UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

__________________________

FORM 10-K

__________________________

x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2017

or

☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Transition Period From __________ to ___________

Commission file number: 001-37793

SiteOne Landscape Supply, Inc.

(Exact name of registrant as specified in its charter)

__________________________

Delaware | 46-4056061 |

(State or other jurisdiction of incorporation or organization) | (IRS Employer Identification No.) |

300 Colonial Center Parkway, Suite 600, Roswell, Georgia 30076 | |

(Address of principal executive offices) (Zip Code) | |

(470) 277-7000

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12 (b) of the Act:

Common stock, par value $0.01 per share | New York Stock Exchange | |

(Title of Each Class) | (Name of Each Exchange on which Registered) | |

Securities registered pursuant to Section 12 (g) of the Act:

None |

(Title of class) |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act (Check One):

Large accelerated filer | ☒ | Accelerated filer | ☐ |

Non-accelerated filer | ☐ (Do not check if a smaller reporting company) | Smaller reporting company | ☐ |

Emerging growth company | ☐ | ||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of July 2, 2017, there were 39,727,901 shares of common stock of SiteOne Landscape Supply, Inc. outstanding, and the aggregate market value of the voting and non-voting common equity of SiteOne Landscape Supply, Inc. held by non-affiliates (assuming only for purposes of this computation that the CD&R Investor and Deere (each as defined below), directors and officers may be affiliates) was approximately $1,752,135,681 based on the closing price of SiteOne Landscape Supply, Inc.’s common stock on The New York Stock Exchange (“NYSE”) on June 30, 2017 (the last trading day of our most recently completed fiscal second quarter).

As of February 20, 2018, the number of shares of the registrant’s common stock outstanding were 40,025,054, par value $0.01 per share.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s proxy statement to be filed with the U.S. Securities and Exchange Commission in connection with the registrant’s 2018 Annual Meeting of Stockholders (the “Proxy Statement”) are incorporated by reference into Part III hereof. Such Proxy Statement will be filed within 120 days of the registrant’s fiscal year ended December 31, 2017.

TABLE OF CONTENTS | ||

Page number | ||

1

Special Note Regarding Forward-Looking Statements and Information

This Annual Report on Form 10-K contains forward-looking statements and cautionary statements within the meaning of the Private Securities Litigation Reform Act of 1995. Some of the forward-looking statements can be identified by the use of terms such as “may,” “intend,” “might,” “will,” “should,” “could,” “would,” “expect,” “believe,” “estimate,” “anticipate,” “predict,” “project,” “potential,” or the negative of these terms, and similar expressions. You should be aware that these forward-looking statements are subject to risks and uncertainties that are beyond our control. Further, any forward-looking statement speaks only as of the date on which it is made, and we undertake no obligation to update any forward-looking statement to reflect events or circumstances after the date on which it is made or to reflect the occurrence of anticipated or unanticipated events or circumstances. New factors emerge from time to time that may cause our business not to develop as we expect, and it is not possible for us to predict all of them. Factors that may cause actual results to differ materially from those expressed or implied by the forward-looking statements include, but are not limited to, the following:

• | cyclicality in residential and commercial construction markets; |

• | general economic and financial conditions; |

• | weather conditions, seasonality and availability of water to end-users; |

• | laws and government regulations applicable to our business that could negatively impact demand for our products; |

• | public perceptions that our products and services are not environmentally friendly; |

• | competitive industry pressures; |

• | product shortages and the loss of key suppliers; |

• | product price fluctuations; |

• | inventory management risks; |

• | ability to implement our business strategies and achieve our growth objectives; |

• | acquisition and integration risks; |

• | increased operating costs; |

• | risks associated with our large labor force; |

• | adverse credit and financial markets events and conditions; |

• | credit sale risks; |

• | retention of key personnel; |

• | performance of individual branches; |

• | environmental, health and safety laws and regulations; |

• | hazardous materials and related materials; |

• | construction defect and product liability claims; |

• | computer data processing systems; |

• | security of personal information about our customers; |

• | intellectual property and other proprietary rights; |

• | requirements of being a public company; |

• | risks related to our internal controls; |

• | the possibility of securities litigation; |

• | our substantial indebtedness and our ability to obtain financing in the future; |

• | increases in interest rates; and |

• | risks related to other factors discussed under “Risk Factors” and elsewhere in this Annual Report on Form 10-K. |

You should read this report completely and with the understanding that actual future results may be materially different from expectations. All forward-looking statements made in this report are qualified by these cautionary statements. These forward-looking statements are made only as of the date of this report, and we do not undertake any obligation, other than as may be required by law, to update or revise any forward-looking or cautionary statements to reflect changes in assumptions, the occurrence of events, unanticipated or otherwise, changes in future operating results over time or otherwise.

Comparisons of results for current and any prior periods are not intended to express any future trends, or indications of future performance, unless expressed as such, and should only be viewed as historical data.

2

PART I

As used in this Annual Report on Form 10-K for the fiscal year ended December 31, 2017, references to: “we,” “us,” “our,” “SiteOne,” or the “Company” refer to SiteOne Landscape Supply, Inc. and its consolidated subsidiaries. The term “Holdings” refers to SiteOne Landscape Supply, Inc. individually without its subsidiaries. References to the “2017 Fiscal Year,” the “2016 Fiscal Year” and the “2015 Fiscal Year” refer to the fiscal years ended December 31, 2017, January 1, 2017 and January 3, 2016, respectively.

Item 1. Business

The following discussion of our business contains “forward-looking statements,” as discussed in “Special Note Regarding Forward-Looking Statements and Information” above. Our business, operations and financial condition are subject to various risks as set forth in Part I, Item 1A, ‘‘Risk Factors’’ below. The following information should be read in conjunction with the Risk Factors, Management’s Discussion and Analysis of Financial Condition and Results of Operations and the Financial Statements and Supplementary Data and related notes included elsewhere in this Annual Report on Form 10-K.

Company Overview

We are the largest and only national wholesale distributor of landscape supplies in the United States and have a growing presence in Canada. Our customers are primarily residential and commercial landscape professionals who specialize in the design, installation and maintenance of lawns, gardens, golf courses and other outdoor spaces. As of February 20, 2018, we had 511 branch locations in 45 U.S. states and six Canadian provinces. Through our expansive North American network, we offer a comprehensive selection of more than 120,000 stock keeping units (“SKUs”) including irrigation supplies, fertilizer and control products (e.g., herbicides), landscape accessories, nursery goods, hardscapes (including paving, natural stone and blocks), outdoor lighting and ice melt products. We also provide value-added consultative services to complement our product offerings and to help our customers operate and grow their businesses. Our consultative services include assistance with irrigation network design, commercial project planning, generation of sales leads, marketing services and product support, as well as a series of technical and business management seminars that we call SiteOne University.

Our typical customer is a private landscape contractor that operates in a single market. We interact regularly with our customers because of the recurring nature of landscape services and because most contractors buy products on an as-needed basis. We believe our high-touch customer service model strengthens relationships, builds loyalty and drives repeat business. In addition, our broad product portfolio, convenient branch locations and nationwide fleet of over 1,400 delivery vehicles position us well to meet the needs of our customers and ensure timely delivery of products. We source our products from approximately 3,000 suppliers, including the major irrigation equipment manufacturers, turf and ornamental fertilizer/chemical companies and a variety of suppliers who specialize in nursery goods, outdoor lighting, hardscapes and other landscape products.

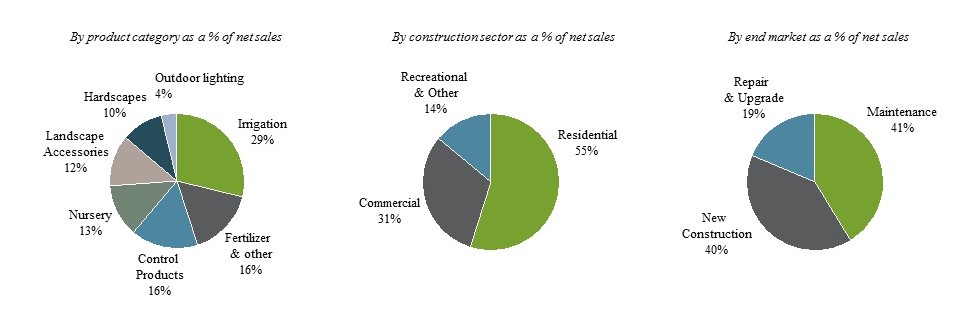

We have a balanced mix of sales across product categories, construction sectors and end markets. We derived approximately 55% of our 2017 Fiscal Year net sales from the residential construction sector, 31% from the commercial (including institutional) construction sector and 14% from the recreational and other construction sector. By end market, we derived approximately 41% of our 2017 Fiscal Year net sales from maintenance of residential, commercial and recreational properties. The recurring nature of landscape maintenance demand helps to provide stability in our financial performance across economic cycles. Fertilizer and control products are the primary products used in maintenance. The sale of products relating to new construction of homes, commercial buildings and recreational spaces accounted for approximately 40% of our 2017 Fiscal Year net sales. These products primarily include irrigation, nursery, hardscapes, outdoor lighting and landscape accessories. Approximately 19% of our 2017 Fiscal Year net sales were derived from sales of products for the repair and upgrade of existing landscapes. These sales benefit from increasing existing home sales, increasing home prices and rising consumer spending.

3

Net Sales for 2017 Fiscal Year

Our History

Our company was established in 2001 after Deere & Company (“Deere”) entered the wholesale landscape distribution market through the acquisitions of McGinnis Farms and Century Rain Aid in 2001, United Green Mark in 2005 and LESCO Inc. (“LESCO”) in 2007, each of which significantly expanded our geographic footprint and broadened our product portfolio. In December 2013, an affiliate (the “CD&R Investor”) of Clayton, Dubilier & Rice, LLC (“CD&R”) purchased a 60% interest in our company from Deere (“CD&R Acquisition”). On May 17, 2016, we completed the initial public offering (“IPO”) of our common stock in which Deere and the CD&R Investor were the sole sellers of our common stock to the public. On December 5, 2016, May 1, 2017 and July 26, 2017, we completed secondary offerings of our common stock in which Deere and CD&R Investor were the sole sellers.

Our Industry

Based on management’s estimates, we believe that our addressable market in North America for the wholesale distribution of landscape supplies represented approximately $18 billion in revenue in 2017. Growth in our industry is driven by a broad array of factors, including consumer spending, housing starts, existing home sales, home prices, commercial construction, repair and remodeling spending, and demographic trends. Within the wholesale landscape supply distribution industry, products sold for residential applications represent the largest construction sector, followed by the commercial and recreational & other sectors. Based on management estimates, we believe that nursery products represent the largest product category in the industry, with sales accounting for more than one-third of industry sales, followed by landscape accessories with approximately one-fifth of industry sales and each of control products, hardscapes, irrigation products and outdoor lighting, and fertilizer & other accounting for approximately one-tenth of industry sales.

The wholesale landscape supply distribution industry is highly fragmented, consisting primarily of regional private businesses that typically have a small geographic footprint, a limited product offering and limited supplier relationships. Wholesale landscape supply distributors primarily sell to landscape service firms, ranging from sole proprietorships to national enterprises. Landscape service firms include general landscape contractors and specialty landscape firms, such as lawn care, tree and foliage maintenance firms. Over the past decade, professional landscape contractors have increasingly offered additional products and services to meet their customers’ needs. These firms historically needed to make numerous trips to branches in various locations to source their products. Consequently, landscape professionals have come to value distribution partners who offer a “one-stop shop” with a larger variety of products and services, particularly given the recurring nature of landscape maintenance services.

Our Strategies

Key elements of our strategy are as follows:

Build Upon Strong Customer and Supplier Relationships to Expand Organically

Our national footprint and broad supplier relationships, combined with our regular interaction with a large and diverse customer base, make us an important link in the supply chain for landscape products. Our suppliers benefit from access to our more than 230,000 customers, a single point of contact for improved production planning and efficiency, and our ability to bring new product launches quickly to market on a national scale. We intend to continue to increase our size and scale in customer, geographic and product reach, which we believe will continue to benefit our supplier base. We will continue to work with new and existing suppliers to maintain the most comprehensive product offering for our customers at competitive prices and enhance our role as a critical player in the supply chain.

4

Grow at the Local Level

The vast majority of our customers operate at a local level. We believe we can grow market share in our existing markets with limited capital investment by systematically executing local strategies to expand our customer base, increase the amount of our customers’ total spending with us, optimize our network of locations, coordinate multi-site deliveries, partner with strategic local suppliers, introduce new products and services, increase our share of underrepresented products in particular markets and improve sales force performance. We currently offer our full product line in only 26% of the metropolitan statistical areas (“MSAs”) in the United States where we have a branch, and therefore believe we have the capacity to offer significantly more product lines and services in our geographic markets.

Pursue Value-Enhancing Strategic Acquisitions

Through recently completed acquisitions, we have added new markets in the United States and Canada, new product lines, talented associates and operational best practices. In addition, we increased our sales by introducing products from our existing portfolio to customers of newly acquired companies. We intend to continue pursuing strategic acquisitions to grow our market share and enhance our local market leadership positions by taking advantage of our scale, operational experience and acquisition know-how to pursue and integrate attractive targets. In addition, we currently have branches in 183 of the 381 U.S. MSAs and are focused on identifying and reviewing attractive new geographic markets for expansion through acquisitions. We will continue to apply a selective and disciplined acquisition strategy to maximize synergies obtained from enhanced sales and lower procurement and corporate costs.

Execute on Identified Operational Initiatives

We continue to undertake operational initiatives, utilizing our scale to improve our profitability, enhance supply chain efficiency, strengthen our pricing and category management capabilities, streamline and refine our marketing process and invest in more sophisticated information technology systems and data analytics. Additionally, we have commenced our e-commerce initiative, to include the relaunch of our website and implementation of a business-to-business (B2B) e-commerce platform. Although we are still in the early stages of these initiatives, they have already contributed to improvement in our profitability, and we believe we will continue to benefit from these and other operational improvements.

Be the Employer of Choice

We believe our associates are the key drivers of our success, and we aim to recruit, train, promote and retain the most talented and success-driven personnel in the industry. Our size and scale enable us to offer structured training and career path opportunities for our associates, while at the area and branch level we have built a vibrant and entrepreneurial culture that rewards performance. We promote ongoing, open and honest communication with our associates to ensure mutual trust, engagement and performance improvement. We believe that high-performing local leaders coupled with creative, adaptable and engaged associates are critical to our success and to maintaining our competitive position, and we are committed to being the employer of choice in our industry.

Our Products and Services

Our comprehensive portfolio of landscape products consists of over 120,000 SKUs from approximately 3,000 suppliers. Our product portfolio includes irrigation, fertilizer & other, control products, landscape accessories, nursery goods, hardscapes and outdoor lighting products. Our customers value our product breadth and geographic reach, as well as our on-site expertise and consultative services. While pricing is important to our customers, availability, convenience and expertise are also important factors in their purchase decisions. In addition to other capabilities, our ability to offer the significant yard space and special equipment that items such as nursery goods and hardscapes require provides us with a competitive advantage over many competitors who offer a more limited selection of product categories.

See Note 12 to our audited financial statements for information on our net sales in the agronomic (fertilizer & other and control products), irrigation and outdoor lighting, landscape accessories and hardscapes and nursery goods categories.

Irrigation

Our irrigation products include controllers, valves, sprinkler heads and irrigation and drainage pipes. The market for irrigation products has historically provided stable growth and is driven primarily by new home construction and maintenance of existing irrigation systems.

Fertilizer & Other

Our fertilizer & other products include fertilizer, grass seed and ice melt products. Fertilizer products are sold to the maintenance end market and accordingly are relatively stable through economic cycles.

5

Control Products

Our control products are specialty products that include herbicides, fungicides, rodenticides and other pesticides. Similar to fertilizer products, control products sales are strongly tied to the maintenance end market and accordingly are relatively stable through economic cycles.

Landscape Accessories

Our landscape accessories products include mulches, soil amendments, tools and sod. Landscape accessories are typically sold in combination with other landscape supply products. As a result, sales of these accessories are often tied to sales of fertilizers and control products, as well as sales of nursery goods and hardscape products.

Nursery Goods

Our nursery goods include deciduous shrubs, evergreen shrubs and trees, ornamental trees, shade trees, both field grown and container-grown nursery stock and hundreds of plant species and cultivars available in a number of heights and bloom colors.

Outdoor Lighting

Our outdoor lighting products include accent lights, dark lights, path lights, up lights, down lights, wall lights and pool and aquatic area lighting.

Hardscapes

Hardscapes include paving, natural stone, blocks and other durable materials.

Proprietary Branded Products

In addition to distributing branded products of third parties, we offer products under our proprietary brands. Sales of LESCO®, Green Tech and Pro-Trade® together accounted for approximately 14% of our 2017 Fiscal Year net sales, the large majority of which is attributable to LESCO®.

LESCO

LESCO® is a premium brand and maintains strong brand awareness with golf and professional landscape contractors.

Under the LESCO® brand, we offer formulations of fertilizer (liquid and granular), combination products (pesticides on a fertilizer carrier), control products (liquid and granular pesticides), specialty chemicals, turf seed, application equipment (engine powered and walk behind or other non-engine powered), paint, maintenance products like engine oil, windshield washer fluid, ice melt, trimmer line and soil tests. We also offer Basic Seed and Basic Nutrition, “sub-brands” of LESCO®, under which we offer fertilizer and landscape accessories. LESCO® products are sold through our branches and retail outlets such as The Home Depot, True Value and Ace Hardware.

Green Tech

We offer pre-packaged landscape and irrigation management solutions that are designed to help customers manage and conserve water under the Green Tech brand. The core Green Tech product lines include central irrigation control systems, solar assemblies, fertilizer injection systems, irrigation pumps and hand-held remote control equipment.

Pro-Trade

In 2017, we launched a line of professional-grade LED lamps and lighting solutions under our Pro-Trade® brand. The Pro-Trade® line of products is sold exclusively through our branches and currently includes lamps, brass and aluminum fixtures and transformers.

Services

We offer a variety of complementary, value-added services to support the sale of our products. We do not derive separate revenue for these services, but we believe they are an important differentiator in establishing our value proposition to our customers.

6

Product Knowledge and Technical Expertise

Consultative services provided by our local staff, many of whom are former landscape contractors or golf course superintendents, include product selection and support, assistance with design and implementation of landscape projects and potential sales leads for new business opportunities. Our SiteOne University program provides customers with access to substantive training and informational seminars that directly support the growth of their businesses. The program includes technical training, licensing, certifications and business management seminars. In addition, our product category experts provide technical knowledge on the features and benefits of products we provide as well as on job installation techniques.

Project Services

We partner with our customers by providing consultative services to help them save time, money and effort in bidding for new projects and for new landscape installations. Our regionally based project services teams specialize in quoting, estimating and completing sales for customers who compete in the commercial construction sector. Other services provided by our project services teams include specifications assistance and irrigation design.

Partners Program

We offer a loyalty program, our Partners Program, which had approximately 17,000 enrolled customers as of December 31, 2017 and provides business and personal rewards, access to business services at preferred rates and technical training and support. Reward points may be spent, for example, on credit on account, trips and special events, gift cards to major retailers and SiteOne University courses and educational events. Access to preferred rate business services includes, for example, payroll and select human resources services, cell phone services, office supplies, auto and fleet insurance and fuel rebates. For the 2017 Fiscal Year, Partners Program participants accounted for approximately 54% of our net sales.

Operational Structure

Our operational philosophy is to create local area teams and branch networks specifically designed to best meet our customers’ needs at the local market level, while supporting these teams with the resources of a large company delivered through regional and divisional management, including company-wide corporate functions.

At the local market level, we organize our 511 branches and approximately 350 outside sales representatives into 50 designated “areas” that each serve a defined geography, typically a large MSA or a combination of MSAs in close proximity. Area managers are responsible for organization and talent planning, branch operations, sales strategy and product delivery strategy. Area managers are supported by an area business manager responsible for executing the local market strategies and key initiatives to grow sales and profitability.

We support our 511 branches and 50 areas with regional management and company-wide corporate functions providing: management of business performance; development and execution of local strategies; sharing of best practices; execution and integration of acquisitions; finance and accounting expertise (credit/collections, payables); category management and procurement; supply chain (planners, buyers); pricing strategies; marketing; and information technology. Our branches are integrated on a single technology platform, allowing us to leverage our full operational scale for procurement, inventory management, financial support, data analytics and performance reporting.

Our outside sales force is organized by geographic area. Each area maintains a number of outside sales representatives who drive sales growth on behalf of several branches across a variety of accounts from landscape contractors to municipal agencies. We also maintain a sales force of agronomic sales representatives who are focused on growing sales to the golf industry.

We have a national account sales organization which leads sales strategy and execution for our largest national and regional customers. The national sales team is organized around five different market verticals: landscape and grounds maintenance, golf, retail, international and environmental accounts. Each national account manager is responsible for a group of large accounts and coordinates our business with them both nationally and locally through our local sales representatives. National account managers negotiate national programs with our largest customers in order to increase our share of their business.

Distribution Network

We use two distribution models to offer a comprehensive selection of products and meet the needs of each local market.

7

Branches

Our branch network is the core of our operations and creates a valuable connection between our suppliers and our customers. Of our approximately 3,000 suppliers, few are set up to serve the shipping needs of our customers as their supply chains are typically focused on bulk quantities shipped from only a few locations. In contrast, many of our customers often require comparatively small quantities of products from numerous suppliers to complete a typical project, making it unfeasible to source directly from those suppliers. Our branch network provides significant value to our suppliers by maintaining local availability of core and complementary products in quantities our customers need.

The majority of our branches carry multiple product categories but do not carry all of them. Branches that carry our full product lines combine our regular branch facilities with large 8-to-15 acre yards suitable for nursery goods and hardscape products. Yards are well-equipped to manage truckload-purchased landscape, nursery and hardscape products and can maintain a diverse variety of greenhouse and nursery plants. All locations offering nursery goods have water distribution systems to maintain inventories, and many of these locations have access to municipal water supply, wells or ponds. Branches are strategically located near residential areas with good highway access. In-store merchandising displays are utilized to emphasize product features and seasonal promotions. We primarily lease 5,000 to 15,000 square foot facilities in both freestanding and multi-tenant buildings, with secured outside storage yards averaging from 10,000 to 20,000 square feet in some branches.

Direct Distribution

Our direct distribution business provides point-to-point logistics for bulk quantities of landscape products between producers and customers. Our direct distribution business provides customers with sourcing and logistics support services for inventory management and delivery, in many cases more economically than the producers might otherwise provide. We believe that producers view us not as competitors, but as providers of a valuable service, brokering these large orders through the use of our network. We typically do not maintain inventory for direct distribution but rather use our existing producer relationships, marketing expertise and ordering and logistics infrastructure to serve this demand, requiring less working capital investment for these sales. Approximately 7% of our 2017 Fiscal Year net sales were from direct distribution.

Direct distribution is preferred for contractors with large projects, typically designed by professional landscape architects. Contractors work hand-in-hand with our outside sales and inside sales teams, including project planning support with material take-offs, product sourcing and bid preparation. Using our large vendor network, our associates arrange convenient direct shipments to jobs, coordinated and staged according to each phase of construction. This distribution channel primarily handles bulk nursery, agronomic, landscape and hardscape products.

Customers

Our customers are primarily residential and commercial landscape professionals who specialize in the design, installation and maintenance of lawns, gardens, golf courses and other outdoor spaces. Our customer base consists of more than 230,000 firms and individuals, with our top 10 customers collectively accounting for approximately 4% of our 2017 Fiscal Year net sales, with no single customer accounting for more than 2% of net sales. Small customers, with annual purchases of up to $25,000, made up 31% of our 2017 Fiscal Year net sales. Medium customers, with annual purchases between $25,000 and $150,000, made up 27% of our 2017 Fiscal Year net sales. Large customers, with annual purchases over $150,000, made up 42% of our 2017 Fiscal Year net sales. Some of our largest customers include BrightView, The Home Depot, Davey Tree Expert Company and TruGreen. Distribution of our LESCO proprietary branded products on a wholesale basis to retailers represented less than 1% of our 2017 Fiscal Year net sales.

Suppliers

We source our products from approximately 3,000 suppliers, including the major irrigation equipment manufacturers, turf and ornamental fertilizer/chemical companies, and a variety of suppliers who specialize in nursery goods, outdoor lighting, hardscapes and other landscape products. Some of our largest suppliers include Hunter, Rain Bird, Toro, Oldcastle, Bayer, Syngenta, BASF, Dow AgroSciences, Vista and NDS. Purchases from our top 10 suppliers accounted for approximately 39% of total purchases for our 2017 Fiscal Year.

We generally procure our products through purchase orders rather than under long-term contracts with firm commitments. We work to develop strong relationships with a select group of suppliers that we target based on a number of factors, including brand and market recognition, price, quality, product support and service, service levels, delivery terms and their strategic positioning. We generally have annual supplier agreements, and while they generally do not provide for specific product pricing, many include volume-based financial incentives that we earn by meeting or exceeding target purchase volumes. Our ability to earn these volume-based incentives is an important factor in our financial results. In limited cases, we have entered into supply contracts with terms that exceed one year for

8

the manufacture of our LESCO branded fertilizer and some nursery goods and grass seed, which may require us to purchase products in the future.

Competition

The majority of our competition comes from other wholesale landscape supply distributors. Among wholesale distributors, we primarily compete against a small number of regional distributors and many small, local, privately-owned distributors. Some of our competitors carry several product categories, while others mainly focus on one product category such as irrigation, fertilizer/control, nursery goods or hardscapes. We are one of the only wholesale distributors which carries the full line of irrigation, fertilizer & other, control products, landscape accessories, nursery goods, hardscapes and outdoor lighting products.

We believe our top nine largest competitors include Ewing, Harrell’s, Horizon Distributors (a subsidiary of Pool Corporation), Winfield Solutions, BWI, Target Specialty Products, Howard Fertilizer and Chemical, BFG Supply and Central Turf & Irrigation Supply.

We believe smaller, regional or local competitors still comprise approximately 90% of the landscape supply industry based on 2017 net sales. The principal competitive factors in our business include, but are not limited to, location, availability of materials and supplies, technical product knowledge and expertise, advisory or other service capabilities, delivery capabilities, pricing of products and availability of credit.

Associates

As of February 20, 2018, we had approximately 3,800 associates, none of whom were affiliated with labor unions. We believe that we have good relations with our associates. Additionally, we believe that the training provided through our development programs and our entrepreneurial, performance-based culture provides significant benefits to our associates. Approximately 92.8% of our associates are employed on a full-time, year-round basis. Our associate count currently includes approximately 260 seasonal associates, who are temporarily employed due to the weather-dependent nature of our business. An associate is anyone employed by the Company.

Service Marks, Trademarks and Trade Names

We hold various trademark registrations, including SiteOne® and LESCO®, which we consider important to our marketing activities. Generally, trademark rights have a perpetual life, provided that they are renewed on a timely basis and continue to be used properly as trademarks. We intend to maintain these trademark registrations and the other trademarks associated with our business so long as they remain valuable to our business. In addition, other than commercially available software licenses, we do not believe that any of our licenses for third-party intellectual property are material to our business, taken as a whole.

Weather Conditions and Seasonality

For a discussion regarding seasonality and weather, see Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations - Weather Conditions and Seasonality,” of this Annual Report on Form 10-K.

Regulatory Compliance

Government Regulations

We are subject to various federal, state, provincial and local laws and regulations, compliance with which increases our operating costs, limits or restricts the products and services we provide or the methods by which we offer and sell those products and services or conduct our business and subjects us to the possibility of regulatory actions or proceedings. Noncompliance with these laws and regulations can subject us to fines or various forms of civil or criminal prosecution, any of which could have a material adverse effect on our reputation, business, financial position, results of operations and cash flows.

These federal, state, provincial and local laws and regulations include laws relating to consumer protection, wage and hour, deceptive trade practices, permitting and licensing, state contractor laws, workers’ safety, tax, healthcare reforms, collective bargaining and other labor matters, environmental and employee benefits.

Environmental, Health and Safety Matters

We are subject to numerous federal, state, provincial and local environmental, health and safety laws and regulations, including laws that regulate the emission or discharge of materials into the environment, govern the use, handling, treatment, storage, disposal and management of hazardous substances and wastes, protect the health and safety of our associates and users of our products and impose

9

liability for investigating and remediating, and damages resulting from, present and past releases of hazardous substances at sites we have ever owned, leased or operated or used as a disposal site.

In the United States, we are regulated under many environmental, health and safety laws, including the Comprehensive Environmental Response, Compensation and Liability Act, the Federal Environmental Pesticide Control Act, the Federal Insecticide, Fungicide and Rodenticide Act, the Clean Air Act, the Clean Water Act and the Occupational Safety and Health Act, each as amended. Certain laws, such as those requiring the registration of herbicides and pesticides, and regulating their use, also involve the oversight of regulatory authorities and public health agencies. Although we strive to comply with such laws and have processes in place designed to achieve compliance, we may be unable to prevent violations of these or other laws from occurring. We could also incur significant investigation and clean-up costs for contamination at any currently or formerly owned or operated facilities, including LESCO’s manufacturing and blending facilities. See “Note 10. Commitments and Contingencies” to our audited consolidated financial statements included in this Annual Report on Form 10-K.

In addition, we cannot predict the effect of possible future environmental, health or safety laws on our operations. Changes in, or new interpretations of, existing laws, regulations or enforcement policies, the discovery of previously unknown contamination, or the imposition of other environmental liabilities or obligations in the future, including obligations with respect to any potential health hazards of our products, may lead to additional compliance or other costs.

Available Information

We make available free of charge on the “Investor Relations” page of our website, www.siteone.com, our filed and furnished reports on Forms 10-K, 10-Q, and 8-K, and all amendments thereto, as soon as reasonably practicable after the reports are filed with or furnished to the Securities and Exchange Commission (the “SEC”).

Our Corporate Governance Guidelines, Board of Directors Communication Policy, Business Code of Conduct and Ethics, Financial Code of Ethics, and the Charters of the Audit Committee, the Compensation Committee, and the Nominating and Corporate Governance Committee of the Board of Directors are also available on the “Investor Relations” page of our website. The information contained on our website is not incorporated herein by reference. Copies of these documents (without exhibits, when applicable) are also available free of charge upon request to us at 300 Colonial Center Parkway, Suite 600, Roswell, Georgia 30076, Attention: Investor Relations or by telephone at (404) 277-7000. In addition, the SEC maintains a website that contains reports, proxy and information statements, and other information regarding issuers, including us, that file electronically with the SEC at www.sec.gov. We are required to disclose any change to, or waiver from, our Business Code of Conduct and Ethics for our executive officers and Board members. We use our website to disseminate this disclosure as permitted by applicable SEC rules.

10

Item 1A. Risk Factors

You should carefully consider the factors described below, in addition to the other information set forth in this Annual Report on Form 10-K. These risk factors are important to understanding the contents of this Annual Report on Form 10-K and of other reports. Our reputation, business, financial position, results of operations and cash flows are subject to various risks. The risks and uncertainties described below are not the only ones relevant to us. Additional risks and uncertainties not currently known to us or that we currently believe are immaterial may also adversely impact our reputation, business, financial position, results of operations and cash flows.

Risks Related to Our Business and Our Industry

Cyclicality in our business could result in lower net sales and reduced cash flows and profitability. We have been, and in the future may be, adversely impacted by declines in the new residential and commercial construction sectors, as well as in spending on repair and upgrade activities.

We sell a significant portion of our products for landscaping activities associated with new residential and commercial construction sectors, which have experienced cyclical downturns, some of which have been severe. The strength of these markets depends on, among other things, housing starts, consumer spending, non-residential construction spending activity and business investment, which are a function of many factors beyond our control, including interest rates, employment levels, availability of credit, consumer confidence and capital spending. Weakness or downturns in residential and commercial construction markets could have a material adverse effect on our business, operating results or financial condition.

Sales of landscape supplies to contractors serving the residential construction sector represent a significant portion of our business, and demand for our products is highly correlated with new residential construction. Housing starts are dependent upon a number of factors, including housing demand, housing inventory levels, housing affordability, foreclosure rates, demographic changes, the availability of land, local zoning and permitting processes, the availability of construction financing and the health of the economy and mortgage markets. Unfavorable changes in any of these factors could adversely affect consumer spending, result in decreased demand for homes and adversely affect our business. Some analysts project that the demand for residential construction may be negatively impacted as the number of renting households has increased in recent years and as a shortage in the supply of affordable housing is expected to result in lower home ownership rates. The timing and extent of any recovery in homebuilding activity and the resulting impact on demand for landscape supplies are uncertain.

Our net sales also depend, in significant part, on commercial construction, which similarly recently experienced a severe downturn. Previously, downturns in the commercial construction market have typically lasted about two to three years, resulting in market declines of approximately 20% to 40%, while the most recent downturn in the commercial construction market lasted over four years, resulting in a market decline of approximately 60%. We cannot predict the duration of the current market conditions or the timing or strength of any future recovery of commercial construction activity in our markets.

We also rely, in part, on repair and upgrade of existing landscapes. High unemployment levels, high mortgage delinquency and foreclosure rates, lower home prices, limited availability of mortgage and home improvement financing, and significantly lower housing turnover, may restrict consumer spending, particularly on discretionary items such as landscape projects, and adversely affect consumer confidence levels and result in reduced spending on repair and upgrade activities.

Our business is affected by general business, financial market and economic conditions, which could adversely affect our financial position, results of operations and cash flows.

Our business and results of operations are significantly affected by general business, financial market and economic conditions. General business, financial market and economic conditions that could impact the level of activity in the wholesale landscape supply industry include the level of new home sales and construction activity, interest rate fluctuations, inflation, unemployment levels, tax rates, capital spending, bankruptcies, volatility in both the debt and equity capital markets, liquidity of the global financial markets, the availability and cost of credit, investor and consumer confidence, global economic growth, local, state and federal government regulation, and the strength of regional and local economies in which we operate. With respect to the residential construction sector in particular, spending on landscape projects is largely discretionary and lower levels of consumer spending or the decision by home-owners to perform landscape upgrades or maintenance themselves rather than outsource to contractors may adversely affect our business.

Seasonality affects the demand for our products and services and our results of operations and cash flows.

The demand for our products and services and our results of operations are affected by the seasonal nature of our irrigation, outdoor lighting, nursery, landscape accessories, fertilizers, turf protection products, grass seed, turf care equipment and golf course maintenance supplies. Such seasonality causes our results of operations to vary considerably from quarter to quarter. Typically, our net

11

sales and net income have been higher in the second and third quarters of each fiscal year due to favorable weather and longer daylight conditions during these quarters. Our net sales and net income, however, are significantly lower in the first and fourth quarters due to lower landscaping, irrigation and turf maintenance activities in these quarters. Accordingly, results for any quarter are not necessarily indicative of the results that may be achieved for the full fiscal year.

Our operations are substantially dependent on weather conditions.

We supply landscape, irrigation and turf maintenance products, the demand for each of which is affected by weather conditions, including, without limitation, potential impacts, if any, from climate change. In particular, droughts could cause shortage in the water supply, which may have an adverse effect on our business. For instance, our supply of plants could decrease, or prices could rise, due to such water shortages, and customer demand for certain types of plants may change in ways in which we are unable to predict. Such water shortages may also make irrigation or the maintenance of turf uneconomical. Governments may implement limitations on water usage that make effective irrigation or turf maintenance unsustainable, which could negatively impact the demand for our products. In California, for instance, mandatory water restrictions went into effect across the state in 2015. We have also recently seen an increased demand in California for products related to drought-tolerant landscaping, including hardscapes and plants that require low amounts of water. There is a risk that demand for landscaping products will decrease overall due to persistent drought conditions in some of the geographic markets we serve, or that demand will change in ways that we are unable to predict.

Furthermore, adverse weather conditions, such as droughts, severe storms, hurricanes and significant rain or snowfall, can adversely impact the demand for our products, timing of product delivery, or our ability to deliver products at all. For example, severe winter storms can cause hazardous road conditions, which may prevent personnel from traveling or delivering to service locations. In addition, unexpectedly severe weather conditions, such as excessive heat or cold, may result in certain applications in the maintenance product cycle being omitted for a season or damage to or loss of nursery goods, sod and other green products in our inventory, which could result in losses requiring writedowns.

Public perceptions that the products we use and the services we deliver are not environmentally friendly or safe may adversely impact the demand for our products or services.

We sell, among other things, fertilizers, herbicides, fungicides, pesticides, rodenticides and other chemicals. Public perception that the products we use and the services we deliver are not environmentally friendly or safe or are harmful to humans or animals, whether justified or not, or the improper application of these chemicals, could reduce demand for our products and services, increase regulation or government restrictions or actions, result in fines or penalties, impair our reputation, involve us in litigation, damage our brand names and otherwise have a material adverse impact on our business, financial position, results of operations and cash flows.

Our industry and the markets in which we operate are highly competitive and fragmented, and increased competitive pressures could reduce our share of the markets we serve and adversely affect our business, financial position, results of operations and cash flows.

We operate in markets with relatively few large competitors, but barriers to entry in the landscape supply industry are generally low, and we may have several competitors within a local market area. Competition varies depending on product line, type of customer and geographic area. Some local competitors may be able to offer higher levels of service or a broader selection of inventory than we can in particular local markets. As a result, we may not be able to continue to compete effectively with our competitors. Any of our competitors may foresee the course of market development more accurately than we do, provide superior service, sell or distribute superior products, have the ability to supply or deliver similar products and services at a lower cost, or on more favorable credit terms, develop stronger relationships with our customers and other consumers in the landscape supply industry, adapt more quickly to evolving customer requirements than we do, develop a superior network of distribution centers in our markets or access financing on more favorable terms than we can obtain. As a result, we may not be able to compete successfully with our competitors.

Competition can also reduce demand for our products and services, negatively affect our product sales and services or cause us to lower prices. Consolidation of professional landscape service firms may result in increased competition for their business. Certain product manufacturers that sell and distribute their products directly to landscapers may increase the volume of such direct sales. Our suppliers may also elect to enter into exclusive supplier arrangements with other distributors.

Former associates may start landscape supply businesses similar to ours, in competition with us. Our industry faces low barriers to entry, making the possibility of former associates starting similar businesses more likely. Increased competition from businesses started by former associates may reduce our market share and adversely affect our business, financial position, results of operations and cash flows.

Our customers consider the performance of the products we distribute, our customer service and price when deciding whether to use our services or purchase the products we distribute. Excess industry capacity for certain products in several geographic markets

12

could lead to increased price competition. We may be unable to maintain our operating costs or product prices at a level that is sufficiently low for us to compete effectively. If we are unable to compete effectively with our existing competitors or new competitors enter the markets in which we operate, our financial condition, operating results and cash flows may be adversely affected.

Product shortages, loss of key suppliers, failure to develop relationships with qualified suppliers or dependence on third-party suppliers and manufacturers could affect our financial health.

Our ability to offer a wide variety of products to our customers is dependent upon our ability to obtain adequate product supply from manufacturers and other suppliers. Any disruption in our sources of supply, particularly of the most commonly sold items, could result in a loss of revenues, reduced margins and damage to our relationships with customers. Supply shortages may occur as a result of unanticipated increases in demand or difficulties in production or delivery. When shortages occur, our suppliers often allocate products among distributors. The loss of, or a substantial decrease in the availability of, products from our suppliers or the loss of key supplier arrangements could adversely impact our financial condition, operating results, and cash flows.

Our ability to continue to identify and develop relationships with qualified suppliers who can satisfy our high standards for quality and our need to be supplied with products in a timely and efficient manner is a significant challenge. Our suppliers’ ability to provide us with products can also be adversely affected in the event they become financially unstable, particularly in light of continuing economic difficulties in various regions of the United States and the world, fail to comply with applicable laws, encounter supply disruptions, shipping interruptions or increased costs, or face other factors beyond our control.

Our agreements with suppliers are generally terminable by either party on limited notice, and in some cases we do not have written agreements with our suppliers. If market conditions change, suppliers may stop offering us favorable terms. Our suppliers may increase prices or reduce discounts on the products we distribute and we may be unable to pass on any cost increase to our customers, thereby resulting in reduced margins and profits. Failure by our suppliers to continue to supply us with products on favorable terms, commercially reasonable terms, or at all, could put pressure on our operating margins or have a material adverse effect on our financial condition, results of operations and cash flows.

The prices and costs of the products we purchase may be subject to large and significant price fluctuations. We might not be able to pass cost increases through to our customers, and we may experience losses in a rising price environment. In addition, we might have to lower our prices in a declining price environment, which could also lead to losses.

We purchase and sell a wide variety of products, the price and availability of which may fluctuate, and may be subject to large and significant price increases. Many of our contracts with suppliers include prices for commodities such as grass seed and chemicals used in fertilizer that are not fixed or are tied to an index, which allows our suppliers to change the prices of their products as the input prices fluctuate. Our business is exposed to these fluctuations, as well as to fluctuations in our costs for transportation and distribution. Changes in prices for the products that we purchase affect our net sales and cost of goods sold, as well as our working capital requirements, levels of debt and financing costs. We might not always be able to reflect increases in our costs in our own pricing. Any inability to pass cost increases on to customers may adversely affect our business, financial condition and results of operations. In addition, if market prices for the products that we sell decline, we may realize reduced profitability levels from selling such products and lower revenues from sales of existing inventory of such products.

We are subject to inventory management risks; insufficient inventory may result in lost sales opportunities or delayed revenue, while excess inventory may harm our gross margins.

We balance the need to maintain inventory levels that are sufficient to ensure competitive lead times against the risk of inventory obsolescence because of changing customer requirements, fluctuating commodity prices, or the life-cycle of nursery goods, sod and other green products. In order to successfully manage our inventories, including grass seed, chemicals used in fertilizers, and nursery goods, sod and other green products, we must estimate demand from our customers and purchase products that substantially correspond to that demand. If we overestimate demand and purchase too much of a particular product, we face a risk that the price of that product will fall, leaving us with inventory that we cannot sell profitably. In addition, we may have to write down such inventory if we are unable to sell it for its recorded value. Contracts with certain suppliers require us to take on additional inventory or pay a penalty, even in circumstances where we have excess inventory. By contrast, if we underestimate demand and purchase insufficient quantities of a product and the price of that product were to rise, we could be forced to purchase that product at a higher price and forego profitability in order to meet customer demand. Insufficient inventory levels may lead to shortages that result in delayed revenue or loss of sales opportunities altogether as potential end-customers turn to competitors’ products that are readily available. Our business, financial condition and results of operations could suffer a material adverse effect if either or both of these situations occur frequently or in large volumes.

13

Many factors, such as weather conditions, agricultural limitations and restrictions relating to the management of pests and disease, affect the supply of nursery goods, grass seed, sod and other green products. If the supply of these products available is limited, prices could rise, which could cause customer demand to be reduced and our revenues and gross margins to decline. For example, nursery goods, sod and grass seed are perishable and have a limited shelf life. Should we be unable to sell our inventory of nursery goods, grass seed, sod and other green products within a certain timeframe, we may face losses requiring write-downs. In contrast, we may not be able to obtain high-quality nursery goods and other green products in an amount sufficient to meet customer demand. Even if available, nursery goods from alternate sources may be of lesser quality or may be more expensive than those currently grown or purchased by us. If we are unable to effectively manage our inventory and that of our distribution partners, our results of operations could be adversely affected.

We may not successfully implement our business strategies, including achieving our growth objectives.

We may not be able to fully implement our business strategies or realize, in whole or in part within the expected time frames, the anticipated benefits of our various growth or other initiatives. Our various business strategies and initiatives, including our growth, operational and management initiatives, are subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond our control. The execution of our business strategy and our financial performance will continue to depend in significant part on our executive management team and other key management personnel, the smooth transition of new senior leadership and our executive management team’s ability to execute the new operational initiatives that they are undertaking. In addition, we may incur certain costs as we pursue our growth, operational and management initiatives, and we may not meet anticipated implementation timetables or stay within budgeted costs. As these initiatives are undertaken, we may not fully achieve our expected efficiency improvements or growth rates, or these initiatives could adversely impact our customer retention, supplier relationships or operations. Also, our business strategies may change from time to time in light of our ability to implement our business initiatives, competitive pressures, economic uncertainties or developments, or other factors.

We may be unable to successfully acquire and integrate other businesses.

Our historical growth has been driven in part by acquisitions, and future acquisitions are an important element of our business strategy. We may be unable to continue to grow our business through acquisitions. We may not be able to continue to identify suitable acquisition targets and may face increased competition for these acquisition targets. In addition, acquired businesses may not perform in accordance with expectations, and our business judgments concerning the value, strengths and weaknesses of acquired businesses may not prove to be correct. We may also be unable to achieve expected improvements or achievements in businesses that we acquire. At any given time, we may be evaluating or in discussions with one or more acquisition targets, including entering into non-binding letters of intent. Future acquisitions may result in the incurrence of debt and contingent liabilities, legal liabilities, goodwill impairments, increased interest expense and amortization expense and significant integration costs.

Acquisitions involve a number of special risks, including:

• | our inability to manage acquired businesses or control integration costs and other costs relating to acquisitions; |

• | potential adverse short-term effects on operating results from increased costs or otherwise; |

• | diversion of management’s attention; |

• | failure to retain existing customers or key personnel of the acquired business and recruit qualified new associates at the location; |

• | failure to successfully implement infrastructure, logistics and systems integration; |

• | potential impairment of goodwill; |

• | risks associated with the internal controls of acquired companies; |

• | exposure to legal claims for activities of the acquired business prior to acquisition and inability to realize on any indemnification claims, including with respect to environmental and immigration claims; |

• | the risks inherent in the systems of the acquired business and risks associated with unanticipated events or liabilities; and |

• | our inability to obtain financing necessary to complete acquisitions on attractive terms or at all. |

Our strategy could be impeded if we do not identify, or face increased competition for, suitable acquisition targets, and such increased competition could result in higher purchase price multiples we have to pay for acquisition targets or reduce the number of suitable targets. Our business, financial condition, results of operations and cash flows could be adversely affected if any of the foregoing factors were to occur.

Increases in operating costs could adversely impact our business, financial position, results of operations and cash flows.

Our financial performance is affected by the level of our operating expenses, such as occupancy costs associated with the leases for our branch locations and costs of fuel, vehicle maintenance, equipment, parts, wages and salaries, employee benefits, health care, self-insurance costs and other insurance premiums as well as various regulatory compliance costs, all of which may be subject to inflationary pressures. In particular, our financial performance is adversely affected by increases in these operating costs.

14

Most of our facilities are located in leased premises. Many of our current leases are non-cancelable and typically have terms ranging from three to five years, with options to renew for specified periods of time. We believe that leases we enter into in the future will likely be long-term and non-cancelable and have similar renewal options. However, we may be unable to renew our current or future leases on favorable terms or at all which could have an adverse effect on our operations and costs. In addition, if we close a location, we generally remain committed to perform our obligations under the applicable lease, which include, among other things, payment of the base rent for the balance of the lease term.

We deliver a substantial volume of products to our customers by truck. Petroleum prices have fluctuated significantly in recent years. Prices and availability of petroleum products are subject to political, economic and market factors that are outside our control. Political events in petroleum-producing regions as well as hurricanes and other weather-related events may cause the price of fuel to increase. Our operating profit will be adversely affected if we are unable to obtain the fuel we require or to fully offset the anticipated impact of higher fuel prices through increased prices or fuel surcharges to our customers. Besides passing fuel costs on to customers, we have not entered into any hedging arrangements that protect against fuel price increases and we do not have any long-term fuel purchase contracts. If shortages occur in the supply of necessary petroleum products and we are not able to pass along the full impact of increased petroleum prices to our customers, our results of operations would be adversely affected.

We cannot predict the extent to which we may experience future increases in costs of occupancy, fuel, vehicle maintenance, equipment, parts, wages and salaries, employee benefits, health care, self-insurance costs and other insurance premiums as well as various regulatory compliance costs and other operating costs. To the extent such costs increase, we may be prevented, in whole or in part, from passing these cost increases through to our existing and prospective customers, and the rates we pay to our suppliers may increase, any of which could have a material adverse impact on our business, financial position, results of operations and cash flows.

Risks associated with our large labor force could have a significant adverse effect on our business.

We have an employee base of approximately 3,800 associates. Various federal and state labor laws govern our relationships with our associates and affect our operating costs. These laws include employee classifications as exempt or non-exempt, minimum wage requirements, unemployment tax rates, workers’ compensation rates, overtime, family leave, anti-discrimination laws, safety standards, payroll taxes, citizenship requirements and other wage and benefit requirements for employees classified as non-exempt. As our associates may be paid at rates that relate to the applicable minimum wage, further increases in the minimum wage could increase our labor costs. Associates may make claims against us under federal or state laws, which could result in significant costs. Significant additional government regulations, including the Employee Free Choice Act, the Paycheck Fairness Act and the Arbitration Fairness Act, could materially affect our business, financial condition and results of operations. In addition, we compete with other companies for many of our associates in hourly positions, and we invest significant resources to train and motivate our associates to maintain a high level of job satisfaction. Our hourly employment positions have historically had high turnover rates, which can lead to increased spending on training and retention and, as a result, increased labor costs. If we are unable to effectively retain highly qualified associates in the future, it could adversely impact our business, financial position, results of operations and cash flows.

None of our associates are currently covered by collective bargaining or other similar labor agreements. However, if a larger number of our associates were to unionize, including in the wake of any future legislation that makes it easier for associates to unionize, our business could be negatively affected. Any inability by us to negotiate collective bargaining arrangements could cause strikes or other work stoppages, and new contracts could result in increased operating costs. If any such strikes or other work stoppages occur, or if other associates become represented by a union, we could experience a disruption of our operations and higher labor costs.

In addition, certain of our suppliers have unionized work forces and certain of our products are transported by unionized truckers. Strikes, work stoppages or slowdowns could result in slowdowns or closures of facilities where the products that we sell are manufactured or could affect the ability of our suppliers to deliver such products to us. Any interruption in the production or delivery of these products could delay or reduce availability of these products and increase our costs.

We depend on a limited number of key personnel. We may not be able to attract or retain key executives, which could adversely impact our business and inhibit our ability to operate and grow successfully.

We depend upon the ability and experience of a number of our executive management and other key personnel who have substantial experience with our operations and within our industry, including Doug Black, our Chief Executive Officer. The loss of the services of one or a combination of our senior executives or key employees could have a material adverse effect on our results of operations. Our business may also be negatively impacted if one of our senior executives or key employees is hired by a competitor. Our success also depends on our ability to continue to attract, manage and retain other qualified management personnel as we grow. We may not be able to continue to attract or retain such personnel in the future.

An impairment of goodwill and/or other intangible assets could reduce net income.

15

Acquisitions frequently result in the recording of goodwill and other intangible assets. As of December 31, 2017, goodwill represented approximately 12% of our total assets. Goodwill is not amortized for financial reporting purposes and is subject to impairment testing at least annually using a fair-value based approach. The identification and measurement of goodwill impairment involves the estimation of the fair value of our reporting units. Our accounting for impairment contains uncertainty because management must use its judgment in determining appropriate assumptions to be used in the measurement of fair value. We determine the fair values of our reporting units by using both a market and income approach.

We evaluate the recoverability of goodwill for impairment in between our annual tests when events or changes in circumstances indicate that the carrying amount of goodwill may not be recoverable. Any impairment of goodwill will reduce net income in the period in which the impairment is recognized.

Adverse credit and financial market events and conditions could, among other things, impede access to, or increase the cost of, financing or cause our customers to incur liquidity issues that could lead to some of our products not being purchased or being cancelled, or result in reduced operating revenue and net income, any of which could have an adverse impact on our business, financial position, results of operations and cash flows.

Disruptions in credit or financial markets could, among other things, lead to impairment charges, make it more difficult for us to obtain, or increase our cost of obtaining, financing for our operations or investments or to refinance our indebtedness, cause our lenders to depart from prior credit industry practice and not give technical or other waivers under the Credit Facilities (as defined under “-Risks Related to Our Substantial Indebtedness” below), to the extent we may seek them in the future, thereby causing us to be in default under one or more of the Credit Facilities. These disruptions could also cause our customers to encounter liquidity issues that could lead to a reduction in the amount of our products purchased or services used, could result in an increase in the time it takes our customers to pay us, or could lead to a decrease in pricing for our products, any of which could adversely affect our accounts receivable, among other things, and, in turn, increase our working capital needs. In addition, adverse developments at federal, state and local levels associated with budget deficits resulting from economic conditions could result in federal, state and local governments increasing taxes or other fees on businesses, including us, to generate more tax revenues, which could negatively impact spending by customers on our products.

The majority of our net sales are derived from credit sales, which are made primarily to customers whose ability to pay is dependent, in part, upon the economic strength of the geographic areas in which they operate, and the failure to collect monies owed from customers could adversely affect our working capital and financial condition.

The majority of our net sales in our 2017 Fiscal Year were derived from the extension of credit to our customers whose ability to pay is dependent, in part, upon the economic strength of the areas where they operate. We offer credit to customers, generally on a short-term basis, either through unsecured credit that is based solely upon the creditworthiness of the customer, or secured credit for materials sold for a specific project where we establish a security interest in the material used in the project. The type of credit we offer depends on the customer’s financial strength. If any of our customers are unable to repay credit that we have extended in a timely manner, or at all, our working capital, financial condition, operating results and cash flows would be adversely affected. Further, our collections efforts with respect to non-paying or slow-paying customers could negatively impact our customer relations going forward.

Because we depend on certain of our customers to repay extensions of credit, if the financial condition of our customers declines, our credit risk could increase as a result. Significant contraction in the residential and non-residential construction markets, coupled with limited credit availability and stricter financial institution underwriting standards, could adversely affect the operations and financial stability of certain of our customers. Should one or more of our larger customers declare bankruptcy, it could adversely affect the collectability of our accounts receivable, bad debt reserves and net income.

Because we operate our business through highly dispersed locations across the United States, our operations may be materially adversely affected by inconsistent practices and the operating results of individual branches may vary.