UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM

OR

For

the fiscal year ended

OR

OR

Date of event requiring this shell company report: ____________________________________

For the transition period from _________________ to __________________

Commission

File No.:

(Exact name of registrant as specified in its charter)

Translation of registrant’s name into English: Not applicable

(Jurisdiction of incorporation or organization)

514-500-1181

(Address of principal executive offices)

(

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

common share | ||||

par value per common share |

Securities registered or to be registered pursuant to Section 12(g) of the Act: None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes

☐

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Exchange Act of 1934.

Yes

☐

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes

☐

Indicate by check mark whether the registrant has submitted every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Yes

☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See definition of “large accelerated filer, “accelerated filer,” and emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☐ | ☒ | |

| Emerging growth company |

If

an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards†

provided pursuant to Section 13(a) of the Exchange Act.

†The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate

by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness

of its internal control over financial reporting under Section 404(b) of the Sarbanes Oxley Act (15 U.S.C. 7262(b)) by the registered

public accounting firm that prepared or issued its audit report.

If

securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant

included in the filing reflect the correction of an error to previously issued financial statements.

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing.

U.S. GAAP ☐

as issued by the International Accounting Standards Board ☒

Other ☐

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

☐ Item 17 ☐ Item 18

If this is an annual report, indicate by check mark whether the registrant is a shell company.

Yes

☐ No

(APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS)

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court.

Yes ☐ No ☐

TABLE OF CONTENTS

i

ii

CERTAIN DEFINED TERMS

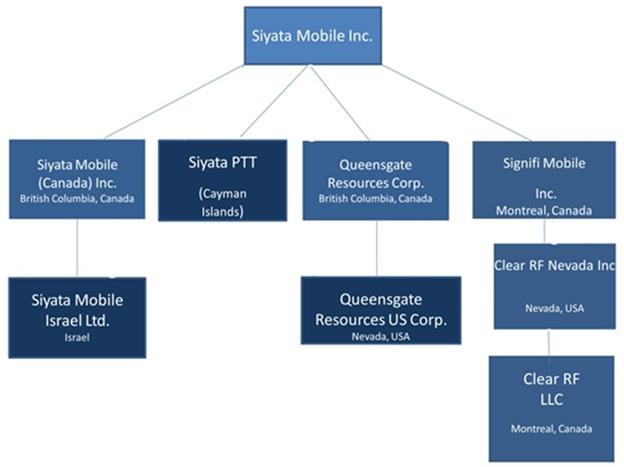

Unless otherwise indicated, all references to “Siyata,” the “Company,” “we,” “our,” “us” or similar terms refer to Siyata Mobile Inc. and its subsidiaries.

NOTE ON PRESENTATION

Our audited consolidated financial statements for the year ended December 31, 2023, included elsewhere in this annual report on Form 20-F, or the Annual Report, are prepared in accordance with International Financial Reporting Standards, or IFRS, as issued by the International Accounting Standards Board, or IASB, and none of the financial statements were prepared in accordance with International Financial Reporting Standards (“IFRS”).

On September 24, 2020, we effected a reverse share split of our issued and outstanding Common Shares on the basis of one (1) Common Share for one hundred and forty-five (145) Common Shares, or the Reverse Split. Unless otherwise indicated, the share and per share information in this Annual Report, reflects the Reverse Split.

On August 9, 2023, we effected a reverse share split of our issued and outstanding Common Shares on the basis of one (1) Common Share for one hundred (100) Common Shares, or the Reverse Split. Unless otherwise indicated, the share and per share information in this Annual Report, reflects the Reverse Split.

On December 4, 2023, we effected a reverse share split of our issued and outstanding Common Shares on the basis of one (1) Common Share for seven (7) Common Shares, or the Reverse Split. Unless otherwise indicated, the share and per share information in this Annual Report, reflects the Reverse Split.

References to “U.S. dollars” and “US$” are to currency of the United States of America, references to “CAD$” are to the currency of Canada, also known as the Canadian dollar and references to “NIS” are to the New Israeli Shekel, the currency of Israel. All financial information presented in this Annual Report is in U.S. dollars unless otherwise expressly stated.

Certain monetary amounts, percentages, and other figures included in this Annual Report have been subject to rounding adjustments. Accordingly, figures shown as totals in certain tables may not be the arithmetic aggregation of the figures that precede them, and figures expressed as percentages in the text may not total 100% or, as applicable, when aggregated may not be the arithmetic aggregation of the percentages that precede them. In addition, the section of this annual report on Form 20-F entitled “Item 4. Information on the Company” contains information obtained from independent industry sources and other sources that we have not independently verified.

iii

EMERGING GROWTH COMPANY STATUS

We qualify as an “emerging growth company,” as defined in the U.S. Jumpstart Our Business Startups Act of 2012, or JOBS Act, and we may take advantage of certain exemptions, including exemptions from various reporting requirements that are otherwise applicable to public traded entities that do not qualify as emerging growth companies. These exemptions include:

| ● | not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002, or the Sarbanes-Oxley Act; and |

| ● | not being required to comply with any requirement that may be adopted by the Public Company Accounting Oversight Board regarding mandatory audit firm rotation or a supplement to the auditor’s report providing additional information about the audit and the financial statements (i.e., an auditor discussion and analysis). |

Section 107 of the JOBS Act also provides that an emerging growth company can take advantage of the extended transition period provided in Section 13(a) of the Securities Exchange Act of 1934, as amended, or the Exchange Act, for complying with new or revised accounting standards. This means that an “emerging growth company” can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. Given that we currently report and expect to continue to report our financial results under IFRS as issued by the IASB, we will not be able to avail ourselves of this extended transition period and, as a result, we will adopt new or revised accounting standards on the relevant dates on which adoption of such standards is required by the IASB.

We will remain an emerging growth company until the earliest of: (i) the last day of the first fiscal year in which our annual gross revenues exceed $1.235 billion; (ii) the last day of the fiscal year following the fifth anniversary of the date of our initial public offering; (iii) the date that we become a “large accelerated filer” as defined in Rule 12b-2 under the Exchange Act, which would occur if the aggregate worldwide market value of our common shares, including common shares represented by warrants, held by non-affiliates is at least $700 million as of the last business day of our most recently completed second fiscal quarter; or (iv) the date on which we have issued more than $1.0 billion in non-convertible debt securities during any three-year period.

TRADEMARKS

All trademarks or trade names referred to in this Annual Report on Form 20-F are the property of their respective owners. Solely for convenience, the trademarks and trade names in this Annual Report on Form 20-F are referred to without the ® and ™ symbols, but such references should not be construed as any indicator that their respective owners will not assert, to the fullest extent under applicable law, their rights thereto. We do not intend the use or display of other companies’ trademarks and trade names to imply a relationship with, or endorsement or sponsorship of us by, any other companies.

iv

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report contains “forward-looking statements,” which includes information relating to future events, future financial performance, financial projections, strategies, expectations, competitive environment and regulation. Words such as “may,” “should,” “could,” “would,” “predicts,” “potential,” “continue,” “expects,” “anticipates,” “future,” “intends,” “plans,” “believes,” “estimates,” and similar expressions, as well as statements in future tense, identify forward-looking statements. Forward-looking statements should not be read as a guarantee of future performance or results and may not be accurate indications of when such performance or results will be achieved. Forward-looking statements are based on information we have when those statements are made or management’s good faith belief as of that time with respect to future events, and are subject to significant risks and uncertainties that could cause actual performance or results to differ materially from those expressed in or suggested by the forward-looking statements. Important factors that could cause such differences include, but are not limited to:

| ● | the size and growth potential of the markets for our products, and our ability to serve those markets; |

| ● | the rate and degree of market acceptance of our products; |

| ● | our ability to expand our sales organization to address effectively existing and new markets that we intend to target; |

| ● | impact from future regulatory, judicial, and legislative changes or developments in the U.S. and foreign countries; |

| ● | our ability to compete effectively in a competitive industry; |

| ● | our ability to obtain funding for our operations and effectively utilize the capital raised therefrom; |

| ● | our ability to attract collaborators and strategic partnerships; |

| ● | our ability to meet the continued listing requirements and standards of the Nasdaq Capital Market, or Nasdaq; |

| ● | our ability to meet our financial operating objectives; |

| ● | the availability of, and our ability to attract, qualified employees for our business operations; |

| ● | general business and economic conditions; |

| ● | our ability to meet our financial obligations as they become due; |

v

| ● | positive cash flows and financial viability of our operations and any new business opportunities; |

| ● | our ability to secure intellectual property rights over our proprietary products or enter into license agreements to secure the legal use of certain patents and intellectual property; |

| ● | our ability to be successful in new markets; |

| ● | our ability to avoid infringement of intellectual property rights; |

| ● | security, political and economic instability in the Middle East that could harm our business, including due to the current war between Israel and Hamas; and |

| ● | the effects of the global COVID-19 pandemic and the war in Ukraine. |

The foregoing does not represent an exhaustive list of matters that may be covered by the forward-looking statements contained herein or risk factors that we are faced with that may cause our actual results to differ from those anticipated in our forward-looking statements. Please see “Item 3. Key Information – D. Risk Factors,” “Item 4. Information on the Company,” and “Item 5. Operating and Financial Review and Prospects” for additional factors that could adversely impact our business and financial performance.

Moreover, new risks regularly emerge and it is not possible for our management to predict or articulate all the risks we face, nor can we assess the impact of all risks on our business or the extent to which any risk, or combination of risks, may cause actual results to differ from those contained in any forward-looking statements. All forward-looking statements included in this Annual Report are based on information available to us on the date of this Annual Report. Except to the extent required by applicable laws or rules, we undertake no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events or otherwise. All subsequent written and oral forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by the cautionary statements contained above and throughout this Annual Report.

Readers are urged to carefully review and consider the various disclosures made throughout this Annual Report which are designed to advise interested parties of the risks and factors that may affect our business, financial condition, results of operations and prospects.

You should not put undue reliance on any forward-looking statements. Any forward-looking statements in this Annual Report are made as of the date hereof, and we undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

MARKET, INDUSTRY AND OTHER DATA

Market data and certain industry data and forecasts used throughout this Annual Report on Form 20-F were obtained from sources we believe to be reliable, including market research databases, publicly available information, reports of governmental agencies, and industry publications and surveys. We have relied on certain data from third party sources, including industry forecasts and market research, which we believe to be reliable based on our management’s knowledge of the industry. While we are not aware of any misstatements regarding the industry data presented in this Annual Report on Form 20-F, our estimates involve risks and uncertainties and are subject to change based on various factors, including those discussed under the heading “Risk Factors” and elsewhere in this Annual Report on Form 20-F.

Statements made in this Annual Report on Form 20-F concerning the contents of any agreement, contract or other document are summaries of such agreements, contracts or documents and are not a complete description of all of their terms. If we filed any of these agreements, contracts or documents as exhibits to this Report or to any previous filing with the Securities and Exchange Commission, or SEC, you may read the document itself for a complete understanding of its terms.

vi

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

Not applicable.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not applicable.

ITEM 3. KEY INFORMATION

| A. | [Reserved] |

| B. | Capitalization and Indebtedness |

Not applicable.

| C. | Reasons for the Offer and Use of Proceeds |

Not applicable.

| D. | Risk Factors |

You should carefully consider the risks described below, together with all of the other information in this Annual Report. The risks described below are not the only risks facing us. Additional risks and uncertainties not currently known to us or that we currently deem to be immaterial may also materially and adversely affect our business operations. If any of these risks actually occurs, our business and financial condition could suffer and the price of our Common Shares and warrants to purchase Common Shares, or the Warrants, could decline.

Summary of Risk Factors

Risks Related to Our Financial Condition and Capital Requirements

| ● | We have a history of operating losses and we may never achieve or maintain profitability. |

| ● | Our consolidated audited financial statements for the fiscal year ended December 31, 2023 includes a “going concern” explanatory paragraph expressing substantial doubt about our ability to continue as an ongoing business for the next twelve months. Our consolidated financial statements do not include any adjustments that may result from the outcome of this uncertainty. If we cannot secure the financing needed to continue as a viable business, our shareholders may lose some or all of their investment in us. |

| ● | In 2023, 2022 and 2021 our independent registered public accountants identified material weaknesses in our internal controls over financial reporting which have been partially remediated. If we are unable to remediate these material weaknesses, we may not be able to report our financial results accurately, prevent fraud or file our periodic reports as a public company in a timely manner. |

Risks Related to Our Business and Industry

| ● | We rely on our channel partners to generate a substantial majority of our revenues. If these channel partners fail to perform or if we cannot enter into agreements with channel partners on favorable terms, our operating results could be significantly harmed. |

| ● | We are materially dependent on the adoption of our solutions by both the industrial enterprise and public sector markets, and if end customers in those markets do not purchase our solutions, our revenues will be adversely impacted, and we may not be able to expand into other markets. |

1

| ● | We participate in a competitive industry, which may become more competitive. Competitors with greater resources and significant experience in high-volume product manufacturing may be able to respond more quickly and cost-effectively than we can to new or emerging technologies and changes in customer requirements. |

| ● | Defects in our products could reduce demand for our products and result in a loss of sales, delay in market acceptance and injury to our reputation, which would adversely impact our business. |

| ● | If our business does not grow as we expect, or if we fail to manage our growth effectively, our operating results and business would suffer. |

| ● | We may not be able to continue to develop solutions to address user needs effectively in an industry characterized by ongoing change and rapid technological advances. |

| ● | The markets for our devices and related accessories may not develop as quickly as we expect, or may not develop at all. Our dependence on our cellular carrier channel partners and their success in promoting Push to Talk over Cellular to their client base is key for the success of the business. |

| ● | Our future success is dependent on our ability to create independent brand awareness for our company and products with end customers, and our inability to achieve such brand awareness could limit our prospects. |

| ● | We are dependent on the continued services and performance of a concentrated group of senior management and other key personnel, the loss of any of whom could adversely impact our business. |

| ● | We compete in a rapidly evolving market, and the failure to respond quickly and effectively to changing market requirements could cause our business and operating results to decline. |

| ● | If we are unable to sell our solutions into new markets, our revenues may not grow. |

| ● | If we are unable to attract, integrate and retain additional qualified personnel, including top technical talent, our business could be adversely impacted. |

| ● | A security breach or other significant disruption of our information technology (“IT”) systems or those of our partners, suppliers or manufacturers, caused by cyberattacks or other means, could have a negative impact on our operations, sales, and operating results. |

| ● | We experience lengthy sales cycles for our products and the delay of an expected large order could result in a significant unexpected revenue shortfall. |

| ● | We have a limited history of contracting with third party manufacturers in Asia for the high-volume commercial production of our devices, and we may face manufacturing capacity constraints. |

| ● | Our financial condition and results of operations as well as those of potential customers could be adversely affected by the Middle East War, which has caused a material adverse effect on the level of economic activity around the world, including in the markets we serve. |

| ● | We rely on industry data and projections which may prove to be inaccurate. |

2

Risks Related to our Reliance on Third Parties

| ● | As we work with multiple vendors for our components, if we fail to adequately forecast demand for our inventory and supply needs, we could incur additional costs or experience manufacturing delays, which could reduce our gross margin or cause us to delay or even lose sales. |

| ● | Our dependence on third-party suppliers for key components of our products could delay shipment of our products and reduce our sales. |

| ● | Because we rely on a small number of channel partners/customers for a large portion of our revenue, the loss of any of these customers would have a material adverse effect on our operating results and cash flows. | |

| ● | The application development ecosystem supporting our devices and related accessories is new and evolving. |

| ● | Failure of our suppliers, subcontractors, distributors, resellers, and representatives to use acceptable legal or ethical business practices, or to fail for any other reason, could negatively impact our business. |

| ● | Our products are subject to risks associated with sourcing and manufacturing. |

| ● | The nature of our business may result in undesirable press coverage or other negative publicity, which would adversely impact our brand identity, future sales and results of operations. |

| ● | Changes in the availability of federal funding to support local public safety or other public sector efforts could impact our opportunities with public sector end customers. |

| ● | Economic uncertainties or downturns, or political changes, could limit the availability of funds available to our customers and potential customers, which could significantly adversely impact our business. |

| ● | Natural or man-made disasters and other similar events may significantly disrupt our business, and negatively impact our operating results and financial condition. |

| ● | We are exposed to risks associated with strategic acquisitions and investments. |

| ● | We could be adversely impacted by changes in accounting standards and subjective assumptions, estimates and judgments by management related to complex accounting matters. |

Risks Related to Government Regulation

| ● | We are subject to anti-corruption, anti-bribery, anti-money laundering, economic sanctions, export control, and similar laws. Non- compliance with such laws can subject us to criminal or civil liability and harm our business, revenues, financial condition and results of operations. |

| ● | We are subject to a wide range of product regulatory and safety, consumer, worker safety and environmental laws and regulations. |

| ● | Changes in laws and regulations concerning the use of telecommunication bandwidth could increase our costs and adversely impact our business. |

| ● | We are subject to a wide range of privacy and data security laws, regulations and other legal obligations. |

3

Risks Related to Our Intellectual Property

| ● | If we are unable to successfully protect our intellectual property, our competitive position may be harmed. |

| ● | Others may claim that we infringe on their intellectual property rights, which may result in costly and time-consuming litigation and could delay or otherwise impair the development and commercialization of our products. |

| ● | Our use of open-source software could subject us to possible litigation or otherwise impair the development of our products. |

| ● | Our inability to obtain and maintain any third-party license required to develop new products and product enhancements could seriously harm our business, financial condition and results of operations. |

Risks Related to our Locations in Israel and Canada and Our International Operations

| ● | We also conduct our operations in Israel. Conditions in Israel, including the recent attack by Hamas and other terrorist organizations from the Gaza Strip and Israel’s war against them, may affect our operations. |

| ● | It may be difficult to enforce a U.S. judgment against us, our officers and directors named herein in Israel or the United States, or to assert U.S. securities laws claims in Israel or serve process on our officers and directors. |

| ● | Because we are a corporation incorporated in British Columbia and some of our directors and officers are resident in Canada, it may be difficult for investors in the United States to enforce civil liabilities against us based solely upon the federal securities laws of the United States. Similarly, it may be difficult for Canadian investors to enforce civil liabilities against our directors and officers residing outside of Canada. |

| ● | We have operations in China, which exposes us to risks inherent in doing business there. |

| ● | The impact of potential changes in customs, tariffs, and trade policies in the United States and the potential corresponding actions by other countries, in which we do business could adversely impact our financial performance. |

| ● | Operating outside of the United States presents specific risks to our business, and we have substantial operations outside of the United States. |

| ● | Foreign currency fluctuations may reduce our competitiveness and sales in foreign markets. |

Risks Related to Ownership of Our Securities

| ● | We may require additional capital to fund our business and support our growth, and our inability to generate and obtain such capital on acceptable terms, or at all, could harm our business, operating results, financial condition and prospects. In addition, such funding may dilute our existing shareholders. |

| ● | We expect that our stock price will fluctuate significantly, and you may not be able to resell your shares at or above the public offering price you paid for your shares. |

4

| ● | If our Common Shares become subject to the penny stock rules, it may be more difficult to sell our Common Shares. |

| ● | If we fail to maintain proper and effective internal controls, our ability to produce accurate financial statements on a timely basis could be impaired. |

| ● | We will continue to incur significant increased costs as a result of operating as a public company in the United States, and our management will be required to devote substantial time to new compliance initiatives. |

| ● | Because we are a foreign private issuer and are exempt from certain Nasdaq corporate governance standards applicable to U.S. issuers, you will have less protection than you would have if we were a domestic issuer. |

| ● | We may lose our foreign private issuer status in the future, which could result in significant additional costs and expenses. |

| ● | We will continue to incur significant increased costs as a result of operating as a public company in the United States, and our management will be required to devote substantial time to new compliance initiatives. |

| ● | Our executive officers and directors, and their affiliated entities, along with our two other largest stockholders, own a significant percentage of our stock and will be able to exert significant control over matters subject to stockholder approval. |

| ● | The exercise of the outstanding warrants may further dilute the Common Shares and adversely impact the price of our Common Shares. |

| ● | The market for our Common Shares may not provide investors with adequate liquidity. |

| ● | Since we do not expect to pay any cash dividends for the foreseeable future, investors in our common shares may be forced to sell their stock in order to obtain a return on their investment. |

| ● | If securities or industry analysts do not publish research or publish inaccurate or unfavorable research about our business, our stock price and trading volume could decline. |

| ● | A possible “short squeeze” due to a sudden increase in demand of our Common Shares that largely exceeds supply may lead to price volatility in our Common Shares. |

5

Risks Related to Our Financial Position and Capital Requirements

We have a history of operating losses and we may never achieve or maintain profitability.

We have a limited operating history and a history of losses from operations. As of December 31, 2023, we had an accumulated deficit of $90,750,457. Our existing cash and cash equivalents will be insufficient to fully fund our business plan. Our ability to achieve profitability will depend on whether we can obtain additional capital when we need it, complete the development of our technology, obtain required regulatory approvals and continue to develop arrangements with channel partners. There can be no assurance that we will ever achieve profitability.

Our independent registered public accounting firm, in its report on our financial statements for the year ended December 31, 2023, concurs with management representation that raises substantial doubt about our ability to continue as a going concern.

We may require additional capital to fund our business and support our growth, and our inability to generate and obtain such capital on acceptable terms, or at all, could harm our business, operating results, financial condition and prospects.

We intend to continue to make substantial investments to fund our business and support our growth. In addition, we may require additional funds to respond to business challenges, including the need to develop new features or enhance our solutions, improve our operating infrastructure or acquire or develop complementary businesses and technologies. As a result, in addition to the revenues we generate from our business, we may need to engage in additional equity or debt financings to provide the funds required for these and other business endeavors. If we raise additional funds through future issuances of equity or convertible debt securities, our existing stockholders could suffer significant dilution, and any new equity securities we issue could have rights, preferences and privileges superior to those of holders of our Common Shares. Any debt financing that we may secure in the future could involve restrictive covenants relating to our capital raising activities and other financial and operational matters, which may make it more difficult for us to obtain additional capital and to pursue business opportunities, including potential acquisitions. We may not be able to obtain such additional financing on terms favorable to us, if at all. If we are unable to obtain adequate financing or financing on terms satisfactory to us when we require it, our ability to continue to support our business growth and to respond to business challenges could be significantly impaired, and our business may be adversely impacted. In addition, our inability to generate or obtain the financial resources needed may require us to delay, scale back, or eliminate some or all of our operations, which may have a significant adverse impact on our business, operating results and financial condition.

Our independent registered public accountants have noted that we may not survive as a going concern.

Our independent registered public accountants have included a “going concern” explanatory paragraph in its report on our consolidated financial statements for the fiscal year ended December 31, 2023, concurring with management representation of expressing substantial doubt about our ability to continue as an ongoing business for the next twelve months. Our consolidated financial statements do not include any adjustments that may result from the outcome of this uncertainty. If we cannot secure the financing needed to continue as a viable business, our shareholders may lose some or all of their investment in us.

Our independent registered public accountants have identified material weaknesses in our internal controls over financial reporting in 2023, 2022 and 2021. If we are unable to remediate these material weaknesses, we may not be able to report our financial results accurately, prevent fraud or file our periodic reports as a public company in a timely manner.

In connection with the audit of our consolidated financial statements for the years ended December 31, 2023, 2022 and 2021, our independent registered public accountants identified several material weaknesses in our internal control over financial reporting. A “material weakness” is a deficiency, or a combination of deficiencies, in internal control over financial reporting such that there is a reasonable possibility that a material misstatement of our annual or interim financial statements will not be prevented or detected on a timely basis.

6

In 2023, our independent registered public accountants identified the following material weaknesses in our internal control over financial reporting. The first material weakness related to our revenue recognition practices where we do not sufficiently determine for specific transactions the correct timing in which the revenue should be recorded after title transfer terms were met. The second material weakness related to insufficient documentation of inventory controls relating to our inventory balances, transfer between sites and off-site inventory tracking is limited. The third material weakness related to internal control weaknesses in the capitalization and coordination of development costs to prevent excess payments and erroneously recorded invoices.

For the material weaknesses identified in our 2023 audit, we have taken steps to remediate these material weaknesses, and to further strengthen our accounting staff and internal controls, as detailed below:

| ● | With respect to the revenue recognition weakness, management has implemented a process that will scrutinize the delivery date for each sale that occurs to ensure that the revenue recognition for each period is calculated properly. This will ensure proper matching of revenues in the period incurred. |

| ● | With respect to the inventory transfers, management has implemented manual processes as a back up to ensure all inventory transfers are recorded properly so that the inventory valuation is correct. |

With respect to the research and development process, our research and development team will be required to approve all invoices from the research and development subcontractor and ensure they fall within the budget and to ensure that new contracts and agreements are made to extend and expand the previous contract once total payments reached the sum in the agreement to ensure the amounts capitalized are not in excess of the original budget with its discounted cash flows. Once the research and development team has approved the invoice based on the above criteria, the Company’s Chief Executive Officer will review the documentation and, once approved, will forward the documentation to the Company’s Chief Financial Officer in Canada for wire initiation.

In 2022, our independent registered public accountants identified the following material weaknesses in our internal control over financial reporting. The first material weakness related to our revenue recognition practices where we do not sufficiently review (i) product returns in relation to product sales and (ii) for title transfer terms to determine when revenue should be recorded. The second material weakness related to insufficient documentation of inventory controls relating to our inventory balances, advances to suppliers, and off-site inventory tracking is limited. The third material weakness related to internal control weaknesses in the capitalization and coordination of development costs to prevent excess payments and erroneously recorded invoices.

For the material weaknesses identified in our 2022 audit, we have taken steps to remediate these material weaknesses, and to further strengthen our accounting staff and internal controls, as detailed below:

| ● | With respect to the revenue recognition practices, management will consistently apply of IFRS15 with respect to the five criterion for revenue recognition, In addition, management will institute peer review of North American sales by the Israeli subsidiary’s chief financial officer and peer review by Company’s Chief Financial Officer of Israeli sales recognition policy on a quarterly basis and engage in dialogue on new customers to ensure the revenue recognition policy and the customer contracts are consistently applied. |

| ● | With respect to the inventory control weaknesses, management will institute the following remediation procedures: |

| ● | Monthly comparison of inventory first and last cost in USD$ between periods to note any changes and to investigate the reason for these discrepancies to provide a more accurate quantum of write downs and consistent costing. |

| ● | The implementation of an IT system to track the inventory movements in North America; |

| ● | Monthly comparison of inventory units between periods to note any changes and to investigate the reason for any inconsistencies. |

| ● | Obtain confirmation of goods in transit with external vendors and consignment customers on a more timely basis. |

| ● | With respect to the development cost weaknesses, the research and development team will be required to approve all invoices from the R&D sub-contractor and ensure they fall within the budget to ensure the amounts capitalized are not in excess of the original budget with its discounted cash flows. Once the R&D team has approved the invoice based on the above criteria, the Company’s Chief Executive Officer will review the documentation and once approved, will forward said documentation to the Company’s Chief Financial Officer in Canada for wire initiation. |

In 2021, our independent registered public accountants identified the following material weaknesses in our internal control over financial reporting. The first material weakness related to the insufficient review of inventory balances for products which are slow-moving. The second material weakness related to the insufficient review of advances to suppliers on products that are no longer selling, the third material weakness relates to insufficient controls surrounding off-site inventory tracking. The fourth material weakness related to insufficient review whether product returns relate to sales recorded in the fiscal year. The fifth material weakness relates to insufficient review of title transfer terms to determine the period in which revenue should be recorded.

7

For the material weaknesses identified in our 2021 audit, we have taken steps to remediate these material weaknesses, and to further strengthen our accounting staff and internal controls, as detailed below:

| ● | On a quarterly basis, the Company now reviews inventory on hand for slow moving merchandise and reviews inventory on hand regularly. For the year ended 2021, it was determined that $4,659,648 (2020- $1,571,649) of the inventory was impaired due to slow movement. The accessories and spare parts related to these products amounted to $839,693 (2020 - $316,000), which was also impaired. |

| ● | The Company now reviews quantities on hand before approving purchase orders. |

| ● | As of April 1, 2022, the Company signed a lease for their own exclusive warehouse space so that outside contract warehouses will not be required. |

| ● | The Company now reviews product returns to compare and ensure that they occur in the same fiscal year. |

| ● | The Company’s controller scrutinizes all revenues earned in the period to ensure compliance with IFRS15. |

| ● | The Company’s controller and CFO in Canada coordinates full scheduling of the year end process to ensure timely close off of accounting periods. |

To date, we have only partially remediated the material weaknesses identified in 2022 and 2021 above. We cannot be certain that other material weaknesses and control deficiencies will not be discovered in the future. If our efforts are not successful or other material weaknesses or control deficiencies occur in the future, we may be unable to report our financial results accurately on a timely basis or help prevent fraud, which could cause our reported financial results to be materially misstated and result in the loss of investor confidence or delisting and cause the market price of our Common Shares to decline.

We began to take steps to remediate these material weaknesses and strengthen our internal control over financial reporting, including the following:

| (i) | documenting and formally assessing our accounting and financial reporting policies and procedures; and |

| (ii) | increasing the use of third-party consultants in assessing significant accounting transactions and other technical accounting and financial reporting issues, preparing accounting memoranda addressing these issues and maintaining these memoranda in our corporate records. |

While we believe that these efforts will improve our internal control over financial reporting, the implementation of these measures is ongoing and will require validation and testing of the design and operating effectiveness of internal controls over a sustained period of financial reporting cycles. We cannot assure you that the measures we have taken to date, and are continuing to implement, will be sufficient to maintain effective internal control over financial reporting. Accordingly, there could continue to be a reasonable possibility that a misstatement of our accounts or disclosures that would result in a material misstatement of our financial statements that would not be prevented or detected on a timely basis.

8

Risks Related to Our Business and Industry

We rely on our channel partners to generate a substantial majority of our revenues. If these channel partners fail to perform or if we cannot enter into agreements with channel partners on favorable terms, our operating results could be significantly harmed.

More than 60% and 50% of our revenues for the years ended December 31, 2023 and 2022, were generated through sales by our channel partners, which are primarily wireless carriers who sell our devices through their sales channels. To the extent our channel partners are unsuccessful in selling or do not promote our products, or we are unable to obtain and retain a sufficient number of high-quality channel partners, our business and operating results could be significantly harmed. Our channel partners are wireless carriers who have direct and indirect sales channels which we are leveraging to get to their customers. Our wireless carrier channel partners currently include:

| ● | AT&T, in the United States; |

| ● | FirstNet, in the United States; |

| ● | Verizon, in the United States; |

| ● | T-Mobile, in the United States; |

| ● | Bell Mobility, in Canada; |

| ● | Rogers, in Canada; and |

| ● | a leading global land mobile radio, or LMR, vendor and distributor in North America and international markets. |

While these arrangements are typically long term, they generally do not contain any firm purchase volume commitments. As a result, our channel partners are not contractually obligated to purchase from us any minimum number of products. We are generally required to satisfy any and all purchase orders delivered to us within specified delivery windows, with limited exceptions (such as orders significantly in excess of forecasts). If we are unable to efficiently manage our supply and satisfy purchase orders on a timely basis to our channel partners, we may be in breach of our sales arrangements and lose potential sales. If a technical issue with any of our covered products exceeds certain present failure thresholds for the relevant performance standard or standards, the channel partner typically has the right to cease selling the product, cancel open purchase orders and levy certain monetary penalties. If our products suffer technical issues or failures following sales to our channel partners, we may be subject to significant monetary penalties and our channel partners may cease making purchase orders, which would significantly harm our business and results of operations. In addition, our channel partners retain sole discretion in which of their stocked products to offer their customers. While we may offer limited customer incentives, we generally have limited to no control over which products our channel partners decide to offer or promote, which directly impacts the number of products that our partners will purchase from us.

In addition, our channel partners may be unsuccessful in marketing, selling and supporting our solutions. They may also market, sell and support solutions that are somewhat competitive with ours, and may devote more resources to the marketing, sales and support of such products. They may have incentives to promote our competitors’ products in lieu of our products, particularly for our bigger competitors with larger volumes of orders, more diverse product offerings and a longer relationship with our generally large-scale channel partners. As a result, our channel partners may stop selling our products completely. While we employ a small direct sales force, our channel partners have significantly larger sales teams who are not contractually obligated to promote any of our devices and often have multiple competing devices in stock to offer their customers. In addition, downstream sales by our channel partners often succeed due to attractive device prices and monthly rate plans, which we do not control. In certain cases, we may promote our own devices through customer incentives, however, there can be no assurance that any such incentives would contribute to increased purchases of our products. Further, given the impact of attractive pricing on ultimate sales, we generally must offer increased promotional funding or price reductions for our more expensive products. This promotional funding or price reductions operate to reduce our margins and significantly impact our profitability.

New sales channel partners may take several months or more to achieve significant sales. Our channel partner sales structure could subject us to lawsuits, potential liability and reputational harm if, for example, any of our channel partners misrepresents the functionality of our products or services to their customers, or violate laws or our corporate policies.

9

If we fail to effectively manage our existing or future sales channel partners, our channel partners fail to promote our products effectively, we are unable to meet our obligations under our sales arrangements or future agreements that we may enter into with wireless carrier customers have terms that are more favorable to the customer, our business and results of operations would be harmed.

We are materially dependent on the adoption of our solutions by both the industrial enterprise and public sector markets, and if end customers in those markets do not purchase our solutions, our revenues will be adversely impacted, and we may not be able to expand into other markets.

Our revenues have been primarily in the industrial enterprise market, and we are materially dependent on the adoption of our solutions by both the industrial enterprise and public sector markets. End customers in the public sector market may remain, for reasons outside our control, tied to LMR solutions or other competitive alternatives to our devices. Sales of our products to these buyers may also be delayed or limited by these competitive conditions. If our products are not widely accepted by buyers in those markets, we may not be able to expand sales of our products into new markets, and our business, results of operations and financial condition may be adversely impacted.

We participate in a competitive industry, which may become more competitive. Competitors with greater resources and significant experience in high-volume product manufacturing may be able to respond more quickly and cost-effectively than we can to new or emerging technologies and changes in customer requirements.

We face significant competition in developing and selling our solutions. Our primary competitors in the non-rugged mobile device market include LG Corporation, Apple Inc. and Samsung Electronics Co. Ltd. Our primary competitors in the rugged mobile device market include Sonim Technologies Inc., Bullitt Mobile Ltd., and Kyocera Corporation. We also face competition from large system integrators and manufacturers of private and public wireless network equipment and devices. Competitors in this space include Harris Corporation, JVC KENWOOD Corporation, Motorola, and Tait International Limited. Within the Cellular Booster category, we have several direct competitors, including Wilson Electronics, LLC, or Wilson Electronics, Nextivity, Inc. and SureCall Company.

We cannot assure you that we will be able to compete successfully against current or future competitors. Increased competition in mobile computing platforms, data capture products, or related accessories and software developments may result in price reductions, lower gross profit margins, and loss of market share, and could require increased spending on research and development, sales and marketing, and customer support. Some competitors may make strategic acquisitions or establish cooperative relationships with suppliers or companies that produce complementary products, which may create additional pressures on our competitive position in the marketplace.

Most of our competitors have longer operating histories, greater name recognition, larger customer bases and significantly greater financial, technical, sales, marketing and other resources and experience than we do. In addition, because of the higher volume of components that many of our competitors purchase from their suppliers, they are able to keep their supply costs relatively low and, as a result, may be able to recognize higher margins on their product sales than we do. Many of our competitors may also have existing relationships with the channel partners who we use to sell our products, or with our potential customers. This competition may result in reduced prices, reduced margins and longer sales cycles for our products. Our competitors may also be able to more quickly and cost-effectively respond to new or emerging technologies and changes in customer requirements. The combination of brand strength, extensive distribution channels and financial resources of the larger vendors could cause us to lose market share and could reduce our margins on our products. If any of our larger competitors were to commit greater technical, sales, marketing and other resources to our markets, our ability to compete would be adversely impacted. If we are unable to successfully compete with our competitors, our sales would suffer and as a result our financial condition will be adversely impacted.

10

Defects in our products could reduce demand for our products and result in a loss of sales, delay in market acceptance and injury to our reputation, which would adversely impact our business.

Complex software, as well as multiple components, displays, plastics and assemblies used in our products may contain undetected defects that are subsequently discovered at any point in the life of the product. Defects in our products may result in a loss of sales, product malfunction, delay in market acceptance and potential injuries to our customers which can bring to injury in our reputation and increased warranty costs.

Additionally, our software may contain undetected errors, defects or bugs. Although we have not suffered significant harm from any errors, defects or bugs to date, we may discover significant errors, defects, or bugs in the future that we may not be able to correct or correct in a timely manner. It is possible that errors, defects or bugs will be found in our existing or future software and/or hardware products and related services with the potential for delays in, or loss of market acceptance of, our products and services, diversion of our resources, injury to our reputation, increased service and warranty expenses, and payment of damages.

Further, errors, defects or bugs in our solutions could be exploited by hackers or could otherwise result in an actual or perceived breach of our information systems. Alleviating any of these problems could require significant expense and could cause interruptions, delays or cessation of our product licensing, which would reduce demand for our products and result in a loss of sales, delay in market acceptance and injure our reputation and could adversely impact our business, results of operations and financial condition.

If our business does not grow as we expect, or if we fail to manage our growth effectively, our operating results and business would suffer.

Our ability to successfully grow our business depends on a number of factors including our ability to:

| ● | accelerate the adoption of our solutions by new end customers; |

| ● | expand into new vertical markets; |

| ● | develop and deliver new products and services; |

| ● | increase awareness of the benefits that our solutions offer; and |

| ● | expand our domestic and international footprint. |

As usage of our solutions grows, we will need to continue to make investments to develop and implement new or updated solutions, software, technologies, security features and cloud-based infrastructure operations. In addition, we will need to appropriately scale our internal business systems and our services organization, including the suppliers of our products and customer support services, to serve our growing customer base. Any failure of, or delay in, these efforts could impair the performance of our solutions and reduce customer satisfaction.

Further, our growth could increase quickly and place a strain on our managerial, operational, financial and other resources, and our future operating results depend to a large extent on our ability to successfully manage our anticipated expansion and growth. To manage our growth successfully, we will need to continue to invest in sales and marketing, research and development, and general and administrative functions and other areas. We are likely to recognize the costs associated with these investments earlier than receiving some of the anticipated benefits, and the return on these investments may be lower, or may develop more slowly, than we expect, which could adversely impact our operating results.

If we are unable to manage our growth effectively, we may not be able to take advantage of market opportunities or develop new solutions or upgrades to our existing solutions, satisfy customer requirements, maintain the quality and security of our solutions or execute on our business plan, any of which could harm our business, operating results and financial condition.

11

We may not be able to continue to develop solutions to address user needs effectively in an industry characterized by ongoing change and rapid technological advances.

To be successful, we must adapt to rapidly changing technological and application needs by continually improving our products, as well as introducing new products and services, to address user demands.

Our industry is characterized by:

| ● | evolving industry standards; |

| ● | frequent new product and service introductions; |

| ● | increasing demand for customized product and software solutions; |

| ● | rapid competitive developments; |

| ● | changing customer demands; and |

| ● | evolving distribution channels. |

Future success will depend on our ability to effectively and economically adapt in this evolving environment. We could incur substantial costs if we must modify our business to adapt to these changes, and may even be unable to adapt to these changes.

The markets for our devices and related accessories may not develop as quickly as we expect, or may not develop at all. Our dependence on our cellular carrier channel partners and their success in promoting Push to Talk over Cellular to their client base is key for the success of the business.

Our future success is substantially dependent upon continued adoption of devices and related accessories in the industrial enterprise and public sector markets, including the transition from LMR to Push to Talk over Cellular and LTE networks. These market developments and transitions may take longer than we expect or may not occur at all, and may not be as widespread as we expect. If the market does not develop as we expect, our business, operating results and financial condition would be significantly harmed.

Our future success is dependent on our ability to create independent brand awareness for our company and products with end customers, and our inability to achieve such brand awareness could limit our prospects.

We depend on wireless carriers to promote and distribute our products. While we intend to ramp up direct marketing and end-customer brand awareness initiatives in the future, our sales and marketing efforts have historically been predominantly focused on channel partners. To increase end-customer brand awareness, we intend to develop sales tools for key verticals within our target markets, increase usage of social media and expand product training efforts, among other things. As a result, we expect our sales and marketing expenses to increase in the future, primarily from increased sales personnel expenses, which will require us to cost-efficiently ramp up our sales and marketing capabilities and effectively target end customers. However, there can be no assurance that we will successfully increase our brand awareness or do so in a cost-efficient manner while maintaining market share within our existing sales channels. Our failure to establish stand-alone brand awareness with end customers of our products will leave us vulnerable to the marketing and selling success of others, including our channel partners, and these developments could have an adverse impact on our prospects. If we are unable to significantly increase the awareness of our brand and solutions with end customers in a cost-efficient manner, we will remain significantly dependent on our channel partners for sales of our products, and our business, financial condition and results of operations could be adversely impacted.

12

We are dependent on the continued services and performance of a concentrated group of senior management and other key personnel, the loss of any of whom could adversely impact our business.

Our future success depends in large part on the continued contributions of a concentrated group of senior management and other key personnel. In particular, the leadership of key management personnel is critical to the successful management of our company, the development of our solutions and our strategic direction. We also depend on the contributions of key technical personnel. Our senior management and key personnel are all employed on an at-will basis, which means that they could terminate their employment with us at any time, for any reason and without notice. The loss of any of our key personnel could significantly delay or prevent the achievement of our development and strategic objectives and harm our business.

We compete in a rapidly evolving market, and the failure to respond quickly and effectively to changing market requirements could cause our business and operating results to decline.

The mobile device market is characterized by rapidly changing technology, changing customer needs, evolving industry standards and frequent introductions of new products and services. In order to deliver a competitive mobile device, our solutions must be capable of operating in an increasingly complex network environment. As new wireless phones are introduced and standards in the mobile device market evolve, we may be required to modify our phones and services to make them compatible with these new products and standards. Likewise, if our competitors introduce new devices and services that compete with ours, we may be required to reposition our solutions or introduce new phones and solutions in response to such competitive pressure. We may not be successful in modifying our current devices or introducing new ones in a timely or appropriately responsive manner, or at all. If we fail to address these changes successfully, our business and operating results could be significantly harmed.

If we are unable to sell our solutions into new markets, our revenues may not grow.

Any new market into which we attempt to sell our solutions may not be receptive. Our ability to penetrate new markets depends on the quality of our solutions, the continued adoption of our public safety solution by first responders, the perceived value of our solutions as a risk management tool and our ability to design our solutions to meet the demands of our customers. If the markets for our solutions do not develop as we expect, our revenues may not grow.

Our ability to successfully face these challenges depends on several factors, including increasing the awareness of our solutions and their benefits, the effectiveness of our marketing programs, the costs of our solutions, our ability to attract, retain and effectively train sales and marketing personnel, and our ability to develop relationships with wireless carriers and other partners. If we are unsuccessful in developing and marketing our solutions into new markets, new markets for our solutions might not develop or might develop more slowly than we expect, either of which would harm our revenues and growth prospects.

If we are unable to attract, integrate and retain additional qualified personnel, including top technical talent, our business could be adversely impacted.

Our future success depends in part on our ability to identify, attract, integrate and retain highly skilled technical, managerial, sales and other personnel. We face intense competition for qualified individuals from numerous other companies, including other software and technology companies, many of whom have greater financial and other resources than we do. Some of these characteristics may be more appealing to high-quality candidates than those we have to offer. In addition, new hires often require significant training and, in many cases, take significant time before they achieve full productivity. We may incur significant costs to attract and retain qualified personnel, including significant expenditures related to salaries and benefits and compensation expenses related to equity awards, and we may lose new employees to our competitors or other companies before we realize the benefit of our investment in recruiting and training them. Moreover, new employees may not be or become as productive as we expect, as we may face challenges in adequately or appropriately integrating them into our workforce and culture. If we are unable to attract, integrate and retain suitably qualified individuals who are capable of meeting our growing technical, operational and managerial requirements on a timely basis or at all, our business will be adversely impacted.

13

Volatility or lack of positive performance in our stock price may also affect our ability to attract and retain our key employees. Many of our senior management personnel and other key employees have become, or will soon become, vested in a substantial amount of stock or stock options. Employees may be more likely to leave us if the shares they own or the shares underlying their vested options have significantly appreciated in value relative to the original purchase prices of the shares or the exercise prices of the options, or, conversely, if the exercise prices of the options that they hold are significantly above the market price of our Common Shares. If we are unable to appropriately incentivize and retain our employees through equity compensation, or if we need to increase our compensation expenses in order to appropriately incentivize and retain our employees, our business, operating results and financial condition would be adversely impacted.

A security breach or other significant disruption of our IT systems or those of our partners, suppliers or manufacturers, caused by cyberattacks or other means, could have a negative impact on our operations, sales, and operating results.

All IT systems are potentially vulnerable to damage, unauthorized access or interruption from a variety of sources, including but not limited to, cyberattacks, cyber intrusions, computer viruses, security breaches, energy blackouts, natural disasters, terrorism, sabotage, war, insider trading and telecommunication failures. A cyberattack or other significant disruption involving our IT systems or those of our outsource partners, suppliers or manufacturers could result in the unauthorized release of proprietary, confidential or sensitive information of ours or result in virus and malware installation on our devices. Such unauthorized access to, or release of, this information or other security breaches could: (i) allow others to unfairly compete with us, (ii) compromise safety or security, (iii) subject us to claims for breach of contract, tort, and other civil claims, and (iv) damage our reputation. Any or all of the foregoing could have a negative impact on our business, financial condition and results of operations.

We experience lengthy sales cycles for our products and the delay of an expected large order could result in a significant unexpected revenue shortfall.

The purchase of our products is often an enterprise-wide decision for prospective customers, which requires us to engage in sales efforts over an extended period of time and provide a significant level of education to prospective customers regarding the uses and benefits of such devices. Prospective customers, especially the wireless carriers that sell our products, often undertake a prolonged evaluation process that may take from several months to several years in certain cases. Consequently, if our forecasted sales from a specific customer are not realized, we may not be able to generate revenues from alternative sources in time to compensate for the shortfall. The loss or delay of an expected large order could also result in a significant unexpected revenue shortfall. Moreover, to the extent we enter into and deliver our products pursuant to significant contracts earlier than we expected, our operating results for subsequent periods may fall below expectations. We may spend substantial time, effort and money on our sales and marketing efforts without any assurance that our efforts will produce any sales. If we are unable to succeed in closing sales with new and existing customers, our business, operating results and financial condition will be harmed.

We have a limited history of contracting with third party manufacturers in Asia for the high-volume commercial production of our devices, and we may face manufacturing capacity constraints.

We have limited history and experience in contracting with third party manufacturers in Asia for the high-volume commercial production of our devices. Because of this limited production history, we face challenges in predicting our business and evaluating its prospects, which may result in breakdowns of our ability to timely supply our devices to our customers. Moreover, we face manufacturing capacity constraints that present further risks to our business. If overall demand of our devices increases in the future, we will need to expand our third party manufacturing capacity in a cost-efficient manner. Failing to meet customer demand due to our failure to successfully address these risks and challenges could adversely impact our reputation and future sales, which would significantly harm our business, results of operations and financial condition.

14

Our financial condition and results of operations as well as those of potential customers could be adversely affected by the Middle East War, which may cause a material adverse effect on the level of economic activity around the world, including in the markets we serve.

In October 2023, war broke out in the Middle East between Israel and Hamas and possibly with other regional powers. As a result of this war, various nations, including the United States, have been monitoring the situation closely. While we currently have customers, assets, liabilities, employees and suppliers in the region we have not experienced any supply disruptions directly related to this war. As this war continues or possibly escalates, this may lead to further disruption, instability and volatility in global markets and industries that could negatively impact our customers, operations and our supply chain. The impact of the conflict and related sanctions on the world economy are subject to rapid change and are difficult to predict. The war could create disruptions in the supply chain for certain of our products which, to date, has not had a substantive impact on our operations. None of our critical raw materials are sourced from, and none of our finished products are manufactured in, the Middle East region. We have no operations or other projects in that region.

We are monitoring any broader economic impact from the Middle East war, including heightened risk of cyberattacks, property damage, employee inaccessibility to the workplace, increased prices of fuel and other commodities, and potential impacts to our partners’ supply chains. Our financial condition, results of operations, and cash flows may be materially adversely affected, but the specific impact on our financial condition, results of operations, and cash flows is currently difficult to determine.

Our financial condition and results of operations as well as those of potential customers could be adversely affected by the Russian invasion of Ukraine, which has caused a material adverse effect on the level of economic activity around the world, including in the markets we serve.

In February 2022, the Russian Federation invaded Ukraine. As a result of the invasion, various nations, including the United States, have instituted economic sanctions against the Russian Federation and Belarus and certain of their citizens. While we currently have no customers or suppliers located in Belarus, the Russian Federation or Ukraine, nor have we experienced any supply disruptions directly related to the Russian invasion of Ukraine as we do not knowingly source any materials originating from Belarus, the Russian Federation or Ukraine, as the war in Ukraine continues or possibly escalates, this may lead to further disruption, instability and volatility in global markets and industries that could negatively impact our customers, operations and our supply chain. The impact of the conflict and related sanctions on the world economy are subject to rapid change and are difficult to predict. The war has created disruptions in the supply chain for certain of our products which, to date, has not had a substantive impact on our operations. None of our critical raw materials are sourced from, and none of our finished products are manufactured in, the sanctioned regions. We have no operations or other projects in that region.

We are monitoring any broader economic impact from Russia’s invasion of Ukraine and the ongoing war between the two nations, including heightened risk of cyberattacks, increased prices of fuel and other commodities, and potential impacts to our partners’ supply chains. Our financial condition, results of operations, and cash flows may be materially adversely affected, but the specific impact on our financial condition, results of operations, and cash flows is currently difficult to determine.

We rely on industry data and projections which may prove to be inaccurate.

We obtained statistical data, market data and other industry data and forecasts used in this prospectus from market research, publicly available information and industry publications. These industry data, including the vehicle communications industry, include projections that are based on a number of assumptions which have been derived from industry and government sources which we believe to be reasonable. The vehicle communications industry may not grow at the rate projected by industry data, or at all. The failure of the industry to grow as anticipated is likely to have a material adverse effect on our business and the market price of our Common Shares. In addition, the rapidly changing nature of the vehicle communications industry subjects any projections or estimates relating to the growth prospects or future condition of our industries to significant uncertainties. Furthermore, if any one or more of the assumptions underlying the industry data turns out to be incorrect, actual results may, and are likely to, differ from the projections based on these assumptions. While we believe that the statistical data, industry data and forecasts and market research are reliable, we have not independently verified the data.

15

Risks Related to our Reliance on Third Parties

As we work with multiple vendors for our components, if we fail to adequately forecast demand for our inventory and supply needs, we could incur additional costs or experience manufacturing delays, which could reduce our gross margin or cause us to delay or even lose sales.

Because our production volumes are based on a forecast of channel partner demand rather than purchase commitments from our major customers, there is a risk that our forecasts could be inaccurate and that we will be unable to sell our products at the volumes and prices we expect, which may result in excess inventory. We provide, and will continue to provide, forecasts of our demand to our third-party suppliers prior to the scheduled delivery of products to our channel partners. If we overestimate our requirements, our contract manufacturers may have excess component inventory, which could increase our costs. If we underestimate our requirements, our contract manufacturers may have inadequate component inventory, which could interrupt the manufacturing of our products and result in delays in shipments and revenues or even lost sales, or could incur unplanned overtime costs to meet our requirements, resulting in significant cost increases. For example, certain materials and components used to manufacture our products may reach end of life during any of our product’s life cycles, following which suppliers no longer provide such expired materials and components. This would require us to either source and qualify an alternative component, which could require a re-certification of the device by the wireless carriers and/or regulatory agencies, or forecast product demand for a final purchase of such materials and components that may reach end of life to ensure that we have sufficient product inventory through a product’s life cycle. If we overestimate forecasted demand, we would hold excess end-of-life materials and components resulting in increased costs. If we underestimate forecasted demand, we could experience delays in shipments and loss of revenues.