UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

| Filed by the Registrant ☒ | Filed by a Party other than the Registrant ☐ |

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material under §240.14a-12 |

| (Name of Registrant as Specified in its Charter) |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check all boxes that apply):

| ☒ | No fee required |

| ☐ | Fee paid previously with preliminary materials |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

June 21, 2024

Dear Fellow Stockholder:

It is my pleasure to invite you to attend the Annual Meeting of Stockholders of Albertsons Companies, Inc. at 3:00 p.m. Mountain Daylight Time on Thursday, August 8, 2024.

We continue to work diligently toward the closing of our proposed merger with Kroger. Through a family of well-known and trusted supermarket banners, this combination will expand customer reach and improve proximity to deliver fresh and affordable groceries to approximately 85 million households with a premier omnichannel experience. Merging with Kroger will also enable us to lower prices for customers, enhance the customer shopping experience, provide new career opportunities for our associates, protect union jobs, increase associate wages, and build on our shared commitment to supporting local communities.

While efforts on the merger were still underway in fiscal 2023, we remained laser-focused on our performance and execution as a stand-alone public company, and made significant progress against our strategic priorities. We continued to deliver on our Customers for Life strategy—investing approximately $2.0 billion in our stores and technology, while advancing our productivity initiatives to increase efficiency and drive cost savings. We also continued to live and fulfill our purpose of bringing people together around the joys of food and inspiring wellbeing.

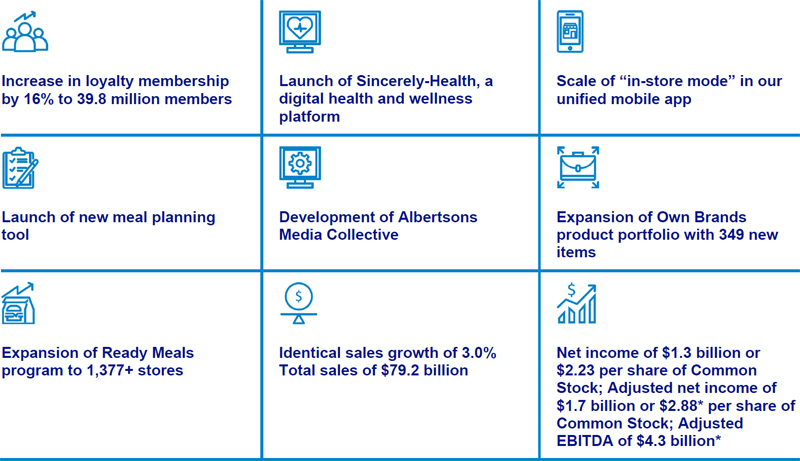

I am incredibly proud of the way our team continued to serve customers and communities while driving solid operating and financial performance. Our results for fiscal 2023 speak to the significant progress we have made amidst industry-wide headwinds. Identical sales increased 3%, total sales were $79.2 billion, and net income was $1.3 billion, or $2.23 per share. Adjusted net income was $1.7 billion, or $2.88 per share, and Adjusted EBITDA was $4.3 billion. We also returned $276 million to our stockholders this fiscal year through common stock dividends.

To ensure we develop new and innovative ways to grow the business and serve our customers and communities in the future, we remained focused on our five strategic priorities during fiscal 2023.

Deepening our Digital Connection and Engagement with our Customers – This has been a critical priority for us for several years now and I am pleased to say we continued to make great strides across a variety of important digital initiatives. We increased loyalty membership by 16% to nearly 40 million customers and grew our digital sales by 22%. At the same time, we continued to strengthen and develop our capabilities in both Drive Up and Go and delivery, to provide our customers with speed and convenience—including 30-minute flash delivery service. We also launched Sincerely Health, a digital health and wellness platform that has deepened and extended the engagement we have with our customers.

Differentiating our Store Experience – We continued to enhance merchandising in our stores with displays designed to make it more convenient for our customers to assemble meals, and have added grab-and-go sections to allow customers to quickly select items from displays at the front of the store. We are also scaling the use of “in-store mode” within our mobile app, which provides a navigational tool to guide a customer’s journey through our store, assisting with the product location, quick access to deals, and other features. We are also enhancing the technology in our stores to automate and simplify tasks, enabling our associates to spend more time on high-touch and valued-added interactions with our customers.

Enhancing What We Offer – To enhance our value proposition for customers, we continued to refine and add to our Own Brands product portfolio, including the launch of new mix-and-match frozen meal solutions that provide high quality, convenient dinners for busy families. We also redesigned packaging on over 4,500 items during the year, including Signature Select, O Organics, and Open Nature, with refreshed modern logos and bold package design to build greater brand recognition. We elevated our distinctiveness in Fresh, tailoring our selection based on local demographics and preferences, enhanced our capabilities in pricing and assortment, and scaled our Ready Meals program to nearly 1,400 stores, now in more than 60% of our stores. In addition, we held our fourth Annual Supplier Diversity Program Summit to provide diverse-owned suppliers the opportunity to expand their business with Albertsons Companies.

Modernizing our Capabilities – We improved our supply chain through automation and continued the rollout of a new enterprise warehouse management system. We have also further developed the Albertsons Media Collective, an easy-to-use, transparent, and modern media collective platform that has dramatically improved our capabilities in client advocacy, innovation, and measurement. We also launched a new meal planning tool that provides shoppable meal plans and recipes on our grocery apps and websites, which includes a budget tracker and cooking guide complete with a built-in timer. This tool was voted the People’s Voice winner for best shopping and retail app in the 28th annual Webby Awards for its seamless omnichannel shopping experience.

Maximizing our Positive Impact – We are committed to supporting causes that impact our customers’ lives and strengthen the communities we serve. In an effort to reduce food insecurity, we enabled more than 220 million meals through our store food donation program and the Nourishing Neighbors Program of the Albertsons Companies Foundation during fiscal 2023. From fiscal 2019 through 2023, we have enabled 1.15 billion meals. In addition, our O Organics brand launched its “Fight Hunger, Serve Hope” campaign to combat hunger for school-aged children during the summer months, and the Nourishing Neighbors Program donated more than $1 million to support meals for families affected by the wildfires in Maui, Hawaii.

Finally, I want to recognize the approximately 285,000 associates who have made our success possible through their commitment to meeting the needs of our customers and communities. Your dedication to serving our customers and communities is what makes our performance possible.

On behalf of our board of directors, thank you for your continued support and investment in Albertsons Companies.

Sincerely,

Vivek Sankaran

Chief Executive Officer and Director

| Notice of Annual Meeting of Stockholders |

|

June 21, 2024

Dear Stockholders:

Notice is hereby given that the 2024 annual meeting (“Annual Meeting”) of the Company will be held virtually on August 8, 2024, at 3:00 p.m. Mountain Daylight Time, for the following purposes:

|

|||

| Proposals | Board

Vote Recommendation |

||

| 1. | To elect 11 directors to serve on our Board for a term of one year. | “FOR” each director nominee | |

| 2. | To ratify the appointment of Deloitte and Touche LLP as the Company’s independent registered public accounting firm for the fiscal year ending February 22, 2025. | “FOR” | |

| 3. | To conduct the annual (non-binding) advisory vote to approve our named executive officer compensation. | “FOR” | |

| 4. | To transact such other business as may properly come before the Annual Meeting or any adjournment thereof. | ||

|

Only stockholders of record of our Class A common stock, par value $0.01 per share (“Common Stock”) as of the close of business on June 11, 2024 (the “Record Date”) will be entitled to notice of, and to vote at, the Annual Meeting. We are making available to our stockholders the proxy statement, the form of proxy and the notice of internet availability of our proxy materials on or about June 21, 2024.

Our Annual Meeting will be held in a virtual-only meeting format to facilitate stockholder attendance and participation from any location at minimal or no cost. Stockholders will be afforded the same rights and opportunities to participate in a virtual-only annual meeting as they would at an in-person meeting, including the right to vote and ask questions through a virtual meeting platform.

See “Questions and Answers About the Annual Meeting and Voting” for information regarding how to attend the Annual Meeting and other details. |

|||

|

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING TO BE HELD ON AUGUST 8, 2024. THE PROXY STATEMENT AND THE 2023 FORM 10-K ARE AVAILABLE AT http://materials.proxyvote.com/

YOUR VOTE IS

|

|

By Order of the Board of Directors,

Vivek Sankaran

Chief Executive Officer, Director

| Table of Contents |

| Proxy Statement Summary |

This summary highlights information contained elsewhere in this proxy statement and in our annual report on Form 10-K for the year ended February 24, 2024 (the “2023 Form 10-K”) as filed with the Securities and Exchange Commission (the “SEC”) on April 22, 2024, for Albertsons Companies, Inc. (the “Company”, “Albertsons”, “we”, “ACI”, “our” or “us”). You should read this proxy statement and the 2023 Form 10-K before voting.

Annual Meeting of Stockholders

|

DATE AND TIME

|

PLACE:

|

RECORD DATE:

|

We are holding the Annual Meeting in a virtual-only format. You will not be able to attend the Annual Meeting in person.

How to Vote

|

BY INTERNET |

● Go to the website http://www.proxyvote.com and follow the instructions, 24 hours a day, seven days a week.

● You will need the 16-digit number included on your proxy card. |

|

BY TELEPHONE |

● From a touch-tone telephone, dial 1-800-690-6903 and follow the recorded instructions, 24 hours a day, seven days a week.

● You will need the 16-digit number included on your proxy card. |

|

BY MAIL |

● Mark your selections on the proxy card.

● Date and sign your name exactly as it appears on your proxy card.

● Mail the proxy card in the enclosed postage-paid envelope provided to you. |

See “Questions and Answers About the Annual Meeting and Voting” for information regarding attending the Annual Meeting.

Annual Meeting Agenda and Voting Roadmap

|

PROPOSAL 1: Election of 11 Director Nominees

At our Annual Meeting, stockholders will elect 11 directors. The nominees were recommended for nomination by our Governance, Compliance and ESG Committee (the “Governance Committee”) and our board of directors (the “Board”) approved the nominees for re-election. If elected, the directors will hold office until our 2025 annual meeting and serve until their successors have been duly elected and qualified or until any such director’s earlier resignation or removal. |

|

|

Our Board recommends a vote “FOR” each director nominee. |

|

PROPOSAL 2: Ratification of the Appointment of the Independent Registered Public Accounting Firm

The Audit and Risk Committee (the “Audit Committee”) has appointed Deloitte and Touche LLP (“Deloitte and Touche”) to serve as our independent registered public accounting firm for the fiscal year ending February 22, 2025. |

|

|

Our Board recommends a vote “FOR” this proposal. |

|

PROPOSAL 3: Advisory (Non-Binding) Vote to Approve the Company’s Named Executive Officer Compensation

As required by Section 14A of the Securities Exchange Act of 1934 (the “Exchange Act”), we are providing stockholders with an opportunity to cast an advisory vote on the compensation of our named executive officers (the “NEOs”) as disclosed in the Compensation Discussion & Analysis (“CD&A”), the compensation tables, narrative discussion, and related footnotes included in this proxy statement. |

|

|

Our Board recommends a vote “FOR” this proposal. |

In addition, we will conduct any other business that may properly come before the Annual Meeting. See “Questions and Answers About the Annual Meeting and Voting” for more information.

Our Director Nominees

The following table provides summary information about each director nominee.

See Proposal 1 beginning on page 15 for more information on our Board and corporate governance.

| Name and Principal Occupation | Age | Director Since |

Committee Membership | Relevant Skills &Experiences | |||||

| CC | AC | GC | TC | FC | |||||

|

Sharon Allen+ Former U.S. Chairman of Deloitte LLP |

72 | 2015 |  |

|

Public Company Leadership; Corporate Governance; Financial Expert; Risk Management; Strategy | |||

|

James Donald*+ Former CEO and President of ACI |

70 | 2019 |  |

Public Company Leadership; Financial Literacy; Risk Management; Food and Retail; Operations; Strategy; Real Estate | ||||

|

Kim Fennebresque+ Former Senior Advisor to Cowen Group Inc. |

74 | 2015 |  |

|

Public Company Leadership; Financial Expert; Risk Management; Operations; Strategy | |||

|

Chan Galbato* CEO of Cerberus Operations and Advisory Company, LLC |

61 | 2021 |  |

Public Company Leadership; Financial Literacy; Risk Management; Operations; Strategy | ||||

|

Allen Gibson+ Chief Investment Officer of Centaurus Capital LP |

58 | 2018 |  |

|

|

Financial Literacy; Risk Management; Corporate Governance; Strategy; Cybersecurity and Technology | ||

|

Lisa Gray Vice Chair and Senior Legal Officer of Cerberus Operations & Advisory Company, LLC |

68 | 2023 |  |

|

Strategy; Financial Literacy; Mergers and Acquisitions and Financial Transactions; Corporate Governance; Compliance; Communications; Human Resources | |||

|

Sarah Mensah+ President of Jordan Brand at Nike Inc. |

59 | 2023 |  |

|

Public Company Leadership; Operations; Retail; Strategy; Risk Management; Marketing; Financial Literacy | |||

|

Vivek Sankaran CEO of ACI |

61 | 2019 | Public Company Leadership; Financial Literacy; Risk Management; Food and Retail; Operations; Strategy | |||||

|

Alan Schumacher+ Former Member of the Federal Accounting Standards Advisory Board |

77 | 2015 |  |

|

Public Company Leadership; Financial Expert; Corporate Governance; Strategy; Risk Management | |||

|

Brian Kevin Turner+ Chairman of Zayo Group and former COO of Microsoft Corporation |

59 | 2020 |  |

|

Public Company Leadership; Financial Literacy; Risk Management; Food and Retail; Operations; Strategy; Cybersecurity (including Artificial Intelligence) and Technology | |||

|

Mary Elizabeth West+ Former Senior Vice President and Chief Growth Officer, The Hershey Company |

61 | 2020 |  |

|

Public Company Leadership; Financial Literacy; Risk Management; Food and Retail; Corporate Governance; Operations; Marketing; Strategy; Mergers and Acquisitions | |||

| AC - Audit Committee | FC - Finance Committee |  Chair Chair |

| CC - Compensation Committee | GC - Governance Committee |  Member Member |

| * Co-Chair of the Board | TC - Technology Committee | |

| + Independent Director |

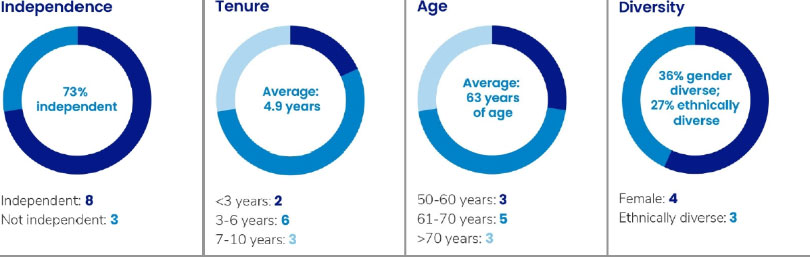

Board Snapshot

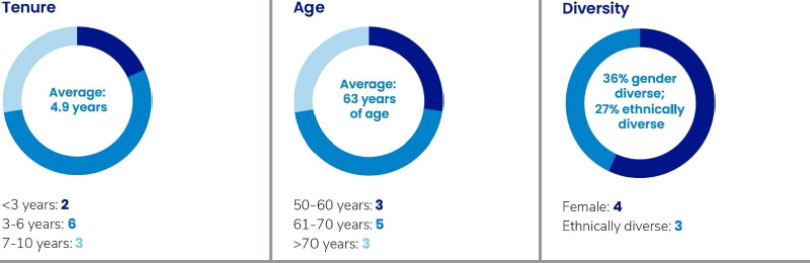

In 2023, the Board appointed two new members - Ms. Lisa Gray and Ms. Sarah Mensah. With the appointment of Mmes. Gray and Mensah, the majority of the Board members continued to be independent, and each of our standing committees is fully independent.

The following summarizes certain aspects of the Board’s current composition:

Below are some of the relevant skills and experiences of our directors.

Relevant Skills & Experiences

|

|

|

| Mergers and Acquisitions and Financial Transactions |

Financial Literacy/Expertise | Risk Management |

| 2 directors | 11 directors | 10 directors |

|

|

|

| Public Company Leadership/ Other Public Company Board Service |

Food and Retail Industry | Strategic Planning |

| 9 directors | 5 directors | 11 directors |

|

|

|

| Information Technology and Cybersecurity |

Operations and Marketing | Real Estate |

| 2 directors | 7 directors | 1 director |

|

||

| Corporate Governance | ||

| 5 directors |

Board Governance Highlights

Our adoption and prioritization of leading governance principles have helped us manage risk and sustain business success over the long term. Our core corporate governance practices are listed in the following table.

| Majority of Board independent | All standing committees are fully independent | Separate CEO and Chair roles | Co-Chair roles promote better Board oversight and governance |

| Our largest stockholder has representation on our Board and has director nomination rights | Board committees with focus on risk management, ESG and cybersecurity | Annual Board and committee evaluations | Regularly scheduled executive sessions during Board and committee meetings |

| Directors subject to stock ownership guidelines to align with long-term stockholder interests | No term limits or mandatory retirement age allowing directors to develop insight into the Company and its operations | Limitation on other board service | Directors regularly attend all Board and committee meetings |

| Unclassified Board and annual election of all directors | Our bylaws require a “majority voting” standard in uncontested director elections | Our only class of voting stock is our Common Stock | Commitment to Board refreshment |

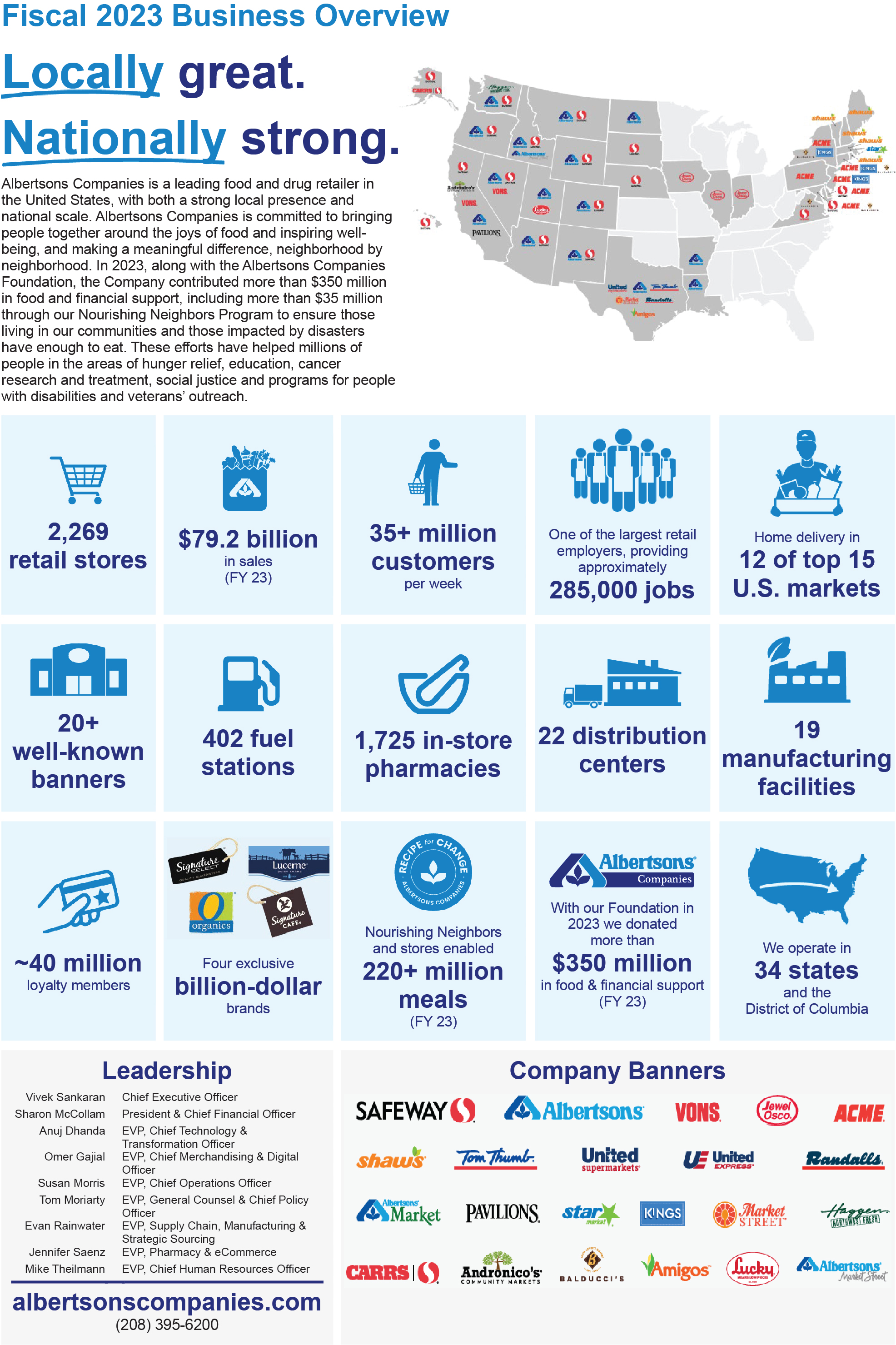

Fiscal 2023 Business Overview

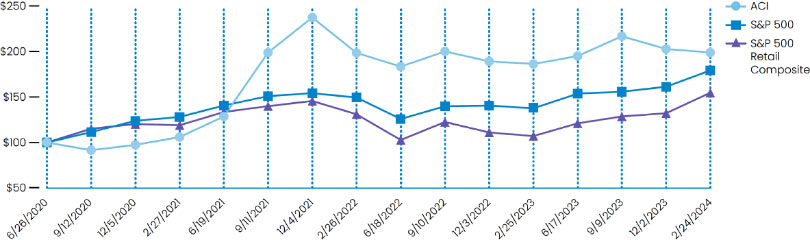

We have also consistently achieved higher total returns as compared to the S&P 500 Index and the S&P 500 Retail Composite Index for the period from June 26, 2020 (the date our Common Stock commenced trading on the NYSE) through the end of our 2023 fiscal year (February 24, 2024).

Comparison of Cumulative Total Return (Since Listing)

Executive Compensation Advisory Vote

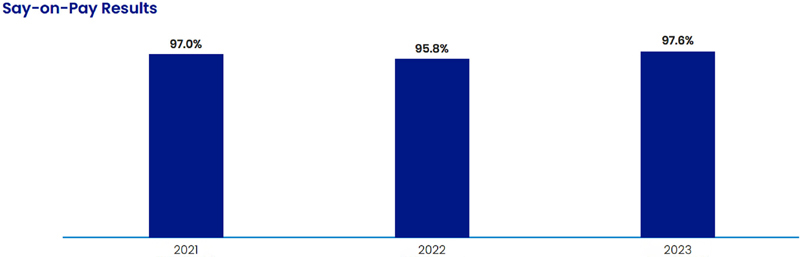

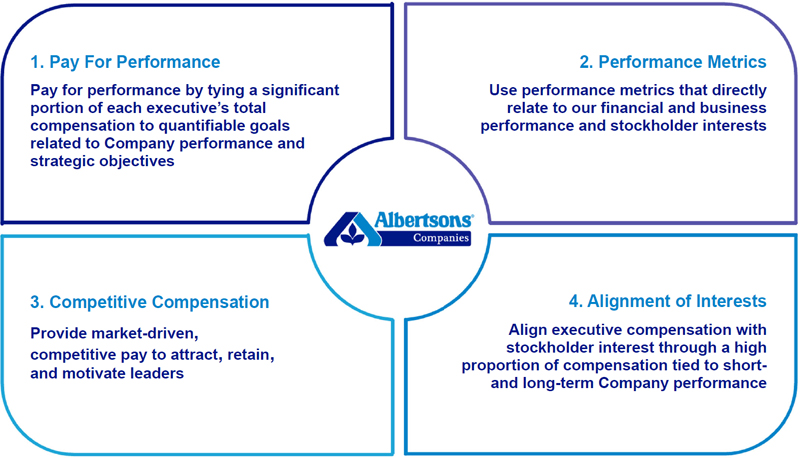

The Compensation Committee structures our executive compensation program to attract, motivate, reward, and retain high caliber talent to lead our Company’s efforts to increase our competitive advantage and deliver results. This includes building a solid foundation for long-term growth while consistently achieving strong near-term results.

As part of the process for setting executive compensation, the Compensation Committee annually reviews our compensation program and considers stockholder feedback. We value the input and insights of our stockholders and are committed to continued engagement with them. Based on feedback received from stockholders with respect to our say-on-pay proposal for the 2023 annual meeting, beginning fiscal 2024, the Compensation Committee changed the grant date of the annual long-term incentive awards from the first day of the fiscal year to two days after the release of the Company’s earnings for the fourth quarter and full year of the prior fiscal year. The annual award grant date for fiscal 2024 was April 24, 2024.

The Compensation Committee made no other modifications to the design of our executive compensation program and determined it strongly aligns with the interests of our stockholders by directly linking pay to Company and individual performance and delivery on key strategic goals.

At the 2023 annual meeting, our stockholders overwhelmingly approved our executive compensation program with 97.6% of the votes cast in favor.

| How We Pay for Performance | ||

|

We executed on our pay for performance philosophy in fiscal 2023 by:

● Providing competitive, market-driven base salaries to our NEOs with no increase from fiscal 2022

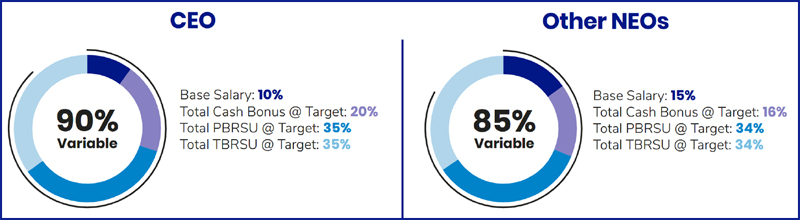

● Allocating a high percentage of annual target compensation for our NEOs as variable

► For Mr. Sankaran, 90% of target compensation was variable of which 55% was performance-based

► For our other NEOs, 85% of target compensation was variable of which 50% was performance-based

● Increasing Mr. Sankaran’s target cash bonus to 200% of base salary from 175% of base salary, tying a greater portion of his compensation to variable incentives

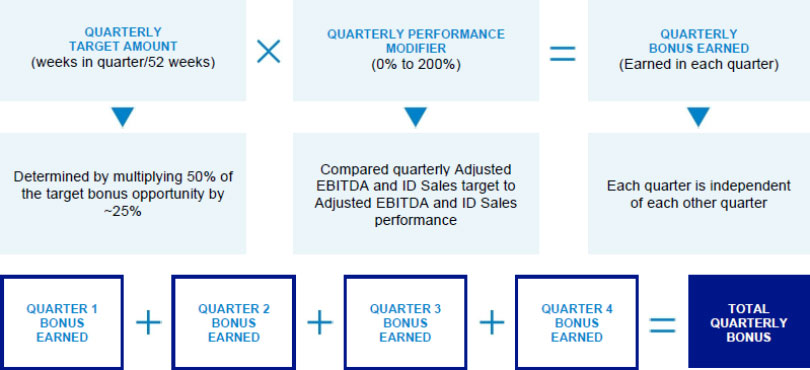

● Setting quantifiable annual financial and operational targets to determine the cash bonus payout with a cap of 200% of target to promote performance and responsible risk practices

● Modifying the final annual cash bonus payout to our NEOs based on achievement against quantifiable key strategic goals in the Senior Leader Scorecard

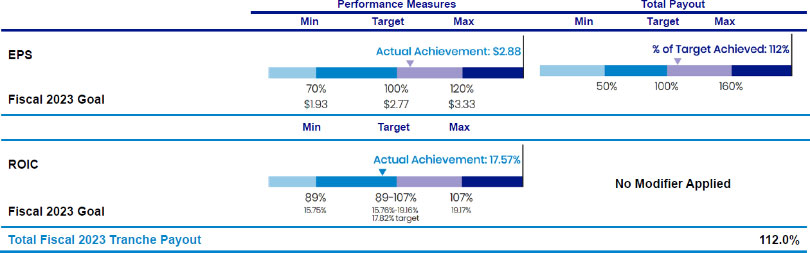

● Tying earnings per share (“EPS”) goals and return on invested capital (“ROIC”) modifiers to our performance-based restricted stock units (“PBRSUs”) to drive Company performance

|

||

| Sound Program Design | ||

|

Our Compensation Committee has adopted “best practices” for executive compensation which enables us to drive our pay-for-performance philosophy. Some of the highlights of our program design are as follows:

|

||

| What We Do | What We Don't Do | |

|

✔ Provide competitive, market-driven base salary

✔ Balance mix of pay components with an appropriate focus on both short- and long-term performance measures

✔ Utilize quantitative targets tied to Company financial and operating performance and strategic goals

✔ Cap the amount of annual cash bonus

✔ Maintain robust stock ownership guidelines

✔ Include fault and no-fault based recoupment or “clawback” policies in our compensation program

✔ Provide double-triggers for change in control provisions in employment agreements

✔ Restrict short sales and other speculative trading on our Common Stock

✔ Retain independent compensation consultant that performs no other services for the Company

|

|

See Proposal 3 beginning on page 43 for more information on our executive compensation.

| General Information |

Solicitation of Proxies

Our Board is soliciting proxies in connection with the Annual Meeting (and any adjournment thereof) to be held virtually on August 8, 2024, at 3:00 p.m. Mountain Daylight Time. The approximate date on which this proxy statement and the enclosed proxy are first being sent to stockholders is June 21, 2024.

Shares Outstanding and Voting Rights

As of the Record Date, 579,090,041 shares of Common Stock of the Company were outstanding. Holders of Common Stock are entitled to one vote for each share so held. Only holders of Common Stock as of the Record Date are entitled to receive notice of, and to vote at, the Annual Meeting.

|

PROPOSAL 1: Election of Directors |

|||

|

Our Board recommends that stockholders vote “FOR” each nominee | ||

Board Composition

Our Board is currently comprised of 11 members. All Board members are elected to serve a one-year term. The majority of the members on our Board are independent and our three standing committees are fully independent.

We are bound by certain contractual provisions under the stockholders’ agreement, dated June 25, 2020 (the “Stockholders’ Agreement”) regarding Board membership. Pursuant to the Stockholders’ Agreement, Cerberus Capital Management, L.P. (“Cerberus”), our largest stockholder, has the right to designate up to four directors for election to our Board. As of February 24, 2024, other than Cerberus, no other party to the Stockholders’ Agreement has any right to nominate a director or observer to the Board.

Cerberus’ designation rights are tied to their Common Stock ownership which provides as follows:

| Common Share Beneficial Ownership Percentage (Outstanding Shares) | Number of Director or Observer Designation Rights | |

| at least 20% | 4 directors | |

| at least 10% | 2 directors | |

| at least 5% | 1 director and 1 observer |

Annual Meeting Slate

At our Annual Meeting, stockholders will elect 11 directors to hold office until our 2025 annual meeting of stockholders, and to serve until their successors have been duly elected and qualified or until any such director’s earlier resignation or removal. Any vacancies on the Board will be filled by a majority of the directors currently serving on the Board. A director appointed to fill a vacancy, or a newly created directorship, shall hold office until the next annual meeting of stockholders and until his or her successor shall be elected and qualified.

Our Board has nominated the following directors for election based on the recommendation of the Governance Committee. At this time, we have no reason to believe that any nominee will be unable or unwilling to serve if elected. However, should any of them become unavailable or unwilling to serve before the Annual Meeting, your proxy card authorizes us to vote for a replacement nominee if the Board names one. The following biographical information is furnished as to each nominee for election as a director as of the Record Date.

|

Sharon Allen

Former U.S. Chairman of Deloitte LLP

Age: 72 Director Since: 2015 |

| Committees: Governance Committee (Chair); Audit Committee | |

| Nominee: Board | |

| Independent: Yes |

PROFESSIONAL HIGHLIGHTS

| ● | Ms. Allen served in various leadership roles at Deloitte LLP (“Deloitte”) for nearly 40 years including serving as U.S. Chairman of Deloitte from 2003 until her retirement from that position in May 2011. |

| ● | She served as a member of the Global Board of Directors, Chair of the Global Risk Committee and U.S. Representative of the Global Governance Committee of Deloitte Touche Tohmatsu Limited from 2003 to May 2011. |

| ● | Among her other leadership roles at Deloitte, Ms. Allen was partner and regional managing partner responsible for audit and consulting services for various Fortune 500 and large privately held companies. |

| ● | Ms. Allen is a Certified Public Accountant (Retired). |

OTHER BOARD ENGAGEMENT

| ● | Ms. Allen has served on the board of Bank of America Corporation, a multinational investment bank and financial services holding company, since 2012. |

| ● | Ms. Allen served on the board of First Solar, Inc., a manufacturer of solar panels and a provider of utility-scale PV power plants and supporting services, from 2013 to 2022. |

SKILLS AND QUALIFICATIONS

Ms. Allen’s extensive accounting and audit experience broadens the scope of our Board’s oversight of our financial performance and reporting. Additionally, her leadership and corporate governance experience with large public companies is valuable to our Board’s governance and compliance, strategic planning, and risk management insight.

|

James Donald

Former CEO and President of ACI

Age: 70 Director Since: 2019 Co-Chairman of the Board |

| Committees: Finance Committee (Co-Chair) | |

| Nominee: Board | |

| Independent: Yes |

PROFESSIONAL HIGHLIGHTS

| ● | Mr. Donald served as our President and CEO from September 2018 to April 2019 and, prior to that, served as our President and Chief Operating Officer (“COO”) from March 2018 to September 2018. |

| ● | Before joining the Company, Mr. Donald served as CEO and Director of Extended Stay America, Inc., a large North American owner and operator of hotels, and its subsidiary, ESH Hospitality, Inc. (together with Extended Stay America, Inc., “ESH”). |

| ● | Prior to joining ESH, Mr. Donald served as President, CEO and Director of Starbucks Corporation, a multinational chain of coffeehouses and roastery reserves, President and CEO of regional food and drug retailer, Haggen Food & Pharmacy, Chairman, President and CEO of regional food and drug retailer Pathmark Stores, Inc., and in a variety of other senior and executive roles at Wal-Mart Stores, Inc., Safeway Inc. and Albertson’s, Inc. |

| ● | Mr. Donald began his grocery and retail career in 1971 with Publix Super Markets, Inc. |

OTHER BOARD ENGAGEMENT

| ● | Mr. Donald has served on the board of Nordstrom, Inc. (“Nordstrom”), a leading fashion retailer since April 2020. |

SKILLS AND QUALIFICATIONS

Mr. Donald’s depth of experience in the retail industry, his expertise across real estate and operations, his decades of leadership roles at consumer-focused companies and his intimate familiarity with the Company makes him a valuable member of our Board.

|

Kim Fennebresque

Former Senior Advisor to Cowen Group Inc.

Age: 74 Director Since: 2015 |

| Committees: Compensation Committee (Chair); Audit Committee | |

| Nominee: Board | |

| Independent: Yes |

PROFESSIONAL HIGHLIGHTS

| ● | Mr. Fennebresque served as a senior advisor to Cowen Group Inc., a diversified financial services firm, from 2008 to 2020, previously having served as its Chairman, President, and CEO from 1999 to 2008. |

| ● | Prior to the Cowen Group, he led the corporate finance and mergers and acquisitions departments at UBS, a global firm providing financial services, and served as general partner and co-head of investment banking at Lazard Frères & Co., a leading financial advisory and asset management firm. |

| ● | From 2010 to 2012, Mr. Fennebresque served as chairman of Dahlman Rose & Co., LLC, an investment bank. |

| ● | Mr. Fennebresque also held various positions at First Boston Corporation, an investment bank acquired by Credit Suisse. |

OTHER BOARD ENGAGEMENT

| ● | Mr. Fennebresque has served on the boards of Ally Financial Inc., a financial services company, since May 2009, and BlueLinx Holdings Inc. (“BlueLinx”), a distributor of building products, since May 2013, including as its chairperson since 2016. |

| ● | Mr. Fennebresque served on the boards of Ribbon Communications Inc., a provider of network communications solutions, from October 2017 to February 2020, Delta Tucker Holdings, Inc. (the parent of DynCorp International), a provider of defense and technical services and government outsourced solutions, from May 2015 to July 2017, and Rotor Acquisition Corp., a special purpose acquisition company, from November 2020 to June 2021. |

SKILLS AND QUALIFICATIONS

Mr. Fennebresque’s leadership experience in the financial services industry, and his role as a director of several public companies brings risk management expertise and a diverse viewpoint to the deliberations of our Board.

|

Chan Galbato

CEO of Cerberus Operations and Advisory Company, LLC

Age: 61 Director Since: 2021 Co-Chairman of the Board |

| Committees: Finance Committee (Co-Chair) | |

| Nominee: Cerberus | |

| Independent: No |

PROFESSIONAL HIGHLIGHTS

| ● | Mr. Galbato is the CEO of Cerberus Operations and Advisory Company (“COAC”), the operations platform of Cerberus where he oversees the platform’s operating executives and functional experts to integrate operating expertise within Cerberus’ portfolio companies and investment strategies. |

| ● | Prior to joining Cerberus in 2009, Mr. Galbato served as President and CEO of the Controls Division of Invensys plc, a multinational engineering and information technology company headquartered in London, United Kingdom, and President of Professional Distribution and Services at The Home Depot, the largest home improvement retailer in the United States. |

| ● | Mr. Galbato served as President and CEO of Armstrong Floor Products and prior to that, was the CEO of Choice Parts. |

| ● | He spent 14 years with General Electric, serving in several operating and finance leadership positions within their various industrial divisions as well as President and CEO of Coregis, a GE Capital company. |

OTHER BOARD ENGAGEMENT

| ● | Mr. Galbato served on the board of Blue Bird Corporation (“Blue Bird”), the leading independent designer and manufacturer of school buses from February 2015 to April 2023. |

| ● | Mr. Galbato served on the boards of KORE Group Holdings, Inc., a pioneer in delivering IoT solutions and services, from September 2021 to February 2022, and AutoWeb, Inc., an automotive media and marketing services company, from January 2019 to May 2022. |

SKILLS AND QUALIFICATIONS

Mr. Galbato’s proven track record as a leader in multiple operational and strategic roles at various public and private companies qualify him to serve as the Co-Chair of the Board. In particular, he provides our Board valuable insights on the Company’s strategy and operations.

|

Allen Gibson

Chief Investment Officer of Centaurus Capital LP

Age: 58 Director Since: 2018 |

| Committees: Governance Committee; Technology Committee

(Co-Chair); Finance Committee |

|

| Nominee: Cerberus | |

| Independent: Yes |

PROFESSIONAL HIGHLIGHTS

| ● | Since April 2011, Mr. Gibson has served as the Chief Investment Officer of Centaurus Capital LP (“Centaurus”), a private investment partnership with interests in oil and gas, private equity, structured finance, and the debt capital markets. |

| ● | He has also served as the Investment Manager for the Laura and John Arnold Foundation since 2011. |

| ● | Prior to Centaurus, Mr. Gibson served as Senior Vice President in institutional asset management at Royal Bank of Canada from February 2008 to April 2011. |

OTHER BOARD ENGAGEMENT

| ● | Mr. Gibson serves on private company boards. |

SKILLS AND QUALIFICATIONS

Mr. Gibson’s knowledge of capital markets enhances the ability of our Board to make prudent financial judgments and provides our Board insight into and understanding of our financial performance and plan.

|

Lisa Gray

Vice Chair and Senior Legal Officer of Cerberus Operations & Advisory Company, LLC

Age: 68 Director Since: 2023 |

| Committees: Technology Committee; Finance Committee | |

| Nominee: Cerberus | |

| Independent: No |

PROFESSIONAL HIGHLIGHTS

| ● | Ms. Gray serves as the Vice Chair and Senior Legal Officer for Cerberus Operations & Advisory Company, LLC (“Cerberus”), a global leader in alternative investing with a dedicated platform focused on supply chain integrity. She is also a member of Cerberus Capital Management’s office of general counsel and served as Cerberus’ general counsel from 2004 to 2015. |

| ● | Prior to Cerberus, Ms. Gray was the COO and general counsel of WAM!NET Inc., a Cerberus portfolio company. |

| ● | Ms. Gray previously served on the Board of Albertsons LLC and various of its subsidiary companies prior to the Company’s initial public offering (“IPO”) in 2020. |

OTHER BOARD ENGAGEMENT

| ● | Ms. Gray serves on the board of directors of various Cerberus portfolio companies. |

SKILLS AND QUALIFICATIONS

Ms. Gray’s previous experience with the Company pre-IPO and deep experience in a broad range of transactions including complex mergers and acquisitions, financings and debt restructurings, and regulatory and legislative advocacy, human resources, corporate communications, and governance, allows her to provide key oversight on risk management, strategy and operations.

|

Sarah Mensah

President of Jordan Brand at Nike Inc.

Age: 59 Director Since: 2023 |

| Committees: Governance Committee; Finance Committee | |

| Nominee: Board | |

| Independent: Yes |

PROFESSIONAL HIGHLIGHTS

| ● | Ms. Mensah is the President of Jordan Brand at Nike Inc., the largest seller of athletic footwear and apparel in the world, where she is responsible for the Jordan Brand’s business operations. She has served in key roles across Nike’s geographical and Jordan Brand businesses since she joined Nike in 2013. |

| ● | Prior to Nike, Ms. Mensah served as Senior Vice President and COO of the National Basketball Association’s Portland Trail Blazers, where she held leadership positions of increasing responsibility for nearly two decades. |

OTHER BOARD ENGAGEMENT

| ● | Ms. Mensah serves on private company boards. |

SKILLS AND QUALIFICATIONS

Ms. Mensah is an accomplished leader with operational, marketing and branding expertise. Her decades-long leadership experience in the retail industry is a significant value add to the Board’s operational and strategic management skills.

|

Vivek Sankaran

CEO of ACI

Age: 61 Director Since: 2019 |

| Committees: None | |

| Nominee: Board | |

| Independent: No |

PROFESSIONAL HIGHLIGHTS

| ● | Mr. Sankaran has served as our CEO and Director since September 2021, and our CEO, President and Director since April 2019. |

| ● | Prior to joining the Company, Mr. Sankaran served since 2009 in various leadership and executive positions at PepsiCo, Inc. (“PepsiCo”), a multinational food, snack, and beverage corporation. |

| ● | From January to March 2019, he served as CEO of PepsiCo Foods North America, a business unit within PepsiCo, where he led PepsiCo’s snack and convenient foods business. |

| ● | Prior to that position, Mr. Sankaran served as President and COO of Frito-Lay North America, a subsidiary of PepsiCo, from April 2016 to December 2018, its COO from February to April 2016 and Chief Commercial Officer, North America, of PepsiCo from 2014 to February 2016, where he led PepsiCo’s cross divisional performance across its North American customers. |

| ● | Prior to joining PepsiCo in 2009, Mr. Sankaran was a partner at McKinsey and Company (“McKinsey”), where he served various Fortune 100 companies, bringing a strong focus on strategy and operations. |

OTHER BOARD ENGAGEMENT

| ● | Mr. Sankaran serves on a private board. |

SKILLS AND QUALIFICATIONS

Mr. Sankaran’s decades of experience in the food and beverage industry, as well as his management and leadership experience, provides our Board with expertise relevant to our business and our operational, financial, and strategic plan.

|

Alan Schumacher

Former Member of the Federal Accounting Standards Advisory Board

Age: 77 Director Since: 2015 |

| Committees: Audit Committee (Chair); Governance Committee | |

| Nominee: Board | |

| Independent: Yes |

PROFESSIONAL HIGHLIGHTS

| ● | Mr. Schumacher worked for 23 years at American National Can Corporation and American National Can Group, where he served as Executive Vice President and Chief Financial Officer from 1997 until his retirement in 2000, and Vice President, Controller and Chief Accounting Officer from 1985 until 1996. |

| ● | Mr. Schumacher served as a member of the Federal Accounting Standards Advisory Board from 2002 through June 2012. |

OTHER BOARD ENGAGEMENT

| ● | Mr. Schumacher serves on the boards of Warrior Met Coal, Inc. (“Warrior Met Coal”), a leading producer and exporter of metallurgical coal for the global steel industry and Evertec Inc. (“Evertec”), a leading electronic transactions and technology company in Latin America. |

| ● | Mr. Schumacher serves on the audit committees of Warrior Met Coal and Evertec. |

| ● | Mr. Schumacher served on the board of BlueLinx Holdings Inc., a distributor of building products, from May 2004 to May 2021 and School Bus Holdings Inc., an indirect parent of school-bus manufacturer Blue Bird Corporation from 2008 to June 2023. |

SKILLS AND QUALIFICATIONS

Mr. Schumacher’s deep understanding of accounting principles and his experience as a board member of several public companies, expands the breadth of our Board’s expertise in accounting and financial reporting oversight and risk management.

|

Brian Kevin Turner

Chairman of Zayo Group and former COO of Microsoft Corporation

Age: 59 Director Since: 2020 |

| Committees: Compensation Committee; Technology Committee (Co-Chair) | |

| Nominee: Cerberus | |

| Independent: Yes |

PROFESSIONAL HIGHLIGHTS

| ● | Mr. Turner has served as the Chairman of Zayo Group, which is one of the largest providers of dark fiber and bandwidth to the world’s most impactful companies, since June 2020. |

| ● | He served as President and CEO of Core Scientific, an emerging leader in blockchain and artificial intelligence infrastructure, hosting, and transaction processing, from July 2018 to May 2021. |

| ● | He served as Vice Chairman and Senior Advisor to our Company’s CEO from August 2017 to February 2020. |

| ● | From August 2016 to January 2017, Mr. Turner served as CEO of Citadel Securities and Vice Chairman of Citadel LLC (“Citadel”), global financial institutions. |

| ● | Prior to Citadel, Mr. Turner served as COO of Microsoft Corporation, an American multinational technology corporation, from 2005 to 2016, and as CEO and President of Sam’s Club, an American chain of membership-only retail warehouse clubs owned and operated by Walmart Inc. (“Walmart”), from 2002 to 2005. |

| ● | Between 1985 and 2002, Mr. Turner held several positions of increasing responsibility with Walmart, including Executive Vice President and Global Chief Information Officer from 2001 to 2002. |

OTHER BOARD ENGAGEMENT

| ● | Mr. Turner was a member of the board of Nordstrom from 2010 to May 2020. |

SKILLS AND QUALIFICATIONS

Mr. Turner’s expertise in cybersecurity, including artificial intelligence, and technology is very valuable to the Board. Additionally, his strategic and operational leadership skills in supply chain, merchandising, branding and marketing provide our Board with valuable insight relevant to our business.

|

Mary Elizabeth West

Former Senior Vice President and Chief Growth Officer, The Hershey Company

Age: 61 Director Since: 2020 |

| Committees: Compensation Committee; Governance Committee | |

| Nominee: Board | |

| Independent: Yes |

PROFESSIONAL HIGHLIGHTS

| ● | Ms. West serves as a Senior Advisor with McKinsey & Company. |

| ● | Ms. West served as the Senior Vice President and Chief Growth Officer of The Hershey Company (“Hershey”), one of the largest chocolate manufacturers in the world, from May 2017 to January 2020. She drove Hershey’s growth and marketing strategies as well as communication, disruptive innovation, research and development, and mergers and acquisitions. Ms. West ignited the transformation of the company’s offerings beyond chocolate into snack categories. |

| ● | Prior to Hershey, Ms. West served as Executive Vice President and Chief Customer and Marketing Officer of J.C. Penney Company, Inc., an American department store chain, after having served on its board from November 2005 to May 2015. |

| ● | From 2012 to 2014, Ms. West served as Executive Vice President, Chief Category and Marketing Officer of Mondelez International, Inc., the snack foods division spun off from Kraft Foods, Inc. (“Kraft Foods”) in 2012. |

| ● | Ms. West began her career at Kraft Foods and served in various capacities over the course of 21 years and was named its Chief Marketing Officer in 2007. During her tenure at Kraft Foods, Ms. West was involved with some of the food industry’s most iconic brands such as Kraft Macaroni and Cheese, Oreo, and Maxwell House coffee. |

OTHER BOARD ENGAGEMENT

| ● | Ms. West has served on the boards of Hasbro, Inc. a global play and entertainment company, since June 2016 and Lowe’s Inc., a home improvement retailer, since April 2021. |

SKILLS AND QUALIFICATIONS

Ms. West’s proven track record of innovation and transformation across myriad facets of retail brings to our Board extensive food and retail industry experience. Ms. West provides our Board with expertise in marketing, brand building and strategic and operational planning.

| Corporate Governance |

Director Qualifications, Expertise and Attributes

The Governance Committee is responsible for facilitating director assessments, identifying skills and expertise that candidates should possess, and screening, selecting, and recommending candidates for approval by our Board, including nominees duly submitted by stockholders. Although our Board retains ultimate responsibility for approving candidates for election, the Governance Committee conducts the initial screening and evaluation. In evaluating candidates, the Governance Committee adheres to the director qualification standards outlined in our Corporate Governance Guidelines. The Board has not established any minimum qualifications that must be met by a candidate or identified any set of specific qualities or skills that it deems to be mandatory. The Governance Committee seeks to achieve a balance of knowledge, experience, and capability on the Board. Some of the factors that are taken into consideration in evaluating the suitability of individual candidates are corporate governance experience (such as an officer or former officer of a publicly-held company), experience as a board member of another publicly-held company, familiarity with the Company, expertise in a specific area of the Company’s operations, expertise in financial markets, education and professional background and existing commitments to other businesses, including service on other company boards. Each candidate must also possess fundamental qualities of intelligence, honesty, demonstrated character and good judgment, high ethics and standards of integrity, fairness and responsibility. The Governance Committee will also consider a candidate’s independence, as set forth in the NYSE listing standards and, as applicable, the Exchange Act in evaluating the qualification of prospective directors.

In determining whether to recommend a director for re-election, the Governance Committee considers the director’s past attendance at meetings and participation in, and contributions to, the activities of the Board.

The Governance Committee will consider candidates recommended by other members of the Board, management and stockholders and may also retain professional search firms to identify candidates. The criteria described above is used to evaluate all candidates, including candidates recommended by stockholders. Ms. Gray was recommended for election by Cerberus, pursuant to the Stockholders Agreement. Ms. Mensah was recommended to the Board by the Governance Committee through a retained professional search firm.

We believe that each of our directors has met the qualifications set forth in our Corporate Governance Guidelines. Our Board is a highly engaged group of individuals who represent a diverse and broad range of attributes, qualifications, experiences, and skills that provide an effective mix of viewpoints and knowledge.

The following matrix summarizes the core competencies of each of our director nominees. A mark indicates a specific area of focus or expertise on which the Board particularly relies. The absence of a mark does not mean the director does not possess that qualification or skill. We believe that each of our directors meets the criteria set forth in our Corporate Governance Guidelines. As noted in the director biographies, our directors have experience, qualifications, and skills across a wide range of public and private companies, possessing a broad spectrum of experience both individually and collectively. Our director nominees’ biographies describe each director’s background and relevant experience in more detail.

| Director | |||||||||||

| Experience | Sharon Allen | James Donald | Kim Fennebresque | Chan Galbato | Allen Gibson | Lisa Gray | Sarah Mensah | Vivek Sankaran | Alan Schumacher | Brian Kevin Turner | Mary Elizabeth West |

| Financial Literacy/Expertise | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● |

| Corporate Governance | ● | ● |

● | ● | ● | ||||||

| Risk Management | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | |

| Public Company Leadership/Other Public Company Board Service | ● | ● | ● | ● |

● | ● | ● | ● | ● | ||

| Food and Retail Industry | ● | ● | ● | ● | ● | ||||||

| Operations and Marketing | ● | ● | ● | ● | ● | ● | ● | ||||

| Strategic Planning | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● |

| Real Estate | ● | ||||||||||

| Information Technology and Cybersecurity | ● |

● | |||||||||

| Mergers and Acquisitions & Financial Transactions |

|

|

|

● | ● | ||||||

Board Leadership

Separation of the Roles of Chairman of the Board and CEO

Our Board separates the roles of the CEO and the Chairman and has appointed two Co-Chairs (Messrs. Donald and Galbato) who preside over Board meetings and execute all other duties to be performed by the Chair under our Corporate Governance Guidelines. Since neither of our Board or our Co-Chairs are members of management, in accordance with our Corporate Governance Guidelines we do not have a Lead Director.

Separating the roles of Chairman and CEO serves two important purposes: (1) it facilitates a more diverse and comprehensive approach to governance as we continue to develop and implement best practices that are consistent with the Board’s oversight role and (2) it enables strong day-to-day executive leadership by the CEO. Through the role of the Co-Chairs, the Board’s committees, and the regular use of executive sessions of the non-management directors, the Board can maintain independent oversight of risks to our business, our long-term strategies, annual business plans, and other corporate priorities. Our Board has determined that its current leadership structure and governance practices support full and free discourse on issues that are important to our stockholders while providing an appropriate oversight over management that serves the interests of our stockholders.

Separate Sessions of Non-Management Directors

Pursuant to our Corporate Governance Guidelines and the rules of the NYSE, our non-management directors regularly meet in executive sessions with no members of management present. Our Board Co-Chairs chair the meetings. In their absence, under our Corporate Governance Guidelines, the non-management directors will select a director present at the meeting to chair.

Board Independence

The Board, in coordination with our Governance Committee, and with the assistance of the Company’s legal counsel, considered the applicable NYSE tests to determine the independence of its members. Based on this review, the Board affirmatively determined that Mmes. Allen, Mensah and West and Messrs. Donald, Fennebresque, Gibson, Turner and Schumacher are (a) independent under the applicable rules of the NYSE and as such term is defined in Rule 10A-3(b)(1) under the Exchange Act, (b) each of Mme. Allen and Messrs. Fennebresque and Schumacher meet all applicable requirements for membership on the Audit Committee, and (c) each of Mme. Allen and Messrs. Fennebresque and Schumacher qualifies as an “audit committee financial expert” as such term is defined in Item 407(d)(5)(ii) of Regulation S-K promulgated by the SEC, and satisfy the NYSE’s financial experience requirements. In May 2024, the Board determined that beginning fiscal 2024, Mr. Donald is deemed independent pursuant to NYSE listing standards.

Board’s Commitment to Diversity

The Governance Committee considers diversity of background (including, but not limited to, gender, race, origin, age, skills, experience, and such other factors as it deems appropriate), in its search for the best candidates to serve on the Board. In appointing board members, our Board considers, in addition to the core attributes, the range of talents, experience and expertise that are needed and would complement those that are currently represented on the Board. Our current directors bring a diverse set of skills, experiences and viewpoints to the Company that are important to drive our strategy forward as the market and competitive landscape evolve. During fiscal 2023, the Board appointed two directors (Mmes. Gray and Mensah) to the Board, which expanded the Board’s gender and ethnic representation.

The following presentation highlights some of the diversity metrics of our Board.

Tenure/Age/Gender/Racial

Role of Board in Risk Oversight

The entire Board is engaged in risk management and the oversight of Company-wide risks. To supplement the Board’s risk oversight practices, our Board assigns to its committees additional oversight duties in their respective areas of focus.

Overseeing the development and execution of the Company’s strategy by management is one of our Board’s primary responsibilities. Our Board and its committees work closely with management to provide oversight, review and counsel on long term strategy, risks, and opportunities. Management benefits from the insights and perspectives of a diverse mix of directors with complementary qualifications, expertise, and attributes. Senior management and other leaders from across the Company provide at least quarterly business and strategy updates to our Board and the Board also reviews the alignment of the Company’s budget and capital plan with its strategic goals. Each committee also provides a report to the full Board at every meeting regarding the issues discussed and actions taken at the preceding committee meeting.

Significant oversight areas of the Board are provided below.

| Board |

| Our full Board has the ultimate oversight responsibility of our risk management process. |

| AUDIT COMMITTEE |

COMPENSATION COMMITTEE |

GOVERNANCE COMMITTEE |

FINANCE COMMITTEE |

TECHNOLOGY COMMITTEE |

| Oversees the quality and integrity of our financial reporting, evaluates the Company’s guidelines and policies regarding risk assessment and management, including risks related to internal control over financial reporting, the Company’s major financial risk exposures and the steps management has taken to monitor and control those exposures. | Oversees the management of risks related to our executive compensation plans and benefits and the incentives created by the compensation awards it administers. | Oversees risks associated with corporate governance, the Company’s non-financial regulatory, ethics and compliance programs and ESG practices, director selection and succession planning, Board effectiveness and independence, adherence to our corporate governance framework and other corporate governance matters. | Oversees management of our financial risks and our capital expenditures. | Responsible for overseeing the management of our IT structure and risks associated with IT and cybersecurity. |

Board Meetings

During fiscal 2023, our Board met four times and acted seven times via written consent. All directors except Ms. Mensah attended at least 75% of all Board and committee meetings. Ms. Mensah joined the Board in December 2023 and due to an unavoidable prior commitment set before she joined the Board she could not attend one committee meeting. Ms. Mensah attended all other Board and committee meetings.

Pursuant to our Corporate Governance Guidelines, absent extraordinary circumstances, each director is expected to attend in person our annual meeting of stockholders. All directors attended our annual meeting in 2023.

Corporate Governance Policies and Charters

Our corporate governance framework is designed to ensure our Board has the authority and procedures in place to provide appropriate oversight, review and evaluate our business operations and to make decisions independent of management. The Board reviews and updates (as needed) our corporate governance framework based on, among other things, the Board and committees’ annual assessments, governance best practices, and regulatory developments.

The following documents make up our corporate governance framework:

|

● Corporate Governance Guidelines

● Audit and Risk Committee Charter (“Audit Committee Charter”)

|

● Governance, Compliance and ESG Committee Charter (“Governance Committee Charter”)

● Compensation Committee Charter (“Compensation Committee Charter”)

|

● Finance Committee Charter (“Finance Committee Charter”)

● Technology Committee Charter (“Technology Committee Charter”)

|

Current copies of the above policies and guidelines are available on our website at https://www.albertsonscompanies.com/investors under the “Governance” tab.

Code of Business Conduct and Ethics

We have also adopted a Code of Business Conduct and Ethics (the “Code of Conduct”), which applies to directors, executive officers, and associates. The Code of Conduct sets forth our policies on critical issues such as conflicts of interest, insider trading, protection of our property, business opportunities and proprietary information. We will post on our website any amendment to, or a waiver from, a provision of the Code of Conduct for executive officers and directors that has been approved by our Board. The Code of Conduct is available on our website at https://albertsonscompanies. com/investors under the “Governance” tab and is also available in print to any stockholder upon request.

Board Committees

Our Board currently has five committees – Audit, Compensation, Governance, Technology, and Finance. The current composition of each of the committees is set forth below.

| Board Members | Audit | Compensation | Governance | Technology | Finance |

| Sharon Allen* |  |

|

|||

| James Donald* Board Co-Chair |

|

||||

| Kim Fennebresque* |  |

|

|||

| Chan Galbato Board Co-Chair |

|

||||

| Allen Gibson* |  |

|

|

||

| Lisa Gray |  |

|

|||

| Sarah Mensah* |  |

|

|||

| Vivek Sankaran | |||||

| Alan Schumacher* |  |

|

|||

| Brian Kevin Turner* |  |

|

|||

| Mary Elizabeth West* |  |

|

|

Chairperson |  |

Member | * Independent Director |

| Audit Committee | Members: Alan Schumacher (Chair) Kim Fennebresque Sharon Allen |

Meetings in Fiscal 2023: 8 Written Consents in Fiscal 2023: 1 |

The Audit Committee maintains open channels of communication between the Board, the independent auditor and management. Our Board has affirmatively determined that each of the three members of the Audit Committee qualify as an “audit committee financial expert” within the meaning of Item 407(d)(5)(ii) of Regulation S-K promulgated by the SEC and satisfies the standards for independence of the NYSE and the SEC as they relate to audit committees.

The Audit Committee is governed by the Audit Committee Charter which sets forth the purpose and responsibilities of this committee.

AUDIT COMMITTEE FUNCTIONS

Some of the key functions of the Audit Committee include:

| ● | assisting the Board in its oversight responsibilities regarding (1) the quality and integrity of our financial statements, financial accounting policies and financial reporting processes, (2) the performance of our internal audit function, (3) enterprise risk management, including major financial risk exposure, (4) the adequacy and effectiveness of our systems of internal control and (5) our accounting and auditing processes generally; |

| ● | appointing, retaining, approving compensation for, evaluating, and replacing our independent auditor; |

| ● | approving audit and non-audit services to be performed by the independent auditor; and |

| ● | establishing procedures for the receipt, retention, and resolution of complaints regarding accounting, internal control or auditing matters submitted confidentially and anonymously by employees through our whistleblower hotline. |

The Audit Committee meets on a quarterly basis with Company management and Deloitte and Touche to review, discuss, and approve (as applicable) among other items, the earnings press release, the Company’s unaudited or audited financial statements related to the quarter and the fiscal year, any changes in significant accounting policies and their impact on the Company’s financial statements, and the Company’s internal controls. The Audit Committee also meets regularly with Deloitte and Touche in executive sessions outside the presence of members of management. Additionally, the Audit Committee meets quarterly with the Company’s internal audit management team to review and discuss the internal audit plan, reports, and significant matters identified by the internal audit team.

The Board has also delegated its authority to approve related party transactions to the Audit Committee. Management must present to the Audit Committee all potential related party transactions for approval. The Audit Committee approves or ratifies related party transactions based upon the determination of whether the transaction is fair and in the best interest of the Company. See “Certain Relationships and Related Party Transactions” for further details on the related party transactions during fiscal 2023.

Approval of Audit and Non-Audit Services

The Audit Committee reviews and pre-approves Deloitte and Touche’s audit plan and estimated fees for the upcoming audit year. The Audit Committee also pre-approves any non-audit services, including tax services to be performed for the Company by Deloitte and Touche.

Fees Paid to Independent Registered Public Accounting Firm

We paid the following fees (in thousands) to Deloitte and Touche and its affiliates for professional services rendered by them during the 2023 and 2022 fiscal years, respectively:

| Fees | Fiscal 2023 |

Fiscal 2022 |

|||

| Audit(1) | $ | 5,620 | $ | 5,275 | |

| Audit Related(2) | $ | 1,200 | $ | 725 | |

| Tax(3) | $ | 557 | $ | 243 | |

| Total | $ | 7,377 | $ | 6,243 | |

| (1) | Fees for professional services rendered for the audit of the Company’s consolidated annual financial statements and review of the interim consolidated financial statements included in quarterly reports. Also includes audit services provided in connection with other statutory audits and regulatory filings. |

| (2) | Fees for services related to the merger, strategic alternatives and employee benefit plans. |

| (3) | Fees related to professional services rendered in connection with tax compliance and preparation related to tax returns and tax audits, as well as for tax consulting and tax planning. |

Audit Committee Report

The Audit Committee has reviewed and discussed with management the Company’s audited financial statements for fiscal 2023. We have discussed with Deloitte and Touche the matters required to be discussed by the applicable requirements of the Public Company Accounting Oversight Board (PCAOB) and the SEC. We have received the written disclosures and the letter from Deloitte and Touche as required by the applicable requirements of the PCAOB regarding the independent accountant’s communications with the Audit Committee concerning independence and have discussed with Deloitte and Touche its independence. Based on the above review and discussions, we recommended to the Board that the audited financial statements for the Company be included in the Company’s 2023 Form 10-K for filing with the SEC.

Respectfully submitted,

Alan Schumacher (Chair)

Kim Fennebresque

Sharon Allen

| Compensation Committee |

Members: Kim Fennebresque (Chair) Brian Kevin Turner |

Meetings in Fiscal 2023: 4 Written Consents in Fiscal 2023: 7

|

Our Board has affirmatively determined that each of our Compensation Committee members satisfies the standards for independence of the NYSE and also qualify as a "non-employee director" as defined under Rule 16b-3 of the Exchange Act. The Compensation Committee is governed by the Compensation Committee Charter, which sets forth the purpose and responsibilities of the committee.

COMPENSATION COMMITTEE FUNCTIONS

Some of the key functions of the Compensation Committee include:

| ● | periodically reviewing and making recommendations to the Board on the Company’s general compensation philosophy and objectives and on all matters of policy and procedures relating to executive compensation; |

| ● | reviewing with the Board an annual evaluation of the performance of the CEO and determining and approving CEO compensation based on such evaluation; |

| ● | determining and approving the compensation of the non-CEO NEOs and reviewing the compensation of certain other executive officers (including reviewing and approving salaries, target bonus percentages, incentives, and equity); |

| ● | administering the Company's various incentive compensation plans (including equity-based compensation), establishing performance metrics, determining incentive payouts and the granting of equity awards to associates and executive officers; |

| ● | reviewing and making recommendations to the Board regarding Board and committee compensation; |

| ● | developing a succession planning program for the CEO and senior management; |

| ● | reviewing, discussing and approving the Company’s CD&A and related executive compensation information for inclusion in the Company’s proxy statement; and |

| ● | periodically reviewing management’s culture, diversity and inclusion policies and initiatives. |

| Governance Committee |

Members: Sharon Allen (Chair) Allen Gibson |

Meetings in Fiscal 2023: 4 Written Consents in Fiscal 2023: 2

|

Our Board has affirmatively determined that each of our Governance Committee members satisfies the standards for independence of the NYSE. The Governance Committee is governed by the Governance Committee Charter setting forth the purpose and responsibilities of this committee.

GOVERNANCE COMMITTEE FUNCTIONS

Some of the key functions of the Governance Committee include:

| ● | identifying individuals qualified to become Board members and evaluating candidates for Board membership; |

| ● | recommending director nominees for election at the annual stockholder meeting and/or filling any Board or committee vacancies; |

| ● | reviewing director independence and suitability for continued service in accordance with listing, governance and other regulatory requirements; |

| ● | developing and recommending to the Board a set of corporate governance guidelines and reviewing and reassessing the adequacy of such guidelines on an annual basis; |

| ● | overseeing the Board’s annual self-evaluation process and the Board’s evaluation of management; |

| ● | periodically reviewing the criteria for the selection of new directors to serve on the Board and recommending any proposed changes to the Board for approval; |

| ● | periodically reviewing and making recommendations regarding the composition and size of the Board or each of the Board’s committees; |

| ● | providing oversight and recommendation to the Board regarding effectiveness of the Company’s ethics and compliance programs, governance framework, non-financial risk management and any significant legal or regulatory compliance exposure; and |

| ● | providing oversight and recommendation to the Board regarding the Company’s ESG strategy, initiatives, and policies. |

| Technology Committee |

Members: Allen Gibson (Co-Chair) Lisa Gray |

Meetings in Fiscal 2023: 4 Written Consents in Fiscal 2023: 0

|

The Technology Committee is governed by the Technology Committee Charter, which sets forth the purpose and responsibilities of the committee.

TECHNOLOGY COMMITTEE FUNCTIONS

Some of the key functions of the Technology Committee are the following:

| ● | reviewing the Company’s technology strategy and emerging technology issues and trends such as artificial intelligence (AI), that may impact the Company’s business; |

| ● | overseeing the Company’s technology planning and development process to support the Company’s growth objectives; |

| ● | overseeing the Company’s technology competitiveness, including its focus on leadership and talent acquisition and development; and |

| ● | overseeing the Company’s technology risk management, including the Company’s programs, policies, practices and safeguards for information technology, cybersecurity and data security. |

| Finance Committee |

Members: James Donald (Co-Chair) Allen Gibson |

Meetings in Fiscal 2023: 4 Written Consents in Fiscal 2023: 1

|

The Finance Committee is governed by the Finance Committee Charter, which sets forth the purpose and responsibilities of the committee.

FINANCE COMMITTEE FUNCTIONS

Some of the key functions of the Finance Committee include:

| ● | overseeing the Company’s financial and investment policies, including those related to short- and long-term financing, issuance of the Company’s capital stock and share repurchases, policies and guidelines related to the Company’s capital structure and derivates or hedging transactions; |

| ● | reviewing strategies and plans for significant transactions; |

| ● | approving significant borrowings and issuances of debt or security; and |

| ● | reviewing, approving and recommending to the Board plans for capital expenditures and significant capital investments. |

Compensation Committee Interlocks and Insider Participation

None of the members of our Compensation Committee is or has at any time during the past year been an officer or employee of the Company. None of our executive officers serves as a member of the compensation committee or board of directors of any other entity that has an executive officer serving as a member of our Board or Compensation Committee.

Director Compensation

Our director compensation program is designed to attract and fairly compensate highly qualified, non-management directors. The Compensation Committee annually reviews and seeks advice from Frederic W. Cook & Co., Inc. (“FW Cook”), our independent compensation consultant, regarding the Company’s director compensation practices compared with those of other similarly situated companies. Based upon peer company data, for fiscal 2023, FW Cook recommended an annual cash retainer fee for the Board Chair position, to be split between Co-Chairs. As previously disclosed, Mr. Donald's employment agreement terminated in fiscal 2022. Consequently, beginning fiscal 2023, Mr. Donald became eligible for compensation under our non-management director compensation policy. The Compensation Committee recommended, and the Board approved the following cash compensation for services on our Board.

Annual Cash Compensation

The cash compensation of the non-management directors for fiscal 2023 was as follows:

| Role | Annual Cash Retainer | |

| Non-Management Board Chair | $ | 200,000 |

| Non-Management Board Member | $ | 125,000 |

| Committee | Chairperson | Member | |||

| Audit | $ | 50,000 | $ | 25,000 | |

| Compensation | $ | 40,000 | $ | 20,000 | |

| Finance | $ | 40,000 | $ | 20,000 | |

| Governance | $ | 40,000 | $ | 20,000 | |

| Technology | $ | 40,000 | $ | 20,000 | |

Annual cash retainers are paid in four equal quarterly installments at the end of each quarter for services rendered during the quarter. We do not pay any meeting fees but reimburse all our directors for reasonable documented out-of-pocket expenses incurred by them in connection with their attendance at Board and committee meetings.

In addition to the annual cash retainers, the non-management directors receive an annual grant of time-based restricted stock units (“TBRSUs”) with a value of $145,000. The number of TBRSUs is determined by dividing $145,000 by the closing price of Common Stock on the grant date, rounded down to the nearest whole share. The grant date for directors is the first business day of the fiscal year, and the vest date is the last day of the corresponding fiscal year. To the extent dividends are declared by our Board, each unvested TBRSU is eligible to receive a dividend equivalent right (“DER”) which will vest according to the same schedule as the underlying unit. Accrued but unvested DERs will also receive DERs in subsequent dividends. This allows the account of the non-management director to be credited with an additional number of TBRSUs equal to the cash dividend that the non-management director would have received had the TBRSUs been vested as of the record date of the dividend.

Director Share Retention Guidelines

The Board has also adopted Non-management Director Share Retention Guidelines to align the interests of its non-management directors with the interests of the Company’s stockholders. Each non-management director must, during his or her service on the Board, retain at least 50% of the shares of Common Stock received as a result of equity or equity-based awards. As of June 21, 2024, all our directors were in compliance with our policy.

2023 Director Compensation

The following table sets forth summary information regarding the compensation of our non-management directors for fiscal 2023. Mr. Sankaran does not receive any compensation for his Board service - See “Compensation Discussion and Analysis” for his compensation.

| Name | Fees

Earned or Paid in Cash(1) |

Stock Awards(2) |

Total | |||||

| Sharon Allen | $ | 190,000 | $ | 144,999 | $ | 334,999 | ||

| James Donald | $ | 265,000 | $ | 144,999 | $ | 409,999 | ||

| Kim Fennebresque | $ | 190,000 | $ | 144,999 | $ | 334,999 | ||

| Chan Galbato | $ | 265,000 | $ | 144,999 | $ | 409,999 | ||

| Allen Gibson | $ | 205,000 | $ | 144,999 | $ | 349,999 | ||

| Lisa Gray | $ | 41,428 | $ | 36,259 | $ | 77,687 | ||

| Sarah Mensah | $ | 33,616 | $ | 29,559 | $ | 63,175 | ||

| Alan Schumacher | $ | 195,000 | $ | 144,999 | $ | 339,999 | ||

| Brian Kevin Turner | $ | 185,000 | $ | 144,999 | $ | 329,999 | ||

| Mary Elizabeth West | $ | 165,000 | $ | 144,999 | $ | 309,999 | ||

| Former Directors Scott Wille(3) |

$ | 115,402 | $ | 144,999 | $ | 260,401 | ||

| (1) | Fees reported for Mmes. Gray and Mensah are pro rata based on their date of election to the Board. |

| (2) | Reflects the grant date fair value calculated in accordance with Accounting Standards Codification 718, Compensation-Stock Compensation (ASC 718). See Notes 1 and 9 – Equity-Based Compensation in our 2023 Form 10-K for a discussion of the assumptions used in determining the grant date fair value of these share-based awards, including forfeiture assumptions and the period over which the Company will recognize the compensation expense for such awards. The amounts reported for Mmes. Gray and Mensah are pro rata based on their date of election to the Board. See “Security Ownership of Certain Beneficial Owners and Management” for total ownership of each of the directors as of the Record Date. |

| (3) | Mr. Wille resigned in November 2023. His 2023 TBRSU award was forfeited upon his resignation from the Board. |

Communications with the Board

As stated in our Corporate Governance Guidelines, any stockholder or other interested party who wishes to communicate with the Board, its Co-Chairs, a committee, the non-employee directors, or any individual director in his or her capacity as such may direct such communication in writing to the following address:

Albertsons Companies, Inc.

c/o General Counsel and Chief Policy Officer

250 Parkcenter Blvd.

Boise, Idaho, 83706

The General Counsel will forward the communication to the appropriate group or individual except for correspondence which is not more suitably directed to management or items of the following nature – advertising, promotions of a product or service, patently offensive material and matters completely unrelated to the Board’s functions, Company performance, Company policies or items that could not reasonably be expected to affect the Company’s public perception.

| Environmental, Social and Governance Disclosure |

As a long-standing neighborhood grocer, we believe we have an ongoing commitment to leverage our resources and expertise to support the communities we serve and the planet we share. Our Board is deeply committed to this effort and the Governance Committee provides oversight to ensure that the Company’s strategy is appropriate, takes account of material risks, and is likely to deliver results.

Our ESG platform, Recipe for Change, is based on four pillars – Planet, People, Product and Community.

As part of our commitment to promote a healthy environment for future generations, we are working to reduce our carbon footprint in line with standards set by the Science Based Targets initiative (“SBTi”), by addressing emissions from our operations and the use of sold goods. We are also engaging suppliers to set their own science-based targets.

To further our carbon emission reductions, we are continuing to improve our energy efficiency, enhance our refrigeration infrastructure and increase the use of renewable energy. During fiscal 2023, we completed more than 500 energy efficiency projects and more than 90 projects to transition stores to refrigerants with lower global warming potential. We expect to publish our carbon emission calculations for fiscal 2023 in our 2024 Recipe for Change Report.

We are also continuing to improve on diverting operational waste from landfills. During fiscal 2023, we recycled over 865 million pounds of cardboard and 25 million pounds of plastic bags and film.

As one of the largest food and drug retailers in the U.S., we recognize that our ability to delight our customers lies in the engagement of our associates. We are committed to fostering a diverse, equitable and inclusive culture and aspire to reflect the vibrant and thriving communities in which we live and work.