| Exhibit 99.3

|

Broadcom to Acquire Brocade

Investor Presentation

November 02, 2016

Broadcom Limited Proprietary and Confidential. © 2016 Broadcom Limited. All rights reserved.

|

|

Announcement Overview

1. Acquiring Brocade, a leader in Fibre Channel storage area network (“FC SAN”) switching and IP Networking, for $5.9 billion

2. Broadcom to retain Brocade’s FC SAN Switching business and divest Brocade’s

IP Networking business including Ruckus Wireless

3. Broadcom tightening Q4 Fiscal 2016 revenue guidance range:

• GAAP Net Revenue expected to be between $4.090 billion and $4.165 billion

• Non-GAAP Net Revenue expected to be between $4.100 billion and $4.175 billion, and includes $10 million of projected licensing revenue not included in GAAP revenue, as a result of the effects of purchase accounting for acquisitions

2 | Broadcom Limited Proprietary and Confidential. © 2016 Broadcom Limited. All rights reserved.

|

|

Highly Strategic to Broadcom Enterprise Storage Business

DAS

Fibre Channel ICs

storage Smart NICs

Note: SAN = Storage Area Network. DAS = Direct Attached Storage. iSCSI = Internet Small Computer Systems Interface. NIC = Network Interface Card. HBA = Host Bus Adapter

3 | Broadcom Limited Proprietary and Confidential. © 2016 Broadcom Limited. All rights reserved.

|

|

Adds Another Key Element to Broadcom Portfolio

Brocade’s Fibre Channel SAN business is consistent with Broadcom’s business model

Wireless Communications Wired Infrastructure Enterprise Storage Ethernet

Wireless Combo Set-Top Box + Switching + HDD / Storage

RF + Touch Broadband PHY + NICS ASICs Fiber Optics SSD ASIC Connectivity FC SAN

Leading P P P P P P P P P

Positions

Key Customers

14%

22%

% of Total 56% 51% Net 25%

22%

Revenue(1)

Current Pro Forma Current Pro Forma Current Pro Forma

(1) Revenue by end market based on Broadcom GAAP revenue for the six months ended July 31, 2016 and Brocade Fibre Channel SAN GAAP revenue for the six months ended July 30, 2016

4 | Broadcom Limited Proprietary and Confidential. © 2016 Broadcom Limited. All rights reserved.

|

|

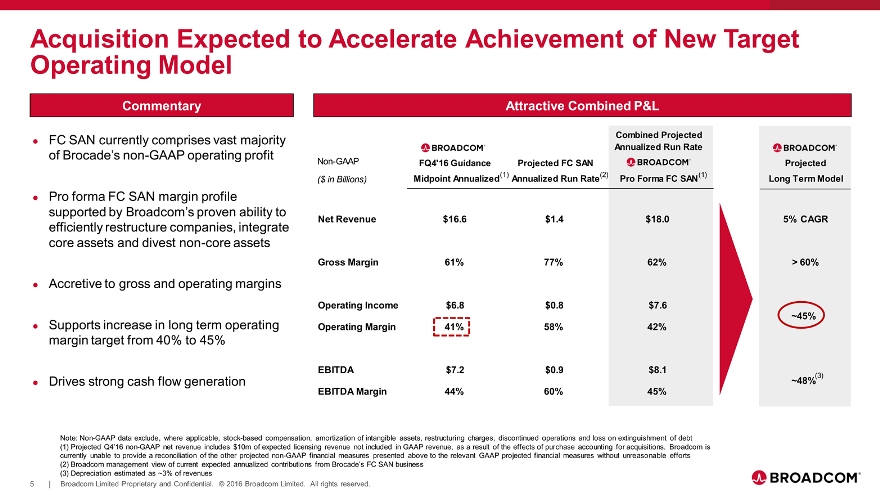

Acquisition Expected to Accelerate Achievement of New Target Operating Model

Commentary Attractive Combined P&L

FC SAN currently Combined Projected

• comprises vast majority

Annualized Run Rate

of Brocade’s non-GAAP operating profit

Non-GAAP FQ4’16 Guidance Projected FC SAN Projected Midpoint Annualize Annualized Run Rate(2) Pro Forma FC SAN(1) Long Term Model

($ in Billions)

• Pro forma FC SAN margin profile supported by Broadcom’s proven ability to

Net Reve $16.6 $1.4 $18.0 5% CAGR

efficiently restructure companies, integrate core assets and divest non-core assets

Gross Margin 61% 77% 62% > 60%

• Accretive to gross and operating margins

Operating Income $6.8 $0.8 $7.6

~45%

• Supports increase in long term operating Operating Margin 41% 58% 42% margin target from 40% to 45%

EBITDA $7.2 $0.9 $8.1

(3)

• Drives strong cash flow generation ~48%

EBITDA Margin 44% 60% 45%

Note: Non-GAAP data exclude, where applicable, stock-based compensation, amortization of intangible assets, restructuring charges, discontinued operations and loss on extinguishment of debt (1) Projected Q4’16 non-GAAP net revenue includes $10m of expected licensing revenue not included in GAAP revenue, as a result of the effects of purchase accounting for acquisitions. Broadcom is currently unable to provide a reconciliation of the other projected non-GAAP financial measures presented above to the relevant GAAP projected financial measures without unreasonable efforts

(2) Broadcom management view of current expected annualized contributions from Brocade’s FC SAN business

(3) Depreciation estimated as ~3% of revenues

5 | Broadcom Limited Proprietary and Confidential. © 2016 Broadcom Limited. All rights reserved.

|

|

Transaction Overview

•

$12.75 per share in cash

Purchase Price

•

$5.5 billion equity value plus $0.4 billion of net debt

•

New debt financing and excess cash

Sources of Financing

•

Anticipate pro forma net leverage at closing of < 2x(1)

FC SAN Projected

•

FY2018E projected pro forma non-GAAP EBITDA contribution of

EBITDA Contribution

approximately $900 million

•

Approval by Brocade shareholders

Approval Process

•

Subject to certain regulatory approvals

Expected Closing

•

Expected closing in the second half of FY2017, subject to customary closing

Timetable

conditions

Note: Non-GAAP data exclude, where applicable, stock-based compensation, amortization of intangible assets, restructuring charges, discontinued operations and loss on extinguishment of debt

(1) Pro forma net leverage

calculated using a) pro forma LTM EBITDA based on Broadcom management’s view of current expected annualized contributions from Brocade’s FC SAN business, and b) pro

forma net debt unadjusted

for any proceeds from the divestitures of IP Networking and Ruckus Wireless

6 | Broadcom Limited Proprietary and Confidential.

© 2016 Broadcom Limited. All rights reserved.

|

|

Strategically and Financially Compelling Transaction

Strengthens position in enterprise data centers

Complements existing enterprise storage offerings

Accretive to non-GAAP gross margins and operating margins

Immediately accretive to non-GAAP EPS and free cash flow (FCF)

Boosts FCF generation to support significant increase in future capital return

Note: Non-GAAP data exclude, where applicable, stock-based compensation, amortization of intangible assets, restructuring charges, discontinued operations and loss on extinguishment of debt

7 | Broadcom Limited Proprietary and Confidential. © 2016 Broadcom Limited. All rights reserved.

|

|

Broadcom connecting everything