UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

(Mark One)

REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

For the fiscal year ended |

OR

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

For the transition period from to |

OR

SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Date of event requiring this shell company report

Commission file number

(Exact name of Registrant as specified in its charter)

N/A

(Translation of Registrant’s name into English)

(Jurisdiction of incorporation or organization)

+852 2121 8200

(Address of principal executive offices)

Chief Executive Officer

Telephone: +

Facsimile: +

(Name, telephone, email and/or facsimile number and address of Company contact person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

Title of each class |

| Trading Symbol(s) |

| Name of each exchange on which registered |

|

Securities registered or to be registered pursuant to Section 12(g) of the Act:

None

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

None

(Title of Class)

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the Annual Report:

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

⌧

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

◻ Yes ⌧

Note—checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 from their obligations under those sections.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

⌧

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

⌧

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See definition of “large accelerated filer,” “accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Accelerated filer ◻ | Non-accelerated filer ◻ | Emerging growth company |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act. ☐

†The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

International Financial Reporting Standards as issued | Other ◻ |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

◻ Item 17 ◻ Item 18

If this is an Annual Report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ◻

Hutchison China MediTech Limited

Table of Contents

3 | ||

5 | ||

7 | ||

7 | ||

7 | ||

7 | ||

54 | ||

141 | ||

141 | ||

172 | ||

186 | ||

190 | ||

190 | ||

190 | ||

201 | ||

201 | ||

203 | ||

203 | ||

Material Modifications to the Rights of Security Holders and Use of Proceeds | 203 | |

203 | ||

204 | ||

204 | ||

204 | ||

204 | ||

205 | ||

Purchases of Equity Securities by the Issuer and Affiliated Purchasers | 205 | |

205 | ||

205 | ||

205 | ||

206 | ||

206 | ||

206 | ||

207 | ||

209 | ||

Introduction

This annual report on Form 20-F contains our audited consolidated statements of operations data for the years ended December 31, 2019, 2018 and 2017 and our audited consolidated balance sheet data as of December 31, 2019 and 2018. Our consolidated financial statements have been prepared in accordance with U.S. generally accepted accounting principles, or U.S. GAAP.

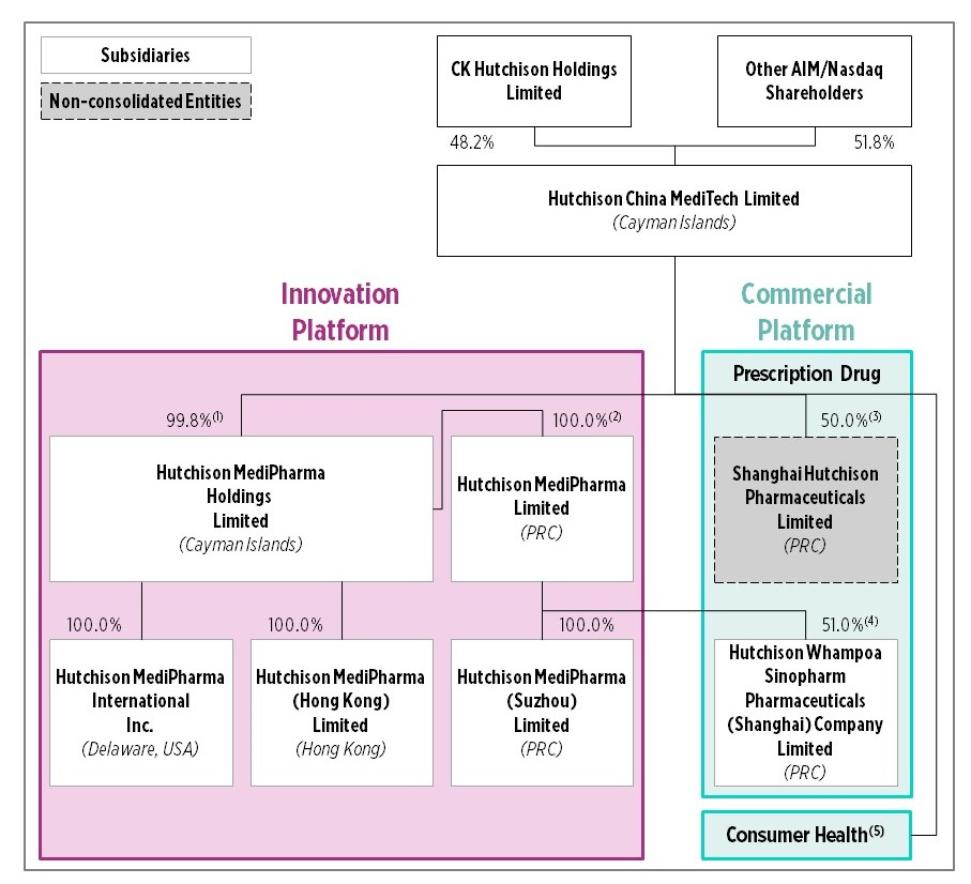

This annual report also includes audited consolidated income statement data for the years ended December 31, 2019, 2018 and 2017 and the audited consolidated statements of financial position data as of December 31, 2019 and 2018 for each of our two non-consolidated joint ventures, Shanghai Hutchison Pharmaceuticals and Hutchison Baiyunshan, which are accounted for using the equity accounting method. This annual report also includes audited consolidated income statement data for the period ended December 9, 2019 and the years ended December 31, 2018 and 2017 and the audited consolidated statement of financial position data as of December 9, 2019 and December 31, 2018 of Nutrition Science Partners when it was our non-consolidated joint venture. On December 9, 2019, we acquired our joint venture partner’s 50% shareholding in Nutrition Science Partners, after which Nutrition Science Partners became our consolidated subsidiary. The financial statements of each of Shanghai Hutchison Pharmaceuticals, Hutchison Baiyunshan and Nutrition Science Partners have been prepared in accordance with International Financial Reporting Standards, or IFRS, as issued by the International Accounting Standard Board, or IASB.

Unless the context requires otherwise, references herein to the “company,” “Chi-Med,” “we,” “us” and “our” refer to Hutchison China MediTech Limited and its consolidated subsidiaries and joint ventures.

Conventions Used in this Annual Report

Unless otherwise indicated, references in this annual report to:

| ● | “ADRs” are to the American depositary receipts, which evidence our ADSs; |

| ● | “ADSs” are to our American depositary shares, each of which represents five ordinary shares; |

| ● | “China” or “PRC” are to the People’s Republic of China, excluding, for the purposes of this annual report only, Taiwan and the special administrative regions of Hong Kong and Macau; |

| ● | “CK Hutchison” are to CK Hutchison Holdings Limited, a company incorporated in the Cayman Islands and listed on The Stock Exchange of Hong Kong Limited, or the Hong Kong Stock Exchange, and the ultimate parent company of our largest shareholder, Hutchison Healthcare Holdings Limited; |

| ● | “Guangzhou Baiyunshan” are to Guangzhou Baiyunshan Pharmaceutical Holdings Company Limited, a leading China-based pharmaceutical company listed on the Shanghai Stock Exchange and the Hong Kong Stock Exchange; |

| ● | “Hain Celestial” are to The Hain Celestial Group, Inc., a Nasdaq-listed, natural and organic food and personal care products company; |

| ● | “HK$” or “HK dollar” are to the legal currency of the Hong Kong Special Administrative Region; |

| ● | “Hutchison Baiyunshan” are to Hutchison Whampoa Guangzhou Baiyunshan Chinese Medicine Company Limited, our non-consolidated joint venture with Guangzhou Baiyunshan in which we have a 50% interest through a holding company in which we have a 80% interest; |

| ● | “Hutchison Consumer Products” are to Hutchison Consumer Products Limited, our wholly owned subsidiary; |

| ● | “Hutchison Hain Organic” are to Hutchison Hain Organic Holdings Limited, our joint venture with Hain Celestial in which we have a 50% interest; |

| ● | “Hutchison Healthcare” are to Hutchison Healthcare Limited, our wholly owned subsidiary; |

3

| ● | “Hutchison MediPharma” are to Hutchison MediPharma Limited, our subsidiary through which we operate our Innovation Platform in which we have a 99.8% interest; |

| ● | “Hutchison MediPharma Holdings” are to Hutchison MediPharma Holdings Limited, our subsidiary in which we have a 99.8% interest and which is the indirect holding company of Hutchison MediPharma; |

| ● | “Hutchison Sinopharm” are to Hutchison Whampoa Sinopharm Pharmaceuticals (Shanghai) Company Limited, our joint venture with Sinopharm in which we have a 50.9% interest; |

| ● | “Nutrition Science Partners” are to Nutrition Science Partners Limited, formerly our non-consolidated joint venture with Nestlé Health Science S.A.; |

| ● | “ordinary shares” or “shares” are to our ordinary shares, par value $0.10 per share; |

| ● | “RMB” or “renminbi” are to the legal currency of the PRC; |

| ● | “Shanghai Hutchison Pharmaceuticals” are to Shanghai Hutchison Pharmaceuticals Limited, our non-consolidated joint venture with Shanghai Pharmaceuticals in which we have a 50% interest; |

| ● | “Shanghai Pharmaceuticals” are to Shanghai Pharmaceuticals Holding Co., Ltd., a leading pharmaceutical company in China listed on the Shanghai Stock Exchange and the Hong Kong Stock Exchange; |

| ● | “Sinopharm” are to Sinopharm Group Co. Ltd., a leading distributor of pharmaceutical and healthcare products and a leading supply chain service provider in China listed on the Hong Kong Stock Exchange; |

| ● | “United States” or “U.S.” are to the United States of America; |

| ● | “$” or “U.S. dollars” are to the legal currency of the United States; and |

| ● | “£” or “pound sterling” are to the legal currency of the United Kingdom. |

Our reporting currency is the U.S. dollar. In addition, this annual report also contains translations of certain foreign currency amounts into U.S. dollars for the convenience of the reader. Unless otherwise stated, all translations of pound sterling into U.S. dollars were made at £1.00 to $1.30, all translations of RMB into U.S. dollars were made at RMB7.03 to $1.00 and all translations of HK dollars into U.S. dollars were made at HK$7.80 to $1.00, which are the exchange rates used in our audited consolidated financial statements as of December 31, 2019. We make no representation that the pound sterling, HK dollar or U.S. dollar amounts referred to in this annual report could have been or could be converted into U.S. dollars, pounds sterling or HK dollars, as the case may be, at any particular rate or at all.

Trademarks and Service Marks

We own or have been licensed rights to trademarks, service marks and trade names for use in connection with the operation of our business, including, but not limited to, our trademark Chi-Med. All other trademarks, service marks or trade names appearing in this annual report that are not identified as marks owned by us are the property of their respective owners.

Solely for convenience, the trademarks, service marks and trade names referred to in this annual report are listed without the ®, (TM) and (sm) symbols, but we will assert, to the fullest extent under applicable law, our applicable rights in these trademarks, service marks and trade names.

4

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This annual report contains forward-looking statements made under the “safe harbor” provisions of the U.S. Private Securities Litigation Reform Act of 1995. These statements relate to future events or to our future financial performance and involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. The words “anticipate,” “assume,” “believe,” “contemplate,” “continue,” “could,” “estimate,” “expect,” “goal,” “intend,” “may,” “might,” “objective,” “plan,” “potential,” “predict,” “project,” “positioned,” “seek,” “should,” “target,” “will,” “would,” or the negative of these terms or other similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. These forward-looking statements are based on current expectations, estimates, forecasts and projections about our business and the industry in which we operate and management’s beliefs and assumptions, are not guarantees of future performance or development and involve known and unknown risks, uncertainties and other factors. These forward-looking statements include statements regarding:

| ● | the initiation, timing, progress and results of our or our collaboration partners’ pre-clinical and clinical studies, and our research and development programs; |

| ● | our or our collaboration partners’ ability to advance our drug candidates into, and/or successfully complete, clinical studies; |

| ● | the timing or regulatory filings and the likelihood of favorable regulatory outcomes and approvals; |

| ● | regulatory developments in China, the United States and other countries; |

| ● | the adaptation of our Commercial Platform to market and sell our drug candidates and the commercialization of our drug candidates, if approved; |

| ● | the pricing and reimbursement of our and our joint ventures’ products and our drug candidates, if approved; |

| ● | our ability to contract on commercially reasonable terms with contract research organizations, or CROs, third-party suppliers and manufacturers; |

| ● | the scope of protection we are able to establish and maintain for intellectual property rights covering our or our joint ventures’ products and our drug candidates; |

| ● | the ability of third parties with whom we contract to successfully conduct, supervise and monitor clinical studies for our drug candidates; |

| ● | estimates of our expenses, future revenue, capital requirements and our needs for additional financing; |

| ● | our ability to obtain additional funding for our operations; |

| ● | the potential benefits of our collaborations and our ability to enter into future collaboration arrangements; |

| ● | the ability and willingness of our collaborators to actively pursue development activities under our collaboration agreements; |

| ● | our receipt of milestone or royalty payments pursuant to our strategic alliances with AstraZeneca AB (publ), or AstraZeneca, and Lilly (Shanghai) Management Company Limited, or Eli Lilly; |

| ● | the rate and degree of market acceptance of our drug candidates; |

| ● | our financial performance; |

| ● | our ability to attract and retain key scientific and management personnel; |

5

| ● | our relationship with our joint venture and collaboration partners; |

| ● | developments relating to our competitors and our industry, including competing drug products; |

| ● | changes in our tax status or the tax laws in the jurisdictions that we operate; and |

| ● | developments in our business strategies and business plans. |

Actual results or events could differ materially from the plans, intentions and expectations disclosed in the forward-looking statements we make. As a result, any or all of our forward-looking statements in this annual report may turn out to be inaccurate. We have included important factors in the cautionary statements included in this annual report on Form 20-F, particularly in the section of this annual report on Form 20-F titled “Risk Factors,” that we believe could cause actual results or events to differ materially from the forward-looking statements that we make. We may not actually achieve the plans, intentions or expectations disclosed in our forward-looking statements, and you should not place undue reliance on our forward-looking statements. Moreover, we operate in a highly competitive and rapidly changing environment in which new risks often emerge. It is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements we may make.

You should read this annual report and the documents that we reference herein and have filed as exhibits hereto completely and with the understanding that our actual future results may be materially different from what we expect. The forward-looking statements contained herein are made as of the date of the filing of this annual report, and we do not assume any obligation to update any forward-looking statements except as required by applicable law.

In addition, this annual report contains statistical data and estimates that we have obtained from industry publications and reports generated by third-party market research firms. Although we believe that the publications, reports and surveys are reliable, we have not independently verified the data and cannot guarantee the accuracy or completeness of such data. You are cautioned not to give undue weight to this data. Such data involves risks and uncertainties and are subject to change based on various factors, including those discussed above.

6

PART I

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

Not applicable.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not applicable.

ITEM 3. KEY INFORMATION

A. Selected Financial Data.

Our Selected Financial Data

The following tables set forth our selected consolidated financial data. We have derived the selected consolidated statements of operations data for the years ended December 31, 2019, 2018 and 2017 and the selected consolidated balance sheet data as of December 31, 2019 and 2018 from our audited consolidated financial statements, which were prepared in accordance with U.S. GAAP and are included elsewhere in this annual report. You should read this data together with such consolidated financial statements and the related notes and Item 5 “Operating and Financial Review and Prospects.” Our historical results are not necessarily indicative of the results to be expected for any future periods. All of our operations are continuing operations and we have not proposed or paid dividends in any of the periods presented.

7

The following selected consolidated financial data for the years ended December 31, 2016 and 2015 and as of December 31, 2017, 2016 and 2015 have been derived from our audited consolidated financial statements for those years, which were prepared in accordance with U.S. GAAP and are not included in this annual report.

Year Ended December 31, | |||||||||||||||

| 2019 |

| 2018 |

| 2017 |

| 2016 |

| 2015 | ||||||

(in thousands, except share and per share data) | |||||||||||||||

Consolidated statements of operations data: |

|

|

|

|

|

|

|

|

|

| |||||

Revenues |

|

|

|

|

|

|

|

|

|

| |||||

Goods—third parties | $ | 175,990 | $ | 156,234 | $ | 194,860 | $ | 171,058 | $ | 118,113 | |||||

—related parties |

| 7,637 |

| 8,306 |

| 8,486 |

| 9,794 |

| 8,074 | |||||

Services—commercialization—third parties |

| 2,584 |

| 11,660 |

| 1,860 |

| — |

| — | |||||

—collaboration research and development—third parties |

| 15,532 |

| 17,681 |

| 16,858 |

| 16,513 |

| 24,848 | |||||

—research and development—third parties |

| — |

| — |

| — |

| 355 |

| 2,573 | |||||

—research and development—related parties |

| 494 |

| 7,832 |

| 9,682 |

| 8,429 |

| 5,383 | |||||

Other collaboration revenue—royalties—third parties |

| 2,653 |

| 261 |

| — |

| — |

| — | |||||

—licensing—third parties |

| — |

| 12,135 |

| 9,457 |

| 9,931 |

| 19,212 | |||||

Total revenues |

| 204,890 |

| 214,109 |

| 241,203 |

| 216,080 |

| 178,203 | |||||

Operating expenses |

|

|

|

|

|

|

|

|

| ||||||

Costs of goods—third parties |

| (152,729) |

| (129,346) |

| (168,331) |

| (149,132) |

| (104,859) | |||||

Costs of goods—related parties |

| (5,494) |

| (5,978) |

| (6,056) |

| (7,196) |

| (5,918) | |||||

Costs of services—commercialization—related parties |

| (1,929) |

| (8,620) |

| (1,433) |

| — |

| — | |||||

Research and development expenses |

| (138,190) |

| (114,161) |

| (75,523) |

| (66,871) |

| (47,368) | |||||

Selling expenses |

| (13,724) |

| (17,736) |

| (19,322) |

| (17,998) |

| (10,209) | |||||

Administrative expenses |

| (39,210) |

| (30,909) |

| (23,955) |

| (21,580) |

| (19,620) | |||||

Total operating expenses |

| (351,276) |

| (306,750) |

| (294,620) |

| (262,777) |

| (187,974) | |||||

| (146,386) |

| (92,641) |

| (53,417) |

| (46,697) |

| (9,771) | ||||||

Other income/(expense) |

|

|

|

|

|

|

|

|

| ||||||

Interest income |

| 4,944 |

| 5,978 |

| 1,220 |

| 502 |

| 451 | |||||

Other income |

| 1,855 |

| 1,798 |

| 808 |

| 609 |

| 386 | |||||

Interest expense |

| (1,030) |

| (1,009) |

| (1,455) |

| (1,631) |

| (1,404) | |||||

Other expense |

| (488) |

| (781) |

| (692) |

| (139) |

| (202) | |||||

Total other income/(expense) |

| 5,281 |

| 5,986 |

| (119) |

| (659) |

| (769) | |||||

Loss before income taxes and equity in earnings of equity investees |

| (141,105) |

| (86,655) |

| (53,536) |

| (47,356) |

| (10,540) | |||||

Income tax expense |

| (3,274) |

| (3,964) |

| (3,080) |

| (4,331) |

| (1,605) | |||||

Equity in earnings of equity investees, net of tax |

| 40,700 |

| 19,333 |

| 33,653 |

| 66,244 |

| 22,572 | |||||

Net (loss)/income |

| (103,679) |

| (71,286) |

| (22,963) |

| 14,557 |

| 10,427 | |||||

Less: Net income attributable to non‑controlling interests |

| (2,345) |

| (3,519) |

| (3,774) |

| (2,859) |

| (2,434) | |||||

Net (loss)/income attributable to the company |

| (106,024) |

| (74,805) |

| (26,737) |

| 11,698 |

| 7,993 | |||||

Accretion on redeemable non‑controlling interests |

| — |

| — |

| — |

| — |

| (43,001) | |||||

Net (loss)/income attributable to ordinary shareholders of the company | $ | (106,024) | $ | (74,805) | $ | (26,737) | $ | 11,698 | $ | (35,008) | |||||

(Losses)/earnings per share attributable to ordinary shareholders of the company—basic ($ per share) | $ | (0.16) | $ | (0.11) | $ | (0.04) | $ | 0.02 | $ | (0.06) | |||||

(Losses)/earnings per share attributable to ordinary shareholders of the company—diluted ($ per share) | $ | (0.16) | $ | (0.11) | $ | (0.04) | $ | 0.02 | $ | (0.06) | |||||

Number of shares used in per share calculation—basic |

| 665,683,145 |

| 664,263,820 |

| 617,171,710 |

| 597,151,730 |

| 546,593,150 | |||||

Number of shares used in per share calculation—diluted |

| 665,683,145 |

| 664,263,820 |

| 617,171,710 |

| 599,710,500 |

| 546,593,150 | |||||

Net (loss)/income | $ | (103,679) | $ | (71,286) | $ | (22,963) | $ | 14,557 | $ | 10,427 | |||||

Other comprehensive (loss)/income: |

|

|

|

|

|

|

|

|

|

| |||||

Foreign currency translation (loss)/gain |

| (4,331) |

| (6,626) |

| 10,964 |

| (10,722) |

| (5,557) | |||||

Total comprehensive (loss)/income |

| (108,010) |

| (77,912) |

| (11,999) |

| 3,835 |

| 4,870 | |||||

Less: Comprehensive income attributable to non‑controlling interests |

| (1,620) |

| (2,566) |

| (5,033) |

| (1,427) |

| (1,732) | |||||

Total comprehensive (loss)/income attributable to the company | $ | (109,630) | $ | (80,478) | $ | (17,032) | $ | 2,408 | $ | 3,138 | |||||

As of December 31, | |||||||||||||||

| 2019 |

| 2018 |

| 2017 |

| 2016 |

| 2015 | ||||||

(in thousands) | |||||||||||||||

Consolidated balance sheet data: |

|

|

|

|

|

|

|

|

|

| |||||

Cash and cash equivalents | $ | 121,157 | $ | 86,036 | $ | 85,265 | $ | 79,431 | $ | 31,941 | |||||

Total assets | $ | 465,122 | $ | 532,118 | $ | 597,932 | $ | 342,437 | $ | 229,599 | |||||

Total current liabilities | $ | 113,101 | $ | 85,479 | $ | 104,600 | $ | 95,119 | $ | 81,062 | |||||

Total non-current liabilities | $ | 39,118 | $ | 34,384 | $ | 8,366 | $ | 43,258 | $ | 46,260 | |||||

Total shareholders’ equity | $ | 312,903 | $ | 412,255 | $ | 484,966 | $ | 204,060 | $ | 102,277 | |||||

8

Selected Financial Data of Our Non-Consolidated Joint Ventures

We have two non-consolidated joint ventures—Shanghai Hutchison Pharmaceuticals and Hutchison Baiyunshan. The following selected income statement and cash flow data of each such joint venture for the years ended December 31, 2019, 2018 and 2017 and the following selected financial position data of each such joint venture as of December 31, 2019 and 2018 have been derived from their respective audited consolidated financial statements, which were prepared in accordance with IFRS as issued by the IASB and are included elsewhere in this annual report. You should read this data together with such consolidated financial statements of our non-consolidated joint ventures and the related notes and Item 5 “Operating and Financial Review and Prospects.” The following selected consolidated financial data for the years ended December 31, 2016 and 2015 and as of December 31, 2017, 2016 and 2015 have been derived from their respective audited consolidated financial statements, which were prepared in accordance with IFRS as issued by the IASB and are not included in this annual report. The historical results of our joint ventures for any prior period are not necessarily indicative of results to be expected in any future periods.

Shanghai Hutchison Pharmaceuticals

Year Ended December 31, | |||||||||||||||

| 2019 |

| 2018 |

| 2017 |

| 2016 |

| 2015 | ||||||

(in thousands) | |||||||||||||||

Income statement and cash flow data: |

|

|

|

|

|

|

|

|

|

| |||||

Revenue | $ | 272,082 | $ | 275,649 | $ | 244,557 | $ | 222,368 | $ | 181,140 | |||||

Profit for the year | $ | 61,301 | $ | 59,767 | $ | 55,623 | $ | 120,499 | $ | 31,307 | |||||

Dividends paid to shareholders | $ | (41,654) | $ | (54,667) | $ | (81,299) | $ | (55,057) | $ | (6,410) | |||||

Our equity in earnings of Shanghai Hutchison Pharmaceuticals reported under U.S. GAAP was $30.7 million, $29.9 million, $27.8 million, $60.3 million and $15.7 million for the years ended December 31, 2019, 2018, 2017, 2016 and 2015, respectively.

As of December 31, | |||||||||||||||

| 2019 |

| 2018 |

| 2017 |

| 2016 |

| 2015 | ||||||

(in thousands) | |||||||||||||||

Financial position data: |

|

|

|

|

|

|

|

|

|

| |||||

Cash and cash equivalents | $ | 41,244 | $ | 25,051 | $ | 43,527 | $ | 20,292 | $ | 43,141 | |||||

Total assets | $ | 232,345 | $ | 223,044 | $ | 233,012 | $ | 244,006 | $ | 224,969 | |||||

Total liabilities | $ | 85,607 | $ | 91,266 | $ | 100,281 | $ | 93,872 | $ | 131,706 | |||||

Total shareholders’ equity | $ | 146,738 | $ | 131,778 | $ | 132,731 | $ | 150,134 | $ | 93,263 | |||||

Hutchison Baiyunshan

Year Ended December 31, | |||||||||||||||

| 2019 |

| 2018 |

| 2017 |

| 2016 |

| 2015 | ||||||

(in thousands) | |||||||||||||||

Income statement and cash flow data: |

|

|

|

|

|

|

|

|

|

| |||||

Revenue | $ | 215,403 | $ | 215,838 | $ | 227,422 | $ | 224,131 | $ | 211,603 | |||||

Profit for the year | $ | 19,287 | $ | 16,476 | $ | 20,805 | $ | 20,128 | $ | 21,216 | |||||

Profit for the year attributable to shareholders of Hutchison Baiyunshan | $ | 19,792 | $ | 16,860 | $ | 20,776 | $ | 20,376 | $ | 21,376 | |||||

Dividends paid to shareholders | $ | (14,615) | $ | (15,077) | $ | (29,872) | $ | (6,000) | $ | (6,410) | |||||

Our equity in earnings of Hutchison Baiyunshan reported under U.S. GAAP was $9.9 million, $8.4 million, $10.4 million, $10.2 million and $10.7 million for the years ended December 31, 2019, 2018, 2017, 2016 and 2015, respectively.

9

As of December 31, | |||||||||||||||

| 2019 |

| 2018 |

| 2017 |

| 2016 |

| 2015 | ||||||

(in thousands) | |||||||||||||||

Financial position data: |

|

|

|

|

|

|

|

|

|

| |||||

Cash and cash equivalents | $ | 21,421 | $ | 16,843 | $ | 13,843 | $ | 23,448 | $ | 31,155 | |||||

Total assets | $ | 219,772 | $ | 216,373 | $ | 208,796 | $ | 221,735 | $ | 202,646 | |||||

Total liabilities | $ | 172,741 | $ | 91,276 | $ | 94,535 | $ | 88,366 | $ | 77,583 | |||||

Total shareholders’ equity | $ | 47,031 | $ | 125,097 | $ | 114,261 | $ | 133,369 | $ | 125,063 | |||||

Selected Financial Data of Nutrition Science Partners

Nutrition Science Partners was previously our non-consolidated joint venture. On December 9, 2019, we acquired our joint venture partner’s 50% shareholding in Nutrition Science Partners, after which Nutrition Science Partners became our consolidated subsidiary.

The following selected income statement data of Nutrition Science Partners for the period ending December 9, 2019 and the years ended December 31, 2018 and 2017 and the following selected financial position data of Nutrition Science Partners as of December 9, 2019 and December 31, 2018 have been derived from its audited consolidated financial statements, which were prepared in accordance with IFRS as issued by the IASB and are included elsewhere in this annual report. You should read this data together with such consolidated financial statements and the related notes and Item 5 “Operating and Financial Review and Prospects.” The following selected consolidated financial data for the years ended December 31, 2016 and 2015 and as of December 31, 2017, 2016 and 2015 have been derived from the audited consolidated financial statements of Nutrition Science Partners, which were prepared in accordance with IFRS as issued by the IASB and are not included in this annual report. The historical results of Nutrition Science Partners for any prior period are not necessarily indicative of results to be expected in any future periods.

Period Ended | Year Ended December 31, | ||||||||||||||

| 2019 |

| 2018 |

| 2017 |

| 2016 |

| 2015 | ||||||

(in thousands) | |||||||||||||||

Income statement data: |

|

|

|

|

|

|

|

|

|

| |||||

Profit/(loss) for the period/year | $ | 199 | $ | (38,198) | $ | (9,210) | $ | (8,482) | $ | (7,552) | |||||

Our equity in earnings/(loss) of Nutrition Science Partners reported under U.S. GAAP was $0.1 million, $(19.1) million, $(4.6) million, $(4.2) million and $(3.8) million for the period ended December 9, 2019 and years ended December 31, 2018, 2017, 2016 and 2015, respectively.

As of | As of December 31, | ||||||||||||||

| 2019 |

| 2018 |

| 2017 |

| 2016 |

| 2015 | ||||||

(in thousands) | |||||||||||||||

Financial position data: |

|

|

|

|

|

|

|

|

|

| |||||

Cash and cash equivalents | $ | 16,769 | $ | 17,320 | $ | 9,640 | $ | 5,393 | $ | 2,624 | |||||

Total assets | $ | 16,794 | $ | 17,320 | $ | 39,640 | $ | 35,393 | $ | 33,034 | |||||

Total liabilities | $ | 392 | $ | 1,117 | $ | 1,239 | $ | 1,782 | $ | 14,941 | |||||

Total shareholders’ equity | $ | 16,402 | $ | 16,203 | $ | 38,401 | $ | 33,611 | $ | 18,093 | |||||

B. Capitalization and Indebtedness.

Not applicable.

C. Reasons for the Offer and Use of Proceeds.

Not applicable.

10

D. Risk Factors.

Risks Relating to Our Financial Position and Need for Capital

We may need substantial additional funding for our product development programs and commercialization efforts. If we are unable to raise capital on acceptable terms when needed, we could incur losses and be forced to delay, reduce or eliminate such efforts.

We expect our expenses to increase significantly in connection with our ongoing activities, particularly as we or our collaboration partners advance the clinical development of our eight clinical drug candidates which are currently in active or completed clinical studies in various countries. We will incur significant expenses as we continue research and development and initiate additional clinical trials of, and seek regulatory approval for, these and other future drug candidates. In addition, we expect to incur significant commercialization expenses related to product manufacturing, marketing, sales and distribution in China for any of our unpartnered drug candidates that may be approved in the future. In particular, the costs that may be required for the manufacture of any drug candidate that receives regulatory approval may be substantial as we may have to modify or increase the production capacity at our current manufacturing facilities or contract with third-party manufacturers. We may also incur expenses as we create additional infrastructure and expand our U.S.-based clinical team to support our operations at our U.S. subsidiary, Hutchison MediPharma International Inc. Accordingly, we may need to obtain substantial funding in connection with our continuing operations through public or private equity offerings, debt financings, collaborations or licensing arrangements or other sources. If we are unable to raise capital when needed or on attractive terms, we could incur losses and be forced to delay, reduce or eliminate our research and development programs or any future commercialization efforts.

Our net cash used in operating activities was $8.9 million, $32.8 million and $80.9 million for the years ended December 31, 2017, 2018 and 2019, respectively. We believe, however, that our expected cash flow from operations, including dividends from our Commercial Platform and milestone and other payments from our collaboration partners, our cash and cash equivalents and short-term investments as well as our unutilized bank facilities as of December 31, 2019, including: (i) the aggregate HK$424.0 million ($54.4 million) revolving credit facilities with The HongKong Shanghai Banking Corporation Limited, or HSBC, (ii) the HK$351.0 million ($45.0 million) revolving credit facility with Bank of America N.A., and (iii) the HK$156.0 million ($20.0 million) revolving credit facility with Deutsche Bank AG, Hong Kong Branch, or Deutsche Bank AG, will enable us to fund our operating expenses, debt service and capital expenditure requirements for at least the next 12 months. We have based this estimate on assumptions that may prove to be wrong, and we could use our capital resources sooner than we currently expect. Our future capital requirements will depend on many factors, including:

| ● | the number and development requirements of the drug candidates we pursue; |

| ● | the scope, progress, timing, results and costs of researching and developing our drug candidates, and conducting pre-clinical and clinical trials; |

| ● | the cost, timing and outcome of regulatory review of our drug candidates; |

| ● | the cost and timing of commercialization activities, including product manufacturing, marketing, sales and distribution, for our drug candidates for which we receive regulatory approval; |

| ● | the amount and timing of any milestone payments from our collaboration partners, with whom we cooperate with respect to the development and potential commercialization of certain of our drug candidates; |

| ● | the cash received from commercial sales of drug candidates for which we receive regulatory approval; |

| ● | our ability to establish and maintain strategic partnerships, collaboration, licensing or other arrangements and the financial terms of such agreements; |

| ● | the cost, timing and outcome of preparing, filing and prosecuting patent applications, maintaining and enforcing our intellectual property rights and defending any intellectual property-related claims; |

11

| ● | our headcount growth and associated costs, particularly as we expand our clinical activities in the United States and Europe; and |

| ● | the costs of operating as a public company listed in the United States and United Kingdom. |

Identifying potential drug candidates and conducting pre-clinical testing and clinical trials is a time-consuming, expensive and uncertain process that may take years to complete, and our commercial revenue, if any, will be derived from sales of products that we do not expect to be commercially available until we receive regulatory approval, if at all. We may never generate the necessary data or results required for certain drug candidates to obtain regulatory approval, and even if approved, they may not achieve commercial success. Accordingly, we will need to continue to rely on financing to achieve our business objectives. Adequate financing may not be available to us on acceptable terms, or at all.

Raising capital may cause dilution to our shareholders, restrict our operations or require us to relinquish rights to technologies or drug candidates.

We expect to finance our cash needs in part through cash flow from our operations, including dividends from our Commercial Platform, and we may also rely on raising capital through a combination of public or private equity offerings, debt financings and/or license and development agreements with collaboration partners. In addition, we may seek capital due to favorable market conditions or strategic considerations, even if we believe we have sufficient funds for our current or future operating plans. To the extent that we raise capital through the sale of equity or convertible debt securities, the ownership interest of our shareholders may be materially diluted, and the terms of such securities could include liquidation or other preferences that adversely affect the rights of our existing shareholders. Debt financing and preferred equity financing, if available, may involve agreements that include restrictive covenants that limit our ability to take specified actions, such as incurring additional debt, making capital expenditures or declaring dividends. Additional debt financing would also result in increased fixed payment obligations.

In addition, if we raise funds through collaborations, strategic partnerships or marketing, distribution or licensing arrangements with third parties, we may have to relinquish valuable rights to our technologies, future revenue streams, research programs or drug candidates or grant licenses on terms that may not be favorable to us. We may also lose control of the development of drug candidates, such as the pace and scope of clinical trials, as a result of such third-party arrangements. If we are unable to raise funds through equity or debt financings when needed, we may be required to delay, limit, reduce or terminate our product development or future commercialization efforts or grant rights to develop and market drug candidates that we would otherwise prefer to develop and market ourselves.

Our existing and any future indebtedness could adversely affect our ability to operate our business.

Our outstanding indebtedness combined with current and future financial obligations and contractual commitments, including any additional indebtedness beyond our current facilities with HSBC, Bank of America N.A. and Deutsche Bank AG could have significant adverse consequences, including:

| ● | requiring us to dedicate a portion of our cash resources to the payment of interest and principal, and prepayment and repayment fees and penalties, thereby reducing money available to fund working capital, capital expenditures, product development and other general corporate purposes; |

| ● | increasing our vulnerability to adverse changes in general economic, industry and market conditions; |

| ● | subjecting us to restrictive covenants that may reduce our ability to take certain corporate actions or obtain further debt or equity financing; |

| ● | limiting our flexibility in planning for, or reacting to, changes in our business and the industry in which we compete; and |

| ● | placing us at a competitive disadvantage compared to our competitors that have less debt or better debt servicing options. |

12

We intend to satisfy our current and future debt service obligations with our existing cash and cash equivalents and short-term investments. Nevertheless, we may not have sufficient funds, and may be unable to arrange for financing, to pay the amounts due under our existing debt. Failure to make payments or comply with other covenants under our existing debt instruments could result in an event of default and acceleration of amounts due.

We are subject to liquidity risk with respect to our investments in our joint ventures.

Our interests in our joint ventures are subject to liquidity risk. Such investments are not as liquid as other investment products as there is no cash flow until dividends are declared and received by us even if such joint ventures are profitable. Furthermore, our ability to promptly sell one or more of our interests in our joint ventures in response to changing corporate strategy or economic, financial and investment conditions is limited. The market for such investments can be affected by various factors, such as general economic and market conditions, availability of financing, interest rates and investor demand, many of which are beyond our control. If we determine to sell any of our joint venture investments, we cannot predict if we will be successful or whether any price or other terms offered by a prospective purchaser would be acceptable to us.

Risks Relating to Our Innovation Platform and Development of Our Drug Candidates

Historically, our in-house research and development division, known as our Innovation Platform, has not generated significant profits or has operated at a net loss. Our future profitability is dependent on the successful commercialization of our drug candidates.

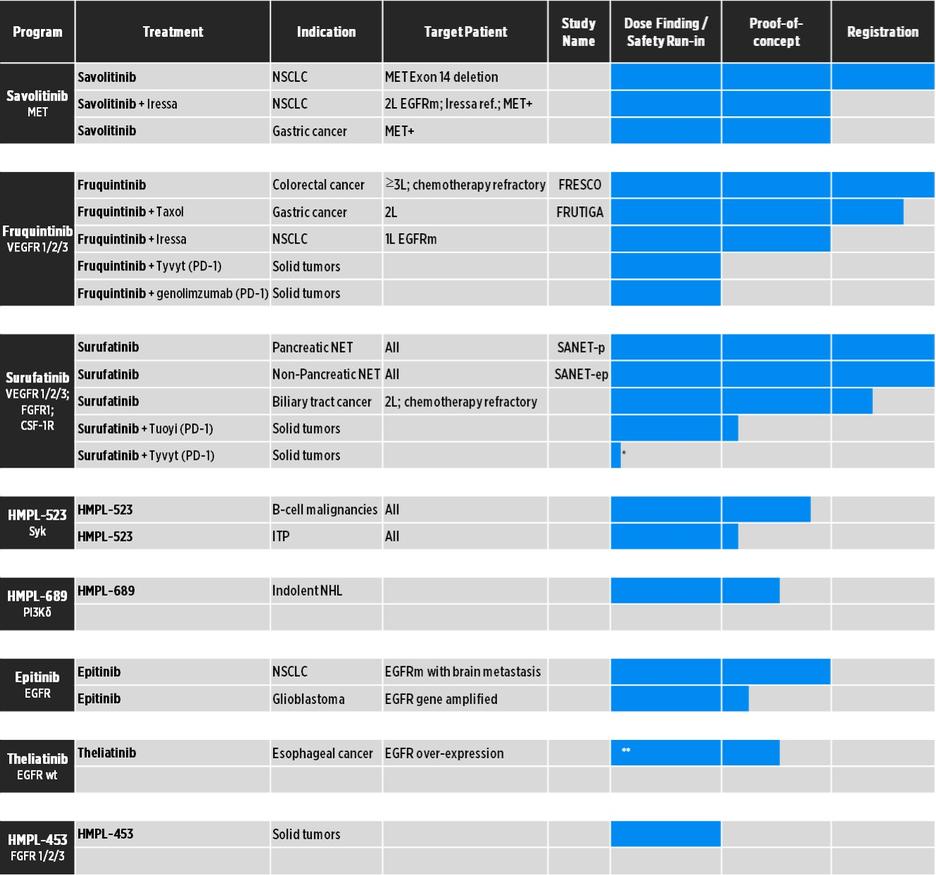

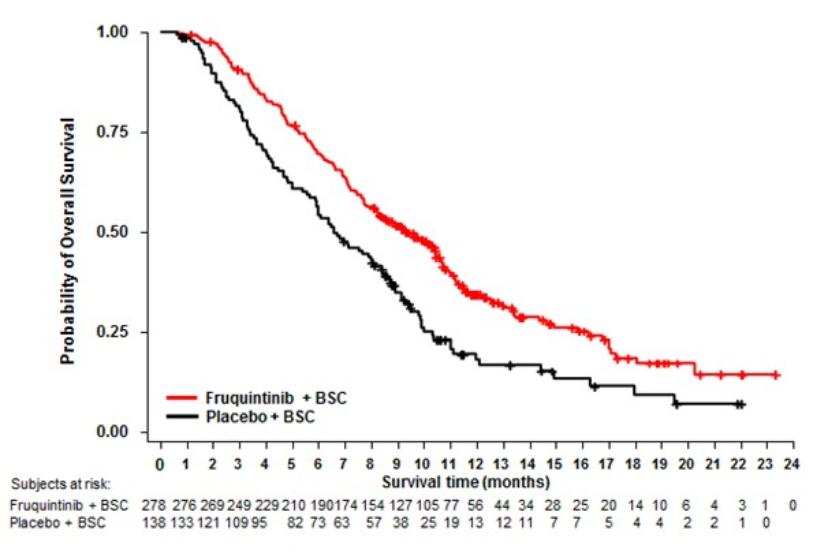

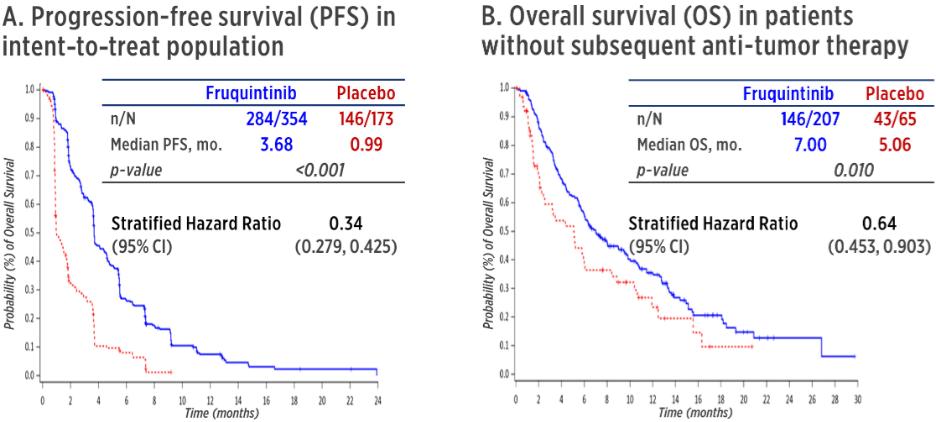

To date, fruquintinib is our only drug candidate that has been approval for sale, and it has only been approved for sale for the treatment of third-line metastatic colorectal cancer patients in China. We do not expect to be significantly profitable unless and until we generate substantial royalties from fruquintinib and/or successfully commercialize our other drug candidates. We expect to incur significant sales and marketing costs as we prepare to commercialize our drug candidates.

Successful commercialization of our drug candidates is subject to many risks. Fruquintinib is currently marketed by our partner, Eli Lilly. Under our amended license and collaboration agreement with Eli Lilly, we may be granted promotion and distribution rights to fruquintinib for certain provinces in China in the future. We have never, as an organization, launched or commercialized any of our drug candidates, and there is no guarantee that we will be able to successfully commercialize any of our drug candidates for their approved indications. There are numerous examples of failures to meet expectations of market potential, including by pharmaceutical companies with more experience and resources than us. While we have an established network of medical sales representatives in China operated by our Commercial Platform, we will need to refine and further develop an oncology and immunology-focused sales team in order to successfully commercialize our drug candidates. Even if we are successful in developing our commercial team, there are many factors that could cause the commercialization of fruquintinib or our other drug candidates to be unsuccessful, including a number of factors that are outside our control. In the case of fruquintinib, for example, the third-line metastatic colorectal cancer patient population in China may be smaller than we estimate or physicians may be unwilling to prescribe, or patients are unwilling to take, fruquintinib due to, among other reasons, its pricing. Additionally, any negative development for fruquintinib in clinical development in additional indications, or in regulatory processes in other jurisdictions, may adversely impact the commercial results and potential of fruquintinib in China and globally. Thus, significant uncertainty remains regarding the commercial potential of fruquintinib.

We may not achieve profitability after generating royalties from fruquintinib and/or sales from our other drug candidates, if ever. If the commercialization of fruquintinib and/or our other drug candidates is unsuccessful or perceived as disappointing, our stock price could decline significantly and the long-term success of the product and our company could be harmed.

All of our drug candidates, other than fruquintinib for one indication in China, are still in development. If we are unable to obtain regulatory approval and ultimately commercialize our drug candidates, or if we experience significant delays in doing so, our business will be materially harmed.

All of our drug candidates are still in development, including fruquintinib which has been approved for the treatment of third-line metastatic colorectal cancer patients in China but is still in development in the United States for this indication and in China and the United States for other cancer indications.

13

Although we receive certain payments from our collaboration partners, including upfront payments and payments for achieving certain development, regulatory or commercial milestones, for certain of our drug candidates, our ability to generate revenue from our drug candidates is dependent on their receipt of regulatory approval for and successful commercialization of such products, which may never occur. Each of our drug candidates in development will require additional pre-clinical and/or clinical trials, regulatory approval in multiple jurisdictions, manufacturing supply, substantial investment and significant marketing efforts before we generate any revenue from product sales. The success of our drug candidates will depend on several factors, including the following:

| ● | successful completion of pre-clinical and/or clinical trials; |

| ● | successful enrollment in, and completion of, clinical trials; |

| ● | receipt of regulatory approvals from applicable regulatory authorities for planned clinical trials, future clinical trials, drug registrations or post-approval trials; |

| ● | successful completion of all safety studies required to obtain regulatory approval and/or fulfillment of post-approval requirements in the United States, China and other jurisdictions for our drug candidates; |

| ● | adapting our commercial manufacturing capabilities to the specifications for our drug candidates for clinical supply and commercial manufacturing; |

| ● | obtaining and maintaining patent and trade secret protection or regulatory exclusivity for our drug candidates; |

| ● | launching commercial sales of our drug candidates, if and when approved, whether alone or in collaboration with others; |

| ● | acceptance of the drug candidates, if and when approved, by patients, the medical community and third-party payors; |

| ● | effectively competing with other therapies; |

| ● | obtaining and maintaining healthcare coverage and adequate reimbursement; |

| ● | enforcing and defending intellectual property rights and claims; and |

| ● | maintaining a continued acceptable safety profile of the drug candidates following approval. |

If we do not achieve one or more of these factors in a timely manner or at all, we could experience significant delays or an inability to successfully commercialize our drug candidates, which would materially harm our business.

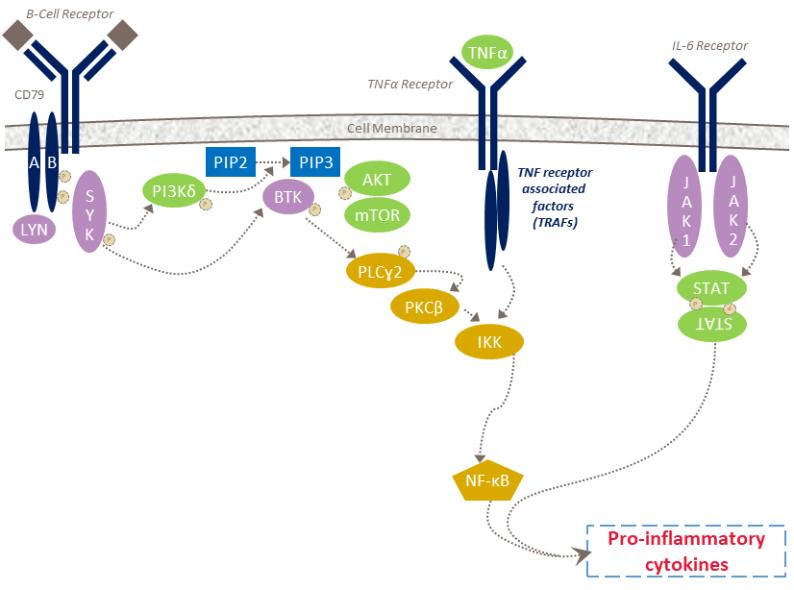

Our primary approach to the discovery and development of drug candidates focuses on the inhibition of kinases, some of which are unproven.

A primary focus of our research and development efforts is on identifying kinase targets for which drug compounds previously developed by others affecting those targets have been unsuccessful due to limited selectivity, off-target toxicity and other problems. We then work to engineer drug candidates which have the potential to have superior efficacy, safety and other features as compared to such prior drug compounds. We also focus on developing drug compounds with the potential to be global best-in-class/next-generation therapies for validated kinase targets.

Even if we are able to develop compounds that successfully target the relevant kinases in pre-clinical studies, we may not succeed in demonstrating safety and efficacy of the drug candidates in clinical trials. Even if we are able to demonstrate safety and efficacy of compounds in certain indications in certain jurisdictions, we may not succeed in demonstrating the same in other indications or same indications in other jurisdictions. As a result, our efforts may not result in the discovery or development of drugs that are commercially viable or are superior to existing drugs or other therapies on the market. While the results of pre-clinical studies, early-stage clinical trials as well as clinical trials in certain indications have suggested that certain of our drug candidates may successfully inhibit kinases and may have significant utility in several cancer indications, potentially in combination with other cancer drugs, chemotherapy and immunotherapies, we have not yet demonstrated efficacy and safety for many of our drug candidates in later stage clinical trials.

14

We may expend our limited resources to pursue a particular drug candidate or indication and fail to capitalize on drug candidates or indications that may be more profitable or for which there is a greater likelihood of success.

Because we have limited financial and managerial resources, we must limit our research programs to specific drug candidates that we identify for specific indications. As a result, we may forego or delay pursuit of opportunities with other drug candidates or for other indications that later prove to have greater commercial potential. Our resource allocation decisions may cause us to fail to capitalize on viable commercial drugs or profitable market opportunities. In addition, if we do not accurately evaluate the commercial potential or target market for a particular drug candidate, we may relinquish valuable rights to that drug candidate through collaboration, licensing or other royalty arrangements when it would have been more advantageous for us to retain sole development and commercialization rights to such drug candidate.

We have no history of commercializing our internally developed drugs, which may make it difficult to evaluate our future prospects.

The operations of our Innovation Platform have been limited to developing and securing our technology and undertaking pre-clinical studies and clinical trials of our drug candidates, either independently or with our collaboration partners. We have a limited history of successfully completing development of our drug candidates, obtaining marketing approvals, manufacturing our internally developed drugs at a commercial scale. In addition, we have not yet demonstrated the ability to successfully conduct sales and regulatory activities necessary for successful product commercialization of our drug candidates. While we believe we will be able to successfully leverage our existing Commercial Platform and have begun to build an oncology-focused sales force to launch our drug candidates in China once approved, any predictions about our future success or viability may not be as accurate as they could be if we had an extensive history of successfully developing and commercializing our internally developed drug candidates.

The regulatory approval processes of the U.S. Food and Drug Administration, or FDA, National Medical Products Administration of China, or NMPA, and comparable authorities are lengthy, time consuming and inherently unpredictable, and if we are ultimately unable to obtain regulatory approval for our drug candidates, our ability to generate revenue will be materially impaired.

Our drug candidates and the activities associated with their development and commercialization, including their design, testing, manufacture, safety, efficacy, recordkeeping, labeling, storage, approval, advertising, promotion, sale, distribution, import and export, are subject to comprehensive regulation by the FDA, NMPA and other regulatory agencies in the United States and China and by comparable authorities in other countries. Securing regulatory approval requires the submission of extensive pre-clinical and clinical data and supporting information to the various regulatory authorities for each therapeutic indication to establish the drug candidate’s safety and efficacy. Securing regulatory approval also requires the submission of information about the drug manufacturing process to, and inspection of manufacturing facilities by, the relevant regulatory authority. Our drug candidates may not be effective, may be only moderately effective or may prove to have undesirable or unintended side effects, toxicities or other characteristics that may preclude our obtaining regulatory approval or prevent or limit commercial use.

The process of obtaining regulatory approvals in the United States, China and other countries is expensive, may take many years if additional clinical trials are required, if approval is obtained at all, and can vary substantially based upon a variety of factors, including the type, complexity and novelty of the drug candidates involved. Changes in regulatory approval policies during the development period, changes in or the enactment of additional statutes or regulations, or changes in regulatory review for each submitted New Drug Application, or NDA, pre-market approval or equivalent application types, may cause delays in the approval or rejection of an application. The FDA, NMPA and comparable authorities in other countries have substantial discretion in the approval process and may refuse to accept any application or may decide that our data are insufficient for approval and require additional pre-clinical, clinical or other studies. Our drug candidates could be delayed in receiving, or fail to receive, regulatory approval for many reasons, including the following:

| ● | the FDA, NMPA or comparable regulatory authorities may disagree with the number, design, size, conduct or implementation of our clinical trials; |

| ● | we may be unable to demonstrate to the satisfaction of the FDA, NMPA or comparable regulatory authorities that a drug candidate is safe and effective for its proposed indication; |

| ● | the results of clinical trials may not meet the level of statistical significance required by the FDA, NMPA or comparable regulatory authorities for approval; |

15

| ● | we may be unable to demonstrate that a drug candidate’s clinical and other benefits outweigh its safety risks; |

| ● | the FDA, NMPA or comparable regulatory authorities may disagree with our interpretation of data from pre-clinical studies or clinical trials; |

| ● | the data collected from clinical trials of our drug candidates may not be sufficient to support the submission of an NDA or other submission or to obtain regulatory approval in the United States or elsewhere; |

| ● | the FDA, NMPA or comparable regulatory authorities may fail to approve the manufacturing processes for our clinical and commercial supplies; |

| ● | the approval policies or regulations of the FDA, NMPA or comparable regulatory authorities may significantly change in a manner rendering our clinical data insufficient for approval; |

| ● | the FDA, NMPA or comparable regulatory authority may prioritize treatments for emerging health crises, such as Covid-19, resulting in delays for our drug candidates; |

| ● | the FDA, NMPA or comparable regulatory authorities may restrict the use of our products to a narrow population; and |

| ● | our collaboration partners or CROs that are retained to conduct the clinical trials of our drug candidates may take actions that materially and adversely impact the clinical trials. |

In addition, even if we were to obtain approval, regulatory authorities may approve any of our drug candidates for fewer or more limited indications than we request, may not approve the price we intend to charge for our drugs, may grant approval contingent on the performance of costly post-marketing clinical trials, or may approve a drug candidate with a label that does not include the labeling claims necessary or desirable for the successful commercialization of that drug candidate. Any of the foregoing scenarios could materially harm the commercial prospects for our drug candidates.

Furthermore, even though the NMPA has granted approval for fruquintinib for use in third-line metastatic colorectal cancer patients, we are still subject to substantial, ongoing regulatory requirements. See “—Even if we receive regulatory approval for our drug candidates, we are subject to ongoing obligations and continued regulatory review, which may result in significant additional expense.”

If the FDA, NMPA or another regulatory agency revokes its approval of, or if safety, efficacy, manufacturing or supply issues arise with, any therapeutic that we use in combination with our drug candidates, we may be unable to market such drug candidate or may experience significant regulatory delays or supply shortages, and our business could be materially harmed.

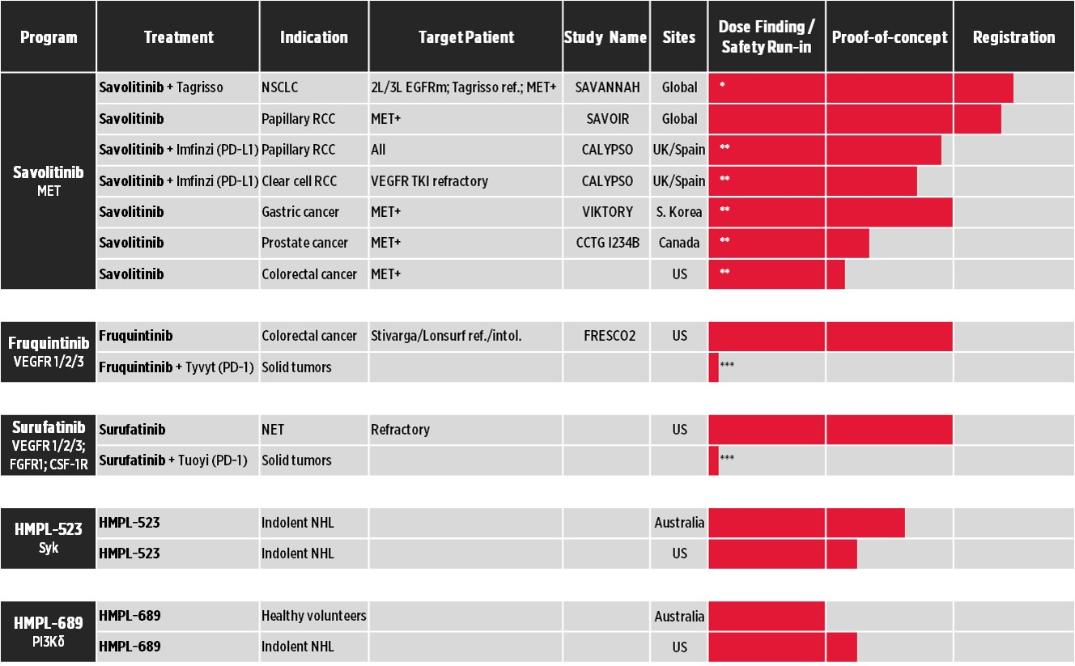

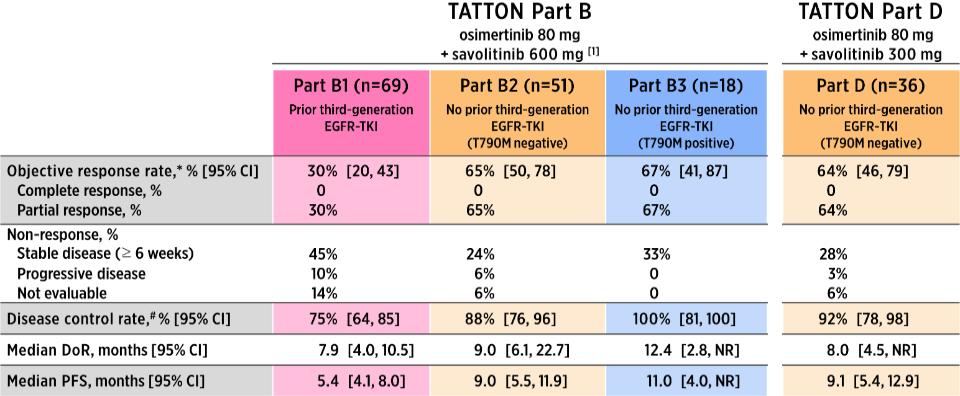

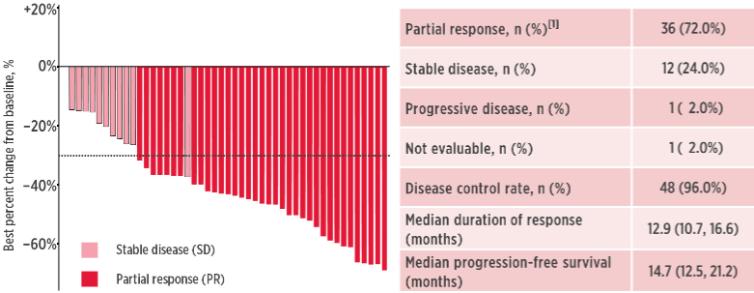

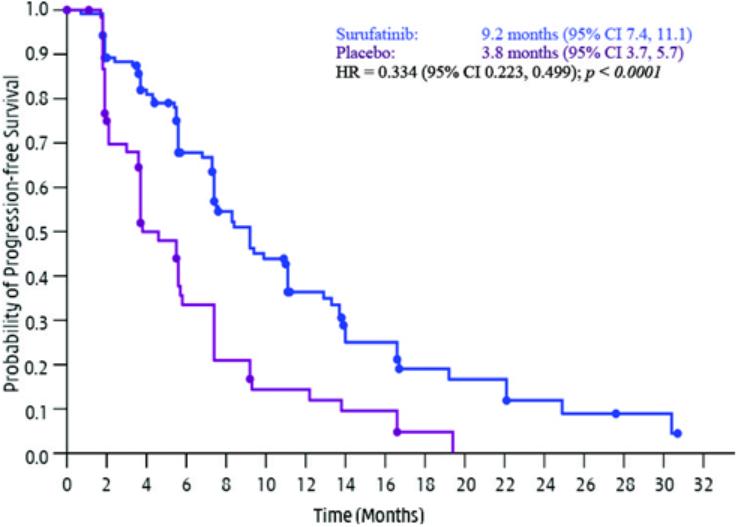

We are currently focusing on the clinical development of savolitinib as both a monotherapy and in combination with immunotherapy (Imfinzi), targeted therapies (Tagrisso and Iressa) and chemotherapy (Taxotere). We are also focusing on the clinical development of our drug candidate fruquintinib as both a monotherapy and in combination with immunotherapies (Tyvyt and genolimzumab), chemotherapy (Taxol) and targeted therapies (Iressa). In addition, we are currently focusing on the clinical development of surufatinib (previously named sulfatinib) as a monotherapy and in combination with immunotherapies (Tuoyi and Tyvyt). However, we did not develop and we do not manufacture or sell, Tagrisso, Iressa, Taxotere, Taxol, Imfinzi, Tyvyt, genolimzumab, Tuoyi or any other therapeutic we use in combination with our drug candidates. We may also seek to develop our drug candidates in combination with other therapeutics in the future.

If the FDA, NMPA or another regulatory agency revokes its approval, or does not grant approval, of any of these and other therapeutics we use in combination with our drug candidates, we will not be able to market our drug candidates in combination with such therapeutics. If safety or efficacy issues arise with these or other therapeutics that we seek to combine with our drug candidates in the future, we may experience significant regulatory delays, and we may be required to redesign or terminate the applicable clinical trials. In addition, if manufacturing or other issues result in a supply shortage of these or any other combination therapeutics, we may not be able to complete clinical development of savolitinib, fruquintinib, surufatinib, HMPL-523 and/or another of our drug candidates on our current timeline or at all.

16

Even if one or more of our drug candidates were to receive regulatory approval for use in combination with a therapeutic, we would continue to be subject to the risk that the FDA, NMPA or another regulatory agency could revoke its approval of the combination therapeutic, or that safety, efficacy, manufacturing or supply issues could arise with one of these combination therapeutics. This could result in savolitinib, fruquintinib, surufatinib, HMPL-523 or one of our other products being removed from the market or being less successful commercially.

We face substantial competition, which may result in others discovering, developing or commercializing drugs before or more successfully than we do.

The development and commercialization of new drugs is highly competitive. We face competition with respect to our current drug candidates, and will face competition with respect to any drug candidates that we may seek to develop or commercialize in the future, from major pharmaceutical companies, specialty pharmaceutical companies and biotechnology companies worldwide. There are a number of large pharmaceutical and biotechnology companies that currently market drugs or are pursuing the development of therapies in the field of kinase inhibition for cancer and other diseases. Some of these competitive drugs and therapies are based on scientific approaches that are the same as or similar to our approach, and others are based on entirely different approaches. Potential competitors also include academic institutions, government agencies and other public and private research organizations that conduct research, seek patent protection and establish collaborative arrangements for research, development, manufacturing and commercialization. Specifically, there are a large number of companies developing or marketing treatments for cancer and immunological diseases, including many major pharmaceutical and biotechnology companies.

Many of the companies against which we are competing or against which we may compete in the future have significantly greater financial resources and expertise in research and development, manufacturing, pre-clinical testing, conducting clinical trials, obtaining regulatory approvals and marketing approved drugs than we do. Mergers and acquisitions in the pharmaceutical, biotechnology and diagnostic industries may result in even more resources being concentrated among a smaller number of our competitors. Smaller or early-stage companies may also prove to be significant competitors, particularly through collaborative arrangements with large and established companies. These competitors also compete with us in recruiting and retaining qualified scientific and management personnel and establishing clinical trial sites and patient registration for clinical trials, as well as in acquiring technologies complementary to, or necessary for, our programs.

Our commercial opportunity could be reduced or eliminated if our competitors develop and commercialize drugs that are safer, more effective, have fewer or less severe side effects, are more convenient or are less expensive than any drugs that we or our collaborators may develop. Our competitors also may obtain FDA, NMPA or other regulatory approval for their drugs more rapidly than we may obtain approval for ours, which could result in our competitors establishing a strong market position before we or our collaborators are able to enter the market. The key competitive factors affecting the success of all of our drug candidates, if approved, are likely to be their efficacy, safety, convenience, price, the level of generic competition and the availability of reimbursement from government and other third-party payors.

Clinical development involves a lengthy and expensive process with an uncertain outcome.

There is a risk of failure for each of our drug candidates. It is difficult to predict when or if any of our drug candidates will prove effective and safe in humans or will receive regulatory approval. Before obtaining regulatory approval from regulatory authorities for the sale of any drug candidate, we or our collaboration partners must complete pre-clinical studies and then conduct extensive clinical trials to demonstrate the safety and efficacy of our drug candidates in humans. Clinical testing is expensive, difficult to design and implement and can take many years to complete. The outcomes of pre-clinical development testing and early clinical trials may not be predictive of the success of later clinical trials, and interim results of a clinical trial do not necessarily predict final results. Moreover, pre-clinical and clinical data are often susceptible to varying interpretations and analyses, and many companies that have believed their drug candidates performed satisfactorily in pre-clinical studies and clinical trials have nonetheless failed to obtain regulatory approval of their drug candidates. Our current or future clinical trials may not be successful.

Commencing each of our clinical trials is subject to finalizing the trial design based on ongoing discussions with the FDA, NMPA or other regulatory authorities. The FDA, NMPA and other regulatory authorities could change their position on the acceptability of our trial designs or clinical endpoints, which could require us to complete additional clinical trials or impose approval conditions that we do not currently expect. Successful completion of our clinical trials is a prerequisite to submitting an NDA or analogous filing to the FDA, NMPA or other regulatory authorities for each drug candidate and, consequently, the ultimate approval and commercial marketing of our drug candidates. We do not know whether any of our clinical trials will begin or be completed on schedule, if at all.

17

We and our collaboration partners may incur additional costs or experience delays in completing our pre-clinical or clinical trials, or ultimately be unable to complete the development and commercialization of our drug candidates.

We and our collaboration partners, including AstraZeneca and Eli Lilly, may experience delays in completing our pre-clinical or clinical trials, and numerous unforeseen events could arise during, or as a result of, future clinical trials, which could delay or prevent us from receiving regulatory approval, including:

| ● | regulators or institutional review boards, or IRBs, or ethics committees or the China Human Genetic Resources Administration Office may not authorize us or our investigators to commence or conduct a clinical trial at a prospective trial site; |

| ● | we may experience delays in reaching, or we may fail to reach, agreement on acceptable terms with prospective trial sites and prospective CROs, who conduct clinical trials on behalf of us and our collaboration partners, the terms of which can be subject to extensive negotiation and may vary significantly among different CROs and trial sites; |

| ● | clinical trials may produce negative or inconclusive results, and we or our collaboration partners may decide, or regulators may require us or them, to conduct additional clinical trials or we may decide to abandon drug development programs; |

| ● | the number of patients required for clinical trials of our drug candidates may be larger than we anticipate, enrollment in these clinical trials may be slower than we anticipate or participants may drop out of these clinical trials or fail to return for post-treatment follow-up at a higher rate than we anticipate; |

| ● | third-party contractors used in our clinical trials may fail to comply with regulatory requirements or meet their contractual obligations in a timely manner, or at all, or may deviate from the clinical trial protocol or drop out of the trial, which may require that we or our collaboration partners add new clinical trial sites or investigators; |

| ● | we or our collaboration partners may elect to, or regulators, IRBs or ethics committees may require that we or our investigators, suspend or terminate clinical research for various reasons, including non-compliance with regulatory requirements or a finding that the participants are being exposed to unacceptable health risks; |

| ● | the cost of clinical trials of our drug candidates may be greater than we anticipate; |

| ● | the supply or quality of our drug candidates, companion diagnostics, if any, or other materials necessary to conduct clinical trials of our drug candidates may be insufficient or inadequate; and |

| ● | our drug candidates may have undesirable side effects or unexpected characteristics, causing us or our investigators, regulators, IRBs or ethics committees to suspend or terminate the trials, or reports may arise from pre-clinical or clinical testing of other cancer therapies that raise safety or efficacy concerns about our drug candidates. |

We could encounter regulatory delays if a clinical trial is suspended or terminated by us or our collaboration partners, by, as applicable, the IRBs of the institutions in which such trials are being conducted, by the Data Safety Monitoring Board, which is an independent group of experts that is formed to monitor clinical trials while ongoing, or by the FDA, NMPA or other regulatory authorities. Such authorities may impose a suspension or termination due to a number of factors, including: a failure to conduct the clinical trial in accordance with regulatory requirements or the applicable clinical protocols, inspection of the clinical trial operations or trial site by the FDA, NMPA or other regulatory authorities that results in the imposition of a clinical hold, unforeseen safety issues or adverse side effects, failure to demonstrate a benefit from using a drug, changes in governmental regulations or administrative actions or lack of adequate funding to continue the clinical trial. Many of the factors that cause a delay in the commencement or completion of clinical trials may also ultimately lead to the denial of regulatory approval of our drug candidates. Further, the FDA, NMPA or other regulatory authorities may disagree with our clinical trial design and our interpretation of data from clinical trials, or may change the requirements for approval even after it has reviewed and commented on the design for our clinical trials.

18

If we or our collaboration partners are required to conduct additional clinical trials or other testing of our drug candidates beyond those that are currently contemplated, if we or our collaboration partners are unable to successfully complete clinical trials of our drug candidates or other testing, if the results of these trials or tests are not positive or are only modestly positive or if there are safety concerns, we may:

| ● | be delayed in obtaining regulatory approval for our drug candidates; |

| ● | not obtain regulatory approval at all; |

| ● | obtain approval for indications or patient populations that are not as broad as intended or desired; |

| ● | be subject to post-marketing testing requirements; or |

| ● | have the drug removed from the market after obtaining regulatory approval. |

Our drug development costs will also increase if we experience delays in testing or regulatory approvals. We do not know whether any of our clinical trials will begin as planned, will need to be restructured or will be completed on schedule, or at all. Significant pre-clinical study or clinical trial delays also could allow our competitors to bring products to market before we do and impair our ability to successfully commercialize our drug candidates and may harm our business and results of operations. Any delays in our clinical development programs may harm our business, financial condition and prospects significantly.

If we or our collaboration partners experience delays or difficulties in the enrollment of patients in clinical trials, the progress of such clinical trials and our receipt of necessary regulatory approvals could be delayed or prevented.

We or our collaboration partners may not be able to initiate or continue clinical trials for our drug candidates if we or our collaboration partners are unable to locate and enroll a sufficient number of eligible patients to participate in these trials as required by the FDA, NMPA or similar regulatory authorities. In particular, we and our collaboration partners have designed many of our clinical trials, and expect to design future trials, to include some patients with the applicable genomic alteration that causes the disease with a view to assessing possible early evidence of potential therapeutic effect. Genomically defined diseases, however, may have relatively low prevalence, and it may be difficult to identify patients with the applicable genomic alteration. In addition, for many of our trials, we focus on enrolling patients who have failed their first or second-line treatments, which limits the total size of the patient population available for such trials. The inability to enroll a sufficient number of patients with the applicable genomic alteration or that meet other applicable criteria for our clinical trials would result in significant delays and could require us or our collaboration partners to abandon one or more clinical trials altogether.

In addition, some of our competitors have ongoing clinical trials for drug candidates that treat the same indications as our drug candidates, and patients who would otherwise be eligible for our clinical trials may instead enroll in clinical trials of our competitors’ drug candidates.

Patient enrollment may be affected by other factors including:

| ● | the severity of the disease under investigation; |

| ● | the total size and nature of the relevant patient population; |

| ● | the design and eligibility criteria for the clinical trial in question; |

| ● | the availability of an appropriate genomic screening test/companion diagnostic; |

| ● | the perceived risks and benefits of the drug candidate under study; |

| ● | the efforts to facilitate timely enrollment in clinical trials; |

19

| ● | the patient referral practices of physicians; |

| ● | the availability of competing therapies which are undergoing clinical trials; |

| ● | the ability to monitor patients adequately during and after treatment; and |

| ● | the proximity and availability of clinical trial sites for prospective patients. |

Enrollment delays in our clinical trials may result in increased development costs for our drug candidates, which could cause the value of our company to decline and limit our ability to obtain financing.

Our drug candidates may cause undesirable side effects that could delay or prevent their regulatory approval, limit the commercial profile of an approved label, or result in significant negative consequences following regulatory approval, if any.

Undesirable side effects caused by our drug candidates could cause us or our collaboration partners to interrupt, delay or halt clinical trials or could cause regulatory authorities to interrupt, delay or halt our clinical trials and could result in a more restrictive label or the delay or denial of regulatory approval by the FDA, NMPA or other regulatory authorities. In particular, as is the case with all oncology drugs, it is likely that there may be side effects, for example, hand-foot syndrome, associated with the use of certain of our drug candidates. Results of our trials could reveal a high and unacceptable severity and prevalence of these or other side effects. In such an event, our trials could be suspended or terminated and the FDA, NMPA or comparable regulatory authorities could order us to cease further development of or deny approval of our drug candidates for some or all targeted indications. The drug-related side effects could affect patient recruitment or the ability of enrolled patients to complete the trial or result in potential product liability claims. Any of these occurrences may harm our business, financial condition and prospects significantly.

Further, our drug candidates could cause undesirable side effects related to off-target toxicity. Many of the currently approved tyrosine kinase inhibitors have been associated with off-target toxicities because they affect multiple kinases. While we believe that the kinase selectivity of our drug candidates has the potential to significantly improve the unfavorable adverse off-target toxicity issues, if patients were to experience off-target toxicity, we may not be able to achieve an effective dosage level, receive approval to market, or achieve the commercial success we anticipate with respect to any of our drug candidates, which could prevent us from ever generating revenue or achieving profitability. Many compounds that initially showed promise in early-stage testing for treating cancer have later been found to cause side effects that prevented further development of the compound.