UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

For the quarterly period ended

For the transition period from ____________ to _____________

Commission File Number

(Exact name of registrant as specified in its charter)

| ||

(State or other jurisdiction of |

| (I.R.S. Employer |

incorporation or organization) |

| Identification No.) |

(Zip Code) | ||

(Address of principal executive offices) |

TINGO, INC.

43 West 23rd Street, 2nd Floor, New York, NY 10010

(Former Name, Former Address and Former Fiscal Year, if Changed Since Last Report)

Registrant’s telephone number, including area code: (

Securities registered pursuant to Section 12(b) of the Act: None.

Securities registered pursuant to Section 12(g) of the Act:

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ☐ | Accelerated filer ☐ | Smaller Reporting Company | Emerging Growth Company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company. Yes

There were

AGRI-FINTECH HOLDINGS, INC. (f/k/a Tingo, Inc.)

(A Nevada Corporation)

INDEX

2

Part I.Financial Information

Item 1. Unaudited Consolidated Financial Statements

AGRI-FINTECH HOLDINGS, INC. (f/k/a Tingo, Inc.)

BALANCE SHEETS

(Unaudited)

| June 30, |

| December 31, | |||

2023 | 2022 | |||||

Assets |

|

|

|

| ||

Current Assets |

|

|

|

| ||

Cash and cash equivalents | $ | |

| $ | | |

Loans and other receivables – related parties | | | ||||

Total Current Assets | | | ||||

| ||||||

Non-Current Assets |

| |||||

Investment in securities | | | ||||

Total Non-Current assets | | | ||||

Total Assets | $ | |

| $ | | |

Liabilities and Stockholders’ Equity | ||||||

Current Liabilities | ||||||

Accounts payable and accruals | $ | |

| $ | | |

Advances from related party | | | ||||

Notes payable – related parties | | | ||||

Settlement liability | | — | ||||

Total Current Liabilities | | |||||

Total Liabilities | | | ||||

Commitments and Contingencies | ||||||

Stockholders’ Equity | ||||||

Common stock - Class A, par value $ | | | ||||

Common Stock - Class B, par value $ | | | ||||

Additional paid-in-capital | | | ||||

Retained earnings | | | ||||

Deferred stock compensation | ( | ( | ||||

Total Stockholders’ Equity | | | ||||

Total Liabilities and Stockholders’ Equity | $ |

| $ | | ||

The accompanying notes are an integral part of these financial statements.

3

AGRI-FINTECH HOLDINGS, INC. (f/k/a Tingo, Inc.)

STATEMENTS OF OPERATIONS AND COMPREHENSIVE INCOME

(Successor Period and Consolidated for the Predecessor Period)

(Unaudited)

Successor Period | Predecessor Period | Successor Period | Predecessor Period | ||||||||||

For the three months ended | For the three months ended | For the six months ended | For the six months ended | ||||||||||

| June 30, 2023 |

| June 30, 2022 |

|

| June 30, 2023 |

| June 30, 2022 | |||||

Revenue | $ | — | $ | | $ | — | $ | | |||||

Cost of revenue | — | ( | — | ( | |||||||||

Gross Profit | — | | — | | |||||||||

Operating Expenses | |||||||||||||

Payroll and related expenses | | | | | |||||||||

Distribution expenses | — | | — | | |||||||||

Professional fees | | | | | |||||||||

Bank fees and charges | | | | | |||||||||

Depreciation and amortization | — | | — | | |||||||||

General and administrative expenses - other | | | | | |||||||||

Bad debt expenses | — | | — | | |||||||||

Total Operating Expenses | | | | | |||||||||

Income (Loss) from Operations | ( | | | ||||||||||

Other Income (Expense) | |||||||||||||

Other income | | | | | |||||||||

Interest expense | ( | ( | ( | ( | |||||||||

Total Other Income (Expense) | ( | | | | |||||||||

Income (Loss) Before Tax | ( | | ( | | |||||||||

Taxation | — | ( | — | ( | |||||||||

Net Income (Loss) | $ | ( | $ | | $ | ( | $ | | |||||

Other Comprehensive Income (Loss) | |||||||||||||

Translation Adjustment | — | ( | — | ( | |||||||||

Total Comprehensive Income (Loss) | $ | ( | $ | | $ | ( | $ | | |||||

Earnings Per Share - Basic and Diluted | $ | ( | $ | | $ | ( | $ | | |||||

Weighted Average number of common shares outstanding | |||||||||||||

Basic and diluted | | | | | |||||||||

The accompanying notes are an integral part of these financial statements.

4

AGRI-FINTECH HOLDINGS, INC. (f/k/a Tingo, Inc.)

STATEMENTS OF SHAREHOLDERS’ EQUITY (SUCCESSOR)

(Successor and Consolidated for the Predecessor Period)

(Unaudited)

(Continued on Next Page)

Six Months Ended June 30, 2023

Common Stock - Class A | Common Stock - Class B | Additional Paid | Deferred Stock | Retained | Translation | Total Stockholders’ | |||||||||||||||||||

| Number of Shares |

| Amount |

| Number of Shares |

| Amount |

| In Capital |

| Compensation |

| Earnings |

| Reserve |

| Equity | ||||||||

Balance as of December 31, 2022 (Successor) |

| | $ | | | $ | | $ | | $ | ( | $ | | $ | — | $ | | ||||||||

Vesting of deferred stock compensation (Successor) |

| — |

| — | — |

| — |

| — |

| | — |

| — | | ||||||||||

|

|

|

|

|

| ||||||||||||||||||||

Net loss for the six months ended June 30, 2023 (Successor) | — | — | — | — | — | — | ( | — | ( | ||||||||||||||||

Balance as of June 30, 2023 (Successor) | | $ | | | $ | | $ | | $ | ( | $ | | $ | — | $ | | |||||||||

Three Months Ended June 30, 2023

Common Stock - Class A | Common Stock - Class B | Additional Paid | Deferred Stock | Retained | Translation | Total Stockholders’ | |||||||||||||||||||

| Number of Shares |

| Amount |

| Number of Shares |

| Amount |

| In Capital |

| Compensation |

| Earnings |

| Reserve |

| Equity | ||||||||

Balance as of March 31, 2023 (Successor) |

| | $ | | | $ | | $ | | $ | ( | $ | | $ | — | $ | | ||||||||

|

|

| |||||||||||||||||||||||

Vesting of deferred stock compensation (Successor) | — |

| — | — | — |

| — | |

| — |

| — |

| | |||||||||||

Net loss for the three months ended June 30, 2023 (Successor) | — | — | — | — | — | — | ( | — | ( | ||||||||||||||||

Balance as of June 30, 2023 (Successor) |

| | $ | | | $ | | $ | | $ | ( | $ | | $ | — | $ | | ||||||||

5

AGRI-FINTECH HOLDINGS, INC. (f/k/a Tingo, Inc.)

STATEMENTS OF SHAREHOLDERS’ EQUITY (PREDECESSOR)

(Successor and Consolidated for the Predecessor Period)

(Unaudited)

(Continued from Previous Page)

Six Months Ended June 30, 2022

Common Stock - Class A | Common Stock - Class B | Additional Paid | Deferred Stock | Retained | Translation | Total Stockholders’ | |||||||||||||||||||

| Number of Shares |

| Amount |

| Number of Shares |

| Amount |

| In Capital |

| Compensation |

| Earnings |

| Reserve |

| Equity | ||||||||

Balance as of December 31, 2021 (Predecessor) |

| | $ | | | $ | | $ | | $ | ( | $ | | $ | ( | $ | | ||||||||

Issuance of shares for incentive compensation plan - consultants (Predecessor) |

| |

| | — |

| — |

| |

| ( |

| — | — |

| — | |||||||||

Issuance of shares for incentive compensation plan - employees (Predecessor) | | | — | — | | ( | — | — | — | ||||||||||||||||

Vesting of deferred stock compensation (Predecessor) | — | — | — | — | — | | — | — | | ||||||||||||||||

Net income for the six months ended June 30, 2022 (Predecessor) | — |

| — | — |

| — |

| — |

| — |

| | — |

| | ||||||||||

Foreign Currency Translation Adjustment (Predecessor) | — |

| — | — |

| — |

| — |

| — |

| — | ( |

| ( | ||||||||||

Balance as of June 30, 2022 (Predecessor) | | $ | | | $ | | $ | | $ | ( | $ | | $ | ( | $ | | |||||||||

Three Months Ended June 30, 2022

Common Stock - Class A | Common Stock - Class B | Additional Paid | Deferred Stock | Retained | Translation | Total Stockholders’ | |||||||||||||||||||

| Number of Shares |

| Amount |

| Number of Shares |

| Amount |

| In Capital |

| Compensation |

| Earnings |

| Reserve |

| Equity | ||||||||

Balance as of March 31, 2022 (Predecessor) |

| | $ | | | $ | | $ | | $ | ( | $ | | $ | ( | $ | | ||||||||

|

|

|

|

|

| ||||||||||||||||||||

Issuance of shares for incentive compensation plan - consultants (Predecessor) | | | — | — | | ( | — | — | — | ||||||||||||||||

Issuance of shares for incentive compensation plan - employees (Predecessor) | | | — | — | | ( | — | — | — | ||||||||||||||||

Vesting of deferred stock compensation (Predecessor) | — | — | — | — | — | | — | — | | ||||||||||||||||

Net income for the three months ended June 30, 2022 (Predecessor) | — | — | — | — | — | — | | — | | ||||||||||||||||

Foreign Currency Translation Adjustment (Predecessor) | — | — | — | — | — | — | — | ( | ( | ||||||||||||||||

Balance as of June 30, 2022 (Predecessor) | | $ | | | $ | | $ | | $ | ( | $ | | $ | ( | $ | | |||||||||

The accompanying notes are an integral part of these financial statements.

6

AGRI-FINTECH HOLDINGS, INC. (f/k/a Tingo, Inc.)

STATEMENTS OF CASH FLOWS

(Successor and Consolidated for the Predecessor Period)

(Unaudited)

| Successor Period | Predecessor Period | |||||

Six Months Ended | Six Months Ended | ||||||

June 30, 2023 |

|

| June 30, 2022 | ||||

Cash flows from operating activities: |

|

|

| ||||

Net income (loss) | $ | ( | $ | | |||

Adjustments to reconcile net income (loss) to cash provided by (used in) operating activities: | |||||||

Depreciation and amortization | — | | |||||

Stock issued for services | — | | |||||

Deferred compensation | | | |||||

Settlement expense | | — | |||||

Increase/decrease related to: | |||||||

Inventories | — | | |||||

Trade and other receivables | — | | |||||

Other current assets | ( | — | |||||

Accounts payable and accruals | | ( | |||||

Deferred income | — | | |||||

Value added tax | — | | |||||

Taxes payable | — | ( | |||||

Net cash provided by (used in) operating activities | | ||||||

Cash flows from financing activities: | |||||||

Proceeds from related party | — | | |||||

Proceeds from notes payable | | | |||||

Payments on advances from related party | ( | — | |||||

Net cash provided by (used in) financing activities | ( | | |||||

Translation adjustment | — | ( | |||||

Net change in cash and cash equivalents | | ||||||

Cash and cash equivalents, beginning of the period | | | |||||

Cash and cash equivalents, end of the period | $ | | $ | | |||

Supplemental Cash flow information | |||||||

Cash paid for period for: | |||||||

Income taxes | $ | — | $ | | |||

Interest | $ | — | $ | | |||

Non-cash disclosures | |||||||

Shares issued under incentive plan – employees | $ | — | $ | | |||

Shares issued to outside parties for services | $ | — | $ | | |||

The accompanying notes are an integral part of these financial statements.

7

AGRI-FINTECH HOLDINGS, INC. (f/k/a Tingo, Inc.)

NOTES TO FINANCIAL STATEMENTS

JUNE 30, 2023

(Unaudited)

| (1) | Description of Business and Basis of Presentation |

Description of Business—Agri-Fintech Holdings, Inc., formerly known as ‘Tingo, Inc.’ (“we,” “us,” “our,” and the “Company”), a Nevada corporation, was formed on February 17, 2015. Our shares trade on the OTC Markets trading platform under the symbol ‘TMNA’.

As described more fully under Note 2 - Sale of Tingo Mobile below, on December 1, 2022, we sold Tingo Mobile Limited (“Tingo Mobile”), our sole operating subsidiary, to Tingo Group, Inc. (“TIO”), a Nasdaq-traded financial services company (formerly known as MICT, Inc.), in exchange for

Prior to our sale of Tingo Mobile, the Company, together with its operating subsidiary, was an Agri-Fintech company offering a comprehensive platform service through use of smartphones – ‘device as a service’ (using GSM technology) to empower a marketplace to enable subscribers/farmers within and outside of the agricultural sector to manage their commercial activities of growing and selling their production to market participants both domestically and internationally. The ecosystem provides a ‘one stop shop’ solution to enable such subscribers to manage everything from airtime top ups, bill pay services for utilities and other service providers, access to insurance services and micro finance to support their value chain from ‘seed to sale’.

Our principal office is located at 11650 South State Street, Suite 240, Draper, UT 84020, and the telephone number is +1-385-463-8168. Our corporate website is located at www.tingoinc.com. We make available free of charge on our website our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and all amendments to those reports as soon as reasonably practicable after such material is electronically filed or furnished to the Securities and Exchange Commission (“SEC”).

Basis of Presentation— The accompanying unaudited financial statements have been prepared in accordance with the instructions to Form 10-Q and Articles 3 and 3A of Regulation S-X. All normal recurring adjustments considered necessary for a fair presentation have been included. The financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America (“US GAAP”).

As a result of the sale of our operating business on December 1, 2022 as described in Note 2, Sale of Tingo Mobile below, the following terms refer to our operations before and after the sale:

| ● | “Predecessor” and “Predecessor Period” refers to the consolidated operations of the Company from January 1, 2022 through June 30, 2022; and |

| ● | “Successor” and “Successor Period” refers to the operations of the Company from December 1, 2022, the date of our sale of Tingo Mobile, through December 31, 2022, and from January 1, 2023 through June 30, 2023. |

Our financial statements include our accounts and those of our wholly-owned subsidiaries, as applicable. All intercompany transactions and balances have been eliminated in the accompanying consolidated financial statements.

Our results of operations for the Predecessor Period ended June 30, 2022, the year ended December 31, 2022, or the six months ended June 30, 2023 are not necessarily indicative of results that ultimately may be achieved for the remainder of 2023.

Due to the lack of comparability of the financial statements of the Predecessor Period with the Successor Period, our financial statements and related footnotes are presented with a “black line” division to emphasize the lack of comparability between amounts presented as of, and after, December 1, 2022 and amounts presented for all prior periods.

8

Reverse Acquisition Accounting—We have adopted reverse acquisition accounting methods in connection with the Company’s Acquisition of Tingo Mobile in 2021. Accordingly, the consolidated financial statements reflect the results of Tingo Mobile for the Predecessor Periods indicated in this Report.

| (2) | Sale of Tingo Mobile |

Overview. On December 1, 2022, we sold Tingo Mobile, our sole operating subsidiary, to Tingo Group, Inc. (formerly known as MICT, Inc.), a Delaware corporation whose common shares are traded on the Nasdaq Capital Market under the symbol ‘TIO’. The sale was accomplished via a multi-phase forward triangular merger. Under the terms of the Merger Agreement we entered into with TIO and representatives of each of the shareholders of the Company and TIO, we contributed our ownership of Tingo Mobile to a newly organized holding company incorporated in the British Virgin Islands (“Tingo BVI Sub”). We then merged Tingo BVI Sub with and into MICT Fintech Ltd, a wholly-owned subsidiary of TIO also incorporated in the British Virgin Islands (“MICT Fintech”), resulting in Tingo Mobile being wholly-owned by TIO as a third-tier subsidiary (hereinafter, the “Merger”).

Consideration Received. As consideration for the Merger, we received the following:

| ● | Common and Preferred Stock. At the closing of the Merger, we received |

| ● | Undertaking to Pay Certain Liabilities of the Company. Pursuant to the terms of the Merger Agreement, we also received an undertaking from TIO to pay certain liabilities and accounts payable of the Company as of November 30, 2022, as well as certain other expenses relating to the maintenance of our reporting status under the Securities Exchange Act for the |

Key Terms of Series B Preferred Stock. Upon approval by Nasdaq of the change of control of TIO and upon the approval of TIO’s stockholders, the Series B Preferred Stock will convert into

Temporary Investment Company Status. Effective upon the closing of the Merger, the Company became subject to the Investment Company Act of 1940, as amended (the “1940 Act”). Under the 1940 Act, any issuer of securities that has more than 100 beneficial owners and holds investment securities that exceed more than 40% of the value of the issuer’s unconsolidated assets is considered an ‘investment company’ and is therefore subject to various requirements of the 1940 Act, unless an exemption therefrom is applicable. Rule 3a-2 permits issuers such as the Company, to be “deemed not to be engaged in the business of investing, reinvesting, owning, holding or trading in securities” for up to one year from the date that the 1940 Act would have technically applied if (i) the issuer’s business activities are inconsistent with those of an investment company, and (ii) the issuer’s governing board passes a resolution stating the issuer’s “bona fide intent to be engaged primarily, as soon as is reasonably possible” to be “in a business other than that of investing, reinvesting, owning, holding or trading in securities” within such one year period. Because the Company is actively involved in acquiring operating assets or otherwise developing other operating businesses, its present activities are inconsistent with those of an investment company. Moreover, inasmuch as the Company expects to effect a conversion of the Series B Preferred Stock no later than September 30, 2023 and, therefore, consolidate the operations of TIO and its subsidiaries with the Company’s own operations, the Company has expressed its bona fide intent to be in a business other than that of an investment company.

9

| (3) | Significant Accounting Policies |

The following is a summary of significant accounting policies followed by the Company in the preparation of our financial statements:

Consolidation—In accordance with Article 6 of Regulation S-X under the Securities Act of 1933, we do not consolidate equity interests we hold in other entities. Under the investment company rules and regulations pursuant to the American Institute of Certified Public Accountants (“AICPA”) Audit and Accounting Guide for Investment Companies, codified in ASC 946, we are precluded from consolidating any entity other than another investment company, except that ASC 946 provides for the consolidation of a controlled operating company that provides substantially all of its services to the investment company or its consolidated subsidiaries.

Valuation of Our Holdings in TIO—In connection with the sale of Tingo Mobile to TIO, we received shares of TIO common stock and two series of convertible preferred stock of TIO, one of which series which has since been converted into TIO common stock. The shares of TIO common stock are traded on the Nasdaq Capital Market under the symbol ‘TIO’. Because, at December 31, 2022 and June 30, 2023, more than 40% of the value of our unconsolidated assets consists of ‘investment securities’ (as such term is defined pursuant to the Investment Company Act of 1940, as amended (the “1940 Act”), we are considered an ‘investment company’ under the 1940 Act and, as a result, we are required to assess the fair value of our holding in TIO.

Fair Value Measurement. Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date and sets out a fair value hierarchy. The fair value hierarchy gives the highest priority to quoted prices in active markets for identical assets or liabilities (Level 1) and the lowest priority to unobservable inputs (Level 3). Inputs are broadly defined as assumptions market participants would use in pricing an asset or liability. The three levels of the fair value hierarchy are described below:

| ● | Level 1—Unadjusted quoted prices in active markets for identical assets or liabilities that the reporting entity has the ability to access at the measurement date. |

| ● | Level 2—Inputs other than quoted prices within Level 1 that are observable for the asset or liability, either directly or indirectly; and fair value is determined through the use of models or other valuation methodologies. |

| ● | Level 3—Inputs are unobservable for the asset or liability and include situations where there is little, if any, market activity for the asset or liability. The inputs into the determination of fair value are based upon the best information under the circumstances and may require significant management judgment or estimation. |

Management Considerations. In certain cases, the inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, an asset’s level within the fair value hierarchy is based on the lowest level of input that is significant to the fair value measurement. Our assessment of the significance of a particular input to the fair value measurement in its entirety requires judgment, and considers factors specific to the asset. In the case of Tingo, we assessed the nature of our holding of common and convertible Preferred Stock in TIO and considered certain factors which, in management’s view, made this holding a Level 2 asset, including the following:

| ● | the lack of institutional trading in TIO common stock; and |

| ● | the conditions associated with conversion of the TIO Preferred Stock into TIO common stock. |

With respect to the last point above, we consider it significant that, should conversion of our Series B Preferred Stock not occur by September 30, 2023, we can require TIO to redeem these shares in exchange for (1) a cash payment obligation of $

Determination of Fair Value. In view of the foregoing analysis and in accordance with ASC 820 and ASC 805, we calculated a fair value of the consideration we received in connection with the Merger at $

10

market value per share of TIO would have led to a significant realized loss as well as other valuation anomalies that it created. Hence, and in accordance with ASC 805-30-30-5, we reassessed the determination of the consideration transferred and determined that the use of the quoted price of our Class A common stock on the OTC at market close is more appropriate in determining the consideration fair value..

Use of Estimates—The preparation of financial statements in accordance with U.S. GAAP requires us to make estimates and assumptions that affect the reported amounts and disclosures in the financial statements. Although we believe the estimates and assumptions used in preparing these financial statements and related notes are reasonable in light of known facts and circumstances, actual results could differ from those estimates.

Earnings Per Share— Basic and diluted per share calculations are computed utilizing the weighted-average number of shares of common stock outstanding for the period. Pursuant to our 2021 Equity Incentive Plan, the unvested shares of restricted stock awarded pursuant to our equity compensation plans are participating securities and, therefore, are included in the basic earnings per share calculation.

Share-Based Compensation—We account for share-based compensation using the fair value method, as prescribed by ASC 718, Compensation-Stock Compensation. Accordingly, for restricted stock awards, we measure the grant date fair value based upon the market price of our common stock on the date of the grant and amortize the fair value of the awards as share-based compensation expense over the requisite service period, which is generally the vesting term. For all share-based awards that are not subject to vesting, we recognize expense associated with the award during the period in which the award is granted, in an amount equal to the number of shares granted, multiplied by the closing trading price of the shares on the relevant grant date. Determining the appropriate fair value of share-based awards requires the use of subjective assumptions, particularly given that the Company’s common stock is not actively traded. The assumptions used in calculating the fair value of share-based awards represent management’s best estimates and involve inherent uncertainties and the application of management’s judgment. As a result, if factors change and management uses different assumptions, share-based compensation expense could be materially different for future awards.

Classes of Common Stock—The Company has

Retained Earnings— The components that make up distributable earnings for the Successor Period and the Predecessor Period on the Company’s Balance Sheet as of June 30, 2023 and 2022 are as follows:

| Successor Period | Predecessor Period | |||||

Six Months Ended | Six Months Ended | ||||||

June 30, 2023 |

|

| June 30, 2022 | ||||

Net income (loss) for period | $ | ( | $ | | |||

Retained Earnings - beginning of period | | | |||||

Retained Earnings | $ | | $ | | |||

11

Accounts Receivable—The Company had

Impairment of Long-Lived Assets—The Company assesses the recoverability of the carrying value of its long-lived assets when events occur that indicate an impairment in value may exist. An impairment loss is indicated if the sum of the expected undiscounted future net cash flows is less than the carrying amount of the assets. If this occurs, an impairment loss is recognized for the amount by which the carrying amount of the assets exceeds the estimated fair value of the assets. There was

Income Taxes—The Company uses the liability method of accounting for income taxes under which deferred tax assets and liabilities are recognized for the future tax consequences of temporary differences between the accounting bases and the tax bases of the Company’s assets and liabilities. The deferred tax assets are computed using enacted tax rates in effect for the year in which the temporary differences are expected to reverse.

The Company has adopted ASC guidance regarding accounting for uncertainty in income taxes. This guidance clarifies the accounting for income taxes by prescribing the minimum recognition threshold an income tax position is required to meet before being recognized in the consolidated financial statements and applies to all income tax positions. Each income tax position is assessed using a two-step process. A determination is first made as to whether it is more likely than not that the income tax position will be sustained, based upon technical merits, upon examination by the taxing authorities. If the income tax position is expected to meet the more likely than not criteria, the benefit recorded in the consolidated financial statements equals the largest amount that is greater than 50% likely to be realized upon its ultimate settlement. As of June 30, 2023 and 2022, there were

The reconciliation of income tax benefit at the U.S. statutory rate of

Six Months Ended June 30, | |||||||||||

| 2023 |

| Percent |

| 2022 |

| Percent | ||||

Income tax benefit | $ | ( | | % | $ | ( | | % | |||

Valuation allowance against net deferred tax assets |

| | | % |

| | | % | |||

Effective Rate | $ | — | | % | $ | — | | % | |||

The tax effects of temporary differences that give rise to the Company’s net deferred tax assets for the six months ended June 30, 2023 and 2022 are as follows:

Deferred Tax Assets |

| June 30, 2023 |

| June 30, 2022 | ||

Beginning of period | $ | — | $ | — | ||

Net operating losses |

| |

| | ||

Valuation allowance |

| ( |

| ( | ||

Net Deferred Tax Assets | $ | — | $ | — | ||

The income of a foreign subsidiary is not necessarily subject to U.S. tax, provided the income is from the active conduct of a trade or business within the non-U.S. jurisdiction. However, earnings of the foreign subsidiary, to the extent reinvested in the U.S. or distributed to the U.S. parent as a dividend, may be subject to U.S. tax. In addition, the Internal Revenue Code requires that transfer pricing between a U.S. parent and a foreign subsidiary be made on an arms’ length basis. Tingo Mobile, our sole operating subsidiary during the Predecessor Period, did not issue any dividends during such period.

12

In our Statements of Operations, as consolidated for the Predecessor Period, we have deducted taxes payable in connection with our former operations in Nigeria. However, inasmuch as the U.S. and Nigeria do not have a tax treaty, we do not receive a corresponding credit in the U.S. for tax paid in Nigeria by Tingo Mobile, then our wholly-owned subsidiary. In addition, our parent company has incurred operating losses on an unconsolidated basis, largely due to non-cash expenses associated with stock awards made pursuant to our 2021 Equity Incentive Plan. Our ability to utilize tax losses associated with the operations of our parent company is restricted, however, due to limitations on the deductibility of certain share compensation to our executive officers and directors that may be deemed ‘excess compensation’ pursuant to Section 162(m) of the Internal Revenue Code.

Subject to any such disallowances pursuant to Code Section 162(m), the Company has approximately $

Operating Segments—We have examined our operating business for the six months ended June 30, 2022 in the Predecessor Period and the six months ended June 30, 2023 in the Successor Period pursuant to the guidance of ASC 280, Segment Reporting, which establishes standards for reporting information about operating segments. It also establishes standards for related disclosures about customers, products and geographic areas. Operating segments are defined as components of an enterprise that engage in business activities that earn revenues, incur expenses and prepare separate financial information that is evaluated regularly by our Chief Operating Decision Maker (“CODM”) in order to allocate resources and assess performance. Resources are allocated and performance is assessed by the CODM.

Based on the provisions of ASC 280, we evaluated our former operating business and considered various factors associated therewith, including the concentration of our business in one country and the integration of our leasing business with the use of our agri-fintech platform that utilizes software embedded within the leased device. Accordingly, this evaluation resulted in

Leased Assets— The Company has entered into leasing arrangements principally for the provision of the offices and related facilities. The rental contracts for offices are on a month-to-month basis. A lease conveys the right to direct the use and obtain substantially all of the economic benefits of an identified asset for a period of time in exchange for consideration.

Measurement and Recognition of Leases as a Lessee— During the Predecessor Period, at lease commencement date, Tingo Mobile recognized a right-of-use asset and a lease liability on the balance sheet. The right-of-use asset is measured at cost, which is made up of the initial measurement of the lease liability, any initial direct expenses incurred by the company, an estimate of any expenses to dismantle and remove the asset at the end of the lease, and any lease payments made in advance of the lease commencement date (net of any incentives received). Tingo Mobile depreciates the right-of-use assets on a straight-line basis from the lease commencement date to the earlier of the end of the useful life of the right-of-use asset or the end of the lease term. Tingo Mobile also assesses the right-of-use asset for impairment when such indicators exist.

Also during the Predecessor Period, at the commencement date, Tingo Mobile measures the lease liability at the present value of the lease payments unpaid at that date, discounted using the interest rate implicit in the lease if that rate is readily available or the incremental borrowing rate. The incremental borrowing rate is the estimated rate that Tingo Mobile would have to pay to borrow the same amount over a similar term, and with similar security to obtain an asset of equivalent value. This rate is adjusted should the lessee entity have a different risk profile to that of Tingo Mobile.

Lease payments included in the measurement of the lease liability are made up of fixed payments (including in substance fixed), variable payments based on an index or rate, amounts expected to be payable under a residual value guarantee and payments arising from options reasonably certain to be exercised.

Subsequent to initial measurement, the liability will be reduced by lease payments that are allocated between repayments of principal and finance expenses. The finance cost is the amount that produces a constant periodic rate of interest on the remaining balance of the lease liability.

13

The lease liability is reassessed when there is a change in the lease payments. Changes in lease payments arising from a change in the lease term or a change in the assessment of an option to purchase a leased asset. The revised lease payments are discounted using the incremental borrowing rate at the date of reassessment when the rate implicit in the lease cannot be readily determined. The amount of the remeasurement of the lease liability is reflected as an adjustment to the carrying amount of the right-of-use asset. The exception being when the carrying amount of the right-of-use asset has been reduced to zero then any excess is recognized in profit or loss.

Payments under leases can also change when there is either a change in the amounts expected to be paid under residual value guarantees or when future payments change through an index or a rate used to determine those payments, including changes in market rental rates following a market rent review. The lease liability is remeasured only when the adjustment to lease payments takes effect and the revised contractual payments for the remainder of the lease term are discounted using an unchanged discount rate. Except for where the change in lease payments results from a change in floating interest rates, in which case the discount rate is amended to reflect the change in interest rates.

The remeasurement of the lease liability is dealt with by a reduction in the carrying amount of the right-of use asset to reflect the full or partial termination of the lease for lease modifications that reduce the scope of the lease. Any gain or loss relating to the partial or full termination of the lease is recognized in profit or loss. The right-of-use asset is adjusted for all other lease modifications.

Tingo Mobile has elected to account for short-term leases and leases of low-value assets using the practical expedients. These leases relate to the use of residential houses for a one-year period by traveling Tingo Mobile executives. Instead of recognizing a right-of-use asset and lease liability, the payments in relation to these are recognized as an expense on a straight-line basis over the lease term.

14

| (4) | Share-Based Compensation |

On October 6, 2021, the Company’s Board of Directors adopted our 2021 Equity Incentive Plan (“Incentive Plan”), the purpose of which was to promote the interests of the Company by encouraging directors, officers, employees, and consultants of Tingo to develop a long-term interest in the Company, align their interests with that of our stockholders, and provide a means whereby they may develop a proprietary interest in the development and financial success of the Company and its stockholders. The Incentive Plan is also intended to enhance the ability of the Company and its subsidiaries to attract and retain the services of individuals who are essential for the growth and profitability of the Company. The Incentive Plan permits the award of restricted stock, common stock purchase options, restricted stock units, and stock appreciation awards. The maximum number of shares of our Class A common stock that are subject to awards granted under the Incentive Plan is

The following table summarizes the activity related to granted, vested, and unvested restricted stock awards under the Incentive Plan for the six months ended June 30, 2023:

|

| Weighted | |||

Number of | Average Grant | ||||

Shares | Date Fair Value | ||||

Unvested shares outstanding, January 1, 2023 |

| | $ | | |

Shares granted |

| — | — | ||

Shares vested |

| | $ | | |

Shares forfeited |

| — |

| — | |

Unvested shares outstanding, June 30, 2023 |

| | $ | | |

| (5) |

(5) | Revenue Recognition |

Policy

Revenue is recognized when a customer obtains control of promised goods or services and is recognized in an amount that reflects the consideration that an entity expects to receive in exchange for those goods or services. In addition, the standard requires disclosure of the nature, amount, timing, and uncertainty of revenue and cash flows arising from contracts with customers. The amount of revenue that is recorded reflects the consideration that the Company expects to receive in exchange for those goods. The Company applies the following five-step model in order to determine this amount:

| 1. | Identification of the promised goods in the contract; |

| 2. | Determination of whether the promised goods are performance obligations, including whether they are distinct in the context of the contract; |

| 3. | Measurement of the transaction price, including the constraint on variable consideration; |

| 4. | Allocation of the transaction price to the performance obligations; and |

15

| 5. | Recognition of revenue when (or as) the Company satisfies each performance obligation. |

The Company only applies the five-step model to contracts when it is probable that the entity will collect the consideration it is entitled to in exchange for the goods or services it transfers to the customer. Once a contract is determined to be within the scope of ASC 606 at contract inception, the Company reviews the contract to determine which performance obligations the Company must deliver and which of these performance obligations are distinct. The Company recognizes as revenues the amount of the transaction price that is allocated to the respective performance obligation when the performance obligation is satisfied or as it is satisfied. During the Predecessor Period, the Company’s performance obligations with regard to its leasing contracts are satisfied over time in the case of our mobile phone leases, and at a point in time in the case of our agri-fintech services, typically upon delivery.

During the Predecessor Period, our revenue was comprised of lease payments for our smartphone devices, and fees for services and financial technology solutions. We offered service-only contracts and contracts that bundle equipment used to access the services and/or with other service offerings. Some contracts had fixed terms and others are cancellable on a short-term basis (i.e., month-to-month arrangements). We have elected to record revenue net of taxes collected from our customers that are remitted to governmental authorities, with the collected taxes recorded within other current liabilities until remitted to the relevant government authority.

Sources

During the Predecessor Period (prior to our sale of Tingo Mobile), the Company had the following principal revenue sources:

| ● | Mobile Leasing – customers entered an annual contract for a fixed monthly rental. The customers are committed for the full term. Our accounting policy was to recognize lease revenue ratably during the term. We did not assess a cost of sales associated with such lease revenue, but instead depreciated our mobile devices ratably on a straight-line basis over their estimated useful life of |

| ● | Call and Data Services – our customers used call and data services at normalized rates which, given the increasing proliferation of wifi connections, even in rural locations, have steadily declined over time. |

| ● | Nwassa services – this is Tingo Mobile’s Agri-Fintech platform powered by the smartphones leased on an annual term as described above, known as ‘device as a service’. Revenue was recognized based on the following basis as out performance obligations are satisfied: |

| ● | Agri- Marketplace –percentage of the value of produce trade on Nwassa |

| ● | Mobile Airtime Top-up – fixed percentage of value of top-up |

| ● | Utilities – fixed percentage of value of transaction |

| ● | Mobile Insurance – fixed fee recognized monthly based on contract |

| ● | Financial Services (Loans and Related Services) – fixed referral fee depending upon service provided |

While Tingo Mobile’s Nwassa applications are integrated with its branded phones, each of the services are distinct and contain independent performance obligations. The range and quantity of services used are determined solely by the end-user.

| (6) | Foreign Currency Translation |

The consolidated financial statements are presented in U.S. dollars, which is the presentation currency and the functional currency during the Successor Period, and the functional currency for the Predecessor Period is Nigeria Naira. Due to the sale of Tingo

16

Mobile, our sole operating subsidiary, on December 1, 2022, the exchange rate is not applicable as of and for the six months ended June 30, 2023.

The exchange rates used for conversion are:

| June 30, |

| December 31, | |

2023 | 2022 | |||

Balance Sheet: |

|

|

|

|

Nigerian Naira |

| n/a |

| |

Statement of Operations: |

|

|

|

|

Nigerian Naira |

| n/a |

| |

Foreign currency transactions are translated into the functional currencies of the Company’s subsidiaries using the exchange rates prevailing at the dates of the transactions. Foreign exchange gains and losses resulting from the settlement of such transactions and from the translation at period-end exchange rates of monetary assets and liabilities denominated in foreign currencies are recognized in the consolidated statements of operations and comprehensive income. Non-monetary items carried at cost are translated using the exchange rate at the date of the transaction. Non-monetary items carried at fair value are translated at the date the fair value is determined. For Nigeria, due to the volatile nature of the exchange rate, during the Predecessor Period, we applied the prudent approach to convert both the Statement of Operations and Balance Sheet at the same rate to indicate a fairer reflection of the state of affairs.

| (7) | Loans and Other Receivables – Related Parties |

Loans and other receivables due from related parties consisted of the following as of June 30, 2023 and December 31, 2022:

| June 30, 2023 |

| December 31, 2022 | |||

Due from related party |

| $ | |

| $ | |

Advances to related party |

| — |

| | ||

Note receivable due from Tingo Mobile, dated October 15, 2022, interest at |

| |

| | ||

Total loans and other receivables – related parties |

| $ | |

| $ | |

Due from related party consists of obligations due under the terms of the Merger Agreement with TIO. Pursuant to the terms of the agreement, TIO agreed to pay certain liabilities and accounts payable of the Company as of November 30, 2022, as well as certain other expenses relating to the maintenance of our reporting status under the Securities Exchange Act for the one-year period following the Merger.

The note receivable due from Tingo Mobile relates to sums provided to Tingo Mobile by the Company during the Predecessor Period to acquire mobile devices in the fourth quarter of 2022 and was advanced to Tingo Mobile prior to its sale to TIO as described Under Note 2 – Sale of Tingo Mobile above. The balance consists of principal in the amount of $

| (8) | Investments in Securities |

Investment in Securities—In connection with the sale of Tingo Mobile as described under Note 2 above, we concluded a value of $

17

| (9) | Liquidity and Financing Arrangements |

Liquidity— There are several factors that may materially affect our liquidity during the reasonably foreseeable future including, for example, currency volatility, foreign exchange controls and other items that affect our cash flows. In view of the foregoing, we believe that our operating cash flow and cash on hand will be sufficient to meet operating requirements from the date of this filing through the next twelve months.

Cash and Cash Equivalents— As of June 30, 2023, we had cash and cash equivalents of approximately $

(10) Current and Non-Current Liabilities

Accounts payable and accruals

Accounts payable and accruals consisted of the following:

| June 30, 2023 |

| December 31, 2022 | |||

Accounts payable |

| $ | |

| $ | |

Accrued compensation |

| |

| | ||

Other payables |

| |

| | ||

Total accounts payable and accruals |

| $ | |

| $ | |

Advances from Related Party— Advances from related party was $

Notes Payable – Related Parties— This amount represents a promissory note in the amount of $

(11) Commitments and Contingencies

Operating Leases—During the Predecessor Period, we were responsible for an operating lease covering office space in Nigeria for Tingo Mobile, our former operating subsidiary. We continue to be subject to an operating lease in the United States on a month-to-month basis. We consider this arrangement to be a ‘low value lease’ and, accordingly, have not recognized a right of use asset or liability in our financial statements.

Litigation Settlement—During the six months ended June 30, 2023, we settled a lawsuit with ClearThink Capital, LLC (“ClearThink”). Pursuant to the terms of the settlement, on the one-year anniversary date of the settlement, we are obligated to pay ClearThink Capital, LLC a combination of Company common stock and common stock of TIO held by the Company equal in value to $

Legal Proceedings―While we are not currently subject to any legal proceedings, from time to time, the Company or one or more of its subsidiaries may become a party to certain proceedings incidental to the normal course of our business. While the outcome of any potential legal proceedings cannot at this time be predicted with certainty, we do not expect that any such proceedings will have a material effect upon our financial condition or results of operations.

Estimated losses from contingencies are accrued by a charge to earnings when information available prior to the issuance of the financial statements indicates that it is likely that a future event will confirm that an asset has been impaired or a liability incurred at the date of the financial statements and the amount of the loss can be reasonably estimated.

(12) Related-Party Transactions and Agreements

See Note 7 – Loans and Other Receivables and the disclosures in Note 10 - Current and Non-current Liabilities.

18

From time-to-time, we may enter into transactions or incur indebtedness to persons affiliated with members of our board of directors, executive officers. We will seek to ensure that, to the greatest extent possible, any such agreements or transactions are undertaken on an arms-length basis and representative of standard commercial terms and conditions that would be available to us from third parties.

Note payable – related party consists of a promissory note due to TIO in connection with the Merger Agreement. The note has a principal amount of $

Note receivable – related party consists of a promissory note due from Tingo Mobile that was used to acquire mobile devices during the Predecessor Period in the fourth quarter of 2022. The note has a principal amount of $

(13) Subsequent Events

Management performed an evaluation of the Company’s activity through the date the financial statements were issued, noting the following subsequent event:

On July 27, 2023, we converted our holding of TIO Series A Preferred Stock into

19

Item 2. | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

Agri-Fintech Holdings, Inc., formerly known as ‘Tingo, Inc.’ (“we,” “us,” “our,” and the “Company”), a Nevada corporation, was formed on February 17, 2015. Our shares trade on the OTC Markets trading platform under the symbol ‘TMNA’.

As described more fully under Sale of Tingo Mobile below, on December 1, 2022, we sold Tingo Mobile Limited (“Tingo Mobile”), our sole operating subsidiary, to Tingo Group, Inc. (“TIO”), a Nasdaq-traded financial services company (formerly known as MICT, Inc.), in exchange for 25,783,675 shares of TIO common stock and two series of preferred stock that are convertible into TIO common stock upon the occurrence of certain conditions (“Preferred Stock”). On July 27, 2023, we converted one of these series of Preferred Stock into 26,042,808 additional shares of TIO common stock. If we convert the remainder of the Preferred Stock, our shareholding in TIO will be equal to 75.0% of TIO’s outstanding common stock, calculated as of the date of the sale of Tingo Mobile. Importantly, because we expect to hold 75.0% of the outstanding TIO common stock at some point during 2023, this report will discuss the historical operations of Tingo Mobile as a former subsidiary of the Company, and will discuss the future operations of Tingo Mobile as a pending subsidiary of the Company.

Prior to our sale of Tingo Mobile, the Company, together with its operating subsidiary, was an Agri-Fintech company offering a comprehensive platform service through use of smartphones – ‘device as a service’ (using GSM technology) to empower a marketplace to enable subscribers/farmers within and outside of the agricultural sector to manage their commercial activities of growing and selling their production to market participants both domestically and internationally. The ecosystem provides a ‘one stop shop’ solution to enable such subscribers to manage everything from airtime top ups, bill pay services for utilities and other service providers, access to insurance services and micro finance to support their value chain from ‘seed to sale’.

Our principal office is located at 11650 South State Street, Suite 240, Draper, UT 84020, and the telephone number is +1-385-463-8168. Our corporate website is located at www.tingoinc.com. We make available free of charge on our website our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and all amendments to those reports as soon as reasonably practicable after such material is electronically filed or furnished to the Securities and Exchange Commission (“SEC”).

Sale of Tingo Mobile

Overview. On December 1, 2022, we sold Tingo Mobile, our sole operating subsidiary, to TIO. The sale was accomplished via a multi-phase forward triangular merger. Under the terms of the Merger Agreement we entered into with TIO and representatives of each of the shareholders of the Company and TIO, we contributed our ownership of Tingo Mobile to a newly organized holding company incorporated in the British Virgin Islands (“Tingo BVI Sub”). We then merged Tingo BVI Sub with and into MICT Fintech Ltd, a wholly-owned subsidiary of TIO also incorporated in the British Virgin Islands (“MICT Fintech”), resulting in Tingo Mobile being wholly-owned by TIO as a third-tier subsidiary (hereinafter, the “Merger”).

Consideration Received. As consideration for the Merger, we received the following:

| ● | Common and Preferred Stock. At the closing of the Merger, we received 25,783,675 shares of newly-issued common stock of TIO equal to 19.9% of its outstanding shares, calculated as of the closing date of the Merger, and two series of convertible preferred shares – Series A Convertible Preferred Stock (“Series A Preferred Stock”) and Series B Convertible Preferred Stock (“Series B Preferred Stock”). On July 27, 2023, we converted the Series A Preferred Stock into 26,042,808 additional shares of TIO common stock. |

| ● | Undertaking to Pay Certain Liabilities of the Company. Pursuant to the terms of the Merger Agreement, we also received an undertaking from TIO to pay certain liabilities and accounts payable of the Company as of November 30, 2022, as well as certain other expenses relating to the maintenance of our reporting status under the Securities Exchange Act for the one-year period following the Merger. As of December 31, 2022 and June 30, 2023, the amount due to us pursuant to this undertaking was approximately $3.7 million and $3.6 million, respectively. This amount is set forth below in our audited financial statements as ‘Due from Related Party’ under Note 7 – Loans and Other Receivables – Related Parties. |

20

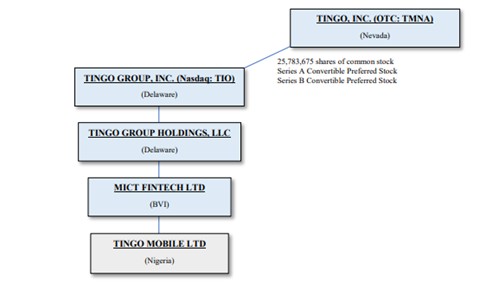

Structure. Immediately following the Merger, our ownership interest in TIO and TIO’s ownership of Tingo Mobile was as shown in the following diagram (other subsidiaries of TIO not shown):

Key Terms of Series B Preferred Stock. Upon approval by Nasdaq of the change of control of TIO and upon the approval of TIO’s stockholders, the Series B Preferred Stock will convert into 35.0% of the outstanding shares of TIO common stock, calculated as of the closing date of the Merger, giving the Company an aggregate ownership of 75.0% of TIO’s outstanding common stock. If such shareholder or Nasdaq approval is not obtained by June 30, 2023, we will have the right to cause TIO to redeem all of the Series B Preferred Stock for either of the following, at our option: (x) $666,666,667 in cash or, (y) a 33.0% ownership interest in Tingo Group Holdings, LLC, a Delaware-incorporated subsidiary of TIO as shown in the diagram above ("TGH"). TGH is the immediate parent of MICT Fintech, which is the sole shareholder of Tingo Mobile.

Temporary Investment Company Status. Effective upon the closing of the Merger, the Company became subject to the Investment Company Act of 1940, as amended (the “1940 Act”). Under the 1940 Act, any issuer of securities that has more than 100 beneficial owners and holds ‘investment securities’ (as defined under the 1940 Act) that exceed more than 40% of the value of the issuer’s unconsolidated assets is considered an ‘investment company’ and is therefore subject to various requirements of the 1940 Act, unless an exemption therefrom is applicable. One such requirement of the 1940 Act includes determining the fair value of equity securities held by the issuer instead of consolidating the underlying operations of such equity holdings. Rule 3a-2 permits issuers such as the Company, to be “deemed not to be engaged in the business of investing, reinvesting, owning, holding or trading in securities” for up to one year from the date that the 1940 Act would have technically applied if (i) the issuer’s business activities are inconsistent with those of an investment company, and (ii) the issuer’s governing board passes a resolution stating the issuer’s “bona fide intent to be engaged primarily, as soon as is reasonably possible” to be “in a business other than that of investing, reinvesting, owning, holding or trading in securities” within such one year period. Because the Company is actively involved in acquiring operating assets or otherwise developing other operating businesses, its present activities are inconsistent with those of an investment company. Moreover, inasmuch as the Company expects to effect a conversion of the Series B Preferred Stock no later than September 30, 2023 and, therefore, consolidate the operations of TIO and its subsidiaries with the Company’s own operations, the Company has expressed its bona fide intent to be in a business other than that of an investment company.

The information contained in this section should be read in conjunction with our financial statements and notes thereto appearing elsewhere in this 10-Q and in conjunction with the financial statements and notes thereto in the Company’s Annual Report on Form 10-K and any subsequent amendments thereto (“10-K”). In addition, some of the statements in this report constitute forward-looking statements. The matters discussed in this 10-Q, as well as in future oral and written statements by management of Tingo, that are forward-looking statements are based on current management expectations that involve substantial risks and uncertainties which could cause actual results to differ materially from the results expressed in, or implied by, these forward-looking statements. Forward-looking statements relate to future events or our future financial performance. We generally identify forward-looking statements by terminology such as “may,” “will,” “should,” “expects,” “plans,” “anticipates,” “could,” “intends,” “target,” “projects,” “believes,” “estimates,” “predicts,” “potential” or “continue” or the negative of these terms or other similar words. Important assumptions include our ability to generate revenues, achieve certain margins and levels of profitability, and the availability of additional capital. In light of

21

these and other uncertainties, the inclusion of a forward-looking statement in this 10-Q should not be regarded as a representation by us that our plans or objectives will be achieved. The forward-looking statements contained in this 10-Q include statements as to:

| ● | our future operating results; |

| ● | our business prospects; |

| ● | currency volatility, foreign exchange, and inflation risk; |

| ● | our contractual arrangements with our customers and other relationships with third parties; |

| ● | the dependence of our future success on the general economy and its impact on the industries in which we invest; |

| ● | political instability in the countries in which we operate; |

| ● | uncertainty regarding certain legal systems in Africa; |

| ● | our dependence upon external sources of capital; |

| ● | our expected financings and capital raising; |

| ● | our regulatory structure and tax treatment; |

| ● | the adequacy of our cash resources and working capital; |

| ● | the timing of cash flows from our operations; |

| ● | the impact of fluctuations in interest rates on our business; |

| ● | market conditions and our ability to access additional capital, if deemed necessary; |

| ● | uncertainty regarding the timing, pace and extent of an economic recovery in the United States and elsewhere; and |

| ● | natural or man-made disasters and other external events that may disrupt our operations. |

There are a number of important risks and uncertainties that could cause our actual results to differ materially from those indicated by such forward-looking statements. For a discussion of factors that could cause our actual results to differ from forward-looking statements contained in this 10-Q, please see the discussion in “Item 1A. Risk Factors” in our 10-K. In particular, you should carefully consider the risks we have described in the 10-K and elsewhere in this 10-Q concerning the coronavirus pandemic and the economic impact of the coronavirus on the Company and our operations. You should not place undue reliance on these forward-looking statements. The forward-looking statements made in this 10-Q relate only to events as of the date on which the statements are made. We undertake no obligation to update any forward-looking statement to reflect events or circumstances occurring after the date this 10-Q is filed with the SEC.

22

Results of Operations

Because we sold Tingo Mobile, our sole operating subsidiary, on December 1, 2022, a comparison of results of operations, cost of revenues, and related items for the six months ended June 30, 2023 with the six months ended June 30, 2022 would not be meaningful and, consequently, has not been included in this section.

Selling, General & Administrative Expenses

The following table sets forth selling, general and administrative expenses for the six months ended June 30, 2023 and 2022:

| Six Months Ended | |||||

| June 30, 2023 |

| June 30, 2022 | |||

Depreciation and amortization | $ | — | $ | 213,617,432 | ||

Professional fees | 579,084 | 68,490,826 | ||||

Payroll and related expenses | 21,950,792 | 39,570,896 | ||||

Bank fees and charges | 1,774 | 996,420 | ||||

Distribution expenses | — | 509,961 | ||||

Bad debt expenses | — | 47,455 | ||||

General and administrative – other | 7,752,555 | 3,708,772 | ||||

Selling, General and Administrative Expenses |

| $ | 30,284,205 |

| $ | 326,941,762 |

The significant payroll expense and professional fees for the first six months of 2022 as compared to the first six months of 2023 relates to the vesting of a significant number of stock awards granted under our 2021 Equity Incentive Plan during the period. This resulted in stock-based compensation expense for staff and directors of $34.4 million and stock-based payments of professional fees of $66.8 million for the six months of 2022, as compared to stock-based compensation expense for staff and directors of $20.4 million and stock-based payments of professional fees of $289,000 for the first six months of 2023.

2021 Equity Incentive Plan

On October 6, 2021, the Company’s Board of Directors adopted our 2021 Equity Incentive Plan (“Incentive Plan”), the purpose of which was to promote the interests of the Company by encouraging directors, officers, employees, and consultants of Tingo to develop a long-term interest in the Company, align their interests with that of our stockholders, and provide a means whereby they may develop a proprietary interest in the development and financial success of the Company and its stockholders. The Incentive Plan is also intended to enhance the ability of the Company and its subsidiaries to attract and retain the services of individuals who are essential for the growth and profitability of the Company. The Incentive Plan permits the award of restricted stock, common stock purchase options, restricted stock units, and stock appreciation awards. The maximum number of shares of our Class A common stock that are subject to awards granted under the Incentive Plan is 131,537,545 shares. The term of the Incentive Plan will expire on October 6, 2031. On October 12, 2021, our stockholders approved our Incentive Plan and, during 2021 and 2022, the Tingo Compensation Committee granted awards under the Incentive Plan to certain directors, executive officers, employees, and consultants in the aggregate amount of 131,370,000 shares. The majority of the awards so issued are each subject to a vesting requirement over a 2-year period unless the recipient thereof is terminated or removed from their position without “cause”, or as a result of constructive termination, as such terms are defined in the respective award agreements entered into by each of the recipients and the Company. We account for share-based compensation using the fair value method, as prescribed by ASC 718, Compensation—Stock Compensation. Accordingly, for restricted stock awards, we measure the grant date fair value based upon the market price of our common stock on the date of the grant and amortize the fair value of the awards as share-based compensation expense over the requisite service period, which is generally the vesting term. For all stock awards under the Incentive Plan that are not subject to vesting, we recognize expense associated with the award during the period in which the award is granted, in an amount equal to the number of shares granted, multiplied by the closing trading price of the shares on the relevant grant date. In connection with these awards, we recorded stock-based compensation expense of $20.7 million and $101.2

23

million for the six months ended June 30, 2023 and 2022, respectively. As of June 30, 2023, total compensation expense to be recognized in future periods is $12.2 million. The weighted average period over which this expense is expected to be recognized is 0.29 years.

The following table summarizes the activity related to granted, vested, and unvested restricted stock awards under the Incentive Plan for the six months ended June 30, 2023:

|

| Weighted | |||

Number of | Average Grant | ||||

Shares | Date Fair Value | ||||

Unvested shares outstanding, January 1, 2023 |

| 16,732,916 | $ | 1.97 | |

Shares Granted |

| — | — | ||

Shares Vested |

| 10,541,406 | $ | 1.96 | |

Shares Forfeited |

| — |

| — | |

Unvested shares outstanding, June 30, 2023 |

| 6,191,516 | $ | 1.98 | |

Liquidity and Capital Resources

Cash on Hand. As of June 30, 2023, our cash and cash equivalents totaled approximately $14,000.

We expect our cash on hand, proceeds received from our assets and operations, cash flow from operations will be sufficient to meet our anticipated liquidity needs for business operations for the next twelve months. There can be no assurance that we will continue to generate cash flows at or above current levels or that we will be able to raise additional financing to support our parent company’s operating and compliance expenditures.

We believe that our operating cash flow and cash on hand will be sufficient to meet operating requirements and to finance routine capital expenditures through the next twelve months.

Off Balance Sheet Arrangements

None.

Dividends

On November 10, 2021, our Board adopted a Dividend Policy for the Company. The Policy provides a process that the Board will undertake when approving quarterly, annual, and special dividends for the Company including, but not limited to, various financial criteria and macroeconomic factors, as well as certain financial and economic factors specific to the Company. In the case of quarterly dividends, within ninety (90) calendar days following the end of each fiscal year, the Board will determine the dividend payment, if any, that will be made to holders of the Company’s capital stock. Such dividend will generally be expressed as a cash amount equal to a percentage of the Company’s consolidated after-tax net income for such prior fiscal year, and will be divided into fourths, with one-fourth of the amount payable each quarter. As of June 30, 2023, the Company has not paid any dividends in its history.

Subsequent Events

Our Management performed an evaluation of the Company’s activity through the date the financial statements were issued, noting the following subsequent event:

On July 27, 2023, we converted our holding of TIO Series A Preferred Stock into 26,042,808 shares of TIO common stock.

24

Item 3. | Quantitative and Qualitative Disclosure about Market Risk |

We are subject to financial market risks, including changes in interest rates, lease rates, credit rates, and general debt terms.

We are subject to risks regarding currency volatility and foreign exchange rates. In particular, we are subject to fluctuations in foreign exchange rates between the U.S. dollar, our reporting currency, and currencies of countries where we market or source our products and services. Such fluctuations may result in significant increases or decreases in our reported revenue and other results as expressed in dollars, and in the reported value of our assets, liabilities and cash flows. In addition, currency fluctuation may adversely affect receivables, payables, debt, firm commitments and forecast transactions denominated in non-U.S. currencies. In particular, transition risks arise where parts of the cost of sales are not denominated in the same currency of such sales. We currently do not hedge this exposure. Fluctuation in exchange rates, depreciation of local currencies, changes in monetary and/or fiscal policy or inflation in the countries in which we operate could have a material adverse effect on our business, financial condition, results of operations and prospects.

In addition to foreign currency risk, our ability to generate operating cash flows at our parent company level depends on the ability of our subsidiaries to upstream funds. Countries in which we may operate have exchange controls that can, from time to time, place restrictions on the exchange of local currency for foreign currency and the transfer of funds abroad. These controls and other controls that may be implemented in the future could limit the ability of our subsidiaries to transfer cash to us and make us dependent upon external sources of cash and credit.

We can offer no assurance that additional restrictions on currency exchange will not be implemented in the future or that these restrictions will not limit the ability of our subsidiaries to transfer cash to us, which could have a material adverse effect on our business, financial condition, results of operations and prospects.

Item 4. | Controls and Procedures |

Our management is responsible for establishing and maintaining adequate internal control over financial reporting, as defined in Rules 13a-15(f) and 15d-15(f) of the Securities Exchange Act of 1934. Our internal control over financial reporting is a process designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles. Our internal control over financial reporting includes those policies and procedures that (i) pertain to the maintenance of records that, in reasonable detail, accurately and fairly reflect the transactions and dispositions of our assets; (ii) provide reasonable assurance that transactions are recorded to permit preparation of financial statements in accordance with generally accepted accounting principles, and that receipts and expenditures of the Company are made only in accordance with authorizations of our management and directors; and (iii) provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use or disposition of our assets that could have a material effect on our financial statements.

Our management, with the participation of our Company’s Chief Executive Officer and Chief Financial Officer, have evaluated the effectiveness of the design and operations of the Company’s “disclosure controls and procedures” (as defined in Rule 13a-15(e) under the Securities Exchange Act of 1934) as of June 30, 2023. Based on their evaluation, our Chief Executive Officer and Chief Financial Officer concluded that the Company’s disclosure controls and procedures were effective at a reasonable assurance level. There has been no change in our internal control over financial reporting during the quarter ended June 30, 2023, that has materially affected, or is reasonably likely to materially affect, our internal control over financial reporting.

25

Part II.Other Information

Item 1. | Legal Proceedings |

From time to time, the Company is a party to certain proceedings incidental to the normal course of our business including the enforcement of our rights under contracts with our customers and subscribers. While the outcome of these legal proceedings cannot at this time be predicted with certainty, we do not expect that these proceedings will have a material effect upon the Company’s financial condition or results of operations.

Item 1A.Risk Factors

In connection with our sale of Tingo Mobile and as a temporary investment company following such sale, we are subject to a number of risks, many of which are identified in our Annual Report on Form 10-K and any subsequent amendments thereto (“10-K”). As the business of the Company and its subsidiaries continues to develop, we intend to identify, as will be reasonably possible, any such additional risks and include the same in our subsequent filings and reports with the SEC.

Readers should carefully consider these risks and all other information contained in our 10-K, including the Company’s financial statements and the related notes thereto. The risks and uncertainties described in our 10-K and throughout this 10-Q are not the only ones facing the Company.

Additional risks and uncertainties not presently known to us, or not presently deemed material by us, may also impair our operations and performance.

Item 2. Unregistered Sales of Equity Securities and Use of Proceeds

None.

Item 3. Defaults Upon Senior Securities

None.

Item 4. Mine Safety Disclosures

Not Applicable.

Item 5. Other Information

Not Applicable.

26

Item 6.Exhibits

3. |

| Articles of Incorporation or Bylaws | |

(a) | |||

(b) | |||

10. | Material Contracts | ||

(a) | |||

(b) | |||

(c) | |||

(d) | |||

31. | Rule 13a-14(a)/15d-14(a) Certifications | ||

1. | |||

2. | |||

32. | Rule 1350 Certifications | ||

1. | |||

2. | |||

101.INS | Formatted in Inline XBRL (Extensible Business Reporting Language) (the instance document does not appear in the Interactive Data File because its XBRL tags are embedded within the Inline XBRL document). | ||

101.SCH | Inline XBRL Taxonomy Extension Schema Document. | ||

101.CAL | Inline XBRL Taxonomy Extension Calculation Linkbase Document. | ||

101.DEF | Inline XBRL Taxonomy Extension Definition Linkbase Document. | ||

101.LAB | Inline XBRL Taxonomy Extension Label Linkbase Document. | ||

101.PRE | Inline XBRL Taxonomy Extension Presentation Linkbase Document. | ||

104 | Cover Page Interactive Data File (formatted as inline XBRL and contained in Exhibit 101). | ||

* Filed herewith

** The certifications furnished in Exhibits 32.1 and 32.2 that accompany this Quarterly Report on Form 10-Q are deemed furnished and not filed with the Securities and Exchange Commission and are not to be incorporated by reference into any filing of the Company under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, whether made before or after the date of this Quarterly Report on Form 10-Q, irrespective of any general incorporation language contained in such filing.

27

SIGNATURE

Pursuant to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934, the Registrant has caused this report to be signed by the undersigned, thereunto duly authorized.

Dated: August 14, 2023

| AGRI-FINTECH HOLDINGS, INC. (f/k/a Tingo, Inc.) |

|

|

| /s/ Dozy Mmobuosi |

| Dozy Mmobuosi |

| Chief Executive Officer |

28