Table of Contents

As submitted confidentially to the Securities and Exchange Commission on January 7, 2021. This draft registration statement has not been publicly filed with the Securities and Exchange Commission and all information herein remains strictly confidential.

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form S-1

REGISTRATION STATEMENT

Under

The Securities Act of 1933

COURSERA, INC.

(Exact name of Registrant as specified in its charter)

| Delaware | 7372 | 45-3560292 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

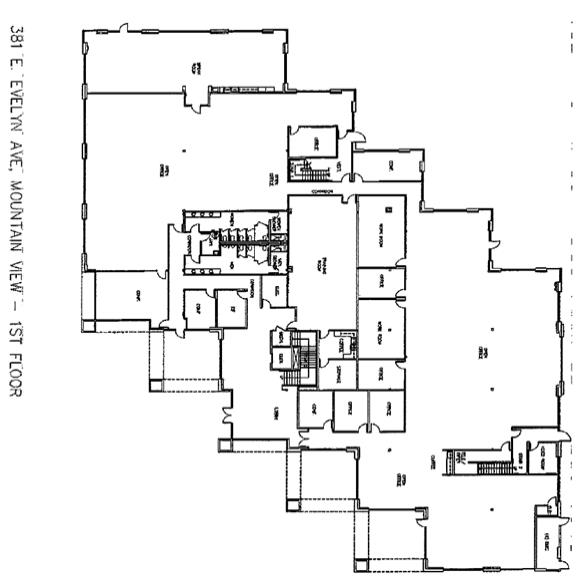

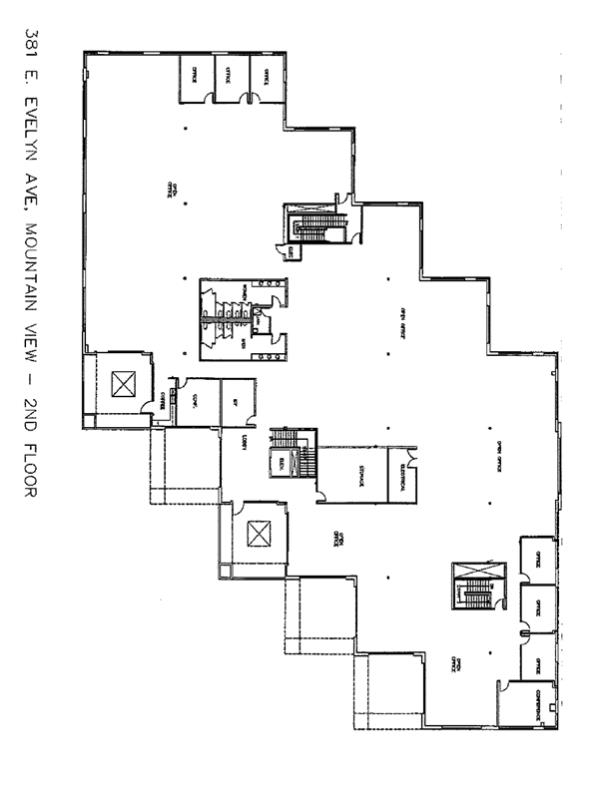

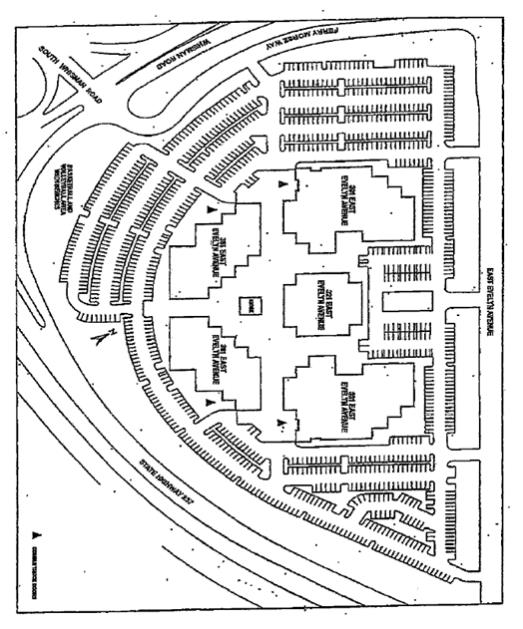

381 E. Evelyn Ave.

Mountain View, California 94041

(650) 963-9884

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

Jeffrey N. Maggioncalda

Chief Executive Officer

381 E. Evelyn Ave.

Mountain View, California 94041

(650) 963-9884

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| Jorge del Calvo Davina K. Kaile Pillsbury Winthrop Shaw Pittman LLP 2550 Hanover St Palo Alto, California 94304 (650) 233-4500 |

Alan F. Denenberg Stephen Salmon Davis Polk & Wardwell LLP 1600 El Camino Real Menlo Park, California 94025 (650) 752-2000 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after this registration statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act, check the following box: ☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |||

| Non-accelerated filer | ☒ | Smaller reporting company | ☐ | |||

| Emerging growth company | ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

CALCULATION OF REGISTRATION FEE

|

| ||||

| Title of Each Class of Securities to be Registered |

Proposed Maximum Aggregate Offering Price(1)(2) |

Amount of Registration Fee | ||

| Common Stock, $0.0001 par value per share |

$ | $ | ||

|

| ||||

|

| ||||

| (1) | In accordance with Rule 457(o) under the Securities Act of 1933, as amended, the number of shares being registered and the proposed maximum aggregate offering price are not included in this table. |

| (2) | Estimated solely for the purpose of computing the amount of the registration fee pursuant to Rule 457(o) under the Securities Act of 1933, as amended. Includes the aggregate offering price of additional shares that the underwriters have the option to purchase to cover over-allotments, if any. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with the provisions of Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities, and is not soliciting an offer to buy these securities, in any jurisdiction where offers or sales are not permitted.

PRELIMINARY PROSPECTUS

(Subject to Completion, dated , 2021)

Shares

COMMON STOCK

This is the initial public offering of shares of common stock of Coursera, Inc. We are offering shares of our common stock and the selling stockholders named in this prospectus are offering an additional shares of our common stock. We will not receive any of the proceeds from the sale of our common stock by the selling stockholders. No public market currently exists for our shares. We anticipate that the initial public offering price will be between $ and $ per share.

We expect to apply to have our common stock listed on under the symbol “COUR”.

We are an “emerging growth company,” as defined in the Jumpstart Our Business Startups Act, and will be subject to reduced public company reporting requirements.

Investing in our common stock involves risks. See “Risk Factors” beginning on page 15 of this prospectus.

|

Price to |

Underwriting |

Proceeds to |

Proceeds

to |

|||||||||||||

| Per share |

$ | $ | $ | $ | ||||||||||||

| Total |

$ | $ | $ | $ | ||||||||||||

| (1) | See “Underwriting” for a description of the compensation payable to the underwriters. |

| (2) | Before expenses. |

We have granted the underwriters the right, for a period of 30 days from the date of this prospectus, to purchase up to additional shares of common stock from us at the initial public offering price less the underwriting discount.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the shares of common stock to purchasers on or about , 2021.

| MORGAN STANLEY | GOLDMAN SACHS & CO. LLC |

, 2021

Table of Contents

In this prospectus, “Coursera,” “Coursera, Inc.,” the “Company,” “we,” “us,” and “our” refer to Coursera, Inc. and its consolidated subsidiaries.

Neither we, the selling stockholders, nor the underwriters have authorized anyone to provide any information other than that, or to make any representations other than those, contained in this prospectus or in any free writing prospectuses we have prepared. Neither we, the selling stockholders, nor the underwriters take any responsibility for, and cannot provide any assurance as to the reliability of, any other information that others may give you. Neither we, the selling stockholders, nor the underwriters are offering to sell, or seeking offers to buy, shares of our common stock in any jurisdiction where these offers and sales are not permitted. The information in this prospectus or in any applicable free writing prospectus is accurate only as of the date of this prospectus, or such free writing prospectus, as applicable, regardless of the time of delivery of this prospectus or any such free writing prospectus or any sale of shares of our common stock. Our business, financial condition, results of operations, and prospects may have and are likely to have changed since that date.

Through and including , 2021 (the 25th day after the date of this prospectus), all dealers effecting transactions in our common stock, whether or not participating in this offering, may be required to deliver a prospectus. This delivery requirement is in addition to the obligation of dealers to deliver a prospectus when acting as underwriters and with respect to their unsold allotments or subscriptions.

For investors outside the United States: Neither we, the selling stockholders, nor the underwriters have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the shares of our common stock and the distribution of this prospectus outside of the United States.

i

Table of Contents

This summary highlights information contained elsewhere in this prospectus and does not contain all of the information you should consider in making your investment decision. Before investing in our common stock, you should carefully read this entire prospectus, including our consolidated financial statements and related notes and the information set forth in “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

Overview

Our mission is to provide universal access to world-class learning so that anyone, anywhere has the power to transform their life through learning.

We believe that education is the source of human progress. In today’s economy in which the skills needed to succeed are rapidly evolving, education is becoming more important than ever. As automation and digital disruption are poised to replace unprecedented numbers of jobs worldwide, giving workers the opportunity to upskill and reskill will be crucial to raising global living standards and increasing social equity. Online education will play a critical role, enabling anyone, anywhere, to gain the valuable skills they need to earn a living in an increasingly digital economy.

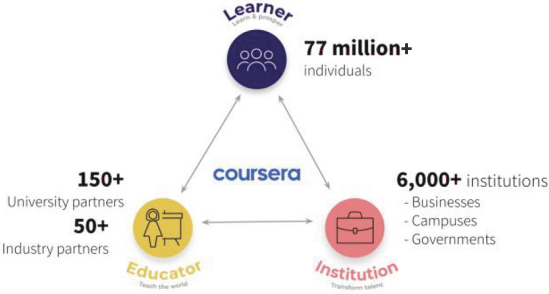

We have built a global platform connecting learners, educators, and institutions, providing world-class educational content that is affordable, accessible, and relevant. We partner with over 200 leading educational institutions and industry partners to bring quality higher education to a broad range of individuals, businesses, organizations, and governments. Our offerings range from Guided Projects to courses to fully online degrees, allowing learners to discover and access relevant and affordable content, consume it on a flexible schedule, and build upon their progress towards a broader program of study with a more advanced credential.

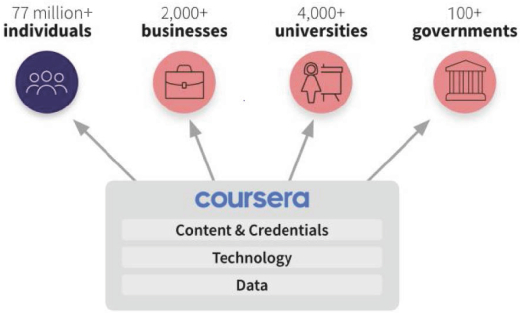

Our business has experienced rapid growth. As of December 31, 2020, more than 77 million learners had registered on our platform, and over 2,000 organizations, 4,000 academic institutions, and 300 government entities had used our platform to upskill and reskill their employees, students, and citizens. We generated revenue of $184.4 million and $ million for the years ended December 31, 2019 and 2020, respectively, representing a growth rate of %. Our net loss was $46.7 million and $ million for the years ended December 31, 2019 and 2020, respectively.

Industry Background: The Need for a New Model of Lifelong Learning

The global economy is changing rapidly. According to our estimates based on data from the International Labour Organization (the “ILO”), the global workforce will grow by 230 million people by 2030. This is expected to happen at a time when up to half of today’s jobs, around 2 billion, are at high risk of disappearing by 2030 due to automation.

The current system of higher education faces inherent challenges. The predominantly classroom-based model may not be able to keep pace with the rapidly emerging skills required to succeed in today’s workforce. While serving certain learners well, the in-person experience may fail to meet the needs of learners in more remote areas and non-traditional learners who need access to education and upskilling the most, both domestically and internationally. Lastly, the cost of education has grown considerably. According to the Federal Reserve Bank of New York, student loan debt in the United States was the second largest component of household debt at $1.55 trillion as of September 30, 2020, creating further headwinds for individuals navigating their careers and personal lives.

While technology will continue to disrupt jobs and labor markets, it can also be the source of significant benefits. Technology, when applied to learning, can reduce distribution costs, increase affordability, extend

1

Table of Contents

access to less wealthy geographical regions, adapt a workforce more quickly to emerging skills, and expand the overall market opportunity for education companies. The need for technological change in education has been exacerbated by the recent global pandemic. According to the United Nations, 1.6 billion students in 190 countries, approximately 94% of all students in the world, saw their schools at least temporarily closed due to the COVID-19 pandemic by August 2020.

We believe the future of education will be characterized by blended classrooms, job-relevant education, and lifelong learning, and that online learning will be the primary means of meeting the urgent global demand for emerging skills. According to an estimate by the World Bank, there were more than 200 million college students around the world as of October 2017, many of whom did not have necessary job-relevant skills. Online learning holds the promise to enable anyone, anywhere to learn new skills in preparation for high demand, digital jobs. The combined forces of online learning and remote work have the potential to increase global social equity by enabling a future where anyone, anywhere has access to both high-quality learning and high-quality job opportunities in an increasingly digital world.

Our Solution: A Platform for Delivering World-Class Learning at Scale

Coursera is a platform that connects a global ecosystem of learners, educators, and institutions with a goal of bringing world-class education to adult learners everywhere. We combine content, data, and technology into a single, unified platform that is customizable and extensible to both individual learners and institutions. Coursera partners with more than 200 leading university and industry partners to provide a flexible, affordable, and job-relevant online learning experience to meet the needs of an increasingly digital world.

Coursera serves the needs of a broad range of customers, including individuals, businesses, universities, and governments, all with a single, unified, scalable platform of technology, data, content, and know-how. Our platform contains:

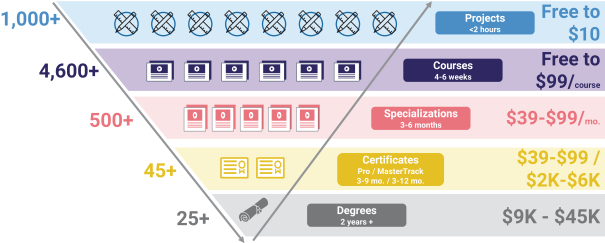

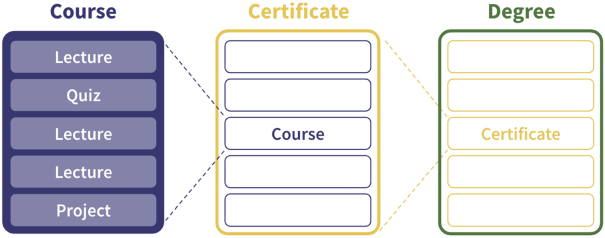

| • | A Catalog of High-Quality Content and Credentials. Coursera provides a broad range of learning offerings, including Guided Projects, courses, Specializations, certificates, and degrees. Coursera provides modular learning offerings to allow learners to gain the skills and credentials they need to reach their goals. Our model of learning is “stackable,” meaning incremental completion of standalone courses can count as progress towards a broader program of study for a more advanced credential. |

| • | Content Developed by Leading University and Industry Partners. Coursera partners with over 200 leading university and industry partners to deliver a broad portfolio of content and credentials. As of December 31, 2020, more than 150 university partners offered more than 4,000 courses across a range of domains including Data Science, Technology, Business, Health, Social Sciences, and Arts and Humanities. In addition, as of December 31, 2020, more than 50 industry partners have offered more than 600 courses primarily in the domains of data science, technology, and business. |

| • | Data and Machine Learning Drive Personalized Learning, Effective Marketing, and Skills Benchmarking. Our proprietary machine learning systems are powered by rich learning data across more than 220 million enrollments and provide tailored support to learners and resources to scale instructors. Fully-automated features such as In-Course Coach provide personalized insights and tips to keep learners motivated and making progress. Additionally, Coursera’s Skills Graph is a system of machine learning models that links learning paths to job skills and helps benchmark learner skills against peers and competitors. |

| • | Technology Delivers a Personalized Learning Experience at Scale. Our unified technology platform enables learners to learn more quickly and effectively, educators to author and deliver high-quality content at low cost, and employers to help employees develop the right skills to be competitive in the marketplace. |

2

Table of Contents

Our Offerings to Individuals and Institutions

| • | Coursera for Individuals. Learners consume content from our diversified portfolio, which is designed to meet a wide variety of goals and preferences. The full Coursera catalog includes the following offerings: |

| • | 1,000+ Guided Projects: Gain a job-relevant skill in less than two hours for $9.99; |

| • | 4,600+ Courses: Learn something new in 4-6 weeks for free, or for prices up to $99; |

| • | 500+ Specializations: Gain a job-relevant skill in 3-6 months for $39-$99/month; |

| • | 30+ Professional Certificates: Earn a certification of job readiness for an in-demand career in 3-9 months for $39-$99/month; |

| • | 15+ MasterTrack Certificates: In 3-12 months, earn a university-issued certificate from a module of a university degree and credit that can be applied to that degree in the future for approximately $2,000-$6,000; and |

| • | 25+ Degrees: Earn a bachelor’s or master’s degree fully online for approximately $9,000-$45,000. |

| * | Time periods noted are intended completion timeframes; actual time to completion varies by learner. |

| • | Coursera for Enterprise. Coursera is available to institutions around the world, allowing businesses, academic institutions, and governments to enable their employees, students, and citizens to gain critical skills aligned to the job market of today and tomorrow. Institutions play a major role in tackling the global reskilling challenge by providing awareness, incentives, and financial support for lifelong learning. Coursera has designed a single, unified platform that allows us to configure a common set of content and features to meet the various needs of business, academic, and government customers. |

| • | Coursera for Business: helps employers upskill and reskill their teams to drive innovation, competitiveness, and growth. Our content in data science, technology, and business is especially relevant to employers; |

| • | Coursera for Campus: empowers academic institutions to offer job-relevant online education to students, faculty, and staff. Our content from leading universities and academic integrity features are especially relevant to colleges that allow students to earn credit towards their college degree by taking online courses; and |

| • | Coursera for Government: helps federal, state, and local governments deliver workforce reskilling programs to provide in-demand skills and paths to new jobs for an entire workforce. Our Professional Certificates and content from leading universities and industry partners are especially relevant to government officials seeking to prepare citizens for emerging jobs in their region and enhance the skills of public sector employees. |

Coursera Social Impact Programs

Over the last four years, we have fostered an initiative to provide learning for tens of thousands of refugees in more than 140 countries. We also work with 69 nonprofit and community organizations to provide refugees, veterans, formerly incarcerated individuals, and underserved high schools with access to high-quality education and job-relevant credentials, at no cost to them. To date, our social impact programs have helped more than 72,000 learners across the globe, who have logged more than 390,000 course enrollments.

The COVID-19 pandemic sharply increased the need for online learning beginning in 2020. Both individuals and institutions relied on online learning to navigate change and disruption. We, along with our partners, launched several initiatives to mitigate the pandemic’s impact on communities worldwide including our

3

Table of Contents

Campus Response, Workforce Recovery, and Employee Resilience Initiatives, as well as a free Contact Tracing Course from John Hopkins University aimed towards public healthcare professionals.

Our Customers: How We Serve the World Through Learning

We offer a wide range of content and credentials from some of the world’s most recognizable educator brands. We help individuals learn and advance in their jobs and careers, and we serve companies, academic institutions, and governments to help them upskill and reskill their employees, students, and citizens. Our customers include:

| • | Learners. Learners can come to Coursera to advance their careers, reach their educational goals, and enhance their lives. As of December 31, 2020, more than 77 million learners have registered on Coursera to learn from more than 200 leading university and industry partners in thousands of offerings ranging from open courses to full diploma-bearing degrees. Coursera serves learners in their homes, through their employers, through their colleges and universities, and through government-sponsored programs. |

| • | Businesses. Employers can use Coursera for Business to help employees develop new skills in order to better acquire and serve customers, lower costs, reduce risk, and remain competitive in today’s economy. The launch of our Enterprise business in 2016 has enabled customers to choose Coursera to upskill their teams with critical skills in business, technology, data science, and other disciplines. As of December 31, 2020, over 2,000 organizations, including over 25% of Fortune 500 companies, were paying customers of Coursera for Business. |

| • | Colleges and Universities. Colleges and universities can use Coursera for Campus to deliver branded online learning at low cost in a new era of financial challenges for higher education and evolving student preferences for hybrid learning. Coursera for Campus enables universities to leverage our global online learning platform to provide job-relevant, credit-ready, high-quality learning at higher scale and lower cost than in-classroom learning alone. Accelerated by the pandemic, thousands of higher education institutions launched Coursera for Campus over the past year, making it one of our fastest growing offerings. As of December 31, 2020, 133 colleges and universities were paying customers of Coursera for Campus. |

| • | Governments. Governments, facing unprecedented levels of unemployment, can use Coursera for Government to build a competitive workforce that drives sustainable economic growth by upskilling employees for public sector success and reskilling citizens for career advancement. As of December 31, 2020, over 100 government agencies were paying customers of Coursera for Government. |

Our Competitive Strengths: The Power of Our Business Model

We believe that our competitive advantage is based on the following key strengths:

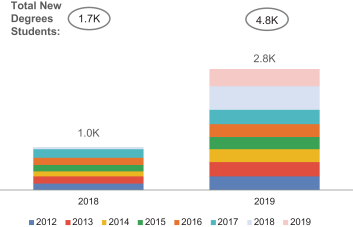

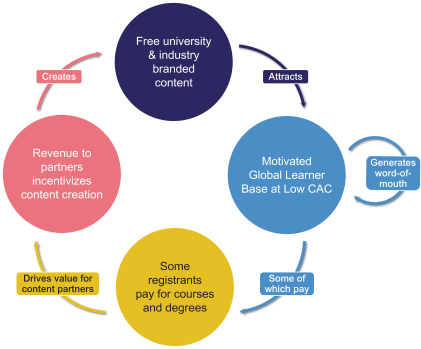

| • | Our consumer flywheel creates a price-to-cost advantage: We believe our efficient learner acquisition model, powered by free, high-quality content, global partner brands, deep expertise in search engine optimization, strong word of mouth referrals, public relations, and a profitable affiliate paid marketing channel, enables us to attract learners to Coursera at scale. This acquisition model has allowed us to add over 12,000 new Degrees students over the two years ended December 31, 2020 at an average acquisition cost of under $2,000. We calculate our average acquisition cost for Degrees students by aggregating directly attributable marketing costs and dividing by the total number of new students. |

| • | Branded catalog of modular and stackable content and credentials: Our broad catalog and flexible technology platform provide many entry points for learners and allow us to give learners a path to |

4

Table of Contents

| achieving their goals, regardless of their starting place. This allows us to help learners find the right learning program based on their prior skills, credentials, and experience and provide pathways for them to accomplish their goals. We believe we are the only platform with the ability to blend industry credentials with traditional academic degree credentials at scale. |

| • | Network of leading academic and industry partners: Our large and global learner base attracts top-tier educator partners by allowing them to reach new audiences and create new revenue streams with relatively small up-front investments. As technology advances and new relevant skill sets emerge, our growing partner relationships enable us to be responsive in providing in-demand skills for aspiring and ascending professionals. |

| • | Job-relevant, hands-on projects, and industry certificates: In order to compete and keep pace with the rapidly changing skills landscape, learners need to be able to quickly identify and learn practical skills using job-relevant tools. For example, Coursera’s technology platform allows instructors to efficiently launch one to two hour Guided Projects that teach the latest in-demand skills to learners with a hands-on learning experience. |

| • | Multi-channel Enterprise model: With a single content catalog and a unified technology and data platform, we are able to distribute content and credentials to a global audience of more than 6,000 businesses, academic institutions, and governments. Our technology enables our educator partners to reach large, globally-distributed employee populations through the workplace and provide them with high-quality lifelong learning. |

| • | Rich data analytics and Skills Graph: Since all of our teaching and learning activities happen online, our platform is able to capture a significant amount of data across millions of enrollments related to teaching, learning, content, and outcomes. These data allow us to drive learner success through personalized learning, mapping skills to content and jobs through a system of machine learning models, and unlocking marketing efficiencies by automating and targeting communications with learners to generate engagement. |

Our Opportunity: The Global Education Market is Large and Growing

As the pace of new knowledge and the demands of the global workforce continue to accelerate, the global adult education market is poised to grow dramatically. According to the education market intelligence firm HolonIQ, the global higher education market was $2.2 trillion in 2019; the global online degree market was $36 billion in 2019 and is expected to grow to $74 billion by 2025. The flexibility of online learning enables non-traditional learners to continue their education, which has allowed the online education industry to demonstrate acyclical growth characteristics.

Our Growth Strategy

We believe that we have a large, underpenetrated addressable opportunity ahead of us to enable the digital transformation of higher education and provide lifelong adult learning at scale. To advance our growth strategy, we intend to:

| • | Continue to invest in growing our Enterprise channels. Coursera’s growth is driven in part by expansion into new logos as well as broader penetration of learners within our existing base of business, university, and government customers. We utilize a land-and-expand strategy with our Enterprise customers that focuses on acquiring new customers and efficiently growing our relationships with existing customers. |

| • | Drive adoption and conversion of freemium Enterprise offerings. During the pandemic, we opened up our platform across our Enterprise customer base through multiple initiatives, enabling over 4,000 |

5

Table of Contents

| institutions globally, including approximately 10% of all degree-granting institutions worldwide, to tap into ready-made, high-quality digital curricula from leading universities with minimal upfront costs through our Coursera for Campus offering. We plan to continue to focus on converting free institutions to paying Enterprise customers as we enable the digital transformation of higher education. |

| • | Expand the number of online degrees and the number of students in Degrees programs. We believe we have a substantial opportunity to increase the number of bachelor’s and master’s programs in new and existing academic disciplines within our current network of university partners. Over time, we also aim to naturally progress current open course university partners into Degrees partners. For existing Degrees program partners, we intend to continue to increase the size of student cohorts in existing Degrees programs and add new online Degrees programs from these partners. |

| • | Continue to grow our learner base and build our brand. We intend to continue to invest in increasing the number of registered learners on Coursera and increasing awareness of the Coursera brand. Our large learner base and brand creates a virtuous cycle, increasing our value to educator partners and providing incentive for them to author additional content and credentials. This broader catalog, in turn, enhances the appeal of Coursera to learners, thereby further growing our learner base. |

| • | Grow our content and credentials catalog and network of educator partners. We plan to continue to invest in growing our catalog of Guided Projects, courses, Specializations, certificates, and degrees across a broad range of topics and expanding our network of educator partners. |

| • | Improve conversion, upsell, and retention of paid Consumer learners. Our Consumer platform makes it easy for individuals to come to Coursera and learn, allowing for a natural progression of learners to go from free projects or courses to full online degrees. In 2020, over 50% of our cash receipts from Consumer offerings came from individual learners who were registered on our platform as of December 31, 2019 and approximately 50% of our new Degrees students were previously registered Coursera learners. |

| • | Continue global expansion. We see a particularly large opportunity to help emerging economies that lack the ability to absorb the large and growing influx of adult students by delivering education in a scalable and affordable way. We plan to continue to market our offerings and programs to individual learners, businesses, academic institutions, and governments globally. |

Risk Factor Summary

Our business is subject to numerous risks, as more fully described in “Risk Factors” and elsewhere in this prospectus. You should read these risks before you invest in our common stock. In particular, risks associated with our business include, among others, the following, any of which could have an adverse effect on our business, financial condition, results of operations, or prospects:

| • | Fluctuations in our quarterly and annual revenue and operating results, which could cause our stock price to fluctuate and the value of your investment to decline; |

| • | Our rapid growth, which may not be indicative of our future growth and our expected decline in revenue growth rate compared to prior years; |

| • | Our limited operating history, which makes it difficult to predict our future financial and operating results; |

| • | We have incurred significant net losses since inception, and anticipate that we will continue to incur losses for the foreseeable future; |

| • | The impact of the COVID-19 pandemic, which has impacted, and may continue to impact, our business, key metrics, and results of operations in volatile and unpredictable ways; |

6

Table of Contents

| • | The nascency of online learning solutions, the market adoption of which may not grow as we expect; |

| • | Our ability to maintain and expand our partnerships with our university and industry partners; |

| • | Our ability to attract and retain learners; |

| • | Our ability to increase sales of our Enterprise offering; |

| • | Our ability to compete effectively; |

| • | Our partners’ ability to comply with international, federal, and state education laws and regulations, including applicable state authorizations for their programs; |

| • | Any changes to the validation or applicability of the DOE “dear colleague letter,” on which our business model relies; |

| • | Any disclosure of sensitive information about our partners, their employees, or our learners, whether due to cyber-attack or otherwise; |

| • | Any disruption or failure of our platform; and |

| • | Our status as a B Corp, which may negatively impact our financial performance. |

Emerging Growth Company Status

We are an “emerging growth company,” as defined in the Jumpstart Our Business Startups Act (the “JOBS Act”) enacted in April 2012. We intend to take advantage of certain exemptions under the JOBS Act from various public company reporting requirements, including not being required to have our internal control over financial reporting audited by our independent registered public accounting firm pursuant to Section 404(b) of the Sarbanes-Oxley Act of 2002, as amended (the “Sarbanes-Oxley Act”), reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and any golden parachute payments not previously approved. In addition, we have in this prospectus taken and intend to continue to take advantage of certain reduced reporting obligations, including disclosing only two years of audited consolidated financial statements and only two years of related management’s discussion and analysis of financial condition and results of operations. We may take advantage of these exemptions until the earlier of the last day of the fiscal year following the fifth anniversary of the completion of this offering or the date we cease to be an “emerging growth company,” which will be the earliest of (i) the last day of the fiscal year in which we have more than $1.7 billion in annual revenue; (ii) the date we qualify as a “large accelerated filer;” and (iii) the date on which we have, during the previous three-year period, issued more than $1 billion in non-convertible debt securities.

In addition, the JOBS Act provides that an “emerging growth company” can take advantage of an extended transition period for complying with new or revised accounting standards. This provision allows an emerging growth company to delay the adoption of some accounting standards until those standards would otherwise apply to private companies. We have elected to use the extended transition period under the JOBS Act. Accordingly, our consolidated financial statements may not be comparable to the financial statements of public companies that comply with such new or revised accounting standards.

Public Benefit Corporation Status

To reinforce our long-term commitment to providing global access to affordable and flexible world-class learning, our board of directors and stockholders have approved an amendment to our certificate of incorporation pursuant to which we will become a Delaware public benefit corporation. Public benefit corporations are a relatively new class of corporations that are intended to produce a public benefit and to operate in a responsible and sustainable manner. Under Delaware law, public benefit corporations are required to identify in their certificate of incorporation the public benefit or benefits they will promote, and their directors have a duty to

7

Table of Contents

manage the affairs of the corporation in a manner that balances the pecuniary interests of the stockholders, the best interests of those materially affected by the corporation’s conduct, and the specific public benefit identified in the public benefit corporation’s certificate of incorporation. See “Risk Factors—Risks Relating to Our Existence as a Public Benefit Corporation” and “Description of Capital Stock—Public Benefit Corporation Status.” The public benefit stated in the approved amendment is to provide global access to flexible and affordable high-quality education that supports personal development, career advancement, and economic opportunity.

Certified B Corporation Status

While not required by Delaware law or the terms of our certificate of incorporation, we are currently undergoing the process required to be designated as a Certified B CorporationTM (“B Corp”). The term “B Corp” does not refer to a particular form of legal entity, but instead refers to companies that are certified by B Lab, an independent nonprofit organization, for meeting rigorous standards of social and environmental performance, accountability, and transparency. See “Business—Certified B Corporation Status.”

Corporate Information

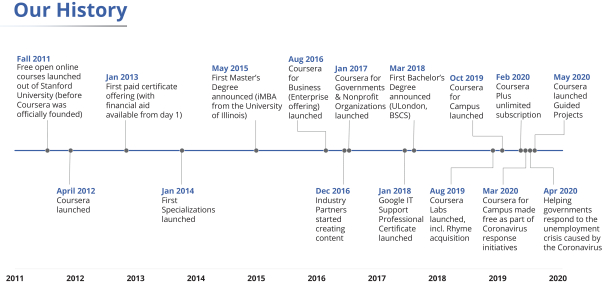

We were incorporated in Delaware on October 7, 2011 and we launched our platform in April 2012. Our principal executive offices are located at 381 E. Evelyn Ave. Mountain View, California 94041 and our telephone number is (650) 963-9884. Our corporate website address is www.coursera.org. Information contained on or accessible through our website is not part of this prospectus, and is not incorporated by reference herein, and should not be relied on in determining whether to make an investment decision. The inclusion of our website address in this prospectus is an inactive textual reference only.

We have obtained registered trademarks for Coursera, which marks are our property. This prospectus also contains references to trademarks belonging to other entities, which marks remain the property of such other entities. Solely for convenience, trademarks and trade names referred to in this prospectus, including logos, artwork and other visual displays, may appear without the ® or TM symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the rights of the applicable licensor to these trademarks and trade names. We do not intend our use or display of other entities’ trade names or trademarks to imply a relationship with, or endorsement or sponsorship of us by, any other entity.

8

Table of Contents

| Common stock offered by us |

shares |

| Common stock offered by the selling stockholders |

shares |

| Underwriters’ option to purchase additional shares |

shares |

| Common stock to be outstanding after this offering |

shares ( shares if the underwriters exercise their option to purchase additional shares in full) |

| Use of proceeds |

We estimate that the net proceeds to us from this offering will be approximately $ million (or $ million if the underwriters exercise their option to purchase additional shares in full), based on an assumed initial public offering price of $ per share (the midpoint of the price range set forth on the cover page of this prospectus), and after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us. We will not receive any proceeds from the sale of shares of common stock by the selling stockholders. |

| We intend to use the net proceeds from this offering primarily for general corporate purposes, including working capital, sales and marketing activities, research and development, general and administrative matters, and capital expenditures, although we do not currently have any specific plans with respect to use of proceeds for such purposes. We also may use a portion of the net proceeds to acquire complementary businesses, offerings, services, or technologies. However, we do not have agreements, commitments, or plans for any specific acquisitions. See “Use of Proceeds.” |

| Risk factors |

You should read “Risk Factors” and the other information included in this prospectus for a discussion of certain of the factors to consider carefully before deciding to purchase any shares of our common stock. |

| Proposed trading symbol on |

“COUR” |

The number of shares of our common stock to be outstanding after this offering is based on 115,606,690 shares of common stock outstanding as of December 31, 2020, and excludes:

| • | 32,495,508 shares of our common stock issuable upon the exercise of stock options outstanding as of December 31, 2020 granted under our Stock Incentive Plan (the “Non-Executive Plan”) and our 2014 Executive Stock Incentive Plan (the “Executive Stock Plan” and collectively with the Non-Executive Plan, the “Predecessor Stock Incentive Plans”), at a weighted-average exercise price of $4.60 per share; |

| • | 3,276,600 shares of our common stock subject to restricted stock units (“RSUs”) outstanding as of December 31, 2020 granted under the Predecessor Stock Incentive Plans; |

| • | shares of our common stock reserved for future issuance under our 2021 Equity Incentive Plan (the “2021 Plan”), which will become effective upon the completion of this offering, as well as any automatic increases in the number of shares of common stock reserved for future issuance under the 2021 Plan, and any shares reserved for issuance but not issued under the Predecessor Stock Incentive |

9

Table of Contents

| Plans as of the effective date of the 2021 Plan, as well as any shares subject to outstanding awards under the Predecessor Plans after such effective date that are subsequently forfeited or terminated, all of which shares shall become available for issuance under the 2021 Plan; and |

| • | shares of our common stock reserved for future issuance under the 2021 Employee Stock Purchase Plan (the “ESPP”), which will become effective upon the completion of this offering. |

Unless otherwise indicated, all information contained in this prospectus assumes or gives effect to:

| • | the automatic conversion of all of our redeemable convertible preferred stock outstanding as of December 31, 2020 into an aggregate of 75,305,400 shares of our common stock immediately prior to the closing of this offering; |

| • | the filing and effectiveness of our amended and restated certificate of incorporation and the adoption of our amended and restated bylaws immediately prior to the completion of this offering; and |

| • | no exercise by the underwriters of their option to purchase up to additional shares of our common stock. |

10

Table of Contents

SUMMARY CONSOLIDATED FINANCIAL DATA

The summary consolidated statements of operations data presented below for the years ended December 31, 2019 and 2020 and the summary consolidated balance sheet data as of December 31, 2019 are derived from our audited consolidated financial statements included elsewhere in this prospectus. The following summary consolidated financial data should be read together with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our audited consolidated financial statements and related notes included elsewhere in this prospectus. The summary consolidated financial data in this section are not intended to replace our audited consolidated financial statements and related notes and are qualified in their entirety thereby. Our historical results are not necessarily indicative of the results that may be expected for any period in the future.

Consolidated Statement of Operations Data

| Years Ended December 31, | ||||||||

| 2019 | 2020 | |||||||

| (in thousands, except share and per share data) |

||||||||

| Revenue |

$ | 184,411 | ||||||

| Cost of revenue(1) |

89,589 | |||||||

|

|

|

|

|

|||||

| Gross profit |

94,822 | |||||||

|

|

|

|

|

|||||

| Operating expenses: |

||||||||

| Research and development(1) |

56,364 | |||||||

| Sales and marketing(1) |

57,042 | |||||||

| General and administrative(1) |

29,810 | |||||||

|

|

|

|

|

|||||

| Total operating expenses |

143,216 | |||||||

|

|

|

|

|

|||||

| Loss from operations |

(48,394 | ) | ||||||

| Other income (expense): |

||||||||

| Interest income |

3,282 | |||||||

| Interest expense |

(625 | ) | ||||||

| Other expense, net |

(264 | ) | ||||||

|

|

|

|

|

|||||

| Loss before income taxes |

(46,001 | ) | ||||||

|

|

|

|

|

|||||

| Income tax expense |

718 | |||||||

|

|

|

|

|

|||||

| Net loss |

(46,719 | ) | ||||||

|

|

|

|

|

|||||

| Net loss attributable to common stockholders, basic and diluted |

$ | (46,719 | ) | |||||

|

|

|

|

|

|||||

| Net loss attributable per share to common stockholders, basic and diluted(2) |

$ | (1.45 | ) | |||||

|

|

|

|

|

|||||

| Weighted-average shares used to compute net loss attributable per share to common stockholders, basic and diluted(2) |

32,276,258 | |||||||

|

|

|

|

|

|||||

| Pro forma net loss attributable per share to common stockholders, basic and diluted (unaudited)(2) |

$ | |||||||

|

|

|

|||||||

| Weighted-average shares used to compute pro forma net loss attributable per share to common stockholders, basic and diluted (unaudited)(2) |

||||||||

|

|

|

|||||||

11

Table of Contents

| (1) | Stock-based compensation expense included in the consolidated statements of operations data above was as follows: |

| Years Ended December 31, | ||||||||

| 2019 | 2020 | |||||||

| (in thousands) | ||||||||

| Cost of revenue |

$ | 491 | ||||||

| Research and development |

7,038 | |||||||

| Sales and marketing |

3,189 | |||||||

| General and administrative |

5,599 | |||||||

|

|

|

|

|

|||||

| Total |

$ | 16,317 | ||||||

|

|

|

|

|

|||||

| (2) | See Note 2 and Note 10 to our audited consolidated financial statements included elsewhere in this prospectus for an explanation of the calculations of our net loss per share attributable to common stockholders, basic and diluted, pro forma net loss per share attributable to common stockholders, basic and diluted, and the weighted-average shares used to compute these amounts. |

Consolidated Balance Sheet Data

| As of December 31, 2019 | ||||||||||||

| Actual | Pro Forma(1) |

Pro Forma as Adjusted(2)(3) |

||||||||||

| (in thousands) | ||||||||||||

| Cash, cash equivalents and marketable securities |

$ | 172,815 | ||||||||||

| Total assets |

$ | 236,263 | ||||||||||

| Working capital(4) |

$ | 123,518 | ||||||||||

| Redeemable convertible preferred stock |

$ | 332,681 | ||||||||||

| Additional paid-in capital |

$ | 94,364 | ||||||||||

| Accumulated deficit |

$ | (276,736 | ) | |||||||||

| Total stockholders’ deficit |

$ | (186,999 | ) | |||||||||

| (1) | The pro forma column gives effect to (a) the automatic conversion of all of our outstanding redeemable convertible preferred stock into 75,305,400 shares of our common stock immediately prior to the closing of this offering and (b) the filing and effectiveness of our amended and restated certificate of incorporation upon the closing of this offering. |

| (2) | The pro forma as adjusted column gives effect to the pro forma adjustments described in footnote (1) above and gives further effect to the sale of shares of common stock by us in this offering at an assumed initial public offering price of $ per share (the midpoint of the price range set forth on the cover page of this prospectus), after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us. The pro forma as adjusted information set forth in the table above is illustrative only and will be adjusted based on the actual initial public offering price and other terms of this offering determined at pricing. |

| (3) | Each $1.00 increase (decrease) in the assumed initial public offering price of $ per share would increase (decrease) each of cash, cash equivalents, and marketable securities, working capital, total assets, and total stockholders’ deficit on a pro forma as adjusted basis by $ , assuming that the number of shares offered by us, as set forth on the cover page of this prospectus, remains the same, and after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us. Similarly, each 1.0 million increase (decrease) in the number of shares offered by us as set forth on the cover page of this prospectus would increase (decrease) each of our cash, cash equivalents, and marketable securities, working capital, total assets, and total stockholders’ deficit on a pro forma as adjusted basis by approximately $ , assuming no change in the assumed initial public offering price per share and after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us. |

| (4) | Working capital is defined as current assets less current liabilities. |

Non-GAAP Financial Measures

We have included adjusted EBITDA and adjusted EBITDA margin, which are non-GAAP financial measures, in this prospectus because they are key measures used by our management team to help us analyze our financial results, establish budgets and operational goals for managing our business, evaluate our performance, and make strategic decisions. Accordingly, we believe that these non-GAAP financial measures provide useful

12

Table of Contents

information to investors and others in understanding and evaluating our operating results in the same manner as our management team and board of directors. In addition, we believe these measures are useful for period-to-period comparisons of our business, as they remove the effect of certain non-cash expenses and certain variable charges. We also believe that the presentation of these non-GAAP financial measures in this prospectus provides an additional tool for investors to use in comparing our core business and results of operations over multiple periods with other companies in our industry, many of which present similar non-GAAP financial measures to investors, and to analyze our cash performance.

The non-GAAP financial measures presented in this prospectus may not be comparable to similarly titled measures reported by other companies due to differences in the way that these measures are calculated. The non-GAAP financial measures presented in this prospectus should not be considered as the sole measure of our performance and should not be considered in isolation from, or as a substitute for, comparable financial measures calculated in accordance with GAAP. The information in the table below sets forth the non-GAAP financial measures along with the most directly comparable GAAP financial measures.

We define adjusted EBITDA as our net loss excluding: (1) depreciation and amortization; (2) interest income, net; (3) stock-based compensation; (4) income tax expense and (5) payroll tax expense related to stock-based activities. We define adjusted EBITDA margin as adjusted EBITDA divided by revenue.

| Year Ended December 31, | ||||||||

| 2019 | 2020 | |||||||

| (in thousands, except percentages) | ||||||||

| Net loss from operations |

$ | (46,719 | ) | |||||

| Adjusted EBITDA (unaudited) |

(26,929 | ) | ||||||

| Net loss margin |

(25 | )% | ||||||

| Adjusted EBITDA margin (unaudited) |

(15 | )% | ||||||

Non-GAAP Reconciliation

The following table provides a reconciliation of net loss, the most directly comparable GAAP financial measure, to adjusted EBITDA.

| Year Ended December 31, | ||||||||

| 2019 | 2020 | |||||||

| (in thousands) | ||||||||

| Net loss |

$ | (46,719 | ) | |||||

| Depreciation and amortization |

5,282 | |||||||

| Interest income, net |

(2,657 | ) | ||||||

| Stock-based compensation |

16,317 | |||||||

| Income tax expense |

718 | |||||||

| Payroll tax expense related to stock-based activities |

130 | |||||||

|

|

|

|

|

|||||

| Adjusted EBITDA (unaudited) |

$ | (26,929 | ) | |||||

|

|

|

|

|

|||||

13

Table of Contents

The following table provides a reconciliation of net loss margin, the most directly comparable GAAP financial measure, to adjusted EBITDA margin:

| Year Ended December 31, | ||||||||

| 2019 | 2020 | |||||||

| (in thousands, except percentages) | ||||||||

| Revenue |

$ | 184,411 | ||||||

| Net loss |

(46,719 | ) | ||||||

| Net loss margin |

(25 | )% | ||||||

| Revenue |

$ | 184,411 | ||||||

| Adjusted EBITDA (unaudited) |

(26,929 | ) | ||||||

| Adjusted EBITDA margin (unaudited) |

(15 | )% | ||||||

14

Table of Contents

Investing in our common stock involves a high degree of risk. You should carefully consider the risks and uncertainties described below, together with all of the other information in this prospectus, including our audited consolidated financial statements and related notes and “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” before investing in our common stock. If any of the following risks are realized, in whole or in part, our business, financial condition, results of operations, and prospects could be materially and adversely affected. In that event, the price of our common stock could decline, and you could lose part or all of your investment. Additional risks and uncertainties not presently known to us or that we currently deem immaterial also may impair our business, financial condition, results of operations, and prospects.

Risks Related to Our Business and Industry

Our quarterly and annual revenue and operating results have fluctuated from period to period and may do so in the future, which could cause our stock price to fluctuate and the value of your investment to decline.

Our quarterly and annual revenue and operating results have historically fluctuated from period to period, and our future operating results may vary significantly from quarter to quarter due to a variety of factors, many of which are beyond our control. You should not rely on period-to-period comparisons of our operating results as an indication of our future performance. Factors that may cause fluctuations in our quarterly operating results include, but are not limited to, the following:

| • | our ability to maintain existing customers and attract new customers, including businesses, governments, and educational institutions who subscribe to our Enterprise platform, as well as learners who access the content and credentialing programs available on our platform; |

| • | our ability to continue to offer compelling content and degrees or other credentialing programs created by our industry and university partners; |

| • | changes in, or trends affecting, subscriptions to our Enterprise platform from businesses, governments, and educational institutions; |

| • | changes in, or trends affecting, learner enrollment and retention levels, including with respect to learners electing to access our paid offerings; |

| • | our ability to increase and manage the growth of our international operations, including our international customer base, and our ability to manage the risks associated therewith; |

| • | the timing of our costs incurred in connection with the launch of new course content and offerings and new certification, degree, or other credentialing programs, and the timing and amount of revenue we generate from new offerings and programs; |

| • | trends and factors impacting the demand for, and acceptance of, online learning and credentialing programs, including the COVID-19 pandemic, and the prices consumers and businesses are willing to pay for such programs; |

| • | changes in, or trends affecting, the mix of partners, including educational institutions, offering open online courses only and those offering certification, degree, or other credentialing programs; |

| • | changes in the rate, volume, and demand for new content and credentialing programs created and offered by our partners on our platform; |

| • | changes in the terms of our existing partnership agreements; |

| • | the timing and terms of any new partnership agreements; |

| • | the timing and amount of our sales and marketing expenses; |

| • | costs necessary to improve and maintain our platform; |

15

Table of Contents

| • | changes in our key metrics or the methods used to calculate our key metrics; |

| • | seasonality, including seasonal engagement patterns of learners and Enterprise customers, which may vary from quarter to quarter or year to year; |

| • | changes in laws, regulations or accounting principles that impact our business; and |

| • | general political, economic, or market conditions and events affecting any of the above, including the outcome of political elections and the impact of the COVID-19 pandemic. |

These and other factors may cause our revenue and operating results to fall below the expectations of market analysts and investors in future periods, which could cause the market price of our common stock to decline substantially. Any decline in the market price of our common would cause the value of your investment to decline.

Our recent, rapid growth may not be indicative of our future growth and we expect our revenue growth rate to decline compared to prior years.

We have experienced rapid revenue growth in recent periods, with revenue of $184.4 million and $ million in 2019 and 2020, respectively. You should not rely on our revenue for any previous quarterly or annual period as any indication of our revenue or revenue growth in future periods. As we grow our business, we expect our revenue growth rates to decline compared to prior years for a number of reasons, which may include more challenging comparisons to prior periods as our revenue grows, slowing demand for our platform, increasing competition, a decrease in the growth of our overall market or market saturation, and our failure to capitalize on growth opportunities. In addition, our growth rates are likely to experience increased volatility, and may decline, as the COVID-19 pandemic evolves and societal and economic circumstances shift.

We have a limited operating history, which makes it difficult to predict our future financial and operating results.

We were founded in 2011; introduced our first open online course in 2012, our first certificates of completion in 2013, our first Specialization in 2014, our Enterprise platform for businesses in 2016, and our first MasterTrack certification in 2018; enrolled the first students in the Degrees programs offered through our platform in 2016; and introduced Guided Projects in 2019 and Coursera for Campus, our Enterprise platform offering for educational institutions, in late 2019. As a result of our limited operating history, our ability to estimate our future operating results is limited and subject to a number of uncertainties, including those discussed in this “Risk Factors” section and elsewhere in this prospectus. If we do not manage these risks successfully, our operating and financial results may differ materially from our expectations and our business and stock price may suffer.

We have incurred significant net losses since inception, and anticipate that we will continue to incur losses for the foreseeable future.

We incurred net losses of $46.7 million and $ in 2019 and 2020, respectively, and we had an accumulated deficit of $ million as of December 31, 2020. We expect to incur significant losses in the future. We will need to generate and sustain increased revenue levels in future periods to achieve profitability, and even if we achieve profitability, we may not be able to maintain or increase our level of profitability. We anticipate that our operating expenses will increase substantially for the foreseeable future as we continue to, among other things:

| • | expand our course offerings and the robustness of our platform; |

| • | expand our learner base and our sales and marketing efforts; |

| • | improve and scale our technology; |

16

Table of Contents

| • | address increased competition; and |

| • | incur significant accounting, legal, and other expenses as a public company that we did not incur as a private company. |

These expenditures will make it more difficult for us to achieve and maintain profitability. Our efforts to grow our business may be more costly than we expect, and we may not be able to increase our revenue enough to offset our higher operating expenses. If we are forced to reduce our expenses, it could negatively impact our growth and growth strategy. As a result, we can provide no assurance as to whether or when we will achieve profitability. If we are not able to achieve and maintain profitability, the value of our company and our common stock could decline significantly, and you could lose some or all of your investment.

The COVID-19 pandemic has impacted, and may continue to impact, our business, key metrics, and results of operations in volatile and unpredictable ways.

The uncertainty around the COVID-19 pandemic in the United States and worldwide will likely continue to adversely impact the national and global economy. The full extent of the impact of the pandemic on our business, key metrics, and results of operations depends on future developments that are uncertain and unpredictable, including the duration, severity, and spread of the pandemic, its impact on capital and financial markets, and any new information that may emerge concerning the virus or vaccines or other efforts to control the virus.

As a result of the COVID-19 pandemic, we have transitioned to an almost fully remote work environment and we may continue to operate on a significantly remote and geographically (including internationally) dispersed basis for the foreseeable future. This remote and dispersed work environment could have a negative impact on the execution of our business plans and operations. For example, if a natural disaster, power outage, connectivity issue, or other event occurred that impacted our employees’ ability to work remotely, it may be difficult or, in certain cases, impossible, for us to continue our business for a substantial period of time. Further, as the COVID-19 pandemic continues, we may experience disruptions if our employees or our partners’ or third-party service providers’ employees become ill and are unable to perform their duties, and our operations, Internet, or mobile networks, or the operations of one or more of our third-party service providers, is impacted. The increase in remote working may also result in consumer privacy, IT security, and fraud vulnerabilities, which, if exploited, could result in significant recovery costs and harm to our reputation. Transitioning to a fully or predominantly remote work environment and providing and maintaining the operational and infrastructure necessary to support a remote work environment also present significant challenges to maintaining our corporate culture, including employee engagement and productivity, both during the immediate pandemic crisis and beyond.

We have also seen significant and rapid shifts in the traditional models of education and training as this pandemic has evolved. Although we believe our business has also been positively impacted to some extent by several trends related to the COVID-19 pandemic, including the increased need or willingness of businesses, governments, and educational institutions to adopt remote, online, and asynchronous learning and training, we cannot predict whether these trends will continue if and when the pandemic begins to subside, restrictions ease, and the risk and barriers associated with in-person learning and training decrease. In addition, the COVID-19 pandemic may negatively impact the financial resources available to learners or the operating budgets of our partners or customers, any of which could in turn negatively impact our business and operating results.

Market adoption of online learning solutions is relatively new and may not grow as we expect, which may harm our business and results of operation.

Our future success will depend in part on the growth, if any, in the demand for online learning solutions. While the COVID-19 pandemic has accelerated the market for online learning solutions, it is still less mature than the market for in-person learning and training, which many businesses currently utilize, and these businesses

17

Table of Contents

may be slow or unwilling to migrate from these legacy approaches. As such, it is difficult to predict learner or partner demand for our platform, learner or partner adoption and renewal, the rate at which existing learners and partners expand their engagement with our platform, the size and growth rate of the market for our platform, the entry of competitive offerings into the market, or the success of existing competitive offerings. Furthermore, even if educators and enterprises want to adopt an online learning solution, it may take them a substantial amount of time to fully transition to this type of learning solution or they could be delayed due to budget constraints, weakening economic conditions, or other factors. Even if market demand for online learning solutions generally increases, we cannot assure you that adoption of our platform will also increase. If the market for online learning solutions does not grow as we expect or our platform does not achieve widespread adoption, it could result in reduced customer spending, learner and partner attrition, and decreased revenue, any of which would adversely affect our business and results of operations.

We may need to change the contract terms, including our pricing model, for the course content and credentialing programs offered on our platform, which in turn would impact our operating results.

We have limited experience with respect to determining the optimal prices and contract length for the course content and certification, degree, and other credentialing programs offered on our platform, and as a result, we have in the past, and expect that we may in the future, need to change our pricing model or target contract length from time to time, which could impact our financial results. For example, in February 2020, we launched Coursera Plus, an annual subscription plan with unlimited access to a variety of our courses, Specializations, and professional certificates, at a fixed annual cost, and we may need to adjust our pricing model as we gain experience with this new offering. As the market for our learning platform grows (if ever), as new competitors introduce competitive applications or services, or as we enter into new international markets, we may be unable to attract new customers at the same price or based on the same pricing models we have historically used, or for contract lengths consistent with our historical averages. Pricing and contract length decisions may also impact the mix of adoption among our offerings and negatively impact our overall revenue. Moreover, competition may require us to make substantial price concessions or accept shorter contract durations. Our revenue and financial position may be adversely affected by any of the foregoing, and we may have increased difficulty achieving profitability.

If we fail to maintain and expand our partnerships with university and industry partners, our ability to grow our business and revenue will suffer.

The success of our business depends in large part on the continued and increased development and volume of compelling course content and credentialing programs by our university and industry partners, which we also refer to as our educator partners. We may face several challenges in establishing and expanding these relationships. For instance, our university and industry partners who use our platform are required to invest significant time and resources to adjust the manner in which they develop course content and degree programs for an online learning environment. The delivery of degree programs online at educational institutions has not yet achieved widespread acceptance, and many administrators and faculty members may have concerns regarding the perceived loss of control over the educational process that might result from offering courses and degrees online and the effectiveness of asynchronous learning, as well as concerns regarding the ability to provide high-quality education online that maintains the standards they set for their on-campus programs. There can be no assurance that online programs, such as those offered on our platform, will ever achieve significant market acceptance, and universities and organizations may therefore decline to engage with our platform. Further, if we were to lose a significant number of university and industry partners, our growth and revenue would be negatively impacted.

If we are required to change the contract terms with our educator partners, including with respect to pricing or contract length, it could materially and adversely affect our business, financial condition, and results of operations.

We work with our educator partners to deliver a broad portfolio of content and credentials on our platform. For our Consumer and Enterprise offerings, we incur content costs in the form of fees paid to educator partners.

18

Table of Contents

In addition, our Degrees services revenue is based on a percentage of the total tuition collected from Degrees students by the university partner. As a result, our revenue, gross profit, and operating results generally could be significantly and negatively impacted if we are required to renegotiate or change the terms of our agreements with these partners. For example, if a significant number of university partners, or university partners whose courses or credentialing programs account for a significant volume of learner enrollment on our platform, were to seek to renegotiate the content fees payable by us or the percentage of tuition payable to us, it could have a material impact on our business and operating results. Further, we may be required to change the terms of these agreements, including the pricing terms or contract length, due to competitive, regulatory, or other reasons. Any significant change in our pricing or other contract terms with these partners could materially and adversely affect our business, financial condition, and results of operations.

Our financial performance depends heavily on our ability to attract and retain learners, and if we fail to do so, our business and operating results will suffer.

Building awareness and acceptance of the online course content and certification, degree, and other credentialing programs offered on our platform among learners is critical to our ability to attract prospective learners and generate revenue. We must also continue to successfully work with our partners to develop new and compelling course content as well as additional certification, degree, and other credentialing programs to maintain the relevancy of content and keep learners interested and engaged. A significant portion of our expenses is attributable to marketing efforts dedicated to attracting potential learners to our platform. Because we generate revenue based on fees from, or as a result of, learners enrolled in the online courses and certification, degree, and other credentialing programs offered on our platform, we must attract learners in a cost-effective manner and increase the rate at which learners enroll in and complete the courses and credentialing programs offered by our partners. We also must retain learners and convert learners from our freemium model to paying customers, which depends in part on our ability to offer engaging and frequently updated content as well as quality customer support and service. The following factors, many of which are largely outside of our control, may prevent us from increasing and maintaining learner enrollment in the online courses and credentialing programs offered on our platform in a cost-effective manner or at all:

| • | Negative perceptions about online learning. Online education programs may not be successful or operate efficiently, which in turn could create the perception that online education in general is not effective. Learners may also be reluctant to enroll in online programs due to concerns that the learning experience may be substandard, that employers may be hesitant to hire learners who received their education or credentials online, or that organizations granting professional licenses or certifications may be reluctant to grant them based on credentials, including degrees, earned through online education or training. |

| • | Reduced support from partners. If partners cease to offer new and compelling course content or certification, degree, or other credentialing programs or limit our ability to promote their courses or programs, learners may reduce or terminate their use of our platform. |

| • | Harm to partner reputation. Many factors affecting our partners’ reputations are beyond our control and can change over time, including their academic performance and ranking among educational institutions, including with respect to a specific degree, certification, or other credentialing program. |

| • | Lack of interest in the certifications, degrees, or other credentials offered on our platform. We may encounter difficulties attracting learners to enroll in certification, degree, or other credentialing programs that are not in demand due to shifting employer or societal preferences and priorities or that are in emerging or unproven fields. |

| • | Learner dissatisfaction. Learner dissatisfaction with the quality of the course content and presentation or the course presenters, changing views of the value of our partners’ programs and certification, degree, or other credentialing programs offered, and perceptions of employment prospects following completion of a program on our platform may negatively impact learner retention. |

19

Table of Contents

| • | Ineffective marketing efforts. Our marketing efforts, which use search engine optimization, paid search, and custom website development and deployment, may prove unsuccessful or cost inefficient. |

| • | Lack of financial resources for learners. Any developments that reduce the availability of financial aid for higher education generally or that reduce the disposable income available to potential learners (including macro-economic developments such as continued or worsening recession or unemployment or the ongoing COVID-19 pandemic) could impair learners’ abilities to meet their financial obligations, which in turn could result in reduced enrollment and harm our ability to generate revenue. |

| • | General economic conditions. Enrollment in the courses and certification, degree, and other credentialing programs offered on our platform may be affected by changes in the U.S. economy and by global economic conditions. For example, an improvement in economic conditions may reduce demand for higher educational services as potential learners may find adequate employment without additional education. Conversely, a decline in employment opportunities or economic conditions may reduce employers’ willingness to sponsor higher educational opportunities for employees given a lack of employer need for enhanced skill sets or an inability to fund such programs, and could discourage learners from pursuing higher education due to an inability to afford our programs or a perception that the financial investment may not result in increased earning potential or improved employment opportunities. |

Any of these factors could reduce enrollment and retention and could cause our costs associated with attracting and retaining learners to increase, which could materially harm our ability to increase our revenue or achieve profitability. These developments could also harm our reputation and make it more difficult for us to engage our partners for new course content or other offerings, which in turn may negatively impact our ability to expand our business and improve our financial performance.

If our learners do not expand beyond our freemium offerings and free trials available on our platform, our ability to grow our business and improve our results of operations may be adversely affected.

Many of our learners initially use the freemium version of our platform or free trials available on our platform, and many of our Enterprise customers engage with our platform only for a specific use case. Specifically, in March 2020, as part of our COVID-19 initiative, we began offering free unlimited access to Coursera for Campus to students and faculty at campuses around the world. Our ability to grow our business depends in part on our ability to persuade learners and other customers to expand their use of our platform to address additional use cases and to convert free subscriptions to paid subscriptions over time.