1GG

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10‑K

|

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended:

|

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file number

(Exact name of registrant as specified in its charter)

|

(State or other jurisdiction of incorporation or organization) |

(IRS Employer Identification No.) |

|

|

|

|

|

(Zip Code) |

Registrant’s telephone number, including area code: (

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

|

|

|

The |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well‑known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such report(s), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S‑T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non‑accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b‑2 of the Exchange Acts.

|

|

|

☒ |

|

Accelerated filer |

|

☐ |

|

|

|

|

|

|

|

|

|

|

|

Non-accelerated filer |

|

☐ |

|

Smaller reporting company |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Emerging growth company |

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b‑2 of the Act). Yes

The aggregate market value of the registrant’s common stock, $0.0001 par value, held by non‑affiliates of the registrant as of the last business day of the registrant’s most recently completed second fiscal quarter was approximately $

The number of shares outstanding of the registrant’s common stock, $0.0001 par value as of March 8, 2022 was

DOCUMENTS INCORPORATED BY REFERENCE

The registrant intends to file a definitive proxy statement pursuant to Regulation 14A within 120 days after the end of the fiscal year ended December 31, 2021. Portions of such proxy statement are incorporated by reference into Part III of this Form 10‑K.

|

|

Auditor Firm ID: |

Auditor Name: |

|

Auditor Location: |

|

i

DERMTECH, INC

ANNUAL REPORT ON FORM 10‑K

YEAR ENDED DECEMBER 31, 2021

TABLE OF CONTENTS

|

|

|

Page No. |

|

|

3 |

|

|

3 |

||

|

28 |

||

|

56 |

||

|

56 |

||

|

56 |

||

|

56 |

||

|

|

57 |

|

|

57 |

||

|

57 |

||

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations. |

58 |

|

|

66 |

||

|

67 |

||

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure. |

105 |

|

|

105 |

||

|

106 |

||

|

Disclosure Regarding Foreign Jurisdictions that Prevent Inspection. |

107 |

|

|

|

108 |

|

|

108 |

||

|

108 |

||

|

Security and Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters. |

108 |

|

|

Certain Relationships and Related Transactions, and Director Independence. |

108 |

|

|

108 |

||

|

|

109 |

|

|

109 |

||

|

111 |

||

|

112 |

||

ii

Special Note Regarding Forward-Looking Statements

This report contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Forward-looking statements are statements other than historical facts and relate to future events or circumstances or our future performance, and they are based on our current assumptions, expectations and beliefs concerning future developments and their potential effect on our business. Words such as, but not limited to “anticipate,” “aim,” “believe,” “contemplate,” “continue,” “could,” “design,” “estimate,” “expect,” “intend,” “may,” “might,” “plan,” “possible,” “potential,” “predict,” “project,” “seek,” “should,” “strategy,” “target,” “will,” “would,” and similar expressions or variations thereof are intended to identify forward-looking statements, but are not deemed to represent an all-inclusive means of identifying forward-looking statements as denoted in this report. These statements include, among other things, statements regarding:

|

|

• |

our ability to attain profitability; |

|

|

• |

our estimates regarding our future performance, including without limitation estimates of potential future revenues; |

|

|

• |

our ability to maintain commercial reimbursement for our tests; |

|

|

• |

our ability to efficiently bill for and collect revenue resulting from our tests; |

|

|

• |

our anticipated need to raise additional capital to fund our operations, commercialize our products, and expand our operations; |

|

|

• |

our ability to market and sell our tests to physicians and other clinical practitioners; |

|

|

• |

our ability to continue to develop our existing test and develop and commercialize additional novel tests; |

|

|

• |

our dependence on third parties for the manufacture of our products; |

|

|

• |

our ability to meet market demand for our current and planned future tests; |

|

|

• |

our reliance on our sole laboratory facility and the harm that may result if this facility became damaged or inoperable; |

|

|

• |

our ability to compete with our competitors and their competing products; |

|

|

• |

the importance of our executive management team; |

|

|

• |

our ability to retain and recruit key personnel; |

|

|

• |

our dependence on third parties for the supply of our laboratory substances, equipment and other materials; |

|

|

• |

the potential for us to incur substantial costs resulting from product liability lawsuits against us and the potential for these lawsuits to cause us to suspend sales of our products; |

|

|

• |

the possibility that a third party may claim we have infringed or misappropriated our intellectual property rights and that we may incur substantial costs and be required to devote substantial time defending against these claims; |

|

|

• |

the potential consequences of our expanding our operations internationally; |

|

|

• |

our ability to continue to comply with applicable privacy laws and protect confidential information from breaches; |

|

|

• |

how changes in federal health care policy could increase our costs, decrease our revenues and impact sales of and reimbursement for our tests; |

|

|

• |

our ability to continue to comply with federal and local laws concerning our business and operations and the consequences resulting from our failure to comply with such laws; |

|

|

• |

the possibility that we may be required to conduct additional clinical studies or trials for our tests and the consequences resulting from the delay in obtaining necessary regulatory approvals; |

|

|

• |

the harm resulting from the potential loss, suspension, or other restriction on one or more of our licenses, permits, certifications or accreditations, or the imposition of a fine or penalty on us under federal, state, or foreign laws; |

|

|

• |

our ability to maintain and our intellectual property protections; |

|

|

• |

how recent and potential future changes in tax policy could negatively impact our business and financial condition; |

|

|

• |

how recent and potential future changes in healthcare policy could negatively impact our business and financial condition; |

1

|

|

• |

our ability to maintain Nasdaq listing; and |

|

|

• |

our ability to manage the increased expenses and administrative burdens as a public company. |

Although forward-looking statements in this report reflect the good faith judgment of our management, such statements can only be based on facts and factors currently known by us. Consequently, forward-looking statements are inherently subject to risks and uncertainties and actual results and outcomes may differ materially from the results and outcomes discussed in or anticipated by the forward-looking statements. Factors that could cause or contribute to such differences in results and outcomes include, without limitation, those specifically addressed under the heading “Risk Factors” below, as well as those discussed elsewhere in this report. Readers are urged not to place undue reliance on these forward-looking statements, which speak only as of the date of this report. We file reports with the Securities and Exchange Commission (the “SEC”), and our electronic filings with the SEC (including our quarterly reports on Form 10-Q and current reports on Form 8-K, and any amendments to these reports) are available free of charge on the SEC’s website at http://www.sec.gov.

We undertake no obligation to revise or update any forward-looking statements in order to reflect any event or circumstance that may arise after the date of this report, except as required by law. Readers are urged to carefully review and consider the various disclosures made throughout the entirety of this report, which are designed to advise interested parties of the risks and factors that may affect our business, financial condition and results of operations. We qualify all of our forward-looking statements by this special note.

We own registered or unregistered trademark rights to DermTech™, DermTech Melanoma Test™, DermTech Stratum™, Smart Sticker™, Luminate™ and our company name and logo among others. Any other service marks, trademarks and trade names appearing in this report are the property of their respective owners. We do not use the ® or ™ symbol in each instance in which one of our trademarks appears in this report, but this should not be construed as any indication that we will not assert our rights thereto to the fullest extent under applicable law.

2

PART I

Item 1. Business

Unless specifically noted otherwise, as used throughout this Business section, “we,” “our,” “us,” or the “Company” refers to the business, operations and financial results of DermTech Operations prior to, and the Company and its subsidiaries subsequent to, the completion of the Business Combination as the context requires. “Constellation” refers to the Company prior to the completion of the Business Combination.

Business Overview

We are a molecular diagnostic company developing and marketing novel non-invasive genomics tests to aid in the diagnosis and management of various skin conditions, including skin cancer, inflammatory diseases, and aging-related conditions. Our technology provides a highly accurate alternative to surgical biopsy, minimizing patient discomfort, scarring, and risk of infection, while maximizing convenience. Our scalable genomics assays have been designed to work with our adhesive patch called the DermTech Smart StickerTM (the “Smart Sticker”) which is used to non-invasively collect tissue samples for analysis.

We are initially commercializing tests that will address unmet needs in the diagnostic pathway of pigmented skin lesions, such as moles or dark colored skin spots. Our DermTech Melanoma Test (the “DMT”) facilitates the clinical assessment of pigmented skin lesions for melanoma. We have initially marketed this test directly to a concentrated group of dermatology clinicians and are currently expanding marketing efforts to a broader group of dermatology clinicians. The simple application of Smart Stickers to collect samples non-invasively may allow us to eventually market the DermTech Melanoma Test to primary care physicians more broadly, beyond integrated primary care networks, and expand our efforts through telemedicine channels. We process our tests in our high complexity molecular laboratory that is certified under the Clinical Laboratory Improvement Amendments of 1988 (“CLIA”), accredited by the College of American Pathologists (“CAP”), and licensed by the State of California as well as other states requiring out-of-state licensure, including New York. We also provide laboratory services to several pharmaceutical companies that access our technology on a contract basis within their clinical trials or other studies to better advance new drugs.

Business Combination, Reverse Split and Domestication

On August 29, 2019, the Company, formerly known as Constellation Alpha Capital Corp. (“Constellation”), and DermTech Operations, Inc., formerly known as DermTech, Inc. (“DermTech Operations”), consummated the transactions contemplated by the Agreement and Plan of Merger, dated as of May 29, 2019, by and among the Company, DT Merger Sub, Inc. (“Merger Sub), and DermTech Operations. We refer to this agreement, as amended by that certain First Amendment to Agreement and Plan of Merger dated as of August 1, 2019, as the Merger Agreement. Pursuant to the Merger Agreement, Merger Sub merged with and into DermTech Operations, with DermTech Operations surviving as our wholly owned subsidiary. We refer to this transaction as the Business Combination. In connection with and two days prior to the completion of the Business Combination, Constellation re-domiciled out of the British Virgin Islands and continued as a company incorporated in the State of Delaware.

On August 29, 2019, immediately following the completion of the Business Combination, we amended and restated our certificate of incorporation (the “Amended and Restated Certificate of Incorporation”) to change the name of the Company to DermTech, Inc. Prior to the completion of the Business Combination, the Company was a shell company. Following the Business Combination, the business of DermTech Operations is the business of the Company.

On August 29, 2019, in connection with and immediately following the completion of the Business Combination, we filed a certificate of amendment (the “Certificate of Amendment”) to the Amended and Restated Certificate of Incorporation to effect a one-for-two reverse stock split of our common stock on August 29, 2019 (the “Reverse Stock Split”). As a result of the Reverse Stock

3

Split, the number of issued and outstanding shares of our common stock immediately prior to the Reverse Stock Split was reduced into a smaller number of shares, such that every two shares of our common stock held by a stockholder immediately prior to the Reverse Stock Split were combined and reclassified into one share of our common stock.

Our Business

We are a molecular diagnostic company developing and marketing novel non-invasive genomics tests that seek to transform the practice of dermatology and related fields. Our platform may change the diagnostic paradigm in dermatology from one that is subjective, invasive, less accurate and higher-cost, to one that is objective, non-invasive, more accurate and lower-cost. Our initial focus is skin cancer. We currently offer the DMT for the enhanced early detection of melanoma and are developing a product for non-melanoma skin cancer. We are also working on products to assess precancerous genomic changes associated with sun UV exposure to the skin. Our scalable genomics platform has been designed to work with our Smart Sticker, which provides a skin sample collected easily and non-invasively, in contrast to the existing standard of care of using a scalpel to biopsy suspicious lesions. We also provide our services and technology platform on a contract basis to pharmaceutical companies who use the technology in their clinical trials to test for the existence of genomic targets of various diseases and to measure the response of new drugs under development. We process our tests in our commercial laboratory that is CLIA certified, CAP accredited and licensed by the California Department of Public Health as well as other states that require out-of-state licensure. As described below, our technology platform is easy to use and integrates seamlessly into the current clinical diagnostic pathway by providing (i) simple and rapid tissue collection and shipping via standard express mail, (ii) sample processing via quantitative polymerase chain reaction (“qPCR”), or other technologies and (iii) physician reporting within 48 to 72 hours. In addition, physicians can bill for their services using existing Evaluation and Management (“E&M”), codes for the visit during which our tests are ordered.

Dermatology is one of the largest medical markets in the United States. The skin cancer segment alone has over 15 million surgical diagnostic procedures performed each year in the United States, with an average annual spend of $8.1 billion, according to the American Academy of Dermatology (“AAD”). Current dermatologic diagnosis is primarily based on subjective visual assessments and subsequent surgical diagnostic procedures. This legacy paradigm is prone to error and results in a substantial number of unnecessary and invasive surgical procedures. Our platform provides a non-invasive alternative that minimizes patient discomfort, scarring, and risk of infection. Further, because our testing results utilize genomic analysis, we provide more accurate, objective diagnostic information than the currently prevailing diagnostic procedures. As described below, the DMT has been demonstrated in a study published in JAMA Dermatology and conducted prior to our introduction of the option to order DMT with an additional test (formerly known as PLAplus) for the presence of telomerase reverse transcriptase gene driver mutations (“TERT”) to lower the cost to diagnose melanoma while providing a more accurate and less invasive alternative to current methods based on assessing genomic atypia.

4

The general genomic testing market is highly saturated with other genomic diagnostic tests that are primarily marketed to pathology and oncology specialists. We are the first company to offer non-invasive genomic tests to the clinical dermatology market. We believe our technology platform will transform the practice of dermatology and will expand the base of clinicians that can practice high quality precision dermatology (e.g., primary care clinicians). As healthcare delivery diverges to support more convenient delivery models, such as pharmacy-based/retail clinics and telemedicine, we believe our platform will facilitate the migration of dermatologic care to these alternative models. We believe our platform may allow for expanded consumer-based sample collection shipped directly to our laboratory, positively impacting the ease of use and convenience of providing dermatologic care.

We originally marketed the DMT under the name Pigmented Lesion Assay or PLA. The PLA assessed pigmented skin lesions, moles or dark skin spots for melanoma and enhances early detection. In particular, the PLA detected expression of the LINC00518 (“LINC”) and preferentially expressed antigen in melanoma (“PRAME”) genes using an amplification process called reverse transcription-polymerase chain reaction (“RT-PCR”). In the second quarter of 2018, we introduced our Nevome product, an adjunctive reflex test for the PLA. The Nevome test was used with histopathology to identify additional risk factors for melanoma and to confirm the diagnosis of melanoma in PLA positive tests, which are subjected to surgical biopsy. The Nevome test analyzed early-stage melanoma driver mutations in the v-Raf murine sarcoma viral oncogene homolog B (“BRAF”), neuroblastoma RAS viral oncogene homolog (“NRAS”) and TERT genes. The Nevome test utilized the same genomic material collected from the initial Smart Sticker sample used for the PLA and did not require additional sampling. We discontinued our Nevome product in November 2020, and replaced it with the introduction of our second-generation PLA test, PLAplusTM, in April 2021. The PLAplus test could identify the presence of TERT using a DNA sequencing technique and adding the TERT promoter mutation analyses to the PLA gene expression test improved the sensitivity of the test to up to 97%. We no longer test for BRAF or NRAS genes, which we tested for in our Nevome product. We have since rebranded our PLA and PLAplus tests as the DermTech Melanoma Test or the DMT. The DMT tests for LINC and PRAME, as it did while branded as the PLA, and may be ordered with or without the add-on test for TERT formerly known as PLAplus. Positive results for LINC, PRAME, or TERT correlate with the presence of melanoma. If the biomarkers are not detected (meaning negative results), this result indicates a greater than 99% probability that the mole being tested is not melanoma.

In March 2019, Medicare’s Molecular Diagnostic Services program, administered by Palmetto GBA (“MolDX”), which performs technology assessments for genomic tests, issued a favorable Local Coverage Determination (“LCD”) draft (the “Draft LCD”) for the DMT (without the add-on test for TERT). Each reference to the DMT in this paragraph refers only to the DMT without the add-on test for TERT. In October 2019, the American Medical Association (“AMA”) provided us with a Current Procedural Technology Proprietary Laboratory Analysis code for the DMT of 0089U (the “PLA Code”). Pricing of $760 for the PLA Code was published on December 24, 2019 as part of the Centers for Medicare and Medicaid Services (“CMS”) Clinical Laboratory Fee Schedule (“CLFS”), for 2020, which has been confirmed for 2022. The Medicare final LCD (the “Final LCD”) first made available on December 26, 2019 expanded the coverage proposal in the Draft LCD from one test per date of service to two tests per date of service for a certain percentage of patients, and allows clinicians to order the DMT if they have sufficient skill and experience to decide whether a pigmented lesion should be biopsied or assessed using the DMT. The DMT became eligible for Medicare reimbursement effective on February 10, 2020. Our local Medicare Administrative Contractor, Noridian Healthcare Solutions, LLC (“Noridian”) relies upon MolDX for technology assessments of genomic-based tests and has adopted the Final LCD issued by MolDX. Noridian has issued its own LCD announcing coverage of the DMT. Even though the effective date of Noridian’s LCD is June 7, 2020, Noridian began reimbursing us for the DMT as of February 10, 2020. No LCD covers the optional add-on test for TERT available to those ordering the DMT.

Of the approximate 4.0 million surgical biopsies performed each year on pigmented skin lesions, over 90% are negative for melanoma and represent avoidable surgical procedures. The DMT improves the assessment of pigmented lesions by reducing the probability of missing melanoma to less than 1.0% (versus approximately 11-17% with the existing standard of care) and by reducing the number of surgical biopsies required to diagnose melanoma by five to tenfold (from about 25:1 to about 2.5-5.0:1). In addition, the DMT improves the positive predictive value (“PPV”) approximately five-fold (from 3-4% with the current surgical techniques to 18.7% with DMT).

The performance of the DMT is supported by numerous investigational studies, which enrolled an aggregate of over 9,000 patients and yielded a total of 22 peer-reviewed publications in top-rated medical dermatology journals. A study published in JAMA Dermatology and conducted prior to our introduction of the option to order DMT with the add-on test for TERT demonstrated that the DMT (referred to as the PLA in this study) significantly lowers the cost to diagnose melanoma while providing a more accurate and less invasive alternative to current methods. The current AAD melanoma guidelines indicate that non-invasive gene expression testing can be used as a part of the initial clinical assessment for pigmented lesions. In January 2021, the National Comprehensive Cancer Network® (“NCCN”) updated their NCCN Clinical Practice Guidelines in Oncology (“NCCN Guidelines®”) for cutaneous melanoma to recommend that the use of pre-diagnostic noninvasive genomic patch testing may be helpful to guide biopsy decisions for cutaneous melanoma. The NCCN reaffirmed their recommendation in January 2022 that pre-diagnostic noninvasive patch testing may be helpful to guide biopsy decisions for cutaneous melanoma. The NCCN’s recommendation indicated that there is uniform consensus that the intervention is appropriate. In addition, an independent panel of melanoma experts has produced consensus recommendations for use of the DMT. We believe the DMT can be used as an alternative for the majority of these surgical biopsy procedures. In 2019, our platform became available for use in Canada based on Health Canada compliance and we have established a non-exclusive partnership with

5

DermTech Canada. We are working with two Canadian provinces, British Columbia, and Ontario, who are evaluating our technology for coverage and reimbursement.

We initiated the commercialization of the DMT in the second quarter of 2016. We currently market our tests directly to dermatologists in the United States with a team of approximately 70 sales representatives throughout the United States and could expand our team into more areas throughout the United States during 2022. With our Medicare coverage, contracts with several large insurers associated with the Blue Cross Blue Shield Association (“Blues plans”) and growth of testing volume and physician users, we believe the DMT is being reviewed for coverage by key United States commercial payors. We believe we will achieve successful coverage outcomes from these efforts over the next 24 to 36 months, although no assurances can be given that any reimbursement coverage approvals will be obtained.

We are expanding our sales efforts as we obtain reimbursement coverage to provide sales coverage to a majority of over 13,000 healthcare professionals specializing in dermatology in the United States.

We believe the total annual United States market opportunity for the DMT exceeds $2.5 billion, and that the select annual worldwide market consisting of Australia, Europe, and Canada exceeds an additional $750 million. We currently only offer the DMT throughout the United States.

We have additional skin cancer product offerings, including for non-melanoma skin cancers (basal cell and squamous cell cancers), currently under development. In the United States, approximately 12 million surgical biopsies are performed each year to diagnose approximately 5.4 million non-melanoma skin cancers. Many of the initial surgical procedures for these skin cancers are performed on cosmetically sensitive areas of the body, such as the face, neck and chest, creating significant demand for a non-invasive alternative. We believe the total market opportunity for our non-melanoma skin cancer products exceeds $3 billion in the United States and $1 billion in select world-wide markets.

We are also working on tests to facilitate the assessment of inflammatory skin diseases, such as atopic dermatitis and psoriasis, which will facilitate the appropriate diagnosis and treatment of these inflammatory diseases. The prevalence of atopic dermatitis in the United States is reported to be approximately 12% in children and 7.0% in adults with approximately 6.6 million patients having moderate-to-severe disease. The prevalence of psoriasis in the United States is approximately 2.2% with approximately 1.3 million patients having moderate to severe disease.

We also make our non-invasive molecular skin analysis platform available to pharmaceutical companies to facilitate the development of new targeted therapies in dermatology and cancer, including biologics. These partners use our platform and services to assess treatment response, monitor side effects and identify likely responders to the therapy under development. We have completed and have ongoing research collaborations with large pharmaceutical companies to facilitate their development of new targeted therapeutics in dermatology. We have initiated programs across the spectrum of pharmaceutical development stages from Phase 1 through Phase 3. We believe that some of these collaborations may lead to a complementary or companion diagnostic product for the pharmaceutical partner’s therapeutic candidate, if it reaches the commercial market. We have booked over $0.7 million of orders pursuant to research contracts in 2021, and many of these contracts are multi-year in length.

We offer our genomic tests through our CLIA certified and CAP accredited commercial laboratory located in La Jolla, California, which is licensed by the State of California and all states requiring out-of-state licensure, including New York, which has the most rigorous licensing process for clinical diagnostic laboratories. We can scale our current laboratory facility to handle approximately 150,000 DMT tests per year. We are in the process of converting office space into a new laboratory facility with the ability to scale to over 1,000,000 tests per year based on the processes and equipment currently used for the DMT.

Our sample collection technology maximizes collection of relevant tissue with minimal patient discomfort using adhesive patches. We have developed significant intellectual property and know-how around the use of adhesives for non-invasive biopsy and the transportation and handling of this type of sample. We have developed a proprietary process that allows us to extract genomic material from the patches with sufficient quality and quantity to perform gene expression, DNA mutation, transcriptomic analyses and other technologies. We believe our technology can be utilized to assess the microbiome of the skin with superior performance to existing methods that use swabs. The results of these efforts will allow us to introduce our sample collection technology to facilitate the diagnosis of a broad array of dermatologic conditions and other conditions where the skin serves as a surrogate target organ.

6

Our Competitive Advantages

Enhancing early detection for superior patient care at a lower cost. The DMT is used to assess pigmented lesions that may harbor melanoma at the earliest stages (melanoma in situ or stage 1a), the most difficult lesions to diagnose. In our clinical studies, the DMT has demonstrated a sensitivity of 91-97% and a specificity of 69-91% in differentiating these early-stage melanomas from non-melanoma using histopathology as the reference standard. This leads to a very high negative predictive value (“NPV”) of greater than 99%, which is the probability the DMT correctly ruled out melanoma. We completed a long-term follow-up study of the DMT (without the add-on test for TERT) that further confirmed the 99% NPV of the DMT by reevaluating and retesting lesions that were DMT negative 12 to 24 months prior to each subject’s enrollment in the study. We also completed a study that demonstrated that the DMT (without the add-on test for TERT) increases the PPV for melanoma diagnosis by approximately fivefold, from 3-4% for the current pathway to 18.7% for the DMT. In addition, the DMT (without the add-on test for TERT) has demonstrated an approximate tenfold reduction in unnecessary surgical procedures, relative to the current visual assessment and histopathology standard of care. Such a reduction can result in significant cost savings for the health care system and reduces patient morbidity as compared to other diagnostic approaches. Table 1 below compares the DMT (without the add-on test for TERT, except for sensitivity) with other techniques and the existing standard of care for assessing early-stage melanoma in pigmented skin lesions.

|

|

|

The DMT |

|

Visual Assessment & Pathology (Current Standard) |

|

Mechanism |

|

Tumor Biology |

|

Pattern Recognition |

|

Surgical Procedure Required |

|

No |

|

Yes |

|

Platform Technology |

|

Yes |

|

N/A |

|

Multiple Dermatologic Indications |

|

Yes |

|

Yes |

|

Physician Payment |

|

Yes |

|

Yes |

|

Simple Practice Integration |

|

Yes |

|

N/A |

|

Ease of Use |

|

Yes |

|

N/A |

|

Number Needed to Biopsy(1) |

|

2.7 |

|

>25 |

|

Number Needed to Excise(2) |

|

1.6 |

|

5.2 |

|

Better Performance |

|

|

|

|

|

NPV(3) |

|

>99% |

|

>81-89% |

|

PPV(4) |

|

18.7% |

|

4% |

|

Sensitivity(5) |

|

91-97% |

|

65-84% |

|

Cost |

|

$760(6) |

|

$947 |

|

Capital Equipment |

|

No |

|

No |

Table 1. The data summarized above compares the DMT with the existing standard of care for assessing early-stage melanoma in pigmented skin lesions.

Footnotes to Table 1:

|

|

(1) |

Number of surgical biopsies required to diagnose one melanoma. |

|

|

(2) |

Number of wide excision surgical procedures per melanoma diagnosed. |

|

|

(3) |

NPV measures the probability that a negative result is truly negative. |

|

|

(4) |

PPV measures the probability that a positive result is truly positive. |

|

|

(5) |

Sensitivity measures the proportion of actual positives that are correctly identified as such. |

|

|

(6) |

Figure represents a projected United States reimbursed price, though this price has not yet been negotiated with major United States payors. Pricing of $760 for the PLA Code was published on December 24, 2019 as part of the CMS Laboratory Fee Schedule for 2020 and confirmed for 2021. The Medicare Final Coverage Decision was made available on December 26, 2019 and the DMT (without the add-on test for TERT) became eligible for Medicare reimbursement on February 10, 2020. |

Our technology platform has the potential to transform dermatologic practice. We are the first and only company to offer non-invasive genomic testing to clinicians that practice dermatology. Current dermatologic practice is based on subjective visual assessments of cellular change that are prone to inaccuracy and lead to invasive surgical procedures that drive unnecessary costs. Our technology platform seeks to dramatically transform this paradigm by enhancing early detection at the genome level where cancer

7

begins providing non-invasive, objective, and more accurate information, thereby broadening the base of clinicians that can practice dermatology while also improving the performance of specialists.

Superior ease of use. Our non-invasive biopsy sample collection procedure can be performed in less than five minutes. All the necessary items, including Smart Stickers, instructions, a marking pen for outlining, and a preaddressed and prepaid return shipping label, are contained in our kit. The collection procedure, when a clinician orders the test, can also be performed at the patient’s home with clinician guidance.

Simple integration into clinical practice. Our tests use a Smart Sticker that replaces the scalpel traditionally used in the initial clinical assessment. Unlike other technologies, our platform does not require the installation and maintenance of capital equipment. The nursing support, documentation, specimen processing, and requisition post procedure are substantially similar to current practice. These issues are critical in a busy clinical practice where clinicians see patients every five to seven minutes.

Strong intellectual property protection. We have seven issued or allowed United States patents, one of which is broadly directed to the use of an adhesive to collect samples containing RNA from the skin for analysis. In addition, we have been awarded patents on unique gene expression profiles and classifiers that differentiate melanoma from non-melanoma, one of which will not expire until 2029, and the other will not expire until 2030. Additional efforts to further expand our patent portfolio are ongoing and a number of provisional and non-provisional patent applications have been filed. We have also developed unique know-how and proprietary processes that allow us to extract sufficient quantities of low-quality genomic material from adhesive patch samples suitable for analysis.

Our Strategy

Our goal is to become the global leader in non-invasive genomics testing for dermatologic conditions. We believe our robust intellectual property portfolio, platform technology, first-to-market advantage, and groundbreaking research will facilitate the achievement of this goal. Specifically, we will focus on the following objectives:

Build a specialized sales force to introduce our products into the dermatology market. We have expanded our existing direct specialty sales force as additional reimbursement coverage has been achieved. Consistent with our current sales strategy, we will continue to recruit experienced sales representatives, primarily those from the dermatology sector who have existing physician relationships. We believe we could also leverage this sales force by establishing distribution relationships with laboratory companies that do business with clinical dermatologists or sell molecular tests.

Secure broad reimbursement coverage for our assays. We have targeted regional and national commercial payors to secure favorable coverage decisions for the reimbursement of our tests. The DMT has completed the necessary analytical validity, clinical validity, and clinical utility studies that payors require molecular tests to undertake. As discussed above, we also published a United States health economic impact study of the DMT (without the add-on test for TERT) in JAMA Dermatology, which shows that the DMT significantly reduces the relative cost to assess a pigmented lesion. The cost to fully adjudicate a pigmented lesion suspicious for melanoma is $947 in the United States. We believe the DMT could lead to cost savings of greater than $650 million per year in aggregate savings, based on approximately 4 million surgical biopsies performed per year to rule out melanoma, and assuming the DMT was to become the standard of care in the United States.

As discussed above, in March 2019, MolDX, which performs technology assessments for genomic tests, issued a favorable Draft LCD for the DMT (without the add-on test for TERT). Each reference to the DMT in this paragraph refers only to the DMT without the add-on test for TERT. In late October 2019, the AMA provided us with the PLA Code. Pricing of $760 for the PLA Code was released on December 24, 2019 as part of the CLFS for 2020. The Final LCD, first made available on December 26, 2019, expanded the coverage proposal in the Draft LCD from one test per date of service to two tests per date of service for a certain percentage of patients, and allowed clinicians to order the DMT if they have sufficient skill and experience to decide whether a pigmented lesion should be biopsied or assessed by the DMT. The DMT became eligible for Medicare reimbursement on February 10, 2020. Our local Medicare Administrative Contractor, Noridian, relies upon MolDX for technology assessments of genomic-based tests and has adopted the Final LCD issued by MolDX. Noridian has issued its own LCD announcing coverage of the DMT. Even though the effective date of Noridian’s LCD is June 7, 2020, Noridian began reimbursing us for the DMT as of February 10, 2020. No LCD covers the optional add-on test for TERT available to those ordering the DMT.

In addition to our demonstrated clinical validity, clinical utility is the most important attribute of a test for establishing coverage policies with payors because it demonstrates how frequently physicians adhere to the recommendation of the test and the resulting improvement in clinical outcomes. In 2020, we completed and published our largest clinical utility study of the DMT (without the add-on test for TERT) based on real-world commercial usage. This most recent clinical utility study on 3,418 cases corroborates earlier utility studies and demonstrates that clinicians adhere to the recommendation of the DMT more than 98% of the time. The DMT significantly reduces surgical procedures and improves the diagnostic pathway for pigmented lesion assessment. Lesions clinically suspicious for melanoma have negative DMT results in over 90% of cases, leading to an approximately 90% reduction in surgical biopsies in our 2020 study. In January of 2021, we published additional registry study data highlighting that use of the DMT (without the add-on test for TERT) enriches biopsied samples for melanoma almost 5-fold. We believe our body of clinical evidence and utility will

8

lead to securing coverage policies from the major commercial payors over the next 24 to 36 months, although no assurances can be given that any reimbursement coverage approvals will be obtained.

We have secured several contracts with major preferred provider networks. We have submitted clinical and technology assessment packages to eviCore healthcare, LLC, which provides consultative services for payors. We are in direct discussion with several national commercial payors which have the DMT currently under review.

Integrate our products into the standard of care. We conduct rigorous clinical research and basic science research and publish the results of this research in peer-reviewed journals. Overall, our research has yielded 22 publications in top peer-reviewed journals; 21 regarding DMT without the add-on test for TERT and one regarding DMT with the add-on test for TERT. The DMT’s (referred to as the PLA in these studies) performance is supported by over ten investigational studies, which enrolled an aggregate of over 9,000 patients. A study published in JAMA Dermatology demonstrated that the DMT (without the add-on test for TERT) significantly lowers the cost to diagnose melanoma while providing a more accurate and less invasive alternative to the current methods. Our research is frequently highlighted at clinical meetings and has several times been accepted for peer-reviewed late-breaking presentations at major medical society meetings.

The AAD melanoma guidelines updated every 5-7 years have indicated that non-invasive gene expression testing can be used as a part of the initial clinical assessment for pigmented lesions. In January 2021, NCCN recommended that there is uniform NCCN consensus to recognize the use of noninvasive genomic patch testing to help guide biopsy decisions for cutaneous melanoma, and it added the intervention to its NCCN Guidelines for cutaneous melanoma. In January 2022, NCCN reaffirmed its unanimous consensus recommendation that pre-diagnostic noninvasive patch testing may be helpful to guide biopsy decisions for cutaneous melanoma. In addition, an independent panel of melanoma experts produced consensus recommendations for use of the DMT (without the add-on test for TERT), which were published in 2019.

We have established an extensive advisory board of eight Key Opinion Leaders (“KOLs”) in dermatology, including two former presidents of the AAD. These KOLs speak extensively about our technology platform and the DMT at various clinical and research meetings. In addition, these KOLs participate in our clinical studies and publish findings in peer-reviewed journals.

Establish alternate care delivery channels. We continue to expand our efforts in alternate care delivery channels including telemedicine, integrated primary care networks, and on-site and near-site employer health and retail clinics. During 2021, we launched our new telemedicine mobile application, DermTech Connect, where permitted by law and applicable standards of care and practice guidelines. Using DermTech Connect, a patient can submit photos of suspicious lesions to an independent clinician who are subscribed to the DermTech Connect platform. The clinician can determine, if they deem it medically necessary, to order the DMT, in which case a Smart Sticker Collection Kit is mailed to the patient, followed by at home self-collection with remote virtual supervision by a DermTech patient liaison.

In December 2021, we entered into an agreement with BioIQ (an analytics-driven population health company) to offer the DMT via our DermTech Connect platform through BioIQ employee and member health programs. Under the agreement with BioIQ, the clinician’s telemedicine services fee and the DMT cost if ordered by the clinician, would be covered by the member health program.

These channels can help to democratize access to high quality dermatologic care, alleviate certain capacity limitations currently within dermatology and the related long lead times for dermatology specialist appointment availability, and improve the delivery of care to patients with ease of use, improved commute and wait times, and reduced patient fear that can accompany referrals to dermatology specialists.

Establish distribution partnerships for primary care. A substantial portion of dermatology is practiced in primary care. Based on the adoption progress we make within dermatology and integrated primary care networks, we plan to eventually access the primary care market more broadly by potentially establishing distribution relationships with companies that focus on this physician call point. An ideal partner would have several hundred sales professionals in the aggregate who access the primary care market, and ideally have experience selling genomic diagnostic products. Alternatively, we may plan to hire sales representatives to make direct calls to primary care offices.

Expand our product offerings. We have developed a platform that provides genomic analysis of the skin using our noninvasive Smart Sticker platform as the sample collection method. This platform can be used to develop multiple products based on the same sample collection method, and it only requires different genomic markers to be assayed in our CLIA-certified laboratory. We are currently working to complete development of additional products, which includes an assessment of non-pigmented lesions for basal cell and squamous cell cancers as well as products that assess precancerous genomic changes associated with sun UV exposure to the skin. In addition, we are working to develop tests for inflammatory diseases of the skin.

Expand our marketing of research services to pharmaceutical companies. Our platform is used by several pharmaceutical companies to facilitate their development of new targeted therapeutics in dermatology. Our Smart Sticker helps identify biomarker treatment responses, track side effects, and identify patients that respond to the therapy. We plan to hire additional business development professionals to sell these services to the pharmaceutical industry. We have recently branded our service offering as DermTech Stratum and are now offering additional services and capabilities. These efforts will include the participation in additional industry conferences and the presentation of our platform and data at additional medical conferences. Additionally, our collaborations with pharmaceutical

9

partners may result in the introduction of complementary or companion diagnostic products for the partners’ therapeutic candidates that reach the commercial market.

Market Opportunity – Skin Cancer

Melanoma is currently one of the fastest growing cancers and the subject of significant attention in the medical community. The incidence of melanoma has doubled from 1982 to 2011. While there has been a 32% decline in cancer deaths overall since 1991, melanoma is one of three cancers facing increasing death rates. According to a study from the Mayo Clinic, the incidence of melanoma increased eightfold among women under 40 and fourfold among men under 40 from 1970 to 2009.

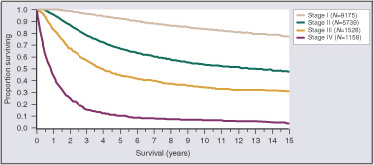

Melanoma is one of the deadliest forms of skin cancer. On average, melanoma causes more than one death every hour of every day of the year in the United States. The Skin Cancer Foundation projects that approximately 7,650 people will die from melanoma in 2022. If diagnosed and removed early in its evolution, when confined to the outermost skin layer and deemed to be “in situ” (Stage 0), patients are expected to have a survival rate of almost 100%. Invasive melanomas that are thin and extend into the uppermost regions of the second skin layer (Stage 1) still have cure rates greater than 90%. However, once the cancer advances into the deeper layers of skin, the risk of it spreading to other parts of the body, or metastasis, and death increases. The table below depicts the survival rate of melanoma based on the stage of the cancer at initial diagnosis.

From Balch CM, Buzaid AC, Soong S-j et al: Final Version of the American Joint Committee on Cancer Staging System for Cutaneous Melanoma. Journal of Clinical Oncology, August 2001.

An estimated 197,700 cases of melanoma will be diagnosed in the U.S. in 2022. Of those, it is estimated that 97,920 cases will be in situ (noninvasive), confined to the epidermis (the top layer of skin), and 99,780 cases will be invasive, penetrating the epidermis into the skin’s second layer (the dermis). On average, 25 surgical biopsies are performed per early-stage melanoma diagnosed, creating a total market opportunity of approximately 4.0 million surgical procedures per year. Outside the United States, the incidence of melanoma is highest in Western Europe, Australia, and Canada. We estimate that these select worldwide markets perform over 1.5 million surgical biopsies annually to diagnose approximately 75,000 melanomas, creating additional market opportunity that we believe exceeds $750 million per annum.

Over 5.4 million non-melanoma skin cancers (basal cell and squamous cell carcinomas) are diagnosed in the United States annually. The number of surgical biopsies needed to diagnose one non-melanoma skin cancer is approximately 2.5-3.0 among dermatologists and can be considerably higher when diagnosed by other clinicians such as nurse practitioners and primary care physicians. While these cancers are not as deadly as melanoma, they commonly occur on the face, head, neck, and other cosmetically sensitive areas, creating an important unmet medical need for a non-invasive alternative, and a potential market opportunity of approximately $3.0 billion in the United States per annum based on the approximately 10-12 million surgical biopsies performed to diagnosis of basal and squamous cell skin cancers.

Limitations of Current Melanoma Diagnostic Pathway

The estimated prevalence of pigmented lesions (moles) ranges from 2% to 8% in fair-skinned persons.

Pigmented lesions may be classified as clinically atypical by meeting one or more of the American Cancer Society’s ABCDE criteria, which includes Asymmetric, irregular Border, variegated or dark Color, Diameter greater than 6 mm, or Evolving mole. Atypical pigmented lesions are at risk for harboring melanoma. A meta-analysis of case-control studies found that the relative risk of melanoma is 1.45 in patients with one atypical mole vs. those with none, and this risk increases to 6.36 in those patients with five atypical moles. Management of atypical pigmented lesions involves ruling out melanoma via a visual assessment followed by surgical biopsy and histopathology. Ideally, when melanomas are identified, they are found at the earliest stages (melanoma in situ or stage 1a) when a high cure rate is possible by wide excision. Since a biopsy only partially removes a lesion for histopathologic analysis, early-stage

10

melanomas diagnosed histopathologically from biopsy material are treated with follow-up wide excision procedures (generally with 0.5-1.0 cm margins).

While the purpose of the visual assessment or surgical biopsy is to rule out melanoma, the poor performance metrics of this diagnostic pathway leads to a low NPV for early-stage disease (Table 2 below). This is related to the low specificity of the visual assessment (3-10%), which results in a high number of biopsies on benign atypical nevi. During histopathologic assessment, a small number of melanomas must be identified from this large pool of biopsied atypical nevi. However, there is significant overlap in the histopathologic diagnostic criteria between atypical nevi and early-stage melanoma, invariably leading to false negative diagnoses and a relatively low sensitivity (65-84%). Elmore et al. BMJ (2017) 357:j2183, concluded that the diagnosis of early stage melanoma was not accurate after finding that 35% of slide interpretations for melanoma in situ or stage 1a melanomas by 187 pathologists received a false negative diagnosis as benign. With the prevalence of early-stage melanoma in biopsied lesions at approximately 5%, the negative predictive value ranges from 75-89%.

Welch and colleagues’ most recent N Engl J Med article (2021, 384:72-79) points out that melanoma diagnoses have increased more than 6-fold over the last 40 years. The authors attribute this increase to more frequent enhanced screening, lower pathological thresholds to label the morphologic changes as cancer, and importantly heightened clinical awareness to biopsy pigmented lesions. However, the article fails to address the main limitations of the current care standard for evaluating pigmented lesions relies primarily on visual atypia to guide biopsy decisions. About 4 million pigmented lesions are biopsied each year in the US alone to diagnose fewer than 200,000 cutaneous melanomas (about 25 biopsies to detect 1 melanoma based on Anderson et al. JAMA Dermatol. (2018) 154(5):569-573. Using non-invasive assessment of genomic atypia offered by the DMT rather than visual atypia alone to guide pigmented lesion biopsy decisions reduces avoidable biopsies while missing fewer melanomas. Precision genomics is currently used in other areas of oncology and has changed the paradigm of treatment. Integrating use of the DMT and precision genomics to enhance early detection non-invasively into standard practice rather than performing fewer skin examinations appears to be a superior solution to the conundrum highlighted by Welch and colleagues.

According to several published papers, the real NPV of the visual assessment or surgical biopsy pathway is likely 80% to 85%. In a study by Malvehy et al., BJD (2014) 171:1099, 206 in situ and stage 1a (thickness less than 0.75 mm) melanomas were diagnosed with a sensitivity of 81% and a specificity of 10%. The prevalence of early melanoma in the study was about 10%, yielding an NPV of 83%. In addition, the current pathway using visual atypia to guide biopsy decisions suffers from a low PPV of approximately 4% for melanoma diagnosis. The addition of the DMT (without the add-on test for TERT) to the visual assessment by clinicians increased the PPV for a melanoma diagnosis by approximately five-fold to 18.7%.

|

|

|

Current Pathway |

|

|

PLA |

|

||

|

Test Purpose |

|

Rule-out melanoma |

|

|

Rule-out melanoma |

|

||

|

Type |

|

Surgical biopsy/ histopathology |

|

|

Non-invasive gene expression |

|

||

|

NPV |

|

83% |

|

|

99% |

|

||

|

Probability of Missed Mel |

|

17% |

|

|

1% |

|

||

|

Probability of Mel Diagnosis |

|

4% |

|

|

18.7% |

|

||

|

Number Needed to Biopsy |

|

25 |

|

|

2.7 |

|

||

|

Number Needed to Excise |

|

5.2 |

|

|

1.6 |

|

||

|

Cost per Lesion Tested |

|

$ |

947 |

|

|

$ |

760 |

|

Table 2. Data summarized above compares the key performance metrics of the DMT (without the add-on test for TERT) versus the current pathway (visual assessment and surgical biopsy/histopathology) for managing pigmented skin lesions.

This low NPV for the current pathway is accompanied by a high number of unnecessary surgical procedures, again driven by the poor specificity of the visual assessment. The number of surgical biopsies needed to identify one melanoma averages 25 and ranges from eight to greater than 30 depending on the clinical setting. Further, the histopathologic review of biopsied lesions is extremely limited with 2% or less of the lesion sectioned and evaluated, leaving doubt as to what may be occurring in the rest of the lesion. Consequently, lesions that have cellular atypia and positive margins are often clinically managed conservatively and subjected to full excisions with margins. However, only 0.2% to less than 1.0% of lesions with atypia and positive margins that undergo excision are diagnostically upgraded, most commonly to a higher level of atypia and rarely to melanoma in situ, and such excisions can be considered unnecessary. Approximately 5.2 excisions with margins are performed per melanoma identified, emphasizing how the current pathway of surgical biopsy and limited histopathology assessment leads to more complex and invasive excisions.

11

Our Products

DermTech Melanoma Test (formerly the PLA and/or PLAplus)

The DMT is a gene expression test that enhances early detection of genomic atypia and helps rule out melanoma and the need for a surgical biopsy of atypical pigmented lesions. The performance of the PLA is supported by over ten investigational studies, which enrolled over 9,000 patients and yielded 22 peer-reviewed publications in top rated medical dermatology journals; 21 regarding DMT without the add-on test for TERT and one regarding DMT with the add-on test for TERT. Key studies and manuscripts are summarized in Table 3 below. The DMT is based on a new platform technology for non-invasive genomic testing of the skin, which allows the molecular analysis of samples collected from adhesive patches. In contrast to the current pathway, the DMT has a very high NPV (greater than 99%) and high sensitivity (91-95% without the add-on test for TERT), ensuring a very low probability of missing melanoma. The DMT’s high specificity (69-91% without the add-on test for TERT) effectively reduces the number of false positive samples undergoing histopathologic review. This improves the overall sensitivity of the pathway and greatly increases the NPV.

The NPV of the DMT (without the add-on test for TERT) is supported by a 12-month follow-up study of 734 patients, which demonstrated that no melanomas were missed in the 12-month period following initial testing. In the third quarter of 2019 we initiated the TRUST study, which further examined long-term follow up of lesions previously tested negative by the DMT, and incorporated repeat testing of the previously tested lesion. This study more definitively confirmed the high NPV of the DMT in a real-world setting, and we announced those topline results in December 2020. Of the lesions evaluated by means of repeat testing with the DMT (n=302), none were found to have clinically obvious melanoma upon the subject’s return to the clinic, confirming the results of the initial chart review. Eighty-nine percent of these lesions were negative on repeat testing with the DMT and 11.2% were positive. Positive lesions were biopsied and subjected to a single read histopathologic review. One percent of lesions (n=3) that tested positive on repeat testing were diagnosed as Stage 0, in situ. Photographic review of the three Stage 0 cases identified changes in clinical appearance since the initial test. The pathology reports from the remaining biopsied lesions indicated a variety of non-melanoma diagnoses, including compound nevi with mild to moderate atypia. Given the early stage (in situ) of the melanomas detected on repeat testing, and length of time from the initial test (an average of 15 months), it is difficult to determine whether these melanomas evolved after the initial test or were present at the time of the initial test. In any case, the finding of three melanomas in a cohort of 302 lesions subjected to repeat testing further confirms an NPV of the DMT of at least 99.0% and is consistent with the results from the full long-term follow‑up cohort. These results exemplify how the DMT repeat testing of lesions that may have evolved over time after the initial negative PLA test have potential to identify early-stage melanoma and benefit patients. TRUST study findings corroborating the DMT’s high NPV were complemented by most recent registry data on the DMT’s high PPV (Brouha et al., SKIN, January 2021, 5(1):13-18). This data show that 316 lesions clinically suspicious for melanoma that were biopsied based on guidance offered by genomic atypia (positive DMT results rather than visual atypia alone) were enriched approximately five-fold for histopathologic features of melanoma.

In addition, the non-invasive sampling leads to a dramatic reduction in surgical biopsies and subsequent excisions. Consequently, our studies have shown that the number of surgical biopsies needed to find one melanoma using the DMT (without the add-on test for TERT) is markedly reduced by almost tenfold to approximately 2.7 and the number of excisions needed is reduced to 1.6. Our studies have shown that the DMT can reduce unnecessary surgical biopsies of lesions clinically suspicious for melanoma by 90%, which is consistent with a 2017 review of 18,715 biopsied pigmented lesions that found that approximately 90% of surgical biopsies to rule out melanoma are performed on pigmented lesions that are not melanoma. Non-invasive gene expression testing has been added to the most recent AAD melanoma guidelines as part of the initial clinical assessment for clinically concerning lesions and non-invasive patch testing is recommended by the NCCN Guidelines as of January 2022. In addition, an independent expert committee has developed and published consensus use criteria for the DMT (without the add-on test for TERT).

During the second quarter of 2021, we announced the launch of the optional add-on test for TERT (then known as PLAplus) available to those ordering the DMT, which delivers objective and actionable information to guide clinical management decisions for skin lesions suspicious of melanoma. This add-on test combines TERT promoter DNA driver mutation analyses as a reflex test to the DMT’s standard RNA gene expression test. TERT is individually associated with histopathologic features of aggressiveness and poor survival in melanoma. The combined tests elevate the sensitivity from 91% to 97% and maintain a negative predictive value of >99%, resulting in a less than 1% probability of missing melanoma. By combining RNA gene expression and DNA mutation analyses, the DMT provides a highly accurate non-invasive genomic test for enhanced early melanoma detection.

12

|

Study |

|

Status |

|

Size (n) |

|

Publication |

|

Analytical Validation |

|

Complete |

|

125 |

|

Yao Z et al. Analytical characteristics of a noninvasive gene expression assay for pigmented skin lesions. Assay Drug Dev Technol. 2016;14(6):355-363. |

|

Clinical Validation-Pathology |

|

Complete |

|

555 |

|

Gerami P et al. Development and validation of a noninvasive 2-gene molecular assay for cutaneous melanoma. J Am Acad Dermatol. 2017;76(1):114-120.e2. |

|

Clinical Validation-Driver Mutations |

|

Complete |

|

626 |

|

Ferris L et al. Noninvasive analysis of high-risk driver mutations and gene expression profiles in primary cutaneous melanoma. J Invest Dermatol. 2019; 139(5):1127-1134. |

|

Clinical Utility |

|

Complete |

|

45 Derms |

|

Ferris L et al. Utility of a noninvasive 2-gene molecular assay for cutaneous melanoma and effect on the decision to biopsy. JAMA Dermatol. 2017;153(7):675-680. |

|

Real-World Clinical Utility |

|

Complete |

|

381 |

|

Ferris L et al. Real-world performance and utility of a noninvasive gene expression assay to evaluate melanoma risk in pigmented lesions. Melanoma Res. 2018; 28(5):478-482. |

|

Real-World Clinical Utility |

|

Complete |

|

1535 |

|

Skelsey et al, Non-Invasive Detection of Genomic Atypia Increases Real-World NPV and PPV of the Melanoma Diagnostic Pathway and Reduces Biopsy Burden. SKIN. 2021 Sep; 5(5). |

|

1-Year Follow Up |

|

Complete |

|

734 |

|

Ferris L et al. Impact on clinical practice of a non-invasive gene expression melanoma rule-out test: 12-month follow-up of negative test results and utility data from a large US registry study. Dermatology Online Journal. 2019; 25(5). |

|

Real-World Utility Registry |

|

Complete |

|

1575 |

|

Ferris L et al. Impact on clinical practice of a non-invasive gene expression melanoma rule-out test: 12-month follow-up of negative test results and utility data from a large US registry study. Dermatology Online Journal. 2019; 25(5). |

|

Real-World Utility Registry |

|

Complete |

|

3418 |

|

Brouha B et al. Real-world utility of a non-invasive gene expression test to rule out primary cutaneous melanoma: a large US registry study. J Drugs Dermatol. 2020; 19(3).

Brouha B et al. Genomic atypia to enrich melanoma positivity in biopsied lesions: gene expression and pathology findings from a large U.S. registry study. SKIN 2021; 5(1):13-18. |

|

Adhesive Patch Validation |

|

Complete |

|

N/A |

|

Yao Z et al. An adhesive patch-based skin biopsy device for molecular diagnostics and skin microbiome studies. J Drugs Dermatol. 2017; 16(10):611-618. |

|

Association With Severe Atypia |

|

Complete |

|

103 |

|

Jackson S et al. Risk Stratification of Severely Dysplastic Nevi by Non-Invasively Obtained Gene Expression and Mutation Analyses. SKIN. 2020 March; 4(2). |

|

Recommendations that Support DMT Use |

|

Complete |

|

N/A |

|

Berman B et al. Appropriate use criteria for the integration of diagnostic and prognostic gene expression profile assays into the management of cutaneous malignant melanoma: an expert panel consensus-based modified Delphi process assessment. SKIN The Journal of Cutaneous Medicine. 2019; 3(5):291-306.

National Comprehensive Cancer Network (NCCN) Clinical Practice Guidelines in Oncology. Cutaneous Melanoma. Version 1.2022 at ME-11

Swetter SM et al. Melanoma: Clinical features and diagnosis. UpToDate. Waltham, MA. September 11 2020 |

|

TERT Validation |

|

Complete |

|

103 |

|

Jackson Cullison, S. R., Jansen, B., Yao, Z., & Ferris, L. K. (2020). Risk Stratification of Severely Dysplastic Nevi by Non-Invasively Obtained Gene Expression and Mutation Analyses. SKIN The Journal of Cutaneous Medicine, 4(2), 124–129 |

13

|

Health Economics |

|

Complete |

|

319 |

|

Hornberger J, Siegel D. Clinical and economic implications of a noninvasive molecular pathology assay for early detection of melanoma. JAMA Dermatol. 2018;154(9):1-8. |

|

Genome Screen |

|

Complete |

|

202 |

|

Wachsman W et al., Noninvasive genomic detection of melanoma. British Journal of Dermatology. 2011; 164:797-806. |

Table 3. Summarizes key clinical studies and publications supporting the DMT. Additional publications can be found on our Company website.

Smart Sticker

We are the inventor and owner of the intellectual property for the Smart Sticker collection kit (pictured below). We have contracted with a Food and Drug Administration (“FDA”) registered supplier to produce our kit under applicable quality systems requirements, and we control the exclusive distribution rights for the kit. Our Smart Sticker allows for the collection of skin samples with minimal patient discomfort. A single kit contains all of the necessary components to complete the sample collection for our analysis, including the Smart Stickers, instructions for use, a marking pen for lesion outlining, and a pre-addressed and prepaid return shipping pack. The unique properties of the Smart Sticker maximize the collection of informative cellular material for the DMT. The sample collection in the clinician’s office usually takes less than five minutes.

Telemedicine Option for the DermTech Melanoma Test

Telemedicine is typically considered to be the provision of health-related services via electronic information and telecommunication technologies. Telemedicine is sometimes used interchangeably with telehealth, but some organizations define telemedicine in a more limited sense to describe remote clinical services, such as diagnosis, treatment and monitoring. Telemedicine enables patient and clinician interaction when rural settings, lack of transport, a lack of mobility, decreased funding, a lack of staff or other limitations such as social distancing guidelines related to the COVID-19 pandemic restrict or make difficult in-person access to healthcare.

Early detection of melanoma, the most deadly and aggressive form of skin cancer, is critical for best patient outcomes. The DMT is the first non-invasive genomic diagnostic test for ruling out melanoma that, in addition to in-office sample collection, enables a patient’s sample collection remotely via telemedicine. For patients who cannot easily attend an in-office visit, we offer two telemedicine solutions that enable dermatologists to conduct a virtual office visit with a patient to collect a skin sample, remote telemedicine collection and DermTech Connect.

Using the remote telemedicine collection option, a clinician can choose to assess the patient’s skin and suspicious lesion(s) via a telemedicine appointment they arrange with their patient and, if indicated, submit a patient-specific order to DermTech for the DMT. In this case, a Smart Sticker Collection Kit is then mailed to the patient directly. During a follow-up telemedicine appointment, a clinician instructs and supervises the patient to collect their sample with the easy-to-use DermTech Smart Sticker. The patient then returns the collected sample(s) back to DermTech via a pre-labeled shipping envelope for analysis. Test results are made available to the ordering clinician within a few days.

Another telemedicine option is available to patients through the DermTech Connect mobile application, where permitted by law and consistent with applicable standards of care and practice guidelines. DermTech Connect enables a user to take a picture of a suspicious lesion with their phone and submit the picture to an independent clinician to assess the lesion. As of the date of this report, DermTech Connect is only available to patients of clinicians subscribed to DermTech Connect in eight states and remains limited in operations. Subscribing clinicians utilizing DermTech Connect charge a pre-determined amount for the patient services and no claims

14

are submitted for reimbursement of the clinical telemedicine services. These subscribing clinicians pay DermTech a fixed amount for use of the DermTech Connect platform. The clinician can also determine, if they deem it medically necessary, to order the DMT, in which case a Smart Sticker Collection Kit is mailed to the patient, followed by at-home self-collection with remote virtual supervision by a DermTech patient liaison. Many state laws and regulations impose various requirements on the practice of telemedicine, the regulatory landscape is evolving and DermTech Connect is not and may not become available in all states. The telemedicine market is relatively new and unproven, especially within dermatology, and it is uncertain whether the telemedicine options for the DMT will achieve and sustain high levels of demand, consumer acceptance and market adoption.

In May 2020, SKIN, the official journal of the National Society for Cutaneous Medicine, published proof-of-concept data demonstrating that patients are able to reliably perform remote self-sampling of concerning moles using the DMT (without the add-on test for TERT) under clinical supervision via telemedicine, enabling actionable molecular testing for accurate melanoma detection. As part of the Institutional Review Board (“IRB”) approved pilot study, 258 eligible melanoma survivors were contacted, and of the 211 who expressed interest in the DMT, there were seven cases of self-identified concerning lesions, which were confirmed by a clinician to be suspicious of melanoma. These patients then conducted sample collections using DermTech’s Smart Sticker at home under the supervision of a clinician via telemedicine. Results from the study showed that skin samples collected by patients enabled successful DMT testing to objectively rule out melanoma in all of the cases evaluated. These findings are in line with sample collection results by licensed providers.

Clinical Research Products

Research on the genomic basis of diseases has increased significantly over the last decade. Genomic analysis can facilitate drug development by identifying drug targets and stratifying patients into groups that will maximize drug response. Genomic analysis is part of the effort to personalize medical therapy to patients’ individual needs. Consequently, tools to facilitate this type of research are in high demand.

We offer a suite of products to facilitate clinical research using our technology platform. We have developed a proprietary process that allows us to extract genomic and protein material from our Smart Sticker with sufficient quality and quantity to perform gene expression, DNA mutation analysis, DNA methylation, and transcriptomic analyses. In addition, our platform can be utilized to assess the microbiome of the skin with superior performance to existing methods that use swabs. We have developed gene expression assays for the Th1, Th2, IFN-gamma, and Th17 inflammatory pathways. We market these assays to pharmaceutical companies developing drug products in dermatology. In addition, we develop custom gene assays to support development for these pharmaceutical partners. We have completed and have ongoing research collaborations with large pharmaceutical companies to facilitate their development of new targeted therapeutics in dermatology. Our technology platform has been deployed in Phase 1 through Phase 3 clinical programs. These efforts may also lead to the introduction of complementary and companion diagnostic products.

Leveraging Our Platform for Other Indications

We believe our Smart Sticker specimen collection platform is applicable to numerous other indications in dermatology. While we are focused initially on skin cancer products, we believe there are significant business development opportunities in other areas. We have undertaken a number of pilot development activities in inflammatory diseases, and skin aging. This effort will also focus on potential licensing and partnering opportunities for the development of complementary and companion diagnostics for the pharmaceutical partners’ drug product candidates, should they reach the commercial market. In addition, because the processing of samples is the same regardless of the disease indication, our development activities will leverage our existing laboratory operations.

UV Damage DNA Risk Assessment Product (Luminate)