Part II

OFFERING CIRCULAR

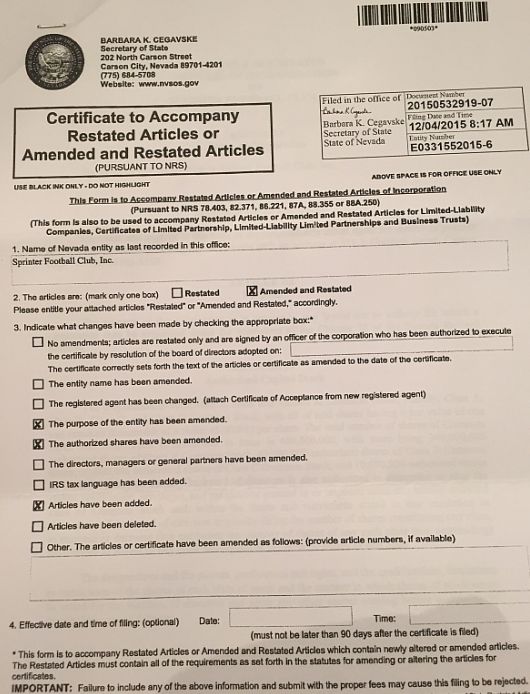

Sprinter Football Club, Inc.

2344 Corte De La Jara

Pleasanton, CA 94566

(760) 579-9885

Dated: January 25, 2016

The

Offering Statement relates to the proposed issuance by the Company of up to 40,000,000

shares Class B common stock, 10,000,000 shares of Class C common stock and 10,000,000

shares of Class D common stock (the “Shares”), with all classes of common

stock having $0.00001 par value per share, to be issued by Sprinter Football Club, Inc.,

(the “Company,” “we,” “us,” or “our”).

Subscribers will not be required to tender funds

for their shares, but, instead, must perform certain promotional services as consideration

for their shares. Our board of directors has used its business judgment in setting the

value of the promotional services provided by the subscribers to be $10,000.20

if the offer is fully subscribed. Using this

measure for valuing the promotional services to be tendered for shares results in our

valuing the consideration being tendered as $0.00016667 per share. We operate

a football (soccer) club in San Diego. Our principal offices are located at 2344 Corte

De La Jara, Pleasanton, CA 94566. The phone number for these offices is (760) 579-9885.

These securities are speculative securities.

Investment in the Company’s stock involves significant risk. You should purchase these securities only if you can afford

a complete loss of your investment. See the “Risk Factors” section on page 4 of this Offering Circular.

We will commence the offering of these securities

promptly after the date this Offering Circular is qualified.

This Offering is being conducted on a “best-efforts”

basis, which means our officers will use their commercially reasonable best efforts in an attempt to offer (in exchange for services

rendered) the shares of the Class B, Class C, and Class D Common Stock. Such officers will not receive any commission or any

other remuneration for these sales. In offering the securities on our behalf, the officers will rely on the safe harbor from broker-dealer

registration set out in Rule 3a4-1 under the Securities Exchange Act of 1934, as amended.

This Offering Circular shall not constitute

an offer to sell or the solicitation of an offer to buy, nor shall there be any sales of these securities in any state or jurisdiction

in which such offer, solicitation or sale would be, unlawful, prior to registration or qualification under the laws of any such

state.

See Item 14, “Securities Being Offered”

on page 45 for more information and descriptions of the Class B, Class C, and Class D Common Stock.

Our Class A Common Stock is mentioned in

this offering where we disclose our Corporation’s capital structure. The performance of each class of common stock may affect

the performance of other classes of common stock. We have not issued any Class A Common Stock to anyone other than the founder

of the Corporation, Mr. Peter Allen Schuh, who owns 100% of the issued Class A Common Stock.

CLASS B

| |

Share valuation

and price to

public |

Underwriting

discount and

commissions |

Services

provided to

issuer |

Proceeds to

other persons |

| Per share/unit: |

$0.00016667 |

$0 |

$0.00016667 |

$0 |

| Total: |

$6,666.80 |

$0 |

$6,666.80 |

$0 |

CLASS C

| |

Share valuation

and price to

public |

Underwriting

discount and

commissions |

Services

provided to

issuer |

Proceeds to

other persons |

| Per share/unit: |

$0.00016667 |

$0 |

$0.00016667 |

$0 |

| Total: |

$1666.70 |

$0 |

$1666.70 |

$0 |

CLASS D

| |

Share valuation

and price

to public |

Underwriting

discount and

commissions |

Services

provided

to issuer |

Proceeds to

other persons |

| Per share/unit: |

$0.00016667 |

$0 |

$0.00016667 |

$0 |

| Total: |

$1666.70 |

$0 |

$1666.70 |

$0 |

Our board of directors has used its business

judgment in setting a value of $0.00016667 per share for the promotional services to be rendered to the Company as consideration

for the stock to be issued under the Offering.

NO FEDERAL OR STATE SECURITIES COMMISSION HAS APPROVED, DISAPPROVED,

ENDORSED, OR RECOMMENDED THIS OFFERING. YOU SHOULD MAKE AN INDEPENDENT DECISION WHETHER THIS OFFERING MEETS YOUR INVESTMENT OBJECTIVES

AND FINANCIAL RISK TOLERANCE LEVEL. NO INDEPENDENT PERSON HAS CONFIRMED THE ACCURACY OR TRUTHFULNESS OF THIS DISCLOSURE, NOR WHETHER

IT IS COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS ILLEGAL.

THE UNITED STATES SECURITIES AND EXCHANGE COMMISSION DOES NOT

PASS UPON THE MERITS OF OR GIVE ITS APPROVAL TO ANY SECURITIES OFFERED OR THE TERMS OF THE OFFERING, NOR DOES IT PASS UPON THE

ACCURACY OR COMPLETENESS OF ANY OFFERING CIRCULAR OR OTHER SOLICITATION MATERIALS. THESE SECURITIES ARE OFFERED PURSUANT TO AN

EXEMPTION FROM REGISTRATION WITH THE COMMISSION; HOWEVER, THE COMMISSION HAS NOT MADE AN INDEPENDENT DETERMINATION THAT THE SECURITIES

OFFERED HEREUNDER ARE EXEMPT FROM REGISTRATION.

THE EXEMPTIONS FOR SECONDARY TRADING AVAILABLE UNDER CALIFORNIA

CORPORATIONS CODE 25104(H) WILL BE WITHHELD BUT THAT THERE MAY BE OTHER EXEMPTIONS TO COVER PRIVATE SALES BY THE BONA FIDE OWNER

FOR HIS OWN ACCOUNT WITHOUT ADVERTISING AND WITHOUT BEING EFFECTED BY OR THROUGH A BROKER DEALER IN A PUBLIC OFFERING.

Item 2: TABLE OF CONTENTS:

TITLE:

| SUMMARY |

4 |

| |

|

| RISK FACTORS |

4 |

| |

|

| DILUTION |

28 |

| |

|

| PLAN OF DISTRIBUTION AND SELLING SECURITYHOLDERS |

28 |

| |

|

| USE OF PROCEEDS |

28 |

| |

|

| SPRINTER FOOTBALL CLUB – DESCRIPTION OF BUSINESS |

29 |

| |

|

| LEGAL MATTERS |

38 |

| |

|

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION |

39 |

| |

|

| DIRECTORS, EXECUTIVE OFFICERS AND SIGNIFICANT EMPLOYEES |

43 |

| |

|

| SECURITIES BEING OFFERED |

45 |

| |

|

| SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS |

49 |

| |

|

| INFORMATION NOT REQUIRED IN PROSPECTUS |

50 |

Item 3. SUMMARY AND RISK FACTORS

SUMMARY

We are a new world football (soccer) club located

in the Metropolitan San Diego, California, United States of America (USA) location. The

market has a growing fan base in a desirable geographical location with year round favorable playing conditions and is not saturated.

We plan to start playing matches in 2016 and hope to play 20 home games throughout the 2016-2017 season. We

will recruit our first players immediately and run a soccer academy to develop those players. We have no home stadium currently.

During our first year we will rent stadiums and travel to play our matches. We hope to start stadium planning and construction

in 2016 with hopes of having a major soccer devoted stadium built by 2018. We

will have various websites in various languages that show media content such as tryouts, practices, games, and meetings.

The focus is on developing a strong fan base through social media and maximizing

electronic media for e-commerce and live broadcasting. We hope to create a large passionate community that might in turn provide

Sprinter Football Club with a worldwide platform to generate significant revenue from multiple sources including broadcasting,

mobile and content, sponsorship, merchandising, product licensing, and Match-Day.

RISK FACTORS

Investment in

our Class B, Class C, and Class D Common Stock as well as the Class A Common Stock (not offered in this filing) involves a high

degree of risk. We expect to be exposed to some or all of the risks described below in our future operations. Any of

the risk factors described below, as well as additional risks of which we are not currently aware, could affect our business operations

and have a material adverse effect on our business, results of operations, financial condition, cash flow and prospects and cause

the value of our shares to decline. Moreover, if and to the extent that any of the risks described below materialize, they may

occur in combination with other risks that would compound the adverse effect of such risks on our business, results of operations,

financial condition, cash flow and prospects.

Risks Related to

Our Business

Our business depends on a strong

brand, and if we are not able to create, maintain and enhance our brand, our ability to gain our base of users, advertisers and

“SprinterFCTV Network” members will be impaired and our business and operating results will be harmed.

We believe that the

brand identity that we hope to develop will significantly contribute to the success of our future business. We also believe that

creating, maintaining and enhancing the “SprinterFCTV Network” brand will be critical to creating our base of users,

advertisers and SprinterFCTV Network members. Creating and enhancing our brand may require us to make substantial investments and

these investments may not be successful. If we fail to promote and maintain the SprinterFCTV Network brand, or if we incur excessive

expenses in this effort, our business, operating results and financial condition will be materially and adversely affected. We

anticipate that, as our market becomes increasingly competitive, maintaining and enhancing our brand may become increasingly difficult

and expensive. Creating, maintaining and enhancing our brand will depend largely on our ability to be a football technology leader

and to continue to provide high quality products and services, which we may not do successfully. To date, we have engaged in relatively

little direct brand promotion activities. This enhances the risk that we may not successfully implement brand enhancement efforts

in the future.

Our business is dependent upon our

ability to attract and retain key personnel, including players.

We are highly dependent

on members of our management, coaching staff and our players. Competition for talented players and staff is, and will continue

to be, intense. Our ability to attract and retain the highest quality players for our first team, reserve team and youth academy

as well as coaching staff is critical to our first team's success in league and cup competitions and increasing popularity and,

consequently, critical to our business, results of operations, financial condition and cash flow. A downturn in the performance

of our first team could adversely affect our ability to attract and retain coaches and players. In addition, our popularity in

certain countries or regions may depend, at least in part, on fielding certain players from those countries or regions. While we

enter into employment contracts with each of our key personnel with the aim of securing their services for the term of the contract,

the retention of their services for the full term of the contract cannot be guaranteed due to possible contract disputes or approaches

by other clubs. Our failure to attract and retain key personnel could have a negative impact on our ability to manage effectively

and grow our business.

We are dependent upon the performance

and popularity of our first team.

Our revenue streams

will be driven by the performance and popularity of our first team. Our income will vary significantly depending on our first team's

participation and performance in various competitions. Our first team's performance affects all of our revenue streams:

| · | sponsorship revenue through sponsorship relationships; |

| · | retail, merchandising, apparel and product licensing revenue through

product sales; |

| · | mobile and content revenue through telecommunications partnerships

and our websites; |

| · | broadcasting revenue through the frequency of appearances and performance

based share of league broadcasting revenue and possibly Confederation of North, Central American

and Caribbean Association Football (CONCACAF) Champions League prize money; and |

| · | Match-Day revenue through ticket sales. |

Our first team currently

does not have a league in which to play. We may apply and possibly be rejected to play in various leagues. Our performance in various

leagues will directly affect, and a weak performance in any league or failure to play in a league could adversely affect, our business,

results of operations, financial condition and cash flow.

We will have major costs that we will need corporate sponsorship

to support operations, including player salaries, management, and stadium construction.

The first major costs in the beginning of the

first year of operations will be salaries of the professionals and management who will need to build out the personnel human resources

staffing infrastructure. These professionals must be in place as the first players are signed to tryouts and then to training contracts.

It is expected that all physical facilities

and even equipment will be rented or leased during the first year of operations.

The building of the stadium would represent

an ecological change for the team and the company. Instead of renting fields for matches and moving around, the physical establishment

of a home field would give an identity to the team as is true for other professional football teams around the world. The image

of the home field would be part of the brand. The building of the stadium is dependent upon many factors, some of which are out

of our control. The major question is whether there is room in the metropolitan area for such a stadium. We have identified several

sites which have favorable features in the metropolitan area. We see the key obstacle as the willingness of the permitting authority

to grant permission and in a timely manner. We believe the major factors in favor of establishing a permanent home stadium are

the combination of our theme of continuing social responsibility and ecological positivism along with our desire to be good corporate

citizens in cooperating with local politics and our knowledge of local issues. We also intend to maintain good stockholder relations

and employee relations. The financial economic infusion by our business operations will be a stimulus to the immediate area where

the stadium is located. Besides our own matches the facility could be available for other uses. This could be expected to be a

steady source of revenues to be continued for many years.

If we fail to retain existing users

or add new users, or if our users decrease their level of engagement with SprinterFCTV Network, our revenue, financial results,

and business may be significantly harmed.

The size of our user

base and our users’ level of engagement are critical to our success. Our financial performance will be significantly determined

by our success in adding, retaining, and engaging active users. We anticipate that our active user growth rate will decline over

time as the size of our active user base increases, and as we achieve higher market penetration rates. To the extent our active

user growth rate slows, our business performance will become increasingly dependent on our ability to increase levels of user engagement

in current and new markets. If people do not perceive our products to be useful, reliable, and trustworthy, we may not be able

to attract or retain users or otherwise maintain or increase the frequency and duration of their engagement. A number of media

companies that achieved early popularity have since seen their active user bases or levels of engagement decline, in some cases

precipitously. There is no guarantee that we will not experience a similar erosion of our active user base or engagement levels.

A decrease in user retention, growth, or engagement could render SprinterFCTV Network less attractive to advertisers, which may

have a material and adverse impact on our revenue, business, financial condition, and results of operations. Any number of factors

could potentially negatively affect user retention, growth, and engagement, including if:

| · | users increasingly engage with competing products; |

| · | we fail to introduce new and improved products or if we introduce

new products or services that are not favorably received; |

| · | we are unable to continue to develop products for mobile devices that

users find engaging, that work with a variety of mobile operating systems and networks, and that achieve a high level of market

acceptance; |

| · | there are changes in user sentiment about the quality or usefulness

of our products or concerns related to privacy and sharing, safety, security, or other factors; |

| · | we are unable to manage and prioritize information to ensure users

are presented with content that is interesting, useful, and relevant to them; |

| · | there are adverse changes in our products that are mandated by legislation,

regulatory authorities, or litigation, including settlements or consent decrees; |

| · | technical or other problems prevent us from delivering our products

in a rapid and reliable manner or otherwise affect the user experience; |

| · | we fail to provide adequate customer service to users, or advertisers;

or |

| · | we, our SprinterFCTV Network, or other companies in our industry are

the subject of adverse media reports or other negative publicity. |

If we are unable to

maintain and increase our user base and user engagement, our revenue, financial results, and future growth potential may be adversely

affected.

We may generate a substantial amount

of our revenue from advertising. The loss of advertisers, or reduction in spending by advertisers with SprinterFCTV Network, could

seriously harm our business.

A substantial amount

of our revenue is anticipated to be generated from third parties advertising on SprinterFCTV Network. Advertisers will not do business

with us, or they will reduce the prices they are willing to pay to advertise with us, if we do not deliver ads and other commercial

content in an effective manner, or if they do not believe that their investment in advertising with us will generate a competitive

return relative to other alternatives. Our advertising revenue could be adversely affected by a number of other factors, including:

| · | decreases in user engagement, including time spent on SprinterFCTV

Network; |

| · | product changes or inventory management decisions we may make that

reduce the size, frequency, or relative prominence of ads and other commercial content displayed on SprinterFCTV Network; |

| · | loss of advertising market share to our competitors; |

| · | adverse legal developments relating to advertising, including legislative

and regulatory developments and developments in litigation; |

| · | adverse media reports or other negative publicity involving us, our

SprinterFCTV Network, or other companies in our industry; |

| · | our inability to create new products that sustain or increase the

value of our ads and other commercial content; |

| · | the degree to which users opt out of social ads or otherwise limit

the potential audience of commercial content; |

| · | changes in the way online advertising is priced; |

| · | the impact of new technologies that could block or obscure the display

of our ads and other commercial content; and |

| · | the impact of macroeconomic conditions and conditions in the advertising

industry in general. |

The occurrence of any

of these or other factors could result in a reduction in demand for our ads and other commercial content, which may reduce the

prices we receive for our ads and other commercial content, or cause advertisers to stop advertising with us altogether, either

of which would negatively affect our revenue and financial results.

We face competition from traditional

media companies, and we may not be included in the advertising budgets of large advertisers, which could harm our operating results.

In addition to Internet

companies, we face competition from companies that offer traditional media advertising opportunities. Most large advertisers have

set advertising budgets, a very small portion of which is allocated to Internet advertising. We expect that large advertisers

will continue to focus most of their advertising efforts on traditional media. If we fail to convince these companies to spend

a portion of their advertising budgets with us our operating results would be harmed.

We will rely on our SprinterFCTV

Network members for a significant portion of our revenues, and otherwise benefit from our association with them. The loss of these

members could prevent us from receiving the benefits we receive from our association with these SprinterFCTV Network members, which

could adversely affect our business.

We will provide advertising,

entertainment through matches and other services to members of our SprinterFCTV Network. We consider this SprinterFCTV Network

to be critical to the future growth of our revenues. However, some of the participants in this network may compete with us in one

or more areas. Therefore, they may decide in the future to terminate their agreements with us. If our SprinterFCTV Network members

decide to use a competitor’s football/soccer network or advertising services, our revenues would decline.

Our business and operations may experience

rapid growth. If we fail to manage our growth, our business and operating results could be harmed and we may have to incur significant

expenditures to address the additional operational and control requirements of this growth.

We may experience rapid

growth in our headcount and operations, which may place significant demands on our management, operational and financial infrastructure.

If we do not manage our growth, the quality of our products and services could suffer, which could negatively affect our brand

and operating results. To manage this growth, we will need to continue to improve our operational, financial and management controls

and our reporting systems and procedures. These systems enhancements and improvements will require significant capital expenditures

and allocation of valuable management resources. If the improvements are not implemented successfully, our ability to manage our

growth will be impaired and we may have to make significant additional expenditures to address these issues, which could harm our

financial position. The required improvements may include:

| · | Enhancing our information and communication systems to ensure that

our potential offices around the world are well coordinated and that we can effectively communicate with our potential growing

base of users, advertisers and SprinterFCTV Network members. |

| · | Enhancing systems of internal controls to ensure timely and accurate

reporting of all of our operations. |

| · | Documenting all of our information technology systems and our business

processes for our ad systems and our billing systems. |

| · | Improving our information technology infrastructure. |

If we fail to maintain an effective

system of internal controls, we may not be able to accurately report our financial results or prevent fraud. As a result, current

and potential stockholders could lose confidence in our financial reporting, which would harm our business and the trading price

of our stock.

Effective internal

controls are necessary for us to provide reliable financial reports and effectively prevent fraud. If we cannot provide reliable

financial reports or prevent fraud, our brand and operating results could be harmed. We may in the future discover areas of our

internal controls that need improvement. We cannot be certain that any measures we implement will ensure that we achieve and maintain

adequate controls over our financial processes and reporting in the future. Any failure to implement required new or improved controls,

or difficulties encountered in their implementation, could harm our operating results or cause us to fail to meet our reporting

obligations. Inferior internal controls could also cause investors to lose confidence in our reported financial information, which

could have a negative effect on the trading price of our stock.

We intend to migrate critical financial

functions to third-party providers. If these potential transitions are not successful, our business and operations could be disrupted

and our operating results would be harmed.

If we do not successfully

implement these projects, our business, reputation and operating results could be harmed. We have no experience managing and implementing

these types of large-scale, cross-functional, international infrastructure projects. We also may not be able to integrate our systems

and processes with those of the third-party service provider on a timely basis, or at all. Even if these potential integrations

are completed on time, the service providers may not perform to agreed upon service levels. Failure of the service providers to

perform satisfactorily could result in customer dissatisfaction, disrupt our operations and adversely affect operating results.

We will have significantly less control over the systems and processes than if we maintained and operated them ourselves, which

increases our risk. If we need to find an alternative source for performing these functions, we may have to expend significant

resources in doing so, and we cannot guarantee this would be accomplished in a timely manner or without significant additional

disruption to our business.

Expansion into international markets

is important to our long-term success, and our inexperience in the operation of our business outside the U.S. increases the risk

that our international expansion efforts will not be successful.

We have limited experience

with operations outside the U.S. Expansion into international markets requires management’s attention and resources. In addition,

we face the following additional risks associated with our expansion outside the U.S.:

| · | Challenges caused by distance, language and cultural differences. |

| · | Longer payment cycles in some countries. |

| · | Credit risk and higher levels of payment fraud. |

| · | Legal and regulatory restrictions. |

| · | Currency exchange rate fluctuations. |

| · | Foreign exchange controls that might prevent us from repatriating

cash earned in countries outside the U.S. |

| · | Political and economic instability and export restrictions. |

| · | Potentially adverse tax consequences. |

| · | Higher costs associated with doing business internationally. |

These risks could harm

our international expansion efforts, which would in turn harm our business and operating results.

Our business may be adversely affected

by malicious third-party applications that interfere with, or exploit security flaws in, our products and services.

Our business may be

adversely affected by malicious applications that make changes to our users’ computers and interfere with the SprinterFCTV

Network experience. These applications have in the past attempted, and may in the future attempt, to change our users’ Internet

experience, including hijacking user information from SprinterFCTV Network, or otherwise interfering with our ability to connect

with our users. The interference often occurs without disclosure to or consent from users, resulting in a negative experience that

users may associate with SprinterFCTV Network. These applications may be difficult or impossible to uninstall or disable, may reinstall

themselves and may circumvent other applications’ efforts to block or remove them. In addition, we will offer a number of

products and services that our users might download to their computers or that they rely on to store information and transmit information

to others over the Internet. These products and services are subject to attack by viruses, worms and other malicious software programs,

which could jeopardize the security of information stored in a user’s computer or in our computer systems and networks. The

ability to reach users and provide them with a superior experience is critical to our success. If our efforts to combat these malicious

applications are unsuccessful, or if our products and services have actual or perceived vulnerabilities, our reputation may be

harmed and our user traffic could decline, which would damage our business.

Our business is highly competitive.

Competition presents an ongoing threat to the success of our business.

We face significant competition in almost every

aspect of our business, including from football clubs such as Real Madrid C.F., Chelsea

F.C., Manchester United F.C., F.C. Barcelona, Juventus F.C., and Manchester City F.C., which offer a variety of football related

Internet products, services, content, and online advertising offerings, as well as from mobile companies and smaller companies

that offer products and services that may compete with specific SprinterFCTV Network features. We also face competition from traditional

and online media businesses for advertising budgets. As we introduce new products, as our existing products evolve, or as other

companies introduce new products and services, we may become subject to additional competition.

Some of our current

and potential competitors have significantly greater resources and better competitive positions in certain markets than we do.

They have teams with more established and longer operating histories with significantly more financial resources. These factors

may allow our competitors to respond more effectively than us to new or emerging technologies and changes in market requirements.

Our competitors may develop products, features, or services that are similar to ours or that achieve greater market acceptance,

may undertake more far-reaching and successful product development efforts or marketing campaigns, or may adopt more aggressive

pricing policies. As a result, our competitors may acquire and engage users at the expense of the growth or engagement of our user

base, which may negatively affect our business and financial results.

We believe that our

ability to compete effectively depends upon many factors both within and beyond our control, including:

| · | the usefulness, ease of use, performance, and reliability of our products

compared to our competitors; |

| · | the quality of our first team |

| · | the size and composition of our user base; |

| · | the engagement of our users with our products; |

| · | the timing and market acceptance of products, including developments

and enhancements to our or our competitors’ products; |

| · | our ability to monetize our products, including our ability to successfully

monetize mobile usage; |

| · | the frequency, size, and relative prominence of the ads and other

commercial content displayed by us or our competitors; |

| · | customer service and support efforts; |

| · | marketing and selling efforts; |

| · | our ability to establish and maintain interest in the SprinterFCTV

Network and Sprinter Football Club brand; |

| · | changes mandated by legislation, regulatory authorities, or litigation,

including settlements and consent decrees, some of which may have a disproportionate effect on us; |

| · | acquisitions or consolidation within our industry, which may result

in more formidable competitors; |

| · | our ability to attract, retain, and motivate talented employees, particularly

professional football players; |

| · | our ability to manage and grow our operations cost-effectively; and |

| · | our reputation and brand strength relative to our competitors. |

If we are not able

to compete effectively, our user base and level of user engagement may decrease, which could make us less attractive to players,

sponsors and advertisers and materially and adversely affect our revenue and results of operations.

Action by governments to restrict

access to SprinterFCTV Network in their countries could substantially harm our business and financial results.

It is possible that

governments of one or more countries may seek to censor content available on SprinterFCTV Network in their country, restrict access

to SprinterFCTV Network from their country entirely, or impose other restrictions that may affect the accessibility of SprinterFCTV

Network in their country for an extended period of time or indefinitely. In addition, governments in other countries may seek to

restrict access to SprinterFCTV Network if they consider us to be in violation of their laws. In the event that access to SprinterFCTV

Network is restricted, in whole or in part, in one or more countries or our competitors are able to successfully penetrate geographic

markets that we cannot access, our ability to retain or increase our user base and user engagement may be adversely affected, we

may not be able to grow our revenue as anticipated, and our financial results could be adversely affected.

If we were to lose the services of

Peter Schuh or our planned senior management team, we may not be able to execute our business strategy.

Our future success

depends in a large part upon the continued service of the key member of our senior management team. In particular, our CEO Peter

Schuh is critical to the overall management of Sprinter F.C. as well as the development of our first team players, our technology,

our culture and our strategic direction. All of our executive officers and key employees are, and will be, at-will employees,

and we do not maintain any key-person life insurance policies. The loss of any of our management or key personnel could seriously

harm our business.

We have a short operating history

and a relatively new business model in an emerging and rapidly evolving market. This makes it difficult to evaluate our future

prospects, may increase the risk that we will not be successful.

We have a very short

operating history. You must consider our business and prospects in light of the risks and difficulties we will encounter as an

early-stage company in a new and rapidly evolving market. We may not be able to successfully address these risks and difficulties,

which could materially harm our business and operating results.

Interruption or failure of our information

technology and communications systems could impair our ability to effectively provide our products and services, which could damage

our reputation and harm our operating results.

Our provision of our

products and services depends on the continuing operation of our information technology and communications systems. Any damage

to or failure of our systems could result in interruptions in our service. Interruptions in our service could reduce our

revenues and profits, and our brand could be damaged if people believe our system is unreliable. Our systems are vulnerable to

damage or interruption from earthquakes, terrorist attacks, floods, fires, power loss, telecommunications failures, computer viruses,

computer denial of service attacks or other attempts to harm our systems, and similar events. Our data centers are located in areas

with a high risk of major earthquakes. Our data centers are also subject to break-ins, sabotage and intentional acts of vandalism,

and to potential disruptions if the operators of these facilities have financial difficulties. Some of our systems are not fully

redundant, and our disaster recovery planning cannot account for all eventualities. The occurrence of a natural disaster, a decision

to close a facility we are using without adequate notice for financial reasons or other unanticipated problems at our data centers

could result in lengthy interruptions in our service.

We may experience system

failures in the future. Any unscheduled interruption in our service puts a burden on our entire organization and would result in

an immediate loss of revenue. If we experience frequent or persistent system failures on our web sites, our reputation and brand

could be permanently harmed. The steps we will take to increase the reliability and redundancy of our systems are expensive, may

reduce our operating margin and may not be successful in reducing the frequency or duration of unscheduled downtime.

If we are unable to create, maintain,

train and build an effective international sales and marketing infrastructure, we will not be able to commercialize and grow our

brand successfully.

As we grow, we may

not be able to secure sales personnel or organizations that are adequate in number or expertise to successfully market and sell

our brand and products on a global scale. If we are unable to expand our sales and marketing capability, train our sales force

effectively or provide any other capabilities necessary to commercialize our brand internationally, we will need to contract with

third parties to market and sell our brand. If we are unable to establish and maintain compliant and adequate sales and marketing

capabilities, we may not be able to increase our revenue, may generate increased expenses, and may not be profitable.

Acquisitions could result in operating

difficulties, dilution and other harmful consequences.

We do not have a great

deal of experience acquiring companies. We can expect to evaluate a wide array of potential strategic transactions. From time to

time, we may engage in discussions regarding potential acquisitions. Any of these transactions could be material to our financial

condition and results of operations. In addition, the process of integrating an acquired company, business or technology may create

unforeseen operating difficulties and expenditures and is risky. The areas where we may face risks include:

| · | The need to implement or remediate controls, procedures and policies

appropriate for a larger public company at companies that prior to the acquisition lacked these controls, procedures and policies. |

| · | Diversion of management time and focus from operating our business

to acquisition integration challenges. |

| · | Cultural challenges associated with integrating employees from the

acquired company into our organization. |

| · | Retaining employees from the businesses we acquire. |

| · | The need to integrate each company’s accounting, management

information, human resource and other administrative systems to permit effective management. |

Foreign acquisitions

involve unique risks in addition to those mentioned above, including those related to integration of operations across different

cultures and languages, currency risks and the particular economic, political and regulatory risks associated with specific countries.

Also, the anticipated benefit of many of our potential acquisitions may not materialize. Future acquisitions or dispositions could

result in potentially dilutive issuances of our equity securities, the incurrence of debt, contingent liabilities or amortization

expenses, or write-offs of goodwill, any of which could harm our financial condition. Future acquisitions may require us to obtain

additional equity or debt financing, which may not be available on favorable terms or at all.

We could become subject to commercial

disputes that could harm our business by distracting our management from the operation of our business, by increasing our expenses

and, if we do not prevail, by subjecting us to potential monetary damages and other remedies.

From time to time we

could be engaged in disputes regarding our commercial transactions. These disputes could result in monetary damages or other remedies

that could adversely impact our financial position or operations. Even if we prevail in these disputes, they may distract our management

from operating our business and the cost of defending these disputes would reduce our operating results.

We have to keep up with rapid technological

change to remain competitive in our rapidly evolving industry.

Our future success

will depend on our ability to adapt to rapidly changing technologies, to adapt our services to evolving industry standards and

to improve the performance and reliability of our services. Our failure to adapt to such changes would harm our business. New technologies

and advertising media could adversely affect us. In addition, the widespread adoption of new Internet, networking or telecommunications

technologies or other technological changes could require substantial expenditures to modify or adapt our services or infrastructure.

Our business depends on increasing

use of the Internet by users searching for information regarding football/soccer related content. If the Internet infrastructure

does not grow and is not maintained to support these activities, our business will be harmed.

Our success will depend

on the continued growth and maintenance of the Internet infrastructure. This includes maintenance of a reliable network backbone

with the necessary speed, data capacity and security for providing reliable Internet services. Internet infrastructure may be unable

to support the demands placed on it if the number of Internet users continues to increase, or if existing or future Internet users

access the Internet more often or increase their bandwidth requirements. In addition, viruses, worms and similar programs may harm

the performance of the Internet. The Internet has experienced a variety of outages and other delays as a result of damage to portions

of its infrastructure, and it could face outages and delays in the future. These outages and delays could reduce the level of Internet

usage as well as our ability to provide our solutions.

The concentration of our capital

stock ownership with our founders, executive officers and our directors and their affiliates will limit your ability to influence

corporate matters.

Our

Class A, Class B, Class C, and Class D Common Stock have one vote per share. At January

25, 2016 our founder, executive officer and director owned 100.00% of our Class A

common stock, representing 100% of the voting power of our outstanding capital stock.

The 100,000,000 shares issued to Peter Schuh are not registered. Peter Schuh therefore

has significant influence over management and affairs and over all matters requiring

stockholder approval, including the election of directors and significant corporate transactions,

such as a merger or other sale of our company or its assets, for the foreseeable future.

This concentrated control limits your ability to influence corporate matters and, as

a result, we may take actions that our stockholders do not view as beneficial. As a result,

the market price of our Class A, Class B, Class C, and Class D Common Stock could be

adversely affected.

It may not be possible to renew or

replace key commercial agreements on similar or better terms, or attract new sponsors.

If we fail to attract,

renew or replace key commercial agreements on similar or better terms, we could experience a material reduction in our commercial

and sponsorship revenue. Such a reduction could have a material adverse effect on our overall revenue and our ability to compete

with the top football clubs in the Americas.

As part of our business

plan, we intend to grow our sponsorship portfolio by developing our geographic and product categorized approach, which will include

partnering with global sponsors, regional sponsors, and mobile and media operators. We may not be able to execute our business

plan successfully in promoting our brand to attract sponsors. We will be subject to certain contractual restrictions under sponsorship

agreements. We cannot assure you that we will be successful in implementing our business plan or that any commercial and sponsorship

revenue to occur at all. Any of these events could negatively affect our ability to achieve our development and commercialization

goals, which could have a material adverse effect on our business, results of operations, financial condition and cash flow.

Negotiation and pricing of key media

contracts are outside our control and those contracts may change in the future.

We may be subject to

media rights contracts with media distributors with whom we may not otherwise contract or media rights contracts that are not as

favorable to us as we might otherwise be able to negotiate individually with media distributors.

Domestic and regional competitions

cannot be relied upon as a source of revenue.

Possible qualification

for the CONCACAF Champions League is dependent upon our first team's performance in the Lamar Hunt U.S. Open Cup, in some circumstances,

the CONCACAF Champions League itself in the previous season, and any league qualification by standing which may allow for qualification.

Qualification for the CONCACAF Champions League cannot, therefore, be guaranteed. Failure to qualify for the CONCACAF Champions

League would result in a material reduction in revenue for each season in which our first team does not participate.

In addition, our participation

in the CONCACAF Champions League may be influenced by factors beyond our control. For example, the number of places in each league

available to the clubs of each national football association in North and Central America and the Caribbean can vary from year

to year based on a ranking system. If the performance of American clubs in CONCACAF declines, the number of places in each CONCACAF

competition available to American clubs may decline and it may be more difficult for our first team to qualify for such league

in future seasons. Further, the rules governing qualification for CONCACAF competitions (whether at the regional or national level)

may change and make it more difficult for our first team to qualify for each league in future seasons.

Moreover, because of

the prestige associated with participating in the CONCACAF Champions League, failure to qualify for the competition, particularly

for consecutive seasons, would negatively affect our ability to attract and retain talented players and coaching staff, as well

as supporters, sponsors and other commercial partners. Any one or more of these events could have a material adverse effect on

our business, results of operation, financial condition and cash flow.

We rely on highly skilled personnel

and, if we are unable to retain or motivate key personnel or hire qualified personnel, we may not be able to grow effectively.

Our performance is

largely dependent on the talents and efforts of highly skilled individuals. Our future success depends on our ability to identify,

hire, develop, motivate and retain highly skilled personnel for all areas of our organization. Competition in our industry for

qualified employees is intense. Our ability to compete effectively depends on our ability to attract new employees and to retain

and motivate our existing employees.

We have a rigorous,

highly selective and time-consuming hiring process. As we grow, our hiring process may prevent us from hiring the personnel we

need in a timely manner. In addition, as we become a more mature company, we may find our recruiting efforts more challenging.

The incentives to attract, retain and motivate employees provided by future arrangements, such as through cash bonuses, may not

be as effective as we would desire. If we do not succeed in attracting excellent personnel or retaining or motivating existing

personnel, we may be unable to grow effectively.

We may be exposed to credit related losses in the event of

non-performance by counterparties to various league, CONCACAF, and Federation Internationale de Football Association (FIFA) media

contracts as well as our key commercial and transfer contracts.

We will derive our

Commercial and Sponsorship revenue from certain corporate sponsors, including global, regional, mobile, media and supplier sponsors

in respect of which we may manage our credit risk by seeking advance payments, installments and/or bank guarantees where appropriate.

The substantial majority of this revenue may be derived from a limited number of sources.

We are also exposed

to other football clubs globally for the payment of transfer fees on players. Depending on the transaction, some of these fees

may be paid to us in installments. We will try to manage our credit risk with respect to those clubs by requiring payments in advance

or, in the case of payments on installment, requiring bank guarantees on such payments in certain circumstances. However, we cannot

ensure these efforts will eliminate our credit exposure to other clubs. A change in credit quality at one of the media broadcasters

for various leagues under the control of FIFA including those regionally controlled by CONCACAF, one of our sponsors or a club

to whom we have sold a player can increase the risk that such counterparty is unable or unwilling to pay amounts owed to us. The

failure of a major television broadcaster or media outlet to pay outstanding amounts owed to its respective league or the failure

of one of our key sponsors or a club to pay outstanding amounts owed to us could have a material adverse effect on our business,

results of operations, financial condition and cash flow.

Match-Day revenue from our supporters

will be a significant portion of overall revenue.

A significant amount

of our revenue will be derived from ticket sales and other Match-Day revenue for our first team matches at various stadiums and

our share of gate receipts from other tournament matches and other potential matches. In particular, the revenue generated from

ticket sales and other Match-Day revenue at various stadiums will be highly dependent on the attendance at matches of our individual

and corporate supporters as well as the number of home matches we play each season. Match attendance is influenced by a number

of factors, some of which are partly or wholly outside of our control. These factors include the success of our first team, broadcasting

coverage and general economic conditions in the United States, which affect personal disposable income and corporate marketing

budgets. A failure to create or maintain a Match-Day attendance could have a material adverse effect on our Match-Day revenue and

our overall business, results of operations, financial condition and cash flow.

The markets in which we operate are

highly competitive, both within the United States of America and internationally, and increased competition could affect our ability

to be profitable.

We will face competition

from other football clubs worldwide. In Major League Soccer, recent investment from wealthy team owners has led to teams with deep

financial backing that are able to acquire top players and coaching staff, which could result in improved performance from those

teams in domestic and regional competitions. As Major League Soccer continues to grow in popularity, the interest of wealthy potential

owners may increase, leading to additional clubs substantially improving their financial position. Competition from worldwide clubs

also remains strong. The increase in competition could result in our first team finishing with a poor record and not being invited

to any regional tournaments and could have a material adverse effect on our Match-Day revenue and our overall business, results

of operations, financial condition and cash flow.

In addition, from a

commercial perspective, we actively compete across many different industries and within many different markets. We believe our

primary sources of competition, both in The United States of America and internationally, include, but are not limited to:

| · | other businesses seeking corporate sponsorships and commercial partners

such as sports teams, other entertainment events and television and digital media outlets; |

| · | providers of sports apparel and equipment seeking retail, merchandising,

apparel and product licensing opportunities; |

| · | digital content providers seeking consumer attention and leisure time,

advertiser income and consumer e-commerce activity; |

| · | other types of television programming seeking access to broadcasters

and advertiser income; and |

| · | alternative forms of live entertainment for the sale of Match-Day

tickets such as other live sports events, concerts, festivals, theater and similar events. |

All of the above forms

of competition could have a material adverse effect on any of our planned revenue streams and our overall business, results of

operations, financial condition and cash flow.

We may be involved in a league where

voting rules may allow other clubs to take action contrary to our interests.

Various leagues have

different rules regarding the governance of their league participants. As of now we are not involved with a league and as such

are not bound by any special rules at this time. We expect this to change and as of this time we do not know what rules we will

be bound to follow. Due to these unknown rules, we may be unable to achieve our goals and strategies or increase our revenue.

Our digital media strategy is unproven

and may not generate the revenue we anticipate.

We will attempt to

create and maintain contact with, and provide entertainment to, a global follower base through a number of digital and other media

channels, including the Internet, mobile services and social media. While we may attract a significant number of followers to our

digital media assets, including our website, the future revenue and income potential of our mobile and content business is

uncertain. You should consider our business and prospects in light of the challenges, risks and difficulties we may encounter in

this new and rapidly evolving market, including:

| · | our ability to provide offerings such as video on demand, highlights

and international memberships through our digital media strategy; |

| · | our ability to create a global follower base, build our follower base

and increase engagement with our followers through our digital media assets; |

| · | our ability to enhance the content offered through our digital media

assets and increase our subscriber base; |

| · | our ability to generate revenue from interaction with our followers

through our digital media assets; |

| · | our ability to attract sponsors and advertisers, to retain such sponsors

and advertisers and demonstrate that our digital media assets will deliver value to them; |

| · | our ability to develop our digital media assets in a cost effective

manner and operate our digital media services profitably and securely; |

| · | our ability to identify and capitalize on new digital media business

opportunities; and |

| · | our ability to compete with other sports and other media for users'

time. |

In addition, as we

attempt to gain and expand our digital and other media channels, including the Internet, mobile services and social media, revenue

from our other business sectors may decrease, including our broadcasting revenue. Moreover, the increase in subscriber base in

some of these digital and other media channels may limit the growth of the subscriber base and popularity of other channels. Failure

to address these risks and difficulties could affect our overall business, financial condition, results of operations, cash flow,

liquidity and profitability.

Serious injuries to or losses of

playing staff may affect our performance, and therefore our results of operations and financial condition.

Injuries to members

of the playing staff, particularly if career-threatening or career-ending, could have a detrimental effect on our business. Such

injuries could have a negative effect upon our first team's performance and may also result in a loss of the income that would

otherwise have resulted from a transfer of that player's registration. In addition, depending on the circumstances, we may write

down the carrying value of a player on our balance sheet and record an impairment charge in our operating expenses to reflect any

losses resulting from career-threatening or career-ending injuries to that player. Our strategy is to maintain a squad of first

team players sufficient to mitigate the risk of player injuries. However, this strategy may not be sufficient to mitigate all financial

losses in the event of an injury, and as a result such injury may affect the performance of our first team, and therefore our business,

results of operations financial condition, cash flow and profitability.

Inability to renew our insurance

policies could expose us to significant losses.

We plan to insure against

the death, permanent disablement and travel-related injuries of members of our first team, although not at such player's market

value. Moreover, we do not plan to carry insurance against career-ending injuries to our players sustained while playing or training.

We plan to carry non-player related insurance typical for our business (including business interruption insurance). When any of

our planned or existing insurance policies expire, it may not be possible to renew them on the same terms, or at all. In such circumstances,

some of our businesses and/or assets may be uninsured. If any of these uninsured businesses or assets were to suffer damage, we

could suffer a financial loss. An inability to renew insurance policies covering our players or other valuable assets could expose

us to significant losses.

Furthermore, although

the Fédération Internationale de Football Association ("FIFA") now provides insurance coverage for loss

of wages for players injured while playing for their senior national team in a match played under the FIFA international match

calendar, our insurance policies will not cover our players, should there be any, during those periods and, under FIFA rules, national

football associations are not obliged to provide insurance coverage for players on international duty.

We could be negatively affected if

we fail to protect follower account information.

We collect and process

personal data (including name, address, age, bank details and other personal data) from our followers, customers, members, suppliers,

business contacts and employees as part of the operation of our business (including online merchandising), and therefore we must

comply with data protection and privacy laws in various countries and jurisdictions where our followers reside. Those laws impose

certain requirements on us in respect of the collection, use and processing of personal information relating to our followers.

In addition, we are exposed to the risk that the personal data we control could be wrongfully accessed and/or used, whether by

employees, followers or other third parties, or otherwise lost or disclosed or processed in breach of data protection regulations.

If we or any of the third party service providers on which we rely fail to process such personal data in a lawful or secure manner

or if any theft or loss of personal follower data were to occur, we could face liability under data protection laws, including

requirements to destroy customer information or notify the people to whom such information relates of any non-compliance as well

as civil or criminal sanctions. This could also result in the loss of the goodwill of our followers and deter new followers. Each

of these factors could harm our business reputation, our brand and have a material adverse effect on our business, results of operations,

financial condition, cash flow and prospects.

Our business is subject to a variety

of U.S. and foreign laws, which could subject us to claims or other remedies based on the nature and content of the information

displayed by our products and services, and could limit our ability to provide information regarding regulated industries and products.

The laws relating to

the liability of providers of online services for activities of their users are currently unsettled both within the U.S. and abroad.

Claims could be threatened and filed under both U.S. and foreign law for defamation, libel, invasion of privacy and other data

protection claims, tort, unlawful activity, copyright or trademark infringement, or other theories based on the nature and content

of the materials searched and the ads posted or the content generated by our users. If one of these complaints results in liability

to us, it could be potentially costly, encourage similar lawsuits, distract management and harm our reputation and possibly our

business. In addition, increased attention focused on these issues and legislative proposals could harm our reputation or otherwise

affect the growth of our business.

The application to

us of existing laws regulating or requiring licenses for certain businesses of our advertisers, including, for example, distribution

of pharmaceuticals, adult content, financial services, alcohol or firearms, can be unclear. Existing or new legislation could expose

us to substantial liability, restrict our ability to deliver services to our users, limit our ability to grow and cause us to incur

significant expenses in order to comply with such laws and regulations.

Several other federal

laws could have an impact on our business. Compliance with these laws and regulations is complex and may impose significant additional

costs on us.

We also face risks

associated with international data protection. The interpretation and application of data protection laws in Europe and elsewhere

are still uncertain and in flux. It is possible that these laws may be interpreted and applied in a manner that is inconsistent

with our data practices. If so, in addition to the possibility of fines, this could result in an order requiring that we change

our data practices, which in turn could have a material effect on our business.

We also face risks

from legislation that could be passed in the future. Compliance with these laws and regulations is complex and may impose significant

additional costs to us that may affect our ability to be profitable.

To the extent our revenues are paid

in foreign currencies, and currency exchange rates become unfavorable, we may lose some of the economic value of the revenues in

U.S. dollar terms.

As we expand our international

operations, more of our customers may pay us in foreign currencies. Conducting business in currencies other than U.S. dollars subjects

us to fluctuations in currency exchange rates. If the currency exchange rates were to change unfavorably, the value of net receivables

we receive in foreign currencies and later convert to U.S. dollars after the unfavorable change would be diminished. This could

have a negative impact on our reported operating results. Hedging strategies, such as forward contracts, options and foreign exchange

swaps related to transaction exposures, that we may implement to mitigate this risk may not eliminate our exposure to foreign exchange

fluctuations. Additionally, hedging programs expose us to risks that could adversely affect our operating results, including the

following:

| · | We have limited experience in implementing or operating hedging programs.

Hedging programs are inherently risky and we could lose money as a result of poor trades. |

| · | We may be unable to hedge currency risk for some transactions because

of a high level of uncertainty or the inability to reasonably estimate our foreign exchange exposures. |

| · | We may be unable to acquire foreign exchange hedging instruments in

some of the geographic areas where we do business, or, where these derivatives are available, we may not be able to acquire enough

of them to offset our exposure. |

We expect to be subject to regulatory

investigations and settlements in the future, which could cause us to incur substantial costs or require us to change our business

practices in a manner materially adverse to our business.

From time to time,

we expect to receive inquiries from regulators regarding our compliance with laws and other matters. It is possible that a regulatory

inquiry might result in changes to our policies or practices. Violation of existing or future regulatory orders or consent decrees

could subject us to substantial monetary fines and other penalties that could negatively affect our financial condition and results

of operations. In addition, it is possible that future orders issued by, or enforcement actions initiated by, regulatory authorities

could cause us to incur substantial costs or require us to change our business practices in a manner materially adverse to our

business.

Our intellectual property rights

are valuable, and any inability to protect them could reduce the value of our products, services and brand.

Our patents, trademarks,

trade secrets, copyrights and all of our other intellectual property rights are important assets for us. There are events that

are outside of our control that pose a threat to our intellectual property rights. For example, effective intellectual property

protection may not be available in every country in which our products and services are distributed or made available through the

Internet. Also, the efforts we have taken to protect our proprietary rights may not be sufficient or effective. Any significant

impairment of our intellectual property rights could harm our business or our ability to compete. Also, protecting our intellectual

property rights is costly and time consuming. Any increase in the unauthorized use of our intellectual property could make it more

expensive to do business and harm our operating results.

Although we seek to

obtain patent protection for our innovations, it is possible we may not be able to protect some of these innovations. In addition,

given the costs of obtaining patent protection, we may choose not to protect certain innovations that later turn out to be important.

Furthermore, there is always the possibility, despite our efforts, that the scope of the protection gained will be insufficient

or that an issued patent may be deemed invalid or unenforceable.

We also seek to maintain

certain intellectual property as trade secrets. The secrecy could be compromised by third parties, or intentionally or accidentally

by our employees, which would cause us to lose the competitive advantage resulting from these trade secrets.

We are, and may in the future be,

subject to intellectual property rights claims, which are costly to defend, could require us to pay damages and could limit our

ability to use certain technologies in the future.

Companies in the Internet,

technology and media industries own large numbers of patents, copyrights, trademarks and trade secrets and frequently enter into

litigation based on allegations of infringement or other violations of intellectual property rights. As we face increasing competition,

the possibility of intellectual property rights claims against us grows. Our technologies may not be able to withstand any third-party

claims or rights against their use. Any intellectual property claims, with or without merit, could be time-consuming, expensive

to litigate or settle and could divert management resources and attention. In addition our potential future agreements with members

of our SprinterFCTV Network may require us to indemnify these members for certain third-party intellectual property infringement

claims, which would increase our costs as a result of defending such claims and may require that we pay damages if there was an

adverse ruling in any such claims. An adverse determination also could prevent us from offering our products and services to others

and may require that we procure substitute products or services for these members.

With respect to any

intellectual property rights claim, we may have to pay damages or stop using technology found to be in violation of a third party’s

rights. We may have to seek a license for the technology, which may not be available on reasonable terms and may significantly

increase our operating expenses. The technology also may not be available for license to us at all. As a result, we may also be

required to develop alternative non-infringing technology, which could require significant effort and expense. If we cannot license

or develop technology for the infringing aspects of our business, we may be forced to limit our product and service offerings and

may be unable to compete effectively. Any of these results could harm our brand and operating results.

From time to time,

we might receive notice letters from patent holders alleging that certain of our products and services infringe their patent rights.

Some of these could result in litigation against us. Companies could also file trademark infringement and related claims against

us over the display of ads in response to user queries that include trademark terms. The outcomes of these lawsuits could differ

from jurisdiction to jurisdiction and negative outcomes could affect our operating results and potential profitability.

Defending lawsuits

could take time and resources. Adverse results in these lawsuits may result in, or even compel, a change in internal controls or

current practices could result in a loss of revenue for us, which could harm our business.

We may be notified

by third parties that they believe features of certain of our products, including SprinterFCTV Network, violate their copyrights.

Generally speaking, any time that we have a product or service that links to or hosts material in which others allege to own copyrights,

we face the risk of being sued for copyright infringement or related claims. Because these products and services will comprise

a significant portion of our products and services, the risk of potential harm from such lawsuits is substantial.

Piracy and illegal live streaming

may adversely impact our Broadcasting and Mobile and Content revenue.

Our broadcasting revenue

will be principally generated by the broadcasting of our matches on pay and free-to-air television channels as well as content

delivered over the Internet and through our own media channel, SprinterFCTV. In recent years, piracy and illegal live streaming

of subscription content over the internet has caused, and is continuing to cause, lost revenue to media distributors showing matches.

If these trends increase or continue unabated, they could pose a risk to subscription television services. The result could be

a reduction in the value of our potential share of football broadcasting rights and of our online and SprinterFCTV services, which

could have a material adverse effect on our business, results of operations, financial condition and cash flow.

Our financial results will fluctuate

from quarter to quarter, which makes them difficult to predict.

Our quarterly financial

results will fluctuate in the future. Additionally, we have a limited operating history with the current scale of our business,

which makes it difficult to forecast our future results. As a result, you should not rely upon our past quarterly financial results

as indicators of future performance. You should take into account the risks and uncertainties frequently encountered by companies

in rapidly evolving markets. Our financial results in any given quarter can be influenced by numerous factors, many of which we

are unable to predict or are outside of our control, including:

| · | our ability to maintain and grow our user base and user engagement; |

| · | our ability to attract and retain advertisers in a particular period; |

| · | seasonal fluctuations in spending by our advertisers; |

| · | the number of ads shown to users; |

| · | the number of seats sold at the venues where we play; |

| · | the number of videos shown on the SprinterFCTV Network; |

| · | concessions sold at venues where we play; |

| · | parking sold at the venues where we play; |

| · | the pricing of our ads and other products; |

| · | our ability to increase payments and other fees revenue; |

| · | the diversification and growth of revenue sources beyond current advertising; |

| · | the development and introduction of new products or services by us

or our competitors; |

| · | increases in marketing, sales, and other operating expenses that we

may incur to grow and expand our operations and to be competitive; |

| · | our ability to have gross margins and operating margins; |

| · | our ability to obtain equipment and technology in a timely and cost-effective

manner; |

| · | system failures or breaches of security or privacy; |

| · | inaccessibility of SprinterFCTV Network due to third-party actions; |

| · | adverse litigation judgments, settlements, or other litigation-related

costs; |

| · | changes in the legislative or regulatory environment, including with

respect to privacy, or enforcement by government regulators, including fines, orders, or consent decrees; |

| · | fluctuations in currency exchange rates and changes in the proportion

of our revenue and expenses denominated in foreign currencies; |

| · | fluctuations in the market values of any future potential portfolio

investments and in interest rates; |

| · | changes in U.S. generally accepted accounting principles; and |

| · | changes in business or macroeconomic conditions. |

Our costs are growing quickly, which

could harm our business and profitability.

Providing our products

to our users is costly and we expect our expenses to continue to increase in the future as we broaden our user base, as users increase

the number of connections and amount of data they share with us, as we develop and implement new product features that require

more computing infrastructure, and as we hire additional employees. We expect our costs to increase each year due to these factors

and we expect to continue to incur increasing costs, in particular for employees, servers, storage, power, and data centers, to

support our anticipated future growth. We expect to invest in our global infrastructure in order to provide our products rapidly

and reliably to all users around the world, including in countries where we do not expect significant short-term monetization.

Our expenses may be greater than we anticipate, and our investments to make our business and our technical infrastructure more

efficient may not be successful. In addition, we may increase marketing, sales, and other operating expenses in order to grow and

expand our operations and to remain competitive. Increases in our costs may adversely affect our business and profitability.

Our business is dependent on our

ability to maintain and scale our technical infrastructure, and any significant disruption in our service could damage our reputation,

result in a potential loss of users and engagement, and adversely affect our financial results.

Our reputation and

ability to attract, retain, and serve our users is dependent upon the reliable performance of SprinterFCTV Network and our underlying

technical infrastructure. Our systems may not be adequately designed with the necessary reliability and redundancy to avoid performance

delays or outages that could be harmful to our business. If SprinterFCTV Network is unavailable when users attempt to access it,

or if it does not load as quickly as they expect, users may not return to our website as often in the future, or at all. As our