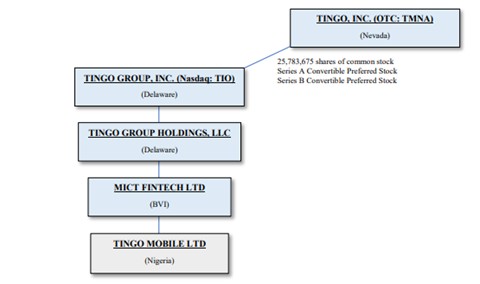

Structure. Immediately following the Merger, our ownership interest in TIO and TIO’s ownership of Tingo Mobile was as shown in the following diagram (other subsidiaries of TIO not shown):

Key Terms of Series A Preferred Stock. Upon the approval of TIO’s stockholders, the Series A Preferred Stock will convert into 20.1% of the outstanding shares of TIO common stock, calculated as of the closing date of the Merger. If such shareholder approval is not obtained by June 30, 2023, all issued and outstanding shares of Series A Preferred Stock must be redeemed by TIO in exchange for Tingo receiving 27.0% of the total issued and outstanding shares of Tingo Group Holdings, LLC, a Delaware-incorporated subsidiary of TIO as shown in the diagram above (“TGH”). TGH is the immediate parent of MICT Fintech, which is the sole shareholder of Tingo Mobile.

Key Terms of Series B Preferred Stock. Upon approval by Nasdaq of the change of control of TIO and upon the approval of TIO’s stockholders, the Series B Preferred Stock will convert into 35.0% of the outstanding shares of TIO common stock, calculated as of the closing date of the Merger, giving the Company an aggregate ownership of 75.0% of TIO’s outstanding common stock. If such shareholder or Nasdaq approval is not obtained by June 30, 2023, we will have the right to cause TIO to redeem all of the Series B Preferred Stock for either of the following, at our option: (x) $666,666,667 in cash or, (y) a 33.0% ownership interest in TGH.

Temporary Investment Company Status. Effective upon the closing of the Merger, the Company became subject to the Investment Company Act of 1940, as amended (the “1940 Act”). Under the 1940 Act, any issuer of securities that has more than 100 beneficial owners and holds ‘investment securities’ (as defined under the 1940 Act) that exceed more than 40% of the value of the issuer’s unconsolidated assets is considered an ‘investment company’ and is therefore subject to various requirements of the 1940 Act, unless an exemption therefrom is applicable. One such requirement of the 1940 Act includes determining the fair value of equity securities held by the issuer instead of consolidating the underlying operations of such equity holdings. Rule 3a-2 permits issuers such as the Company, to be “deemed not to be engaged in the business of investing, reinvesting, owning, holding or trading in securities” for up to one year from the date that the 1940 Act would have technically applied if (i) the issuer’s business activities are inconsistent with those of an investment company, and (ii) the issuer’s governing board passes a resolution stating the issuer’s “bona fide intent to be engaged primarily, as soon as is reasonably possible” to be “in a business other than that of investing, reinvesting, owning, holding or trading in securities” within such one year period. Because the Company is actively involved in acquiring operating assets or otherwise developing other operating businesses, its present activities are inconsistent with those of an investment company. Moreover, inasmuch as the Company expects to effect a conversion of the Series A Preferred Stock and the Series B Preferred Stock no later than June 30, 2023 and, therefore, consolidate the operations of TIO and its subsidiaries with the Company’s own operations, the Company has expressed its bona fide intent to be in a business other than that of an investment company.

The information contained in this section should be read in conjunction with our financial statements and notes thereto appearing elsewhere in this Amended 10-Q and in conjunction with the financial statements and notes thereto in the Company’s Annual Report on Form 10-K and any subsequent amendments thereto (“10-K”). In addition, some of the statements in this report constitute forward-looking statements. The matters discussed in this Amended 10-Q, as well as in future oral and written statements by management of Tingo, that are forward-looking statements are based on current management expectations that involve substantial risks

20