UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

(Mark One)

[

For the fiscal year ended

OR

For the transition period from ______________to ______________

Commission file number:

(Exact name of registrant as specified in its charter)

|

|

|

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

|

|

|

|

|

|

| (Address of principal executive offices) | (Zip code) |

Registrant's telephone number, including area code:

(

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

||

| N/A | N/A | N/A |

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, par value $0.0001 per share

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined by Rule 405 of the Securities Act.

Yes [ ]

|

| 1 |

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes [ ]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted every Interactive Data File required to be submitted pursuant to Rule 405 of Regulations S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company" and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| Large accelerated filer [ ] | Accelerated filer [ ] |

|

|

Smaller reporting company |

| Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

Indicate by check mark whether the registrant has filed a report on and attestation to its management's assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the fi ling reflect the correction of an error to previously issued financial statements.

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant's executive officers during the relevant recovery period pursuant to §240.10D-1(b). [ ]

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

Yes [ ] No [

The aggregate market value of the 97,060,703 voting common stock held by non-affiliates of the registrant as of June 30, 2023 (the last business day of the registrant's most recently completed second fiscal quarter) was $

The number of shares of Common Stock, $0.0001 par value, of the registrant outstanding as of May 15, 2024 was

DOCUMENTS INCORPORATED BY REFERENCE

None

|

| 2 |

TABLE OF CONTENTS

|

| 3 |

PART 1

RESULTS OF OPERATIONS FOR THE YEARS ENDED DECEMBER 31, 2023 AND 2022

Item 1. Business.

OVERVIEW

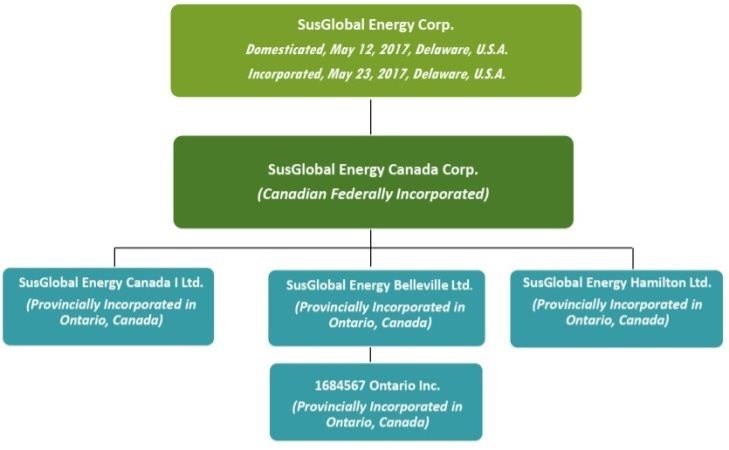

The following organization chart sets forth our wholly owned subsidiaries:

General

On February 4, 2019, the Company registered its common stock, having a par value of $.0001 per share, pursuant to Section 12(g) of the Securities Exchange Act of 1934, as amended (the "Exchange Act") and is effective pursuant to General Instruction A.(d).

SusGlobal Energy Corp. ("SusGlobal") was formed by articles of amalgamation on December 3, 2014, in the Province of Ontario, Canada and its executive office is in Toronto, Ontario, Canada, at 200 Davenport Road. Our telephone number is 416-223-8500. Our website address is www.susglobalenergy.com. Our annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K are all available, free of charge, on our website as soon as practicable after we file the reports with the Securities and Exchange Commission (the "SEC"). SusGlobal Energy Corp., a company in the start-up stages and Commandcredit Corp. ("Commandcredit"), an inactive Canadian public company, amalgamated to continue business under the name of SusGlobal Energy Corp.

|

| 4 |

On May 23, 2017, SusGlobal filed an Application for Authorization to continue in another Jurisdiction with the Ministry of Government Services in Ontario and a certificate of corporate domestication and certificate of incorporation with the Secretary of State of the State of Delaware under which it changed its jurisdiction of incorporation from Ontario to the State of Delaware (the "Domestication"). In connection with the Domestication each of the currently issued and outstanding common shares were automatically converted on a one-for-one basis into common shares compliant with the laws of the state of Delaware (the "Shares"). As a result of the Domestication, pursuant to Section 388 of the General Corporation Law of the State of Delaware (the "DGCL"), SusGlobal continued its existence under the DGCL as a corporation incorporated in the State of Delaware. The business, assets and liabilities of SusGlobal and its subsidiaries on a consolidated basis, as well as its principal location and fiscal year, were the same immediately after the Domestication as they were immediately prior to the Domestication. SusGlobal filed a Registration Statement on Form S-4 to register the Shares and this registration statement was declared effective by the Securities and Exchange Commission on May 12, 2017.

SusGlobal is a renewables company focused on acquiring, developing and monetizing a global portfolio of proprietary technologies in the waste to energy and regenerative products application.

When the terms "the Company," "we," "us" or "our" are used in this document, those terms refer to SusGlobal Energy Corp., and its wholly owned subsidiaries, SusGlobal Energy Canada Corp., SusGlobal Energy Canada I Ltd., SusGlobal Energy Belleville Ltd., SusGlobal Energy Hamilton Ltd., and 1684567 Ontario Inc.

On December 11, 2018, the Company began trading on the OTCQB venture market exchange, under the ticker symbol SNRG.

As the global amount of organic waste continues to grow, a solution for sustainable global management of these wastes is paramount. SusGlobal through its proprietary technology and processes is equipped and confident to deliver this objective. Management believes renewable energy is the energy of the future. Sources of this type of energy are more evenly distributed over the earth's surface than finite energy sources, making it an attractive alternative to petroleum-based energy. Biomass, one of the renewable resources, is derived from organic material such as forestry, food, plant and animal residuals. SusGlobal can therefore help you turn what many consider waste into precious energy and regenerative products. The portfolio will be comprised of three distinct types of technologies: (a) Process Source Separated Organics ("SSO") in anaerobic digesters to divert from landfills and recover biogas. This biogas can be converted to gaseous fuel for industrial processes, electricity to the grid or cleaned for compressed renewable gas. (b) Maximizing the capacity of existing infrastructure (anaerobic digesters) to allow processing of SSO to increase biogas yield. (c) and (c) process SSO and digestate to produce an organic compost or a pathogen free organic liquid fertilizer. The convertibility of organic material into valuable end products such as biogas, liquid biofuels, organic fertilizers and compost shows the utility of renewables. These products can be converted into electricity, fuels and marketed to agricultural operations that are looking for an increase in crop yields, soil amendment and environmentally-sound practices. This practice also diverts these materials from landfills and reduces Greenhouse Gas Emissions ("GHG") that result from landfilling organic wastes. The Company can provide peace of mind that the full lifecycle of organic material is achieved, global benefits are realized and stewardship for total sustainability is upheld. It is management's objective to grow SusGlobal into a significant sustainable waste to energy and regenerative products provider, as Leaders in The Circular Economy®.

We believe the products and services offered can benefit both the public and private markets. The following includes some of our work managing organic waste streams: Anaerobic Digestion, Dry Digestion, Wastewater Treatment, In-Vessel Composting, SSO Treatment, Biosolids Heat Treatment, Leachate Management, Composting and Liquid Fertilizers.

The Company can provide a full range of services for handling organic residuals in a period where innovation and sustainability are paramount. From start to finish we offer in-depth knowledge, a wealth of experience and cutting-edge technology for handling organic waste.

The primary focus of the services SusGlobal provides includes integrating our technologies with capital investment to optimize the processing of SSO. Our processes not only divert significant organic waste from landfills, but also result in methane avoidance, with significant GHG reductions from waste disposal. The processes produce regenerative products through the conversion of organic wastes into organic fertilizer, both dry compost and liquid.

Currently, the primary customers are municipalities in both rural and urban centers in Ontario, Canada. Where necessary, to follow provincial and local environmental laws and regulations, SusGlobal submits applications to the respective authorities for approval prior to any necessary engineering being carried out.

We are a "smaller reporting company," as defined under SEC Regulation S-K. As such, we also are exempt from the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act and are subject to less extensive disclosure requirements regarding executive compensation in our periodic reports and proxy statements. We will continue to be deemed a smaller reporting company until (i) our public float exceeds $250 million on the last day of our second fiscal quarter in our prior fiscal year (if our annual revenues exceeded $100 million in such prior fiscal year); or (ii) our public float exceeds $700 million on the last day of our second fiscal quarter in our prior fiscal year (if our annual revenues were less than $100 million in such prior fiscal year).

|

| 5 |

RECENT BUSINESS DEVELOPMENTS

On October 3, 2023, the Company announced it signed Commercial Terms for a ten (10) year Renewable Natural Gas ("RNG") Purchase and Sale Agreement (the "Agreement"). The Buyer will pay a purchase price of over US$20.00 (CA$27.00) per Metric Million British Thermal Unit ("MMbtu"), equivalent to approximately one Gigajoule ("GJ") of RNG at the delivery point, valuing the ten (10) year offtake agreement at approximately US$138,000,000 (CA$186,856,830). The Agreement is an industry standard summary of the commercial terms for the Renewable Natural Gas purchase and sale which allows the parties to maintain confidentiality while finalizing the definitive Renewable Natural Gas Purchase and Sale Agreement ("RNGPA") in the form of a GasEDI Base Contract with special provisions which were both subsequently signed and transaction confirmations of The RNGPA incorporating mutually agreeable and additional, more comprehensive terms, representations, warranties, and covenants customary to meet the local natural gas operating system standards, purchase offtake arrangements and required reporting to be agreed upon and signed.

On October 12, 2023, the Company announced that its wholly owned subsidiary SusGlobal Energy Belleville Ltd. ("SusGlobal Belleville") has generated approximately 12,500 additional Verified Emission Reductions and Removals ("VERRs") and sold a further 9,000 carbon credits as part of the Anew™ SusGlobal Belleville Composting Offset Project in Ontario (the "Project"). The Project has generated approximately 137,000 VERRS (generated from 2017 through 2022). The Project and report are listed on the GHG CleanProjects® Registry, https://www.csaregistries.ca/GHG_VR_Listing/CleanProjectDetail?ProjectId=909 a business unit of the Standards Division of the Canadian Standards Association ("CSA") for developed and marketed greenhouse gas ("GHG") offset credits from the Company's 49-acre Organic & Non-Hazardous Waste Processing & Composting Facility in Belleville, Ontario. The Project was developed by Anew Climate, LLC formerly known as Blue Source Canada ULC) ("Anew").

On November 2, 2023, the Company completed the purchase of additional land, consisting of a 2.03-acre site in Hamilton, Ontario, Canada for $2,292,760 (C$3,100,000). Prior to completing the purchase, the Company paid deposits of $229,276 (C$310,000) to the vendor. The balance of the purchase price was satisfied with a $1,479,200 (C$2,000,000) vendor take-back mortgage bearing interest at 7% annually, maturing in two years and the balance in cash financed by a second mortgage on the additional land bearing interest at 13% annually, maturing in one year and is secured by a third mortgage on the property in Belleville, Ontario, Canada.

On December 14, 2023, the Company announced an advisory and distribution agreement with Oak Hill Asset Management Inc., ("Oak Hill"), a prominent Toronto-based financial advisory firm with a strong track record of success and expertise in the investment sector. The non-exclusive agreement with Oak Hill to perform advisory and Exempt Market Dealer services is designed to better align the Company's balance sheet with both its growth opportunities and the perceived undervaluation of its assets by the public. The Company is actively pursuing Green Bond financing with accredited investors.

On or around November 27, 2023 and March 6, 2024, the Company experienced an outflow of contaminated water from its stormwater pond, which spilled over into the City of Belleville's roadside ditch and has continued to periodically overflow. The Company is working with its environmental consultants and its Canadian legal counsel to assess the damage caused, remediate this occurrence and report regularly to the Ministry of the Environment, Conservation and Parks from the Province of Ontario (the "MECP").

As a result of an order issued by the Ministry of Labour, Immigration, Training and Skills Development, specifically relating to high ammonia levels in one of the Company's composting buildings, the Company ceased accepting waste after January 10, 2024, to address this and other compliance matters issued by the MECP. The Company also received orders from the MECP to address repairs, the clean-up of unusable waste on site, re-habilitating its stormwater management system and other matters. Management anticipates these matters will take several months to complete, will require significant investment, and are dependent on the Company securing funding. We believe that our operating property, vehicle and equipment had been adequately maintained but will require significant investment to carry out repairs and improvements as ordered by the MECP. This will also include replacement of certain equipment at the Company's Belleville waste processing and composting facility.

New and Renewed Consulting Contracts

The Company entered into an Executive Chairman Consulting Agreement (the "CEO's Consulting Agreement"), by and among the Company, Travellers International Inc. ("Travellers"), and the CEO, who is also a director, the Executive Chairman and President of the Company, effective January 1, 2023 (the "Effective Date"). The CEO's Consulting Agreement replaced the consulting agreement which expired on December 31, 2022.

|

| 6 |

Pursuant to the terms of the CEO's Consulting Agreement, for his services as the CEO, the compensation is at a rate of $30,244 (C$40,000) per month for twelve (12) months, beginning on the Effective Date, and at a rate of $37,805 (C$50,000) per month for twelve (12) months, beginning January 1, 2024. In addition, the Company agreed to grant the CEO 3,000,000 restricted shares of the Company's common stock, par value of $0.0001 per share (the "Common Stock") on the Effective Date. This common stock was issued on January 3, 2023. The Company has also agreed to reimburse the CEO for certain out-of-pocket expenses incurred by the CEO.

The CEO's Consulting Agreement is for a term of twenty-four (24) months. Upon a Constructive Discharge (as defined in the CEO's Consulting Agreement) and subject to certain notification requirements and the Company's opportunity to cure the Constructive Discharge, the CEO will be entitled to a compensation of twelve (12) months' fees, as well as any bonus compensation owing.

The Company also entered into an Executive Consulting Agreement (the "CFO Consulting Agreement"), by and between the Company and the CFO of the Company, effective January 1, 2023. Pursuant to the terms of the CFO Consulting Agreement, the CFO is entitled to fees of $9,451 (C$12,500) per month for twelve (12). In addition, the Company has also agreed to grant the CFO 100,000 restricted shares of the Company's common stock, par value of $0.0001 per share on the Effective Date. The Company has also agreed to reimburse the CFO for certain out-of-pocket expenses incurred by the CFO. This common stock was issued on January 3, 2023. The CFO's Consulting Agreement replaced the consulting agreement which expired on December 31, 2022.

The CFO's Consulting Agreement is for a term of twelve (12) months. Upon a Constructive Discharge (as defined in the CFO's Consulting Agreement) and subject to certain notification requirements and the Company's opportunity to cure the Constructive Discharge, the CFO will be entitled to a compensation of two (2) months' fees, as well as any bonus compensation owing.

Financings

(a) Securities Purchase Agreements

On December 31, 2023, the Company had and currently has 5 security purchase agreements outstanding with 4 investors. The outstanding principal balance at December 31, 2023 of the convertible promissory notes was $7,442,600, including accrued interest of $1,232,440 with a fair value of $10,519,824. Please refer to the consolidated financial statements, convertible promissory notes, note 12 and fair value measurement, note 13 for details on the convertible promissory notes.

On April 15, 2024, the Company received proceeds of $100,500, net of an original issue discount of 10% and disbursements, on a new convertible promissory note in the principal amount of $120,000.

(b) PACE

On March 28, 2023, the Company and PACE finalized a full and final mutual release of all the obligations owing to PACE, including accrued interest, in exchange for an amount of $922,875 (C$1,250,000). The funds were being held in escrow by the Company's Canadian legal counsel. The funds were to be released to PACE once the letter of credit, in the amount of $204,384 (C$276,831), was released by the MECP to PACE. On November 3, 2023, immediately prior to the full and final release of the funds held in escrow, the obligations owing to PACE were $3,452,655 (C$4,668,274), included under long-term debt and accrued interest of $391,785 (C$529,725) included under accrued liabilities in the consolidated balance sheets, in total $3,844,440 (C$5,197,999).

As noted above, on November 3, 2023, the funds held in escrow, in the amount of $924,500 (C$1,250,000), were released to PACE (now Alterna Savings and Credit Union Limited "Alterna") and Alterna released all security it held to the Company.

The Company continues to be responsible in replacing the letter of credit previously held by PACE in favor of the MECP which is in the amount of $482,117 ($C637,637). The MECP is accepting an amount of $110,759 ($C146,487) until the Company provides details supporting the revised financial assurance.

For the year ended December 31, 2023, $70,615 (C$95,297) (2022-$357,038; C$464,168), in interest was incurred on the PACE long-term debt. As at December 31, 2023, $nil (C$nil) (2022-$288,407; C$390,636) in accrued interest is included in accrued liabilities in the consolidated balance sheets

|

| 7 |

(c) Mortgages

| i. | The Company obtained a 1st mortgage provided by private lenders to finance the acquisition of the shares of 1684567 and to provide funds for additional financing needs, including additional lands, received in four tranches totaling $3,931,720 (C$5,200,000) (December 31, 2022-$3,839,160; C$5,200,000). The fourth tranche was received on August 13, 2021 in the amount of $1,402,770 (C$1,900,000) and a portion of this fourth tranche, $1,368,759 (C$1,853,933), was used to fund a portion of the purchase of the first Hamilton Property on August 17, 2021. The 1st mortgage was repayable interest only on a monthly basis at an annual rate of the higher of the Royal Bank of Canada's prime rate plus 6.05% per annum and 10% per annum with a maturity date of December 1, 2023. The Company continued to be charged at the rate of 10% per annum. On December 1, 2023, the 1st mortgage was renewed with a new maturity date of June 1, 2024 and a fixed interest rate of 13% per annum. On renewal, the 1st mortgage was increased by $314,749 (C$416,280) to account for increased interest based on the previous variable rate, three months of prepaid interest and a financing fee. The 1st mortgage is secured by the shares held of 1684567, a 1st mortgage on the premises located at 704 Phillipston Road, Roslin (near Belleville), Ontario, Canada and a general assignment of rents. Financing fees on the 1st mortgage totaled $344,342 (C$455,419). As at December 31, 2023 $44,555 (C$58,928) (December 31, 2022-$31,555; C$42,740) of accrued interest is included in accrued liabilities in the consolidated balance sheets. In addition, as at December 31, 2022 there is $32,764 (C$43,333) (December 31, 2022-$56,409; C$76,404) of unamortized financing fees included in long-term debt in the consolidated balance sheets. |

| ii. | On March 1, 2023, the Company obtained a 2nd mortgage in the amount of $1,134,150 (C$1,500,000) bearing interest at the annual rate of 12%, repayable monthly, interest only with a maturity date of March 1, 2024, secured as noted under (c) i above. The Company incurred financing fees of $45,366 (C$60,000). As at December 31, 2023 $11,187 (C$14,795) (December 31, 2022-$nil; C$nil) of accrued interest is included in accrued liabilities in the interim condensed consolidated balance sheets. In addition, as at December 31, 2023 there is $7,457 (C$9,863) of unamortized financing fees included in long-term debt in the consolidated balance sheets. |

| iii. | On November 2, 2023, the Company completed the purchase of additional land, consisting of a 2.03-acre site in Hamilton, Ontario, Canada for $2,292,760 (C$3,100,000), prior to an additional disbursement of $44,213 (C$58,475) representing land transfer tax. The Company obtained a vendor take-back mortgage in the amount of $1,479,200 (C$2,000,000) bearing interest at 7% annually, payable monthly, interest only and maturing November 2, 2025. An additional mortgage, as noted below under paragraph (c) iv, was arranged to complete the purchase. |

| iv. | In connection with the purchase of additional land noted above under paragraph (c) iii above, a 2nd mortgage was obtained in the amount of $793,905 (C$1,050,000) bearing interest at 13% annually, payable monthly interest only and secured by a 3rd mortgage on the property in Belleville, Ontario, Canada. |

| v. | On December 14, 2023, the Company made arrangements to repay the previous 1st mortgage on the first property purchased in Hamilton, Ontario, Canada on August 17, 2021, for a new 1st mortgage in the amount of $1,688,597 ($C2,233,298) with new creditors. The original 1st mortgage was a vendor take back mortgage, as noted below under paragraph (c) vi. |

| vi. | On August 17, 2021, the Company obtained a vendor take-back 1st mortgage in the amount of $1,476,600 (C$2,000,000), on the purchase of the first property in Hamilton, Ontario, Canada. The 1st mortgage bore interest at an annual rate of 2% per annum, was repayable monthly interest only and had a maturity date of August 17, 2023 and was secured by the assets on this first property in Hamilton, Ontario, Canada. As noted under paragraph (c) v above, this mortgage was repaid on the transfer to the new creditors. |

For the year ended December 31, 2023, $718,535 (C$969,683) (2022-$430,772; C$560,026) in interest was incurred on the mortgages payable.

(d) Canada Emergency Business Account (the "CEBA")

As a result of the COVID-19 virus, the Government of Canada launched the CEBA, a program to ensure that small businesses have access to the capital they need to see them through the current challenges and better position them to quickly return to providing services to their communities and creating employment. The program is administered by Canadian chartered banks and credit unions.

On April 27, 2020, the Company received a total of $60,488 (C$80,000) and on December 17, 2020 a further $15,122 (C$20,000) under this program, from its Canadian chartered bank.

Under the initial term date of the loans, which is detailed in the CEBA term loan agreements, the amounts were due on December 31, 2022 and are interest-free. If the loans were not repaid by December 31, 2022, the Company could make payments, interest only, on a monthly basis at an annual rate of 5%, under the extended term date, beginning January 1, 2023, maturing December 31, 2025.

|

| 8 |

The CEBA term loan agreements were amended by extending the interest free repayment date by one year to December 31, 2023. If paid by January 18, 2024 or 30% $22,683 (C$30,000), of the loans would be forgiven. Repayment terms on the extended period were unchanged. The loans were repaid subsequent to the year-end on January 9, 2024 and January 11, 2024 and the forgiven amount was as noted above.

(e) Financings Related to Obligations Under Capital Lease

The Company has one remaining lease obligation under capital lease for machinery and equipment at their waste management and composting facility, as noted below:

| (i) | The lease agreement for certain equipment for the Company's organic waste processing and composting facility at a cost of $294,614 (C$389,650), is payable in monthly blended installments of principal and interest of $5,181 (C$6,852), plus applicable harmonized sales taxes for a period of fifty-nine months plus an initial deposit of $14,706 (C$19,450) plus applicable harmonized sales taxes and an option to purchase the equipment for a final payment of a nominal amount of $76 (C$100) plus applicable harmonized sales taxes on February 27, 2025. The leasing agreement bears interest at the rate of 3.59% annually, compounded monthly, due January 27, 2025. |

| For the year ended December 31, 2023, $3,687 (C$4,976) (2022-$4,762; C$6,191) in interest was incurred. |

(f) Other

On April 8, 2021, the Company took delivery of a truck and hauling trailer for a total purchase price of $165,085 (C$218,338) plus applicable harmonized sales taxes. The purchase was financed by a bank term loan of $151,220 (C$200,000), over a forty-eight-month term, bearing interest at 4.95% per annum with monthly blended instalments of principal and interest payments of $3,706 (C$4,901) due April 7, 2025.

For the year ended December 31, 2023, $3,238 (C$4,369) (2022-$5,500; C$7,150) in interest was incurred.

During the year ended December 31, 2022, the Company raised $380,971 (2022-$907,760), in a private placement on the issuance of 1,536,582 (2022-4,444,041) common shares of the Company.

During the year ended December 31, 2023, the director's company, Travellers, converted a total of $278,845 (C$372,483) (2022- $nil; C$nil) of loans provided during the year and $300,156 (C$406,800) (2022-$33,371; C$45,200) of accounts payable owing to Travellers for 2,911,852 (2022-193,778) common shares. For the year ended December 31, 2023, $nil (C$nil) (2022-$518; C$674) of interest was incurred on loans from the CFO which were repaid during the year.

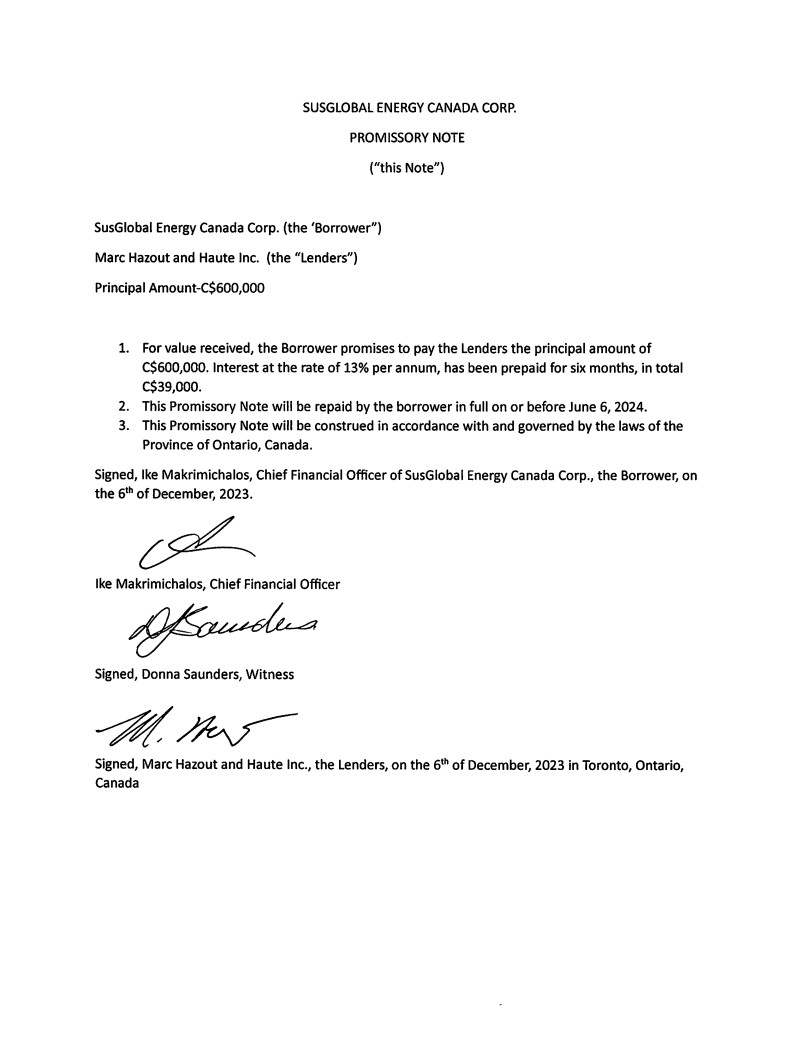

On January 9, 2024, the Company received a loan in the amount of $249,263 (C$329,670) from Haute Inc., an Ontario company controlled by the CEO. The proceeds received on January 9, 2024 net of capitalized interest for six months and a financing fee amounted to $226,830 (C$300,000).

On January 15, 2024, Travellers International Inc. ("Travellers"), an Ontario company controlled by a director and chief executive officer (the "CEO"), converted a total of $102,527 (C$135,600) of accounts payable owing for 809,044 common shares of the Company.

On April 2, 2024, the Company received funds in the amount of $148,217 (C$196,028), on a 4 th mortgage in the amount of $244,815 (C$323,786) net of unpaid interest, a financing fee and six months of capitalized interest, on the Company's waste processing and composting facility in Belleville, Ontario, Canada.

On April 15, 2024, the Company received proceeds of $100,500, net of an original issue discount of 10% and disbursements, on a new convertible promissory note in the principal amount of $120,000.

Treatment of Organic Waste and Septage

On February 28, 2019, the Company announced that it had received the project completion report titled: Development Optimization and Validation of an Innovative Integrated Anaerobic Thermophilic Digester Treatment of Organic Waste and Septage. The report was written by a research team at Fleming College's Centre for Advancement of Water and Wastewater Technologies, located in Lindsay, Ontario, Canada. The collaborative project was supported by the Advancing Water Technologies Program (the "AWT Program") of Southern Ontario Water Consortium. The project focused on the development of a new and innovative technology for handling and processing organic residuals. This new technology utilizes the anaerobic mesophilic digestion process coupled with thermophilic digestion to maximize biogas yields and produce organic fertilizer through optimal operations.

|

| 9 |

On September 21, 2022, the Company announced that its wholly owned subsidiary SusGlobal Energy Belleville Ltd. ("SusGlobal Belleville") has generated its first Verified Emission Reductions and Removals ("VERRs") and sold its first carbon credits as part of the Anew™ SusGlobal Belleville Composting Offset Project in Ontario (the "Project"). The Project generated approximately 137,000 VERRS from 2017 through 2022 with an approximate market value of between $3.78 (C$5.00) and $7.56 (C$10.00) per VERR. Up to the date of this filing, the Company has sold 42,302 VERRS. The Project report was submitted to the GHG CleanProjects® Registry, a business unit of the Standards Division of the Canadian Standards Association ("CSA"). The Project is part of the Offset Development and Marketing Agreement with Anew Canada ULC (formerly known as Blue Source Canada ULC) ("Anew Canada") for developed and marketed greenhouse gas ("GHG") offset credits from the Company's 49-acre Organic & Non-Hazardous Waste Processing & Composting Facility in Belleville, Ontario.

The Project has enabled an increase in the diversion of organic waste from landfills, thereby avoiding methane generation. Methane is a highly potent greenhouse gas which is 28 times more effective at trapping heat energy in our atmosphere than carbon dioxide. As organic waste decomposes in landfills, the methane builds up and must be released to prevent dangerous working conditions. By diverting waste that contributes to this problem, the Project benefits the community as well as the climate.

Operations

The Company owns Environmental Compliance Approvals (the "ECAs") issued by the MECP from the Province of Ontario, in place to accept up to 70,000 metric tonnes ("MT") of waste annually from the provinces of Ontario, Quebec and from New York state, and to operate a waste transfer station with the capacity to process up to an additional 50,000 MT of waste annually. Once built, the location of the waste transfer station will be alongside the Organic and Non-Hazardous Waste Processing and Composting Facility which is currently operating in Belleville, Ontario, Canada.

Waste Transfer Station- Access to the waste transfer station is critical to haulers who collect waste in areas not in close proximity to disposal facilities where such disposal continues to be permitted. Tipping fees charged to third parties at waste transfer stations are usually based on the type and volume or weight of the waste deposited at the waste transfer station, the distance to the disposal site, market rates for disposal costs and other general market factors.

Organic Composting Facility- As noted above, the Company's organic waste processing and composting facility, located in Belleville, Ontario Canada, has ECAs in place to accept up to 70,000 MT of waste annually and is currently in operation. Certain assets of the organic waste processing and composting facility, including the ECAs for the waste transfer station (not yet built), were acquired by the Company on September 15, 2017, from the Receiver for Astoria, under the asset purchase agreement (the"APA"). The Company charges tipping fees for the waste accepted at the organic waste composting facility based on arrangements in place with the customers and the type of waste accepted. Typical waste accepted includes, SSO, leaf and yard, food, liquid, paper sludge and biosolids. During the year ended December 31, 2023, tipping fees ranged from $51 (C$69) to $118 (C$159) per MT.

The Company owns a 41,535 square foot facility (approximately 27% complete) on 5.29 acres in Hamilton, Ontario (the "Hamilton Facility"), which includes an Environmental Compliance Approval to process 65,884 MT per annum of organic waste, 24 hours per day 7 days a week. The facility has been designed to produce, distribute and warehouse the Company's SusGro™ organic liquid fertilizer and other products that are anticipated to be provided under private label and to be sold through big box retailers, consumer lawn and garden suppliers, and for end use to the wine, cannabis and agriculture industries. With the addition of a further 11,000 square feet of office space and R&D labs, the Hamilton facility will also house the continued development of SusGlobal's proprietary formulations and branded liquid and dry organic fertilizers.

Market Opportunity

Industry Overview

Sustainable solutions to processing organic waste streams and diverting them from landfills to reduce GHG provides an opportunity for the infrastructure which SusGlobal operates with the ECA's attached to the Company's facilities. As more governments legislate and mandate that no organic wastes are to be landfilled as part of a climate change initiative SusGlobal can process these waste streams and produce regenerative products as part of the Company's Circular Economy initiative.

|

| 10 |

Industry Trends

The organic fertilizer market is expected to grow at a compounded annual growth rate. The major drivers for this market are increasing consumption of organic food and products such as cannabis, wine and favorable government rules and regulations. SusGlobal produces a dry organic compost currently and expects to produce an organic liquid pathogen-free fertilizer at its Hamilton Facility to meet the growing demand in this market.

Operating Businesses and Revenue

The Company has five wholly owned and active subsidiaries: SusGlobal Energy Canada Corp., SusGlobal Energy Canada I Ltd., SusGlobal Energy Belleville Ltd., SusGlobal Energy Hamilton Ltd. and 1684567 Ontario Inc. The Company currently has five full-time employees and two independent contractors. Of the five full-time employees, three are employed in management and administrative positions, and the balance in operations. The two independent contractors provide services in management positions. None of our employees are covered by collective bargaining agreements.

We operate the following businesses:

| • | Environmental Compliance Approvals: The Company owns the Environmental Compliance Approvals (the "ECAs") issued by the MECP from the Province of Ontario, in place to accept up to 70,000 MT of waste annually from the provinces of Ontario, Quebec and from New York state, and to operate a waste transfer station with the capacity to process up to an additional 50,000 MT of waste annually. Once built, the location of the waste transfer station will be alongside the organic waste processing and composting facility which has been operating in Belleville, Ontario, Canada. The Company owns the Environmental Compliance Approvals (the "ECAs") issued by the MECP from the Province of Ontario, in place to accept up to 65,884 MT of waste annually from the province of Ontario at the facility located in Hamilton, Ontario, Canada. |

| • | Waste Transfer Station: Access to the waste transfer station is critical to haulers who collect waste in areas not in close proximity to disposal facilities where such disposal continues to be permitted. Tipping fees charged to third parties at waste transfer stations are usually based on the type and volume or weight of the waste deposited at the waste transfer station, the distance to the disposal site, market rates for disposal costs and other general market factors. |

| • | Organic Composting Facility: As noted above, the Company's organic waste processing and composting facility, located in Belleville, Ontario Canada, has ECAs in place to accept up to 70,000 MT of waste annually and is currently in operation. Certain assets of the organic waste processing and composting facility, including the ECAs for the waste transfer station (not yet built), were acquired by the Company on September 15, 2017, from the Receiver for Astoria, under an APA. The Company charges tipping fees for the waste accepted at the organic waste composting facility based on arrangements in place with the customers and the type of waste accepted. Typical waste accepted includes, SSO, leaf and yard, food, liquid, paper sludge and biosolids. As noted above, once operations commence, anticipated to be mid-year 2025, in the Hamilton Facility (purchased on August 17, 2021) and located in Hamilton, Ontario, Canada, will have the capacity to process 65,884 MT of waste annually to produce an organic liquid fertilizer. |

We generate revenue from the following activities:

• Tipping fees paid by municipalities and haulers from green bin programs of SSO and other non-hazardous waste,

• the sale of the regenerative products such as organic dry compost and in the future organic liquid fertilizer at our Hamilton Facility with solution-specific brands sold to consumer markets, agriculture, wine and the cannabis industry; and

• the sale of carbon credits generated by our facilities.

The direct costs of our revenue consist primarily of employee costs, utilities, various equipment and automotive-related expenses, landfilling costs and depreciation.

Our Strengths

SusGlobal has the expertise, proprietary processes, technologies, the environmental compliance approvals and permits to operate and process high volumes of organic waste streams to produce proprietary regenerative products and sell in a high demand market.

|

| 11 |

Our Growth Strategy

SusGlobal owns two (2) processing and production properties, one of which is under renovation (approximately 27% complete), as part of a regional model and strategy which the Company expects will be exported to other municipalities in North America and globally. The processing facilities, one of which is under renovation, have production lines, warehouses, research and development and offices. The Company will continue to acquire, develop and monetize proprietary technologies and processes in the waste to regenerative products globally, focusing on implementing a robust intellectual property strategy. The Company will invest in research and development to bring more products to market and increase revenue and cash flow by increasing output, higher production speeds and overall efficiency of all segments of our business.

Sales and Marketing Strategy

The Company contacts major organic waste generators such as municipalities, commercial and industrial organic waste sources and bids for municipal and commercial contracts. The Company is expected to employ a sales team to market its products to the various agriculture, wine and cannabis industries and lawn and garden consumer market for its organic fertilizer products.

Competition

Many of our current and potential competitors are well established and have longer operating histories, significantly greater financial and operational resources and name recognition. Although some of our competitors have been in business for over 100 years, we believe that with our diverse product line, current and expected, better efficiencies resulting in lower wholesale cost of sales, we could obtain a large market share and continue to generate sales growth and compete in the industry. The principal competitive factors in all our product markets are technical features, quality, availability, price, customer support and distribution coverage. The relative importance of each of these factors varies depending on the region. We believe using our expected direct store distribution model nationwide will open significant opportunities for growth.

The markets in which we operate currently and, in the future, can be generally categorized as highly competitive. To maximize our competitive advantages, we expect to continue to expand our product portfolio to capitalize on market trends, changes in technology and new product releases.

Intellectual Property

The protection of our intellectual property is an essential aspect of our business. We own our domain names and trademarks relating to our website's design and content, including our brand name and various logos and slogans. We rely upon a combination of trademarks, trade secrets, copyrights, confidentiality procedures, contractual commitments and other legal rights to establish and protect our intellectual property. We generally enter into confidentiality agreements and invention or work product assignment agreements with our employees and consultants to control access to and clarify ownership of our processes, documentation, and other proprietary information.

As of the date of this filing, we held 4 registered trademarks in the United States. Trademarks include the terms SUSGLOBAL®, CARING FOR EARTH'S JOURNEY®, EARTH'S JOURNEY®, LEADERS IN THE CIRCULAR ECONOMY®. Our SUSGRO trademark application had been opposed but has since been withdrawn by The Scotts Miracle-Gro Company (NYSE: SMG) and is now being registered for use by the Company.

Seasonal Trends

Our operating revenues tend to be somewhat higher in summer months, primarily due to waste volumes resulting from higher construction and demolition waste volumes and the availability of leaf and yard waste along with any contracts involving the grinding of leaf and yard waste. In addition, revenue from the sale of organic compost would be higher beginning in late spring and tapering off in the fall.

Employees

As noted above, we currently have five full time employees (four on December 31, 2023), and two independent contractors. Of the five current full-time employees, three are employed in management and administrative positions, and the balance in operations. The two independent contractors provide services in management positions. None of our employees are covered by collective bargaining agreements.

|

| 12 |

Financial Assurance and Insurance Obligations

Financial Assurance

Municipal and governmental waste service contracts generally require contracting parties to demonstrate financial responsibility for their obligations under the contract. Financial assurance is also a requirement for (i) obtaining or retaining disposal site or waste transfer station operating permits; and (ii) estimated post-closure and environmental remedial obligations at our operations. We have established financial assurance using letters of credit and/or deposits with the municipalities. The type of assurance used is based on several factors, most importantly: jurisdiction, contractual requirements, market factors and availability of credit capacity.

As required by the MECP, on a tri-annual basis, the financial assurance is reviewed and updated. The financial assurance requested by the MECP was updated to $482,117 (C$637,637) and now reduced to $110,759 (C$146,487) as the Company is in the process of resubmitting its financial assurance estimates submission to the MECP, through the assistance of an environmental consultant. The Company has not yet provided this financial assurance, which was to replace the previous financial assurance provided by PACE that expired on September 30, 2023.

Insurance

We have in the past carried a broad range of insurance coverages, which may include general liability, automobile liability, workers' compensation, real and personal property, directors' and officers' liability, environmental and pollution legal liability and other coverages we believe are customary to the industry. Our exposure to loss for insurance claims is generally limited to the per-incident deductible under the related insurance policy. The impact of any known casualty, property, environmental or other contingency may have a material impact on our financial condition, results of operations or cash flows. As a result of the lack of funding we have not been able to provide complete insurance coverage or self-insure for the current year.

Regulation

Our business is subject to extensive and evolving federal, provincial and local environmental, health, safety and transportation laws and regulations. These laws and regulations are administered by the MECP, Environment Canada, and various other federal, provincial and local environmental, zoning, transportation, land use, health and safety agencies in Canada. Many of these agencies regularly examine our operations to monitor compliance with these laws and regulations and have the power to enforce compliance, obtain injunctions or impose civil or criminal penalties in case of non-compliance. During 2020 and 2023, the MECP has carried out inspections of our waste processing and composting facility to address certain items of non-compliance with our ECAs. These inspections and orders issued by the MECP have and will result in significant expenditures to begin addressing the items of non-compliance. Some of the corrective action includes certain sampling, testing, removal of excess waste from the facility and addressing the water level in the facility's stormwater pond which far exceeds the required level as stipulated in its ECA. The Company has completed some of the corrective action and communicates regularly with the MECP and will continue with the remaining corrective action through 2024. As at December 31, 2023, the Company has accrued the estimated costs totaling $2,153,214 (C$2,847,790 (2022-$667,635 (C$904,287) in connection with the corrective action.

An offence notice for exceeding odor units was filed by the MECP on the Company in the prior year. A proceeding was held remotely on March 21, 2022, at a Provincial Offence Court and was adjourned to April 11, 2022, to address and accept a Crown resolution offer of fines assessed by the MECP, in the amount of $99,520 (C$131,255). On May 16, 2022 the Company agreed to accept the Crown resolution offer and fine in the amount of $99,620 (C$131,255). This amount is included under accounts payable on the consolidated balance sheets.

Since the primary mission of our business is to manage solid and liquid waste hauled to our organic waste processing and composting facility in an environmentally sound manner, our capital expenditures are related, either directly or indirectly, to environmental protection measures, including compliance with federal, provincial and local rules. There are costs associated with siting, design, permitting, operations, monitoring, site maintenance, corrective actions, financial assurance, and facility closure and post-closure obligations. With acquisition, development or expansion of a waste management or waste transfer station, we must often spend considerable time, effort and money to obtain or maintain required permits and approvals. There are no assurances that we will be able to obtain or maintain required governmental approvals. Once obtained, operating permits are subject to renewal, modification, suspension or revocation by the issuing agency. Compliance with current regulations and future requirements could require us to make significant capital and operating expenditures. However, most of this expenditure is made in the normal course of business and does not place us at any competitive disadvantage.

|

| 13 |

The primary Provincial statutes affecting our business are summarized below:

Provincial and Local Regulations

Various provincial and local regulations affect our operations. The Province of Ontario has its own laws and regulations governing solid waste disposal, water and air pollution, and, in most cases, releases and cleanup of hazardous substances and liabilities for such matters. The Province of Ontario has also adopted regulations governing the design, operation, maintenance and closure of waste transfer stations. Some regions, municipalities and other local governments in Ontario have adopted similar laws and regulations. Our facilities and operations are likely to be subject to these types of requirements.

Our operations are affected by the increasing preference for alternatives to landfill disposal. Many regional and local governments in Ontario mandate recycling and waste reduction at the source and prohibit the disposal of certain types of waste, such as yard waste, food waste and electronics at landfills. The number of regional and local governments in Ontario with recycling requirements and disposal bans continues to grow, while the logistics and economics of recycling the items remain challenging. In addition, Ontario has imposed timelines for the ban of organics from landfills in the province in an effort to totally divert these wastes from landfills. This will provide opportunities for the expansion of facilities like ours. This had already occurred in the province of Quebec and in the United States of America (the "USA"), where various states have enacted, or are considering enacting, laws that restrict the disposal within the state of solid waste generated outside the state. While laws that overtly discriminate against out-of-state waste have been found to be unconstitutional, some laws that are less overtly discriminatory have been upheld in court. From time to time, the United States Congress has considered legislation authorizing states to adopt regulations, restrictions, or taxes on the importation of out-of-state or out-of-jurisdiction waste. Additionally, several state and local governments have enacted "flow control" regulations, which attempt to require that all waste generated within the state or local jurisdiction be deposited at specific sites. In 1994, the U.S. Supreme Court ruled that a flow control ordinance that gave preference to a local facility that was privately owned was unconstitutional, but in 2007, the Court ruled that an ordinance directing waste to a facility owned by the local government was constitutional. The United States Congress' adoption of legislation allowing restrictions on interstate transportation of out-of-state or out-of-jurisdiction waste or certain types of flow control, or courts' interpretations of interstate waste and flow control legislation, could adversely affect our solid and hazardous waste management services.

Federal, Provincial and Local Climate Change Initiatives

Considering regulatory and business developments related to concerns about climate change, we have identified a strategic business opportunity to provide our public and private sector customers with sustainable solutions to reduce their Greenhouse Gas ("GHG") emissions. As part of our on-going marketing evaluations, we assess customer demand for and opportunities to develop waste services offering verifiable carbon reductions, such as waste reduction, increased recycling, and conversion of biogas and discarded materials into electricity and fuel. We use carbon life cycle tools in evaluating potential new services and in establishing the value proposition that makes us attractive as an environmental service provider. We are active in support of public policies that encourage development and use of lower carbon energy and waste services that lower users' carbon footprints. We understand the importance of broad stakeholder engagement in these endeavors, and actively seek opportunities for public policy discussion on more sustainable materials management practices. In addition, we work with stakeholders at the federal and provincial level in support of legislation that encourages production and use of renewable, low-carbon fuels and electricity. Despite the past U.S. withdrawal from the Paris Climate Accords, we have seen no reduction in customer demand for services aligned with their GHG reduction goals and strategies. Ontario is part of the WCI led by the state of California and, if anything, California has doubled down on their GHG reduction goals. The states of Oregon and Washington are also considering joining the WCI that currently includes, amongst other states and provinces, California, Ontario and Quebec as members.

We continue to assess the physical risks to company operations from the effects of severe weather events and use risk mitigation planning to increase our resiliency in the face of such events. We are investing in infrastructure to withstand more severe storm events, which may afford us a competitive advantage and reinforce our reputation as a reliable service provider through continued service in the aftermath of such events.

Item 1A. Risk Factors.

To keep our stockholders and the public informed about our business, we may make "forward-looking statements." Forward-looking statements usually relate to future events and anticipated revenues, earnings, cash flows or other aspects of our operations or operating results. Forward-looking statements are often identified by the words, "will," "may," "should," "continue," "anticipate," "believe," "expect," "plan," "forecast," "project," "estimate," "intend" and words of a similar nature and generally include statements containing:

|

| 14 |

• projections about accounting and finances;

• plans and objectives for the future;

• projections or estimates about assumptions relating to our performance; or

• our opinions, views or beliefs about the effects of current or future events, circumstances or performance.

You should view these statements with caution. These statements are not guarantees of future performance, circumstances or events. They are based on facts and circumstances known to us as of the date the statements are made. All aspects of our business are subject to uncertainties, risks and other influences, many of which we do not control. Any of these factors, either alone or taken together, could have a material adverse effect on us and could change whether any forward-looking statement ultimately turns out to be true. Additionally, we assume no obligation to update any forward-looking statement as a result of future events, circumstances or developments. The following discussion should be read together with the Consolidated Financial Statements and the notes thereto. Outlined below are some of the risks that we believe could affect our business and financial statements for 2023 and beyond and that could cause actual results to be materially different from those that may be set forth in forward-looking statements made by the Company.

Any investment in our securities involves a high degree of risk, including the risks described below. Our business, financial condition and results of operations could suffer as a result of these risks, and the trading price of our shares could decline, perhaps significantly, and you could lose all or part of your investment. The risks discussed below also include forward-looking statements and our actual results may differ substantially from those discussed in these forward-looking statements. See the section entitled "Information Regarding Forward-Looking Statements."

Risks Related to Our Business and Industry

We may experience claims that our products infringe the intellectual property rights of others, which may cause us to incur unexpected costs or prevent us from selling our products.

We seek to improve our business processes and develop new products and applications. Many of our competitors have a substantial amount of intellectual property that we must continually monitor to avoid infringement. We cannot guarantee that we will not experience claims that our processes and products infringe issued patents (whether present or future) or other intellectual property rights belonging to others. If we are sued for infringement and lose, we could be required to pay substantial damages or be enjoined from using or selling the infringing products or technology. Further, intellectual property litigation is expensive and time-consuming, regardless of the merits of any claim, and could divert our management's attention from operating our business.

Our relationship with our employees could deteriorate, and certain key employees could leave the Company, which could adversely affect our business and our results of operations.

Our business involves complex operations and therefore demands a management team and employee workforce that is knowledgeable and expert in many areas necessary for our operations. We rely on our ability to attract and retain skilled employees, including our specialized research and development and sales and service personnel, to maintain our efficient production. The departure of a significant number of our highly skilled employees or of one or more employees who hold key management positions could have an adverse impact on our operations, including as a result of customers choosing to follow a regional manager to one of our competitors.

We face intense competition, and our failure to compete successfully may have an adverse effect on our net sales, gross profit and financial condition.

Our industry is highly competitive. Many of our competitors may have greater financial, technical and marketing resources than we do and may be able to devote greater resources to promoting and selling certain products.

If we do not compete successfully by developing and deploying new cost-effective products, processes and technologies on a timely basis and by adapting to changes in our industry and the global economy, our net sales, gross profit and financial condition could be adversely affected.

|

| 15 |

Failure to comply with the Foreign Corrupt Practices Act, or FCPA, and other similar anti-corruption laws, could subject us to penalties and damage our reputation.

We are subject to the FCPA, which generally prohibits U.S. companies and their intermediaries from making corrupt payments to foreign officials for the purpose of obtaining or keeping business or otherwise obtaining favorable treatment and requires companies to maintain certain policies and procedures. Certain jurisdictions in which we conduct business may be at a heightened risk for corruption, extortion, bribery, pay-offs, theft and other fraudulent practices. Under the FCPA, U.S. companies may be held liable for actions taken by their strategic or local partners or representatives. If we, or our intermediaries, fail to comply with the requirements of the FCPA, or similar laws of other countries, governmental authorities in the United States or elsewhere, as applicable, could seek to impose civil and/or criminal penalties, which could damage our reputation and have a material adverse effect on our business, financial condition and results of operations.

We are not insured against all potential risks.

To the extent available and where financially possible, we maintain insurance coverage that we believe is customary in our industry. Such insurance does not, however, provide coverage for all liabilities, including certain hazards incidental to our business, and we cannot assure you that our insurance coverage will be adequate to cover claims that may arise or that we will be able to maintain adequate insurance at rates we consider reasonable. As a result of the lack of funding we have not been able to provide complete insurance coverage for the current year.

We may not be able to consummate future acquisitions or successfully integrate acquisitions into our business, which could result in unanticipated expenses and losses.

Part of our strategy is to grow through acquisitions. Consummating acquisitions of related businesses, or our failure to integrate such businesses successfully into our existing businesses, could result in unanticipated expenses and losses. Furthermore, we may not be able to realize any of the anticipated benefits from the acquisitions.

In connection with potential future acquisitions, the process of integrating acquired operations into our existing operations may result in unforeseen operating difficulties and may require significant financial resources that would otherwise be available for the ongoing development or expansion of existing operations. Some of the risks associated with acquisitions include:

• unexpected losses of key employees or customers of the acquired company;

• conforming the acquired company's standards, processes, procedures and controls with our operations;

• coordinating new product and process development;

• hiring additional management and other critical personnel;

• negotiating with labor unions; and

• increasing the scope, geographic diversity and complexity of our operations.

In addition, we may encounter unforeseen obstacles or costs in the integration of businesses we may acquire. Also, the presence of one or more material liabilities of an acquired company that are unknown to us at the time of acquisition may have a material adverse effect on our financial condition or results of operations.

Business disruptions could seriously harm revenues and increase our costs and expenses.

Our operations could be subject to extraordinary events, including natural disasters, political disruptions, terrorist attacks, acts of war and other business disruptions, which could seriously harm our net sales and increase our costs and expenses. These blackouts, floods and storms could cause disruptions to our operations or the operations of our suppliers, distributors, resellers or customers. Similar losses and interruptions could also be caused by earthquakes, telecommunications failures, water shortages, tsunamis, typhoons, fires, extreme weather conditions, medical epidemics and other natural or manmade disasters for which we are predominantly self-insured.

Risks Relating to Our Common Stock

An active trading market may not result for our common stock.

On December 11, 2018, our common stock commenced quotation on the OTCQB Market, under the symbol, SNRG. We cannot predict the extent to which investor interest in us will lead to the development of an active trading market or how liquid that market might become. An active public market for our common stock may not develop or be sustained. If an active public market does not develop or is not sustained, it may be difficult for you to sell your shares of common stock at a price that is attractive to you, or at all.

|

| 16 |

We have a history of net losses, and we expect to incur additional losses.

In each year since our inception, we have incurred losses and have generated in total, since inception, only $6,262,852 in revenue. For the year ended December 31, 2023, net losses attributable to common stockholders aggregated $8,225,334 (2022-$12,010,548) and at December 31, 2023, the Company's accumulated deficit was $38,570,531 (2022-$30,345,197). We expect to incur further losses in the development of our business. We cannot assure you that we can achieve profitable operations in any future period.

Our independent registered public accounting firms' report contains an explanatory paragraph that expresses substantial doubt as to our ability to continue as a going concern.

Although our consolidated financial statements have been prepared assuming we will continue as a going concern, our independent registered public accounting firm in their report accompanying our consolidated financial statements as of and for the years ended December 31, 2023 and 2022, expressed substantial doubt as to our ability to continue as a going concern as of December 31, 2023 and as of December 31, 2022, as a result of our operating losses since inception, because the Company expects to incur further losses in the development of its business and the Company's ability to settle its current liabilities owing to service providers and creditors. The inclusion of a going concern explanatory paragraph may make it more difficult for us to secure additional financing or enter into strategic relationships on terms acceptable to us, if at all, and may materially and adversely affect the terms of any financing that we may obtain.

We have no intention of declaring dividends in the foreseeable future.

The decision to pay cash dividends on our common stock rests with our board of directors and will depend on our earnings, unencumbered cash, capital requirements and financial condition. We do not anticipate declaring any dividends in the foreseeable future, as we intend to use any excess cash to fund our operations. Investors in our common stock should not expect to receive dividend income on their investment in the foreseeable future.

We may issue preferred stock in the future, and the terms of the preferred stock may reduce the value of our common stock.

Under the certificate of incorporation of the Company, our Board of Directors are authorized to create and issue one or more additional series of preferred stock, and, with respect to each series, to determine number of shares constituting the series and the designations and the powers, preferences and rights, and the qualifications, limitations and restrictions thereof, which may include dividend rights, conversion or exchange rights, voting rights, redemption rights and terms and liquidation preferences, without stockholder approval. If we create and issue one or more additional series of preferred stock, it could affect your rights or reduce the value of our outstanding common stock. Our Board of Directors could, without stockholder approval, issue preferred stock with voting and other rights that could adversely affect the voting power of the holders of our common stock and which could have certain anti-takeover effects.

Special Meetings of our Stockholders may only be called by our Board of Directors or our CEO and as such, our stockholders do not have the ability to call a meeting.

Under our bylaws only our Board of Directors or CEO may call a special meeting of shareholders and as such, your ability to participate and take certain corporate actions like amending the Company's certificate of incorporation or electing directors is limited.

We may be exposed to risks relating to evaluations of controls required by Sarbanes-Oxley Act of 2002.

Pursuant to Sarbanes-Oxley Act of 2002, our management will be required to report on, and our independent registered public accounting firm may in the future be required to attest to, the effectiveness of our internal control over financial reporting. Although we prepare our financial statements in accordance with accounting principles generally accepted in the United States of America ("US GAAP"), our internal accounting controls may not meet all standards applicable to companies with publicly traded securities. If we fail to implement any required improvements to our disclosure controls and procedures, we may be obligated to report control deficiencies and our independent registered public accounting firm may not be able to certify the effectiveness of our internal controls over financial reporting. In either case, we could become subject to regulatory sanction or investigation. Further, these outcomes could damage investor confidence in the accuracy and reliability of our financial statements.

|

| 17 |

If our internal controls and accounting processes are insufficient, we may not detect in a timely manner misstatement that could occur in our financial statements in amounts that could be material.

As a public company, we will have to devote substantial efforts to the reporting obligations and internal controls required of a public company, which will result in substantial costs. A failure to properly meet these obligations could cause investors to lose confidence in us and have a negative impact on the market price of our shares. We expect to devote significant resources to the documentation, testing and continued improvement of our operational and financial systems for the foreseeable future. These improvements and efforts with respect to our accounting processes that we will need to continue to make may not be sufficient to ensure that we maintain adequate controls over our financial processes and reporting in the future. Any failure to implement required, new or improved controls, or difficulties encountered in their implementation, could cause us to fail to meet our reporting obligations in the USA or result in misstatements in our financial statements in amounts that could be material. Insufficient internal controls could also cause investors to lose confidence in our reported financial information, which could have a negative effect on the trading price of our shares and may expose us to litigation risk.

As a public company, we will be required to document and test our internal control procedures to satisfy the requirements of Section 404 of Sarbanes-Oxley, which requires annual management assessments of the effectiveness of our internal control over financial reporting. During the course of our testing, we may identify deficiencies which we may not be able to remediate in time to meet our deadline for compliance with Section 404. We may not be able to conclude on an ongoing basis that we have effective internal control over financial reporting in accordance with Section 404. If we are unable to conclude that we have effective internal control over financial reporting, then investors could lose confidence in our reported financial information, which could have a negative effect on the trading price of our shares.

Information Regarding Forward-Looking Statements

Statements in this Form 10-K may be "forward-looking statements." Forward-looking statements include, but are not limited to, statements that express our intentions, beliefs, expectations, strategies, predictions or any other statements relating to our future activities or other future events or conditions. These statements are based on current expectations, estimates and projections about our business based, in part, on assumptions made by management. These statements are not guarantees of future performance and involve risks, uncertainties and assumptions that are difficult to predict. Therefore, actual outcomes and results may, and are likely to, differ materially from what is expressed or forecasted in the forward-looking statements due to numerous factors, including those described above and those risks discussed from time to time in this prospectus, including the risks described under "Risk Factors," and "Management's Discussion and Analysis of Financial Condition and Results of Operations" in this prospectus and in other documents which we file with the SEC.

In addition, such statements could be affected by risks and uncertainties related to:

• our ability to raise funds for general corporate purposes and operations, including our clinical trials;

• our ability to recruit qualified management and technical personnel;

• our ability to complete successfully within our industry;

• fluctuations in foreign currency exchange rates;

• our ability to maintain and enhance our technological capabilities and to respond effectively to technological changes in our industry; and

• our ability to protect our intellectual property, on which our business avoiding infringing the intellectual property rights of others;

Any forward-looking statements speak only as of the date on which they are made, and except as may be required under applicable securities laws, we do not undertake any obligation to update any forward-looking statement to reflect events or circumstances after the date of this prospectus.

|

| 18 |

If we fail to implement our business strategy, our financial performance and our growth could be materially and adversely affected.

Our future financial performance and success are dependent in large part upon our ability to implement our business strategy successfully. Implementation of our strategy will require effective management of our operational, financial and human resources and will place significant demands on those resources.

See Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations - Overview for more information on our business strategy.

There are risks involved in pursuing our strategy, including the following:

• Our employees, customers or investors may not embrace and support our strategy.

• We may not be able to hire or retain the personnel necessary to manage our strategy effectively.

• We may be unsuccessful in implementing improvements to operational efficiency and such efforts may not yield the intended result.

• We may not be able to maintain cost savings achieved through restructuring efforts.

• Strategic decisions with respect to our asset portfolio may result in impairments to our assets.

• Our ability to make strategic acquisitions depends on our ability to identify desirable acquisition targets, negotiate advantageous transactions despite competition for such opportunities, fund such acquisitions on favorable terms, obtain regulatory approvals and realize the benefits we expect from those transactions.

• Acquisitions, investments and/or new service offerings may not increase our earnings in the timeframe anticipated, or at all, due to difficulties operating in new markets or providing new service offerings, failure of emerging technologies to perform as expected, failure to operate within budget, integration issues, or regulatory issues, among others.

• Integration of acquisitions and/or new services offerings could increase our exposure to the risk of inadvertent noncompliance with applicable laws and regulations.

• Liabilities associated with acquisitions, including ones that may exist only because of past operations of an acquired business, may prove to be more difficult or costly to address than anticipated.

• Execution of our strategy, particularly growth through acquisitions, may cause us to incur substantial additional indebtedness, which may divert capital away from our traditional business operations and other financial plans.

• We continue to seek to divest underperforming and non-strategic assets if we cannot improve their profitability. We may not be able to successfully negotiate the divestiture of underperforming and non-strategic operations, which could result in asset impairments or the continued operation of low-margin businesses.

In addition to the risks set forth above, implementation of our business strategy could also be affected by a number of factors beyond our control, such as increased competition, legal developments, government regulation, general economic conditions, increased operating costs or expenses and changes in industry trends. We may decide to alter or discontinue certain aspects of our business strategy at any time. If we are not able to implement our business strategy successfully, our long-term growth and profitability may be adversely affected. Even if we are able to implement some or all of the initiatives of our business strategy successfully, our operating results may not improve to the extent we anticipate, or at all.

|

| 19 |

Compliance with existing or increased future regulations and/or enforcement of such regulations may restrict or change our operations, increase our operating costs or require us to make additional capital expenditures, and a decrease in regulation may lower barriers to entry for our competitors.

Stringent government regulations at the federal, state, provincial and local level in the U.S. and Canada have a substantial impact on our business, and compliance with such regulations is costly. A large number of complex laws, rules, orders and interpretations govern environmental protection, health, safety, land use, zoning, transportation and related matters. Among other things, governmental regulations and enforcement actions may restrict our operations and adversely affect our financial condition, results of operations and cash flows by imposing conditions such as:

• limitations on constructing a new waste transfer station, recycling or processing facilities or on expanding existing facilities;