September 22, 2015

By Hand and EDGAR

United States Securities and Exchange Commission,

Division of Corporation Finance,

100 F Street N.E.,

Washington, D.C. 20549

Division of Corporation Finance,

100 F Street N.E.,

Washington, D.C. 20549

Attention: | Laura Nicholson, Special Counsel | |

Re: | New Business Netherlands N.V. Amendment No. 1 to Registration Statement on Form F-1 (File No. 333-205804) | |

Dear Ms. Nicholson:

On behalf of our client, New Business Netherlands N.V. (the “Registrant”), we are writing to respond to the letter, dated September 15, 2015, from the Staff of the Securities and Exchange Commission regarding the above-referenced amendment to the registration statement on Form F-1 (the “Amended Registration Statement”) that was filed on August 31, 2015. Concurrently with the submission of this letter, the Registrant is filing Amendment No. 2 to the Registration Statement (the “Second Amended Registration Statement”). To facilitate the Staff’s review, we are also providing courtesy hard copies of the Second Amended Registration Statement, including a version of the Second Amended Registration Statement marked to reflect changes to the Amended Registration Statement, and this letter, to you.

The Registrant appreciates the Staff’s review of the Amended Registration Statement and looks forward to working with the Staff to resolve the Staff’s comments expeditiously. As a result of changes in the Second Amended Registration Statement, some page references in the Second Amended Registration Statement have changed from those in the Amended Registration Statement. The page references in the Staff’s comments refer to page numbers in the Amended Registration Statement, while the page numbers in the Registrant’s responses refer to page numbers in the Second Amended Registration Statement. For your convenience, the Registrant has reproduced each of the Staff’s comments below and provided its responses below each comment. Capitalized terms that are in this letter but not defined herein have the meanings assigned to them in the Second Amended Registration Statement.

In response to a number of the comments, the Registrant has changed or supplemented the disclosures in the Amended Registration Statement. It is doing so in order to address the Staff’s views in a constructive manner and not because the Registrant believes its prior filings were deficient or inaccurate in any respect. Accordingly, any changes reflected in the Second Amended Registration Statement, or any changes implemented in future filings, should not be taken as an admission that prior disclosures were in any way deficient or inaccurate.

LONDON:517820.7

Securities and Exchange Commission | ||

September 22, 2015 | ||

- 2 - | ||

The Registrant has also indicated in a number of its responses that it believes no change in disclosure is appropriate, and this response letter seeks to explain the reasons for this view. The Registrant understands that the Staff’s comments, even where the Staff requests or suggests a disclosure change, are based on the Staff’s understanding of information available to it, which may be less complete than the information available to the Registrant. Accordingly, the Registrant understands that those Staff comments may be withdrawn or modified based on the additional explanation or information provided by the Registrant. Of course, the Registrant would be pleased to respond by telephone or in further correspondence to any further comments that the Staff may have.

General

1. | We note your response to our prior comment 1. Please provide additional analysis as to why you believe that none of the transactions described on pages 125 - 126 require registration under the Securities Act. Please include the following in your response: |

• | Please address why you believe that the framework described in Staff Legal Bulletin No. 4 applies to this series of transactions that involves the first demerger, the second demerger, and the merger of FE Newco with the registrant. In that regard, we note that Staff Legal Bulletin No. 4 describes a spin-off as a transaction in which the parent company distributes shares of a subsidiary to the parent company’s shareholders. |

• | Please otherwise explain why you believe that none of these transactions involve a sale within the meaning of Section 2(a)(3) of the Securities Act. |

• | With respect to the question of whether registration is required under Rule 145, please tell us what the FCA shareholders will be voting on in connection with the first demerger and why a vote is not necessary for the transactions that follow the first demerger. |

• | Please identify any exemptions from registration that you believe apply. |

Response:

The Registrant respectfully advises the Staff that the transactions by which FCA intends to separate its remaining interest in Ferrari after the IPO, taken together, are a distribution of shares by the parent company of the type addressed by Staff Legal Bulletin No. 4 (“SLB 4”) and prior related no action relief provided by the Commission.

The Registrant believes that the series of transactions described in the registration statement (i.e., the first and second demergers and the merger (the “Merger”) of FE New with the Registrant, which the Registrant refers to collectively as the “Spin-off”) represent a single multi-step transaction: no step

LONDON:517820.7

Securities and Exchange Commission | ||

September 22, 2015 | ||

- 3 - | ||

can take place if the others do not, all steps will take place over a brief period of time -- occurring in between two consecutive trading days, and all steps have no purpose or effect other than to effect a pro rata distribution of shares of FCA’s subsidiary, New Business Netherlands N.V. (“NBNV”), to FCA shareholders.

Nevertheless, even if the several integrated steps that form the Spin-off were considered individually, each of them would be exempt from registration, as discussed further below.

(a) | The Spin-off by way of demerger meets the conditions of SLB 4 and prior no action relief |

The Registrant believes that the Spin-off will not involve an “offer to sell” or “sale” of securities within the meaning of Section 2(3) of the Securities Act and, consequently, registration of the securities involved in the transaction is not required. In a series of no-action letters, the Division has consistently taken the position that shares distributed in European demergers do not require registration under the Securities Act so long as the conditions of SLB 4 are satisfied. See, e.g., Bunzl plc No Action Letter (May 27, 2005); Kingfisher plc No Action Letter (April 25, 2003); Sanpaolo IMI S.p.A. No Action Letter (October 28, 1999). In each of those letters, the Staff has recognized that a spin-off transaction does not need to be in the form of a simple pro rata dividend of shares in a subsidiary, and that a spin-off effected through a European style demerger does not require registration under the Securities Act so long as the other factors set forth in SLB 4 are met.

Moreover, the effect of the Spin-off contemplated for Ferrari is identical to the result that would be achieved through a simple dividend in kind. As with a dividend in kind of NBNV shares, in the Spin-off, FCA shareholders would receive a pro-rata portion of the NBNV shares held by FCA following the IPO. Under Dutch law, a demerger is (i) the transfer of the whole or part of a company’s business or assets to one or more newly-formed or pre-existing companies, combined with (ii) the distribution of shares of the transferee company to the parent company’s shareholders. FCA has structured the Spin-off through the two demergers and the Merger described in the Registration Statement rather than as a US-style dividend in kind because a simple dividend of shares is not practicable for a Dutch public company as it would effectively require prior consent of each shareholder -- and even if practicable would be tax disadvantageous for shareholders in certain jurisdictions. A second demerger (which has the same attributes as the first demerger) has been included in the sequence of steps in order to mitigate certain Dutch law statutory liability risks for Ferrari and ensure that the allocation of liabilities as between the parent company and the distributed subsidiary respect the separateness of the legal entities in a manner that is again consistent with the treatment that would be accorded to a parent company and its subsidiary in a simple dividend in kind. The Merger completes the separation process to ensure that a single listed entity survives as the parent company of Ferrari – the same result that would be obtained through a dividend in kind of the Registrant’s shares directly to FCA shareholders. As outlined in greater detail

LONDON:517820.7

Securities and Exchange Commission | ||

September 22, 2015 | ||

- 4 - | ||

by the Registrant’s response to prior comment number 1, when taken together, the Spin-off is a distribution of shares meeting the requirements of SLB 4 because of the following factors:

• | The parent’s shareholders do not provide consideration for the spun-off shares: FCA’s shareholders will not provide any consideration for the spun-off shares of the Registrant; |

• | The spin-off is pro rata to the parent’s shareholders: The spin-off is pro-rata because FCA shareholders will have the same proportionate interest in FCA and the Registrant both before and after the demergers, as described in the Registration Statement; |

• | The parent provides adequate information about the spin-off and the subsidiary to its shareholders and to the trading markets: FCA intends to give its U.S. shareholders an information document describing the Spin-off and the Registrant that will substantially comply with Regulation 14A or Regulation 14C under the Exchange Act of 1934 (the “Exchange Act”). The Registration Statement includes information regarding NBNV and the Spin-off substantially similar to the information that would be required by Regulation 14A or 14C and a shareholders’ circular under Dutch law will be made available to FCA shareholders that will contain the relevant information regarding NBNV from the Registration Statement. Furthermore, the Form 8-A that will be filed to register the Registrant’s shares under the Exchange Act will incorporate all relevant information from the Registration Statement. Pursuant to the Merger described in the Registration Statement under the heading “The Restructuring and Separation Transaction”, common shares of FE New will be issued to the holders of common shares of the Registrant, which at that time will be registered under Section 12(b) of the Exchange Act and, therefore, the common shares of FE New will be deemed to be registered under Section 12(b) of the Exchange Act pursuant to Section 12g-3(a) under the Exchange Act; |

• | The parent has a valid business purpose for the spin-off: The spin-off has a valid business purpose, as described in the Registration Statement under the heading “The Restructuring and Separation Transaction”. |

(b) | The vote of FCA shareholders on the demerger does not involve a Rule 145 transaction |

As required by Dutch law, FCA shareholders will be asked to approve the first demerger forming part of the Spin-off, i.e., they will be asked to approve a transaction by which the shares of the Registrant held by FCA following the IPO will be transferred to FE Interim B.V. (“FE Interim”), a newly formed Dutch company, and the shares of FE Interim will be distributed pro rata to FCA shareholders. The FCA shareholders will not vote upon any other step of the Spin-off although appropriate disclosures regarding the Spin-off in its entirety will be provided to the FCA shareholders in connection with the

LONDON:517820.7

Securities and Exchange Commission | ||

September 22, 2015 | ||

- 5 - | ||

shareholders’ meeting at which they will be asked to approve the first demerger.

No other transaction forming part of the Spin-off will be submitted to the vote of the shareholders of FCA or shareholders of the Registrant following the IPO. For the reasons set forth below, the Registrant does not believe that submitting the first demerger to the vote of FCA shareholders should be viewed as involving an “offer to sell” or “sale” of securities within the meaning of Section 2(3) of the Securities Act thereby requiring registration pursuant to Rule 145 under the Securities Act.

The Preliminary Note to Rule 145 makes clear that the Rule was designed to provide the protections of registration under the Securities Act to persons who are making a new investment decision regarding a new or different security in connection with any of the business combinations enumerated in the Rule. Subparagraph (a) (3)(B) of Rule 145 lists as a business combination subject to the Rule a transaction in which there is submitted to a shareholders’ vote a plan for a transfer of assets of a corporation to another person in consideration of the issuance of securities of such other person, if the plan provides for a pro rata or similar distribution of such securities to the voting shareholders.

However, no new investment decision is required to be made by the holders of FCA’s shares or by holders of the Registrant’s shares following the IPO and prior to the separation; no sale of assets to an independent third party in the sense intended in Rule 145 will take place; and no “value” under Section 2(3) of the Securities Act is being given by the holders of FCA shares or the Registrant’s shares for the FE New shares.

As stated in numerous prior no-action letters and in SLB 4, shareholder consent to a spin-off does not constitute a new investment decision of the kind that Rule 145 was intended to address provided certain conditions are met. See, e.g., Kingfisher II (April 25, 2003), INA (October 27, 1998), British Gas (December 4, 1996), Hanson (August 29, 1996), Hafslund Nycomed AS (April 19, 1996), and English China Clays (September 1, 1994). In those letters, three reasons were cited as to why spin-offs do not require shareholders to make a new investment decision (i) each shareholder already indirectly owns the shares to be spun-off, (ii) the spin-off does not represent a fundamental change in any shareholder’s investment, and (iii) no shareholder will receive a new or different security for such shareholder’s existing security. These three reasons also apply to the Spin-off. Prior to the Spin-off, the FCA shareholders will hold their existing equity interest in the Ferrari business indirectly through their equity interest in FCA. Following the Spin-off, they will hold directly the same proportionate equity interest in the Ferrari business. Similarly, the Spin-off will not cause FCA shareholders to make a fundamental change in their investment, because it will result in such shareholders holding directly the same proportionate interest in Ferrari that they held indirectly before the Spin-off. Finally, the three-step transaction will not cause FCA shareholders to exchange new or different securities for their existing securities. Rather, they will receive a number of FE New shares in proportion to their FCA shares, which they will retain. SLB 4 indicates that a

LONDON:517820.7

Securities and Exchange Commission | ||

September 22, 2015 | ||

- 6 - | ||

spin-off is required to be registered when the shareholders of the parent are required to vote on the transfer of assets to a company partly held by third parties. No such vote or such transfer is required in the Spin-off.

(c) | No single step of the Spin-off requires registration. |

For the reasons explained above, the Spin-off is a single multi-step transaction. However, even if the steps of the Spin-off were considered in isolation, no such step would be required to be registered under the Securities Act.

The first demerger is a distribution of shares of a subsidiary to the shareholders of the parent meeting the conditions of SLB 4. FCA shareholders do not provide consideration for the shares of FE Interim, the distribution of FE Interim shares is pro-rata, adequate information is provided regarding the transaction and the transaction has a valid business purpose. FCA shareholders vote to approve the first demerger but, for the reasons set forth above, such vote does not subject the transaction to registration under the Securities Act.

Similarly, the second demerger is also a distribution of shares of a subsidiary to the shareholders of the parent meeting the conditions of SLB 4. FE Interim shareholders do not provide consideration for the shares of FE New, the distribution of FE New shares is pro-rata, adequate information is provided regarding the transaction and the transaction has a valid business purpose. The second demerger will be approved by FE Interim’s single shareholder prior to the time, upon effectiveness of the first demerger, when FE Interim will acquire public shareholders.

The Merger is not a Rule 145 transaction because, as noted by the Registrant in its prior letter to the Staff, the Merger will have been approved by all necessary corporate action of the Registrant prior to the offering, and therefore the Merger will not be submitted to the Registrant’s shareholders or any other public shareholders.

The Registrant respectfully advises the Staff that, based on the foregoing analysis, registration of the securities to be distributed to FCA shareholders in the Spin-off is not required under the Securities Act.

Summary, page 1

2. | We note your response to our prior comment 7, and reissue such comment in part. Please revise this section to provide a more balanced discussion of the historical success of Scuderia Ferrari to reflect recent racing results. For example, where you disclose that the team won 223 Grand Prix races, please disclose the time period during which you have measured such results. In addition, please disclose in this section or in the risk factor “Our brand image depends in part on the success of our Formula 1 racing team” more recent racing results of the team, or tell us why you do not believe that such information is material. In that regard, we note your |

LONDON:517820.7

Securities and Exchange Commission | ||

September 22, 2015 | ||

- 7 - | ||

disclosure on page 12 that the success of your racing team forms a large part of your brand identity.

Response:

In response to the Staff’s comment, the Registrant has revised the disclosure in the Amended Registration Statement. See pages 1, 12, 42, 87 and 108-109.

Tax Consequences, page 146

3. | You state on page 153 that the first demerger and second demerger “should” not be a taxable event for Dutch tax purposes with respect to a holder of Ferrari common shares and, if applicable, Ferrari special voting shares. Similarly, in the section “Material United States Federal Income Tax Consequences” you state on page 179 that the first demerger and second demerger “should” not be a taxable event with respect to holders of Ferrari common shares, and you describe the tax consequences of the merger that a U.S. holder of Ferrari common shares “should” have. Please revise to disclose why the tax consequences are subject to uncertainty, and include risk factor disclosure with respect to any related risks that are material. |

Response:

In response to the Staff’s comment, the Registrant has revised the disclosure in the Amended Registration Statement. See pages 29 and 154.

Audited Financial Statements for the Year Ended December 31, 2014

Statements of Cash Flows, page F-27

4. | We note from your response to our prior comment 29 that you do not consider that the deposits in the FCA cash management pools meet the definition of cash and cash equivalents pursuant to paragraph 7 of IAS 7 in part because your ability to receive the cash depends on FCA’s ability to pay at the relevant time. However, we also note from your disclosure on page F-59 that these are deposits in highly liquid money market instruments or bank deposits and it appears that you access these funds on a daily basis. In this regard, your disclosures in the filing appear to indicate that the amounts are consistent with the definition of cash and cash equivalents. Please advise or revise your disclosure to clearly indicate why they do not meet the criteria of cash and cash equivalents. |

Response:

In response to the Staff's comment, the Registrant respectfully advises the Staff that while FCA deposits the cash in highly liquid money market instruments or bank deposits, the use of FCA liquidity is at the discretion of and under the control of FCA and could be affected by FCA’s operational needs. Although the Registrant can access the cash on a daily basis, the practical ability to convert the entire amount held with FCA into cash is

LONDON:517820.7

Securities and Exchange Commission | ||

September 22, 2015 | ||

- 8 - | ||

subject to FCA’s liquidity requirements. Therefore, the Registrant determined that the deposits may not be readily convertible and accordingly, the Registrant does not believe that the deposits meet the requirements of IAS 7 paragraph 7 to be classified as cash and cash equivalents.

Furthermore, the arrangements for such deposits are expected to be terminated pursuant to the Separation and Restructuring, with the use of such deposits to repay the debt with FCA and partially repay the FCA Note. The Registrant believes the separate classification of the deposits with FCA from cash and cash equivalents is more appropriate in the circumstances, to allow the reader to more fully understand the financial position of the Group, also in view of the Separation and Restructuring. Additionally, the Registrant notes that appropriate disclosures of the composition of cash and cash equivalents were made on pages F-41 and F-59, pursuant to IAS 7 paragraph 46, such that the reader can clearly determine the nature of the Registrant’s cash and cash equivalent balances and its deposits with FCA Group cash management pools.

5. | We also note from your response that you believe these amounts should be considered a loan and receivable based on the definition in paragraph 9 of IAS 39. In this regard, we would expect if the amounts meet the definition of a loan or receivable, rather than cash and cash equivalents, the cash inflows and outflows would be presented on the statement of cash flows as investing activities in accordance with paragraph 16 of IAS 7. Please advise or revise accordingly. |

Response:

The Registrant respectfully submits that the Registrant considers that the deposits in FCA Group cash management pools are not held for investing purposes as their primary purpose is not to generate future income as required by IAS 7 paragraph 16. The Registrant has determined that the borrowings with FCA Group and the deposits in FCA Group cash management pools are similar in nature and should be considered as part of the capital structure of FCA in Ferrari. The Registrant notes that IAS 7 paragraph 6 defines financing activities as activities that result in changes in the size and composition of the contributed equity and borrowings of the entity.

As previously explained, the Registrant’s participation in the FCA Group’s cash management system and the debt facilities with the FCA Group will be terminated on completion of the Separation. Furthermore the net cash surplus from terminating such arrangements will be used to partially repay the FCA Note therefore, the deposits will effectively remain with the FCA Group.

The Registrant believes that the intercompany financing with FCA meets this criteria and therefore considering also that the facilities will be terminated believes that classifying both of these facilities as financing activities rather than investing activities provides clear and transparent disclosure which is supported by IAS 7 paragraph 6.

LONDON:517820.7

Securities and Exchange Commission | ||

September 22, 2015 | ||

- 9 - | ||

Note 1. Background and Basis of Presentation

6. | We note from your response to our prior comment 3 that you believe that retrospectively accounting for the capital reorganization is consistent with the guidance in ASC 805-50-30-5, paragraph 64 of IAS 33, and SAB Topic 4C. Please revise your disclosure in Note 1 to the financial statements to provide more detail supporting the basis for your accounting for this transaction. |

Response:

In response to the Staff’s comment, the Registrant has revised the disclosure in the Amended Registration Statement. See page F-33.

Note 2. Significant Accounting Policies

Revenue Recognition, page F-40

7. | We note from your response to our prior comment 30 that you have revised the notes to the financial statements to disclose that revenues are recorded net of discounts which include sales incentives and performance related bonuses. If material, please revise your discussion in MD&A to disclose the amount of these discounts. Also, please tell us the nature of the performance related bonuses that are netted against revenue and explain to us why you believe your accounting is appropriate and in accordance with IAS 18. |

Response:

The Registrant respectfully advises the Staff that it incentivizes its dealers for the sale of new cars using discounts which include sales incentives and performance based bonuses. In particular, the arrangements generally entitle the dealer to discounts mainly on the achievement of specified targets (including but not limited to the number of car units shipped by model, extent of personalization and marketing activities).

The discounts offered to dealers are recorded as a reduction of revenue at the time of the recognition of the related revenue, and subsequently monitored and settled either as a reduction of payments due from or as cash payments due to the dealer, on a monthly, quarterly or annual basis depending on dealer jurisdiction.

The Registrant notes that IAS 18 paragraph 9 states that revenue shall be measured at the fair value of the consideration received or receivable. IAS 18 paragraph 10 states that the fair value of the consideration received or receivable takes into account the amount of any trade discounts and volume rebates.

The Registrant believes that its accounting for revenue discounts complies with the requirements of IAS 18 as described above.

LONDON:517820.7

Securities and Exchange Commission | ||

September 22, 2015 | ||

- 10 - | ||

The Registrant advises the Staff that the revenue discounts referred to above represent less than five percent of consolidated gross revenues from the sale of cars and spare parts for each of the periods presented in the Amended Registration Statement and the structure and composition of such discounts has not materially changed, therefore the Registrant does not consider these discounts material for disclosure in the MD&A.

Segment Reporting, page F-42

8. | We note from your response to our prior comment 31 that the direct reports to your Chairman, identified as the CODM, are the CEO, the CFO, and the Managing Director of racing activities. We also note that these individuals are responsible for the revenue streams related to the sale of engines and brand revenues, financial services revenues, and sponsorship and commercial revenues and rental of engines, respectively. We also note that the Chief Marketing and Commercial Officer is responsible for the revenue stream related to cars and spare parts. Please tell us the type of financial information available related to each of these revenue streams (or lines of business) and tell us whether the individuals responsible for the revenue streams review or assess profitability related to their applicable revenue streams. If not, please tell us what role these individuals have related to these revenue streams and tell us if anyone reviews profitability or other financial information related to the revenue streams. Also, tell us how operating decisions related to these revenue streams are made. Please also address the following: |

• | Explain how budgets for the Ferrari business are prepared, who approves the budget at each step of the process, the level of detail discussed at each step, and the level at which each of the CEO and the Chairman makes changes to the budget; |

• | Separately describe the level of detail communicated to each of the CEO and the Chairman when the actual results differ from budgets and who is involved in meetings with the CODM to discuss budget-to-actual variances; |

• | Describe the basis for determining the compensation for each of the individuals that report to each of the CEO and the Chairman; |

• | Please clearly define the role and responsibilities of the Chief Executive Officer. Explain why you have decided to organize the business this way, including how you have allocated responsibilities for the operations between the Chairman and the CEO and why that is. Also, tell us if you expect the organization to change following the transaction; |

• | Please identify for us the CEO’s direct reports. Tell us the nature of all significant decisions the CEO has the power to make and tell us the type of information the CEO looks at to make those decisions; and |

LONDON:517820.7

Securities and Exchange Commission | ||

September 22, 2015 | ||

- 11 - | ||

• | Please list for us the key operating decisions that the company makes, the individuals involved in those decisions and the nature of the financial information reviewed to make those decisions. |

Response:

As a threshold matter, as set out in its response to the Staff’s previous comment, the Registrant respectfully advises the Staff that it has a single operating and a single reporting segment – it designs, manufactures and sells luxury performance cars; all activities of the Group are intended to further that single aim. The CODM reviews information on a consolidated basis in order to assess performance and allocate resources. The Registrant prepares its financial statements accordingly, in order to provide the users of its financial statements information presented on the same basis on which the CODM makes those decisions on behalf of the Group.

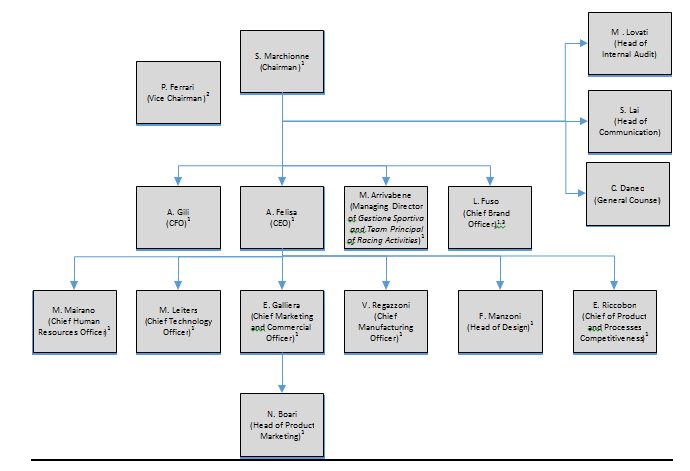

To provide the Staff with a framework for evaluating this issue and assessing the Registrant’s responses to the individual questions and information requests in comment no. 8, the Registrant believes it would be useful for the Staff to have a simple organizational chart that sets out both the management functions and the responsible individuals. Set out below is a chart representing the Registrant’s management organizational structure, including direct reporting lines. Members of the Registrant’s Group Executive Council (“GEC”) described in the Registrant’s prior letter to the Staff are identified by footnote 1.

1. | GEC members |

2. | Invited to all GEC meetings as guest. |

3. | Mr. Luca Fuso joined the group on September 7, 2015. |

LONDON:517820.7

Securities and Exchange Commission | ||

September 22, 2015 | ||

- 12 - | ||

The remainder of this response addresses the Staff’s specific inquiries. In order to facilitate the Staff’s review of the individual responses we have set out the specific bullet points in the comment followed by a response to that particular comment.

Please tell us the type of financial information available related to each of these revenue streams (or lines of business) and tell us whether the individuals responsible for the revenue streams review or assess profitability related to their applicable revenue streams. If not, please tell us what role these individuals have related to these revenue streams and tell us if anyone reviews profitability or other financial information related to the revenue streams. Also, tell us how operating decisions related to these revenue streams are made.

The Registrant respectfully advises the Staff that the financial information available to each of the individuals responsible for the revenue streams includes principally the revenue-related information that is summarized in the following table:

Revenue classification | Revenue stream | Responsible person | Position | Type of financial information available to person responsible for revenue stream |

Cars and spare parts | Cars | Mr. Galliera | Chief Marketing and Commercial Officer | Sales of cars in Euro (and invoicing currency) and units by model, geographic hub and market |

Spare parts | Mr. Galliera | Chief Marketing and Commercial Officer | Sales of parts in Euro (and invoicing currency) by market | |

Engines | Sale of engines to Maserati | Mr. Felisa | Chief Executive Officer | Sales in Euro and units by engine type |

Rental of engines to other Formula 1 racing teams | Mr. Arrivabene | Managing Director of Gestione Sportiva and Team Principal of Racing Activities | Rental revenues in Euro (and invoicing currency) by contract | |

Sponsorship, commercial and brand | Sponsorship | Mr. Arrivabene | Managing Director of Gestione Sportiva and Team Principal of Racing Activities | Sponsorship revenues in Euro by contract |

Commercial | Mr. Arrivabene | Managing Director of Gestione Sportiva and Team Principal of Racing Activities | Commercial revenues in USD by contract | |

Brand | Mr. Fuso* | Chief Brand Officer | Licensing revenues in Euro by contract Retail stores revenues in Euro (and invoicing currency) - analyzed (i) between directly operated and franchised stores and (ii) by store E-commerce revenues in Euro by product Theme park licensing revenues by contract | |

Other | Mugello race track | Mr. Arrivabene | Managing Director of Gestione Sportiva and Team Principal of Racing Activities | Revenues in Euro by event |

Financial services | Mr. Gili | Chief Financial Officer | Revenues in Euro by legal entity | |

* | Mr. Luca Fuso was appointed as the Chief Brand Officer on September 7, 2015. Prior to his appointment, the brand revenue stream was under the responsibility of Mr. Felisa. |

The individuals responsible for the revenue streams also receive certain information on direct costs that are related to the revenue streams for which they are responsible.

Direct cost information available to the individuals responsible for the various revenue streams relates principally to different costs by nature rather than the

LONDON:517820.7

Securities and Exchange Commission | ||

September 22, 2015 | ||

- 13 - | ||

particular revenue stream, and therefore it does not necessarily correspond to the various revenue streams. The cost information generally available for each type of activity is summarized in the table below:

Type of Activity | Available Direct Cost Information |

Sales and Commercial | Selling expenses, marketing costs, direct labor costs |

Manufacturing | Direct materials, direct labor costs, utilities |

Engineering | R&D costs, labor costs |

Design | Labor costs, external consultancy fees |

ICT | Labor costs, consultancy fees |

Brand | Selling expenses, labor costs |

Racing | R&D costs, general expenses, labor costs |

The individuals responsible for the revenue streams identified above have direct access to various operating metrics from the Group’s reports in order to readily identify issues or trends as they arise and facilitate consultation at GEC meetings if necessary in order to plan and execute appropriate remediation actions. The Registrant respectfully advises the Staff that profit and loss information by revenue stream or any other disaggregated basis is not prepared by the Registrant and therefore is not reviewed by the individuals responsible for each revenue stream or any other individual within the organisation. As indicated above, the individuals responsible for the revenue streams are only responsible for certain direct costs attributable to their revenue streams and have no visibility or influence with respect to any remaining direct and indirect costs associated with the revenue stream. The direct cost information available to those individuals allows them to monitor and manage certain controllable costs for which they are functionally responsible. While the information may enable the individuals to make certain estimates of partial performance measures with respect to one or more revenue streams, the Registrant believes that those partial performance measures are of limited use and are not intended to be used to make operating or resource allocation decisions. Moreover, the individuals are not assessed on the basis of those estimates or the underlying information, which is not provided to enable them to monitor any disaggregated measure of profitability and would not be adequate or sufficient for that purpose.

For example, Mr. Galliera, who is responsible for cars and spare parts revenue streams, monitors the headcount and compensation of personnel in the commercial team across geographic areas. He is not, however, responsible for nor does he manage or have visibility into the costs associated with the production of cars and spare parts, which are instead under the functional responsibility of the Chief Manufacturing Officer, Mr. Regazzoni. Similarly, Mr. Galliera does not manage or review the costs incurred in the design of new models, which are under the responsibility of the Head of Design, Mr.

LONDON:517820.7

Securities and Exchange Commission | ||

September 22, 2015 | ||

- 14 - | ||

Manzoni. The information that Mr. Galliera monitors does not have the purpose and would not be sufficient to evaluate the profitability of the revenue stream for which he is responsible.

The Group’s management is organized by function (as illustrated in the management organizational chart above) to support the Group’s core operations and complementary activities, all of which are aimed at directly or indirectly facilitating the sale of luxury cars, whether by improving the engineering and design of the cars, generating enthusiasm for luxury performance cars or promoting the image of the Ferrari brand—all of which is done in order to stimulate demand for Ferrari cars. The Group’s functions are linked to a number of activities and are therefore interdependent; for example the technology developed for the Formula 1 vehicles is also utilized in activities related to cars and engines. Therefore, for example the costs related to the Research and Development function cannot be seen as directly attributable to any one revenue stream. As the Group is organized by function, the Registrant does not believe that profit measures by revenue stream would be meaningful to management or the Chairman (who has been identified as the CODM as explained in the Registrant’s response to prior comment 31) due to the interdependency of the Group’s activities and therefore does not regularly prepare such information and does not use such information for purposes of resources allocation. Therefore the information with respect to overall costs and profitability is prepared, monitored and reviewed on a consolidated level only.

The CFO has access to data from which he is able to derive overall direct and indirect costs relating to different revenue streams. The CFO uses information to assess whether the business as a whole is performing in line with historical experience and the consolidated budget discussed and approved by the CODM and to determine among other things whether any variances are attributable to operational or control issues. This information is not, however, reported to the CODM or other members of the GEC nor is it used for resource allocation purposes.

With respect to the questions regarding the roles of the individuals responsible for the revenue streams and regarding how operating decisions related to the revenue streams are made, the Registrant respectfully advises the Staff that the role of the individuals responsible for each of the revenue streams is to manage their respective revenue streams and their respective operational metrics including the origination and performance of contracts to ensure that the commercial operations of the Group are carried out as defined by the CODM in the business plan and strategy of the Company. However, most significant operating decisions related to such revenue streams have not been delegated to these individuals. For example, all contracts above €10 million must be reviewed by the GEC and approved by the Chairman, even if they are included within the categories of costs for which the individual has visibility and responsibility.

• | Explain how budgets for the Ferrari business are prepared, who approves the budget at each step of the process, the level of detail |

LONDON:517820.7

Securities and Exchange Commission | ||

September 22, 2015 | ||

- 15 - | ||

discussed at each step, and the level at which each of the CEO and the Chairman makes changes to the budget;

The budget is prepared annually and updated forecasts are prepared three times per year at the end of the first, second and third quarters of the year. In addition, a five year business plan is prepared annually. The budget and the updated forecasts are developed using a combination of a top down and bottom up process as described below:

• | The CODM reviews the operating plans and establishes operating and financial targets for the Group as a whole. The operating targets include several specific KPIs across the business such as car shipments, car production volumes, engine volumes, ranking of the Formula 1 Team and number of stores. All financial targets included in the budget such as Adjusted EBITDA, Net Cash and Free Cash Flow are applicable to the Group on a consolidated basis -- no profitability targets are set for individual activities; |

• | The CEO and other executives on the GEC meet in order to implement within the budget the assumptions, strategies and targets established by the CODM. One of the initial inputs to the budget is the Piano Gamma Prodotto (long range plan ”LRP” or “PGP”), which establishes the volumes of each model and the strategic decisions relating to model launches and phase out of older models. A commercial plan is then developed based on the PGP, allocating commercial targets to the individual regions, taking into consideration, among other things, price positioning. The PGP is also used by the manufacturing department to determine production volumes (which drives production hours and therefore level of production headcounts) and by the technology (R&D) department in order to estimate the development activities necessary to meet the demands of the budget, including the planned research and development internal and external resources . A similar process is applicable to the other revenue streams and functional units of the Company; |

• | the finance team coordinates all steps of the budgeting process and provides a final structured document for discussion at a meeting of the GEC; this document presents all budget items on a consolidated basis using the same level of detail as in the Ferrari Results Report described in the Registrant’s prior letter to the Staff; |

• | The key assumptions of the budget are presented by the CODM at the GEC meeting. This presentation, which is consistent with the budget and the Ferrari Results Report, is prepared and discussed on a consolidated basis, with no disaggregated financial information. Once the CODM is satisfied that the budget is consistent with the strategic and financial objectives for the Group as set in the Group’s five year business plan, it is then submitted to the Board of Directors for discussion and final approval. |

LONDON:517820.7

Securities and Exchange Commission | ||

September 22, 2015 | ||

- 16 - | ||

• | the consolidated budget is approved by the Board of Directors and there are no formal approvals associated with any of the individual inputs used in building the budget at the various steps of the process; |

• | the process described above is followed for any subsequent revision to the budget and therefore only the CODM is empowered to modify the budget; |

• | The CEO has input into the budget as part of the bottom up process and review by the executive members; however, he does not have the authority to define or change the guidelines or strategy. |

• | Separately describe the level of detail communicated to each of the CEO and the Chairman when the actual results differ from budgets and who is involved in meetings with the CODM to discuss budget-to-actual variances; |

Budget to actual variances are prepared on a monthly basis and reviewed by the CFO. Budget to actual variance analysis are reviewed on a consolidated basis at GEC meetings at least 3 times per year. The CODM and the GEC receive a report, prepared by the CFO, which analyses variances on budget (or yearly forecasts) to actual. The analysis included in the report is presented using the same granularity of information communicated in the Ferrari Results Report. Therefore, cost variances are analyzed on a consolidated basis while net revenue variances are analyzed by revenue stream. The budget (or yearly forecasts) to actual financial variances are analyzed using the same granularity of information as provided in the Ferrari Results report. In addition to monitoring financial results, the KPIs established in the budget (or yearly forecasts) are monitored to ensure that the business is performing according to expectations e.g., with respect to the number of new store openings, new theme park openings, shipments by model/region.

• | Describe the basis for determining the compensation for each of the individuals that report to each of the CEO and the Chairman; |

The individual GEC members are identified by footnote 1 in the organizational charts set out at the beginning of this response. The variable remuneration for GEC members is determined based on consolidated company-wide performance metrics, which are: (i) Adjusted EBITDA and (ii) Free Cash Flow, each as defined in the Amended Registration Statement. GEC members are also remunerated based on individual specific operating objectives, none of which is based on profitability of a separate business unit; for example, the Managing Director of Racing Activities has a portion of variable compensation based upon the number of Formula 1 racing wins; the Chief Sales and Marketing Officer is measured on improvements in dealer network quality (measured through dealers’ financial health and customer satisfaction surveys); the Head of Design is measured on whether design-related project milestones within the product development process are reached on time and within the assigned budgeted hours. Furthermore, the Registrant also is considering the adoption of a Group-wide long-term incentive plan which is based on the achievement of consolidated profit metrics. The

LONDON:517820.7

Securities and Exchange Commission | ||

September 22, 2015 | ||

- 17 - | ||

Registrant believes that incentivizing employees based on consolidated metrics helps to focus the individuals on executing the CODM’s guidelines for the Group as a whole, further evidencing the interdependent nature of the Registrant’s various activities.

• | Please clearly define the role and responsibilities of the Chief Executive Officer. Explain why you have decided to organize the business this way, including how you have allocated responsibilities for the operations between the Chairman and the CEO and why that is. Also, tell us if you expect the organization to change following the transaction; |

• | Please identify for us the CEO’s direct reports. Tell us the nature of all significant decisions the CEO has the power to make and tell us the type of information the CEO looks at to make those decisions; and |

• | Please list for us the key operating decisions that the company makes, the individuals involved in those decisions and the nature of the financial information reviewed to make those decisions. |

The CEO’s responsibilities are focused on the design, engineering, production and development of cars and development and implementation of new technologies and products, including the Group’s product portfolio. His responsibilities also include commercial performance related to the sale of cars. With over 40 years of experience in the design and production of high performance and luxury cars, the CEO has extensive product, engineering and technological competencies which he uses to ensure that the Company is executing against the operational targets established by the CODM. The direct reports of the CEO are identified in the organizational chart above.

All significant operating and financial decisions are under the authority of the Chairman, who has been designated as the CODM, following consultation with the GEC. The Chairman has extensive financial, legal and complex business management competencies. While the Chairman, as a matter of practice consults with the members of the GEC, including the CEO, on significant operating decisions, he is solely empowered to make decisions on his own authority. The Chairman, rather than the CEO, also has direct responsibility for the various functional areas of the Group , including legal, finance, communications and the brand and racing activities, which as described in the Amended Registration Statement are the focus of the Registrant’s marketing and promotional efforts.

The Company has organized its management in this way in order to enable the Chairman and the CEO to focus on their respective key competencies, and best serve the interests of the Group and its shareholders. The Registrant does not expect the organizational structure to change as a result of becoming a public entity or as a result of the Separation.

All significant decisions including resource allocations are made by the CODM, following consultation with the GEC. In this respect, the CEO is able to solicit and discuss reasons for supporting or rejecting key operating

LONDON:517820.7

Securities and Exchange Commission | ||

September 22, 2015 | ||

- 18 - | ||

decisions at the GEC meetings, in the presence of the GEC members; however, the ultimate decisions rests with the CODM. The following matrix illustrates the key operational decisions the Company makes and the financial information which is reviewed by the GEC as part of the broader business case to support the CODM in making his decisions.

Type of decision | Financial information reviewed by the GEC | ||

1 | All product investment initiatives(a) | Expected capital expenditure Expected research and development investment | |

2 | All multiannual investments(b) | The net present value of the investment | |

3 | All investments in properties | The value of the property | |

4 | All company restructurings or re-organizations | Expected costs related to the restructuring or reorganization | |

5 | All spending authorizations above €10 million | Contracts and cost detail analysis | |

6 | Additional costs related to items 1-5 above which exceeds 10% of the original approved amount | ||

7 | Any deviation to standard company policy related to pricing, purchasing, financing, exceptions to the general terms and conditions of purchase, communication, investments, recruiting, restructuring, product planning, contract management, organization, environment, quality and safety | No financial information is reviewed in order to make such decisions. Instead the individual circumstances are evaluated based on a qualitative discussion of why such deviation should be permitted. | |

(a) product initiative approval requires the definition of some key operational and financial metrics such as volumes, prices, direct costs (materials, labor, warranties, selling expenses, labor costs) (b) multiannual investment can be for example related to the opening of a new direct retail store; in this case the approval requires the definition of the location, rental costs (display space), personnel costs (direct selling expenses) | |||

IFRS 8 paragraph 5 defines operating segments as “a component of an entity:

(a) that engages in business activities from which it may earn revenues and incur expenses (including revenues and expenses relating to transactions with other components of the same entity),

(b) whose operating results are regularly reviewed by the entity’s chief operating decision maker to make decisions about resources to be allocated to the segment and assess its performance, and

(c) for which discrete financial information is available.”

Based on the above analysis, the information provided in the Registrant’s response to prior comment 31 and consistent with the principles of IFRS 8, the Registrant respectfully advises the Staff that it has a single operating and a single reporting segment and prepares its financial statements accordingly, in order to provide the readers of the financial statements with information presented on the same basis on which the CODM allocates resources and assesses performance across the Group.

* * * * * |

LONDON:517820.7

Securities and Exchange Commission | ||

September 22, 2015 | ||

- 19 - | ||

The Registrant appreciates very much the Staff’s prompt and helpful review of the Registration Statement and its continued cooperation in the Registrant’s efforts to complete the proposed initial public offering on its schedule. The Registrant anticipates setting a price range in consultation with the representatives of the underwriters at the end of September and providing price range information to the Staff at that time with a view to printing preliminary prospectuses beginning October 2, 2015 and commencing marketing the offering on October 5, 2015. Any questions or comments with respect to the responses may be communicated to the undersigned (tel: 212-558-3109 or email: millersc@sullcrom.com). Please send copies of any correspondence relating to this filing to me by email and facsimile (212-291-9101) with the original by mail c/o Sullivan & Cromwell LLP, 125 Broad Street, New York, New York 10004.

Very truly yours, |

/s/ Scott D. Miller |

Scott D. Miller |

cc: | Sonia Bednarowski |

Claire Erlanger | |

Melissa Raminpour | |

(Securities and Exchange Commission) | |

Alessandro Gili | |

Carlo Daneo | |

(New Business Netherlands N.V.) | |

Richard K. Palmer | |

Giorgio Fossati | |

(Fiat Chrysler Automobiles N.V.) | |

LONDON:517820.7