Document

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended September 30, 2017

Commission File Number: 001-37597

NORTHSTAR REALTY EUROPE CORP.

(Exact Name of Registrant as Specified in its Charter)

|

| |

Maryland (State or Other Jurisdiction of Incorporation or Organization) | 32-0468861 (IRS Employer Identification No.) |

399 Park Avenue, 18th Floor, New York, NY 10022

(Address of Principal Executive Offices, Including Zip Code)

(212) 547-2600

(Registrant’s Telephone Number, Including Area Code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

|

| | | | | | |

Large accelerated filer o | | Accelerated filer x | | Non-accelerated filer o (Do not check if a smaller reporting company) | | Smaller reporting company o

Emerging growth company x |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. x

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date:

The Company has one class of common stock, $0.01 par value per share, 55,396,627 shares outstanding as of November 6, 2017.

NORTHSTAR REALTY EUROPE CORP.

FORM 10-Q

TABLE OF CONTENTS

FORWARD-LOOKING STATEMENTS

This Quarterly Report on Form 10-Q contains certain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, or Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or Exchange Act. Forward-looking statements are generally identifiable by use of forward-looking terminology such as “may,” “will,” “should,” “potential,” “intend,” “expect,” “seek,” “anticipate,” “estimate,” “believe,” “could,” “project,” “predict,” “continue,” “future” or other similar words or expressions. Forward-looking statements are not guarantees of performance and are based on certain assumptions, discuss future expectations, describe plans and strategies, contain projections of results of operations or of financial condition or state other forward-looking information. Such statements include, but are not limited to, those relating to the operating performance of our investments, our liquidity and financing needs, the effects of our current strategies and investment activities, our ability to grow our business, our expected leverage, our expected cost of capital, our ability to divest non-strategic properties, our management’s track record and our ability to raise and effectively deploy capital. Our ability to predict results or the actual effect of plans or strategies is inherently uncertain, particularly given the economic environment. Although we believe that the expectations reflected in such forward-looking statements are based on reasonable assumptions, our actual results and performance could differ materially from those set forth in the forward-looking statements and you should not unduly rely on these statements. These forward-looking statements involve risks, uncertainties and other factors that may cause our actual results in future periods to differ materially from those forward-looking statements. These factors include, but are not limited to:

| |

• | the effect of economic conditions, particularly in Europe, on the valuation of our investments and on the tenants of the real property that we own; |

| |

• | the effect of the Mergers (as defined in Note 1) on our business; |

| |

• | the ability of Colony NorthStar Inc., or CLNS, to scale its operations in Europe to effectively manage our company; |

| |

• | the unknown impact of the exit of the United Kingdom, or Brexit, or one or more other countries from the European Union, or EU, or the potential default of one or more countries in the EU or the potential break-up of the EU; |

| |

• | our ability to qualify and remain qualified as a real estate investment trust, or REIT; |

| |

• | adverse domestic or international economic geopolitical conditions and the impact on the commercial real estate industry; |

| |

• | volatility, disruption or uncertainty in the financial markets; |

| |

• | access to debt and equity capital and our liquidity; |

| |

• | our substantial use of leverage and our ability to comply with the terms of our borrowing arrangements; |

| |

• | our ability to monetize our assets on favorable terms or at all; |

| |

• | our ability to obtain mortgage financing on our real estate portfolio on favorable terms or at all; |

| |

• | our ability to acquire attractive investment opportunities and the impact of competition for attractive investment opportunities; |

| |

• | the effect of an increased amount of activist stockholders owning our stock and stockholder activism generally; |

| |

• | the effects of being an externally-managed company, including our reliance on CLNS and its affiliates and sub-advisors/co-venturers in providing management services to us, the payment of substantial base management and incentive fees to our manager, the allocation of investments by CLNS among us and CLNS’s other sponsored or managed companies and strategic vehicles and various conflicts of interest in our relationship with CLNS; |

| |

• | performance of our investments relative to our expectations and the impact on our actual return on invested equity, as well as the cash provided by these investments and available for distribution; |

| |

• | restrictions on our ability to engage in certain activities and the requirement that we may be required to access capital at inopportune times as a result of our borrowings; |

| |

• | our ability to make borrowings under our credit facility; |

| |

• | the impact of adverse conditions affecting office properties; |

| |

• | illiquidity of properties in our portfolio; |

| |

• | our ability to realize current and expected return over the life of our investments; |

| |

• | tenant defaults or bankruptcy; |

| |

• | any failure in our due diligence to identify all relevant facts in our underwriting process or otherwise; |

| |

• | the impact of terrorism or hostilities involving Europe; |

| |

• | our ability to manage our costs in line with our expectations and the impact on our cash available for distribution, or CAD, and net operating income, or NOI, of our properties; |

| |

• | our ability to satisfy and manage our capital requirements; |

| |

• | environmental and regulatory requirements, compliance costs and liabilities relating to owning and operating properties in our portfolio and to our business in general; |

| |

• | effect of regulatory actions, litigation and contractual claims against us and our affiliates, including the potential settlement and litigation of such claims; |

| |

• | changes in European, international and domestic laws or regulations governing various aspects of our business; |

| |

• | future changes in foreign, federal, state and local tax law that may have an adverse impact on the cash flow and value of our investments; |

| |

• | the impact that a rise in future interest rates may have on our floating rate financing; |

| |

• | potential devaluation of foreign currencies, predominately the Euro and U.K. Pound Sterling, relative to the U.S. dollar due to quantitative easing in Europe, Brexit and/or other factors which could cause the U.S. dollar value of our investments to decline; |

| |

• | general foreign exchange risk associated with properties located in European countries located outside of the Euro Area, including the United Kingdom; |

| |

• | the loss of our exemption from the definition of an “investment company” under the Investment Company Act of 1940, as amended; |

| |

• | CLNS’ ability to hire and retain qualified personnel and potential changes to key personnel providing management services to us; |

| |

• | the lack of historical financial statements for properties we have acquired and may acquire in compliance with U.S. Securities and Exchange Commission, or SEC, requirements and U.S. generally accepted accounting principles, or U.S. GAAP, as well as the lack of familiarity of our tenants and third-party service providers with such requirements; |

| |

• | the potential failure to maintain effective internal controls and disclosure controls and procedures; |

| |

• | our status as an emerging growth company; and |

| |

• | compliance with the rules governing REITs. |

The foregoing list of factors is not exhaustive. All forward-looking statements included in this Quarterly Report on Form 10-Q are based on information available to us on the date hereof and we are under no duty to update any of the forward-looking statements after the date of this report to conform these statements to actual results.

Factors that could have a material adverse effect on our operations and future prospects are set forth in our filings with the SEC included in Part I, Item 1A. of our Annual Report on Form 10-K for the fiscal year ended December 31, 2016 and in Part II, Item 1A. of this Form 10-Q, each under “Risk Factors.” The risk factors set forth in our filings with the SEC could cause our actual results to differ significantly from those contained in any forward-looking statement contained in this report.

PART I

Item 1. Financial Statements

NORTHSTAR REALTY EUROPE CORP. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

(Dollars in Thousands)

(Unaudited)

|

| | | | | | | |

| September 30, 2017 | | December 31,

2016 |

Assets |

| | |

Operating real estate, gross | $ | 1,751,141 |

| | $ | 1,614,432 |

|

Less: accumulated depreciation | (96,805 | ) | | (63,585 | ) |

Operating real estate, net | 1,654,336 |

| | 1,550,847 |

|

Preferred equity investments | 35,086 |

| | — |

|

Cash and cash equivalents | 49,728 |

| | 66,308 |

|

Restricted cash | 8,516 |

| | 10,242 |

|

Receivables, net of allowance of $611 and $553 as of September 30, 2017 and December 31, 2016, respectively | 8,114 |

| | 6,015 |

|

Assets held for sale | 76,141 |

| | 28,208 |

|

Derivative assets, at fair value | 8,054 |

| | 13,729 |

|

Intangible assets, net | 123,141 |

| | 148,403 |

|

Other assets, net | 26,117 |

| | 21,640 |

|

Total assets | $ | 1,989,233 |

| | $ | 1,845,392 |

|

Liabilities |

| | |

Mortgage and other notes payable, net | $ | 1,272,758 |

| | $ | 1,149,119 |

|

Accounts payable and accrued expenses | 25,318 |

| | 28,004 |

|

Due to related party (refer to Note 6) | 3,483 |

| | 4,991 |

|

Derivative liabilities, at fair value | 5,547 |

| | — |

|

Intangible liabilities, net | 29,911 |

| | 30,802 |

|

Liabilities held for sale | 2,453 |

| | 2,041 |

|

Other liabilities | 29,996 |

| | 28,918 |

|

Total liabilities | 1,369,466 |

| | 1,243,875 |

|

Commitments and contingencies |

| |

|

Redeemable non-controlling interest (refer to Note 9) | 1,809 |

| | 1,610 |

|

Equity | | | |

NorthStar Realty Europe Corp. Stockholders’ Equity | | | |

Preferred stock, $0.01 par value, 200,000,000 shares authorized, no shares issued and outstanding as of September 30, 2017 and December 31, 2016 | — |

| | — |

|

Common stock, $0.01 par value, 1,000,000,000 shares authorized, 55,313,294 and 55,395,143 shares issued and outstanding as of September 30, 2017 and December 31, 2016, respectively | 554 |

| | 554 |

|

Additional paid-in capital | 937,195 |

| | 925,473 |

|

Retained earnings (accumulated deficit) | (340,198 | ) | | (282,769 | ) |

Accumulated other comprehensive income (loss) | 15,281 |

| | (51,424 | ) |

Total NorthStar Realty Europe Corp. stockholders’ equity | 612,832 |

| | 591,834 |

|

Non-controlling interests | 5,126 |

| | 8,073 |

|

Total equity | 617,958 |

| | 599,907 |

|

Total liabilities, redeemable non-controlling interest and equity | $ | 1,989,233 |

| | $ | 1,845,392 |

|

Refer to accompanying notes to consolidated financial statements.

NORTHSTAR REALTY EUROPE CORP. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS

(Dollars in Thousands, Except Per Share Data)

(Unaudited)

|

| | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2017 | | 2016 | | 2017 |

| 2016 |

Revenues |

|

|

|

|

|

|

|

Rental income | $ | 27,747 |

|

| $ | 29,798 |

|

| $ | 79,308 |

|

| $ | 98,622 |

|

Escalation income | 5,641 |

|

| 7,828 |

|

| 16,360 |

|

| 19,825 |

|

Interest income | 704 |

|

| — |

|

| 1,001 |

|

| — |

|

Other income | 171 |

|

| 149 |

|

| 708 |

|

| 899 |

|

Total revenues | 34,263 |

|

| 37,775 |

|

| 97,377 |

|

| 119,346 |

|

Expenses |

|

|

|

|

|

|

|

Properties - operating expenses | 7,519 |

|

| 9,493 |

|

| 22,521 |

|

| 27,263 |

|

Interest expense | 6,536 |

|

| 9,301 |

|

| 19,641 |

|

| 33,484 |

|

Transaction costs | 332 |

|

| 150 |

|

| 1,565 |

|

| 2,633 |

|

Impairment losses | — |

|

| — |

|

| — |

|

| 27,468 |

|

Management fee, related party | 3,585 |

|

| 3,548 |

|

| 10,716 |

|

| 10,548 |

|

Other expenses | 1,996 |

|

| 2,848 |

|

| 6,604 |

|

| 9,579 |

|

General and administrative expenses | 1,723 |

|

| 2,199 |

|

| 5,875 |

|

| 5,181 |

|

Compensation expense (1) | 2,839 |

|

| 5,194 |

|

| 20,094 |

|

| 12,225 |

|

Depreciation and amortization | 14,396 |

|

| 13,989 |

|

| 39,479 |

|

| 51,264 |

|

Total expenses | 38,926 |

|

| 46,722 |

|

| 126,495 |

|

| 179,645 |

|

Other income (loss) |

|

|

|

|

|

|

|

|

|

|

|

Unrealized gain (loss) on derivatives and other (refer to Note 10) | (3,472 | ) |

| (4,982 | ) |

| (12,068 | ) |

| (19,775 | ) |

Realized gain (loss) on sales and other | 1,681 |

|

| 3,814 |

|

| 8,632 |

|

| 6,188 |

|

Income (loss) before income tax benefit (expense) | (6,454 | ) |

| (10,115 | ) |

| (32,554 | ) |

| (73,886 | ) |

Income tax benefit (expense) | (352 | ) |

| (2,655 | ) |

| (316 | ) |

| (2,515 | ) |

Net income (loss) | (6,806 | ) |

| (12,770 | ) |

| (32,870 | ) |

| (76,401 | ) |

Net (income) loss attributable to non-controlling interests | 36 |

|

| 49 |

|

| 303 |

|

| 792 |

|

Net income (loss) attributable to NorthStar Realty Europe Corp. common stockholders | $ | (6,770 | ) |

| $ | (12,721 | ) |

| $ | (32,567 | ) |

| $ | (75,609 | ) |

Earnings (loss) per share: |

|

|

|

|

|

|

|

|

|

|

|

Basic | $ | (0.12 | ) | | $ | (0.22 | ) | | $ | (0.59 | ) | | $ | (1.28 | ) |

Diluted | $ | (0.12 | ) | | $ | (0.22 | ) | | $ | (0.59 | ) | | $ | (1.28 | ) |

Weighted average number of shares: | | | | | | | |

Basic | 55,155,440 |

| | 58,239,941 |

| | 55,004,888 |

| | 58,923,027 |

|

Diluted | 55,602,078 |

| | 58,928,421 |

| | 55,565,341 |

| | 59,612,985 |

|

Dividends per share of common stock | $0.15 |

| $0.15 |

| $0.45 |

| $0.45 |

____________________

| |

(1) | Compensation expense for the three and nine months ended September 30, 2017 and 2016 is comprised of equity-based compensation expenses. For the nine months ended September 30, 2017, compensation expense includes the impact of substantially all time based and certain performance based awards vesting in connection with the change of control of the Manager (refer to Note 7). |

Refer to accompanying notes to consolidated financial statements.

NORTHSTAR REALTY EUROPE CORP. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS)

(Dollars in Thousands)

(Unaudited)

|

| | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2017 | | 2016 | | 2017 | | 2016 |

Net income (loss) | $ | (6,806 | ) | | $ | (12,770 | ) | | $ | (32,870 | ) | | $ | (76,401 | ) |

Other comprehensive income (loss): | | | | | | | |

Foreign currency translation adjustment, net | 20,532 |

| | (4,964 | ) | | 67,005 |

| | (10,753 | ) |

Total other comprehensive income (loss) | 20,532 |

|

| (4,964 | ) | | 67,005 |

| | (10,753 | ) |

Comprehensive income (loss) | 13,726 |

|

| (17,734 | ) |

| 34,135 |

| | (87,154 | ) |

Comprehensive (income) loss attributable to non-controlling interests | 61 |

| | (278 | ) | | 3 |

| | 739 |

|

Comprehensive income (loss) attributable to NorthStar Realty Europe Corp. common stockholders | $ | 13,787 |

|

| $ | (18,012 | ) |

| $ | 34,138 |

| | $ | (86,415 | ) |

Refer to accompanying notes to consolidated financial statements.

NORTHSTAR REALTY EUROPE CORP. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF EQUITY

(Dollars and Shares in Thousands) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Common Stock | | Additional

Paid-in

Capital | | Retained

Earnings

(Accumulated

Deficit) | | Accumulated

Other

Comprehensive

Income (Loss) | | Total NorthStar Stockholders’ Equity | | Non-controlling

Interests | | Total

Equity |

|

| Shares | | Amount | |

Balance as of December 31, 2015 | 59,326 |

|

| $ | 593 |

|

| $ | 968,662 |

|

| $ | (186,246 | ) |

| $ | 2,560 |

|

| $ | 785,569 |

|

| $ | 10,173 |

|

| $ | 795,742 |

|

Reallocation of interest in Operating Partnership (refer to Note 9) | — |

| | — |

| | 2,252 |

| | — |

| | — |

| | 2,252 |

| | (2,252 | ) | | — |

|

Amortization of equity-based compensation | — |

| | — |

| | 15,682 |

| | — |

| | — |

| | 15,682 |

| | 2,557 |

| | 18,239 |

|

Issuance and vesting of restricted stock, net of tax withholding | 1,731 |

| | 17 |

| | (17 | ) | | — |

| | — |

| | — |

| | — |

| | — |

|

Tax withholding related to vesting of equity-based compensation | — |

| | — |

| | (2,546 | ) | | — |

| | — |

| | (2,546 | ) | | — |

| | (2,546 | ) |

Retirement of shares of common stock | (5,662 | ) | | (56 | ) | | (58,560 | ) | | — |

| | — |

| | (58,616 | ) | | — |

| | (58,616 | ) |

Other comprehensive income (loss) | — |

| | — |

| | — |

| | — |

| | (53,984 | ) | | (53,984 | ) | | (1,242 | ) | | (55,226 | ) |

Dividends on common stock and equity-based compensation | — |

| | — |

| | — |

| | (34,770 | ) | | — |

| | (34,770 | ) | | (414 | ) | | (35,184 | ) |

Net income (loss) | — |

| | — |

| | — |

| | (61,753 | ) | | — |

| | (61,753 | ) | | (749 | ) | | (62,502 | ) |

Balance as of December 31, 2016 | 55,395 |

|

| 554 |

|

| 925,473 |

|

| (282,769 | ) |

| (51,424 | ) |

| 591,834 |

|

| 8,073 |

|

| 599,907 |

|

Reallocation of interest in Operating Partnership (refer to Note 9) | — |

| | — |

| | 1,817 |

| | — |

| | — |

| | 1,817 |

| | (1,817 | ) | | — |

|

Conversion of Common Units to common stock (refer to Note 9) | 263 |

| | 3 |

| | 3,054 |

| | — |

| | — |

| | 3,057 |

| | (3,057 | ) | | — |

|

Amortization of equity-based compensation (refer to Note 7) | — |

| | — |

| | 17,842 |

| | — |

| | — |

| | 17,842 |

| | 2,174 |

| | 20,016 |

|

Issuance and vesting of restricted stock, net of tax withholding | 516 |

| | 6 |

| | (6 | ) | | — |

| | — |

| | — |

| | — |

| | — |

|

Tax withholding related to vesting of equity-based compensation | (861 | ) | | (9 | ) | | (10,985 | ) | | — |

| | — |

| | (10,994 | ) | | — |

| | (10,994 | ) |

Other comprehensive income (loss) | — |

| | — |

| | — |

| | — |

| | 66,705 |

| | 66,705 |

| | 300 |

| | 67,005 |

|

Dividends on common stock and equity-based compensation | — |

| | — |

| | — |

| | (24,862 | ) | | — |

| | (24,862 | ) | | (244 | ) | | (25,106 | ) |

Net income (loss) | — |

| | — |

| | — |

| | (32,567 | ) | | — |

| | (32,567 | ) | | (303 | ) | | (32,870 | ) |

Balance as of September 30, 2017 (unaudited) | 55,313 |

|

| $ | 554 |

|

| $ | 937,195 |

|

| $ | (340,198 | ) |

| $ | 15,281 |

|

| $ | 612,832 |

|

| $ | 5,126 |

|

| $ | 617,958 |

|

Refer to accompanying notes to consolidated financial statements.

NORTHSTAR REALTY EUROPE CORP. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Dollars in Thousands)

(Unaudited)

|

| | | | | | | |

| Nine Months Ended September 30, |

| 2017 | | 2016 |

Cash flows from operating activities: | | | |

Net income (loss) | $ | (32,870 | ) | | $ | (76,401 | ) |

Adjustments to reconcile net income (loss) to net cash provided by (used in) operating activities: | | | |

Depreciation and amortization | 39,479 |

| | 51,264 |

|

Amortization of deferred financing costs | 2,340 |

| | 5,570 |

|

Amortization of equity-based compensation | 20,016 |

| | 11,456 |

|

Allowance for uncollectible accounts | 403 |

| | 425 |

|

Unrealized (gain) loss on derivatives and other | 12,068 |

| | 19,775 |

|

Realized (gain) loss on sales and other | (8,632 | ) | | (6,188 | ) |

Impairment losses | — |

| | 27,468 |

|

Amortization of capitalized above/below market leases | (256 | ) | | 2,615 |

|

Straight line rental income | (3,864 | ) | | (6,049 | ) |

Deferred income taxes, net | (141 | ) | | (2,189 | ) |

Changes in assets and liabilities: | | | |

Restricted cash | 1,971 |

| | (1,696 | ) |

Receivables | (1,380 | ) | | 154 |

|

Other assets | (579 | ) | | 2,669 |

|

Accounts payable and accrued expenses | (6,412 | ) | | (9,191 | ) |

Due to related party | (1,507 | ) | | (340 | ) |

Other liabilities | 875 |

| | 275 |

|

Net cash provided by (used in) operating activities | 21,511 |

|

| 19,617 |

|

Cash flows from investing activities: | | | |

Improvements of operating real estate | (10,143 | ) | | (7,858 | ) |

Origination of preferred equity investments | (35,086 | ) | | — |

|

Proceeds from sale of operating real estate | 48,622 |

| | 364,771 |

|

Other assets | (3,813 | ) | | (8,320 | ) |

Changes in restricted cash | — |

| | 10,026 |

|

Net cash provided by (used in) investing activities | (420 | ) |

| 358,619 |

|

Cash flows from financing activities: | | | |

Repayment of mortgage and other notes payable | (12,888 | ) | | (190,693 | ) |

Borrowings from credit facility | 35,000 |

| | 65,000 |

|

Borrowings from mortgage and other notes payable | 5,567 |

| | 11,770 |

|

Repayment of credit facility | (35,000 | ) | | (65,000 | ) |

Repurchase of Senior Notes | — |

| | (273,359 | ) |

Payment of financing costs | (1,888 | ) | | (3,946 | ) |

Purchase of derivative instruments | — |

| | (380 | ) |

Settlement of derivatives | 1,688 |

| | (1,095 | ) |

Retirement of shares of common stock | — |

| | (29,132 | ) |

Tax withholding related to vesting of equity-based compensation | (10,994 | ) | | (195 | ) |

Dividends | (25,106 | ) | | (26,859 | ) |

Distributions to non-controlling interest | — |

| | (133 | ) |

Net cash provided by (used in) financing activities | (43,621 | ) |

| (514,022 | ) |

Effect of foreign currency translation on cash and cash equivalents | 5,950 |

| | 1,108 |

|

Net increase (decrease) in cash and cash equivalents | (16,580 | ) |

| (134,678 | ) |

Cash and cash equivalents—beginning of period | 66,308 |

| | 283,844 |

|

Cash and cash equivalents—end of period | $ | 49,728 |

|

| $ | 149,166 |

|

Refer to accompanying notes to consolidated financial statements.

NORTHSTAR REALTY EUROPE CORP. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Dollars in Thousands) (Continued)

(Unaudited)

|

| | | | | | | |

| Nine Months Ended September 30, |

| 2017 | | 2016 |

Supplemental disclosure of non-cash investing and financing activities: | | | |

Reclassification of operating real estate to assets held for sale | $ | 45,224 |

| | $ | 44,324 |

|

Conversion of Common Units to common stock | 3,057 |

| | — |

|

Reclassification of intangibles to assets and liabilities held for sale | 25,608 |

| | 2,958 |

|

Reclassification of other assets and liabilities to assets held for sale | 2,856 |

| | — |

|

Reclassification related to measurement adjustments/other | — |

| | 5,587 |

|

Retirement of shares of common stock | — |

| | 1,753 |

|

Reallocation of interest in Operating Partnership | 1,817 |

| | 2,548 |

|

Accrued capital expenditures and deferred assets | 689 |

| | — |

|

Refer to accompanying notes to consolidated financial statements.

NORTHSTAR REALTY EUROPE CORP. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

| |

1. | Formation and Organization |

NorthStar Realty Europe Corp. (“NorthStar Europe” or the “Company”) (NYSE: NRE), a publicly-traded real estate investment trust (“REIT”), is a European focused commercial real estate company with predominantly prime office properties in key cities within Germany, the United Kingdom and France (the “Core Portfolio”). The Company’s objective is to provide its stockholders with stable and recurring cash flow supplemented by capital growth over time.

The Company is externally managed and advised by an affiliate of the Manager. References to “the Manager” refer to NorthStar Asset Management Group Inc. (“NSAM”) for the period prior to the Mergers (refer below) and Colony NorthStar, Inc. (“Colony NorthStar” or “CLNS”), for the period subsequent to the Mergers. As part of the Mergers, NSAM changed its name to Colony NorthStar, Inc.

Substantially all of the Company’s assets, directly or indirectly, are held by, and the Company conducts its operations, directly or indirectly, through NorthStar Realty Europe Limited Partnership, a Delaware limited partnership and the operating partnership of the Company (the “Operating Partnership”). The Company has elected to be taxed, and will continue to conduct its operations so as to continue to qualify, as a REIT for U.S. federal income tax purposes.

All references herein to the Company refer to NorthStar Realty Europe Corp. and its consolidated subsidiaries, including the Operating Partnership, collectively, unless the context otherwise requires.

Merger Agreements among NSAM, NorthStar Realty and Colony Capital, Inc.

On January 10, 2017, the Company’s external manager, NSAM, completed a tri-party merger with NorthStar Realty Finance Corp. (“NorthStar Realty”) and Colony Capital, Inc. (“Colony”), pursuant to which the companies combined in an all-stock merger (“the Mergers”) of equals transaction to create a diversified real estate and investment management company. Under the terms of the merger agreement, NSAM, Colony and NorthStar Realty, through a series of transactions, merged with and into NSAM, which was renamed Colony NorthStar (NYSE: CLNS). Colony NorthStar is a leading global equity REIT with an embedded investment management platform.

Amended and Restated Management Agreement

On November 9, 2017, the Company entered into an amended and restated management agreement (the “Amended and Restated Management Agreement”) with an affiliate of our Manager, effective as of January 1, 2018. Refer to Note 14 “Subsequent Events” for a description of the terms of the Amended and Restated Management Agreement.

| |

2. | Summary of Significant Accounting Policies |

Basis of Quarterly Presentation

The accompanying unaudited consolidated financial statements and related notes of the Company have been prepared in accordance with accounting principles generally accepted in the United States (“U.S. GAAP”) for interim financial reporting and the instructions to Form 10-Q and Rule 10-01 of Regulation S-X. Accordingly, certain information and note disclosures normally included in the consolidated financial statements prepared under U.S. GAAP have been condensed or omitted. In the opinion of management, all adjustments considered necessary for a fair statement of the Company’s financial position, results of operations and cash flows have been included and are of a normal and recurring nature. The operating results presented for interim periods are not necessarily indicative of the results that may be expected for any other interim period or for the entire year. These consolidated financial statements should be read in conjunction with the Company’s consolidated financial statements and notes thereto included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2016, which was filed with the U.S. Securities and Exchange Commission (the “SEC”).

Principles of Consolidation

The consolidated financial statements include the accounts of the Company, the Operating Partnership and their consolidated subsidiaries. The Company consolidates variable interest entities (“VIE”) where the Company is the primary beneficiary and voting interest entities which are generally majority owned or otherwise controlled by the Company. All significant intercompany balances are eliminated in consolidation.

Variable Interest Entities

A VIE is an entity that lacks one or more of the characteristics of a voting interest entity. A VIE is defined as an entity in which equity investors do not have the characteristics of a controlling financial interest or do not have sufficient equity at risk for the entity to finance its activities without additional subordinated financial support from other parties. The determination of whether

NORTHSTAR REALTY EUROPE CORP. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Unaudited)

an entity is a VIE includes both a qualitative and quantitative analysis. The Company bases its qualitative analysis on its review of the design of the entity, its organizational structure including decision-making ability and relevant financial agreements and the quantitative analysis on the forecasted cash flow of the entity. The Company reassesses its initial evaluation of an entity as a VIE upon the occurrence of certain reconsideration events.

A VIE must be consolidated only by its primary beneficiary, which is defined as the party who, along with its affiliates and agents has both the: (i) power to direct the activities that most significantly impact the VIE’s economic performance; and (ii) obligation to absorb the losses of the VIE or the right to receive the benefits from the VIE, which could be significant to the VIE. The Company determines whether it is the primary beneficiary of a VIE by considering qualitative and quantitative factors, including, but not limited to: which activities most significantly impact the VIE’s economic performance and which party controls such activities; the amount and characteristics of its investment; the obligation or likelihood for the Company or other interests to provide financial support; consideration of the VIE’s purpose and design, including the risks the VIE was designed to create and pass through to its variable interest holders and the similarity with and significance to the business activities of the Company and the other interests. The Company reassesses its determination of whether it is the primary beneficiary of a VIE each reporting period. Significant judgments related to these determinations include estimates about the current and future fair value and performance of investments held by these VIEs and general market conditions.

The Company will evaluate its investments to determine whether they are a VIE. The Company analyzes new investments and financings, as well as reconsideration events for existing investments and financings, which vary depending on type of investment or financing.

Voting Interest Entities

A voting interest entity is an entity in which the total equity investment at risk is sufficient to enable it to finance its activities independently and the equity holders have the power to direct the activities of the entity that most significantly impact its economic performance, the obligation to absorb the losses of the entity and the right to receive the residual returns of the entity. The usual condition for a controlling financial interest in a voting interest entity is ownership of a majority voting interest. If the Company has a majority voting interest in a voting interest entity, the entity will generally be consolidated. The Company does not consolidate a voting interest entity if there are substantive participating rights by other parties and/or kick-out rights by a single party or through a simple majority vote.

The Company performs on-going reassessments of whether entities previously evaluated under the voting interest framework have become VIEs, based on certain events, and therefore subject to the VIE consolidation framework.

Non-controlling Interests

A non-controlling interest in a consolidated subsidiary is defined as the portion of the equity (net assets) in a subsidiary not attributable, directly or indirectly, to the Company. A non-controlling interest is required to be presented as a separate component of equity on the consolidated balance sheets and presented separately as net income (loss) and other comprehensive income (loss) (“OCI”) attributable to non-controlling interests. An allocation to a non-controlling interest may differ from the stated ownership percentage interest in such entity as a result of a preferred return and allocation formula, if any, as described in such governing documents.

Estimates

The preparation of consolidated financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that could affect the amounts reported in the consolidated financial statements and accompanying notes. Actual results could materially differ from those estimates and assumptions.

Reclassifications

Certain prior period amounts have been reclassified in the consolidated financial statements to conform to current period presentation including the gain (loss) on net cash on derivatives from unrealized gain (loss) to realized gain (loss) on the consolidated statements of operations for the three and nine months ended September 30, 2016 (refer to Note 10).

Comprehensive Income (Loss)

The Company reports consolidated comprehensive income (loss) in separate statements following the consolidated statements of operations. Comprehensive income (loss) is defined as the change in equity resulting from net income (loss) and OCI. The components of OCI principally include the foreign currency translation adjustment, net.

NORTHSTAR REALTY EUROPE CORP. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Unaudited)

Restricted Cash

Restricted cash primarily consists of amounts related to operating real estate such as escrows for taxes, insurance, capital expenditures, tenant security deposits and payments required under certain lease agreements and amounts related to the Company’s borrowings.

Operating Real Estate

Operating real estate is carried at historical cost less accumulated depreciation. Ordinary repairs and maintenance are expensed as incurred. Major replacements and improvements which extend the life of the asset are capitalized and depreciated over their useful life. Operating real estate is depreciated using the straight-line method over the estimated useful lives of the assets.

The Company accounts for purchases of operating real estate that qualify as business combinations using the acquisition method, where the purchase price is allocated to tangible assets such as land, building, tenant and land improvements and other identified intangibles, such as in-place leases, above/below-market leases and goodwill. Costs directly related to an acquisition deemed to be a business combination are expensed and included in transaction costs in the consolidated statements of operations.

Operating real estate is depreciated using the straight-line method over the estimated useful lives of the assets, summarized as follows:

|

| | |

Category: | | Term: |

Building | | 40 years |

Building improvements | | Lesser of the useful life or remaining life of the building |

Building leasehold interests | | Lesser of 40 years or remaining term of the lease |

Tenant improvements | | Lesser of the useful life or remaining term of the lease |

Preferred Equity Investments

Preferred equity investments are generally intended to be held to maturity and, accordingly, are carried at cost, net of unamortized loan fees, premium, discount and unfunded commitments, if any. Preferred equity investments that are deemed to be impaired are carried at amortized cost less a loan loss reserve, if deemed appropriate, which approximates fair value. Preferred equity investments where the Company does not have the intent to hold the investment for the foreseeable future or until its expected payoff are classified as held for sale and recorded at the lower of cost or fair value.

Assets and Liabilities Held For Sale

Operating real estate which has met the criteria to be classified as held for sale is separately presented on the consolidated balance sheets. Such operating real estate is recorded at the lower of its carrying value or its estimated fair value less the cost to sell net of the intangible assets associated with the asset, with any write-down to fair value less cost to sell recorded as an impairment loss. Once a property is determined to be held for sale, depreciation is no longer recorded. The Company records a gain or loss on sale of real estate when title is conveyed to the buyer and the Company has no substantial economic involvement with the property. If the sales criteria for the full accrual method are not met, the Company defers some or all of the gain or loss recognition by applying the finance, leasing, profit sharing, deposit, installment or cost recovery method, as appropriate, until the sales criteria are met.

Deferred Costs

Deferred costs primarily include deferred financing costs and deferred lease costs. Deferred financing costs represent commitment fees, legal and other third-party costs associated with obtaining financing. Costs related to revolving credit facilities are recorded in other assets and are amortized to interest expense using the straight-line basis over the term of the facility. Costs related to other borrowings are recorded net against the carrying value of such borrowings and are amortized into interest expense using the effective interest method or straight-line method depending on the type of financing. Unamortized deferred financing costs are expensed when the associated borrowing is repaid before maturity to realized gain (loss) on sales and other. Costs incurred in seeking financing transactions, which do not close, are expensed in the period in which it is determined that the financing will not occur. Deferred lease costs consist of fees incurred to initiate and renew operating leases, which are amortized on a straight-line basis over the remaining lease term and are recorded to depreciation and amortization in the consolidated statements of operations.

Intangible Assets and Intangible Liabilities

The Company records acquired identified intangibles, which includes intangible assets (such as value of the above-market leases, in-place leases, below-market ground leases, goodwill and other intangibles) and intangible liabilities (such as the value of below-market leases), based on estimated fair value. The value allocated to the above or below-market leases is amortized net to rental income, the value of below-market ground leases is amortized into properties - operating expense and in-place leases is amortized

NORTHSTAR REALTY EUROPE CORP. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Unaudited)

into depreciation and amortization expense, respectively, in the consolidated statements of operations on a straight-line basis over the respective remaining lease term.

Goodwill represents the excess of the purchase price over the fair value of net tangible and intangible assets acquired in a business combination and is not amortized. The Company analyzes goodwill for impairment on an annual basis and whenever events or changes in circumstances indicate that the carrying value of goodwill may not be fully recoverable. The Company first assesses qualitative factors to determine whether it is more likely than not that the fair value of a reporting unit, related to such goodwill, is less than the carrying amount as a basis to determine whether the two-step impairment test is necessary. The first step in the impairment test compares the fair value of the reporting unit with its carrying amount. If the carrying amount exceeds fair value, the second step is required to determine the amount of the impairment loss, if any, by comparing the implied fair value of the reporting unit goodwill with the carrying amount of such goodwill. The implied fair value of goodwill is derived by performing a hypothetical purchase price allocation for the reporting unit as of the measurement date, allocating the reporting unit’s estimated fair value to its net assets and identifiable intangible assets. The residual amount represents the implied fair value of goodwill. To the extent this amount is below the carrying value of goodwill, an impairment loss is recorded in the consolidated statements of operations.

The following table presents identified intangibles as of September 30, 2017 and December 31, 2016 (dollars in thousands):

|

| | | | | | | | | | | | | | | | | | | | | | | |

| September 30, 2017 | | December 31, 2016 |

| Gross Amount | | Accumulated Amortization | | Net | | Gross Amount | | Accumulated Amortization | | Net |

Intangible assets: | | | | | | | | | | | |

In-place lease | $ | 85,507 |

| | $ | (37,932 | ) | | $ | 47,575 |

| | $ | 84,743 |

| | $ | (29,012 | ) | | $ | 55,731 |

|

Above-market lease | 37,961 |

| | (11,117 | ) | | 26,844 |

| | 36,704 |

| | (8,198 | ) | | 28,506 |

|

Below-market ground lease | 34,242 |

| | (1,000 | ) | | 33,242 |

| | 51,218 |

| | (832 | ) | | 50,386 |

|

Goodwill(1) | 15,480 |

| | N/A |

| | 15,480 |

| | 13,780 |

| | N/A |

| | 13,780 |

|

Total | $ | 173,190 |

|

| $ | (50,049 | ) |

| $ | 123,141 |

|

| $ | 186,445 |

|

| $ | (38,042 | ) | | $ | 148,403 |

|

| | | | | | | | | | | |

Intangible liabilities: | | | | | | | | | | | |

Below-market lease | $ | 37,554 |

| | $ | (12,917 | ) | | $ | 24,637 |

| | $ | 34,163 |

| | $ | (8,104 | ) | | $ | 26,059 |

|

Above-market ground lease | 5,437 |

| | (163 | ) | | 5,274 |

| | 4,839 |

| | (96 | ) | | 4,743 |

|

Total | $ | 42,991 |

| | $ | (13,080 | ) | | $ | 29,911 |

| | $ | 39,002 |

| | $ | (8,200 | ) | | $ | 30,802 |

|

| |

(1) | Represents goodwill associated with certain acquisitions in exchange for shares in the underlying portfolios. The goodwill and a corresponding deferred tax liability was recorded at acquisition based on tax basis differences. |

NORTHSTAR REALTY EUROPE CORP. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Unaudited)

Other Assets and Other Liabilities

The following tables present a summary of other assets and other liabilities as of September 30, 2017 and December 31, 2016 (dollars in thousands):

|

| | | | | | | |

| September 30, 2017 | | December 31, 2016 |

Other assets: | | | |

Prepaid expenses | $ | 3,025 |

| | $ | 1,951 |

|

Deferred leasing and other costs, net | 6,547 |

| | 3,029 |

|

Deferred tax assets, net | 32 |

| | — |

|

Straight-line rent, net | 12,502 |

| | 10,182 |

|

Escrow receivable | 3,242 |

| | 6,168 |

|

Other | 769 |

| | 310 |

|

Total | $ | 26,117 |

| | $ | 21,640 |

|

| | | |

| September 30, 2017 | | December 31, 2016 |

Other liabilities: |

| | |

Deferred tax liabilities | $ | 10,284 |

| | $ | 8,916 |

|

Prepaid rent received and unearned revenue | 9,942 |

| | 13,585 |

|

Tenant security deposits | 4,322 |

| | 4,322 |

|

Prepaid escalation and other income | 5,163 |

| | 1,560 |

|

Other | 285 |

| | 535 |

|

Total | $ | 29,996 |

| | $ | 28,918 |

|

Revenue Recognition

Operating Real Estate

Rental and escalation income from operating real estate is derived from leasing of space to various types of tenants. Rental revenue recognition commences when the tenant takes possession of the leased space and the leased space is substantially ready for its intended use. The leases are for fixed terms of varying length and generally provide for annual rentals, subject to indexation, and expense reimbursements to be paid in quarterly or monthly installments. Rental income from leases is recognized on a straight-line basis over the term of the respective leases. The excess of rents recognized over amounts contractually due pursuant to the underlying leases are included in other assets, net on the consolidated balance sheets. The Company amortizes any tenant inducements as a reduction of revenue utilizing the straight-line method over the term of the lease. Escalation income represents revenue from tenant leases which provide for the recovery of all or a portion of the operating expenses and real estate taxes paid by the Company on behalf of the respective property. This revenue is accrued in the same period as the expenses are incurred.

In a situation in which a lease or leases associated with a significant tenant have been, or are expected to be, terminated early, the Company evaluates the remaining useful life of depreciable or amortizable assets in the asset group related to the lease that will be terminated (i.e., tenant improvements, above and below market lease intangibles, in-place lease value and leasing commissions). Based upon consideration of the facts and circumstances surrounding the termination, the Company may write-off or accelerate the depreciation and amortization associated with the asset group. Such amounts are included within depreciation and amortization in the consolidated statements of operations.

Preferred Equity Investments

Interest income is recognized on an accrual basis and any related premium, discount, origination costs and fees are amortized over the life of the investment using the effective interest method. The amortization is reflected as an adjustment to interest income in the consolidated statements of operations. The amortization of a premium or accretion of a discount is discontinued if such investment is reclassified to held for sale.

NORTHSTAR REALTY EUROPE CORP. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Unaudited)

Impairment on Investments

Operating Real Estate

The Company’s real estate portfolio is reviewed on a quarterly basis, or more frequently as necessary, to assess whether there are any indicators that the value of its operating real estate may be impaired or that its carrying value may not be recoverable. A property’s value is considered impaired if the Company’s estimate of the aggregate expected future undiscounted cash flow to be generated by the property is less than the carrying value of the property. In conducting this review, the Company considers global macroeconomic factors, real estate sector conditions, together with investment specific and other factors. To the extent an impairment has occurred, the loss is measured as the excess of the carrying value of the property over the estimated fair value of the property and recorded in impairment losses in the consolidated statements of operations. For the three and nine months ended September 30, 2017 and the three months ended September 30, 2016, the Company did not recognize any impairment losses. For the nine months ended September 30, 2016, the Company recognized $27.5 million of impairment losses.

An allowance for a doubtful account for a tenant receivable is established based on a periodic review of aged receivables resulting from estimated losses due to the inability of a tenant to make required rent and other payments contractually due. Additionally, the Company establishes, on a current basis, an allowance for future tenant credit losses on unbilled rent receivable based on an evaluation of the collectability of such amounts.

Preferred Equity Investments

Preferred equity investments are considered impaired when, based on current information and events, it is probable that the Company will not be able to collect all principal and interest amounts due according to the contractual terms. The Company assesses the credit quality of the portfolio and adequacy of investment loss reserves on a quarterly basis or more frequently as necessary. Significant judgment of the Company is required in this analysis. The Company considers the estimated net recoverable value of the investment as well as other factors, including but not limited to the fair value of any collateral, the amount and the status of any senior debt, the quality and financial condition of the borrower and the competitive situation of the area where the underlying collateral is located. Because this determination is based on projections of future economic events, which are inherently subjective, the amount ultimately realized may differ materially from the carrying value as of the balance sheet date. If upon completion of the assessment, the estimated fair value of the underlying collateral is less than the net carrying value of the investment, an investment loss reserve is recorded with a corresponding charge to provision for investment losses. The investment loss reserve for each investment is maintained at a level that is determined to be adequate by management to absorb probable losses.

Income recognition is suspended for an investment at the earlier of the date at which payments become 90-days past due or when, in the opinion of the Company, a full recovery of income and principal becomes doubtful. When the ultimate collectability of the principal of an impaired investment is in doubt, all payments are applied to principal under the cost recovery method. When the ultimate collectability of the principal of an impaired investment is not in doubt, contractual interest is recorded as interest income when received, under the cash basis method until an accrual is resumed when the investment becomes contractually current and performance is demonstrated to be resumed. Interest accrued and not collected will be reversed against interest income. An investment is written off when it is no longer realizable and/or legally discharged. As of September 30, 2017, the Company did not have any impaired preferred equity investments.

Equity-Based Compensation

The Company accounts for equity-based compensation awards using the fair value method, which requires an estimate of fair value of the award. Awards may be based on a variety of measures such as time, performance, market or a combination thereof. For time-based awards, fair value is determined based on the stock price on the grant date. The Company recognizes compensation expense over the vesting period on a straight-line basis or the attribution method depending if the grant is to an employee or non-employee. For performance-based awards, fair value is determined based on the stock price at the date of grant and an estimate of the probable achievement of such measure. The Company recognizes compensation expense over the requisite service period, net of estimated forfeitures, using the accelerated attribution expense method. For market-based measures, fair value is determined using a Monte Carlo analysis under a risk-neutral premise using a risk-free interest rate. The Company recognizes compensation expense, over the requisite service period, net of estimated forfeitures, on a straight-line basis. For awards with a combination of performance or market measures, the Company estimates the fair value as if it were two separate awards. First, the Company estimates the probability of achieving the performance measure. If it is not probable the performance condition will be met, the Company records the compensation expense based on the fair value of the market measure, as described above. This expense is recorded even if the market-based measure is never met. If the performance-based measure is subsequently estimated to be achieved, the Company records compensation expense based on the performance-based measure. The Company would then record a cumulative catch-up adjustment for any additional compensation expense.

NORTHSTAR REALTY EUROPE CORP. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Unaudited)

Equity-based compensation issued to non-employees is accounted for using the fair value of the award at the earlier of the performance commitment date or performance completion date. Time-based awards are remeasured every quarter based on the stock price as of the end of the reporting period until such awards vest, if any.

Derivatives

The Company seeks to use derivative instruments to manage exposure to interest rate risk and foreign currency exchange rate risk. The change in fair value for a derivative is recorded in unrealized gain (loss) on derivatives and other in the consolidated statements of operations.

The Company’s derivative instruments are recorded on the consolidated balance sheets at fair value and do not qualify as hedges under U.S. GAAP.

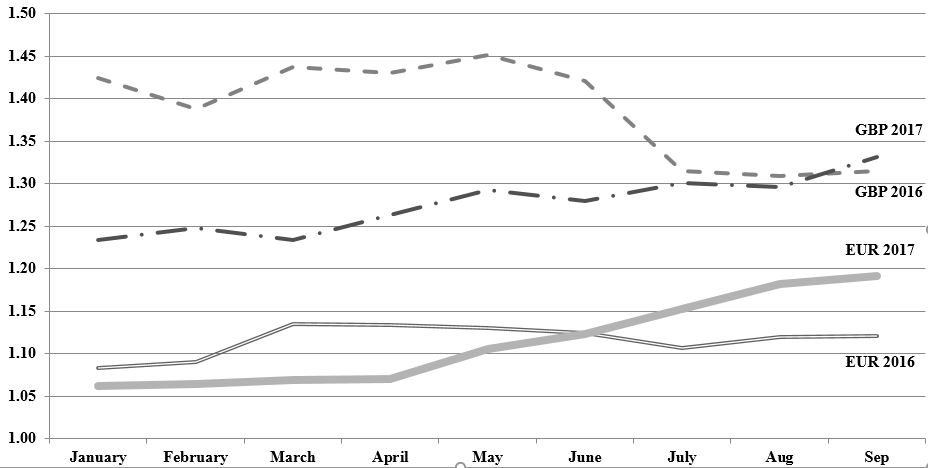

Foreign Currency

Assets and liabilities denominated in a foreign currency for which the functional currency is a foreign currency are translated using the currency exchange rate in effect at the end of the period presented and the results of operations for such entities are translated into U.S. dollars using the average currency exchange rate in effect during the period. The resulting foreign currency translation adjustment (“CTA”), net, is recorded as a component of accumulated OCI in the consolidated statements of equity. For the three months ended September 30, 2017 and 2016, the Company reclassified $0.1 million and $11.5 million, respectively, of CTA to realized gain (loss) on sales and other in the consolidated statements of operations due to the sale of certain real estate assets. For the nine months ended September 30, 2017 and 2016, the Company reclassified $(0.3) million and $11.9 million, respectively, of CTA to realized gain (loss) on sales and other in the consolidated statements of operations due to the sale of certain real estate assets (refer to Note 3).

Assets and liabilities denominated in a foreign currency for which the functional currency is the U.S. dollar are remeasured using the currency exchange rate in effect at the end of the period presented and the results of operations for such entities are remeasured into U.S. dollars using the average currency exchange rate in effect during the period. The resulting foreign currency remeasurement adjustment is recorded in unrealized gain (loss) on derivatives and other in the consolidated statements of operations.

Earnings Per Share

The Company’s basic earnings per share (“EPS”) is calculated by dividing net income (loss) attributable to common stockholders by the weighted average number of common stock outstanding. Diluted EPS includes restricted stock and the potential dilution that could occur if outstanding restricted stock units (“RSUs”) or other contracts to issue common stock, assuming performance hurdles have been met, were converted to common stock (including limited partnership interests in the Operating Partnership owned by holders other than the Company (“Common Units”) and Common Units which are structured as profits interests (“LTIP Units” collectively referred to as Unit Holders) (refer to Note 7), where such exercise or conversion would result in a lower EPS. The dilutive effect of such RSUs and Unit Holders is calculated assuming all units are converted to common stock.

Income Taxes

The Company has elected to be taxed as a REIT for U.S. federal income tax purposes and will continue to comply with the related provisions of the Internal Revenue Code of 1986, as amended, the (“Internal Revenue Code”). Accordingly, the Company generally will not be subject to U.S. federal income tax to the extent of its distributions to stockholders and as long as certain asset, income and share ownership tests are met. To maintain its qualification as a REIT, the Company must annually distribute at least 90% of its REIT taxable income to its stockholders and meet certain other requirements. Under certain circumstances, federal income and excise taxes may be due on its undistributed taxable income. The Company distributes to its stockholders 100% of its taxable income and therefore no provision for U.S. federal income taxes has been included in the accompanying consolidated financial statements for the three and nine months ended September 30, 2017 and 2016.

The Company conducts its business through foreign subsidiaries which may be subject to local level income tax in the European jurisdictions it operates. The Company has also elected taxable REIT subsidiary (“TRS”) status for one of the Company’s foreign subsidiaries. This enables the Company to provide services that would otherwise be considered impermissible for REITs and participate in activities that do not qualify as “rents from real property.” The TRS is not resident in the U.S. and, as such, not subject to U.S. taxation but is subject to foreign income taxes only. In addition, the REIT will not generally be subject to any additional U.S. taxes on the repatriation of its earnings.

For the Company’s foreign subsidiaries, including the Company’s foreign TRS, deferred tax assets and liabilities are established for temporary differences between the financial reporting basis and the foreign tax basis of assets and liabilities at the enacted tax rates expected to be in effect when the temporary differences reverse. The Company evaluates the realizability of its deferred tax assets (e.g. net operating loss) and recognizes a valuation allowance if, based on the available evidence, it is more likely than not

NORTHSTAR REALTY EUROPE CORP. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Unaudited)

that some portion or all of its deferred tax assets will not be realized. When evaluating the realizability of its deferred tax assets, the Company considers estimates of expected future taxable income, existing and projected book/tax differences, tax planning strategies available and the general and industry specific economic outlook. This realizability analysis is inherently subjective, as it requires the Company to forecast its business and general economic environment in future periods. Due to past and projected losses in certain local jurisdictions where the Company does not have carryback potential and/or cannot sufficiently forecast future taxable income, the Company recognized net cumulative valuation allowances against the Company’s deferred tax assets. The Company will continue to review its deferred tax assets in accordance with U.S. GAAP.

The Company recorded an income tax expense for the three months ended September 30, 2017 and 2016 of $0.4 million and $2.7 million, respectively. The Company recorded an income tax expense for the nine months ended September 30, 2017 and 2016 of $0.3 million and $2.5 million, respectively.

Other

Refer to Note 2 of the consolidated financial statements in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2016 for further disclosure of the Company’s significant accounting policies.

Recent Accounting Pronouncements: Accounting Standards Adopted in 2017

In March 2016, the Financial Accounting Standards Board (“FASB”) issued guidance (Accounting Standards Update “ASU” No. 2016-05) clarifying that an assessment of whether an embedded contingent put or call option is clearly and closely related to a borrowing requires only an analysis of the four-step decision sequence. Additionally, entities are not required to separately assess whether the contingency itself is clearly and closely related. Entities are required to apply the guidance to existing instruments in scope using a modified retrospective transition method as of the period of adoption. The guidance is effective for fiscal years beginning after December 15, 2016 and interim periods within those years. The Company has adopted this guidance and it did not have any material impact on its consolidated financial position, results of operations and financial statement disclosures.

In March 2016, the FASB issued guidance (ASU No. 2016-09) which amends several aspects of the accounting for equity-based payment transactions, including the income tax consequences, classification of awards as either equity or liabilities and classification on the statements of cash flows. The guidance is effective for interim and annual reporting periods in fiscal years beginning after December 15, 2016. The Company has adopted this guidance and has made a policy election to account for forfeitures upon occurrence. The adoption did not have a material impact on the Company’s consolidated financial position, results of operations and financial statement disclosures.

Recent Accounting Pronouncements: Future Application of Accounting Standards

In May 2014, FASB issued an accounting update (ASU No. 2014-09) requiring a company to recognize as revenue the amount of consideration it expects to be entitled to in connection with the transfer of promised goods or services to customers. The accounting standard update will replace most of the existing revenue recognition guidance currently promulgated by U.S. GAAP. In July 2015, the FASB decided to delay the effective date of the new revenue standard by one year. The effective date of the new revenue standard for the Company will be January 1, 2018. The Company has commenced the process of adopting the new revenue standard; including forming a project team and compiling an inventory of the sources of revenue the Company expects will be impacted by the adoption of this standard. The Company plans to adopt the standard on its required effective date of January 1, 2018 using the modified retrospective approach. The new revenue standard specifically excludes revenue streams for which specific guidance is stipulated in other sections of the codification, therefore it will not impact rental income or interest income generated on financial instruments such as preferred equity investments. Rental revenue from lease contracts represents a significant portion of our total revenues and is a specific scope exception provided by this guidance. However, common area maintenance and other tenant reimbursable expenses provided to the lessee are considered a non-lease component and will be required to be separated from rental revenue and recorded on a separate financial statement line item upon adoption of the new accounting guidance on leases discussed below. The Company expects to apply the revenue recognition guidance related to its non-lease components within leases on January 1, 2019, upon its adoption of the lease accounting update. While this revenue stream is subject to the application of the new revenue recognition standard, the Company believes that the pattern and timing of recognition of income will be consistent with the current accounting model.

In February 2016, the FASB issued an accounting update (ASU No. 2016-02) that sets out the principles for the recognition, measurement, presentation and disclosure of leases for both parties to a contract (i.e., lessees and lessors). The update requires lessees to apply a dual approach, classifying leases as either finance or operating leases based on the principle of whether or not the lease is effectively a financed purchase of the leased asset by the lessee. This classification will determine whether the lease expense is recognized based on an effective interest method or on a straight-line basis over the term of the lease. A lessee is also required to record a right-of-use asset and a lease liability for all leases with a term of greater than 12 months regardless of their

NORTHSTAR REALTY EUROPE CORP. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Unaudited)

classification. Leases with a term of 12 months or less will be accounted for similar to existing guidance for operating leases today. The update is expected to result in the recognition of a right-to-use asset and related liability to account for the Company’s future obligations under its ground lease arrangements for which it is the lessee. As of September 30, 2017, the Company has three ground lease agreements with annual payments of $0.8 million. Additionally, the new update will require that lessees and lessors capitalize, as initial direct costs, only those costs that are incurred due to the execution of a lease. Under this guidance, allocated payroll costs and other costs that are incurred regardless of whether the lease is obtained will no longer be capitalized as initial direct costs and instead will be expensed as incurred. Lessors will continue to account for leases using an approach that is substantially equivalent to existing guidance for sales-type leases, direct financing leases and operating leases. The new guidance is to be applied using a modified retrospective approach at the beginning of the earliest comparative period in the financial statements and is effective for fiscal years beginning after December 15, 2018, including interim periods within those fiscal years. The Company is evaluating the impact, if any, that this guidance will have on its consolidated financial position, results of operations and financial statement disclosures.

In June 2016, the FASB issued guidance (ASU No. 2016-13) that changes the impairment model for most financial instruments by requiring companies to recognize an allowance for expected losses, rather than incurred losses as required currently by the other-than-temporary impairment model. The guidance will apply to most financial assets measured at amortized cost and certain other instruments, including trade and other receivables, loans, held-to-maturity debt securities, net investments in leases and off-balance-sheet credit exposures (e.g., loan commitments). The new guidance is effective for reporting periods beginning after December 15, 2019 and will be applied as a cumulative adjustment to retained earnings as of the effective date. The Company is evaluating the impact, if any, that this guidance will have on its consolidated financial position, results of operations and financial statement disclosures.

In August 2016, the FASB issued guidance (ASU No. 2016-15) that makes eight targeted changes to how cash receipts and cash payments are presented and classified in the statement of cash flows. The guidance is effective for fiscal years beginning after December 15, 2017 and interim periods within those fiscal years. If an entity early adopts the amendments in an interim period, any adjustments should be reflected as of the beginning of the fiscal year that includes that interim period. The new guidance requires adoption on a retrospective basis unless it is impracticable to apply, in which case the Company would be required to apply the amendments prospectively as of the earliest date practicable. The Company does not expect the adoption of this standard to have a material impact on its consolidated statements of cash flows.

In November 2016, the FASB issued guidance (ASU No. 2016-18) which requires entities to show the changes in the total of cash and cash equivalents and restricted cash and restricted cash equivalents in the statement of cash flows. Entities will no longer be permitted to present transfers between cash and cash equivalents and restricted cash and restricted cash equivalents in the statement of cash flows. The guidance is effective for reporting periods beginning after December 15, 2017 and will be applied retrospectively to all periods presented. The Company does not expect the adoption of this standard to have a material impact on its consolidated statement of cash flows.

In January 2017, the FASB issued guidance (ASU No. 2017-01) to clarify the definition of a business under ASC 805. This new standard clarifies the definition of a business and provides a screen to determine when an integrated set of assets and activities is not a business. The screen requires that when substantially all of the fair value of the gross assets acquired (or disposed of) is concentrated in a single identifiable asset or a group of similar identifiable assets, the set is not a business. The guidance is effective for fiscal years, and interim periods within those years, beginning December 15, 2017. The amendments in this update will be applied on a prospective basis. The Company expects that acquisitions of real estate or in-substance real estate will not meet the revised definition of a business because substantially all of the fair value is concentrated in a single identifiable asset or group of similar identifiable assets (i.e. land, buildings, and related intangible assets). The Company is evaluating the impact, if any, that this guidance will have on its consolidated financial position, results of operations and financial statement disclosures.

In January 2017, the FASB issued guidance (ASU No. 2017-04) which removes Step 2 from the goodwill impairment test. The guidance is effective for annual or any interim goodwill impairment tests in fiscal years beginning after December 15, 2019. The Company is evaluating the impact, if any, that this guidance will have on its consolidated financial position, results of operations and financial statement disclosures.

In February 2017, the FASB issued an accounting update (ASU No. 2017-05) which clarifies the scope of recently established guidance on nonfinancial asset derecognition, which applies to the derecognition of all nonfinancial assets and in-substance nonfinancial assets. In addition, the guidance clarifies the accounting for partial sales of nonfinancial assets and in-substance nonfinancial assets to align with the new revenue recognition standard to be more consistent with the accounting for sale of a business. Specifically, in a partial sale to a noncustomer, when a noncontrolling interest is received or retained, the latter is considered a noncash consideration and measured at fair value, which would result in full gain or loss recognized upon sale. This guidance has the same effective date as the new revenue guidance, which is January 1, 2018, with early adoption permitted beginning

NORTHSTAR REALTY EUROPE CORP. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Unaudited)

January 1, 2017. Both the revenue guidance and this update must be adopted concurrently. While the options for transition are similar to the new revenue guidance, either full retrospective or modified retrospective, the transition approach need not be aligned between both updates. The Company is evaluating the impact, if any, that this guidance will have on its consolidated financial position, results of operations and financial statement disclosures.

In May 2017, the FASB issued guidance (ASU No. 2017-09) clarifying when to account for a change to the terms or conditions of a share-based payment award as a modification. The guidance is effective for fiscal years beginning after December 15, 2017 and interim periods within those years. The Company is evaluating the impact, if any, that this guidance will have on its consolidated financial position, results of operations and financial statement disclosures.

The following table presents operating real estate, net as of September 30, 2017 and December 31, 2016 (dollars in thousands):

|

| | | | | | | | |

| | September 30, 2017 | | December 31, 2016 |

Land | | $ | 400,366 |

| | $ | 360,555 |

|

Buildings and improvements | | 1,095,858 |

| | 980,053 |

|

Building, leasehold interests and improvements | | 189,873 |

| | 212,864 |

|

Furniture, fixtures and equipment | | 854 |

| | 1,214 |

|

Tenant improvements | | 64,190 |

| | 59,746 |

|

Operating real estate, gross | | 1,751,141 |

| | 1,614,432 |

|

Less: accumulated depreciation | | (96,805 | ) | | (63,585 | ) |

Operating real estate, net | | $ | 1,654,336 |

| | $ | 1,550,847 |

|

Real Estate Held for Sale

The following table summarizes the Company’s operating real estate held for sale as of September 30, 2017 (dollars in thousands):

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | Assets(1) | | Liabilities(1) |

Location | | Type | | Properties | | Operating Real Estate, Net | | Intangible Assets, Net | | Other Assets | | Total(2) | | Intangible Liabilities, Net | | Other Liabilities | | Total(2) |

Woking, United Kingdom | | Office | | 1 | | $ | 45,224 |

| | $ | 26,211 |

| | $ | 4,706 |

| | $ | 76,141 |

| | $ | 603 |

| | $ | 1,850 |

| | $ | 2,453 |

|

Total | | | | 1 |

| $ | 45,224 |

|

| $ | 26,211 |

| | $ | 4,706 |

|

| $ | 76,141 |

| | $ | 603 |

| | $ | 1,850 |

| | $ | 2,453 |

|

___________________

| |

(1) | The assets and liabilities classified as held for sale are expected to be sold on the open market as a share sale subject to standard industry terms and conditions. The asset contributed $2.3 million and $2.2 million of revenue and income before income tax benefit (expense) of $0.7 million and $0.3 million for the three months ended September 30, 2017 and 2016, respectively. The asset contributed $7.0 million and $6.6 million of revenue and income before income tax benefit (expense) of $2.3 million and $0.3 million for the nine months ended September 30, 2017 and 2016, respectively. |

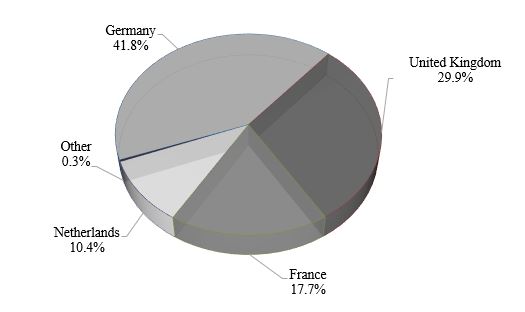

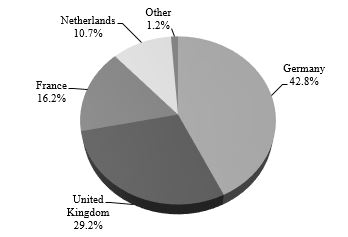

| |