ngvt-20201231false2020FY0001653477P3YP1YP3YP1YP3YP3Yus-gaap:PropertyPlantAndEquipmentAndFinanceLeaseRightOfUseAssetAfterAccumulatedDepreciationAndAmortizationus-gaap:LongTermDebtCurrentus-gaap:LongTermDebtAndCapitalLeaseObligations00016534772020-01-012020-12-31iso4217:USD00016534772020-06-30xbrli:shares00016534772021-02-1500016534772019-01-012019-12-3100016534772018-01-012018-12-31iso4217:USDxbrli:shares00016534772020-12-3100016534772019-12-310001653477us-gaap:CommonStockMember2017-12-310001653477us-gaap:AdditionalPaidInCapitalMember2017-12-310001653477us-gaap:RetainedEarningsMember2017-12-310001653477us-gaap:AccumulatedOtherComprehensiveIncomeMember2017-12-310001653477us-gaap:TreasuryStockMember2017-12-310001653477us-gaap:NoncontrollingInterestMember2017-12-3100016534772017-12-310001653477us-gaap:RetainedEarningsMember2018-01-012018-12-310001653477us-gaap:NoncontrollingInterestMember2018-01-012018-12-310001653477us-gaap:AccumulatedOtherComprehensiveIncomeMember2018-01-012018-12-310001653477us-gaap:CommonStockMember2018-01-012018-12-310001653477us-gaap:AdditionalPaidInCapitalMember2018-01-012018-12-310001653477us-gaap:TreasuryStockMember2018-01-012018-12-310001653477srt:CumulativeEffectPeriodOfAdoptionAdjustmentMemberus-gaap:RetainedEarningsMember2017-12-310001653477srt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2017-12-310001653477us-gaap:CommonStockMember2018-12-310001653477us-gaap:AdditionalPaidInCapitalMember2018-12-310001653477us-gaap:RetainedEarningsMember2018-12-310001653477us-gaap:AccumulatedOtherComprehensiveIncomeMember2018-12-310001653477us-gaap:TreasuryStockMember2018-12-310001653477us-gaap:NoncontrollingInterestMember2018-12-3100016534772018-12-310001653477us-gaap:RetainedEarningsMember2019-01-012019-12-310001653477us-gaap:NoncontrollingInterestMember2019-01-012019-12-310001653477us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-01-012019-12-310001653477us-gaap:CommonStockMember2019-01-012019-12-310001653477us-gaap:AdditionalPaidInCapitalMember2019-01-012019-12-310001653477us-gaap:TreasuryStockMember2019-01-012019-12-310001653477us-gaap:CommonStockMember2019-12-310001653477us-gaap:AdditionalPaidInCapitalMember2019-12-310001653477us-gaap:RetainedEarningsMember2019-12-310001653477us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-12-310001653477us-gaap:TreasuryStockMember2019-12-310001653477us-gaap:NoncontrollingInterestMember2019-12-310001653477us-gaap:RetainedEarningsMember2020-01-012020-12-310001653477us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-01-012020-12-310001653477us-gaap:CommonStockMember2020-01-012020-12-310001653477us-gaap:AdditionalPaidInCapitalMember2020-01-012020-12-310001653477us-gaap:TreasuryStockMember2020-01-012020-12-310001653477srt:CumulativeEffectPeriodOfAdoptionAdjustmentMemberus-gaap:RetainedEarningsMember2019-12-310001653477srt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2019-12-310001653477us-gaap:CommonStockMember2020-12-310001653477us-gaap:AdditionalPaidInCapitalMember2020-12-310001653477us-gaap:RetainedEarningsMember2020-12-310001653477us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-12-310001653477us-gaap:TreasuryStockMember2020-12-310001653477us-gaap:NoncontrollingInterestMember2020-12-31ngvt:segmentxbrli:pure0001653477ngvt:IngevityGeorgiaLLCMember2018-12-3100016534772020-03-012020-03-310001653477us-gaap:CustomerConcentrationRiskMemberus-gaap:AccountsReceivableMember2020-01-012020-12-310001653477us-gaap:CustomerConcentrationRiskMemberus-gaap:AccountsReceivableMember2019-01-012019-12-310001653477us-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMember2020-01-012020-12-310001653477us-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMember2019-01-012019-12-310001653477us-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMember2018-01-012018-12-310001653477us-gaap:LeaseholdsAndLeaseholdImprovementsMembersrt:MinimumMember2020-01-012020-12-310001653477us-gaap:LeaseholdsAndLeaseholdImprovementsMembersrt:MaximumMember2020-01-012020-12-310001653477us-gaap:MachineryAndEquipmentMembersrt:MinimumMember2020-01-012020-12-310001653477us-gaap:MachineryAndEquipmentMembersrt:MaximumMember2020-01-012020-12-310001653477ngvt:ProductionVesselsandKilnsStorageTanksPipingMember2020-12-310001653477ngvt:ProductionVesselsandKilnsStorageTanksPipingMember2020-01-012020-12-310001653477ngvt:ControlsystemsInstrumentationMeteringEquipmentMember2020-12-310001653477ngvt:ControlsystemsInstrumentationMeteringEquipmentMember2020-01-012020-12-310001653477ngvt:BlendingEquipmentStorageTanksPipingShippingEquipmentandPlatformsSafetyEquipmentMember2020-12-310001653477srt:MinimumMemberngvt:BlendingEquipmentStorageTanksPipingShippingEquipmentandPlatformsSafetyEquipmentMember2020-01-012020-12-310001653477srt:MaximumMemberngvt:BlendingEquipmentStorageTanksPipingShippingEquipmentandPlatformsSafetyEquipmentMember2020-01-012020-12-310001653477ngvt:ProductionControlSystemEquipmentandHardwareLaboratoryTestingEquipmentMember2020-12-310001653477ngvt:ProductionControlSystemEquipmentandHardwareLaboratoryTestingEquipmentMembersrt:MinimumMember2020-01-012020-12-310001653477ngvt:ProductionControlSystemEquipmentandHardwareLaboratoryTestingEquipmentMembersrt:MaximumMember2020-01-012020-12-310001653477ngvt:MachineryandEquipmentSupportStructuresandFoundationsMember2020-12-310001653477ngvt:MachineryandEquipmentSupportStructuresandFoundationsMember2020-01-012020-12-310001653477srt:OtherPropertyMember2020-12-310001653477srt:OfficeBuildingMembersrt:MinimumMember2020-12-310001653477srt:MaximumMembersrt:OfficeBuildingMember2020-12-310001653477srt:MinimumMemberus-gaap:BuildingMember2020-12-310001653477srt:MaximumMemberus-gaap:BuildingMember2020-12-310001653477srt:MinimumMemberngvt:ManufacturingandOfficeEquipmentMember2020-12-310001653477srt:MaximumMemberngvt:ManufacturingandOfficeEquipmentMember2020-12-310001653477ngvt:WarehousingandStorageFacilitiesMembersrt:MinimumMember2020-12-310001653477ngvt:WarehousingandStorageFacilitiesMembersrt:MaximumMember2020-12-310001653477us-gaap:VehiclesMembersrt:MinimumMember2020-12-310001653477us-gaap:VehiclesMembersrt:MaximumMember2020-12-310001653477ngvt:RailCarsMembersrt:MinimumMember2020-12-310001653477ngvt:RailCarsMembersrt:MaximumMember2020-12-310001653477srt:MinimumMember2020-01-012020-12-310001653477srt:MaximumMember2020-01-012020-12-310001653477us-gaap:SoftwareDevelopmentMembersrt:MinimumMember2020-01-012020-12-310001653477us-gaap:SoftwareDevelopmentMembersrt:MaximumMember2020-01-012020-12-3100016534772020-01-012020-01-0100016534772020-01-010001653477us-gaap:AccountsReceivableMember2020-12-310001653477ngvt:RestrictedInvestmentMember2020-12-310001653477us-gaap:FairValueInputsLevel1Member2020-12-310001653477ngvt:AutomotiveTechnologiesMemberngvt:PerformanceMaterialsMember2020-01-012020-12-310001653477ngvt:AutomotiveTechnologiesMemberngvt:PerformanceMaterialsMember2019-01-012019-12-310001653477ngvt:AutomotiveTechnologiesMemberngvt:PerformanceMaterialsMember2018-01-012018-12-310001653477ngvt:PerformanceMaterialsMemberngvt:ProcessPurificationMember2020-01-012020-12-310001653477ngvt:PerformanceMaterialsMemberngvt:ProcessPurificationMember2019-01-012019-12-310001653477ngvt:PerformanceMaterialsMemberngvt:ProcessPurificationMember2018-01-012018-12-310001653477ngvt:PerformanceMaterialsMember2020-01-012020-12-310001653477ngvt:PerformanceMaterialsMember2019-01-012019-12-310001653477ngvt:PerformanceMaterialsMember2018-01-012018-12-310001653477ngvt:OilfieldTechnologiesMemberngvt:PerformanceChemicalsMember2020-01-012020-12-310001653477ngvt:OilfieldTechnologiesMemberngvt:PerformanceChemicalsMember2019-01-012019-12-310001653477ngvt:OilfieldTechnologiesMemberngvt:PerformanceChemicalsMember2018-01-012018-12-310001653477ngvt:PavementTechnologiesMemberngvt:PerformanceChemicalsMember2020-01-012020-12-310001653477ngvt:PavementTechnologiesMemberngvt:PerformanceChemicalsMember2019-01-012019-12-310001653477ngvt:PavementTechnologiesMemberngvt:PerformanceChemicalsMember2018-01-012018-12-310001653477ngvt:PerformanceChemicalsMemberngvt:IndustrialSpecialtiesMember2020-01-012020-12-310001653477ngvt:PerformanceChemicalsMemberngvt:IndustrialSpecialtiesMember2019-01-012019-12-310001653477ngvt:PerformanceChemicalsMemberngvt:IndustrialSpecialtiesMember2018-01-012018-12-310001653477ngvt:EngineeredPolymersProductLineMemberngvt:PerformanceChemicalsMember2020-01-012020-12-310001653477ngvt:EngineeredPolymersProductLineMemberngvt:PerformanceChemicalsMember2019-01-012019-12-310001653477ngvt:EngineeredPolymersProductLineMemberngvt:PerformanceChemicalsMember2018-01-012018-12-310001653477ngvt:PerformanceChemicalsMember2020-01-012020-12-310001653477ngvt:PerformanceChemicalsMember2019-01-012019-12-310001653477ngvt:PerformanceChemicalsMember2018-01-012018-12-310001653477srt:NorthAmericaMember2020-01-012020-12-310001653477srt:NorthAmericaMember2019-01-012019-12-310001653477srt:NorthAmericaMember2018-01-012018-12-310001653477srt:AsiaPacificMember2020-01-012020-12-310001653477srt:AsiaPacificMember2019-01-012019-12-310001653477srt:AsiaPacificMember2018-01-012018-12-310001653477ngvt:EuropeMiddleEastandAfricaMember2020-01-012020-12-310001653477ngvt:EuropeMiddleEastandAfricaMember2019-01-012019-12-310001653477ngvt:EuropeMiddleEastandAfricaMember2018-01-012018-12-310001653477srt:SouthAmericaMember2020-01-012020-12-310001653477srt:SouthAmericaMember2019-01-012019-12-310001653477srt:SouthAmericaMember2018-01-012018-12-310001653477us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2020-12-310001653477us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2020-12-310001653477us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2020-12-310001653477us-gaap:FairValueMeasurementsRecurringMember2020-12-310001653477us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2019-12-310001653477us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2019-12-310001653477us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2019-12-310001653477us-gaap:FairValueMeasurementsRecurringMember2019-12-310001653477us-gaap:FairValueMeasurementsNonrecurringMemberus-gaap:FairValueInputsLevel1Member2020-12-310001653477us-gaap:FairValueMeasurementsNonrecurringMemberus-gaap:FairValueInputsLevel2Member2020-12-310001653477us-gaap:FairValueMeasurementsNonrecurringMemberus-gaap:FairValueInputsLevel3Member2020-12-310001653477us-gaap:FairValueMeasurementsNonrecurringMember2020-12-310001653477ngvt:WickliffeKentuckyManufacturingFacilityMember2020-12-310001653477srt:StandardPoorsAAPlusRatingMember2020-12-310001653477srt:StandardPoorsAARatingMember2020-12-310001653477srt:StandardPoorsARatingMember2020-12-310001653477srt:StandardPoorsAMinusRatingMember2020-12-310001653477srt:StandardPoorsBBBPlusRatingMember2020-12-310001653477ngvt:DebtObligationsMember2019-12-310001653477ngvt:DebtObligationsMember2020-12-310001653477ngvt:DebtObligationsMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2020-12-310001653477ngvt:DebtObligationsMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2019-12-310001653477ngvt:VariableInterestRateMember2020-12-310001653477ngvt:VariableInterestRateMember2019-12-310001653477ngvt:SeniorNotesIssued2018Member2020-12-310001653477ngvt:SeniorNotesIssued2018Member2019-12-310001653477us-gaap:FairValueInputsLevel2Memberngvt:SeniorNotesIssued2018Member2020-12-310001653477us-gaap:FairValueInputsLevel2Memberngvt:SeniorNotesIssued2018Member2019-12-3100016534772020-05-310001653477us-gaap:LiabilityMember2020-12-310001653477us-gaap:LiabilityMember2019-12-310001653477us-gaap:LiabilityMember2020-01-012020-12-310001653477us-gaap:MachineryAndEquipmentMember2020-12-310001653477us-gaap:MachineryAndEquipmentMember2019-12-310001653477ngvt:BuildingsAndLeaseholdImprovementsMember2020-12-310001653477ngvt:BuildingsAndLeaseholdImprovementsMember2019-12-310001653477us-gaap:LandAndLandImprovementsMember2020-12-310001653477us-gaap:LandAndLandImprovementsMember2019-12-310001653477us-gaap:ConstructionInProgressMember2020-12-310001653477us-gaap:ConstructionInProgressMember2019-12-310001653477us-gaap:MachineryAndEquipmentMemberngvt:WickliffeKentuckyManufacturingFacilityMember2020-12-310001653477us-gaap:MachineryAndEquipmentMemberngvt:WickliffeKentuckyManufacturingFacilityMember2019-12-310001653477us-gaap:MachineryAndEquipmentMemberngvt:WaynesboroGeorgiaManufacturingFacilityMember2020-12-310001653477us-gaap:MachineryAndEquipmentMemberngvt:WaynesboroGeorgiaManufacturingFacilityMember2019-12-310001653477ngvt:WaynesboroGeorgiaManufacturingFacilityMemberus-gaap:ConstructionInProgressMember2020-12-310001653477ngvt:WaynesboroGeorgiaManufacturingFacilityMemberus-gaap:ConstructionInProgressMember2019-12-310001653477ngvt:WaynesboroGeorgiaManufacturingFacilityMemberngvt:BuildingsAndLeaseholdImprovementsMember2020-12-310001653477ngvt:WaynesboroGeorgiaManufacturingFacilityMemberngvt:BuildingsAndLeaseholdImprovementsMember2019-12-310001653477ngvt:PerformanceChemicalsMember2018-12-310001653477ngvt:PerformanceMaterialsMember2018-12-310001653477ngvt:PerformanceChemicalsMember2019-12-310001653477ngvt:PerformanceMaterialsMember2019-12-310001653477ngvt:PerformanceChemicalsMember2020-12-310001653477ngvt:PerformanceMaterialsMember2020-12-310001653477ngvt:PerformanceChemicalsMemberngvt:CustomerContractsAndRelationshipsMember2020-12-310001653477ngvt:PerformanceChemicalsMemberngvt:CustomerContractsAndRelationshipsMember2019-12-310001653477us-gaap:TrademarksAndTradeNamesMemberngvt:PerformanceChemicalsMember2020-12-310001653477us-gaap:TrademarksAndTradeNamesMemberngvt:PerformanceChemicalsMember2019-12-310001653477us-gaap:CustomerRelationshipsMemberngvt:PerformanceChemicalsMember2020-12-310001653477us-gaap:CustomerRelationshipsMemberngvt:PerformanceChemicalsMember2019-12-310001653477ngvt:PerformanceChemicalsMemberus-gaap:OtherIntangibleAssetsMember2020-12-310001653477ngvt:PerformanceChemicalsMemberus-gaap:OtherIntangibleAssetsMember2019-12-310001653477ngvt:OtherIntangiblesNetMemberngvt:PerformanceChemicalsMember2020-12-310001653477ngvt:OtherIntangiblesNetMemberngvt:PerformanceChemicalsMember2019-12-310001653477us-gaap:CustomerContractsMember2020-01-012020-12-310001653477us-gaap:TrademarksAndTradeNamesMember2020-01-012020-12-310001653477us-gaap:CustomerRelationshipsMember2020-01-012020-12-310001653477us-gaap:OtherIntangibleAssetsMember2020-01-012020-12-310001653477us-gaap:CostOfSalesMember2020-01-012020-12-310001653477us-gaap:CostOfSalesMember2019-01-012019-12-310001653477us-gaap:CostOfSalesMember2018-01-012018-12-310001653477us-gaap:SellingGeneralAndAdministrativeExpensesMember2020-01-012020-12-310001653477us-gaap:SellingGeneralAndAdministrativeExpensesMember2019-01-012019-12-310001653477us-gaap:SellingGeneralAndAdministrativeExpensesMember2018-01-012018-12-310001653477us-gaap:CurrencySwapMember2020-06-300001653477ngvt:USDollarDenominationMemberus-gaap:CurrencySwapMember2020-06-300001653477us-gaap:EurodollarMemberus-gaap:CurrencySwapMember2020-06-300001653477us-gaap:CurrencySwapMember2020-12-310001653477us-gaap:CurrencySwapMember2019-12-310001653477us-gaap:CurrencySwapMember2020-01-012020-12-310001653477us-gaap:CurrencySwapMember2019-01-012019-12-310001653477us-gaap:ForeignExchangeContractMember2020-12-310001653477us-gaap:ForeignExchangeContractMember2019-12-31ngvt:mmbtus0001653477us-gaap:SwapMemberus-gaap:CommodityContractMember2020-12-310001653477ngvt:ZeroCostCollarMemberus-gaap:CommodityContractMember2020-12-310001653477us-gaap:CommodityContractMember2020-12-310001653477us-gaap:CommodityContractMember2019-12-310001653477us-gaap:InterestRateSwapMember2020-06-300001653477us-gaap:InterestRateSwapMember2020-12-310001653477us-gaap:InterestRateSwapMember2019-12-310001653477us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMemberus-gaap:CurrencySwapMember2020-01-012020-12-310001653477us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMemberus-gaap:CurrencySwapMember2019-01-012019-12-310001653477us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:CurrencySwapMember2020-01-012020-12-310001653477us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:CurrencySwapMember2019-01-012019-12-310001653477us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMemberus-gaap:CommodityContractMember2020-01-012020-12-310001653477us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMemberus-gaap:CommodityContractMember2019-01-012019-12-310001653477us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMemberus-gaap:CommodityContractMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2020-01-012020-12-310001653477us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMemberus-gaap:CommodityContractMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2019-01-012019-12-310001653477us-gaap:InterestRateSwapMemberus-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2020-01-012020-12-310001653477us-gaap:InterestRateSwapMemberus-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2019-01-012019-12-310001653477us-gaap:InterestRateSwapMemberus-gaap:AccumulatedGainLossNetCashFlowHedgeParentMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2020-01-012020-12-310001653477us-gaap:InterestRateSwapMemberus-gaap:AccumulatedGainLossNetCashFlowHedgeParentMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2019-01-012019-12-310001653477us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2020-01-012020-12-310001653477us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2019-01-012019-12-310001653477us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2020-01-012020-12-310001653477us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2019-01-012019-12-310001653477us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:CurrencySwapMemberus-gaap:NetInvestmentHedgingMember2020-01-012020-12-310001653477us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:CurrencySwapMemberus-gaap:NetInvestmentHedgingMember2019-01-012019-12-310001653477us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CommodityContractMemberus-gaap:FairValueInputsLevel1Member2020-12-310001653477us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CommodityContractMember2020-12-310001653477us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CommodityContractMemberus-gaap:FairValueInputsLevel3Member2020-12-310001653477us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CommodityContractMember2020-12-310001653477us-gaap:ForeignExchangeContractMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2020-12-310001653477us-gaap:FairValueInputsLevel2Memberus-gaap:ForeignExchangeContractMemberus-gaap:FairValueMeasurementsRecurringMember2020-12-310001653477us-gaap:ForeignExchangeContractMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2020-12-310001653477us-gaap:ForeignExchangeContractMemberus-gaap:FairValueMeasurementsRecurringMember2020-12-310001653477ngvt:NetInvestmentHedgeMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2020-12-310001653477us-gaap:FairValueInputsLevel2Memberngvt:NetInvestmentHedgeMemberus-gaap:FairValueMeasurementsRecurringMember2020-12-310001653477ngvt:NetInvestmentHedgeMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2020-12-310001653477ngvt:NetInvestmentHedgeMemberus-gaap:FairValueMeasurementsRecurringMember2020-12-310001653477us-gaap:InterestRateSwapMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2020-12-310001653477us-gaap:InterestRateSwapMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2020-12-310001653477us-gaap:InterestRateSwapMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2020-12-310001653477us-gaap:InterestRateSwapMemberus-gaap:FairValueMeasurementsRecurringMember2020-12-310001653477ngvt:NetInvestmentHedgeMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2019-12-310001653477us-gaap:FairValueInputsLevel2Memberngvt:NetInvestmentHedgeMemberus-gaap:FairValueMeasurementsRecurringMember2019-12-310001653477ngvt:NetInvestmentHedgeMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2019-12-310001653477ngvt:NetInvestmentHedgeMemberus-gaap:FairValueMeasurementsRecurringMember2019-12-310001653477us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CommodityContractMemberus-gaap:FairValueInputsLevel1Member2019-12-310001653477us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CommodityContractMember2019-12-310001653477us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CommodityContractMemberus-gaap:FairValueInputsLevel3Member2019-12-310001653477us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CommodityContractMember2019-12-310001653477us-gaap:InterestRateSwapMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2019-12-310001653477us-gaap:InterestRateSwapMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2019-12-310001653477us-gaap:InterestRateSwapMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2019-12-310001653477us-gaap:InterestRateSwapMemberus-gaap:FairValueMeasurementsRecurringMember2019-12-310001653477us-gaap:LineOfCreditMember2020-12-310001653477us-gaap:LineOfCreditMember2019-12-310001653477ngvt:TermLoanFacilityMemberngvt:A2019TermLoanMember2020-12-310001653477ngvt:TermLoanFacilityMemberngvt:A2019TermLoanMember2019-12-310001653477ngvt:TermLoanFacilityMemberngvt:A2017TermLoanMember2020-12-310001653477ngvt:TermLoanFacilityMemberngvt:A2017TermLoanMember2019-12-310001653477ngvt:OtherDebtMember2020-12-310001653477ngvt:OtherDebtMember2019-12-310001653477us-gaap:SeniorNotesMemberngvt:A2020SeniorNotesMember2020-12-310001653477us-gaap:SeniorNotesMemberngvt:A2020SeniorNotesMember2019-12-310001653477us-gaap:SeniorNotesMemberngvt:SeniorNotesIssued2018Member2020-12-310001653477us-gaap:SeniorNotesMemberngvt:SeniorNotesIssued2018Member2019-12-310001653477ngvt:FinanceLeaseObligationsMember2020-12-310001653477ngvt:FinanceLeaseObligationsMember2019-12-310001653477ngvt:CorporateHeadquartersMember2020-12-310001653477us-gaap:RevolvingCreditFacilityMember2020-12-310001653477us-gaap:RevolvingCreditFacilityMember2020-10-280001653477us-gaap:RevolvingCreditFacilityMemberus-gaap:BaseRateMembersrt:MinimumMember2020-01-012020-12-310001653477us-gaap:RevolvingCreditFacilityMemberus-gaap:BaseRateMembersrt:MaximumMember2020-01-012020-12-310001653477us-gaap:LondonInterbankOfferedRateLIBORMemberus-gaap:RevolvingCreditFacilityMembersrt:MinimumMember2020-01-012020-12-310001653477us-gaap:LondonInterbankOfferedRateLIBORMemberus-gaap:RevolvingCreditFacilityMembersrt:MaximumMember2020-01-012020-12-310001653477us-gaap:RevolvingCreditFacilityMember2020-01-012020-12-310001653477us-gaap:RevolvingCreditFacilityMember2019-01-012019-12-310001653477us-gaap:RevolvingCreditFacilityMember2018-01-012018-12-31ngvt:loan0001653477ngvt:A2019TermLoanMember2020-10-012020-12-310001653477ngvt:A2019TermLoanMember2019-03-070001653477us-gaap:BaseRateMemberngvt:A2019TermLoanMembersrt:MinimumMember2019-03-072019-03-070001653477us-gaap:BaseRateMemberngvt:A2019TermLoanMembersrt:MaximumMember2019-03-072019-03-070001653477us-gaap:LondonInterbankOfferedRateLIBORMemberngvt:A2019TermLoanMembersrt:MinimumMember2019-03-072019-03-070001653477us-gaap:LondonInterbankOfferedRateLIBORMemberngvt:A2019TermLoanMembersrt:MaximumMember2019-03-072019-03-070001653477ngvt:AmendmentNo1Member2017-08-210001653477ngvt:Original2017TermLoanMember2017-08-210001653477ngvt:A2017TermLoanMember2020-12-310001653477ngvt:A2017TermLoanMemberngvt:Year12And3Member2018-08-070001653477ngvt:AfterYear3Memberngvt:A2017TermLoanMember2018-08-070001653477ngvt:A2017TermLoanMemberus-gaap:BaseRateMembersrt:MinimumMember2018-08-072018-08-070001653477ngvt:A2017TermLoanMemberus-gaap:BaseRateMembersrt:MaximumMember2018-08-072018-08-070001653477us-gaap:LondonInterbankOfferedRateLIBORMemberngvt:A2017TermLoanMembersrt:MinimumMember2018-08-072018-08-070001653477us-gaap:LondonInterbankOfferedRateLIBORMemberngvt:A2017TermLoanMembersrt:MaximumMember2018-08-072018-08-070001653477ngvt:A2017TermLoanMember2018-08-070001653477ngvt:A2017TermLoanMember2018-12-310001653477ngvt:A2017TermLoanMember2017-12-310001653477us-gaap:SeniorNotesMemberngvt:A2020SeniorNotesMember2020-10-280001653477us-gaap:SeniorNotesMemberngvt:A2020SeniorNotesMember2020-10-282020-10-280001653477us-gaap:SeniorNotesMemberngvt:SeniorNotesIssued2018Member2018-01-240001653477us-gaap:SeniorNotesMemberngvt:SeniorNotesIssued2018Member2018-01-242018-01-240001653477us-gaap:RevolvingCreditFacilityMembersrt:MaximumMember2020-12-310001653477us-gaap:RevolvingCreditFacilityMembersrt:MinimumMember2020-12-310001653477ngvt:A2017TermLoanMembersrt:MaximumMember2020-12-310001653477ngvt:NewMarketTaxCreditMember2019-11-140001653477ngvt:NewMarketTaxCreditMemberngvt:WellsFargoMember2019-11-140001653477ngvt:IngevityVirginiaCorporationMemberngvt:NewMarketTaxCreditMember2019-11-140001653477ngvt:InnovateCDEMemberngvt:NewMarketTaxCreditMember2019-11-140001653477ngvt:NewMarketTaxCreditMember2020-12-310001653477ngvt:NewMarketTaxCreditMember2019-12-310001653477ngvt:OmnibusIncentivePlanMember2020-12-310001653477us-gaap:PerformanceSharesMember2020-01-012020-12-3100016534772016-12-092016-12-090001653477us-gaap:EmployeeStockMember2016-12-092016-12-090001653477us-gaap:EmployeeStockMember2016-12-090001653477us-gaap:EmployeeStockMember2020-12-310001653477us-gaap:EmployeeStockMember2020-01-012020-12-310001653477us-gaap:EmployeeStockOptionMember2020-01-012020-12-310001653477us-gaap:EmployeeStockOptionMember2019-01-012019-12-310001653477us-gaap:EmployeeStockOptionMember2018-01-012018-12-310001653477us-gaap:EmployeeStockMember2019-01-012019-12-310001653477us-gaap:EmployeeStockMember2018-01-012018-12-310001653477ngvt:RestrictedStockUnitsNonemployeeDirectorDeferredStockUnitsandPerformancebasedRestrictedStockUnitsMember2020-01-012020-12-310001653477ngvt:RestrictedStockUnitsNonemployeeDirectorDeferredStockUnitsandPerformancebasedRestrictedStockUnitsMember2019-01-012019-12-310001653477ngvt:RestrictedStockUnitsNonemployeeDirectorDeferredStockUnitsandPerformancebasedRestrictedStockUnitsMember2018-01-012018-12-310001653477srt:MinimumMemberus-gaap:EmployeeStockOptionMember2020-01-012020-12-310001653477srt:MaximumMemberus-gaap:EmployeeStockOptionMember2020-01-012020-12-310001653477us-gaap:EmployeeStockOptionMember2020-12-310001653477ngvt:RestrictedStockUnitsandNonemployeeDirectorDeferredStockUnitsMembersrt:MinimumMember2020-01-012020-12-310001653477ngvt:RestrictedStockUnitsandNonemployeeDirectorDeferredStockUnitsMembersrt:MaximumMember2020-01-012020-12-310001653477ngvt:RestrictedStockUnitsandNonemployeeDirectorDeferredStockUnitsMember2019-12-310001653477us-gaap:PerformanceSharesMember2019-12-310001653477ngvt:RestrictedStockUnitsandNonemployeeDirectorDeferredStockUnitsMember2020-01-012020-12-310001653477ngvt:RestrictedStockUnitsandNonemployeeDirectorDeferredStockUnitsMember2020-12-310001653477us-gaap:PerformanceSharesMember2020-12-310001653477ngvt:RestrictedStockUnitsandNonemployeeDirectorDeferredStockUnitsMemberngvt:NonEmployeeDirectorMember2020-12-310001653477ngvt:RestrictedStockUnitsNonemployeeDirectorDeferredStockUnitsandPerformancebasedRestrictedStockUnitsMember2020-12-310001653477us-gaap:AccumulatedForeignCurrencyAdjustmentIncludingPortionAttributableToNoncontrollingInterestMember2019-12-310001653477us-gaap:AccumulatedForeignCurrencyAdjustmentIncludingPortionAttributableToNoncontrollingInterestMember2018-12-310001653477us-gaap:AccumulatedForeignCurrencyAdjustmentIncludingPortionAttributableToNoncontrollingInterestMember2017-12-310001653477us-gaap:AccumulatedForeignCurrencyAdjustmentIncludingPortionAttributableToNoncontrollingInterestMember2020-01-012020-12-310001653477us-gaap:AccumulatedForeignCurrencyAdjustmentIncludingPortionAttributableToNoncontrollingInterestMember2019-01-012019-12-310001653477us-gaap:AccumulatedForeignCurrencyAdjustmentIncludingPortionAttributableToNoncontrollingInterestMember2018-01-012018-12-310001653477us-gaap:AccumulatedForeignCurrencyAdjustmentIncludingPortionAttributableToNoncontrollingInterestMember2020-12-310001653477us-gaap:AccumulatedNetGainLossFromCashFlowHedgesIncludingPortionAttributableToNoncontrollingInterestMember2019-12-310001653477us-gaap:AccumulatedNetGainLossFromCashFlowHedgesIncludingPortionAttributableToNoncontrollingInterestMember2018-12-310001653477us-gaap:AccumulatedNetGainLossFromCashFlowHedgesIncludingPortionAttributableToNoncontrollingInterestMember2017-12-310001653477us-gaap:AccumulatedNetGainLossFromCashFlowHedgesIncludingPortionAttributableToNoncontrollingInterestMember2020-01-012020-12-310001653477us-gaap:AccumulatedNetGainLossFromCashFlowHedgesIncludingPortionAttributableToNoncontrollingInterestMember2019-01-012019-12-310001653477us-gaap:AccumulatedNetGainLossFromCashFlowHedgesIncludingPortionAttributableToNoncontrollingInterestMember2018-01-012018-12-310001653477us-gaap:AccumulatedNetGainLossFromCashFlowHedgesIncludingPortionAttributableToNoncontrollingInterestMember2020-12-310001653477us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2019-12-310001653477us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2018-12-310001653477us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2017-12-310001653477us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2020-01-012020-12-310001653477us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2019-01-012019-12-310001653477us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2018-01-012018-12-310001653477us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2020-12-310001653477us-gaap:AccumulatedNetGainLossFromCashFlowHedgesIncludingPortionAttributableToNoncontrollingInterestMemberus-gaap:ForeignExchangeContractMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2020-01-012020-12-310001653477us-gaap:AccumulatedNetGainLossFromCashFlowHedgesIncludingPortionAttributableToNoncontrollingInterestMemberus-gaap:ForeignExchangeContractMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2019-01-012019-12-310001653477us-gaap:AccumulatedNetGainLossFromCashFlowHedgesIncludingPortionAttributableToNoncontrollingInterestMemberus-gaap:ForeignExchangeContractMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2018-01-012018-12-310001653477us-gaap:AccumulatedNetGainLossFromCashFlowHedgesIncludingPortionAttributableToNoncontrollingInterestMemberus-gaap:CommodityContractMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2020-01-012020-12-310001653477us-gaap:AccumulatedNetGainLossFromCashFlowHedgesIncludingPortionAttributableToNoncontrollingInterestMemberus-gaap:CommodityContractMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2019-01-012019-12-310001653477us-gaap:AccumulatedNetGainLossFromCashFlowHedgesIncludingPortionAttributableToNoncontrollingInterestMemberus-gaap:CommodityContractMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2018-01-012018-12-310001653477us-gaap:AccumulatedNetGainLossFromCashFlowHedgesIncludingPortionAttributableToNoncontrollingInterestMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2020-01-012020-12-310001653477us-gaap:AccumulatedNetGainLossFromCashFlowHedgesIncludingPortionAttributableToNoncontrollingInterestMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2019-01-012019-12-310001653477us-gaap:AccumulatedNetGainLossFromCashFlowHedgesIncludingPortionAttributableToNoncontrollingInterestMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2018-01-012018-12-310001653477us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetPriorServiceCostCreditMember2020-01-012020-12-310001653477us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetPriorServiceCostCreditMember2019-01-012019-12-310001653477us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetPriorServiceCostCreditMember2018-01-012018-12-310001653477us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetUnamortizedGainLossMember2020-01-012020-12-310001653477us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetUnamortizedGainLossMember2019-01-012019-12-310001653477us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetUnamortizedGainLossMember2018-01-012018-12-310001653477us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2020-01-012020-12-310001653477us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2019-01-012019-12-310001653477us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2018-01-012018-12-310001653477ngvt:PurificationCellutionsLLCMemberngvt:PurificationCellutionsLLCMember2018-08-010001653477ngvt:PurificationCellutionsLLCMember2018-08-012018-08-010001653477us-gaap:NoncontrollingInterestMemberngvt:PurificationCellutionsLLCMember2018-08-012018-08-010001653477ngvt:PurificationCellutionsLLCMemberus-gaap:AdditionalPaidInCapitalMember2018-08-012018-08-0100016534772020-02-280001653477us-gaap:PropertyPlantAndEquipmentMember2020-12-310001653477us-gaap:PropertyPlantAndEquipmentMember2019-12-310001653477us-gaap:OtherAssetsMember2020-12-310001653477us-gaap:OtherAssetsMember2019-12-310001653477us-gaap:PropertyPlantAndEquipmentMember2020-01-012020-12-310001653477us-gaap:OtherAssetsMember2020-01-012020-12-310001653477us-gaap:PropertyPlantAndEquipmentMember2019-01-012019-12-310001653477us-gaap:OtherAssetsMember2019-01-012019-12-31ngvt:lease0001653477us-gaap:RailroadTransportationEquipmentMember2020-12-310001653477us-gaap:NonqualifiedPlanMember2020-01-012020-12-310001653477us-gaap:QualifiedPlanMemberngvt:ScenarioOneMember2020-01-012020-12-310001653477us-gaap:QualifiedPlanMemberngvt:ScenarioTwoMember2020-01-012020-12-310001653477ngvt:WestRockCashBalanceMember2020-01-012020-12-310001653477ngvt:FinalAveragePayPensionMember2020-01-012020-12-310001653477us-gaap:PensionPlansDefinedBenefitMemberus-gaap:QualifiedPlanMember2020-12-310001653477us-gaap:PensionPlansDefinedBenefitMemberus-gaap:QualifiedPlanMember2019-12-310001653477us-gaap:QualifiedPlanMemberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2020-12-310001653477us-gaap:QualifiedPlanMemberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2019-12-310001653477us-gaap:PensionPlansDefinedBenefitMemberus-gaap:NonqualifiedPlanMember2020-12-310001653477us-gaap:PensionPlansDefinedBenefitMemberus-gaap:NonqualifiedPlanMember2019-12-310001653477us-gaap:NonqualifiedPlanMemberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2020-12-310001653477us-gaap:NonqualifiedPlanMemberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2019-12-310001653477us-gaap:PensionPlansDefinedBenefitMember2019-12-310001653477us-gaap:PensionPlansDefinedBenefitMember2018-12-310001653477us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2019-12-310001653477us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2018-12-310001653477us-gaap:PensionPlansDefinedBenefitMember2020-01-012020-12-310001653477us-gaap:PensionPlansDefinedBenefitMember2019-01-012019-12-310001653477us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2020-01-012020-12-310001653477us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2019-01-012019-12-310001653477us-gaap:PensionPlansDefinedBenefitMember2020-12-310001653477us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2020-12-310001653477us-gaap:PensionPlansDefinedBenefitMember2018-01-012018-12-310001653477us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2018-01-012018-12-310001653477us-gaap:PensionPlansDefinedBenefitMemberus-gaap:QualifiedPlanMember2020-01-012020-12-310001653477us-gaap:PensionPlansDefinedBenefitMemberus-gaap:QualifiedPlanMember2019-01-012019-12-310001653477us-gaap:PensionPlansDefinedBenefitMemberus-gaap:QualifiedPlanMember2018-01-012018-12-310001653477us-gaap:QualifiedPlanMemberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2020-01-012020-12-310001653477us-gaap:QualifiedPlanMemberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2019-01-012019-12-310001653477us-gaap:QualifiedPlanMemberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2018-01-012018-12-310001653477us-gaap:PensionPlansDefinedBenefitMemberus-gaap:NonqualifiedPlanMember2020-01-012020-12-310001653477us-gaap:PensionPlansDefinedBenefitMemberus-gaap:NonqualifiedPlanMember2019-01-012019-12-310001653477us-gaap:PensionPlansDefinedBenefitMemberus-gaap:NonqualifiedPlanMember2018-01-012018-12-310001653477us-gaap:NonqualifiedPlanMemberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2020-01-012020-12-310001653477us-gaap:NonqualifiedPlanMemberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2019-01-012019-12-310001653477us-gaap:NonqualifiedPlanMemberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2018-01-012018-12-310001653477us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CashAndCashEquivalentsMember2020-12-310001653477us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:CashAndCashEquivalentsMember2020-12-310001653477us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:MutualFundMember2020-12-310001653477us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:MutualFundMemberus-gaap:FairValueInputsLevel1Member2020-12-310001653477us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:BalancedFundsMember2020-12-310001653477us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:BalancedFundsMember2020-12-310001653477us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:OtherInvestmentsMember2020-12-310001653477us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:OtherInvestmentsMember2020-12-310001653477us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueMeasurementsRecurringMember2020-12-310001653477us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2020-12-310001653477us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2020-12-310001653477us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2020-12-310001653477us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberus-gaap:FairValueMeasurementsRecurringMember2020-12-310001653477us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CashAndCashEquivalentsMember2019-12-310001653477us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:CashAndCashEquivalentsMember2019-12-310001653477us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:MutualFundMember2019-12-310001653477us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:MutualFundMemberus-gaap:FairValueInputsLevel1Member2019-12-310001653477us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:BalancedFundsMember2019-12-310001653477us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:BalancedFundsMember2019-12-310001653477us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:OtherInvestmentsMember2019-12-310001653477us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:OtherInvestmentsMember2019-12-310001653477us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueMeasurementsRecurringMember2019-12-310001653477us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2019-12-310001653477us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2019-12-310001653477us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2019-12-310001653477us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberus-gaap:FairValueMeasurementsRecurringMember2019-12-310001653477ngvt:PalmeiraSantaCatarinaBrazilPerformanceChemicalsMember2020-01-012020-12-310001653477ngvt:PalmeiraSantaCatarinaBrazilPerformanceChemicalsMember2018-01-012018-12-310001653477ngvt:DuqueDeCaxiasRiodeJaneiroBrazilPerformanceChemicalsMember2018-01-012018-12-310001653477srt:MinimumMember2020-12-310001653477srt:MaximumMember2020-12-310001653477ngvt:NonCapitalizableCostsMembersrt:MinimumMember2020-12-310001653477ngvt:NonCapitalizableCostsMembersrt:MaximumMember2020-12-310001653477ngvt:CaprolactoneAcquisitionMember2019-02-13iso4217:EUR0001653477ngvt:CaprolactoneAcquisitionMember2019-02-132019-02-130001653477ngvt:CaprolactoneAcquisitionMember2019-12-310001653477us-gaap:CustomerRelationshipsMemberngvt:CaprolactoneAcquisitionMember2019-01-012019-12-310001653477us-gaap:CustomerRelationshipsMemberngvt:CaprolactoneAcquisitionMember2019-12-310001653477us-gaap:DevelopedTechnologyRightsMemberngvt:CaprolactoneAcquisitionMember2019-01-012019-12-310001653477us-gaap:DevelopedTechnologyRightsMemberngvt:CaprolactoneAcquisitionMember2019-12-310001653477ngvt:CaprolactoneAcquisitionMemberus-gaap:TradeNamesMember2019-01-012019-12-310001653477ngvt:CaprolactoneAcquisitionMemberus-gaap:TradeNamesMember2019-12-310001653477us-gaap:NoncompeteAgreementsMemberngvt:CaprolactoneAcquisitionMember2019-01-012019-12-310001653477us-gaap:NoncompeteAgreementsMemberngvt:CaprolactoneAcquisitionMember2019-12-310001653477ngvt:CaprolactoneAcquisitionMember2019-01-012019-12-310001653477ngvt:CaprolactoneAcquisitionMember2019-03-310001653477ngvt:CaprolactoneAcquisitionMember2020-01-012020-12-310001653477ngvt:CaprolactoneAcquisitionMember2020-12-310001653477ngvt:GeorgiaPacificChemicalsLLCMember2018-03-082018-03-080001653477ngvt:CaprolactoneAcquisitionMember2018-01-012018-12-310001653477ngvt:PurificationCellutionsLLCMember2018-08-010001653477ngvt:PurificationCellutionsLLCMember2018-08-012018-08-0100016534772018-08-012018-08-010001653477srt:NorthAmericaMember2020-12-310001653477srt:NorthAmericaMember2019-12-310001653477srt:AsiaPacificMember2020-12-310001653477srt:AsiaPacificMember2019-12-310001653477us-gaap:EMEAMember2020-12-310001653477us-gaap:EMEAMember2019-12-310001653477srt:SouthAmericaMember2020-12-310001653477srt:SouthAmericaMember2019-12-310001653477us-gaap:OperatingSegmentsMemberngvt:PerformanceMaterialsMember2020-12-310001653477us-gaap:OperatingSegmentsMemberngvt:PerformanceMaterialsMember2019-12-310001653477us-gaap:OperatingSegmentsMemberngvt:PerformanceChemicalsMember2020-12-310001653477us-gaap:OperatingSegmentsMemberngvt:PerformanceChemicalsMember2019-12-310001653477us-gaap:OperatingSegmentsMember2020-12-310001653477us-gaap:OperatingSegmentsMember2019-12-310001653477us-gaap:CorporateNonSegmentMember2020-12-310001653477us-gaap:CorporateNonSegmentMember2019-12-3100016534772020-01-012020-03-3100016534772020-04-012020-06-3000016534772020-07-012020-09-3000016534772020-10-012020-12-3100016534772019-01-012019-03-3100016534772019-04-012019-06-3000016534772019-07-012019-09-3000016534772019-10-012019-12-310001653477us-gaap:AllowanceForCreditLossMember2019-12-310001653477us-gaap:AllowanceForCreditLossMember2020-01-012020-12-310001653477us-gaap:AllowanceForCreditLossMember2020-12-310001653477ngvt:SECSchedule1209AllowanceHeldToMaturityDebtSecuritiesCreditLossAllowanceMember2019-12-310001653477ngvt:SECSchedule1209AllowanceHeldToMaturityDebtSecuritiesCreditLossAllowanceMember2020-01-012020-12-310001653477ngvt:SECSchedule1209AllowanceHeldToMaturityDebtSecuritiesCreditLossAllowanceMember2020-12-310001653477us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2019-12-310001653477us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2020-01-012020-12-310001653477us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2020-12-310001653477us-gaap:AllowanceForCreditLossMember2018-12-310001653477us-gaap:AllowanceForCreditLossMember2019-01-012019-12-310001653477us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2018-12-310001653477us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2019-01-012019-12-310001653477us-gaap:AllowanceForCreditLossMember2017-12-310001653477us-gaap:AllowanceForCreditLossMember2018-01-012018-12-310001653477us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2017-12-310001653477us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2018-01-012018-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_______________________________________________________________________

FORM 10-K

______________________________________________________________________________________________________

| | | | | |

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2020

OR

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File Number 001-37586

__________________________________________________________________________

INGEVITY CORPORATION

(Exact name of registrant as specified in its charter)

_________________________________________________________________________

| | | | | | | | | | | |

| Delaware | 47-4027764 |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

| | | |

| 4920 O'Hear Avenue Suite 400 | North Charleston | South Carolina | 29405 |

| (Address of principal executive offices) | (Zip code) |

843-740-2300

(Registrant’s telephone number)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of Each Class: | Trading Symbol(s) | Name of Each Exchange on Which Registered: |

| Common Stock ($0.01 par value) | NGVT | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes x No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes o No x

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports); and (2) has been subject to such filing requirements for the past 90 days.

Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| | | | | | | | | | | |

| Large accelerated filer | x | Accelerated filer | o |

Non-accelerated filer | o | Smaller reporting company | ☐ |

| | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

o

Indicate by check mark whether the registrant has filed a report on and attestation to its management's assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

☒

Indicate by check mark whether the Registrant is a shell company (as defined by Rule 12b-2 of the Exchange Act). Yes ☐ No x

At June 30, 2020, the aggregate market value of common stock held by non-affiliates of the Registrant was $2,162,317,073. The market value held by non-affiliates excludes the value of those shares held by executive officers and directors of the Registrant.

The Registrant had 40,468,010 shares of common stock, $0.01 par value, outstanding at February 15, 2021.

| | | | | | | | | | | |

| Documents Incorporated by Reference |

| Portions of the Company's definitive 2021 Annual Meeting Proxy Statement are incorporated by reference into Part III of this report. |

Ingevity Corporation

Form 10-K

INDEX

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements within the meaning of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), and the Private Securities Litigation Reform Act of 1995 that reflect our current expectations, beliefs, plans or forecasts with respect to, among other things, future events and financial performance. Forward-looking statements are often characterized by words or phrases such as “may,” “will,” “could,” “should,” “would,” “anticipate,” “estimate,” “expect,” “project,” “intend,” “plan,” “believe,” “target,” “prospects,” “potential” and “forecast,” and other words, terms and phrases of similar meaning.

These statements, by their nature, involve certain estimates, expectations, projections, forecasts and assumptions and are subject to various risks and uncertainties that are difficult to predict and often beyond our control. These risks and uncertainties may, and often do, cause actual results to differ materially from those contained in a forward-looking statement. Accordingly, readers are cautioned not to place undue reliance on any forward-looking statement. Any forward-looking statement is based on information currently available to us and speaks only as of the date that it is made. We have no duty, and undertake no obligation, to update any forward-looking statement to reflect developments occurring after the statement is made.

The risks and uncertainties that may cause actual results to differ materially from those indicated in any forward-looking may be included with the forward-looking statement itself. Other such risks and uncertainties include, but are not limited to, those discussed in Item 1A. Risk Factors in this report, as well as the following:

•adverse effects from the novel coronavirus ("COVID-19") pandemic;

•we may be adversely affected by general economic and financial conditions beyond our control;

•we are exposed to risks related to our international sales and operations;

•our reported results could be adversely affected by currency exchange rates and currency devaluation could impair our competitiveness;

•our operations outside the U.S. require us to comply with a number of U.S. and foreign regulations, violations of which could have a material adverse effect on our financial condition and results of operations;

•we may be adversely affected by changes in trade policy, including the imposition of tariffs and the resulting consequences;

•adverse conditions in the global automotive market or adoption of alternative and new technologies may adversely affect demand for our automotive carbon products;

•we face competition from producers of alternative products and new technologies, and new or emerging competitors;

•we face competition from infringing intellectual property activity;

•if increasingly more stringent air quality standards worldwide are not adopted, our growth could be impacted;

•we may be adversely affected by a decrease in government infrastructure spending;

•adverse conditions in cyclical end markets may adversely affect demand for our engineered polymers products;

•our printing inks business serves customers in a market that is facing declining volumes and downward pricing;

•our Performance Chemicals segment is highly dependent on crude tall oil ("CTO") which is limited in supply;

•lack of access to sufficient CTO would impact our ability to produce CTO-based products;

•a prolonged period of low energy prices may materially impact our results of operations;

•our engineered polymers product line may be adversely affected by the United Kingdom’s ("UK") withdrawal from the European Union;

•the acquisition (the "Caprolactone Acquisition") of Perstorp Holding AB's caprolactone division (the "Caprolactone Business") may expose us to unknown or understated liabilities;

•we are dependent upon third parties for the provision of certain critical operating services at several of our facilities;

•we may be adversely affected by disruptions in our supply chain;

•the occurrence of natural disasters, such as hurricanes, winter or tropical storms, earthquakes, tornadoes, floods, fires or other unanticipated problem such as labor difficulties (including work stoppages), equipment failure or unscheduled maintenance and repair, which could result in operational disruptions of varied duration;

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS (CONTINUED)

•we are dependent upon attracting and retaining key personnel;

•from time to time, we are called upon to protect our intellectual property rights and proprietary information though litigation and other means;

•if we are unable to protect our intellectual property and other proprietary information, we may lose significant competitive advantage;

•information technology security breaches and other disruptions;

•complications with the design or implementation of our new enterprise resource planning system;

•government policies and regulations, including, but not limited to, those affecting the environment, climate change, tax policies, tariffs and the chemicals industry; and

•losses due to lawsuits arising out of environmental damage or personal injuries associated with chemical or other manufacturing processes.

PART I

Item 1. Business

General

Ingevity provides products and technologies that purify, protect, and enhance the world around us. Through a diverse team of talented and experienced people, we develop, manufacture, and bring to market solutions that are both largely renewably sourced and help customers solve complex problems, while making the world more sustainable. We operate in two reporting segments: Performance Materials and Performance Chemicals. Our products are used in a variety of demanding applications, including automotive components that reduce gasoline vapor emissions, asphalt paving, oil exploration and production, agrochemicals, adhesives, lubricants, publication inks, coatings, elastomers, and bioplastics.

Throughout this Annual Report on Form 10-K, except where otherwise stated or indicated by the context, "Ingevity", the "Company", "we", "us", or "our" means Ingevity Corporation and its consolidated subsidiaries and their predecessors.

Our business originated as part of the operations of our former parent company, Westvaco Corporation, in 1964, and we operated as a division of Westvaco Corporation and its corporate successors, including MeadWestvaco Corporation and WestRock Company (“WestRock”) until our separation from WestRock in May 2016 (the “Separation”). Our common stock began "regular-way" trading on the New York Stock Exchange in May 2016 under the symbol "NGVT." Since the Separation, we acquired substantially all of the assets used in Georgia-Pacific Chemicals LLC’s pine chemical business (the “Pine Chemical Business”) in March 2018 and acquired Perstorp Holding AB’s entire caprolactone business (the “Caprolactone Business”) in February 2019. For additional information on these acquisitions, see Note 17 to the consolidated financial statements included within Part II. Item 8 of this Form 10-K.

Our principal executive offices are located at 4920 O'Hear Avenue, Suite 400, North Charleston, South Carolina 29405. Ingevity maintains a website at www.ingevity.com. We make available, free of charge through our website, our filings with the Securities and Exchange Commission (the “SEC”), including our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and any amendments to those reports, as soon as reasonably practicable after such items are filed with, or furnished to, the SEC. We also use our website to publish additional information that may be important to investors, such as presentations to analysts. Information contained in or connected to our website is not incorporated by reference into this Annual Report on Form 10-K. Reports we file with the SEC may also be viewed at www.sec.gov.

The table below illustrates our product lines and the primary end uses for our products by segment, as well as our revenue by segment for fiscal year 2020. For more information on our U.S. and foreign operations, see Notes 5 and 20, to the consolidated financial statements included within Part II. Item 8 of this Form 10-K.

| | | | | | | | | | | | | | | | | | | | |

| Performance Materials | Performance Chemicals |

| Product Lines | Automotive Technologies | Process Purification | Pavement Technologies | Oilfield Technologies | Industrial Specialties | Engineered Polymers |

| Primary End Uses | Gasoline vapor emissions control

| Purification of food, water, beverages and chemicals | Warm mix asphalt

Pavement preservation

Pavement reconstruction and recycling

| Well service additives

Production and downstream applications | Adhesives

Agrochemicals

Lubricants

Printing inks

Industrial intermediates | Coatings

Resins

Elastomers

Adhesives

Bioplastics

Medical devices |

| 2020 Revenue | $510.0 million | $706.1 million |

Segments

Performance Materials

Our automotive technologies product line engineers, manufactures, and sells hardwood-based, chemically activated carbon products, produced through a highly technical and specialized process primarily for use in gasoline vapor emission control systems in cars, trucks, motorcycles, and boats. To maximize the productivity of our manufacturing assets, we also produce a number of other activated carbon products for food, water, beverage, and chemical purification applications, which are sold through our process purification product line.

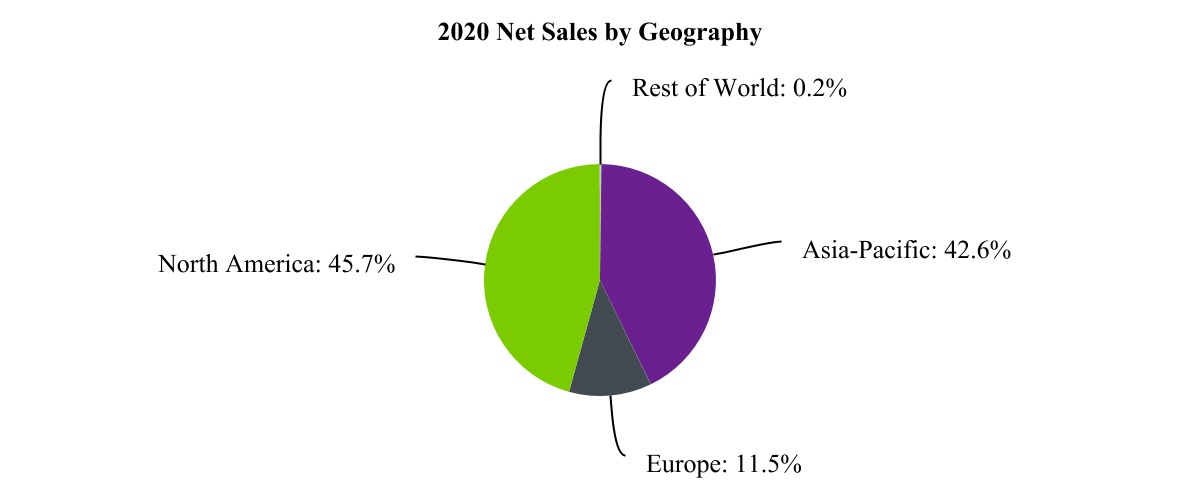

Our automotive activated carbon products primarily take the form of granular, pellets and honeycomb "scrubber", which are primarily utilized in vehicle-based gasoline vapor emission control systems that capture gasoline vapor emissions that would otherwise be released into the atmosphere as volatile organic compounds. The captured gasoline vapors are largely purged from the activated carbon and directed to the engine where they are used as supplemental power for the vehicle. In this way, our automotive activated carbon products are part of a system that provides for both environmental control and energy recovery. Performance Materials' net sales for 2020, 2019, and 2018 were $510.0 million, $490.6 million, and $400.4 million, respectively; the chart below allocates our 2020 Performance Materials' net sales by geography. Sales are assigned to geographic areas based on the location of the third party to which product was shipped.

Customers

We sell our automotive technologies products to over 60 customers around the globe. In 2020, our ten largest customers accounted for approximately 90 percent of the product line's sales. We are the trusted source of these products for many of the world’s largest automotive parts manufacturers, including BorgWarner Inc. (previously Delphi Technologies PLC), A. Kayser Automotive System GmbH, Korea Fuel-Tech Corporation, MAHLE GmbH, and many other large and small component manufacturers throughout the global automotive supply chain. Our process purification products are sold to approximately 70 customers globally. We sell our automotive technologies and process purification products primarily through our own direct sales force in North America, Europe, South America and Asia and also have a smaller, focused network of third-party distributors that have established a strong direct sales and marketing presence in North America and China.

Competition

Our automotive technologies competitors include Cabot Corp., Kuraray Co., Ltd., and several Chinese manufacturers. Ingevity has a decades-long track record of providing activated carbon that achieves life-of-vehicle emission standards. Given the imperative for automotive manufacturers to produce vehicles for the U.S., Canadian, and Chinese markets capable of meeting life-of-vehicle emission standards, or potentially face expensive recalls and unfavorable publicity, our automotive activated carbon products provide our customers the low-risk choice for this high performance application.

Competitors in our process purification product line include Cabot Corp., Kuraray Co., Ltd., Osaka Gas Chemicals Co., Ltd., and several domestic U.S. manufacturers and distributors of imported products.

Raw Materials and Production

Our Performance Materials segment serves customers globally from three manufacturing locations in the U.S. and two in China. The primary raw material (by volume) used in the manufacture of our activated carbon is hardwood sawdust. Sawdust is readily available and is sourced through multiple suppliers to protect against supply disruptions and to maintain competitive pricing.

We also utilize phosphoric acid, which is used to chemically activate the hardwood sawdust. This phosphoric acid is sourced through multiple suppliers to protect against supply disruptions and to maintain competitive pricing. The market price of phosphoric acid is affected by the global agriculture market as the majority of global phosphate rock production is used for fertilizer production and only a portion of that production is used to manufacture purified phosphoric acid.

Performance Chemicals

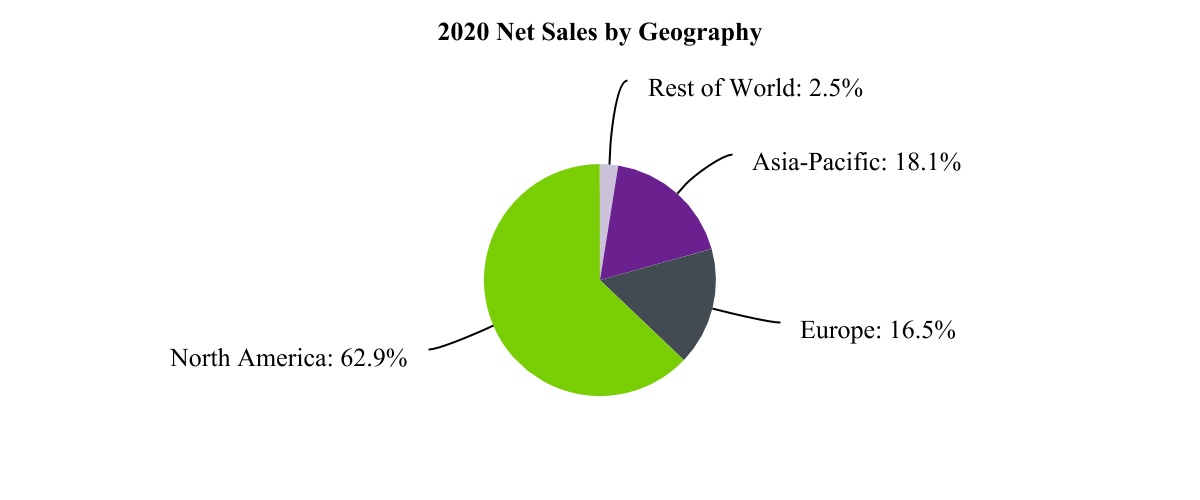

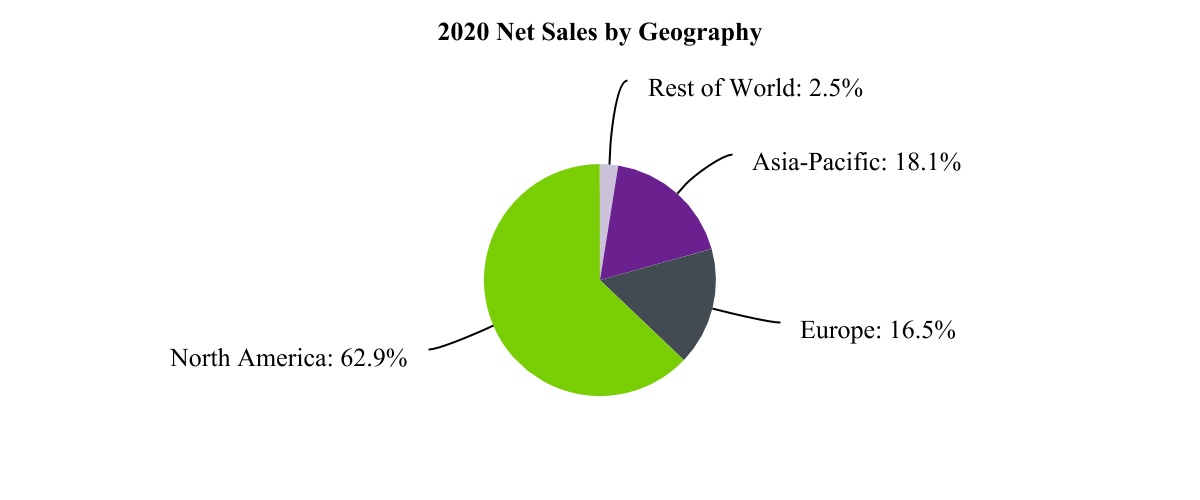

Ingevity’s Performance Chemicals segment is comprised of four product lines: pavement technologies, oilfield technologies, industrial specialties, and engineered polymers. Our products are utilized in warm mix paving, pavement preservation, pavement reconstruction and recycling, oil well service additives, oil production and downstream applications, adhesives, agrochemical dispersants, lubricants, printing inks, coatings, resins, elastomers, bioplastics, medical devices, and other diverse industrial uses. Our application expertise is often called upon by our customers to provide unique solutions that maximize resource efficiency. We have a broad and diverse customer base in this segment. In 2020, our top ten customers accounted for approximately 20 percent of our segment revenue, with the next 100 customers making up approximately 45 percent of our segment revenue. Performance Chemicals' net sales for 2020, 2019 and 2018 were $706.1 million, $802.3 million, and $733.2 million, respectively; the chart below allocates our 2020 Performance Chemicals' net sales by geography. Sales are assigned to geographic areas based on the location of the third party to which product was shipped.

Markets Served

Pavement Technologies

Our pavement technologies product line produces a broad line of innovative additives and technologies utilized globally in road construction and pavement preservation, including pavement reconstruction and recycling.

Warm Mix Asphalt. Evotherm®, our premier road construction additive, is a warm mix asphalt technology that promotes adhesion by acting as both a liquid antistrip and a warm mix asphalt. Once Evotherm is mixed into the binder utilized for road layer construction, production temperatures can be significantly cooler than conventional hot mix asphalt. Lower production temperatures allow our customers to reduce emissions and fuel use during road construction as well as extend their paving seasons into colder months.

Pavement Preservation. We provide an array of pavement preservation products that eliminate many traditional asphalt heating, mixing and transportation demands – saving our customers time, energy and money. Our technical team matches the right emulsifier and design to our customers’ materials and conditions to create high-performing emulsions. We offer a full range of specialized cationic, anionic and amphoteric emulsifiers with additional, custom-formulated specialty additives.

Pavement Reconstruction and Recycling. We provide an array of pavement reconstruction and recycling additives that reduce the life cycle cost of pavement by enabling the milling and reuse of existing roadways. Our cold in-place recycling additives allow our customers to reopen existing roadways faster, while also lowering overall costs and jobsite emissions.

Customers

We supply our pavement technologies products to approximately 500 customers in 60 countries through our own direct sales force, primarily in North America and Asia, as well as a network of third-party distributors. In 2020, our ten largest customers accounted for 40 percent of the product line's sales. Our largest customers include: Colas SA, Ergon, Inc., Associated Asphalt Inc., and Idaho Asphalt Supply Inc.

Competition

Our primary competitors in pavement technologies are Nouryon Chemicals B.V., Arkema S.A., and Kao Specialties Americas LLC. We compete based on deep knowledge of our customers’ businesses and extensive insights into road building technologies and trends globally. We use these strengths to develop consulting relationships with government departments of transportation, facilitating new technology introduction into key markets around the world. Our combined expertise in the disciplines of chemistry and civil engineering provides us with a comprehensive understanding of the relationship between the molecular structure of our products and their impact on the performance of pavement systems. This allows us to develop products customized to local markets and to consistently deliver cost-effective solutions for our customers.

Oilfield Technologies

Our oilfield technologies product line produces and sells a wide range of innovative specialty chemical products for the global oilfield industry, including well service additives and chemical solutions for production and downstream applications.

Well Service Additives. Our well service additive products are formulated to increase emulsion stability and aid in fluid loss control for oil-based drilling fluids. Other additives include rheology modifiers, which are used to improve the viscosity properties of oil-based fluids and are typically used in deep water applications and wetting agents, which provide improved wetting of solids and aid in the efficiency of the drilling process. This family of products aids in accessing difficult to reach oil and gas reserves, both on and offshore around the globe.

Production and Downstream Applications. Our production and downstream products serve as corrosion inhibitors or their components. Crude oil and natural gas production are characterized by variable production rates and unpredictable changes due to the nature of the produced fluids including but not limited to water and salt content. Our corrosion inhibitors maximize production rates by reducing the downtime for key equipment and pipes due to corrosion.

Customers

We sell our oilfield technologies products to approximately 70 customers around the globe using our own sales representatives and third-party distributors. In 2020, our ten largest customers accounted for 70 percent of the product line's sales. Our largest customers include Ecolab, Inc., Halliburton Co., Schlumberger Ltd., and Newpark Resources, Inc.

Competition

Our primary oilfield technologies competitors include Lamberti S.p.A., Mobile Rosin Oil Company, Inc., and First Source Technologies, Inc. We compete based on our ability to understand our customers’ applications and deliver solutions that aid in their improvement of the exploration and production of oil and gas for end users. Our scale and manufacturing flexibility help us deliver the creativity, expedience, and confidence that customers in oilfield technologies require.

Industrial Specialties

Our industrial specialties product line produces and sells chemicals utilized in several industrial applications, including adhesive tackifiers, agrochemical dispersants, lubricant additives, printing ink resins, and industrial intermediates.

Adhesives. We are a global supplier of tackifier resins, which provide superior adhesion to difficult-to-bond materials, to the adhesives industry. Adhesive applications for our products include construction, product assembly, packaging, pressure sensitive labels and tapes, hygiene products, and road markings.

Agrochemicals. We produce dispersants for crop protection products as well as other naturally derived products for agrochemicals. Crop protection formulations are highly engineered, specifically formulated and cover a range of different formulation types, from liquids to solids. We deliver a wide range of dispersants that are high performing and consistent. In addition, our crop protection products are approved for use as inert ingredients in agrochemicals by regulatory agencies throughout the world.

Lubricants. We supply lubricant additives and corrosion inhibitors for the metalworking and fuel additives markets. Our lubricant products are multi-functional additives that contribute to lubricity, wetting, corrosion inhibition, emulsification, and general performance efficiency. Our products are valued because of their ease in handling, robust performance, and improved formulation stability.

Printing Inks. We are a leading supplier of ink resins from renewable resources to the global graphic arts industry for the preparation of printing inks. Our products improve gloss, drying speed, viscosity, adhesion, and rub resistance of the finished ink to the substrate. We produce a wide array of resins, typically specifically tailored to a customer’s use, which can vary by application, pigment type, end use, formulation, manufacturing, and printing process.

Industrial Intermediates. Our functional chemistries are sold across a diverse range of industrial markets including, among others, paper chemicals, textile dyes, rubber, cleaners, mining, and nutraceuticals.

Customers

We sell our industrial specialties products to approximately 500 customers around the globe in over 45 countries through our own direct sales representatives and third-party sales representatives and distributors. In 2020, our ten largest customers accounted for 40 percent of the product line's sales. Our largest customers include Ennis-Flint, Inc., H.B. Fuller Co., Syngenta Crop Protection AG, and Flint Group.

Competition

Our competitors, which differ depending on the product, application, and region, include Kraton Corp., Eastman Chemical Co., ExxonMobil Corp., Borregaard ASA, Lawter, Inc., Respol S.A., Firmenich SA, as well as several others. Specific to our industrial specialty products, our customers select the product that provides the best balance of performance, consistency, and price. Reputation and loyalty are also valued by our customers and allow us to win business when other factors are equal. In adhesives, our products compete against other tackifiers, including other tall oil resin ("TOR") based tackifiers as well as tackifiers produced from gum rosin and hydrocarbon starting materials. In addition, the choice of polymer used in an adhesive formulation drives the selection of tackifier. In agrochemicals, the selection of a dispersant is made early in the product development cycle and the formulator has a choice among our sulfonated lignin products, lower quality lignosulfonates and other surfactants such as naphthalene sulfonates. In lubricants, we compete against other producers of distilled tall oil and additives. In printing inks, our products compete against other resins that can be derived from TOR, gum rosin and, to a lesser extent, hydrocarbon sources. In our industrial intermediates business, our tall oil fatty acid ("TOFA") competes against widely available fats and oils derived from tallow, soy, rapeseed, palm, and cotton sources.

Engineered Polymers

Our engineered polymers product line includes caprolactone and caprolactone based specialty chemicals for use in coatings, resins, elastomers, adhesives, bioplastics, and medical devices.

Coatings. We supply coating products that are used in automobile refinishing, sports floors, and marine applications. Our products enhance product performance by providing abrasion resistance, long durability, high quality finish, and enhanced performance in resin modification. Our products are often preferred because they provide a combination of traits that allows customers to displace several combinations of other products.

Resins. We supply resin products that are used in acrylic resins, polyurethane, and inks. Our products enhance product performance due to their protective properties, all weather performance and reduction or elimination of the need for solvents in formulations. Our products tend to be preferred where superior or particular performance levels are required.

Elastomers. We supply products that are used in wheel seals, mining screens, and polyurethane films. Our products enhance product performance due to their resistance to wear and tear, ability to maintain form and function under pressure and temperature and excellent UV resistance. Our products are often used in highly demanding applications where competing products do not reach required performance levels.

Adhesives. We supply products that are used in hot-melts, fabric lamination, and miscellaneous footwear components. Our products enhance product performance through their durability and substrate compatibility. Our products are often preferred because they are found to be easier to process and apply compared to competitive offerings.

Bioplastics. We supply products that are used in films, paper coatings, disposable cups, utensils, and packaging. Our products enhance product performance due to the combination of their biodegradability, improved mechanical properties, and wide processability when used in combination with other bioplastic solutions. Special grades are also available to help comply with food contact legislation in various regions and applications.

Medical Devices. We also supply products that are used in medical devices. Our products enhance end product performance due to their low melting point and ability to be thermoformed. Our products improve process conditions and provide patient comfort compared to competitive thermoplastic offerings.

Customers

We sell our engineered polymers chemicals to over 300 customers around the globe through our own direct sales representatives and third-party sales representatives and distributors. In 2020, our ten largest customers accounted for 40 percent of the product line's sales. Our largest customers include polyurethane, adhesive, coatings, and bioplastics manufacturers.

Competition

Our primary caprolactone competitors are Daicel, Corp. and BASF SE, but we also face competition from other competing materials. We compete based on performance as compared to the other competitive materials. We also compete by strengthening our technology-focused relationships with our customers.

Raw Materials and Production

Our Performance Chemicals segment serves customers globally from three manufacturing locations in the U.S. and one in the UK. Most of our pavement technologies, oilfield technologies, and industrial specialties products are derived from CTO, a co-product of the kraft pulping process, where pine is used as the source of the pulp. We also produce products derived from lignin, which is extracted from black liquor, another co-product of the kraft pulping process.

In 2016, we entered into a long-term supply agreement with WestRock pursuant to which we purchase all of the CTO and CTO equivalent tons of black liquor soap skimming ("BLSS"), the precursor to CTO, from WestRock's kraft mills as of such date, subject to certain exceptions. In 2018, we entered into a 20-year supply agreement with Georgia-Pacific LLC (“Georgia-Pacific”), pursuant to which we purchase the lesser of 125,000 tons of CTO and the aggregate output of CTO produced and originating at certain of Georgia-Pacific’s paper mills.

These relationships with WestRock and Georgia-Pacific are strategically important to our Performance Chemicals business due to the limited supply of CTO globally, of which we believe a significant portion is already under long-term supply agreements with other consumers of CTO. Under these agreements, we currently expect to source approximately 60 to 70 percent of our CTO requirements through 2025 based on the maximum operating rates of our three Performance Chemicals' pine chemicals facilities. The remainder of our CTO needs are sourced through short-term contracts in the open market.

We believe the supply from Georgia-Pacific, WestRock, and our other contracted sources of CTO will allow us to serve expected customer demand through 2021.