UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D. C. 20549

FORM

(Mark One)

|

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended

or

|

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number 001‑37961

(Exact name of registrant as specified in its charter)

|

|

|

|

|

Not Applicable |

|

(State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

(Address of principal executive offices, including Zip Code)

(

(Registrant's telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

|

|

|

|

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well‑known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S‑T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non‑accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b‑2 of the Exchange Act.

|

Large accelerated filer |

☐ |

|

|

☒ |

|

Non-accelerated filer |

☐ |

|

Smaller reporting company |

|

|

Emerging Growth Company |

|

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes‑Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b‑2 of the Act). Yes

There were

DOCUMENTS INCORPORATED BY REFERENCE

The information required by Part III of Form 10‑K is incorporated herein by reference to the registrant’s definitive Proxy Statement relating to its 2020 General Meeting, which will be filed with the Securities and Exchange Commission within 120 days after the end of the registrant’s fiscal year.

TABLE OF CONTENTS

|

|

Page |

|

|

PART I |

|

|

|

ITEM 1. |

1 |

|

|

ITEM 1A. |

10 |

|

|

ITEM 1B. |

27 |

|

|

ITEM 2. |

28 |

|

|

ITEM 3. |

28 |

|

|

ITEM 4. |

28 |

|

|

|

|

|

|

PART II |

|

|

|

ITEM 5. |

28 |

|

|

ITEM 6. |

30 |

|

|

ITEM 7. |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

31 |

|

ITEM 7A. |

43 |

|

|

ITEM 8. |

43 |

|

|

ITEM 9. |

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE |

43 |

|

ITEM 9A. |

43 |

|

|

ITEM 9B. |

44 |

|

|

|

|

|

|

PART III |

|

|

|

ITEM 10. |

45 |

|

|

ITEM 11. |

45 |

|

|

ITEM 12. |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED SHAREHOLDER MATTERS |

45 |

|

ITEM 13. |

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE |

45 |

|

ITEM 14. |

45 |

|

|

|

|

|

|

PART IV |

|

|

|

ITEM 15. |

45 |

|

|

ITEM 16. |

45 |

|

CAUTIONARY STATEMENT CONCERNING FORWARD‑LOOKING STATEMENTS

This report contains forward-looking statements within the meaning of the federal securities laws. All statements other than statements of historical fact included in this report are forward-looking statements. These statements relate to analyses and other information, which are based on forecasts of future results and estimates of amounts not yet determinable. These statements also relate to our future prospects, developments and business strategies. These forward-looking statements are identified by the use of terms and phrases such as “anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “predict,” “project,” “will” and similar terms and phrases, including references to assumptions. However, these words are not the exclusive means of identifying such statements. These statements are contained in many sections of this report, including those entitled “Business” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” Although we believe that our plans, intentions and expectations reflected in or suggested by such forward-looking statements are reasonable, we cannot assure you that we will achieve those plans, intentions or expectations. All forward-looking statements are subject to risks and uncertainties that may cause actual results to differ materially from those that we expected.

Important factors that could cause actual results to differ materially from our expectations, or cautionary statements, are disclosed under the sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in this report. All written and oral forward-looking statements attributable to us, or persons acting on our behalf, are expressly qualified in their entirety by the cautionary statements contained in this report under the heading “Risk Factors,” as well as other cautionary statements that are made from time to time in our other filings with the Securities and Exchange Commission and public communications. You should evaluate all forward-looking statements made in this report in the context of these risks and uncertainties.

We caution you that the important factors referenced above may not contain all of the factors that are important to you. In addition, we cannot assure you that we will realize the results or developments we expect or anticipate or, even if substantially realized, that they will result in the consequences or affect us or our operations in the way we expect. The forward-looking statements included in this report are made only as of the date hereof. We undertake no obligation to publicly update or revise any forward-looking statement as a result of new information, future events or otherwise, except as otherwise required by law.

PART I

ITEM 1. BUSINESS

Unless expressly indicated or the context requires otherwise, the terms “Ichor,” “Company,” “we,” “us,” “our,” and similar terms in this report refer to Ichor Holdings, Ltd. and its consolidated subsidiaries.

We use a 52- or 53-week fiscal year ending on the last Friday in December. The following table details our fiscal periods included elsewhere in this report. All references to fiscal years or quarters relate to our fiscal period as so detailed.

|

Fiscal Period |

|

Period Ending |

|

Weeks in Period |

|

Fiscal Year 2020: |

|

December 25, 2020 |

|

52 |

|

First Quarter |

|

March 27, 2020 |

|

13 |

|

Second Quarter |

|

June 26, 2020 |

|

13 |

|

Third Quarter |

|

September 25, 2020 |

|

13 |

|

Fourth Quarter |

|

December 25, 2020 |

|

13 |

|

|

|

|

|

|

|

Fiscal Year 2019: |

|

December 27, 2019 |

|

52 |

|

First Quarter |

|

March 29, 2019 |

|

13 |

|

Second Quarter |

|

June 28, 2019 |

|

13 |

|

Third Quarter |

|

September 27, 2019 |

|

13 |

|

Fourth Quarter |

|

December 27, 2019 |

|

13 |

|

|

|

|

|

|

|

Fiscal Year 2018: |

|

December 28, 2018 |

|

52 |

|

First Quarter |

|

March 30, 2018 |

|

13 |

|

Second Quarter |

|

June 29, 2018 |

|

13 |

|

Third Quarter |

|

September 28, 2018 |

|

13 |

|

Fourth Quarter |

|

December 28, 2018 |

|

13 |

|

|

|

|

|

|

|

Fiscal Year 2017: |

|

December 29, 2017 |

|

52 |

|

|

|

|

|

|

|

Fiscal Year 2016 |

|

December 30, 2016 |

|

53 |

Company Overview

We are a leader in the design, engineering, and manufacturing of critical fluid delivery subsystems and components for semiconductor capital equipment. Our product offerings include gas and chemical delivery systems and subsystems, collectively known as fluid delivery systems and subsystems, which are key elements of the process tools used in the manufacturing of semiconductor devices. Our gas delivery subsystems deliver, monitor, and control precise quantities of the specialized gases used in semiconductor manufacturing processes such as etch and deposition. Our chemical delivery systems and subsystems precisely blend and dispense the reactive liquid chemistries used in semiconductor manufacturing processes such as chemical-mechanical planarization, electroplating, and cleaning. We also manufacture precision machined components, weldments, and proprietary products for use in fluid delivery systems for direct sales to our customers. This vertically integrated portion of our business is primarily focused on metal and plastic parts that are used in gas and chemical systems, respectively.

Fluid delivery subsystems ensure accurate measurement and uniform delivery of specialty gases and chemicals at critical steps in the semiconductor manufacturing processes. Any malfunction or material degradation in fluid delivery reduces yields and increases the likelihood of manufacturing defects in these processes. Most OEMs outsource all or a portion of the design, engineering, and manufacturing of their gas delivery subsystems to a few specialized suppliers, including us. Additionally, many OEMs are also increasingly outsourcing the design, engineering, and manufacturing of their chemical delivery subsystems due to the increased fluid expertise required to manufacture these subsystems. Outsourcing these subsystems has allowed OEMs to leverage the suppliers’ highly specialized engineering, design, and production skills while focusing their internal resources on their own value-added processes. We believe that this outsourcing trend has enabled OEMs to reduce their costs and development time, as well as provide growth opportunities for specialized subsystems suppliers like us.

1

Our goal is to be a leading supplier of fluid delivery subsystems and components to OEMs engaged in manufacturing capital equipment to produce semiconductors and to leverage our technology and products to expand the share of our addressable markets. To achieve this goal, we engage with our customers early in their design and development processes and utilize our deep engineering resources and operating expertise, as well as our expanded product portfolio, to jointly create innovative and advanced solutions that meet the current and future needs of our customers. We employ this approach with three of the largest manufacturers of semiconductor capital equipment in the world. We believe this approach enables us to design products that meet the precise specifications our customers demand, allows us to often be the sole supplier of these subsystems during the initial production ramp, and positions us to be the preferred supplier for the full five to ten-year lifespan of the process tool.

The broad technical expertise of our engineering team, coupled with our early customer engagement approach, enables us to offer innovative and reliable solutions to complex fluid delivery challenges. With two decades of experience developing complex fluid delivery subsystems and meeting the constantly changing production requirements of leading semiconductor OEMs, we have developed expertise in fluid delivery that we offer to our OEM customers. In addition, our capital efficient model provides us the flexibility to fulfill increased demand and meet changing customer requirements with relatively low levels of capital expenditures. With an aim to provide superior customer service, we have a global footprint with many facilities strategically located in close proximity to our customers. We have long standing relationships with top tier OEM customers, including Lam Research, Applied Materials, and ASML, which were our three largest customers by sales in 2020.

We generated revenue of $914.2 million, $620.8 million, and $823.6 million in 2020, 2019, and 2018, respectively. We generated net income of $33.3 million, $10.7 million, and $57.9 million in 2020, 2019, and 2018, respectively. We generated non-GAAP net income of $59.0 million, $28.3 million, and $75.1 million in 2020, 2019, and 2018, respectively. See Item 7 – Management's Discussion and Analysis of Financial Condition and Results of Operations, Non-GAAP Results for a discussion of non-GAAP net income, an accompanying presentation of the most directly comparable financial measure calculated in accordance with generally accepted accounting principles in the United States, net income, and a reconciliation of the differences between non-GAAP net income and net income.

Our Competitive Strengths

As a leader in the fluid delivery industry, we believe that our key competitive strengths include the following:

Deep Fluids Engineering Expertise

We believe that our engineering team, comprised of chemical engineers, mechanical engineers, and software and systems engineers, has positioned us to expand the scope of our solutions, provide innovative products and subsystems, and strengthen our incumbent position at our OEM customers. Many of our engineers are industry veterans and have spent a significant portion of their careers at our customers, bringing first-hand expertise and a heightened understanding of our customers’ needs. Our engineering team acts as an extension of our customers’ product development teams, providing our customers with technical expertise that is outside of their core competencies.

Early Engagement with Customers on Product Development

We seek to engage with our customers and potential customers very early in their process for new product development. We believe this approach enables us to collaborate on product design, qualification, manufacturing, and testing in order to provide a comprehensive, customized solution. Through early engagement during the complex design stages, our engineering team gains early insight into our customers’ technology roadmaps which enables us to pioneer innovative and advanced solutions. In many cases, our early engagement with our customers enables us to be the sole source supplier when the product is initially introduced.

Long History and Strong Relationships with Top Tier Customers

We have established deep relationships with top tier OEMs such as Lam Research, Applied Materials, and ASML, which were our three largest customers by sales in 2020. Our customers are global leaders by sales in the semiconductor capital equipment industry. Our existing relationships with our customers have enabled us to effectively compete for new fluid delivery subsystems for our customers’ next generation products in development. We leverage our deep-rooted existing customer relationships with these market leaders to penetrate new business opportunities created through industry consolidation. Our close collaboration with them has contributed to our established market position and several key supplier awards.

2

Operational Excellence with Scale to Support the Largest Customers

Over our 20-year experience in designing and building fluid delivery systems, we have developed deep capabilities in operations. We have strategically located our manufacturing facilities near our customers’ locations in order to provide fast and efficient responses to new product introductions and accommodate configuration or design changes late in the manufacturing process. We will continue to add capacity as needed to support future growth. In addition to providing high quality and reliable fluid delivery subsystems, one of our principal strategies is delivering the lead-times that provide our customers the required flexibility needed in their production processes. We have accomplished this by investing in manufacturing systems and processes and an efficient supply chain. Our focus on operational efficiency and flexibility allows us to reduce manufacturing cycle times in order to respond quickly to customer requests and lead-times that are often less than four weeks.

Capital Efficient and Scalable Business Model

In general, our business is not capital intensive and we are able to grow sales with a low investment in property, plant, and equipment. In 2020, 2019, and 2018, our total capital expenditures were $10.3 million, $12.3 million, and $13.9 million, respectively, representing only 1.1%, 2.0%, and 1.7% of sales, respectively. The semiconductor capital equipment market has historically been cyclical. We have structured our business to minimize fixed manufacturing overhead and operating expenses to enable us to grow net income at a higher rate than sales during periods of growth. Conversely, our low fixed cost approach allows us to minimize the impact of cyclical downturns on our net income but results in a lower level of gross margin leverage or improvement as a percentage of sales in times of increased demand.

Our Growth Strategy

Our objective is to enhance our position as a leader in providing fluid delivery solutions, including subsystems, components, and tool refurbishment, to our customers by leveraging our core strengths. The key elements of our growth strategy are:

Grow Our Market Share within Existing Customer Base

We intend to grow our position within our existing customers by continuing to leverage our specialized engineering talent, early collaboration approach with OEMs to foster long-term relationships, and expanded product offerings. Each of our customers produces many different process tools for various process steps. At each customer, we are an outsourced supplier of fluid delivery subsystems and components for a subset of their entire process tool offerings. We are constantly looking to expand our market share at our existing customers. We believe that our early collaborative approach with customers positions us to deliver innovative and dynamic solutions, offer timely deployment and meet competitive cost targets, further increasing our market share. Through our acquisition of a precision machining operation in December 2020, an intellectual property (“IP”) purchase of developed flow controller technology in 2019, and our acquisitions of a weldment company and a precision machining company in 2017, we significantly expanded our served customer base and also entered the market for chemical delivery subsystems for wet process tools where we had only limited engagement in the past. Using this and our existing engineering capability, we developed a liquid delivery module and was qualified on a wet process equipment system at one of our largest customers who is a market leader in this space.

Grow Our Total Available Market and Share of the Market with Expanded Product Offerings

We continue to work with our existing core customers on additional opportunities, including chemical delivery, one of our important potential growth areas. We believe that wet processes, including clean and electrochemical deposition (“ECD”), that require precise chemical delivery are currently an underpenetrated market opportunity for us. By leveraging our existing customer relationships and strong reputation in fluid mechanics, we intend to increase our chemical delivery module market share and introduce additional related products. Through our acquisition of a precision machining operation in December 2020, our IP purchase of developed flow controller technology in 2019, our acquisition of a Korean gas panel supplier in 2018, and our acquisitions of a weldment company and a precision machining company in 2017, we significantly expanded our served customer base with expanded product offerings. The acquisitions allow us to manufacture and assemble the complex plastic and metal products and precision machined components for the semiconductor equipment, including our existing customer base, as well as medical device, and general-industrial industries, while providing us exposure to and growth opportunities in the Korean and Japanese semiconductor capital equipment market.

Expand Our Total Customer Base within Fluid Delivery Market

We have expanded our customer base and are currently a supplier of gas delivery systems for a leading lithography system manufacturer, a leading ALD system manufacturer, and Korean process tool OEMs. We continue to actively engage with new customers that are considering outsourcing their gas and chemical delivery needs as well as expanding our components business.

3

Continue to Improve Our Manufacturing Process Efficiency

We continually strive to improve our processes to reduce our manufacturing process cycle time, improve our ability to respond to short lead-time and last minute configuration changes, reduce our manufacturing costs, and improve our inventory efficiency requirements in order to improve profitability and make our product offerings more attractive to new and existing customers.

Our Products and Services

We are a leader in the design, engineering and manufacturing of critical fluid delivery subsystems. Our product and service offerings are classified in the following categories:

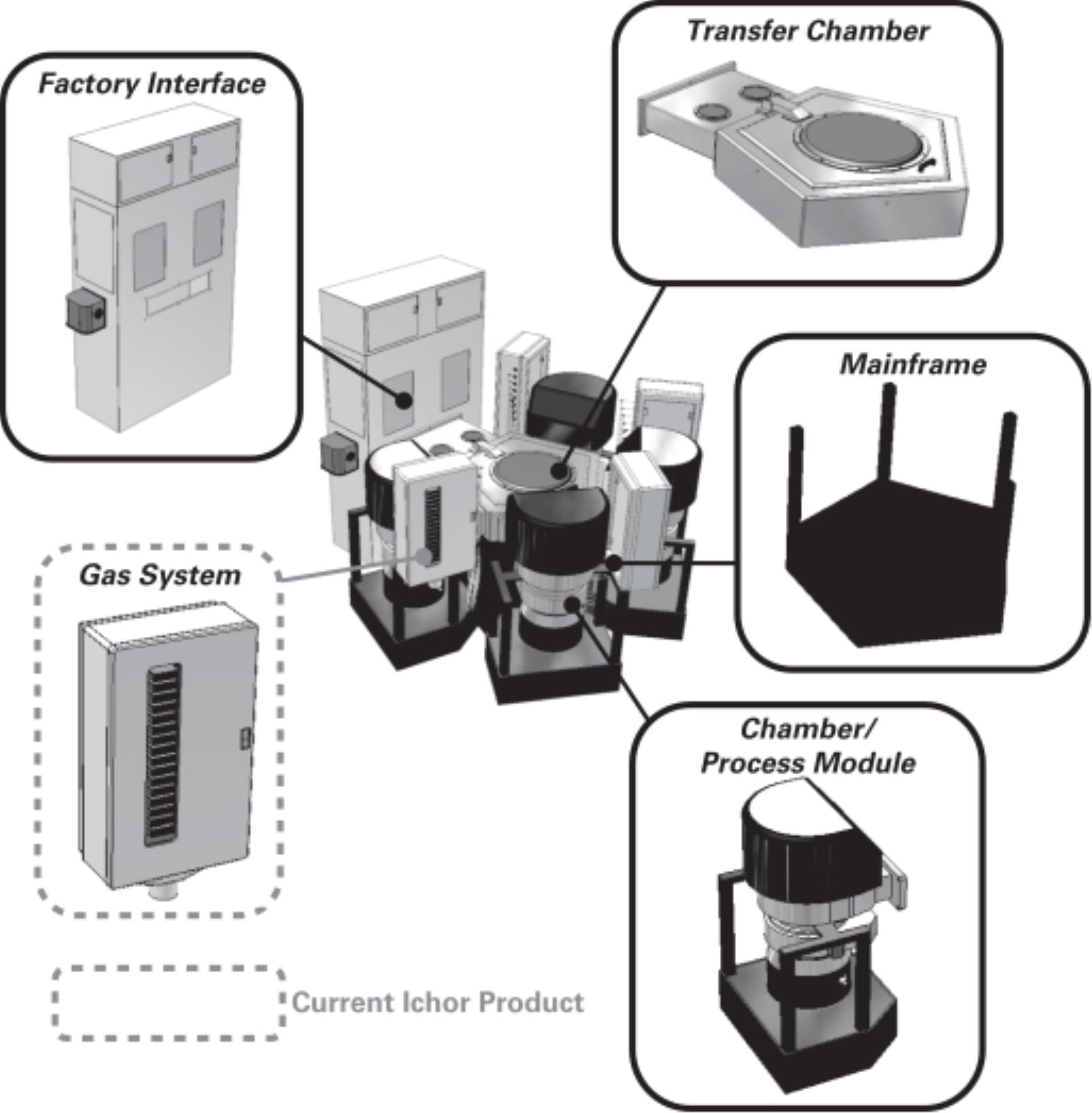

Gas Delivery Subsystems

Gas delivery is among the most technologically complex functions in semiconductor capital equipment and is used to deliver, monitor and control precise quantities of the vapors and gases critical to the manufacturing process. Our gas delivery systems consist of a number of gas lines, each controlled by a series of mass flow controllers, regulators, pressure transducers, and valves, and an integrated electronic control system. Our gas delivery subsystems are primarily used in equipment for “dry” manufacturing processes, such as etch, chemical vapor deposition, physical vapor deposition, epitaxy, and strip.

4

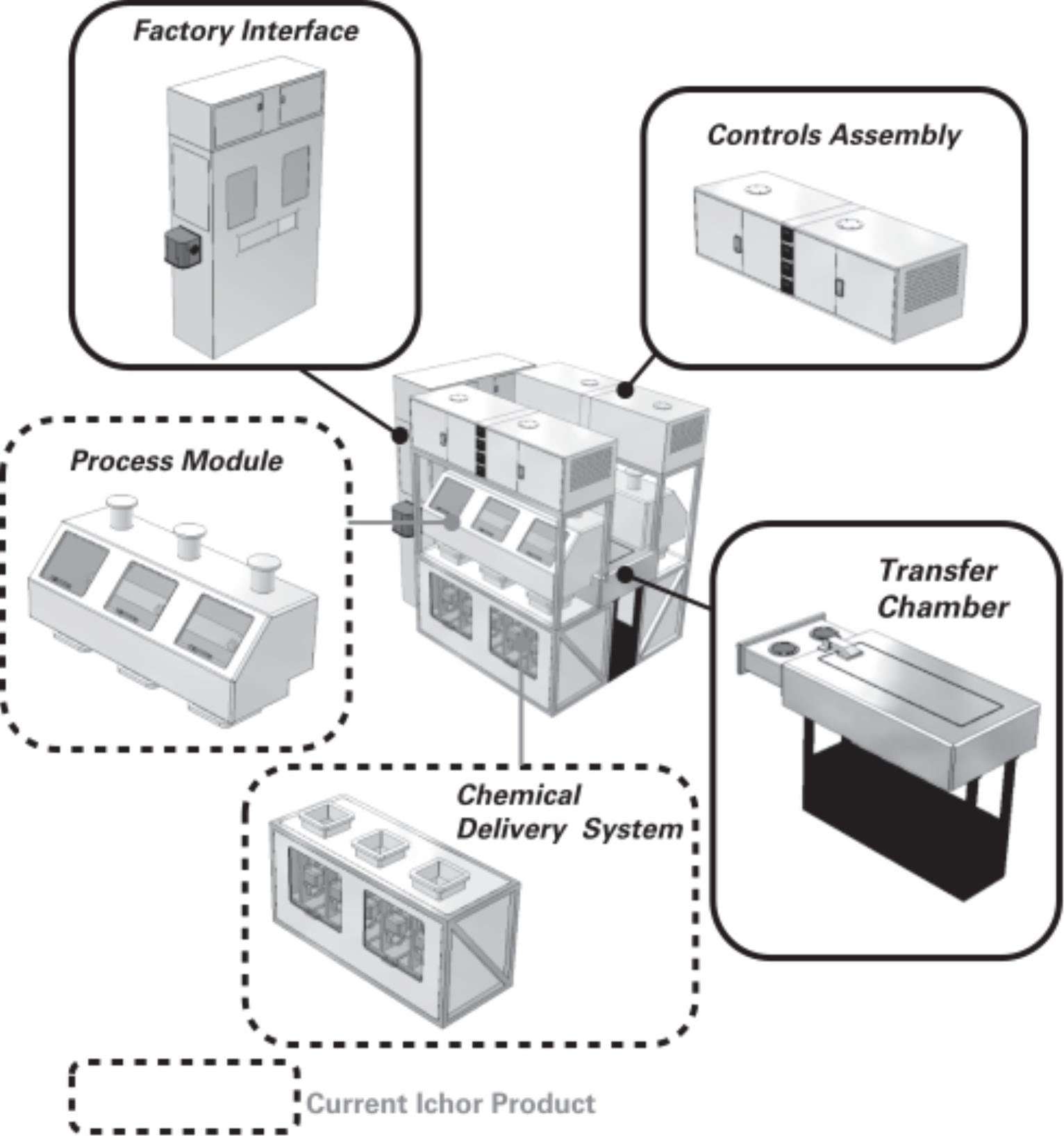

Chemical Delivery Products and Subsystems

Our chemical delivery products and subsystems are used to precisely blend and dispense reactive chemistries and colloidal slurries critical to the specific “wet” front-end process, such as wet clean, electro chemical deposition, and chemical-mechanical planarization (“CMP”). In addition to the chemical delivery subsystem, we also manufacture the process modules that apply the various chemicals directly to the wafer in a process and application-unique manner to create the desired chemical reaction.

The image below shows a typical wet-process front end semiconductor tool, with a chemical delivery subsystem and corresponding application process module highlighted:

Weldments

Our complete offering of weldments support the delivery of gases through the process tool. We have developed both automated and manual welding processes to support world class workmanship on all types of metals needed to support fluid delivery within the semiconductor market. The welded assemblies are used in both wet and dry processes.

Precision Machining

Precision machining provides us the ability to supply our customers with components used in our gas delivery systems and weldments, while also providing custom machined solutions throughout customers’ equipment. Many of these items are used downstream of the gas system and in process critical applications. Our precision machined products can be used in both wet and dry applications.

5

History

We were originally incorporated as Celerity, Inc. (“Celerity”) in 1999. Our business of designing and manufacturing critical systems for semiconductor capital equipment manufacturers operated as a stand-alone business until 2009 when Celerity sold the business to a private equity fund. Francisco Partners (“FP”) acquired the business in December 2011 and formed Ichor Holdings, Ltd., an exempt company incorporated in the Cayman Islands, in March 2012 to serve as the parent company as part of a restructuring to accommodate the expansion of our business in Singapore and Malaysia. In April 2012, we acquired Semi Scenic UK Limited to provide refurbishment services for legacy tools. In April 2016, we purchased Ajax-United Patterns & Molds, Inc. (“Ajax”) for $17.6 million to add chemical delivery subsystem capabilities with existing customers. We completed the initial public offering of our ordinary shares in December 2016. In July 2017 we acquired Cal‑Weld, Inc. (“Cal‑Weld”) for $56.2 million to add to our gas delivery subsystem and weldment capabilities. In December 2017 we acquired Talon Innovations Corporation (“Talon”) for $137.8 million to add to our gas delivery subsystem, precision machining, and component manufacturing capabilities. In April 2018, we acquired IAN Engineering Co., Ltd. (“IAN”) for $6.5 million to provide us exposure to and growth opportunities in the Korean semiconductor capital equipment market. In December 2020, we acquired certain operating assets and assumed the operations of a business in Nogales, Mexico for $5.0 million to increase our precision machined component manufacturing capacity. We intend to continue to evaluate opportunistic acquisitions to supplement our organic growth.

Customers, Sales and Marketing

We primarily market and sell our products directly to equipment OEMs in the semiconductor equipment market. In Japan, we utilize a value-added reseller to market and sell our chemical delivery system. We are dependent upon a small number of customers, as the semiconductor equipment manufacturer market is highly concentrated with five companies accounting for over 80% of all process tool revenues. For 2020, our two largest customers were Lam Research and Applied Materials, which accounted for 52% and 35% of sales, respectively. We do not have long-term contracts that require customers to place orders with us in fixed or minimum volumes, and we generally operate on a purchase order basis with customers.

Our sales and marketing efforts focus on fostering close business relationships with our customers. As a result, we locate many of our account managers near the customer they support. Our sales process involves close collaboration between our account managers and engineering and operations teams. Account managers and engineers work together with customers and in certain cases provide on-site support, including attending customers’ internal meetings related to production and engineering design. Each customer project is supported by our account managers and customer support team who ensure we are aligned with all of the customer’s quality, cost, and delivery expectations.

Operations, Manufacturing and Supply Chain Management

We have developed a highly flexible manufacturing model with cost-effective locations situated nearby the manufacturing facilities of our largest customers. We have facilities in the United States, Singapore, Malaysia, the United Kingdom, Korea, and Mexico.

Operations

Our product cycle engagements begin by working closely with our customers to outline the solution specifications before design and prototyping even begin. Our design and manufacturing process is highly flexible, enabling our customers to make alterations to their final requirements throughout the design, engineering, and manufacturing process. This flexibility results in significantly decreased order-to-delivery cycle times for our customers. For instance, it can take as little as 20 to 30 days for us to manufacture a gas delivery system with fully evaluated performance metrics after receiving an order.

Manufacturing

We are ISO 9001 certified or compliant at our manufacturing locations, and our manufactured subsystems and modules adhere to strict design tolerances and specifications. We operate Class 100 and Class 10,000 clean room facilities for customer-specified testing, assembly, and integration of high-purity gas and chemical delivery systems at our locations in Singapore, Oregon, Texas, and Korea. We operate additional facilities in Malaysia, Oregon, Texas, and California for weldments and related components used in our gas delivery subsystems, and we operate facilities in California and Malaysia for critical components used in our chemical delivery subsystems. We operate facilities in Minnesota and Mexico for precision machining of components for sale to our customers and internal use. Many of our facilities are located in close proximity to our largest customers to allow us to collaborate with them on a regular basis and to enable us to deliver our products on a just-in-time basis, regardless of order size or the degree of changes in the applicable configuration or specifications.

6

We qualify and test key components that are integrated into our subsystems and test our fluid delivery subsystems during the design process and again prior to shipping. Our quality management system allows us to access real-time corrective action reports, non-conformance reports, customer complaints, and controlled documentation. In addition, our senior management conducts quarterly reviews of our quality control system to evaluate effectiveness. Our customers also complete quarterly surveys which allow us to measure satisfaction.

Supply Chain Management

We use a wide range of components and materials in the production of our gas and chemical delivery systems, including filters, mass flow controllers, regulators, pressure transducers, and valves. We obtain components and materials from a large number or sources, including single source and sole source suppliers.

We use consignment material and just-in-time stocking programs to better manage our component inventories and better respond to changing customer requirements. These approaches enable us to significantly reduce our inventory levels and maintain flexibility in responding to changes in product demand. A key part of our strategy is to identify multiple suppliers with a strong global reach that are located within close proximity to our manufacturing locations.

Technology Development and Engineering

We have a long history of engineering innovation and development. We continue to transition from being an integration engineering and components company into a gas and chemical delivery system and subsystem leader with product development and systems engineering, as well as integration expertise. Our industry continues to experience rapid technological change, requiring us to continuously invest in technology and product development and regularly introduce new products and features that meet our customers’ evolving requirements.

We have built a team of fluid delivery experts. As of December 25, 2020, our engineering team consisted of approximately 90 engineers and designers with mechanical, electrical, chemical, systems, and software expertise. Our engineers are closely connected with our customers and typically work at our customers’ sites and operate as an extension of our customers’ design team. We engineer within our customers’ processes, design vaults, drawing standards, and part numbering systems. These development efforts are designed to meet specific customer requirements in the areas of subsystem design, materials, component selection, and functionality. The majority of our sales are generated from projects during which our engineers cooperated with our customer early in the design cycle. Through this early collaborative process, we become an integral part of our customers’ design and development processes, and we are able to quickly anticipate and respond to our customers’ changing requirements.

Our engineering team also works directly with our suppliers to help them identify new component technologies and make necessary changes in, and enhancements to, the components that we integrate into our products. Our analytical and testing capabilities enable us to evaluate multiple supplier component technologies and provide customers with a wide range of appropriate component and design choices for their gas and chemical delivery systems and other critical subsystems. Our analytical and testing capabilities also help us anticipate technological changes and the requirements in component features for next-generation gas delivery systems and other critical subsystems.

Competition

The markets for our products are very competitive. When we compete for new business, we face competition from other suppliers of gas or chemical delivery subsystems, and in some cases with the internal manufacturing groups of OEMs. While many OEMs have outsourced the design and manufacturing of their gas and chemical delivery systems, we would face additional competition if in the future these OEMs elected to develop and build these systems internally.

The fluid delivery subsystem market is concentrated, and we face competition primarily from Ultra Clean Technology, with additional competition from regional suppliers. The chemical delivery subsystem, weldments, and precision machining industries are fragmented, and we face competition from numerous smaller suppliers. In addition, the market for tool refurbishment is fragmented, and we compete with many regional competitors. The primary competitive factors we emphasize include:

|

|

• |

customer relationships; |

|

|

• |

early engagement with customers; |

|

|

• |

large and experienced engineering staff; |

|

|

• |

design-to-delivery cycle times; and |

|

|

• |

flexible manufacturing capabilities. |

7

We expect our competitors to continue to improve the performance of their current products and to introduce new products or new technologies that could adversely affect sales of our current and future products. In addition, the limited number of potential customers in our industry further intensifies competition. We anticipate that increased competitive pressures may cause intensified price-based competition and we may have to reduce the prices of our products. In addition, we expect to face new competitors as we enter new markets.

Intellectual Property

Our success depends, in part, upon our ability to develop, maintain, and protect our technology and products and to conduct our business without infringing the proprietary rights of others. We continue to invest in securing intellectual property protection for our technology and products and protect our technology by, among other things, filing patent applications. We also rely on a combination of trade secrets and confidentiality provisions, and to a much lesser extent, copyrights and trademarks, to protect our proprietary rights. We have historically focused our patent protection efforts in the United States. As of December 25, 2020, we held 52 patents, 24 of which were U.S. patents and 14 of which were acquired as part of our IP purchase of developed flow controller technology in May 2019. While we consider our patents to be valuable assets, we do not believe the success of our business or our overall operations are dependent upon any single patent or group of related patents. In addition, we do not believe that the loss or expiration of any single patent or group of related patents would materially affect our business.

We develop intellectual property for our own use in our products, as well as for our customers. Intellectual property developed on behalf of our customers is generally owned exclusively by those customers. In addition, we have agreed to indemnify certain of our customers against claims of infringement of the intellectual property rights of others with respect to our products. Historically, we have not paid any claims under these indemnification obligations, and we do not have any pending indemnification claims against us.

Human Capital Resources

In order to be a successful company, we believe that we must be a good corporate citizen, socially responsible, and recognize that our employees are our most important asset. We recognize and value each person’s diverse background and unique skill set and seek to foster an environment that encourages personal growth and professional development. We continue to further increase our commitment to diversity, inclusion, and equity through specific policies, practices, employee and manager training, and demonstrated executive leadership. Below are details demonstrating our commitment in this area.

Demographics

As of December 25, 2020, we had approximately 1,600 full‑time employees and 430 contract or temporary workers, which allow flexibility as business conditions and geographic demand change. Of our total workforce, approximately 90 are engineers, 80 are engaged in sales and marketing, 1,715 are engaged in manufacturing, and 145 perform executive and administrative functions. Our voluntary attrition was 12%, reduced from 15% from the prior year. Our employees are not unionized, and we have no participation in works councils. We have not experienced any material work stoppages at any of our facilities, with the exception of temporary shutdowns at certain of our facilities in the first half of 2020 due to the COVID‑19 pandemic. We believe our relationship with our employees to be good.

Total Rewards

As part of our total rewards philosophy, we believe in offering market-competitive compensation and benefits programs for our employees to attract and retain a talented and productive workforce. Our programs are designed to be externally competitive, internally fair and equitable, and our pay-for-performance philosophy aims to reward each individual for their contributions while striving for equal pay for work regardless of gender, race, or ethnicity. We offer a combination of fixed and variable pay which can vary by business and function. For our leadership and key talent, we provide equity based long-term compensation to create retention and incentive towards the company’s strategies and objectives. We provide benefits that are locally competitive, including retirement and savings plans with company contributions, health and welfare plans aimed to provide protection to employees, and in some instances, protection for employees’ families, and we provide a discounted employee stock purchase plan. We invest in wellness programs to promote physical, emotional, and financial well-being. In 2020, we expanded our employee cash spot bonus program to recognize employee contributions in improving quality and operational cost savings.

8

Learning and Development

We support our employees in their career development by providing a multi-dimensional approach to learning and development, including internal and external opportunities for professional development. This includes tuition reimbursement, online training, on the job training, diversity and inclusion training, and managerial coaching. We actively invest in leadership development, cultivating involvement, engagement, and empowerment of our future leaders in an active investment in succession planning and development. We also believe that maintaining an effective employee review and appraisal process, with regular managerial feedback and coaching, is critical to cultivating a learning organization.

Health and Safety

We are committed to monitoring and maintaining a healthy and safe environment for our employees. We facilitate “skip level” sessions, periodically survey employees, and use other communication forums to allow employees to express their opinions and concerns to management. We maintain a "whistle blower" hotline available to all employees for communicating concerns, including those around health and safety. During the COVID‑19 pandemic, we took necessary steps to ensure the health and safety of our employees and extended communities by following and often exceeding CDC and other government health organization guidelines from around the world. We adopted remote working as a new norm for office staff and made a significant investment in our IT infrastructure to enable uninterrupted virtual communication. For factory workers, we adopted strict guidelines to maintain safety of our workforce and business continuity.

Community Involvement

We have expanded our charitable contributions this past year to include educational scholarships specifically earmarked for under-represented minority groups attending college. We continue to support foodbanks and other local charities in the communities in which we operate.

Environmental, Health, and Safety Regulations

Our operations and facilities are subject to federal, state, and local regulatory requirements and foreign laws and regulations, relating to environmental, waste management, and health and safety matters, including those relating to the release, use, storage, treatment, transportation, discharge, disposal, and remediation of contaminants, hazardous substances, and wastes, as well as practices and procedures applicable to the construction and operation of our facilities. We believe that our business is operated in substantial compliance with applicable regulations. However, in the future we could incur substantial costs, including cleanup costs, fines or civil or criminal sanctions, or third-party property damage, or personal injury claims, in the event of violations or liabilities under these laws and regulations, or non-compliance with the environmental permits required at our facilities. Potentially significant expenditures could be required in order to comply with environmental laws that may be adopted or imposed in the future. We are not aware of any threatened or pending environmental investigations, lawsuits, or claims involving us, our operations, or our current or former facilities.

Available Information

Our internet address is ichorsystems.com. We make a variety of information available, free of charge, at our Investor Relations website, ir.ichorsystems.com. This information includes our Annual Reports on Form 10‑K, our Quarterly Reports on Form 10‑Q, our Current Reports on Form 8‑K, and any amendments to those reports as soon as reasonably practicable after we electronically file those reports with or furnish them to the Securities and Exchange Commission (“SEC”), as well as our Code of Business Ethics and Conduct and other governance documents.

The SEC maintains an internet site that contains reports, proxy and information statements, and other information regarding issuers that file documents electronically with the SEC at sec.gov.

The contents of these websites, or the information connected to those websites, are not incorporated into this report. References to websites in this report are provided as a convenience and do not constitute, and should not be viewed as, incorporation by reference of the information contained on, or available through, the website.

9

ITEM 1A. RISK FACTORS

There are many factors that affect our business and the results of operations, some of which are beyond our control. The following is a description of some important factors that may cause the actual results of operations in future periods to differ materially from those currently expected or desired.

Risk Factor Summary

The following is a summary of some important risk factors that could adversely affect our business, operations, and financial results.

Economic and Strategic Risks

|

|

• |

Our business depends significantly on expenditures by manufacturers in the semiconductor capital equipment industry. |

|

|

• |

We rely on a very small number of OEM customers for a significant portion of our sales. |

|

|

• |

Our customers exert a significant amount of negotiating leverage over us. |

|

|

• |

The industries in which we participate are highly competitive and rapidly evolving. |

|

|

• |

We are exposed to risks associated with weakness in the global economy and geopolitical instability. |

|

|

• |

Our business has been adversely affected by the COVID‑19 pandemic and we continue to face risks related to COVID‑19. |

|

|

• |

If we do not keep pace with developments in the industries we serve and with technological innovation generally, our products and services may not be competitive. |

|

|

• |

We must design, develop, and introduce new products that are accepted by OEMs in order to retain our existing customers and obtain new customers. |

|

|

• |

Future acquisitions may present integration challenges, and the goodwill, indefinite-lived intangible assets, and other long-term assets recorded in connection with such acquisitions become impaired. |

|

|

• |

We are subject to fluctuations in foreign currency exchange rates. |

Operational Risks

|

|

• |

The manufacturing of our products is highly complex. |

|

|

• |

Defects in our products could damage our reputation, decrease market acceptance of our products. |

|

|

• |

We may incur unexpected warranty and performance guarantee claims. |

|

|

• |

Our dependence on a limited number of suppliers may harm our production output and increase our costs. |

|

|

• |

We are subject to order and shipment uncertainties. |

|

|

• |

Our customers generally require that they qualify our engineering, documentation, manufacturing and quality control procedures. |

|

|

• |

We may be subject to interruptions or failures in our information technology systems. |

|

|

• |

Certain of our customers require that we consult with them in connection with specified fundamental changes in our business. |

|

|

• |

Our business is largely dependent on the know-how of our employees, and we generally do not have an intellectual property position that is protected by patents. |

|

|

• |

The technology labor market is very competitive. |

|

|

• |

Labor disruptions could materially adversely affect our business. |

|

|

• |

Our business is subject to the risks of catastrophic events. |

Legal and Regulatory Risks

|

|

• |

Our business is subject to a variety of U.S. and international laws, rules, policies, and other obligations regarding privacy, data protection, and other matters. |

|

|

• |

Third parties have claimed and may in the future claim we are infringing their intellectual property. |

|

|

• |

From time to time, we may become involved in other litigation and regulatory proceedings. |

|

|

• |

As a global company, we are subject to the risks of doing business internationally. |

|

|

• |

Changes in U.S. trade policy, tariff, and import/export regulations may have a material adverse effect on our business. |

|

|

• |

We are subject to numerous environmental laws and regulations. |

|

|

• |

Failure to maintain effective internal controls in accordance with Section 404 of the Sarbanes-Oxley Act could have a material adverse effect on our business. |

|

|

• |

We previously identified material weaknesses in our internal control over financial reporting, and the failure to maintain an effective system of internal controls and procedures may cause investors to lose confidence in our financial reporting |

|

|

• |

The failure of our control systems may materially impact us |

|

|

• |

Compliance with SEC rules relating to “conflict minerals” may require us and our suppliers to incur substantial expense. |

10

|

|

• |

Changes in tax laws, tax rates or tax assets and liabilities could materially adversely affect our financial condition and results of operations. |

Liquidity and Capital Resources Risks

|

|

• |

Restrictive covenants under our Credit Facilities may limit our current and future operations. |

|

|

• |

The interest rates on our credit agreement might change based on changes to the method in which LIBOR or its replacement rate is determined. |

|

|

• |

We may not be able to generate sufficient cash to service all of our indebtedness. |

Ordinary Share Ownership Risks

|

|

• |

Our quarterly sales and operating results fluctuate significantly from period to period. |

|

|

• |

The price of our ordinary shares may fluctuate substantially. |

|

|

• |

Future sales of our ordinary shares, or the perception in the public markets that these sales may occur, may depress our share price. |

|

|

• |

We intend to remain an “emerging growth company” through the end of fiscal 2021. |

|

|

• |

We do not expect to pay any cash dividends for the foreseeable future. |

|

|

• |

Our articles of association contain anti-takeover provisions. |

|

|

• |

The issuance of preferred shares could adversely affect holders of ordinary shares. |

|

|

• |

You may face difficulties in protecting your interests as a shareholder. |

|

|

• |

Certain judgments obtained against us by our shareholders may not be enforceable. |

|

|

• |

There can be no assurance that we will not be a passive foreign investment company for any taxable year. |

|

|

• |

If a U.S. person is treated as owning at least 10% of our shares, such person may be subject to adverse U.S. federal income tax consequences. |

Economic and Strategic Risks

Our business depends significantly on expenditures by manufacturers in the semiconductor capital equipment industry, which, in turn, is dependent upon the semiconductor device industry. When that industry experiences cyclical downturns, demand for our products and services is likely to decrease, which would likely result in decreased sales. We may also be forced to reduce our prices during cyclical downturns without being able to proportionally reduce costs.

Our business, financial condition and results of operations depend significantly on expenditures by manufacturers in the semiconductor capital equipment industry. In turn, the semiconductor capital equipment industry depends upon the current and anticipated market demand for semiconductor devices. The semiconductor device industry is subject to cyclical and volatile fluctuations in supply and demand and in the past has periodically experienced significant downturns, which often occur in connection with declines in general economic conditions, and which have resulted in significant volatility in the semiconductor capital equipment industry. The semiconductor device industry has also experienced recurring periods of over-supply of products that have had a severe negative effect on the demand for capital equipment used to manufacture such products. We have experienced, and anticipate that we will continue to experience, significant fluctuations in customer orders for our products and services as a result of such fluctuations and cycles. Any downturns in the semiconductor device industry could have a material adverse effect on our business, financial condition and results of operations.

In addition, we must be able to appropriately align our cost structure with prevailing market conditions, effectively manage our supply chain and motivate and retain employees, particularly during periods of decreasing demand for our products. We may be forced to reduce our prices during periods of decreasing demand. While we operate under a low fixed cost model, we may not be able to proportionally reduce all of our costs if we are required to reduce our prices. If we are not able to timely and appropriately adapt to the changes in our business environment, our business, financial condition and results of operations will be materially adversely affected. The cyclical and volatile nature of the semiconductor device industry and the absence of long-term fixed or minimum volume contracts make any effort to project a material reduction in future sales volume difficult.

11

We rely on a very small number of OEM customers for a significant portion of our sales. Any adverse change in our relationships with these customers could materially adversely affect our business, financial condition and results of operations.

The semiconductor capital equipment industry is highly concentrated and has experienced significant consolidation in recent years. As a result, a relatively small number of OEM customers have historically accounted for a significant portion of our sales, and we expect this trend to continue for the foreseeable future. For 2020, our top two customers accounted for approximately 52% and 35%, respectively, of sales, and we expect that our sales will continue to be concentrated among a very small number of customers. We do not have any long-term contracts that require customers to place orders with us in fixed or minimum volumes. Accordingly, the success of our business depends on the success of our customers and those customers and other OEMs continuing to outsource the manufacturing of critical subsystems and process solutions to us. Because of the small number of OEMs in the markets we serve, a number of which are already our customers, it would be difficult to replace lost sales resulting from the loss of, or the reduction, cancellation or delay in purchase orders by, any one of these customers, whether due to a reduction in the amount of outsourcing they do, their giving orders to our competitors, their acquisition by an OEM who is not a customer or with whom we do less business, or otherwise. We have in the past lost business from customers for a number of these reasons. If we are unable to replace sales from customers who reduce the volume of products and services they purchase from us or terminate their relationship with us entirely, such events could have a material adverse impact on our business, financial condition and results of operations.

Additionally, if one or more of the largest OEMs were to decide to single- or sole-source all or a significant portion of manufacturing and assembly work to a single equipment manufacturer, such a development would heighten the risks discussed above.

Our customers exert a significant amount of negotiating leverage over us, which may require us to accept lower prices and gross margins or increased liability risk in order to retain or expand our market share with them.

By virtue of our largest customers’ size and the significant portion of our sales that is derived from them, as well as the competitive landscape, our customers are able to exert significant influence and pricing pressure in the negotiation of our commercial arrangements and the conduct of our business with them. Our customers often require reduced prices or other pricing, quality or delivery commitments as a condition to their purchasing from us in any given period or increasing their purchase volume, which can, among other things, result in reduced gross margins in order to maintain or expand our market share. Our customers’ negotiating leverage also can result in customer arrangements that may contain significant liability risk to us. For example, some of our customers require that we provide them indemnification against certain liabilities in our arrangements with them, including claims of losses by their customers caused by our products. Any increase in our customers’ negotiating leverage may expose us to increased liability risk in our arrangements with them, which, if realized, may have a material adverse effect on our business, financial condition and results of operations. In addition, new products often carry lower gross margins than existing products for several quarters following their introduction. If we are unable to retain and expand our business with our customers on favorable terms, or if we are unable to achieve gross margins on new products that are similar to or more favorable than the gross margins we have historically achieved, our business, financial condition and results of operations may be materially adversely affected.

The industries in which we participate are highly competitive and rapidly evolving, and if we are unable to compete effectively, our business, financial condition and results of operations could be materially adversely affected.

We face intense competition from other suppliers of gas or chemical delivery subsystems, as well as the internal manufacturing groups of OEMs. Increased competition has in the past resulted, and could in the future result, in price reductions, reduced gross margins or loss of market share, any of which would materially adversely affect our business, financial condition and results of operations. We are subject to significant pricing pressure as we attempt to maintain and increase market share with our existing customers. Our competitors may offer reduced prices or introduce new products or services for the markets currently served by our products and services. These products may have better performance, lower prices and achieve broader market acceptance than our products. OEMs also typically own the design rights to their products. Further, if our competitors obtain proprietary rights to these designs such that we are unable to obtain the designs necessary to manufacture products for our OEM customers, our business, financial condition and results of operations could be materially adversely affected.

Certain of our competitors may have or may develop greater financial, technical, manufacturing and marketing resources than we do. As a result, they may be able to respond more quickly to new or emerging technologies and changes in customer requirements, devote greater resources to the development, promotion, sale and support of their products and services, and reduce prices to increase market share. In addition to organic growth by our competitors, there may be merger and acquisition activity among our competitors and potential competitors that may provide our competitors and potential competitors with an advantage over us by enabling them to expand their product offerings and service capabilities to meet a broader range of customer needs. The introduction of new technologies and new market entrants may also increase competitive pressures.

12

We are exposed to risks associated with weakness in the global economy and geopolitical instability.

Our business is dependent upon manufacturers of semiconductor capital equipment, whose businesses in turn ultimately depend largely on consumer spending on semiconductor devices. Continuing uncertainty regarding the global economy continues to pose challenges to our business. Economic uncertainty and related factors, including current unemployment levels, uncertainty in debt markets, geopolitical instability in various parts of the world, fiscal uncertainty in the U.S. economy, market volatility and the slow rate of recovery of many countries from recent recessions, exacerbate negative trends in business and consumer spending and may cause certain of our customers to push out, cancel or refrain from placing orders for products or services, which may reduce sales and materially adversely affect our business, financial condition and results of operations. Difficulties in obtaining capital, uncertain market conditions or reduced profitability may also cause some customers to scale back operations, exit businesses, merge with other manufacturers, or file for bankruptcy protection and potentially cease operations, leading to customers’ reduced research and development funding and/or capital expenditures and, in turn, lower orders from our customers and/or additional slow moving or obsolete inventory or bad debt expense for us. These conditions may also similarly affect our key suppliers, which could impair their ability to deliver parts and result in delays for our products or require us to either procure products from higher-cost suppliers, or if no additional suppliers exist, to reconfigure the design and manufacture of our products, and we may be unable to fulfill some customer orders. Any of these conditions or events could have a material adverse effect on our business, financial condition and results of operations.

In 2016, the United Kingdom voted to leave the European Union (“EU”) (commonly referred to as “Brexit”). On December 24, 2020, an agreement was reached between the UK and EU regarding trade, services, commerce and human rights. The UK is now primarily focused on negotiating trade agreements with the United States and other countries. While the current UK – EU agreement does not create any new taxes for cross border commerce, a significant increase in paperwork required at the border could delay goods and as a result increase transit costs and time for delivery. The long-term nature of the UK’s relationship with other countries now that the EU negotiation is complete is unclear and there is considerable uncertainty with regards to future UK trade relationships. Brexit continues to have the potential to disrupt the free movement of goods, services, and people between the UK, the EU, and elsewhere. There can be no assurance that any or all of these events, or others that we cannot anticipate at this time, will not have a material adverse effect on our business, financial condition and results of operations.

Our business has been adversely affected by the COVID‑19 pandemic and we continue to face risks related to COVID‑19 which could significantly disrupt our operations, customer demand, and our suppliers’ ability to support us, resulting in material adverse impacts to our business, financial condition, operating results, and cash flows.

We are closely monitoring the COVID‑19 pandemic. The virus has spread to many countries and has been declared by the World Health Organization to be a pandemic, resulting in action from federal, national, state, and local governments that has significantly affected virtually all facets of the U.S. and global economies. The U.S. government has implemented enhanced screenings, quarantine requirements, and travel restrictions in connection with the COVID‑19 outbreak.

Shelter-in-place orders and other measures, including work-from-home and social distancing policies implemented to protect employees, have resulted in reduced workforce availability at product manufacturing sites, construction delays, and reduced output at some of our vendors and suppliers. Restrictions on our access to or operation of manufacturing facilities or on our support operations or workforce, or similar limitations for our vendors and suppliers, can impact our ability to meet customer demand and could have a material adverse effect on our financial condition and results of operations, particularly if prolonged. Similarly, current and future restrictions or disruptions of transportation, such as reduced availability of air transport, port closures, and increased border controls or closures, can also impact our ability to meet demand and could materially adversely affect us. Our customers have experienced, and may continue to experience, disruptions in their operations and supply chains, which can result in delayed, reduced, or canceled orders, or collection risks, and which may adversely affect our results of operations.

Our business may be more adversely impacted by the effects of COVID‑19 in the future. We source materials from different parts of the world that have been affected by the virus which could have an adverse impact on our supply chain operations and ability to get materials needed to build our products. Additionally, the disruption to global markets that has occurred due to the epidemic has increased uncertainty for semiconductor demand. The current outbreak has resulted in an economic slowdown in many parts of the world, and it is impossible to predict the duration, speed, and location of a recovery and the impact a recovery would have on semiconductor demand and the demand for semiconductor capital equipment. Given the significant economic uncertainty and volatility created by the pandemic, it is difficult to predict the nature and extent of impacts on demand for our products.

The spread of COVID‑19 has caused us to modify our business practices (including employee travel, employee work locations, cancellation of physical participation in meetings, events and conferences, and social distancing measures), and we may take further actions as may be required by government authorities or that we determine are in the best interests of our employees, customers, partners, vendors, and suppliers. Work-from-home and other measures introduce additional operational risks, including cybersecurity risks, and have affected the way we conduct our product development, validation, and qualification, customer support, and other activities, which could have an adverse effect on our operations. There is no certainty that such measures will be sufficient to mitigate

13

the risks posed by the virus, and illness and workforce disruptions could lead to unavailability of key personnel and harm our ability to perform critical functions.

The extent of the impact of COVID‑19 on our operational and financial performance will depend on future developments, including, but not limited to, the duration and spread of the outbreak, the speed of local vaccination distribution and the effectiveness of the vaccine, government mandates and guidelines designed to address the current state of the pandemic, and related travel advisories and restrictions, all of which are highly uncertain and cannot be predicted. In most countries in which we operate, the local government authorities have designated our operations as an “essential business” which allows us to continue to operate our factories and business under specific rules and protocols designed to ensure the health and safety of our employees, suppliers, and visitors to our facilities, however, changes to this classification may result in potential closure of our operations for an uncertain duration, impacting our business. Preventing the effects from, and responding to, this market disruption or any other public health threat, related or otherwise, may further increase costs of our business and may have a material adverse effect on our business, financial condition, and results of operations.

If we do not keep pace with developments in the industries we serve and with technological innovation generally, our products and services may not be competitive.

Rapid technological innovation in the markets we serve requires us to anticipate and respond quickly to evolving customer requirements and could render our current product offerings, services and technologies obsolete. In particular, the design and manufacturing of semiconductors is constantly evolving and becoming more complex in order to achieve greater power, performance and efficiency with smaller devices. Capital equipment manufacturers need to keep pace with these changes by refining their existing products and developing new products.

We believe that our future success will depend upon our ability to design, engineer and manufacture products that meet the changing needs of our customers. This requires that we successfully anticipate and respond to technological changes in design, engineering and manufacturing processes in a cost-effective and timely manner. If we are unable to integrate new technical specifications into competitive product designs, develop the technical capabilities necessary to manufacture new products or make necessary modifications or enhancements to existing products, our business, financial condition and results of operations could be materially adversely affected.

The timely development of new or enhanced products is a complex and uncertain process which requires that we:

|

|

• |

design innovative and performance-enhancing features that differentiate our products from those of our competitors; |

|

|

• |

identify emerging technological trends in the industries we serve, including new standards for our products; |

|

|

• |

accurately identify and design new products to meet market needs; |

|

|

• |

collaborate with OEMs to design and develop products on a timely and cost-effective basis; |

|

|

• |

ramp-up production of new products, especially new subsystems, in a timely manner and with acceptable yields; |

|

|

• |

manage our costs of product development and the costs of producing the products that we sell; |

|

|

• |

successfully manage development production cycles; and |

|

|

• |

respond quickly and effectively to technological changes or product announcements by others. |

If we are unsuccessful in keeping pace with technological developments for the reasons above or other reasons, our business, financial condition and results of operations could be materially adversely affected.

We must design, develop, and introduce new products that are accepted by OEMs in order to retain our existing customers and obtain new customers.

The introduction of new products is inherently risky because it is difficult to foresee the adoption of new standards, coordinate our technical personnel and strategic relationships and win acceptance of new products by OEMs. We attempt to mitigate this risk by collaborating with our customers during their design and development processes. We cannot, however, assure you that we will be able to successfully introduce, market and cost-effectively manufacture new products, or that we will be able to develop new or enhanced products and processes that satisfy customer needs. In addition, new capital equipment typically has a lifespan of five to ten years, and OEMs frequently specify which systems, subsystems, components and instruments are to be used in their equipment. Once a specific system, subsystem, component or instrument is incorporated into a piece of capital equipment, it will often continue to be purchased for that piece of equipment on an exclusive basis for 18 to 24 months before the OEM generates enough sales volume to consider adding alternative suppliers. Accordingly, it is important that our products are designed into the new systems introduced by the OEMs. If any of the new products we develop are not launched or successful in the market, our business, financial condition and results of operations could be materially adversely affected.

14

Future acquisitions may present integration challenges, and if the goodwill, indefinite-lived intangible assets, and other long-term assets recorded in connection with such acquisitions become impaired, we would be required to record impairment charges, which may be significant.

We have acquired strategic businesses in the past and if we find appropriate opportunities in the future, we may acquire businesses, products or technologies that we believe are strategic. The process of integrating an acquired business, product or technology may produce unforeseen operating difficulties and expenditures, fail to result in expected synergies or other benefits and absorb significant attention of our management that would otherwise be available for the ongoing development of our business. In addition, we may record a portion of the assets we acquire as goodwill, other indefinite-lived intangible assets or finite-lived intangible assets. We do not amortize goodwill and indefinite-lived intangible assets, but rather review them for impairment on an annual basis or whenever events or changes in circumstances indicate that their carrying value may not be recoverable. The recoverability of goodwill and indefinite-lived intangible assets is dependent on our ability to generate sufficient future earnings and cash flows. Changes in estimates, circumstances or conditions, resulting from both internal and external factors, could have a significant impact on our fair valuation determination, which could then have a material adverse effect on our business, financial condition and results of operations.

We are subject to fluctuations in foreign currency exchange rates which could cause operating results and reported financial results to vary significantly from period to period.

The vast majority of our sales are denominated in U.S. dollars. Many of the costs and expenses associated with our Singapore, Malaysian and U.K. operations are paid in Singapore dollars, Malaysian ringgit or British pounds (or euros), respectively, and we expect our exposure to these currencies to increase as we increase our operations in those countries. As a result, our risk exposure from transactions denominated in non-U.S. currencies is primarily related to the Singapore dollar, Malaysian ringgit, British pound and euro. In addition, because the majority of our sales are denominated in the U.S. dollar, if one or more of our competitors sells to our customers in a different currency than the U.S. dollar, we are subject to the risk that the competitors’ products will be relatively less expensive than our products due to exchange rate effects. We have not historically established transaction-based hedging programs. Foreign currency exchange risks inherent in doing business in foreign countries could have a material adverse effect on our business, financial condition and results of operations.

Operational Risks

The manufacturing of our products is highly complex, and if we are not able to manage our manufacturing and procurement process effectively, our business, financial condition and results of operations may be materially adversely affected.

The manufacturing of our products is a highly complex process that involves the integration of multiple components and requires effective management of our supply chain while meeting our customers’ design-to-delivery cycle time requirements. Through the course of the manufacturing process, our customers may modify design and system configurations in response to changes in their own customers’ requirements. In order to rapidly respond to these modifications and deliver our products to our customers in a timely manner, we must effectively manage our manufacturing and procurement process. If we fail to manage this process effectively, we risk losing customers and damaging our reputation. We may also be subject to liability under our agreements with our customers if we or our suppliers fail to re- configure manufacturing processes or components in response to these modifications. In addition, if we acquire inventory in excess of demand or that does not meet customer specifications, we could incur excess or obsolete inventory charges. We have from time to time experienced bottlenecks and production difficulties that have caused delivery delays and quality control problems. These risks are even greater as we seek to expand our business into new subsystems. In addition, certain of our suppliers have been, and may in the future be, forced out of business as a result of the economic environment. In such cases, we may be required to procure products from higher-cost suppliers or, if no additional suppliers exist, reconfigure the design and manufacture of our products. This could materially limit our growth, adversely impact our ability to win future business and have a material adverse effect on our business, financial condition and results of operations.

Defects in our products could damage our reputation, decrease market acceptance of our products and result in potentially costly litigation.

A number of factors, including design flaws, material and component failures, contamination in the manufacturing environment, impurities in the materials used and unknown sensitivities to process conditions, such as temperature and humidity, as well as equipment failures, may cause our products to contain undetected errors or defects. Errors, defects or other problems with our products may:

|

|

• |

cause delays in product introductions and shipments; |

|

|

• |

result in increased costs and diversion of development resources; |

|

|

• |