UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

10/A

(Amendment No.

2)

GENERAL

FORM FOR REGISTRATION OF SECURITIES

Pursuant

to Section 12(b) or (g) of the Securities Exchange Act of 1934

CHECKPOINT

THERAPEUTICS, INC.

(Exact Name of Registrant as Specified in

its Charter)

| |

|

|

| Delaware |

|

47-2568632 |

| (State or Other Jurisdiction of |

|

(I.R.S. Employer |

| Incorporation or Organization) |

|

Identification No.) |

| |

|

|

2 Gansevoort Street, 9th

Floor

New York, New York |

|

10014 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code: (781) 652-4500

Securities registered pursuant to Section 12(b)

of the Act:

| (Title of Class) |

|

(Name of exchange on which registered) |

| n/a |

|

n/a |

Securities registered pursuant to section

12(g) of the Act:

(Title of Class)

Common Stock, par value $0.0001 per

share

Indicate by check mark whether the registrant

is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions

of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2

of the Exchange Act.

| Large accelerated filer |

¨ |

Accelerated filer |

¨ |

| |

|

|

|

| Non-accelerated filer |

¨ (Do not check if a smaller reporting company) |

Smaller reporting company |

x |

CHECKPOINT THERAPEUTICS, INC.

FORM 10

TABLE OF CONTENTS

SPECIAL CAUTIONARY NOTICE REGARDING FORWARD-LOOKING

STATEMENTS

Certain matters discussed in this registration

statement may constitute forward-looking statements for purposes of the Securities Act of 1933, as amended (the “Securities

Act”) and the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and involve known and unknown

risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different

from the future results, performance or achievements expressed or implied by such forward-looking statements. The words “anticipate,”

“believe,” “estimate,” “may,” “expect” and similar expressions are generally intended

to identify forward-looking statements. Our actual results may differ materially from the results anticipated in these forward-looking

statements due to a variety of factors, including, without limitation, those discussed under the captions “Risk Factors,”

and elsewhere in this registration statement. All written or oral forward-looking statements attributable to us are expressly qualified

in their entirety by these cautionary statements. Such forward-looking statements include, but are not limited to, statements about

our:

| |

· |

expectations for increases or decreases in expenses; |

| |

· |

expectations for the clinical and pre-clinical development, manufacturing, regulatory approval, and commercialization of our pharmaceutical product candidates or any other products we may acquire or in-license; |

| |

|

|

| |

· |

our use of clinical research centers and other contractors; |

| |

· |

expectations for incurring capital expenditures to expand our research and development and manufacturing capabilities; |

| |

· |

expectations for generating revenue or becoming profitable on a sustained basis; |

| |

· |

expectations or ability to enter into marketing and other partnership agreements; |

| |

· |

expectations or ability to enter into product acquisition and in-licensing transactions; |

| |

· |

expectations or ability to build our own commercial infrastructure to manufacture, market and sell our drug candidates; |

| |

· |

acceptance of our products by doctors, patients or payors; |

| |

· |

our ability to compete against other companies and research institutions; |

| |

· |

our ability to secure adequate protection for our intellectual property; |

| |

· |

our ability to attract and retain key personnel; |

| |

· |

availability of reimbursement for our products; |

| |

· |

estimates of the sufficiency of our existing cash and cash equivalents and investments to finance our operating requirements, including expectations regarding the value and liquidity of our investments; |

| |

· |

the volatility of our stock price; |

| |

· |

expectations for future capital requirements. |

The forward-looking statements contained

in this registration statement reflect our views and assumptions as of the effective date of this registration statement. Except

as required by law, we assume no responsibility for updating any forward-looking statements.

We qualify all of our forward-looking statements

by these cautionary statements.

References in this registration statement

to “Checkpoint Therapeutics,” “Checkpoint,” “our company,” “we,” “us”

and “our” refer to Checkpoint Therapeutics, Inc., a Delaware company.

Item 1: Business

OVERVIEW

We are an immuno-oncology

biopharmaceutical company focused on the acquisition, development and commercialization of novel, non-chemotherapy, immune-enhanced

combination treatments for patients with solid tumor cancers. We aim to acquire rights to these technologies by licensing the

rights or otherwise acquiring an ownership interest in the technologies, funding their research and development and eventually

either out-licensing or bringing the technologies to market. Currently we are developing a portfolio of fully human immuno-oncology

targeted antibodies generated in the laboratory of Dr. Wayne Marasco, MD, PhD, a professor in the Department of Cancer

Immunology and AIDS at the Dana-Farber Cancer Institute (“Dana-Farber”). The portfolio of antibodies we licensed

from Dana-Farber includes antibodies targeting programmed death-ligand 1 (“PD-L1”), glucocorticoid-induced TNFR related

protein (“GITR”) and carbonic anhydrase IX (“CAIX”) (together, the “Dana-Farber Antibodies”).

We plan to develop these novel immuno-oncology and checkpoint inhibitor antibodies on their own and in combination with each other,

as published literature suggests that combinations of these targets may work synergistically together. We expect to submit investigational

new drug (“IND”) applications for our anti-PD-L1, anti-GITR and anti-CAIX antibodies in 2017. We have also licensed

and are developing two oral targeted anti-cancer therapies, consisting of a small molecule inhibitor of poly (ADP-ribose) polymerase

(“PARP”) and a small molecule inhibitor of epidermal growth factor receptor (“EGFR”) mutations. We plan

to submit an IND application for our EGFR inhibitor, CK-101, in the first half of 2016, followed by the commencement of a Phase

1/2 clinical study. We are currently developing a clinical program for our PARP inhibitor, CK-102, which we expect to commence

in the next six to twelve months. Additionally, we will seek to add additional immuno-oncology drugs as well as other targeted

therapies to create wholly-owned proprietary combinations that leverage the immune system and other complimentary mechanisms.

To date, we have not received approval for the sale of any product candidate in any market and, therefore, have not generated

any product sales from any product candidates. In addition, we have incurred substantial operating losses since our inception,

and expect to continue to incur significant operating losses for the foreseeable future and may never become profitable. As of

March 31, 2016, we have an accumulated deficit of $14.5 million.

In December 2015,

we closed on gross proceeds of $57.8 million, before commissions and expenses, in a series of private placement financings. Net

proceeds from this offering were approximately $51.5 million. The financing involved the sale of Units, each consisting of 10,000

shares of common stock and a warrant exercisable for 2,500 shares of common stock at an exercise price of $7.00 per share, for

a purchase price of $50,000 per Unit. The warrants have a five year term and are only exercisable for cash. We expect to use the

net proceeds primarily for general corporate purposes, which may include financing our growth, developing new or existing product

candidates, and funding capital expenditures, acquisitions and investments. We currently anticipate that our cash balances at

March 31, 2016, are sufficient to fund our anticipated operating cash requirements for approximately the next 24 months.

We are a majority controlled

subsidiary of Fortress Biotech, Inc. (“Fortress”).

CORPORATE INFORMATION

Checkpoint Therapeutics,

Inc. was incorporated in Delaware on November 10, 2014. Our executive offices are located at 2 Gansevoort Street, 9th

Floor, New York, NY 10014. Our telephone number is (781) 652-4500 and our email address is ir@checkpointtx.com.

We are currently filing

for registration under this Form 10 under the Exchange Act and we are not subject to the reporting requirements of section 13(a)

or 15(d) of the Exchange Act.

PRODUCTS UNDER DEVELOPMENT

Immuno-Oncology Agents

Anti-PD-L1 Research Program

Our anti-PD-L1 monoclonal antibody is a

fully human antagonistic antibody designed to bind to PD-L1 and block its interaction with Programmed cell death protein 1 (“PD-1”).

Scientific literature indicates that PD-1 and its ligand PD-L1 are checkpoints of immune activation and play a very important role

in negative regulation of T-cell effector function and proliferation. Physiological interaction between these molecules inhibits

immune activation to prevent autoimmunity and to induce self-tolerance. Many different cancers take advantage of this pathway by

expressing PD-L1 and triggering negative signaling in PD-1 expressing tumor reactive T-cells thus blocking anti-tumor T-cell immune

response.

Numerous preclinical and clinical studies

of third party products have demonstrated that antibodies that block the interaction of PD-1 with its ligands, PD-L1 and PD-L2,

or those that block only the interaction of PD-L1 with PD-1 can augment anti-tumor T-cell responses and lead to complete and lasting

tumor eradication in a certain proportion of patients. Confirmed overall response rate (“ORR”) in the U.S. Food and

Drug Administration (“FDA”) labels for the approved PD-1 blocking antibodies was cited in the 20-30% range based on

clinical trials in patients with metastatic melanoma. Potent therapeutic anti-tumor responses due to blocking of PD-1/PD-L1 interaction

has been demonstrated by these approved products in patients with melanoma, renal cell carcinoma (“RCC”) and non-small

cell lung cancer (“NSCLC”).

We plan to

develop an anti-PD-L1 antibody for oncology indications, including, but not limited to, the treatment of patients with NSCLC

and RCC, indications where studies of other PD-1/PD-L1 antibodies have shown the potential to be effective. In March of 2015,

we entered into a Global Collaboration Agreement with TG Therapeutics, Inc. (“TGTX”) to develop and commercialize

anti-PD-L1 antibodies in the field of hematological malignancies. We retain the right to develop and commercialize anti-PD-L1

antibodies in solid tumors. We believe that an anti-PD-L1 antibody has the potential to be effective in many oncological

indications as a monotherapy or in combination with other anti-tumor immune response potentiating compounds and other

targeted therapies.

We licensed the

exclusive worldwide rights to anti-PD-L1 antibodies from Dana-Farber in March 2015. Currently, we are in preclinical development

for this program. In early 2016, we commenced chemistry, manufacturing and control (“CMC”) development activities,

which include the construction and testing of a production cell line, the development of a manufacturing process for production

of the antibody, as well as the development of suitable analytical methods to characterize the antibody. We plan to develop control

mechanisms to satisfy Good Manufacturing Practice (“GMP”) requirements and scale-up manufacturing in order to conduct

the required pharmacology and toxicology studies in the second half of 2016 to support a planned IND application filing in the

first half of 2017.

Anti-GITR Research Program

Our anti-GITR monoclonal antibody is a fully

human agonistic antibody that is designed to bind and trigger signaling in GITR expressing cells. Scientific literature indicates

that GITR is a co-stimulatory molecule of the TNF receptor family and is expressed on activated T cells, B cells, natural killer

(“NK”) and regulatory T cells (“Treg”). As a co-stimulatory molecule, GITR engagement increases proliferation,

activation, and cytokine production of CD4+ and CD8+ T cells. Our anti-GITR monoclonal antibody abrogates immunosuppressive

activity of natural Treg on expansion of T-effector cells. GITR-specific agonistic monoclonal antibodies under development by third

parties have been shown to induce tumor regression in vivo through the activation of CD4+ T cells, CD8+ T cells and NK cells in

a number of tumor models.

We plan to develop

an anti-GITR antibody for oncology indications, including, but not limited to, the treatment of patients with NSCLC and RCC, indications

where scientific literature supports the potential for an anti-GITR to be effective. In March of 2015, we entered into a Global

Collaboration Agreement with TGTX to develop and commercialize anti-GITR antibodies in the field of hematological malignancies.

We retain the right to develop and commercialize anti-GITR antibodies in solid tumors. We believe that an anti-GITR antibody has

the potential to be effective in many oncological indications as a monotherapy or in combination with anti-PD-L1 or anti-CAIX

as well as other anti-tumor immune response potentiating compounds and other targeted therapies.

We licensed the

exclusive worldwide rights to anti-GITR antibodies from Dana-Farber in March 2015. Currently, we are in preclinical development

for this program and are in the process of identifying and optimizing a lead anti-GITR antibody to select as a clinical candidate.

We plan to commence CMC development, pharmacology and toxicology activities on a lead anti-GITR antibody in the second half of

2016 in order to submit an IND application to the FDA in 2017.

Targeted Anti-Cancer Agents

CK-101 (formerly RX-518) EGFR Inhibitor

Program

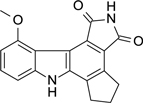

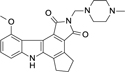

We are developing CK-101 as an oral, third

generation covalent inhibitor against selective mutations of EGFR. Activating mutations in the tyrosine kinase domain of

EGFR are found in approximately 20% of patients with advanced NSCLC. Compared to chemotherapy, first generation EGFR inhibitors

significantly improved ORR and progression free survival in previously untreated NSCLC patients carrying EGFR mutations.

However, tumor progression could develop due to resistance mutations, often within months of treatment with first generation EGFR

inhibitors.

The EGFR T790M “gatekeeper”

mutation is the most common resistant mutation found in patients treated with first generation EGFR inhibitors. The mutation

decreases the affinity of first generation inhibitors to EGFR kinase domain, rendering the drugs ineffective. Second generation

EGFR inhibitors have improved in vitro potency against the T790M mutation, but have not provided meaningful benefits

in NSCLC patients due to toxicity from the wildtype EGFR activities.

Third generation

EGFR inhibitors are designed to be highly selective against the T790M mutation while sparing wildtype EGFR, thereby improving

tolerability and safety profiles. Recently, in November 2015, TAGRISSO(TM) (osimertinib), a third generation EGFR tyrosine kinase

inhibitor ("TKI") developed by AstraZeneca that specifically targets the T790M mutation, received accelerated FDA approval

for the treatment of patients with metastatic EGFR T790M mutation-positive NSCLC who have progressed on or after EGFR TKI therapy.

The approval of TAGRISSO was based on an objective response rate of 59% in a pooled analysis of 411 patients in two single arm

trials. In addition, third generation TKIs, including CK-101, have shown potential activity, pre-clinically, against activating

EGFR mutations seen in first-line NSCLC patients such as L858R and del 19.

We plan to develop

CK-101 for the treatment of various advanced and metastatic solid tumor cancers, including, but not limited to, the treatment

of NSCLC patients carrying the susceptible EGFR mutations. These include the EGFR T790M mutation in second-line NSCLC patients

as well as the EGFR L858R and del 19 mutations in first-line NSCLC patients. We believe that CK-101 has the potential to

be effective in these oncological indications as a monotherapy or in combination with other anti-tumor immune response potentiating

compounds and other targeted therapies. Existing preclinical data from other programs support the combination of third generation

EGFR inhibitor with checkpoint inhibitors (PD-1 or PD-L1), cMET inhibitors, or MEK inhibitors.

In March 2015,

we entered into an exclusive license agreement with NeuPharma, Inc. (“NeuPharma”) to develop and commercialize novel

covalent third generation EGFR inhibitors on a worldwide basis outside of certain Asian countries. We have substantially

completed the CK-101 CMC development, and in-life portions of the pharmacology and toxicology programs required to file an IND

application with the FDA, including the 28-day repeat dose toxicity studies in rats and dogs conducted under Good Laboratory Practices.

In June 2016, following the manufacture of a GMP drug product batch, including one month stability data, we plan to submit an

IND application to the FDA, to be followed by the initiation of a Phase 1/2 clinical study in advanced solid tumor cancers.

CK-102 (formerly CEP-9722) PARP Inhibitor

Program

In December 2015, we obtained the exclusive

worldwide rights to develop and commercialize CK-102 (formerly CEP-9722) from Teva Pharmaceutical Industries Ltd., through its

subsidiary, Cephalon, Inc. CK-102 is an oral, small molecule selective inhibitor of PARP-1 and PARP-2 enzymes in early clinical

development for solid tumors.

PARP enzymes are involved in normal cellular

homeostasis, such as DNA transcription, cell cycle regulation, and DNA repair. DNA repair enzymes such as PARP, whose activity

and expression are up-regulated in tumor cells, are believed to contribute to resistance and dampen the effects of chemotherapy

and radiation. By inhibiting PARP, certain cancer cells may be rendered unable to repair single strand DNA breaks, which in turn

causes double strand DNA breaks and can lead to cancer cell death. Across multiple tumor types, including breast, ovarian and prostate

cancer, PARP inhibitors have shown promising activity as a monotherapy against tumors with existing DNA repair defects, such as

BRCA1 and BRCA2, and as a combination therapy when administered together with anti-cancer agents that induce DNA damage.

In November 2010,

the licensor of CK-102 submitted an IND application to the FDA for CK-102 for the treatment of patients with advanced or metastatic

solid tumors. Between 2009 and 2013, the licensor of CK-102 conducted three Phase 1 studies to evaluate the maximum tolerated

dose, safety, pharmacokinetics, and pharmacodynamics of CK-102, as a single agent and in combination with chemotherapy in patients

with advanced solid tumor cancers. Details of the studies are as follows:

| · | Study

1065, a first-in-human study of CK-102, was an open-label, non-randomized, dose-escalating

Phase 1 study to identify the maximum tolerated dose of CK-102 and to evaluate the safety,

pharmacokinetics, and pharmacodynamics of the combination treatment of CK-102 and temozolomide,

administered at 150 mg/m2/day, in patients with advanced solid tumors. The

study enrolled and dosed 26 patients at two sites in France and the United Kingdom. In

the study, the combination of oral CK-102 and oral temozolomide given on days 1 to 5

of 28-day cycles was determined to be adequately tolerated with no indication of potentiation

of the known toxicities of temozolomide. One patient with melanoma treated with CK-102

at 1000 mg/day demonstrated a confirmed partial response that lasted up to 5.8 months.

The patient did not progress on the study. In addition, four patients treated with CK-102

at 300 to 750 mg/day experienced stable disease for at least two months. A dose of CK-102

of 750 mg/day in combination with the standard dose of temozolomide of 150 mg/m2/day

was recommended as the regimen for further study. |

| · | Study

1092 was a dose-escalation, open-label, phase 1 study to identify the maximum tolerated

dose of CK-102 and to evaluate the safety, pharmacokinetics, and pharmacodynamics of

CK-102 in combination with gemcitabine and cisplatin in patients with advanced solid

tumors. In the study, conducted at three sites in France and Belgium, 18 patients were

enrolled and received at least one dose of CK-102. Gemcitabine was administered at 1250

mg/m2 intravenously on day 1 and day 8 of each 21-day cycle. Cisplatin was

administered at 75 mg/m2 intravenously on day 1 of each cycle, after the infusion

of gemcitabine. The study was stopped before reaching its objective of determining the

maximum tolerated dose of CK-102 when given in combination with cisplatin and gemcitabine

due to the limited tolerability of the cisplatin and gemcitabine regimen and the variable

exposure to the active moiety of CK-102 during the study. |

| · | Study

2051 was a Phase 1, multicenter, open-label study to determine the maximum tolerated

dose of CK-102 when administered as a single-agent in patients with advanced or metastatic

solid tumors. In the study, conducted at four sites in the United States, 44 patients

were enrolled and received at least one dose of CK-102. Though twelve patients had stable

disease in the study, the variable systemic exposure to the active moiety of CK-102 within

each cohort precluded any definitive efficacy conclusions. A dose of 750 mg administered

twice daily was determined to be the maximum tolerated dose for CK-102 administered as

a single agent. |

We plan to develop

CK-102 as both a monotherapy and in combination with other anti-cancer agents, including our novel immuno-oncology and checkpoint

inhibitor antibodies currently in development. Currently, the transfer of ownership of the CK-102 active IND is in process, and

the transfer to us should be completed in the second quarter of 2016. Due to the variable systemic exposure of the active moiety

of CK-102 in the prior Phase 1 studies, we plan to evaluate a reformulation of the CK-102 drug product to improve its bioavailability,

following which, we plan to commence a Phase 1b clinical study in advanced or metastatic solid tumors with existing DNA repair

defects, such as BRCA1 and BRCA2.

Anti-CAIX Research Program

Our Anti-CAIX is a fully human pre-clinical

antibody designed to recognize CAIX expressing cells and kill them via antibody-dependent cell-mediated cytotoxicity (“ADCC”)

and complement-dependent cytotoxicity (“CDC”). Scientific literature indicates that CAIX is a well characterized tumor

associated antigen (“TAA”) with expression almost exclusively limited to the cells of RCC. More than 85% of RCC cases

have been demonstrated to express high levels of CAIX expression. There is a very limited expression of this antigen on healthy

tissue which limits reactivity of this antibody against healthy tissues.

In 2015, pre-clinical

data were published in the peer-reviewed journal, Molecular Cancer, that demonstrated that our anti-CAIX antibodies are able to

trigger killing of CAIX-positive human RCC cell lines in tissue culture via ADCC and CDC. The killing activity correlated positively

with the level of CAIX expression on RCC tumor cell lines. In addition, the study demonstrated that our anti-CAIX antibodies inhibited

growth of CAIX-positive tumors in a mouse xenograft model as well as led to the activation of T-cells and NK cells.

We plan to develop an anti-CAIX antibody

for the treatment of patients with RCC in combination with an anti-PD-L1 and/or anti-GITR antibody as well as other anti-tumor

immune response potentiating compounds and/or targeted therapies.

We licensed the

exclusive worldwide rights to anti-CAIX antibodies from Dana-Farber in March 2015. Currently, we are in preclinical development

for this program and are in the process of identifying and optimizing a lead anti-CAIX antibody to select as a clinical candidate.

We plan to commence CMC development, pharmacology and toxicology activities in the second half of 2016 in order to submit an IND

application to the FDA in 2017.

COSTS AND TIME TO COMPLETE PRODUCT DEVELOPMENT

The information below provides estimates

regarding the costs associated with the completion of the current development phase and our current estimated range of the time

that will be necessary to complete that development phase for our product candidates. For a description of the risk factors that

could significantly affect our ability to meet these cost and time estimates, see Item 1A of this registration statement.

| Product Candidate | |

Target Indication | |

Development

Status | |

| Completion

of Phase | | |

Estimated

Cost to

Complete Phase |

| Immuno-Oncology Agents | |

| |

| |

| | | |

|

| Anti-PD-L1 | |

Multiple Forms of Cancer | |

Preclinical | |

| 1H

2017 | | |

$4 to $6 million |

| Anti-GITR | |

Multiple Forms of Cancer | |

Preclinical | |

| 2017 | | |

$4 to $6 million |

| | |

| |

| |

| | | |

|

| Targeted Anti-Cancer Agents | |

| |

| |

| | | |

|

| CK-101 | |

Lung Cancer | |

Preclinical | |

| 1H 2016 | | |

$1 to $3 million |

| CK-102 | |

Multiple Forms of Cancer | |

IND transfer in-process / Phase 1b study planned

| |

| 2017 | | |

$2 to $4 million |

| Anti-CAIX | |

Renal Cell Carcinoma | |

Preclinical | |

| 2017 | | |

$4 to $6 million |

Completion

dates and costs in the above table are estimates due to the uncertainties associated with pre-clinical testing and clinical trials

and the related requirements of development. In the cases where the requirements for pre-clinical testing and clinical trials and

development programs have not been fully defined, or are dependent on the success of other trials, we cannot estimate trial completion

or cost with any certainty. The actual spending on each trial during the year is also dependent on funding.

INTELLECTUAL PROPERTY AND PATENTS

General

Our goal is to obtain, maintain and enforce

patent protection for our products, formulations, processes, methods and other proprietary technologies, preserve our trade secrets,

and operate without infringing on the proprietary rights of other parties, both in the United States and in other countries.

Our policy is to actively seek to obtain, where appropriate, the broad intellectual property protection for our product candidates,

proprietary information and proprietary technology through a combination of contractual arrangements and patents, both in the U.S.

and elsewhere in the world.

We also depend upon the skills, knowledge

and experience of our scientific and technical personnel, as well as that of our advisors, consultants and other contractors (“know-how”).

To help protect our proprietary know-how which is not patentable, and for inventions for which patents may be difficult to enforce,

we rely on trade secret protection and confidentiality agreements to protect our interests. To this end, we require all employees,

consultants, advisors and other contractors to enter into confidentiality agreements which prohibit the disclosure of confidential

information and, where applicable, require disclosure and assignment to us of the ideas, developments, discoveries and inventions

important to our business.

Patents and other proprietary rights are

crucial to the development of our business. We will be able to protect our proprietary technologies from unauthorized use by third

parties only to the extent that our proprietary rights are covered by valid and enforceable patents, supported by regulatory exclusivity

or are effectively maintained as trade secrets. We have a few patents and patent applications related to our compounds and other

technology, but we cannot guarantee the scope of protection of the issued patents, or that such patents will survive a validity

or enforceability challenge, or that any of the pending patent applications will issue as patents.

Generally, patent applications in the U.S.

are maintained in secrecy for a period of 18 months or more. The patent positions of biotechnology and pharmaceutical companies

are highly uncertain and involve complex legal and factual questions. Therefore, we cannot predict the breadth of claims allowed

in biotechnology and pharmaceutical patents, or their enforceability. To date, there has been no consistent policy regarding the

breadth of claims allowed in biotechnology patents. Third parties or competitors may challenge or circumvent our patents or patent

applications, if issued. If our competitors prepare and file patent applications in the U.S. that claim technology also claimed

by us, we may have to participate in interference proceedings declared by the U.S. Patent and Trademark Office to determine priority

of invention, which could result in substantial cost, even if the eventual outcome is favorable to us. Because of the extensive

time required for development, testing and regulatory review of a potential product, it is possible that before we commercialize

any of our products, any related patent may expire or remain in existence for only a short period following commercialization,

thus reducing any advantage of the patent. However, the life of a patent covering a product that has been subject to regulatory

approval may have the ability be extended through the patent restoration program, although any such extension could still be minimal.

If a patent is issued to a third party containing

one or more preclusive or conflicting claims, and those claims are ultimately determined to be valid and enforceable, we may be

required to obtain a license under such patent or to develop or obtain alternative technology. In the event of litigation involving

a third party claim, an adverse outcome in the litigation could subject us to significant liabilities to such third party, require

us to seek a license for the disputed rights from such third party, and/or require us to cease use of the technology. Further,

our breach of an existing license or failure to obtain a license to technology required to commercialize our products may seriously

harm our business. We also may need to commence litigation to enforce any patents issued to us or to determine the scope and validity

of third-party proprietary rights. Litigation would involve substantial costs.

We in-licensed

in March 2015 intellectual property related to certain antibodies from Dana-Farber. The intellectual property includes issued

patents in a number of countries, including the United States and Europe, as well as pending patent applications in several countries

elsewhere. The issued patents and pending patent applications relate generally to compositions and methods of treatment

involving antibodies against CAIX, PD-L1 and GITR. In particular, we have exclusive rights under U.S. Patent No. 8,466,263,

directed to CAIX antibodies, which is scheduled to expire no earlier than July 2029. Its European counterpart is in force

in Switzerland, Liechtenstein, Germany, France and the United Kingdom. A Canadian counterpart patent has also issued.

Both the European and Canadian counterpart patents, as well as any pending applications outside the United States, are scheduled

to expire no sooner than December 2026. The PD-L1 segment of the portfolio includes patent applications pending in the United

States, Australia, Canada, Europe, Israel and Korea. Any patents maturing from these pending applications will expire no

sooner than October 2033. The GITR segment of the portfolio includes an International Application No. PCT/US2015/054010,

filed in October 2015. Any national stage applications, which are pursued off of this international application (including one

in the United States Patent and Trademark Office), would expire no earlier than October 2035.

In March

2015, we in-licensed intellectual property from NeuPharma, which is directed to technology involving small molecules that are

inhibitors of EGFR and kinase mutants. EGFR is a receptor tyrosine kinase of the ErbB family and is also known as “Her1”

and “ErbB1.” The in-licensed patent estate includes an international application and a pending U.S. non-provisional

application. In February 2016, we filed separate national stage applications in the relevant territories worldwide. Any

patents maturing from this patent estate are expected to expire no sooner than August 2034.

In December 2015, we in-licensed intellectual

property from Teva Pharmaceutical Industries Ltd., through its subsidiary, Cephalon. Under the terms of the license agreement,

Cephalon granted us exclusive, worldwide rights under Cephalon’s patents and know-how covering small molecule inhibitors

of PARP, an enzyme important to a cell’s ability to repair DNA. Cephalon’s patents include four patent families covering

certain compounds and pharmaceutical compositions, including claims to the compound, certain salts, and crystalline polymorphs

of the pro-drug, CK-102, processes for preparing same, pharmaceutical compositions of same and certain methods of inhibition or

prevention associated with certain indications. Cephalon’s patents include three granted United States patents, which are

scheduled to expire as early as January 2023 and as late as September 2030. Foreign counterparts included in each patent family

exist in numerous jurisdictions around the world having expected expiration dates ranging from May 2021 to June 2027 (November

2027 for certain methods of sensitizing tumors), August 2030 for claims directed to novel polymorphs and November 2035 for certain

salts of CK-102.

Other Intellectual Property Rights

We depend upon trademarks, trade secrets,

know-how and continuing technological advances to develop and maintain our competitive position. To maintain the confidentiality

of trade secrets and proprietary information, we require our employees, scientific advisors, consultants and collaborators, upon

commencement of a relationship with us, to execute confidentiality agreements and, in the case of parties other than our research

and development collaborators, to agree to assign their inventions to us. These agreements are designed to protect our proprietary

information and to grant us ownership of technologies that are developed in connection with their relationship with us. These agreements

may not, however, provide protection for our trade secrets in the event of unauthorized disclosure of such information.

In addition to patent protection, we may

utilize orphan drug regulations or other provisions of the Food, Drug and Cosmetic Act of 1938, as amended, or FDCA, to provide

market exclusivity for certain of our product candidates. Orphan drug regulations provide incentives to pharmaceutical and biotechnology

companies to develop and manufacture drugs for the treatment of rare diseases, currently defined as diseases that exist in fewer

than 200,000 individuals in the U.S., or, diseases that affect more than 200,000 individuals in the U.S. but that the sponsor does

not realistically anticipate will generate a net profit. Under these provisions, a manufacturer of a designated orphan-drug can

seek tax benefits, and the holder of the first FDA approval of a designated orphan product will be granted a seven-year period

of marketing exclusivity for such FDA-approved orphan product.

LICENSING AGREEMENTS AND COLLABORATIONS

Dana-Farber Cancer Institute, Inc.

On March 2, 2015,

we entered into a License Agreement with Dana-Farber Cancer Institute, Inc., and on October 5, 2015, we entered into a First Amendment

to the License Agreement, whereby we obtained an exclusive, worldwide license to Dana-Farber’s patents for the Dana-Farber

Antibodies. The field of use license includes all prophylactic, therapeutic or diagnostic uses in humans or animals excluding

use in chimeric antigen receptor technology. The Dana- Farber Antibodies were generated in the laboratory of Dr. Wayne Marasco,

MD, PhD, a Professor in the Department of Cancer Immunology and AIDS at Dana-Farber. Under the terms of the agreement, we paid

Dana-Farber an up-front licensing fee of $1.0 million and granted Dana-Farber five percent of our common stock on a fully-diluted

basis, equal to 500,000 shares valued at $32,500. The agreement included an anti-dilution clause that maintained Dana-Farber’s

ownership at 5% until such time that we raised $10 million in cash in exchange for common shares. Pursuant to this provision,

on September 30, 2015, we granted to Dana-Farber an additional 136,830 shares of common stock valued at approximately $0.6 million

and the anti-dilution clause thereafter expired. Dana-Farber is eligible to receive payments of up to an aggregate of approximately

$21.5 million for each licensed product upon our successful achievement of certain clinical development, regulatory and first

commercial sale milestones. In addition, Dana-Farber is eligible to receive up to an aggregate of $60.0 million upon our successful

achievement of certain sales milestones based on aggregate net sales, in addition to royalty payments based on a tiered low to

mid-single digit percentage of net sales. Following the second anniversary of the effective date of the agreement, Dana-Farber

will receive an annual license maintenance fee, which is creditable against milestone payments or royalties due Dana-Farber. The

license will terminate on a country-by-country and product-by-product basis until the royalty term in such country with respect

to such product expires, at which time this Agreement shall expire in its entirety with respect to such Licensed Product in such

country. The royalty term, on a product-by-product and country-by-country basis, is the later of (i) ten years after first

commercial sale of a given product in such country, or (ii) the expiration of the last-to-expire Dana-Farber patent containing

a valid claim to the product in such country. To date, we have incurred $1.0 million of upfront licensing and milestone payments

under the License Agreement.

NeuPharma, Inc.

On March 17, 2015,

Fortress entered into a License Agreement with NeuPharma, which agreement was assigned to us by Fortress on the same date, whereby

we obtained an exclusive, worldwide license, other than certain Asian countries, to NeuPharma’s patents to a library of

EGFR inhibitors. Under the terms of the agreement, we paid NeuPharma an up-front licensing fee of $1.0 million, and NeuPharma

is eligible to receive payments of up to an aggregate of approximately $40.0 million per licensed product upon our successful

achievement of certain clinical development and regulatory milestones in up to three indications, of which $22.5 million are due

upon various regulatory approvals to commercialize the products. In addition, NeuPharma is eligible to receive payments of up

to an aggregate of $40.0 million upon our successful achievement of certain sales milestones based on aggregate net sales, in

addition to royalty payments based on a tiered mid to high-single digit percentage of net sales. The license will terminate on

a product-by-product and country-by-country basis upon the expiration of the last licensed patent right, unless the agreement

is earlier terminated. To date, we have incurred $1.0 million of upfront licensing and milestone payments under the License Agreement.

The license will

terminate on a country-by-country and product-by-product basis until the royalty term in such country with respect to such product

expires, at which time this Agreement shall expire in its entirety with respect to such Licensed Product in such country. The

royalty term, on a product-by-product and country-by-country basis, is the later of (i) ten years after first commercial sale

of a given product in such country, or (ii) the expiration of the last-to-expire NeuPharma patent containing a valid claim to

the product in such country.

In connection with

the license agreement with Neupharma, we entered into a Sponsored Research Agreement with NeuPharma for certain research and development

activities. Effective January 11, 2016, TGTX agreed to assume all costs associated with this Sponsored Research Agreement and

reimbursed the Company for all amounts paid previously by the Company. Accordingly, TGTX reimbursed us $260,000 in the three

months ended March 31, 2016.

Teva Pharmaceutical

Industries Ltd. (through its subsidiary, Cephalon, Inc.)

On December 18,

2015, Fortress entered into a License Agreement with Teva Pharmaceutical Industries Ltd. through its subsidiary, Cephalon, Inc.

(“Cephalon”), which agreement was assigned to us by Fortress on the same date, whereby we obtained an exclusive, worldwide

license to Cephalon’s patents relating to CEP-8983 and its small molecule prodrug, CEP-9722, which we now refer to as CK-102.

Under the terms of the agreement, we paid Cephalon an up-front licensing fee of $0.5 million, and Cephalon is eligible to receive

milestone payments of up to an aggregate of approximately $220.0 million upon our successful achievement of certain clinical development,

regulatory approval and product sales milestones, of which approximately $206.5 million are due on or following regulatory approvals

to commercialize the product. In addition, Cephalon is eligible to receive royalty payments based on a tiered low double digit

percentage of net sales. The license will terminate on a product-by-product and country-by-country basis upon the later of (i)

expiration of the last licensed patent right, (ii) the end of any regulatory exclusivity period, or (iii) a specified number of

years after first commercial sale of a product; in each case unless the agreement is earlier terminated. To date, we have incurred

$0.5 million of upfront licensing and milestone payments under the License Agreement.

Collaboration Agreement and Option

Agreement with TGTX

In connection with the License Agreement

with Dana-Farber, on March 3, 2015, we entered into a Global Collaboration Agreement with TGTX to develop and commercialize the

Anti-PD-L1 and Anti-GITR antibody research programs in the field of hematological malignancies. We retain the right to develop

and commercialize these antibodies in solid tumors. Both programs are currently in pre-clinical development. Under the terms of

the Global Collaboration Agreement, TGTX paid us $500,000, representing a reimbursement for their share of the licensing fee, and

we are eligible to receive up to an aggregate of approximately $21.5 million for each product upon TGTX’s successful achievement

of certain clinical development, regulatory and first commercial sale milestones. In addition, we are eligible to receive up to

an aggregate of $60.0 million upon TGTX’s successful achievement of certain sales milestones based on aggregate net sales,

in addition to royalty payments based on a tiered high single digit percentage of net sales. Following the second anniversary of

the effective date of the agreement, we will receive an annual license maintenance fee, which is creditable against milestone payments

or royalties due to us. The Global Collaboration Agreement will terminate on a product-by-product and country-by-country basis

upon the expiration of the last licensed patent right, unless the agreement is earlier terminated.

In connection with

the License Agreement with NeuPharma, Inc., on March 17, 2015, Fortress entered into an Option Agreement with TGTX, which was

assigned to us on the same date, granting TGTX the right, but not the obligation to enter into a global collaboration to develop

and commercialize NeuPharma’s patents to a library of EGFR inhibitors in the field of hematological malignancies. We would

retain the right to develop and commercialize the EGFR inhibitors in solid tumors. Under the terms of the Option Agreement, TGTX

paid us $25,000, representing consideration for granting the option. If the option is exercised, we are eligible to receive up

to an aggregate of approximately $14.5 million upon TGTX’s successful achievement of certain clinical development and regulatory

milestones under a collaboration agreement. In addition, we are eligible to receive up to an aggregate of $40.0 million upon TGTX’s

successful achievement of certain sales milestones based on aggregate net sales by TGTX, in addition to royalty payments based

on a tiered mid to high-single digit percentage of net sales by TGTX. The Option Agreement will expire on July 17, 2016, unless

both parties agree to extend the option period.

COMPETITION

Competition in the

pharmaceutical and biotechnology industries is intense. Our competitors include pharmaceutical companies and biotechnology companies,

as well as universities and public and private research institutions. In addition, companies that are active in different but related

fields represent substantial competition for us. Many of our competitors have significantly greater capital resources, larger research

and development staffs and facilities and greater experience in drug development, regulation, manufacturing and marketing than

we do. These organizations also compete with us to recruit qualified personnel, attract partners for joint ventures or other collaborations,

and license technologies that are competitive with ours. To compete successfully in this industry we must identify novel and unique

drugs or methods of treatment and then complete the development of those drugs as treatments in advance of our competitors.

The drugs that we are

attempting to develop will have to compete with existing therapies. In addition, a large number of companies are pursuing the development

of pharmaceuticals that target the same conditions that we are targeting. Other companies have products or product candidates in

various stages of pre-clinical or clinical development, or with marketing approvals, to treat conditions for which we are also

seeking to discover and develop product candidates. Some of these potential competing drugs are further advanced in development

than our product candidates and may be commercialized earlier.

In the Immuno-Oncology

area, almost every major pharmaceutical company has a PD-1 and/or PD-L1 in clinical development or on the market, including, without

limitation, Merck & Co. (approved drug PD-1 with the brand name Keytruda®), Bristol-Myers Squibb (approved PD-1 with the

brand name (Opdivo®), Astra-Zeneca/Celgene and Pfizer/Merck KGA. We are aware of several anti-GITR antibody development programs

in pre-clinical or early clinical studies, including by Merck & Co. and GITR, Inc., and an anti-CAIX antibody in past clinical

studies by Wilex AG.

In the targeted anti-cancer

agent area, there are several companies with marketing approvals or in late stage development with EGFR and PARP inhibitors that

are targeting mutations similar to our programs. Tarceva®, Iressa® and Gilotrif® are

currently approved drugs for the treatment of first-line EGFR-mutant NSCLC. In November 2015, AstraZeneca’s TagrissoTM

(formerly AZD9291) was approved by the FDA for the treatment of patients with metastatic EGFR T790M mutation-positive NSCLC who

have progressed on or after EGFR tyrosine kinase inhibitor therapy. In addition, we are aware of a number of products in development

targeting cancer-causing mutant forms of EGFR for the treatment of NSCLC patients, including Clovis Oncology’s rociletinib

(formerly CO-1686) which has a new drug application under review by the FDA, Pfizer’s PF-299804 (dacomitinib), Astellas Pharma’s

ASP8273, Novartis’ EGF816, Hanmi Pharmaceutical’s HM61713 and HM781-36B (Poziotinib), and Acea Bio (Hangzhou)’s

avitinib.

In the PARP inhibitor

space, in late 2014, AstraZeneca’s Lynparza™ (olaparib) was approved in the U.S. as monotherapy in patients with germline

BRCA mutated advanced ovarian cancer who have been treated with three or more prior lines of chemotherapy and in the EU for the

maintenance treatment of BRCA mutated platinum-sensitive relapsed serous ovarian cancer. There are a number of other PARP inhibitors

in late-stage clinical development including Clovis Oncology’s rucaparib, AbbVie’s ABT-888 (veliparib), Tesaro, Inc’s

niraparib, Eisai’s E-7016, and Biomarin’s BMN-673 (talazoparib).

Additional information can be found under

Item 1A - Risk Factors – Other Risks Related to Our Business.

EMPLOYEES

As of the date of this registration statement,

we have two full-time employees, including our Chief Executive Officer, and two part-time employees.

SUPPLY AND MANUFACTURING

We have limited experience in manufacturing

products for clinical or commercial purposes. We currently do not have any manufacturing capabilities. We have established, or

intend to establish, contract manufacturing relationships for the preliminary supplies of our product candidates, in each case

with a single manufacturer. As with any supply program, obtaining raw materials of the correct quality cannot be guaranteed and

we cannot ensure that we will be successful in this endeavor.

At the time of commercial sale, to the extent

possible and commercially practicable, we would seek to engage a back-up supplier for each of our product candidates. Until such

time, we expect that we will rely on a single contract manufacturer to produce each of our product candidates under current Good

Manufacturing Practice (“cGMP”) regulations. Our third-party manufacturers have a limited number of facilities in which

our product candidates can be produced and will have limited experience in manufacturing our product candidates in quantities sufficient

for commercialization. Our third-party manufacturers will have other clients and may have other priorities that could affect their

ability to perform the work satisfactorily and/or on a timely basis. Both of these occurrences would be beyond our control.

We expect to similarly rely on contract

manufacturing relationships for any products that we may in-license or acquire in the future. However, there can be no assurance

that we will be able to successfully contract with such manufacturers on terms acceptable to us, or at all.

Contract manufacturers are subject to ongoing

periodic and unannounced inspections by the FDA, the Drug Enforcement Administration and corresponding state agencies to ensure

strict compliance with cGMP and other state and federal regulations. Our contractors, if any, in Europe face similar challenges

from the numerous European Union and member state regulatory agencies and authorized bodies. We do not have control over third-party

manufacturers’ compliance with these regulations and standards, other than through contractual obligations. If they are deemed

out of compliance with cGMPs, product recalls could result, inventory could be destroyed, production could be stopped and supplies

could be delayed or otherwise disrupted.

If we need to change manufacturers after

commercialization, the FDA and corresponding foreign regulatory agencies must approve these new manufacturers in advance, which

will involve testing and additional inspections to ensure compliance with FDA regulations and standards and may require significant

lead times and delay. Furthermore, switching manufacturers may be difficult because the number of potential manufacturers is limited.

It may be difficult or impossible for us to find a replacement manufacturer quickly or on terms acceptable to us, or at all.

GOVERNMENT AND INDUSTRY REGULATIONS

Numerous governmental authorities, principally

the FDA and corresponding state and foreign regulatory agencies, impose substantial regulations upon the clinical development,

manufacture and marketing of our product candidates, as well as our ongoing research and development activities. None of our product

candidates have been approved for sale in any market in which we have marketing rights. Before marketing in the U.S., any drug

that we develop must undergo rigorous pre-clinical testing and clinical trials and an extensive regulatory approval process implemented

by the FDA under the FDCA. The FDA regulates, among other things, the pre-clinical and clinical testing, safety, efficacy, approval,

manufacturing, record keeping, adverse event reporting, packaging, labeling, storage, advertising, promotion, export, sale and

distribution of biopharmaceutical products.

The regulatory review and approval process

is lengthy, expensive and uncertain. We are required to submit extensive pre-clinical and clinical data and supporting information

to the FDA for each indication or use to establish a product candidate’s safety and efficacy before we can secure FDA approval

to market or sell a product in the U.S. The approval process takes many years, requires the expenditure of substantial resources

and may involve ongoing requirements for post-marketing studies or surveillance. Before commencing clinical trials in humans, we

must submit an IND to the FDA containing, among other things, pre-clinical data, chemistry, manufacturing and control information,

and an investigative plan. Our submission of an IND may not result in FDA authorization to commence a clinical trial.

The FDA may permit expedited development,

evaluation, and marketing of new therapies intended to treat persons with serious or life-threatening conditions for which there

is an unmet medical need under its fast track drug development programs. A sponsor can apply for fast track designation at the

time of submission of an IND, or at any time prior to receiving marketing approval of the new drug application (“NDA”).

To receive fast track designation, an applicant must demonstrate:

| · | that the drug is intended to treat a serious or life-threatening

condition; |

| · | that the drug is intended to treat a serious aspect of

the condition; and |

| · | that the drug has the potential to address unmet medical

needs, and this potential is being evaluated in the planned drug development program. |

The FDA must respond to a request for fast

track designation within 60 calendar days of receipt of the request. Over the course of drug development, a product in a fast track

development program must continue to meet the criteria for fast track designation. Sponsors of products in fast track drug development

programs must be in regular contact with the reviewing division of the FDA to ensure that the evidence necessary to support marketing

approval will be developed and presented in a format conducive to an efficient review. Sponsors of products in fast track drug

development programs ordinarily are eligible for priority review of a completed application in six months or less and also may

be permitted to submit portions of an NDA to the FDA for review before the complete application is submitted.

Sponsors of drugs designated as fast track

also may seek approval under the FDA’s accelerated approval regulations. Under this authority, the FDA may grant marketing

approval for a new drug product on the basis of adequate and well-controlled clinical trials establishing that the drug product

has an effect on a surrogate endpoint that is reasonably likely, based on epidemiologic, therapeutic, pathophysiologic, or other

evidence, to predict clinical benefit or on the basis of an effect on a clinical endpoint other than survival or irreversible morbidity.

Approval will be subject to the requirement that the applicant study the drug further to verify and describe its clinical

benefit where there is uncertainty as to the relation of the surrogate endpoint to clinical benefit or uncertainty as to the relation

of the observed clinical benefit to ultimate outcome. Post-marketing studies are usually underway at the time an applicant

files the NDA. When required to be conducted, such post-marketing studies must also be adequate and well-controlled.

The applicant must carry out any such post-marketing studies with due diligence. Many companies who have been granted the right

to utilize an accelerated approval approach have failed to obtain approval. Moreover, negative or inconclusive results from the

clinical trials we hope to conduct or adverse medical events could cause us to have to repeat or terminate the clinical trials.

Accordingly, we may not be able to complete the clinical trials within an acceptable time frame, if at all, and, therefore, could

not submit the NDA to the FDA or foreign regulatory authorities for marketing approval.

Clinical testing must meet requirements

for institutional review board oversight, informed consent and good clinical practices, and must be conducted pursuant to an IND,

unless exempted.

For purposes of NDA approval, clinical trials

are typically conducted in the following sequential phases:

| · | Phase 1: The drug is administered to a small group

of humans, either healthy volunteers or patients, to test for safety, dosage tolerance, absorption, metabolism, excretion and

clinical pharmacology. |

| · | Phase 2: Studies are conducted on a larger number

of patients to assess the efficacy of the product, to ascertain dose tolerance and the optimal dose range, and to gather additional

data relating to safety and potential adverse events. |

| · | Phase 3: Studies establish safety and efficacy in

an expanded patient population. |

| · | Phase 4: The FDA may require Phase 4 post-marketing

studies to find out more about the drug’s long-term risks, benefits, and optimal use, or to test the drug in different populations. |

The length of time necessary to complete

clinical trials varies significantly and may be difficult to predict. Clinical results are frequently susceptible to varying interpretations

that may delay, limit or prevent regulatory approvals. Additional factors that can cause delay or termination of our clinical trials,

or that may increase the costs of these trials, include:

| · | slow patient enrollment due to the nature of the clinical

trial plan, the proximity of patients to clinical sites, the eligibility criteria for participation in the study or other factors; |

| · | inadequately trained or insufficient personnel at the study

site to assist in overseeing and monitoring clinical trials or delays in approvals from a study site’s review board; |

| · | longer treatment time required to demonstrate efficacy

or determine the appropriate product dose; |

| · | insufficient supply of the product candidates; |

| · | adverse medical events or side effects in treated patients;

and |

| · | ineffectiveness of the product candidates. |

In addition, the FDA, equivalent foreign

regulatory authority, or a data safety monitoring committee for a trial may place a clinical trial on hold or terminate it if it

concludes that subjects are being exposed to an unacceptable health risk, or for futility. Any drug is likely to produce some toxicity

or undesirable side effects in animals and in humans when administered at sufficiently high doses and/or for a sufficiently long

period of time. Unacceptable toxicity or side effects may occur at any dose level at any time in the course of studies in animals

designed to identify unacceptable effects of a product candidate, known as toxicological studies, or clinical trials of product

candidates. The appearance of any unacceptable toxicity or side effect could cause us or regulatory authorities to interrupt, limit,

delay or abort the development of any of our product candidates and could ultimately prevent approval by the FDA or foreign regulatory

authorities for any or all targeted indications.

Sponsors of drugs may apply for a special

protocol assessment (“SPA”) from the FDA. The SPA process is a procedure by which the FDA provides official evaluation

and written guidance on the design and size of proposed protocols that are intended to form the basis for a new drug application.

However, final marketing approval depends on the results of efficacy, the adverse event profile and an evaluation of the benefit/risk

of treatment demonstrated in the Phase 3 trial. The SPA agreement may only be changed through a written agreement between the sponsor

and the FDA, or if the FDA becomes aware of a substantial scientific issue essential to product safety or efficacy.

Before receiving FDA approval to market

a product, we must demonstrate that the product is safe and effective for its intended use by submitting to the FDA an NDA containing

the pre-clinical and clinical data that have been accumulated, together with chemistry and manufacturing and controls specifications

and information, and proposed labeling, among other things. The FDA may refuse to accept an NDA for filing if certain content criteria

are not met and, even after accepting an NDA, the FDA may often require additional information, including clinical data, before

approval of marketing a product.

It is also becoming more common for the

FDA to request a Risk Evaluation and Mitigation Strategy, or REMS, as part of a NDA. The REMS plan contains post-market obligations

of the sponsor to train prescribing physicians, monitor off-label drug use, and conduct sufficient Phase 4 follow-up studies and

registries to ensure the continued safe use of the drug.

As part of the approval process, the FDA

must inspect and approve each manufacturing facility. Among the conditions of approval is the requirement that a manufacturer’s

quality control and manufacturing procedures conform to cGMP. Manufacturers must expend significant time, money and effort to ensure

continued compliance, and the FDA conducts periodic inspections to certify compliance. It may be difficult for our manufacturers

or us to comply with the applicable cGMP, as interpreted by the FDA, and other FDA regulatory requirements. If we, or our contract

manufacturers, fail to comply, then the FDA may not allow us to market products that have been affected by the failure.

If the FDA grants approval, the approval

will be limited to those conditions and patient populations for which the product is safe and effective, as demonstrated through

clinical studies. Further, a product may be marketed only in those dosage forms and for those indications approved in the NDA.

Certain changes to an approved NDA, including, with certain exceptions, any significant changes to labeling, require approval of

a supplemental application before the drug may be marketed as changed. Any products that we manufacture or distribute pursuant

to FDA approvals are subject to continuing monitoring and regulation by the FDA, including compliance with cGMP and the reporting

of adverse experiences with the drugs. The nature of marketing claims that the FDA will permit us to make in the labeling and advertising

of our products will generally be limited to those specified in FDA approved labeling, and the advertising of our products will

be subject to comprehensive monitoring and regulation by the FDA. Drugs whose review was accelerated may carry additional restrictions

on marketing activities, including the requirement that all promotional materials are pre-submitted to the FDA. Claims exceeding

those contained in approved labeling will constitute a violation of the FDCA. Violations of the FDCA or regulatory requirements

at any time during the product development process, approval process, or marketing and sale following approval may result in agency

enforcement actions, including withdrawal of approval, recall, seizure of products, warning letters, injunctions, fines and/or

civil or criminal penalties. Any agency enforcement action could have a material adverse effect on our business.

Failure to comply with applicable federal,

state and foreign laws and regulations would likely have a material adverse effect on our business. In addition, federal, state

and foreign laws and regulations regarding the manufacture and sale of new drugs are subject to future changes.

Other Healthcare Laws and Compliance

Requirements

In the United States,

our activities are potentially subject to regulation by various federal, state and local authorities in addition to the FDA, including

the Centers for Medicare and Medicaid Services (formerly the Health Care Financing Administration), other divisions of the United

States Department of Health and Human Services (e.g., the Office of Inspector General), the United States Department of Justice

and individual United States Attorney offices within the Department of Justice, and state and local governments.

Pharmaceutical Coverage, Pricing and

Reimbursement

In the United States

and markets in other countries, sales of any products for which we receive regulatory approval for commercial sale will depend

in part on the availability of reimbursement from third-party payors, including government health administrative authorities, managed

care providers, private health insurers and other organizations. Third-party payors are increasingly examining the medical necessity

and cost-effectiveness of medical products and services, in addition to their safety and efficacy, and, accordingly, significant

uncertainty exists as to the reimbursement status of newly approved therapeutics. Adequate third party reimbursement may not be

available for our products to enable us realize an appropriate return on our investment in research and product development. We

are unable to predict the future course of federal or state health care legislation and regulations, including regulations that

will be issued to implement provisions of the health care reform legislation enacted in 2010, known as the Affordable Care Act.

The Affordable Care Act and further changes in the law or regulatory framework could have a material adverse effect on our business.

International Regulation

In addition to regulations

in the United States, there are a variety of foreign regulations governing clinical trials and commercial sales and distribution

of any product candidates. The approval process varies from country to country, and the time may be longer or shorter than that

required for FDA approval.

Item 1A. Risk

Factors

The following information sets forth risk factors that could

cause our actual results to differ materially from those contained in forward-looking statements we have made in this registration

statement and those we may make from time to time. You should carefully consider the risks described below, in addition to the

other information contained in this registration statement, before making an investment decision. Our business, financial condition

or results of operations could be harmed by any of these risks. The risks and uncertainties described below are not the only ones

we face. Additional risks not presently known to us or other factors not perceived by us to present significant risks to our business

at this time also may impair our business operations.

Risks Related to Our Business and Industry

We currently have no drug products

for sale. We are heavily dependent on the success of our product candidates, and we cannot give any assurances that any of our

product candidates will receive regulatory approval or be successfully commercialized.

To date, we have invested a significant

portion of our efforts and financial resources in the acquisition and development of our product candidates. We have not demonstrated

our ability to perform the functions necessary for the successful acquisition, development or commercialization of the technologies

we are seeking to develop. As an early stage company, we have limited experience and have not yet demonstrated an ability to successfully

overcome many of the risks and uncertainties frequently encountered by companies in new and rapidly evolving fields, particularly

in the biopharmaceutical area. Our future success is substantially dependent on our ability to successfully develop, obtain regulatory

approval for, and then successfully commercialize such product candidates. Our product candidates are currently in preclinical

development or in clinical trials. Our business depends entirely on the successful development and commercialization of our product

candidates, which may never occur. We currently generate no revenues from sales of any drugs, and we may never be able to develop

or commercialize a marketable drug.

The successful development, and any commercialization,

of our technologies and any product candidates would require us to successfully perform a variety of functions, including:

| · | developing our technology platform; |

| · | identifying, developing, manufacturing and commercializing

product candidates; |

| · | entering into successful licensing and other arrangements

with product development partners; |

| · | participating in regulatory approval processes; |

| · | formulating and manufacturing products; |

| · | obtaining sufficient quantities of our product candidates

from our third-party manufacturers as required to meet clinical trial needs and commercial demand at launch and thereafter; |

| · | establishing and maintaining agreements with wholesalers,

distributors and group purchasing organizations on commercially reasonable terms; and |

| · | conducting sales and marketing activities including hiring,

training, deploying and supporting our sales force and creating market demand for our product candidates through our own marketing

and sales activities, and any other arrangements to promote our product candidates that we may later establish; and |

| · | maintaining patent protection and regulatory exclusivity

for our product candidates. |

Our operations have been limited to organizing

our company, acquiring, developing and securing our proprietary technology and identifying and obtaining preclinical data or clinical

data for various product candidates. These operations provide a limited basis for you to assess our ability to continue to develop

our technology, identify product candidates, develop and commercialize any product candidates we are able to identify and enter

into successful collaborative arrangements with other companies, as well as for you to assess the advisability of investing in

our securities. Each of these requirements will require substantial time, effort and financial resources.

Each of our product candidates will require

additional preclinical or clinical development, management of preclinical, clinical and manufacturing activities, regulatory approval

in multiple jurisdictions, obtaining manufacturing supply, building of a commercial organization, and significant marketing efforts

before we generate any revenues from product sales. We are not permitted to market or promote any of our product candidates before

we receive regulatory approval from the FDA or comparable foreign regulatory authorities, and we may never receive such regulatory

approval for any of our product candidates.

Pre-clinical development is highly speculative and has

a high risk of failure.

All but one of our current product candidates

are in pre-clinical development, and, thus, have never been used in humans. Pre-clinical development is highly speculative and

carries a high risk of failure. We can provide no assurances that pre-clinical toxicology and/or pre-clinical activity of our product

candidates will support moving any of these product candidates into clinical development. If we are unsuccessful in our pre-clinical

development efforts for any of these product candidates and they fail to reach clinical development, it would have a material adverse

effect on our business and financial condition.

Delays in clinical testing could result in increased costs

to us and delay our ability to generate revenue.

Although we are planning for certain clinical

trials relating to our product candidates, there can be no assurance that the FDA will accept our proposed trial designs. We may

experience delays in our clinical trials and we do not know whether planned clinical trials will begin on time, need to be redesigned,

enroll patients on time or be completed on schedule, if at all. Clinical trials can be delayed for a variety of reasons, including

delays related to:

| · | obtaining regulatory approval to commence a trial; |

| · | reaching agreement on acceptable terms with prospective

contract research organizations, or CROs, and clinical trial sites, the terms of which can be subject to extensive negotiation

and may vary significantly among different CROs and trial sites; |

| · | obtaining institutional review board, or IRB, approval

at each site; |

| · | recruiting suitable patients to participate in a trial; |

| · | clinical sites deviating from trial protocol or dropping

out of a trial; |

| · | having patients complete a trial or return for post-treatment

follow-up; |

| · | developing and validating companion diagnostics on a timely

basis, if required; |

| · | adding new clinical trial sites; or |

| · | manufacturing sufficient quantities of product candidate

for use in clinical trials. |

Patient enrollment, a significant factor

in the timing of clinical trials, is affected by many factors including the size and nature of the patient population, the proximity

of patients to clinical sites, the eligibility criteria for the trial, the design of the clinical trial, competing clinical trials

and clinicians’ and patients’ perceptions as to the potential advantages of the drug being studied in relation to other

available therapies, including any new drugs that may be approved for the indications we are investigating. Furthermore, we intend

to rely on CROs and clinical trial sites to ensure the proper and timely conduct of our clinical trials and we intend to have agreements

governing their committed activities, however, we will have limited influence over their actual performance.

We could encounter delays if a clinical

trial is suspended or terminated by us, by the IRBs of the institutions in which such trials are being conducted, by the Data Safety

Monitoring Board, or DSMB, for such trial or by the FDA or other regulatory authorities. Such authorities may impose such a suspension

or termination due to a number of factors, including failure to conduct the clinical trial in accordance with regulatory requirements

or our clinical protocols, inspection of the clinical trial operations or trial site by the FDA or other regulatory authorities

resulting in the imposition of a clinical hold, unforeseen safety issues or adverse side effects, failure to demonstrate a benefit

from using a drug, changes in governmental regulations or administrative actions or lack of adequate funding to continue the clinical

trial.

If we experience delays in the completion