Document

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

|

| |

(Mark One) | |

x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2018 |

or |

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to |

Commission File Number: 001-37597

NORTHSTAR REALTY EUROPE CORP.

(Exact Name of Registrant as Specified in its Charter) |

| |

Maryland (State or Other Jurisdiction of Incorporation or Organization) | 32-0468861 (IRS Employer Identification No.) |

590 Madison Avenue, 34th Floor, New York, NY 10022

(Address of Principal Executive Offices, Including Zip Code)

(212) 547-2600

(Registrant’s Telephone Number, Including Area Code)

Securities registered pursuant to Section 12(b) of the Act: |

| | |

Title of Class | | Name of Each Exchange on Which Registered |

Common Stock, $0.01 par value | | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Annual Report on Form 10-K or any amendment to this Annual Report on Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

| | | | | | | | |

Large accelerated filer | o | | Accelerated filer | x | | Non-accelerated filer o | | Smaller reporting company o Emerging growth company x

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. x

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date:

The aggregate market value of the registrant’s voting and non-voting common equity held by non-affiliates of the registrant as of June 30, 2018, was $648,184,155. As of March 8, 2019, the registrant had issued and outstanding 49,807,566 shares of common stock, $0.01 par value per share.

DOCUMENTS INCORPORATED BY REFERENCE

NORTHSTAR REALTY EUROPE CORP.

FORM 10-K

TABLE OF CONTENTS

FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains certain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, or Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or Exchange Act. Forward-looking statements are generally identifiable by use of forward-looking terminology such as “may,” “will,” “should,” “potential,” “intend,” “expect,” “seek,” “anticipate,” “estimate,” “believe,” “could,” “project,” “predict,” “continue,” “future” or other similar words or expressions. Forward-looking statements are not guarantees of performance and are based on certain assumptions, discuss future expectations, describe plans and strategies, contain projections of results of operations or of financial condition or state other forward-looking information. Such statements include, but are not limited to, those relating to the operating performance of our investments, our liquidity and financing needs, the effects of our current strategies and investment activities, our ability to grow our business, our expected leverage, our expected cost of capital, our ability to divest non-strategic properties, our management’s track record and our ability to raise and effectively deploy capital. Our ability to predict results or the actual effect of plans or strategies is inherently uncertain, particularly given the economic environment. Although we believe that the expectations reflected in such forward-looking statements are based on reasonable assumptions, our actual results and performance could differ materially from those set forth in the forward-looking statements and you should not unduly rely on these statements. These forward-looking statements involve risks, uncertainties and other factors that may cause our actual results in future periods to differ materially from those forward-looking statements. These factors include, but are not limited to:

| |

• | the effect of economic conditions, particularly in Europe, on the valuation of our investments and on the tenants of the real property that we own; |

| |

• | the effect of the Mergers (as defined in Item 1. Business) on our business; |

| |

• | the process undertaken by the Strategic Review Committee of our board of directors to explore strategic alternatives for the Company, which may include a potential sale or internalization of management, and the associated costs and diversion of management’s attention; |

| |

• | our ability to conduct our business if we internalize our management rather than a sale of the Company; |

| |

• | the ability of Colony Capital Inc., or CLNY, to effectively manage our company; |

| |

• | the unknown impact of the exit of the United Kingdom, or Brexit, or one or more other countries from the European Union, or EU, or the potential default of one or more countries in the EU or the potential break-up of the EU and the uncertain terms and timing of Brexit; |

| |

• | our ability to qualify and remain qualified as a real estate investment trust, or REIT; |

| |

• | adverse domestic or international economic geopolitical conditions and the impact on the commercial real estate industry; |

| |

• | volatility, disruption or uncertainty in the financial markets; |

| |

• | access to debt and equity capital and our liquidity; |

| |

• | our substantial use of leverage and our ability to comply with the terms of our borrowing arrangements; |

| |

• | the impact that rising interest rates may have on our floating rate financing; |

| |

• | our ability to monetize our assets on favorable terms or at all; |

| |

• | our ability to obtain mortgage financing on our real estate portfolio on favorable terms or at all; |

| |

• | our ability to acquire attractive investment opportunities and the impact of competition for attractive investment opportunities; |

| |

• | the effect of an increased number of activist stockholders owning our stock and stockholder activism generally; |

| |

• | the effects of being an externally-managed company, including our reliance on CLNY and its affiliates and sub-advisors/co-venturers in providing management services to us, the payment of substantial base management and incentive fees to our manager, the allocation of investments by CLNY among us and CLNY’s other sponsored or managed companies and strategic vehicles and various conflicts of interest in our relationship with CLNY; |

| |

• | performance of our investments relative to our expectations and the impact on our actual return on invested equity, as well as the cash provided by these investments and available for distribution; |

| |

• | restrictions on our ability to engage in certain activities and the requirement that we may be required to access capital at inopportune times as a result of our borrowings; |

| |

• | our ability to make borrowings under our credit facility; |

| |

• | the impact of adverse conditions affecting office properties; |

| |

• | illiquidity of properties in our portfolio; |

| |

• | our ability to realize current and expected return over the life of our investments; |

| |

• | tenant defaults or bankruptcy; |

| |

• | any failure in our due diligence to identify all relevant facts in our underwriting process or otherwise; |

| |

• | the impact of terrorism or hostilities involving Europe; |

| |

• | our ability to manage our costs in line with our expectations and the impact on our cash available for distribution, or CAD, and net operating income, or NOI, of our properties; |

| |

• | our ability to satisfy and manage our capital requirements; |

| |

• | environmental and regulatory requirements, compliance costs and liabilities relating to owning and operating properties in our portfolio and to our business in general; |

| |

• | effect of regulatory actions, litigation and contractual claims against us and our affiliates, including the potential settlement and litigation of such claims; |

| |

• | changes in European, international and domestic laws or regulations governing various aspects of our business; |

| |

• | future changes in foreign, federal, state and local tax law that may have an adverse impact on the cash flow and value of our investments; |

| |

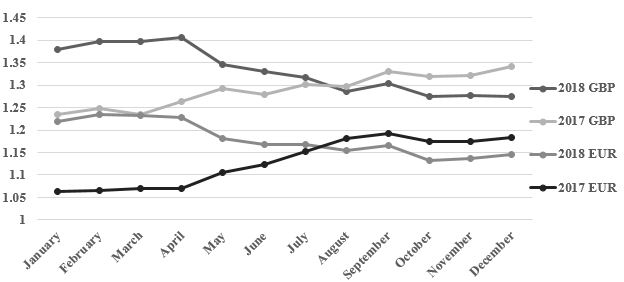

• | potential devaluation of foreign currencies, predominately the Euro and U.K. Pound Sterling, relative to the U.S. dollar due to quantitative easing in Europe, Brexit and/or other factors which could cause the U.S. dollar value of our investments to decline; |

| |

• | general foreign exchange risk associated with properties located in European countries located outside of the Euro Area, including the United Kingdom; |

| |

• | the loss of our exemption from the definition of an “investment company” under the Investment Company Act of 1940, as amended; |

| |

• | CLNY’s ability to hire and retain qualified personnel and potential changes to key personnel providing management services to us; |

| |

• | the potential failure to maintain effective internal controls and disclosure controls and procedures; |

| |

• | the historical consolidated financial statements included in this Annual Report on Form 10-K not providing an accurate indication of our performance in the future or reflecting what our financial position, results of operations or cash flow would have been had we operated as an independent public company during the periods presented; |

| |

• | our status as an emerging growth company; and |

| |

• | compliance with the rules governing REITs. |

The foregoing list of factors is not exhaustive. All forward-looking statements included in this Annual Report on Form 10-K are based on information available to us on the date hereof and we are under no duty to update any of the forward-looking statements after the date of this report to conform these statements to actual results.

Factors that could have a material adverse effect on our operations and future prospects are set forth in “Risk Factors” in this Annual Report on Form 10-K beginning on page 14. The risk factors set forth in our filings with the SEC could cause our actual results to differ significantly from those contained in any forward-looking statement contained in this report.

PART I

Item 1. Business

References to “NorthStar Europe”, “we,” “us” or “our” refer to NorthStar Realty Europe Corp. and its subsidiaries unless the context specifically requires otherwise. References to “our Manager” refer to NorthStar Asset Management Group Inc., or NSAM, for the period prior to the completed tri-party merger with NorthStar Realty Finance Corp., or NorthStar Realty and Colony Capital, Inc., or Legacy Colony, pursuant to which the companies combined in an all-stock merger, or the Mergers, and Colony Capital, Inc., formerly known as Colony NorthStar, Inc. before June 25, 2018, for the period subsequent to the Mergers.

Overview

NorthStar Realty Europe Corp., a publicly-traded real estate investment trust, or REIT, (NYSE: NRE) is a European focused commercial real estate company with predominantly prime office properties in key cities within Germany, the United Kingdom and France. We commenced operations on November 1, 2015 following the spin-off by NorthStar Realty, of its European real estate business (excluding its European healthcare properties) into a separate publicly-traded company, NorthStar Realty Europe Corp., a Maryland corporation, or the Spin-off. Our objective is to provide our stockholders with stable and recurring cash flow supplemented by capital growth over time.

We are externally managed and advised by an affiliate of our Manager. Substantially all of our assets, directly or indirectly, are held by, and we conduct our operations, directly or indirectly, through NorthStar Realty Europe Limited Partnership, a Delaware limited partnership and our operating partnership, or our Operating Partnership. We have elected to be taxed and will continue to conduct our operations so as to continue to qualify as a REIT for U.S. federal income tax purposes.

Significant Developments

Amended and Restated Management Agreement

On November 7, 2018, we entered into Amendment No. 1, or the Amendment, to the amended and restated management agreement, or the Amended and Restated Management Agreement, dated November 9, 2017, with an affiliate of our Manager. The Amendment provides for the termination of the Amended and Restated Management Agreement upon the consummation of a change of control of NorthStar Europe or in connection with an internalization of management. The Amendment provides that upon the termination, we will be obligated to pay to our Manager a termination payment equal to (i) $70 million, minus (ii) the amount of any Incentive Fee (as defined in the Amended and Restated Management Agreement) paid pursuant to the Amended and Restated Management Agreement. As of December 31, 2018, the termination fee due to the Manager was $64.6 million. No Incentive Fee will be payable to our Manager for any period after the Termination Date.

Refer to Note 6 “Related Party Arrangements” in our accompanying consolidated financial statements included in Part II, Item 8 “Financial Statements and Supplementary Data” for a description of the terms of the Amendment and the Amended and Restated Management Agreement.

Strategic Review Committee

On November 7, 2018, we announced that the Strategic Review Committee of our board of directors has engaged financial and legal advisors to review strategic alternatives, including a potential sale of the Company or internalization of management.

Sales

In April 2018, we completed the sale of the Maastoren property, our largest non-core asset in the Netherlands, for approximately $193 million and received net equity proceeds of approximately $69 million after repayment of financing and transaction costs (based on the April 30, 2018 applicable exchange rate).

In September 2018, we completed the sale of an asset in Lisbon, Portugal for approximately $14 million and received net equity proceeds of approximately $14 million after transaction costs (based on the September 30, 2018 applicable exchange rate).

In December 2018, we completed the sale of Trianon Tower and received net equity proceeds of approximately $360 million, after repayment of mortgage financing and payment of transaction costs. Simultaneously with the completion of the closing, we prepaid and terminated the mortgage financing of $375 million, which included the prepayment penalties, secured by the Trianon Tower (based on the December 12, 2018 applicable exchange rate).

Additionally, in December 2018, we sold three assets in the United Kingdom for approximately $40 million and received net equity proceeds of approximately $23 million after repayment of financing and transaction costs (based on the December 21, 2018 applicable exchange rate).

Leasing

For the year ended December 31, 2018, we signed new leases or lease extensions relating to 60,000 square meters. These leases included a nine year lease extension for 11,200 square meters with BNP Paribas S.A. on a property on Boulevard MacDonald, in

Paris, France, increasing the weighted average lease term of the asset by five years and a new 32,800 square meter lease on a property at Marly, in Greater Paris, France, increasing the asset’s occupancy from 45% to 100%. As a result, together with other leases signed during the year, portfolio occupancy increased from 81% as of December 31, 2017 to 95% as of December 31, 2018.

Refinancing

In May 2018, we entered into a second amended and restated loan agreement related to the Trias Germany portfolio, which reduced the margin from 1.55% to 1.00%, extended the maturity date of the loan from December 2020 to June 2025 and eliminated certain covenants limited to portfolio concentration and required capital expenditures.

In August 2018, we amended and restated the loan agreement related to the Trias France portfolio, increasing the principal balance to $76 million, reducing the blended margin from 1.85% per annum to 1.65% per annum and extending the maturity by two years from April 8, 2020 to April 8, 2022.

Our Investments

Our primary business line is investing in European real estate. We are predominantly focused on real estate equity and preferred equity.

Real Estate Equity

Overview

Our real estate equity investment strategy is focused on European prime office properties located in key cities within Germany, the United Kingdom and France.

Our Portfolio

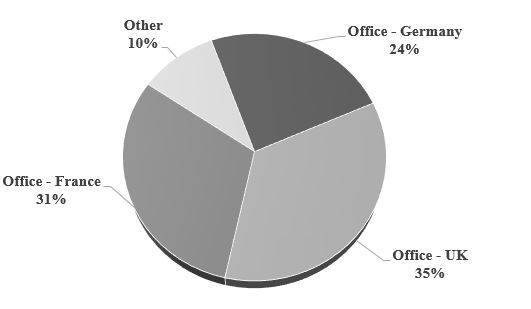

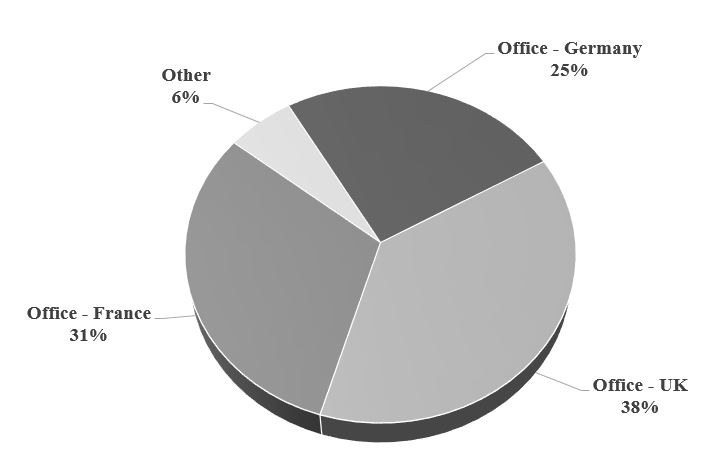

The following presents a summary of our portfolio as of December 31, 2018:

|

| | | | |

| | | Portfolio by Geographic Location |

| | December 31, 2018(6) | December 31, 2017(6) |

Gross Book Value(1) | $1.0 billion | | |

Number of properties(2) | 18 |

Number of countries | 3 |

Total square meters(3) | 205,884 |

Weighted average occupancy | 95% |

Weighted average occupancy - Office | 94% |

Weighted average lease term | 6.2 years |

In-place rental income:(4) | |

Office portfolio | 90% |

Other(5) | 10% |

_____________________________

| |

(1) | Represents gross operating real estate and intangibles as of December 31, 2018 and includes gross assets held-for-sale. |

| |

(2) | Includes four assets held-for-sale as of December 31, 2018, of which three were sold as of March 8, 2019. |

| |

(3) | Based on contractual rentable area, located in many key European markets, including Frankfurt, Hamburg, Berlin, London and Paris. |

| |

(4) | In-place rental income represents contractual rent adjusted for vacancies based on the rent roll as of December 31, 2018 and is translated using foreign exchange rates as of December 31, 2018. |

| |

(5) | Other represents five assets including two retail in Germany, one industrial asset in France and two hotel (net lease) assets in Germany. |

| |

(6) | Based on rental income for 18 assets owned as of December 31, 2018. |

The following table presents significant tenants in our portfolio, including assets held-for-sale as of December 31, 2018, based on in-place rental income as of December 31, 2018:

|

| | | | | | | | |

Significant tenants: | | Asset (Location) | | Square Meters(1) | | Percentage of In-Place Rental Income | | Weighted Average Lease Term (in years) |

BNP PARIBAS RE | | Berges de Seine (Paris, France) | | 15,406 | | 16.1% | | 1.1 |

BNP PARIBAS SA | | Boulevard Macdonald (Paris, France) | | 11,210 | | 9.2% | | 7.7 |

Invesco UK Limited | | Portman Square (London, UK) | | 4,406 | | 9.1% | | 8.7 |

Cushman & Wakefield LLP | | Portman Square (London, UK) | | 5,150 | | 8.4% | | 6.3 |

Morgan Lewis & Bockius LLP | | Condor House (London, UK) | | 4,848 | | 6.6% | | 7.0 |

PAREXEL International GmbH | | Parexel (Berlin, Germany) | | 18,254 | | 5.7% | | 15.5 |

Moelis & Co UK LLP | | Condor House (London, UK) | | 3,366 | | 4.5% | | 6.5 |

Bigpoint GmbH | | Drehbahn (Hamburg, Germany) | | 11,916 | | 4.5% | | 2.4 |

Globe Express | | Marly (Paris, France) | | 32,790 | | 3.2% | | 8.8 |

InterCityHotel GmbH | | IC Hotel (Berlin, Germany) | | 8,457 | | 2.8% | | 11.3 |

Total | | | | 115,803 |

| 70.1% | | 6.5 |

_____________________________

| |

(1) | Based on contractual rentable area. |

The following table presents gross book value, percentage of net operating income, or NOI, square meters and weighted average lease term concentration by country and type for our portfolio as of December 31, 2018 (dollars in thousands):

|

| | | | | | | | | | | | | |

Country | | Number of Properties | | Gross Book Value(1) | | Percentage of NOI(2) | | Square Meters(3) | | Weighted Average Lease Term (in years) |

Office | | | | | | | | | | |

Germany(4) | | 7 | | $ | 236,901 |

| | 24% | | 74,837 |

| | 8.0 |

United Kingdom | | 2 | | 353,010 |

| | 35% | | 21,758 |

| | 6.9 |

France | | 4 | | 307,790 |

| | 31% | | 32,059 |

| | 3.9 |

Subtotal | | 13 | | 897,701 |

| | 90% | | 128,654 |

| | 6.1 |

Other Property Types | | | | | | | | | | |

France/Germany(5) | | 5 | | 89,149 |

| | 10% | | 77,230 |

| | 6.5 |

Total | | 18 | | $ | 986,850 |

| | 100% | | 205,884 |

| | 6.2 |

_____________________________

| |

(1) | Represents gross operating real estate and intangibles as of December 31, 2018. |

| |

(2) | Based on annualized NOI, for the year ended December 31, 2018 (refer to “Non-GAAP Financial Measures” for a description of this metric) for the 18 assets held as of December 31, 2018. |

| |

(3) | Based on contractual rentable area. |

| |

(4) | Includes one asset held for sale as of December 31, 2018. |

| |

(5) | Other represents five assets including two retail in Germany, one industrial asset in France and two hotel (net lease) assets in Germany. Includes three assets held of sale as of December 31, 2018. |

Preferred Equity

In December 2018, in connection with the sale of Trianon Tower, we retained a $5.7 million (€5 million) equity interest in the form of preferred equity, with a 7% yield and five year maturity.

In May 2017, we partnered with a leading property developer in China to acquire a Class A office building in London United Kingdom with 22,557 square meters, 100% occupancy and a 5.2 year weighted average lease term to expiry. We invested approximately $33.4 million (£26.2 million) of preferred equity with a base yield of 8% plus equity participation rights.

Investing Strategy

We seek to provide our stockholders with a stable and recurring cash flow for distribution supplemented by capital growth over time. Our business is predominantly focused on prime office properties in key cities within Germany, the United Kingdom and France which are not only the largest economies in Europe, but are the most established, liquid and among the most stable office markets in Europe. We seek to utilize our established local networks to source suitable investment opportunities. We have a long term investment approach and expect to make equity investments, directly or indirectly through joint ventures.

Financing Strategy

We pursue a variety of financing arrangements such as mortgage notes and bank loans available from the commercial mortgage-backed securities market, finance companies and banks. However, we generally seek to limit our reliance on recourse borrowings. We target overall leverage of 40% to 50% over time, although there is no assurance that this will be the case. Borrowing levels for our investments may be dependent upon the nature of the investments and the related financing that is available.

Attractive long-term, non-recourse, non-mark-to-market, financing continues to be available in the European markets. We predominately use floating rate financing and we seek to mitigate the risk of interest rates rising through hedging arrangements including interest rate caps.

In addition, we may use corporate level financing such as credit facilities. In April 2017, we amended and restated our revolving credit facility, or Credit Facility, with a commitment of $35 million and with an initial two year term. The Credit Facility no longer contains a limitation on availability based on a borrowing base and the interest rate remains the same.

In March 2018, we amended the Credit Facility, increasing the size to $70 million and extending the term until April 2020 with one year extension option. The Credit Facility includes an accordion feature, providing for the ability to increase the facility to $105 million.

In May 2018, we entered into a second amendment and restatement loan agreement related to the Trias Germany portfolio with a principal balance of $87 million, which reduced the margin from 1.55% to 1.00%, extended the maturity date of the loan from December 2020 to June 2025 and eliminated certain covenants limited to portfolio concentration and required capital expenditures.

In August 2018, we amended and restated the loan agreement related to the Trias France portfolio, increasing the principal balance to $76 million, reducing the blended margin from 1.85% per annum to 1.65% per annum and extending the maturity by two years from April 8, 2020 to April 8, 2022.

Refer to Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations - Liquidity and Capital Resources” for discussion of liquidity requirements and sources of capital resources.

Risk Management

Risk management is a significant component of our strategy to deliver consistent risk-adjusted returns to our stockholders. Given our need to maintain our qualification as a REIT for U.S. federal income tax purposes, we closely monitor our portfolio and actively seek to manage risks associated with, among other things, our assets, interest rates and foreign exchange rates. In addition, the audit committee of our board of directors, or the Board, in consultation with management, will periodically review our policies with respect to risk assessment and risk management, including key risks to which we are subject, such as credit risk, liquidity risk, financing risk, foreign currency risk and market risk, and the steps that management has taken to monitor and control such risks. The audit committee of the Board maintains oversight of financial reporting risk matters.

Underwriting

Prior to making any equity investments, our underwriting team, in conjunction with third-party providers, undertakes a rigorous asset-level due diligence process, involving intensive data collection and analysis, to seek to ensure that we understand fully the state of the market and the risk-reward profile of the asset. In addition, we evaluate material accounting, legal, financial and business matters in connection with such investment. These issues and risks are built into the valuation of an asset and ultimate pricing of an investment.

During the underwriting process, we review the following data, including, but not limited to: property financial data including historic and budgeted financial statements, liquidity and capital expenditure plans, property operating metrics (including occupancy, leasing activity, lease expirations, sales information, tenant credit review, tenant delinquency reports, operating expense efficiency and property management efficiency) and local real estate market conditions including vacancy rates, absorption, new supply, rent levels and comparable sale transactions, as applicable.

In addition to evaluating the merits of any proposed investment, we evaluate the diversification of our portfolio of assets. Prior to making a final investment decision, we determine whether a target asset will cause our portfolio of assets to be too heavily concentrated with, or cause too much exposure to, any one real estate sector, geographic region, source of cash flow such as tenants or borrowers, or other geopolitical issues. If we determine that a proposed investment presents excessive concentration risk, we may decide not to pursue an otherwise attractive investment.

Portfolio Management

Our Manager performs portfolio management services on our behalf. In addition, we rely on the services of local third-party service providers. The comprehensive portfolio management process includes day-to-day oversight by the portfolio management team, regular management meetings and a quarterly investment review process. These processes are designed to enable management to evaluate and proactively identify investment-specific matters and trends on a portfolio-wide basis. Nevertheless,

we cannot be certain that such review will identify all potential issues within our portfolio due to, among other things, adverse economic conditions or events adversely affecting specific investments; therefore, potential future losses may also stem from investments that are not identified during these investment reviews.

Our Manager uses many methods to actively manage our risks to seek to preserve income and capital, which includes our ability to manage our investments and our tenants in a manner that preserves cost and income and minimizes credit losses that could decrease income and portfolio value. Frequent re-underwriting, dialogue with tenants/property managers and regular inspections of our properties have proven to be an effective process for identifying issues early. Monitoring tenant creditworthiness is an important component of our portfolio management process, which may include, to the extent available, a review of financial statements and operating statistics, delinquencies, third party ratings and market data. During the quarterly portfolio review, or more frequently if necessary, investments may be put on highly-monitored status and identified for possible asset impairment based upon several factors, including missed or late contractual payments, tenant rating downgrades (where applicable) and other data that may indicate a potential issue in our ability to recover our invested capital from an investment.

We may need to make unplanned capital expenditures in connection with changes in laws and governmental regulations in relation to real estate. Where properties are being repositioned or refurbished, we may also be exposed to unforeseen changes in scope and timing of capital expenditures.

Given our need to maintain our qualification as a REIT for U.S. federal income tax purposes, and in order to maximize returns and manage portfolio risk, we may dispose of an asset earlier than anticipated or hold an asset longer than anticipated if we determine it to be appropriate depending upon prevailing market conditions or factors regarding a particular asset. We can provide no assurances, however, that we will be successful in identifying or managing all of the risks associated with acquiring, holding or disposing of a particular investment or that we will not realize losses on certain dispositions.

Interest Rate and Foreign Currency Hedging

Subject to maintaining our qualification as a REIT for U.S. federal income tax purposes, we may mitigate the risk of interest rate volatility through the use of hedging instruments, such as interest rate swap agreements and interest rate cap agreements. The goal of our interest rate management strategy is to minimize or eliminate the effects of interest rate changes on the value of our assets, to improve risk-adjusted returns and, where possible, to lock in, on a long-term basis, a favorable spread between the yield on our assets and the cost of financing such assets.

In addition, because we are exposed to foreign currency exchange rate fluctuations, we employ foreign currency risk management strategies, including the use of, among others, currency hedges, and matched currency financing.

We can provide no assurances, however, that our efforts to manage interest rate and foreign currency exchange rate volatility will successfully mitigate the risks of such volatility on our portfolio.

Regulation

We are subject, in certain circumstances, to supervision and regulation by international, federal, state and local governmental authorities and are subject to various laws and judicial and administrative decisions imposing various requirements and restrictions, which, among other things:

• regulate our public disclosures, reporting obligations and capital raising activity;

• require compliance with applicable REIT rules;

• regulate credit granting activities;

• require disclosures to customers;

• govern secured transactions;

• set collection, taking title to collateral, repossession and claims-handling procedures and other trade practices;

• regulate land use and zoning;

• regulate the foreign ownership or management of real property or mortgages;

| |

• | regulate the ability of foreign persons or corporations to remove profits earned from activities within the country to the person’s or corporation’s country of origin; |

• regulate tax treatment and accounting standards; and

| |

• | regulate use of derivative instruments and our ability to hedge our risks related to fluctuations in interest rates and exchange rates. |

We qualified to be taxed as a REIT under Sections 856 through 860 of the Internal Revenue Code of 1986, as amended, or the Internal Revenue Code, beginning with the year ended December 31, 2015 upon filing our initial U.S. federal income tax return. As a REIT, we must currently distribute, at a minimum, an amount equal to 90% of our taxable income. In addition, we must distribute 100% of our taxable income to avoid paying corporate U.S. federal income taxes. REITs are also subject to a number of organizational and operational requirements in order to elect and maintain REIT status. These requirements include specific share ownership tests and assets and gross income composition tests. If we fail to continue to qualify as a REIT in any taxable year, we will be subject to U.S. federal income tax (including any applicable alternative minimum tax) on our taxable income at regular corporate tax rates. Even if we qualify for taxation as a REIT, we may be subject to tax in foreign jurisdictions in which we operate or own property and state and local income taxes and to U.S. federal income tax and excise tax on our undistributed income.

We believe that we are not, and intend to conduct our operations so as not to become regulated as, an investment company under the Investment Company Act of 1940, as amended, or the Investment Company Act. We have relied, and intend to continue to rely on current interpretations of the staff of the U.S. Securities and Exchange Commission, or SEC, in an effort to continue to qualify for an exemption from registration under the Investment Company Act. For more information on the exemptions that we use refer to Item 1A. “Risk Factors - Risks Related to Regulatory Matters and Our REIT Tax Status.”

Real estate properties owned by us and the operations of such properties are subject to various international laws and regulations concerning the protection of the environment, including air and water quality, hazardous or toxic substances and health and safety. In addition, such properties are required to comply with applicable fire and safety regulations, building codes, legal or regulatory provisions regarding access to our properties for persons with disabilities and other land use regulations. For further information regarding environmental matters, refer to “Environmental Matters” below.

In addition, we currently own two hotels, leased to third-party operators, which are subject to various covenants, laws, ordinances and regulations, including regulations relating to common areas. We believe each of our hotels have the necessary permits and approvals to operate its business.

In the judgment of management, while we do incur significant expense complying with the various regulations to which we are subject, existing statutes and regulations have not had a material adverse effect on our business. However, it is not possible to forecast the nature of future legislation, regulations, judicial decisions, orders or interpretations, nor their impact upon our future business, financial condition and results of operations or prospects.

Environmental Matters

A wide variety of environmental and occupational health and safety laws and regulations affect our properties. These complex laws, and their enforcement, involve a myriad of regulations, many of which involve strict liability on the part of the potential offender. Some of these laws may directly impact us. Under various local environmental laws, ordinances and regulations, an owner of real property, such as us, may be liable for the costs of removal or remediation of hazardous or toxic substances at, under or disposed of in connection with such property, as well as other potential costs relating to hazardous or toxic substances (including government fines and damages for injuries to persons and adjacent property). The cost of any required remediation, removal, fines or personal or property damages and the owner’s liability therefore could exceed or impair the value of the property, and/or the assets of the owner. In addition, the presence of such substances, or the failure to properly dispose of or remediate such substances, may adversely affect the owner’s ability to sell or rent such property or to borrow using such property as collateral which, in turn, could reduce our revenues.

Selected Regulations Regarding our Operations in Germany, the United Kingdom and France

Our commercial real estate investments are subject to a variety of laws and regulations in Europe. If we fail to comply with any of these laws and regulations, we may be subject to civil liability, administrative orders, fines or even criminal sanctions. The following provides a brief overview of selected regulations that are applicable to our business operations in Germany, the United Kingdom and France, where a majority of our properties in terms of contribution to rental income are located.

Germany

Land-use Regulations, Building Regulations and Tenancy Law for Commercial Properties

Land-use Regulations. There are several regulations regarding the use of land including German planning law and urban restructuring planning by communities.

Urban Restructuring Planning. Communities may designate certain areas as restructuring areas and undertake comprehensive modernization efforts regarding the infrastructure in such areas. While this may improve the value of properties located in restructuring areas, being located in a restructuring area also imposes certain limitations on the affected properties (e.g., the sale, encumbrance and leasing of such properties, as well as reconstruction and refurbishment measures, are generally subject to special consent by municipal authorities).

Building Regulations. German building laws and regulations are quite comprehensive and address a number of issues, including, but not limited to, permissible types of buildings, building materials, proper workmanship, heating, fire safety, means of warning and escape in case of emergency, access and facilities for the fire department, hazardous and offensive substances, noise protection, ventilation and access and facilities for disabled people. Owners of erected buildings may be required to conduct alterations or improvements of the property if safety or health risks with respect to users of the building or the general public occur, including fire risks, traffic risks, risks of collapse and health risks from injurious building materials such as asbestos. To our knowledge, there are currently no official orders demanding any alterations to existing buildings owned by us.

Tenancy Law for Commercial Properties. German tenancy laws for commercial properties generally provide landlords and tenants with far-reaching discretion in how they structure lease agreements and use general terms and conditions. Certain legal restrictions apply with regard to the strict written form requirements regarding the lease agreement and any addenda thereto, transfer of operating costs and maintenance costs, cosmetic repairs and final decorative repairs. Lease agreements with a term of more than one year must be executed in writing or are deemed to have been concluded for an indefinite period. As a consequence, and regardless of the contractually agreed lease term, such lease agreements can then be terminated by the lessor or the lessee at the end of one year turning over the leased property to the lessee at the earliest, and on the third working day of a calendar quarter to the end of the following calendar quarter thereafter. Subject to certain exceptions, operating costs of commercial tenancies may be apportioned to the tenants if the lease agreement stipulates explicitly and specifically which operating costs shall be borne by the tenant. Responsibility for maintenance and repair costs may be transferred to tenants, except for the full cost transfer of maintenance and repair costs for roof, structures and areas used by several tenants in general terms and conditions. Expenses for cosmetic repairs (Schönheitsreparaturen) may, in principle, be allocated to tenants, provided that the obligation to carry out ongoing cosmetic repairs is not combined with an undertaking to perform initial and/or final decorative repairs. German law considers standardized terms to be invalid if they are not clear and comprehensive or if they are disproportionate and provide an unreasonable disadvantage for the other party. For example, clauses allocating decorative repair costs and ancillary costs have been subject to extensive case law in Germany.

Regulation Relating to Environmental Damage and Contamination

The portion of our commercial real estate portfolio located in Germany is subject to various rules and regulations relating to the remediation of environmental damage and contamination.

Soil Contamination. Pursuant to the German Federal Soil Protection Act (Bundesbodenschutzgesetz), the responsibility for residual pollution and harmful changes to soil, or Contamination, lies with, among others, the perpetrator of the Contamination, such perpetrator’s universal successor, the current owner of the property, the party in actual control of the property and, if the title was transferred after March 1999, the previous owner of the property if such owner knew or should have known about the Contamination, or the Liable Persons. The Liable Person that carried out the remediation work may claim indemnification on a pro rata basis from the other Liable Persons. Independently, from the aforementioned liability, civil law liability for Contaminations can arise from contractual warranty provisions or statutory law.

United Kingdom

For a discussion of the impact of regulations in the United Kingdom, refer to Item 1A. “Risk Factors — Risks Related to our Financing Strategy- “We are subject to risks associated with obtaining mortgage financing on our real estate, which could materially adversely affect our business, financial condition and results of operations and our ability to make distributions to our stockholders.”

France

Participation in Organismes de placement collectif immobilier

We hold participations in Organismes de placement collectif immobilier, or OPCIs, each of which takes the form of a Société de Placement à Prépondérance Immobilière à Capital Variable, or SPPICAV. These SPPICAVs and their management company, Swiss Life Reim (France), are authorized and supervised by the French Autorité des Marchés Financiers.

Commercial Lease Regulation

The contractual conditions applying to commercial lease periods, renewal, rent and rent indexation are heavily regulated. The minimum duration of commercial leases is nine years. We cannot terminate the lease before such period has expired, except in very specific cases (such as reconstructing or elevating an existing building or converting an existing building into a residential building (immeuble à usage principal d’habitation) through reconstruction, renovation or rehabilitation thereof). The tenant, on the other hand, has the power to terminate the lease at the end of every three-year period, subject to a six-month prior notice requirement. However, leases of premises to be used exclusively as office spaces may contain provisions restricting or excluding, such power of the tenant to terminate the lease.

The tenant has also a right of renewal of the lease at the end of its initial period and a right to a review of the rent every three years and, unless otherwise agreed by the parties, upon renewal of the lease. The rent variation is capped. In case of review, after a three-year period or in case of a renewal (unless otherwise agreed by the parties), the variation of the rent cannot exceed the

variation of the Commercial Rent Index (indice trimestriel des loyers commerciaux) or the Tertiary Activities Rent Index (indice trimestriel des loyers des activités tertiaires), which are published by the French National Institute of Statistics and Economic Studies (Institut national de la statistique et des études économiques), except in case of (i) a rent review after a three-year period where the rental value has considerably changed (i.e., increase or decrease by more than 10%), (ii) a renewal of a lease where either the features of the premises, the use of the premises, the obligations of the parties under the lease or local marketing factors were significantly modified, (iii) a renewal of a lease, the initial duration of which exceeded nine years or the effective duration of which exceeded twelve years and (iv) certain variable rent leases (such as leases including sales-based or revenue-based rent clauses). In addition, a rent increase for a given year cannot exceed 10% of the rent paid during the previous year.

Moreover, the tenant has a right of first refusal if the leased premises are offered for sale.

The legal allocation of charges (rental expenses, related costs and taxes) between us and the tenant can be contractually determined. However, Articles L. 145-40-2 and R. 145-35 of the French Code de commerce, make it mandatory for the property owner in leases entered into or renewed, on or after November 5, 2014 to incur expenditures for major repairs, in particular those related dilapidated premises and those required to meet changing regulation.

Bankruptcy Law

In France, a safeguard proceeding (sauvegarde), judicial restructuring (redressement judiciaire) or judicial liquidation (liquidation judiciaire) procedure commencement order involving an insolvent tenant does not lead to the automatic termination of the lease. In such cases, we will not be able to get paid directly by the tenant and any due and unpaid rent as of the date of the commencement order will be subject to the rules applicable to the insolvency proceeding, which may have a substantial negative impact on our ability to be paid. Furthermore, the tenant, or the insolvency court-appointed receiver (administrateur judiciaire or liquidateur judiciaire) acting on behalf of the tenant, will have the choice to continue or terminate any unexpired lease. If the tenant chooses to continue an unexpired lease, but still fails to pay rent in connection with the occupancy after the issue of the commencement order, we cannot legally request the termination of the lease before the end of a three-month period from the date of issue of the commencement order.

Environmental Law

In France, our investments are subject to regulations regarding the accessibility of buildings to persons with disabilities, public health and the environment, covering a number of areas, including the ownership and use of classified facilities; the use, storage, and handling of hazardous materials in building construction; inspections for asbestos, lead, and termites; inspection of gas and electricity facilities; assessments of energy efficiency; and assessments of technological and natural risks.

Emerging Growth Company Status

We are an “emerging growth company,” as defined in the Jumpstart Our Business Act, or JOBS Act and we are eligible to take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not “emerging growth companies.” These exemptions include not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements and exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and stockholder approval of any golden parachute payments not previously approved.

We have availed ourselves of some of the reduced regulatory and reporting requirements that are available to us as long as we qualify as an emerging growth company, except that we have irrevocably elected not to take advantage of the extension of time to comply with new or revised financial accounting standards available under Section 102(b) of the JOBS Act.

We will, in general, remain as an emerging growth company for up to five full fiscal years including December 31, 2015. We would cease to be an emerging growth company and, therefore, become ineligible to rely on the above exemptions, if we:

| |

• | have more than $1.07 billion in annual revenue in a fiscal year; |

| |

• | issue more than $1 billion of non-convertible debt during the preceding three-year period; or |

| |

• | become a “large accelerated filer” as defined in Exchange Act Rule 12b-2, which would occur at the end of the fiscal year after: (i) we have filed at least one annual report pursuant to the Exchange Act; (ii) we have been an SEC-reporting company for at least 12 months; and (iii) the market value of our common stock that is held by non-affiliates exceeds $700 million as of the last business day of our most recently completed second fiscal quarter. |

Competition

We are subject to increased competition in seeking investments. We compete with many third parties engaged in real estate investment activities including publicly-traded REITs, insurance companies, commercial and investment banking firms, private equity funds, sovereign wealth funds and other investors. Some of these competitors, including other REITS and private real estate companies and funds, have substantially greater financial resources than we do. Such competitors may also enjoy significant competitive advantages that result from, among other things, a lower cost of capital and enhanced operating efficiencies.

Future competition from new market entrants may limit the number of suitable investment opportunities offered to us. It may also result in higher prices, lower yields and a narrower spread over our borrowing costs, making it more difficult for us to originate or acquire new investments on attractive terms.

Employees

We are externally managed by our Manager and do not have our own employees.

Available Information and Corporate Governance

We emphasize the importance of professional business conduct and ethics through our corporate governance initiatives. Our board of directors consists of a majority of independent directors; the audit, compensation and nominating and corporate governance committees of the board of directors are composed exclusively of independent directors. We have adopted corporate governance guidelines and a code of business conduct and ethics, which delineate our standards for our officers, directors and employees.

Our internet address is www.nrecorp.com. The information on our website is not incorporated by reference in this Annual Report on Form 10-K. We make available, free of charge through a link on our website, our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, financial supplements, and amendments to such reports, if any, as filed or furnished with the SEC, as soon as reasonably practicable after such filing or furnishing. We also post corporate presentations on our website from time-to-time. Our website further contains our code of business conduct and ethics, code of ethics for senior financial officers, corporate governance guidelines and the charters of our audit committee, nominating and corporate governance committee and compensation committee of our board of directors. Within the time period required by the rules of the SEC and the NYSE we will post on our website any amendment to our code of business conduct and ethics and our code of ethics for senior financial officers as defined in the code. All of our reports, proxy and information statements filed with the SEC can also be obtained at the SEC’s website at www.sec.gov.

Item 1A. Risk Factors

The following risk factors and other information included in this Annual Report on Form 10-K should be carefully considered. The risks and uncertainties described below are not the only ones we face. Additional risks and uncertainties not presently known to us, which we currently deem immaterial or that generally apply to all businesses also may adversely impact our business. If any of the following risks occur, our business, financial condition, operating results, cash flow and liquidity could be materially adversely affected.

Risks Related to Our Business

The commercial real estate industry has been and may continue to be adversely affected by economic conditions and geopolitical events in Europe, the United States and elsewhere.

Our business and operations are dependent on the commercial real estate industry generally, which in turn is dependent upon global economic conditions and geopolitical events in Europe, the United States and elsewhere. Concerns over global economic conditions, energy and commodity prices, geopolitical events, acts of war and terrorism, nuclear proliferation, inflation, deflation, rising interest rates, divergent central bank policy making, foreign exchange rates, the durability of the Euro as a currency, the availability and cost of credit, the sovereign debt crisis, the U.K. vote on June 23, 2016 to leave the European Union, or Brexit, the rise of protectionism and populism in the United States and Europe, and weak consumer confidence in many markets continue to contribute to increased economic uncertainty for the global economy. These factors, combined with the volatile prices of oil and declining business and consumer confidence in certain markets could precipitate an economic slowdown, as well as cause extreme volatility in security prices. Global economic and political headwinds, along with global market instability, the risk of maturing commercial real estate debt that may have difficulties being refinanced, and divergent central bank policy making, may continue to cause periodic volatility in the commercial real estate market for some time. Adverse economic conditions in the commercial real estate industry, geopolitical events, acts of war or terrorism could harm our business and financial condition by, among other factors, reducing the value of our properties, limiting our access to debt and equity capital, impairing our ability to obtain new financing or refinance existing obligations and otherwise negatively impacting our operations.

Liquidity in the capital markets is essential to our business.

Liquidity is essential to our business. Our business may be adversely affected by disruptions in the debt and equity capital markets and institutional lending market, including a lack of access to capital or prohibitively high costs of obtaining or replacing capital, both within the United States and Europe. We depend on external financing to fund the growth of our business mainly because one of the requirements of the Internal Revenue Code for a REIT is that we distribute 90% of our taxable income to our stockholders, including taxable income where we do not receive corresponding cash. Our access to equity or debt financing depends on the willingness of third parties to make equity and debt investments in us. It also depends on conditions in the capital markets generally. Companies in the real estate industry, including us, are currently experiencing, and have at times historically experienced, limited availability of capital and new capital sources may not be available on acceptable terms. Our ability to raise capital could be impaired if the capital markets have a negative perception of our long-term or short-term financial prospects or the prospects for REITs and the commercial real estate market generally. Sufficient funding or capital may not be available to us in the future on terms that are acceptable to us. If we cannot obtain sufficient funding on acceptable terms, we will not be able to grow our business and may have difficulty maintaining liquidity and making distributions to our stockholders, which would have a negative impact on the market price of our common stock. For information about our available sources of funds, refer to “Management’s Discussion and Analysis of Financial Condition and Results of Operations - Liquidity and Capital Resources” in Item 7 of Part II of this Annual Report on Form 10-K and the notes to our consolidated financial statements in Item 8 of Part II of this Annual Report on Form 10-K.

We use significant leverage in connection with our investments, which increases the risk of loss associated with our investments and restricts our ability to engage in certain activities.

As of December 31, 2018 we had $0.7 billion of borrowings outstanding. We may also incur additional borrowings in the future to satisfy our capital and liquidity needs. Although the use of leverage may enhance returns and increase the number of investments that we can make, it may increase our risk of loss, impact our liquidity and restrict our ability to engage in certain activities. Our substantial borrowings, among other things, may:

| |

• | require us to dedicate a large portion of our cash flow to pay principal and interest on our borrowings, which will reduce the availability of cash flow to fund working capital, capital expenditures and other business activities; |

| |

• | require us to maintain minimum unrestricted cash; |

| |

• | increase our vulnerability to general adverse economic and industry conditions; |

| |

• | require us to post additional reserves and other additional collateral to support our financing arrangements, which could reduce our liquidity and limit our ability to leverage our assets; |

| |

• | subject us to maintaining various debt, operating income, net worth, cash flow and other covenants and financial ratios; |

| |

• | limit our flexibility in planning for, or reacting to, changes in our business and the industry in which we operate; |

| |

• | restrict our operating policies and ability to make strategic acquisitions, dispositions or exploit business opportunities; |

| |

• | require us to maintain a borrowing base of assets; |

| |

• | place us at a competitive disadvantage compared to our competitors that have fewer borrowings; |

| |

• | put us in a position that necessitates raising equity capital at a time that is unfavorable to us and dilutive to our stockholders; |

| |

• | limit our ability to borrow additional funds (even when necessary to maintain adequate liquidity), dispose of assets or make distributions to our stockholders; and |

| |

• | increase our cost of capital. |

If we fail to comply with the covenants in the instruments governing our borrowings or do not generate sufficient cash flow to service our borrowings, our liquidity may be materially and adversely affected. If we default or fail to meet certain coverage tests, we may be required to repay outstanding obligations, together with penalties, prior to the stated maturity, post additional collateral, sell assets to generate cash at inopportune times, subject our assets to foreclosure and/or require us to seek protection under bankruptcy laws.

The failure of any bank in which we deposit our funds or severe disruption in the financial markets could cause us to incur losses, reduce the amount of cash we have available to pay distributions and make additional investments.

We have deposited our cash and cash equivalents in multiple banking institutions in an attempt to minimize exposure to the failure of any one of these entities. However, limited amounts per depositor per insured bank are generally insured. At December 31, 2018, we had $444.5 million of cash and cash equivalents and restricted cash deposited transaction accounts at certain financial institutions exceeding these insured levels. If any of the banking institutions in which we have deposited funds ultimately fails, we may lose our deposits over the insured levels. The loss of our deposits could reduce the amount of cash we have available to distribute or invest. We further hold a portion of our cash in money market funds or bank money market accounts which are not insured. A severe decline in the financial markets could result in a loss on value of some or all of these holdings. In addition, during times of severe economic distress, money market funds have experienced intense redemption pressure and have had difficulty satisfying redemption requests. As such, we may not be able to access the cash in our money market funds if such event occurs. In each case, a disruption affecting the money markets where certain of our cash is held could cause us to incur losses, reduce the amount of cash we have available to pay distributions and make additional investments.

Continuing concerns regarding European debt, market perceptions concerning the instability and suitability of the Euro as a single currency, volatility and price movements in the rate of exchange between the U.S. dollar and the Euro could adversely affect our business, results of operations and financings.

Concerns persist regarding the debt burden of certain Euro Area countries and their potential inability to meet their future financial obligations, the overall stability of the Euro and the suitability of the Euro as a single currency, given the diverse economic and political circumstances in individual Euro Area countries, Brexit and volatility in the value of the Euro. These concerns could lead to the re-introduction of individual currencies in one or more Euro Area countries, or, in more extreme circumstances, the possible dissolution of the Euro currency entirely. Should the Euro dissolve entirely, the legal and contractual consequences for holders of Euro-denominated obligations would be uncertain. Such uncertainty would extend to, among other factors, whether obligations previously expressed to be owed and payable in Euros would be re-denominated in a new currency (with considerable uncertainty over the conversion rates), what laws would govern and which country’s courts would have jurisdiction. These potential developments, or market perceptions concerning these and related issues, could materially adversely affect the value of our Euro-denominated investments and obligations.

Furthermore, market concerns about economic growth in the Euro Area relative to the United States and speculation surrounding the potential impact on the Euro of a possible Greek or other country sovereign default and/or exit from the Euro Area as well as the resurgence of distress in certain Euro Area banking sectors, such as Italy, may continue to exert downward pressure on the rate of exchange between the U.S. dollar and the Euro, which may adversely affect our results of operations and our ability to obtain financing.

The U.K. vote to leave the European Union, or EU, could adversely impact our business, results of operations and financial condition.

In a June 2016 referendum, the United Kingdom voted to leave the EU. On March 29, 2017, the United Kingdom formally notified the European Council of its intention to leave the EU. Under Article 50(3) of the Treaty on the European Union (Article 50), the EU Treaties will cease to apply to the United Kingdom from the earlier of (i) the date of effectiveness of any withdrawal agreement between the European Union and the United Kingdom or (ii) two years after the notification of its intention to leave under Article 50, unless the European Council, in agreement with the United Kingdom, unanimously decides to extend this period or the United Kingdom revokes its Article 50 notice. The announcement of Brexit caused significant volatility in global stock markets and currency exchange rate fluctuations that resulted in the strengthening of the U.S. dollar against the U.K. Pound Sterling. On November 25, 2018, the EU and the U.K. government agreed to the terms of a withdrawal agreement that must be ratified by the U.K. and European parliaments ahead of the U.K.’s withdrawal on March 29, 2019. Failure to obtain parliamentary approval of an agreed withdrawal agreement would, absent a revocation of the United Kingdom’s notification to withdraw or some other delay, mean that the United Kingdom would leave the European Union on March 29, 2019, likely with no agreement (a so-called “hard Brexit”). Current discussions between the United Kingdom and the European Union may result in any number of outcomes including an extension or delay of the United Kingdom’s withdrawal from the European Union. The consequences for the economies of the European Union member states as a result of the United Kingdom’s withdrawal from the European Union are unknown and unpredictable, especially in the case of a hard Brexit. On January 15, 2019, the U.K. parliament rejected the withdrawal agreement. The implications of this rejection for Brexit are uncertain. The full impact of the Brexit vote depends on the terms of the U.K.’s withdrawal from the EU which have not yet been finalized. The announcement of Brexit caused significant volatility in global stock markets and currency exchange rate fluctuations that resulted in the strengthening of the U.S. dollar against the U.K. Pound Sterling. Strengthening of the U.S. dollar relative to the U.K. Pound Sterling may adversely affect our results of operations, in a number of ways, including:

| |

• | All of the rent payments under our leases are denominated in Euro or U.K. Pound Sterling. A significant portion of our operating expenses and borrowings are also transacted in local currency. We report our results of operations and consolidated financial information in U.S. dollars. As a result, to the extent we are unable to fully hedge our exchange rate exposure, our results of operations as reported in U.S. dollars is impacted by fluctuations in the value of the local currencies in which we conduct our business. |

| |

• | While we seek to mitigate the risk of fluctuations in currency exchange rates by utilizing hedging strategies to reduce the impact of exchange rates fluctuations on our income, we do not employ any hedging techniques on our Euro or U.K. Pound Sterling denominated assets, which fully exposes our asset values to exchange rate risk. |

The U.K.’s withdrawal from the EU could result in a regional economic, political and legal instability, which could depress the demand for European commercial real estate. The U.K. also could lose access to the European Economic Area single market and to the global trade deals negotiated by the EU on behalf of its members, depressing trade between the U.K. and other countries, which would negatively impact the demand for, and the value of, our properties located in the U.K. Additionally, we may face new regulations in the U.K. Compliance with any such regulations could be costly, negatively impacting our business, results of operations and financial condition. Further, the U.K.’s withdrawal from the EU could include changes to the U.K.’s border and immigration policy, which could negatively impact our Manager’s ability in the U.K. to recruit and retain employees to work in its U.K. based offices.

Risks Related to Our Manager

Our ability to achieve our investment objectives and to pay distributions to our stockholders depends in substantial part upon the performance of our Manager.

We rely upon our Manager to manage our day-to-day operations and our investments. Our ability to achieve our investment objectives and grow our business is dependent upon the performance of our Manager in the acquisition or disposition of investments, the determination of financing arrangements and the management of our investments and operation of our day-to-day activities under the supervision of, and subject to the policies and guidelines established by, our board of directors. As a result of our recent Amendment with our Manager to terminate our Amended and Restated Management Agreement, upon the consummation of a change of control of NorthStar Europe or in connection with an internalization of management, our Manager may be less incentivized to perform services obligated under the Amended and Restated Management Agreement, which could adversely affect our Manager’s performance during the remainder of the term. If our Manager performs poorly and as a result fails to manage our investments successfully, we may be unable to achieve our investment objectives or to pay distributions to our stockholders.

Any adverse changes in our Manager’s stock price, financial health, the public perception of our Manager or our relationship with our Manager could hinder our operating performance and adversely affect our financial condition and results of operations.

Because our Manager is a publicly-traded company, any negative reaction by the stock market reflected in the price of its securities or deterioration in the financial health or public perception of our Manager or any of its officers could result in an adverse effect on its ability to manage our portfolio, including acquiring or disposing of assets and obtaining financing from third parties on favorable terms or at all. Our Manager depends upon the management and other fees and reimbursement of costs that it receives from us and our Manager’s other managed companies in connection with the acquisition, management and sale of properties to conduct its operations. Any adverse changes in the financial condition of our Manager or our relationship with our Manager could hinder our Manager’s ability to successfully support our business, which could have a material adverse effect on our financial condition and results of operations.

Failure of our Manager to effectively perform its obligations to us, including under the management agreement, could have an adverse effect on our business and performance.

We have engaged our Manager to provide asset management and other services to us pursuant to a management agreement. Our ability to achieve our investment and business objectives and to make distributions to our stockholders depends in substantial part upon the performance of our Manager and its ability to provide us with asset management and other services. We are also dependent on other third party service providers to whom our Manager has delegated various responsibilities or engaged on our behalf. If for any reason our Manager or any other service provider is unable to perform such services at the level we require, our ability to terminate our Management Agreement earlier than the agreed termination date is limited. For example, even if we were able to terminate our management agreement with our Manager before the agreed termination date, alternate service providers may not be readily available on acceptable terms or at all and any internalization of these functions would take time to complete, which could adversely affect our performance and materially harm our ability to execute our business plan.

Our ability to terminate our management agreement with our Manager is limited and we may be required to pay our Manager a substantial termination fee in connection with a termination.

Pursuant to the terms of our Amendment, we will terminate upon the earlier of (i) the closing of an NRE Change of Control (as defined in the Asset Management Agreement) and (ii) the completion of an internalization of the management of our company within nine months of the later of (x) April 30, 2019, if on such date there is not in place a definitive agreement for an NRE Change of Control and (y) if on April 30, 2019 there is a definitive agreement for an NRE Change of Control, such date on which such agreement is terminated, if any, if no other definitive agreement for an NRE Change of Control is entered into within 30 days thereafter. Prior to this termination date the Management Agreement is only terminable by us for cause and we are unable to terminate our management agreement for any other reason, including if our Manager performs poorly or is unable to manage our company successfully. The term “cause” is limited to specific circumstances set forth in the management agreement. Termination for unsatisfactory financial performance does not constitute “cause” under our management agreement.

Our limited termination rights under the management agreement increases our risk that our Manager may not perform well and our business could suffer. This risk is heightened due to the near term termination date as agreed with our Manager. If our Manager’s performance as our Manager does not meet our or our stockholders’ expectations, and we are unable to terminate the management agreement at such time, the market price of our common stock could be adversely affected. For additional information relating to the terms of the management agreement please refer to Note 6 “Related Party Arrangements” in our accompanying consolidated financial statements included in Part II Item 8. “Financial Statements and Supplementary Data”.

Our incentive fee structure with our Manager could encourage our Manager to invest our assets in riskier investments.

Our Manager has the ability to earn incentive fees based on our total stockholder return exceeding a 10% cumulative annual hurdle rate, which may create an incentive for our Manager to invest in investments with higher yield potential, that are generally riskier or more speculative, or sell an investment prematurely for a gain, in an effort to increase our short-term net income and thereby increase our stock price and the incentive fees to which it is entitled. If our interests and those of our Manager are not aligned, the execution of our business plan and our results of operations could be adversely affected, which could materially and adversely affect the market price of our common stock and our ability to make distributions to our stockholders.

The provisions of our original management agreement were not determined on an arm’s length basis; therefore, we did not have the benefit of arm’s length negotiations of the type normally conducted between unrelated parties.

The provisions of our original management agreement entered into at the time of the Spin-off were not determined on an arm’s length basis. As a result, the provisions of such agreement, including the amount of the management fees, were determined without the benefit of arm’s length negotiations of the type normally conducted between unrelated parties and may have been in excess of amounts that we would otherwise have paid to third parties for such services. Although our Amended and Restated Management Agreement and the Amendment thereto were negotiated and approved by an independent, special committee of our board of

directors and in consultation with financial advisors, it is possible that we would have been able to negotiate more favorable management agreement terms with an unaffiliated third party if we were not already subject to the original management agreement.

In addition to the management fees we pay to our Manager, we reimburse our Manager for costs and expenses incurred on our behalf, including certain indirect personnel and employment costs of our Manager, which costs and expenses may be substantial.