NOTICE OF ANNUAL GENERAL MEETING 2024 THIS DOCUMENT IS IMPORTANT AND REQUIRES YOUR IMMEDIATE ATTENTION. If you are in any doubt about the action you should take, you should immediately consult your stockbroker, solicitor, accountant or other appropriately authorised independent professional adviser. If you have sold or otherwise transferred all your shares in Coca-Cola Europacific Partners plc, please hand this document, together with the accompanying documents, to the purchaser or transferee, or to the stockbroker or other agent through whom the sale or transfer was effected, for transmission to the purchaser or transferee.

Contents Page Number Chairman's letter 4 Part I: Notice of the 2024 Annual General Meeting 7 Part II: Explanatory notes on resolutions 13 Part III: Notes to the Notice of 2024 Annual General Meeting 28 Part IV: Additional Information 32 Part V: Definitions 44

Coca-Cola Europacific Partners plc Chairman's letter 4 April 2024 Dear Shareholder Annual General Meeting ("AGM" or "Meeting") of Coca-Cola Europacific Partners plc ("Company" or "CCEP") I am delighted to enclose the Notice of Meeting for CCEP's eighth AGM ("Notice"). The AGM is to be held at 1A Wimpole Street, London, W1G 0EA, United Kingdom on 22 May 2024 at 12:00pm. The Notice sets out the resolutions proposed, together with explanatory and guidance notes for Shareholders who wish to vote electronically or by post. Proxy appointment forms are also enclosed. If you have requested a printed copy of CCEP’s Integrated Report and Accounts for the year ended 31 December 2023 ("2023 Integrated Report"), it is included in this pack. If you asked to receive the 2023 Integrated Report electronically, please accept this letter as notification that it has now been published on our website: ir.cocacolaep.com/financial-reports-and-results/integrated-reports Shareholder questions at the AGM If Shareholders are unable to attend this year’s AGM, we recognise that they will not have the opportunity to ask questions at the Meeting. Therefore, if Shareholders have questions for the Board in relation to the matters to be discussed at the AGM, please submit them by email to shareholders@ccep.com by 12:00pm on 20 May 2024 (or, in the event of any adjournment, at least 48 hours before the time of the adjourned meeting). Business of the AGM Please read the enclosed Notice which explains the business to be considered at the Meeting. In addition to the standard items of business I would like to highlight the following items: Election and re-election of Directors - Resolutions 3 - 18 As announced on 14 December 2023, and outlined in our 2023 Integrated Report, Guillaume Bacuvier was appointed to the Board with effect from 1 January 2024 and will stand for election at this year's AGM. Guillaume brings valuable perspectives on consumer behaviours and strategy, as well as marketing effectiveness insights from across Europe and APAC and has a strong track record of commercial and technological business transformation. In line with CCEP's Articles of Association ("Articles"), all other Directors (with the exception of the Chairman) will stand for re-election at the AGM. The Board considers that each of the Directors standing for election and re-election will or will continue to make a strong contribution to the Board and its Committees through their skills and experience and have sufficient time to commit to CCEP. Further information can be found in their biographies on pages 14 to 22 of this Notice. At the conclusion of this year's AGM, subject to the election and re-election of the Directors (with such re-election being recommended by the Board as set out below), your Board will comprise a Chairman, an executive Director, nine independent Non-executive Directors and six non-independent Non-executive Directors. 4

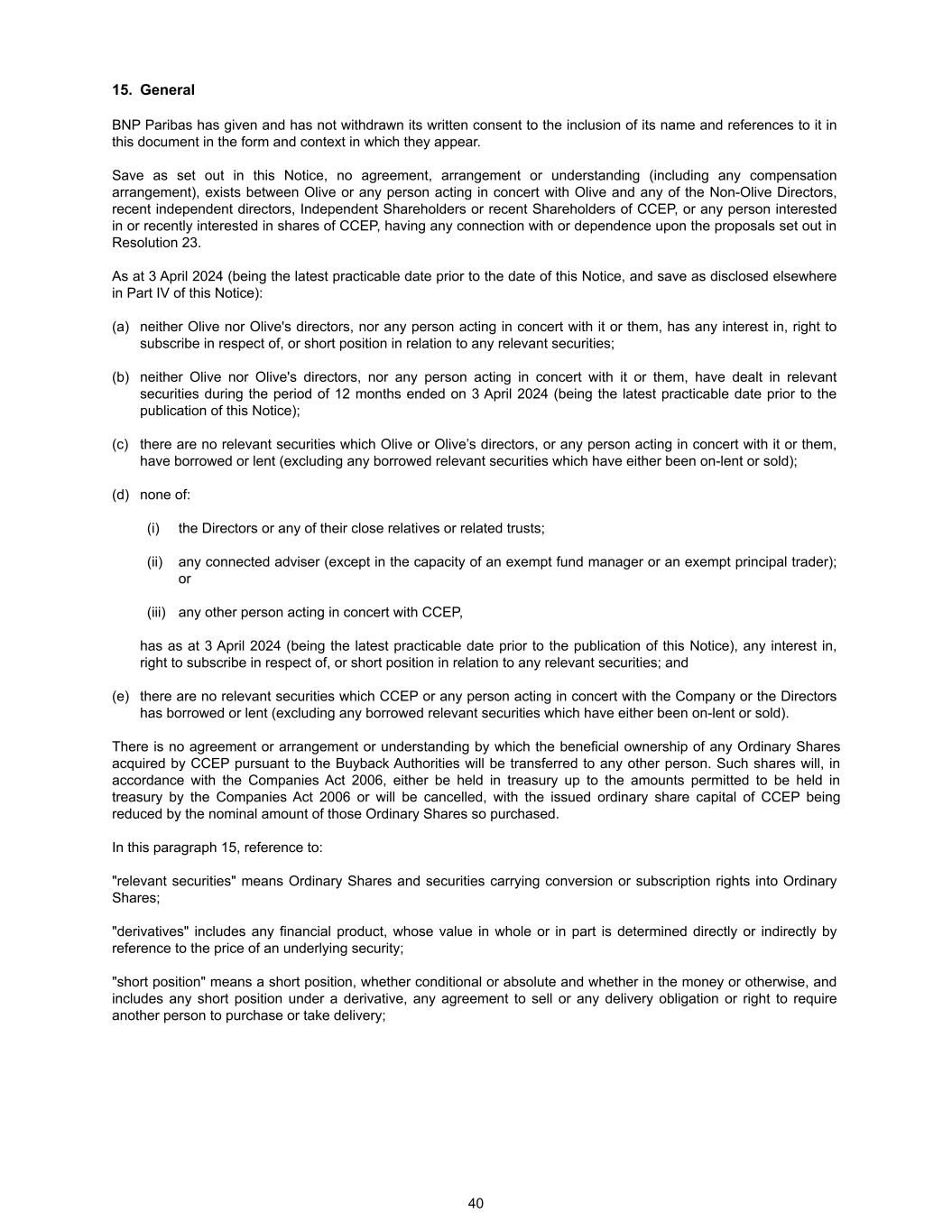

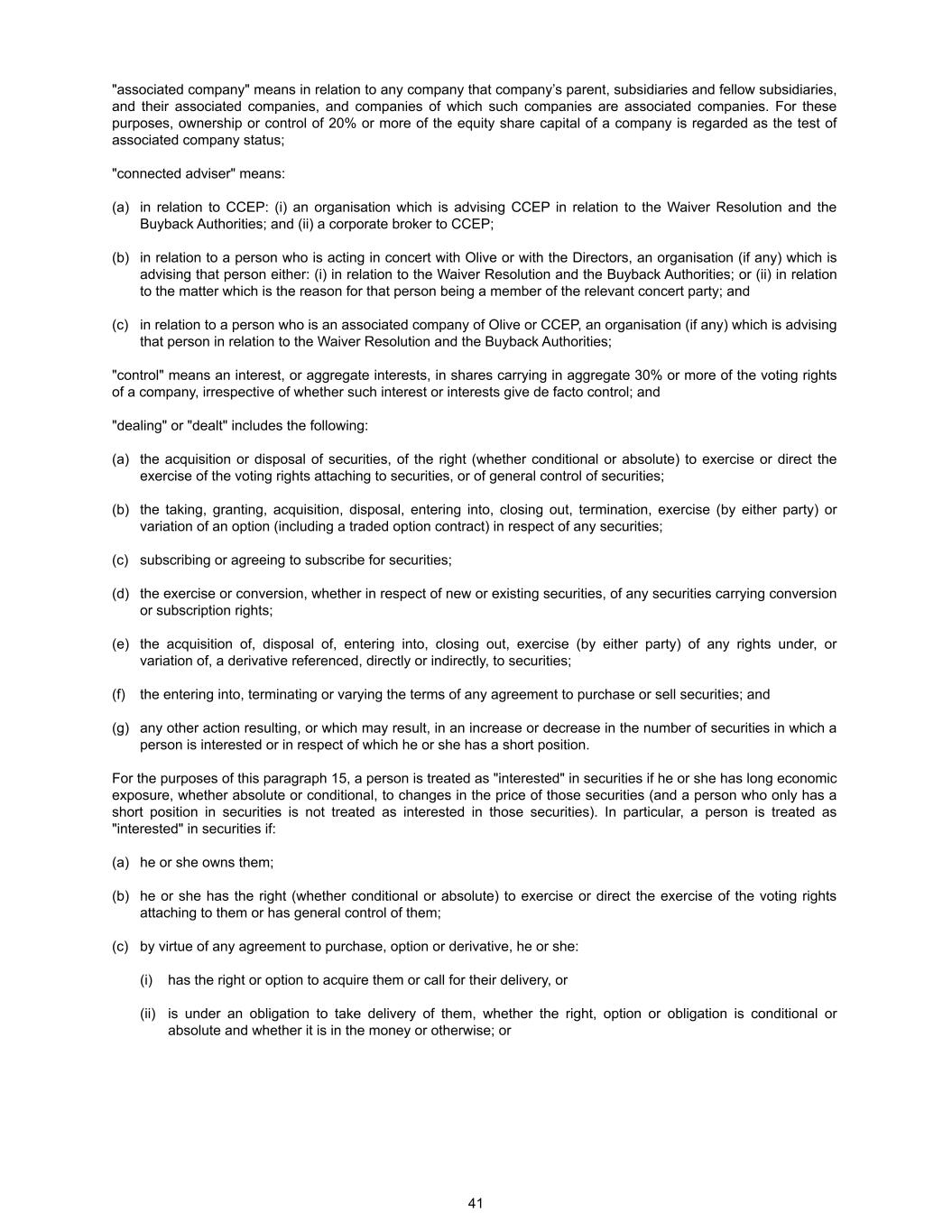

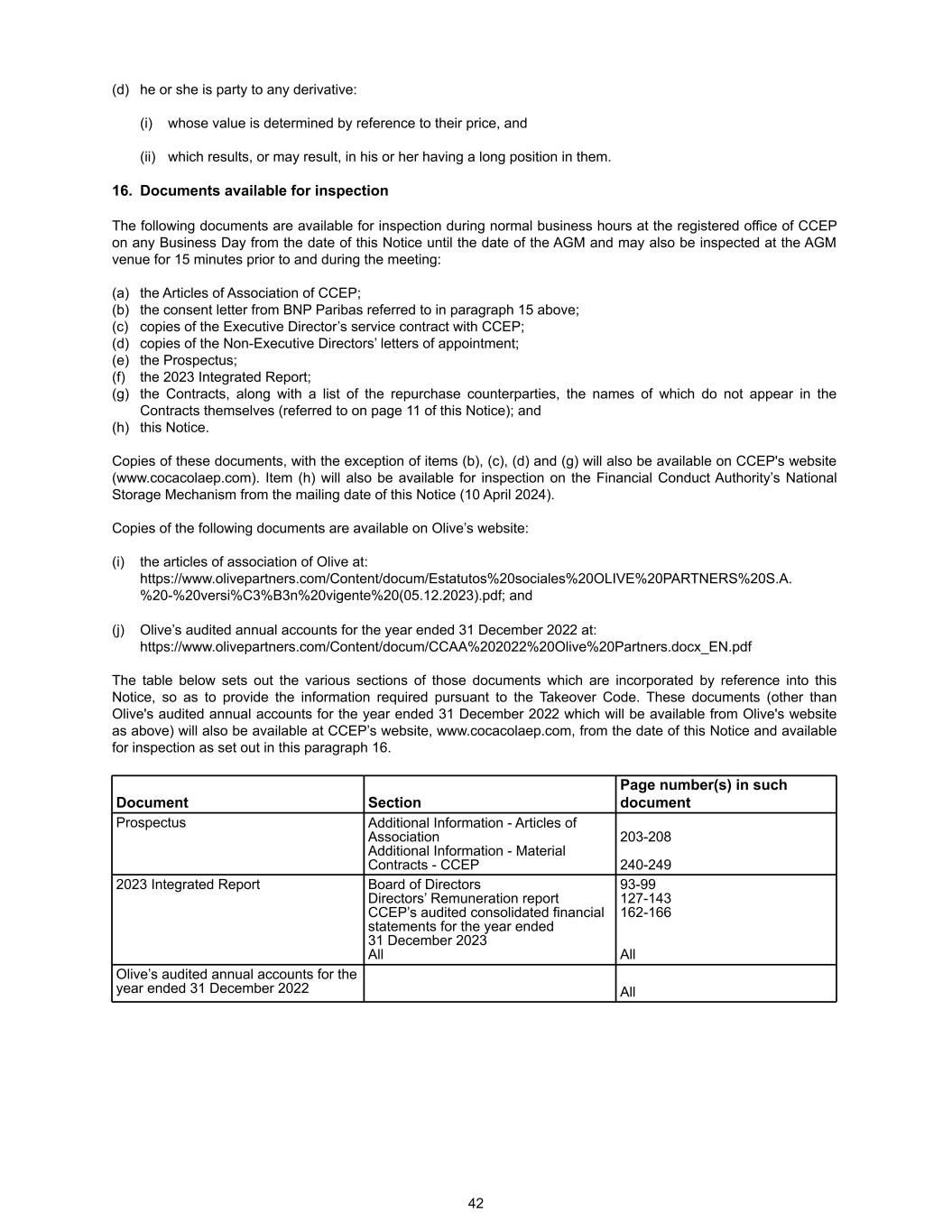

Rule 9 waiver granted by the Panel on Takeovers and Mergers (the "Panel") in favour of Olive Partners, S.A. ("Olive") - Resolution 23 As with previous years, CCEP has applied to the Panel for a waiver of Rule 9 of the Takeover Code to permit the buyback authorities proposed under Resolutions 26 and 27 to be exercised without obliging Olive to make a general offer to Shareholders. The Takeover Code is administered by the Panel and applies to CCEP as a UK public company. The Panel is the UK body which provides a framework for takeovers in the UK and ensures fair and equal treatment of shareholders in relation to takeovers. Accordingly, the Panel was consulted at an early stage regarding the waiver of Rule 9 of the Takeover Code. The Panel has reviewed Resolution 23 (Waiver of mandatory offer provisions set out in Rule 9 of the Takeover Code) and has agreed, subject to the approval of the Shareholders other than Olive or any concert party of Olive ("Independent Shareholders"), to waive the requirement for Olive and any person acting in concert with Olive to make a general offer to all Shareholders where such an obligation would arise as a result of purchases by CCEP of up to 46,027,917 of its own ordinary shares of €0.01 each ("Ordinary Shares") pursuant to Resolutions 26 and 27. Under the proposed Resolution 23 we are asking the Independent Shareholders for such approval. An explanation of the reasons for such a request and the background to the obligation arising from Rule 9 of the Takeover Code are set out in the Explanatory Notes to Resolution 23 and in Part IV of this Notice. The Board believes that it is in the best interests of Shareholders that CCEP has the flexibility to return cash to shareholders by buying back shares. The Board believes that the best way to facilitate this is to pass Resolutions 23, 26 and 27. Voting Your vote is important to us. All Shareholders are strongly encouraged to vote by: • submitting your proxy instruction/vote online; • completing, signing and returning the enclosed form of proxy; or • attending and voting in person at the AGM in accordance with the instructions set out in Part III of this Notice. All resolutions will be put to a vote by poll based on the instructions received. On a poll, each Shareholder has one vote for every share held and the Board considers that this will result in a fairer and more accurate indication of the views of Shareholders as a whole. The final results of the poll will be announced shortly after the Meeting and published on CCEP's website (www.cocacolaep.com). These results will include the votes cast by non-attending Shareholders prior to the Meeting, and the votes cast by Shareholders at the Meeting. Recommendation Your Board believes that each Resolution proposed in this Notice is in the best interests of CCEP and Shareholders as a whole and recommends that you vote in favour of all Resolutions. In accordance with the Takeover Code, I and my fellow Directors, José Ignacio Comenge, Álvaro Gómez-Trénor Aguilar, Alfonso Líbano Daurella and Mario Rotllant Solá, being nominated to the Board by Olive ("Olive Nominated Directors") did not participate in the Board’s recommendation with regard to Resolution 23 (Waiver of mandatory offer provisions set out in Rule 9 of the Takeover Code), as it is the percentage increase in Olive’s interest in Ordinary Shares that is the subject of the waiver under Resolution 23. Accordingly, the Directors, with the exceptions just described, unanimously recommend Shareholders to vote in favour of the Resolutions, as they intend to do in respect of their own shareholdings, save that Olive and the Olive Nominated Directors will not vote in respect of their shareholdings (if any) on Resolution 23, in which they are considered to be interested. As at 3 April 2024 (being the latest practicable date prior to the publication of this Notice), the Directors' shareholdings amounted to, in aggregate, 609,394 Ordinary Shares, representing approximately 0.1324% of the total voting rights of the Company. As at 3 April 2024, Olive’s shareholding amounted to 166,128,987 Ordinary Shares, representing approximately 36.0931% of the total voting rights of the Company. The Olive Nominated Directors have no direct shareholding in the Company, but are indirectly interested in 51,086,304 Ordinary Shares, representing approximately 11.0990% of the total voting rights of the Company through their interests in Olive. 5

The Directors other than the Olive Nominated Directors ("Non-Olive Directors"), who have been so advised by BNP Paribas, consider Resolution 23 to be fair and reasonable and in the best interests of the Independent Shareholders and the Company as a whole. In providing its advice to the Non-Olive Directors, BNP Paribas has taken account of the Non-Olive Directors' commercial assessments. The Non-Olive Directors also consider Resolution 23 to be in the best interests of CCEP and the Shareholders as a whole. Accordingly, the Non-Olive Directors unanimously recommend that the Independent Shareholders vote in favour of Resolution 23, as they intend to do in respect of their own shareholdings, which, as at 3 April 2024 (being the latest practicable date prior to the publication of this Notice) amounted to, in aggregate, 609,394 Ordinary Shares, representing approximately 0.1324% of the total voting rights of the Company. Yours faithfully Sol Daurella Chairman 6

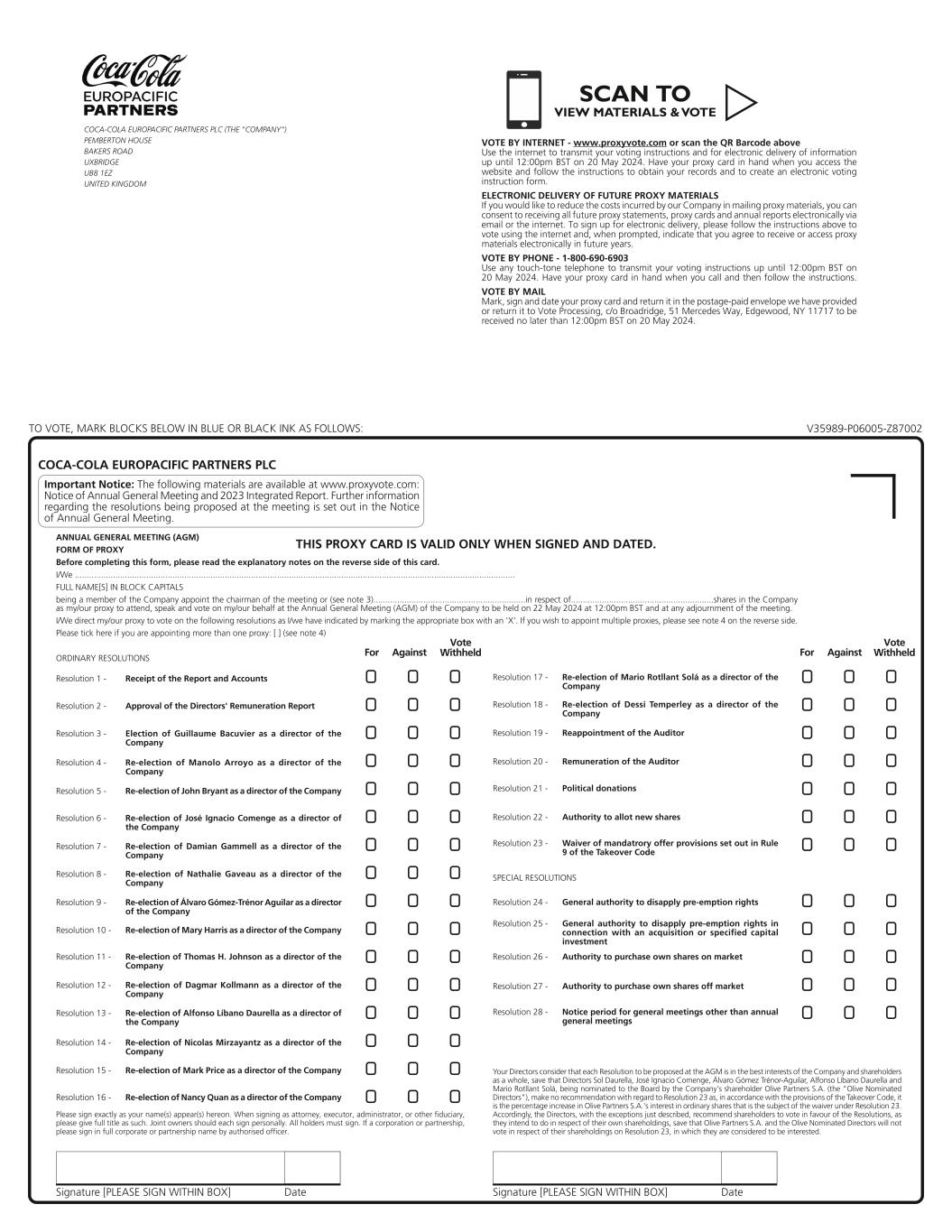

Part I Notice of the 2024 Annual General Meeting Notice is hereby given that the AGM of the Company will be held at 1A Wimpole Street, London, W1G 0EA, United Kingdom on 22 May 2024 at 12:00pm. You will be asked to consider and, if thought fit, to pass the resolutions below. Resolutions 1 to 23 will be proposed as ordinary resolutions, which require more than half of votes to be cast in favour to be passed. Resolutions 24 to 28 will be proposed as special resolutions, which require at least three quarters of votes to be cast in favour to be passed. All Resolutions will be voted on by poll. Explanatory Notes to the Resolutions are set out on pages 13 to 27 of this Notice. Resolution 23 (Waiver of mandatory offer provisions set out in Rule 9 of the Takeover Code) will be proposed as an ordinary resolution where only votes cast by Independent Shareholders will be counted. This means that, for Resolution 23 to be passed, more than half of those votes cast by Independent Shareholders on the poll must be in favour of the resolution. Olive has confirmed to the Company that it, and any person acting in concert with it, will abstain from voting on Resolution 23. For more information, see the Explanatory Notes to Resolution 23 on pages 23 to 25 of this document. ORDINARY RESOLUTIONS Resolution 1 - Receipt of the Report and Accounts THAT the audited accounts of the Company for the financial year ended 31 December 2023 together with the strategic report and the reports of the Directors and of the Auditor be hereby received. Resolution 2 - Approval of the Directors' Remuneration Report THAT the Directors' Remuneration Report for the financial year ended 31 December 2023, set out on pages 127 to 143 of the 2023 Integrated Report be hereby approved. Resolution 3 - Election of Director THAT Guillaume Bacuvier be elected as a director of the Company. Resolutions 4 to 18 - Re-election of Directors Resolution 4 - THAT Manolo Arroyo be re-elected as a director of the Company Resolution 5 - THAT John Bryant be re-elected as a director of the Company. Resolution 6 - THAT José Ignacio Comenge be re-elected as a director of the Company. Resolution 7 - THAT Damian Gammell be re-elected as a director of the Company. Resolution 8 - THAT Nathalie Gaveau be re-elected as a director of the Company. Resolution 9 - THAT Álvaro Gómez-Trénor Aguilar be re-elected as a director of the Company. Resolution 10 - THAT Mary Harris be re-elected as a director of the Company. Resolution 11 - THAT Thomas H. Johnson be re-elected as a director of the Company. 7

Resolution 12 - THAT Dagmar Kollmann be re-elected as a director of the Company. Resolution 13 - THAT Alfonso Líbano Daurella be re-elected as a director of the Company. Resolution 14 - THAT Nicolas Mirzayantz be re-elected as a director of the Company. Resolution 15 - THAT Mark Price be re-elected as a director of the Company. Resolution 16 - THAT Nancy Quan be re-elected as a director of the Company. Resolution 17 - THAT Mario Rotllant Solá be re-elected as a director of the Company. Resolution 18 - THAT Dessi Temperley be re-elected as a director of the Company. Resolution 19 - Reappointment of the Auditor THAT Ernst & Young LLP be reappointed as Auditor of the Company from the conclusion of this AGM until the conclusion of the next annual general meeting of the Company. Resolution 20 - Remuneration of the Auditor THAT the Board, acting through the Audit Committee of the Board, be authorised to determine the remuneration of the Auditor. Resolution 21 - Political donations THAT, in accordance with sections 366 and 367 of the Companies Act 2006, the Company, and all companies that are its subsidiaries at any time during the period for which this Resolution is effective, are authorised, in aggregate, to: (a) make political donations to political parties and/or independent election candidates not exceeding £100,000 in total; (b) make political donations to political organisations other than political parties not exceeding £100,000 in total; and (c) incur political expenditure not exceeding £100,000 in total, (as such terms are defined in sections 363 to 365 of the Companies Act 2006) in each case during the period commencing on the effective date of Resolution 21 and ending on the date of the annual general meeting of the Company to be held in 2025 or, if earlier, until close of business on Monday 30 June 2025, provided that the authorised sum referred to in paragraphs (a), (b) and (c) above may be comprised of one or more amounts in different currencies which, for the purposes of calculating that authorised sum, shall be converted into pounds sterling at such rate as the Board may, in its absolute discretion, determine on the day on which the relevant donation is made or the relevant expenditure is incurred or, if earlier, on the day on which the Company or its subsidiary enters into any contract or undertaking in relation to such donation or expenditure (or, if such day is not a business day, the first business day thereafter). 8

Resolution 22 - Authority to allot new shares THAT the Board be generally and unconditionally authorised, without prejudice to the authority conferred on it by ordinary resolution passed on 26 May 2016 but in substitution for all additional subsisting authorities, to allot shares in the Company and to grant rights to subscribe for or convert any security into shares in the Company: (a) up to a nominal amount of €1,534,263.92 (such amount to be reduced by any allotments or grants made under paragraph (b) below in excess of such sum); and (b) comprising equity securities (as defined in the Companies Act 2006) up to a nominal amount of €3,068,527.85 (such amount to be reduced by any allotments or grants made under paragraph (a) above) in connection with an offer by way of a rights issue: (i) to ordinary shareholders in proportion (as nearly as may be practicable) to their existing holdings; and (ii) to holders of other equity securities as required by the rights of those securities or as the Board otherwise considers necessary, and so that the Board may impose any limits or restrictions and make any arrangements which it considers necessary or appropriate to deal with treasury shares, fractional entitlements, record dates, legal, regulatory or practical problems in, or under the laws of, any territory or any other matter, such authority to apply until the end of next year’s annual general meeting or, if earlier, until the close of business on Monday 30 June 2025, but in each case during this period the Company may make offers and enter into agreements which would, or might, require shares to be allotted or rights to subscribe for or convert securities into shares to be granted after the authority ends and the Board may allot shares or grant rights to subscribe for or convert securities into shares under any such offer or agreement as if the authority had not ended. Resolution 23 - Waiver of mandatory offer provisions set out in Rule 9 of the Takeover Code THAT approval be granted for the waiver by the Panel on Takeovers and Mergers of any obligation that could arise pursuant to Rule 9 of the Takeover Code for Olive Partners S.A. ("Olive"), or any persons acting in concert with Olive, to make a general offer for all the ordinary issued share capital of the Company, following any increase in the percentage of shares of the Company carrying voting rights in which Olive and any persons acting in concert with Olive are interested, resulting from the exercise by the Company of the authority to purchase up to 46,027,917 of its own Ordinary Shares of €0.01 each, granted to the Company pursuant to Resolutions 26 and 27 below, subject to the following limitations and provisions: (a) no approval for such waiver is given where the resulting interest of Olive, together with the interest of those acting in concert with Olive, exceeds 40.1034% or more of the shares of the Company carrying voting rights; and (b) such approval shall expire at the end of next year’s annual general meeting (or, if earlier, the close of business on Monday 30 June 2025). Resolution 23 shall be voted on by the Independent Shareholders only by a poll. SPECIAL RESOLUTIONS Resolution 24 - General authority to disapply pre-emption rights THAT, if Resolution 22 (Authority to allot new shares) is passed, the Board be given power to allot equity securities (as defined in the Companies Act 2006) for cash under the authority given by that resolution and/or to sell Ordinary shares of €0.01 each held by the Company as treasury shares for cash as if section 561 of the Companies Act 2006 did not apply to any such allotment or sale, such power to be limited: 9

(a) to the allotment of equity securities or sale of treasury shares in connection with an offer of, or invitation to apply for, equity securities (but in the case of the authority granted under paragraph (b) of Resolution 22, by way of a rights issue only): (i) to ordinary shareholders in proportion (as nearly as may be practicable) to their existing holdings; and (ii) to holders of other equity securities, as required by the rights of those securities, or as the Board otherwise considers necessary, and so that the Board may impose any limits or restrictions and make any arrangements which it considers necessary or appropriate to deal with treasury shares, fractional entitlements, record dates, legal, regulatory or practical problems in, or under the laws of, any territory or any other matter; and (b) in the case of the authority granted under paragraph (a) of Resolution 22 and/or in the case of any sale of treasury shares, to the allotment of equity securities or sale of treasury shares (otherwise than under paragraph (a) above) up to a nominal amount of €230,139.58, such power to apply until the end of next year’s annual general meeting or, if earlier, until the close of business on Monday 30 June 2025, but in each case during this period the Company may make offers, and enter into agreements, which would, or might, require equity securities to be allotted (and treasury shares to be sold) after the power ends and the Board may allot equity securities (and sell treasury shares) under any such offer or agreement as if the power had not ended. Resolution 25 - General authority to disapply pre-emption rights in connection with an acquisition or specified capital investment THAT, if Resolution 22 (Authority to allot new shares) is passed, the Board be given the power in addition to any power granted under Resolution 24 (General authority to disapply pre-emption rights) to allot equity securities (as defined in the Companies Act 2006) for cash under the authority given by that Resolution 22 and/or to sell Ordinary shares of €0.01 each held by the Company as treasury shares for cash as if section 561 of the Companies Act 2006 did not apply to any such allotment or sale, such power to be: (a) limited to the allotment of equity securities or sale of treasury shares up to a nominal amount of €230,139.58; and (b) used only for the purposes of financing (or refinancing, if the authority is to be used within 12 months of the original transaction) a transaction which the Board of the Company determines to be an acquisition or other capital investment of a kind contemplated by the Statement of Principles on Disapplying Pre-Emption Rights most recently published by the Pre-Emption Group prior to the date of this Notice such power to apply until the end of next year’s annual general meeting or, if earlier, until the close of business on Monday 30 June 2025, but in each case during this period the Company may make offers, and enter into agreements, which would, or might, require equity securities to be allotted (and treasury shares to be sold) after the power ends and the Board may allot equity securities (and sell treasury shares) under any such offer or agreement as if the power had not ended. Resolution 26 - Authority to purchase own shares on market THAT, if Resolution 23 (Waiver of mandatory offer provisions set out in Rule 9 of the Takeover Code) is passed, the Company be authorised for the purposes of section 701 of the Companies Act 2006 to make one or more market purchases (as defined in section 693(4) of the Companies Act 2006) of its Ordinary Shares of €0.01 each (the "Ordinary Shares") provided that the: (a) maximum aggregate number of Ordinary Shares hereby authorised to be purchased is 46,027,917, such limit to be reduced by: 10

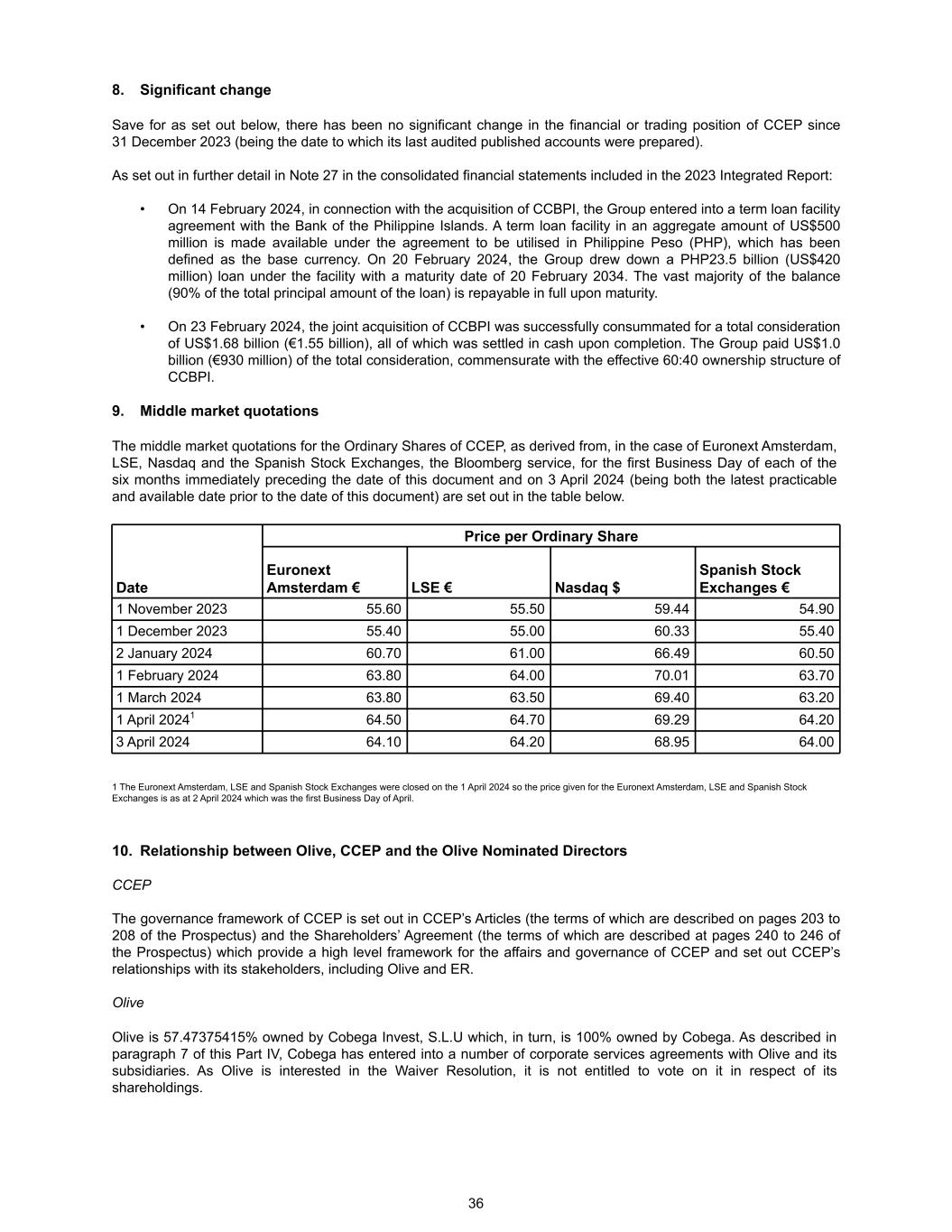

(i) the number of Ordinary Shares purchased or agreed to be purchased by the Company after 3 April 2024 and before 22 May 2024 pursuant to any authority granted at the Company's 2023 annual general meeting; and (ii) the number of Ordinary Shares purchased pursuant to the authority granted at Resolution 27 (Authority to purchase own shares off market); (b) minimum price (exclusive of expenses) which may be paid for an Ordinary Share is €0.01; and (c) the maximum price (exclusive of expenses) which may be paid for an Ordinary Share is the highest of: (i) an amount equal to 5% above the average market value of an Ordinary Share purchased on the trading venue where the purchase is carried out for the five business days immediately preceding the day on which that Ordinary Share is contracted to be purchased; and (ii) the higher of the price of the last independent trade and the highest current independent bid for an Ordinary Share on the trading venue where the purchase is carried out at the relevant time, such authority to apply until the end of next year’s annual general meeting or, if earlier, until the close of business on Monday 30 June 2025, but during this period the Company may enter into a contract to purchase Ordinary Shares, which would, or might, be completed or executed wholly or partly after the authority ends and the Company may purchase Ordinary Shares pursuant to any such contract as if the authority had not ended. Resolution 27 - Authority to purchase own shares off market THAT, if Resolution 23 (Waiver of mandatory offer provisions set out in Rule 9 of the Takeover Code) is passed, for the purposes of section 694 of the Companies Act 2006, the terms of the buyback contracts entered into conditionally on the passing of this resolution or to be entered into between the Company and any or all of BNP Paribas, BNP Paribas Securities Corp, Mizuho Securities USA LLC, Goldman Sachs International, Goldman Sachs Bank Europe SE and Goldman Sachs & Co. LLC (in the form produced to the meeting and made available at the Company's registered office for not less than 15 days ending with the date of the meeting) (each a "Contract" and, collectively, the "Contracts") are approved and the Company be authorised to undertake off- market purchases (within the meaning of section 693(2) of the Companies Act 2006) of its Ordinary Shares of €0.01 each (the "Ordinary Shares") and pursuant to such Contracts, provided that the maximum aggregate number of Ordinary Shares hereby authorised to be purchased is 46,027,917, such limit to be reduced by: (a) the number of Ordinary Shares purchased or agreed to be purchased by the Company after 3 April 2024 and before 22 May 2024 pursuant to any authority granted at the Company's 2023 annual general meeting; and (b) the number of Ordinary Shares purchased pursuant to the authority granted at Resolution 26 (Authority to purchase own shares on market), such authority to apply until the end of next year's annual general meeting or, if earlier, until the close of business on Monday 30 June 2025, but during this period the Company may agree to purchase Ordinary Shares pursuant to any Contract, even if such purchase would, or might, be completed or executed wholly or partly after the authority ends and the Company may accordingly purchase such Ordinary Shares pursuant to any such Contract as if the authority had not ended. 11

Resolution 28 - Notice period for general meetings other than annual general meetings THAT the Directors be authorised to call general meetings (other than an annual general meeting) on not less than 14 clear days' notice, such authority shall apply until the end of next year’s annual general meeting or, if earlier, until the close of business on Monday 30 June 2025. By order of the Board Clare Wardle Company Secretary 4 April 2024 Registered Office: Pemberton House Bakers Road Uxbridge UB8 1EZ United Kingdom Registered in England and Wales No. 09717350 12

Part II Explanatory notes on resolutions Resolution 1 - Receipt of the Report and Accounts We are required by the Companies Act 2006 to present the Strategic Report and the Reports of the Directors and the Auditor and CCEP's audited accounts for the financial year ended 31 December 2023 to the Meeting. These are available at ir.cocacolaep.com/financial-reports-and-results/integrated-reports CCEP's Articles permit the Directors to pay interim dividends, which is CCEP's current practice. Resolution 2 - Approval of the Directors' Remuneration Report Under UK company law, quoted companies are required to present to their shareholders a directors' remuneration report for the financial year. This Resolution invites Shareholders to vote on the Directors' Remuneration Report for the year ended 31 December 2023, as set out on pages 127 to 143 of the 2023 Integrated Report. The 2023 Integrated Report is available at ir.cocacolaep.com/financial-reports-and-results/integrated-reports This vote is advisory and will not affect the future remuneration of the Directors. Resolutions 3 to 18 - Election and re-election of Directors Under CCEP's Articles, all Directors are now required to retire and submit themselves for re-election at each AGM, with the exception of the Chairman. Resolution 3 relates to the election of Guillaume Bacuvier, and resolutions 4 to 18 relate to the re-election of Manolo Arroyo, John Bryant, José Ignacio Comenge, Damian Gammell, Nathalie Gaveau, Álvaro Gómez-Trénor Aguilar, Mary Harris, Thomas H. Johnson, Dagmar Kollmann, Alfonso Líbano Daurella, Nicolas Mirzayantz, Mark Price, Nancy Quan, Mario Rotllant Solá and Dessi Temperley. Biographies of the Directors seeking election and re-election are set out below. In respect of each Director, the strengths and experiences set out indicate why their contribution is, and continues to be, important to the Company's long-term sustainable success. The Board reviewed the independence of the Directors and it has been determined that a majority of the Board and of the Non-executive Directors is independent. The Board recognises that eight of CCEP’s Directors, including the Chairman and Chief Executive Officer, cannot be considered independent. However, CCEP benefits from the non-independent Non-Executive Directors' industry experiences and skills, and they continue to demonstrate effective judgement when carrying out their roles, and understand their obligations as Directors, including under section 172 of the Companies Act 2006. 13

Time Commitment The Board, both prior to a Director’s initial appointment and when nominating a Director for election or re-election, enquires and obtains assurance, that each Director is, or will be, capable of devoting the appropriate time expected of them to board activities and is, or will be, capable of fulfilling their individual, anticipated obligations to CCEP alongside any unanticipated demands which may be placed on them in relation to CCEP or by any other commitments. The Board has carefully considered the additional commitments held by the Directors and has applied the same standard of enquiry for each of them. Our focus is to determine the ability of each Director to commit sufficient time to fulfil their individual obligations, rather than a strict adherence to a numeric count of directorships. Where Directors hold other roles either outside of or elsewhere within the Group, or prior to accepting any additional roles, particular attention is paid to ensure that they are able to commit sufficient time to the Company. The biographies on pages 14 to 22 set out the skills and experience which underpin the contribution each Director brings to the Board for the long term sustainable success of the Company. Based upon the review undertaken, the Board has satisfied itself that each of the Directors is fully able to discharge their duties to the Company and that they each have sufficient capacity to meet their commitments to the Company. Biography of Director standing for election Guillaume Bacuvier Non-executive Director Date appointed to the Board: January 2024 Independent: Yes Key strengths/expertise: • Valuable perspectives on consumer behaviours and strategy • Brings a wealth of marketing effectiveness insights from across Europe and APAC • Strong track record of commercial and technological business transformation Key external commitments: CEO of Worldpanel, Kantar’s consumer panel market research division, and non-executive director of Berger-Levrault Previous roles: CEO of dunnhumby, a number of senior positions at Google and Orange and non-executive director of Attest Technologies Limited and VEON Ltd 14

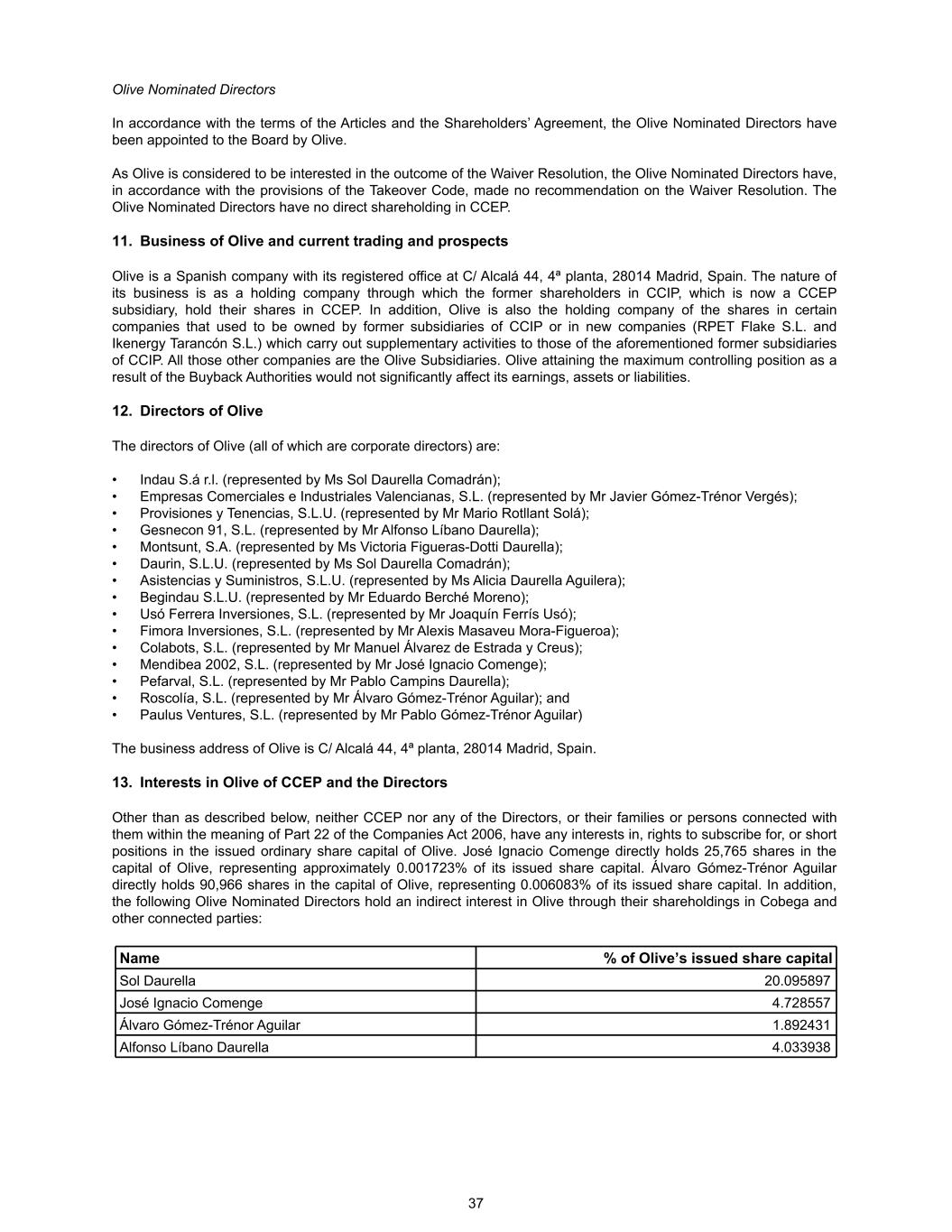

Biographies of Directors standing for re-election Manolo Arroyo Non-executive Director Member of the Nomination Committee and Remuneration Committee Date appointed to the Board: May 2021 Independent: No Key strengths/experience: • Extensive experience working in the Coca-Cola system • Strong operational leadership experience in international consumer goods groups, lived and worked on four continents, both developed and emerging markets • Strategic marketing, commercial and bottling expertise • Served as CEO of publicly listed FMCG company • In depth understanding of brands in the Coca-Cola system Key external commitments: Executive Vice President and Global Chief Marketing Officer at The Coca-Cola Company ("TCCC") Previous roles: President of the Asia Pacific Group, Bottling Investments Group, and Mexico business unit of TCCC, CEO of Deoleo, S.A., Senior Vice President and President, Asia Pacific of S.C. Johnson & Son, Inc., President of the ASEAN and SEWA business units of TCCC, General Manager of the Spain business unit of TCCC; Vice-Chairman of Coca-Cola COFCO Bottling China, non-executive Director of ThaiNamthip Limited and Coca-Cola Andina and non-executive director of Effie Worldwide John Bryant Non-executive Director Chairman of the Remuneration Committee and Member of the Audit Committee Date appointed to the Board: January 2021 Independent: Yes Key strengths/experience: • Chairman/CEO of a multinational public company • Expert in strategy, mergers and acquisitions, restructuring and portfolio transformation • 30 years’ experience in consumer goods • Strong track record of finance and operational leadership, experience in overseeing information technology • Engaged in the cyber security strategy process Key external commitments: Chairman of the Board and of the Nomination Committee and member of the Remuneration Committee of Flutter Entertainment plc, non-executive director, Chairman of the Remuneration Committee and member of the Audit, Corporate Responsibility and Nomination Committees of Compass Group plc and non-executive director and member of the Audit and Nominating and Corporate Governance Committees of Ball Corporation Previous roles: Executive Chairman and CEO of Kellogg Company having previously held a variety of senior roles in the Kellogg Company, strategy advisor at A.T. Kearney and Marakon Associates and non-executive director of Macy's Inc 15

José Ignacio Comenge Non-executive Director Member of the Remuneration Committee Date appointed to the Board: May 2016 Independent: No Key strengths/experience: • Extensive experience of the Coca-Cola system • Broad board experience across industries and sectors • Knowledgeable about the industry in our key market of Iberia • Insights in formulating strategy drawn from leadership roles in varied sectors Key external commitments: Director of Olive Partners, S.A., ENCE Energía y Celulosa, S.A., Compañía Vinícola del Norte de España, S.A., Ebro Foods S.A., Barbosa & Almeida SGPS, S.A., Mendibea 2002, S.L. and Chairman of Ball Beverage Can Iberica, S.L Previous roles: Senior roles in the Coca-Cola system, AXA, S.A., Aguila and Heineken Spain and Vice-Chairman and CEO of MMA Insurance Damian Gammell Chief Executive Officer Date appointed to the Board: December 2016 Independent: No Key strengths/experience: • Strategy, risk management, development and execution experience • Vision, customer focus and transformational leadership • Developing people and teams and promoting sustainability • Over 25 years of leadership experience and in depth understanding of the non-alcoholic ready to drink (NARTD) industry and within the Coca-Cola system Key external commitments: N/A Previous roles: Beverage Group President of Anadolu Group and CEO of Anadolu Efes, CEO and Managing Director of Coca-Cola İçecek A.Ş. and a number of other senior executive roles in the Coca-Cola system including in Russia, Australia and Germany 16

Nathalie Gaveau Non-executive Director Member of the Environmental, Social and Governance Committee and the Affiliated Transaction Committee Date appointed to the Board: January 2019 Independent: Yes Key strengths/experience: • Successful tech entrepreneur and investor • Expert in e-commerce and digital transformation, innovation, mobile, data and social marketing • International consumer goods experience Key external commitments: Non-executive director of Lightspeed Commerce Inc., Sonepar and PortAventura World and Senior Advisor to BCG Previous roles: Founder and CEO of Shopcade, Interactive Business director of the TBWA Tequila Group, Asia Pacific E-business and CRM Manager for Club Med, co-founder and Managing Director of Priceminister, Financial Analyst for Lazard and non-executive director of HEC Paris and Calida Group and President of Tailwind International Corp, special acquisition company Álvaro Gómez-Trénor Aguilar Non-executive Director Date appointed to the Board: March 2018 Independent: No Key strengths/experience: • Broad knowledge of working in the food and beverage industry • Extensive understanding of the Coca-Cola system, particularly in Iberia • Expertise in finance and investment banking • Strategic and investment advisor to businesses in varied sectors Key external commitments: Director of Olive Partners, S.A. Previous roles: Various board appointments in the Coca-Cola system, including as President of Begano, S.A., director and Chairman of the Audit Committee of Coca-Cola Iberian Partners, S.A., as well as key executive roles in Grupo Pas and Garcon Vallvé & Contreras and director of Global Omnium (Aguas de Valencia, S.A.) and Sinensis Seed Capital SCR de RC, S.A. 17

Mary Harris Non-executive Director Member of the Nomination Committee and Remuneration Committee Date appointed to the Board: May 2023 Independent: Yes Key strengths/expertise: • Top level strategic outlook with international and consumer focus • Significant non-executive director experience gained from other major listed companies • Deep understanding of remuneration requirements gained from previous Remuneration Committee chair roles Key external commitments: Designated non-executive director for workforce engagement and a member of the Remuneration Committee of Reckitt plc(A) and a Supervisory Board member at HAL Holding N.V. Previous roles: Non-executive director at ITV plc, Unibail-Rodamco-Westfield SE, Sainsbury’s, TNT Express and TNT N.V. and Partner at McKinsey & Company (A) Mary Harris will be appointed as Chairman of the Remuneration Committee of Reckitt plc with effect from the Reckitt plc AGM on 2 May 2024. Thomas H. Johnson Non-executive Director and Senior Independent Director Chairman of the Nomination Committee and member of the Remuneration Committee Date appointed to the Board: May 2016 Independent: Yes Key strengths/experience: • Chairman/CEO of international public companies • Manufacturing and distribution expertise • Extensive international management experience in Europe • Investment and finance experience Key external commitments: CEO of The Taffrail Group, LLC and non-executive director of Universal Corporation Previous roles: Chairman and CEO of Chesapeake Corporation, President and CEO of Riverwood International Corporation and director of Coca-Cola Enterprises, Inc., GenOn Corporation, Mirant Corporation, ModusLink Global Solutions, Inc., Superior Essex Inc. and Tumi, Inc. 18

Dagmar Kollmann Non-executive Director Chairman of the Affiliated Transaction Committee and member of the Audit Committee Date appointed to the Board: May 2019 Independent: Yes Key strengths/experience: • Expert in finance and international listed groups • Thorough understanding of capital markets and mergers and acquisitions • Extensive commercial and investor relations experience • Strong executive and senior leadership experience in global businesses • Risk oversight and corporate governance expertise Key external commitments: Chairman of the Supervisory Board of Citigroup Global Markets Europe AG, member of the Supervisory Board of Unibail-Rodamco-Westfield SE and Deutsche Telekom AG, non-executive director of Paysafe Group Limited, and Commissioner in the German Monopolies Commission Previous roles: CEO and Country Head in Germany and Austria for Morgan Stanley, member of the boards of Morgan Stanley International Ltd and Morgan Stanley and Co. International Ltd in London, Associate Director of UBS in London, non-executive director of KfW IPEX-Bank and Deputy Chairman of the Supervisory Boards of Hypo Real Estate Holdings AG and Deutsche Pfandbriefbank AG Alfonso Líbano Daurella Non-executive Director Member of the Affiliated Transaction Committee Date appointed to the Board: May 2016 Independent: No Key strengths/experience: • Developed the Daurella family’s association with the Coca-Cola system • Detailed knowledge of the Coca-Cola system • Insight to CCEP’s impact on communities from experience as trustee or director of charitable and public organisations • Experienced corporate social responsibility (CSR) committee chair Key external commitments: Vice Chairman and Member of the Executive Committee of Cobega, S.A., director of Olive Partners, S.A., Chairman of Equatorial Coca-Cola Bottling Company, S.L., Vice-Chairman of MECC Soft Drinks JLT, Co-chair of the Polaris Committee at United Nations and FBN, and Ambassador of the Family Business Network and member of the board of the American Chamber of Commerce in Spain Previous roles: Various roles at the Daurella family’s Coca-Cola bottling business, director and Chairman of the Quality & CRS Committee of Coca-Cola Iberian Partners, S.A, director of Grupo Cacaolat, S.L. and director of The Coca-Cola Bottling Company of Egypt, S.A.E, member of the board of Banco Espanol de Credito Banesto, and Chair of Family Business Europe 19

Nicolas Mirzayantz Non-executive Director Member of the Audit Committee and Environmental, Social and Governance Committee Date appointed to the Board: May 2023 Independent: Yes Key strengths/expertise: • Over 30 years of strategic, operational and business transformation experience • A deep understanding of the FMCG industry • Strong sustainability and ESG experience Key external commitments: Director of Puig S.L. Previous roles: Various senior roles at IFF, including President, Nourish Division and Divisional CEO, Scent Division. Previously served on the Board of the International Fragrance Association and was a Cultural Leader at the World Economic Forum Mark Price Non-executive Director Member of the Environmental, Social and Governance Committee and Nomination Committee Date appointed to the Board: May 2019 Independent: Yes Key strengths/experience: • Extensive experience in the retail industry • A deep understanding of international trade • Strong strategic and sustainable development skills Key external commitments: Member of the House of Lords, Founder of WorkL, Chair of Trustees of the Fairtrade Foundation UK and President and Chairman of the Chartered Management Institute Previous roles: Managing Director of Waitrose and Deputy Chairman of John Lewis Partnership, non-executive director and Deputy Chairman of Channel 4 TV and Minister of State for Trade and Investment and Trade Policy, Chair of Business in the Community, The Prince’s Countryside Fund and Member of Council at Lancaster University 20

Nancy Quan Non-executive Director Member of the Environmental, Social and Governance Committee Date appointed to the Board: May 2023 Independent: No Key strengths/expertise: • Extensive knowledge of the Coca-Cola system • Significant leadership experience spanning innovation and consumer trends, research and development, and supply chain • Experience applicable to our expanded geographical footprint in the Australia, Pacific and Indonesia region Key external commitments: Executive Vice President and Global Chief Technical and Innovation Officer at TCCC, a member of the Liberty Mutual Group Board of Directors, the Industry Affiliates Advisory Board for the University of California Davis MBA Program and the FIRST (For Inspiration and Recognition of Science and Technology) Executive Advisory Board Previous roles: Various senior roles at TCCC including Chief Technical Officer for Coca-Cola North America, Global Research and Development Officer, Vice President, Innovation, Research and Development General Manager for Europe and Eurasia Group, Vice President, Research and Development, Pacific Group, responsible for the Shanghai, Japan and India Research and Development Centres Mario Rotllant Solá Non-executive Director Chairman of the Environmental, Social and Governance Committee Date appointed to the Board: May 2016 Independent: No Key strengths/experience: • Extensive international experience in the food and beverage industry • Experience of chairing a remuneration committee • In-depth technical knowledge of the Coca-Cola system and the bottling industry • Development of non-profit organisations Key external commitments: Vice-Chairman of Olive Partners, S.A., Co-Chairman and member of the Executive Committee of Cobega, S.A., Chairman of the North Africa Bottling Company, Chairman of the Advisory Board of Banco Santander, S.A. in Catalonia and a director of Equatorial Coca-Cola Bottling Company, S.L. Previous roles: Second Vice-Chairman and member of the Executive Committee and Chairman of the Appointment and Remuneration Committee of Coca-Cola Iberian Partners, S.A. 21

Dessi Temperley Non-executive Director Chairman of the Audit Committee Date appointed to the Board: May 2020 Independent: Yes Key strengths/experience: • Financial and technical accounting expertise • Strong commercial insights and knowledge of European markets • International consumer brands experience • Skilled in technology Key external commitments: Non-executive director and Chairman of the Audit Committee of Cimpress plc, non-executive director and member of the Audit and Risk Committee of Philip Morris International Inc. and member of the Supervisory Board of Corbion N.V. Previous roles: Group CFO of Beiersdorf AG, member of the Supervisory Board of Tesa SE, Head of Investor Relations at Nestlé, CFO of Nestlé Purina EMENA and CFO of Nestlé South East Europe, and finance roles at Cable & Wireless and Shell Resolutions 19 and 20 - Reappointment and Remuneration of the Auditor CCEP is required to appoint an auditor for each financial year, to hold office until the end of the next general meeting at which accounts are laid before the Shareholders. Ernst & Young LLP were first appointed by the Company to audit the financial statements for the year ending 31 December 2016 (following the Company's creation in 2016 after the merger). The period of total uninterrupted engagement since the Company's creation, including previous renewals and reappointments is eight years, covering the years ending 31 December 2016 to 31 December 2023. Accordingly, the Board, on the unanimous recommendation of the Audit Committee, which has evaluated the effectiveness and independence of the external auditor, is proposing the reappointment of CCEP's existing Auditor, Ernst & Young LLP, as Auditor of CCEP for the financial year ending 31 December 2024, under Resolution 19. The Directors may set the remuneration of the Auditor if authorised by the Shareholders to do so. The Competition and Markets Authority’s Statutory Audit Services Order, which came into effect on 1 January 2015 (and with which CCEP voluntarily complies), clarified certain responsibilities of the Audit Committee, including providing that, acting collectively or through its chairman, and for and on behalf of the Board, it is permitted to negotiate and agree the statutory audit fee. Resolution 20 seeks authority for the Audit Committee to determine the Auditor’s remuneration for 2024. Resolution 21 - Political donations The Companies Act 2006 prohibits companies from making political donations to political organisations, independent candidates or incurring UK political expenditure exceeding £5,000 in any 12 month period unless authorised by Shareholders in advance. CCEP does not make, and does not intend to make, donations to political organisations or independent election candidates, nor does it incur any political expenditure. However, the definitions of political donations, political organisations and political expenditure used in the Companies Act 2006 are very wide. As a result, this can cover activities such as sponsorship, subscriptions, payment of expenses, paid leave for employees fulfilling certain public duties, and support for bodies representing the business community in policy review or reform. Shareholder approval is being sought on a precautionary basis only, to allow CCEP and any company which, at any time during the period for which this resolution has effect, is a subsidiary of CCEP, to continue to support the community and put forward its views on wider business and government interests, without running the risk of inadvertently breaching the legislation. 22

The Board is therefore seeking authority to: (a) make political donations to political organisations and independent election candidates not exceeding £100,000 in total; (b) make political donations to political organisations other than political parties not exceeding £100,000 in total; and (c) incur political expenditure not exceeding £100,000 in total, provided that the aggregate of all expenditure under (a), (b) and (c) shall not exceed £100,000 in total. In line with best practice guidelines published by the Investment Association (IA), this resolution is put to Shareholders annually rather than every four years as required by the Companies Act 2006. For the purposes of this resolution, the terms 'political donations', 'political organisations', 'independent election candidate' and 'political expenditure' shall have the meanings given to them in sections 363 to 365 of the Companies Act 2006. Resolution 22 - Authority to allot new shares This resolution seeks authority from the Shareholders to allot shares or grant rights to subscribe for or to convert any securities into Ordinary Shares. The authority is expected to be renewed at each annual general meeting. Paragraph (a) of this resolution would give the Directors the authority to allot Ordinary Shares or grant rights to subscribe for or convert any securities into Ordinary Shares up to an aggregate nominal amount equal to €1,534,263.92 (representing 153,426,392 Ordinary Shares). This amount represents approximately one-third of the issued ordinary share capital of CCEP as at 3 April 2024, the latest practicable date prior to publication of this Notice. In line with guidance issued by the IA, paragraph (b) of this resolution would give the Directors authority to allot Ordinary Shares or grant rights to subscribe for or convert any securities into Ordinary Shares in connection with a rights issue in favour of ordinary shareholders up to an aggregate nominal amount equal to €3,068,527.85 (representing 306,852,785 Ordinary Shares), as reduced by the nominal amount of any shares issued under paragraph (a) of this resolution). This amount (before any reduction) represents approximately two-thirds of the issued ordinary share capital of CCEP as at 3 April 2024, the latest practicable date prior to publication of this Notice. The Directors have no present intention to exercise the authority sought under this resolution. The authority is, however, sought to ensure that CCEP has maximum flexibility in managing CCEP's capital resources. If they do exercise the authority, the Directors intend to follow IA recommendations concerning its use (including as regards the Directors standing for re-election in certain cases). The authority sought under this resolution would apply until the end of next year’s annual general meeting or, if earlier, until the close of business on Monday 30 June 2025. As at the date of this Notice, no Ordinary Shares are held as treasury shares by CCEP. Resolution 23 - Waiver of mandatory offer provisions set out in Rule 9 of the Takeover Code Resolution 23 ("Waiver Resolution") seeks approval from the Independent Shareholders of a waiver under Rule 9 of the Takeover Code. As described in greater detail below, if Olive's interest in Ordinary Shares increases as a result of CCEP purchasing its own shares, an obligation could arise on Olive, and any person acting in concert with Olive, to make a general offer for the entire issued share capital of the Company. If the Waiver Resolution is approved at the AGM, Olive will not, thereby, be restricted from making an offer for CCEP. However, under the terms of the Shareholders' Agreement, as more fully described in the Prospectus, neither European Refreshments Unlimited Company ("ER") nor Olive may acquire shares in CCEP that, when aggregated with the shares held by the other, represent more than 67% of the issued CCEP shares, other than as a result of an offer (as defined in the Takeover Code) recommended by a simple majority of the Independent Non-executive Directors ("INEDs") of CCEP. Resolutions 26 and 27, which are each conditional on the passing of this Resolution 23, would allow CCEP to buy back its own Ordinary Shares. If Resolutions 26 and 27 pass, CCEP would have authorisation to purchase up to 46,027,917 Ordinary Shares ("Buyback Authorities"). Currently, Olive is interested in an aggregate of 166,128,987 Ordinary Shares representing approximately 36.0931% of the issued share capital of CCEP. If CCEP were to repurchase shares from persons other than Olive, or any person acting in concert with Olive, all the Ordinary Shares for which it is seeking the Buyback Authorities (and assuming no other allotments of Ordinary Shares), the maximum potential shareholding of Olive and any person acting in concert with Olive would increase to approximately 40.1034% of the issued ordinary share capital of CCEP. 23

Accordingly, an increase in the percentage of the shares carrying voting rights in which Olive or any person acting in concert with Olive are interested, as a result of any exercise of the Buyback Authorities, would ordinarily, in the absence of a waiver granted by the Panel and the Waiver Resolution (if approved), have the effect of triggering Rule 9 of the Takeover Code and result in Olive and any person acting in concert with Olive being under an obligation to make a general offer to all Shareholders. Following exercise of the Buyback Authorities (either in whole or in part), Olive will continue to be interested in Ordinary Shares carrying more than 30% of the voting rights of CCEP, but will not hold Ordinary Shares carrying more than 50% of such voting rights, and any further increase in that interest (other than a further exercise of the Buyback Authorities) will be subject to the provisions of Rule 9 of the Takeover Code. The Takeover Code is administered by the Panel and applies to CCEP because it is a UK public company, which has its registered office in the United Kingdom and has securities admitted to trading on a regulated market in the UK. The Panel is the UK body which provides a framework for takeovers in the UK and ensures fair and equal treatment of shareholders in relation to takeovers. Under Rule 9 of the Takeover Code, when (i) any person acquires, whether by a series of transactions over a period of time or not, an interest in shares which, taken together with shares in which he and persons acting in concert with him are interested, carry 30% or more of the voting rights of a company subject to the Takeover Code, or (ii) any person who, together with persons acting in concert with him, is interested in shares which in aggregate carry not less than 30% of the voting rights of a company, but does not hold shares carrying more than 50% of such voting rights and such person, or any person acting in concert with him, acquires an interest in any other shares which increases the percentage of the shares carrying voting rights in which he is interested, then in either case, that person is normally required to make a general offer in cash for all the remaining equity share capital of that company at the highest price paid by him, or any persons acting in concert with him, for shares in that company within the 12 months prior to the announcement of the offer. Under Rule 37 of the Takeover Code, when a company purchases its own voting shares, any resulting increase in the percentage of shares carrying voting rights in which a person or group of persons acting in concert is interested will be treated as an acquisition for the purpose of Rule 9 of the Takeover Code (although a shareholder who is neither a director nor acting in concert with a director will not normally incur an obligation to make a Rule 9 offer). However, Rule 37.1 also provides that, subject to prior consultation, the Panel will normally waive any resulting obligation to make a general offer if there is a vote of independent shareholders. Accordingly, the Panel was consulted at an early stage regarding the Waiver Resolution and the Buyback Authorities. The Panel has reviewed the Waiver Resolution and the Buyback Authorities and the Panel has agreed, subject to the Independent Shareholders’ approval on a poll, and in accordance with Rule 37.1 of the Takeover Code, to waive the application of Rule 9 of the Takeover Code. The waiver granted by the Panel relates only to any increase in the percentage of Ordinary Shares held by Olive or any person acting in concert with Olive as a result of purchases by CCEP of Ordinary Shares pursuant to the Buyback Authorities which are sought from the Shareholders in Resolutions 26 and 27 at the AGM and conditional on the passing of Resolution 23 by the Independent Shareholders of CCEP on a poll. As Olive, and any concert party of Olive, are interested in the outcome of Resolution 23, they will be precluded from voting on that Resolution. The approval in Resolution 23 (if it is given) shall expire at the end of next year’s annual general meeting or, if earlier, the close of business on Monday 30 June 2025. Further details in relation to the Waiver Resolution are set out in Part IV of this Notice. Olive’s intentions Olive has confirmed that it has no intention to make any changes with respect to the following matters because of any increase in its shareholding resulting from a share buyback: (a) the future business of CCEP, including its intentions for any research and development functions of CCEP; (b) the continued employment of the employees and management of CCEP and of its subsidiaries, including any material change in conditions of employment or in the balance of the skills and functions of the employees and management; 24

(c) CCEP's strategic plans, and their likely repercussions on employment or the locations of CCEP's places of business, including on the location of CCEP’s headquarters and headquarters functions; (d) employer contributions into CCEP's pension scheme(s) (including with regard to current arrangements for the funding of any scheme deficit), the accrual of benefits for existing members, and the admission of new members; (e) the redeployment of the fixed assets of CCEP; or (f) the maintenance of CCEP’s listing on Euronext Amsterdam, the NASDAQ Global Select Market ("Nasdaq"), London Stock Exchange (“LSE”) and the Spanish Stock Exchanges. Olive has confirmed that, if it attains the maximum potential shareholding that it could obtain, of approximately 40.1034% of the issued share capital of CCEP, as a result of the Buyback Authorities, this would not materially affect the running of its future business, including in relation to (b) and (c) above as regards itself, nor significantly affect its earnings, assets or liabilities. BNP Paribas has provided advice to the Non-Olive Directors, in accordance with the requirements of paragraph 4(a) of Appendix 1 to the Takeover Code, in relation to the granting of the waiver by the Panel of the obligation that could arise on Olive to make an offer under Rule 9 of the Takeover Code in relation to Resolutions 26 and/or 27. This advice was provided by BNP Paribas to the Non-Olive Directors only, and in providing such advice BNP Paribas has taken into account the Non-Olive Directors’ commercial assessments. Resolutions 24 and 25 - Authority to disapply pre-emption rights If we allot new shares or sell treasury shares for cash (other than in connection with employee share schemes or the dividend reinvestment programme), we are required by the Companies Act 2006 to first offer the shares to Shareholders in proportion to their existing holdings (known as pre-emption rights), but we may seek Shareholder approval to disapply pre-emption rights, or issue shares on a non pre-emptive basis. Resolutions 24 and 25 are proposed as special resolutions, which requires a 75% majority of the votes to be cast in favour to be passed. They would give the Directors the power to allot Ordinary Shares (or sell any Ordinary Shares which CCEP elects to hold in treasury) for cash without first offering them to existing Shareholders in proportion to their existing shareholdings. The power in Resolution 24 would be limited to: (a) allotments or sales in connection with pre-emptive offers and offers to holders of other equity securities if required by the rights of those shares or as the Board otherwise considers necessary; or (b) up to an aggregate nominal amount of €230,139.58 (representing 23,013,958 Ordinary Shares). This aggregate nominal amount represents approximately 5% of the issued ordinary share capital of CCEP (excluding treasury shares) as at 3 April 2024, being the latest practicable date prior to publication of this Notice. Resolution 25 is intended to give the Company flexibility to make non pre-emptive issues of Ordinary Shares in connection with acquisitions and other capital investments as contemplated by Statement of Principles on Disapplying of Pre-emption Rights published by the Pre-Emption Group in November 2022 (the ‘2022 Principles’). The power under Resolution 25 is in addition to that proposed by Resolution 24 and would be limited to allotments or sales of up to an aggregate nominal amount of €230,139.58 (representing 23,013,958 Ordinary Shares). The Board confirms that it will only use the additional authority under Resolution 25 where that allotment is in connection with an acquisition or specified capital investment (within the meaning given in the 2022 Principles) which is announced contemporaneously with the allotment, or which has taken place in the preceding twelve-month period and is disclosed in the announcement of the allotment. This aggregate nominal amount represents approximately 5% of the issued ordinary share capital of CCEP (excluding treasury shares) as at 3 April 2024, being the latest practicable date prior to publication of this Notice. The 2022 Principles permit a company to allot shares for cash on a non pre-emptive basis of up to: (i) 10% of its issued share capital (excluding treasury shares) on an unrestricted basis; and (ii) a further 10% of its issued share capital (excluding treasury shares) for use in connection with an acquisition or specified capital investment as contemplated by the 2022 Principles described above. In both cases, a further authority of up to an 2% can be sought in connection with a follow-on offer to retail investors or existing investors not allocated shares in the offer. The Board acknowledges the provisions of the 2022 Principles. However, at this time, the Board considers it appropriate to retain the limits of 5% of the issued ordinary share capital of CCEP in Resolutions 24 and 25 and have not adopted the increased limits of 10% set out in the 2022 Principles.The Board considers that the 5% limits provide 25

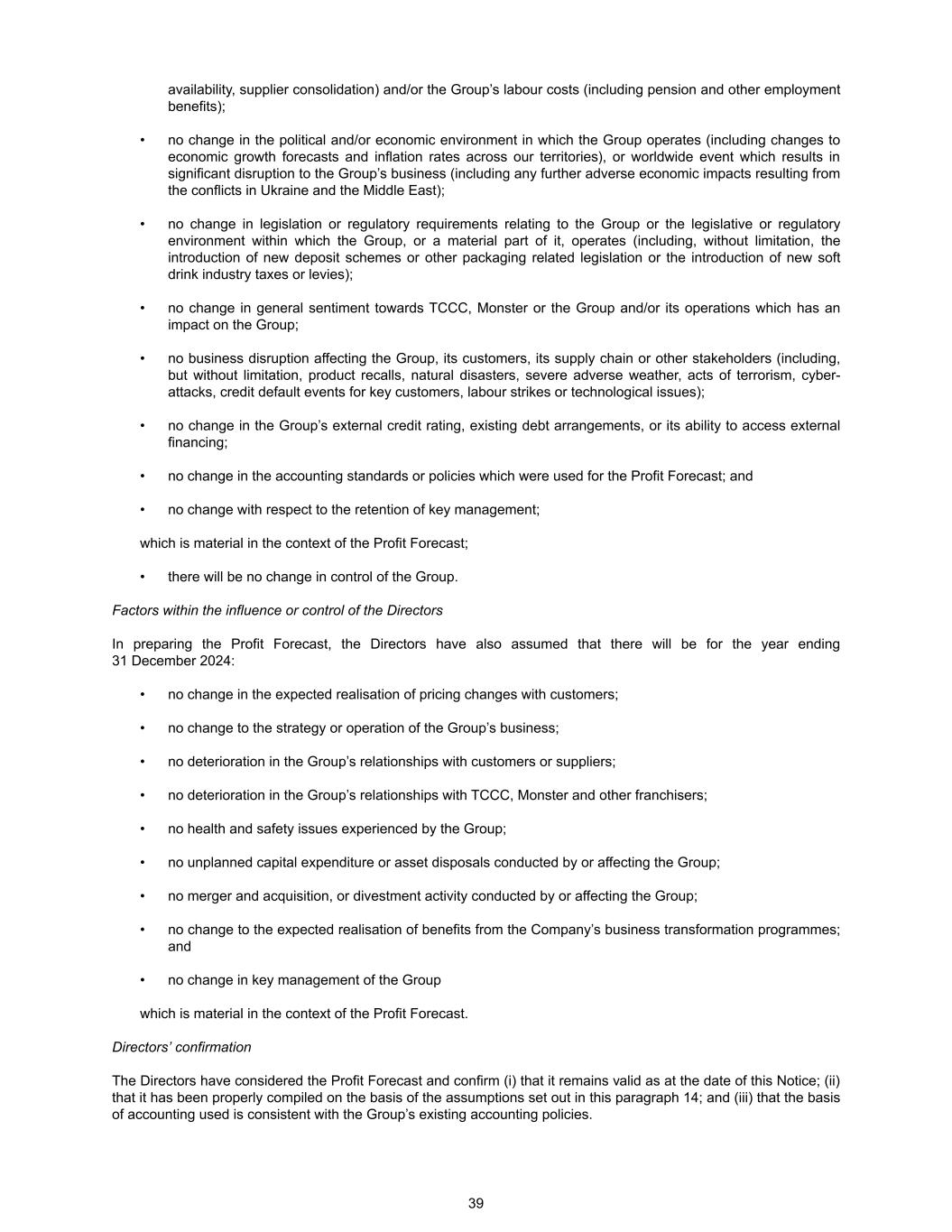

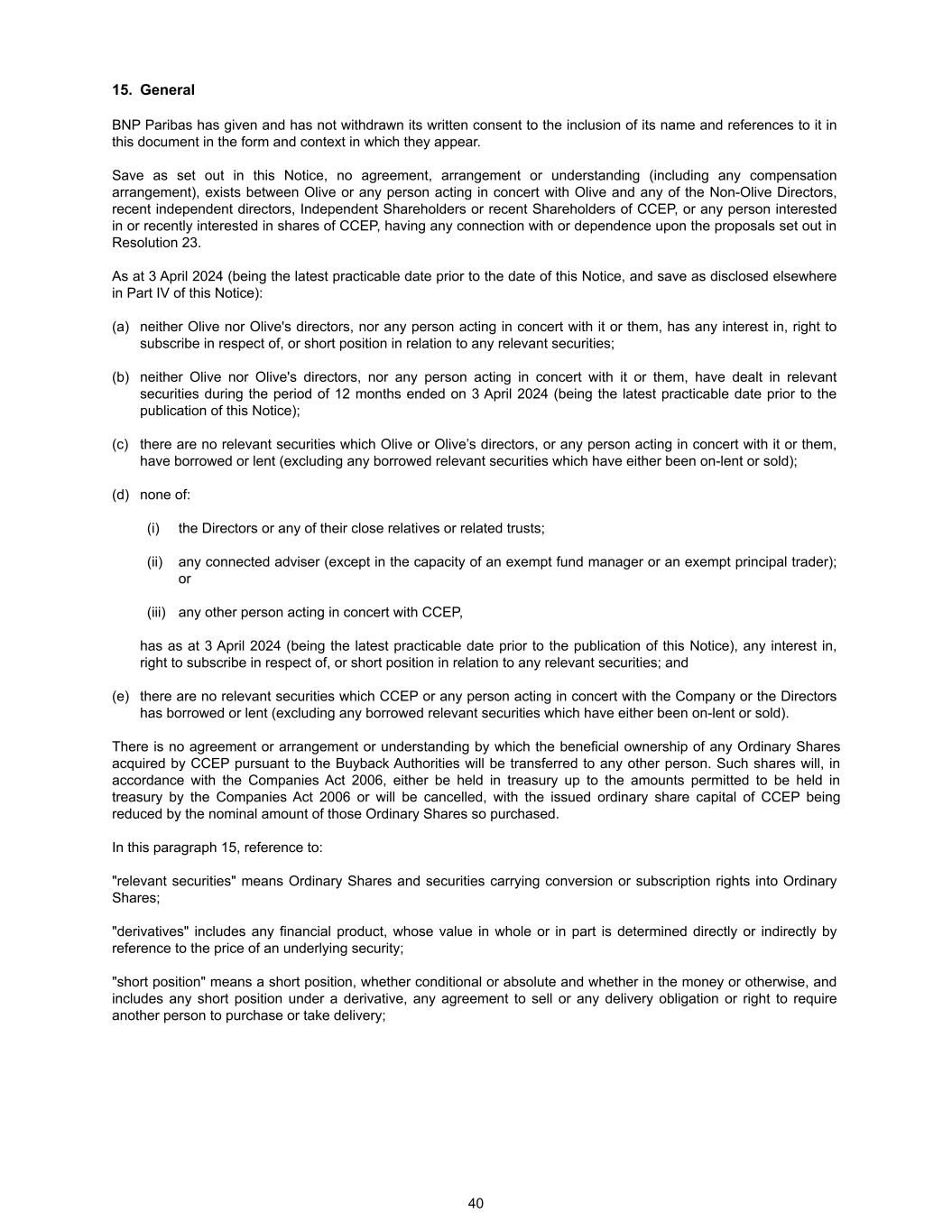

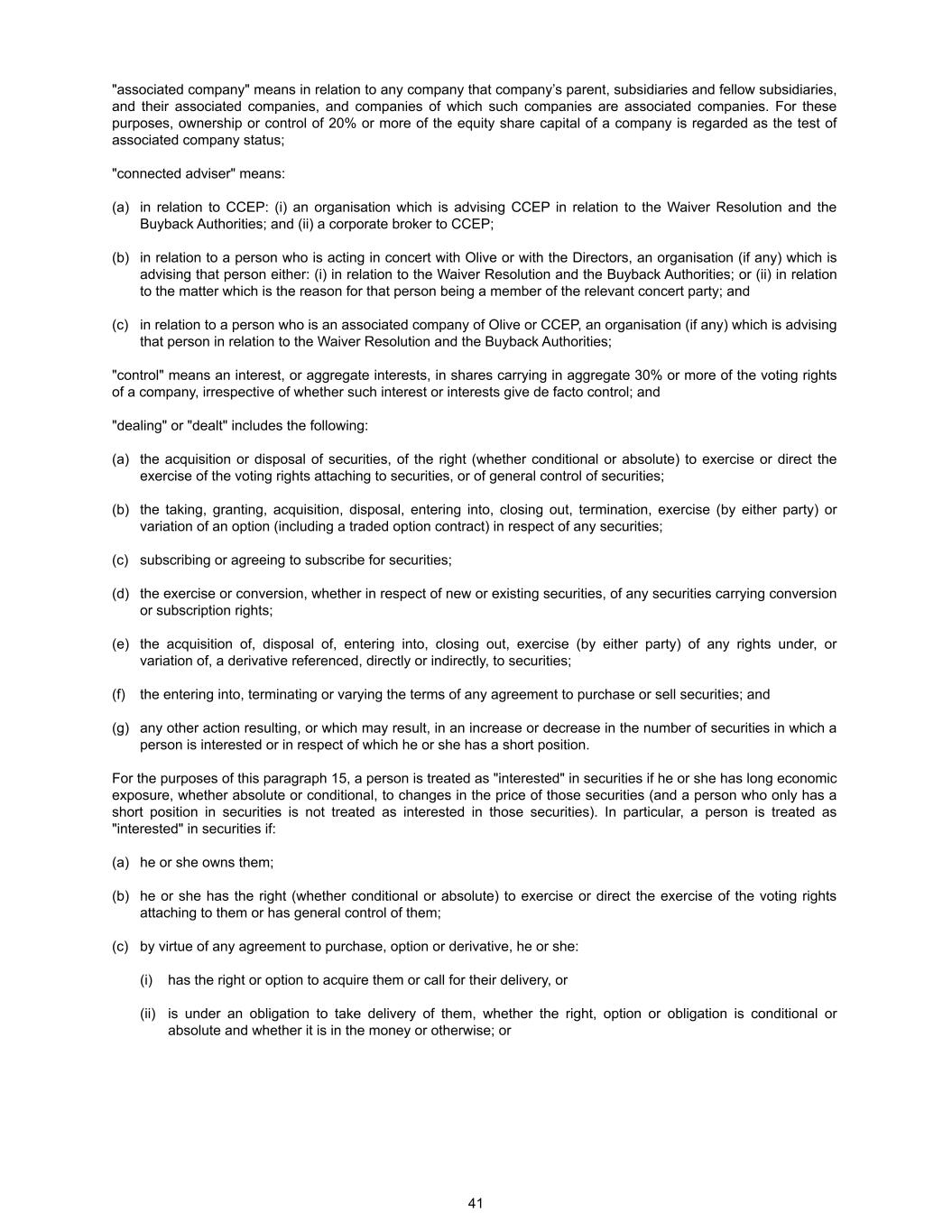

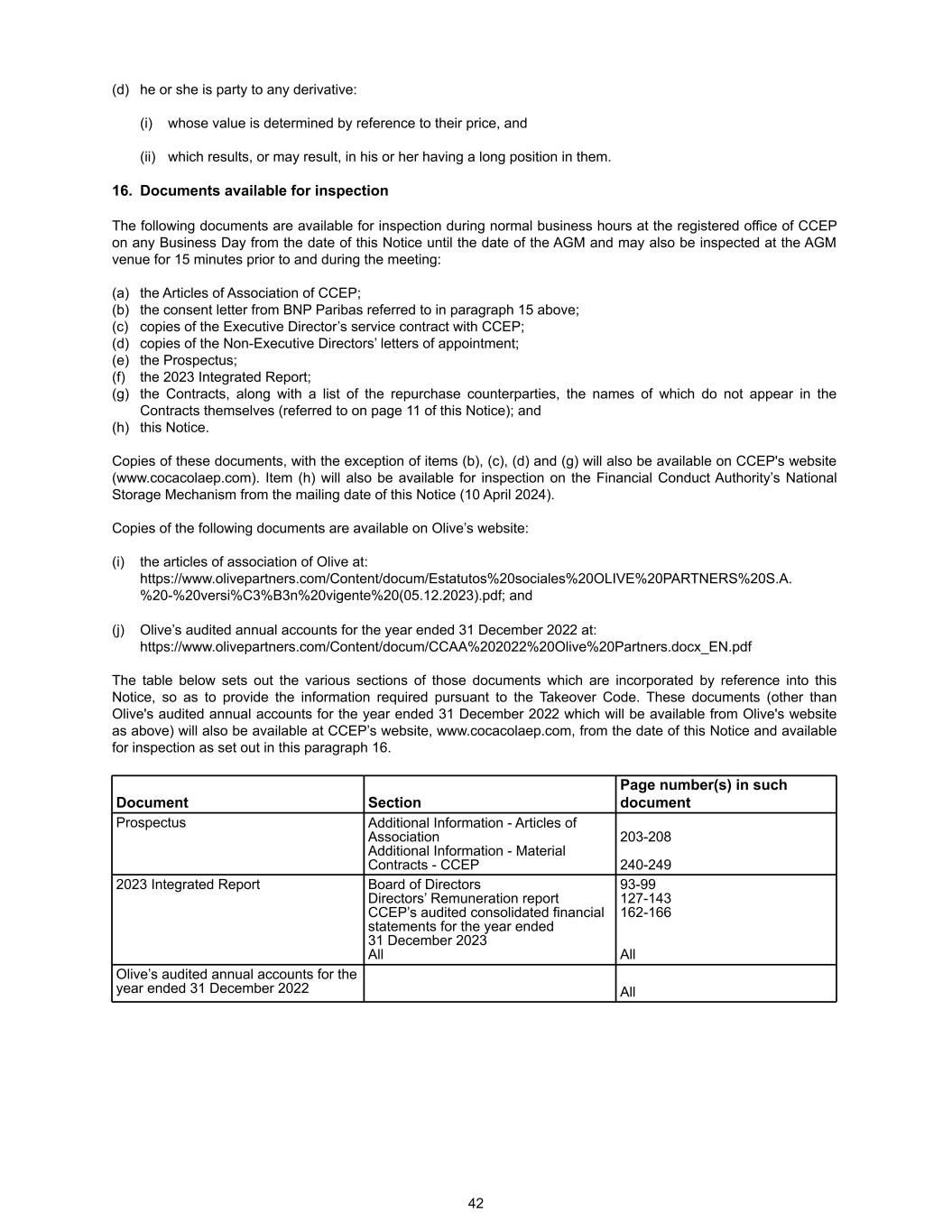

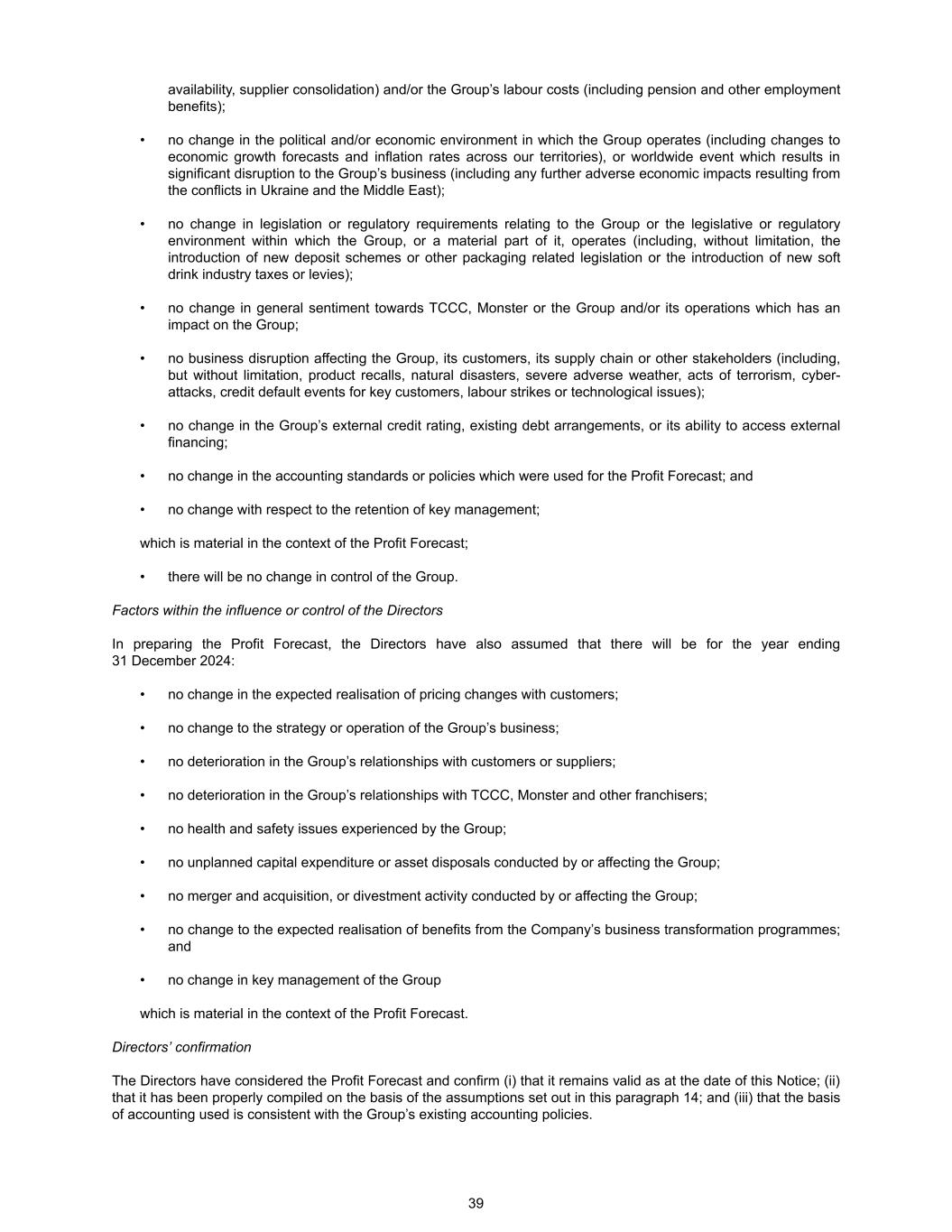

sufficient flexibility to CCEP at present, but will keep emerging market practice under review and will consider what is in the best interests of the Company. The Board has no present intention of exercising the authorities sought under Resolutions 24 and 25.The Board confirms that, in considering the exercise of the authority under Resolutions 24 and 25, they intend to follow the shareholder protections set out in Part 2B of the 2022 Principles to the extent reasonably practicable and relevant (as the Company is not seeking authority for follow-on offers). The powers sought under Resolutions 24 and 25 would apply until the end of next year's annual general meeting or, if earlier, until the close of business on Monday 30 June 2025. Resolutions 26 and 27 - Authority to purchase own shares Resolutions 26 and 27, which are each conditional on the passing of Resolution 23 (Waiver of mandatory offer provisions set out in Rule 9 of the Takeover Code), would allow CCEP to buy back its own Ordinary Shares via methods permitted by the Companies Act 2006. Resolution 26 would allow CCEP to buy back its Ordinary Shares by way of on-market purchases on a recognised investment exchange pursuant to section 701 of the Companies Act 2006. However, as the Nasdaq, Euronext Amsterdam and the Spanish Stock Exchanges are not recognised investment exchanges for the purposes of section 693(2) of the Companies Act 2006, repurchases conducted on these exchanges do not qualify as 'on-market' purchases. Therefore approval of off-market purchases is sought under Resolution 27 to enable share repurchases of shares quoted on any of these exchanges. The Directors consider it to be desirable to have the general authority to make purchases either by way of on market purchases under Resolution 26 or off market purchases under Resolution 27 (the latter of which, as described above, could include open-market repurchases of shares quoted on the Nasdaq, Euronext Amsterdam or the Spanish Stock Exchanges) to have maximum flexibility in managing CCEP's capital resources or offset the dilutive effect of the issue of new shares under CCEP's share award plans. The Directors will only buy back shares when they consider that such purchases would be in the interests of CCEP and Shareholders generally, and could be expected to result in an increase in the earnings per share of CCEP. There can be no certainty as to whether CCEP will repurchase any of its shares, or as to the amount of any such repurchases or the prices at which such repurchases may be made. Any decision by CCEP to repurchase any of its shares would involve due consideration to the Company's leverage position. CCEP ended FY23 with a net debt to comparable EBITDA ratio of 3 times, returning to the top end of the Company’s target leverage range of 2.5 to 3 times. This demonstrated the pace of deleveraging, reflecting the Company's strong free cash flow generation, since the Company closed the Coca-Cola Amatil Limited acquisition in May 2021. The Company completed the acquisition of Coca-Cola Beverages Philippines Inc. ("CCBPI") in February 2024. As this has only a modest impact on leverage and given the Company's strong focus on driving cash and further working capital improvements, the Company anticipates it will return to within its target leverage during 2024 whilst remaining fully committed to its strong investment grade ratings. CCEP currently has no Ordinary Shares held in treasury. Under the Companies Act 2006, Ordinary Shares bought back may be held in treasury or may be cancelled. Ordinary Shares held in treasury may be either sold for cash or transferred for the purposes of an employee share scheme (subject, if necessary, to Shareholders’ approval at a general meeting). Whilst CCEP therefore has a choice of either holding or cancelling any Ordinary Shares it may purchase, given that its Ordinary Shares are held and settled within DTC, CCEP is most likely to choose to cancel any such Ordinary Shares. If, notwithstanding the above, CCEP decides not to cancel such Ordinary Shares, but instead hold them in treasury, CCEP would have regard to any investor guidelines regarding the purchase of Ordinary Shares intended to be held in treasury and their holding or resale. CCEP has share awards outstanding over 1,670,197 Ordinary Shares, representing 0.3629% of CCEP’s ordinary issued share capital as at 3 April 2024. Authority is sought for CCEP to purchase, in aggregate under Resolutions 26 and/or 27, an amount of Ordinary Shares which, as at 3 April 2024, is up to 10% of its issued Ordinary Shares, however, this authorised amount will be reduced by an amount equal to the number of Ordinary Shares that are purchased or agreed to be purchased by CCEP after 3 April 2024 and before 22 May 2024 pursuant to the authority granted at CCEP’s 2023 annual general meeting (if any). This is to ensure that the amount being whitewashed pursuant to Resolution 23 will always be the maximum potential shareholding of Olive and any person acting in concert with Olive. Resolutions 26 and/or 27 are proposed as special resolutions, which require 75% majority of the votes to be cast in favour to be passed. 26

On market purchases Under Resolution 26, which is conditional on the passing of Resolution 23, authority is sought to allow CCEP to buy back its own Ordinary Shares by way of market purchases (as such term is defined in section 693(4) of the Companies Act 2006), in accordance with specific procedures set out in the Companies Act 2006. The minimum price, exclusive of expenses, which may be paid for an Ordinary Share on-market is €0.01, its nominal value. The maximum price, exclusive of expenses, which may be paid for an Ordinary Share on-market is equal to the highest of: (a) an amount equal to 5% above the average market value of an Ordinary Share purchased on the trading venue where the purchase is carried out for the five business days immediately preceding the day on which that Ordinary Share is contracted to be purchased; and (b) the higher of the price of the last independent trade and the highest current independent bid for an Ordinary Share on the trading venue where the purchase is carried out at the relevant time. Off market purchases Under Resolution 27, which is conditional on the passing of Resolution 23, authority is sought to allow CCEP to buy back its own Ordinary Shares by way of off market purchases (as such term is defined in section 693(2) of the Companies Act 2006, which would include open-market repurchases of Ordinary Shares quoted on any of the Nasdaq, Euronext Amsterdam and the Spanish Stock Exchanges), in accordance with specific procedures set out in the Companies Act 2006. Such repurchases may only be made pursuant to a share repurchase contract, the terms of which have been approved by Shareholders in accordance with section 694 of the Companies Act 2006. Resolution 27 specifies which counterparties may each enter into such contracts with CCEP. Under the Companies Act 2006, CCEP may enter into any such contracts prior to, but conditional on, the approval of their terms by Shareholders, or subsequently, once their terms have been approved by Shareholders. As it did at the 2023 annual general meeting, CCEP is seeking approval of the terms of the Contract as defined in Resolution 27. Any Contracts that have not already been approved by Shareholders and which are entered into prior to this year’s AGM will be conditional on the approval of their terms at the AGM and no purchase of any Ordinary Shares will take place under them unless and until such approval is given. Copies of the Contract and the list of repurchase counterparties related to such Contract, will be made available for Shareholders to inspect at CCEP's registered office at Pemberton House, Bakers Road, Uxbridge UB8 1EZ, United Kingdom from 1 May 2024 until the date of the AGM. Copies of the Contract and the list of repurchase counterparties will also be available for inspection at the AGM. Under the Companies Act 2006, CCEP must seek authorisation for share repurchase contracts and counterparties at least every five years. However, if Resolution 27 is approved, CCEP may repurchase shares pursuant to the form of Contract with the relevant counterparties until the end of next year’s annual general meeting or, if earlier, until the close of business on Monday 30 June 2025. Resolution 28 - Notice period for general meetings other than annual general meetings Under UK company law, general meetings are required to be called on 21 clear days’ notice, except where reduced by special resolution of the shareholders. Resolution 28, which is proposed as a special resolution and requires 75% of votes to be cast in favour to be passed, seeks authority for the Directors to call general meetings (other than annual general meetings) on 14 days’ notice. However, as CCEP has a global shareholder base, in practice we would always aim to provide a longer notice period to allow overseas investors to participate fully. The shorter notice period will not be used as a matter of routine and will only be used where it makes sense to do so, having regard to the business to be transacted at that meeting. In addition, the Directors will not make use of the shorter notice period except where they consider that doing so would be beneficial to the Shareholders as a whole. If the authority is used, CCEP would expect to explain its reasons for taking this exceptional action in its next integrated report and accounts. The authority granted by this resolution shall apply until the end of next year’s annual general meeting or, if earlier, until the close of business on Monday 30 June 2025, and is intended to be renewed every year. CCEP would meet the requirements for electronic voting to be available at any general meeting held on short notice. 27

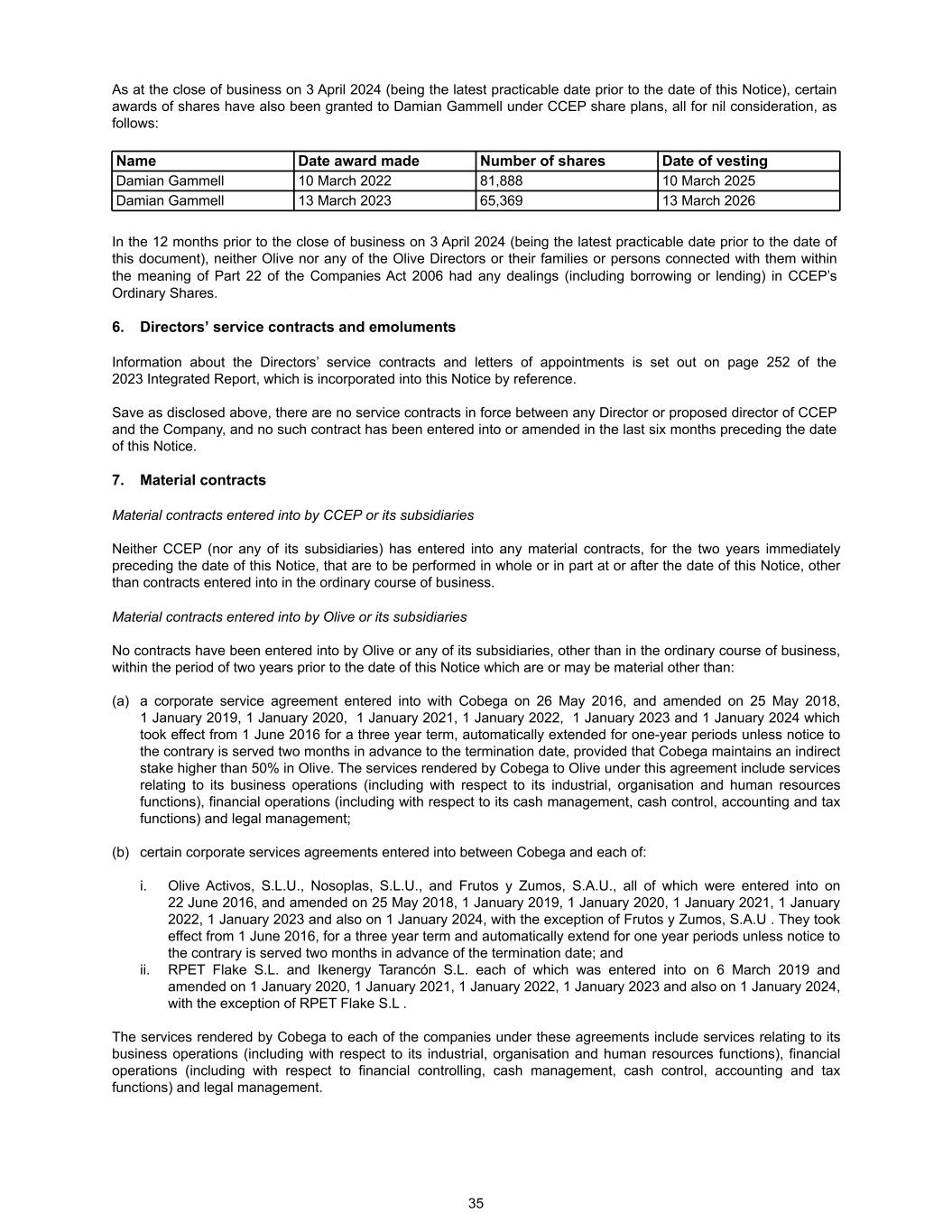

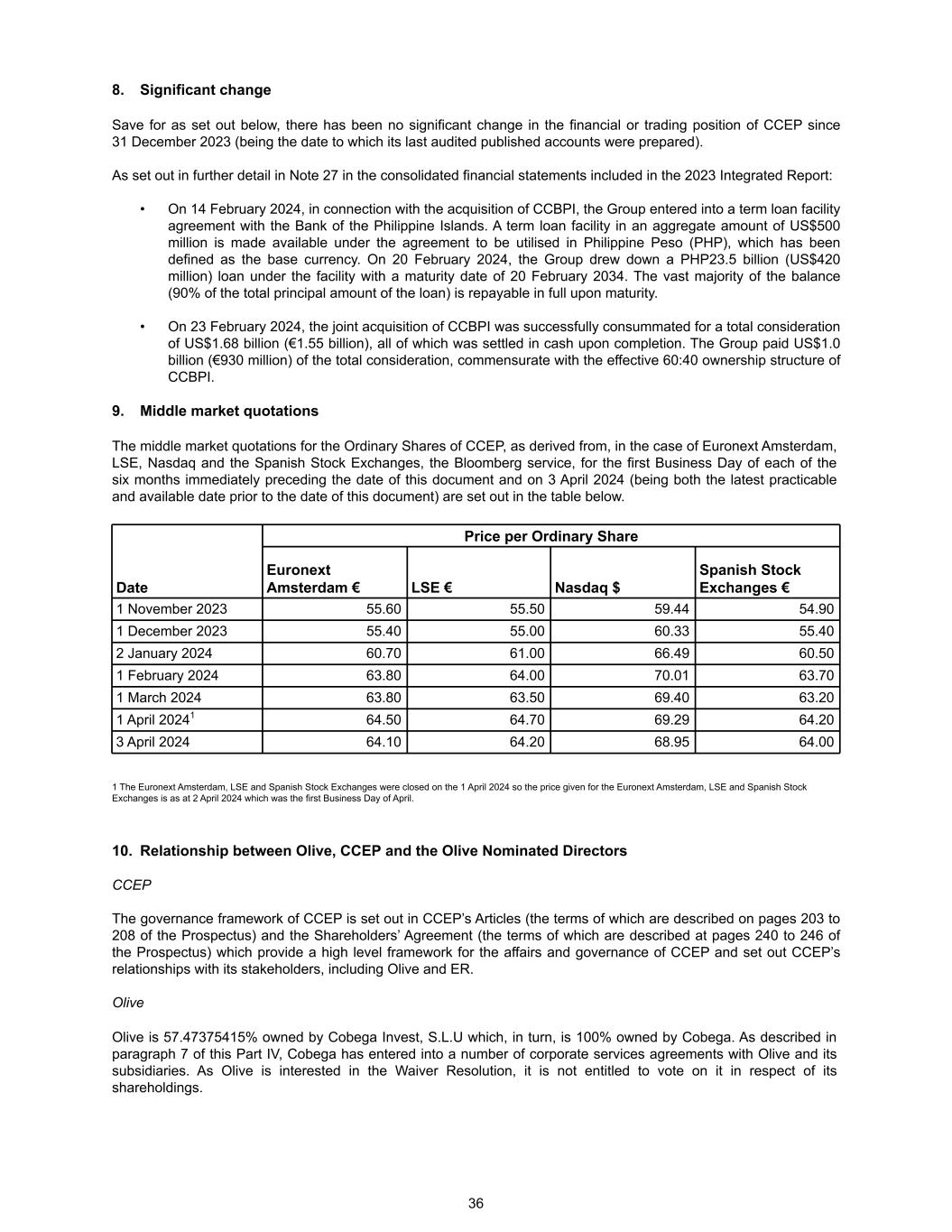

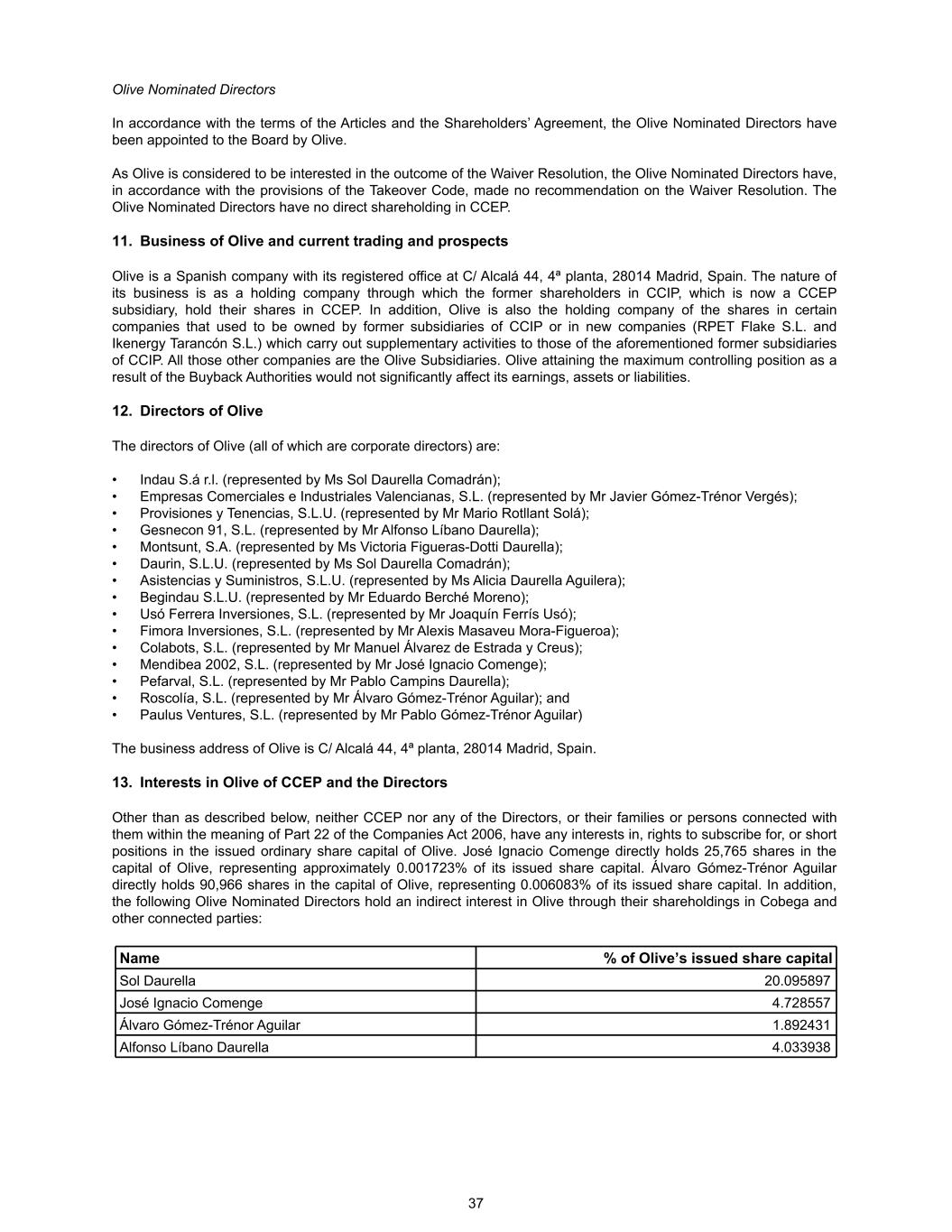

Part III Notes to the Notice of 2024 Annual General Meeting Appointment of proxies 1. Shareholders are entitled to appoint a proxy to exercise all or any of their rights to attend and to speak and vote on their behalf at the meeting. A Shareholder may appoint more than one proxy in relation to the AGM provided that each proxy is appointed to exercise the rights attached to a different share or shares held by that Shareholder. If a member appoints more than one proxy and the proxy forms appointing those proxies would give those proxies the apparent right to exercise votes on behalf of the member over more shares than are held by the member, then each of those proxy forms will be invalid and none of the proxies so appointed will be entitled to attend, speak or vote at the AGM. A proxy need not be a Shareholder of CCEP. 2. A proxy form which may be used to make such appointment and give proxy instructions accompanies this Notice. If you do not have a proxy form and believe that you should have one, or if you require additional forms, please contact the Company Secretary at Pemberton House, Bakers Road, Uxbridge UB8 1EZ, United Kingdom, or by email at shareholders@ccep.com. 3. Any power of attorney or any other authority under which the proxy form is signed (or a duly certified copy of such power or authority) must be included with the proxy form. 4. To be valid, any proxy form or other instrument appointing a proxy must be received no later than 12:00pm on 20 May 2024 (or, in the event of any adjournment, 48 hours before the time of the adjourned Meeting). A member may vote by choosing one of the following methods: (a) Voting via the internet: to vote via the internet, go to www.proxyvote.com. Have the information printed on the proxy form in the box marked by the arrow →[xxxx xxxx xxxx xxxx] available and follow the instructions. (b) Voting by mail: to vote by mail, request a paper copy of the proxy materials, which will include a proxy form and postage-paid envelope for returning your proxy card. (c) Voting in person: to vote at the Meeting, you will need to request a poll card and complete it at the Meeting. 5. In the case of a Shareholder which is a company, the proxy form must be executed under its common seal or signed on its behalf by an officer, attorney or other person authorised to sign it for CCEP. 6. The proceedings of a general meeting shall not be invalidated where an appointment of a proxy in respect of that meeting is sent in electronic form as provided above, but because of a technical problem it cannot be read by the recipient. 7. In the case of joint holders, where more than one of the joint holders purports to appoint a proxy, only the appointment submitted by the most senior holder will be accepted. Seniority is determined by the order in which the names of the joint holders appear in CCEP's register of members in respect of the joint holding (the first-named being the most senior). 8. If you submit more than one valid proxy appointment in respect of the same share, the appointment received last before the latest time for the receipt of proxies will take precedence. If CCEP is unable to determine which notice was last received, none of them shall be treated as valid in respect of that share. 9. A vote withheld is not a vote in law, which means that the vote will not be counted in the calculation of votes for or against the resolution. If no voting indication is given, your proxy will vote or abstain from voting at his or her discretion. Your proxy will vote (or abstain from voting) as he or she thinks fit in relation to any other matter which is put before the AGM. 10. The return of a completed proxy form, other such instrument or any CREST Form of Instruction or similar proxy instruction (as described in paragraphs 11 to 14 below) will not prevent a Shareholder attending the AGM and voting in person if he/she wishes to do so. 28