 12% CAGR $43.1 $39.0 $34.5 $27.1 $30.3 2015A 2016A 2017A 2018E 2019E Organic Inorganic Gross Profit(2) ($ millions) 12% CAGR $104.3 $111.0 $97.4 $80.3 $70.5 2015A 2016A 2017A 2018E 2019E Contribution by 2017 Reseller Volume & Gross Profit Channels Retail Resellers(3) Non-risk bearing resellers leverage Priority’s complete operating infrastructure and brand recognition % Volume % Gross Profit 46% 57% eCommerce / Wholesale Resellers(3) eCommerce and wholesale resellers bear 100% of processing and chargeback risk % Volume % Gross Profit 27% 45% ISVs / VARs(3) Priority’s ISVs & VARs directly integrate with Priority’s MX Payments and onboarding APIs for a seamless customer experience % Volume % Gross Profit 16% 9% (1) Integrated Merchants = Merchants on MX or integrated through ISVs & eCommerce. (2) Priority’s 2018E Net Revenue, Gross Profit and Adj. EBITDA excludes the anticipated full-year impact of $9m of identified acquisitions. (3) Volume and gross profit for period ended FY 2017. 10

COMPANY OVERVIEW Priority’s Purpose-Built Payment Cloud: Monetizing Merchant Networks MX Merchant: virtual payment processing terminal and business management tool that creates an integrated merchant experience Fully customizable platform through proprietary & 3rd party add-on applications MX Connect: powerful reseller CRM and business operating system Low-friction electronic onboarding to improve merchant acquisition Superior data sharing capability, enabling resellers to better manage client service needs and retain merchants Merchant Community Reseller Community Associations VARs Merchant Connect Wholesale/ Retail Resellers Banks & FIs ISVs Vortex Core Processing & Transaction System Application UI Layer Proprietary Apps 3rd Party Products 11

COMPANY OVERVIEW Illustrative Consumer Payments Transaction ILLUSTRATIVE $100 TRANSACTION, WITH 2.5% MERCHANT DISCOUNT RATE Merchant Acquiring / Payment Processing $0.40 $0.28 $0.01 Sponsor Bank Resellers / Merchant Acquirer ISVs <$0.05 Processor $1.60 Card Issuing Bank $0.16 Payment Network $97.50 Merchant ($100.00) Consumer Payment / Item Flow Authorization / Data Flow 12

COMPANY OVERVIEW Commercial Payments & Managed Services Overview PRIORITY’S COMMERCIAL PAYMENTS & MANAGED SERVICES SEGMENT PROVIDES FULL-SERVICE B2B PAYMENT PROCESSING Overview Provides account automation solutions and curated managed services to industry leading financial institutions and networks such as Citi, MasterCard and American Express Leveraging CPX, clients are able to increase efficiencies across the AP process while creating new revenue streams Managed Services programs include receivable finance management, consulting services, closed loop acquiring services as well as supplier adoption and education CPX Volume ($ millions) $1,295.7 $805.2 $190.3 $46.9 $95.8 2015A 2016A 2017A 2018E 2019E Commercial Payments Net Revenue(1) ($ millions) 25% CAGR $27.7 $22.4 $18.4 $16.6 $11.3 2015A 2016A 2017A 2018E 2019E Cumulative AMEX Funded Loan Count & BIP Volume ($ millions) $6,000 50,000 $5,098 40,000 $3,802 42,099 $4,000 30,000 $2,702 28,943 20,000 $2,000 17,790 10,000 $- 0 2015A 2016A 2017A AMEX BIP $ Volume AMEX Funded Loan Count (1) Net revenue = gross revenue less interchange, network and association fees and residual and commission expenses. 13

COMPANY OVERVIEW Commercial Payments Priority CPX DELIVERING SUBSTANTIAL VALUE TO THE FAST GROWING, MASSIVE B2B PAYMENTS MARKET CPX Overview CPX Payments leverages a complete suite of traditional and transitional payment solutions to fully automate B2B AP files Supports one-time virtual cards, P-Cards, electronic fund transfers, ACH and check payments Based on the payment type, Priority earns a percentage of the total dollar volume processed, which is paid for by the supplier accepting the payment (i.e. a merchant discount) CPX Gateway accepts single payment files and intelligently routes each transaction via the optimal payment method CPX: Transforming & Monetizing Through Automation Typical Commercial Payments(1) 100% Commercial Payments with CPX ACH, 24% P-Card, 13% Wire, 10% Check, 53% Virtual Card, 30% CPX Direct, 25% DD, 5% CPX ACH+, 10% Check, 10% ACH, 20% Simplifying Buyer / Supplier Transactions(2) Upload Pay File Payment Processing VCard, BIP, Dynamic Discount EFT Fund Settlement With Record (*$) and CTX Buyers / Payers Simple Pay File Integration Reconciliation Activate Suppliers Short form Electronic Onboarding & Automated Underwriting (1) PayStream Advisors. (2) Refer to following page for detailed CPX payment process flow. 14

COMPANY OVERVIEW Detailed CPX Process Flow CPX CAN BE DELIVERED AS A COMPLETE SOLUTION OR AN ENHANCEMENT TO AN EXISTING PAYMENT PROCESS Buyer ERP System Consolidated Payment File CPX Gateway Virtual Card Supplier Initiated Buyer Initiated (Networks) CPX Direct ACH / Dynamic Discounting Check VISA / MC Settlement CPX Settlement CPX Settlement Print / Postage / Mail Settlement Repository Vortex UI Layer Access Repository Buyer / Supplier Portal Reconciliation & Reporting MERCHANTS / SUPPLIERS 15

COMPANY OVERVIEW Multi-Faceted Growth Opportunities PRIORITY INTENDS TO CONTINUE TO EXECUTE A MULTI-PRONGED GROWTH STRATEGY, WITH MULTIPLE ORGANIC INITIATIVES SUPPLEMENTED BY M&A Accretive Acquisitions Expand Electronic Payments Share of B2B Transactions with CPX Deploy Industry Specific Payment Technology Increase Margin per Merchant with Complementary Products and Services Expand Its Network of Distribution Partners Organic Growth in its Consumer Reseller and Merchant Base 16

COMPANY OVERVIEW Accretive Acquisition Strategy PRIORITY INTENDS TO SELECTIVELY PURSUE STRATEGIC AND TACTICAL ACQUISITIONS THAT MEET CERTAIN CRITERIA, WITH A CONSISTENT, LONG-TERM GOAL OF MAXIMIZING SHAREHOLDER VALUE; THE VORTEX.CLOUD INFRASTRUCTURE WAS PURPOSE BUILT TO RAPIDLY AND SEAMLESSLY CONSOLIDATE COMPLEMENTARY BUSINESSES Acquisition Target Categories Integrated Payments Vertical & Horizontal Software B2B Payments Scale Innovative Products / Technology Opportunistic / Financial Acquisition Criteria + Accretive to revenue growth + Accretive to cash EPS + Predictable, recurring revenue + Scalable, leverageable + Low capital intensity / high cash conversion + Complementary technology offerings + Strong chemistry / cultural fit Vortex Common Platform 17

Technology Holdings 3. INDUSTRY OVERVIEW

INDUSTRY OVERVIEW Strong Industry Tailwinds Drive Continued Growth for Consumer Payments WE BELIEVE THE SHIFTING PAYMENT LANDSCAPE FROM CASH AND CHECKS TO CARD-BASED PAYMENTS COUPLED WITH GROWTH OF THE SMALL AND MID-SIZE MERCHANT SEGMENT PROVIDES STRONG TAILWINDS FOR PRIORITY Continued Shift from Cash to Credit Historical & Projected Payment Type % (1) 2021 14% 17% $12TN 69% 2016 14% 25% $10TN 61% 2011 13 % 36 $8TN % 51 % Paper Cards Electronic Large Addressable End-Market Customer Segmentation of the Merchant Acquiring Industry (2) Merchant Size Est. Credit/Debit Value ($BN) Mega $1,562 125 $0.5 Large 50K $750 $1.1 Small 7,000k $350 $3.6 Micro 20,000K <$300 <$2.2 Est. # of Businesses Est. Merchant Acquirer Net Rev ($BN) 18

INDUSTRY OVERVIEW Demand for SaaS-Based Solutions Provides an Opportunity for iPOS WHILE NOT A HARDWARE PROVIDER, WE BELIEVE PRIORITY IS WELL POSITIONED TO BENEFIT FROM MERCHANTS’ DEMAND FOR INTEGRATED PAYMENTS SOLUTIONS AND THE EARLY STAGES OF AN UPGRADE CYCLE SMB Spending on SaaS Expected to Increase. . . 11% CAGR 79% 31% 2013 2020 . . .Driving Adoption of Technology-Enabled iPOS. . . New Revenue Streams & Stickier Merchants Product Organization Tools Omni-Channel Payment Acceptance Ability to Manage Supplier Relationships Invoicing and Reconciliation Analytics and Additional Reporting . . .As Merchants Seek to Upgrade Their Solutions. . . iPOS Usage (% of Total Retailers)(2) +48% 79% 31% 2013 2020 . . .Creating a Significant Revenue Opportunity iPOS & mPOS Addressable Market ($BN)(2) 5% CAGR >$4.4 ~$3.8 2017 2020 (1) BCG “Merchant Acquiring: How to Win in a Digital World”. (2) Ingenico’s 2020 Strategic Plan Presentation. 19

INDUSTRY OVERVIEW B2B Payments Presents a Significant Revenue Opportunity B2B PAYMENTS IS THE LARGEST PAYMENT MARKET IN THE U.S. AND PRESENT A SIGNIFICANT REVENUE OPPORTUNITY FOR PROVIDERS TO CONVERT CHECK TO ELECTRONIC PAYMENTS, INCLUDING CARD-BASED B2B Leads Total Payment Volume. .. . U.S. Payment Market Size(1) B2B $18TN B2C $9TN C2C $709BN B2B payments present a vast opportunity for payment providers at ~2x the size of B2C payments With businesses looking for efficiency and cost-savings, electrification of B2B payments has gained momentum . . . Continues to Grow. . . B2B Payment Volume ($TN) (2) 5.8% CAGR $23.1 $16.5 2014 2020 B2B payments represent one of the fastest-growing markets in the U.S. Domestic B2B Payments makes up nearly 75% of the market with cross-boarder payments accounting for the remaining 25% of payments The largest opportunity is large businesses with more than $1BN in revenue . . .and Represents Opportunity for Disruption Organization’s B2B Payments Made by Check(1) 100% 81% 80% 74% 67% 60% 50% 51% 40% Despite an increase in electronic payments, 51% of B2B volume is 20% still paid via check 0% 2004 2007 2010 2013 2016 Nearly 51% of B2B volume is still paid via check This is due to the complex and cumbersome process such as invoicing, delayed payment terms and multiple banks / platforms Companies with the ability to eliminate this friction will be best positioned to benefit (1) Business Insider: “THE B2B PAYMENTS EXPLAINER: Why business payments have been slow to digitize, and what’s changing that in 2017.” (2) Deloitte “B2B payments market is a significant untapped opportunity.” 20

Technology Holdings 4. TRANSACTION OVERVIEW

TRANSACTION OVERVIEW Sources & Uses Transaction Detail ($mm)(1,2,3,4,5,6) Pro Forma Enterprise Value of $1.0bn and EV / 2018 Earnout Adj. EBITDA of 12.5x Priority equityholders will roll 100% of their equity Share Price $10.30 (x) Total Shares Outstanding 66.7 Equity Value $687.5 (+) Priority Exisiting Debt at Close 351.1 (-) Pro Forma Cash (35.7) Enterprise Value $1,003.0 Priority 2018E Earnout Adj. EBITDA $80.2 Priority 2019E Earnout Adj. EBITDA $88.4 2018 Earnout Adj. EBITDA Multiple 12.5x Net Debt / 2018 Earnout Adj. EBITDA 3.9x 2019 Earnout Adj. EBITDA Multiple 11.4x Net Debt / 2019 Earnout Adj. EBITDA 3.6x Cash Sources & Uses ($mm)(2,5) Sources M I Cash In Trust $55.1 Existing Cash on Balance Sheet 19.9 Total Sources $75.0 Uses Change of Control Roll-up $25.0 Transaction Fees & Expenses 14.4 Cash to Balance Sheet 35.7 Total Uses $75.0 1.0% 8.0% 91.0% Pro Forma Ownership(1,2,3) Priority Equityholders M I Public Shareholders M I Sponsors (1) Based on fully diluted shares outstanding; inclusive of 5.3m MACQ shares and 1.2m net founder shares. Excludes outstanding out-of-the money warrants exercisable at a share price of $11.50 per share, 300,000 unit purchase option exercisable at a share price of $12.00 per share and Thomas Priore’s call option on all or a portion of M I Sponsor shares post-close. (2) Assumes no redemptions from cash in trust by M I’s existing shareholders and includes all in-the-money options and warrants. Actual results may differ. (3) Excludes shares contingent upon earnout thresholds being met. (4) Includes $9.0m of additional EBITDA from identified acquisitions; see pages 29 & 30 for Earnout Adj. EBITDA bridge. (5) Projected cash and debt balances at close. (6) Anticipated initial enterprise value based on cash in trust price of $10.30 per share (not including interest earned on the trust account and any funds deposited in the trust account to extend the time M I has to complete a business combination) and expected cash and debt balances at close. 21

Valuation Benchmarking EV / 2018E Earnout Adj. EBITDA EV / 2018E Adj. EBITDA Priority’s 12.5x multiple represents a ~17% discount to the peer median of 15.1x 12.5x 10.8x 16.8x 16.1x 14.2x Valuation Highlights Attractive Growth Profile Estimates 2015-2019E Pro Forma Net Revenue and Earnout Adj. EBITDA CAGR of 12% and 19%, respectively Strong Visibility Recurring transaction / volume-based revenue Minimal historical losses and strong merchant retention Differentiated Margin Profile Estimated 45%+ 2018 Earnout Adj. EBITDA margin Consistent Cash Conversion 90%+ free cash flow conversion Source: Capital IQ as of 4/27/2018. Note: Priority’s Earnout Adj. EBITDA includes anticipated full-year impact of $9m of identified acquisitions. 22

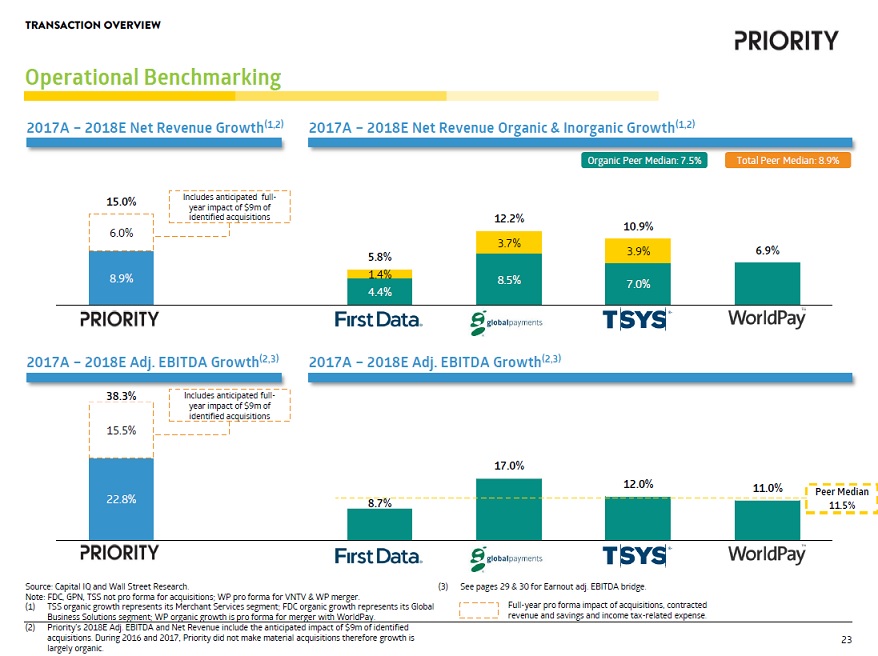

TRANSACTION OVERVIEW Operational Benchmarking 2017A 2018E Net Revenue Growth(1,2) 2017A 2018E Net Revenue Organic & Inorganic Growth(1,2) 15.0% Includes anticipated full-year impact of $9m of identified acquisitions 6.0% 8.9% 12.2% 10.9% 3.7% 3.9% 6.9% 5.8% 1.4% 8.5% 7.0% 4.4% 2017A 2018E Adj. EBITDA Growth(2,3) 38.3% Includes anticipated full-year impact of $9m of identified acquisitions 15.5% 22.8% 2017A 2018E Adj. EBITDA Growth(2,3) 17.0% 12.0% 11.0% Peer Median 8.7% 11.5% Source: Capital IQ and Wall Street Research. Note: FDC, GPN, TSS not pro forma for acquisitions; WP pro forma for VNTV & WP merger. (1) TSS organic growth represents its Merchant Services segment; FDC organic growth represents its Global Business Solutions segment; WP organic growth is pro forma for merger with WorldPay. (2) Priority’s 2018E Adj. EBITDA and Net Revenue include the anticipated impact of $9m of identified acquisitions. During 2016 and 2017, Priority did not make material acquisitions therefore growth is largely organic. (3) See pages 29 & 30 for Earnout adj. EBITDA bridge. Full-year pro forma impact of acquisitions, contracted revenue and savings and income tax-related expense. 23

TRANSACTION OVERVIEW Operational Benchmarking (Cont’d) 2018E Earnout Adj. EBITDA Margin(1,2) 2018E Adj. EBITDA Margin 46.8% 48.6% 37.6% Peer Median 34.5% 35.6% 38.9% 2018E Free Cash Flow Conversion(1,2,3) 91.6% 2018E Free Cash Flow Conversion 86.0% 86.5% 85.6% Peer Median 85.8% 81.8% Source: Capital IQ. (1) Priority’s 2018E Earnout Adj. EBITDA and Net Revenue include the anticipated full-year impact of $9m of identified acquisitions. (2) Full-year pro forma impact of acquisitions, contracted revenue and savings and income tax-related expense. (3) Priority free cash flow is defined as (Earnout Adj. EBITDA CAPEX) / Earnout Adj. EBITDA.. Peers’ free cash flow is defined as (Adj. EBITDA CAPEX) / Adj. EBITDA.. 24

Tecnology Holdings 5. FINANCIAL OVERVIEW

FINANCIAL OVERVIEW Historical & Forecasted Financials - Consolidated Net Revenue & Pro Forma Net Revenue(1) ($ millions) 12% CAGR $116.7 $6.0 $110.7 2015A $136.8 $9.0 $127.7 2016A $152.6 $3.5 $149.2 2017A $171.5 $9.0 $162.5 2018E Includes anticipated full-year impact of $9m of identified acquisitions $186.5 2019E Adj. EBITDA & Earnout Adj. EBITDA(2) ($ millions) 19% CAGR $43.7 $7.2 $36.5 2015A $57.6 $10.8 $46.7 2016A $61.3 $3.3 $58.0 2017A $80.2 $9.0 $71.2 2018E Includes anticipated full-year impact of $9m of identified acquisitions $88.4 2019E (1) Net revenue = gross revenue less interchange, network and association fees and residual and commission expenses. (2) See pages 29 & 30 for Earnout adj. EBITDA bridge. Full-year pro forma impact of acquisitions, contracted revenue and savings and income tax-related expense. 25

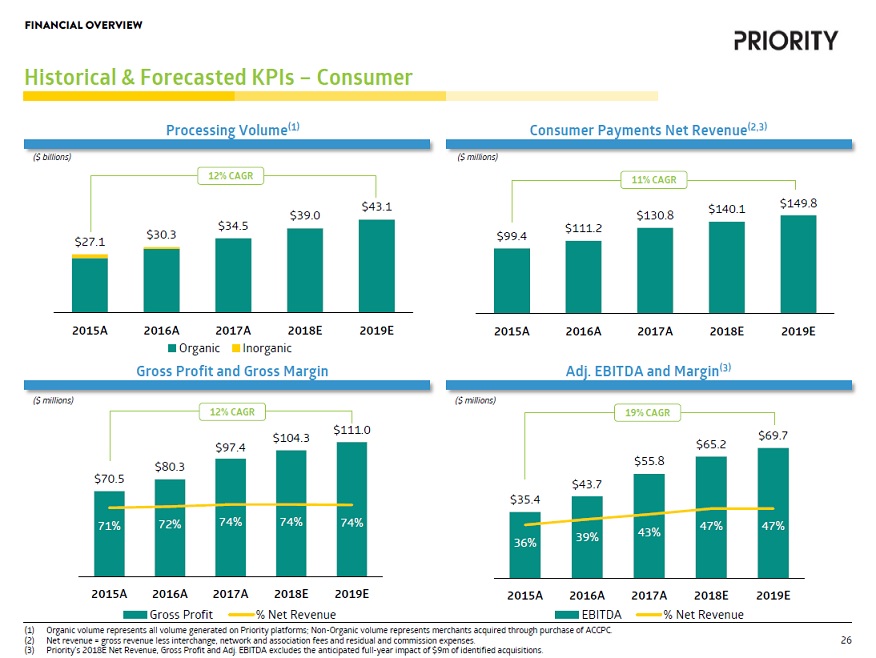

FINANCIAL OVERVIEW Historical & Forecasted KPIs Consumer Processing Volume(1) ($ billions) 12% CAGR $43.1 $39.0 $34.5 $30.3 $27.1 2015A 2016A 2017A 2018E 2019E Organic Inorganic Gross Profit and Gross Margin ($ millions) 12% CAGR $120.0 $111.0 150% $104.3 $97.4 $100.0 $80.3 $80.0 $70.5 100% $60.0 $40.0 71% 72% 74% 74% 74% 50% $20.0 $0.0 0% 2015A 2016A 2017A 2018E 2019E Gross Profit % Net Revenue Consumer Payments Net Revenue(2,3) 11% CAGR $140.1 $149.8 $130.8 $111.2 $99.4 2015A 2016A 2017A 2018E 2019E Adj. EBITDA and Margin(3) ($ millions) 19% CAGR $80.0 100% $69.7 $65.2 $60.0 $55.8 75% $43.7 $40.0 $35.4 50% 43% 47% 47% $20.0 36% 39% 25% $0.0 0% 2015A 2016A 2017A 2018E 2019E EBITDA % Net Revenue (1) Organic volume represents all volume generated on Priority platforms; Non-Organic volume represents merchants acquired through purchase of ACCPC. (2) Net revenue = gross revenue less interchange, network and association fees and residual and commission expenses. (3) Priority’s 2018E Net Revenue, Gross Profit and Adj. EBITDA excludes the anticipated full-year impact of $9m of identified acquisitions. 26

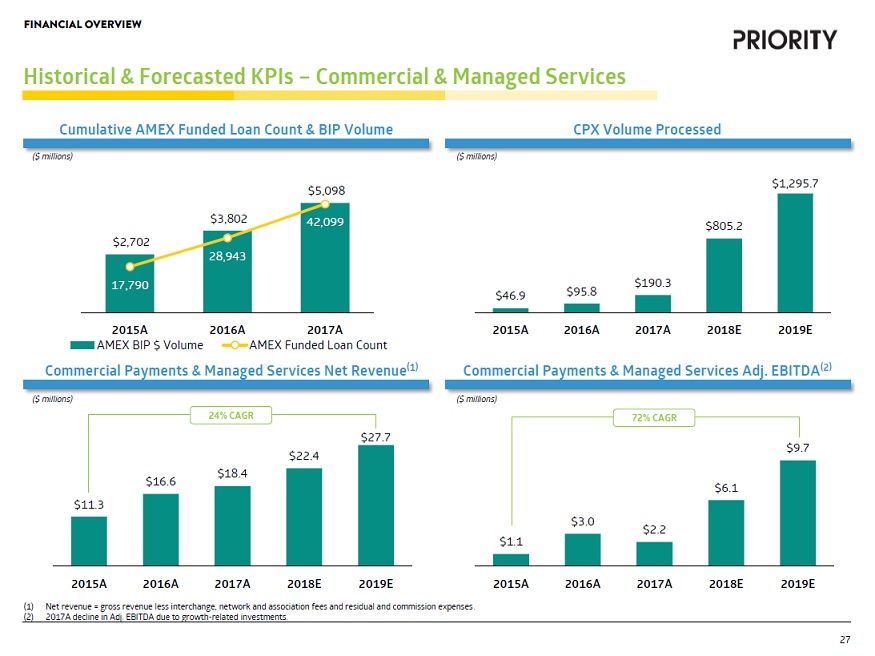

FINANCIAL OVERVIEW Historical & Forecasted KPIs Commercial & Managed Services Cumulative AMEX Funded Loan Count & BIP Volume ($ millions) $6,000 50,000 $5,098 40,000 $3,802 42,099 $4,000 30,000 $2,702 28,943 20,000 $2,000 17,790 10,000 $- 0 2015A 2016A 2017A AMEX BIP $ Volume AMEX Funded Loan Count Commercial Payments & Managed Services Net Revenue(1) ($ millions) 24% CAGR $27.7 $22.4 $18.4 $16.6 $11.3 2015A 2016A 2017A 2018E 2019E CPX Volume Processed $1,295.7 $805.2 $190.3 $46.9 $95.8 2015A 2016A 2017A 2018E 2019E Commercial Payments & Managed Services Adj. EBITDA(2) ($ millions) 72% CAGR $9.7 $6.1 $3.0 $2.2 $1.1 2015A 2016A 2017A 2018E 2019E (1) Net revenue = gross revenue less interchange, network and association fees and residual and commission expenses. (2) 2017A decline in Adj. EBITDA due to growth-related investments. 27

Technology Holdings 6. APPENDIX

APPENDIX Equity Capitalization and Earnout Structure Summary Earnout Structure(1) Additional consideration to Priority equityholders in the event business performance and stock price exceed certain thresholds If the 2018 earnout threshold is not met, contingent shares rollover and are available if the Earnout Adjusted EBITDA and stock price thresholds are met in 2019 M I has 174,863 founders shares linked to Priority’s earnout; shares will be cancelled and will not be reissued if threshold targets are not met 2018 2019 ($ millions, except per share data) Earnout Adj. EBITDA: $82.5 $91.5 Stock Price: $12.00 $14.00 New Shares Issued: 4.9 4.9 Equity Capitalization Summary(2,3) No Earnout Full Earnout Shares % Shares % Common Shares Priority Equityholders 60,737,662 91.0% 70,537,662 91.9% M I Public Shareholders 5,310,109 8.0% 5,310,109 6.9% M I Sponsors 699,454 1.0% 874,317 1.1% Shares Outstanding 66,747,225 100.0% 76,722,088 100.0% Note: Excludes out-of-the money warrants outstanding exercisable at a share price of $11.50 per share. Excludes 300,000 unit purchase option exercisable at a share price of $12.00 per share. Reflects no redemptions from cash in trust by M I’s existing shareholders. Actual results may differ. (1) Stock price thresholds: $12.00 for any 20-trading days within any consecutive 30-trading day period during fiscal years Dec. 31, 2018 & 2019; $14.00 for any 20-trading days within any consecutive 30-trading day period during fiscal years Dec. 31, 2019 & 2020 (2) Post-close, Thomas Priore will be granted a call option on all or a portion of M I Sponsor shares. To effect the option, Thomas Priore must provide notice to M I of its intent to call the equity, upon which a 20 trading day Pricing Period shall commence. After this period, the call will be executed and funds / shares will be transferred at a price equal to the greater of: a) $10.30, b) the VWAP in the 20 trading-days prior to the notice date, c) the VWAP during the pricing period. Shares called by Thomas Priore are not included as a portion of Priority Equityholders ownership. (3) Includes 421,107 private placement shares and 453,120 founder shares purchased by Priority from M I. 28

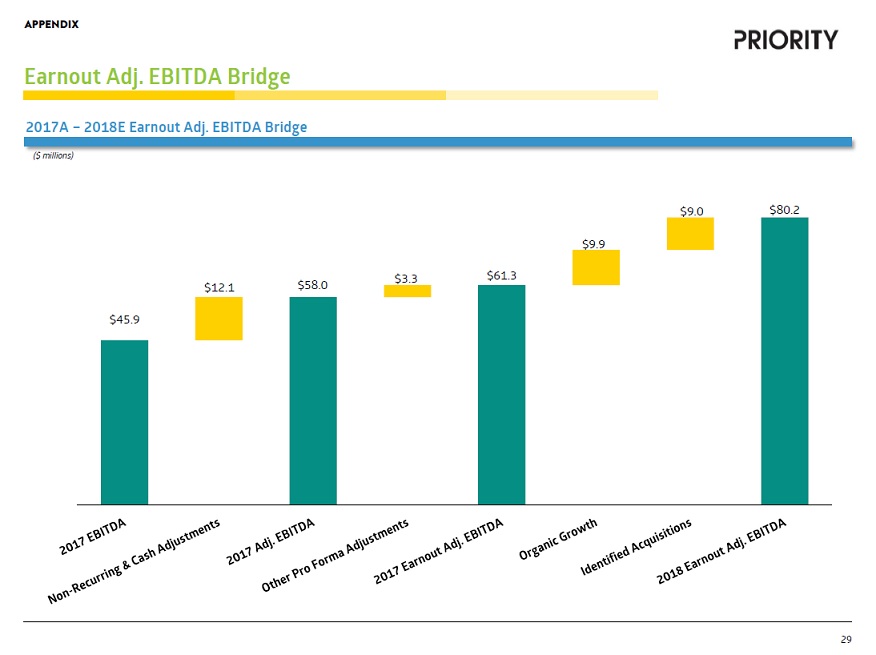

APPENDIX Earnout Adj. EBITDA Bridge 2017A 2018E Earnout Adj. EBITDA Bridge ($ millions) $9.0 $80.2 $9.9 $3.3 $61.3 $12.1 $58.0 $45.9 29

APPENDIX GAAP Net Income to Earnout Adj. EBITDA Reconciliation (in $ millions) 2015A 2016A 2017A Net Income (GAAP) $9.27 $20.19 $4.59 Interest Expense $4.05 $4.78 $26.68 Depreciation and Amortization $15.63 $14.73 $14.67 EBITDA (non-GAAP) $28.95 $39.70 $45.94 Non-cash and certain other expense $2.22 ($1.42) $4.20 Litigation settlement costs $0.04 $2.33 Certain Legal services $1.98 $2.14 $2.70 Professional and consulting fees and expenses $2.05 $2.90 $1.67 Severance, seperation and employee settlements $0.66 $0.09 $0.14 Share-based compensation $2.31 $1.02 One-time transaction-related expenses and adjustments $0.66 $0.98 $0.04 Adjusted EBITDA (non-GAAP) $36.52 $46.73 $58.03 Pro forma impacts for acquisitions $1.71 $2.29 $1.30 Contracted revenue and savings $5.37 $8.45 $1.74 Corporate income tax expense $0.12 $0.10 $0.25 Earnout Adjusted EBITDA (non-GAAP) $43.72 $57.58 $61.33 30

Q & A