Filed Pursuant to Rule 424(b)(3)

Registration No. 333-206017

CNL HEALTHCARE PROPERTIES II, INC.

STICKER SUPPLEMENT NO. 1 DATED MARCH 15, 2018

TO THE PROSPECTUS DATED APRIL 26, 2017

This sticker supplement no. 1 is part of, and should be read in conjunction with, our prospectus dated April 26, 2017. This sticker supplement replaces all prior sticker supplements to the prospectus. Unless otherwise defined herein, capitalized terms used in this sticker supplement have the same meanings as prescribed to them in the prospectus.

The purpose of this sticker supplement is to disclose:

| • | the status of the offering; |

| • | updated information regarding the duration of this offering; |

| • | updated information regarding escrow; |

| • | an updated estimated net asset value (“NAV”) per share and offering prices for our shares; |

| • | information regarding our distribution reinvestment plan; |

| • | information regarding our share redemption plan; |

| • | updates to the net proceeds table; |

| • | updates to the estimated use of proceeds; |

| • | updates to the management compensation disclosure; |

| • | updates to the plan of distribution; |

| • | updated information regarding certain U.S. federal income tax considerations; |

| • | updates to our management; |

| • | updates to the cover page; |

| • | updates to our risk factors; |

| • | updated information regarding our distribution policy; |

| • | updated information with respect to our real properties and borrowings; |

| • | selected information regarding our operations; |

| • | information regarding fees and expenses payable to our advisor, our dealer manager and their affiliates; |

| • | updated experts information; |

| • | “Management’s Discussion and Analysis of Financial Condition and Results of Operations” similar to that filed in our Annual Report on Form 10-K for the fiscal year ended December 31, 2017; |

| • | updated quantitative and qualitative disclosures about market risk; and |

| • | our consolidated financial statements and the notes thereto as of and for the year ended December 31, 2017. |

Status of the Offering

We commenced this offering of up to $2,000,000,000 in shares of Class A, Class T or Class I common stock on March 2, 2016. On July 11, 2016, we broke escrow through the sale of 250,000 Class A shares to our advisor for $2.5 million. As described in the prospectus, we do not pay selling commissions or dealer manager fees in connection with the sale of Class A shares to our advisor. As of August 25, 2017, we had received gross offering proceeds of approximately $20.1 million, which is sufficient to satisfy the minimum offering amounts in all states where we are conducting this offering except Pennsylvania, which has a minimum offering amount of $87.5 million. As of March 14, 2018, we had accepted aggregate gross offering proceeds of approximately $37.0 million in the primary offering and $0.6 million in the distribution reinvestment plan.

Except with respect to subscriptions from Pennsylvania, subscribers should make their checks payable to “CNL Healthcare Properties II, Inc.” Until we have raised $87.5 million Pennsylvania investors should continue to make their checks payable to “UMB Bank, N.A., Escrow Agent for CNL Healthcare Properties II, Inc.”

Duration of the Offering

On December 21, 2017, our board of directors extended this primary initial public offering for an additional one-year period. Accordingly, we will continue to offer shares of our common stock on a continuous basis until the earlier of the date on which the maximum offering amount has been sold, or March 2, 2019, unless extended in accordance with applicable securities laws.

Updated Information Regarding Escrow

The following disclosure replaces the similar disclosure in the section of the prospectus entitled “How to Subscribe” and all related disclosure throughout the prospectus.

| • | Except with respect to subscriptions from Pennsylvania investors, deliver your check payable to “CNL Healthcare Properties II, Inc.” for the full purchase price of the shares of our common stock being subscribed for, along with a completed, executed subscription agreement to your participating broker-dealer. |

| • | Pennsylvania investors should make checks payable to “UMB Bank, N.A., Escrow Agent for CNL Healthcare Properties II, Inc.” until such time as we have raised $87,500,000 in subscription proceeds, and the funds are released from escrow. At that time, we will notify our dealer manager and participating brokers and ask that checks thereafter be made payable to “CNL Healthcare Properties II, Inc.” See “Plan of Distribution—The Offering” and “Plan of Distribution—Subscription Procedures.” |

The following disclosure replaces the fifth paragraph in the section of the prospectus entitled “Plan of Distribution—The Offering” and all related disclosure throughout the prospectus.

This offering commenced on March 2, 2016. On July 11, 2016, we broke escrow through the sale of 250,000 Class A shares to our advisor for $2.5 million. As of August 25, 2017, we had received gross offering proceeds of approximately $20.1 million, which is sufficient to satisfy the minimum offering amounts in all states where we are conducting this offering except Pennsylvania, which has a minimum offering amount of $87.5 million. Subscription funds from Pennsylvania investors will be held in escrow until we sell $87.5 million in shares of common stock. The offering proceeds from Pennsylvania investors will be held in an interest bearing escrow account at the escrow agent, UMB Bank, N.A., until we meet the minimum offering requirement. Thereafter, the offering proceeds will be released to us and will be available for investment or the payment of fees and expenses as soon as we accept your subscription agreement. We generally intend to admit stockholders on a daily basis. Subject to certain exceptions, you must initially invest at least $5,000 in shares of our common stock. We may continue to offer shares of our common stock until the earlier of the date on which the maximum offering amount has been sold, or March 2, 2018, unless extended for an additional period in accordance with Commission rules. However, in certain states the offering may continue for just one year unless we renew the offering period. We reserve the right to terminate this offering at any time.

The following disclosure replaces the similar disclosure in the second paragraph in the section of the prospectus entitled “Plan of Distribution—Subscription Procedures” and all related disclosure throughout the prospectus.

Checks may be made payable to “CNL Healthcare Properties II, Inc.,” except for Pennsylvania investors. Pennsylvania investors should make checks payable to “UMB Bank, N.A., Escrow Agent for CNL Healthcare Properties II, Inc.” until we have accepted subscriptions for shares totaling at least $87,500,000. Completed subscription agreements from Pennsylvania investors and the subscribers’ checks will be sent directly to the transfer agent by the participating brokers, and our transfer agent will deliver such checks to the escrow agent no later than the close of business on the day that the transfer agent receives the checks.

The following disclosure replaces the similar disclosure in the third paragraph in the section of the prospectus entitled “Plan of Distribution—Subscription Procedures” and all related disclosure throughout the prospectus.

If the subscription documents from Pennsylvania investors are found to be in good order, then the investor’s funds will remain in escrow pending our receipt and acceptance of subscriptions for the minimum

2

offering amount. If the subscription documents are rejected for any reason, we will instruct the escrow agent to promptly issue a refund payment payable to the subscriber to be transmitted to our transfer agent for return to the subscriber.

Determination of Estimated Net Asset Value per Share and Offering Prices

On March 14, 2018, our board of directors unanimously approved $10.06 as the estimated NAV per share of each class of our common stock outstanding as of December 31, 2017, based on the estimated value of our assets less the estimated value of our liabilities, divided by 3,074,396 shares issued and outstanding as of December 31, 2017, including restricted shares to our advisor. There have been no material changes between December 31, 2017 and the date of this supplement that would impact the overall estimated NAV per share. Also, on March 14, 2018, our board of directors unanimously approved offering prices for each class of shares of our common stock to be sold in our public offering based on the estimated NAV per share for each class plus applicable upfront selling commissions and dealer manager fees, effective after the close of business on March 15, 2018. Accordingly, the offering prices will be $10.99, $10.56 and $10.06 per share for the purchase of Class A, Class T and Class I shares of our common stock, respectively, (the “Offering Prices”) in our ongoing primary public offering.

In establishing the estimated NAV, our board of directors engaged an independent investment banking firm that specializes in providing real estate financial services, CBRE Capital Advisors, Inc. (“CBRE Cap”), to provide (i) property-level and aggregate valuation analyses of the company, (ii) a range for the estimated NAV per share for each class of shares of our common stock; and (iii) consideration of other information provided by our advisor.

Background

In February 2018, our board of directors initiated a process to update our estimated NAV to (i) provide existing investors and broker-dealers with increased transparency and an estimated value of our shares based on the value of our current portfolio as of December 31, 2017; and (ii) furnish potential new investors and broker-dealers with updated information regarding our performance and assets to enhance a better understanding of us. The valuation committee of our board of directors (the “Valuation Committee”), comprised solely of independent directors, was charged with oversight of the valuation process, including review and approval of the valuation process and methodology, the consistency of the valuation methodology with real estate industry standards and practices, and the reasonableness of the assumptions utilized in the valuation. On the recommendation of the Valuation Committee and the approval of our board of directors, we engaged CBRE Cap as our independent valuation expert.

From CBRE Cap’s engagement through the issuance of its valuation report as of March 14, 2018, (the “Valuation Report”), CBRE Cap held discussions with our advisor and conducted or commissioned such appraisals, investigations, research, review and analyses as it deemed necessary. The Valuation Committee, upon its receipt and review of the Valuation Report, concluded that the range of $9.71 and $10.40 for our estimated NAV per share for each class of our common stock proposed in CBRE Cap’s Valuation Report was reasonable, and recommended to our board of directors that it adopt $10.06 as the estimated NAV per share of each class of our common stock, which value falls within the range determined by CBRE Cap in its Valuation Report. At a special meeting of our board of directors held on March 14, 2018, our board of directors accepted the recommendation of the Valuation Committee and approved $10.06, which is the midpoint of the range, as the estimated NAV per share of each class of our common stock as of December 31, 2017, exclusive of any portfolio premium or discount. Our board of directors also approved the Offering Prices for each class of shares of our common stock to be sold in our ongoing Primary Offering of $10.99 per share for Class A shares, $10.56 per share for Class T shares and $10.06 per share for Class I shares, based on the estimated NAV per share for each class of our common stock plus applicable upfront selling commissions and dealer manager fees, effective after close of business on March 15, 2018. CBRE Cap is not responsible for the estimated value per share approved by our board of directors and did not participate in the determination of the Offering Prices for each class of shares of our common stock.

Valuation Methodologies

In preparing the Valuation Report, CBRE Cap, among other things:

| • | reviewed financial and operating information requested from or provided by our advisor; |

3

| • | reviewed and discussed with our senior management and our advisor the historical and anticipated future financial performance of our properties, including forecasts prepared by our advisor; |

| • | commissioned restricted use appraisals which contained analysis on our real property assets (the “MAI Appraisals”) and performed analyses and studies for the properties; |

| • | conducted or reviewed CBRE Cap proprietary research, including market and sector capitalization rate surveys; |

| • | reviewed third-party research, including Wall Street equity reports and online data providers; |

| • | compared our financial information to similar information of companies that CBRE Cap deemed to be comparable; |

| • | reviewed our reports filed with the U.S. Securities and Exchange Commission; and |

| • | reviewed the unaudited financial statements for the period ended December 31, 2017. |

The MAI Appraisals were performed in accordance with Uniform Standards of Professional Appraisal Practice (“USPAP”). The MAI Appraisals were commissioned by CBRE Cap from CBRE Valuation and Advisory Services, a CBRE affiliate that conducts appraisals and valuations of real properties. The MAI Appraisals were prepared by personnel who are members of the Appraisal Institute and have the Member of Appraisal Institute (“MAI”) designations. CBRE Appraisal Group is not responsible for the estimated value per share approved by our board of directors and did not participate in the determination of the Offering Prices for each class of shares of our common stock.

As of December 31, 2017, we owned two real estate investments consisting of a seniors housing community in Pensacola, Florida and a medical office building in Overland Park, Kansas.

Our real estate properties were classified as wholly owned operating assets in the Valuation Report. Our board of directors considered the following valuation methodologies with respect to such asset class, which were applied by CBRE Cap and summarized in its Valuation Report:

Operating Assets. Unlevered, ten-year discounted cash flow analysis from MAI Appraisals were created for our wholly owned, fully operational properties. The “terminal capitalization rate” method was used to calculate terminal value of the assets, with such rate based on the specific geographic location of the assets and other relevant factors.

Debt. Our debt from our December 31, 2017 balance sheet, with certain adjustments related to amortized loan costs, was reviewed for reasonableness by CBRE Cap and utilized in its Valuation Report.

Valuation Summary; Material Assumptions

The valuation process used by us to determine an estimated NAV was designed generally in accordance with certain recommendations of the Investment Program Association, a trade association for non-listed direct investment vehicles (the “IPA”), in the Practice Guideline 2013-01, Valuations of Publicly Registered Non-Listed REITs, issued by the IPA in April, 2013.

The following table summarizes the key assumptions that were employed by CBRE Cap in the discounted cash flow model to estimate the value of our operating assets as of December 31, 2017.

| TABLE OF MAJOR INPUTS |

||||

| Assumptions |

December 31, 2017 Amount / Range |

|||

| Discount rates |

||||

| Wholly Owned Properties |

||||

| Senior Housing |

8.71% - 8.29% | |||

| Medical Office |

6.92% - 6.58% | |||

| Terminal capitalization rates |

||||

| Wholly Owned Properties |

||||

| Senior Housing |

7.69% - 7.31% | |||

| Medical Office |

6.41% - 6.09% | |||

4

In its Valuation Report, CBRE Cap included an estimate of the December 31, 2017 value of our assets, including cash and other assets net of payables, accruals and other liabilities. Such values were derived from our adjusted balance sheet as of December 31, 2017.

In its Valuation Report, CBRE Cap estimated the value of our real estate portfolio to be in the range of $37.8 million to $39.9 million and our NAV to range from between $29.8 million and $32.0 million, or between $9.71 and $10.40 per share, based on a share count of 3,074,396 shares issued and outstanding as of December 31, 2017, including restricted shares to our advisor.

The valuation range was calculated by varying the discount rates and terminal capitalization rates by 2.5% in either direction, which represents a 5% sensitivity. CBRE Cap set the range at a weighted average of approximately 39 basis points on the discount rate and approximately 35 basis points on the terminal capitalization rate. The terminal capitalization rates were used to calculate the terminal value of the assets and were sourced from MAI Appraisals, which were based on location, asset quality and supply and demand metrics.

Taking into consideration the reasonableness of the valuation methodologies, assumptions and estimated range of values contained in CBRE Cap’s Valuation Report, the Valuation Committee recommended that our board of directors approve $10.06 as the estimated NAV per share and our board of directors ultimately approved $10.06 as the estimated NAV per share of each class of our common stock. As with any valuation methodology, the methodologies considered by the Valuation Committee and our board of directors, in reaching an estimate of the value of our shares, are based upon all of the foregoing estimates, assumptions, judgments and opinions that may, or may not, prove to be correct. The use of different estimates, assumptions, judgments or opinions may have resulted in significantly different estimates of the value of our shares.

The following table summarizes the material components of our estimated NAV as of December 31, 2017 compared to those as of June 30, 2017:

Table of Value Estimates for Components of Net Asset Value

| Value as of 12/31/17 ($ in 000’s) |

Value as of 12/31/17 Per Share (1) |

Value as of 6/30/17 ($ in 000’s) |

Value as of 6/30/17 Per Share (2) |

|||||||||||||

| Present value of wholly owned operating asset(s) |

$ | 38,880 | $ | 12.65 | $ | 23,600 | $ | 14.44 | ||||||||

| Cash and cash equivalents |

12,422 | 4.04 | 9,525 | 5.82 | ||||||||||||

| Other assets |

189 | 0.06 | 196 | 0.12 | ||||||||||||

| Wholly-owned debt outstanding |

(19,813 | ) | (6.44 | ) | (16,363 | ) | (10.01 | ) | ||||||||

| Accounts payable and other accrued expenses |

(478 | ) | (0.16 | ) | (480 | ) | (0.29 | ) | ||||||||

| Other liabilities |

(287 | ) | (0.09 | ) | (121 | ) | (0.08 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net asset value |

$ | 30,914 | $ | 10.06 | $ | 16,358 | $ | 10.00 | ||||||||

| (1) | Based on approximately 3.07 million shares outstanding as of December 31, 2017. |

| (2) | Based on approximately 1.63 million shares outstanding as of June 30, 2017. |

Additional Information Regarding the Valuation, Limitations of Estimated Share Value and the Engagement of CBRE Cap

Throughout the valuation process, the Valuation Committee, our advisor and senior members of management reviewed, confirmed and approved the processes and methodologies and their consistency with real estate industry standards and best practices.

CBRE Cap’s Valuation Report was based upon market, economic, financial and other information, circumstances and conditions existing prior to December 31, 2017, and any material change in such information, circumstances and/or conditions may have a material effect on our estimated NAV. CBRE Cap’s valuation materials were addressed solely to our board of directors to assist it in establishing an estimated value of each class of our common stock. CBRE Cap’s valuation materials were not addressed to the public and should not be relied upon by any other person to establish an estimated value of each class of our common stock. CBRE Cap’s Valuation Report does not constitute a recommendation by CBRE Cap to purchase or sell any shares of our common stock.

5

In connection with its review, while CBRE Cap reviewed for reasonableness the information supplied or otherwise made available to it by us or our advisor, CBRE Cap assumed and relied upon the accuracy and completeness of all such information and of all information supplied or otherwise made available to it by any other party, and did not undertake any duty or responsibility to verify independently any of such information. With respect to financial forecasts and other information and data provided to or otherwise reviewed by or discussed with CBRE Cap, CBRE Cap assumed that such forecasts and other information and data were reasonably prepared in good faith on bases reflecting the best currently available estimates and judgments of our management, and relied upon us to advise CBRE Cap promptly if any information previously provided became inaccurate or was required to be updated during the period of its review. In preparing its valuation materials, CBRE Cap did not, and was not requested to, solicit third party indications of interest for us in connection with possible purchases of our securities or the acquisition of all or any part of us.

In performing its analyses, CBRE Cap made numerous assumptions as of various points in time with respect to industry performance, general business, economic and regulatory conditions, current and future rental market for our operating properties and other matters, many of which are necessarily subject to change and beyond the control of CBRE Cap and us. The analyses performed by CBRE Cap are not necessarily indicative of actual values, trading values or actual future results of our common stock that might be achieved, all of which may be significantly more or less favorable than suggested by the Valuation Report. The analyses do not purport to be appraisals or to reflect the prices at which the properties may actually be sold, and such estimates are inherently subject to uncertainty. The actual value of our common stock may vary significantly depending on numerous factors that generally impact the price of securities, our financial condition and the state of the real estate industry more generally. Accordingly, with respect to the estimated NAV of each class of our common stock, neither we nor CBRE Cap can give any assurance that:

| • | a stockholder would be able to resell his or her shares at this estimated value for the respective class of shares; |

| • | a stockholder would ultimately realize distributions per share equal to our estimated NAV for the respective class of shares of common stock upon liquidation of our assets and settlement of our liabilities or a sale of us; |

| • | our shares would trade at a price equal to or greater than the estimated NAV for the respective class of shares if we listed them on a national securities exchange; or |

| • | the methodology used to estimate our NAV would be acceptable to FINRA or under ERISA for compliance with its reporting requirements. |

The December 31, 2017, estimated NAV was determined by our board of directors at a special meeting held on March 14, 2018. The value of our shares will fluctuate over time as a result of, among other things, developments related to individual assets and responses to the real estate and capital markets. We currently expect to continue to determine our estimated NAV at least annually.

CBRE Group, Inc., (“CBRE”) is a Fortune 500 and S&P 500 company headquartered in Los Angeles, California and one of the world’s largest commercial real estate services and investment firms (in terms of 2017 revenue). CBRE Cap, a FINRA registered broker-dealer and a subsidiary of CBRE, is an investment banking firm that specializes in providing real estate financial services. CBRE Cap and affiliates possess substantial experience in the valuation of assets similar to those owned by us and regularly undertake the valuation of securities in connection with public offerings, private placements, business combinations and similar transactions. For the preparation of the Valuation Report, we paid CBRE Cap a customary fee for services of this nature, no part of which was contingent relating to the provision of services or specific findings. We have not engaged CBRE Cap for any other services.

During the past four years we and our affiliates have engaged CBRE Cap and other affiliates of CBRE for various real estate-related services and/or to serve as a third-party valuation advisor. We anticipate that CBRE Cap and other affiliates of CBRE will continue to provide similar services to us and our affiliates in the future. In addition, we may in our discretion engage CBRE Cap to assist our board of directors in future determinations of our estimated NAV. We are not affiliated with CBRE, CBRE Cap or any of their affiliates. While we and our affiliates have engaged and/or may engage in the future CBRE, CBRE Cap or their affiliates for commercial real estate services of various kinds, we believe that there are no material conflicts of interest with respect to our engagement of CBRE Cap. In the ordinary course of its business, CBRE, its affiliates, directors and officers may structure and effect transactions for its own account or for the accounts of its customers in commercial real estate assets of the same kind and in the same markets as our assets.

6

Distribution Reinvestment Plan Share Price

We will continue to offer shares of each class of our common stock pursuant to our Distribution Reinvestment Plan (“DRP”). Effective March 29, 2018, the price for sales of shares under the DRP will be equal to the updated estimated NAV per share for each class of shares of our common stock, as applicable.

Redemption Plan

Our Amended and Restated Redemption Plan continues to provide eligible stockholders with limited interim liquidity by enabling them to sell shares back to us prior to any listing of our shares.

Effective March 29, 2018, under the Amended and Restated Redemption Plan, all shares of common stock or fractions thereof that have been held for at least one year may be submitted for redemption at an amount equal to our updated estimated NAV per share for each class, as applicable, as of the redemption date.

There is no assurance that there will be sufficient funds available for redemption or that we will redeem shares and, accordingly, a stockholder’s shares may not be redeemed. The Amended and Restated Redemption Plan does not limit our ability to repurchase shares from stockholders by any other legally available means for any reason that our advisor, in its discretion, deems to be in our best interests. None of our sponsor, advisor, any member of our board of directors, or any of their affiliates will receive any fee in connection with the repurchase of shares by us under the Amended and Restated Redemption Plan.

Net Proceeds Table

The following table replaces the similar table on the cover of the prospectus.

| Maximum Aggregate Price to Public |

Maximum Selling Commissions and Dealer Manager Fees |

Proceeds to Us |

||||||||||

| Maximum Offering |

$ | 1,750,000,000 | $ | 82,250,000 | (2) | $ | 1,667,750,000 | |||||

| Class A Shares, Per Share (2) |

$ | 10.99 | $ | 0.93 | $ | 10.00 | ||||||

| Class T Shares, Per Share (3) |

$ | 10.56 | $ | 0.50 | $ | 10.00 | ||||||

| Class I Shares, Per Share (3) |

$ | 10.06 | $ | — | $ | 10.00 | ||||||

| Distribution Reinvestment Plan (4) |

$ | 250,000,000 | $ | — | $ | 250,000,000 | ||||||

| Class A Shares, Per Share |

$ | 10.00 | $ | — | $ | 10.00 | ||||||

| Class T Shares, Per Share |

$ | 10.00 | $ | — | $ | 10.00 | ||||||

| Class I Shares, Per Share |

$ | 10.00 | $ | — | $ | 10.00 | ||||||

| (1) | The proceeds are calculated without deducting certain organization and offering expenses. The total of the other organization and offering expenses, excluding selling commissions, dealer manager fees and annual distribution and stockholder servicing fees, are estimated to be approximately $17,500,000 if the maximum primary offering amount is sold. Our advisor will pay these other organization and offering expenses on our behalf, without reimbursement by us. |

| (2) | The maximum and minimum selling commissions and dealer manager fees assume that 5%, 90% and 5% of the gross offering proceeds from the primary offering are from sales of Class A, Class T, and Class I, respectively. The maximum upfront selling commissions and dealer manager fees are equal to 8.5%, 4.75% and 0% of the sale price for Class A, Class T and Class I shares, respectively, with discounts available to some categories of investors. Prior to March 20, 2017, the maximum selling commissions and dealer manager fees were equal to 9.75% of the sale price for Class A shares, with discounts available to some categories of investors. An insignificant number of Class A shares, Class T shares and Class I were sold on the terms in effect prior to March 20, 2017, and therefore we have assumed for purposes of this table and similar estimates throughout this prospectus that all Class A shares, Class T shares and Class I shares are sold on the terms in effect pursuant to this prospectus. |

| (3) | The Company will also pay an annual distribution and stockholder servicing fee, subject to certain limits, with respect to the Class T and Class I shares sold in the primary offering in an annual amount equal to 1.00% and 0.50%, respectively of the current primary gross offering price per Class T or Class I share, respectively, or, in certain cases, the estimated net asset value per Class T or Class I share, respectively, payable on a quarterly basis. See “Plan of Distribution.” |

| (4) | We will not pay selling commissions, dealer manager fees, annual distribution and stockholder servicing fees, or reimburse issuer costs, in connection with shares of common stock issued through our distribution reinvestment plan. For participants in the distribution reinvestment plan, distributions paid on Class A shares, Class T shares and Class I shares, as applicable, will be used to purchase Class A shares, Class T shares and Class I shares, respectively. |

7

Estimated Use of Proceeds

The following disclosure replaces the first paragraph in the “Estimated Use of Proceeds” section of the prospectus.

The following tables present information about how the proceeds raised in this primary offering will be used. Information is provided assuming (i) the sale of the maximum offering amount and (ii) that 5% of the gross offering proceeds from the primary offering is from sales of Class A shares, 90% is from sales of Class T shares and 5% is from sales of Class I shares, based on the offering prices of $10.99, $10.56 and $10.06, respectively. The

5%/90%/5% allocation assumption is based upon our dealer manager’s expectations, taking into consideration experiences of other multi-class blind pool initial public offerings of common stock by REITs as well as upcoming regulatory changes. There can be no assurance that this assumption will prove to be accurate. Many of the numbers in the table are estimates because all fees and expenses cannot be determined precisely at this time. The actual amount of investment service fees and expenses cannot be determined at the present time and will depend on numerous factors, including the aggregate amount borrowed. The actual use of proceeds is likely to be different than the figures presented in the table because we may not raise the maximum offering amount. Raising less than the maximum offering amount or selling a different percentage of Class A, Class T and Class I shares will alter the amounts of commissions, fees and expenses set forth below.

The following disclosure replaces footnote (3) to the tables in the “Estimated Use of Proceeds” section of the prospectus.

(3) Other organization and offering expenses include any and all costs and expenses, excluding selling commissions, dealer manager fees and annual distribution and stockholder servicing fees, incurred by us in connection with our formation, qualification and registration, and the marketing and distribution of our shares in this offering, including, without limitation, the following: amounts for Commission registration fees, FINRA filing fees, printing and mailing expenses, blue sky fees and expenses, legal fees and expenses, accounting fees and expenses, advertising and sales literature, transfer agent fees, due diligence expenses, personnel costs associated with processing investor subscriptions, escrow fees and other administrative expenses of the offering. The total of these other organization and offering expenses are estimated to be approximately $17,500,000 if the maximum primary offering amount is sold. For purposes of these tables, estimated other organization and offering expenses are allocated among the Class A, Class T and Class I shares pro rata on a per share basis, assuming 5% of the gross offering proceeds from the primary offering is from sales of Class A shares, 90% is from sales of Class T shares and 5% is from sales of Class I shares, based on the offering prices of $10.99, $10.56 and $10.06, respectively. Our advisor will pay these other organization and offering expenses on our behalf, without reimbursement by us. See “The Advisor and the Advisory Agreement.”

Management Compensation

The following disclosure replaces footnote (1) to the table in the “Management Compensation” section of the prospectus.

(1) The estimated maximum dollar amounts are based on the assumed sale of the maximum primary offering as follows: for the $1,750,000,000 in shares sold, 5% of the gross offering proceeds are from Class A shares, 90% of the gross offering proceeds are from Class T shares and 5% of the gross offering proceeds are from Class I shares.

Plan of Distribution

The following disclosure replaces the second paragraph in the “Plan of Distribution—The Offering” section of the prospectus.

Shares of our common stock in the primary offering are being offered to the public at $10.99 per Class A share, $10.56 per Class T share and $10.06 per Class I share. See below for a description of the discounts that are available to certain Class A purchasers. Subject to certain exceptions described in this prospectus, you must initially invest at least $5,000 in shares of our common stock. Class I shares are available (i) to investors purchasing through certain registered investment advisors and (ii) to any other categories of purchasers or through any other distribution channels that we name in an amendment or supplement to this prospectus.

The following disclosure replaces the second paragraph in the “Plan of Distribution—Compensation Paid for Sales of Shares—Front-End Selling Commissions, Dealer Manager Fee and Discounts (Class A and Class T Shares)” section of the prospectus.

8

We expect our dealer manager to utilize multiple distribution channels to sell our Class A and Class T shares, including through FINRA-registered broker-dealers and financial intermediaries exempt from broker-dealer registration. In the event of the sale of shares in our primary offering by broker-dealers that are members of FINRA, the purchase price generally will be $10.99 per Class A share and $10.56 per Class T share. Selling commissions and dealer manager fees generally will be paid in connection with such sales. In the event of the sale of Class A shares in our primary offering through certain investment advisory representatives as described below, the purchase price of such shares will be $10.33 per share, reflecting the fact that we will not pay our dealer manager the 6.00% selling commission on such Class A shares, as described in more detail below. The Class T shares will not be sold through investment advisory representatives.

The following disclosure replaces the eighth paragraph in the “Plan of Distribution—Compensation Paid for Sales of Shares—Front-End Selling Commissions, Dealer Manager Fee and Discounts (Class A and Class T Shares)” section of the prospectus.

If $1.75 billion in shares (consisting of $87.5 million in Class A shares, $1.575 billion in Class T shares, and $87.5 million in Class I shares) are sold in the primary offering, then, based solely on estimated selling commissions and dealer manager fees, a maximum amount of approximately $67.8 million in annual distribution and stockholder servicing fees may be paid before the 10% limit on Class T shares and Class I shares is reached. These estimates will change if the actual allocation of Class A, Class T and Class I shares differs from our estimate. The aggregate amount of underwriting compensation for the Class A shares, Class T shares and Class I shares, including the annual distribution and stockholder servicing fees for the Class T shares and Class I shares, will not exceed FINRA’s 10% cap on underwriting compensation.

The following disclosure replaces the similar disclosure in the “Plan of Distribution—Volume Discounts (Class A and Class T Shares Only)” section of the prospectus.

Volume Discounts (Class A and Class T Shares Only)

In connection with the purchase of a certain minimum number of Class A shares by an investor who does not otherwise qualify for the reduction in selling commissions described above, the amount of selling commissions otherwise payable to the dealer manager (and reallowable by the dealer manager to a participating broker) may be reduced in accordance with the following schedule:

| Maximum Reallowable Commissions on Sales per Incremental Share in Volume Discount Range |

||||||||||||

| Amount of Shares Purchased |

Purchase Price per Incremental Class A Share in Volume Discount Range |

Percent | Dollar Amount | |||||||||

| Up to $500,000 |

$ | 10.990 | 6.00 | % | $ | 0.659 | ||||||

| $500,001—$1,000,000 |

$ | 10.880 | 5.00 | % | $ | 0.550 | ||||||

| $1,000,001—$2,500,000 |

$ | 10.770 | 4.00 | % | $ | 0.440 | ||||||

We will apply the reduced selling price per share and selling commissions to the incremental shares within the indicated range only. Thus, for example, a total subscription amount of $1,250,000 would result in the purchase of 114,663.562 shares at a weighted average purchase price of $10.901 per share as shown below:

| • | $500,000 at $10.990 per share = 45,495.905 shares (6.00% selling commission + 2.50% dealer manager fee); |

| • | $500,000 at $10.880 per share = 45,955.460 shares (5.00% selling commission + 2.50% dealer manager fee); and |

| • | $250,000 at $10.770 per share = 23,212.197 shares (4.00% selling commission + 2.50% dealer manager fee). |

9

In connection with the purchase of a certain minimum number of Class T shares by an investor, the amount of selling commissions otherwise payable to the dealer manager (and reallowable by the dealer manager to a participating broker) may be reduced in accordance with the following schedule (for the purposes of the table below, we assume the maximum selling commission of 3.00%; if a lower selling commission is chosen then we will still assume 3.00% has been chosen for purposes of computing the volume discount, and apply it to the dealer manager fee if necessary):

| Maximum Reallowable Commissions on Sales per Incremental Share in Volume Discount Range |

||||||||||||

| Amount of Shares Purchased |

Purchase Price per Incremental Class T Share in Volume Discount Range |

Percent | Dollar Amount | |||||||||

| Up to $500,000 |

$ | 10.560 | 3.00 | % | $ | 0.317 | ||||||

| $500,001—$1,000,000 |

$ | 10.454 | 2.00 | % | $ | 0.211 | ||||||

| $1,000,001—$2,500,000 |

$ | 10.349 | 1.00 | % | $ | 0.106 | ||||||

We will apply the reduced selling price per share and selling commissions to the incremental shares within the indicated range only. Thus, for example, an investment of $1,250,000 in shares of our common stock would result in a total purchase of approximately 119,332.627 shares at a weighted average purchase price of $10.475 per share as shown below:

| • | $500,000 at $10.560 per share = 47,348.485 shares (3.00% selling commission + 1.75% dealer manager fee); |

| • | $500,000 at $10.454 per share = 47,826.752 shares (2.00% selling commission + 1.75% dealer manager fee); and |

| • | $250,000 at $10.349 per share = 24,157.390 shares (1.00% selling commission + 1.75% dealer manager fee). |

To the extent requested in writing by an investor as described below, our volume discount is cumulative. To the extent an investor’s cumulative purchases qualify for a volume discount, the investor’s purchase will qualify for a volume discount equal to (i) the volume discount for the applicable individual purchase or (ii) to the extent the subsequent purchase when aggregated with the prior purchase(s) qualifies for a greater volume discount, a greater discount. If an investor purchases more than one class of shares, then volume discounts will be determined by taking into account an investor’s complete subscription for shares regardless of share class and applied to the separate class purchases on a pro rata basis.

Updates to U.S. Federal Income Tax Considerations

On November 16, 2017, the U.S. House of Representatives passed the Tax Cuts and Jobs Act (H.R. 1). On December 2, 2017, the Senate passed a different version of the Tax Cuts and Jobs Act. On December 15, 2017, the House and Senate released a Conference report reconciling the House and Senate bills and producing a bill, which was subsequently adopted by both the House and the Senate, and signed into law by the President on December 22, 2017.

The Tax Cuts and Jobs Act made significant changes to the U.S. federal income tax rules for taxation of individuals and corporations. In the case of individuals, the tax brackets were adjusted, the top federal income rate was reduced to 37%, special rules reduce taxation of certain income earned through pass-through entities and reduce the top effective rate applicable to ordinary dividends from REITs to 29.6% (through a 20% deduction for ordinary REIT dividends received that are not “capital gain dividends” or “qualified dividend income,” subject to complex limitations) and various deductions were eliminated or limited, including limiting the deduction for state and local taxes to $10,000 per year. Most of the changes applicable to individuals are temporary and apply only to taxable years beginning after December 31, 2017 and before January 1, 2026. The top corporate income tax rate was

10

reduced to 21%, and the corporate alternative minimum tax was repealed. Additionally, for taxable years beginning after December 31, 2017, the Tax Cuts and Jobs Act limits interest deductions for businesses, whether in corporate or pass-through form, to the sum of the taxpayer’s business interest income for the tax year and 30% of the taxpayer’s adjusted taxable income for the tax year. This limitation could apply to our operating partnership, underlying partnerships and potential taxable REIT subsidiaries. This limitation does not apply to an “electing real property trade or business.” We have not yet determined whether we or any of our subsidiaries will elect out of the new interest expense limitation or whether each of our subsidiaries is eligible to elect out. One consequence of electing to be an “electing real property trade or business” is that the new expensing rules will not apply to certain property used in an electing real property trade or business. In addition, in the case of an electing real property trade or business, real property and “qualified improvement property” are depreciated under the alternative depreciation system, with 40-year useful life for nonresidential real property and a 20-year useful life for qualified improvement property (although a potential drafting error makes the useful life for qualified improvement property uncertain). There are only minor changes to the REIT rules (other than the 20% deduction applicable to individuals for ordinary REIT dividends received). The Tax Cuts and Jobs Act makes numerous other large and small changes to the tax rules that do not affect REITs directly but may affect our stockholders and may indirectly affect us. For example, the Tax Cuts and Jobs Act amended the rules for accrual of income so that income is taken into account no later than when it is taken into account on applicable financial statements, even if financial statements take such income into account before it would accrue under the original issue discount rules, market discount rules or other rules in the Internal Revenue Code. Such rule may cause us to recognize income before receiving any corresponding receipt of cash, which may make it more likely that we could be required to borrow funds or take other action to satisfy the REIT distribution requirements for the taxable year in which such income is recognized, although the precise application of this rule is unclear at this time. In addition, the Tax Cuts and Jobs Act reduced the limit for individual’s mortgage interest expense to interest on $750,000 of mortgages and does not permit deduction of interest on home equity loans (after grandfathering all existing mortgages). Such change and the reduction in deductions for state and local taxes (including property taxes) may potentially (and negatively) affect the markets in which we may invest.

Prospective stockholders are urged to consult with their tax advisors with respect to the Tax Cuts and Jobs Act and any other regulatory or administrative developments and proposals and their potential effect on investment in our common stock.

Management

The following disclosure updates the section entitled “Management – Directors and Executive Officers” and all related disclosure throughout the prospectus.

On June 12, 2017, our board of directors appointed L. Burke Rainey, age 35, to serve as our chief accounting officer and vice president, effective as of June 12, 2017. In connection with Mr. Rainey’s appointment, Ixchell C. Duarte, who has served as our chief accounting officer and senior vice president since January 2016, resigned as our chief accounting officer and continues to serve as a senior vice president.

The following is a summary of Mr. Rainey’s business experience and other biographical information:

L. Burke Rainey, Chief Accounting Officer and Vice President. Mr. Rainey has served as our vice president and chief accounting officer since June 2017. He previously served as our controller from the Company’s inception to June 2017. Mr. Rainey has also served as the controller of CNL Healthcare Properties, Inc., a public non-traded REIT, from April 2014 to June 2017 and as their director of accounting and financial reporting from November 2012 to March 2014. Mr. Rainey also served in comparable positions at Global Income Trust, Inc., a public non-traded REIT, from November 2012 through the completion of its exit strategy and dissolution in December 2015. Prior to joining the Company, Mr. Rainey worked in the assurance practice of Ernst & Young LLP’s Miami office; most recently serving as an audit manager on several multinational clients. He is a licensed certified public accountant in the State of Florida and a chartered global management accountant. Mr. Rainey received a B.B.A with a major in accountancy and an M.S.A with a concentration in financial reporting and assurance services from the Mendoza College of Business at the University of Notre Dame.

11

On December 6, 2017, Thomas K. Sittema, who has served as our chairman of the board of directors since November 2015 and as a director since our inception, notified our board of his intention to resign from his position as chairman of the board and as a director effective December 31, 2017. Mr. Sittema also announced his intention to resign from his position as chief executive officer of our advisor.

Upon receipt of Mr. Sittema’s notice, on December 7, 2017, the remaining members of our board, by unanimous written consent, elected Mr. Stephen H. Mauldin to serve as chairman of the board effective January 1, 2018. Mr. Mauldin previously served as a director and vice chairman of the board until being appointed as chairman. Mr. Mauldin will continue to serve as our chief executive officer and president. No additional directors have been elected by the board at this time.

On January 30, 2018, Kevin R. Maddron tendered his resignation as our chief financial officer, chief operating officer and treasurer, effective as of February 7, 2018. In connection with Mr. Maddron’s resignation, our board of directors appointed Ixchell C. Duarte, age 51, to serve as our chief financial officer and treasurer, effective February 7, 2018, and John F. Starr, age 43, to serve as our chief operating officer, effective February 7, 2018.

The following is a summary of Mr. Starr’s business experience and other biographical information:

John F. Starr, Chief Operating Officer and Senior Vice President. Mr. Starr has served as our chief operating officer since February 2018 and as our senior vice president since January 2016. Mr. Starr has served as senior vice president of our advisor since its inception on July 9, 2015. Mr. Starr has served as chief operating officer of CNL Healthcare Properties, Inc., a public, non-traded REIT, since February 2018 and as senior vice president since January 2016. He has served as senior vice president of CNL Healthcare Corp., the advisor to CNL Healthcare Properties, Inc. since March 2013. Mr. Starr served as senior vice president of CNL Lifestyle Properties, Inc., from March 2013 until its dissolution in December 2017. Mr. Starr served as chief portfolio management officer of CNL Growth Properties, Inc., a public, non-traded REIT from December 2012 until its dissolution in October 2017. Since 2002, Mr. Starr has held various positions with multiple CNL affiliates. Mr. Starr served as chief portfolio management officer of Global Income Trust, Inc. from December 2012 until its dissolution in December 2015. Mr. Starr has served as group chief operating officer at CNL Financial Group Investment Management, LLC since February 2018, and served as chief portfolio management officer (January 2013 to November 2015) and chief portfolio officer (November 2015 to February 2018) responsible for developing and implementing strategies to maximize the financial performance of CNL’s real estate portfolios, which included executive leadership of the platform portfolio reporting and debt capital markets groups. He also served as a senior vice president of CNL Private Equity Corp. from December 2010 until his appointment as the chief portfolio management officer. Between June 2009 and December 2010, he served as CNL Private Equity Corp.’s senior vice president of asset management, responsible for the oversight and day-to-day management of all real estate assets from origination to disposition. At CNL Management Corp., Mr. Starr served as senior vice president of asset management, from June 2007 to December 2010. Between January 2004 and February 2005, Mr. Starr served as vice president of real estate portfolio management at Trustreet, and from February 2005 to February 2007, he served as Trustreet’s vice president of special servicing, and as president of a Trustreet affiliate, where he was responsible for the resolution and value optimization of distressed leases and loans. From February 2007 to May 2007, following the sale of Trustreet to GE Capital, he served as GE Capital, Franchise Finance’s vice president of special servicing, before rejoining CNL affiliates in June 2007. Between May 2002 and January 2004, Mr. Starr was assistant vice president of special servicing at CNL Restaurant Properties, Inc. Prior to joining CNL’s affiliates, Mr. Starr served in various positions in the credit products management group at Wachovia Bank, Orlando, Florida, from December 1997 to May 2002. Mr. Starr received a B.S. in business and an M.B.A. from the University of Florida in 1997 and 2007, respectively.

The following disclosure replaces the biography of Ms. Duarte in the section of the prospectus entitled “Management –Directors and Executive Officers.”

Ixchell C. Duarte, Chief Financial Officer, Treasurer and Senior Vice President. Ms. Duarte has served as our chief financial officer and treasurer since February 2018 and as senior vice president since January 2016. Ms. Duarte served as our chief accounting officer from January 2016 to June 2017. Ms. Duarte has served as senior vice president and chief accounting officer of our advisor since its inception on July 9, 2015. Ms. Duarte has served as chief financial officer and treasurer of CNL Healthcare Properties, Inc., a public, non-traded REIT, since February

12

2018 and as a senior vice president since March 2012. Ms. Duarte also served as chief accounting officer from March 2012 until June 2017, and was previously a vice president from February 2012 to March 2012. She also has served as senior vice president and chief accounting officer of CNL Healthcare Corp., the advisor to CNL Healthcare Properties, Inc., since November 2013. Ms. Duarte served as senior vice president and chief accounting officer of CNL Lifestyle Properties, Inc., a public, non-traded REIT from March 2012 until its dissolution in December 2017. Ms. Duarte served as senior vice president and chief accounting officer of its advisor from November 2013 to December 2017. Ms. Duarte served as senior vice president and chief accounting officer of CNL Growth Properties, Inc., a public non-traded REIT from June 2012 until its dissolution in October 2017. Ms. Duarte served as senior vice president of its advisor from November 2013 to December 2017. She also served as senior vice president and chief accounting officer of Global Income Trust, Inc., a public non-traded REIT, from June 2012 until its dissolution in December 2015, and served as a senior vice president of its advisor from November 2013 to December 2016. Ms. Duarte served as controller at GE Capital, Franchise Finance, from February 2007 through January 2012 and served as senior vice president and chief accounting officer of Trustreet Properties, Inc., a publicly traded REIT. Prior to that, she held various other positions with Trustreet and predecessor CNL companies, including senior vice president, chief financial officer, secretary and treasurer. Ms. Duarte began her career in the audit practice of KPMG, LLP and then Coopers & Lybrand. She received a B.S. in accounting from the Wharton School of the University of Pennsylvania and is a certified public accountant.

Cover Page

The following disclosure replaces the similar risk factor found on the cover page of the prospectus.

As of the date of this supplement, a significant portion of distributions paid to stockholders have been funded with the net proceeds from shares sold in this offering. We may have difficulty funding our distributions with funds provided by cash flows from operating activities; therefore, during our offering stage or until we generate sufficient operating cash flow, it is likely we will continue to fund a portion of distributions to our stockholders with cash flows from financing activities, which may include borrowings and net proceeds from shares sold in this offering, cash resulting from a waiver or deferral of fees or expense reimbursements otherwise payable to our advisor or its affiliates, cash resulting from our advisor or its affiliates paying certain of our expenses, and proceeds from the sales of assets or from our cash balances (which may constitute a return of capital). The use of these sources to pay distributions could adversely impact the value of your shares.

Risk Factors

The following risk factors supplement the risk factors, or update or replace the similar risk factors, in the section of the prospectus entitled “Risk Factors—Risks Related to This Offering” and all related disclosure throughout the prospectus.

We only own two properties, which increases the risk that adverse changes in the performance or value of those properties could materially affect our results of operations, our NAV and returns to our investors.

We currently own two real estate investments consisting of a seniors housing community and a medical office building. As a result, we are subject to greater risks associated with geographic and property-type concentration in a small number of assets. A decline in in the performance or value of those assets will adversely affect our performance and the value of the investments of our stockholders.

Because the current offering prices for our shares in this public offering exceed the net tangible book value per share, investors in this offering will experience immediate dilution in the net tangible book value of their shares.

The offering prices in this primary public offering are based on the estimated NAV per share for each class, as determined by our board of directors, plus applicable upfront selling commissions and dealer manager fees. In addition, under our distribution reinvestment plan distributions will be reinvested in additional shares at prices per share equal to the current NAV per share for each class, as applicable. Our current public offering prices for our shares exceed our net tangible book value per share, which amount is the same for all three classes. Our net tangible book value per share is a rough approximation of value calculated as total book value of assets minus total book

13

value of liabilities, divided by the total number of shares of common stock outstanding. Net tangible book value is used generally as a conservative measure of net worth that we do not believe reflects our estimated value per share. It is not intended to reflect the value of our assets upon an orderly liquidation of the company in accordance with our investment objectives. However, net tangible book value does reflect certain dilution in value of our common stock from the issue price in this offering primarily as a result of (i) the substantial fees paid in connection with this offering, including selling commissions, dealer manager fees and annual distribution and stockholder servicing fees, (ii) the fees and expenses paid to our advisor and its affiliates in connection with the selection, acquisition, management and sale of our investments, (iii) general and administrative expenses, (iv) accumulated depreciation and amortization of real estate investments, and (v) the issuance of stock dividends. As of December 31, 2017, our net tangible book value per share of shares of our shares was $8.78. To the extent we are able to raise substantial proceeds in this offering, some of the expenses that cause dilution of the net tangible book value per share are expected to decrease on a per share basis, resulting in increases in the net tangible book value per share. This increase would be partially offset by increases in depreciation and amortization expenses related to our real estate investments.

Our offering prices per share for each class of our shares are primarily based on the estimated NAV per share of each class of our shares plus applicable upfront selling commissions and dealer manager fees, but also based upon subjective judgments, assumptions and opinions by management, which may or may not turn out to be correct. Therefore, our offering prices may not reflect the amount that might be paid to you for your shares in a market transaction and may not be indicative of the price at which our shares would trade if they were actively traded.

On March 14, 2018, our board of directors approved an estimated NAV per share of $10.06 for each class of shares of our common stock as of December 31, 2017. To assist FINRA members and their associated persons that participate in this offering of common stock in meeting their customer account statement reporting obligations pursuant to applicable FINRA and NASD Conduct Rules, we will disclose in our Annual Reports on Form 10-K, our Quarterly Reports on Form 10-Q and/or in our Current Reports on Form 8-K, our estimated NAV per share of each class of our shares. This estimated value per share will be accompanied by any disclosures required under the FINRA and NASD Conduct Rules.

The estimated NAV per share for each class of our shares will be based on valuations of our assets and liabilities performed at least annually, by, or with the material assistance or confirmation of, a third-party valuation expert or service and will generally be consistent with the recommendations in the Investment Program Association Practice Guideline 2013-01- Valuations of Publicly Registered, Non-Listed REITs. The three share classes in this offering are meant to provide broker-dealers with more flexibility to facilitate investment in us and are offered partially in response to recent changes to the applicable FINRA and NASD Conduct Rules regarding the reporting of our estimated NAV per share of each class of our shares.

Our board of directors determined the offering price of each class of our shares based upon a number of factors but primarily based on the estimated NAV per share of our shares determined by our board of directors. Although we established the estimated NAV per share generally in accordance with our valuation policy and certain recommendations and methodologies of the Investment Program Association, the valuation methodologies used by the independent valuation firm retained by our board of directors to estimate the value of our property and the estimated NAV of each class of our shares as of December 31, 2017 involved subjective judgments, assumptions and opinions, which may or may not turn out to be correct. Our board of directors also took into consideration applicable upfront selling commissions and dealer manager fees of this offering in establishing the current offering prices for each class of our shares. As a result of these, as well as other factors, our offering prices for each class of our shares may not reflect the amount that might be paid to you for your shares in a market transaction or of the proceeds that you would receive if we were liquidated or dissolved and the proceeds were distributed to our stockholders. See “Description of Capital Stock—Valuation Policy” for a description of our policy with respect to valuations of our common stock.

The estimated NAV per share of each class of our shares is based upon a valuation of two of our properties as of December 31, 2017 and does not take into account how developments subsequent to the valuation date related to individual assets, the financial or real estate markets or other events may have increased or decreased the value of our portfolio. The valuation and appraisal of our properties are estimates of fair value and

14

may not necessarily correspond to realizable value upon the sale of our properties. Therefore, our estimated NAV per share for each class of our shares may not reflect the amount that would be realized upon a sale of our properties.

On March 14, 2018, our board of directors approved a NAV per share of $10.06 for each class of shares of our common stock as of December 31, 2017. We intend to use this NAV as the estimated per share value of each class of our shares until the next net asset valuation approved by our board of directors. We expect to perform a net asset valuation at least annually. We will disclose future estimates of our NAV to stockholders in our filings with the Commission.

Further, our estimated NAV per share is based on the estimated value of our assets less the estimated value of our liabilities, divided by the number of shares outstanding, all as of December 31, 2017. We did not make any adjustments to our estimated NAV subsequent to December 31, 2017, including adjustments relating to, among others, the issuance of common stock, the payment of related offering costs, net operating income earned or distributions declared. The NAV of our shares will fluctuate over time in response to a number of factors, including but not limited to the proceeds raised from this offering, future investments, the performance of individual assets in our portfolio, the management of those assets, and the real estate and finance markets.

For the purposes of calculating our estimated NAV per share of each class of our shares, we retained an investment banking firm as valuation expert to provide a range of per share values for our and a valuation of our property as of December 31, 2017. The valuation methodologies used to estimate the NAV of each class of our shares, as well as the value of one of our properties, involved certain subjective judgments, including but not limited to, discounted cash flow analysis. Ultimate realization of the value of an asset depends to a great extent on economic and other conditions beyond our control and the control of our advisor and our valuation expert. Further, valuations do not necessarily represent the price at which an asset would sell, since market prices of assets can only be determined by negotiation between a willing buyer and seller. Therefore, the valuation of our property may not correspond to the realizable value upon a sale of the asset. Because the price you will pay for shares in this offering is primarily based on our estimated NAV per share for each class of shares plus applicable upfront selling commissions and dealer manager fees, you may pay more than realizable value for your investment when you purchase your shares or receive less than realizable value when you sell your shares.

The actual value of shares that we repurchase under our redemption plan may be substantially less than what we pay.

Under our redemption plan, the price for the repurchase of shares shall be equal to the then-current NAV per share, as published from time to time in an Annual Report on Form 10-K, a Quarterly Report on Form 10-Q and/or a Current Report on Form 8-K publicly filed with the Commission. These prices may not accurately represent the current value of our assets per share of our common stock at any particular time and may be higher or lower than the actual value of our assets per share at such time. Accordingly, when we repurchase shares of our common stock, the actual value of the shares that we repurchase may be less than the price that we pay, and the repurchase may be dilutive to our remaining stockholders.

We may have difficulty funding our distributions with funds provided by cash flows from operating activities; therefore, we may use cash flows from financing activities, which may include borrowings and net proceeds from primary shares sold in this offering, proceeds from the issuance of shares under our distribution reinvestment plan, cash resulting from a waiver or deferral of fees by our advisor or from expense support provided by our advisor or other sources to fund distributions to our stockholders. The use of these sources to pay distributions and the ultimate repayment of any liabilities incurred could adversely impact our ability to pay distributions in future periods, decrease the amount of cash we have available for operations and new investments and/or potentially impact the value or result in dilution of your investment by creating future liabilities, reducing the return on your investment or otherwise.

Until the proceeds from this offering are fully invested, and from time to time thereafter, we may not generate sufficient cash flows from operating activities, as determined on the basis of generally accepted accounting principles (“GAAP”), to fully fund distributions to you. Therefore, particularly during our offering stage, it is likely we will continue to fund a portion of distributions to our stockholders with cash flows from financing activities,

15

which may include borrowings and net proceeds from primary shares sold in this offering, proceeds from the issuance of shares under our distribution reinvestment plan, cash resulting from a waiver or deferral of fees or expense reimbursements otherwise payable to our advisor or its affiliates, cash resulting from our advisor or its affiliates paying certain of our expenses, and proceeds from the sales of assets or from our cash balances. As of the date of this supplement, a significant portion of distributions paid to stockholders have been funded with the net proceeds from shares sold in this offering. However, our advisor and its affiliates are under no obligation to defer or waive fees in order to support our distributions and there is no limit on the amount of time that we may use such sources to fund distributions. We may be required to fund distributions from a combination of some of these sources if our investments fail to perform as anticipated, if expenses are greater than expected or as a result of numerous other factors. We have not established a cap on the amount of our distributions that may be paid from any of these sources. Using certain of these sources may result in a liability to us, which would require a future repayment.

The use of these sources for distributions and the ultimate repayment of any liabilities incurred could adversely impact our ability to pay distributions in future periods, decrease the amount of cash we have available for operations and new investments and potentially reduce your overall return and adversely impact and dilute the value of your investment in shares of our common stock. Because the prices at which we sell each class of our shares are fixed and we do not currently intend to change them, new investors will be impacted to the extent dilutive distributions in excess of earnings have been paid in prior periods as well as if they are paid in future periods. To the extent distributions in excess of current and accumulated earnings and profits (i) do not exceed a stockholder’s adjusted tax basis in our stock, such distributions will not be taxable to a stockholder, but rather a stockholder’s adjusted tax basis in our stock will be reduced; and (ii) exceed a stockholder’s adjusted tax basis in our stock, such distributions will be included in income as long-term capital gain if the stockholder has held its shares for more than one year and otherwise as short-term capital gain.

In addition, our advisor or its affiliates could choose to receive shares of our common stock or interests in the operating partnership in lieu of cash or deferred fees or the repayment of advances to which they are entitled, and the issuance of such securities may dilute your investment in shares of our common stock.

The following risk factor replaces the similar risk factor found in the section of the prospectus entitled “Prospectus Summary—Summary Risk Factors.”

As of the date of this supplement, a significant portion of distributions paid to stockholders have been funded with the net proceeds from shares sold in this offering. We may have difficulty funding our distributions with funds provided by cash flows from operating activities; therefore, during our offering stage or until we generate sufficient operating cash flow, it is likely we will continue to fund a portion of distributions to our stockholders with cash flows from financing activities, which may include borrowings, net proceeds from primary shares sold in this offering, proceeds from the issuance of shares under our distribution reinvestment plan, cash resulting from a waiver or deferral of fees or expense reimbursements otherwise payable to our advisor or its affiliates, cash resulting from our advisor or its affiliates paying certain of our expenses, and proceeds from the sales of assets or from our cash balances (which may constitute a return of capital). The use of these sources to pay distributions and the ultimate repayment of any liabilities incurred could adversely impact our ability to pay distributions in future periods, decrease the amount of cash we have available for operations and new investments and/or potentially impact the value or result in dilution of your investment by creating future liabilities, reducing the return on your investment or otherwise.

Distribution Policy

The following disclosure replaces the third paragraph in the section of the prospectus entitled “Prospectus Summary—Our Distribution Policy.”

We intend to declare distributions monthly and pay distributions to our stockholders on a quarterly basis provided that our board of directors determines we have, or anticipate having, sufficient cash available to do so. As noted above, cash distributions may be paid from sources other than cash flows from operating activities, such as cash flows from financing activities, which may include borrowings and net proceeds from shares sold in this offering. As of the date of this supplement, a significant portion of distributions paid to stockholders have been funded with the net proceeds from shares sold in this offering During our offering stage or until we generate

16

sufficient operating cash flow, it is likely we will continue to fund a portion of distributions to our stockholders with proceeds from shares sold in this offering. There is no assurance we will pay distributions in any particular amount, if at all.

The following disclosure replaces the fourth paragraph in the section of the prospectus entitled “Distribution Policy.”

Many of the factors that can affect the availability and timing of cash distributions to stockholders are beyond our control, and a change in any one factor could adversely affect our ability to pay future distributions. There can be no assurance that we will be able to achieve expected cash flows necessary to pay distributions or maintain distributions at any particular level, or that distributions will increase over time. As of the date of this supplement, a significant portion of distributions paid to stockholders have been funded with proceeds from our offering. During our offering stage or until we generate sufficient operating cash flow, it is likely we will continue to fund a portion of distributions to our stockholders with proceeds from our offering. See “Risk Factors—Company Related Risks.”

Updated Information Regarding Our Real Properties and Borrowings

Real Property Portfolio

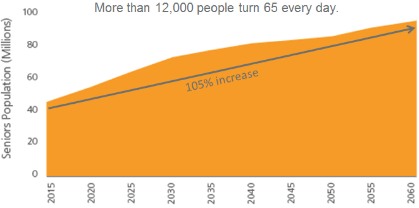

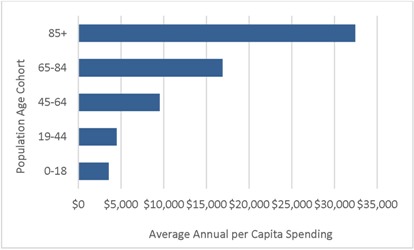

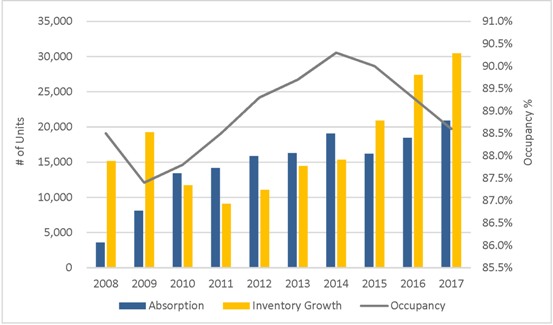

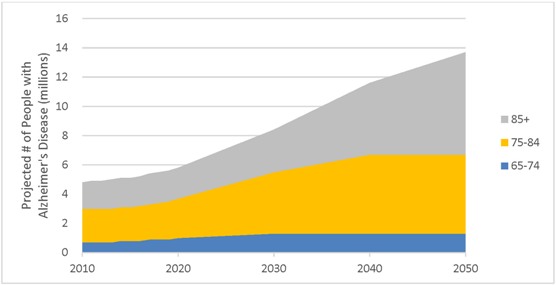

We believe recent demographic trends and compelling supply and demand indicators present a strong case for an investment focus on healthcare real estate and real estate-related assets. We believe that the healthcare sector will continue to provide attractive opportunities as compared to other asset sectors over the long-term.

As of December 31, 2017, our healthcare investment portfolio consisted of interests in one seniors housing property and one medical office building (“MOB.”) Our seniors housing property, Summer Vista Assisted Living (“Summer Vista”) is operated under a RIDEA structure pursuant to a property management agreement with SRI Management, LLC (“Superior Residences”), which represents our only RIDEA operator as of December 31, 2017. Our MOB, Mid America Surgery Institute (“Mid America Surgery”), consisted of five tenants with the largest tenant, Mid America Surgery Institute, accounting for 50.6% of total rentable square feet.

While we are not directly impacted by the performance of our third-party tenants, we believe that the financial and operational performance of our tenants provides an indication about the stability of our tenants and their ability to pay rent. To the extent that our tenants or property managers experience operating difficulties and become unable to generate sufficient cash to make rent payments to us, there could be a material adverse impact on our consolidated results of operations, liquidity and/or financial condition. Our tenants and property managers are generally contractually required to provide this information to us in accordance with their respective lease and/or management agreements. Therefore, in order to mitigate the aforementioned risk, we monitor our investments through a variety of methods determined by the type of property.

We monitor the credit of our tenants to stay abreast of any material changes in quality. We monitor tenant credit quality by (1) reviewing financial statements that are publicly available or that are required to be delivered to us under the applicable lease, (2) direct interaction with onsite property managers, (3) monitoring news and rating agency reports regarding our tenants (or their parent companies) and their underlying businesses, (4) monitoring the timeliness of rent collections and (5) monitoring lease coverage.

As of December 31, 2017, we had investments in two real estate investment properties. The following table sets forth details on our consolidated healthcare investment portfolio by asset class:

17

| Name |

Structure | Date Acquired |

Encumbrance (in millions) |

Purchase Price (in millions) |

||||||||||||

| Medical Office |

||||||||||||||||

| Mid America Surgery Institute |

Leased | 12/27/2017 | $ | 5.6 | $ | 14.0 | ||||||||||

| Overland Park, KS (“Kansas City”) |

||||||||||||||||

| Seniors Housing |

||||||||||||||||

| Summer Vista Assisted Living |

RIDEA | 3/31/2017 | 13.9 | 21.4 | ||||||||||||

| Pensacola, FL |

||||||||||||||||

|

|

|

|

|

|||||||||||||

| $ | 19.5 | $ | 35.4 | |||||||||||||

|

|

|

|

|

|||||||||||||

Portfolio Evaluation