| Contacts: | |||||

| Anthony N. Leo | Scott J. McKim | ||||

| Chief Executive Officer | Chief Financial Officer | ||||

| 727.399.5678 | 727.521.7085 | ||||

BayFirst Financial Corp. Reports Third Quarter 2023 Results;

Highlighted by Third Consecutive Quarter of Earnings Growth and

Continued Core Loan and Deposit Growth

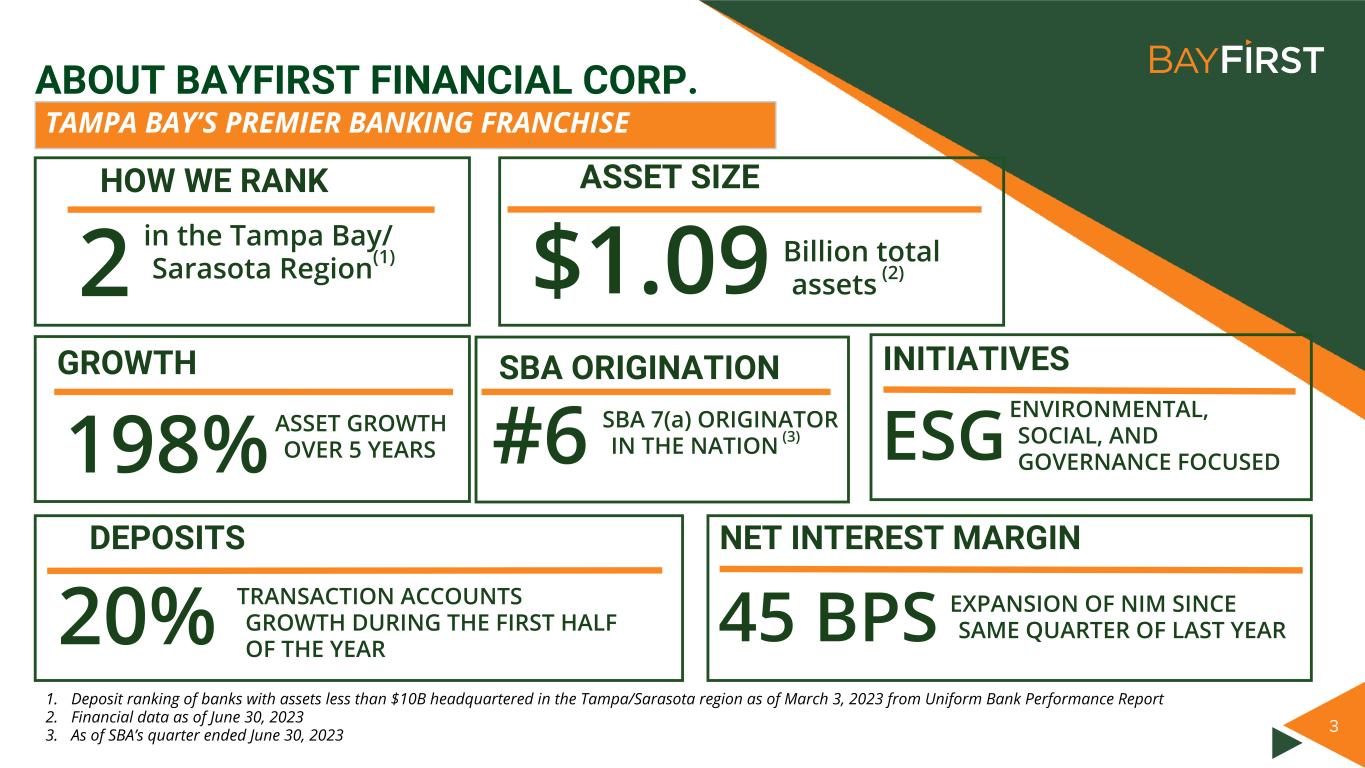

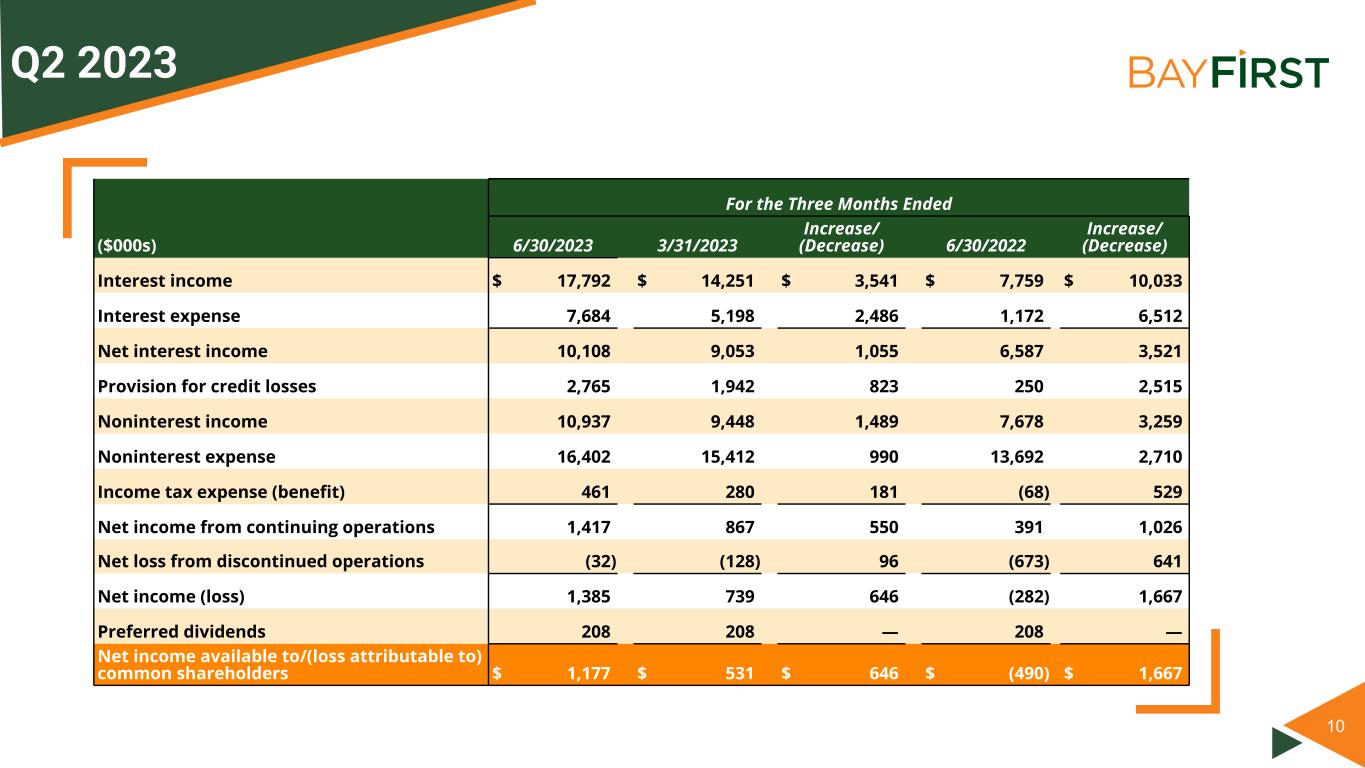

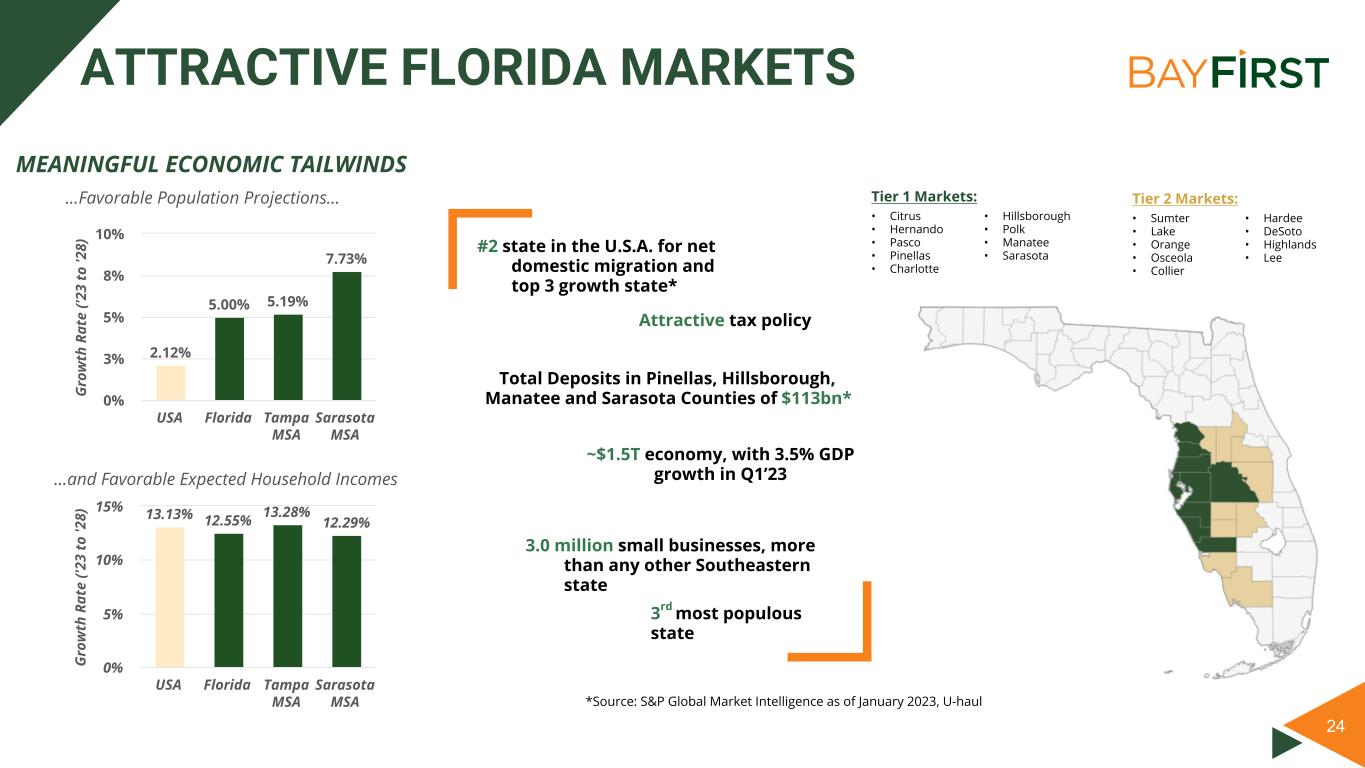

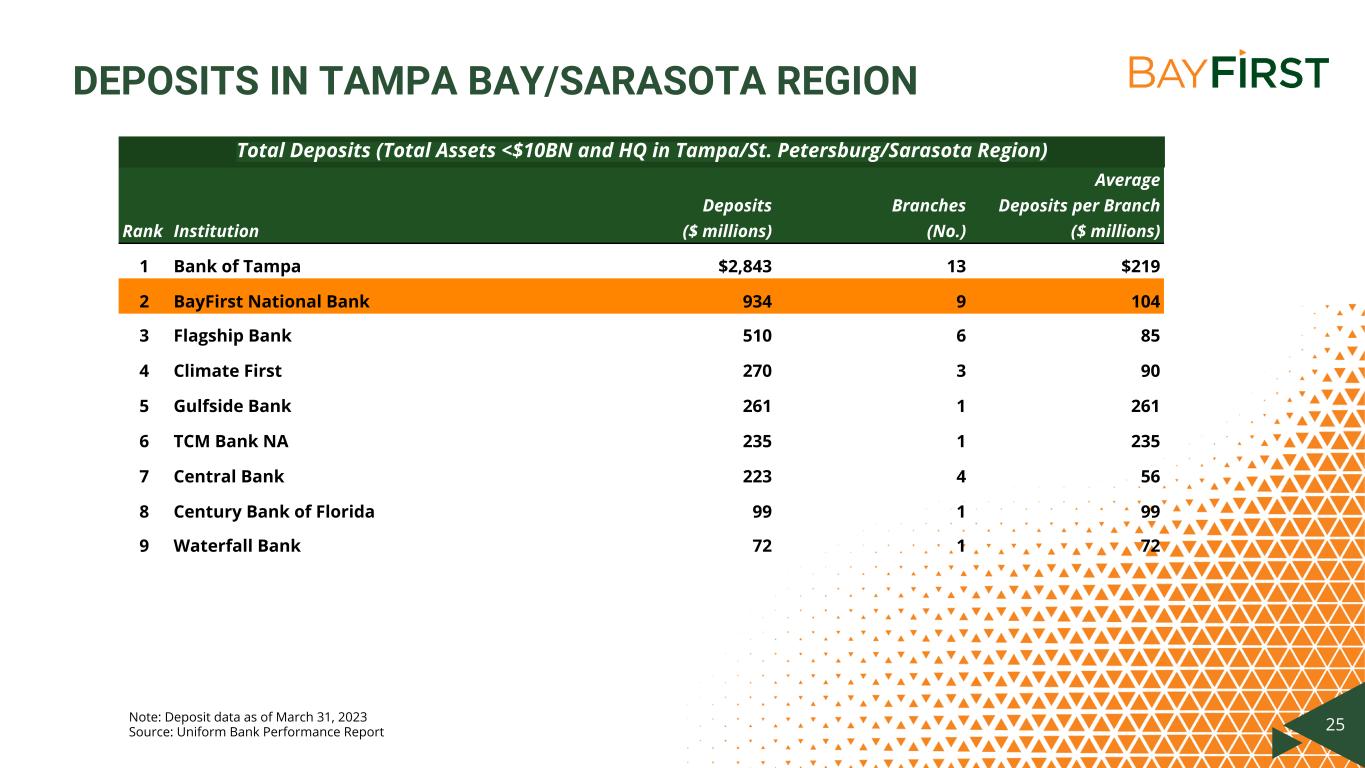

ST. PETERSBURG, FL. — October 26, 2023 — BayFirst Financial Corp. (NASDAQ: BAFN) (“BayFirst” or the “Company”), parent company of BayFirst National Bank (the “Bank”) today reported net income of $1.9 million, or $0.41 per diluted common share, for the third quarter of 2023 compared to $1.4 million, or $0.29 per diluted common share, in the second quarter of 2023. Net income from continuing operations was $2.0 million for the third quarter of 2023, compared to net income from continuing operations of $1.4 million in the second quarter of 2023 and $3.1 million in the third quarter of 2022.

The increase in earnings from continuing operations during the third quarter of 2023, as compared to the second quarter of 2023, was primarily the result of higher noninterest income of $3.7 million, or 34.2%, substantially attributable to an increase in gain on sale of government guaranteed loans of $1.1 million and an increase in the fair value gain on government guaranteed loans of $1.6 million. The increase was partially offset by increases in deposit interest expense of $2.0 million and noninterest expense of $1.0 million.

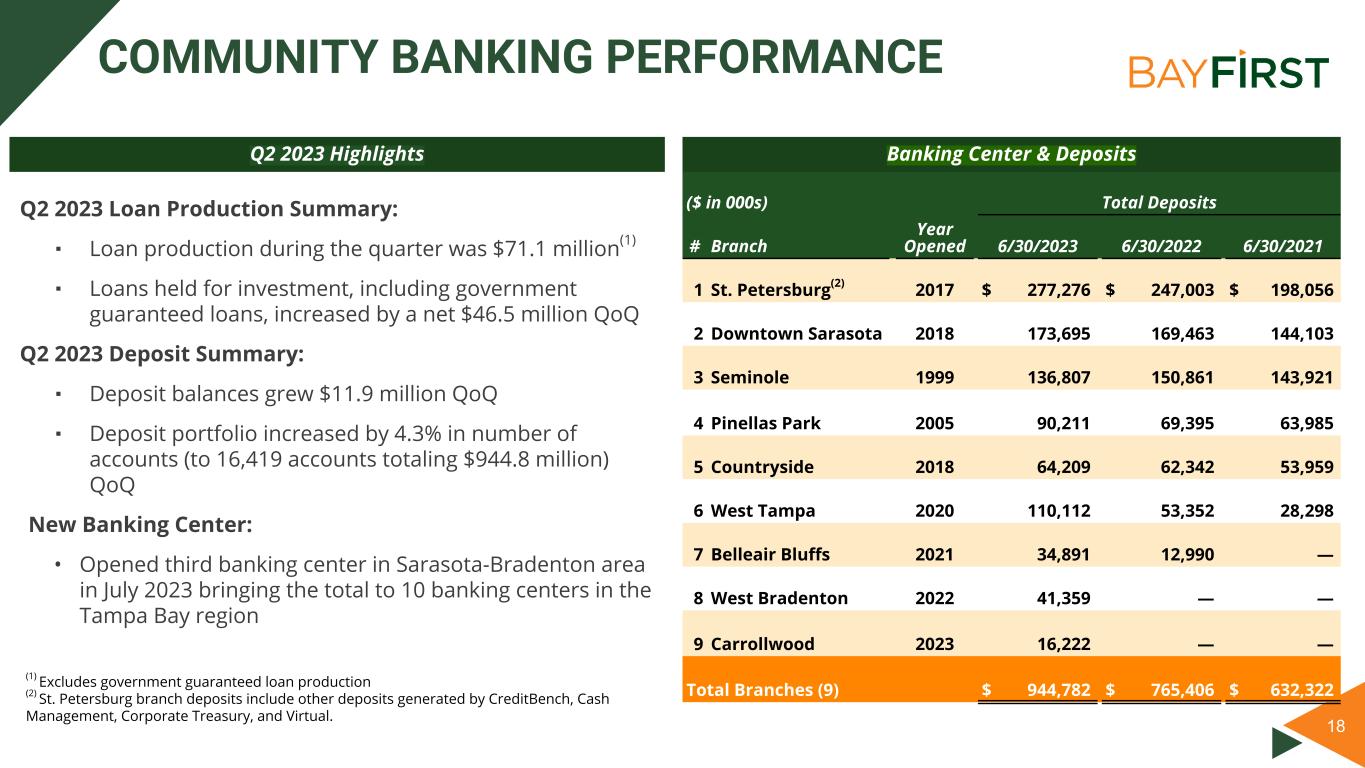

“BayFirst’s third quarter results reflect the continued progress in our efforts to fine tune our operations with third quarter net income increasing 39% over the prior quarter, highlighted by the strength of our community banking operations and record quarterly production by our CreditBench government guaranteed lending division," stated Anthony N. Leo, Chief Executive Officer. "Although net interest margin compressed in the third quarter as compared to the prior quarter, the number of checking accounts in our bank has expanded by 22% year-to-date, while transaction account balances have grown by 23% over the same period. We cater to individuals, families, and small businesses, with a focus on checking and savings accounts which are not only less rate sensitive, but also far less volatile in times of economic disruptions.”

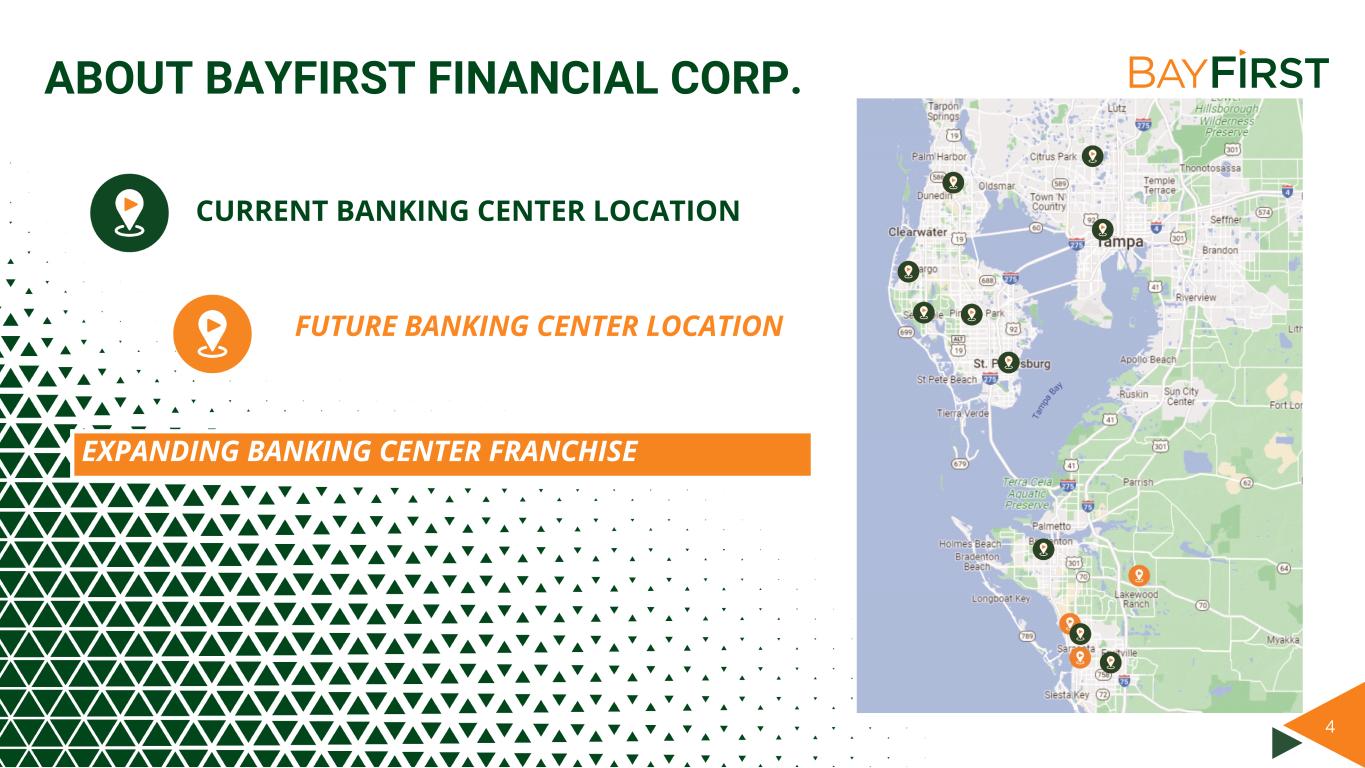

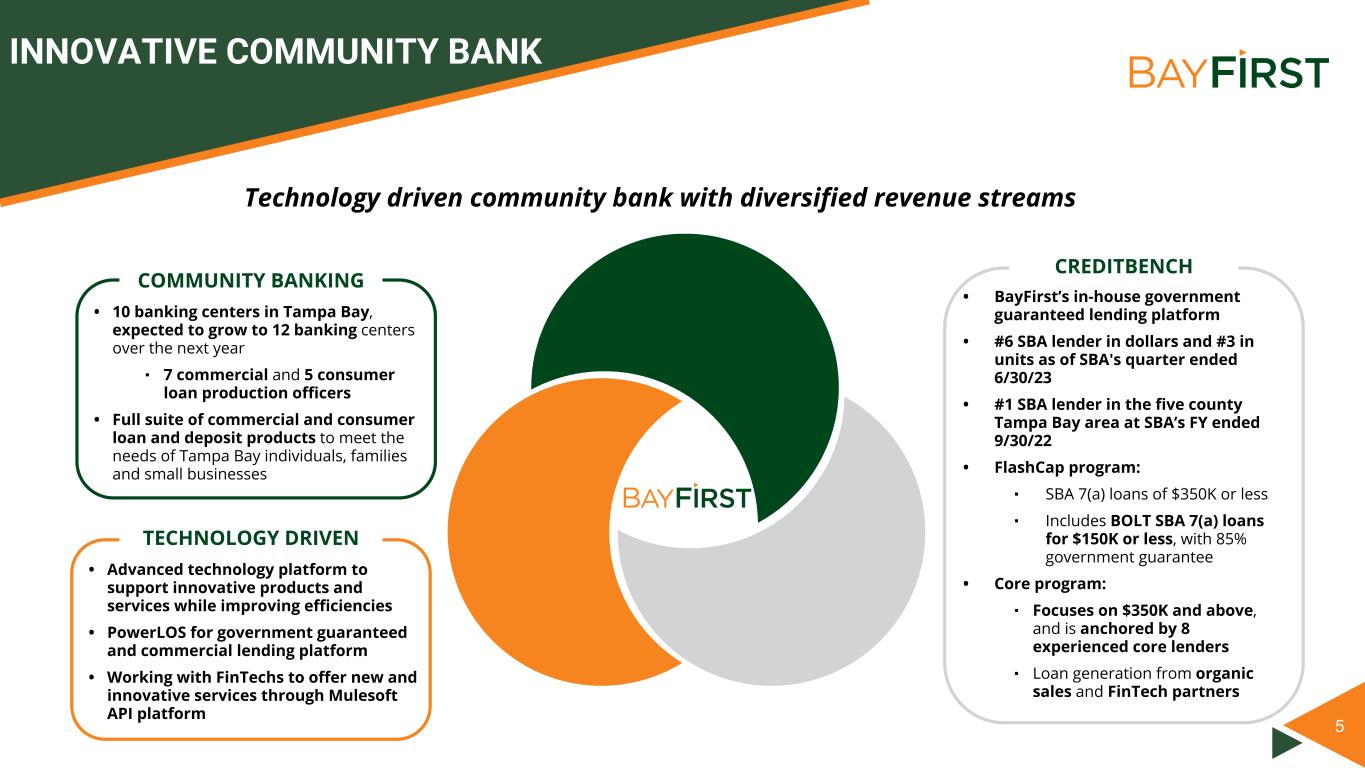

“The third quarter progress is the result of our continued focus on becoming the premier community bank in the Tampa Bay market,” stated Thomas G. Zernick, President. “During the third quarter, we opened our tenth banking center in Sarasota, representing our third banking center in the Sarasota Bradenton portion of the Tampa Bay region. In addition, construction is progressing on our Sarasota South Tamiami Trail Banking Center, which will be our marquee office in the Sarasota area and is expected to open later this year. CreditBench produced $155.9 million in new loans during the quarter, with $84.9 million of that production coming from the SBA small loan program, particularly loans of $150 thousand or less which carry an 85% government guaranty as well as a higher yield than other SBA loans. In addition, loans originated through our community bank also had solid growth during the quarter, increasing $21.6 million from the prior quarter end."

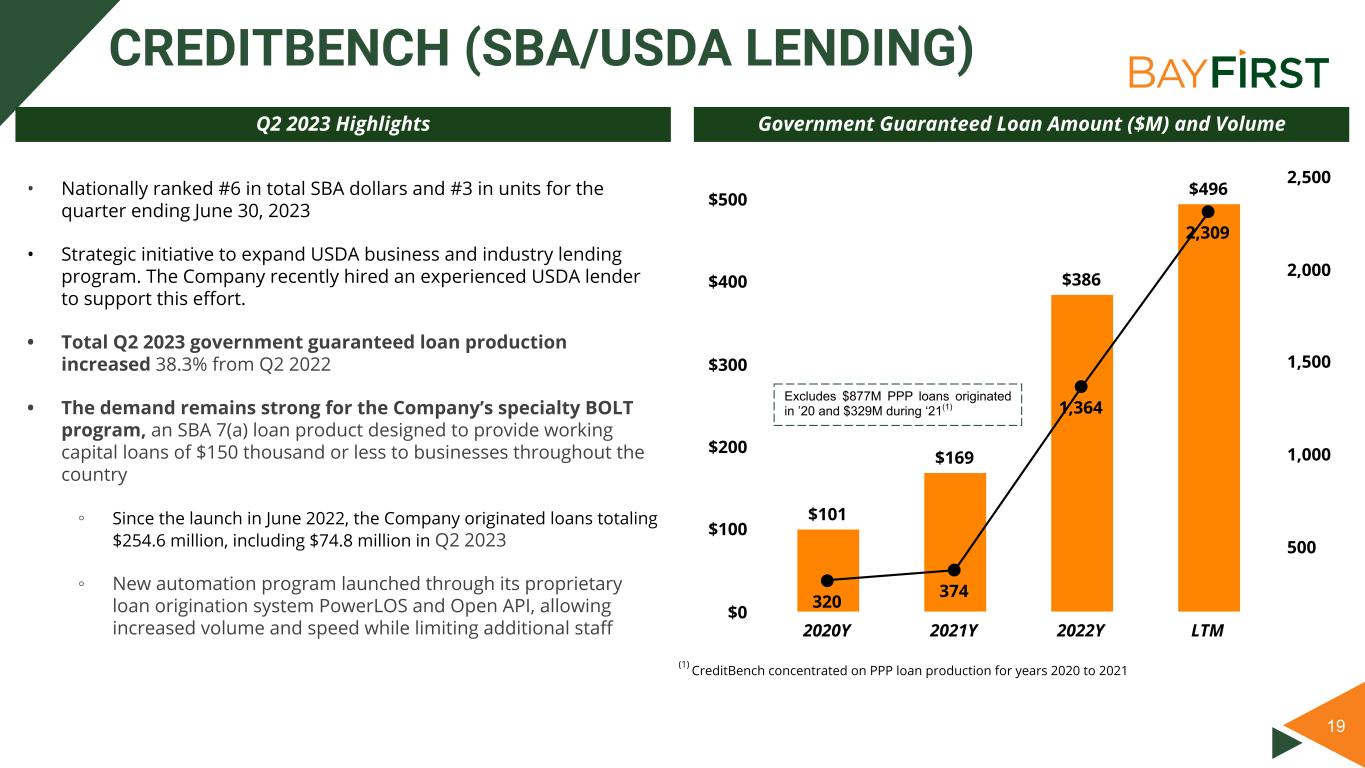

Third Quarter 2023 Performance Review

•The Company’s government guaranteed loan origination platform, CreditBench, originated $155.9 million in new government guaranteed loans during the third quarter of 2023, an increase of 25.2% over $124.5 million of loans produced in the previous quarter, and an 11.8% increase over $139.5 million of loans produced during the third quarter of 2022. Demand remains strong for the Company's BOLT loan program, an SBA 7(a) loan product designed to expeditiously provide working capital loans of $150 thousand or less to businesses throughout the country. Since the launch in late second quarter of 2022, the Company has

BayFirst Financial Corp. Reports Third Quarter 2023 Results

October 26, 2023

Page 2

originated 2,629 BOLT loans totaling $339.5 million, of which 652 BOLT loans totaling $84.9 million were originated during the quarter.

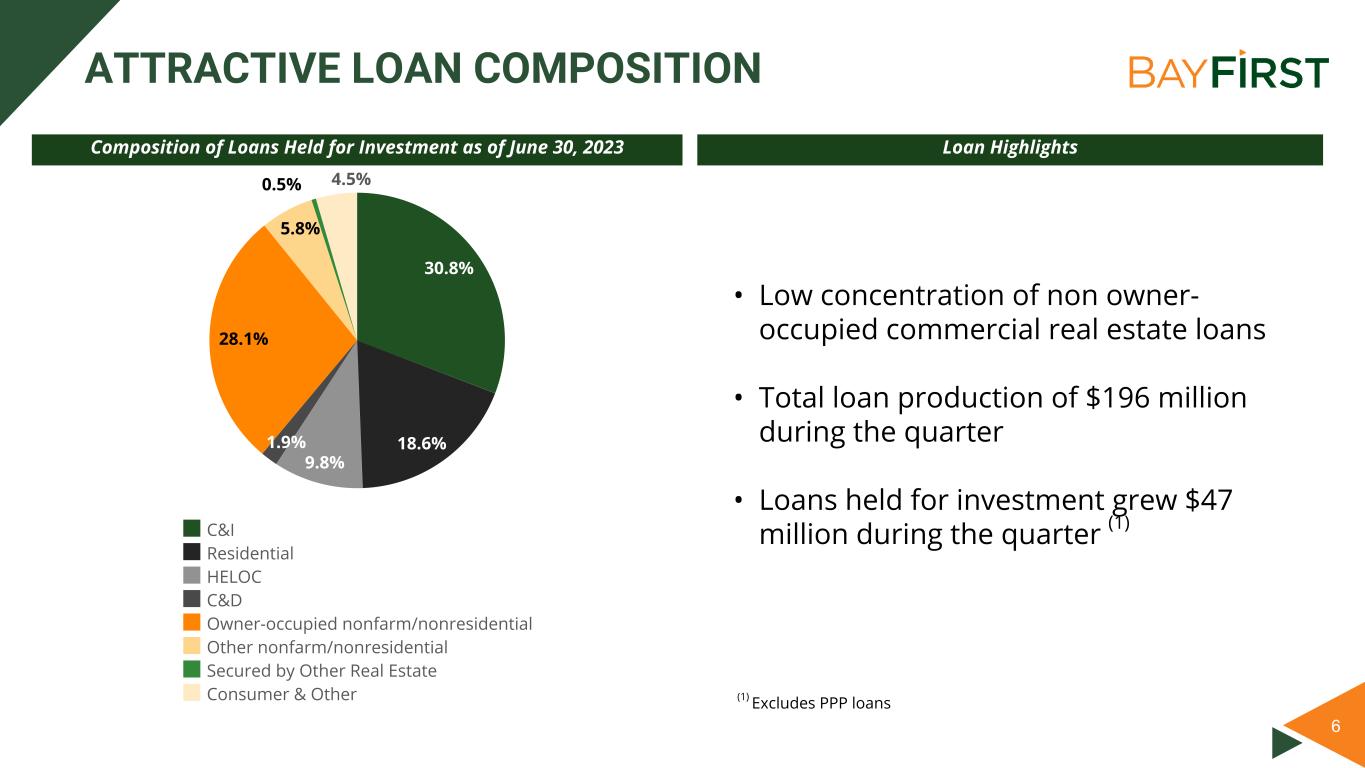

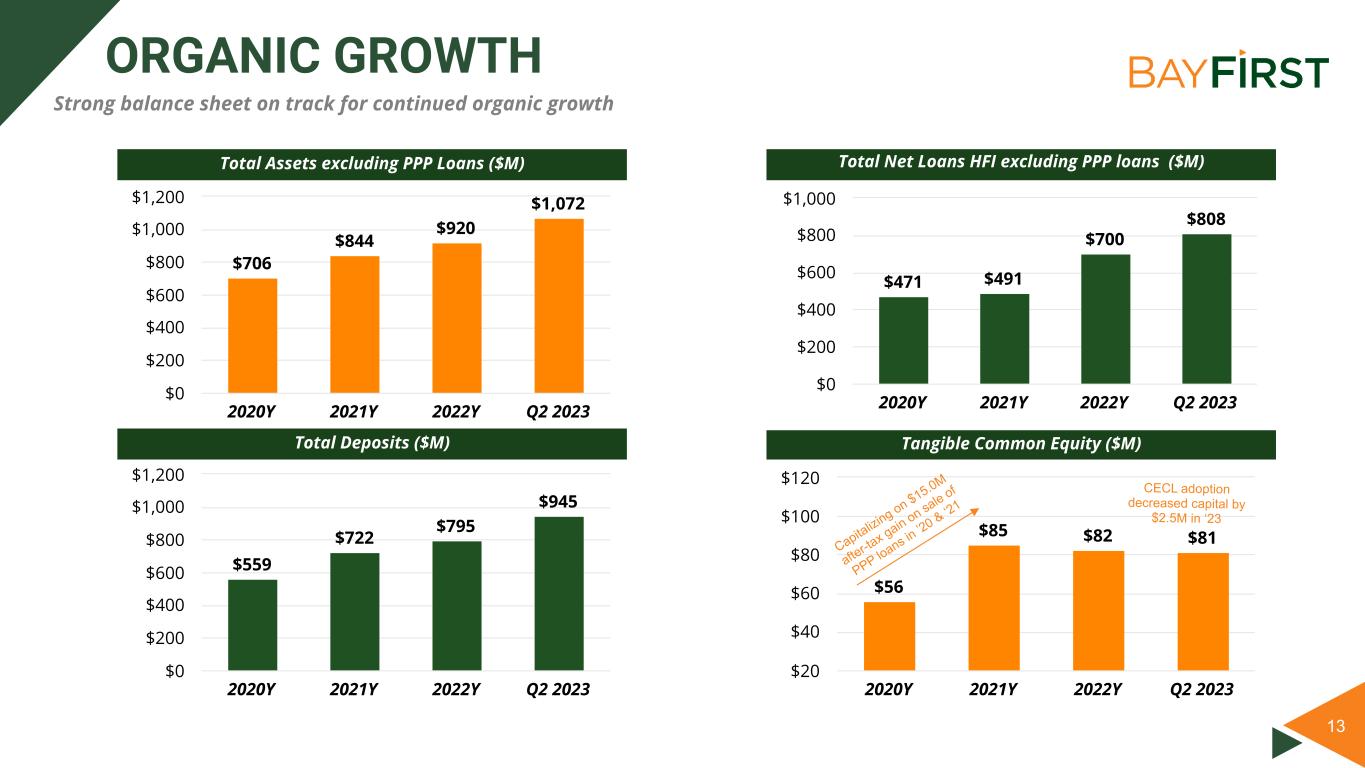

•Loans held for investment, excluding PPP loans of $15.2 million, increased by $42.2 million, or 5.1%, during the third quarter of 2023 to $863.2 million and $204.5 million, or 31.1%, over the past year. During the quarter, the Company originated $197.1 million of loans, purchased $6.9 million of government guaranteed loans, and sold $131.9 million of government guaranteed loan balances.

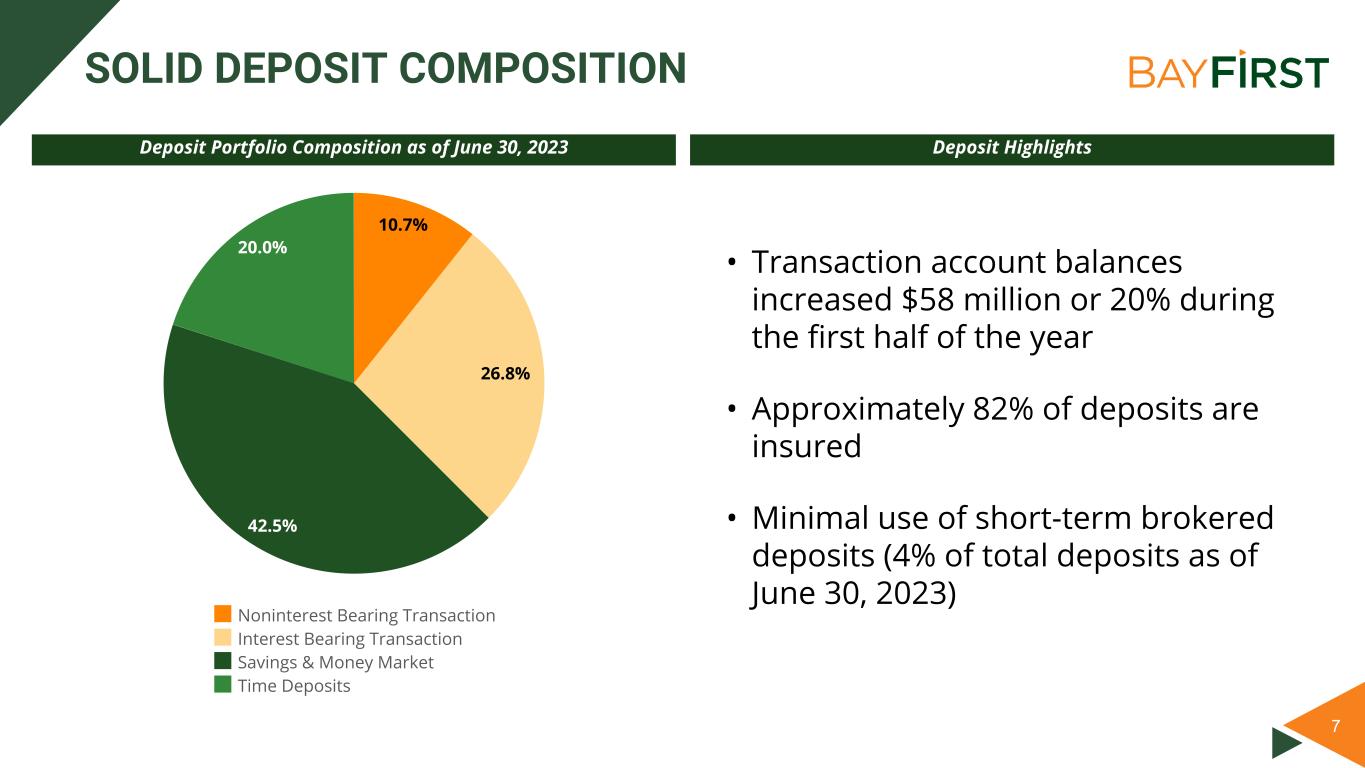

•Deposits increased $73.0 million, or 7.7%, during the third quarter of 2023 and increased $232.1 million, or 29.5%, over the past year to $1.02 billion. During the third quarter of 2023, interest-bearing transaction account balances increased $14.3 million and time deposit balances increased $113.6 million. These increases were partially offset by decreases in savings and money market deposit account balances of $51.8 million and noninterest-bearing deposit account balances of $3.1 million. The time deposit balance increase included a $6.4 million decrease in short-term Certificate of Deposit Account Registry Service ("CDARS") and listing service balances.

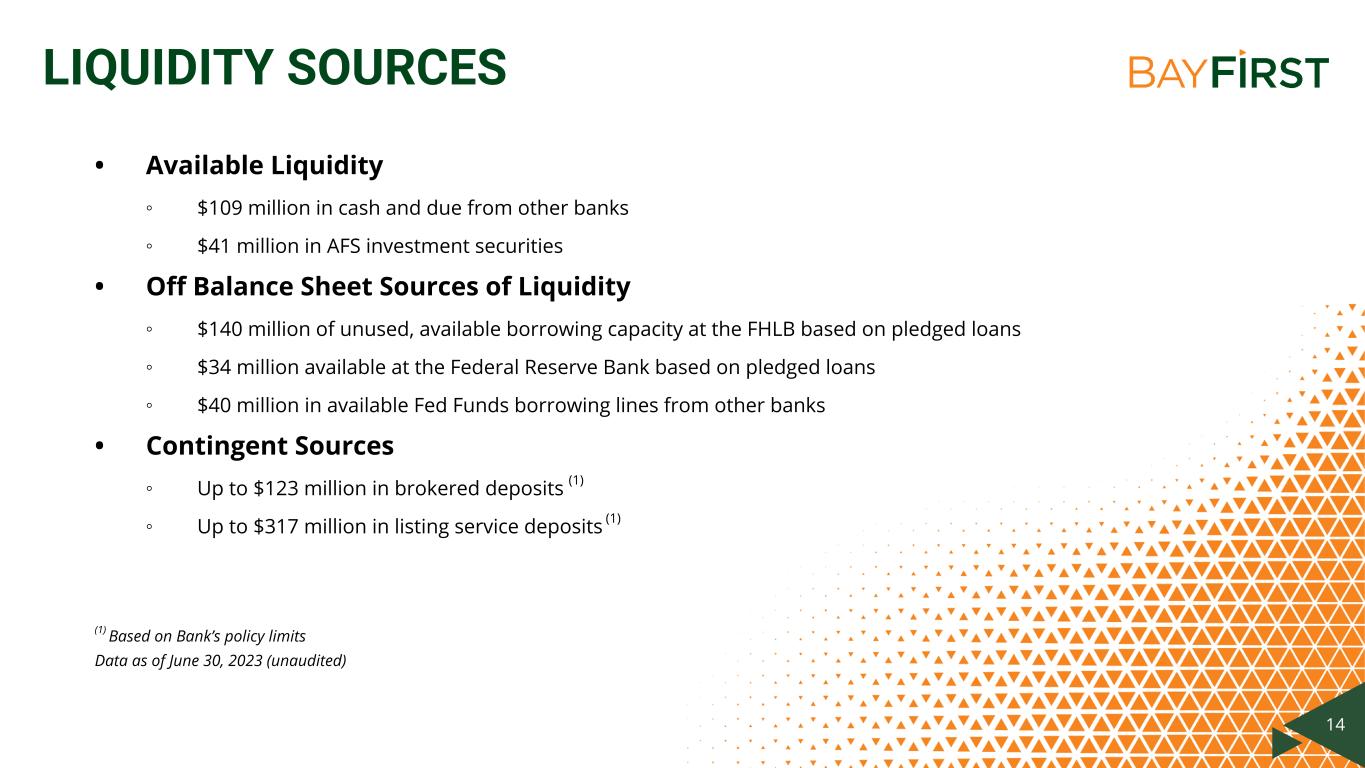

•Balance sheet liquidity remains strong, with $117.2 million in cash balances and time deposits with other banks as of September 30, 2023. Additionally, the Company maintains significant borrowing capacity through the FHLB and Federal Reserve discount window, furthermore approximately 85% of the Company's deposits are insured.

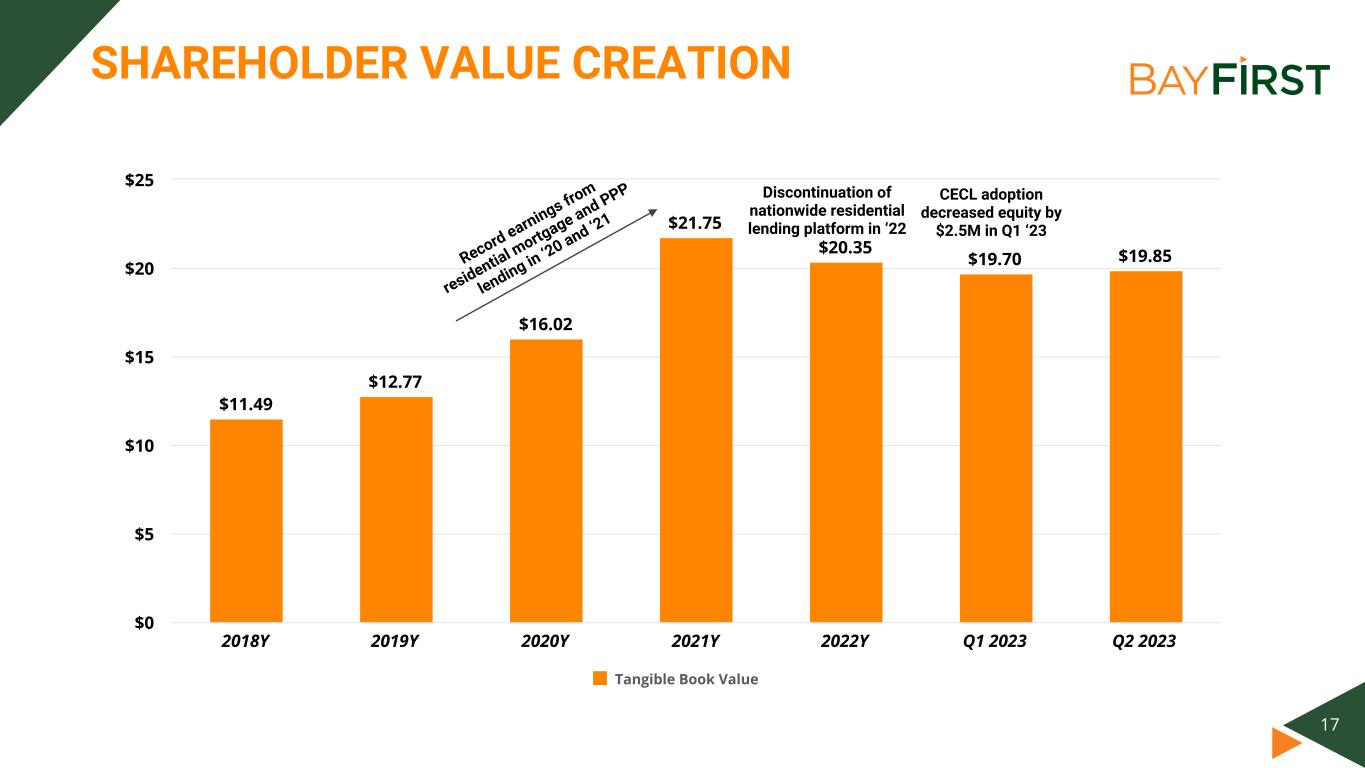

•Book value and tangible book value at September 30, 2023 were $20.12 per common share, up from $19.85 at June 30, 2023.

•Net interest margin including discontinued operations decreased by 82 bps to 3.36% in the third quarter of 2023, from 4.18% in the second quarter of 2023 primarily due to increases in deposit costs. Furthermore, the second quarter margin was inflated by 30 basis points related to the accelerated recognition of unamortized deferred premiums on the sale of $10.9 million of unguaranteed loan balances. Management does not anticipate further need to raise above market priced deposits which should support the improvement in our net interest margin in the fourth quarter.

Results of Operations

Net Income (Loss)

Net income was $1.9 million for the third quarter of 2023, compared to $1.4 million in the second quarter of 2023 and a net loss of $1.4 million in the third quarter of 2022. The increase in net income for the third quarter of 2023 from the preceding quarter was primarily due to an increase of $1.1 million in gain on sale of government guaranteed loans and an increase in the fair value gains on government guaranteed loans of $1.6 million, partially offset by higher interest expense on deposits of $2.0 million and higher noninterest expense of $1.0 million. The increase in net income from the third quarter of 2022 was due to an increase in gain on sale of government guaranteed loans of $3.5 million, an increase in other noninterest income of $1.4 million, and a decrease of $4.4 million in the net loss on discontinued operations. This was partially offset by an increase of $2.3 million in provision for credit losses and an increase in noninterest expense of $3.3 million. In the third quarter of 2022, the Company made the strategic decision to discontinue the Bank’s nationwide residential mortgage operations which resulted in the net loss from discontinued operations.

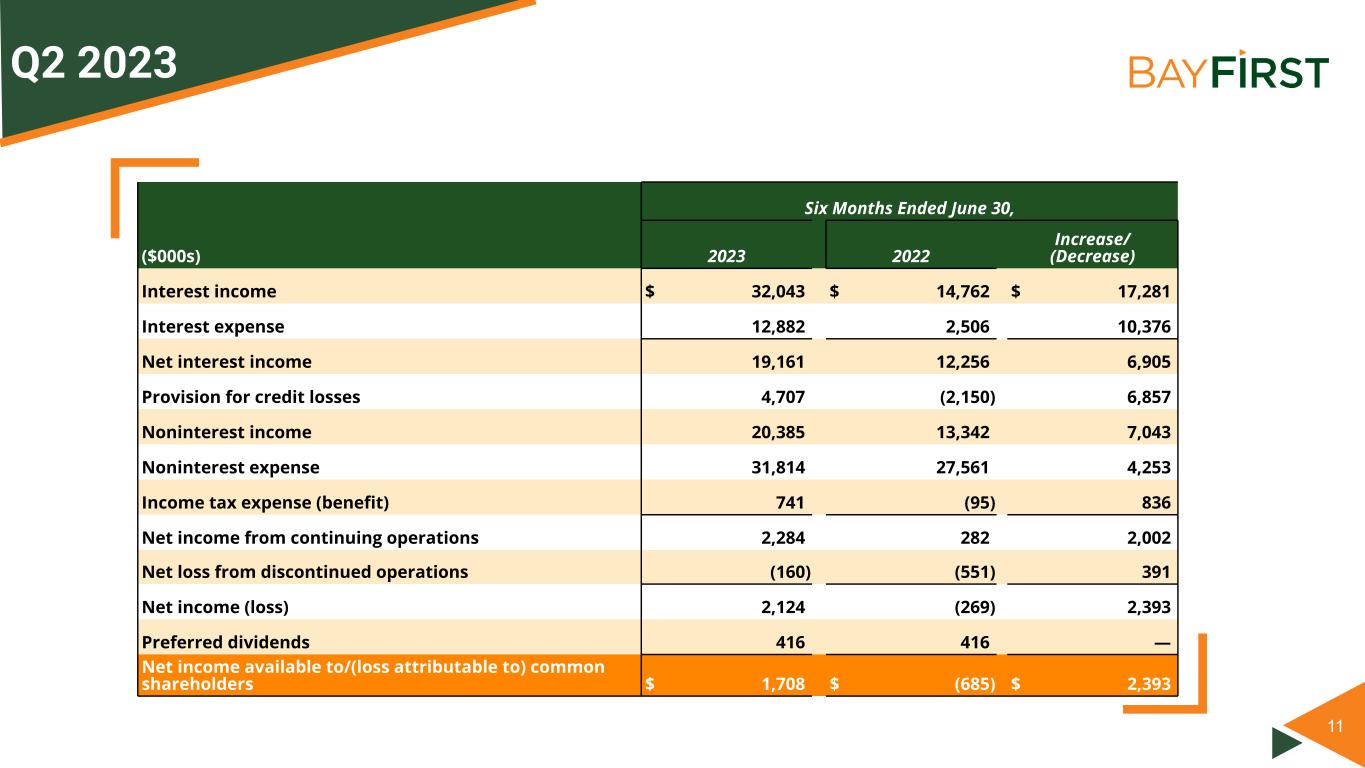

In the first nine months of 2023, net income was $4.0 million, an increase of $5.7 million from the net loss of $1.7 million for the first nine months of 2022. The increase was primarily the result of higher interest income from continuing operations of $23.6 million, an increase of $7.5 million in government guaranteed loan fair value gains, an increase in other noninterest income of $1.9 million, an increase of $1.7 million in gain on sale of government guaranteed loans, and a decrease of $4.8 million in net loss from discontinued operations. This was partially offset by

BayFirst Financial Corp. Reports Third Quarter 2023 Results

October 26, 2023

Page 3

an increase of $16.9 million in interest expense on deposits, an increase of $9.1 million in provision for credit losses, and an increase of $7.5 million in noninterest expense.

Net Interest Income and Net Interest Margin

Net interest income from continuing operations was $8.4 million in the third quarter of 2023, a decrease of $1.7 million, or 17.0%, from the second quarter of 2023, and a decrease of $0.8 million, or 8.5%, from the third quarter of 2022. The net interest margin rate compressed by 82 basis points, of which 30 basis points was related to the recognition of unamortized deferred premiums related to the sale of the $10.9 million of high yielding, but also higher risk, unguaranteed SBA loans in the second quarter of 2023. The remaining compression was primarily from higher deposit interest expense during the quarter, specifically the Company's 6%, 13-month time deposit special, which ended on August 31, 2023. The additional time deposits, which replaced other non-core funding, will fund current and future small dollar SBA loans currently earning Prime plus 4.75%. Although time deposit balances increased in the third quarter, $71 million of time deposits are maturing in the fourth quarter of 2023, the majority of which are not expected to renew.

The decrease during the third quarter of 2023 as compared to the year ago quarter was mainly due to higher interest expense on deposits of $7.2 million, partially offset by an increase in loan interest income, including fees, of $5.4 million.

Net interest income from continuing operations was $27.6 million in the first nine months of 2023, an increase of $6.2 million, or 28.6%, from $21.4 million in the first nine months of 2022. The increase was mainly due to an increase in loan interest income, including fees, of $20.7 million, partially offset by an increase in deposit interest expense of $16.9 million.

Noninterest Income

Noninterest income from continuing operations was $14.7 million for the third quarter of 2023, an increase of $3.8 million, or 34.2%, from $10.9 million in the second quarter of 2023, and an increase of $4.9 million, or 49.7%, from $9.8 million in the third quarter of 2022. The increase in the third quarter of 2023, as compared to the prior quarter, was primarily due to an increase of $1.1 million in gain on sale of government guaranteed loans, net, and an increase of $1.6 million in fair value gains related to held for investment government guaranteed loans. The increase in the third quarter of 2023, as compared to the third quarter of 2022, was the result of increases in fair value gains related to held for investment government guaranteed loans of $3.5 million and other noninterest income of $1.4 million. The increase in other noninterest income was primarily attributable to higher government guaranteed loan packaging fees of $1.0 million.

Noninterest income from continuing operations was $35.1 million for the first nine months of 2023, an increase of $12.0 million, or 51.5%, from $23.1 million in the first nine months of 2022. The increase was primarily due to higher gains on the sale of government guaranteed loans of $1.7 million, a $7.5 million increase in fair value gains related to held for investment government guaranteed loans, and an increase in other noninterest income of $1.9 million. The increase in other noninterest income was primarily due to higher government guaranteed loan packaging fees of $1.6 million.

Noninterest Expense

Noninterest expense from continuing operations was $17.4 million in the third quarter of 2023, which was a $1.0 million, or 6.2%, increase from $16.4 million in the second quarter of 2023 and a $3.2 million, or 23.1%, increase compared to $14.2 million in the third quarter of 2022. The increase in the third quarter of 2023, as compared to the prior quarter, was primarily due to increases in compensation and incentive costs related to higher loan production, data processing expense, and nondeferrable origination expenses on fair value loans. The increase in the third quarter

BayFirst Financial Corp. Reports Third Quarter 2023 Results

October 26, 2023

Page 4

of 2023, as compared to the third quarter of 2022 was primarily due to higher compensation costs of $1.7 million and higher loan origination expense of $0.9 million.

Noninterest expense from continuing operations was $49.2 million in the first nine months of 2023, which was a $7.5 million, or 18.0%, increase from $41.7 million in the first nine months of 2022. The increase was primarily the result of higher compensation costs and loan origination and collection expense.

Discontinued Operations

Net loss on discontinued operations was $47 thousand in the third quarter of 2023, which was $15 thousand higher than the net loss of $32 thousand in the second quarter of 2023. The company recorded net loss on discontinued operations of $4.5 million in the third quarter of 2022. The loss in the second and third quarters of 2023 were partially due to lagging facilities costs as we seek to sublease vacant space. The $4.4 million decrease in the net loss from the year-ago quarter was primarily due to a decrease in noninterest expense of $13.9 million, partially offset by decreases in residential loan fee income of $7.1 million, interest income of $0.9 million, and income tax benefit of $1.5 million. In the third quarter of 2022, the Company recognized $3.7 million of restructuring charges from the discontinuation of the residential mortgage operations which was recorded to noninterest expense.

Net loss from discontinued operations was $207 thousand in the first nine months of 2023, which was a $4.8 million reduction from a net loss of $5.0 million in the first nine months of 2022. The majority of the discontinued loss in 2022 was recorded in the third quarter of 2022. As such, the net loss from discontinued operations for the first nine months of 2022 included restructuring charges of $4.3 million and the discontinued loss in the first nine months of 2023 represented a modest amount of trailing expenses from the discontinuation.

Balance Sheet

Assets

Total assets increased $46.6 million, or 4.3%, during the third quarter of 2023 to $1.13 billion, mainly due to new loan production, partially offset by the sale of $131.9 million in government guaranteed loans and an increase of $8.8 million in cash and cash equivalents.

Loans

Loans held for investment, excluding PPP loans, increased $42.2 million, or 5.1%, during the third quarter of 2023 and $204.5 million, or 31.1%, over the past year to $863.2 million, due to increases in both conventional community bank loans and government guaranteed loans, partially offset by government guaranteed loan sales. PPP loans, net of deferred origination fees, decreased $0.4 million in the third quarter of 2023 to $15.2 million.

Deposits

Deposits increased $73.0 million, or 7.7%, during the third quarter of 2023 and $232.1 million, or 29.5%, from September 30, 2022, ending the third quarter of 2023 at $1.02 billion. During the third quarter, there was growth in interest-bearing transaction account balances of $14.3 million and time deposit balances of $113.6 million, partially offset by decreases in savings and money market deposit account balances of $51.8 million and noninterest-bearing deposit account balances of $3.1 million. The time deposit balance increase included a decrease of $6.4 million in short-term CDARS and listing service balances.

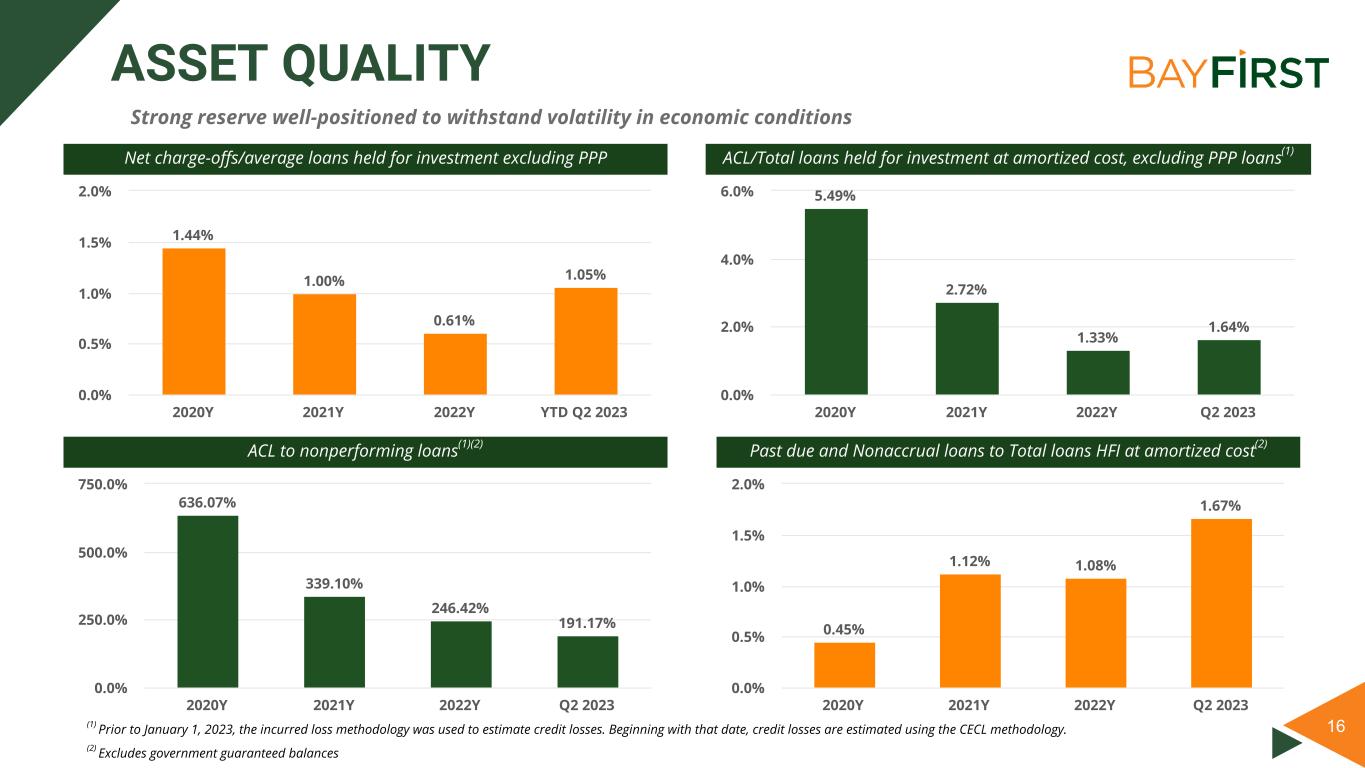

Asset Quality

In accordance with changes in generally accepted accounting principles, the Company adopted the new credit loss accounting standard known as CECL on January 1, 2023. At the time of adoption, the allowance for credit losses ("ACL") for loans increased by $3.1 million to 1.73% of loans, the reserve on unfunded commitments increased $213 thousand, and an $18 thousand reserve was established for held to maturity investment securities. These one-time increases resulted in an after tax decrease to capital of $2.5 million, with no impact to earnings. Under CECL, the ACL is based on projected credit losses rather than on incurred losses.

The Company recorded a provision for credit losses in the third quarter of $3.0 million, which compared to a $2.8 million provision for the second quarter of 2023. The Company recorded a $0.8 million provision for loan losses under the incurred loss methodology during the third quarter of 2022. The Company recorded a provision for credit

BayFirst Financial Corp. Reports Third Quarter 2023 Results

October 26, 2023

Page 5

losses in the first nine months of 2023 of $7.7 million, which compared to a $1.4 million negative provision under the incurred loss methodology for the first nine months of 2022.

The ratio of ACL to total loans held for investment at amortized cost, excluding government guaranteed loans, was 2.03% at September 30, 2023, 2.03% as of June 30, 2023, and 1.90% as of September 30, 2022.

Net charge-offs for the third quarter of 2023 were $2.2 million, a $0.1 million decrease from $2.3 million for the second quarter of 2023 and a $1.6 million increase compared to $0.6 million in the third quarter of 2022. Annualized net charge-offs as a percentage of average loans held for investment at amortized cost, excluding PPP loans, were 1.27% for the third quarter of 2023, down from 1.18% in the second quarter of 2023 and up from 0.37% in the third quarter of 2022. Net charge-offs for the first three quarters of 2023 were elevated by $1.9 million due to the performance from a purchased portfolio of unsecured consumer loans. The Company stopped purchasing these loans at the end of 2022 and the portfolio balances have decreased from $29.4 million to $19.6 million since the beginning of 2023. Nonperforming assets, excluding government guaranteed loans, to total assets was 0.77% as of September 30, 2023, compared to 0.61% as of June 30, 2023, and 0.44% as of September 30, 2022.

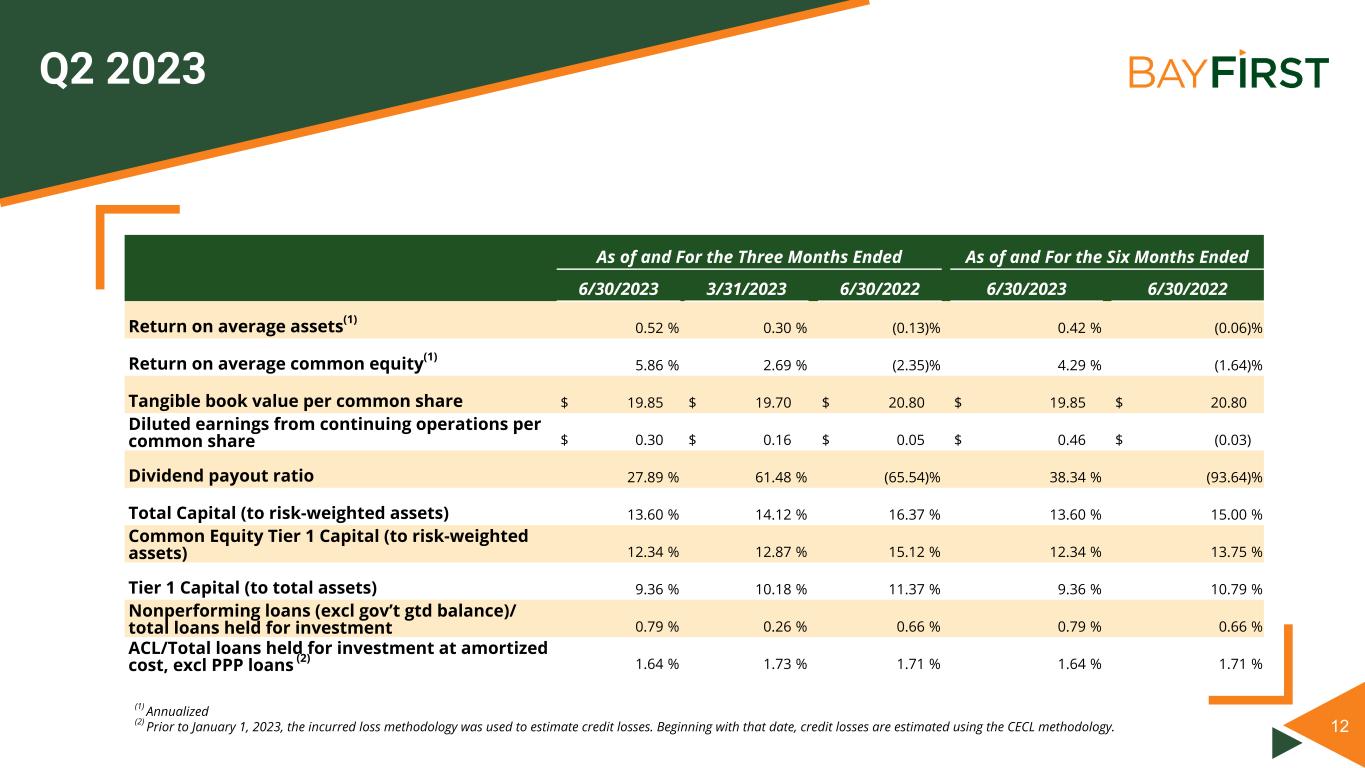

Capital

The Bank’s Tier 1 leverage ratio was 9.16% as of September 30, 2023, compared to 9.36% as of June 30, 2023, and 10.48% at September 30, 2022. The CET 1 and Tier 1 capital ratio to risk-weighted assets were 12.21% as of September 30, 2023, compared to 12.34% as of June 30, 2023, and 13.77% as of September 30, 2022. The total capital to risk-weighted assets ratio was 13.46% as of September 30, 2023, compared to 13.60% as of June 30, 2023, and 15.02% as of September 30, 2022.

Recent Events

Preferred Stock Offering. On September 30, 2023, the Company issued 1,835 shares of 11.0% Series C Cumulative Convertible Preferred Stock. These shares have no par value and a liquidation preference of $1,000 per share plus an amount equal to all accumulated dividends thereon (whether or not earned or declared but without interest) to the date payment of such distribution is made in full. An additional 1,995 shares were issued on October 18, 2023. Total gross proceeds from the preferred stock offering currently total $3.83 million, which will be used for operating expenses or to contribute capital to BayFirst National Bank to support its growth and operations.

Fourth Quarter Common Stock Dividend. On October 24, 2023, BayFirst’s Board of Directors declared a fourth quarter 2023 cash dividend of $0.08 per common share. The dividend will be payable December 15, 2023 to common shareholders of record as of December 1, 2023. This dividend marks the 30th consecutive quarterly cash dividend paid since BayFirst initiated cash dividends in 2016.

Conference Call

BayFirst’s management team will host a conference call on Friday, October 27, 2023 at 9:00 a.m. ET to discuss its third quarter results. Interested investors may listen to the call live under the Investor Relations tab at www.bayfirstfinancial.com. Investment professionals are invited to dial (888) 259-6580 to participate in the call. A replay will be available for one week at (877) 674-7070 using access code 913503# or at www.bayfirstfinancial.com.

About BayFirst Financial Corp.

BayFirst Financial Corp. is a registered bank holding company based in St. Petersburg, Florida which commenced operations on September 1, 2000. Its primary source of income is derived from its wholly owned subsidiary, BayFirst National Bank, a national banking association which commenced business operations on February 12, 1999. The Bank currently operates ten full-service banking offices throughout the Tampa Bay region and offers a broad range of commercial and consumer banking services to businesses and individuals. The Bank was the 7th largest SBA 7(a) lender by dollar volume and 3rd by number of units originated nationwide through the SBA's 2023 fiscal year ended September 30, 2023. Additionally, it was the number one SBA 7(a) lender in dollar volume in the 5 county Tampa Bay market for the SBA's 2023 fiscal year. As of September 30, 2023, BayFirst Financial Corp. had $1.13 billion in total assets.

BayFirst Financial Corp. Reports Third Quarter 2023 Results

October 26, 2023

Page 6

Forward-Looking Statements

In addition to the historical information contained herein, this presentation includes "forward-looking statements" within the meaning of such term in the Private Securities Litigation Reform Act of 1995. These statements are subject to many risks and uncertainties, including, but not limited to, the effects of health crises, global military hostilities, or climate change, including their effects on the economic environment, our customers and our operations, as well as any changes to federal, state or local government laws, regulations or orders in connection with them; the ability of the Company to implement its strategy and expand its banking operations; changes in interest rates and other general economic, business and political conditions, including changes in the financial markets; changes in business plans as circumstances warrant; risks related to mergers and acquisitions; changes in benchmark interest rates used to price loans and deposits, changes in tax laws, regulations and guidance; and other risks detailed from time to time in filings made by the Company with the SEC, including, but not limited to those “Risk Factors” described in our most recent Form 10-K and Form 10-Q. Readers should note that the forward-looking statements included herein are not a guarantee of future events, and that actual events may differ materially from those made in or suggested by the forward-looking statements.

BayFirst Financial Corp. Reports Third Quarter 2023 Results

October 26, 2023

Page 7

BAYFIRST FINANCIAL CORP.

SELECTED FINANCIAL DATA (Unaudited)

| At or for the three months ended | |||||||||||||||||||||||||||||

| (Dollars in thousands, except for share data) | 9/30/2023 | 6/30/2023 | 3/31/2023 | 12/31/2022 | 9/30/2022 | ||||||||||||||||||||||||

| Balance sheet data: | |||||||||||||||||||||||||||||

| Average loans held for investment at amortized cost, excluding PPP loans | $ | 705,577 | $ | 763,854 | $ | 625,129 | $ | 688,759 | $ | 525,922 | |||||||||||||||||||

| Average total assets | 1,088,517 | 1,064,068 | 969,489 | 925,194 | 939,847 | ||||||||||||||||||||||||

| Average common shareholders’ equity | 81,067 | 80,310 | 78,835 | 80,158 | 83,014 | ||||||||||||||||||||||||

| Total loans held for investment | 878,447 | 836,704 | 792,777 | 728,652 | 680,805 | ||||||||||||||||||||||||

| Total loans held for investment, excluding PPP loans | 863,203 | 821,016 | 774,467 | 709,479 | 658,669 | ||||||||||||||||||||||||

| Total loans held for investment, excl gov’t gtd loan balances | 687,141 | 638,148 | 596,505 | 569,892 | 520,408 | ||||||||||||||||||||||||

Allowance for credit losses (1) | 13,365 | 12,598 | 12,208 | 9,046 | 9,739 | ||||||||||||||||||||||||

| Total assets | 1,133,979 | 1,087,399 | 1,069,839 | 938,895 | 930,275 | ||||||||||||||||||||||||

| Common shareholders’ equity | 82,725 | 81,460 | 80,734 | 82,279 | 81,032 | ||||||||||||||||||||||||

| Share data: | |||||||||||||||||||||||||||||

| Basic earnings (loss) per common share | $ | 0.42 | $ | 0.29 | $ | 0.13 | $ | 0.28 | $ | (0.40) | |||||||||||||||||||

| Diluted earnings (loss) per common share | 0.41 | 0.29 | 0.13 | 0.28 | (0.35) | ||||||||||||||||||||||||

| Dividends per common share | 0.08 | 0.08 | 0.08 | 0.08 | 0.08 | ||||||||||||||||||||||||

| Book value per common share | 20.12 | 19.85 | 19.70 | 20.35 | 20.10 | ||||||||||||||||||||||||

Tangible book value per common share (2) | 20.12 | 19.85 | 19.70 | 20.35 | 20.10 | ||||||||||||||||||||||||

| Performance and capital ratios: | |||||||||||||||||||||||||||||

Return on average assets(3) | 0.71 | % | 0.52 | % | 0.30 | % | 0.57 | % | (0.60) | % | |||||||||||||||||||

Return on average common equity(3) | 8.46 | % | 5.86 | % | 2.69 | % | 5.56 | % | (7.76) | % | |||||||||||||||||||

| Net interest margin | 3.36 | % | 4.18 | % | 4.17 | % | 4.19 | % | 4.63 | % | |||||||||||||||||||

| Dividend payout ratio | 19.15 | % | 27.89 | % | 61.48 | % | 28.99 | % | (20.02) | % | |||||||||||||||||||

| Asset quality ratios: | |||||||||||||||||||||||||||||

Net charge-offs(3) | $ | 2,234 | $ | 2,253 | $ | 1,887 | $ | 1,393 | $ | 575 | |||||||||||||||||||

Net charge-offs/avg loans held for investment at amortized cost, excl PPP(3) | 1.27 | % | 1.18 | % | 1.08 | % | 0.82 | % | 0.37 | % | |||||||||||||||||||

| Nonperforming loans | $ | 10,393 | $ | 8,606 | $ | 5,890 | $ | 10,468 | $ | 10,267 | |||||||||||||||||||

| Nonperforming loans (excluding gov't gtd balance) | $ | 8,776 | $ | 6,590 | $ | 2,095 | $ | 3,671 | $ | 4,015 | |||||||||||||||||||

| Nonperforming loans/total loans held for investment | 1.18 | % | 1.03 | % | 0.74 | % | 1.44 | % | 1.51 | % | |||||||||||||||||||

| Nonperforming loans (excl gov’t gtd balance)/total loans held for investment | 1.00 | % | 0.79 | % | 0.26 | % | 0.50 | % | 0.59 | % | |||||||||||||||||||

ACL/Total loans held for investment at amortized cost (1) | 1.68 | % | 1.61 | % | 1.69 | % | 1.29 | % | 1.48 | % | |||||||||||||||||||

ACL/Total loans held for investment at amortized cost, excl PPP loans (1) | 1.72 | % | 1.64 | % | 1.73 | % | 1.33 | % | 1.54 | % | |||||||||||||||||||

ACL/Total loans held for investment at amortized cost, excl government guaranteed loans (1) | 2.03 | % | 2.03 | % | 2.10 | % | 1.62 | % | 1.90 | % | |||||||||||||||||||

| Other Data: | |||||||||||||||||||||||||||||

| Full-time equivalent employees | 307 | 302 | 300 | 291 | 524 | ||||||||||||||||||||||||

| Banking center offices | 10 | 9 | 9 | 8 | 8 | ||||||||||||||||||||||||

(1) Prior to January 1, 2023, the incurred loss methodology was used to estimate credit losses. Beginning with that date, credit losses are estimated using the CECL methodology. | |||||||||||||||||||||||||||||

(2) See section entitled "GAAP Reconciliation and Management Explanation of Non-GAAP Financial Measures" below for a reconciliation to most comparable GAAP equivalent. | |||||||||||||||||||||||||||||

(3) Annualized | |||||||||||||||||||||||||||||

BayFirst Financial Corp. Reports Third Quarter 2023 Results

October 26, 2023

Page 8

GAAP Reconciliation and Management Explanation of Non-GAAP Financial Measures

Some of the financial measures included in this report are not measures of financial condition or performance recognized by GAAP. These non-GAAP financial measures include tangible common shareholders' equity and tangible book value per common share. Our management uses these non-GAAP financial measures in its analysis of our performance, and we believe that providing this information to financial analysts and investors allows them to evaluate capital adequacy.

The following presents these non-GAAP financial measures along with their most directly comparable financial measures calculated in accordance with GAAP:

| Tangible Common Shareholders' Equity and Tangible Book Value Per Common Share (Unaudited) | ||||||||||||||||||||||||||||||||

| As of | ||||||||||||||||||||||||||||||||

| (Dollars in thousands, except for share data) | September 30, 2023 | June 30, 2023 | March 31, 2023 | December 31, 2022 | September 30, 2022 | |||||||||||||||||||||||||||

| Total shareholders’ equity | $ | 94,165 | $ | 91,065 | $ | 90,339 | $ | 91,884 | $ | 90,637 | ||||||||||||||||||||||

| Less: Preferred stock liquidation preference | (11,440) | (9,605) | (9,605) | (9,605) | (9,605) | |||||||||||||||||||||||||||

| Total equity available to common shareholders | 82,725 | 81,460 | 80,734 | 82,279 | 81,032 | |||||||||||||||||||||||||||

| Less: Goodwill | — | — | — | — | — | |||||||||||||||||||||||||||

| Tangible common shareholders' equity | $ | 82,725 | $ | 81,460 | $ | 80,734 | $ | 82,279 | $ | 81,032 | ||||||||||||||||||||||

| Common shares outstanding | 4,110,650 | 4,103,834 | 4,098,805 | 4,042,474 | 4,031,937 | |||||||||||||||||||||||||||

| Tangible book value per common share | $ | 20.12 | $ | 19.85 | $ | 19.70 | $ | 20.35 | $ | 20.10 | ||||||||||||||||||||||

BayFirst Financial Corp. Reports Third Quarter 2023 Results

October 26, 2023

Page 9

| BAYFIRST FINANCIAL CORP. | |||||||||||

| CONSOLIDATED BALANCE SHEETS | |||||||||||

| (Dollars in thousands) | 9/30/2023 | 6/30/2023 | 9/30/2022 | ||||||||

| Assets | Unaudited | Unaudited | Unaudited | ||||||||

| Cash and due from banks | $ | 4,501 | $ | 4,593 | $ | 3,131 | |||||

| Interest-bearing deposits in banks | 108,052 | 99,114 | 33,365 | ||||||||

| Cash and cash equivalents | 112,553 | 103,707 | 36,496 | ||||||||

| Time deposits in banks | 4,631 | 4,881 | 4,881 | ||||||||

Investment securities available for sale, at fair value (amortized cost $44,569, $45,713, and $48,016 at September 30, 2023, June 30, 2023, and September 30, 2022, respectively) | 39,683 | 41,343 | 42,915 | ||||||||

Investment securities held to maturity, at amortized cost, net of allowance for credit losses of $19, $19, and $0 (fair value: $2,282, $2,222, and $4,995 at September 30, 2023, June 30, 2023, and September 30, 2022, respectively) | 2,482 | 2,483 | 5,008 | ||||||||

Nonmarketable equity securities | 4,250 | 5,332 | 2,531 | ||||||||

| Government guaranteed loans held for sale | 1,855 | 1,247 | 573 | ||||||||

Government guaranteed loans held for investment, at fair value | 84,178 | 52,165 | 24,965 | ||||||||

Loans held for investment, at amortized cost net of allowance for credit losses of $13,365, $12,598, and $9,739 at September 30, 2023, June 30, 2023, and September 30, 2022, respectively) | 780,904 | 771,941 | 646,101 | ||||||||

| Accrued interest receivable | 6,907 | 5,929 | 3,789 | ||||||||

| Premises and equipment, net | 37,992 | 40,052 | 32,779 | ||||||||

| Loan servicing rights | 14,216 | 12,820 | 9,932 | ||||||||

| Deferred income tax assets | 414 | 925 | 1,937 | ||||||||

| Right-of-use operating lease assets | 2,594 | 2,804 | 2,985 | ||||||||

| Bank owned life insurance | 25,630 | 25,469 | 25,004 | ||||||||

| Other assets | 15,292 | 15,850 | 13,632 | ||||||||

| Assets from discontinued operations | 398 | 451 | 76,747 | ||||||||

| Total assets | $ | 1,133,979 | $ | 1,087,399 | $ | 930,275 | |||||

| Liabilities: | |||||||||||

| Noninterest-bearing deposits | $ | 98,008 | $ | 101,081 | $ | 104,215 | |||||

| Interest-bearing transaction accounts | 267,404 | 253,112 | 190,985 | ||||||||

| Savings and money market deposits | 350,110 | 401,941 | 380,576 | ||||||||

| Time deposits | 302,274 | 188,648 | 109,960 | ||||||||

| Total deposits | 1,017,796 | 944,782 | 785,736 | ||||||||

| FHLB and FRB borrowings | 0 | 30,000 | 28,000 | ||||||||

| Subordinated debentures | 5,947 | 5,945 | 5,990 | ||||||||

| Notes payable | 2,503 | 2,617 | 2,958 | ||||||||

| Accrued interest payable | 632 | 572 | 236 | ||||||||

| Operating lease liabilities | 2,812 | 3,018 | 3,355 | ||||||||

| Accrued expenses and other liabilities | 9,409 | 8,461 | 9,374 | ||||||||

| Liabilities from discontinued operations | 715 | 939 | 3,989 | ||||||||

| Total liabilities | 1,039,814 | 996,334 | 839,638 | ||||||||

BayFirst Financial Corp. Reports Third Quarter 2023 Results

October 26, 2023

Page 10

| BAYFIRST FINANCIAL CORP. | |||||||||||

| CONSOLIDATED BALANCE SHEETS | |||||||||||

| (Dollars in thousands) | 9/30/2023 | 6/30/2023 | 9/30/2022 | ||||||||

| Shareholders’ equity: | Unaudited | Unaudited | Unaudited | ||||||||

Preferred stock, Series A; no par value, 10,000 shares authorized, 6,395 shares issued and outstanding at September 30, 2023, June 30, 2023, and September 30, 2022, respectively; aggregate liquidation preference of $6,395 each period | 6,161 | 6,161 | 6,161 | ||||||||

Preferred stock, Series B; no par value, 20,000 shares authorized, 3,210 shares issued and outstanding at September 30, 2023, June 30, 2023, and September 30, 2022; aggregate liquidation preference of $3,210 each period | 3,123 | 3,123 | 3,123 | ||||||||

Preferred stock, Series C; no par value, 10,000 shares authorized, 1,835 shares issued and outstanding at September 30, 2023 and no shares issued and outstanding as of June 30, 2023 and September 30, 2022; aggregate liquidation preference of $1,835 at September 30, 2023 | 1,835 | — | — | ||||||||

Common stock and additional paid-in capital; no par value, 15,000,000 shares authorized, 4,110,650, 4,103,834, and 4,031,937 shares issued and outstanding at September 30, 2023, June 30, 2023, and September 30, 2022, respectively | 54,500 | 54,384 | 52,770 | ||||||||

| Accumulated other comprehensive loss, net | (3,621) | (3,239) | (3,780) | ||||||||

| Unearned compensation | (1,242) | (1,386) | (323) | ||||||||

| Retained earnings | 33,409 | 32,022 | 32,686 | ||||||||

| Total shareholders’ equity | 94,165 | 91,065 | 90,637 | ||||||||

| Total liabilities and shareholders’ equity | $ | 1,133,979 | $ | 1,087,399 | $ | 930,275 | |||||

BayFirst Financial Corp. Reports Third Quarter 2023 Results

October 26, 2023

Page 11

| BAYFIRST FINANCIAL CORP. | |||||||||||||||||||||||||||||

| CONSOLIDATED STATEMENTS OF INCOME | |||||||||||||||||||||||||||||

| For the Quarter Ended | Year-to-Date | ||||||||||||||||||||||||||||

| (Dollars in thousands, except per share data) | 9/30/2023 | 6/30/2023 | 9/30/2022 | 9/30/2023 | 9/30/2022 | ||||||||||||||||||||||||

| Interest income: | Unaudited | Unaudited | Unaudited | Unaudited | Unaudited | ||||||||||||||||||||||||

| Loans, including fees | $ | 16,032 | $ | 16,372 | $ | 10,650 | $ | 45,475 | $ | 24,812 | |||||||||||||||||||

| Interest-bearing deposits in banks and other | 1,588 | 1,420 | 634 | 4,188 | 1,234 | ||||||||||||||||||||||||

| Total interest income | 17,620 | 17,792 | 11,284 | 49,663 | 26,046 | ||||||||||||||||||||||||

| Interest expense: | |||||||||||||||||||||||||||||

| Deposits | 9,055 | 7,098 | 1,856 | 21,076 | 4,133 | ||||||||||||||||||||||||

| Other | 172 | 586 | 258 | 1,033 | 487 | ||||||||||||||||||||||||

| Total interest expense | 9,227 | 7,684 | 2,114 | 22,109 | 4,620 | ||||||||||||||||||||||||

| Net interest income | 8,393 | 10,108 | 9,170 | 27,554 | 21,426 | ||||||||||||||||||||||||

| Provision for credit losses | 3,001 | 2,765 | 750 | 7,708 | (1,400) | ||||||||||||||||||||||||

| Net interest income after provision for credit losses | 5,392 | 7,343 | 8,420 | 19,846 | 22,826 | ||||||||||||||||||||||||

| Noninterest income: | |||||||||||||||||||||||||||||

| Loan servicing income, net | 760 | 649 | 620 | 2,149 | 1,508 | ||||||||||||||||||||||||

| Gain on sale of government guaranteed loans, net | 7,139 | 6,028 | 7,446 | 17,576 | 15,915 | ||||||||||||||||||||||||

| Service charges and fees | 408 | 379 | 347 | 1,166 | 951 | ||||||||||||||||||||||||

| Government guaranteed loans fair value gain, net | 4,543 | 2,904 | 999 | 11,021 | 3,510 | ||||||||||||||||||||||||

| Other noninterest income | 1,829 | 977 | 392 | 3,152 | 1,262 | ||||||||||||||||||||||||

| Total noninterest income | 14,679 | 10,937 | 9,804 | 35,064 | 23,146 | ||||||||||||||||||||||||

| Noninterest Expense: | |||||||||||||||||||||||||||||

| Salaries and benefits | 7,912 | 7,780 | 6,758 | 23,527 | 21,177 | ||||||||||||||||||||||||

| Bonus, commissions, and incentives | 1,406 | 1,305 | 883 | 3,515 | 1,833 | ||||||||||||||||||||||||

| Occupancy and equipment | 1,262 | 1,183 | 1,070 | 3,608 | 3,010 | ||||||||||||||||||||||||

| Data processing | 1,526 | 1,316 | 1,247 | 4,189 | 3,486 | ||||||||||||||||||||||||

| Marketing and business development | 929 | 1,102 | 662 | 2,696 | 2,100 | ||||||||||||||||||||||||

| Professional services | 816 | 874 | 956 | 2,587 | 3,089 | ||||||||||||||||||||||||

| Loan origination and collection | 1,981 | 1,221 | 1,068 | 4,697 | 2,486 | ||||||||||||||||||||||||

| Employee recruiting and development | 543 | 556 | 518 | 1,667 | 1,653 | ||||||||||||||||||||||||

| Regulatory assessments | 284 | 232 | 110 | 615 | 299 | ||||||||||||||||||||||||

| Other noninterest expense | 768 | 833 | 886 | 2,140 | 2,586 | ||||||||||||||||||||||||

| Total noninterest expense | 17,427 | 16,402 | 14,158 | 49,241 | 41,719 | ||||||||||||||||||||||||

| Income before taxes from continuing operations | 2,644 | 1,878 | 4,066 | 5,669 | 4,253 | ||||||||||||||||||||||||

| Income tax expense from continuing operations | 674 | 461 | 983 | 1,415 | 888 | ||||||||||||||||||||||||

| Net income from continuing operations | 1,970 | 1,417 | 3,083 | 4,254 | 3,365 | ||||||||||||||||||||||||

| Loss from discontinued operations before income taxes | (62) | (43) | (5,973) | (275) | (6,706) | ||||||||||||||||||||||||

| Income tax benefit from discontinued operations | (15) | (11) | (1,488) | (68) | (1,670) | ||||||||||||||||||||||||

| Net loss from discontinued operations | (47) | (32) | (4,485) | (207) | (5,036) | ||||||||||||||||||||||||

| Net income (loss) | 1,923 | 1,385 | (1,402) | 4,047 | (1,671) | ||||||||||||||||||||||||

| Preferred dividends | 208 | 208 | 208 | 624 | 624 | ||||||||||||||||||||||||

| Net income available to (loss attributable to) common shareholders | $ | 1,715 | $ | 1,177 | $ | (1,610) | $ | 3,423 | $ | (2,295) | |||||||||||||||||||

BayFirst Financial Corp. Reports Third Quarter 2023 Results

October 26, 2023

Page 12

| BAYFIRST FINANCIAL CORP. | |||||||||||||||||||||||||||||

| CONSOLIDATED STATEMENTS OF INCOME | |||||||||||||||||||||||||||||

| For the Quarter Ended | Year-to-Date | ||||||||||||||||||||||||||||

| (Dollars in thousands, except per share data) | 9/30/2023 | 6/30/2023 | 9/30/2022 | 9/30/2023 | 9/30/2022 | ||||||||||||||||||||||||

| Basic earnings (loss) per common share: | Unaudited | Unaudited | Unaudited | Unaudited | Unaudited | ||||||||||||||||||||||||

| Continuing operations | $ | 0.43 | $ | 0.30 | $ | 0.71 | $ | 0.89 | $ | 0.68 | |||||||||||||||||||

| Discontinued operations | (0.01) | (0.01) | (1.11) | (0.05) | (1.25) | ||||||||||||||||||||||||

| Basic earnings (loss) per common share | $ | 0.42 | $ | 0.29 | $ | (0.40) | $ | 0.84 | $ | (0.57) | |||||||||||||||||||

| Diluted earnings (loss) per common share: | |||||||||||||||||||||||||||||

| Continuing operations | $ | 0.42 | $ | 0.30 | $ | 0.68 | $ | 0.88 | $ | 0.67 | |||||||||||||||||||

| Discontinued operations | (0.01) | (0.01) | (1.03) | (0.05) | (1.15) | ||||||||||||||||||||||||

| Diluted earnings (loss) per common share | $ | 0.41 | $ | 0.29 | $ | (0.35) | $ | 0.83 | $ | (0.48) | |||||||||||||||||||

BayFirst Financial Corp. Reports Third Quarter 2023 Results

October 26, 2023

Page 13

Loan Composition

(Dollars in thousands) | 9/30/2023 | 6/30/2023 | 3/31/2023 | 12/31/2022 | 9/30/2022 | ||||||||||||||||||||||||

Real estate: | (Unaudited) | (Unaudited) | (Unaudited) | (Unaudited) | |||||||||||||||||||||||||

Residential | $ | 248,973 | $ | 235,339 | $ | 214,638 | $ | 202,329 | $ | 176,574 | |||||||||||||||||||

Commercial | 280,620 | 272,200 | 239,720 | 231,281 | 220,210 | ||||||||||||||||||||||||

Construction and land | 25,339 | 15,575 | 11,069 | 9,320 | 9,259 | ||||||||||||||||||||||||

Commercial and industrial | 174,238 | 198,639 | 199,721 | 194,643 | 183,631 | ||||||||||||||||||||||||

Commercial and industrial - PPP | 15,364 | 15,808 | 18,430 | 19,293 | 22,286 | ||||||||||||||||||||||||

Consumer and other | 39,024 | 38,103 | 32,697 | 37,288 | 37,595 | ||||||||||||||||||||||||

Loans held for investment, at amortized cost, gross | 783,558 | 775,664 | 716,275 | 694,154 | 649,555 | ||||||||||||||||||||||||

Deferred loan costs, net | 12,928 | 11,506 | 10,678 | 10,740 | 9,047 | ||||||||||||||||||||||||

Discount on government guaranteed loans sold | (6,623) | (5,937) | (6,046) | (5,621) | (5,068) | ||||||||||||||||||||||||

Premium on loans purchased, net | 4,406 | 3,306 | 2,823 | 2,301 | 2,306 | ||||||||||||||||||||||||

Allowance for credit losses (1) | (13,365) | (12,598) | (12,208) | (9,046) | (9,739) | ||||||||||||||||||||||||

Loans held for investment, at amortized cost | $ | 780,904 | $ | 771,941 | $ | 711,522 | $ | 692,528 | $ | 646,101 | |||||||||||||||||||

Nonperforming Assets (Unaudited)

| (Dollars in thousands) | 9/30/2023 | 6/30/2023 | 3/31/2023 | 12/31/2022 | 9/30/2022 | ||||||||||||||||||||||||

Nonperforming loans (government guaranteed balances) | $ | 1,617 | $ | 2,016 | $ | 3,795 | $ | 6,797 | $ | 6,252 | |||||||||||||||||||

Nonperforming loans (unguaranteed balances) | 8,776 | 6,590 | 2,095 | 3,671 | 4,015 | ||||||||||||||||||||||||

Total nonperforming loans | 10,393 | 8,606 | 5,890 | 10,468 | 10,267 | ||||||||||||||||||||||||

OREO | — | 3 | 3 | 56 | 56 | ||||||||||||||||||||||||

Total nonperforming assets | $ | 10,393 | $ | 8,609 | $ | 5,893 | $ | 10,524 | $ | 10,323 | |||||||||||||||||||

Nonperforming loans as a percentage of total loans held for investment | 1.18 | % | 1.03 | % | 0.74 | % | 1.44 | % | 1.51 | % | |||||||||||||||||||

Nonperforming loans (excluding government guaranteed balances) to total loans held for investment | 1.00 | % | 0.79 | % | 0.26 | % | 0.50 | % | 0.59 | % | |||||||||||||||||||

Nonperforming assets as a percentage of total assets | 0.92 | % | 0.79 | % | 0.55 | % | 1.12 | % | 1.11 | % | |||||||||||||||||||

Nonperforming assets (excluding government guaranteed balances) to total assets | 0.77 | % | 0.61 | % | 0.20 | % | 0.40 | % | 0.44 | % | |||||||||||||||||||

ACL to nonperforming loans (1) | 128.60 | % | 146.39 | % | 207.27 | % | 86.42 | % | 94.86 | % | |||||||||||||||||||

ACL to nonperforming loans (excluding government guaranteed balances) (1) | 152.29 | % | 191.17 | % | 582.72 | % | 246.42 | % | 242.57 | % | |||||||||||||||||||

(1) Prior to January 1, 2023, the incurred loss methodology was used to estimate credit losses. Beginning with that date, credit losses are estimated using the CECL methodology.

Note: Transmitted on Globe Newswire on October 26, 2023, at 4:00 p.m. ET.