Exhibit 10.1

PURCHASE AND SALE AGREEMENT

BETWEEN

OREOF19 BR, LLC,

a Delaware limited liability company, as Seller

and

GENERATION INCOME PROPERTIES, L.P.,

a Delaware limited partnership, as Purchaser

October 28, 2021

Subject Property:

Best Buy Store

585 24 ½ Road

Grand Junction, Colorado

[client file number]

SLK_TAM-#2712021-v2-Purchase_and_Sale_Agreement_-_SLK_redraft_-_6_16_17.doc

|

|

|

|

|

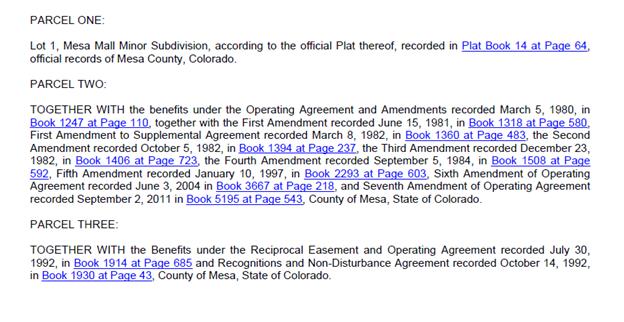

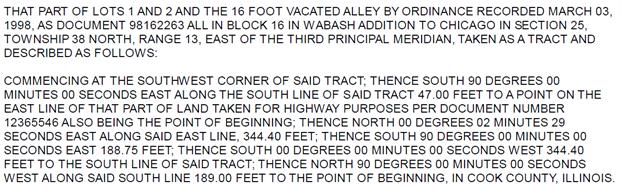

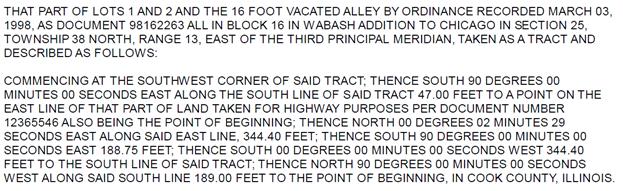

Exhibit “A” |

Description of Land |

|

i

18250087_6

SCHEDULE OF AGREED-UPON FORM CLOSING DOCUMENTS

|

Schedule 1 |

Form of Special Warranty Deed

|

|

Schedule 2 |

Form of Assignment and Assumption of Leases and Security Deposits

|

|

Schedule 3 |

Form of General Assignment of Seller’s Interest in Intangible Property

|

|

Schedule 4 |

Form of OA Estoppel Certificate / REA Estoppel Certificate

|

|

Schedule 5 |

Form of Seller’s Certificate (as to Seller’s Representations and Warranties)

|

|

Schedule 6 |

Form of Seller’s FIRPTA Affidavit

|

|

Schedule 7 |

Form of Purchaser’s Certificate (as to Purchaser’s Representations and Warranties)

|

ii

18250087_6

Best Buy Store

585 24 ½ Road

Grand Junction, Colorado

THIS PURCHASE AND SALE AGREEMENT (this “Agreement”) is made and entered into as of the Effective Date (as defined herein) by and between OREOF19 BR, LLC, a Delaware limited liability company (“Seller”), and GENERATION INCOME PROPERTIES L.P., a Delaware limited partnership (“Purchaser”).

W I T N E S E T H:

WHEREAS, Seller desires to sell certain real property on which a commercial retail building and related infrastructure and support improvements (as more particularly described herein) are located in Grand Junction, Mesa County, Colorado, together with certain related personal and intangible property to the extent, if any, owned by Seller, and Purchaser desires to purchase such real, personal and intangible property; and

WHEREAS, the parties hereto desire to provide for said sale and purchase on the terms and conditions set forth in this Agreement.

NOW, THEREFORE, for and in consideration of the premises, the mutual covenants and agreements hereinafter set forth, and for other good and valuable consideration, the receipt, adequacy, and sufficiency of which are hereby acknowledged by the parties hereto, the parties hereto hereby covenant and agree as follows:

For purposes of this Agreement, each of the following capitalized terms shall have the meaning ascribed to such terms as set forth below:

“Additional Earnest Money” shall mean the sum of Ninety Thousand and No/100 Dollars ($90,000.00 U.S.).

“Affiliate” shall mean a Person that directly or indirectly, through one or more intermediaries, controls, is controlled by, or is under common control with the Person in question.

“Assignment and Assumption of Lease” shall mean the form of assignment and assumption of Lease and Security Deposit to be executed and delivered by Seller and Purchaser at the Closing in the form attached hereto as Schedule 2.

“Brokers” shall have the meaning ascribed thereto in Section 10.1 of this Agreement.

“Business Day” shall mean any day other than a Saturday, Sunday or other day on which banking institutions in the State of Colorado are authorized by law or executive action to close.

18250087_6

Exhibit 10.1

“Closing” shall mean the consummation of the purchase and sale of the Property pursuant to the terms of this Agreement.

“Closing Date” shall have the meaning ascribed thereto in Section 2.5 of this Agreement.

“Deed” shall mean the form of deed attached hereto as Schedule 1.

“Earnest Money” shall mean the sum of Fifty Thousand and No/100 Dollars ($50,000.00 U.S.) actually paid by Purchaser (or which Purchaser is obligated to pay) to Escrow Agent hereunder, together with all interest which accrues thereon as provided in Section 2.3(c) hereof. After payment of the Additional Earnest Money, the Additional Earnest Money shall be included in the definition of “Earnest Money”.

“Effective Date” shall mean the last date upon which Purchaser and Seller shall have executed this Agreement and shall have delivered at least one (1) fully executed counterpart of this Agreement to the other party.

“Environmental Law” shall mean any law, ordinance, rule, regulation, order, judgment, injunction or decree relating to pollution or substances or materials which are considered to be hazardous or toxic, including, without limitation, the Resource Conservation and Recovery Act, the Comprehensive Environmental Response, Compensation and Liability Act, the Hazardous Materials Transportation Act, the Clean Water Act, the Toxic Substances Control Act, the Emergency Planning and Community Right to Know Act, any state and local environmental law, all amendments and supplements to any of the foregoing and all regulations and publications promulgated or issued pursuant thereto.

“Environmental Reports” shall mean any and all existing environmental reports/assessments/studies obtained by Seller and provided to Purchaser, if any, pursuant to the provisions of Section 3.2(a).

“Escrow Agent” shall mean the Title Company (as hereinafter defined).

“FIRPTA Affidavit” shall mean the form of FIRPTA Affidavit to be executed and delivered by Seller to Purchaser at Closing in the form attached hereto as Schedule 6.

“General Assignment” shall have the meaning ascribed thereto in Section 5.1(e) of this Agreement.

“Hazardous Substances” shall mean any and all pollutants, contaminants, toxic or hazardous wastes or any other substances that might pose a hazard to health or safety, the removal of which may be required or the generation, manufacture, refining, production, processing, treatment, storage, handling, transportation, transfer, use, disposal, release, discharge, spillage, seepage or filtration of which is or shall be restricted, prohibited or penalized under any Environmental Law (including, without limitation, lead paint, asbestos, urea formaldehyde foam insulation, petroleum, and polychlorinated biphenyls).

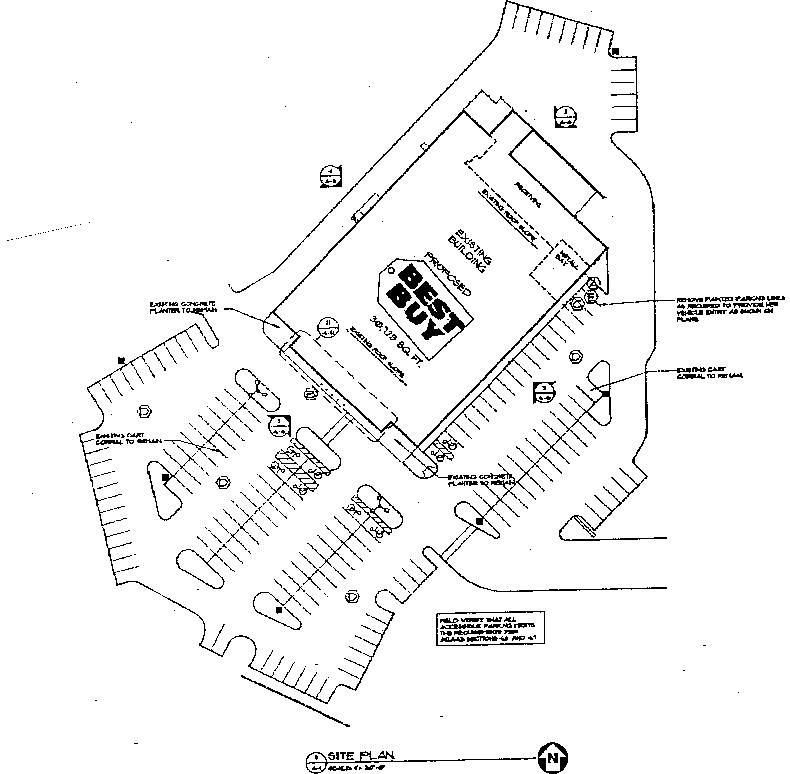

“Improvements” shall mean all buildings, structures, improvements, drainage facilities, parking, equipment, apparatus and any other items constructed and/or installed on the Land.

2

18250087_6

Exhibit 10.1

“Inspection Period” shall mean the period expiring at 11:59 P.M. Eastern Daylight Time on the date which is forty-five (45) days after the Effective Date.

“Intangible Property” shall mean all intangible property, if any, owned by Seller and related to the Land and Improvements, including without limitation, Seller’s rights and interests, if any, in and to the following: (i) all assignable plans and specifications and other architectural and engineering drawings for the Land and Improvements; (iii) all assignable warranties or guaranties given or made in respect of the Improvements or Personal Property; and (iv) all transferable consents, authorizations, variances or waivers, development rights, concurrency reservations, impact fee credits, licenses, permits and approvals from any governmental or quasi-governmental agency, department, board, commission, bureau or other entity or instrumentality solely in respect of the Land or Improvements.

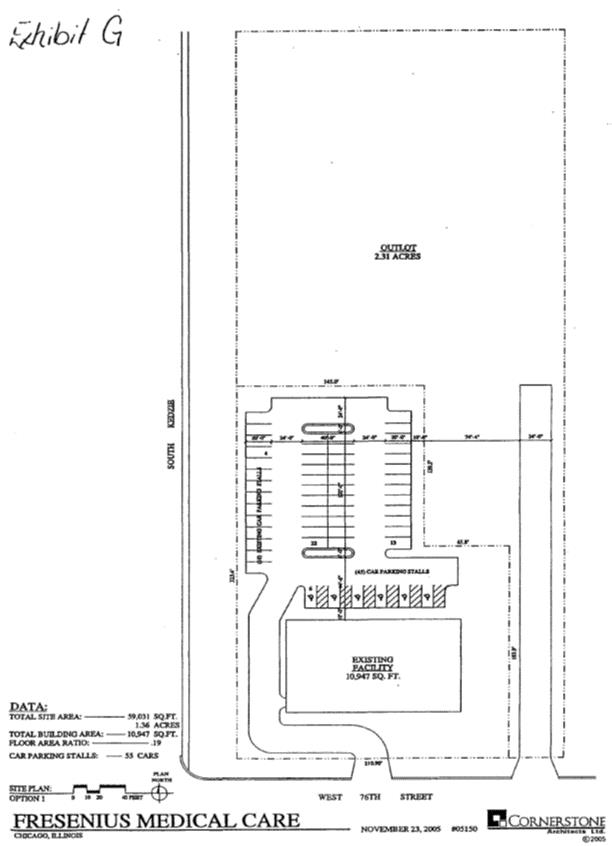

“Land” shall mean that certain parcel of real property located in Grand Junction, Mesa County, Colorado, which is more particularly described on Exhibit “A” attached hereto and made a part hereof, together with all rights, privileges and easements appurtenant to said real property, and all right, title and interest of Seller, if any, in and to any land lying in the bed of any street, road, alley or right-of-way, open or closed, adjacent to or abutting the Land.

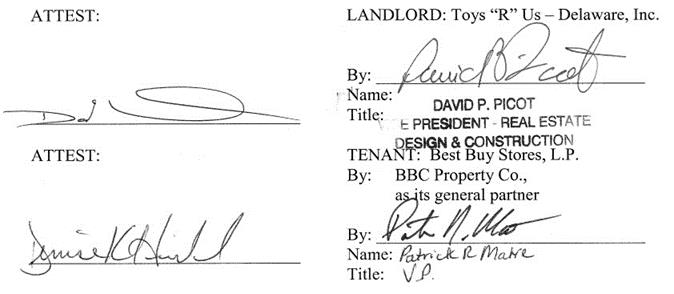

“Lease” shall (collectively) mean that certain Lease entered into by and between Seller, as successor-in-interest to Toys “R” US – Delaware, Inc., as landlord, and Best Buy Stores, L.P., a Virginia limited partnership, as tenant, effective as of February 27, 2007, with respect to the Property, together with any guaranties or other documents incorporated by reference therein, and all amendments or modifications with respect thereto, including that certain First Amendment to Lease dated May 19, 2021.

“Monetary Objection” or “Monetary Objections” shall mean (a) any mortgage, deed of trust or similar security instrument encumbering all or any part of the Property and voluntarily granted by Seller or an Affiliate of Seller to the holder of the lien, (b) any mechanic’s, materialman’s or similar lien arising out of any work performed by Seller or an Affiliate of Seller, (c) the lien of ad valorem real or personal property taxes, assessments and governmental charges affecting all or any portion of the Property which are delinquent and are not the responsibility of the Tenant under the Lease (provided, however, that in the event any lien or other encumbrance affecting title to the Property arises due to the actions, or failure to act, of Tenant, as hereinafter defined, Seller agrees to use commercially reasonable efforts to enforce all applicable rights and the performance or observance of applicable obligations existing under the Lease and will diligently communicate with Tenant in furtherance thereof; however, Seller shall not be in default for Tenant’s failure to discharge any such Monetary Objection(s) and shall have no obligation to initiate legal proceedings (including, without limitation, filing suit) against Tenant to enforce such rights or the performance or observance of such obligations, as the case may be, under the Lease), and (d) any judgment of record against Seller (to be clear, Seller, or an Affiliate of Seller, and not any other party, including any predecessor in title or Tenant) in the county or other applicable jurisdiction in which the Property is located.

“Operating Agreement” means that certain Operating Agreement recorded in Book 1247, Page 110, as amended by that certain First Amendment of Operating Agreement recorded in Book 1318, Page 580, as amended by that certain First Amendment to Supplemental Agreement

3

18250087_6

Exhibit 10.1

recorded in Book 1360, Page 483, as amended by that certain Second Amendment of Operating Agreement recorded in Book 1394, Page 237, as amended by that certain Third Amendment of Operating Agreement recorded in Book 1406, Page 723, as amended by that certain Fourth Amendment of Operating Agreement recorded in Book 1508, Page 592, as amended by that certain Fifth Amendment of Operating Agreement recorded in Book 2293, Page 603, as amended by that certain Sixth Amendment of Operating Agreement recorded in Book 3667, Page 218 and as amended by that certain Seventh Amendment of Operating Agreement recorded in Book 5195, Page 543, all of the Public Records of Mesa County, Colorado.

“OA Estoppel Certificate” shall mean a certificate that Seller shall use commercially reasonable efforts to obtain from the appropriate party(ies) under the Operating Agreement, including any property owner’s association, in the form attached hereto as Schedule 4. Seller’s obtaining such OA Estoppel Certificate shall be a condition to Purchaser’s obligation to close the transaction contemplated under this Agreement pursuant to the provisions of Section 6.1(f) and, as stated above, Seller shall use commercially reasonable efforts to obtain (however, Seller’s failure to obtain any OA Estoppel Certificate despite such efforts shall not be a default under this Agreement, but shall be a condition to Purchaser’s obligation to close the transaction contemplated hereunder) such OA Estoppel Certificate from the appropriate party(ies) and shall request same therefrom within three (3) business days following the Effective Date.

“Permitted Exceptions” shall mean, collectively, (a) liens for taxes, assessments and governmental charges not yet due and payable or due and payable but not yet delinquent, (b) the Lease, and (c) such other easements, restrictions and encumbrances that are approved by Purchaser pursuant to Section 3.4 of this Agreement, or deemed approved because Seller does not agree to cure (except for Monetary Objections, which Seller must cure, subject to the proviso above regarding Tenant caused Monetary matters) and yet Purchaser does not terminate this Agreement, all as set forth in Section 3.4.

“Person” shall means any individual, sole proprietorship, partnership, joint venture, trust, unincorporated organization, association, corporation, limited liability company, institution, entity, party or government (whether federal, state, county, city or otherwise, including, without limitation, any instrumentality, division, agency, body or department thereof).

“Personal Property” shall mean all furniture (including common area furnishings and interior landscaping items), carpeting, draperies, appliances, personal property (excluding any computer software which is licensed to Seller), machinery, apparatus and equipment owned by Seller and currently used exclusively in the operation, repair and maintenance of the Land and Improvements and situated thereon, and all non-confidential books, records and files (excluding any attorney work product or attorney-client privileged documents) relating to the Land and Improvements. The Personal Property does not include any property owned by Tenant, contractors or licensees.

“Property” shall have the meaning ascribed thereto in Section 2.1 of this Agreement.

“Purchase Price” shall be the applicable amount specified in Section 2.4 of this Agreement.

4

18250087_6

Exhibit 10.1

“Purchaser’s Certificate” shall have the meaning ascribed thereto in Section 5.2(d) of this Agreement.

“Reciprocal Easement and Operation Agreement” means that certain Reciprocal Easement and Operation Agreement recorded in Book 1914, Page 685, of the Public Records of Mesa County, Colorado.

“REA Estoppel Certificate” shall mean a certificate that Seller shall use commercially reasonable efforts to obtain from the appropriate party(ies) under the Reciprocal Easement and Operation Agreement, including any property owner’s association, in the form attached hereto as Schedule 4. Seller’s obtaining such REA Estoppel Certificate shall be a condition to Purchaser’s obligation to close the transaction contemplated under this Agreement pursuant to the provisions of Section 6.1(g) and, as stated above, Seller shall use commercially reasonable efforts to obtain (however, Seller’s failure to obtain any REA Estoppel despite such efforts shall not be a default under this Agreement, but obtaining same shall be a condition to Purchaser’s obligation to close the transaction contemplated hereunder) such REA Estoppel Certificate from the appropriate party(ies) and shall request same therefrom within three (3) business days following the Effective Date.

“Right of First Offer” shall collectively mean any right of first refusal or right of first offer with respect to the Property that has been granted to a third party, including the Tenant.

“Security Deposit” shall mean any security deposits, rent or damage deposits or similar amounts (other than rent paid for the month in which the Closing occurs) actually held by Seller with respect to the Lease.

“Seller’s Affidavit” shall mean the Title Agent’s form of owner’s affidavit to be given by Seller at Closing to the Title Agent.

“Seller’s Certificate” shall mean the form of certificate to be executed and delivered by Seller to Purchaser at the Closing with respect to the truth and accuracy of Seller’s warranties and representations contained in this Agreement in the form attached hereto as Schedule 5.

“Seller’s Disclosure Materials Delivery Date” shall have the meaning ascribed thereto in Section 3.2(a) of this Agreement.

“Survey” shall have the meaning ascribed thereto in Section 3.4(e) of this Agreement.

“Taxes” shall have the meaning ascribed thereto in Section 5.4(c) of this Agreement.

“Tenant” shall mean Best Buy Stores, L.P., a Virginia limited partnership

“Tenant Estoppel Certificate” shall mean a certificate to be obtained by Seller from the Tenant and certified to Purchaser and Purchaser’s lender (“Purchaser’s Lender”) in the same form attached to the Lease as Schedule A.

“Tenant Notice of Sale” shall have the meaning ascribed thereto in Section 5.1(m) of this Agreement..

5

18250087_6

Exhibit 10.1

“Title Company” shall mean Fidelity National Title Insurance Company.

“Title Commitment” shall have the meaning ascribed thereto in Section 3.4 of this Agreement.

2.1Agreement to Sell and Purchase. Subject to and in accordance with the terms and provisions of this Agreement, Seller agrees to sell and Purchaser agrees to purchase, the following property (collectively, the “Property”):

(a)the Land;

(b)the Improvements;

(c)all of Seller’s right, title and interest in and to the Lease, any guaranties of the Lease and any Security Deposits; and

(d)the Intangible Property.

2.2Permitted Exceptions. The Property shall be conveyed subject only to the Permitted Exceptions.

2.3Earnest Money.

(a)Within three (3) business days of the Effective Date, Purchaser shall deposit the Earnest Money to Escrow Agent by federal wire transfer payable to Escrow Agent, which Earnest Money shall be held and released by Escrow Agent in accordance with the terms of this Agreement.

(b)Unless this Agreement is terminated by Purchaser in accordance with Section 3.3. hereof, within three (3) business days after the last day of the Inspection Period, Purchaser shall deposit the Additional Earnest Money with Escrow Agent.

(c)The Earnest Money shall be applied to the Purchase Price at the Closing and shall otherwise be held, refunded, or disbursed in accordance with the terms of this Agreement. All interest and other income from time to time earned on the Initial Earnest Money and the Additional Earnest Money shall be earned for the account of Purchaser, and shall be a part of the Earnest Money; and the “Earnest Money” hereunder shall be comprised of the Initial Earnest Money and the Additional Earnest Money, and all such interest and other income. After the Inspection Period, the Earnest Money shall be nonrefundable except (i) in the event one or more of the conditions to Purchaser’s obligation to close are not satisfied and as a consequence Purchaser terminates this Agreement and (ii) as otherwise expressly provided in this Agreement.

2.4Purchase Price. Subject to adjustment and credits as otherwise specified in this Section 2.4 and elsewhere in this Agreement, the purchase price (the “Purchase Price”) to be paid by Purchaser to Seller for the Property shall be Four Million Seven Hundred Thousand and No/100

6

18250087_6

Exhibit 10.1

Dollars ($4,700,000.00 U.S.). The applicable Purchase Price shall be paid by Purchaser to Seller at the Closing as follows:

(a)The Earnest Money shall be paid by Escrow Agent to Seller at Closing; and

(b)An amount equal to the applicable Purchase Price shall be paid by Purchaser to Seller through the Escrow Agent at the Closing by wire transfer of immediately available federal funds to an account designated by Seller, less the amount of the Earnest Money paid by Escrow Agent to Seller at Closing, and subject to prorations, adjustments and credits as otherwise specified in this Agreement.

2.5Closing. The consummation of the sale by Seller and purchase by Purchaser of the Property (the “Closing”) shall be conducted by depositing the closing deliveries set forth in Article 5 hereof with the Escrow Agent on or before the date which is fifteen (15) days after the expiration of the Inspection Period, subject to the satisfaction of each of the Conditions Precedent set forth in Section 6.1 below (the “Closing Date”).

ARTICLE 3.

Purchaser’s Inspection and Review Rights

3.1Due Diligence Inspections.

(a)For a period of forty-five (45) days after the Effective Date (the “Inspection Period”), or earlier termination of this Agreement, Seller shall permit Purchaser and its authorized representatives, upon at least twenty-four (24) hours prior written notice to Seller to inspect the Property to perform due all diligence, studies, appraisals, inspections, soil analysis and environmental investigations and tests, at such times during normal business hours as Purchaser or its representatives may request. All such inspections shall be performed in compliance with Seller’s rights and obligations as landlord under the Lease. Further, Purchaser shall use commercially reasonable efforts to not affect, interrupt or interfere with Tenant’s use, business or operations on the Property. All inspection fees, appraisal fees, engineering fees and all other costs and expenses of any kind incurred by Purchaser relating to the inspection of the Property shall be solely Purchaser’s expense. Purchaser shall not perform a Phase II environmental assessment without Seller’s prior written consent, which consent shall not be unreasonably withheld, condition or delayed (and, if such consent is given, (i) Purchaser shall be obligated to pay to Seller promptly upon demand the cost of repairing and restoring any damage caused by any boring, drilling or other invasive testing performed in connection with such Phase II environmental assessment and (ii) Seller and Purchaser shall reasonably cooperate in good faith to establish the scope and the timing of any such boring, drilling or other invasive testing on the Property to performed in connection with such Phase II environmental assessment). Purchaser shall not contact the Tenant without providing Seller at least forty-eight (48) hours prior notice (i.e., via e-mail to Sanz (as hereinafter defined) at csanz@orionmiami.com) and Seller shall have the right to be present and/or participate (by phone/video call) in any such communication. Notwithstanding anything herein contained to the contrary, Purchaser may continue its physical investigation up to the Closing Date for the purpose of confirming no material adverse change has occurred in the condition of the Property as set forth in Section 6.1(a) of this Agreement, subject to the Purchaser’s insurance and indemnity obligations contained herein.

7

18250087_6

Exhibit 10.1

(b)To the extent that Purchaser or any of its representatives, agents, consultants or contractors damages or disturbs the Property or any portion thereof, Purchaser shall return the same to substantially the same condition which existed immediately prior to such damage or disturbance. Purchaser hereby agrees to and shall indemnify, defend and hold harmless Seller from and against any and all expense, loss or damage which Seller may incur (including, without limitation, reasonable attorney’s fees actually incurred) as a result of any act or omission of Purchaser or its representatives, agents or contractors, other than any expense, loss or damage to the extent arising from any act or omission of Seller and other than any expense, loss or damage resulting from the discovery or release of any Hazardous Substances at the Property (other than Hazardous Substances brought on to the Property by Purchaser or its representatives, agents or contractors). The foregoing Purchaser obligation to indemnify, defend and hold Seller harmless shall survive the termination of this Agreement.

(c)Purchaser shall keep the results of all inspections conducted pursuant to this Agreement confidential and shall not disclose such results except (i) to such of Purchaser’s employees, consultants, attorneys, affiliates and advisors who have a need to know the information in connection with the contemplated transaction and who have agreed, in writing, to be bound by the terms of this confidentiality provision, (ii) to the permitted assignee of Purchaser and to such of its members, managers or general partners and their employees, consultants, attorneys, affiliates and advisors who have a need to know the information in connection with the contemplated transaction and who have agreed, in writing, to be bound by the terms of this confidentiality provision, (iii) to any lender or investor or any prospective lender or investor of Purchaser or any permitted assignee and who have agreed, in writing, to be bound by the terms of this confidentiality provision, (iv) to the extent the same shall be or have otherwise become publicly available other than as a result of a disclosure by Purchaser, its permitted assignee or affiliates, (v) to the extent required to be disclosed by law or during the course of or in connection with any litigation, hearing or other legal proceeding, or (vi) with the written consent of Seller, as the case may be; it being expressly acknowledged and agreed by Purchaser that the foregoing confidentiality agreements shall survive the termination of this Agreement.

(d)Purchaser shall not permit any construction, mechanic’s, materialman’s or other lien to be filed against any of the Property as the result of any work, labor, service or materials performed or furnished, by, for or to Purchaser, its employees, agents and/or contractors. If any such lien shall at any time be filed against the Property, Purchaser shall, without expense to Seller, cause the same to be discharged of record by payment, bonds, order of a court of competent jurisdiction or otherwise, within thirty (30) days of the filing thereof. Purchaser shall indemnify, defend and hold harmless Seller against any and all claims, losses, damages, costs and expenses (including, but not limited to, attorneys’ fees and costs), arising out of the filing of any such liens and/or the failure of Purchaser to cause the discharge thereof as same is provided herein. The foregoing Purchaser obligation to indemnify, defend and hold Seller harmless shall survive the termination of this Agreement.

(e)Purchaser shall procure (or shall cause its agents or representatives entering the Property to procure) and continue in force and effect from and after the date Purchaser first desires to enter the Property, and continuing throughout the term of this Agreement, the following insurance coverages with an insurance company licensed to do business in the State of Florida: comprehensive general liability insurance with a combined

8

18250087_6

Exhibit 10.1

single limit of not less than $1,000,000.00 per occurrence or commercial general liability insurance with limits of not less than $1,000,000.00 per occurrence and in the aggregate. To the extent such $1,000,000.00 limit of liability is shared with multiple properties, a per location aggregate of not less than $1,000,000.00 shall be included. Seller and Tenant shall be included as additional insureds under such comprehensive general liability or commercial general liability coverage. Purchaser shall deliver to Seller a certificate of such insurance evidencing such coverage prior to the date Purchaser is permitted to enter the Property. Such insurance may not be cancelled or amended except upon thirty (30) days’ prior written notice to Seller. The minimum levels of insurance coverage to be maintained by Purchaser hereunder shall not limit Purchaser’s liability under this Section 3.1.

3.2Seller's Deliveries to Purchaser; Purchaser’s Access to Seller’s Property Records.

(a)As of the Effective Date, and subject to the terms and conditions set forth below, Seller represents and warrants to Purchaser that it has provided Purchaser with the following materials (collectively, the “Seller’s Disclosure Materials”), to the extent such Seller’s Disclosure Materials exist and are within Seller’s possession or within Seller’s reasonable control:

|

|

(i) |

A copy of the Lease, including all documents incorporated therein by reference, and all letter agreements or amendments relating thereto existing as of the Effective Date. |

|

|

(ii) |

A copy of any guaranties of the Lease. |

|

|

(iii) |

All records of any operating costs and expenses for the Property and any prior appraisals of all or any part of the Property. |

|

|

(iv) |

Copies of the financial statements or other financial information of the Tenant (and the Lease guarantors, if any). |

|

|

(v) |

A copy of any and all agreements pertaining to the Property, Tenant (other than the Lease), including any service or maintenance agreements. |

|

|

(vi) |

A copy of Seller’s (or its affiliate’s) current policy of title insurance with respect to the Land with copies of all matters listed as title exceptions in such policy. |

|

|

(vii) |

A copy of any surveys of the Property. |

|

|

(viii) |

A copy of the most recent insurance certificates that Tenant has delivered to Seller, if any. |

|

|

(ix) |

Copies of any zoning reports, entitlements or other written evidence confirming the current zoning of the Property. |

9

18250087_6

Exhibit 10.1

|

|

(x) |

Copies of any Rights of First Offer that are known to Seller and not contained in any title exception document listed in the Title Commitment or contained in the Lease. |

|

|

(xi) |

Copies of any existing environmental reports or other materials related to investigations, studies or correspondence with governmental agencies concerning the presence or absence of Hazardous Substances on, in or under the Property, including the Environmental Reports. |

|

|

(xii) |

Copies of any permits, licenses, or other similar documents relating to the development of the Improvements. |

|

|

(xiii) |

A copy of the certificate of occupancy/completion (or its equivalent) issued by the applicable governmental authority with respect to the Improvements being leased to the Tenant pursuant to the Lease. |

|

|

(xiv) |

Copies of all available construction plans and specifications relating to the development of the Improvements. |

|

|

(xv) |

Copies of any written notices received by Seller from Tenant, any third party or any governmental authority. |

|

|

Notwithstanding anything to the contrary in this Section, the following terms and conditions shall apply with respect to Seller’s obligations under this Section: |

|

|

(a)As to any Seller’s Disclosure Materials generated prior to Seller’s period of ownership of the Property, Seller shall only be obligated to provide such Seller’s Disclosure Materials to the extent actually delivered to Seller by the prior owner of the Property. |

|

|

(b)To the extent any Seller’s Disclosure Materials are required from Tenant, Seller shall use commercially reasonable efforts to obtain such Seller’s Disclosure Materials from Tenant and shall provide Purchaser with copies of any such written requests to Tenant for such Seller’s Disclosure Materials; provided, however, Seller’s failure to obtain such Seller’s Disclosure Materials from Tenant shall not constitute a default by Seller as long as Seller uses commercially reasonable efforts to obtain such Seller’s Disclosure Materials from Tenant. Furthermore, any such materials have not, obviously, already been delivered to Purchaser as of the Effective Date. |

|

|

(c)Nothing in this Section shall require Seller to create a breakdown or report that does not already exist as of the Effective Date. |

|

|

(d)Seller shall have a continuing duty, within five (5) days of Seller's receipt of any Seller's Disclosure Material, to make supplemental deliveries to Purchaser through the date of the final Closing of any addition or modification to the Seller's Disclosure Materials that come into Seller's possession. |

10

18250087_6

Exhibit 10.1

3.3Termination of Agreement. Purchaser shall have until the expiration of the Inspection Period to determine, in Purchaser’s sole opinion and discretion, the suitability of the Property for acquisition by Purchaser or Purchaser’s permitted assignee. Purchaser shall have the right to terminate this Agreement at any time on or before said time and date of expiration of the Inspection Period by giving written notice to Seller of such election to terminate. If Purchaser so elects to terminate this Agreement pursuant to this Section 3.3, Purchaser shall immediately return to Seller any hard-copies of documents, plans, studies or other materials related to the Property that were provided by Seller to Purchaser, and upon Purchaser returning such materials to Seller, Escrow Agent shall pay the Earnest Money to Purchaser, whereupon, except for those provisions of this Agreement which by their express terms survive the termination of this Agreement, no party hereto shall have any other or further rights or obligations under this Agreement. If Purchaser fails to so terminate this Agreement prior to the expiration of the Inspection Period, Purchaser shall have no further right to terminate this Agreement pursuant to this Section 3.3.

3.4 Title and Survey. Within ten (10) days after the Effective Date, Purchaser, at its sole cost and expenses, shall obtain from Title Agent an ALTA Form Commitment (“Title Commitment”) for an owner's title insurance policy (“Title Policy”) issued by the Title Company in an amount no less than the Purchase Price, together with all exception documents referenced in Schedule B, Section of the Title Commitment. The Title Commitment shall evidence that Seller is vested with fee simple title to the Land and that upon the execution, delivery and recordation of the deed to be delivered at the Closing provided for hereunder and the satisfaction of all requirements specified in Schedule B, Section 1 of the Title Commitment, Purchaser shall acquire fee simple title to the Land, subject only to the Permitted Exceptions.

(a)If Purchaser determines that the Title Commitment does not meet the requirements specified above, or that title to the Land is unsatisfactory to Purchaser for reasons other than the existence of Permitted Exceptions or exceptions which are to be discharged by Seller at or before Closing, then Purchaser shall notify Seller of those liens, encumbrances, exceptions or qualifications to title which either are not Permitted Exceptions, are unsatisfactory to Purchaser or are not contemplated by this Agreement to be discharged by Seller at or before Closing, and any such liens, encumbrances, exceptions or qualifications shall be hereinafter referred to as “Title Defects.” Purchaser's failure to deliver notification to Seller of the Title Defects prior to the expiration of the Inspection Period shall be deemed to constitute acceptance of such matters. Seller shall notify Purchaser in writing no later than five (5) days after Seller's receipt of Purchaser's notice setting forth the existence of any Title Defects and indicate to Purchaser that Seller either (i) intends to cure the Title Defects within the applicable cure period, or (ii) intends not to cure some or all of such exceptions, identifying which of the Title Defects Seller intends to cure and/or not cure (Seller being under no obligation to cure Title Defects other than the Monetary Objections). If Seller does not respond to the notice setting forth the existence of any Title Defects within such five (5) day period, then Seller shall be deemed to have responded on such fifth (5th) day and elected not to cure any title/survey objections (except for Monetary Obligations).

(b)If Seller has elected in writing to cure any Title Defects, Seller shall have thirty (30) days, or such longer period as Purchaser may grant in its sole and absolute discretion, following receipt of written notice of the existence of Title Defects in which to undertake a good faith, diligent and continuous commercially reasonable effort and, in fact, cure or eliminate the

11

18250087_6

Exhibit 10.1

Title Defects which Seller has elected to cure to the satisfaction of Purchaser and the Title Company in such manner as to permit the Title Company to either endorse the Title Commitment or issue a replacement commitment to delete the Title Defects therefrom. Seller’s failure to cure any such Title Defect shall not constitute a default by Seller as long as Seller undertakes a good faith, diligent and continuous commercially reasonable effort to cure or eliminate same.

(c)Within five (5) days prior to Closing, Purchaser shall cause the Title Agent to deliver to Purchaser an update to the Title Commitment (the “Updated Title Commitment”). Any matters disclosed in the Updated Title Commitment which were not of record as of the Effective Date and which were not exceptions in the previous Title Commitment shall automatically be deemed Title Defects which Seller shall have the election to cure except that Seller must cure any such matters that were voluntarily placed of record by Seller, without Purchaser's joinder and consent. The cure of any such new Title Defects shall be effected within such time periods as were provided in connection with curing Title Defects under the initial Title Commitment. If Seller shall in fact cure or eliminate the new Title Defects, the Closing shall take place on the date specified in this Agreement. If Seller does not elect to cure, cure or eliminate the new Title Defects, Purchaser may elect to terminate this Agreement or proceed to Closing as provided in Section 3.4(d) below.

(d)If Seller elects not to cure (or is deemed to have elected not to cure by failure to respond to Purchaser’s title/survey objections, as set forth above) or is unable to cure or eliminate any Title Defects (including any new Title Defects revealed by the Updated Title Commitment to be provided to Purchaser as set forth in Section 3.4(c) above) within the time allowed, Purchaser may elect to terminate this Agreement within five business (5) days following (i) Seller’s election not to cure (or deemed election not to cure), or (ii) as to a Title Defect that Seller has elected to cure, the expiration of the curative period without cure thereof being accomplished, by giving written notice of termination to Seller, or, alternatively, Purchaser may elect to close its purchase of the Property, accepting the conveyance of the Property subject to such Title Defect(s), without a reduction in the Purchase Price, in which event the Closing shall take place on the date specified in this Agreement, subject to any delays provided for above. If, by giving written notice to Seller within the time allowed, Purchaser elects to terminate this Agreement because of the existence of Seller’s election (or deemed election) not to cure, or due to uncured Title Defects after attempting to cure same, the Earnest Money shall be returned to Purchaser and upon such return the obligations of the parties under this Agreement shall be terminated, except for those provisions of this Agreement which by their express terms survive the termination of this Agreement. Notwithstanding the foregoing, Seller shall use commercially reasonable efforts to communicate with Tenant to facilitate the curing of any Title Defect(s) caused by the failure of Tenant to observe or perform any of Tenant’s obligations under the Lease, provided, however, such efforts of Seller shall not include any obligation of Seller to commence legal proceedings against Tenant to enforce the terms of the Lease. The foregoing right of Purchaser to terminate this Agreement upon the failure to cure a Title Defect which Seller is obligated to cure shall not be deemed to limit the Purchaser's rights and remedies to which Purchaser might otherwise be entitled for the breach by Seller of any of its covenants, duties, obligations, representations or warranties hereunder.

Purchaser may, at Purchaser's expense, within the Inspection Period, obtain a boundary survey of the Land (“Survey”). Such Survey, if any, shall be prepared by a land surveyor duly

12

18250087_6

Exhibit 10.1

licensed and registered as such in the State of Colorado, shall be certified by such surveyor to Purchaser, Seller, the Title Agent and the Title Company, shall set forth the legal description of the Land and shall otherwise be in a form satisfactory to the Title Company to eliminate the standard survey exceptions from the Title Policy to be issued at Closing. Purchaser shall notify Seller in writing prior to the expiration of the Inspection Period specifying any matters shown on the Survey which adversely affect the title to the Land or constitute a zoning violation and the same shall thereupon the deemed to be Title Defects hereunder and Seller shall elect to cure, or elect (or be deemed to have elected) not cure the same, as provided in Section 3.4(a) of this Agreement and if Seller elects to undertake the cure thereof it shall do so within the time and in the manner provided in Section 3.4(b) of this Agreement.

ARTICLE 4.

REPRESENTATIONS, WARRANTIES AND OTHER AGREEMENTS

4.1Representations and Warranties of Seller. Seller hereby makes the following representations and warranties to Purchaser:

(a)Organization, Authorization and Consents. Seller is a duly organized and validly existing limited liability company under the laws of the State of Delaware. Seller has the right, power and authority to enter into this Agreement and to convey the Property in accordance with the terms and conditions of this Agreement, to engage in the transactions contemplated in this Agreement and to perform and observe the terms and provisions hereof.

(b)Action of Seller, Etc. Seller has taken all necessary action to authorize the execution, delivery and performance of this Agreement by Seller, and upon the execution and delivery of any document to be delivered by Seller on or prior to the Closing, this Agreement and such document shall constitute the valid and binding obligation and agreement of Seller, enforceable against Seller in accordance with its terms, except as enforceability may be limited by bankruptcy, insolvency, reorganization, moratorium or similar laws of general application affecting the rights and remedies of creditors.

(c)No Violations of Agreements. Neither the execution, delivery or performance of this Agreement by Seller, nor compliance with the terms and provisions hereof, will result in any breach of the terms, conditions or provisions of, or conflict with or constitute a default under, or result in the creation of any lien, charge or encumbrance upon the Property or any portion thereof pursuant to the terms of any indenture, deed to secure debt, mortgage, deed of trust, note, evidence of indebtedness or any other material agreement or instrument by which Seller is bound.

(d)Litigation. No investigation, action or proceeding is pending or, to Seller’s knowledge, threatened, which (i) if determined adversely to Seller, materially affects the use or value of the Property, or (ii) questions the validity of this Agreement or any action taken or to be taken pursuant hereto. Furthermore, to Seller’s knowledge there is no investigation, action or proceeding pending, or formally threatened, that involves condemnation or eminent domain proceedings involving the Property or any portion thereof.

13

18250087_6

Exhibit 10.1

(e)Existing Leases. (i) Other than the Lease, Seller has not entered into any contract or agreement with respect to the occupancy or sale of the Property or any portion or portions thereof which will be binding on Purchaser after the Closing; (ii) the Lease has not been amended by Seller and Tenant except for the above referenced First Amendment, and constitutes the entire agreement between Seller and the Tenant thereunder; and (iii) to Seller's knowledge, there are no existing defaults by Seller or Tenant under the Lease.

(f)Existing Operating Agreement and Reciprocal Easement and Operation Agreement. (i) Other than as set forth in the copies of the Operating Agreement and Reciprocal Easement and Operation Agreement provided by Seller to Purchaser, to Seller’s knowledge the Operating Agreement and Reciprocal Easement and Operation Agreement have not been amended and constitute the entire agreement between the parties thereto; and (iii) to Seller's knowledge, there are no existing defaults by Seller or Tenant under the Operating Agreement or the Reciprocal Easement and Operation Agreement nor has there occurred any event which, by lapse of time or otherwise, will result in any default by Seller or Tenant under the Operating Agreement or the Reciprocal Easement and Operation Agreement.

(g)Leasing Commissions. There are no lease brokerage agreements, leasing commission agreements or other agreements providing for payments of any amounts for leasing activities or procuring tenants with respect to the Property or any portion or portions thereof. Notwithstanding the foregoing representation, to the extent there may be any lease brokerage agreements, leasing commission agreements or other agreements providing for payments of any amounts for leasing activities or procuring tenants with respect to the Property or any portion or portions thereof, Seller shall terminate them as to the Property and the Lease prior to the Closing and pay all sums that may be due thereunder at Closing at no cost to Purchaser, all such that neither the Property nor Purchaser shall have any liability for or with respect to such agreements or any amounts due thereunder.

(h)Taxes and Assessments. Seller has not filed, and has not retained anyone to file, notices of protests against, or to commence action to review, real property tax assessments against the Property. To Seller’s knowledge, the Land is assessed as a separate tax lot or lots or tax parcel or parcels, independent of any other parcels or assets not being conveyed hereunder, and has been validly, finally and unappealably subdivided from all other property for conveyance purposes. Seller has no knowledge and Seller has not received notice of any assessments by a public body, whether municipal, county or state, imposed, contemplated or confirmed and ratified against any of the Property for public or private improvements which are now or hereafter payable, but the representation in this sentence shall not apply to any assessments or the like that are either disclosed in Purchaser’s title commitment or are reasonably ascertainable by the Purchaser checking with the applicable assessing authorities.

(i)Environmental Matters. To Seller's knowledge, there are no Hazardous Substances located in, upon or under the Property in violation of any applicable Environmental Laws, except as may be disclosed in the Environmental Reports delivered to Purchaser pursuant to Section 3 above.

(j)Compliance with Laws. Seller has not received written notice from applicable governmental authorities there are any violations of law (including zoning or other land

14

18250087_6

Exhibit 10.1

use law), municipal or county ordinances, or other legal requirements with respect to the Property or any portion thereof.

(k)Easements and Other Agreements. Seller has no knowledge of any default in complying with the terms and provisions of any of the terms, covenants, conditions, restrictions or easements constituting a Permitted Exception.

(l)Other Agreements. Except for the Lease, and the Permitted Exceptions, to Seller’s actual knowledge there are no (and Seller’s represents without such knowledge qualifier that it has entered into no) management agreements, service agreements, brokerage agreements, leasing agreements, licensing agreements, easement agreements, or other agreements or instruments in force or effect that (i) grant to any person or any entity any right, title, interest or benefit in and to all or any part of the Property or any rights relating to the use, operation, management, maintenance or repair of all or any part of the Property, or (ii) establish, in favor of the Property, any right, title, interest in any other real property relating to the use, operation, management, maintenance or repair of all or any part of the Property which, in either event, will survive the Closing or be binding upon Purchaser. To be clear, this means that there may be such agreements, but if there are then Seller shall cause them to be terminated at or prior to the Closing such that there is no liability of the Property or Purchaser for same from and after the Closing. Seller represents that it has no service contracts relative to the Property.

(m)Insurance. Seller has not received any written notice from the respective insurance carriers which issued any of the insurance policies required to be obtained and maintained by Seller under the Lease stating that any of the policies or any of the coverage provided thereby will not or may not be renewed. Seller shall terminate all of such insurance policies as of Closing and Purchaser shall have no obligations for payments that may come due under any of Seller's insurance policies for periods of time either prior to or after Closing.

(n)Submission Items. As to all materials, information, records, and documentation delivered or to be delivered to Purchaser by Seller pursuant to this Agreement, including the Seller’s Disclosure Materials, Seller does not represent or warranty that any of them are complete, true and/or correct, but does represent and warranty that they are complete copies of such items as are in Seller’s possession or control.

(o)Commitments to Governmental Authority. Seller has not made any commitments to any governmental authority, developer, utility company, school board, church or other religious body or any property owners’ association or to any other organization, group or individual relating to the Property which would impose an obligation upon Purchaser or its successors and assigns to make any contribution or dedications of money or land or to construct, install or maintain any improvements of a public or private nature on or off the Property. The provisions of this section shall not apply to any local real estate taxes assessed against the Property.

(p)Personal Property. There is no Personal Property located on the Property that is owned by Seller. Any personal property located on the Property is owned by Tenant.

(q)No Rights to Purchase. Except for this Agreement, Seller has not entered into, and has no actual knowledge of (unless same is contained in the Lease or in a title exception

15

18250087_6

Exhibit 10.1

document listed in the Title Commitment) any other agreement, commitment, option, right of first refusal, right of first offer or any other agreement, whether oral or written, with respect to the sale, purchase, assignment or transfer of all or any portion of the Property.

The representations and warranties made in this Agreement by Seller shall be continuing and shall be deemed remade in all material respects by Seller as of the Closing Date, with the same force and effect as if made on, and as of, such date. All representations and warranties made in this Agreement by Seller shall survive the Closing for a period of twelve (12) months (the “Limitation Period”), and upon expiration thereof shall be of no further force or effect except to the extent that with respect to any particular alleged breach, Purchaser gives Seller written notice prior to the expiration of said twelve (12) month period of such alleged breach with reasonable detail as to the nature of such breach. Notwithstanding anything to the contrary contained in this Agreement, there shall be no survival limitation, except statutory limitations, with respect to acts involving fraud, i.e. intentional misrepresentation, on behalf of Seller. Seller acknowledges and agrees that Purchaser has relied and has the right to rely upon the foregoing in connection with Purchaser’s consummation of the transaction set forth in this Agreement.

Subject to the immediately preceding paragraph, and the Limitation Period and statutory limitations referenced therein, Seller hereby agrees to indemnify, protect, defend (through attorneys reasonably acceptable to Purchaser) and hold harmless Purchaser and its subsidiaries, affiliates, officers, directors, agents, employees, successors and assigns from and against any and all claims, damages, losses, liabilities, costs and expenses (including reasonable attorneys’ fees actually incurred) (i) which may be asserted against or suffered by Purchaser or the Property after the Closing Date as a result or on account of any breach of any representation or warranty on the part of Seller made herein or in any instrument or document delivered by Seller pursuant hereto. For purposes of this Section 4.3, Purchaser’s knowledge means the current, actual knowledge of Christopher Sanz (“Sanz”) without duty of inquiry or investigation and does not include knowledge imputed to Seller from any other person or entity. In no event shall said person have any personal liability hereunder. The foregoing indemnity is limited to Two Hundred Fifty Thousand and No/100 Dollars ($250,000.00) except in the event of fraud or intentional misrepresentation.

4.2Covenants and Agreements of Seller.

(a)Seller’s Continued Performance under the Lease. Seller shall continue to perform in all material respects all of its obligations under the Lease consistent with the terms and conditions of the Lease.

(b)Leasing and Licensing Arrangements. During the pendency of this Agreement, Seller will not enter into any lease or license affecting the Property, or modify or amend in any material respect, or terminate the Lease without Purchaser’s prior written consent, which consent shall not be unreasonably withheld, conditioned or delayed. Any such requests by Seller shall be accompanied by a copy of any proposed modification or amendment of the Lease or of any new lease or license that Seller wishes to execute between the Effective Date and the Closing Date.

16

18250087_6

Exhibit 10.1

(c)New Contracts and Easements. During the pendency of this Agreement, Seller will not enter into any contract or easement, or modify, amend, renew or extend any existing contract or easement, that will be an obligation on or otherwise affect the Property or any part thereof subsequent to the Closing without Purchaser’s prior written consent in each instance, which consent shall not be unreasonably withheld, conditioned or delayed, except contracts entered into in the ordinary course of business that shall be terminated at Closing without penalty or premium to Purchaser.

(d)Tenant Estoppel Certificate. Seller shall use commercially reasonable efforts to obtain and deliver to Purchaser prior to Closing an original written Tenant Estoppel Certificate signed by Tenant as provided for in Section 6.1(e).

(e)OA Estoppel Certificate. Seller shall use commercially reasonable efforts to obtain and deliver to Purchaser prior to Closing an original written OA Estoppel Certificate executed by the appropriate parties as provided for in Section 6.1(f).

(f)REA Estoppel Certificate. Seller shall use commercially reasonable efforts to obtain and deliver to Purchaser prior to Closing an original written REA Estoppel Certificate executed by the appropriate parties as provided for in Section 6.1(g).

(g)Waiver of Right of First Offer. To the extent a Right of First Offer exists with respect to the Property, then within three (3) business days after the date Purchaser deposits the Earnest Money with Escrow Agent, Seller shall provide the holder of any such Right of First Offer (“ROFO Holder”) with written notice of the transaction contemplated in this Agreement consistent with the terms and conditions of any Right of First Offer (the “ROFO Notice”), and Seller shall provide a copy of same to Purchaser when made. Seller shall keep Purchaser reasonably informed as to the status of the ROFO Holder’s response to the ROFO Notice. If the ROFO Holder (i) responds to the ROFO Notice by informing Seller that it does not elect to exercise the Right of First Offer as it pertains to this transaction, or (ii) fails to respond in writing to the ROFO Notice within the required time frame set forth in the Right of First Offer in order to exercise the Right of First Offer, then, as a condition precedent to Purchaser’s obligation to close on the sale and purchase of the Property pursuant to this Agreement, Seller shall execute and deliver to Purchaser, on or before the expiration of the Inspection Period, an original, executed affidavit in form reasonably acceptable to Title Company, attesting to Seller’s delivery of the ROFO Notice pursuant to the Right of First Offer and either the ROFO Holder’s election not to exercise the Right of First Offer or the ROFO Holder’s failure to timely respond to same so as to allow the Title Company to issue the Title Policy without exception for the Right of First Offer (“Seller’s ROFO Affidavit”). In the event Seller is unable to obtain and deliver to Purchaser the Seller’s ROFO Affidavit, or if the ROFO Holder has elected in writing to exercise its Right of First Offer, then Purchaser shall have the right to terminate this Agreement by providing written notice to Seller, in which case all Earnest Money deposited by Purchaser shall be immediately returned to Purchaser and the parties hereto shall have no further rights or obligations, other than those that by their terms survive the termination of this Agreement. Notwithstanding anything to the contrary contained in this Agreement, in the event the Closing does not occur within the applicable time period under the Right of First Offer in which Seller is free to sell and convey the Property to Purchaser, then Seller shall be obligated to send the ROFO Holder a new ROFO Notice, in which case the

17

18250087_6

Exhibit 10.1

foregoing terms, covenants, conditions and rights set forth in this Section 4.2(g) shall apply to such new ROFO Notice.

(h)Notices of Violation. Immediately upon receipt of written notice thereof, Seller shall provide Purchaser with written notice of any violation of any legal requirements or insurance requirements affecting the Property, any service of process relating to the Property or which affects Seller’s ability to perform its obligations under this Agreement, or any complaints or allegations of default received from Tenant.

4.3Representations and Warranties of Purchaser.

(a)Organization, Authorization and Consents. Purchaser is a duly organized and validly existing limited partnership under the laws of the State of Delaware. Purchaser has the right, power and authority to enter into this Agreement and to purchase the Property in accordance with the terms and conditions of this Agreement, to engage in the transactions contemplated in this Agreement and to perform and observe the terms and provisions hereof.

(b)Action of Purchaser, Etc. Purchaser has taken all necessary action to authorize the execution, delivery and performance of this Agreement, and upon the execution and delivery of any document to be delivered by Purchaser on or prior to the Closing, this Agreement and such document shall constitute the valid and binding obligation and agreement of Purchaser, enforceable against Purchaser in accordance with its terms, except as enforceability may be limited by bankruptcy, insolvency, reorganization, moratorium or similar laws of general application affecting the rights and remedies of creditors.

(c)No Violations of Agreements. Neither the execution, delivery or performance of this Agreement by Purchaser, nor compliance with the terms and provisions hereof, will result in any breach of the terms, conditions or provisions of, or conflict with or constitute a default under the terms of any indenture, deed to secure debt, mortgage, deed of trust, note, evidence of indebtedness or any other agreement or instrument by which Purchaser is bound.

(d)Litigation. No investigation, action or proceeding is pending or, to Purchaser’s knowledge, threatened, which questions the validity of this Agreement or any action taken or to be taken pursuant hereto.

The representations and warranties made in this Agreement by Purchaser shall be continuing and shall be deemed remade by Purchaser as of the Closing Date, with the same force and effect as if made on, and as of, such date. All representations and warranties made in this Agreement by Purchaser shall survive the Closing for a period of twelve (12) months, and upon expiration thereof shall be of no further force or effect except to the extent that with respect to any particular alleged breach, Seller gives Purchaser written notice prior to the expiration of said twelve (12) month period of such alleged breach with reasonable detail as to the nature of such breach. Notwithstanding anything to the contrary contained in this Agreement, there shall be no survival limitation, except statutory limitations, with respect to acts involving fraud (i.e., intentional misrepresentation) on behalf of Purchaser. Purchaser acknowledges and agrees that Seller has relied and has the right to rely upon the foregoing in connection with Seller’s consummation of the transaction set forth in this Agreement.

18

18250087_6

Exhibit 10.1

Subject to the immediately preceding paragraph, and the Limitation Period and statutory limitations referenced therein, Purchaser hereby agrees to indemnify, protect, defend (through attorneys reasonably acceptable to Seller) hold harmless Seller and its subsidiaries, affiliates, officers, directors, agents, employees, successors and assigns from and against any and all claims, damages, losses, liabilities, costs and expenses (including reasonable attorneys’ fees actually incurred) which may at any time be asserted against or suffered by Seller after the Closing Date as a result or on account of any breach of any warranty or representation on the part of Purchaser made herein or in any instrument or document delivered pursuant hereto. For purposes of this Section 4.3, Purchaser’s knowledge means the current, actual knowledge of David Sobelman (“Sobelman”) without duty of inquiry or investigation and does not include knowledge imputed to Purchaser from any other person or entity. In no event shall said person have any personal liability hereunder. The foregoing indemnity is limited to Two Hundred Fifty Thousand and No/100 Dollars ($250,000.00) except in the event of fraud or intentional misrepresentation.

ARTICLE 5.

CLOSING DELIVERIES, CLOSING COSTS AND PRORATIONS

5.1Seller’s Closing Deliveries. For and in consideration of, and as a condition precedent to Purchaser’s delivery to Seller of the Purchase Price, Seller shall obtain or execute and deliver to Purchaser or the Title Agent (as applicable) at Closing the following documents, all of which shall be duly executed, acknowledged and notarized where required:

(a)Deed. A special warranty deed to the Land and Improvements, in the form attached hereto as Schedule 1 (the “Deed”), subject only to the Permitted Exceptions;

(b)Assignment and Assumption of Lease and Security Deposits. An assignment and assumption of Lease and Security Deposits and, to the extent required elsewhere in this Agreement, in the form attached hereto as Schedule 2 (the “Assignment and Assumption of Lease”);

(c)Memorandum of Assignment of Lease. A memorandum of assignment of Lease in form acceptable to Seller and Purchaser (the “Memorandum of Assignment of Lease”);

(d)Subordination, Non-Disturbance and Attornment Agreement. If applicable, an original Subordination, Non-Disturbance and Attornment Agreement executed by Tenant in form acceptable to Purchaser’s Lender (the “SNDA”);

(e)General Assignment. An assignment of the Intangible Property in the form attached hereto as Schedule 3 (the “General Assignment”);

(f)Seller’s Affidavit. An owner’s affidavit in a form to be provided by Title Agent (“Seller’s Affidavit”);

(g)Seller’s Certificate. A certificate in the form attached hereto as Schedule 5 (“Seller’s Certificate”), evidencing the reaffirmation of the truth and accuracy in all material respects of Seller’s representations, warranties, and agreements set forth in Section 4.1 hereof;

19

18250087_6

Exhibit 10.1

(h)FIRPTA Certificate A FIRPTA Certificate in the form attached hereto as Schedule 6;

(i)Evidence of Authority Such documentation as may reasonably be required by the Title Company to establish that this Agreement, the transactions contemplated herein, and the execution and delivery of the documents required hereunder, are duly authorized, executed and delivered;

(j)Settlement Statement A settlement statement setting forth the amounts paid by or on behalf of and/or credited to each of Purchaser and Seller pursuant to this Agreement;

(k)Surveys and Plans. Such surveys, site plans, plans and specifications, and other matters relating to the Property as are in the possession of Seller to the extent not theretofore delivered to Purchaser;

(l)Lease. To the extent the same are in Seller’s possession, original executed counterparts of the Lease;

(m)Notice of Sale. Seller will join with Purchaser (or its Affiliate) in executing a notice, in form and content reasonably satisfactory to Seller and Purchaser (the “Notice of Sale”), which Purchaser shall send to Tenant under the Lease informing such tenant of the transfer of the Property and of assignment to and assumption by Purchaser (or its Affiliate) of the Lease and Security Deposit and directing that all rent and other sums payable for periods after the Closing under the Lease shall be paid as set forth in the notice;

(n)Keys. All of the keys to any door or lock on the Property in Seller’s possession, if any; and

(o)Other Documents. Such other documents as shall be reasonably requested by Purchaser’s counsel or the Title Agent to effectuate the purposes and intent of this Agreement.

5.2Purchaser’s Closing Deliveries. Purchaser shall obtain or execute and deliver to Seller or the Title Company (as applicable) at Closing the following documents, all of which shall be duly executed, acknowledged and notarized where required:

(a)Assignment and Assumption of Lease. An Assignment and Assumption of Lease;

(b)Memorandum of Assignment of Lease. A Memorandum of Assignment of Lease;

(c)General Assignment. A General Assignment;

(d)Purchaser’s Certificate. A certificate in the form attached hereto as Schedule7 (“Purchaser’s Certificate”), evidencing the reaffirmation of the truth and accuracy in all material respects of Purchaser’s representations, warranties and agreements contained in Section 4.3 of this Agreement;

20

18250087_6

Exhibit 10.1

(e)Settlement Statement A settlement statement setting forth the amounts paid by or on behalf of and/or credited to each of Purchaser and Seller pursuant to this Agreement;

(f)Notice of Sale. A Notice of Sale; and

(g)Other Documents. Such other documents as shall be reasonably requested by Seller’s counsel or the Title Agent to effectuate the purposes and intent of this Agreement.

5.3Closing Costs. Seller shall pay the cost of the documentary/revenue stamps, transfer taxes, excise taxes imposed by the State of Colorado or the county in which the Land is located upon the conveyance of the Property pursuant hereto, the attorneys’ fees of Seller, the cost of obtaining and recording any curative title instruments, and all other costs and expenses incurred by Seller in closing and consummating the purchase and sale of the Property pursuant hereto. Purchaser shall pay the cost of the Title Commitment and the Title Policy, including title examination fees related thereto and any updates to the Title Commitment, the Survey, all recording fees on all instruments to be recorded in connection with this transaction (except any curative title instruments), the cost of any endorsements to the Title Policy, the cost of any loan policy of title insurance and endorsements thereto, documentary stamps and intangible taxes with respect to any loan obtained by Purchaser, the attorneys’ fees of Purchaser, and all other costs and expenses incurred by Purchaser in the performance of Purchaser’s due diligence inspection of the Property and in closing and consummating the purchase and sale of the Property pursuant hereto.

5.4Prorations and Credits. The items in this Section 5.4 shall be prorated between Seller and Purchaser or credited, as specified:

(a)Fixed Rents. Fixed rent (i.e. “Minimum Rent” as referred to in the Lease) shall be prorated as of the Closing Date and be adjusted against the Purchase Price. Purchaser shall receive at Closing a credit for Purchaser’s pro rata share of the fixed rent, payments payable for the month of Closing and for all other rents and other amounts that apply to periods from and after the Closing, but which are received by Seller prior to Closing. Purchaser agrees to pay to Seller (in the form of Seller receiving a credit at Closing for), any rents or other payments by Tenant under the Lease that apply to periods prior to Closing but are to be received by Purchaser after Closing; provided, however, that any delinquent rents or other payments by Tenant shall be applied first to any current amounts owing by Tenant, then to delinquent rents in the order in which such rents are most recently past due, with the balance, if any, paid over to Seller to the extent of delinquencies existing at the time of Closing to which Seller is entitled; it being understood and agreed that Purchaser shall not be legally responsible to Seller for the collection of any rents or other charges payable with respect to the Lease or any portion thereof, which are delinquent or past due as of the Closing Date. Seller shall be responsible for collecting and remitting all sales and use taxes that are due or become due on rent payments under the Lease received by Seller prior to Closing. Purchaser shall be responsible for collecting and remitting all sales and use taxes that become due on rent payments under the Lease received by Purchaser after Closing. The provisions of this Section 5.4(a) shall survive the Closing.

(b)Security Deposits. Purchaser shall receive a credit at Closing for all Security Deposits (and any interest thereon required to be reimbursed to any tenant), if any, pursuant to the Lease or pursuant to applicable law. Seller agrees to and does hereby indemnify,

21

18250087_6

Exhibit 10.1

defend and hold Purchaser harmless from and against any liability or expense incurred by Purchaser by reason of any Security Deposit (and interest thereon, if required by law) actually collected by Seller and not actually paid (or credited) to Purchaser at the Closing. Purchaser agrees to and does hereby indemnify and hold Seller harmless from and against any liability or expense incurred by Seller by reason of any Security Deposit (and interest thereon, if required by law) which is paid (or credited) to Purchaser at the Closing and which Purchaser does not properly refund to the Tenant. The provisions of this Section 5.4(b) shall survive the Closing.

(c)Real Property Taxes. Real estate taxes and assessments are hereinafter referred to as “Taxes”. Tenant is responsible to pay all Taxes pursuant to the terms of the Lease, and Seller represents and warrants that this is currently being administered in the form of Seller (i.e. landlord) presenting an invoice to Tenant once a year (the last invoice was presented to Tenant on approximately March 12, 2021, covering the year 2020) and Tenant reimbursing Seller based on such invoice (Tenant reimbursed Seller on May 3, 2021 based on the above-referenced March 2021 invoice). Since Tenant is ultimately responsible for the Taxes there shall be no proration of Taxes, per se, at the Closing, but there will be a proration of Tenant’s reimbursement obligation, as set forth below. Seller shall receive a credit at Closing for Taxes (i.e., 2021 Taxes) that have, at the time of Closing, been paid by Seller but not yet reimbursed by Tenant (because the yearly invoice for 2021 Taxes will not yet have been presented to Tenant). Purchaser shall then be entitled to keep the entire Taxes reimbursement for the 2021 Taxes, in the Spring of 2022. The provisions of this Section 5.4(c) shall survive the Closing

(d)Insurance. Because Tenant obtains the property insurance for the building pursuant to the terms of the Lease, there shall be no proration of such property insurance.

(e)Maintenance. Because Tenant performs all repairs and maintenance (subject to replacement of the roof, as discussed below) at its own cost pursuant to the terms of the Lease, there shall be no prorations relative to repair or maintenance. In addition, Seller represents and warrants that Tenant is not presently making (nor is obligated to make) any amortization payments relative to roof replacement pursuant to Section 7.01(b) of the Lease, nor is there any roof replacement underway at present, nor has Seller received any notice from Tenant pursuant to Section 7.01(b) that the roof needs to be replaced.

(f)Utilities. Tenant is responsible to obtain and pay for (per separate meter) all utilities pursuant to the terms of the Lease so there shall be no proration of utilities.

(g)Year End Reconciliations. Seller represents and warrants that there is no year end reconciliation in the sense of monthly estimated payments being reconciled following the end of the applicable year. There is a one time per year reimbursement by Tenant to Seller of Taxes, as described above.

(h)Miscellaneous. If there are any items of Additional Rent not captured by the foregoing discussions, or if there are any other items which are customary to prorate, or which otherwise are clearly fair and equitable to prorate (including without limitation payments under any service contracts that Purchaser elects to assume, or any items of additional rent that need to be prorated but not captured by the provisions of this Section 5.4) but are not addressed above in this Section shall be prorated in a fair and equitable manner at the Closing.

22

18250087_6

Exhibit 10.1

ARTICLE 6.

CONDITIONS TO CLOSING

6.1Conditions Precedent to Purchaser’s Obligations. The obligations of Purchaser hereunder to consummate the transaction contemplated hereunder shall in all respects be conditioned upon the satisfaction of each of the following conditions on or before Closing or on or before such time specified in this Agreement (whichever is applicable), any of which may be waived by Purchaser in its sole discretion by written notice to Seller at or prior to the Closing Date (collectively, the “Conditions Precedent”):

(a)No material adverse change in the condition of the Property has occurred since the Effective Date of this Agreement.

(b)Seller shall have delivered to Purchaser all of the items required to be delivered to Purchaser pursuant to the terms of this Agreement, including, but not limited to Section 5.1 hereof.

(c)Seller shall have performed, in all material respects, all covenants, agreements and undertakings of Seller contained in this Agreement.

(d)All representations and warranties of Seller as set forth in this Agreement shall be true and correct in all material respects as of the date of this Agreement and as of Closing.

(e)It is a condition that at least five (5) business days prior to the Closing, Seller has obtained and delivered to Purchaser an original executed Tenant Estoppel Certificate from Tenant in the form attached to the Lease as Schedule A, dated within thirty (30) days of the Closing. To be clear, Seller must use commercially reasonable efforts to obtain said estoppel but Seller will not be in default if Seller has been unable to despite such commercially reasonably efforts (but in that event Purchaser may terminate this Agreement and received back the Earnest Money, as discussed below).

(f)It is a condition that at least five (5) business days prior to the Closing, Seller has obtained and delivered to Purchaser an original executed OA Estoppel Certificate from the appropriate parties thereto, including any applicable property owner’s association, in the form attached hereto as Schedule 4, dated within thirty (30) days of the Closing. To be clear, Seller must use commercially reasonable efforts to obtain said estoppel but Seller will not be in default if Seller has been unable to despite such commercially reasonably efforts (but in that event Purchaser may terminate this Agreement and received back the Earnest Money, as discussed below).

(g)It is a condition that at least five (5) business days prior to the Closing, Seller has obtained and delivered to Purchaser an original executed REA Estoppel Certificate from the appropriate parties thereto, including any applicable property owner’s association, in the form attached hereto as Schedule 4, dated within thirty (30) days of the Closing. To be clear, Seller must use commercially reasonable efforts to obtain said estoppel but Seller will not be in default if Seller has been unable to despite such commercially reasonably efforts (but in that event Purchaser may terminate this Agreement and received back the Earnest Money, as discussed below).

23

18250087_6

Exhibit 10.1

(h)That there are no title matters other than Permitted Exceptions.

In the event any of the conditions in this Section 6.1 have not been satisfied (or otherwise waived in writing by Purchaser) on or before the time period specified herein (as same may be extended or postponed as provided in this Agreement), Purchaser shall have the right to terminate this Agreement by written notice to Seller given prior to the Closing, whereupon (i) Escrow Agent shall return the Earnest Money to Purchaser; and (ii) except for those provisions of this Agreement which by their express terms survive the termination of this Agreement, no party hereto shall have any other or further rights or obligations under this Agreement.

ARTICLE 7.

CASUALTY AND CONDEMNATION